0 ratings0% found this document useful (0 votes)

11 viewsFM Chap. 4

FM Chap. 4

Uploaded by

Ali HassenCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

FM Chap. 4

FM Chap. 4

Uploaded by

Ali Hassen0 ratings0% found this document useful (0 votes)

11 views15 pagesOriginal Title

FM CHAP. 4

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

11 views15 pagesFM Chap. 4

FM Chap. 4

Uploaded by

Ali HassenCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 15

CHAPTER – FOUR

THE FINANCING DECISION

BY: ALI.H

SEP.2024

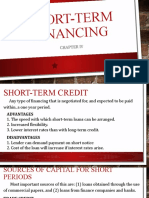

4.1 Short Term Sources of Finance

The repayment term of short term financing is usually shorter than one year.

Creditworthiness is an important aspect which the entrepreneur or the venture must satisfy

before any short term financing will be granted. The following aspects are considered

when assessing creditworthiness.

Character: The reputation of honesty and reliability.

Capacity: The business sense of the borrower, the level of experience and business history.

Circumstances: The general business circumstances in the industry and the economy.

Insurance Cover: The extent of the cover of insurable risks taken out by the borrower.

Guarantees: The lender may require the borrower to use assets to guarantee the loan.

4.1.1 Different Aspects of Short Term Finance

A. Trade creditors

• the basic source of finance and many entrepreneurs do not realise that by acquiring items

on credit they are obtaining short term finance.

• Credit just like any other source of finance has interest element hidden which most are not

able to recognize.

• The discount may be offered to encourage early payment and the receiving company may

not advantage of the discount the cost arise.

B. Terms of Trade Credit

Terms of credit vary considerably from industry to industry. Theoretically, four main factors

are determined the length of credit allowed.

The economic nature of the product: products with a high sales turnover are sold on short

credit terms.

The financial position of the buyer: if the buyer is in weak liquidity position he may take

long time to settle the balance.

Cash discounts: when cash discounts are taken into account, the cost of capital can be

surprisingly high.

C. Factoring

• Factoring involves raising funds on the security of the company’s debts, so that cash is

received earlier than if the company waited for the debtors to pay.

• Most factoring companies offer these three services: Sales ledger accounting,

dispatching invoices and making sure bills are paid.

Credit management, including guarantees against bad debts is the provision of finance,

advancing clients up to 80% of the value of the debts that they are collecting.

I. Sales ledger administration

The factoring companies will takeover the administration of receivable department,

maintaining the sales records, credit control and the collection of receivables.

II. Credit management

For a fee the factor can provide up to 100% protection against non payment of approved

sales. The factoring company will always assess the credit profile of an enterprise before

entering into such an agreement.

III. Provision of finance

This is the main product which most factoring companies offer. Factor companies provide

finance which is used to boost the working capital; of the business. The factoring is not as

cheap as may be the bank overdrafts .

D. Invoice Discounting

This is purely a financial arrangement which benefits the liquidity position of the enterprise.

Invoice discounting is the transferring of invoice to a finance house in exchange with

immediate cash.

E. Bank Overdraft

One of the most commonly used sources of short term of finance because of its cost and

flexibility. When borrowed funds are no longer required they can quickly and easily be paid.

F. Counter Trade

Counter trade is a method of financing trade, but goods rather than money are used to fund

the transaction. It is a form of barter.

It is a form of barter. Goods are exchanged for the other goods. This form of business for

private enterprises is diminishing in local trading but for international trade is still a popular

way of funding the business activities.

4.1.2. Short Term Financing and Lenders

Lenders favor businesses that exhibit strong management, steady growth potential and

reliable projected cash flow (demonstrating the business ability to pay the monthly interest

payments on this line of credit from its projected.

Why Do Firms Need Short-term Financing?

Cash flow from operations may not be sufficient to keep up with growth-related financing

needs.

Firms may prefer to borrow now for their inventory or other short term asset needs rather

than wait until they have saved enough.

Firms prefer short-term financing instead of long-term sources of financing due to:

• easier availability

• usually has lower cost (remember yield curve)

• matches need for short term assets, like inventory

4.1.3. Types of short-term loans

A. Line of Credit

• The borrowing limit that a bank sets for a firm after reviewing the cash budget.

• The firm can borrow up to that amount of money without asking, since it is pre-

approved

• Usually informal agreement and may change over time

• Usually covers peak demand times, growth spurts, etc.

