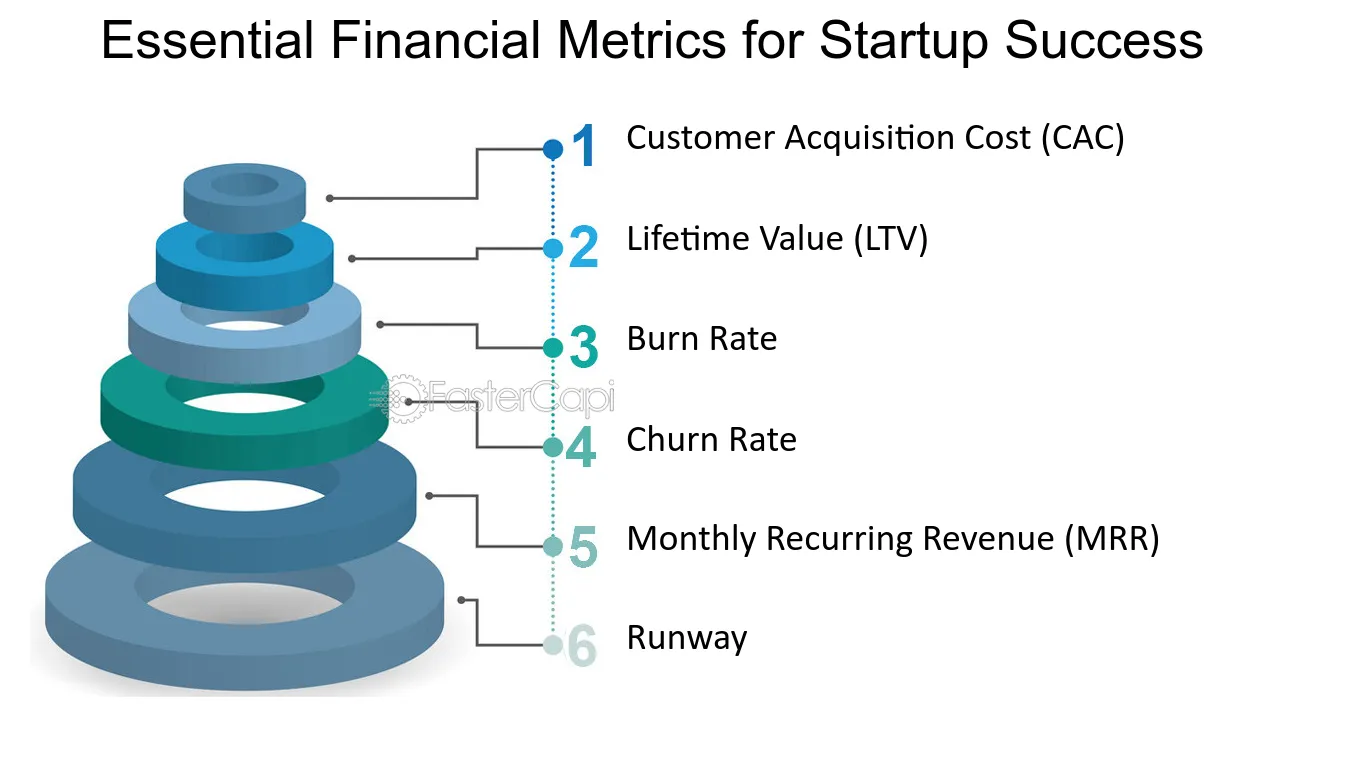

1. Essential Financial Metrics for Startup Success

Tracking and measuring financial metrics specific to startups is crucial to monitor progress and identify areas for improvement. While these metrics may vary based on the nature of your startup, here are some essential financial metrics to consider:

1. Customer Acquisition Cost (CAC): CAC measures the cost incurred to acquire a new customer. It helps you understand the effectiveness of your marketing and sales strategies and assess their impact on profitability.

