1. Advantages and disadvantages of block trades

Block trades refer to the buying or selling of a large number of securities at a predetermined price between two parties. Block trades can be advantageous to both the buyer and the seller, but they also have their drawbacks. In this section, we will examine the advantages and disadvantages of block trades.

Advantages:

1. Price Certainty: One of the primary advantages of block trades is that they provide price certainty. By agreeing on a price before the trade, both parties know exactly what they are getting, and there is no risk of price fluctuations.

2. Efficiency: Block trades are also more efficient than buying or selling securities on the open market. Since the trade is prearranged, there is no need to spend time and resources searching for a buyer or seller.

3. Privacy: Block trades are typically conducted in private, away from the public eye. This can be advantageous for investors who do not want to reveal their trading strategies or intentions.

4. Liquidity: Block trades can also provide liquidity to the market. By matching buyers and sellers, block trades can help to facilitate the movement of large amounts of securities without disrupting the market.

Disadvantages:

1. Limited Price Discovery: One of the main disadvantages of block trades is that they can limit price discovery. Since the trade is prearranged, there is no opportunity for the market to determine the true value of the securities being traded.

2. Lack of Transparency: Block trades are conducted in private, which can be a disadvantage for investors who rely on transparency and public information to make investment decisions.

3. Market Impact: Block trades can also have a significant impact on the market. large block trades can move the market price of the securities being traded, which can be disadvantageous for investors who are not part of the trade.

4. Counterparty Risk: Block trades also come with counterparty risk. If one of the parties fails to fulfill their obligations, the other party may be left holding the bag.

Block trades have their advantages and disadvantages. While they can provide price certainty, efficiency, privacy, and liquidity, they can also limit price discovery, lack transparency, have a significant market impact, and come with counterparty risk. Ultimately, the decision to engage in block trades will depend on the specific circumstances of the trade and the risk tolerance of the parties involved.

Advantages and disadvantages of block trades - Block trades: Examining Block Trades and Rule 10b18 Regulations

2. The role of market makers in block trades

Market makers play a crucial role in the execution of block trades. These trades involve large quantities of shares or securities that are bought or sold in a single transaction. Such trades can be challenging to execute without causing significant price movements, and market makers help to facilitate the transaction by providing liquidity and minimizing price impact. In this section, we will explore the role of market makers in block trades, their importance, and the different strategies they use to execute these trades efficiently.

1. What are market makers?

Market makers are individuals or firms that act as intermediaries between buyers and sellers in financial markets. They provide liquidity by buying and selling securities at quoted prices, thereby facilitating trading. They earn a profit by buying low and selling high, taking advantage of the spread between the bid and ask prices. Market makers are essential to the functioning of financial markets, as they ensure that there is always a buyer or seller available for any given security.

2. Why are market makers important in block trades?

Block trades involve large quantities of securities that can be challenging to execute without causing significant price movements. Market makers play a critical role in facilitating these trades by providing liquidity and minimizing price impact. They can absorb large orders without affecting the market price, as they have access to deep pools of liquidity and can adjust their bid-ask spreads accordingly. Market makers also help to match buyers and sellers, ensuring that the trade is executed efficiently and at a fair price.

3. What strategies do market makers use to execute block trades?

Market makers use a variety of strategies to execute block trades efficiently. One common strategy is to use algorithms that break up the large order into smaller, more manageable pieces. This allows the market maker to execute the trade over time, minimizing price impact and reducing the risk of adverse selection. Another strategy is to use dark pools, which are private exchanges that allow buyers and sellers to trade without revealing their identities or the size of their orders. Dark pools can be particularly useful for executing large block trades, as they provide a more discreet and efficient trading environment.

4. How do market makers ensure fair pricing in block trades?

Market makers use a variety of techniques to ensure fair pricing in block trades. One approach is to use reference prices, such as the closing price or the average price over a specific period, as a benchmark for determining the fair value of the security. Market makers can also use their knowledge of market conditions and supply and demand to adjust their bid-ask spreads to reflect the current market price. Finally, market makers can use their expertise to negotiate with buyers and sellers to ensure that the trade is executed at a fair price for both parties.

5. What are the risks of using market makers in block trades?

While market makers provide valuable services to buyers and sellers in block trades, there are also risks involved. One risk is that market makers may not be able to execute the trade at the desired price, particularly if market conditions change rapidly. Another risk is that market makers may engage in unethical or illegal practices, such as front-running or insider trading. To mitigate these risks, buyers and sellers should carefully vet their market maker and ensure that they have a clear understanding of the terms of the trade.

Market makers play a vital role in facilitating block trades by providing liquidity, minimizing price impact, and ensuring fair pricing. They use a variety of strategies to execute trades efficiently, including algorithmic trading and the use of dark pools. While there are risks involved in using market makers, buyers and sellers can mitigate these risks by carefully vetting their market maker and understanding the terms of the trade.

The role of market makers in block trades - Block trades: Examining Block Trades and Rule 10b18 Regulations

3. Introduction to Block Trades

Block Trades: Large Trader Tactics: Unveiling the Power of Block Trades

Introduction to Block Trades

Block trades are a common occurrence in the financial markets. They are usually executed by large traders who are looking to buy or sell a significant amount of shares or other financial instruments. Block trades are often used by institutional investors who need to execute large orders without affecting the market price of the underlying asset.

There are different types of block trades, including those executed on an exchange and those executed over-the-counter (OTC). Exchange-traded block trades are executed on a public exchange, while OTC block trades are executed between two parties outside of a public exchange.

In this section, we will provide an introduction to block trades and explain how they work. We will also discuss the advantages and disadvantages of using block trades, as well as some of the risks involved.

1. How do block trades work?

Block trades are executed by large traders who need to buy or sell a significant amount of shares or other financial instruments. These trades are often executed off-exchange, which means that they are not visible to the public. Instead, they are negotiated between two parties and are usually executed at a pre-determined price.

Block trades can be executed in different ways. For example, a trader may use a broker to execute the trade on their behalf, or they may negotiate the trade directly with another party. In some cases, block trades may be executed on an exchange, but the trade is still negotiated off-exchange.

2. Advantages of using block trades

Block trades have several advantages for large traders. One of the main advantages is that they allow traders to execute large orders without affecting the market price of the underlying asset. This is because block trades are executed off-exchange and are not visible to the public.

Another advantage of using block trades is that they can be executed quickly. This is because block trades are negotiated between two parties and can be executed at a pre-determined price. This can be useful for traders who need to execute large orders quickly.

3. Disadvantages of using block trades

Despite their advantages, block trades also have some disadvantages. One of the main disadvantages is that they are not visible to the public. This means that traders may not be able to get the best price for their trade. Additionally, block trades can be risky because they are executed off-exchange and are not subject to the same regulations as exchange-traded trades.

Another disadvantage of using block trades is that they can be expensive. This is because traders need to pay a commission to the broker or counterparty who executes the trade on their behalf.

4. Risks involved in block trades

There are several risks involved in using block trades. One of the main risks is that the trade may not be executed at the desired price. This can happen if the market moves against the trader between the time the trade is negotiated and the time it is executed.

Another risk of using block trades is that the trader may not be able to find a counterparty to execute the trade. This can happen if the trader is looking to buy or sell a large amount of shares or other financial instruments at a price that is not attractive to other traders.

5. Conclusion

Block trades are a useful tool for large

Introduction to Block Trades - Block Trades: Large Trader Tactics: Unveiling the Power of Block Trades

4. Benefits of Block Trades for Large Traders

Block trades have become increasingly popular among large traders, as they offer numerous benefits compared to traditional trading methods. In this blog section, we will explore the benefits of block trades for large traders, including reduced market impact, increased liquidity, and improved execution.

1. Reduced Market Impact

One of the primary advantages of block trades is that they can significantly reduce market impact. When large traders execute trades in the open market, their orders can move the market, which can result in slippage and higher transaction costs. Block trades, however, allow traders to execute large orders without affecting the market price. This is because block trades are executed off-exchange, either through a broker or through a dark pool. By executing trades in this manner, traders can avoid the negative effects of market impact, resulting in better execution and lower transaction costs.

2. Increased Liquidity

Another benefit of block trades is that they offer increased liquidity. When a large trader executes a block trade, they are essentially matching their order with another large trader or institution. This means that the transaction is much larger than a typical trade, which can make it easier to find a counterparty. In addition, because block trades are executed off-exchange, they can tap into additional sources of liquidity, such as dark pools or other alternative trading venues. This can result in faster execution times and lower transaction costs.

3. Improved Execution

Block trades can also offer improved execution compared to traditional trading methods. Because block trades are executed off-exchange, they can be customized to meet the specific needs of the trader. For example, a trader may want to execute a block trade over a longer period of time to avoid market impact, or they may want to execute the trade all at once to take advantage of a specific market condition. By working with a broker or using a dark pool, traders can tailor their block trades to meet their specific needs, resulting in better execution and improved performance.

