0 ratings0% found this document useful (0 votes)

2 viewsPersonal Income Tax Inggris

Personal Income Tax Inggris

Uploaded by

AhlamCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Personal Income Tax Inggris

Personal Income Tax Inggris

Uploaded by

Ahlam0 ratings0% found this document useful (0 votes)

2 views47 pagesOriginal Title

Personal Income Tax inggris

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views47 pagesPersonal Income Tax Inggris

Personal Income Tax Inggris

Uploaded by

AhlamCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 47

Personal Income Tax

DISCUSSION

• General Income Tax: Definition, Legal basis, Tax Subject and

Subjective Tax Liability

• Income Tax Objects and Not Objects

• Expenses / fees that can and should not

deducted from gross income

• Non-Taxable Income (PTKP) and Income Tax Rates

• How to Calculate and Pay Income Tax

INCOME TAX (GENERAL) /

Definition and Legal Basis of Income Tax

• Income tax is a tax imposed on taxpayers on the income they

receive or earn in one tax year.

Income tax subject (tax subject) is anything that has the potential

to earn income and becomes the target to be subject to Income Tax

Taxpayer (WP) / taxpayer is a tax subject (individual / entity) who

has fulfilled subjective and objective obligations.

Legal Basis / The basics:

Income Tax Law, eg Law No. 36/2008

Government Regulation (PP), eg PP No 80/2010

Presidential Decree

KMK / PMK, for example KMK No 536/2000

Kep. Or Per. Director General of Taxes, eg Per 57/2009

Director General of Taxes Circular

LEGAL BASIS

• UU no. 7 of 1983 concerning Income Tax (PPh).

UU no. 7 of 1991 concerning the First Amendment to

Law no. 7 of 1983 concerning Income Tax

UU no. 10 of 1994 concerning the Second

Amendment to Law no. 1983 regarding Income Tax.

UU no. 17 of 2000 concerning the Third Amendment

of Law no. 7 of 1983 concerning Income Tax

UU no. 36 of 2008 regarding the Fourth Amendment

of Law no. 7 of 1983 concerning Income Tax

Income Tax Subject (ARTICLE 2 uu No

36/2008)

• 1. Personal

2. Undivided inheritance as a unit replaces those who

are entitled.

Body

BUT (Permanent Establishment)

Permanent Establishment is a tax subject whose tax

treatment is the same as that of a corporate tax

subject

The tax subject is also divided into domestic tax

subjects and foreign tax subjects

TAX SUBJECT

• Individual tax subjects can reside or reside in Indonesia or

outside Indonesia

An undivided inheritance is subject to a substitute tax,

namely replacing those entitled, namely the heirs.

Agency is a group of people and / or capital which is a

unit, whether doing business or not doing business, which

includes PT, CV, other companies, BUMN, BUMD under

whatever name and form, joint venture, cooperative,

pension fund, partnership, associations, foundations,

mass organizations, orsospol and similar, institutions, PE,

and other forms of bodies including mutual funds

TAX SUBJECT

• BUT is a form of business that is used by an

individual who does not reside in Indonesia or

is in Indonesia for no more than 183 days

within a 12 month period, or an entity that is

not established and domiciled in Indonesia, to

run a business or carry out activities in

Indonesia.

DOMESTIC TAX SUBJECTS

• The OP resides / is in Indonesia> 183 days in 12

months or intends to stay in Indonesia

• Bodies that are established or domiciled in

Indonesia, except for certain units of

government agencies that meet the specified

criteria

• Undivided inheritance as one unit

OVERSEAS TAX SUBJECTS

• OP resides / is in Indonesia in Indonesia for no more than

183 days or intends to stay in Indonesia and entities that

are not established or domiciled in Indonesia that carry

out business or carry out activities through a Permanent

Establishment in Indonesia

• The OP resides / is in Indonesia for not more than 183

days and an entity that is not established or domiciled in

Indonesia that can receive or earn income from Indonesia

does not from running a business or carrying out activities

through a Permanent Establishment

Important differences between domestic

and foreign tax subjects

Difference Domestic Tax Subject Foreign Tax Subject

Principles Domicile (Domestic and Source

Foreign Income) (Earnings earned by DN)

