1. Comparing EBITDAL to Other Intangible Asset Measures

EBITDAL (Earnings Before Interest, Taxes, Depreciation, Amortization, and Leases) is a measure of a company's financial performance that adds back certain expenses to the net income. The purpose of this measure is to provide a more accurate representation of a company's profitability by excluding non-operating expenses. While EBITDAL is a useful measure, it is not the only measure of intangible assets. In this section, we will compare EBITDAL to other intangible asset measures to determine which is the best option for evaluating a company's financial performance.

1. EBITDA

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is a measure of a company's financial performance that adds back certain expenses to the net income. The purpose of this measure is to provide a more accurate representation of a company's profitability by excluding non-operating expenses. EBITDA is a commonly used measure of intangible assets, but it does not include lease expenses. EBITDA may be a good measure for companies that do not have significant lease expenses, but it may not be the best option for companies that do.

2. Adjusted EBITDA

Adjusted EBITDA is a measure of a company's financial performance that adds back certain expenses to the net income. The purpose of this measure is to provide a more accurate representation of a company's profitability by excluding non-operating expenses. Adjusted EBITDA is similar to EBITDA, but it includes adjustments for certain items such as stock-based compensation and restructuring charges. Adjusted EBITDA may be a good measure for companies that have significant non-operating expenses, but it may not be the best option for companies that do not.

3. Free Cash Flow

Free Cash Flow is a measure of a company's ability to generate cash from its operations. The purpose of this measure is to determine how much cash a company has available to pay dividends, buy back stock, or invest in growth opportunities. Free Cash Flow is calculated by subtracting capital expenditures from operating cash flow. Free Cash Flow may be a good measure for companies that have significant capital expenditures, but it may not be the best option for companies that do not.

4. Return on Assets

Return on Assets is a measure of a company's profitability relative to its total assets. The purpose of this measure is to determine how efficiently a company is using its assets to generate profits. Return on Assets is calculated by dividing net income by total assets. Return on Assets may be a good measure for companies that have significant assets, but it may not be the best option for companies that do not.

There is no one-size-fits-all measure of intangible assets. Each measure has its strengths and weaknesses, and the best option depends on the company's specific circumstances. EBITDAL may be a good measure for companies that have significant lease expenses, but it may not be the best option for companies that do not. Companies should carefully evaluate their financial performance using multiple measures to get a more complete picture of their financial health.

Comparing EBITDAL to Other Intangible Asset Measures - Amortization: Evaluating EBITDAL as a Measure of Intangible Assets

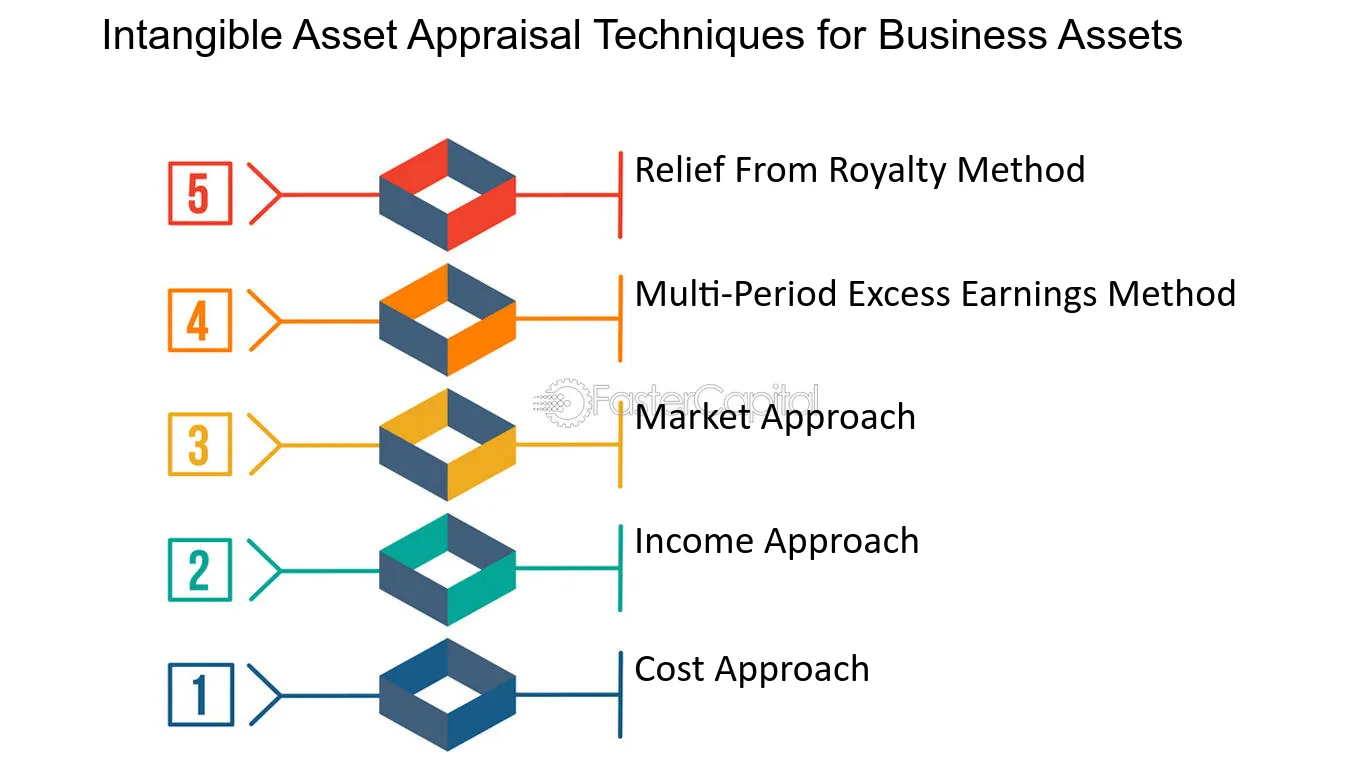

2. Intangible Asset Appraisal Techniques for Business Assets

When it comes to valuing a business, intangible assets play a crucial role. These assets are generally non-physical, but they can be valuable in terms of contributing to a company's overall value. Examples of intangible assets include intellectual property, brand recognition, customer relationships, and proprietary technology. However, putting a value on these assets can be a tricky business. In this section, we will explore some of the most commonly used intangible asset appraisal techniques for business assets.

1. Cost Approach

The cost approach is a method that estimates the value of an intangible asset by calculating the cost of replacing it. This technique is primarily used for assets that are not easily transferable, such as patents or copyrights. The cost approach takes into account the cost of research and development, legal fees, and other expenses associated with creating the asset. However, this approach can be challenging to use for assets that are difficult to replicate.

2. Income Approach

The income approach is a method of valuing an intangible asset based on the income it generates. This technique is commonly used for assets such as trademarks, customer relationships, and proprietary technology. The income approach involves estimating future cash flows generated by the asset and discounting them to the present value. This approach can be challenging to use if the asset's future income is uncertain.

3. Market Approach

The market approach is a method of valuing an intangible asset based on the prices of comparable assets in the market. This technique is commonly used for assets such as trademarks, patents, and copyrights. The market approach involves analyzing the prices of similar assets sold in the past and using that information to estimate the value of the asset. This approach can be challenging to use if there are few comparable assets in the market.

4. Multi-Period Excess Earnings Method

The multi-period excess earnings method is a method that estimates the value of an intangible asset based on the cash flows it generates over a period of years. This technique is commonly used for assets such as customer relationships and proprietary technology. The multi-period excess earnings method involves estimating the expected cash flows generated by the asset over a period of years and discounting them to the present value. This approach can be challenging to use if the asset's future cash flows are uncertain.

5. Relief From Royalty Method

The relief from royalty method is a method of valuing an intangible asset based on the amount of money that would need to be paid to license the asset. This technique is commonly used for assets such as patents and copyrights. The relief from royalty method involves estimating the amount of money that would need to be paid to license the asset and discounting it to the present value. This approach can be challenging to use if there are few comparable assets in the market.

There are several intangible asset appraisal techniques for business assets. Each method has its advantages and disadvantages, and the best approach depends on the type of asset being valued. The income approach is the most commonly used technique, but it can be challenging to use if the asset's future income is uncertain. The market approach is useful for assets with many comparable assets in the market, while the cost approach is suitable for assets that are difficult to replicate. The multi-period excess earnings method and the relief from royalty method are useful for estimating the value of assets with long-term cash flows and licensing potential, respectively. Understanding these techniques can help businesses unlock the value of their intangible assets and make informed decisions about their investments.

Intangible Asset Appraisal Techniques for Business Assets - Appraisal Capital Techniques: Unlocking Value in Business Assets

3. Intellectual Property as an Intangible Asset

Intellectual property (IP) refers to creations of the mind, such as inventions, literary and artistic works, designs, and symbols. It is protected by various legal mechanisms, including patents, copyrights, trademarks, and trade secrets. Intellectual property is a valuable intangible asset for companies as it grants them exclusive rights over their innovations and creations, allowing them to capitalize on their investment in research and development.

Valuing Intellectual Property:

1. cost approach: The cost approach determines the value of intellectual property based on the cost incurred to create or replace it.

2. Market Approach: The market approach estimates the value of intellectual property by comparing it to similar assets that have been sold in the market.

3. Income Approach: The income approach values intellectual property based on the expected future income it will generate for the company.

Intellectual Property as an Intangible Asset - Delving into Intangible Assets and their Effect on a Balance Sheet

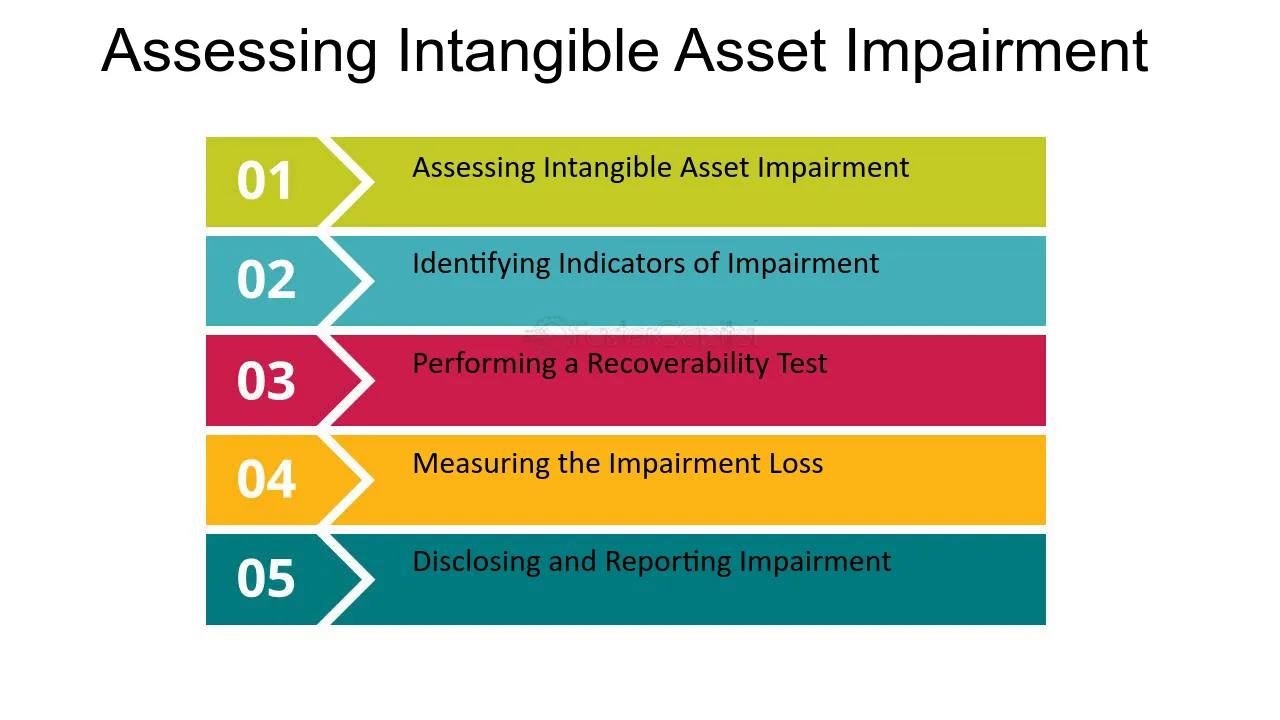

4. Assessing Intangible Asset Impairment

1. Assessing Intangible Asset Impairment

Intangible assets play a vital role in the success and value of a company. These assets, such as patents, trademarks, and customer relationships, are often the drivers of future cash flows and competitive advantage. However, just like tangible assets, intangible assets can also become impaired, resulting in a decrease in their value. In this section, we will explore the process of assessing intangible asset impairment and the considerations involved.