4. Examples

To illustrate the benefits of block trades, let's look at a hypothetical example. Imagine that a large trader wants to purchase 1 million shares of a particular stock. If they were to execute this trade in the open market, they would likely move the market and incur significant transaction costs. However, by executing a block trade through a broker or dark pool, they could match their order with another large trader or institution, resulting in faster execution times and lower transaction costs.

5. Comparison

While block trades offer numerous benefits, it is important to note that they may not be suitable for all traders. For example, smaller traders may not have access to the same sources of liquidity as larger traders, making block trades less advantageous. In addition, traders who are not concerned about market impact may prefer to execute trades in the open market to take advantage of price movements. Ultimately, the best trading strategy will depend on the individual trader's goals and risk tolerance.

Block trades offer numerous benefits for large traders, including reduced market impact, increased liquidity, and improved execution. By working with a broker or using a dark pool, traders can customize their block trades to meet their specific needs, resulting in better execution and improved performance. While block trades may not be suitable for all traders, they offer a powerful tool for those looking to execute large orders with minimal market impact.

Benefits of Block Trades for Large Traders - Block Trades: Large Trader Tactics: Unveiling the Power of Block Trades

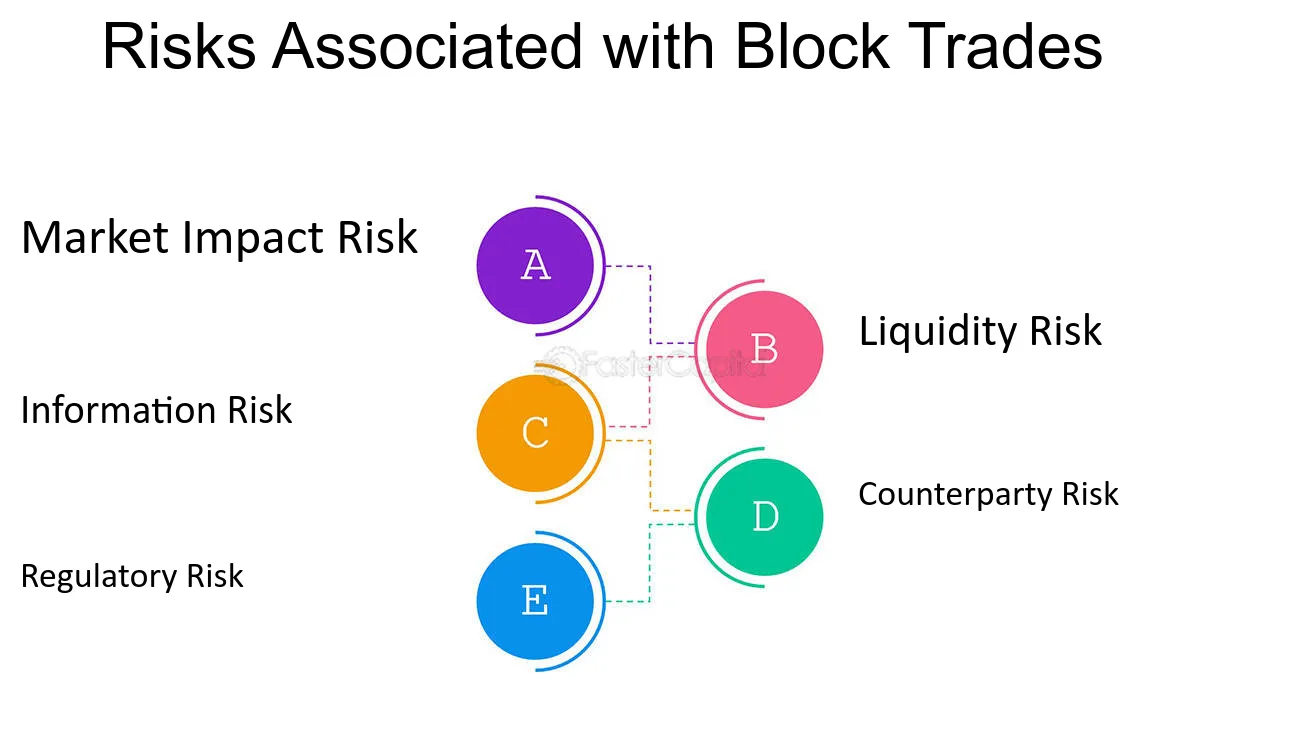

5. Risks Associated with Block Trades

Block trades are large transactions made by institutional investors or traders that involve a significant number of shares or securities. These trades are often executed outside of the open market, which means that they can have a significant impact on the price of the underlying asset. While block trades can be an effective way to quickly buy or sell a large amount of securities, there are also several risks associated with these types of transactions. In this section, we will explore some of the most significant risks that traders and investors should be aware of when considering block trades.

1. Market Impact Risk: One of the most significant risks associated with block trades is market impact risk. When a large block trade is executed, it can have a significant impact on the price of the underlying asset. If the trader is buying a large block of shares, it can drive up the price of the stock, making it more expensive for other investors to buy shares. Conversely, if the trader is selling a large block of shares, it can drive down the price of the stock, making it more difficult to find buyers. This can result in the trader receiving a lower price than they expected, or in some cases, not being able to execute the trade at all.

2. Liquidity Risk: Another risk associated with block trades is liquidity risk. When a trader executes a large block trade, it can be difficult to find enough buyers or sellers to complete the transaction. This can result in the trader not being able to execute the trade at all, or having to accept a lower price than they expected. This risk is particularly significant in markets where there is limited liquidity or where the underlying asset is not frequently traded.

3. Information Risk: Block trades can also pose information risk. When a large block trade is executed, it can signal to other investors that there is significant buying or selling pressure in the market. This can cause other investors to adjust their positions, which can impact the price of the underlying asset. In some cases, this can result in the trader not being able to execute the trade at the desired price, or in some cases, not being able to execute the trade at all.

4. Counterparty Risk: When executing a block trade, traders must work with a counterparty to complete the transaction. This can pose counterparty risk, which is the risk that the counterparty will not be able to fulfill their obligations under the trade. This can result in the trader not being able to execute the trade at all, or in some cases, incurring significant losses.

5. Regulatory Risk: Finally, block trades can also pose regulatory risk. In some cases, regulators may view block trades as a way to manipulate the market or engage in insider trading. Traders who execute block trades must be aware of the regulatory environment in which they are operating and ensure that they are complying with all applicable laws and regulations.

While block trades can be an effective way for institutional investors and traders to quickly buy or sell a large amount of securities, there are also several significant risks associated with these types of transactions. Traders and investors must be aware of these risks and take steps to mitigate them, including carefully considering market impact risk, liquidity risk, information risk, counterparty risk, and regulatory risk. By doing so, traders can ensure that they

Risks Associated with Block Trades - Block Trades: Large Trader Tactics: Unveiling the Power of Block Trades

6. Impact of Block Trades on Market Conditions

Block trades are an essential part of the financial markets. They are large transactions that take place outside of the normal exchange channels, typically involving institutional investors or large traders. These trades have a significant impact on market conditions, and understanding their effects is crucial for any investor or trader.

1. Price Movements

One of the most significant impacts of block trades is on price movements. When a large trader executes a block trade, it can cause a sudden and significant movement in the price of the asset being traded. This effect is particularly pronounced in illiquid markets, where a large block trade can cause a significant disruption to the market.

2. Spillover Effects

Another impact of block trades is on spillover effects. When a large trader executes a block trade, it can cause a chain reaction in the market, as other traders react to the sudden movement in price. This can lead to increased volatility and further price movements, which can be difficult to predict.

3. Market Liquidity

Block trades can also have an impact on market liquidity. When a large trader executes a block trade, it can temporarily reduce the liquidity in the market, as other traders may be hesitant to enter the market until the effects of the block trade have subsided. This can lead to wider bid-ask spreads and increased transaction costs.

4. Investor Confidence

Block trades can also have an impact on investor confidence. When a large trader executes a block trade, it can signal to other investors that there is significant interest in the asset being traded. This can lead to increased investor confidence and a subsequent increase in trading activity.

5. Mitigating the Impact of Block Trades

There are several ways that investors and traders can mitigate the impact of block trades on market conditions. One option is to use limit orders, which allow traders to specify the maximum price they are willing to pay for an asset. This can help to prevent sudden price movements and reduce the impact of block trades.

Another option is to use algorithmic trading strategies, which can help to automate the execution of trades and reduce the impact of human emotion and bias. Algorithmic trading can also help to identify and take advantage of trading opportunities that arise as a result of block trades.

