0 ratings0% found this document useful (0 votes)

Huc-Asm 6

Huc-Asm 6

Uploaded by

kokebe birhanuCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

Huc-Asm 6

Huc-Asm 6

Uploaded by

kokebe birhanu0 ratings0% found this document useful (0 votes)

Original Title

HUC-ASM 6

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

Huc-Asm 6

Huc-Asm 6

Uploaded by

kokebe birhanuCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1/ 24

Chapter Six

The Nature of Strategy

Analysis and Choice

• After studying this chapter you be able to:

1. Describe a three stage framework for choosing

among alternative strategies

2. Identify important behavioral, political, ethical,

and social responsibility considerations in

strategy analysis

• and choice

• 3. Explain how to develop a SWOT Matrix,

SPACE Matrix, BCG Matrix, IE Matrix, and QSPM.

• 4. Discuss the role of organizational culture in

strategic analysis and choice.

The Nature of Strategy Analysis and Choice

Strategy analysis and choice seek to determine alternative

courses of action that could best enable the firm to achieve

its mission and objectives. The firm’s present strategies,

objectives, and mission, coupled with the external and

internal audit information, provide a basis for generating

and evaluating feasible alternative strategies.

Unless a desperate situation confronts the firm, alternative

strategies will likely represent incremental steps that move

the firm from its present position to a desired future

position.

Alternative strategies do not come out of the wild blue

yonder; they are derived from the firm’s vision, mission,

objectives, external audit, and internal audit; they are

consistent with, or build on, past

strategies that have worked well.

The Process of Generating and Selecting Strategies

Strategists never consider all feasible alternatives that

could benefit the firm because there are an infinite

number of possible actions and an infinite number of

ways to implement those actions. Therefore, a

manageable set of the most attractive alternative

strategies must be developed.

The advantages, disadvantages, trade-offs, costs, and

benefits of these strategies should be determined.

Identifying and evaluating alternative strategies should

involve many of the managers and employees who earlier

assembled the organizational vision and mission statements,

performed the external audit, and conducted the internal

Audit.

All participants in the strategy analysis and choice activity

should have the firm’s external and internal audit

information by their sides.

This information, coupled with the firm’s mission statement,

will help participants crystallize in their own minds particular

strategies that they believe could benefit the firm most.

Creativity should be encouraged in this thought process.

When all feasible strategies identified by participants are

given and understood, the strategies should be ranked in

order of attractiveness by all participants, with

1 .should not be implemented,

2 .possibly should be implemented,

3 .probably should be implemented, and

4 .definitely should be implemented.

This process will result in a prioritized list of best strategies that

reflects the collective wisdom of the group.

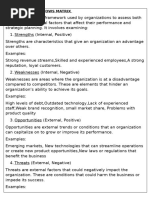

The Strengths-Weaknesses-Opportunities-Threats Matrix

The Strengths-Weaknesses-Opportunities-Threats (SWOT)

Matrix is an important matching tool that helps managers

develop four types of strategies:

1. SO (strengths-opportunities) Strategies,

2. WO (weaknesses-opportunities) Strategies,

3. ST (strengths-threats) Strategies, and

4. WT (weaknesses-threats) Strategies.

Matching key external and internal factors is the most

difficult part of developing a SWOT Matrix and requires

good judgment and there is no one best set of matches.

Strength: Opportunity Strategies use a firm’s internal

strengths to take advantage of external opportunities. All

managers Would like their organizations to be in a position

in which internal strengths can be used to take advantage of

external trends and events.

Organizations generally will pursue WO, ST, or WT strategies to

get into a situation in which they can apply SO Strategies.

When a firm has major weaknesses, it will strive to overcome

them and make them strengths.

When an organization faces major threats, it will seek to avoid

them to concentrate on opportunities.

WO Strategies aim at improving internal weaknesses by

taking advantage of external opportunities. Sometimes key

external opportunities exist, but a firm has internal

weaknesses that prevent it from exploiting those

opportunities.

ST Strategies use a firm’s strengths to avoid or reduce the

impact of external threats. This does not mean that a strong

organization should always meet threats in the external

environment head-on. Rival firms that copy ideas, innovations,

and patented products are a major threat in many industries.

WT Strategies are defensive tactics directed at

reducing internal weakness and avoiding external

threats.

