100%(1)100% found this document useful (1 vote)

466 viewsWhat Is Specialized Industry

What Is Specialized Industry

Uploaded by

Stephany PorrasThe document discusses specialized industries that have unique accounting standards, such as airlines, banking, agriculture, and oil extraction. It notes that auditing these industries requires competence in the applicable standards and an understanding of industry-specific risks. The audit firm must ensure it has the capabilities and resources to properly audit specialized clients. They may provide additional guidance to assist auditors and consider using experts. However, auditors cannot fully rely on experts and must still evaluate other risks and audit evidence.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

What Is Specialized Industry

What Is Specialized Industry

Uploaded by

Stephany Porras100%(1)100% found this document useful (1 vote)

466 views20 pagesThe document discusses specialized industries that have unique accounting standards, such as airlines, banking, agriculture, and oil extraction. It notes that auditing these industries requires competence in the applicable standards and an understanding of industry-specific risks. The audit firm must ensure it has the capabilities and resources to properly audit specialized clients. They may provide additional guidance to assist auditors and consider using experts. However, auditors cannot fully rely on experts and must still evaluate other risks and audit evidence.

Original Title

What is Specialized Industry

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

The document discusses specialized industries that have unique accounting standards, such as airlines, banking, agriculture, and oil extraction. It notes that auditing these industries requires competence in the applicable standards and an understanding of industry-specific risks. The audit firm must ensure it has the capabilities and resources to properly audit specialized clients. They may provide additional guidance to assist auditors and consider using experts. However, auditors cannot fully rely on experts and must still evaluate other risks and audit evidence.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

100%(1)100% found this document useful (1 vote)

466 views20 pagesWhat Is Specialized Industry

What Is Specialized Industry

Uploaded by

Stephany PorrasThe document discusses specialized industries that have unique accounting standards, such as airlines, banking, agriculture, and oil extraction. It notes that auditing these industries requires competence in the applicable standards and an understanding of industry-specific risks. The audit firm must ensure it has the capabilities and resources to properly audit specialized clients. They may provide additional guidance to assist auditors and consider using experts. However, auditors cannot fully rely on experts and must still evaluate other risks and audit evidence.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 20

I.

Audit & Assurance:

Specialized Industries

What is a specialized industry?

•A specialized industry is a distinct market that has a unique

way of accounting for transactions and reporting its

financial results. These differences are allowed under the

applicable accounting framework such as IFRS or GAAP.

• Specialized industries include:

• Airline

• Banking and insurance

• Agriculture, and

• Oil extraction

Specialized industries

- are likely to have specific financial reporting standards

applicable to them, or to have a distinct accounting

policies which have been developed to account for

specialized transactions and balances which are based

on the normally-applied financial reporting standards.

For instance:

PAS 41, Agriculture is clearly relevant specifically to the

agriculture sector

PFRS 7, Financial Instruments: Disclosure

- Will need specific application by companies operating

in the banking sector.

AUDIT CONSIDERATIONS

COMPETENCE

When accepting an audit engagement involving a

specialist industry, the audit firm needs to pay close

attention to the competence of the audit firm to

provide the service.

PSQC 1, Quality Control for Firms That Perform Audits

and Reviews of Financial Statements, and Other

Assurance and Related Services Engagements

- Requires the audit firm to consider whether the firm

is competent to perform the engagement and has the

capabilities, including time and resources, to do so.

- This should include consideration of whether the

audit firm personnel has:

knowledge of relevant industries

has experience with relevant regulatory or reporting

requirements, or

the ability to gain the necessary skills and knowledge

effectively.

- Regardless of size, audit firms may choose to

specialize themselves in the audit of clients in a

particular market or sector.

- The audit firm should also ensure that there is

adequate documentation to demonstrate that

competence has been considered, and the steps that

have been taken to improve competence where

necessary, for example through appropriate staff

training.

AUDIT CONSIDERATIONS

AUDIT PLANNING

Identification of the risk of material misstatement in a

specialized industry should be approached in the same

way as in any other audit – by obtaining appropriate

understanding of the business and its environment.

To assist audit team members assigned to a specialized

industry client, the audit firm is likely to have additional

resources available.

- There may be briefing notes or internal technical

guidance on how financial reporting standards should

be applied within the sector.