Block trades have a significant impact on market conditions, and understanding their effects is crucial for any investor or trader. By using limit orders and algorithmic trading strategies, investors and traders can mitigate the impact of block trades and take advantage of trading opportunities that arise as a result.

Impact of Block Trades on Market Conditions - Block Trades: Large Trader Tactics: Unveiling the Power of Block Trades

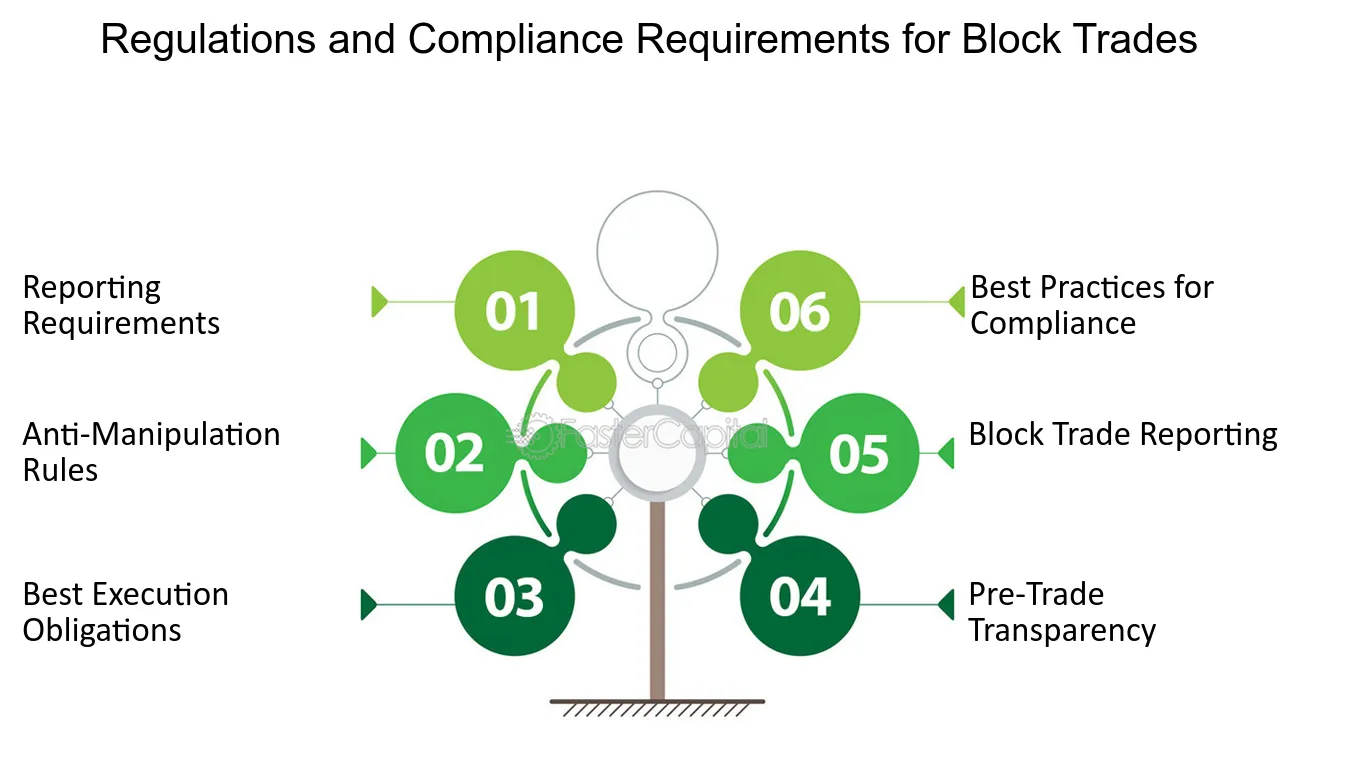

7. Regulations and Compliance Requirements for Block Trades

Block trades are large transactions that involve buying or selling a significant quantity of securities. These trades can have a significant impact on the market, which is why they are regulated by various laws and rules. Compliance with these regulations is essential for traders who engage in block trades, as non-compliance can result in severe penalties and legal consequences. In this section, we will explore the different regulations and compliance requirements for block trades.

1. Reporting Requirements

One of the primary regulations that traders must comply with when engaging in block trades is reporting requirements. Under the securities and Exchange commission (SEC) rules, traders must report any block trades they make within 15 minutes of executing the trade. The report must include information such as the security being traded, the price, the size of the trade, and the parties involved. This information is essential for regulators to monitor the market and detect any potential market manipulation.

2. Anti-Manipulation Rules

Another critical regulation that traders must comply with is the anti-manipulation rules. These rules prohibit traders from engaging in any activities that could manipulate the market's price or volume. For example, traders cannot engage in insider trading or pump and dump schemes. Violating these rules can result in severe penalties, including fines and imprisonment.

3. Best Execution Obligations

Traders engaged in block trades also have a best execution obligation. This means that they must execute trades at the best possible price for their clients. Failure to do so can result in legal action against the trader and their firm. To ensure compliance with this regulation, traders must use sophisticated algorithms and trading systems that can provide them with real-time market data and help them execute trades at the best possible price.

4. Pre-Trade Transparency

Pre-trade transparency is another critical requirement for block trades. This regulation requires traders to disclose certain information about the trade before executing it. For example, traders may need to disclose the size of the trade, the price, and the parties involved. This information helps other market participants to make informed decisions about whether to participate in the trade or not.

5. Block Trade Reporting

Block trade reporting is another requirement that traders must comply with. Under this regulation, traders must report any block trades they make to the relevant authorities. This information is used to monitor market activity and detect any potential market manipulation. Failure to comply with this regulation can result in severe penalties, including fines and imprisonment.

6. Best Practices for Compliance

To ensure compliance with these regulations, traders can follow some best practices. For example, traders can use sophisticated trading systems that can help them execute trades at the best possible price. They can also use real-time market data to make informed decisions about when to execute trades. Additionally, traders can work closely with their compliance teams to ensure that they are following all relevant regulations and rules.

Compliance with regulations and requirements is essential for traders engaged in block trades. Failure to comply with these regulations can result in severe penalties and legal consequences. To ensure compliance, traders must follow reporting requirements, anti-manipulation rules, best execution obligations, pre-trade transparency, and block trade reporting requirements. By following these regulations and best practices, traders can engage in block trades safely and effectively.

Regulations and Compliance Requirements for Block Trades - Block Trades: Large Trader Tactics: Unveiling the Power of Block Trades

