User:Farcaster

Introduction

[edit]What did George Washington say about institutions like Wikipedia?

[edit]"Promote, then, as an object of primary importance, institutions for the general diffusion of knowledge. In proportion as the structure of government gives force to public opinion, it is essential that public opinion should be enlightened."

Some info about Farcaster

[edit]- Professional internal auditor with significant experience leading Sarbanes-Oxley compliance efforts.

- Multiple professional certifications and a graduate degree.

- Life-long traditional martial arts student with a background in Karate and Taekwon do.

Some articles I've worked on

[edit]- United States federal budget

- Subprime mortgage crisis

- Unemployment in the United States

- Strategic management

What this page is about

[edit]Wikipedia articles have to be fact-based with credible sources. However, this is a user page. I get to opine on whatever I want here. As I learn about a topic and find particular sources helpful, I put the info here or in the subject article. It helps me connect the current events dots. Further, the edit history gives me a record of how my views have evolved and changed over time. Writing them out helps me get my own thinking straight on the topic.

Cool things people can do

[edit]Now bring on the politics and economics!

A comment on the "post-truth" world (December 2016)

[edit]It's difficult to have a constructive argument or solve problems when people are shouting unsupported opinions past each other. Effective argument requires that a claim (opinion) be supported by credible statements (premises) that bear on the claim. In formal logic, an argument consists of two parts:

- Premises: One or more statements, each of which is demonstrably true or false.

- Claims: An opinion, conclusion or recommendation that the arguer believes flows from the premises, either with probability or certainty.

In addition, the concept of a fact is important:

- A fact is statement that is independently verifiable; anyone can look it up and agree. Otherwise, it is not a fact. A fact merely exists. Facts come from sources of varying credibility.

- In effective arguments, premises should contain factual statements that support the claim.

For example, here is a simple argument in terms of structure:

- Premise: "The CBO Budget & Economic Outlook: Fiscal Years 2009-2019 report states that extending the Bush income tax cuts after their scheduled 2010 expiration would add $2.9 trillion to the debt over the 2010-2019 period."

- Claim: Income tax cuts don't pay for themselves; they increase deficits and debt.

The fact contained in the premise is irrefutable; everyone can look it up and see that is indeed what the CBO reported. That makes it a fact; everyone can agree that is a true statement. Whether you agree or disagree with the claim is your own opinion. To me, the premise provides a high level of evidence that the claim is true as well. However, the truth of a claim is often a matter of probability; often only the Supreme Being knows the truth of the matter.

In the immortal words attributed to Daniel Patrick Moynihan: "You are entitled to your own opinions, but not your own facts." Facts are a common resource that everyone can draw upon and agree on; otherwise they are not facts. Without a solid fact base, our ability to solve problems is diminished and we create much more heat than light.

The NYT sums up the risks of a post-truth world here nicely: NYT-Truth and Lies in the Age of Trump

What is going on anyway?

[edit]The U.S. is transitioning from a Cold War strategy to the Globalization era. The past was about big geopolitical and military competition vs. the Soviet Union. The future is about economic competition with emerging nations, managing our changing demographics, managing the risk of failed states, and clean energy.

The near-collapse of our economy in 2008, narrowly averted by massive government borrowing and credit easing by the Fed, was a serious warning that Cold War policies won't cut it in the age of globalization. David Brooks wrote in the NYT: "The U.S. now has an economy shifted too much toward consumption, debt and imports and too little toward production, innovation and exports. It now has a mounting federal debt that creates present indulgence and future hardship." Thomas Friedman argues that "nation building at home" should be the key theme of American renewal for the 21st century.

Globalization

[edit]- Globalization is the integration/connection of economies due to technology, the free flow of trade and money, and supply chain innovation. It is the new global system replacing the Cold War, which ended with the fall of Soviet Union in 1989. The internet and PC are the main technology developments. Trade barrier removal means goods can be sourced and sold anywhere. The emergence of large bond management firms that can move billions electronically and instantly give them immense power in influencing policy globally. Innovations in supply chains allow goods to be made in low-wage countries and transported to high-wage countries for less than producing the goods domestically.

- Globalization is helping lift millions out of poverty in developing countries, shifting the world to economic competition instead of geopolitical and military competition. See Zakaria-The Secrets of Stability

- This is helping developing countries, who are winning with lower-priced labor, creating structural (long-term) unemployment in the U.S. and other developing countries. See Newsweek-Foroohar

- Labor power is declining along with union membership, which has fallen from around 30% in the 1960's to about 10% today. Very little of the private sector is unionized. Canada did not experience this decline, due to more labor-friendly policies. See Bloomberg-The Real Reason for Decline of American Unions

- Advances in automation / robotics are replacing millions of workers. U.S. manufacturing employment has declined by about 5 million jobs since 2000 (about one-third) but manufacturing output has returned to 2000 levels. Productivity is not being captured in wage increases for those with jobs. See NYT-Raging Against the Robots

While globalization represents a form of economic pressure, it can be countered by policy choices. The U.S. has decided in favor of corporations and against labor as of 2012 in its regulations. There are few incentives or penalties against off-shoring labor or sourcing inputs domestically. This is leading to higher unemployment, stagnating wages, higher income inequality, higher safety net costs (and corresponding budget deficits) and concerns of corporate oligarchy.

Corporatism

[edit]- Corporate power is increasing, as their ability to source goods and labor anywhere gives them power to bargain for lower taxes and more deregulation.

- U.S. corporate taxes are far below their historical average and OECD countries. Profits in 2012 were at record levels while unemployment was very high, a new divergence.

- Corporations are increasingly concentrated, with fewer larger players in major industries. This reduces competition and increases their influence in the political system.

- CEO and Chairman of the Board roles are often combined, a conflict of interest. Shareholders are supposed to elect boards to oversee management; this combines the two duties.

- CEO pay has grown from roughly 50x the average workers salary in the 1950's to about 250x.

Unemployment, income inequality and wage stagnation

[edit]Globalization and deregulation are shifting ever-more income to the top of the income spectrum. One example of the transmission mechanism is a CEO off-shoring (or sourcing overseas) thousands of jobs and holding wages constant, to earn a sizable bonus by hitting corporate profitability targets. Wages have stagnated for most of the population, with rising healthcare costs displacing wage increases. There are policy decisions related to trade, healthcare costs, and taxation that can help address the problem.

- Job creation is anemic. The U.S. created about 20 million jobs each decade from 1970-2000; it created about 6 million jobs 2000-2013.

- Income inequality is increasing. The top 1% got about 20% of the income in 2007, versus about 10% from 1950-1970.[1] The U.S. is 30th percentile in income equality, meaning 70% of the world has a more even income distribution, according to the CIA World Factbook.

The nature of things is that the rich / "capital" will take whatever they can get from the middle class / "labor" and so government exists to keep things from getting out of hand. So allowing corporate money in politics defeats the very purpose of government in the first place. So class warfare is well-underway and the middle class is losing big-time. Just laugh extra hard when you hear a Republican saying how Obama is preaching class warfare.

Bruce Bartlett has provided a nice summary of who pays the taxes and who gets government benefits.[2]

Demographics and fiscal sustainability

[edit]In terms of domestic policy, we must respond to the aging of America, with demographics changing from 5 workers per retiree in 1960, to 3.3 in 2009, to 2.1 by 2040. These changes require significant policy adjustments. We have no choice but to get back to a steeply progressive tax system for both individuals and corporations. We also have to throw every good idea at Medicare/ healthcare reform and reduce future cost of living adjustments in the Social Security program. If we don't, these programs ultimately absorb all government revenue and will squeeze out more and more other types of spending each year. The major government financial watchdogs (GAO and CBO) call our current fiscal path "unsustainable."

Financial instability

[edit]Due to the pressures of globalization and a consumer culture, U.S. household debt increased dramatically after 1980, rising from around 50% GDP to about 100% GDP by 2008. Much of the increase after 2000 was due to housing price increases. When the flow of credit was cut off in 2008, the banking system collapsed and a deep recession resulted. Recovery from financial crises often take a decade or longer, as consumers and businesses pay down debt ("de-leverage") rather than consuming and investing.