• Promissory note

A legal IOU that spells out the terms of the loan agreement, usually the loan

amount, the term of the loan and the interest rate.

Often requires that loan be repaid in full with interest at the end of the loan period.

Usually with a Bank or Financial Institution; occasionally with suppliers or

equipment manufacturers

B. Estimation of Cost of Short-Term Credit

Calculation is easiest if the loan is for a one year period:

Effective Interest Rate is used to determine the cost of the credit to be able to compare

differing terms.

Effective = Cost (interest + fees)

Interest Rate Amount you get to use

4.2. Long term debt and lease

4.2.1. The Expanding Role of Debt

A lease of ten years or longer-Long-term leases are common in commercial real estate, but

unusual in residential real estate.

• Growth in corporate debt is attributed to:

– Rapid business expansion. Inflationary impact on the economy.

– Inadequate funds generated from the internal operations of business firms.

• Expansion of the U.S. economy has placed pressure on the Government to raise capital.

– New set of rules have been developed for evaluating corporate bond issues.

4.2.2. The Debt Contract

• Contract bond: the basic long-term debt instrument for most large U.S corporations –

basic items include:

– Par value: initial value of the bond.

• Principal or face value.

– Coupon rate: actual interest rate on the bond.

– Maturity date: repayment date of the principal.

• Bond indenture, a supplement to the bond agreement.

• Secured debts have specific assets pledged to bondholders in the event of default.

– These assets are seldom actually sold and distributed (proceeds).

– Terms used to denote collateralized or secured debts:

• Mortgage agreement: real property is pledged.

• After-acquired property clause: requires any new property to be placed under the

original mortgage.

– Greater the protection offered, lower the interest rate on the bond.

• Debt that is not secured by a claim to a specific asset.

– Debenture: unsecured long-term corporate bond.

• General claim against the corporation is common for defaults.

– Subordinated debenture

• Payment to the holder will occur only after the designated senior debenture

holders.

4.2.3. Methods of Repayment

• Does not always involve a lump-sum disbursement at the maturity date.

– Repayment of bonds can be done by:

• Simplest method - single-sum payment at maturity.

• Serial payments: paid off in installments over the life of the issue.

• Sinking-fund provision: semiannual/ annual contributions made into a fund run

by a trustee.

• Conversion: converting debt to common stock.

• Call feature: retire or force in debt issue before maturity.

Bond Prices, Yields, and Ratings

A. Bond Prices

• Financial managers must be sensitive to the bond market with regard to:

– Interest rate changes.

– Price movements.

• Market conditions will influence:

– Timing of new issues. Coupon rate offered Maturity date.

• Bonds do not maintain stable long-term price patterns.

B. Bond Yields

different ways Some of these different types of bond yields include among others, the so

called running yield, nominal yield, yield to maturity (YTM), yield to call (YTC) and yield to

worst (YTW).

C. Bond Ratings

• Two major bond rating agencies:

– Moody’s Investor Service.

– Standard and Poor’s.

• Ratings are based on a corporation’s:

– Ability to make interest payments. Working capital position

– Consistency of performance. Size. Debt-equity ratio.

4.2.4. Advantages of Debt

• Interest payments are tax-deductible.

• The financial obligation is clearly specified and of a fixed nature.

– Exception: floating rate bonds.

• In an inflationary economy, debt may be paid with ‘cheaper dollars.’

• The use of debt, up to a prudent point, may lower the cost of capital to the firm.

4.2.5. Leasing as a Form of Debt

• Leasing has the characteristics of a debt.

– A corporation contracts to lease and signs a non-cancelable, non-term agreement.

– Companies are expected to fully divulge all information about leasing obligations.

• Leasing was made official as a result of Statement of Financial Accounting Standards

(SFAS):

• Four conditions for identification include:

– The arrangement transfers ownership of the property to the lessee by the end of the

lease term.

– The lease contains a bargain purchase price at the end of the lease.

– The lease term is equal to 75% or more of the estimated life of the leased property.

– The present value of the minimum lease payments equals 90% or more of the fair

value of the leased property at the inception of the lease.

• Does not meet the conditions of a capital lease.

• Usually short-term, cancelable at the option of the lessee.

• The lessor may provide for the maintenance and upkeep of the asset.

• Does not require a capitalization, or presentation, of a full obligation on the balance sheet.