An organization faced with numerous external

threats and Internal weaknesses may indeed be in a

precarious position. In fact, such a firm may have to

fight for its survival, merge, retrench, declare

bankruptcy, or choose liquidation.

There are eight steps involved in constructing a

SWOT Matrix:

1. List the firm’s key external opportunities.

2. List the firm’s key external threats.

3. List the firm’s key internal strengths.

4. List the firm’s key internal weaknesses.

5. Match internal strengths with external opportunities, and

record the resultant SO Strategies in the appropriate cell.

6. Match internal weaknesses with external opportunities,

and record the resultant WO Strategies.

7. Match internal strengths with external threats, and

record the resultant ST Strategies.

8. Match internal weaknesses with external threats, and

record the resultant WT Strategies.

A Comprehensive Strategy-Formulation Framework

Important strategy-formulation techniques can be

integrated into a three-stage decision making framework.

The tools presented in this framework Are applicable to all

sizes and types of organizations and can help strategists

identify, evaluate, and select strategies. These stages are:

1. The Input Stage

2. The Matching Stage

3. The decision Stage

Input Stage: The input tools require strategists to quantify subjectivity during early

stages of the strategy-formulation process. Making small decisions in the input

matrices regarding the relative importance of external and internal factors allows

strategists to more effectively generate and evaluate alternative strategies. Good

intuitive judgment is always needed in determining appropriate weights & ratings.

The Matching Stage

Strategy is sometimes defined as the match an

organization makes between its internal resources and

skills and the opportunities and risks created by its

external factors. Matching external and internal critical

success factors is a key to effectively generating feasible

alternative strategies.

Any organization, whether military, product-oriented,

service-oriented, governmental, or even athletic, must

develop and execute good strategies to win.

A good offense without a good defense, or vice versa,

usually leads to defeat.

Developing strategies that use strengths to capitalize on

opportunities could be considered an offense.

whereas strategies designed to improve upon

weaknesses while avoiding threats could be

termed defensive.

Every organization has some external

opportunities and threats and internal strengths

and weaknesses that can be aligned to formulate

feasible alternative strategies.

The above Boston Consulting Group(BCG) Quadrant

describes the matching stages a strategy.

Quadrant I: Question Marks—Divisions in this

Quadrant have a low relative market share position,

yet they compete in a high-growth industry.

Generally these firms’ cash needs are high and their

cash generation is low.

These businesses are called Question Marks

because the organization must decide whether to

strengthen them by pursuing an intensive strategy

(market penetration, market development, or

product development) or to sell them.

The Stars (Quadrant II): such businesses represent the

organization’s best long-run opportunities for growth and

profitability. Divisions with a high relative market share and

a high industry growth rate should receive substantial

investment to maintain or strengthen their dominant

positions. Forward, backward, and horizontal integration;

market penetration; market development; and product

development are appropriate strategies for these divisions

to consider.

Cash Cows (Quadrant III): Divisions positioned in have a high

relative market share position but compete in a low-growth

industry. This stage is called Cash Cows because they

generate cash in excess of their needs, they are often

milked. Many of today’s Cash Cows were yesterday’s Stars.

Cash Cow divisions should be managed to maintain

their strong position for as long as possible. Product

development or diversification may be attractive strategies for

strong Cash Cows. However, as a Cash Cow division becomes

weak, retrenchment or divestiture can become more

appropriate.

The Dogs Stage (Quadrant IV): divisions of the organization

have a low relative market share position and compete in a

slow- or no-market-growth industry; they are Dogs in the firm’s

portfolio. Because of their weak internal and external position,

these businesses are often liquidated, divested, or trimmed

down through retrenchment. When a division first becomes a

Dog, retrenchment can be the best strategy to pursue because

many Dogs have bounced back, after strenuous asset and cost

reduction, to become viable, profitable divisions.

In summary:

The major benefit of the BCG Matrix is that it draws attention to the

cash flow, investment characteristics, and needs of an organization’s

various divisions. The divisions of many firms evolve over time:

Dogs become Question Marks,

Question Marks become Stars,

Stars become Cash Cows, and

Cash Cows become Dogs in an ongoing

counterclockwise motion. Less frequently,

Stars become Question Marks,

Question Marks become Dogs,

Dogs become Cash Cows, and

Cash Cows become Stars (in a clockwise motion).