Views from the experts on U.S. strategy

[edit]Here are some thought-leaders on what to do next:

- See Brooks-NYT-The Nation of Futurity and Brooks-NYT-An Innovation Agenda

- See Friedman-NYT-More Poetry Please

- See Friedman-Advice from Grandma

- See Sachs-Econ Strategy

- See Porter-Business Week-Why the U.S. Needs an Economic Strategy

- See National Economic Council - A Strategy for American Innovation-September 2009

Polarization

[edit]As of early 2013, the U.S. Congress was the most polarized it has ever been. There are only about 10% moderates in the House. Voting is increasingly along party lines.[3]

Mann & Orstein put it well: "We have been studying Washington politics and Congress for more than 40 years, and never have we seen them this dysfunctional. In our past writings, we have criticized both parties when we believed it was warranted. Today, however, we have no choice but to acknowledge that the core of the problem lies with the Republican Party. The GOP has become an insurgent outlier in American politics. It is ideologically extreme; scornful of compromise; unmoved by conventional understanding of facts, evidence and science; and dismissive of the legitimacy of its political opposition. When one party moves this far from the mainstream, it makes it nearly impossible for the political system to deal constructively with the country’s challenges."[4]

It's on the Republicans to bring themselves back to center and the independent voters to avoid them until they do.

Initiatives

[edit]In my view, the key strategic approaches or initiatives are:

- Transitioning to a clean energy economy, including shifting from military production to clean energy investment and making ourselves oil-independent. This will require a price on carbon, with coal-based utilities paying more and nuclear/clean energy utilities paying less. President Obama has taken a great step, which was raising the fuel economy standards.

- Implementing policies to roll-back the impact of globalization on the workforce. This involves higher taxes on the wealthy to offset increasing safety net costs and to fund retraining and education programs; currency manipulation penalties for countries that won't let their currency float freely, generally giving their exporters an advantage; and devaluing the dollar moderately ("printing money").

These initiatives will reduce our $740 billion goods trade deficit significantly, avoid damage from the inevitable spikes in oil prices that create periodic recessions, and reduce our interests in the Middle East, which are incredibly costly in lives and treasure. Our ability to balance our budget over time depends significantly on our ability to compete globally, which is hampered by our dependence on both foreign oil and imports.

President Obama said on January 8, 2010: "Building a robust clean energy sector is how we will create the jobs of the future -- jobs that pay well and can't be outsourced. But it's also how we will reduce our dangerous dependence on foreign oil, a dependence that endangers our economy and our security. And it is how we will combat the threat of climate change and leave our children a planet that's safer than the one we inherited."

Fareed Zakaria wrote: "Our entire economic conversation these days is about the country's debt, which is understandable and appropriate because our debt is unsustainable in the long run. But we also need to find ways to solve the unemployment problem, or everything else, including the debt problem, will get much worse. Without more workers, we will never have the tax revenue we need to fund even limited government. Right now we have our priorities badly skewed. We spend far too much on retirement and health care programs for the elderly, the Defense Department and tax exceptions and deductions for the middle and upper classes. But we spend far too little on the investment programs that will create good new jobs for the future. We need to do both in a grand national rebalancing — and we need to do it fast." Fareed Zakaria - A Flight Plan for the American Economy - May 2011

China is building 50 nuclear power plants. See Friedman-China & Clean Energy

A second-term agenda for President Obama

[edit]Budget / Fiscal responsibility

[edit]Some good overviews of the budget situation:

- Bartlett-NYT-The Real Long-Term Budget Challenge

- Wonkblog-Everything You Need to Know About the Deficit

- CRS-Debt Ceiling History

- CBO-Debt Ceiling Options

What to do:

- Freeze defense and non-defense discretionary spending at 2012 levels, essentially keeping the Budget Control Act of 2011 sequester in place; no need to cut anything, just let inflation pare it back while we grow the economy.

- Let the Bush tax cuts expire for incomes over $250,000. Put a 50% bracket on income over $1 million.

- Initiate bi-partisan commission for Healthcare Cost Reform. The long-term budget challenge is mainly healthcare cost per capita.

- Don't let Social Security fall into deficit. Raise the payroll tax cap ($117,000 in 2014) to infinity, meaning tax all income. The Social Security actuaries estimate that doing so would reduce the projected program deficit by about 85%. The Urban Institute reported that: "Between 1983 and 2008, the share of total wages covered by Social Security and subject to tax has declined from almost 90 percent to about 83.5 percent because earnings have grown rapidly near the top of the earnings distribution." So income inequality is also hurting the financial status of the program.[5]

Clean energy

[edit]- Run a major infrastructure stimulus bill to put folks back to work building nuclear, solar, and wind clean energy plants.

- Put a price on carbon via a cap and trade system. Utilities that emit carbon above a threshold will pay a tax, while those that emit less than the threshold will get a bonus funded by those paying the tax. There is no need to raise the overall tax level, simply make it more expensive to emit lots of carbon while rewarding those who produce less.

- Establish a $0.10 cent gas tax and raise it $0.02 annually until it reaches $0.30. This will encourage more production and purchases of electric cars.

- Establish a bi-partisan commission to coordinate government and private industry efforts towards oil independence.

Corporate governance and banking reform

[edit]- Re-instate Glass-Steagall separation of investment and depository banking. Depository banks should be tightly controlled and run like utilities and can be relatively larger. Investment banks should be smaller and be allowed to take more risk.

- Breakup banks with over $300 billion in assets.

- Require the separation of CEO and Chairman of the Board roles. Shareholders are supposed to elect boards to select and watch over management. Allowing one person to lead both management and the board is a major conflict of interest, as the most important things that boards do are select and remove the CEO.

Employment and trade policy

[edit]- Attack the trade deficit and off-shoring, by taxing/tariffs for the wage differential when companies source or employ overseas. We've had a string of bubbles and some experts are saying our enormous trade deficit (imports greater than exports) is to blame. See Samuelson-Triple Crisis.

- Declare China and others as currency manipulators.

- Ask the Fed to set a higher inflation target, devaluing the dollar to make our exports more competitive.

Domestic / social policies

[edit]- Put in some prudent gun control measures, such as disallowing sales at gun shows, stronger background checks, more cops in schools, conceal carry permits for trained teachers, etc.

- Build a pipeline from the Mississipi to help the arid Western states. A great public works project; why let millions of gallons of fresh water flow into the ocean if you can divert a bit to places that need water? Fits nicely with the stimulus...

Military and Foreign Policy

[edit]- Get us out of Afghanistan by the end of 2014, except for special forces and drones and trainers.

- Use the bi-partisan commission model for a comprehensive risk assessment of the military and terrorism threats we face. Use this to re-prioritize and reduce spending. A steady-state spend of approximately $350 billion (about 2.5% of GDP or 15% of tax revenues) should be the long-term goal. This is drastically reduced from the current steady-state of around $550 billion, which excludes another $150 billion for Iraq/Afghanistan. Smarter policies and international cooperation will enable drastic spending reductions. It is our current large military expenditure and difficult financial circumstances that make the world extremely nervous. We can ill afford to have other countries begin military buildups in response to our continued spending. Even George Washington warned against overgrown military establishments.

Understanding the financial and economic crisis

[edit]Introduction

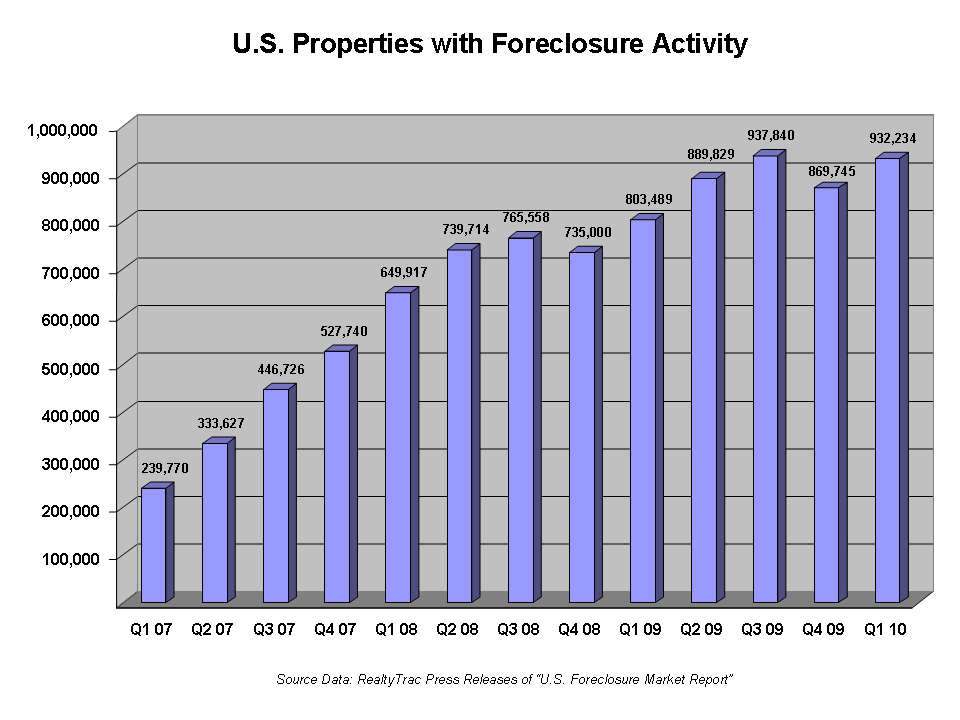

[edit]Trying to figure this thing out is one of my hobbies. Much of that journey is recorded in the Subprime mortgage crisis and Unemployment in the United States articles. Why did the world suddenly stop lending to us? Why was our system so vulnerable? Why aren't we creating jobs like we used to? Why didn't we see it coming? What do we do next?