• Capital lease

– Requires treatment similar to a purchase-borrowing arrangement.

• Intangible asset is amortized, or written off, over the life of the lease - annual expense

deduction.

• Liability account is written off through regular amortization - implied interest cost on the

balance.

• Operating lease

– Requires annual expense deduction equal to the lease payment, with no specific amortization.

Advantages of Leasing

• Takes care of lack sufficient funds or the credit capability issues to purchase assets.

• Obligation may be substantially less restrictive.

• May not require a down payment.

• Lessor’s expertise – may reduce negative effects of obsolescence.

• Lease on chattels have no such limitations for bankruptcy and reorganization proceedings.

• Tax advantage factors include:

– Depreciation write-off or research related tax credits.

• Infusion of capital can occur if a firm chooses to engage in a sale-leaseback arrangement.

– Allows the lessee to continue the usage of the asset.

Thank you

for Your Attention

You might also like

- Lab Iii Audit of Sales and Collection Cycle: I. TujuanDocument8 pagesLab Iii Audit of Sales and Collection Cycle: I. TujuanyenitaNo ratings yet

- Document 10 4Document31 pagesDocument 10 4misganabbbbbbbbbbNo ratings yet

- Document 10 4Document31 pagesDocument 10 4misganabbbbbbbbbbNo ratings yet

- Ev1 FFDocument8 pagesEv1 FFwillyriverag15No ratings yet

- Ent 6Document26 pagesEnt 6workinehamanuNo ratings yet

- Unit 4 B Note - Long Term Debt and Prefered StockDocument18 pagesUnit 4 B Note - Long Term Debt and Prefered StockRajendra LamsalNo ratings yet

- Accounting For Management Decisions: Week 12 Financing The Business Reading: Text CH 14Document32 pagesAccounting For Management Decisions: Week 12 Financing The Business Reading: Text CH 14Raj TyagiNo ratings yet

- Chapter 5Document15 pagesChapter 5Nicole LasiNo ratings yet

- CH-6 Business FinancingDocument27 pagesCH-6 Business FinancingNatiphotography01No ratings yet

- Topic 4 - Sources of Finance - BasicsDocument36 pagesTopic 4 - Sources of Finance - BasicsSandeepa KaurNo ratings yet

- 8 SOBF notesDocument4 pages8 SOBF noteshetdpatel1205No ratings yet

- ch12 - Debt FinancingDocument60 pagesch12 - Debt Financingsongvuthy100% (1)

- FM Lo2Document28 pagesFM Lo2Minh Anh ĐỗNo ratings yet

- E BusinessfinanceDocument15 pagesE BusinessfinanceDipannita RoyNo ratings yet

- Current Liabilities ManagementDocument7 pagesCurrent Liabilities ManagementJack Herer100% (1)

- Debt and Equity Financing summaryDocument7 pagesDebt and Equity Financing summaryGiang Trần PhươngNo ratings yet

- Business Studies Notes - (: Accounting and Finance)Document10 pagesBusiness Studies Notes - (: Accounting and Finance)PN PNNo ratings yet

- Raising Funds Through EquityDocument20 pagesRaising Funds Through Equityapi-3705920No ratings yet

- FM1 Unit 4Document5 pagesFM1 Unit 4SimranNo ratings yet

- Source of FinanceDocument4 pagesSource of FinanceShaik ParvezNo ratings yet

- Financing - Debt Finance: Chapter Learning ObjectivesDocument9 pagesFinancing - Debt Finance: Chapter Learning ObjectivesDINEO PRUDENCE NONGNo ratings yet

- Presentation WPS Office 2Document43 pagesPresentation WPS Office 2danilocorpin4No ratings yet

- 1.2 and Short TermDocument18 pages1.2 and Short TermDeeNo ratings yet

- Banking Ppt3Document27 pagesBanking Ppt3pramil guptaNo ratings yet

- LM04 Fixed-Income Markets For Corporate Issuers IFT NotesDocument11 pagesLM04 Fixed-Income Markets For Corporate Issuers IFT Notessimranchotani.lsrNo ratings yet

- Presentation WPS OfficeDocument44 pagesPresentation WPS Officedanilocorpin4No ratings yet

- Sources of FinanceDocument10 pagesSources of FinanceOmer Uddin100% (1)

- Finance For Non Finance ProfessionalsDocument28 pagesFinance For Non Finance Professionalsneeraj petelNo ratings yet