- For example, in the audit of banking sector clients, an

audit firm may produce guidance on the specific

application of IFRS Standards relating to the range of

financial instruments typically held by banks.

- Audit staff can then refer to this guidance when

performing the audit, particularly when identifying

risks of material misstatement.

- It is also important to remember that while there may

be specific risks of material misstatement relating to

the industry-specific balances and transactions, there

must also be appropriate consideration of the

“normal” balances and transactions.

- For instance, in the audit of bank, there will be plenty

of risks to consider other than those relating to bank-

specific transactions and balances, for example the

depreciation of properties, recognition of provisions

and impairment of goodwill would all still be relevant.

- These ‘normal’ types of risk must not be forgotten,

just because the client operates in a specialized

industry.

RELIANCE ON EXPERTS

Linked to the previous matters, competence, audit

planning and the specialised nature of some transactions

and balances, the auditor may plan to use an auditor’s

expert to obtain audit evidence.

This is quite likely in a specialised industry as despite

being competent to perform the engagement, the audit

firm may not have the necessary specific expertise in

some areas.

For instance in the audit of a bank, specialists may be brought

in to value complex financial instruments.

In this situation, the audit firm must adhere to the

requirements and principles of ISA 620, Using the Work of an

Auditor’s Expert which deals with matters including the

evaluation of the objectivity, competence and capabilities of

the auditor’s expert, determining and communicating the

scope and objectives of their work, and assessing their

findings.

It is particularly important that the auditor evaluates

the relevance and adequacy of the expert’s findings

or conclusions. There is a danger of over-reliance on

the expert’s work; the fact that the audit is of a

specialised nature does not mean that the auditor

can pass all responsibility over to an expert.

For instance, the auditor must consider whether the

expert’s findings are consistent with the auditor’s

understanding of the client and with the conclusions

of other audit procedures. Any inconsistencies must

be investigated.

CONCLUSION

The audit of a client in a specialised industry can pose

some challenges to the audit firm. However, with proper

consideration of competence, and by providing staff with

additional support and guidance, these audits should not

necessarily be more complex or challenging to plan and

perform.

Using experts can provide high quality audit evidence in

specialist situations, but the auditor must be careful to

fully evaluate the findings of the auditor’s expert and not

to over-rely on their work.

For audit staff, working on this type of engagement can be

very rewarding, providing exposure to sometimes unusual

businesses.

REFERENCE/S

• www.accountingtools.com

• www.accaglobal.com

BIBLICAL INTEGRATION

Psalm 139:14

“I praise you, for I am fearfully and wonderfully made.

Wonderful are your works; my soul knows it very well.”

You might also like

- ACD-BOA-05 Rev 01 App Form Acc of Individual CPADocument3 pagesACD-BOA-05 Rev 01 App Form Acc of Individual CPAPrinchipe ni BebangNo ratings yet

- FM Chap 6 8 ProbsDocument41 pagesFM Chap 6 8 ProbsMychie Lynne Mayuga91% (11)

- Finc5000 HWDocument4 pagesFinc5000 HWjessicasellers9528100% (2)

- AA025 PYQ 2015 - 2014 (ANS) by SectionDocument4 pagesAA025 PYQ 2015 - 2014 (ANS) by Sectionnurauniatiqah49No ratings yet

- MODULE 1.0 - AUDIT IN SPECIALIZED INDUSTRIES (An Overview)Document16 pagesMODULE 1.0 - AUDIT IN SPECIALIZED INDUSTRIES (An Overview)Jene Lm100% (10)

- 09 Fraud, Error and Non-ComplianceDocument5 pages09 Fraud, Error and Non-ComplianceEdwina Cornel100% (1)

- NFJPIA Region XII 8th Annual Regional Convention Mock Board ExaminationDocument49 pagesNFJPIA Region XII 8th Annual Regional Convention Mock Board ExaminationRonnel Tagalogon100% (1)

- Chapter 25 - Substantive Test of LiabilitiesDocument10 pagesChapter 25 - Substantive Test of LiabilitiesQuijano GpokskieNo ratings yet

- Test Bank For Quiz BeeDocument5 pagesTest Bank For Quiz BeeRandy PaderesNo ratings yet