Tax base Net Income (Gross Pph Gross income

after deducting allowable

expenses)

Tariff / Tax rate General Tariff (Tariff Article Equivalent rates (20%) or

17 of the Income Tax Law), according to P3B (double

except for certain peng tax avoidance agreement)

The basis for determining Must Submit SPT Not subject to SPT (only

the tax payable / reporting through withholding tax

that is final)

Subjective Tax Obligation

• It means that the tax obligations that are

attached to the subject and cannot be

delegated to other people.

Determination of the start and end of

subjective tax liabilities for:

Type of Tax Subject Start Ends

DN-OP Tax Subject When Born Died or left Indonesia for

good

Domestic Tax Subject When Founded When Disbanded

Foreign tax subject in the When it started operating When it was disbanded in

form of Permanent in Indonesia Indonesia

Establishment

Non-PE Foreign Tax When he started earning When leaving Indonesia

Subjects income in Indonesia

Legacy Before dividing After being divided

TAX SUBJECT EXCLUSION (Article 3 paragraph

1 Law No. 36/2008 on Income Tax)

• 1. FOREIGN STATE REPRESENTATIVE AGENCY

• 2. OFFICERS 2 PERW. DIPLOMATIC

• 3. INTERNATIONAL ORGANIZATIONS

• 4. PERW OFFICERS. INTERNATIONAL ORGS

TAX OBJECT

• The object of tax is income, which is any

additional economic capability received or

obtained by a Taxpayer, whether originating

from Indonesia or outside Indonesia, which

can be used for consumption or to increase

the wealth of the Taxpayer concerned, under

whatever name and form.

LANJ .. TAX OBJECT

• Judging from the additional economic

capacity, income can be grouped into:

Income from work in employment and

independent employment.

Income from business and activities.

Income from capital or use of assets

Other income, namely income that cannot be

grouped into the previous three categories.

TYPES OF INCOME AS TAX OBJECT (ARTICLE 4

VERSE 1 of the PPH Law)

• compensation or remuneration in respect of work or services

received or obtained including salaries, wages, allowances,

honoraria, commissions, bonuses, gratuities, pension

payments, or other forms of compensation, unless otherwise

stipulated in this Law.

prizes from raffles or jobs or activities and awards;

Operating profit

profit due to sale or transfer of property

receipt of tax payments that have been charged as an

additional fee and payment of tax returns;

interest including premium, discount, and compensation for

debt repayment guarantees;

• g. dividends, in whatever name and form, including

dividends from insurance companies to policyholders, and

distribution of income from the cooperative.

h. royalty or compensation for the use of rights;

i. rent and other income in connection with the use of

assets;

j. receipt or collection of periodic payments;

k. gains due to debt relief, except up to a certain amount as

stipulated by a Government Regulation;

l. foreign exchange differences;

m. excess difference due to asset revaluation;

n. insurance premium;

• o. contributions received or obtained by an

association from its members, which consist of

taxpayers who run independent businesses or jobs;

p. additional net assets originating from income

that has not been taxed;

q. income from sharia-based businesses;

r. interest compensation as referred to in the Law

concerning general provisions and tax procedures;

and

s. Bank Indonesia's surplus.