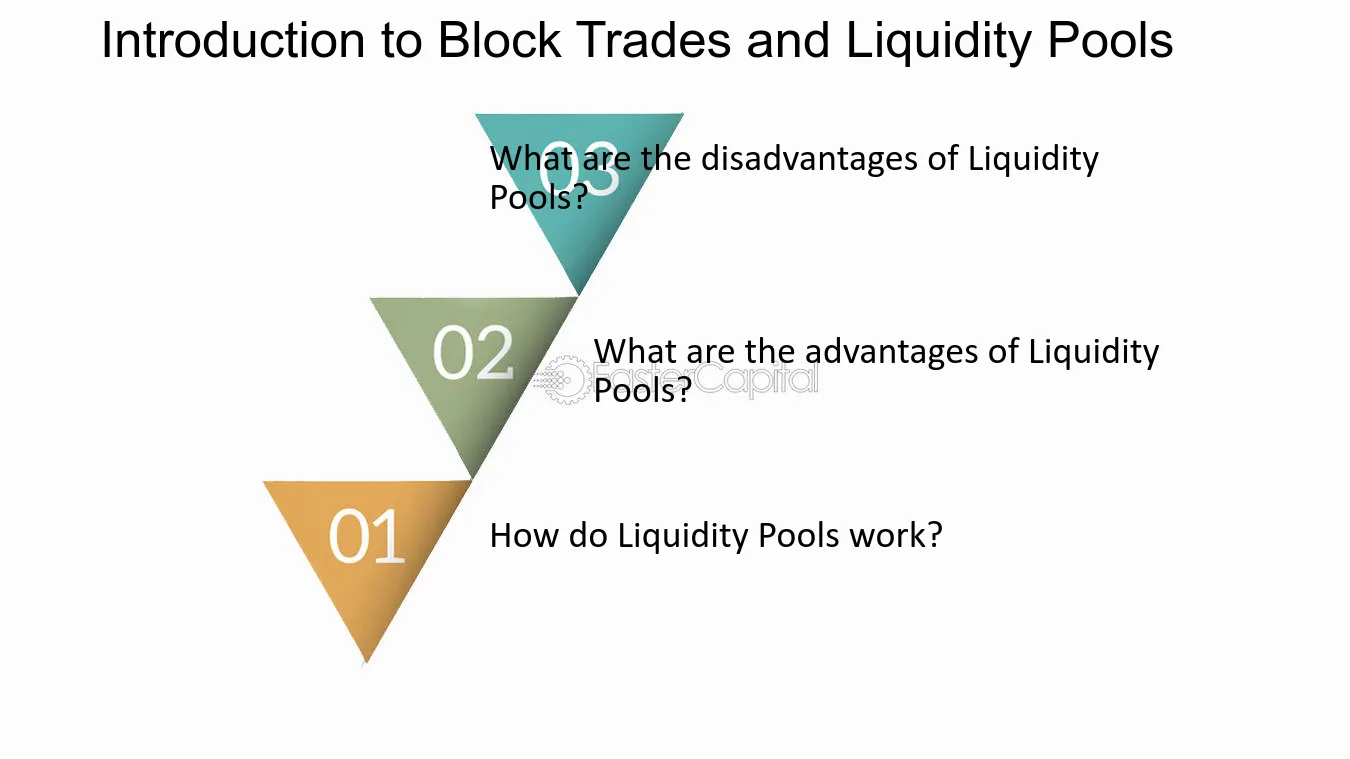

8. Introduction to Block Trades and Liquidity Pools

Block Trades and Liquidity Pools are two concepts that are often mentioned in the world of finance and trading. They are crucial components of trading infrastructure that facilitate large transactions in a timely and efficient manner. In this section, we will explore the basics of Block Trades and Liquidity Pools and how they work.

Block Trades

Block Trades refer to the buying or selling of a large number of shares or contracts in a single transaction. These trades are usually executed outside of the open market and are often negotiated between two parties. Block trades are typically used by institutional investors such as hedge funds, mutual funds, and pension funds to quickly and efficiently execute large trades without causing significant market disruption.

1. How do Block Trades work?

Block Trades are executed through a broker-dealer who acts as a middleman between the buyer and the seller. The broker-dealer finds a counterparty who is willing to buy or sell the desired amount of shares or contracts at a pre-agreed price. Once the trade is agreed upon, the broker-dealer facilitates the transaction and ensures that it is settled in a timely manner.

2. What are the advantages of Block Trades?

Block Trades have several advantages over traditional market transactions. They allow buyers and sellers to execute large trades without significantly affecting the price of the underlying asset. They also provide greater privacy and confidentiality as the transaction is negotiated between two parties and not visible to the public. Additionally, Block Trades can be executed quickly and efficiently, which is crucial for institutional investors who need to move large amounts of capital in a timely manner.

3. What are the disadvantages of Block Trades?

One of the main disadvantages of Block Trades is that they are often executed at a premium or discount to the prevailing market price. This is because the buyer or seller is willing to pay a premium or accept a discount in exchange for the speed and convenience of executing a large trade. This can result in higher transaction costs and lower returns for investors.

Liquidity Pools

Liquidity Pools refer to a group of market participants who pool their resources together to create a large pool of liquidity. This liquidity is then used to facilitate trades in a particular market or asset class. Liquidity pools are often used by high-frequency traders, algorithmic traders, and other market makers to ensure that there is sufficient liquidity in the market to facilitate their trading strategies.

1. How do Liquidity Pools work?

Liquidity Pools are created by a group of market participants who agree to pool their resources together to create a large pool of liquidity. This liquidity is then used to facilitate trades in a particular market or asset class. Liquidity Pools are typically accessed through electronic trading platforms that allow traders to buy and sell assets in real-time.

2. What are the advantages of Liquidity Pools?

Liquidity Pools have several advantages over traditional market transactions. They provide greater liquidity and depth in the market, which can help to reduce transaction costs and improve execution quality. They also provide greater transparency and price discovery as the transaction prices are visible to all market participants. Additionally, Liquidity Pools can be accessed by a wide range of market participants, which helps to ensure that there is sufficient liquidity in the market at all times.

3. What are the disadvantages of Liquidity Pools?

One of the main disadvantages of Liquidity Pools is that they can be subject to market manipulation and abuse. High-frequency traders and other market makers can use their access to the pool to manipulate prices and exploit other market participants. Additionally, Liquidity Pools can be subject to liquidity shocks, where a sudden influx or outflow of capital can cause significant market disruption.

Block Trades and Liquidity Pools are two important components of trading infrastructure that facilitate large transactions in a timely and efficient manner. While they have several advantages over traditional market transactions, they also have their own set of disadvantages that investors need to be aware of. Ultimately, the choice between Block Trades and Liquidity Pools will depend on the specific needs and objectives of the investor.

Introduction to Block Trades and Liquidity Pools - Block trades: Navigating the Dark Waters of Liquidity Pools

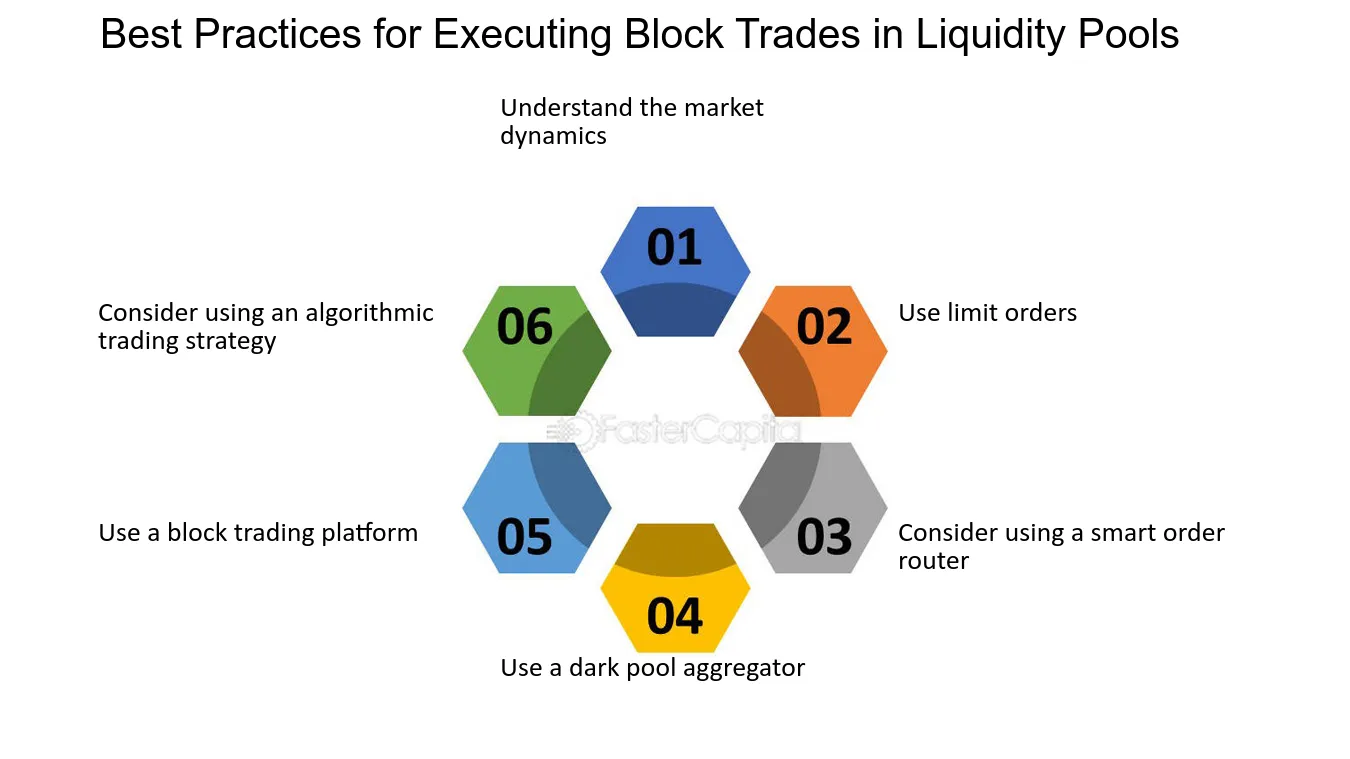

9. Best Practices for Executing Block Trades in Liquidity Pools

Executing block trades in liquidity pools can be a challenging task, especially for those who are new to the game. Block trades involve large volumes of assets and executing them efficiently requires a deep understanding of market dynamics, order types, and execution strategies. In this section, we will discuss some of the best practices that can help traders execute block trades in liquidity pools with ease and efficiency.

1. Understand the market dynamics: Before executing a block trade, it is essential to understand the market dynamics of the liquidity pool. This includes understanding the order book, liquidity depth, and trading volumes. Traders should also be aware of any market events or news that may impact the market's liquidity.