- Investing and Financing Cycle QuizDocument1 pageInvesting and Financing Cycle QuizAira Jaimee GonzalesNo ratings yet

- Audit in A CIS Environment 5Document2 pagesAudit in A CIS Environment 5Shyrine EjemNo ratings yet

- Auditing Specialised IndustryDocument3 pagesAuditing Specialised IndustryAcheampong AnthonyNo ratings yet

- Basic Accounting Reviewer Step 1 To 3Document12 pagesBasic Accounting Reviewer Step 1 To 3Mary Gleyne100% (1)

- Aud Spec 101Document19 pagesAud Spec 101Yanyan GuadillaNo ratings yet

- BanksDocument58 pagesBanksgrace100% (1)

- Audit of Companies Under Specialized IndustriesDocument19 pagesAudit of Companies Under Specialized IndustriesMarj Manlagnit100% (1)

- Specialized BusinessDocument16 pagesSpecialized BusinessMaritess LobrigoNo ratings yet

- Auditing in Specialized IndustriesDocument3 pagesAuditing in Specialized IndustriesJeremae Ann CeriacoNo ratings yet

- Audit of Cash and Cash Equivalents: Problem No. 20Document6 pagesAudit of Cash and Cash Equivalents: Problem No. 20Robel MurilloNo ratings yet

- Auditing and Assurance: Specialized Industries ACCO 30073: College of Accountancy and Finance Department of AccountancyDocument7 pagesAuditing and Assurance: Specialized Industries ACCO 30073: College of Accountancy and Finance Department of AccountancyLee Teuk100% (2)

- Audit of Specialized IndustriesDocument7 pagesAudit of Specialized IndustriesCatherine Bercasio Dela CruzNo ratings yet

- Auditing Theory 100 Questions 2015Document22 pagesAuditing Theory 100 Questions 2015Louie de la TorreNo ratings yet

- Applied Auditing 2Document11 pagesApplied Auditing 2Leny Joy DupoNo ratings yet

- Midterms Quiz 1 GdocsDocument41 pagesMidterms Quiz 1 GdocsIris FenelleNo ratings yet

- 1.0 Notes Cash and Cash Equivalents 1.0 Notes Cash and Cash EquivalentsDocument181 pages1.0 Notes Cash and Cash Equivalents 1.0 Notes Cash and Cash EquivalentsLawrence YusiNo ratings yet

- Audit of Cash TheoryDocument7 pagesAudit of Cash TheoryShulamite Ignacio GarciaNo ratings yet

- Psa 320Document18 pagesPsa 320Joanna CaballeroNo ratings yet

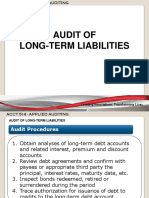

- Audit of Long-Term LiabilitiesDocument43 pagesAudit of Long-Term LiabilitiesEva Dagus0% (1)

- Quiz On Chapter 17: Ul-College of Accountancy Csc42: Auditing in A Cis EnvironmentDocument5 pagesQuiz On Chapter 17: Ul-College of Accountancy Csc42: Auditing in A Cis EnvironmentSyra SorianoNo ratings yet

- Auditing Problems: Audit of Cash and Cash Equivalents Problem No. 1Document21 pagesAuditing Problems: Audit of Cash and Cash Equivalents Problem No. 1ATLASNo ratings yet

- AFAR Qualifying ExamDocument7 pagesAFAR Qualifying ExamJeser JavierNo ratings yet

- INTRODUCTION TO FINANCIAL STATEMENT AUDIT and PRE ENGAGEMENT ACTIVITIES by Sir Rain SorianoDocument43 pagesINTRODUCTION TO FINANCIAL STATEMENT AUDIT and PRE ENGAGEMENT ACTIVITIES by Sir Rain SorianoSherwin DueNo ratings yet

- Auditing in A Computer Information Systems (CIS) EnvironmentDocument4 pagesAuditing in A Computer Information Systems (CIS) EnvironmentxernathanNo ratings yet

- ReceivablesDocument12 pagesReceivablesRizalene AgustinNo ratings yet

- Psa 401Document5 pagesPsa 401novyNo ratings yet

- Auditing Theory Cpa ReviewDocument53 pagesAuditing Theory Cpa ReviewIvy Michelle Habagat100% (1)