Income subject to final tax (article 4

paragraph 2)

• a. income in the form of interest on deposits and other savings,

interest on bonds and government debt securities, and interest

on deposits paid by the cooperative to individual cooperative

members;

b. income in the form of lottery prizes;

c. income from transactions in shares and other securities,

derivative transactions traded on the stock exchange, and

transactions for sale of shares or transfer of equity participation

in a partner company received by a venture capital company;

d. income from transfer of assets in the form of land and / or

buildings, construction service business, real estate business, and

land and / or building leasing; and

e. other certain income,

TAX OBJECT EXCLUSIONS (Article 4

Paragraph 3)

• a. 1. assistance or donations, including zakat received by amil zakat bodies

or amil zakat institutions established or authorized by the government and

received by entitled zakat recipients or mandatory religious donations for

adherents of recognized religions in Indonesia, which are accepted by the

institution religions that are established or legalized by the government

and received by the entitled recipient of donations, the provisions of

which are regulated by or based on a Government Regulation and

2. grants received by blood relatives in a straight line of one degree,

religious bodies, educational bodies, social agencies including foundations,

cooperatives, or individuals running micro and small businesses, the

provisions of which are regulated by or based on a Regulation of the

Minister of Finance,

as long as there is no relationship with the business, work, ownership, or

control of the parties concerned;

Tax Object Exceptions

• b. legacy;

c. assets including cash deposits received by the entity as referred to in Article

2 paragraph (1) letter b as a substitute for shares or as a substitute for capital

participation;

d. compensation or compensation in connection with work or services

received or obtained in kind and / or enjoyment from the Taxpayer or the

Government, except for those provided by non-taxpayers, taxpayers who are

subject to final tax or taxpayers who use special calculation norms (deemed

profit) as referred to in Article 15;

e. payments from insurance companies to individuals in connection with

health insurance, accident insurance, life insurance, endowment insurance and

scholarship insurance;

f. dividends or a share of profits received or obtained by a limited liability

company as a resident taxpayer, cooperative, state-owned company, or

regional-owned business entity, from capital participation in a business entity

established and domiciled in Indonesia provided that:

• g. contributions received or obtained by a pension fund

whose establishment has been approved by the Minister

of Finance, whether paid by the employer or the

employee;

h. income from capital invested by pension funds as

referred to in letter g, in certain fields which are

stipulated by a Decree of the Minister of Finance;

i. part of profit received or accrued by members of limited

partnership whose capital does not consist of shares,

partnerships, associations, firms, and kongsi, including

the unit holders of collective investment contracts;

• j. income received or earned by a venture capital company

in the form of a share of profits from a business partner

entity that is established and runs a business or activity in

Indonesia, provided that the partner entity:

1. is a micro, small, medium-sized company, or which

carries out activities in business sectors regulated by or

based on a Regulation of the Minister of Finance; and

2. its shares are not traded on a stock exchange in

Indonesia;

k. scholarships that meet certain requirements whose

provisions are further regulated by or based on a Regulation

of the Minister of Finance;

• l. the excess received or obtained by a non-profit agency or

institution engaged in the field of education and / or research

and development, which has been registered with the agency in

charge of it, which is reinvested in the form of facilities and

infrastructure for educational and / or research and development

activities, within the a maximum period of 4 (four) years from the

time the excess is obtained, the provisions of which are further

stipulated by or based on a Regulation of the Minister of Finance;

and

m. assistance or compensation paid by the Social Security

Administering Body to certain taxpayers, the provisions of which

are further regulated by or based on a Regulation of the Minister

of Finance.

CALCULATING INCOME TAX

• Income tax payable is calculated by

multiplying a certain rate against taxable

income (PKP).

The PKP used as the basis for calculating the

income tax is calculated in different ways

depending on the type of taxpayer.

Apart from these methods of calculating PKP,

there is also a calculation of PKP using SPECIAL

CALCULATION NORMS.

Tax rates

• The tax rate is a certain percentage used to

calculate the amount of income tax payable.

In Indonesia, 2 tariffs apply, namely the general

rate in accordance with Article 17 of the Income

Tax Law and a special rate.

The system for applying the PPh tax rate in

accordance with Article 17 of the Income Tax Law

is divided into 2, namely domestic WPOP and

Domestic Corporate Taxpayer and Permanent

Establishment.