In some organizations, no cyclical motion is apparent. Over time, organizations

should strive to achieve a portfolio of divisions that are Stars.

The Decision Stage

Analysis and intuition provide a basis for making

strategy-formulation decisions. The matching

techniques just discussed reveal feasible alternative

strategies. Many of these strategies will likely have

been proposed by managers and employees

participating in the strategy analysis and choice

activity.

Any additional strategies resulting from the

matching analyses could be discussed and added to

the list of feasible alternative options.

Cultural Aspects of Strategy Choice

All organizations have a culture. Culture includes the set of

shared values, beliefs, attitudes, customs, norms,

personalities, heroes, and heroines that describe a firm.

Culture is the unique way an organization does business. It is

the human dimension that creates solidarity and meaning,

and it inspires commitment and productivity in an

organization when strategy changes are made.

All human beings have a basic need to make sense of the

world, to feel in control, and to make meaning. When events

threaten meaning, individuals react defensively. Managers

and employees may even sabotage new strategies in an

effort to recapture the status quo.

It is beneficial to view strategic management from a cultural

perspective, because success often rests upon the degree of

support that strategies receive from a firm’s culture.

If a firm’s strategies are supported by cultural products such

as values, beliefs, rites, rituals, ceremonies, stories, symbols,

language, heroes, and heroines, then managers often can

implement changes swiftly and easily.

However, if a supportive culture does not exist and is not

cultivated, then strategy changes may be ineffective or even

counterproductive. A firm’s culture can become antagonistic

to new strategies, and the result of that antagonism may be

confusion and disarray.

The Politics of Strategy Choice

All organizations are political. Unless managed, political

maneuvering:

consumes valuable time,

subverts organizational objectives,

diverts human energy, and

results in the loss of valuable employees.

Sometimes political biases and personal preferences get

unduly embedded in strategy choice decisions. Internal

politics affect the choice of strategies in all organizations

In the absence of objective analyses, strategy

decisions too often are based on the politics of the

moment.

With development of Improved strategy-formation

tools, political factors become less important in

making strategic decisions.

In the absence of objectivity, political factors

sometimes dictate strategies, and this is unfortunate.

Managing political relationships is an integral part of

building enthusiasm and esprit de corps in an

organization.

McKensy 7s framework

Strategy implementation requires the 7-S factors

1. Strategy: A set of decision & action which aims to gain

competitive advantage

2.Structure: The organizational chart presenting ,who reports

to whom, and how task to be divided.

3. Systems: Sequential activities engaged in the daily

operations

4.Style (leadership)

5. Staff (management):It is related to employees training

6. Shared values (culture):is subjected to commonly used

beliefs ,mindsets & assumptions

7.Skills (management):concerned with organization’s

dominant capabilities & competencies

You might also like

- Employee Retention Engagement and CareersNo ratings yetEmployee Retention Engagement and Careers25 pages

- A Synopsis On Inventory Management AT: Heritage Foods LimitedNo ratings yetA Synopsis On Inventory Management AT: Heritage Foods Limited9 pages

- Evaluation of Alternatives and Strategic Choice: Chapter # 7No ratings yetEvaluation of Alternatives and Strategic Choice: Chapter # 724 pages

- Sales and Distribution Management Kurdola Case Analysis Under The Guidance of100% (1)Sales and Distribution Management Kurdola Case Analysis Under The Guidance of7 pages

- Lecture 5 - Strategy Analysis and ChoiceNo ratings yetLecture 5 - Strategy Analysis and Choice24 pages

- Strategic MGT Chapter 4 (Last Modified New2003) 222No ratings yetStrategic MGT Chapter 4 (Last Modified New2003) 2229 pages

- Strategy Analysis and Choice: Learning ObjectivesNo ratings yetStrategy Analysis and Choice: Learning Objectives6 pages

- Unit 2 (Assign)strategic management submittedNo ratings yetUnit 2 (Assign)strategic management submitted5 pages

- Fred R. David Strategic Management 13e Chapter 6 NotesNo ratings yetFred R. David Strategic Management 13e Chapter 6 Notes6 pages

- What Are The Steps To Perform A Strategic Analysis?100% (1)What Are The Steps To Perform A Strategic Analysis?3 pages