2. Lifetime Value (LTV): LTV represents the total revenue a customer generates over their lifetime as a customer. Comparing LTV with CAC helps you assess the long-term profitability of your customer acquisition efforts.

3. Burn Rate: Burn rate measures the rate at which your startup consumes cash to cover its operating expenses. This metric provides insights into the runway your startup has before running out of funds.

4. Churn Rate: Churn rate measures the percentage of customers who discontinue using your product or service over a specific period. By monitoring and minimizing churn rate, you can improve customer retention and revenue stability.

5. Monthly Recurring Revenue (MRR): MRR reflects the predictable revenue your startup generates on a monthly basis. Tracking MRR helps you monitor revenue growth and assess the effectiveness of your pricing and subscription models.

6. Runway: Runway represents the period your startup can continue operating without raising additional funds. Calculating runway helps you plan your financial activities and prioritize strategies to extend your startup's lifespan.

Customize the selection of financial metrics based on your startup's unique characteristics and industry requirements. Regularly analyze these metrics to identify trends, make data-driven decisions, and drive the financial success of your startup.

Essential Financial Metrics for Startup Success - How to manage finances in startup 1

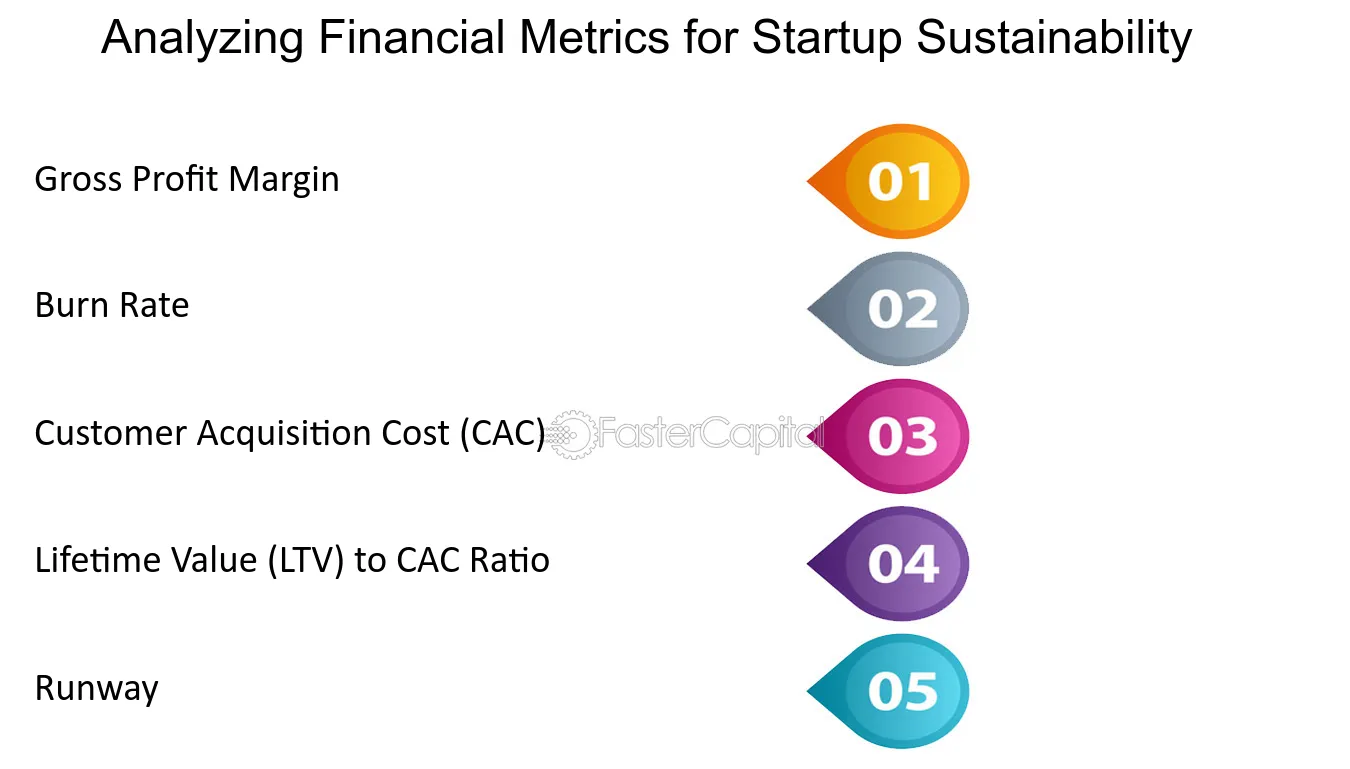

2. Analyzing Financial Metrics for Startup Sustainability

Financial metrics play a crucial role in assessing the viability and sustainability of a startup. By closely monitoring and analyzing these metrics, entrepreneurs and investors can gain valuable insights into the financial health of the business, identify areas of improvement, and make informed decisions to drive growth. In this section, we will explore some key financial metrics that startups should analyze to ensure their long-term success.

The gross profit margin is a fundamental metric that measures the profitability of a startup's core operations. It represents the percentage of revenue left after deducting the cost of goods sold (COGS). A high gross profit margin indicates that the startup can generate profits efficiently, while a low margin may suggest pricing or cost inefficiencies. For example, if a software service (SaaS) startup generates $100,000 in revenue and incurs $30,000 in COGS, its gross profit margin would be 70%.

2. Burn Rate:

The burn rate is a critical metric that measures the rate at which a startup is spending its cash reserves. It indicates how long the startup can sustain its operations before running out of funds. Startups with a high burn rate may face challenges in raising additional capital or achieving profitability. Conversely, a low burn rate demonstrates financial discipline and a sustainable business model. For instance, if a startup has $500,000 in cash reserves and is spending $50,000 per month, its burn rate would be $50,000.