It's arguable whether our economic model is working. Free trade with low wage countries and rapid progress in automation have slowed our jobs engine too much to keep our economy going. So the government has been borrowing a ton of money and the Federal Reserve has dialed-up the money printing presses.

Automation supporting a variety of self-service applications (e.g., banking via ATM, self-checkout in retail, online ordering, etc), plus industries such as manufacturing and logistics, are destroying jobs faster than they are being created. The truth is we haven't created jobs fast enough since about 2000, even with the bubble. Nobody seems to have a good answer yet and we spend far too much time arguing over "results" (budget deficits and unemployment) rather than causes (e.g., free trade and automation).

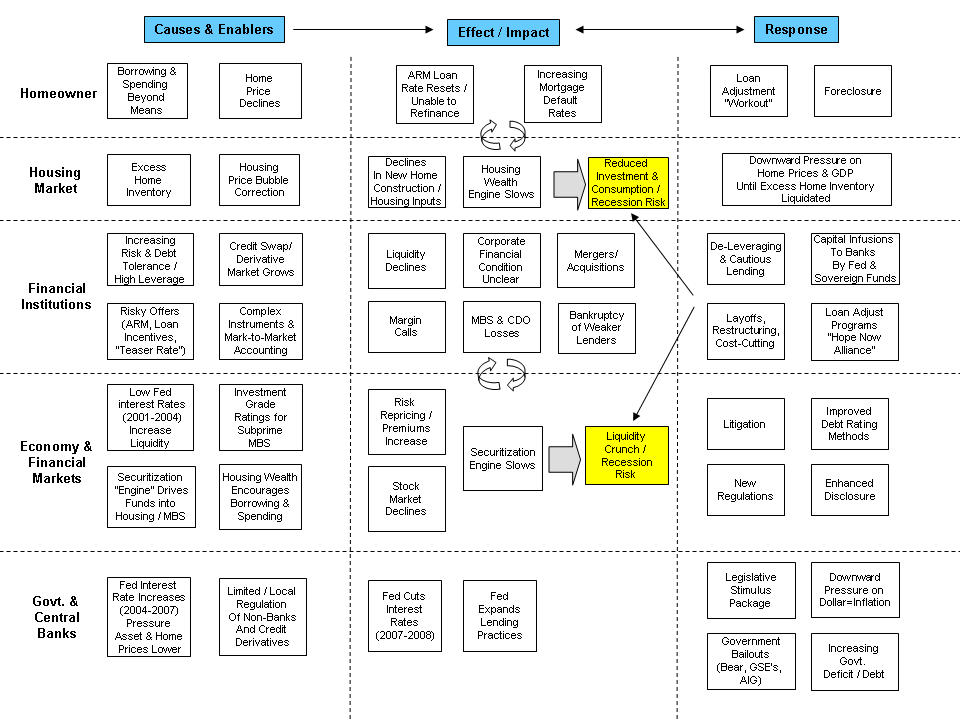

Causes

[edit]

Understanding the primary causes is a key first step. Financial innovation and easy credit conditions, among other factors, connected the $70 trillion global pool of fixed income investments to the housing markets of developed nations, driving an enormous debt and housing bubble. Subprime lending went from a historical level under 10% of originations, to 20% each year between 2004 and 2006, as lenders and regulators removed traditional controls such as a 20% housing down payment and income verification, to service demand from the global pool. During that time, major investment banks increased their leverage ratios from around 20, to over 30, taking on enormous risks yet getting huge rewards. These big 5 investment banks, 3 of which are now gone and the last 2 of which are now chartered as regular banks so the Fed could give them a lifeline, invented the complex and difficult to value financial instruments that brought the financial world to its knees. It was the private, barely regulated rating agencies with rampant conflicts of interest, that rated the toxic, garbage instruments "AAA" so investors all over the world would buy them. This funded the housing boom, which then became self reinforcing. Homeowners began to treat their homes as ATM machines, accumulating record personal debt levels. When the housing price bubble burst, the value of housing and related assets collapsed while the debt remained at full price, making many homeowners and financial institutions insolvent. Concerns over this insolvency caused credit markets to shut down. Since "too-big-to-fail" institutions existed that the government could not (or would not) shut-down with the proper hit taken by equity and bondholders, taxpayers had to step in.

In general, the nature of the resulting crisis is that the economy is resetting at a lower level because our debt-financed consumption binge is unsustainable. This crisis is better described as the "Great Reset" rather than the "Great Recession" as some call it. We cannot maintain a higher standard of living than the rest of the world, when foreign labor is increasingly competitive at much lower cost and barriers to free trade are removed. We have attempted to forestall this inevitable decline in our standard of living by borrowing. Individuals, banks, and corporations are over-leveraged, meaning they are carrying too much debt and are now defaulting. Therefore, short-term solutions should focus on reducing debt burdens, while financial reforms should focus on reinstating the key controls lacking or removed from the system due to deregulation. That's the easy part. The hard part is learning how to compete again, which will involve significant reductions in wages, consumption and imports and improving our educational system. GM is the warning shot that should wake us all up to this reality. If that isn't enough, consider the $12 trillion our nation has borrowed to finance our standard of living, the current huge budget shortfalls at the state level, or the unimaginably huge unfunded liabilities in the Medicare and Social Security programs, which our government cannot possibly honor.

Steve Pearlstein summarized this nicely: "But it's also important to remember that culpability for the crisis extends well beyond Wall Street bankers to asleep-at-the-switch regulators, conflicted rating agencies, sleazy brokers, greedy mortgage bankers, reckless money managers and millions of clueless homeowners, along with an entire country that insisted on living beyond its means." See Pearlstein-Washington Post

Solutions

[edit]

The best use of government stimulus or bailout funds is to stabilize the banking system and help people avoid foreclosure, so that private capital can return to salvage the banks' balance sheets. The second best use of government funds is to make the U.S. energy independent, so that we don't send so much wealth overseas. To the extent a stimulus package addresses these objectives, it makes sense. Otherwise, save the remainder for the social safety net (i.e., unemployment, food stamps, and universal health insurance).

It is the inability of homeowners to pay their mortgages that causes mortgage-backed securities to become "toxic" on the banks balance sheets. To use an analogy, it is the "upstream" problem of homeowners defaulting that creates toxic assets and banking insolvency "downstream." By assisting homeowners "upstream" at the core of the problem, banks would be assisted "downstream," helping both parties with the same set of funds. However, the government's primary assistance through April 2009 has been to the banks, helping only the "downstream" party rather than both.

The big short-term "to do's" to solve this:

- Systematically reduce mortgage balances by about 20-30%; in exchange, the banks would get a share of any future home appreciation.

- Convert ARM's to affordable (5%) fixed rate mortgages systematically (computer driven, not case-by-case).

- Ask bondholders at the largest 10 banks to take a 20% haircut, swapping debt for equity.

The big long-term "to do's" to prevent this from happening again involve putting the key leverage controls back into the system via regulation:

- Require 20% down payment on housing, with mortgage terms reasonable relative to the verified income and net worth of the buyer.

- Capital requirements/leverage restrictions for banks and lenders in the shadow banking system, which become more restrictive with the size of the institution. An 8% common stock ratio should be the starting point, rising to 15% for the mega-banks, as opposed to the 3-4% today. Canadian banks weathered the crisis effectively by maintaining a sufficient capital cushion.