- Chapter 15 AnsDocument10 pagesChapter 15 AnsDave ManaloNo ratings yet

- Quiz 3 - Business Combination and Consolidated Financial StatementsDocument3 pagesQuiz 3 - Business Combination and Consolidated Financial StatementsMaria LopezNo ratings yet

- Audit Process - Performing Substantive TestDocument49 pagesAudit Process - Performing Substantive TestBooks and Stuffs100% (2)

- RESA Tax 1410 Preweek 165Document20 pagesRESA Tax 1410 Preweek 165Mike AntolinoNo ratings yet

- Substantive Test of Intangible Assets, Prepaid Expenses (Autosaved)Document38 pagesSubstantive Test of Intangible Assets, Prepaid Expenses (Autosaved)Mej AgaoNo ratings yet

- AUDITINGDocument11 pagesAUDITINGMaud Julie May FagyanNo ratings yet

- Reviewer For Liabilities and Substantive Test of LiabilitiesDocument4 pagesReviewer For Liabilities and Substantive Test of LiabilitiesErica FlorentinoNo ratings yet

- Semi-Final Examination: Auditing Assurance in Specialized IndustriesDocument3 pagesSemi-Final Examination: Auditing Assurance in Specialized IndustriesNikky Bless LeonarNo ratings yet

- Test Bank - NFJPIA - UP Diliman - Auditing Theory QuestionsDocument14 pagesTest Bank - NFJPIA - UP Diliman - Auditing Theory QuestionsMarkie Grabillo100% (2)

- P 1Document8 pagesP 1Ken Mosende TakizawaNo ratings yet

- Topic 1Document65 pagesTopic 1Carl Dhaniel Garcia SalenNo ratings yet

- Chapter 22 - Financial Reporing in Hyperinflationary EconomiesDocument19 pagesChapter 22 - Financial Reporing in Hyperinflationary EconomiesErwin Labayog MedinaNo ratings yet

- Prelim Set ADocument13 pagesPrelim Set AJanine LerumNo ratings yet

- Auditing Theory - TOCDocument16 pagesAuditing Theory - TOCmoreNo ratings yet

- Pre104: Auditing and Assurance: Specialized Industries 1. Overview of Auditing in Specialized IndustriesDocument2 pagesPre104: Auditing and Assurance: Specialized Industries 1. Overview of Auditing in Specialized IndustriesCristina ElizaldeNo ratings yet

- Module 13 - Intangible AssetsDocument13 pagesModule 13 - Intangible AssetsJehPoyNo ratings yet

- Audit and Assurance Bank and Other Financial InstitutionsDocument44 pagesAudit and Assurance Bank and Other Financial InstitutionsJohann Villegas100% (1)

- 1Document35 pages1Rommel CruzNo ratings yet

- Chapter 11 - RR: ConsignmentDocument17 pagesChapter 11 - RR: ConsignmentJane DizonNo ratings yet

- Module 2 - Major Specialized IndustriesDocument10 pagesModule 2 - Major Specialized IndustriesKalven Perry AgustinNo ratings yet

- 02 Audit of Mining Entities PDFDocument12 pages02 Audit of Mining Entities PDFelaine piliNo ratings yet

- Introduction To Financial Statement AuditDocument28 pagesIntroduction To Financial Statement AuditJnn CycNo ratings yet

- Psa 315Document18 pagesPsa 315Joanna Caballero100% (1)

- Audit of Banks: Audited Financial StatementsDocument7 pagesAudit of Banks: Audited Financial StatementsMa. Hazel Donita Diaz100% (1)

- CH 07Document50 pagesCH 07Janesene SolNo ratings yet

- KYLE DE VERA BSA-3A (Auditing & Assurance in SPCL Industries MT Exam) AnswersDocument3 pagesKYLE DE VERA BSA-3A (Auditing & Assurance in SPCL Industries MT Exam) AnswersKyree Vlade100% (1)

- Auditing in CIS Midter Exam QuestionsDocument3 pagesAuditing in CIS Midter Exam QuestionswmcapunoNo ratings yet

- Auditing Specialised IndustryDocument3 pagesAuditing Specialised IndustryAcheampong AnthonyNo ratings yet