2. Use limit orders: Limit orders are a popular order type for executing block trades in liquidity pools. They allow traders to set a minimum price for buying or selling an asset, ensuring that the trade is executed at a favorable price. Limit orders also help to reduce slippage and ensure that the trade is executed efficiently.

3. Consider using a smart order router: A smart order router is a tool that automatically routes trades to different liquidity pools, depending on market conditions. This ensures that traders get the best possible price for their trades, regardless of the liquidity pool they are trading on.

4. Use a dark pool aggregator: Dark pool aggregators are platforms that aggregate liquidity from multiple dark pools. They provide traders with access to a larger pool of liquidity, which can help to execute block trades more efficiently.

5. Use a block trading platform: Block trading platforms are designed specifically for executing block trades. They provide traders with access to a wide range of liquidity pools, order types, and execution strategies. Block trading platforms also offer tools and analytics that can help traders optimize their block trades.

6. Consider using an algorithmic trading strategy: Algorithmic trading strategies are designed to execute trades automatically, based on pre-set rules and parameters. They can help traders to execute block trades more efficiently, by automatically routing trades to the most favorable liquidity pools and executing trades at the best possible prices.

Executing block trades in liquidity pools requires a deep understanding of market dynamics, order types, and execution strategies. Traders should consider using limit orders, smart order routers, dark pool aggregators, block trading platforms, and algorithmic trading strategies to execute block trades efficiently. By following these best practices, traders can minimize slippage, reduce trading costs, and execute block trades with ease.

Best Practices for Executing Block Trades in Liquidity Pools - Block trades: Navigating the Dark Waters of Liquidity Pools

10. Common Challenges and Solutions in Trading Block Trades in Liquidity Pools

Block trading in liquidity pools can be a complex process due to its opaque nature, lack of transparency and the need for speed. This article will explore some of the common challenges traders face when navigating the dark waters of liquidity pools and offer solutions to overcome them.

1. Lack of Transparency

One of the biggest challenges of block trading in liquidity pools is the lack of transparency. Unlike traditional exchanges, which provide real-time price and order book data, liquidity pools are often opaque, making it difficult for traders to assess market conditions and execute trades effectively.

Solution: The best way to overcome this challenge is to use a liquidity aggregator that can provide real-time pricing information from multiple liquidity pools. This can help traders to identify the best prices and execute trades more efficiently.

2. High Slippage

Another challenge of block trading in liquidity pools is high slippage. Slippage occurs when the price of an asset changes between the time a trade is initiated and the time it is executed, resulting in a higher cost or lower profit for the trader.

Solution: To reduce slippage, traders can use limit orders that allow them to set a maximum price for buying or selling an asset. This can help to ensure that trades are executed at the desired price, minimizing the impact of slippage.

3. Counterparty Risk

Counterparty risk is another challenge of block trading in liquidity pools. This risk arises when one or more parties fail to fulfill their obligations under a trade, resulting in financial losses for the other parties involved.

Solution: To reduce counterparty risk, traders can use a trusted intermediary or clearinghouse that can act as a neutral party to ensure that trades are executed and settled properly. This can help to ensure that all parties involved in a trade are protected from financial losses.

4. Regulatory Compliance

Regulatory compliance is another challenge of block trading in liquidity pools. Different jurisdictions have different regulations and requirements for trading in liquidity pools, making it difficult for traders to navigate the regulatory landscape.

Solution: To ensure regulatory compliance, traders can work with a broker or trading platform that is licensed and regulated to operate in their jurisdiction. This can help to ensure that all trades are executed in compliance with local regulations and requirements.

5. Liquidity Risk

Liquidity risk is another challenge of block trading in liquidity pools. This risk arises when there is insufficient liquidity in a market to execute a trade at the desired price.

Solution: To mitigate liquidity risk, traders can use a liquidity aggregator that can access multiple liquidity pools to ensure that there is sufficient liquidity to execute trades at the desired price. This can help to ensure that trades are executed efficiently and effectively.

Block trading in liquidity pools can be challenging, but with the right tools and strategies, traders can navigate the dark waters of liquidity pools and execute trades effectively. By using a liquidity aggregator, limit orders, trusted intermediaries, regulatory compliant brokers and liquidity mitigating strategies, traders can overcome the challenges of block trading in liquidity pools and achieve their trading objectives.

Common Challenges and Solutions in Trading Block Trades in Liquidity Pools - Block trades: Navigating the Dark Waters of Liquidity Pools

11. Regulatory Considerations for Block Trades in Liquidity Pools

When it comes to block trades in liquidity pools, regulatory considerations are extremely important to take into account. These considerations can range from legal requirements to compliance issues and can vary depending on the jurisdiction and the type of asset being traded. Therefore, it is crucial for traders to be aware of the regulatory landscape and to ensure that they are following all the necessary rules and regulations. In this section, we will explore some of the key regulatory considerations for block trades in liquidity pools.

1. Compliance with Securities Laws

One of the most important regulatory considerations for block trades in liquidity pools is compliance with securities laws. In the United States, for example, securities laws require that all transactions involving securities be registered with the Securities and Exchange commission (SEC) unless an exemption applies. This means that traders must ensure that their block trades comply with the relevant securities laws and regulations. Failure to do so can result in fines, legal action, or even criminal charges.

2. KYC and AML Requirements

Know-Your-Customer (KYC) and anti-Money laundering (AML) requirements are also critical considerations for block trades in liquidity pools. KYC regulations require traders to identify and verify the identity of their clients, while AML regulations require traders to implement measures to prevent money laundering and terrorist financing. These regulations are in place to prevent criminal activity and protect the integrity of the financial system. Traders must ensure that they have appropriate KYC and AML procedures in place to comply with these regulations.

3. Counterparty Risk

Counterparty risk is another important regulatory consideration for block trades in liquidity pools. When trading in a liquidity pool, traders are typically dealing with multiple counterparties, each with their own level of creditworthiness. This can create a risk that one or more counterparties may default on their obligations, which can have a significant impact on the trader's position. To mitigate this risk, traders should consider using a clearinghouse or other intermediary to manage counterparty risk.

4. Reporting Requirements

Finally, reporting requirements are also an important regulatory consideration for block trades in liquidity pools. Traders must ensure that they are reporting their trades accurately and in a timely manner, as required by the relevant regulatory authorities. Failure to do so can result in fines or other penalties. Traders should also be aware of any reporting requirements specific to the liquidity pool or asset being traded, as these may vary depending on the platform or asset.

Regulatory considerations are a key factor to take into account when trading block trades in liquidity pools. Traders must ensure that they are complying with all relevant securities laws and regulations, have appropriate KYC and AML procedures in place, manage counterparty risk, and meet any reporting requirements. By doing so, traders can help to protect themselves and the integrity of the financial system.

Regulatory Considerations for Block Trades in Liquidity Pools - Block trades: Navigating the Dark Waters of Liquidity Pools

12. Successful Block Trades in Liquidity Pools

Block trades are complex transactions that require special attention and expertise to be executed successfully. In particular, block trades in liquidity pools can be challenging, as they involve large volumes of assets and require finding counterparties with matching orders. Nevertheless, many traders have managed to navigate the dark waters of liquidity pools and achieve successful block trades. In this section, we will analyze some case studies of successful block trades in liquidity pools, and discuss the factors that contributed to their success.

1. Understanding the liquidity pool dynamics

One key factor that can make or break a block trade in a liquidity pool is the understanding of the pool's dynamics. Liquidity pools are constantly changing, with new orders being added and executed, and liquidity providers joining and leaving the pool. Therefore, traders need to have a deep understanding of the pool's rules and mechanisms, as well as the behavior of the other traders and liquidity providers. For example, some pools may have minimum and maximum order sizes, or may prioritize certain types of orders over others. By understanding these dynamics, traders can optimize their order placement and execution, and increase their chances of finding a matching counterparty.

2. Leveraging technology and data analysis

Another key factor in successful block trades in liquidity pools is the use of technology and data analysis. Many liquidity pools provide real-time data feeds and analytics tools that can help traders monitor the pool's activity and identify potential matches for their orders. Moreover, some pools offer algorithmic trading services that can automatically execute trades based on predefined parameters. By leveraging these tools, traders can save time and reduce the risk of human error, while also improving the accuracy and speed of their trades.

3. Building relationships with liquidity providers

In addition to technology and data analysis, building relationships with liquidity providers can also be a critical factor in successful block trades in liquidity pools. liquidity providers are the backbone of liquidity pools, and their participation can greatly impact the pool's dynamics and liquidity. Therefore, traders who establish strong relationships with liquidity providers can benefit from better pricing, faster execution, and more favorable terms. Moreover, by working closely with liquidity providers, traders can gain valuable insights into the pool's behavior and trends, and adjust their strategies accordingly.