- Breakup financial institutions that are "too big to fail."

- Limitations on the nature of assets owned and obligations assumed by large financial institutions, using a financial products safety commission. Our largest banks should not be allowed to issue or purchase subprime mortgages or instruments derived from them.

Learning to compete again:

- Get to clean energy independence by building 200 nuclear power plants and other clean energy infrastructure. Encourage electric cars, which must be made within U.S. borders by U.S. workers. This will create jobs and reduce the trade deficit. This is the "Put a Man on the Moon" challenge this country desperately needs. We are drifting and reacting, not leading and in control of our own destiny.

- Re-industrialize the U.S. We do not have a sustainable, stable economy with 80% of our workers in service industries and 40% of profits (now proven an illusion) from the banking sector. Financial products are not real products, they simply re-package money or define how money will be transferred. We must make more of what we consume; our trade deficit is robbing us of over $500 billion each year as we send wealth overseas. This may require some moderate protectionist measures in key industries. These manufacturing jobs may not pay a lot, as they must compete with lower-wage workers in other countries.

- Address income inequality. The argument of free-trade expanding incomes is moot when the top 10% (especially the top 1%) gets most of the benefit. We need to get back to a really progressive tax system, with very high marginal tax rates. Do not underestimate the rising backlash against globalization because only the top income brackets are getting the benefit.

- Create special schools to ensure everyone completes high school. These would be run like military schools. Nobody healthy drops out; the alternative is earning the GED in jail.

Addressing the budget deficit and debt

[edit]See: United States federal budget

Describing the problem

[edit]There is no immediate budget crisis as of early 2013, as interest rates were near record lows. The U.S. has enough demand for its securities or the Fed can buy them without significant risk of inflation while the economy recovers. However, the most serious long-term threat the U.S. faces is financial over-extension. Demographics and healthcare costs per person are driving entitlement costs to a level that cannot possibly be funded. Defense spending is entirely out of control. CBO projections of a $10 trillion national debt increase over the 2013-2022 decade under current policies indicate substantial risk, due to extremely high interest costs and increasing risk of a fiscal crisis, in which financial markets stop buying our debt. This issue has been ignored for years despite dire warnings from the CBO and GAO, which have called the fiscal path "unsustainable."

Congress often passes laws that would reduce the deficit then reverses them before the pain hits. For example, the Bush tax cuts were supposed to expire in 2010, but then were extended indefinitely for all but the wealthiest taxpayers via the American Taxpayer Relief Act of 2012, thereby avoiding the United States fiscal cliff. Further, the defense and non-defense discretionary spending cuts in the Budget Control Act of 2011 (also known as the sequester) are expected to be avoided.

CBO estimates of future spending and revenue relative to GDP assume strong growth (3-4%) over the 2013-2022 period. However, we are a mature economy and with globalization making the world more competitive, we would be lucky to have a 2% real GDP growth rate in the absence of gigantic government borrowing. Politicians cling to the belief that we can outgrow some or all of our problems, offering painless solutions, which is simply not realistic. Further, economic growth from around 1990 to 2008 was significantly financed by increasing levels of household debt, which is not sustainable.

Folks have to get prepared for spending cuts and tax increases. The sooner we act, the less drastic the changes from the status quo have to be.

Solutions

[edit]The goal is a sustainable budget deficit, roughly 2-3% GDP. We'll have to run a budget deficit roughly the same size as our trade deficit; see sectoral analysis for more information.

- Eliminate tax expenditures for the top 1%, roughly $300 billion/year. Eliminate some of the $550 billion/year that the next 19% get.

- Put Social Security on sound financial footing. The solutions are well-known. The most popular (or least despised) options are: a) Raising the level of income subject to the payroll tax from around $128,000 to infinity (so all income is taxed); b) Raise the payroll tax about 1 percentage point.

- Freeze defense spending so it falls to 3% GDP and maintain it at that level. The sequester would do this, if allowed to proceed. We last balanced the budget when defense spending was 3% GDP under Clinton; it was around 5-6% GDP in 2012. Focus on things that actually keep us safe from the threats we face; there is a terrible mismatch of spend and risk at present.

- Raise top income tax rates to 40% for income over $500,000 and 50% for income over $1 million.

- Tax stock buybacks, initially at 25% and increasing over time to 50%.

- Throw every good idea at Medicare and healthcare reform regardless of source. The key cost drivers are: obesity, defensive medicine, incentives that reward more care instead of better care, expensive intervention vs. inexpensive hospice, a shortage of doctors and nurses, fraud, redundant payment systems, and insurance company overhead. The 2010 debate was really about coverage; the key cost issues have yet to be addressed. Make it clear that if Medicare expenses hit a certain ratio of GDP, we begin the transition to a single-payer/rationing system similar to other developed countries that get similar results at half the cost. Give the private system one last chance to cut costs to the bone.

Do these solutions sound somewhat radical to some of you? Well, the choices get more painful the longer we wait. There are no free lunches; the credible experts say we cannot outgrow the problem and tax cuts increase deficits. Further, does a budget proposal that we add a trillion dollars a year indefinitely to our debt without detailed reform plans for Social Security, Defense, and Medicare sound a bit strange to you?

Our national debt of $21 trillion represents goods and services we have enjoyed beyond our national income. The government's plan to increase this debt by over $1 trillion each year for the indefinite future is a serious abdication of responsibility by our leaders. Those of you who oppose higher taxes and lower entitlement and defense spending are a huge part of the problem and need to begin to deal with the reality of the modern global economic competition the U.S. faces.

A great place for additional information on the budget crisis: GAO Presentation - January 2008 - Yep, Pre Obama

- See a great article on jobs: Tyson-NYT-Jobs Deficit, Investment Deficit, Fiscal Deficit

- See also Warren Buffet on the Deficit-August 2009

- See also Economist-Stemming The Tide-Nov 09

- See also Niall Ferguson-Empire at Risk-Nov 09

- See also Center on Budget and Policy Priorities-January 2010

- This article summarizes studies indicating tax cuts increase deficits: Washington Post-CBO, Treasury, Harvard say tax cuts increase deficits

Federal Reserve Vice-Chair Janet Yellen described the risks of growing deficits and debt in December, 2010:[6]

"A failure to address these fiscal challenges would expose the United States to serious economic costs and risks. A high and rising level of government debt relative to national income is likely to eventually put upward pressure on interest rates, thereby restraining capital formation, productivity, and economic growth. Indeed, once the economy has recovered from its downturn, fiscal deficits will crowd out private spending. Large fiscal deficits will also likely put upward pressure on our current account deficits with the rest of the world; the associated greater reliance on borrowing from abroad means that an increasing share of our future income will be required to make interest payments on federal debt held abroad, thereby reducing the amount of income available for domestic spending and investment. A large federal debt will also limit the ability and flexibility of policymakers to address future economic stresses and other emergencies, a risk that is underscored by the critical fiscal policy actions that were taken to buffer the effects of the recent recession and stabilize financial markets in the wake of the crisis. And a prolonged failure by policymakers to address America's fiscal challenges could eventually undermine confidence in U.S. economic management."

Tax Policy

[edit]A few facts about U.S. taxation:

- U.S. taxes are low relative to the OECD Developed Countries, about 27% GDP at all levels (Federal, state, local) versus the 36% GDP OECD average.

- U.S. revenues were 15.8% GDP in 2012, well below the historical average of 18.0% GDP. Revenues have been below average relative to GDP from 2009 onward.

- U.S. corporate income taxes were about 1.6% GDP in 2012, versus the 2.0% GDP historical average. They were 2.7% GDP in 2006 and 2007.

- U.S. corporations paid an effective tax rate of about 17% in 2012, versus 28% in 2000.

Do tax cuts increase deficits?

[edit]

Duh, yes.

- It is a economic fallacy that tax cuts increase government revenue; the evidence is clear they increase deficits. Conservatives may argue for tax cuts anyway because it is part of their core ideology of smaller government. It is an attempt to "starve the government beast."

- The CBO estimates the Bush tax cuts already cost the Treasury about $1.8 trillion over 10 years and will cost another $3.3 trillion if extended at all levels for a decade. CRS estimates they represent about 2% GDP of our deficit each year; the deficit was 7% GDP in 2012. See CBO Analysis of Bush Tax Cuts on page 6 and CBPP-Bush Tax Cuts Chart Book

- Krugman rips on the fallacy here: "Republicans remain committed to deep voodoo, the claim that cutting taxes actually increases revenues. It’s not true, of course. Ronald Reagan said that his tax cuts would reduce deficits, then presided over a near-tripling of federal debt. When Bill Clinton raised taxes on top incomes, conservatives predicted economic disaster; what actually followed was an economic boom and a remarkable swing from budget deficit to surplus. Then the Bush tax cuts came along, helping turn that surplus into a persistent deficit, even before the crash. But we’re talking about voodoo economics here, so perhaps it’s not surprising that belief in the magical powers of tax cuts is a zombie doctrine: no matter how many times you kill it with facts, it just keeps coming back. And despite repeated failure in practice, it is, more than ever, the official view of the G.O.P." See Krugman - Voodoo Economics-July 2010

- During 2003, over 450 economists, including 10 Nobel laureates, argued against the Bush 43 tax cuts. Their letter stated: "Passing these tax cuts will worsen the long-term budget outlook, adding to the nation’s projected chronic deficits. This fiscal deterioration will reduce the capacity of the government to finance Social Security and Medicare benefits as well as investments in schools, health, infrastructure, and basic research. Moreover, the proposed tax cuts will generate further inequalities in after-tax income." See Economists Letter Arguing Against Bush 43 Tax Cuts

- The Washington Post editorial board summarized other CBO, Harvard, and Treasury studies (some of them completed by conservative economists) that indicated tax cuts increase deficits. See A Heckuva Claim See also Washington Post - The Return of Voodoo Economics and Washington Post – Bush Should End His Tax Cut Myth

Sources of budget info

[edit]- CBO: Budget and Economic Outlook

- OMB: OMB-The President's Budget

- Treasury: Treasury - Combined Statement of Receipts, Outlays & Balances

- Treasury & GAO: Financial Report of the U.S. Government

Dealing with Terrorism & Al Qaeda

[edit]The goal of Al Qaeda is to bankrupt the U.S. It wins if we either over-spend trying to pursue an elusive enemy or let ourselves fall prey to fear and sacrifice our free way of life.

Fareed Zakaria put it brilliantly here: Zakaria-Perspective on Reacting to Terrorism

"The purpose of terrorism is not to kill the few hundred that are attacked, but to terrorize the tens upon tens of millions who watch. Terrorism is unique as a military strategy, in that it depends for its effectiveness on the response of the society. For it to work, all of us have to respond with fear and hysteria. So far, we're doing just that. I don't mean to suggest by this that the system worked. Obviously, it didn't. When U.S. officials got information from the terrorist's father, they should have immediately checked if he had a visa, or put him on a no-fly list. They should not have allowed him to enter an airplane with a bomb, a make-shift bomb. These are all mistakes. They should be fixed. But there will be other mistakes uncovered over the years as we continue going through this process. And we must have the ability to calmly, seriously and effectively react to these problems, improve the system, so that it gets better and better every year, rather than going crazy. The atmosphere in Washington these days, the media calls the political wrangling, the calls for heads to roll, these are all indications of panic -- and partisanship. And over-reacting will produce the worst policy responses -- large, broad-brush, expensive efforts, pat down thousands of more grandmothers every day, get the military involved in every place that claims they have al Qaeda. But these might not be the most effective fixes. We need less grandstanding from everyone, including the president of the United States, and more sober efforts to simply improve security and resilience within this country."

President Eisenhower said: "We will bankrupt ourselves in the vain search for absolute security." With the resources we have, we're likely to be able to afford to have trainers along with our special forces operating out of bases with drones helping spot and take out targets. We don't have the money to put 100,000+ plus troops on the ground indefinitely to win over a population in a place like Afghanistan. We need to do more nation building at home, while getting our troops and interests out of the Middle East by reducing our dependence on oil.

Healthcare reform

[edit]U.S. healthcare costs were approximately $3.2 trillion or nearly $10,000 per person on average in 2015. Major categories of expense include hospital care (32%), physician and clinical services (20%), and prescription drugs (10%).[7] U.S. costs in 2016 were substantially higher than other OECD countries, at 17.2% GDP versus 12.4% GDP for the next most expensive country (Switzerland).[8] For scale, a 5% GDP difference represents about $1 trillion or $3,000 per person. Some of the many reasons cited for the cost differential with other countries include: Higher administrative costs of a private system with multiple payment processes; higher costs for the same products and services; more expensive volume/mix of services with higher usage of more expensive specialists; aggressive treatment of very sick elderly versus palliative care; less use of government intervention in pricing; and higher income levels driving greater demand for healthcare.[9][10][11] Healthcare costs are a fundamental driver of health insurance costs, which leads to coverage affordability challenges for millions of families. There is ongoing debate whether the current law (ACA/Obamacare) and the Republican alternatives (AHCA and BCRA) do enough to address the cost challenge.[12]

Introduction

[edit]

Read this and be more informed than anyone else you know on this topic: New Yorker - Atul Gawande - The Cost Conundrum and New Yorker - Atul Gawande - Testing Testing

Delivery and payment systems

[edit]Think about healthcare reform in two parts:

- delivery system - how medical services are selected and executed for patients

- payment system - the administrative handling of payments

The delivery system is the most critical and difficult one to solve. Experts recommend setting up an independent panel (like a Federal Reserve only for medicine) to analyze the significant variation in costs across different geographies and hospital systems, both per person and for particular ailments. This would help doctors make the most cost-effective decisions. This requires better healthcare technology, statistical studies that examine treatment alternative cost-effectiveness, process improvements, mechanisms for sharing best practices, and incentives changes (e.g., salary instead of pay-for-service). This will be an iterative, empirical process that will take a decade or more according to experts before significant savings appears.

In the short run, we can tackle the payments system, which is a straightforward technical challenge but major political challenge. First, we should go to a single-payer system to minimize administrative costs. Replacing our private insurance system (1,300 companies) with one provider (Uncle Sam) would save $200 billion per year according to Paul Krugman, by removing insurance company overhead. There is a bill called the United States National Health Care Act that proposes this, which is what Americans should be fighting for right now. You pick your doctor and the government picks up the tab...its really simple from an administrative standpoint. If we cannot get this bill passed, then a public option is critical to beginning the transition. The complexity in this debate arises because we are trying to preserve the private insurance system. See Krugman on Single Payer

Medicare costs are not sustainable

[edit]Providing Medicare to 47 million uninsured will create an incremental cost of between $120 and $160 billion per year. Bear in mind we are already covering emergency care for these folks in the form of higher insurance premiums; the incremental costs are preventive care. Paul Krugman points out this would cost the Treasury less than the 2001 and 2003 Bush tax cuts. Further, it is close to what we are presently spending each year in Iraq and Afghanistan. Understand also that at present 47 million Americans are excluded from insurance coverage based on their income, nature of employment (corporate or otherwise) or pre-existing conditions. THIS IS RATIONING. I would much rather see rationing based on quality and quantity of life that is gained by incremental expense. Ultimately, we must assign a value to human life, as awful a task as that is, if we try to cover everyone. A prime example is Alzheimer's, which costs us an estimated $150 billion per year and growing rapidly. We should all be able to voluntarily sign a living will early in life that allows us to be put down with dignity once the disease hits a certain stage.

Solution options

[edit]- Mandatory coverage - health insurers must provide coverage to all, regardless of pre-existing conditions.

- Mandatory participation - all must pay health insurance premiums, with government subsidies for the poor.

- Public option - creating a public plan you can pay for instead of a private insurer. This would begin the transition to a single-payer system, which is why the insurance companies and the best Congress money can buy will fight it.

- Comparative effectiveness - understand why we pay twice as much in some cities versus others for similar ailments. Use this to identify best practices in medical services delivery.

- Tax some private (corporate-paid) benefits as income.

- Address "over-insurance" - Higher co-pays, with better coverage for catastrophic claims. Nobody should owe more than $3,000 at a time.

- Incentives - doctor salaries; experiment and analyze "pay for service" vs. salary options.

- Incentives - educational reimbursement for doctors and nurses that take on more Medicare patients and to get more people into the field.

- Incentives - tax breaks for the manufacturing of key medical equipment (e.g., MRI machines).

- Incentives - pay for reduced queue times for common non-emergency surgeries (like Sweden did, cutting their wait times).

- Technology - get everyone onto a single national system or multi-state regional systems, to enhance analysis.

- Tort reform - set standard, lower limits on lawsuits so doctors do not over-prescribe "defensive" medicine. This will dramatically reduce insurance premiums, lowering costs for all. We should also go after medical malpractice costs, which are estimated to be between 5-10% of total healthcare spending, due to defensive medicine and malpractice insurance premiums.

- Budgeting and rationing - set overall limits on how much we will pay. No heroic interventions if quality of life will not be improved. Prioritized spending within a defined limit. What in life is not rationed or limited? Why is healthcare exempt from reality? About 25-33% of Medicare spending is for people in last year of life.

Expert opinions

[edit]- See Krugman - Charlie Rose Interview

- See Peterson - Charlie Rose Interview 15 min in

- See - The Economist on U.S. Healthcare Reform

- See Singer - Healthcare Rationing Wow!

- See Gawande.com - Several good articles here

- See Cost of Medical Malpractice

- See Gingrich Op-Ed

- See Leonhardt-Cost Effectiveness Analysis

- Politics and process - need a high-profile commission to make recommendations to make major changes politically feasible. Should address all budget issues, not just healthcare. Budget processes, taxes, and benefit reductions. Peterson suggests Paul Volcker or Sam Nunn. His CEO at the Peterson foundation is David Walker, who should be on the team.

- Communicate about cost cutting measures now.

It is amazing that conservatives can fight so hard against universal insurance, yet advocate ANNUAL trillion dollar defense-related spending (Department of Defense, Homeland Security, and Veteran's Affairs). In other words, covering the 47 million without insurance coverage costs about 10-15% of what our national defense costs us. As I discuss elsewhere here, what threat justifies such a trade-off?

Talking Points & Strategies for Healthcare Reform

[edit]Key strategies for addressing healthcare reform are summarized in: Healthcare reform strategies

State the goals

[edit]There are three key goals:

- How to provide universal coverage, to ensure all Americans have access to quality preventive care and cannot have it taken away;

- Reducing healthcare delivery system costs, those services provided by your doctors, nurses, and hospitals, without compromising quality;

- Reducing payment system costs, those administrative or overhead costs related to billing and payments, which are about 30% of total costs.

Make the case for reform

[edit]Summarize the compelling case for reform. Key points:

- Medicare and Medicaid will eventually absorb all federal tax revenues. We cannot raise taxes enough to cover these costs; we will increasingly be forced to cut spending on Social Security and Defense to pay for Medicare.

- Millions more people will lose their health insurance as costs rise. The number of under-insured will also grow rapidly.

- Health insurance premiums are rising far faster than wages and in fact are increasingly displacing them.

- Real wages will stagnate or decline, as companies pay to cover increasing insurance premiums rather than salaries and wages.

- Medical bills are a leading cause of personal bankruptcy in the U.S., contributing to as many as 60% of them.

- Our companies will be less competitive, as they will be forced to raise prices to reflect their health insurance costs. This will also increase unemployment.

Explain why Medicare reform is essential and that tough choices are ahead: The U.S. is $12 trillion in debt now. The increasing costs of services provided by Medicare (due to an aging population and higher costs per person) make the program unsustainable in its present form. Eventually, Medicare absorbs all federal tax revenues. It has already begun forcing us to borrow, because we have yet to reduce other major spending categories like defense, social security, or education.

We are faced now difficult choices: Borrowing increasing amounts from other countries, big cuts in other spending categories like Social Security, Defense and Education, and large tax increases.

Mention that other developed countries have reformed their healthcare in a way popular with their citizens, such that quality care is being delivered at considerably lower cost than our system. Others have completed the path that we must undertake. We have entered an important debate in how best to do that. There are many with an interest in maintaining the status quo, but even they know that status quo is not sustainable. Time is not our ally; the longer we wait, the more painful the choices get.

Issue #1-Providing universal coverage

[edit]Explain the moral argument for covering all citizens. Every other developed country does it. No one should be excluded from insurance coverage due to pre-existing conditions. Explain how many Americans will lose their insurance, as more and more small companies are dropping coverage as costs increase. Explain how millions of Americans have only partial coverage. Be realistic that this is a new entitlement, which will cost about $100 billion per year, about 4% of our tax receipts in 2008. Explain that letting the Bush tax cuts expire on schedule will more than pay for this, as will our eventual draw-down in Iraq and Afghanistan. Since emergency care for the uninsured is represented in higher insurance premiums for those presently insured, you may see some relief in your premiums also.

It is the right thing to do for our fellow Americans, and it is affordable.

Issue #2-Reforming healthcare service delivery

[edit]Many experts believe the major cost-driver is the over-utilization of care. Doctors may over-prescribe tests, medicine, or procedures for a variety of reasons, some of which make sense and some of which do not. We must establish a sustainable process for systematically analyzing costs and outcomes and making sure we enable doctors to make the most cost-effective treatment decisions. Some experts believe it will take a decade or more years of hard work to reduce these costs, so we need to get started now. Propose a panel of doctors and other experts to oversee such analysis and recommend the most cost-effective treatment options.

There are various strategies for reforming service delivery: 1) Change doctor incentives, basing their compensation on salary and bonuses for value (quality relative to cost), rather than fee-for-services; 2) Establish a panel of experts to analyze medical spending across the country, to identify treatments that work at the most cost-effective price. 3) Improve technology, to make both delivery of services and paperwork processing more efficient; 4) Establish incentives for Americans to make healthy choices; 5) Encourage realistic discussions about end-of-life treatment options; 6) Tort reform; 7) Regulatory changes to encourage competition among insurers, who tend to have near-monopolies over particular geographies; and 8) Tax reform, to begin taxing some healthcare benefits as income.

Key cost drivers include:

- Obesity

- Defensive medicine

- Incentives that reward more care instead of better care

- Shortage of doctors, nurses and other healthcare professionals

- Redundant payment systems

- Fraud

- Heroic intervention at the end of life

Issue #3-Reducing payment system costs

[edit]Mention also that under our current system, we are all essentially paying a 30% markup in our insurance premiums to cover health insurer overhead. Perhaps half of that could be saved with a more efficient administrative model, as other countries have done with a single payer system. Drive this improvement with two key concepts:

- Require insurance companies to form a handful of regional or national payment clearinghouses, to significantly reduce overhead. This might take on a form like VISA or Mastercard, co-operatives that are mostly owned by banks but run as separate entities. All billing and payments could be routed through them, allowing streamlining of processes and automation. This would be a private-sector version of a single-payer entity;

- If the above does not reduce administrative costs sufficiently (say a 40% reduction in five years), then include a "trigger" to create a government option. This would encourage private insurers to dramatically reduce overhead and begin a transition to a single-payer system should it be necessary to more aggressively contain costs in the long-run.

Say that we may have no choice eventually but to go to a single payer model anyway, to reduce these overhead costs to minimize any further rationing of care. We may also have to set a budget or limit on annual Medicare expenditure, prioritizing treatment accordingly based on objective criteria, as is done in the UK.

This may be avoidable to a lesser or greater extent if other efforts are successful. Most other developed countries have single-payer systems to keep their costs low, as we do with Medicare and the V.A. system. If we use a public option, we could use these existing programs for those out of work or working for smaller companies, while those at large companies would be required to be part of that company's program. Tax or other incentives would have to be structured to keep as many under the private insurance option of big companies, keeping the public option for those out of work or at smaller companies.

Global warming: What you need to know

[edit]See: Scientific opinion on climate change

Scientific consensus

[edit]The scientific consensus is that climate change is real and man-influenced, with few or no scientific organizations dissenting formally from that consensus. The National Oceanic and Atomospheric Administration wrote in 2011:

"Human activity has been increasing the concentration of greenhouse gases in the atmosphere (mostly carbon dioxide from combustion of coal, oil, and gas; plus a few other trace gases). There is no scientific debate on this point. Pre-industrial levels of carbon dioxide (prior to the start of the Industrial Revolution) were about 280 parts per million by volume (ppmv), and current levels are greater than 380 ppmv and increasing at a rate of 1.9 ppm yr-1 since 2000. The global concentration of CO2 in our atmosphere today far exceeds the natural range over the last 650,000 years of 180 to 300 ppmv. According to the IPCC Special Report on Emission Scenarios (SRES), by the end of the 21st century, we could expect to see carbon dioxide concentrations of anywhere from 490 to 1260 ppm (75-350% above the pre-industrial concentration)." In other words, we are playing with fire.