Domestic OP tax income tax rates

PKP layer Rates

Up to IDR 50,000,000 5%

Above IDR 50,000,000 to IDR 15%

250,000,000

Above IDR 250,000,000 to IDR 25%

500,000,000

Above IDR 500,000,000 30%

The highest tariff as referred to in paragraph

(1) letter a can be reduced to a minimum of

25% (twenty five percent) which is regulated

by a Government Regulation.

Corporate Income Tax Rates

• Domestic corporate taxpayers and Permanent Establishments, the

tax rate is 28%

The rate as stated above is 25% (twenty five percent) which comes

into force since the 2010 tax year.

Domestic corporate taxpayers in the form of a public company that

are at least 40% (forty percent) of the total paid-up shares traded

on the stock exchange in Indonesia and meet certain other

requirements may receive a rate of 5% (five percent) lower than

the rate. as referred to in paragraph (1) letter b and paragraph (2a)

which are regulated by or based on a Government Regulation.

The tariff imposed on income in the form of dividends distributed

to individual domestic taxpayers is a maximum of 10% (ten

percent) and is final.

Taxable Income (PKP)

• The calculation of PKP is divided into 5 groups

according to the type of WP, namely:

Corporate Taxpayer

Individual WP (OP) who keeps the books

WP OP using calculation norms

WP BUT

WP OP whose subjective tax liability covers

only a part of the tax year

PKP WP AGENCY

• PKP = NETTO INCOME

= GROSS INCOME - REDUCING / COSTS

APPROVED IN ACCORDANCE with the Income

Tax Law

PKP = NETTO INCOME - LOSS COMPENSATION

= (GROSS INCOME-REDUCTION / COSTS

APPROVED IN ACCORDANCE WITH THE PPh-

LOSS COMPENSATION Law)

PKP WP OP

• PKP = NETTO INCOME - PTKP

= Gross Income - Deductions / Fees permitted

in accordance with the Income Tax Law - PTKP

For Muslims who pay zakat to BAZIS, the

amount of zakat paid can be deducted from

their net income

PKP OP using Calculation Norms

• PKP = NETTO INCOME - PTKP

= (Business Turnover x NPPN Percentage) -

PTKP

NPPN = Calculation Norm of Net Income

Regulated in the Decree of the Director

General of Taxes Kep-536 /

PJ / 2000

WP BUTs and Individuals with their subjective

tax obligations are included in the tax year

• PKP BUT is the same as Domestic Agency WP.

PKP for WP OP payable in a tax year is calculated

based on the net income received or earned in part

of the tax year.

Example: Mr. Ahmad's income (TK / 0) for 3 months

is IDR 10,000,000

Annual income = 360 / 3x30 x IDR 10,000,000

Reduce PTKP

Obtained PKP

Calculate Tax Payable by multiplying PKP by tax rate.

Net Income Calculation Norms

• Correct and complete information about taxpayers is very

important to be able to impose fair and reasonable taxes

in accordance with the economic capability of the

taxpayers. To be able to present this information, the

taxpayer must keep books of account. But not all

taxpayers are able to keep books, therefore the law allows

individual taxpayers not to keep books on condition:

maximum gross circulation of Rp. 4,800,000,000.00 per

year.

apply within the first 3 months of the financial year.

keeping records.

TAX NOTICE (SPT) TAXPAYER FOR PERSONAL

TAXES

Form and Content of the Individual

Taxpayer's Annual Income Tax Return

• Legal Basis:

Regulation of the Director General of Taxes

PER-34 / PJ / 2010, as lastly revised with PER-

36 / PJ / 2015

Form and Content of the Individual

Taxpayer's Annual Income Tax Return

• Annual Income Tax Return of Individual

Taxpayers can be divided into 3, namely:

Annual Income Tax Return of Individual

Taxpayers who have income:

From business and / or independent work

From one or more employers

Those who are subject to final and / or final PPh

Other domestic / overseas

This SPT is coded Form 1770

• Annual Income Tax Return of Individual Taxpayers who

have income:

From one or more employers

In other countries, and / or

Those who are subject to final and / or final PPh

This SPT is coded Form 1770 S

Annual Income Tax Return for Individual Taxpayers who

have income other than business and / or independent

work with a total gross income from work of not more

than IDR 60,000,000 a year

This SPT is coded Form 1770 SS

Obligation to have NPWP for husband and

wife

• If there is a separation of assets agreement:

The wife is required to have her own NPWP (PH)

If there is no asset separation agreement:

The wife can choose whether to have her own

NPWP (MT) or join her husband's NPWP (KK)

If the husband and wife have lived apart based

on the Judge's Decision:

Husband and wife are required to have NPWP

separately (HB)

Example of filling

Provisions for the Combination of Husband

and Wife's Income

• All income or losses for a woman who is married at the

beginning of the tax year or at the beginning of the tax

year, as well as losses from previous years that have not

been compensated as referred to in Article 6 paragraph

(2) of the Income Tax Law are considered as income or

loss of her husband. , unless the income is solely

received or obtained from 1 (one) employer whose tax

has been withheld under the provisions of Article 21

and the work has nothing to do with the business or

independent work of the husband or other family

members.

Provisions for the Combination of Husband

and Wife's Income

• The net income of husband and wife with the

status of PH or MT is taxed based on the

combination of the husband and wife's net income

and the amount of tax to be paid by each husband

and wife is calculated according to their net

income ratio.

In the event that the husband and wife have lived

separately based on the judge's decision (HB), the

calculation of Taxable Income and the imposition

of taxes shall be carried out separately.

Provisions for the Combination of Husband

and Wife's Income

• The income of a minor child, regardless of source of

income and whatever the nature of the job, is

combined with the income of the parents in the same

tax year.

What is meant by "children who are not yet mature"

are children who are not yet 18 (eighteen) years old

and have never been married.

If a child is a minor, whose parents have separated,

received or earned income, the tax imposition is

combined with the income of the father or mother

based on actual circumstances.

Provisions for the Combination of Husband

and Wife's Income

• In the event that the wife chooses to exercise her tax rights

and obligations using the husband's NPWP (KK), the wife's

income is not combined with the husband's income (the

wife's income is considered Final income) in the event that

the wife's income is obtained from work as an employee

which has been deducted by Article 21 PPh. employer,

provided that:

the wife's income is solely obtained from one employer, and

The wife's income comes from work that has nothing to do

with the business or independent work of her husband or

other family members

Example of Calculation

• Taxpayer A who receives a net income from the business of Rp. 100,000,000.00

(one hundred million rupiah) has a wife who is an employee with a net income of

Rp. 70,000,000.00 (seventy million rupiah). If the wife's income is obtained from

one employer and the employer has deducted the tax and the job has nothing to

do with the husband's business or other family members, the net income of

Rp.70,000,000.00 (seventy million rupiah) is not combined with income A and the

tax imposition on the wife's income is final.

If apart from being an employee, wife A also runs a business, for example a beauty

salon with a net income of IDR 80,000,000.00 (eighty million rupiah), then the

entire wife's income is IDR 150,000,000.00 (IDR 70,000,000.00 + IDR 80,000,000,

00) combined with income A. With the combination, A is subject to tax on net

income of IDR 250,000,000.00 (IDR 100,000,000.00 + IDR 70,000,000.00 + IDR

80,000,000.00). The tax deduction on the wife's income is not final, meaning that

it can be credited against the tax payable on the income of Rp. 250,000,000.00

(two hundred and fifty million rupiah) which is reported in the Annual Income Tax

Return.

Example of Calculation

• If the wife runs a beauty salon business, the tax

imposition is calculated based on the total income of IDR

250,000,000.00 (two hundred and fifty million rupiah).

For example, the tax payable on this total income is

Rp.27,550,000.00 (twenty-seven million five hundred

and fifty thousand rupiah), so for each husband and wife

the tax is calculated as follows:

Husband: (100,000,000 / 250,000,000) x IDR 27,550,000

= IDR 11,020,000

Wife: (150,000,000 / 250,000,000) x IDR 27,550,000 =

IDR 16,530,000

You might also like

- Theatre Project Budget Template Round 1 2014Document2 pagesTheatre Project Budget Template Round 1 2014m_lefay75% (4)

- Business Unit Strategy Plan TemplateDocument58 pagesBusiness Unit Strategy Plan TemplateSharjahman100% (15)

- Rosenbaum and Pearl Investment Banking Summary Chps 1 To 3Document18 pagesRosenbaum and Pearl Investment Banking Summary Chps 1 To 3sgyn6cb4th0% (1)

- Reconciliation Process FlowchartDocument9 pagesReconciliation Process Flowchartzahoor80No ratings yet

- Introduction To Air Transport Economics PDFDocument696 pagesIntroduction To Air Transport Economics PDFOanna100% (1)

- Notes in TaxationDocument13 pagesNotes in Taxationjamaica_maglinteNo ratings yet

- Basic-Concepts-Ita 1961Document26 pagesBasic-Concepts-Ita 1961Gurpreet Sandhu100% (1)

- Tax Income in GeneralDocument38 pagesTax Income in GeneralRIRI RUMAIZHANo ratings yet

- Corporate Income TaxDocument24 pagesCorporate Income TaxRIRI RUMAIZHANo ratings yet

- International TaxationDocument6 pagesInternational Taxationsuyash dugarNo ratings yet

- Assignment Answer of Questions Raihan Shidqi Raditiya 1910533024Document3 pagesAssignment Answer of Questions Raihan Shidqi Raditiya 1910533024Raihan RaditiyaNo ratings yet

- Basic Concept of Income TaxDocument4 pagesBasic Concept of Income TaxNaurah Atika DinaNo ratings yet

- Topic 4-Income Tax Act-Imposition of Income TaxDocument35 pagesTopic 4-Income Tax Act-Imposition of Income TaxDeus MalimaNo ratings yet

- Tax Structure in India1Document9 pagesTax Structure in India1Subholina SenNo ratings yet

- EC1B1 - Intro TaxationDocument38 pagesEC1B1 - Intro TaxationZen Marcus RodasNo ratings yet

- Income TaxDocument32 pagesIncome TaxAeiaNo ratings yet

- Taxation System in IndiaDocument30 pagesTaxation System in IndiaSwapnil Pisal-DeshmukhNo ratings yet

- MidTerm Lesson Part 1Document34 pagesMidTerm Lesson Part 1ARMAN WAYNE ANGELESNo ratings yet

- Rubel Final Corporate Taxation in BDDocument8 pagesRubel Final Corporate Taxation in BDskn092No ratings yet

- E Filing Income Tax Return OnlineDocument53 pagesE Filing Income Tax Return OnlineMd MisbahNo ratings yet

- Situs of Taxation Literally Means Place of TaxationDocument19 pagesSitus of Taxation Literally Means Place of TaxationRowie Ann Arista SiribanNo ratings yet

- Wealth ManagementDocument10 pagesWealth ManagementAditi pandeyNo ratings yet

- Tax Planning and ManagementDocument16 pagesTax Planning and ManagementDeepika GuptaNo ratings yet

- Basic Concepts of Income TaxDocument12 pagesBasic Concepts of Income TaxSumaira AslamNo ratings yet

- Income Tax Law: An IntroductionDocument26 pagesIncome Tax Law: An Introductionekta singhNo ratings yet

- Income Tax Law: An IntroductionDocument31 pagesIncome Tax Law: An Introductionrajdeep pradhaniNo ratings yet

- Definition of Income Tax: FinanceDocument10 pagesDefinition of Income Tax: FinanceStXvrNo ratings yet

- Angela Jano - 2C1Document2 pagesAngela Jano - 2C1Angela Bea JanoNo ratings yet

- Penyegaran UU PPH (English) - RevisiDocument70 pagesPenyegaran UU PPH (English) - Revisifirst honey octavianiNo ratings yet

- B - Individual Taxation: PhilippinesDocument4 pagesB - Individual Taxation: PhilippinesJasper Allen B. Barrientos100% (1)

- Basic Concepts of WhatDocument31 pagesBasic Concepts of WhatRajdeep KarmakarNo ratings yet

- Income TaxDocument20 pagesIncome TaxuzmaNo ratings yet

- Learning Plan FABM 2 3-2 Q2Document11 pagesLearning Plan FABM 2 3-2 Q2Zeus MalicdemNo ratings yet

- With Its Rich Cultural Landscape and International PopulationDocument6 pagesWith Its Rich Cultural Landscape and International PopulationYongkiNo ratings yet

- Taxation 2 NIRCDocument84 pagesTaxation 2 NIRCEric GarciaNo ratings yet

- ITA BriefDocument16 pagesITA Brief128hrithikabishtNo ratings yet

- Corporate TaxDocument10 pagesCorporate TaxHasnain AliNo ratings yet

- Value Added Tax Black Book 2 2332Document47 pagesValue Added Tax Black Book 2 2332sanket yelaweNo ratings yet

- Tax Obligations For Individuals and CorporDocument4 pagesTax Obligations For Individuals and Corporgabriel6lambokNo ratings yet

- Unit 4Document112 pagesUnit 4Vetri Velan100% (1)

- Comparision Between Pre GST and Post Gst....Document26 pagesComparision Between Pre GST and Post Gst....Yash MalhotraNo ratings yet

- Module 1: Income Tax PrinciplesDocument18 pagesModule 1: Income Tax PrinciplesJun MagallonNo ratings yet

- income tax notes ggv unit 1Document10 pagesincome tax notes ggv unit 1rakesh.lilasiNo ratings yet

- Indian Taxation SystemDocument15 pagesIndian Taxation SystemassatputeNo ratings yet

- Direct and Indirect TaxesDocument17 pagesDirect and Indirect Taxeskchehria100% (6)

- Income Tax NotesDocument17 pagesIncome Tax Notesrushdarais7No ratings yet

- Economics Project Taxation Class 12thDocument40 pagesEconomics Project Taxation Class 12thHarshNo ratings yet

- Preliminaries Tax'Document14 pagesPreliminaries Tax'J A SoriaNo ratings yet

- Actual Intrenship ReportDocument83 pagesActual Intrenship ReportKshitija BalwadkarNo ratings yet

- National TaxDocument6 pagesNational TaxRoi RimasNo ratings yet

- CTP Unit 3Document10 pagesCTP Unit 3SANDEEP KUMARNo ratings yet

- Revenue Administration - Turkish Taxation System - 2015-08-09Document14 pagesRevenue Administration - Turkish Taxation System - 2015-08-09Tim JonesNo ratings yet

- Lesson 4.2 - TAXATION INCOMEDocument4 pagesLesson 4.2 - TAXATION INCOMEIshi MaxineNo ratings yet

- Summary of Income TaxDocument11 pagesSummary of Income TaxPriyanka KhadkaNo ratings yet

- I. Basic Concepts in Income TaxationDocument79 pagesI. Basic Concepts in Income Taxationcmv mendoza100% (1)

- Fabm2 TaxationDocument4 pagesFabm2 TaxationFrancine Joy AvenidoNo ratings yet

- Subject: Taxation Law-I: Chanakya National Law University, PatnaDocument20 pagesSubject: Taxation Law-I: Chanakya National Law University, PatnaKritika SinghNo ratings yet

- 3 Income Tax ConceptsDocument37 pages3 Income Tax ConceptsRommel Espinocilla Jr.No ratings yet

- Pragya Singh - 48Document8 pagesPragya Singh - 48pragya.ps267No ratings yet

- BasicDocument18 pagesBasicHello BrotherNo ratings yet

- 1itap Long NotesDocument13 pages1itap Long Notessatyam ranaNo ratings yet

- Indonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaFrom EverandIndonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaNo ratings yet

- Jose Rizal University SET: SubjectDocument2 pagesJose Rizal University SET: SubjectGreg DomingoNo ratings yet

- Raclannual Report For The Year 2018-19Document140 pagesRaclannual Report For The Year 2018-19shountyNo ratings yet

- Your Independent Investment AdvisorDocument4 pagesYour Independent Investment AdvisorMarcus GreenNo ratings yet

- Accounting of Non-Profit OrganizationsDocument22 pagesAccounting of Non-Profit OrganizationsNeelamaQureshiNo ratings yet

- Tax Finals ReviewerDocument52 pagesTax Finals ReviewerJezreel Y. ChanNo ratings yet

- Adani Ports SEZDocument19 pagesAdani Ports SEZNikhil JohriNo ratings yet

- Chapter 13 Lecture Notes (TA 2020) - Non-Financial and Current LiabilitiesDocument20 pagesChapter 13 Lecture Notes (TA 2020) - Non-Financial and Current LiabilitiesTSEvansNo ratings yet

- Taxable Earnings Hours/Day S Amount PHP Deductions Amount PHP Amount PHPDocument1 pageTaxable Earnings Hours/Day S Amount PHP Deductions Amount PHP Amount PHPKent CantoNo ratings yet

- Managerial Accounting: Assignment: 02Document5 pagesManagerial Accounting: Assignment: 02Asma HatamNo ratings yet

- Cash FlowDocument6 pagesCash FlowKailaNo ratings yet

- Business Plan For Co-OperativeDocument4 pagesBusiness Plan For Co-Operativeipkvgrmzg100% (1)

- IFB Solved ICAP Questions Aut. 24Document19 pagesIFB Solved ICAP Questions Aut. 24wk4630187No ratings yet

- Session 21 The First Meat Sector IPO Al Shaheer CorporationDocument23 pagesSession 21 The First Meat Sector IPO Al Shaheer CorporationAnas SohailNo ratings yet

- Basic Accounting Concept 1Document45 pagesBasic Accounting Concept 1孔垂文No ratings yet

- Chapter 1 Valuation Concepts MethodsDocument30 pagesChapter 1 Valuation Concepts MethodstjasonkiddNo ratings yet

- Cost of Capital FormulasDocument2 pagesCost of Capital FormulasGabrielle VaporNo ratings yet

- Draft of Agreement For Sale of A HouseDocument3 pagesDraft of Agreement For Sale of A HousesolomonNo ratings yet

- HL Portfolio +: Adventurous IncomeDocument2 pagesHL Portfolio +: Adventurous IncomekaynataNo ratings yet

- Q1. Patson Corp: Journal EntriesDocument2 pagesQ1. Patson Corp: Journal EntriesPrince-SimonJohnMwanzaNo ratings yet

- Consolidated Financial Statements (Part 3)Document39 pagesConsolidated Financial Statements (Part 3)Jade AlyssonNo ratings yet

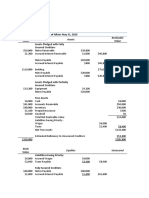

- Book Value Assets Realizable Value: Nama: Firda Arfianti NIM: 2301949596Document2 pagesBook Value Assets Realizable Value: Nama: Firda Arfianti NIM: 2301949596FirdaNo ratings yet

- Tally Important NotesDocument34 pagesTally Important NotesPasbanSaibanNo ratings yet

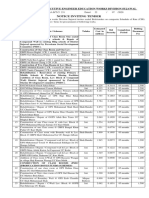

- Notice Inviting Tender: Office of The Executive Engineer Education Works Division SujawalDocument4 pagesNotice Inviting Tender: Office of The Executive Engineer Education Works Division SujawalalibuxjatoiNo ratings yet

- Dairy Queen Financial StatementsDocument2 pagesDairy Queen Financial StatementsHassan AliNo ratings yet

- Financial Marketing Group 4Document31 pagesFinancial Marketing Group 4Emijiano RonquilloNo ratings yet