- Chapter-4-Department-Of-Business-And-Administration SlidesDocument21 pagesChapter-4-Department-Of-Business-And-Administration SlidesKaram AlhajNo ratings yet

- Final Exam - Project Appraisal (Lumintang, Stephanie Rima)Document7 pagesFinal Exam - Project Appraisal (Lumintang, Stephanie Rima)tiphanie lumintangNo ratings yet

- PICPA Building, 700 Shaw BLVD., Mandaluyong CityDocument2 pagesPICPA Building, 700 Shaw BLVD., Mandaluyong CityPedro MarcoNo ratings yet

- Article Assistant: VisionDocument1 pageArticle Assistant: Visionഅരവിന്ദ് പ്രദീപ്No ratings yet

- POA Sessional-Paper IDocument5 pagesPOA Sessional-Paper Iwaseemhasan85No ratings yet

- Bahagian A Mengandungi LIMA Soalan. Jawab SEMUA.: BBAW2103 (SAMPLE 1)Document6 pagesBahagian A Mengandungi LIMA Soalan. Jawab SEMUA.: BBAW2103 (SAMPLE 1)Faidz FuadNo ratings yet

- Module 1 Financial Analysis and Reporting FM2Document10 pagesModule 1 Financial Analysis and Reporting FM2Christine Joy BieraNo ratings yet

- The British Accounting Review: James Guthrie, Federica Ricceri, John DumayDocument15 pagesThe British Accounting Review: James Guthrie, Federica Ricceri, John DumayHuỳnh Minh Gia HàoNo ratings yet

- Csec Poa May 2021 P2Document28 pagesCsec Poa May 2021 P2Daniella Alleyne 2GNo ratings yet

- Engineering EconomicsDocument12 pagesEngineering EconomicsAwais SiddiqueNo ratings yet

- Mess BillDocument1 pageMess BillJeffrish raidnNo ratings yet

- PRIA FAR - 018 Financial Statements (PAS 1, Etc.) Notes and SolutionDocument12 pagesPRIA FAR - 018 Financial Statements (PAS 1, Etc.) Notes and SolutionEnrique Hills RiveraNo ratings yet

- 2024W MGAC01 CPA Handbook Exercise 2 Q OnlyDocument7 pages2024W MGAC01 CPA Handbook Exercise 2 Q OnlyselyanmakhloufNo ratings yet

- Intermediate Accounting 3 Part 1: Cash Flows Objectives of Cash Flow StatementDocument19 pagesIntermediate Accounting 3 Part 1: Cash Flows Objectives of Cash Flow StatementAG VenturesNo ratings yet

- Accounts ReceivableDocument2 pagesAccounts ReceivableCaila Nicole M. ReyesNo ratings yet

- IFRS 6 - Exploration For and Evaluation of Mineral ResourcesDocument2 pagesIFRS 6 - Exploration For and Evaluation of Mineral ResourcesLoui BayauaNo ratings yet

- II Semester 2016-17 Course Handout BAV ECON F355Document19 pagesII Semester 2016-17 Course Handout BAV ECON F355Tushit ThakkarNo ratings yet

- 1.invoice April 2020Document7 pages1.invoice April 2020Astri SeptianiNo ratings yet

- N. Title Location: List of Examples IFRS 15 Revenue From Contracts With CustomersDocument27 pagesN. Title Location: List of Examples IFRS 15 Revenue From Contracts With CustomersHồ Đan ThụcNo ratings yet

- PHD in StrategyDocument16 pagesPHD in StrategyVinod JoshiNo ratings yet

- AccountancyDocument45 pagesAccountancyBRISTI SAHANo ratings yet

- Akdas 7Document4 pagesAkdas 7Titan TrenadyNo ratings yet

- Generic Papers Examination by Centre of Language StudiesDocument9 pagesGeneric Papers Examination by Centre of Language StudiesDennis CunninghamNo ratings yet

- Bukidnon2012 Audit ReportDocument157 pagesBukidnon2012 Audit ReportQuint Reynold DobleNo ratings yet

- Acc 2021 GR 10 T 1 Week 5 DJ Daj Eng v2Document7 pagesAcc 2021 GR 10 T 1 Week 5 DJ Daj Eng v2Linda Dladla100% (1)