- 6. Ent. ch. 6. pptDocument31 pages6. Ent. ch. 6. pptbekib2057No ratings yet

- FinancialDocument232 pagesFinancialks8004208135No ratings yet

- Busfin 7 Sources and Uses of Short Term and Long Term FundsDocument5 pagesBusfin 7 Sources and Uses of Short Term and Long Term FundsRenz Abad50% (2)

- Chapter 6 2Document7 pagesChapter 6 2ArkokhanNo ratings yet

- Final Case Study FM 108Document6 pagesFinal Case Study FM 108Jeff Beloso BasNo ratings yet

- Financial RequirementsDocument14 pagesFinancial RequirementsFiromsa DineNo ratings yet

- Financing Your Franchised BusinessDocument17 pagesFinancing Your Franchised BusinessDanna Marie BanayNo ratings yet

- Lecture 09Document17 pagesLecture 09simraNo ratings yet

- Financial MGTDocument1 pageFinancial MGTtuhin khanNo ratings yet

- Chapter 12 Senior SecurityDocument23 pagesChapter 12 Senior SecuritySumonNo ratings yet

- 1.sources of Long Term Finance-Sem2Document54 pages1.sources of Long Term Finance-Sem2simransharma3881No ratings yet

- Financial Management in Construction 3Document17 pagesFinancial Management in Construction 3malik mac100% (1)

- M-I-4.Sources of FinanceDocument21 pagesM-I-4.Sources of Financemonalisha mishraNo ratings yet

- FINANCE MANAGEMENT FIN420 CHP 9Document38 pagesFINANCE MANAGEMENT FIN420 CHP 9Yanty IbrahimNo ratings yet

- FM (Group 7)Document10 pagesFM (Group 7)Nasir RockNo ratings yet

- Chapter 5 Sources of FinancingDocument56 pagesChapter 5 Sources of FinancingTeku ThwalaNo ratings yet

- Chapter 6-8 - Sources of Finance & Short Term FinanceDocument8 pagesChapter 6-8 - Sources of Finance & Short Term FinanceTAN YUN YUNNo ratings yet

- Enter Chapter 6 RA-2Document26 pagesEnter Chapter 6 RA-2davemanNo ratings yet

- Sources of FinanceDocument19 pagesSources of Financedeveshrai1312No ratings yet

- 34 34 Sources of FinanceDocument23 pages34 34 Sources of FinanceShri DongareNo ratings yet

- Working Capital ManagementDocument30 pagesWorking Capital ManagementEvangelineNo ratings yet

- CH 4 Final FormattedDocument15 pagesCH 4 Final FormattedcaksashiqNo ratings yet

- Sources of FinanceDocument42 pagesSources of Financeravi bhushan100% (2)

- Get Chapter 8 Sources of Business Finance Class 11 Notes PDF For FREEDocument15 pagesGet Chapter 8 Sources of Business Finance Class 11 Notes PDF For FREEkimseo130120No ratings yet

- Pt7 - Lending To Business CustomersDocument38 pagesPt7 - Lending To Business Customerssavira andayaniNo ratings yet

- Finance PPT 2Document40 pagesFinance PPT 2api-679810879No ratings yet

- Chapter 2Document21 pagesChapter 2fentawmelaku1993No ratings yet

- Bank CreditDocument5 pagesBank Creditnhan thanhNo ratings yet

- CHAPTER 22 MA2Document6 pagesCHAPTER 22 MA2Ok TuckNo ratings yet

- Chapter 7. Sources of FinanceDocument20 pagesChapter 7. Sources of FinanceHastings KapalaNo ratings yet

- 3 Sources of FinanceDocument23 pages3 Sources of FinanceSuryakant FulpagarNo ratings yet

- The Art of Persuasion: Cold Calling Home Sellers for Owner Financing OpportunitiesFrom EverandThe Art of Persuasion: Cold Calling Home Sellers for Owner Financing OpportunitiesNo ratings yet

- QUEENS FM Fnal ExamDocument5 pagesQUEENS FM Fnal ExamAli HassenNo ratings yet

- QUEENS FM Fnal Exam 2Document5 pagesQUEENS FM Fnal Exam 2Ali HassenNo ratings yet

- FM Mid Exam Aug, 2024Document3 pagesFM Mid Exam Aug, 2024Ali HassenNo ratings yet