4. Considering the tradeoffs between pools

Finally, when navigating the dark waters of liquidity pools, traders need to consider the tradeoffs between different pools. Each pool has its own characteristics, such as the number and type of participants, the assets traded, the fees charged, and the order matching algorithms used. Moreover, some pools may be more suitable for certain types of trades or traders, depending on their risk appetite, investment horizon, and trading style. Therefore, traders need to carefully evaluate the pros and cons of each pool, and choose the one that best fits their needs and objectives.

Successful block trades in liquidity pools require a combination of knowledge, technology, relationships, and strategy. By understanding the pool's dynamics, leveraging technology and data analysis, building relationships with liquidity providers, and considering the tradeoffs between pools, traders can increase their chances of executing successful block trades and navigating the dark waters of liquidity pools.

Successful Block Trades in Liquidity Pools - Block trades: Navigating the Dark Waters of Liquidity Pools

13. Introduction to Block Trades and Odd Lots

Block trades and odd lots are two different concepts in the world of finance, yet they are closely related. Understanding the difference between the two and their relationship is vital for any investor or trader. In this section, we will delve into the world of block trades and odd lots, their definitions, how they differ from each other, and their importance in the trading world.

1. Definition of Block Trades: A block trade is a large order of shares or securities that is traded off-exchange, often between two parties, outside of the public market. These trades usually involve a large number of shares, and are executed at a negotiated price and without the benefit of transparency that comes with trading on an exchange. They are usually executed by institutional investors such as hedge funds, mutual funds, and pension funds.

2. Definition of Odd Lots: An odd lot is a group of shares that is less than the standard lot size, which is usually 100 shares. These are typically traded in the public market, and are usually bought and sold by individual investors rather than institutional investors.

3. Differences between Block Trades and Odd Lots: The main difference between block trades and odd lots is the size of the trade. Block trades are usually much larger than odd lots, and are executed off-exchange, while odd lots are smaller and are traded in the public market. Additionally, block trades are usually executed by institutional investors, while odd lots are usually bought and sold by individual investors.

4. Importance of Block Trades and Odd Lots: Block trades and odd lots are important for different reasons. Block trades are important because they allow institutional investors to execute large trades without disrupting the market, as they are executed off-exchange. This makes it easier for institutional investors to buy or sell large positions without moving the market. Odd lots are important because they provide liquidity to the market, as individual investors are able to buy and sell shares in smaller quantities.

Block trades and odd lots are two important concepts in the world of finance. While they differ in size and the way they are executed, they are both important for allowing investors to buy and sell shares in a way that best suits their needs. Understanding the difference between the two is essential for anyone looking to invest in the stock market.

Introduction to Block Trades and Odd Lots - Block trades: Unraveling the Relationship between Block Trades and Oddlots

14. Understanding the Basics of Block Trades

A block trade is a large trade of financial securities, such as stocks or bonds, that is completed off the open market, outside of the central exchange, and is usually executed between two parties. It is a way for institutional investors, such as hedge funds, pension funds, and mutual funds, to buy or sell large quantities of securities without disrupting the market and affecting the security's current price. A block trade typically involves a minimum of 10,000 shares of stock or $200,000 worth of bonds, although this can vary depending on the security and the exchange. Understanding the basics of block trades is essential for any investor who wants to invest in the stock market, as it provides insight into how the market operates and the forces that influence it.

Here are some key points to keep in mind when it comes to block trades:

1. Block trades are executed off-exchange: Unlike regular trades, which are executed on the open market, block trades are conducted off-exchange, either through a broker or through an electronic trading system. This allows institutional investors to buy or sell securities without disrupting the market and affecting the security's current price.

2. Block trades can have an impact on the market: While block trades are designed to be executed off-exchange, they can still have an impact on the market if they are large enough. If a block trade is particularly large, it can cause the price of the security to move significantly, which can in turn affect the broader market.

3. Block trades can be used to hide trading activity: Because block trades are executed off-exchange, they can be used to hide trading activity. This can be a concern for regulators who want to ensure that the market is transparent and that investors have access to all relevant information.

4. Block trades can be executed in different ways: There are a variety of ways to execute a block trade, including using a broker, using an electronic trading system, or using an exchange. Each method has its own advantages and disadvantages, and investors should carefully consider which method is best for them.

5. Block trades require careful planning and execution: Because block trades are so large, they require careful planning and execution. Investors need to be aware of the market conditions, the liquidity of the security they are trading, and any other factors that could impact the trade. Failure to properly plan and execute a block trade can result in significant losses for the investor.

Understanding the basics of block trades is essential for any investor who wants to invest in the stock market. By understanding how block trades work, investors can make more informed decisions and better navigate the complex world of investing.

Understanding the Basics of Block Trades - Block trades: Unraveling the Relationship between Block Trades and Oddlots

15. The Relationship between Block Trades and Odd Lots

Block trades and odd lots are two terms that are frequently mentioned in the world of finance. While they might seem unrelated, there is, in fact, a relationship between the two. The two terms refer to different types of trades in the stock market, but they can both be used to gain insight into market trends and investor sentiment. understanding the relationship between block trades and odd lots is crucial for anyone who wants to get a comprehensive understanding of the stock market.

Here are some insights into the relationship between block trades and odd lots:

1. Block trades are large trades that involve a significant number of shares, usually over 10,000 shares. Odd lots, on the other hand, refer to trades that involve less than 100 shares. The key difference between the two is the size of the trade.

2. While block trades and odd lots are different, they can both provide valuable information about the market. Block trades can be an indicator of institutional investor activity, while odd lots can provide insight into retail investor sentiment.

3. Block trades are often used by institutional investors to buy or sell large positions in a stock. Since these trades involve such a large number of shares, they can have a significant impact on the stock's price. As a result, block trades are closely monitored by traders and analysts.

4. Odd lots are typically used by retail investors who are buying or selling a small number of shares. While these trades are not as significant as block trades, they can still provide valuable information about investor sentiment. For example, an increase in odd-lot selling may indicate that retail investors are becoming more bearish on a particular stock.

5. The relationship between block trades and odd lots can be seen in the bid-ask spread. The bid-ask spread is the difference between the highest price a buyer is willing to pay for a stock (the bid) and the lowest price a seller is willing to accept (the ask). When there are more buyers than sellers (i.e., bullish sentiment), the bid-ask spread narrows. Conversely, when there are more sellers than buyers (i.e., bearish sentiment), the bid-ask spread widens. Block trades and odd lots can both impact the bid-ask spread, and traders often use this information to make trading decisions.

Understanding the relationship between block trades and odd lots is crucial for anyone who wants to gain a comprehensive understanding of the stock market. By paying attention to both types of trades, investors can gain valuable insights into market trends and investor sentiment.

The Relationship between Block Trades and Odd Lots - Block trades: Unraveling the Relationship between Block Trades and Oddlots

16. Impact of Block Trades on Liquidity and Price Discovery

Block trades are a common occurrence in the financial markets, and they can have a significant impact on liquidity and price discovery. The execution of a large block trade can result in substantial changes in the market, such as the price moving rapidly in one direction or a significant increase or decrease in the traded volume. These changes can make it challenging for market participants to determine the fair value of the security and can lead to market inefficiencies. However, block trades can also have positive effects, such as improving liquidity, which can make it easier for investors to buy or sell securities quickly.

Here are some in-depth insights about the impact of block trades on liquidity and price discovery:

1. Block trades can improve liquidity: When executed correctly, block trades can inject liquidity into the market, making it easier for investors to buy or sell securities. This is because block trades are typically executed at a price that is close to the market price, and the large size of the trade means that there is a correspondingly large amount of liquidity available. This can be especially useful for institutional investors who need to buy or sell large positions quickly.

2. Block trades can negatively impact price discovery: The execution of a large block trade can cause the security's price to move rapidly in one direction. This can make it difficult for market participants to determine the fair value of the security, and can lead to market inefficiencies. For example, if a large sell order is executed, it can cause the price to drop quickly, which can trigger stop-loss orders and lead to further selling, resulting in a self-fulfilling cycle of price drops.

3. Block trades can lead to information leakage: Block trades are typically executed by institutional investors who have access to more information about the security than retail investors. This can lead to the potential for insider trading or other forms of information leakage, as the execution of a large block trade can signal the investor's intention to buy or sell the security.

4. Oddlots can be used to mitigate the impact of block trades: Oddlots are trades that are smaller than the standard trading unit for a security. For example, if the standard trading unit for a stock is 100 shares, a trade for 50 shares would be considered an oddlot. Oddlots can be used to mitigate the impact of block trades by breaking up the large trade into smaller pieces, which can reduce the potential for market disruption.

Block trades are a necessary part of the financial markets, and they can have both positive and negative impacts on liquidity and price discovery. By understanding the potential impact of block trades, market participants can make more informed trading decisions and better manage their risk exposure.