Commentator views

[edit]Here's how Tom Friedman put it: See Friedman-Climate "When I see a problem that has even a 1 percent probability of occurring and is “irreversible” and potentially “catastrophic,” I buy insurance. That is what taking climate change seriously is all about. If we prepare for climate change by building a clean-power economy, but climate change turns out to be a hoax, what would be the result? Well, during a transition period, we would have higher energy prices. But gradually we would be driving battery-powered electric cars and powering more and more of our homes and factories with wind, solar, nuclear and second-generation biofuels. We would be much less dependent on oil dictators who have drawn a bull’s-eye on our backs; our trade deficit would improve; the dollar would strengthen; and the air we breathe would be cleaner. In short, as a country, we would be stronger, more innovative and more energy independent."

Friedman also said: "If you start the conversation with “climate” you might get half of America to sign up for action. If you start the conversation with giving birth to a “whole new industry” — one that will make us more energy independent, prosperous, secure, innovative, respected and able to out-green China in the next great global industry — you get the country." See Friedman-Denmark's Best Practices

Mayor Bloomberg: "...number one, the science is clear. But let's just make a simple argument that will convince you to go ahead and do something about the environment. There's four possibilities, the combinations of we're damaging the planet or we're not damaging the planet and we do something or we don't do something about it. One of those four combinations is deadly. And if we run the risk that, in fact, there is -- we say there's nothing wrong and it turns out that there was something wrong but we didn't do anything about it, it may very well be so irreversible and have such terrible consequences for people all over this globe, it's not an intelligent risk to run...We need a carbon tax, plain and simple. Nobody wants to hear it, but if you had a carbon tax, you would reduce the total amount of carbon put in the air." See Bloomberg on CNN

Here is the CBO: "Human activities around the world are producing increasingly large quantities of greenhouse gases, particularly carbon dioxide (CO2) resulting from the consumption of fossil fuels and deforestation. Most experts expect that the accumulation of such gases in the atmosphere will result in a variety of environmental changes over time, including a gradual warming of the global climate, extensive changes in regional weather patterns, and significant shifts in the chemistry of the oceans.1 Although the magnitude and consequences of such developments are highly uncertain, researchers generally conclude that a continued increase in atmospheric concentrations of greenhouse gases would have serious and costly effects." See CBO on Global Warming

International trade and competitiveness

[edit]

Computing the trade deficit

[edit]The trade deficit is imports greater than exports. Since foreign workers make the goods we import, a large trade deficit means a lot of jobs overseas instead of here. Our trade deficit is a net number, calculated from a goods deficit of about $740 billion and a services surplus of $180 billion, for a net $560 billion trade deficit in 2011.

Effect on employment

[edit]Since $150 billion is 1% GDP, the trade deficit was about 4% GDP in 2011. This represents about 4 million jobs. For scale, we had about 4 million fewer jobs at the end of 2012 than at the pre-crisis peak in January 2008.

Contribution to financial instability

[edit]One interesting tidbit is something called the balance of payments identity. It basically means that a net importer (i.e., a country running a trade or current account deficit) like the U.S. must borrow the money from abroad to finance these imports. In other words, we use "vendor financing" to purchase them in the words of historian Niall Ferguson. This begs an interesting question: If China stops lending to us, can we buy their goods? Is there a credible threat then of them doing so?

These huge trade deficits, which peaked at $800 billion in 2006, coincided with the peak in the housing bubble. They are related, although the mechanism is complex. Essentially, we send money to China and they send us goods. They then lend the money back to us, buying U.S. treasury bonds, Fannie Mae and Freddie Mac mortgage securities. Purchases of these mortgage-backed securities helped finance the housing bubble. A couple of sources I've found helpful in learning about this:

- See Bernanke-The Savings Glut and the U.S. Current Account Deficit

- See the short form of Bernanke's long piece above: Krugman-Revenge of the Glut

- See Robert Reich-WSJ Op Ed-China and the American Jobs Machine

Hidden costs of a trade deficit

[edit]Costs are created when we buy foreign goods that are not always readily apparent:

- We are buying goods made by workers in other countries rather than our own. Using a rule of thumb of 1% GDP = 1 million jobs, a 4% GDP trade deficit is about 4 million jobs. For scale, we were 4 million jobs below our 2008 employment peak in early 2013.

- By definition, a trade deficit must be financed by borrowing. So we incur incremental interest costs in the private sector.

- Since we are employing foreign workers instead of our own, this adds to safety net costs (e.g., unemployment compensation) and therefore to our budget deficit. During the 2009-2012 period, unemployment insurance was about $70-100 billion higher each year than pre-crisis.

- A higher budget deficit means higher federal interest costs as well as the private interest costs mentioned above.

- A trade deficit means foreign capital is pouring into the country, which contributed to our housing bubble and lower interest rates according to The Economist.

Currency manipulation

[edit]Paul Krugman has estimated that Chinese exchange rate policies cost the U.S. 1.4 million jobs. The Chinese currency should be allowed to appreciate, which is what typically happens when a country is running a large trade surplus. This would help the exports of other economies, as China's cheap currency makes their exports relatively more attractive. See Krugman - Chinese Mercantilism

Clean energy and competitiveness implications

[edit]Thomas Friedman wrote: "Andy Grove, co-founder of Intel, liked to say that companies come to “strategic inflection points,” where the fundamentals of a business change and they either make the hard decision to invest in a down cycle and take a more promising trajectory or do nothing and wither. The same is true for countries. The U.S. is at just such a strategic inflection point. We are either going to put in place a price on carbon and the right regulatory incentives to ensure that America is China’s main competitor/partner in the E.T. revolution, or we are going to gradually cede this industry to Beijing and the good jobs and energy security that would go with it." See Friedman-China & Green Energy

What is China up to? Friedman again: "In the last year alone, so many new solar panel makers emerged in China that the price of solar power has fallen from roughly 59 cents a kilowatt hour to 16 cents, according to The Times’s bureau chief here, Keith Bradsher. Meanwhile, China last week tested the fastest bullet train in the world — 217 miles per hour — from Wuhan to Guangzhou. As Bradsher noted, China “has nearly finished the construction of a high-speed rail route from Beijing to Shanghai at a cost of $23.5 billion. Trains will cover the 700-mile route in just five hours, compared with 12 hours today. By comparison, Amtrak trains require at least 18 hours to travel a similar distance from New York to Chicago.” China is also engaged in the world’s most rapid expansion of nuclear power. It is expected to build some 50 new nuclear reactors by 2020; the rest of the world combined might build 15."

Combating Dangerous Republican / Conservative Ideology

[edit]The myths and rebuttals

[edit]A short list of conservative nonsense commonly heard in the media, along with the rebuttal.

- Myth: "Tax cuts increase revenues." Fact: CBO estimates the Bush/Obama tax cuts will add $3 trillion to the debt if extended for a decade.

- Myth: "We have a spending problem not a revenue problem." Fact: CBO reported for FY2012 that spending of 22.8% GDP was 1.8% GDP above the historical average, while revenue of 15.8% GDP was 2.2% GDP away from historical average. In other words, the spending problem and revenue problem are comparable in size.

- Myth: "Higher marginal income tax rates slow job creation" Fact: There is no evidence of this. Per the CBPP, we grew jobs and GDP faster after the Clinton tax hikes than the Bush tax cuts.

- Myth: "Regulations kill jobs." Fact: There is no evidence of this. Some regulations probably create jobs and others destroy them; a generalization is not supported by evidence.

- Myth: "The crisis of 2008 was caused by Fannie, Freddie, and the Community Reinvestment Act (CRA)." Fact: The Financial Crisis Inquiry Commission concluded that Fannie & Freddie played a minor role and CRA played no role; the big investment banks (all of which collapsed or were bailed-out) weren't even subject to CRA or any other meaningful regulation.

- Myth: "Climate change is neither real nor man caused." Fact: As of mid-2011, not one globally-recognized scientific organization had dissented from the scientific consensus that climate change is real and man-caused. Some had a neutral view, neither agreeing nor disagreeing.