3. Customer Acquisition Cost (CAC):

The customer acquisition cost is an essential metric for startups that measures the amount of money spent to acquire a new customer. It includes the costs associated with marketing, sales, and other customer acquisition activities. A high CAC relative to the average revenue per customer can be an indication of an inefficient customer acquisition strategy or an unsustainable business model. On the other hand, a low CAC demonstrates the startup's ability to acquire customers cost-effectively. For example, if a startup spends $10,000 on marketing and sales efforts and acquires 100 new customers, its CAC would be $100.

4. Lifetime Value (LTV) to CAC Ratio:

The LTV to CAC ratio compares the lifetime value of a customer to the customer acquisition cost. It helps startups assess the long-term profitability and sustainability of their customer acquisition efforts. A ratio of less than 1 suggests that the startup is spending more to acquire customers than their lifetime value, indicating an unsustainable business model. Conversely, a ratio greater than 1 indicates a healthy return on investment (ROI) from customer acquisition activities. For instance, if the lifetime value of a customer is $1,000 and the CAC is $100, the LTV to CAC ratio would be 10:1.

5. Runway:

The runway is a financial metric that calculates the duration for which a startup can continue operating based on its available cash reserves and burn rate. It provides valuable insights into the startup's financial sustainability and ability to weather unforeseen circumstances. A longer runway allows startups to focus on growth and scalability, while a shorter runway may require immediate fundraising efforts or cost-cutting measures. For example, if a startup has $1,000,000 in cash reserves and a burn rate of $100,000 per month, its runway would be 10 months.

By diligently analyzing these financial metrics, startups can gain a comprehensive understanding of their financial health, identify potential risks and opportunities, and make data-driven decisions to ensure long-term sustainability. Remember, measuring and analyzing financial metrics is not a one-time task but an ongoing process that should be integrated into the startup's regular monitoring and evaluation practices.

Analyzing Financial Metrics for Startup Sustainability - Importance of measuring and analyzing startup metrics

3. Measure progress and track metrics for your startup

As a startup, it is important to measure progress and track metrics in order to ensure that your business is on track. There are a number of different ways to do this, and the best approach will vary depending on your specific business goals and objectives.

One way to measure progress is to track key metrics over time. This can help you identify trends and see how your business is performing against specific goals. For example, you might track website traffic, number of new customers, or sales revenue.

Another way to measure progress is to conduct customer surveys or interviews. This can give you valuable feedback about your product or service and help you identify areas for improvement.

Finally, its also important to set aside time on a regular basis to reflect on your progress and celebrate your successes. This can help you stay motivated and focused on your long-term goals.

No matter how you choose to measure progress, tracking metrics is an essential part of running a successful startup. By monitoring your performance and making changes as needed, you can ensure that your business is moving in the right direction.

4. The Key Financial Metrics Every Startup Needs to Track

Every startup needs to track key financial metrics in order to gauge their success and plan for future growth. Understanding the different financial metrics is essential for any business, as it helps you measure performance and make informed decisions about the future.

The most important financial metrics for startups include cash flow, revenue, expenses, profitability, and capital. cash flow is essential for any business as it measures the incoming and outgoing funds in a given period of time. Cash flow can be positive if more money is coming in than going out, or negative if more money is going out than coming in. Its important to monitor cash flow to ensure your business has enough money to cover its expenses and obligations.

Revenue is another key metric as it measures how much money your business brings in over a period of time. Revenue should be tracked regularly as it provides insights into the health of your business. Its important to understand which products or services generate the most revenue and what can be done to increase it.

Expenses are also important to track as they provide an indication of how efficiently a business is run. Expenses can include rent, payroll, taxes, marketing, and other costs associated with running the business. Monitoring expenses allows you to identify areas where you can reduce costs and cut back on unnecessary spending.

Profitability is also an important metric as it measures the difference between revenue and expenses. A profitable business means that more money is coming in than going out, which will help sustain the business over time. Knowing your profitability allows you to make informed decisions about pricing and marketing strategy.

Capital is also an important metric for startups as it measures the amount of money invested into the business. Capital can come from equity investments or loans, and can help a startup scale quickly if managed properly. Understanding your capital helps you make informed decisions about investments and scaling up operations.

Overall, these are the key financial metrics every startup needs to track in order to measure its performance and plan for future growth. By understanding these metrics, you can make informed decisions about pricing, marketing strategy, investments, and other areas of your business. This will help ensure your startups long-term success and sustainability.

5. Using Financial Metrics to Value a Startup

There are many ways to value startups. However, the most effective way to do so is through financial metrics. This can help ensure that the startup is valued fairly and accurately.

1. Financial ratios: A financial ratio is a tool that helps trustees assess a company's health and future prospects. It measures how much debt, assets, profits, and liabilities the company has relative to its total resources.

A startup's financial ratio should be kept low if the startup plans to continue operations for an extended period of time or if the company is making progress in terms of growth and profitability. A high financial ratio might suggest that liquidation could be necessary in order for the business to meet its goals or that there are potential investors who would not dare invest in a new stock offering from a known risk-taker.

2. cash flow: Cash flow can also be used as a measure of success for startups because it reflects how efficiently a business spends its money (and how much it has saved up).cash flow measures how much money a company has on hand at any given point in time minus any outstanding liabilities (such as CapEx). The higher cash flow indicates that the startup is generating more revenue than it spending, which can indicate strong investor confidence and support for continued operations

Using Financial Metrics to Value a Startup - The Top Methods for Valuing Startups

6. Defining key metrics for your startup

As a startup, its critical to track and measure key metrics to ensure your business is on track. But, what exactly should you be measuring? It can be tough to know where to start, but luckily, were here to help.

So, lets get started!

What Are Key Metrics?

Key metrics are those essential measures that help you track progress and understand whether your business is on track. They can be financial or non-financial measures, but they should always be aligned with your business goals.

For example, if your goal is to increase revenue, then key metrics might include measures like total sales, conversion rate, or average order value. If your goal is to reduce costs, then key metrics might include measures like cost of goods sold or employee turnover.

There are literally hundreds of different metrics that you could track for your business. But, as a startup, you likely dont have the time or resources to track them all. Thats why its so important to focus on those key metrics that will give you the most insights into your business.

How to Choose the Right Key Metrics for Your Startup

There are a few things to keep in mind when choosing key metrics for your startup:

1. Align with Business Goals

As we mentioned before, your key metrics should always be aligned with your business goals. This will help you stay focused on whats most important and ensure that your metrics are actually providing valuable insights.

2. Keep It Simple

Startups are often resource-strapped, so its important to keep your key metrics simple. You dont want to overwhelm yourself (or your team) with too many measures to track.

Ideally, you should focus on 3-5 key metrics that you can track on a regular basis. This will give you a good overview of how your business is performing without being too overwhelming.

3. Make It Actionable

Your key metrics should also be actionable, meaning they should give you insights into what you can do to improve your business. For example, if youre tracking customer acquisition costs (CAC), then that metric can tell you whether your current marketing efforts are working or not.

If CAC is too high, then thats a sign that you need to rethink your marketing strategy. But, if CAC is low and youre still not seeing the results you want, then maybe its time to adjust your business goals. Either way, actionable metrics are essential for driving growth in your startup.

4. Track Progress Over Time

Finally, its important to track your key metrics over time so that you can see how your business is progressing. This is especially important for startup businesses because they often go through a lot of changes in a short period of time.

For example, lets say you track customer acquisition costs (CAC) for your startup. If CAC starts to increase over time, that could be a sign that your marketing efforts are becoming less effective. Or, if CAC decreases suddenly, that could be a sign that you made a change that had a positive impact on your business.

Either way, tracking progress over time will give you valuable insights into your business and help you make better decisions about where to focus your efforts.

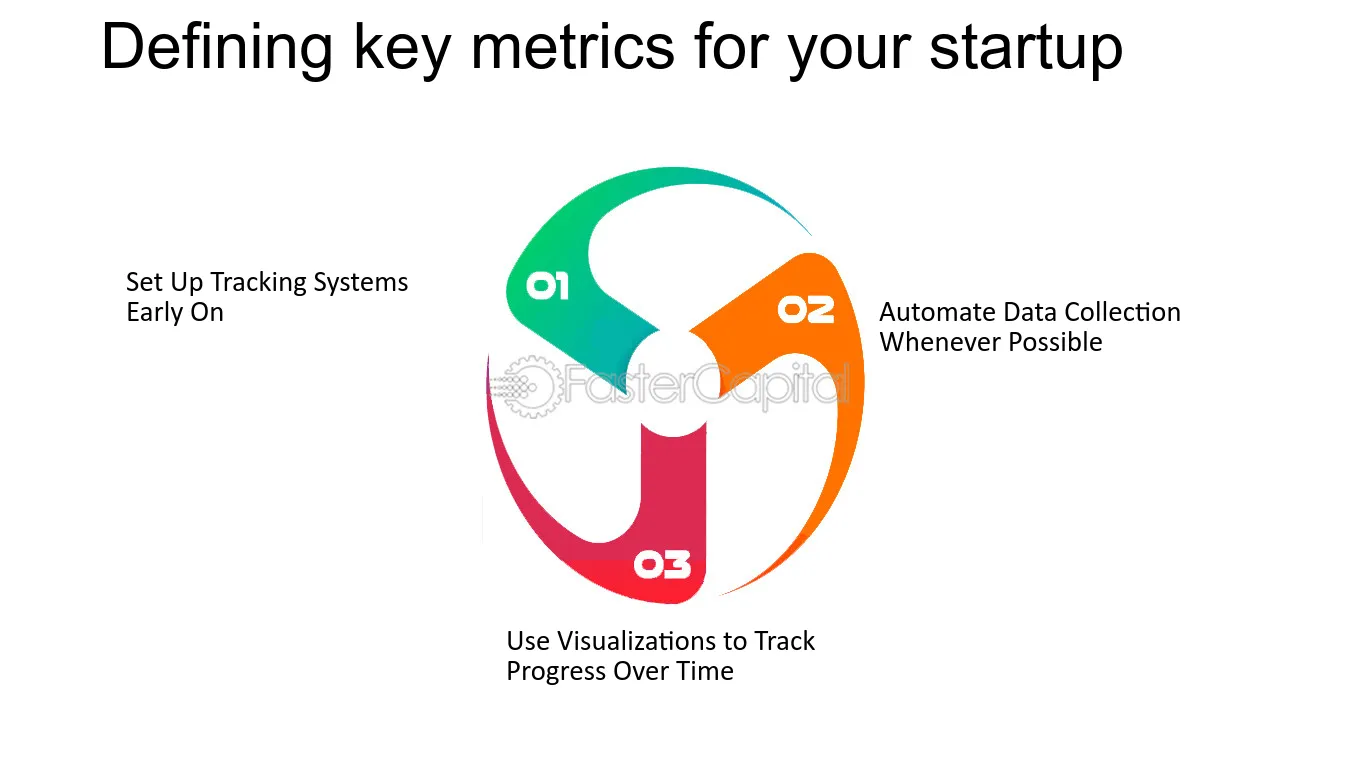

How to Track Key Metrics Effectively

Once youve chosen the right key metrics for your startup, its time to start tracking them effectively. Here are a few tips:

1. Set Up Tracking Systems Early On

Its important to set up tracking systems early on so that you can start collecting data as soon as possible. This data will be essential for understanding how your business is performing and making informed decisions about where to focus your efforts.

There are a few different ways to track key metrics, but one of the easiest is to use a spreadsheet like Google Sheets or Microsoft Excel. You can also use specialized software like QuickBooks or FreshBooks if you want something more robust (and if you have the budget for it).

2. Automate Data Collection Whenever Possible

Data collection can be time-consuming, so its important to automate it whenever possible. For example, if youre tracking website traffic data, you can use Google Analytics to automatically collect and organize this data for you. This will free up time so that you can focus on other things (like running your business!).

3. Use Visualizations to Track Progress Over Time

Visualizations (like charts and graphs) can be really helpful for tracking progress over time. They make it easy to see trends and compare data points side-by-side. Plus, they can be really helpful for communicating information to other people (like investors or stakeholders).

Defining key metrics for your startup - Track and measure key metrics for your startup

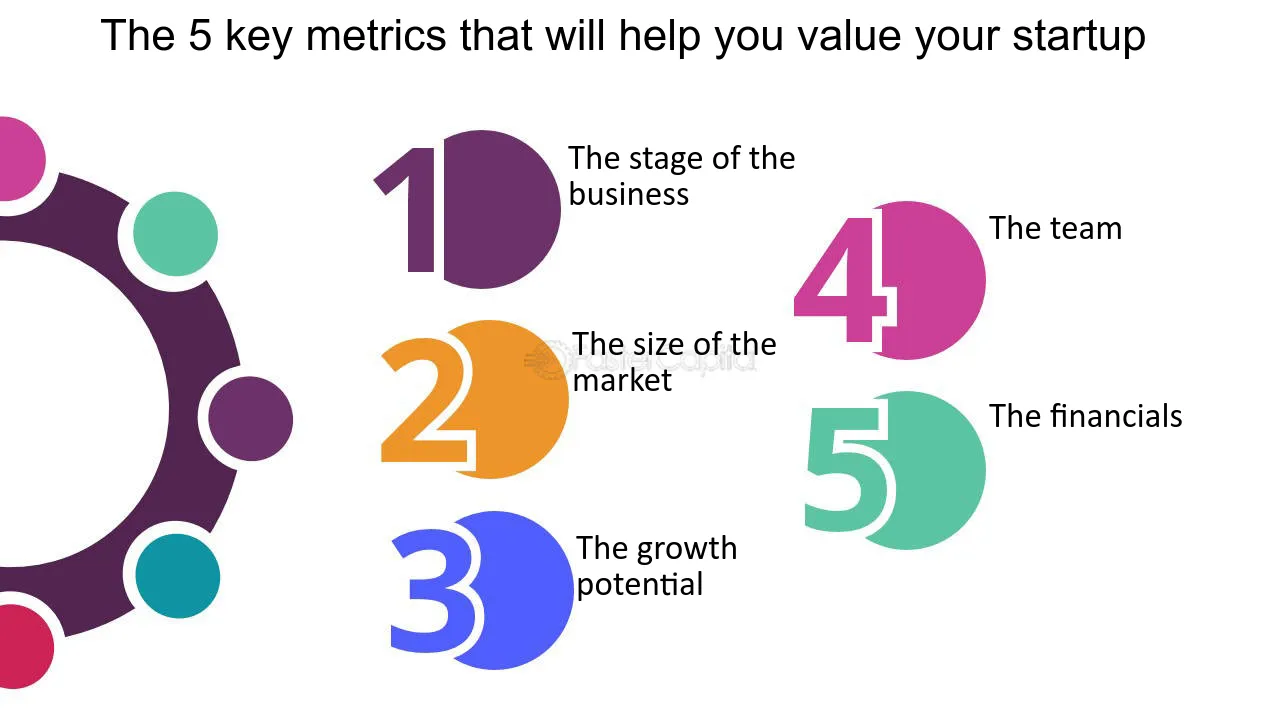

7. The 5 key metrics that will help you value your startup

When it comes to valuing a startup, there are a few key metrics that you should always keep in mind. Here are the five most important ones:

1. The stage of the business: This is probably the most important metric when it comes to valuing a startup. Is the company still in its early stages with just an idea, or is it further along with a product or service already in the market? The stage of the business will have a big impact on its value.

2. The size of the market: Another key metric is the size of the market that the startup is targeting. A startup that is targeting a large market will obviously be worth more than one that is only targeting a small niche.

3. The growth potential: This is closely related to the size of the market, but it also takes into account the potential for growth within that market. A startup with high growth potential will be worth more than one with lower growth potential.

4. The team: The team behind a startup is also a very important factor in its value. Is the team experienced and capable of executing on their business plan? Do they have a good track record? The answers to these questions will impact the value of the startup.

5. The financials: Finally, the financials of the startup are also a key metric. This includes things like revenue, burn rate, and runway. A startup with strong financials will obviously be worth more than one with weak financials.

Keep these five key metrics in mind when valuing a startup and youll be on your way to making a smart investment decision.

The 5 key metrics that will help you value your startup - Value Your Startup in Just Hours or Less

8. The 5 key metrics that will help you value your startup

If you're thinking about starting a startup, you're probably wondering how to value your startup. After all, valuations can make or break a deal.

The good news is that there are some key metrics that can help you value your startup. Here are the five most important ones:

1. Annual recurring revenue

Annual recurring revenue (ARR) is one of the most important metrics for startups. It measures the amount of revenue that a company generates on a yearly basis from its recurring customers.

2. Customer churn rate

Customer churn rate is the percentage of customers who cancel or do not renew their subscription to a product or service. A high churn rate can be a sign that a company is not providing enough value to its customers.

3. Gross margin

Gross margin is the difference between a company's revenue and its cost of goods sold (COGS). It measures how much profit a company makes on each sale after accounting for the costs of goods sold. A high gross margin indicates that a company is efficient and is able to generate a lot of profits.

4. Net Promoter Score® (NPS)

Net Promoter Score® (NPS) is a metric that measures customer satisfaction. It asks customers how likely they are to recommend a company's products or services to a friend or colleague. A high NPS indicates that customers are happy with a company's products or services and are more likely to recommend them to others.

5. User acquisition costs

User acquisition costs (UAC) measures the amount of money that a company spends to acquire new users. A high UAC can be a sign that a company is spending too much money to acquire new customers and should focus on reducing these costs.