Impact of Block Trades on Liquidity and Price Discovery - Block trades: Unraveling the Relationship between Block Trades and Oddlots

17. Role of Block Trades in Institutional Trading Strategies

Block trades are an important aspect of institutional trading strategies, with both sell-side and buy-side firms utilizing them for a variety of reasons. This trading mechanism allows for the buying or selling of a large number of shares in a single transaction, which can provide several benefits to investors. For instance, the anonymity of block trades can be a desirable feature for institutional investors who wish to conceal their positions from the market. Additionally, block trades can be executed more quickly and efficiently than smaller transactions, which can help to minimize market impact.

Here are some key roles that block trades play in institutional trading strategies:

1. Providing Liquidity: Block trades are an essential source of liquidity in the market. When large institutional investors need to buy or sell a significant number of shares, they can rely on block trades to provide a quick and efficient way to execute the trade. Without block trades, these investors would need to break up their orders into smaller pieces, which can take longer to execute and may result in higher transaction costs.

2. minimizing Market impact: By executing a large trade through a block trade, institutional investors can minimize market impact. This is because the trade is executed all at once, rather than in smaller pieces over time. This can help to prevent the price of the security from moving too much in either direction, which can be beneficial for both the buyer and seller.

3. Concealing Positions: Another benefit of block trades is that they can be executed anonymously. This means that institutional investors can buy or sell a large number of shares without revealing their position to the market. This can be particularly useful for investors who wish to keep their trading strategies private or who are concerned about other market participants copying their trades.

4. Improving Execution Quality: Block trades can also help to improve execution quality. For example, if an institutional investor needs to sell a large number of shares, they may be able to find a buyer through a block trade who is willing to pay a higher price than they could get by selling the shares in smaller pieces. This can result in a better overall price for the trade.

Overall, block trades play a crucial role in institutional trading strategies. They provide liquidity, minimize market impact, allow for anonymous trading, and can improve execution quality. As such, they are an essential tool for institutional investors who need to execute large trades quickly and efficiently.

Role of Block Trades in Institutional Trading Strategies - Block trades: Unraveling the Relationship between Block Trades and Oddlots

18. Advantages and Disadvantages of Block Trades

Block trades are a popular method of trading in the stock market. They are often used by institutional investors to buy or sell large quantities of shares without affecting the market price. However, there are both advantages and disadvantages to using block trades. In this section, we will discuss the pros and cons of block trades to help you better understand the implications of using this trading method.

Advantages:

1. efficiency - Block trades allow large orders to be executed quickly, reducing the time and costs associated with executing multiple smaller trades.

Example: An institutional investor wants to buy 1 million shares of a particular stock. By executing a block trade, they can buy all of the shares at once, rather than having to execute multiple smaller trades.

2. Privacy - Block trades are often executed off-exchange, which means that the details of the trade are not publicly disclosed. This can be beneficial for investors who want to keep their trading strategies private.

Example: A hedge fund wants to buy a large number of shares in a company before announcing their intention to take over the company. By executing a block trade, they can buy the shares without alerting other investors to their plans.

3. Price improvement - Block trades can sometimes be executed at better prices than smaller trades because they are less likely to move the market price.

Example: An institutional investor wants to sell a large number of shares in a company. By executing a block trade, they can sell the shares without driving down the market price.

Disadvantages:

1. Illiquidity - Block trades can be illiquid, meaning that there may not be enough buyers or sellers to execute the trade. This can result in the trade being executed at a less favorable price than if it had been executed in smaller trades.

Example: An institutional investor wants to sell a large number of shares in a small-cap company. There may not be enough buyers in the market to execute a block trade, so the investor may have to sell the shares in smaller trades at a less favorable price.

2. Information asymmetry - Because block trades are often executed off-exchange, other investors may not be aware of the trade. This can create information asymmetry, where some investors have access to information that others do not.

Example: A large institutional investor executes a block trade to buy a large number of shares in a company. Other investors may not be aware of the trade and may not have access to the same information as the institutional investor, which could put them at a disadvantage.

3. Market impact - Despite the benefits of block trades, they can still have a significant market impact if the trade is large enough. This can result in the market price moving against the investor.

Example: An institutional investor executes a large block trade to buy shares in a company. The market price moves up as a result of the trade, making it more expensive for the investor to buy the shares.

Advantages and Disadvantages of Block Trades - Block trades: Unraveling the Relationship between Block Trades and Oddlots

19. Introduction to block trades and agency cross transactions

In the world of finance, block trades and agency cross transactions are two important concepts that are often used by investors to move large amounts of securities. Block trades are a type of transaction that involves the buying or selling of a large quantity of securities, typically at least 10,000 shares or a value of $200,000 or more. On the other hand, agency cross transactions are trades that are arranged by a broker-dealer between two clients, where the broker-dealer acts as an intermediary and does not take any principal position in the transaction.

Both block trades and agency cross transactions have their own unique characteristics and benefits, and it is important for investors to understand the differences between the two. Here are some key points to keep in mind:

1. Block trades are often used by institutional investors, such as mutual funds or pension funds, who need to buy or sell large amounts of securities quickly. By executing a block trade, these investors can avoid the market impact that might occur if they were to place a large number of smaller trades.

2. While block trades can be executed on exchanges, they are more commonly done over-the-counter (OTC). This means that the transaction is negotiated directly between the buyer and seller, rather than being executed on a centralized exchange.

3. Because block trades involve such large amounts of securities, they can have a significant impact on the market. As a result, regulators often require that these trades be reported to ensure that they are not being used to manipulate the market.

4. Agency cross transactions, on the other hand, are typically used by clients who want to trade securities with each other without going through a public exchange. Because the broker-dealer is acting as an intermediary, it can help to ensure that the transaction is executed fairly and at a reasonable price.

5. Unlike block trades, agency cross transactions are typically executed on an exchange. This means that the transaction is subject to the rules and regulations of the exchange, which can help to ensure that the transaction is executed fairly.

Overall, both block trades and agency cross transactions can be useful tools for investors who need to move large amounts of securities. By understanding the differences between the two, investors can choose the method that best suits their needs and helps them achieve their investment goals.

Introduction to block trades and agency cross transactions - Block Trades and Agency Cross Transactions: A Comprehensive Guide

20. Pros and cons of block trades

Block trades are an essential part of the financial market, allowing investors to buy or sell large volumes of securities outside the open market. These transactions are often executed by institutional investors or hedge funds and can range in size from tens of thousands to millions of shares. While block trades offer several benefits, they also come with some drawbacks that investors should consider before engaging in these transactions.

1. Pros of Block Trades:

- Efficiency: Block trades can be executed quickly and efficiently, allowing investors to avoid the time and cost associated with placing multiple smaller orders.

- Price Improvement: By executing a large transaction in a single trade, investors may be able to negotiate a better price than they would receive in the open market.

- Discretion: Block trades can be executed discreetly, allowing investors to avoid tipping off the market to large positions.

2. Cons of Block Trades:

- Lack of Transparency: Block trades are not reported on the public market until after the transaction is complete, which can make it difficult to gauge the true value of a security.

- Liquidity Risk: Block trades can be risky if the investor needs to sell the security before the market is able to absorb it. This can lead to a drop in price, resulting in a loss for the investor.

- Limited Access: Block trades are typically only available to institutional investors, which can limit access to these transactions for smaller investors.

For example, suppose an institutional investor wants to purchase a large block of shares in a company. If the investor were to purchase these shares on the open market, it could take several days or even weeks to acquire the desired number of shares. By executing a block trade, the investor can acquire the shares in a single transaction, potentially at a better price than they would receive in the open market.

Overall, block trades can be an effective way for institutional investors to execute large transactions quickly and efficiently. However, investors should carefully consider the potential risks and benefits before engaging in these transactions.

Pros and cons of block trades - Block Trades and Agency Cross Transactions: A Comprehensive Guide

21. Key players in block trades and agency cross transactions

When it comes to block trades and agency cross transactions, there are several key players involved in the process. From the investment banks and brokers to the institutional investors and hedge funds, each party has a specific role to play in ensuring the success of the transaction. Understanding who these key players are and what they bring to the table is essential to navigating the world of block trades and agency cross transactions.

1. investment banks: Investment banks are often the intermediaries between the buyer and seller in a block trade or agency cross transaction. They may facilitate the transaction by finding potential buyers or sellers, negotiating the terms of the trade, and executing the transaction itself. Investment banks may also provide additional services, such as research and analysis, to help their clients make informed decisions.

2. Brokers: Brokers are another important player in the world of block trades and agency cross transactions. They act as the middlemen between the investment banks and the buyers and sellers, helping to facilitate the trade and ensuring that the transaction is executed smoothly. Brokers may also provide additional services, such as market analysis and research, to help their clients make informed decisions.