2. Identifying Indicators of Impairment

The first step in assessing intangible asset impairment is to identify indicators that suggest a potential decrease in value. These indicators can include internal factors such as changes in the legal or regulatory environment, loss of key personnel, or technological advancements that render the asset obsolete. External factors like changes in market conditions, increased competition, or a decline in the industry's growth rate can also signal impairment.

For example, a software development company may have invested significant resources in developing a proprietary technology. However, if a competitor releases a similar technology that gains widespread adoption, it could indicate impairment of the company's intangible asset.

3. Performing a Recoverability Test

Once indicators of impairment are identified, a recoverability test is conducted to determine whether the carrying value of the intangible asset can be recovered through future cash flows. This test compares the asset's carrying value to its estimated undiscounted future cash flows. If the carrying value exceeds the estimated future cash flows, it suggests that the asset is impaired.

For instance, a pharmaceutical company may have acquired a patent for a new drug. However, if the estimated future cash flows from the drug's sales are lower than the carrying value of the patent, it may indicate impairment.

4. Measuring the Impairment Loss

If the recoverability test indicates impairment, the next step is to measure the impairment loss. The impairment loss is calculated as the difference between the carrying value of the intangible asset and its fair value. The fair value can be determined using various methods, such as discounted cash flow analysis, market multiples, or independent appraisals.

For example, a media company may have acquired a brand name that has lost its relevance due to changing consumer preferences. To measure the impairment loss, the company may engage an independent appraiser to assess the fair value of the brand name based on its market recognition and potential future earnings.

5. Disclosing and Reporting Impairment

Once the impairment loss is measured, it must be disclosed and reported in the company's financial statements. The disclosure should provide sufficient information about the impairment, including the nature of the intangible asset, the reasons for impairment, and the amount of the impairment loss.

It is important for companies to adhere to accounting standards and guidelines when assessing and reporting intangible asset impairment. Failure to do so can result in misleading financial statements and potential legal consequences.

Assessing intangible asset impairment requires a systematic approach and careful consideration of various indicators and factors. By identifying potential impairment, performing recoverability tests, measuring impairment losses, and properly disclosing and reporting the impairment, companies can ensure the accuracy and transparency of their financial statements.

Assessing Intangible Asset Impairment - Examining Acquisition Adjustments: Testing for Asset Impairment

5. An Essential Intangible Asset

Trademarks are an essential intangible asset that can add significant value to a business. A trademark is a unique symbol, design, word, phrase, or a combination of these that distinguishes a company's products or services from those of its competitors. It is a valuable asset for a business as it helps to build brand recognition and customer loyalty. A strong trademark can help a business stand out in a crowded market and create a positive image in the minds of its customers. From a legal perspective, a trademark provides exclusive rights to use the mark in connection with the goods or services it represents, preventing others from using it without permission.

Here are some important insights into why trademarks are an essential intangible asset:

1. Brand Recognition: A strong trademark can help a business stand out in a crowded market and create a positive image in the minds of its customers. It helps to create brand recognition and customer loyalty, which can lead to increased sales and profits. For example, the Apple logo is instantly recognizable and has become synonymous with quality and innovation.

2. Competitive Advantage: A trademark can provide a competitive advantage by preventing others from using a similar mark in connection with similar goods or services. This helps to protect the business from potential infringements and copycats, which can damage the brand and reputation of the company.

3. Asset Value: A trademark is an intangible asset that can add significant value to a business. It can be licensed, sold, or used as collateral for financing. The value of a trademark can increase over time as the brand becomes more established, making it a valuable long-term investment.

4. Legal Protection: A trademark provides legal protection to the owner by giving them exclusive rights to use the mark in connection with the goods or services it represents. This prevents others from using the mark without permission, protecting the brand and reputation of the business.

Trademarks are an essential intangible asset that adds value to a business. They help to create brand recognition, provide a competitive advantage, have asset value, and provide legal protection. A strong trademark can help a business stand out in a crowded market and create a positive image in the minds of its customers, leading to increased sales and profits.

An Essential Intangible Asset - From Trademarks to Profits: Amortizing Intangibles for Business Success

6. A Valuable Intangible Asset

When it comes to building a successful business, it's not just about the physical assets that a company owns. In today's economy, intangible assets can be just as valuable, if not more so, than tangible ones. And one intangible asset that is often overlooked is customer relationships. These relationships are built on trust, loyalty, and satisfaction, and they can be a valuable source of revenue for a business. In fact, studies have shown that it is 6-7 times more expensive to acquire a new customer than it is to retain an existing one. This is why customer relationships should be considered a valuable intangible asset that can be leveraged for long-term success.

Here are some insights on why customer relationships are so valuable:

1. Repeat business: When customers are satisfied with a company's products or services, they are more likely to come back for more. This not only generates repeat business, but it can also lead to positive word-of-mouth marketing. Satisfied customers are more likely to recommend a company to their friends and family, which can lead to even more business down the line.

2. Brand loyalty: Building strong customer relationships can also lead to brand loyalty. customers who are loyal to a brand will continue to choose that brand over its competitors, even if they are offered similar products or services at a lower price. This can be a powerful advantage in a competitive market.

3. reduced marketing costs: When a company has a loyal customer base, it can reduce its marketing costs. Instead of spending money on expensive marketing campaigns to attract new customers, the company can focus on retaining its existing customers through loyalty programs, personalized experiences, and excellent customer service.

4. Increased revenue: Companies with strong customer relationships can also generate more revenue. Satisfied customers are more likely to purchase additional products or services from the company, and they may also be willing to pay more for those products or services. This can lead to increased profits and a stronger bottom line.

Customer relationships are a valuable intangible asset that should not be overlooked by businesses. By building strong relationships with customers, companies can generate repeat business, increase brand loyalty, reduce marketing costs, and increase revenue. Investing in customer relationships can pay off in the long run, and it can be a key factor in a company's long-term success.

A Valuable Intangible Asset - From Trademarks to Profits: Amortizing Intangibles for Business Success

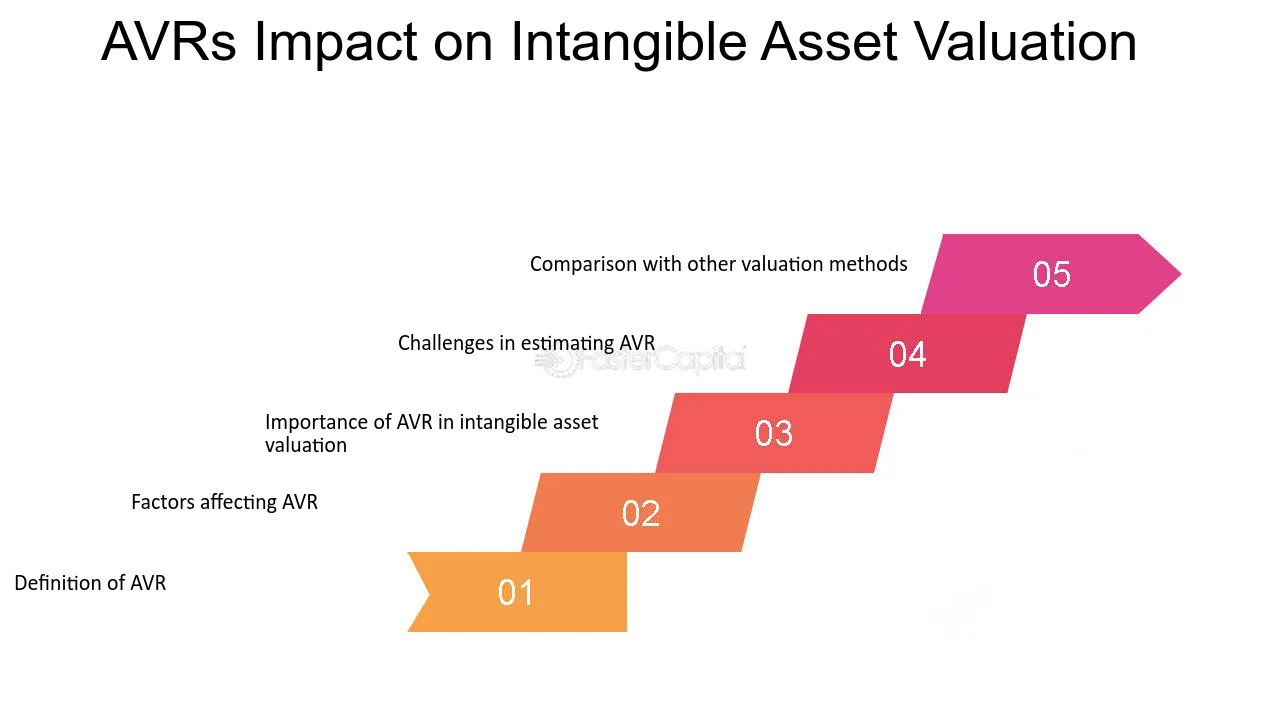

7. AVRs Impact on Intangible Asset Valuation

Intangible assets refer to non-physical assets that provide value to a company, such as intellectual property, brand recognition, and customer relationships. Assessing the value of these assets is crucial for businesses, especially when it comes to mergers and acquisitions. One important tool used to evaluate intangible assets is the Adjusted Present Value (APV) method, which takes into account the Asset Value Reversion (AVR) of the assets. In this section, we will explore the impact of AVR on intangible asset valuation.

1. Definition of AVR: AVR is the expected rate of growth of the intangible asset's operating income after a certain period of time. This growth rate is used to forecast the future cash flows generated by the asset. The APV method then discounts these cash flows back to their present value to determine the asset's current value. The AVR can be positive, negative, or zero, depending on the asset's expected performance.