- 2ND-TOPIC-LEARN-TO-THINK-STRATEGICALLY-INDUSTRY-ANALYSIS-AUGUST-2024 2No ratings yet2ND-TOPIC-LEARN-TO-THINK-STRATEGICALLY-INDUSTRY-ANALYSIS-AUGUST-2024 219 pages

- Introduction To Strategic Performance ManagementNo ratings yetIntroduction To Strategic Performance Management11 pages

- Module-Iv Swot Analysis Analyzing Company's Resources & Competitive PositionNo ratings yetModule-Iv Swot Analysis Analyzing Company's Resources & Competitive Position6 pages

- Name: Farhan Jamil Satti Roll No: BN524484 Subject: Strategic Management Assignment #: 1st Course Code: 5574No ratings yetName: Farhan Jamil Satti Roll No: BN524484 Subject: Strategic Management Assignment #: 1st Course Code: 557411 pages

- Gray Yellow Modern Professional Business Strategy PresentationNo ratings yetGray Yellow Modern Professional Business Strategy Presentation86 pages

- Chapter 1 Nature of Strategic ManagementNo ratings yetChapter 1 Nature of Strategic Management9 pages

- 469d0international Strategic Management For ClassNo ratings yet469d0international Strategic Management For Class20 pages

- Lec 1,2,3 Chapter Strategic Management EssentialsNo ratings yetLec 1,2,3 Chapter Strategic Management Essentials11 pages

- 5c617international Strategic Management For Class100% (1)5c617international Strategic Management For Class29 pages

- Chapter Six Strategy Analysis and Choice/Strategy FormulationNo ratings yetChapter Six Strategy Analysis and Choice/Strategy Formulation12 pages

- Strategy Formulation. Strategy Analysis & Choice (8-10M)No ratings yetStrategy Formulation. Strategy Analysis & Choice (8-10M)45 pages

- Chapter 1-Nature of Strategic ManagementNo ratings yetChapter 1-Nature of Strategic Management10 pages

- Chapter Five The Nature of Strategy Analysis and ChoiceNo ratings yetChapter Five The Nature of Strategy Analysis and Choice10 pages

- Strategic Analysis of Internal Environment of a Business OrganisationFrom EverandStrategic Analysis of Internal Environment of a Business OrganisationNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:554439300190723 Date of Filing: 19-Jul-2023No ratings yetIndian Income Tax Return Acknowledgement: Acknowledgement Number:554439300190723 Date of Filing: 19-Jul-20231 page

- Company Profile of PT. Hammadia Mineral Resources.100% (1)Company Profile of PT. Hammadia Mineral Resources.24 pages

- NHS FPX 6008 Assessment 3 Business Case For ChangeNo ratings yetNHS FPX 6008 Assessment 3 Business Case For Change8 pages

- R3 - Darden Board Ouster - A Warning To Corporate America - UnlockedNo ratings yetR3 - Darden Board Ouster - A Warning To Corporate America - Unlocked5 pages

- Assignment - Strategic Management: Answer No. 1)No ratings yetAssignment - Strategic Management: Answer No. 1)8 pages

- Case Study - Aquisition - HR Angle of The TATA-Jaguar Acquisition - Precise VersionNo ratings yetCase Study - Aquisition - HR Angle of The TATA-Jaguar Acquisition - Precise Version7 pages

- Presentation On Various Sources of Finance in Hospital ManagementNo ratings yetPresentation On Various Sources of Finance in Hospital Management10 pages

- Presentations Are Communication Tools That Can Be Used As Demonstrations, Lectures, Speeches, Reports, and More. PDFNo ratings yetPresentations Are Communication Tools That Can Be Used As Demonstrations, Lectures, Speeches, Reports, and More. PDF14 pages

- Municipio de Mariana and Others V BHP Group and AnotherNo ratings yetMunicipio de Mariana and Others V BHP Group and Another299 pages

- 2021 HEC Dow Jones Mid Market Buyout PE Ranking 1650144774No ratings yet2021 HEC Dow Jones Mid Market Buyout PE Ranking 165014477410 pages

- Abdul Waheed: AL-BUAINAIN GROUP (Kingdom of Saudi Arabia)No ratings yetAbdul Waheed: AL-BUAINAIN GROUP (Kingdom of Saudi Arabia)1 page

- Declining Balance Method of Depreciation: - Sajan Mahat Roll No.: 30No ratings yetDeclining Balance Method of Depreciation: - Sajan Mahat Roll No.: 3013 pages

- Indian Income Tax Return AcknowledgementNo ratings yetIndian Income Tax Return Acknowledgement1 page

- A Synopsis On Inventory Management AT: Heritage Foods LimitedA Synopsis On Inventory Management AT: Heritage Foods Limited

- Evaluation of Alternatives and Strategic Choice: Chapter # 7Evaluation of Alternatives and Strategic Choice: Chapter # 7

- Sales and Distribution Management Kurdola Case Analysis Under The Guidance ofSales and Distribution Management Kurdola Case Analysis Under The Guidance of

- Strategic MGT Chapter 4 (Last Modified New2003) 222Strategic MGT Chapter 4 (Last Modified New2003) 222

- Fred R. David Strategic Management 13e Chapter 6 NotesFred R. David Strategic Management 13e Chapter 6 Notes

- What Are The Steps To Perform A Strategic Analysis?What Are The Steps To Perform A Strategic Analysis?

- 2ND-TOPIC-LEARN-TO-THINK-STRATEGICALLY-INDUSTRY-ANALYSIS-AUGUST-2024 22ND-TOPIC-LEARN-TO-THINK-STRATEGICALLY-INDUSTRY-ANALYSIS-AUGUST-2024 2

- Module-Iv Swot Analysis Analyzing Company's Resources & Competitive PositionModule-Iv Swot Analysis Analyzing Company's Resources & Competitive Position

- Name: Farhan Jamil Satti Roll No: BN524484 Subject: Strategic Management Assignment #: 1st Course Code: 5574Name: Farhan Jamil Satti Roll No: BN524484 Subject: Strategic Management Assignment #: 1st Course Code: 5574

- Gray Yellow Modern Professional Business Strategy PresentationGray Yellow Modern Professional Business Strategy Presentation

- Chapter Six Strategy Analysis and Choice/Strategy FormulationChapter Six Strategy Analysis and Choice/Strategy Formulation

- Strategy Formulation. Strategy Analysis & Choice (8-10M)Strategy Formulation. Strategy Analysis & Choice (8-10M)

- Chapter Five The Nature of Strategy Analysis and ChoiceChapter Five The Nature of Strategy Analysis and Choice

- Strategic Analysis of Internal Environment of a Business OrganisationFrom EverandStrategic Analysis of Internal Environment of a Business Organisation

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:554439300190723 Date of Filing: 19-Jul-2023Indian Income Tax Return Acknowledgement: Acknowledgement Number:554439300190723 Date of Filing: 19-Jul-2023

- Company Profile of PT. Hammadia Mineral Resources.Company Profile of PT. Hammadia Mineral Resources.

- NHS FPX 6008 Assessment 3 Business Case For ChangeNHS FPX 6008 Assessment 3 Business Case For Change

- R3 - Darden Board Ouster - A Warning To Corporate America - UnlockedR3 - Darden Board Ouster - A Warning To Corporate America - Unlocked

- Case Study - Aquisition - HR Angle of The TATA-Jaguar Acquisition - Precise VersionCase Study - Aquisition - HR Angle of The TATA-Jaguar Acquisition - Precise Version

- Presentation On Various Sources of Finance in Hospital ManagementPresentation On Various Sources of Finance in Hospital Management

- Presentations Are Communication Tools That Can Be Used As Demonstrations, Lectures, Speeches, Reports, and More. PDFPresentations Are Communication Tools That Can Be Used As Demonstrations, Lectures, Speeches, Reports, and More. PDF

- Municipio de Mariana and Others V BHP Group and AnotherMunicipio de Mariana and Others V BHP Group and Another

- 2021 HEC Dow Jones Mid Market Buyout PE Ranking 16501447742021 HEC Dow Jones Mid Market Buyout PE Ranking 1650144774

- Abdul Waheed: AL-BUAINAIN GROUP (Kingdom of Saudi Arabia)Abdul Waheed: AL-BUAINAIN GROUP (Kingdom of Saudi Arabia)

- Declining Balance Method of Depreciation: - Sajan Mahat Roll No.: 30Declining Balance Method of Depreciation: - Sajan Mahat Roll No.: 30