- FM Cha 3Document7 pagesFM Cha 3Ali HassenNo ratings yet

- StudentDocument3 pagesStudentAli HassenNo ratings yet

- Study Material Question Bank and Answer Key Economics: Money and CreditDocument14 pagesStudy Material Question Bank and Answer Key Economics: Money and CreditsaanviNo ratings yet

- Balance Sheet & Ratio AnalysisDocument24 pagesBalance Sheet & Ratio AnalysisPayal PatnaikNo ratings yet

- Case 1Document9 pagesCase 1William DC RiveraNo ratings yet

- CH 05Document10 pagesCH 05Antonios Fahed0% (1)

- CBSE Class 12 Accountancy Sample Paper 2020 Solved Set DDocument14 pagesCBSE Class 12 Accountancy Sample Paper 2020 Solved Set Dadibamahtab044No ratings yet

- MCQs For Banking LawsDocument18 pagesMCQs For Banking LawsAli Asghar RindNo ratings yet

- Accountancy Ques PaperDocument5 pagesAccountancy Ques Papersudarshanjha.0001No ratings yet

- 62230126Document20 pages62230126ROMULO CUBIDNo ratings yet

- Reading and SpeakingDocument4 pagesReading and SpeakingKarmaPoliceNo ratings yet

- Satisfy Short-Term Obligations.: Maintain IAS Levels of Preference and Ordinary DividendsDocument12 pagesSatisfy Short-Term Obligations.: Maintain IAS Levels of Preference and Ordinary DividendsJohn FloresNo ratings yet

- Action Construction Equipment LTD.: S'J.:JiqDocument15 pagesAction Construction Equipment LTD.: S'J.:Jiqjilu_siluNo ratings yet

- Chapter Two: Principles of Accounting and Financial Reporting For State and Local GovernmentDocument49 pagesChapter Two: Principles of Accounting and Financial Reporting For State and Local GovernmentYoseph KassaNo ratings yet

- Ultimate Book of Accountancy: Dr. Vinod Kumar Vishvas PublicationsDocument4 pagesUltimate Book of Accountancy: Dr. Vinod Kumar Vishvas PublicationsPramod VasudevNo ratings yet

- Articles 1173-1178 - 0Document10 pagesArticles 1173-1178 - 0luyangzapirahjoy10No ratings yet

- Indefinite Pronouns: Grammar WorksheetDocument6 pagesIndefinite Pronouns: Grammar Worksheetliceth marcela garcia baños100% (1)

- 5.25.23 Mayor Aftab Budget Transmittal LetterDocument3 pages5.25.23 Mayor Aftab Budget Transmittal LetterWVXU NewsNo ratings yet

- Dee Hwang Liong V AsiamedDocument1 pageDee Hwang Liong V AsiamedJeunaj LardizabalNo ratings yet

- Not For Profit OrganisationDocument8 pagesNot For Profit OrganisationNidhiNo ratings yet

- Affidavit of Ownership by RepossessionDocument1 pageAffidavit of Ownership by Repossessiongood hansNo ratings yet

- 문제은행 (2차) 국제재무기초 이상휘Document23 pages문제은행 (2차) 국제재무기초 이상휘JunNo ratings yet

- Unit 10 AssignmentDocument11 pagesUnit 10 AssignmentMd ArkanNo ratings yet

- Intermediate Accounting Volume 1 Chapter 5Document179 pagesIntermediate Accounting Volume 1 Chapter 5Catherine JaramillaNo ratings yet

- Sample FM 8Document22 pagesSample FM 8adventurineNo ratings yet

- Flipkart: Deal ReportDocument2 pagesFlipkart: Deal Reportakashtamhane1212No ratings yet

- Financial Analysis Spreadsheet From The Kaplan GroupDocument4 pagesFinancial Analysis Spreadsheet From The Kaplan GroupmagnatamaNo ratings yet

- Exam Business Law FinalDocument2 pagesExam Business Law FinalBENJIELITO EMPENADONo ratings yet

- Assignment-1 Grp-3-3Document8 pagesAssignment-1 Grp-3-3Gaurang GawasNo ratings yet

- Cash Flow StatementDocument7 pagesCash Flow Statementlianapha.dohNo ratings yet

- Affairs Mind May 2024 Best 200 MCQsDocument601 pagesAffairs Mind May 2024 Best 200 MCQsvarda.ghare09No ratings yet