2. Factors affecting AVR: The AVR of an intangible asset is influenced by several factors, including the asset's industry, the level of competition, and the asset's age. For example, a new technology patent in a rapidly growing industry may have a high AVR, while a mature brand in a highly competitive market may have a low AVR.

3. Importance of AVR in intangible asset valuation: The AVR plays a crucial role in determining the value of intangible assets, as it affects the future cash flows generated by the asset. A higher AVR will result in a higher asset value, while a lower AVR will result in a lower value. Therefore, it is important to accurately forecast the AVR when valuing intangible assets.

4. Challenges in estimating AVR: Estimating the AVR of an intangible asset can be challenging due to the uncertainty surrounding future cash flows. A variety of methods can be used to estimate the AVR, including regression analysis, expert opinions, and industry benchmarks. However, these methods are not foolproof and can result in inaccurate valuations.

5. Comparison with other valuation methods: The APV method with AVR is not the only method used to value intangible assets. Other methods, such as the discounted cash flow (DCF) method and the market approach, may also be used. However, the APV method with AVR is considered to be more accurate in valuing intangible assets, as it takes into account the asset's unique characteristics and expected future performance.

The AVR is a crucial factor in valuing intangible assets, as it determines the future cash flows generated by the asset. Accurately forecasting the AVR can be challenging, but it is important for businesses to use the most appropriate method to estimate it. The APV method with AVR is considered to be the most accurate method for valuing intangible assets, but it is important to consider other methods as well to ensure a comprehensive valuation.

AVRs Impact on Intangible Asset Valuation - Goodwill: AVR s Impact on Assessing the Value of Intangible Assets

8. Defining The Intangible Asset

Goodwill is a term that has been used in accounting for many years and it is an important concept that businesses need to understand. It is an intangible asset that represents the value of a business beyond its tangible assets. Goodwill is a measure of a company's reputation, brand recognition, and customer loyalty. It is considered to be an intangible asset because it cannot be seen or touched, but it is still an important part of a company's value. In this section, we will define goodwill and explain why it is important for businesses to understand.

1. Definition of Goodwill: Goodwill is the intangible asset that represents the value of a business beyond its tangible assets. It can be defined as the value of a company's reputation, brand recognition, and customer loyalty. Goodwill is created when a business has a strong brand image and a good reputation in the market. It is also created when a business has a loyal customer base that is willing to pay a premium for its products or services.

2. Importance of Goodwill: Goodwill is important for businesses because it helps to establish their reputation in the market. A strong reputation can help a business to attract new customers and retain existing ones. Goodwill is also important for investors because it represents the value of a company's intangible assets. Investors are interested in the value of goodwill because it can affect the price of a company's stock.

3. Examples of Goodwill: There are many examples of goodwill in the market. For example, Apple is a company that has a strong brand image and a good reputation in the market. Its customers are loyal and willing to pay a premium for its products. Another example is Coca-Cola, which has a strong brand image and a loyal customer base. Customers are willing to pay a premium for Coca-Cola products because of the company's reputation.

4. Factors that affect Goodwill: There are many factors that can affect the value of goodwill. Some of these factors include the company's brand image, reputation, customer loyalty, and market position. Changes in any of these factors can affect the value of goodwill.

5. Valuation of Goodwill: Valuing goodwill can be a complex process because it is an intangible asset. There are many methods that can be used to value goodwill, including the excess earnings method, the relief from royalty method, and the market capitalization method. Each method has its own advantages and disadvantages, and the method used will depend on the specific circumstances of the business.

Goodwill is an important concept that businesses need to understand. It is the intangible asset that represents the value of a business beyond its tangible assets. Goodwill is important for businesses because it helps to establish their reputation in the market, and it is important for investors because it represents the value of a company's intangible assets. Understanding the factors that affect goodwill and the methods used to value it is important for businesses and investors alike.

Defining The Intangible Asset - Goodwill: Evaluating the Intangible Value of Reputation and Branding

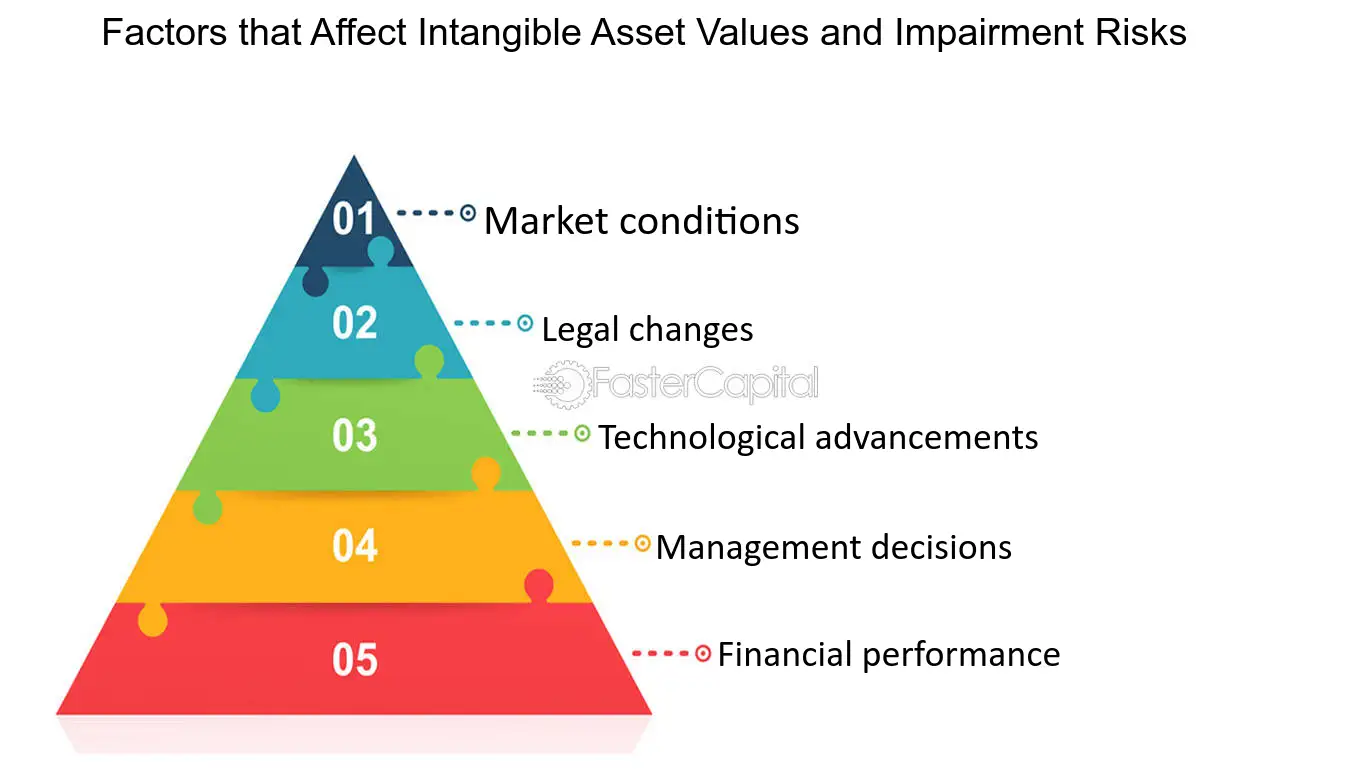

9. Factors that Affect Intangible Asset Values and Impairment Risks

A company's intangible assets, such as patents, trademarks, and copyrights, can be valuable contributors to its success. However, their values can be influenced by various factors, including market conditions, legal changes, and technological advancements. This can increase the risk of impairment, which occurs when the carrying value of the asset exceeds its recoverable amount. To minimize this risk, it is important to understand the factors that affect the values of intangible assets and the impairment risks they pose.

Here are some of the key factors that can affect the values of intangible assets and the risks of impairment:

1. Market conditions: Changes in the market can have a significant impact on the values of intangible assets. For example, a patent for a particular technology may lose value if a new, more efficient technology emerges. Similarly, a trademark may lose value if a company's brand reputation is damaged by negative publicity.

2. Legal changes: Changes in laws and regulations can also affect the values of intangible assets. For example, a change in patent laws may make it easier for competitors to replicate a company's technology, reducing the value of its patents. Changes in trademark laws may also impact the value of a company's branding efforts.

3. Technological advancements: Advances in technology can render certain intangible assets obsolete. For example, a company that holds patents for a particular type of software may see their value decrease if a new, more advanced software is developed.

4. Management decisions: Management decisions can also impact the values of intangible assets. For example, a company that invests heavily in a new product line may see the value of its patents increase if the product is successful.

5. Financial performance: The financial performance of a company can also impact the values of intangible assets. A company that is struggling financially may see the values of its intangible assets decrease as investors become more risk-averse.

In summary, there are many factors that can affect the values of intangible assets and the risks of impairment. Companies need to carefully monitor these factors to ensure that they are accurately valuing their intangible assets and minimizing the risks of impairment.

Factors that Affect Intangible Asset Values and Impairment Risks - Impairment Testing: Managing Intangible Amortization Risks

10. Reporting Intangible Asset Amortization

Intangible assets are an increasingly important part of many businesses, particularly in the technology and entertainment industries. When a company acquires an intangible asset, such as a patent or a copyright, it must account for that asset in its financial statements. One of the ways that companies account for intangible assets is by amortizing them over time. Amortization is the process of gradually reducing the value of an asset over its useful life. For intangible assets, this means that the asset's value is gradually reduced over the period in which the asset provides economic benefit to the company.

Reporting intangible asset amortization is an important part of a company's financial reporting. Here are some key points to keep in mind:

1. Intangible assets must be amortized over their useful lives. The useful life of an intangible asset is the period over which the asset is expected to provide economic benefit to the company. For example, if a company acquires a patent that is expected to be valid for 20 years, the useful life of the patent is 20 years, and the company must amortize the patent over that period.

2. The method of amortization can vary depending on the type of intangible asset. Some intangible assets are amortized on a straight-line basis, which means that the asset is amortized by the same amount each year. Other intangible assets are amortized on an accelerated basis, which means that more of the asset's value is amortized in the early years of its useful life.

3. The amount of intangible asset amortization that a company reports in its financial statements can have a significant impact on its financial performance. For example, if a company has a large amount of intangible asset amortization, its net income may be lower than it would be if the company did not have those expenses.

4. Intangible asset amortization is a non-cash expense, which means that it does not involve an actual cash outlay. However, it is still an important expense to consider when analyzing a company's financial performance.

Overall, reporting intangible asset amortization is an important part of a company's financial reporting. By understanding the key points outlined above, investors and analysts can gain a better understanding of a company's financial performance and the impact that intangible assets have on that performance.