3. Institutional investors: Institutional investors are typically the buyers or sellers in a block trade or agency cross transaction. These investors may include pension funds, mutual funds, and hedge funds, among others. Institutional investors often have significant financial resources at their disposal, which allows them to participate in large transactions such as block trades and agency cross transactions.

4. hedge funds: Hedge funds are a type of institutional investor that often participate in block trades and agency cross transactions. These funds may use these transactions to take advantage of market inefficiencies or to implement specific investment strategies. For example, a hedge fund may use a block trade to acquire a large position in a particular stock, which can help to drive up the price of the stock and generate a profit for the fund.

In summary, the key players in block trades and agency cross transactions include investment banks, brokers, institutional investors, and hedge funds. Each of these parties has a specific role to play in ensuring the success of the transaction, and understanding their roles and responsibilities is essential to navigating the world of block trades and agency cross transactions.

Key players in block trades and agency cross transactions - Block Trades and Agency Cross Transactions: A Comprehensive Guide

22. Risks associated with block trades and agency cross transactions

Block trades and agency cross transactions are common practices in financial markets, especially in the world of institutional trading. These transactions enable large blocks of securities to be traded without disrupting the market. While these transactions can be beneficial for market participants, they can also pose significant risks.

From the perspective of the seller, block trades and agency cross transactions provide an opportunity to dispose of large blocks of securities without adversely impacting the market. A seller may prefer to use a block trade or agency cross transaction to avoid the risk of a sudden drop in the price of the security, which might occur if they were to sell the shares on the open market. Similarly, the buyer may prefer to use a block trade or agency cross transaction to acquire a large block of securities without driving up the price.

However, there are risks associated with these types of transactions. For example, the market price of the security could change between the time the transaction is agreed and the time it is executed. This could result in one party receiving a better or worse price than they expected. Additionally, block trades and agency cross transactions may be subject to less transparency than trades on an exchange, which could lead to disputes over the price of the security.

Here are some of the risks associated with block trades and agency cross transactions:

1. Price risk: The price of the security may change between the time the transaction is agreed and the time it is executed. This could result in one party receiving a better or worse price than they expected.

2. Liquidity risk: The size of the trade may be so large that it cannot be easily unwound if the market moves against the trader. This could result in a loss for the trader.

3. Counterparty risk: There is a risk that the counterparty will default on the transaction. This risk can be mitigated through the use of collateral and other risk management techniques.

4. operational risk: There is a risk that errors or delays in the settlement process could result in losses for one or both parties.

5. Regulatory risk: Block trades and agency cross transactions may be subject to less regulatory oversight than trades on an exchange. This could increase the risk of market manipulation or other abuses.

For example, suppose a hedge fund wants to sell a large block of shares in a company that it believes is overvalued. The hedge fund could use a block trade or agency cross transaction to sell the shares without driving down the price. However, if the market price of the shares falls sharply before the transaction is executed, the hedge fund may receive a worse price than it expected.

Overall, it is important for market participants to be aware of the risks associated with block trades and agency cross transactions. These transactions can offer benefits in terms of price and liquidity, but they also pose significant risks that must be carefully managed and monitored.

Risks associated with block trades and agency cross transactions - Block Trades and Agency Cross Transactions: A Comprehensive Guide

23. Regulatory framework governing block trades and agency cross transactions

When it comes to block trades and agency cross transactions, there is a regulatory framework in place that governs these practices. These regulations are designed to maintain fair and orderly markets, prevent market manipulation, and protect investors. From different points of view, the regulatory framework for block trades and agency cross transactions can be viewed as both beneficial and restrictive. On one hand, these regulations provide a framework for market participants to engage in these practices in a fair and transparent manner. On the other hand, some market participants may perceive these regulations as overly restrictive and burdensome.

To better understand the regulatory framework governing block trades and agency cross transactions, consider the following in-depth information:

1. Regulation ATS: Regulation ATS (Alternative Trading System) is a set of SEC rules that governs the operation of alternative trading systems, which are electronic trading platforms that match buyers and sellers of securities. Some ATSs are specifically designed to facilitate block trades and agency cross transactions.

2. Rule 144: Rule 144 is an SEC rule that regulates the resale of restricted securities. When a market participant engages in a block trade or agency cross transaction involving restricted securities, they must comply with the requirements of Rule 144.

3. Reporting Requirements: Market participants engaging in block trades and agency cross transactions may be subject to reporting requirements, which vary depending on the type of security and the size of the transaction. Reporting requirements may include the filing of Form 4, Form 13D, or Form 13F.

4. Exchange Rules: In addition to SEC regulations, exchanges may have their own rules governing block trades and agency cross transactions. For example, the New york Stock exchange has rules that require block trades to be executed at a price that is no worse than the current market price.

In summary, the regulatory framework governing block trades and agency cross transactions is designed to provide a fair and transparent market for all participants. While these regulations may be viewed as both beneficial and restrictive from different points of view, they ultimately serve to maintain the integrity of the market.

Regulatory framework governing block trades and agency cross transactions - Block Trades and Agency Cross Transactions: A Comprehensive Guide

24. The Importance of Price Improvement in Large Block Trades

Large block trades are an essential part of the financial markets. They involve the buying or selling of a significant number of securities in a single transaction. While these trades can be lucrative for investors, they can also be challenging to execute. One of the biggest challenges of large block trades is getting a fair price. That's where price improvement comes in. Price improvement is the difference between the price a buyer pays for a security and the lowest price a seller is willing to accept. In this section, we'll discuss the importance of price improvement in large block trades.

1. What is price improvement?

Price improvement is a crucial factor in large block trades. It can be defined as the difference between the price a buyer pays for a security and the lowest price a seller is willing to accept. Price improvement can be achieved in several ways, such as negotiating with the seller, using limit orders, or using algorithms that seek to find the best price in the market.

2. Why is price improvement important in large block trades?

Price improvement is essential in large block trades because it can significantly impact the profitability of the transaction. A small improvement in price can translate into significant profits, especially in high-value trades. Price improvement can also help to reduce the market impact of large block trades, which can cause prices to move against the investor.

3. How can price improvement be achieved?

There are several ways to achieve price improvement in large block trades. One common method is to negotiate with the seller to get a better price. This can be done by using a broker or directly with the seller. Another way to achieve price improvement is to use limit orders. A limit order is an instruction to buy or sell a security at a specific price or better. This allows investors to specify the maximum price they are willing to pay or the minimum price they are willing to accept.

4. What are the risks of not achieving price improvement?

The risks of not achieving price improvement in large block trades can be significant. If an investor pays too much for a security, it can reduce the profitability of the transaction. It can also increase the market impact of the trade, which can cause prices to move against the investor. Additionally, if an investor is not able to achieve price improvement, it may be an indication that the market is not favorable for the trade.

5. What are the best strategies for achieving price improvement?

The best strategies for achieving price improvement in large block trades depend on various factors, such as the size of the trade, the liquidity of the market, and the urgency of the transaction. One effective strategy is to use algorithms that seek to find the best price in the market. These algorithms can take into account various factors, such as the current market conditions, the bid-ask spread, and the order book depth. Another effective strategy is to use a broker who has experience in negotiating large block trades and can help to find the best price for the investor.

Price improvement is a crucial factor in large block trades. It can significantly impact the profitability of the transaction and reduce the market impact of the trade. Achieving price improvement can be done in several ways, such as negotiating with the seller, using limit orders, or using algorithms that seek to find the best price in the market. The best strategies for achieving price improvement depend on various factors, such as the size of the trade, the liquidity of the market, and the urgency of the transaction. It's essential for investors to understand the importance of price improvement and to use effective strategies to achieve it.

The Importance of Price Improvement in Large Block Trades - Block trading: Price Improvement Strategies for Large Block Trades

25. Types of Price Improvement Strategies for Large Block Trades

When it comes to executing large block trades, price improvement strategies play a crucial role in achieving the best possible outcome for investors. A price improvement strategy is a method used to obtain a better price for a large block trade than the prevailing market price. In this section, we will discuss the different types of price improvement strategies that can be used for large block trades, along with their advantages and disadvantages.

1. VWAP Cross

A VWAP (Volume Weighted Average Price) cross is a price improvement strategy that involves executing a large block trade at the VWAP price. The VWAP price is calculated by taking the total value of all trades executed in a specific time period and dividing it by the total volume traded. The VWAP cross allows investors to execute a large block trade at an average price that is representative of the prevailing market price.

Advantages:

- Provides a benchmark price for the execution of large block trades.

- Can be used to minimize market impact by executing trades over a longer period.

- Can be used to achieve a better price than the prevailing market price.

Disadvantages: