0 ratings0% found this document useful (0 votes)

116 viewsNature of Accountancy Research 1

Nature of Accountancy Research 1

Uploaded by

Rolando G. Cua Jr.Accountancy research aims to systematically study the accounting profession to increase understanding and solve problems. There are various types including financial, management, auditing, and tax accounting research. Research can be basic/applied and use positive/normative/interpretive approaches. Contemporary trends include interdisciplinary work and studying accounting's wider impacts. Major topics now include technology, outsourcing, and performance measurement. While established abroad, accountancy research remains nascent in the Philippines.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Nature of Accountancy Research 1

Nature of Accountancy Research 1

Uploaded by

Rolando G. Cua Jr.0 ratings0% found this document useful (0 votes)

116 views29 pagesAccountancy research aims to systematically study the accounting profession to increase understanding and solve problems. There are various types including financial, management, auditing, and tax accounting research. Research can be basic/applied and use positive/normative/interpretive approaches. Contemporary trends include interdisciplinary work and studying accounting's wider impacts. Major topics now include technology, outsourcing, and performance measurement. While established abroad, accountancy research remains nascent in the Philippines.

Original Description:

Accountancy Research

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Accountancy research aims to systematically study the accounting profession to increase understanding and solve problems. There are various types including financial, management, auditing, and tax accounting research. Research can be basic/applied and use positive/normative/interpretive approaches. Contemporary trends include interdisciplinary work and studying accounting's wider impacts. Major topics now include technology, outsourcing, and performance measurement. While established abroad, accountancy research remains nascent in the Philippines.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

116 views29 pagesNature of Accountancy Research 1

Nature of Accountancy Research 1

Uploaded by

Rolando G. Cua Jr.Accountancy research aims to systematically study the accounting profession to increase understanding and solve problems. There are various types including financial, management, auditing, and tax accounting research. Research can be basic/applied and use positive/normative/interpretive approaches. Contemporary trends include interdisciplinary work and studying accounting's wider impacts. Major topics now include technology, outsourcing, and performance measurement. While established abroad, accountancy research remains nascent in the Philippines.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 29

1.

Meaning of Accountancy Research

2. Accountancy Research as a System

3. Landscape of Contemporary Accountancy

Research

4. Motivations for Accountancy Research

Accountancy Research

- systematic process of collecting & analyzing

information in order to increase one’s

understanding of a professional accountant’s

functions & contribute to the solution of

problems besetting the practice of the

profession

- Can be categorized into:

1. Functional classification

2. Sectoral classification

Functional Classification

- Accountancy research is classified by

functional area:

1. Financial accounting

2. Management accounting

3. Auditing and assurance

4. Tax

5. Other functional areas

Financial Accounting Research

- Primarily studies collection, recording &

reporting of financial info about an entity

- Looks into effect of economic events on

process of summarizing, analyzing, verifying,

& reporting standardized financial info, & on

effects of reported info on economic events

Management Accounting Research

- systematic inquiry on the provision & use of

acctg. info to mgrs.

- could look at impact of org. change on acctg.

practices, or interaction between mgt. acctg.

techniques & functional strategies (e.g.,

TQM)

Auditing Research

- Examines auditors’ process of gathering &

evaluating evidence on assertions about

economic actions & events

- Looks into means of communicating audit

results, quality of audit services & value-

adding functions of audit

- Expandable to include assurance &

attestation services

Tax Research

- Has a broad scope; can be at macro or micro level

- Macro level: can be an analysis involving:

- Assessment of taxation proposals

- Evaluation of fiscal policy issues

- Other revenue-raising powers of gov’t.

- Micro or organizational level: can be on:

- income tax expense reported for financial acctg.

- Corporate tax avoidance

- Tax-related decisions on investment, capital structure,

org. form

- Taxes & asset pricing

Other Functional Areas of Accountancy

- Relate to specific functions, e.g,:

- Fraud prevention & investigation

- Corporate governance

- Internal auditing

- Risk management

- Sustainability reporting

Sectoral Classification

- refers to either the subject of the research, or

the context wherein research findings &

recommendations will be useful

- includes:

1. Education/academe

2. Commerce & industry

3. Public practice

4. Government

Researches in Other Disciplines

- may cut across accountancy profession:

Research Type Description Link to Accountancy

Social Research Answers questions re society, May deal w/ capital markets,

its structure & processes social enterprises w/ links to

financial reporting & controls

Social auditing: blend of

social science & auditing

Business Process of conducting inquiry May require financial info

Research on a mgt. dilemma

Marketing Processing of info to improve May require costing & pricing

Research decision making & solve

problems in mktg.

Basic & Applied Accountancy Research

Basic accountancy research:

geared towards knowledge generation

usually conducted by educators & scholars

research reports are published in journals

Applied accountancy research:

Intended to solve problems, clarify issues/gray

areas, & provide inputs to policy development &

decision-making

Primarily conducted by public accountancy firms

(for internal or client’s needs)

Can be initiated by authoritative bodies & funding

institutions for regulation & legislation purposes

Examples: feasibility studies; program/project

evaluation; documentation of best practices, etc.

Accountancy research: falls under category of

social sciences

Landscape characterized by:

1. Research perspectives

2. Trends

3. Functional thrusts & directions

Perspectives in Accountancy Research

- Accountancy research started out using the

normative approach: it seeks to develop &

implement specific acctg. practices deemed

superior to existing ones

- Subsequently, there was a shift towards

positive approach: it’s analytical & its focus is

on impact of acctg.

Sample Normative & Positive Research

Questions

Normative Questions Positive Questions

1. How should leases be treated on 1. Why do most firms continue to

the statement of financial position? allocate overhead charges to

performance centers?

2. Should replacement or liquidation 2. How have court regulation &

values be used in financial reporting? rulings influenced accounting

practice?

3. What should be reported in the 3. Why are public accountancy firms

annual financial statements? organized as partnerships?

Other postpositive perspectives applicable to

accountancy research:

1. Interpretive

2. Criticalist

3. Postmodernist

Interpretive Accountancy Research

- Seeks to understand social nature of accountancy

practice

- Seeks to explain actions/behaviors of individuals &

groups & human interactions in line w/ functioning of

different regulatory & policy directions in the profession

- Considers how accountancy practice could be modified

to take into account social & environmental aspects of

org’s undertakings

- Possible subjects of research:

- - Lobbying of audit firms on standard-setting

- - Functioning of mgt. acctg. & control systems amidst

financial scandals

Critical Accountancy Research

- Provides a position on the status quo

- Focuses on role of accountancy in sustaining

privileged position of individuals controlling

certain resources while stifling access & voice of

those w/o capital

- Aims to stimulate progressive change

- Centers on broader level of society

- Possible subjects of research:

- Functioning of audit & its role in financial failures

- Move to fair value accounting

Interpretive vs. Critical Approach

INTERPRETIVE CRITICAL

Similarity Subjective value of social world

Differences Focuses more on how Focuses on explaining

accountancy is socially w/c ideological pressure

constructed & how is influential & w/c group

perceptions preserve the interest is met by

status quo accountancy regulations

Takes a neutral stand Takes a particular

position on research

nature & purpose & its

political/societal

implications

Postmodern Accountancy Research

- Argues that everyone constructs his/her own reality & it’s

not possible to compare various realities due to absence of

independent criteria for comparison purposes

- Believes that problems can only be addressed through

discourse & communication

- Encourages debunking of old systems & theories, &

creates new ones

- Suggests that accountancy techniques be reexamined &

assessed over time

- Possible subjects of research:

- Triple-entry bookkeeping

- Suitability of public disclosure of internal control deficiencies of

publicly-listed companies

Trends in Accountancy Research

Interdisciplinary orientation

Evolving, dynamic

Studies consequences & modes of financial

acctg’s functioning in wider institutional

setting/wider whole (not only financial acctg.

itself)

In mgt.acctg.: direction is practice-oriented

research

Major topics indicative of new directions in mgt.

acctg. research:

Acctg. software

Budgeting

Business process improvement

Cash management

Compensation plans

Cost accounting

Cost management

Effects of financial reporting on internal systems

Effects of information technology on internal

systems

Improving profits

Internal control

Management acctg. practices

Outsourcing

Performance measurement

Research methods

Shareholder value

Both financial & mgt. acctg. have to cope w/ a

more complex commercial & institutional

environment

Profound changes in profession: diminishing

scope of service over time

Research themes in auditing:

Audit engagement

Audit education

Audit markets

Audit procedures

Audit report & going-concern opinion

Audit review

Audit sampling

Auditor behavior

Auditor’s judgment

Corporate governance

Earnings quality

Information processing

Internal auditing

International regulation

Liability fraud and litigation

Profession and regulation

Tax audit

Contemporary accountancy research:

Descriptive

Explanatory

Prescriptive

Alternative accountancy research methods:

1. Analytical modeling: tools of economics, mathematics, &

statistics considered in examining issues

2. Behavioral experimentation: can be used in areas related

to judgments & decisions, specifically in auditing

3. Evaluation research: may focus on assumptions used,

incentives offered & extent of restrictions imposed in

different functional areas of accountancy

Not much progress in the Philippines (unlike in the US and

many European countries): still in its infancy stage

Not much attention is given by academic institutions &

practitioners

CHED: mandated to enhance research functions of HEIs

In accountancy education: requirement for research

embodied in CHED MO #3, 2007 series, w/c requires

accountancy schools to:

Have competent & qualified research staff

Undertake research

Support faculty & students in the conduct of research

Revised policies in said MO intend to adopt locally the

International Accounting Education Standards, to keep

Phil.graduates competitive in the global workplace

You might also like

- Exercise 1: On December 31, Bryniuk's Company, The Accounting Records Showed The Following InformationDocument10 pagesExercise 1: On December 31, Bryniuk's Company, The Accounting Records Showed The Following InformationJohn Kenneth Bohol50% (2)

- Module 1 Coop 20093 Cooperative Law and Social LegislationsDocument7 pagesModule 1 Coop 20093 Cooperative Law and Social LegislationsIrish EllamilNo ratings yet

- Chapter 2597Document19 pagesChapter 2597Barsha MaharjanNo ratings yet

- Flipkart Labels 22 Dec 2015 01 52 PDFDocument6 pagesFlipkart Labels 22 Dec 2015 01 52 PDFshireenNo ratings yet

- Financial Accounting Theory PDFDocument7 pagesFinancial Accounting Theory PDFLaela Yuniar SariNo ratings yet

- Approved CAE - BSA BSMA BSAIS BSIA-ACC 214 - SucuahiDocument106 pagesApproved CAE - BSA BSMA BSAIS BSIA-ACC 214 - Sucuahirechell obusaNo ratings yet

- Cost Accounting Book of 3rd Sem Mba at Bec DomsDocument174 pagesCost Accounting Book of 3rd Sem Mba at Bec DomsBabasab Patil (Karrisatte)100% (1)

- SIM ACC 111 Financial Accounting and Reporting 1Document60 pagesSIM ACC 111 Financial Accounting and Reporting 1Marianne Adalid MadrigalNo ratings yet

- Marketing ResearchDocument51 pagesMarketing ResearchMd.Azizul IslamNo ratings yet

- DYBSAAap313 - Auditing & Assurance Principles (PRELIM MODULE) PDFDocument10 pagesDYBSAAap313 - Auditing & Assurance Principles (PRELIM MODULE) PDFJonnafe Almendralejo IntanoNo ratings yet

- BCom IB Year 2 International Business Environment Semester 2 January 2021Document113 pagesBCom IB Year 2 International Business Environment Semester 2 January 2021Khomo MalwaNo ratings yet

- OBE SyllabusDocument8 pagesOBE SyllabusRomy WacasNo ratings yet

- Finals IBTDocument33 pagesFinals IBTkara mNo ratings yet

- Medyo RevisedDocument35 pagesMedyo RevisedAllan CamachoNo ratings yet

- CBMEC 2 - Operations Management TQMDocument3 pagesCBMEC 2 - Operations Management TQMcherish.jorge.patalNo ratings yet

- Week 2 - Lesson 2 Costs in Managerial AccountingDocument7 pagesWeek 2 - Lesson 2 Costs in Managerial AccountingReynold Raquiño AdonisNo ratings yet

- Advanced MGT Accounting Paper 3.2Document242 pagesAdvanced MGT Accounting Paper 3.2Noah Mzyece DhlaminiNo ratings yet

- Ob NotesDocument64 pagesOb NotesHarsh ChopraNo ratings yet

- Self-Instructional Manual (SIM) For Self-Directed Learning (SDL)Document144 pagesSelf-Instructional Manual (SIM) For Self-Directed Learning (SDL)Ninia Cresil Ann JalagatNo ratings yet

- Quantitative Techniques and Analysis in BusinessDocument7 pagesQuantitative Techniques and Analysis in BusinessCjhay MarcosNo ratings yet

- BSA3B - Activity - GAD LawsDocument3 pagesBSA3B - Activity - GAD LawsPhebe LagutaoNo ratings yet

- Module 2, Audit An Overview PowerpointDocument31 pagesModule 2, Audit An Overview PowerpointMAG MAGNo ratings yet

- To Business Finance and Philippine Financial SystemDocument85 pagesTo Business Finance and Philippine Financial SystemSanson OrozcoNo ratings yet

- AC 55 Managerial EconomicsDocument10 pagesAC 55 Managerial EconomicsRaymond PacaldoNo ratings yet

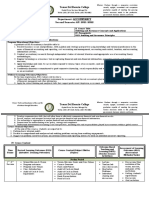

- MKTGPM34705rConrPr - CB - Module 1 GuptaDocument49 pagesMKTGPM34705rConrPr - CB - Module 1 GuptaSyed AbrarNo ratings yet

- Earning Outcomes: LSPU Self-Paced Learning Module (SLM)Document20 pagesEarning Outcomes: LSPU Self-Paced Learning Module (SLM)Jamie Rose AragonesNo ratings yet

- ICAN EXEMPTION FEE Sheet1Document3 pagesICAN EXEMPTION FEE Sheet1Niyi SeiduNo ratings yet

- @2 Managerial Accounting - WSUDocument166 pages@2 Managerial Accounting - WSUAbaynesh ANo ratings yet

- Intro To Accountancy Research PDFDocument50 pagesIntro To Accountancy Research PDFbilly fernandezNo ratings yet

- Research Methods For Accouting and Finance PDFDocument16 pagesResearch Methods For Accouting and Finance PDFAqil NovruzluNo ratings yet

- PGDBM 416 - Block1Document246 pagesPGDBM 416 - Block1koushik VeldandaNo ratings yet

- F2.1 Notes & PPDocument220 pagesF2.1 Notes & PPjbah saimon baptiste100% (2)

- Kalinga Colleges of Science and Technolgy Moldero St. P5 Bulanao, Tabuk City, Kalinga 3800 College of Criminology Third YearDocument3 pagesKalinga Colleges of Science and Technolgy Moldero St. P5 Bulanao, Tabuk City, Kalinga 3800 College of Criminology Third YearJaden Fate SalidaNo ratings yet

- Accounting Assignment 3 - FinalDocument21 pagesAccounting Assignment 3 - FinalMiia SiddiqiNo ratings yet

- The Determinants of Interest RatesDocument4 pagesThe Determinants of Interest RatesEkjon Dipto100% (1)

- Operations Management A Research OverviewDocument65 pagesOperations Management A Research OverviewNguyễn Trần Hoàng100% (1)

- Syllabus: Managerial AccountingDocument7 pagesSyllabus: Managerial AccountingAnonymous EAhdEfPK0kNo ratings yet

- Chapter 1 An Overview in Human Behavior in OrganizationDocument17 pagesChapter 1 An Overview in Human Behavior in Organizationjerico garciaNo ratings yet

- Introduction To PsychologyDocument197 pagesIntroduction To PsychologyAfaq MalikNo ratings yet

- Module 2 - Introduction To BusinessDocument4 pagesModule 2 - Introduction To BusinessMarjorie Rose GuarinoNo ratings yet

- Ethics Governance PDFDocument2 pagesEthics Governance PDFBarbaraNo ratings yet

- AT - Diagnostic Examfor PrintingDocument8 pagesAT - Diagnostic Examfor PrintingMichaela PortarcosNo ratings yet

- PEM GTU Study Material E-Notes All-Units 07042020021753PMDocument108 pagesPEM GTU Study Material E-Notes All-Units 07042020021753PMPrakash MakawanaNo ratings yet

- Mapping AAS 13 Vs ISA 320Document24 pagesMapping AAS 13 Vs ISA 320Amitesh AgarwalNo ratings yet

- Applied Auditing SyllabusDocument9 pagesApplied Auditing SyllabusveehneeNo ratings yet

- BA Course Outline (ACCSB)Document6 pagesBA Course Outline (ACCSB)rubabNo ratings yet

- Chapter 1 Professional Practice of AccountancyDocument44 pagesChapter 1 Professional Practice of AccountancyVanjo MuñozNo ratings yet

- Business Research Slides - 2Document111 pagesBusiness Research Slides - 2Danudear DanielNo ratings yet

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document11 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo GironellaNo ratings yet

- Module1, Part 2 OpAud - Asynchronous, Risk-BasedDocument18 pagesModule1, Part 2 OpAud - Asynchronous, Risk-BasedMA. CARMELLA VALDEZNo ratings yet

- Course Content: Introduction To EntrepreneurshipDocument2 pagesCourse Content: Introduction To EntrepreneurshipJezibel MendozaNo ratings yet

- ACT102 Managerial Accounting IIIDocument5 pagesACT102 Managerial Accounting IIILEARELL DEYPALUBOSNo ratings yet

- Principles of Project ManagementDocument95 pagesPrinciples of Project Managementsunshine777100% (1)

- Competency Appraisal 2022 Modular Plan - Second Semester, 2021-2022Document10 pagesCompetency Appraisal 2022 Modular Plan - Second Semester, 2021-2022Ben Vallecer Espiritu Jr.No ratings yet

- Juneedited Imrad Quantitative - Doc As of June 2018.doc111Document12 pagesJuneedited Imrad Quantitative - Doc As of June 2018.doc111rudyNo ratings yet

- OBE Syllabus Pricing and Costing San Francisco CollegeDocument4 pagesOBE Syllabus Pricing and Costing San Francisco CollegeJerome SaavedraNo ratings yet

- Bsa Operations Auditing - CompressDocument27 pagesBsa Operations Auditing - CompressDion Ata100% (1)

- Corporate Strategy Lecture NotesDocument121 pagesCorporate Strategy Lecture Notesnonhlakanipho.mkNo ratings yet

- 1 - Overview of AccountingDocument19 pages1 - Overview of AccountingMichelle Matubis Bongalonta100% (7)

- The Effects of Taxation on Multinational CorporationsFrom EverandThe Effects of Taxation on Multinational CorporationsRating: 5 out of 5 stars5/5 (1)

- 100-305 Acquisition of Bond InvestmentDocument3 pages100-305 Acquisition of Bond InvestmentRolando G. Cua Jr.No ratings yet

- Advanced Accounting Part 2 Dayag 2015 Chapter 16Document1 pageAdvanced Accounting Part 2 Dayag 2015 Chapter 16Rolando G. Cua Jr.No ratings yet

- Introduction of The Euro: SIC Interpretation 7Document4 pagesIntroduction of The Euro: SIC Interpretation 7Rolando G. Cua Jr.No ratings yet

- Japanese Phrase Tanoshii-OmoshiroiDocument9 pagesJapanese Phrase Tanoshii-OmoshiroiRolando G. Cua Jr.No ratings yet

- Jikoshoukai VocabularyDocument5 pagesJikoshoukai VocabularyRolando G. Cua Jr.100% (1)

- Jiko Shou KaiDocument16 pagesJiko Shou KaiRolando G. Cua Jr.100% (1)

- ACC132 - Home Office and Branch Accounting PDFDocument50 pagesACC132 - Home Office and Branch Accounting PDFRolando G. Cua Jr.92% (12)

- Work AllotmentDocument2 pagesWork AllotmentasarthiNo ratings yet

- Accounts Assignment 2Document12 pagesAccounts Assignment 2shoaiba167% (3)

- (MB0053) International Business ManagementDocument14 pages(MB0053) International Business ManagementAjay KumarNo ratings yet

- Financial Accounting II - MGT401 Quiz 1Document30 pagesFinancial Accounting II - MGT401 Quiz 1john cutterNo ratings yet

- Depreciation at Delta Air Lines and Singapore Airlines: Kendra Yates ACCT 5401.001 September 19, 2006Document42 pagesDepreciation at Delta Air Lines and Singapore Airlines: Kendra Yates ACCT 5401.001 September 19, 2006Ribika ChowdhuryNo ratings yet

- Exercise No.3 (Acctg 7) - TanDocument2 pagesExercise No.3 (Acctg 7) - TanFaith Reyna TanNo ratings yet

- Afar Assign 1Document8 pagesAfar Assign 1버니 모지코No ratings yet

- ACC 577 Week 1 QuizDocument8 pagesACC 577 Week 1 QuizMaryNo ratings yet

- Problem 1Document14 pagesProblem 1Syed100% (1)

- Teresita Buenaflor ShoesDocument5 pagesTeresita Buenaflor ShoestpequitNo ratings yet

- Standards On Auditing 200-299 300-499 500-599 600-699 700-799Document2 pagesStandards On Auditing 200-299 300-499 500-599 600-699 700-799Pali Hill City100% (1)

- Internal Audit Contribution To Efficient Risk ManagementDocument14 pagesInternal Audit Contribution To Efficient Risk ManagementNia MNo ratings yet

- Acc Assignment Merge UpdatedDocument9 pagesAcc Assignment Merge UpdatedDEEVEYAH A/P S.RAMASI / UPM0% (1)

- CHAPTER 10 Auditing-Theory-MCQs-Continuation-by-Salosagcol-with-answersDocument1 pageCHAPTER 10 Auditing-Theory-MCQs-Continuation-by-Salosagcol-with-answersMichNo ratings yet

- Cost Accounting3Document9 pagesCost Accounting3stephborinagaNo ratings yet

- Silabus Pengauditan InternalDocument5 pagesSilabus Pengauditan InternalAco AritonangNo ratings yet

- Professional Resume FormatDocument4 pagesProfessional Resume FormatsankalpadixitNo ratings yet

- Practical Accounting 2Document4 pagesPractical Accounting 2James Perater100% (2)

- Exercise 5.3 (A)Document10 pagesExercise 5.3 (A)Stephanie XieNo ratings yet

- The Budget Process-Cabilangan Crispin JayDocument3 pagesThe Budget Process-Cabilangan Crispin JayJerico ManaloNo ratings yet

- AmalgamationDocument35 pagesAmalgamationKaran VyasNo ratings yet

- Cost Accounting Vol II PDFDocument464 pagesCost Accounting Vol II PDFAnonymous qAegy6G100% (2)

- Mb310tocDocument3 pagesMb310tocpratikNo ratings yet

- Hansard - CPIC - 28.2.2023 - Kisumu CEDocument46 pagesHansard - CPIC - 28.2.2023 - Kisumu CEOwuor BridgetteNo ratings yet

- Responsibility AccountingDocument7 pagesResponsibility AccountingISHFAQ ASHRAFNo ratings yet

- Fabm 1 Las April 082024Document12 pagesFabm 1 Las April 082024gwynethpolia11No ratings yet

- MR11 GRIR Clearing Account MaintenanceDocument9 pagesMR11 GRIR Clearing Account MaintenanceJayanth MaydipalleNo ratings yet

- TMA For Spring 2019-2020-Cutoff Date May 5, 2020Document5 pagesTMA For Spring 2019-2020-Cutoff Date May 5, 2020Sara MlaNo ratings yet