Reporting Intangible Asset Amortization - Intangible Asset Acquisitions: Implications for Amortization

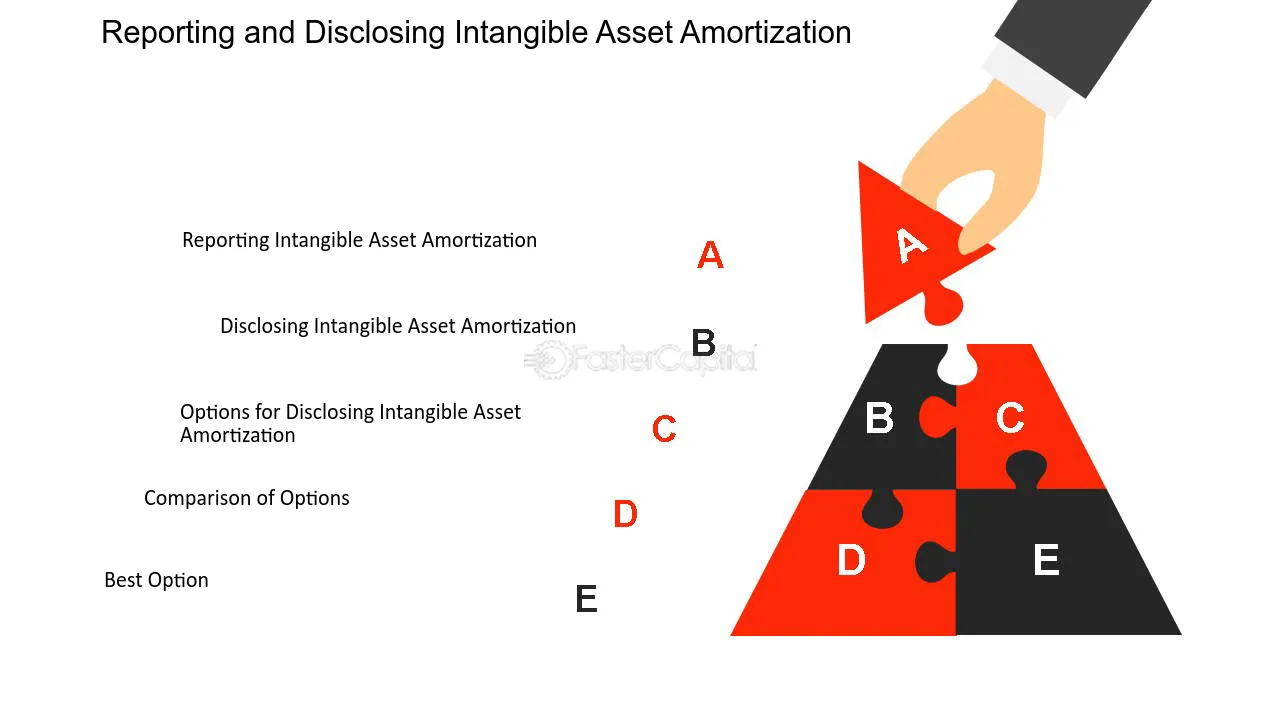

11. Reporting and Disclosing Intangible Asset Amortization

Intangible assets have become increasingly important in today's knowledge-based economy, as they represent a significant portion of a company's value. Amortization of intangible assets is a process of gradually expensing the cost of these assets over their useful life. In this blog section, we will discuss the reporting and disclosing of intangible asset amortization, which is an important aspect of financial reporting for any company that holds intangible assets.

1. Reporting Intangible Asset Amortization

Companies are required to report their intangible asset amortization in their financial statements. The amortization expense is reported on the income statement and is deducted from the revenue to arrive at the net income. The amount of amortization expense is also reported on the balance sheet, as a reduction in the carrying value of the intangible asset.

2. Disclosing Intangible Asset Amortization

In addition to reporting the amortization expense, companies are also required to disclose certain information about their intangible assets in the notes to the financial statements. This includes the total carrying amount of the intangible assets, the amortization expense for the current year, and the estimated future amortization expense for the next five years.

3. Options for Disclosing Intangible Asset Amortization

There are several options for disclosing intangible asset amortization in the notes to the financial statements. One option is to disclose the total amount of amortization expense for the current year and the estimated future amortization expense for the next five years. Another option is to disclose the amortization expense for each individual intangible asset, along with the estimated useful life of each asset.

4. Comparison of Options

Both options have their advantages and disadvantages. Disclosing the total amount of amortization expense is simpler and easier to understand, but it does not provide detailed information about individual intangible assets. Disclosing the amortization expense for each individual intangible asset is more detailed, but it can be more complex and time-consuming.

5. Best Option

The best option for disclosing intangible asset amortization depends on the nature of the company's intangible assets and the needs of the users of the financial statements. If the company has a large number of intangible assets with different useful lives, it may be more useful to disclose the amortization expense for each individual asset. However, if the company has a small number of intangible assets with similar useful lives, it may be more useful to disclose the total amount of amortization expense.

Reporting and disclosing intangible asset amortization is an important aspect of financial reporting for any company that holds intangible assets. Companies should carefully consider their options for disclosing this information and choose the best option based on the nature of their intangible assets and the needs of the users of the financial statements.

Reporting and Disclosing Intangible Asset Amortization - Intangible Asset Amortization: A Unit of Production Approach

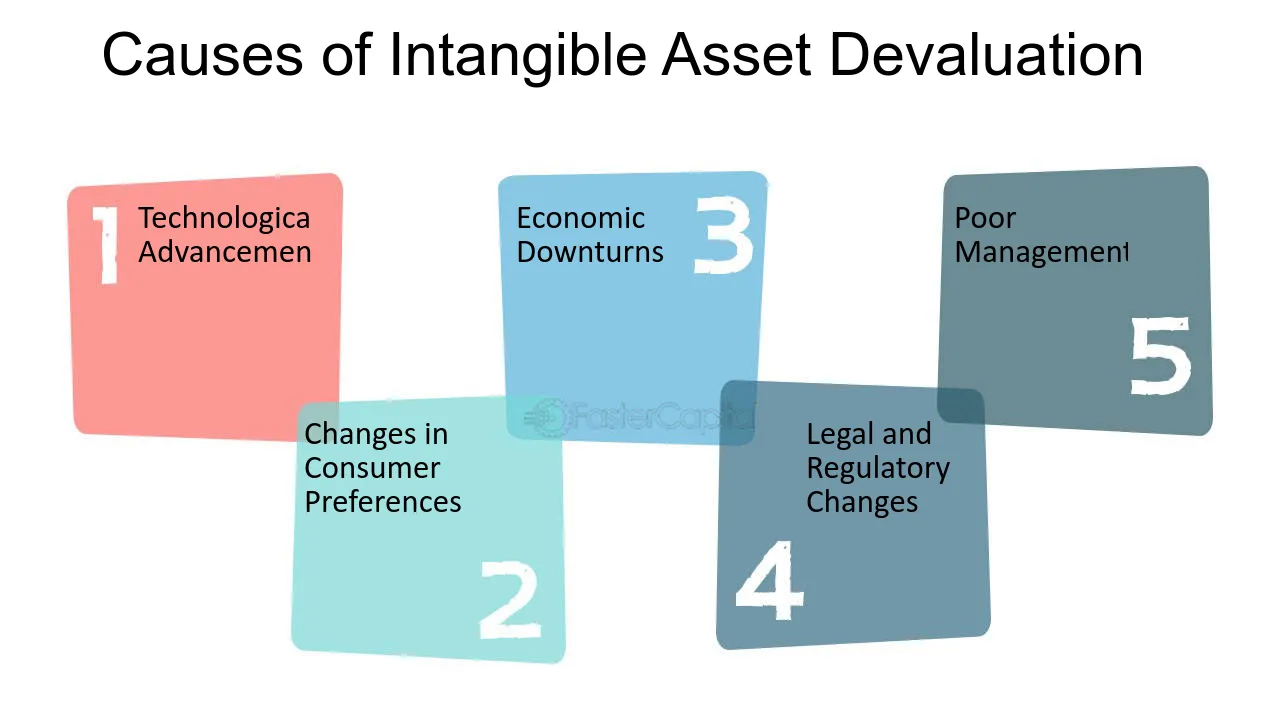

12. Causes of Intangible Asset Devaluation

Intangible assets are the backbone of many businesses, and they account for a significant portion of the company's value. However, these assets can lose their value over time, and this is known as intangible asset devaluation. There are many reasons why intangible assets can lose their value, and it is essential for companies to understand these causes to avoid any significant losses. In this blog, we will explore the various causes of intangible asset devaluation and the methods that companies can use to write down these assets.

1. Technological Advancements

One of the main causes of intangible asset devaluation is technological advancements. With the rapid pace of innovation, many companies find that their once-valuable intangible assets are no longer relevant or useful. For example, a software company may have invested heavily in a particular technology that is now obsolete due to newer and more advanced technologies. As a result, the company's intangible assets lose value, and they may need to write them down.

2. Changes in Consumer Preferences

Consumer preferences can also play a significant role in intangible asset devaluation. As consumer preferences change, a company's intangible assets may no longer be in demand, and their value may decline. For example, a fashion company that invested heavily in a particular brand may find that the brand is no longer popular with consumers, and as a result, the brand loses value.

3. Economic Downturns

Economic downturns can also lead to intangible asset devaluation. During an economic recession, companies may need to cut costs, which can include writing down intangible assets. Moreover, a recession can lead to reduced demand for a company's products or services, which can negatively impact the value of their intangible assets.

4. Legal and Regulatory Changes

Legal and regulatory changes can also cause intangible asset devaluation. For example, a company that holds a patent may find that the patent is no longer enforceable due to changes in patent law. In this case, the value of the patent would decline, and the company may need to write it down.

5. Poor Management

Poor management can also lead to intangible asset devaluation. When a company fails to manage its intangible assets properly, they can lose value over time. For example, a company that fails to protect its intellectual property may find that its patents, trademarks, or copyrights lose value due to infringement.

There are many causes of intangible asset devaluation, and companies must be aware of these causes to avoid significant losses. Technological advancements, changes in consumer preferences, economic downturns, legal and regulatory changes, and poor management are some of the main causes of intangible asset devaluation. To write down these assets, companies can use various methods, including the cost method, market method, and income method. Ultimately, the best method will depend on the specific circumstances of the company and the intangible asset in question.

Causes of Intangible Asset Devaluation - Intangible asset devaluation: Exploring Writedown Methods

13. Impacts of Intangible Asset Devaluation on Financial Statements

Intangible assets are essential to the success of many businesses, including patents, trademarks, copyrights, and goodwill. However, the value of these assets can fluctuate depending on various factors, including market conditions, changes in technology, and changes in management. When the value of these assets decreases, it can have a significant impact on the financial statements of a company. In this section, we will explore the impacts of intangible asset devaluation on financial statements.

Intangible assets are recorded on the balance sheet at their fair value. When the value of these assets decreases, it leads to a decrease in the total assets of the company. This decrease can affect the company's ability to obtain financing and may lead to a breach of loan covenants. Additionally, it can lead to a decrease in the market value of the company's stock.

2. Impacts on Income Statement:

Intangible asset devaluation can also impact the income statement of a company. When the value of these assets decreases, it leads to a decrease in amortization expense. This decrease can improve the company's profitability, but it also indicates that the company is not able to generate the same level of revenue from its intangible assets.

3. Impacts on cash Flow statement:

Changes in the value of intangible assets can also impact the cash flow statement of a company. If the value of these assets decreases, it may lead to a decrease in cash flow from operating activities. This decrease can affect the company's ability to invest in future projects or pay dividends to shareholders.

4. Options for Dealing with Intangible Asset Devaluation:

There are several options available for companies to deal with intangible asset devaluation. One option is to write down the value of the assets on the balance sheet. This option is often used when the decrease in value is considered permanent. Another option is to conduct impairment tests to determine if the decrease in value is temporary or permanent. If the decrease is temporary, the company can continue to carry the assets at their original value.

5. Best Option:

The best option for dealing with intangible asset devaluation depends on the specific circumstances of the company. If the decrease in value is considered permanent, writing down the value of the assets on the balance sheet is the best option. However, if the decrease is temporary, conducting impairment tests is the best option. This approach allows the company to continue to carry the assets at their original value while still acknowledging the decrease in value.

Intangible asset devaluation can have a significant impact on a company's financial statements. It is essential for companies to understand the impacts of these devaluations and the options available for dealing with them. By choosing the best option for their specific circumstances, companies can mitigate the impacts of intangible asset devaluation on their financial statements.

Impacts of Intangible Asset Devaluation on Financial Statements - Intangible asset devaluation: Exploring Writedown Methods

14. Understanding the Importance of Intangible Asset Valuation

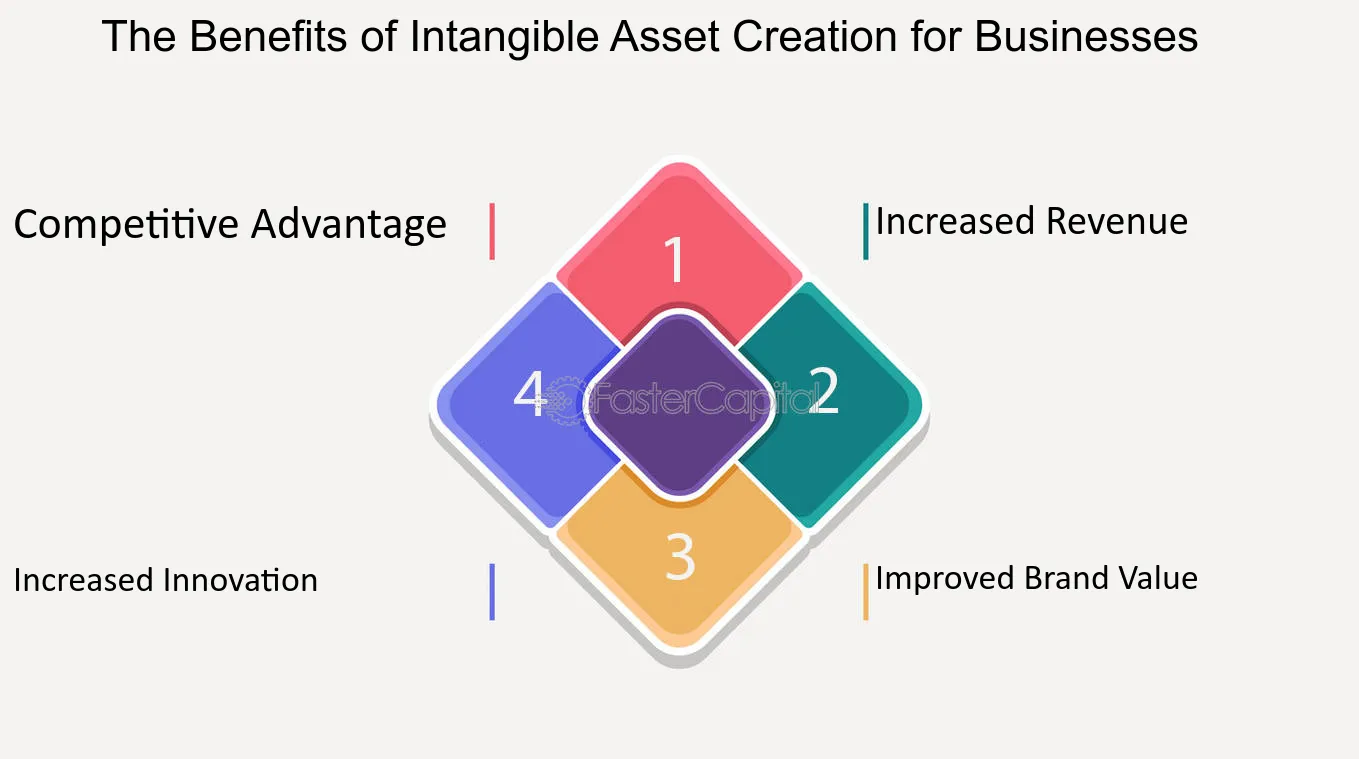

Understanding the importance of intangible asset valuation is crucial for businesses in today's knowledge-based economy. While tangible assets such as buildings, machinery, and inventory are easily quantifiable and accounted for, intangible assets pose a unique challenge due to their non-physical nature. Intangible assets encompass a wide range of valuable resources, including intellectual property, brand reputation, customer relationships, and proprietary technology. These intangibles often play a significant role in driving a company's competitive advantage and long-term success.

From a financial perspective, accurately valuing intangible assets is essential for several reasons. Firstly, it allows businesses to make informed decisions regarding mergers and acquisitions, licensing agreements, or joint ventures. Without a clear understanding of the value of intangibles involved in such transactions, companies risk overpaying or undervaluing these assets, potentially leading to unfavorable outcomes. Secondly, proper valuation of intangibles enables organizations to effectively manage their balance sheets and accurately reflect their true worth. This is particularly important for investors and stakeholders who rely on financial statements to assess a company's overall health and potential for future growth.

From an operational standpoint, understanding the value of intangible assets can help businesses allocate resources more efficiently. For instance, by identifying which intangibles contribute the most to revenue generation or customer loyalty, companies can prioritize investments in those areas to maximize returns. Additionally, knowing the value of intangibles can aid in strategic decision-making by providing insights into market positioning and competitive advantages.

To delve deeper into the importance of intangible asset valuation, let us explore some key points:

1. Identifying hidden value: Intangible assets often hold hidden value that may not be immediately apparent. For example, a well-established brand name can command higher prices for products or services compared to lesser-known competitors. By valuing these intangibles accurately, businesses can unlock this hidden value and leverage it to gain a competitive edge.

2. Risk management: Intangible asset valuation plays a crucial role in risk assessment and mitigation. For instance, if a company heavily relies on a single patent for its revenue stream, understanding the value of that patent becomes vital to assess the potential impact of expiration or infringement risks.

3. compliance and regulatory requirements: Proper valuation of intangible assets is essential to comply with accounting standards and regulatory frameworks. Failure to accurately account for these assets can result in financial misstatements, legal issues, and reputational damage.

4. Investor confidence: Investors increasingly recognize the significance of intangible assets in determining a

Understanding the Importance of Intangible Asset Valuation - Intangible asset valuation: Uncovering the true worth of goodwill

15. Examining Successful Intangible Asset Valuation Strategies

Case studies are an invaluable tool for understanding and analyzing successful intangible asset valuation strategies. By examining real-world examples, we can gain insights from different perspectives and learn from the experiences of others. These case studies provide a deeper understanding of the complexities involved in valuing intangible assets such as goodwill, patents, trademarks, and customer relationships. In this section, we will delve into some notable case studies that shed light on effective strategies for valuing intangible assets.

1. Case Study 1: The Coca-Cola Company

The Coca-Cola Company is renowned for its strong brand value, which is a significant intangible asset. In this case study, we explore how Coca-Cola's brand valuation strategy has contributed to its success. By consistently investing in marketing campaigns, sponsorships, and brand-building activities, Coca-Cola has managed to create a powerful brand image that resonates with consumers worldwide. This case study highlights the importance of considering brand value as a key component of intangible asset valuation.

2. Case Study 2: Google's Intellectual Property Portfolio

Google's intellectual property (IP) portfolio is a prime example of how patents and technology-related intangible assets can significantly impact a company's valuation. Through strategic acquisitions and internal innovation, Google has built an extensive IP portfolio that includes valuable patents and proprietary technologies. This case study emphasizes the need to assess the quality and market potential of a company's IP assets when valuing intangibles.

3. Case Study 3: Amazon's Customer Relationships

Amazon's success can be attributed in part to its strong customer relationships, which are considered valuable intangible assets. By leveraging data analytics and personalized recommendations, Amazon has created a loyal customer base that drives its revenue growth. This case study demonstrates the importance of evaluating customer relationships and their potential for generating future cash flows when valuing intangible assets.

4. Case Study 4: Nike's Brand Endorsements

Nike's endorsement deals with high-profile athletes have played a crucial role in building its brand value. By associating itself with successful athletes, Nike has created a strong brand image that resonates with sports enthusiasts worldwide. This case study highlights the significance of assessing the impact of brand endorsements and sponsorships on intangible asset valuation.

5. Case Study 5: Microsoft's Software Licensing Agreements

Microsoft's software licensing agreements are an essential intangible asset that contributes significantly to its valuation. Through strategic partnerships and licensing deals, Microsoft has expanded the reach of its software products, generating substantial revenue streams. This case

Examining Successful Intangible Asset Valuation Strategies - Intangible asset valuation: Uncovering the true worth of goodwill

16. Examples of Intangible Asset Valuation with Book Value per Common

When it comes to assessing the hidden value of intangible assets, one of the key metrics used is the book value per common share. This metric takes into account the total book value of a company's assets, including both tangible and intangible assets, and divides it by the number of outstanding common shares. The resulting figure provides an estimate of the value of each share of common stock based on the company's assets. In this section, we will take a closer look at some case studies that illustrate how this metric can be used to assess the value of a company's intangible assets.

1. Case Study 1: Coca-Cola

Coca-Cola is a prime example of a company with significant intangible assets. The Coca-Cola brand is one of the most valuable brands in the world, and its intangible assets also include patents, trademarks, and proprietary technology. When we look at Coca-Cola's book value per common share, we see that it is significantly higher than its market price per share. This indicates that the market may not be fully valuing Coca-Cola's intangible assets. In this case, investors who recognize the value of Coca-Cola's intangible assets may see an opportunity to buy the stock at a discount.

2. Case Study 2: Amazon

Amazon is another company with significant intangible assets, including its brand, patents, and proprietary technology. However, when we look at Amazon's book value per common share, we see that it is actually lower than its market price per share. This suggests that the market is valuing Amazon's intangible assets at a premium. In this case, investors who are considering buying Amazon stock need to carefully evaluate whether they believe the market is accurately valuing the company's intangible assets.

3. Case Study 3: Microsoft

Microsoft is a company that has undergone a significant transformation in recent years, moving from a focus on desktop software to cloud computing and other areas. When we look at Microsoft's book value per common share, we see that it has been steadily increasing over the past few years. This suggests that the market is recognizing the value of Microsoft's intangible assets, including its brand, patents, and proprietary technology. In this case, investors who are considering buying Microsoft stock may see an opportunity to invest in a company that is successfully leveraging its intangible assets to drive growth.

4. Case Study 4: Apple

Apple is a company that is often cited as an example of how intangible assets can drive significant value. Apple's brand is one of the most valuable in the world, and its intangible assets also include patents, trademarks, and proprietary technology. When we look at Apple's book value per common share, we see that it is significantly higher than its market price per share. This suggests that the market may not be fully valuing Apple's intangible assets. In this case, investors who recognize the value of Apple's intangible assets may see an opportunity to buy the stock at a discount.

5. Comparing the Options

When we compare these case studies, we see that there is no one-size-fits-all approach to assessing the value of intangible assets. In some cases, the market may undervalue a company's intangible assets, while in other cases, it may overvalue them. Investors who are considering buying stock in a company with significant intangible assets need to carefully evaluate the company's book value per common share, as well as other factors such as the company's growth prospects and competitive position. By taking a comprehensive approach to assessing a company's value, investors can make informed decisions about whether to buy or sell its stock.

Examples of Intangible Asset Valuation with Book Value per Common - Intangible assets: Assessing Hidden Value with Book Value per Common

17. Cultivating a Strong Organizational Culture as an Intangible Asset

In today's highly competitive business landscape, companies are constantly seeking ways to gain a competitive edge. While financial assets and tangible resources play a crucial role in driving growth, it is essential not to overlook the power of intangible assets. These intangible assets, such as brand reputation, intellectual property, and organizational culture, can often be the differentiating factor that sets successful companies apart from their competitors. In this section, we will delve into the significance of cultivating a strong organizational culture as an intangible asset and explore how it can contribute to the overall growth and success of a company.

1. fostering a Sense of belonging and Purpose:

A strong organizational culture creates a sense of belonging and purpose among employees, leading to higher levels of engagement and motivation. When employees feel connected to the company's values and vision, they are more likely to go the extra mile, resulting in increased productivity and innovation. For example, companies like Google and Zappos have successfully cultivated a culture of innovation and employee empowerment, which has propelled them to become industry leaders.

2. attracting and Retaining Top talent:

Organizational culture plays a pivotal role in attracting and retaining top talent. In today's job market, prospective employees are not only looking for competitive compensation packages but also for a work environment that aligns with their values and provides a sense of fulfillment. A strong culture acts as a magnet, attracting individuals who resonate with the company's mission and values. Moreover, it helps retain existing employees by fostering a positive work environment and promoting employee satisfaction. For instance, companies like Netflix and Patagonia have built a reputation for their unique cultures, which has enabled them to attract and retain top talent in their respective industries.

3. Driving Innovation and Adaptability:

A strong organizational culture promotes a mindset of innovation and adaptability. When employees feel empowered to take risks and think outside the box, they are more likely to generate new ideas and drive innovation within the company. This culture of innovation allows companies to stay ahead of the curve and adapt to rapidly changing market conditions. Take the example of Apple, where a strong culture of innovation has been instrumental in their ability to consistently introduce groundbreaking products that disrupt the market.

4. enhancing Customer experience:

Organizational culture also has a direct impact on the customer experience. When employees are aligned with the company's values and committed to delivering exceptional service, it translates into a positive interaction for customers. A strong culture that prioritizes customer-centricity can create a competitive advantage by fostering customer loyalty and advocacy. Companies like Amazon and Southwest Airlines have built a strong reputation for their customer-centric cultures, which has contributed to their success and growth.

5. Nurturing Collaboration and Teamwork:

A strong organizational culture fosters collaboration and teamwork, enabling employees to work together towards a common goal. When employees feel a sense of camaraderie and trust within their teams, it leads to improved communication, knowledge sharing, and problem-solving capabilities. For example, companies like Pixar and IDEO have cultivated a culture that values collaboration and creativity, resulting in highly successful and innovative projects.

A strong organizational culture can be a valuable intangible asset that drives growth and success. By fostering a sense of belonging, attracting top talent, driving innovation, enhancing the customer experience, and nurturing collaboration, companies can leverage their culture to gain a competitive edge in the marketplace. As businesses continue to prioritize intangible assets, it is crucial to recognize the immense value of cultivating a strong organizational culture as an intangible asset.

Cultivating a Strong Organizational Culture as an Intangible Asset - Intangible assets: Leveraging Intangible Non Financial Assets for Growth

18. Legal Considerations for Intangible Asset Management

Intangible assets are valuable assets that do not have physical existence, such as intellectual property, goodwill, and brand recognition. As such, managing intangible assets requires careful consideration of legal issues that may arise. Failure to address legal issues can lead to lost value, litigation, or even loss of rights to the asset. Therefore, it is crucial to consider legal considerations when managing intangible assets.

1. Identify and Protect Your Intangible Assets: Identifying and protecting your intangible assets is the first step towards effective management. This includes registering trademarks, copyrights, patents, and trade secrets. By doing this, you can prevent others from using your intellectual property without permission and protect the value of your assets.

2. Conduct due diligence: Conducting due diligence is another essential step. This involves researching your intangible assets to identify any potential legal issues. For example, if you are acquiring a company, you should conduct due diligence to ensure that the company has the necessary intellectual property rights to its assets. Failure to conduct due diligence can result in legal disputes or loss of value.

3. Draft Contracts: Drafting contracts that outline the terms of use for your intangible assets is also crucial. For example, licensing agreements can help you generate revenue from your assets while controlling their use. The contracts should be clear and legally binding to avoid misunderstandings and legal disputes.

4. Monitor Your Assets: Monitoring your intangible assets is crucial to prevent their misuse. This includes monitoring the internet for any infringement on your intellectual property rights. For example, if you own a trademark, you should monitor the internet for any unauthorized use of your mark.

5. Enforce Your Rights: Enforcing your rights is essential to protect the value of your intangible assets. This involves taking legal action against any infringement on your intellectual property rights. For example, if someone is using your trademark without permission, you can file a lawsuit to stop them from doing so.

Legal considerations are crucial when managing intangible assets. Identifying and protecting your assets, conducting due diligence, drafting contracts, monitoring your assets, and enforcing your rights are all important steps towards effective management. By considering these legal issues, you can protect the value of your intangible assets and avoid legal disputes.

Legal Considerations for Intangible Asset Management - Intangible assets: The Hidden Value in Non Physical Assets

19. A Significant Intangible Asset in Book Value Reduction

1. Goodwill: A Significant Intangible Asset in Book Value Reduction

Goodwill is a key intangible asset that often plays a significant role in book value reduction. It represents the premium paid by a company to acquire another business above its net tangible assets. While goodwill is not a physical asset, it holds immense value for a company as it encompasses the intangible benefits associated with the acquired business, such as brand reputation, customer loyalty, and intellectual property. In this section, we will delve into the importance of goodwill in book value reduction and explore some examples, tips, and case studies to gain a deeper understanding of its impact.

2. The Nature of Goodwill

Goodwill arises when a company acquires another business and pays more than the fair value of its identifiable net assets. It is classified as an intangible asset on the balance sheet and is subject to periodic impairment testing. Goodwill is not amortized like other intangible assets but is instead tested for impairment at least annually or whenever there are indications of potential impairment. If the carrying value of goodwill exceeds its recoverable amount, a write-down is necessary, resulting in a reduction of the company's book value.

3. Factors Influencing Goodwill Impairment

Various factors can lead to goodwill impairment, including changes in market conditions, adverse economic events, shifts in consumer preferences, or a decline in the acquired business's performance. For example, if a company acquires a technology firm with a strong brand presence, but advancements in the industry render the acquired technology obsolete, the value of the goodwill associated with that acquisition may diminish. Similarly, if a company experiences a significant decline in its market share or faces reputational damage, it may trigger the need for goodwill impairment testing.

4. Tips to Mitigate Goodwill Impairment Risks

To minimize the risks associated with goodwill impairment and subsequent book value reduction, companies can adopt several strategies. Firstly, conducting thorough due diligence before acquiring a business is crucial. This includes assessing the sustainability of the acquired business's competitive advantage and estimating potential synergies. Secondly, regularly monitoring market and industry trends can help identify any early warning signs of impairment. It is also essential to maintain transparent financial reporting practices and provide sufficient disclosures regarding the assumptions and judgments made during goodwill impairment testing.

5. Case Study: The AOL-Time Warner Merger

The AOL-Time Warner merger, which took place in 2000, serves as a notable example of goodwill impairment and subsequent book value reduction. AOL, an internet service provider, purchased Time Warner, a media conglomerate, for a staggering $165 billion. However, the merger failed to realize the anticipated synergies and faced challenges due to the dot-com bubble burst and changes in the media landscape. Consequently, AOL-Time Warner recorded a goodwill impairment charge of approximately $99 billion in 2002, one of the largest write-downs in corporate history. This impairment significantly reduced the company's book value and had lasting implications for its financial performance.

6. Conclusion

Goodwill plays a crucial role in book value reduction, as it represents the intangible benefits acquired through business acquisitions. Understanding the nature of goodwill, factors influencing its impairment, and implementing effective strategies to mitigate risks are vital for companies to maintain a healthy book value. The AOL-Time Warner case study serves as a reminder of the importance of accurately assessing the value of goodwill and the potential consequences of overestimating its worth. By carefully managing goodwill, companies can safeguard their financial health and ensure accurate reflection of their true value.

A Significant Intangible Asset in Book Value Reduction - Intangible Assets: The Intangible Side of Book Value Reduction

20. The Importance of Unveiling Intangible Asset Insights

Section 1: Unveiling the Hidden Gems

In the realm of market research, the focus has historically been on tangible assets – the physical properties, stocks, and monetary assets that are easily quantified and assessed. However, in today's rapidly evolving business landscape, intangible assets have emerged as equally, if not more, critical. These non-physical assets, such as intellectual property, brand reputation, and customer relationships, play a significant role in a company's overall value. Yet, their value remains largely concealed, making it imperative to unveil the insights they hold.

1. Recognizing the Intangible Asset Spectrum: Intangible assets come in various forms, from patents and copyrights to trademarks and goodwill. Different industries and businesses possess distinct types of intangible assets, each contributing differently to their worth. It's essential to understand this spectrum to prioritize effectively.

2. Quantifying the Unquantifiable: A challenge arises when attempting to quantify the value of intangible assets. Unlike tangible assets with concrete market values, intangibles rely on subjective estimations. Methods like cost, market, and income approaches are used to assess them. For instance, Apple's brand reputation, an intangible asset, is estimated to be worth billions.

3. Risks and Rewards of Unveiling: Companies that successfully unveil their intangible assets can experience substantial benefits, such as attracting investors, enhancing market positioning, and improving strategic decision-making. However, unveiling also poses risks, like potential imitation by competitors, making it essential to strike a balance.

4. Data-Driven Insights: One effective way to uncover intangible asset insights is through comprehensive data analysis. Companies can leverage big data and analytics tools to gain insights into customer sentiment, market trends, and competitive landscapes. For instance, social media sentiment analysis can reveal how a brand is perceived, offering valuable insights into its reputation.

Section 2: Measuring Intangible Assets

Understanding the value of intangible assets is one thing, but measuring them accurately is a whole new challenge. Companies have several options, each with its pros and cons.

1. Market Valuation: Assessing intangible assets based on their market value is suitable for assets like trademarks, which might have a readily available market price. However, this method can't capture the full value of assets like intellectual property, which is more challenging to trade in a market.

2. Cost Approach: This method entails calculating the costs incurred in creating an intangible asset, such as research and development expenses. While it provides a solid basis for valuation, it often fails to account for the asset's potential for future earnings.

3. Income Approach: The income approach estimates the value of intangible assets based on the income they generate. It's suitable for assets like patents with clear revenue streams but may be less accurate for assets with uncertain future returns.

4. Hybrid Methods: Many experts recommend using a combination of approaches to assess intangible assets comprehensively. For instance, combining the market and income approaches may provide a more accurate valuation for assets with uncertain markets but clear income potential.

Section 3: Protecting Intangible Assets

Once uncovered and measured, it's crucial to protect intangible assets. The following options are available:

1. Legal Protections: Trademarks, patents, and copyrights can be legally protected. For instance, Coca-Cola's secret formula is a closely guarded trade secret, legally protected from disclosure.

2. Reputation Management: Companies can invest in reputation management strategies to safeguard their brand's intangible value. Maintaining a positive image and addressing crises promptly can prevent reputational damage.

3. Cybersecurity: In the digital age, protecting intangible assets like proprietary software and customer databases from cyber threats is paramount. Implementing robust cybersecurity measures is essential.

4. Insurance: Some companies opt for intangible asset insurance, which can cover losses due to reputational damage or intellectual property infringement.

By understanding the importance of unveiling intangible asset insights, measuring their value, and protecting them, businesses can harness these hidden gems to drive growth and secure their competitive advantage in today's dynamic markets.

The Importance of Unveiling Intangible Asset Insights - Market Research Data: Unveiling Intangible Asset Insights

21. Unveiling Intangible Asset Insights for Business Success

Intangible assets are the hidden gems that every business has but often neglects. They are the non-physical assets that contribute to the value of a company, such as brand reputation, customer loyalty, intellectual property, and human capital. While tangible assets like buildings, equipment, and inventory can be easily measured, intangible assets are not so straightforward. However, understanding and leveraging intangible assets is critical for business success. In this section, we will delve into case studies that highlight the importance of intangible assets and how they can be used to gain a competitive advantage.

1. Case Study: Apple Inc.

Apple Inc. Is a prime example of a company that has leveraged its intangible assets to become one of the most successful companies in the world. The company's brand reputation is one of the strongest in the world, and its loyal customer base is a testament to this fact. Apple's brand is so powerful that it has become a status symbol, with people willing to pay a premium for its products. Additionally, Apple's intellectual property, such as patents and trademarks, has allowed the company to protect its innovations and prevent competitors from copying its ideas.

2. Case Study: Coca-Cola

Coca-Cola is another company that has successfully leveraged its intangible assets. The company's brand is recognized worldwide, and its products are sold in over 200 countries. Coca-Cola's brand is so strong that it has become synonymous with soft drinks. The company has also invested heavily in advertising and marketing, which has helped to create and maintain its brand reputation. Coca-Cola's intangible assets have allowed the company to dominate the soft drinks industry for over a century.

3. Case Study: Google

Google, now a subsidiary of Alphabet Inc., is a company that has built its success on its intangible assets. The company's search engine is one of the most powerful in the world, and its algorithms and data analytics have allowed it to provide users with relevant search results. Google's human capital is also a key intangible asset, with the company attracting some of the most talented engineers, data scientists, and marketers in the world. Google's intangible assets have allowed the company to dominate the search engine market and expand into other areas such as cloud computing, artificial intelligence, and self-driving cars.

4. Case Study: Kodak

Kodak is a cautionary tale of a company that failed to leverage its intangible assets and adapt to changing market conditions. The company was once a dominant player in the photography industry, with its brand and patents giving it a competitive advantage. However, Kodak failed to recognize the shift towards digital photography and was slow to adapt. The company's intangible assets became a liability, with its brand losing relevance and its patents becoming less valuable. Kodak filed for bankruptcy in 2012, a victim of its inability to leverage its intangible assets.

5. The Best Option

The case studies above illustrate the importance of intangible assets for business success. Companies that understand and leverage their intangible assets can gain a competitive advantage and create long-term value. The best option for businesses is to conduct a comprehensive intangible asset analysis to identify their key intangible assets and develop strategies to leverage them. This analysis should include identifying the company's brand reputation, intellectual property, human capital, and customer relationships. By understanding and leveraging their intangible assets, businesses can unlock their full potential and achieve sustainable growth.

Unveiling Intangible Asset Insights for Business Success - Market Research Data: Unveiling Intangible Asset Insights

22. Future Trends in Unveiling Intangible Asset Insights

As the world becomes more digitally-driven, the importance of intangible assets continues to grow. In today's economy, intangible assets such as brand reputation, customer loyalty, and intellectual property are often more valuable than physical assets. However, measuring and understanding the value of these assets can be a challenge. Fortunately, advancements in technology and data analysis are making it easier to unveil insights into intangible assets. In this blog section, we will explore some of the future trends in uncovering intangible asset insights.

1. Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are revolutionizing the way we analyze data. These technologies can process vast amounts of data and identify patterns that would be impossible for humans to detect. In the context of intangible assets, AI and ML can be used to analyze social media sentiment, identify customer preferences, and predict future market trends. For example, a company can use AI to analyze customer reviews and identify areas for improvement in their product or service.

2. Blockchain Technology

Blockchain technology has the potential to revolutionize the way we track and manage intangible assets. By using a decentralized, secure ledger, blockchain can provide a transparent and tamper-proof record of ownership and usage of intangible assets. This can be particularly useful in industries such as music and art, where ownership and usage rights can be complex and difficult to track. For example, blockchain can be used to track the usage of copyrighted music and ensure that the appropriate royalties are paid to the owners.

3. Data Visualization

Data visualization tools are becoming increasingly sophisticated, making it easier to understand and interpret complex data. In the context of intangible assets, data visualization can be used to identify trends and patterns in customer behavior, brand reputation, and market trends. For example, a company can use data visualization to track the sentiment of social media mentions of their brand and identify areas where they need to improve their reputation.

4. Predictive Analytics

Predictive analytics can be used to forecast future trends and identify potential opportunities and risks. In the context of intangible assets, predictive analytics can be used to identify emerging market trends, predict customer behavior, and forecast changes in brand reputation. For example, a company can use predictive analytics to identify emerging trends in their industry and adjust their product or service offerings accordingly.

5. Collaborative Data Analysis

Collaborative data analysis involves bringing together multiple stakeholders to analyze and interpret data. This approach can be particularly useful in the context of intangible assets, where multiple stakeholders may have different perspectives on the value and usage of these assets. By bringing together stakeholders such as customers, employees, and investors, companies can gain a more comprehensive understanding of their intangible assets and how they can be leveraged for competitive advantage.

The future of uncovering intangible asset insights is exciting and full of potential. By leveraging advancements in technology and data analysis, companies can gain a deeper understanding of the value and usage of their intangible assets. Whether through AI and ML, blockchain technology, data visualization, predictive analytics, or collaborative data analysis, companies can gain a competitive advantage by unlocking the insights hidden in their intangible assets.

Future Trends in Unveiling Intangible Asset Insights - Market Research Data: Unveiling Intangible Asset Insights

23. Strategies for Maximizing ROI through Intangible Asset Amortization

When it comes to maximizing ROI, intangible assets such as technology patents can play a critical role in achieving this goal. However, many companies struggle to fully leverage these assets, often because they do not understand how to amortize them effectively. In this section, we will explore the strategies that companies can use to amortize their intangible assets and achieve maximum ROI.

From a legal perspective, amortizing intangible assets can be a complex process. Companies must navigate a variety of regulations and requirements, including tax laws, accounting rules, and industry-specific regulations. Additionally, the valuation of intangible assets can be challenging, as they often lack a clear market value. However, despite these challenges, amortizing intangible assets can provide significant benefits for companies that are willing to invest the time and resources necessary to do it right.

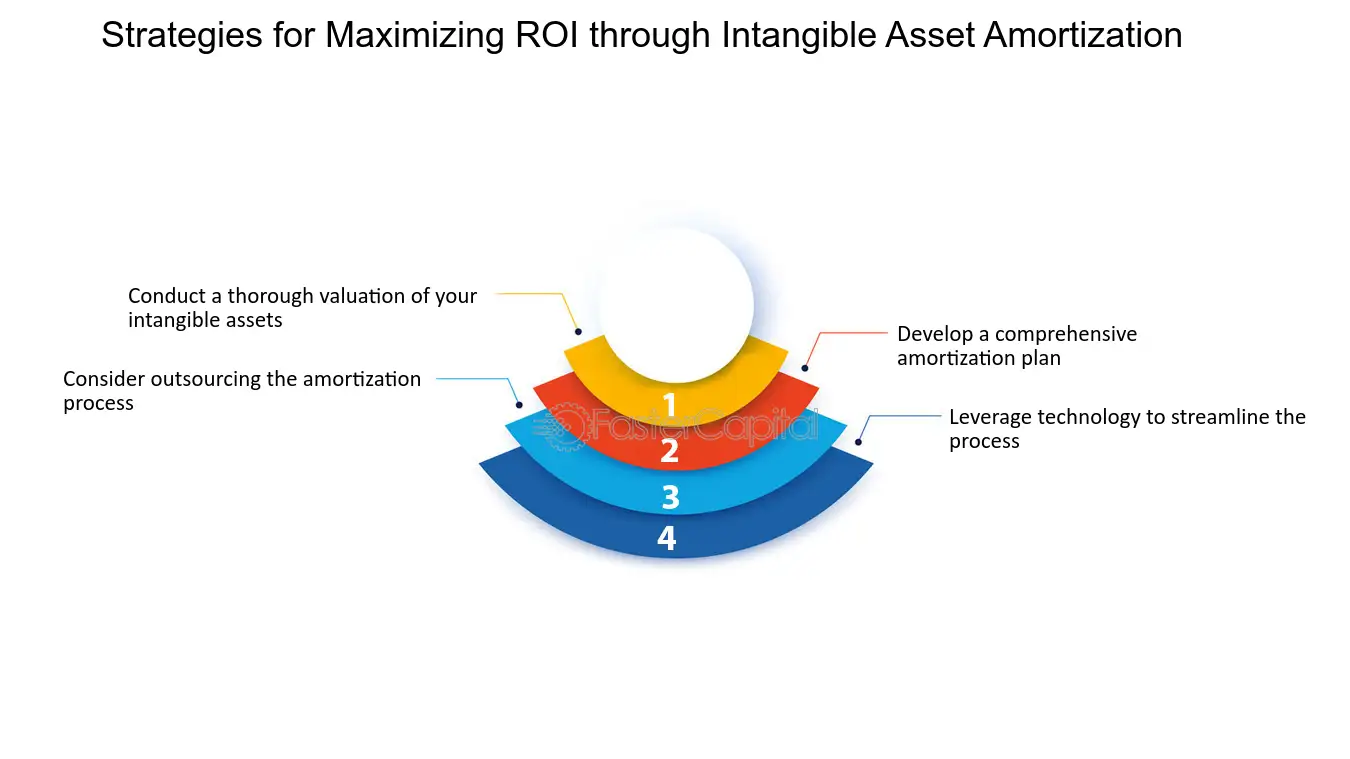

To help companies maximize ROI through intangible asset amortization, we have compiled a list of strategies that can be used to achieve this goal:

1. Conduct a thorough valuation of your intangible assets: Before you can effectively amortize your intangible assets, you need to have a clear understanding of their value. This requires a detailed valuation process that takes into account a range of factors, including market demand, industry trends, and your company's unique competitive advantage.

2. Develop a comprehensive amortization plan: Once you have a clear understanding of the value of your intangible assets, you can begin to develop an amortization plan that aligns with your overall financial goals. This plan should take into account factors such as tax implications, cash flow needs, and long-term growth objectives.

3. Consider outsourcing the amortization process: For many companies, the process of amortizing intangible assets can be overwhelming. In these cases, outsourcing the process to a third-party provider can be an effective solution. This approach allows companies to leverage the expertise of experienced professionals while freeing up internal resources for other critical tasks.

4. Leverage technology to streamline the process: Technology can play a critical role in streamlining the intangible asset amortization process. For example, specialized software can help companies track and manage their intangible assets, while automation tools can reduce the time and effort required to complete routine tasks.

By implementing these strategies, companies can effectively amortize their intangible assets and achieve maximum ROI. For example, a technology company that has developed a valuable patent can leverage these strategies to maximize the return on their investment and drive long-term growth. Ultimately, effective intangible asset amortization requires a combination of financial expertise, legal knowledge, and technology tools to be successful.

Strategies for Maximizing ROI through Intangible Asset Amortization - Maximizing ROI: Amortizing Intangibles in Technology Patents

24. Maintaining Intangible Asset Value

When it comes to navigating the complex world of goodwill impairment, one crucial aspect that cannot be overlooked is the value of intangible assets. These intangibles, such as brand reputation, customer relationships, patents, and intellectual property, often play a significant role in determining the overall value of a company. Therefore, it becomes imperative for organizations to adopt effective strategies to mitigate the risks associated with goodwill impairment and ensure the preservation of their intangible asset value.

From a financial perspective, maintaining the value of intangible assets can directly impact a company's bottom line. A decline in the value of these assets can lead to impairment charges, which not only affect reported earnings but also erode shareholder value. Additionally, from an operational standpoint, the loss of intangible asset value can result in decreased market competitiveness and hinder future growth prospects.

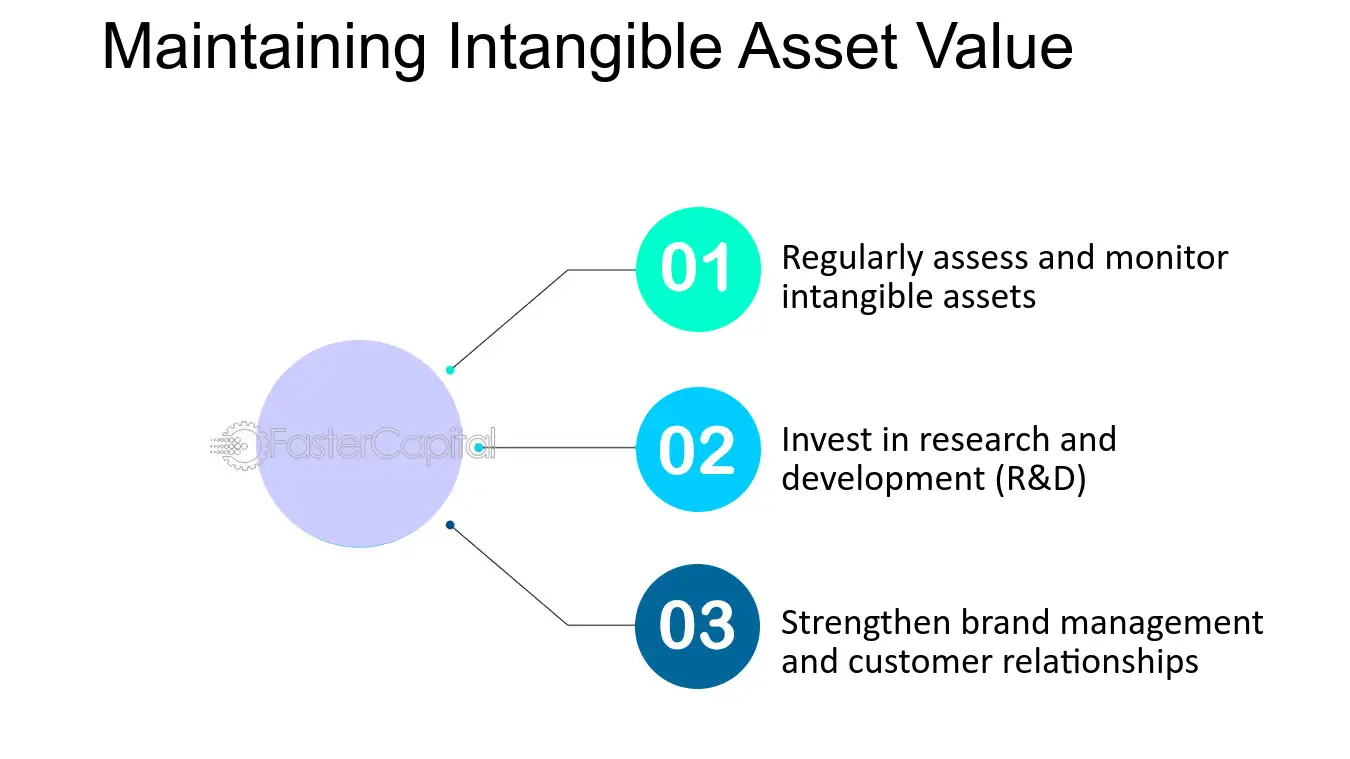

To address these risks and safeguard intangible asset value, organizations can employ various strategies:

1. Regularly assess and monitor intangible assets: Conducting periodic assessments of intangible assets allows companies to identify any potential impairments early on. By monitoring factors such as changes in market conditions, technological advancements, or shifts in consumer preferences, organizations can proactively respond to threats that may impact the value of their intangibles.

For example, consider a software development company that relies heavily on its proprietary technology for competitive advantage. To maintain the value of its intellectual property rights, the company regularly conducts audits to ensure compliance with copyright laws and monitors industry trends to stay ahead of emerging technologies that could render its software obsolete.

2. Invest in research and development (R&D): Continuous investment in R&D activities is crucial for businesses reliant on innovation-driven intangibles. By allocating resources towards developing new products or enhancing existing ones, companies can strengthen their competitive position and protect the value of their intangible assets.

For instance, a pharmaceutical company that holds patents for groundbreaking drugs must consistently invest in R&D to stay ahead of competitors and maintain the exclusivity of its intellectual property. This ongoing commitment to innovation not only preserves the value of existing intangibles but also creates opportunities for future growth.

3. Strengthen brand management and customer relationships: Intangible assets like brand reputation and customer relationships are often the most valuable assets for companies operating in consumer-driven industries. Organizations should focus on building strong brand equity through effective marketing strategies, maintaining consistent product quality, and delivering exceptional customer experiences.

Take the example of

Maintaining Intangible Asset Value - Navigating Goodwill Impairment: The Impact of Intangible Assets

25. The Role of R&D in Intangible Asset Creation

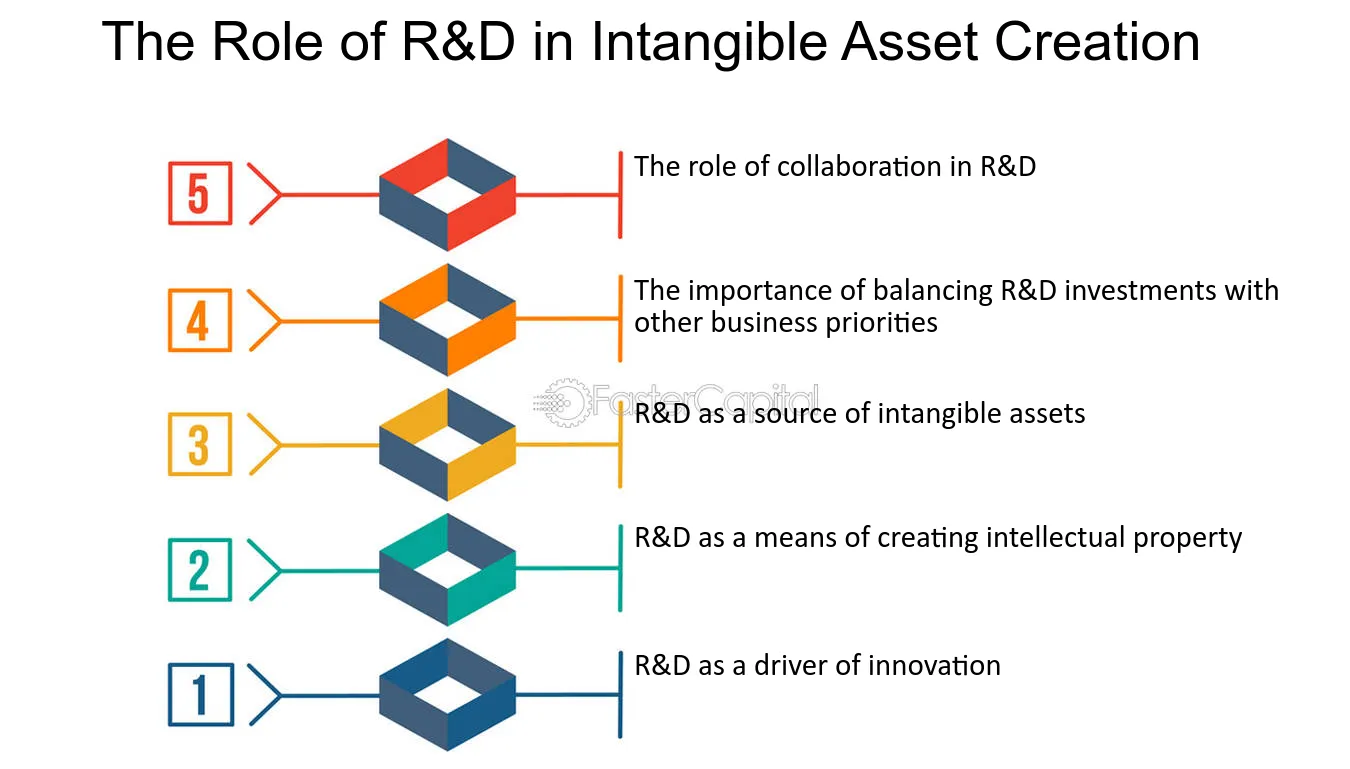

In today's fast-paced and competitive business environment, companies need to constantly innovate and create new products to stay ahead of the competition. Research and Development (R&D) plays a crucial role in this process, as it provides the necessary resources and expertise to create intangible assets that can drive growth and profitability. In this blog section, we will explore the role of R&D in intangible asset creation and provide insights from different perspectives.

1. R&D as a driver of innovation