Why conservatives make this stuff up

[edit]We liberals know the above are myths that conservatives use to argue for their ideology. The conservative philosophy is low taxes, smaller government, except for big defense spending, with minimal restriction to the free market and international trade. Under this philosophy, people are supposed to fend for themselves, with the federal government primarily concerning itself with international relations and defense. This philosophy works well for the wealthiest two-thirds of us, for whom capitalism works. By nature however, there are winners and losers in a free market environment. And increasingly, our fates are intertwined as has become more apparent with the current crisis. When the poor or unemployed cannot pay their mortgages, more fortunate folks pocketbooks take a hit. Further, the more income and wealth becomes concentrated with the few rather than spread among the many, the less overall buy-in to the system exists. If the poor and middle-classes see the fruits of their increasingly productive labor captured by a wealthy elite, the system will eventually collapse.

In addition, energy independence and environmental protection do not have effective free market incentives. Cheap oil drives bad behavior. The U.S. consumes energy resources disproportionally to its population and is among the largest polluters. Whether we believe in the science of global warming or not, world opinion is very negative against us regarding these issues and we have been an impediment to progress, rather than a leader. The government can provide helpful incentives, through auto mile-per-gallon (mpg) and emission standards, carbon cap & trade regimes, funding for nuclear plants and clean energy, etc.

Nevertheless, Republican philosophy increasingly revolves around tax cuts, because they think eventually this should "starve the [big government] beast." This really means they want big cuts in Social Security and Medicare, as these are the big-ticket items in the budget that compete with defense and require significant taxes. (President Bush tried to do this with his ridiculous privatization proposal, for example). In addition, these programs represent an enormous wealth transfer from the rich to the poor. They try to conceal this agenda, saying tax cuts are about economic growth. They often cite Reagan, saying his tax cuts grew the economy. Well, see the charts on this page for the truth there; Reagan was a huge spender (over 22% of GDP on average). Keynes would argue it was this spending that grew the economy. Income tax revenues declined under Bush 43 after his 2001 & 2003 tax cuts and did not regain their 2000 peak until 2006, the peak of an unsustainable debt-financed economic boom. Deficits and debt increases under Reagan and Bush 43 were significant. There is clear historical evidence tax cuts increased government deficits dramatically from these administrations. Studies from CBO, Treasury and Harvard say a dollar of tax cuts increases the deficit from 50 cents to 90 cents. Why? Since tax revenues are about 20% of GDP, it would take nearly 5 dollars of incremental GDP growth to offset a dollar of tax cuts. Nobody credible believes that happens.

Unfortunately, the U.S. just borrows money instead of cutting spending, surrendering control over our future to foreign countries and pushing the burden and risk of a weaker financial position to our kids. We need to tax to cover our spending, period. Not taxing sufficiently also adds money to the system during boom times, bidding up asset prices and causing bubbles to develop. We need to get back to the steeply graduated tax system the U.S. had in the past, which worked quite well. This means the wealthy need to pay a lot more--they've got the money. We might also consider a counter-cyclical tax regime, in which taxes increase when economic growth exceeds a particular rate.

Other Conservative diversions

[edit]Republican strategists also use various diversionary tactics that are easy to rebut with a bit of explanation:

- Defense: This dangerous Republican strategy is to scare Americans into believing that we must spend enormous amounts of money on defense to keep ourselves safe from terrorism. However, short of a nuclear terror attack we can take whatever the enemy can dish out. Preventing a terror attack is primarily a police, intelligence, and special forces matter that requires good relations with countries all over the world. Spending $600 billion steady-state and another $150 billion for Iraq & Afghanistan may very well bankrupt us. In general, any defense spending above a bare minimum is deficit financed and increases the national debt. That is a much bigger threat than terrorism. The next major attacks may be through cyberspace; tanks and planes don't do a whole lot there to protect us either. Nor do they protect us from some foreign country shipping a nuke in a container. Joseph Stiglitz put it well: "With so much money spent on weapons that don't work against enemies that don't exist, there is ample room to increase security at the same time that we cut defense expenditures." Amen! We need a fresh risk assessment of the threats the post-Cold War world presents and spend accordingly (but no more than about $300 billion a year). According to Defense Secretary Gates, the U.S. Navy battle fleet is "larger than the next 13 navies combined--and 11 of those 13 navies are U.S. allies or partners." His quote is a great illustration both of how lopsided our advantage is and how useless it is. We've actually spent $150 billion on "Star Wars" missile defense, with mixed results. That's enough to put 2.5 million kids through state college.

- Social Security is just fine. Conservatives would have you believe it is in crisis. If we do nothing, it will still pay out about 75% of scheduled benefits starting sometime between 2030 and 2040. This scares conservatives for two big reasons: 1) Social Security is a higher priority than defense, as it is a mandatory spending program. The government must pay it first. Given a choice, 90% of people over 40 will vote for Social Security over tanks and planes every day of the week. 2) It's a big government program that requires taxes. We'll, thank goodness for Social Security now that our portfolios are down 40% and house prices are down 20%. We are all now seeing how ridiculous privatization schemes are. Nearly 2/3 of elderly folks derive over half their income from Social Security. It is a wonderful program. It threatens big corporate interests in the military-industrial complex, as we ultimately will have to choose between big Social Security payouts as the boomers retire and defense spending. Reform should focus on not providing benefits to wealthier retirees. A great idea is progressive indexing, which means that wealthier folks do not get as large of an annual increase in the rate of payout as less wealthy folks. This covers most of the shortfall. Alternatively, raising payroll taxes from the current 12.4% to 14.3% or reducing payouts by 13% put the program in balance for the next century.

- Healthcare: Other countries spend about half what we do with similar results. We have no choice but to nationalize healthcare or otherwise provide insurance to all at much lower overall cost; otherwise, Medicare and Medicaid will absorb all federal tax revenue sometime later this century according to the CBO. What an incredible opportunity to enable Americans to innovate, if not tied to companies for health insurance! Further, our corporations cannot possibly compete in the global economy with massive healthcare costs; see GM for a great example. Of course, conservatives will fight this tooth and nail also. Why? Who knows.

In short, if you vote Republican you are not voting for policies that make rational sense. We cannot all win in a capitalist society and those of us better off can no longer ignore the poor in an interconnected world.

Rebuttal talking points

[edit]Republican says: "Tax cuts will help grow the economy" or "Tax cuts pay for themselves." Informed person says: "Under Reagan and Bush 43, tax cuts dramatically increased government deficits and debt. Conventional economic wisdom is that a dollar of government spending increases GDP by more than $1, but a tax cut does not, intuitively because some of the latter is saved or used to pay down debt. Under Clinton, we had surpluses and economic growth was excellent, due in-part to tax hikes under Bush 41. Studies from CBO, Treasury and Harvard say a dollar of tax cuts increases the deficit from 50 cents to 90 cents. There is no free lunch. We either pay the taxes or we borrow from foreign nations and pass the buck (or lack thereof) to our kids. By the way, we are paying 15 cents of every tax dollar towards interest on the debt already, another form of tax, due to our $11 trillion in debt. There is talk of our debt causing the U.S. to lose its AAA credit rating."

Republican says: "Social Security is bankrupt." Informed person says: "Nope, it is fully funded until 2037. Then, it will get cut to 75% or so of the scheduled payouts and hold that level thereafter. It is a legally-mandated program and therefore will be paid prior to defense spending or other non-mandatory programs. Moderate tax increases or spending cuts can make it pay all its commitments for the remainder of the century."

Republican says: "We need to spend $750 billion a year to keep us safe." Informed person just bursts out laughing, picks self off ground after a couple of minutes and says: "How do our 10+ aircraft carrier groups protect us from terrorists? Or the F-22 Raptor? Or high-tech artillery? Or having troops on Arab land, the one thing that drives them the craziest? What is the threat that merits this type of payout, considering 40,000 of us die every year in car accidents? The real War on Terror is about economics. In the long-run, we can be no stronger than our finances. We surrender our sovereignty when we borrow and lessen our security. Let's save the money until real military threats emerge. As George Washington said, "...avoid the necessity of overgrown military establishments, which, under any form of government, are inauspicious to liberty..."

Republican says: "Don't socialize medicine." Informed person says: "Our system is just too expensive as is and must be reformed. We will all have to wait longer for treatment and some very difficult rationing decisions will have to be made for all. Right now healthcare is rationed based on wealth; about 45 million people cannot afford insurance, so we pay anyway when they go to the emergency room only at 5 times the rate we should. Hundreds of private corporations out to maximize profit involved in processing healthcare claims means a lot of overhead vs. a single payer system."