The 5 key metrics that will help you value your startup - Value Your Startup in Just 2 Hours or Less!

9. The role of key metrics in a startup s success

When it comes to startups, key metrics are essential in measuring success and determining the direction of the business. By tracking the right metrics, startups can understand how their products and services are performing, how customers are responding, and how their strategies are progressing.

At its core, key metrics help startups determine whether their efforts are paying off. They provide an objective measure of success and help startups track progress over time. Additionally, key metrics can help startups identify areas of opportunity, identify potential problems, and pursue sustainable growth.

To be successful, startups must identify appropriate key metrics and develop strategies to track their performance. Different types of businesses have different needs when it comes to selecting key metrics. For example, SaaS companies may be more interested in tracking user engagement than e-commerce companies. Similarly, B2B companies likely need to focus on customer lifetime value rather than website traffic.

Once the right metrics have been identified, startups must use them to gauge progress and make decisions based on data-driven insights. Metrics should be monitored regularly and used to inform strategy and product development decisions. This helps ensure that the startup is focused on activities that will contribute to its long-term success.

In addition to tracking key metrics, startups should also use them to compare their performance against competitors. This helps them understand how they stack up against other businesses in the industry and identify areas for improvement. Furthermore, tracking competitor data gives startups valuable insights into what strategies are working for other businesses and allows them to stay ahead of the game.

Finally, key metrics should also be used to track customer feedback and satisfaction levels. This helps startups understand what customers think about their products and services and pinpoint areas where they can improve. Additionally, this data can give startups a better understanding of customer behavior and preferences which can help them create better products and services in the future.

In short, key metrics are essential for a startups success. They provide an objective measure of progress and allow businesses to make informed decisions based on data-driven insights. By tracking the right metrics, startups can ensure that their efforts are paying off and stay ahead of the competition.

10. Commonly Used Metrics for Startup Ranking

This blog post will discuss some commonly used metrics for startup ranking, with a focus on the methodology used to calculate them. In particular, we'll discuss the following:

- The different types of startup rankings

- The calculation of startup ranking metrics

- How these metrics are used

There are a variety of startup ranking metrics out there, and each one has its own advantages and disadvantages. We'll look at the most popular ones here, but keep in mind that there are many more. We won't be able to cover them all, but we'll give you a broad overview of the most common ones.

Type of Startup Ranking

The first thing to consider when ranking startups is the type of ranking you're looking for. There are three main types of startup rankings:

1. Global Startup Ranking: This is the most popular type of startup ranking, and it's based on a calculation called the "Growth-to-Date Score." This score takes into account how fast a startup is growing compared to its competitors, based on data from evaluating their websites, social media presence, and other relevant factors.

2. Regional Startup Ranking: This type of ranking is focused on specific regions, such as North America, Europe, Asia Pacific, and so on. Companies are ranked based on how well they're doing in that region compared to their competitors.

3. Local Startup Ranking: This type of ranking is focused on specific cities or towns. Companies are ranked based on how well they're doing compared to their competitors in that location.

Calculation of Startup Ranking Metrics

The next thing to consider is the calculation methodology used to generate the rankings. There are a variety of methods out there, but we'll focus on two here: the "Growth-to-Date Score" and the "Y Combinator Continuation Score."

The Growth-to-Date Score is based on a formula that takes into account how fast a startup is growing compared to its competitors over a certain period of time (usually three years).

The Y Combinator Continuation Score is based on how many times a startup has been accepted into the prestigious Y Combinator accelerator program.

How These Metrics Are Used

Once the rankings have been calculated, they can be used in a number of ways. For example, some companies use them to determine which startups to invest in. Others use them to decide which startups to team up with. And still others use them to determine which startups to acquire.

There are many different ways that these rankings can be used, and it really depends on the company's specific needs and goals.

Commonly Used Metrics for Startup Ranking - What is Startup Ranking?

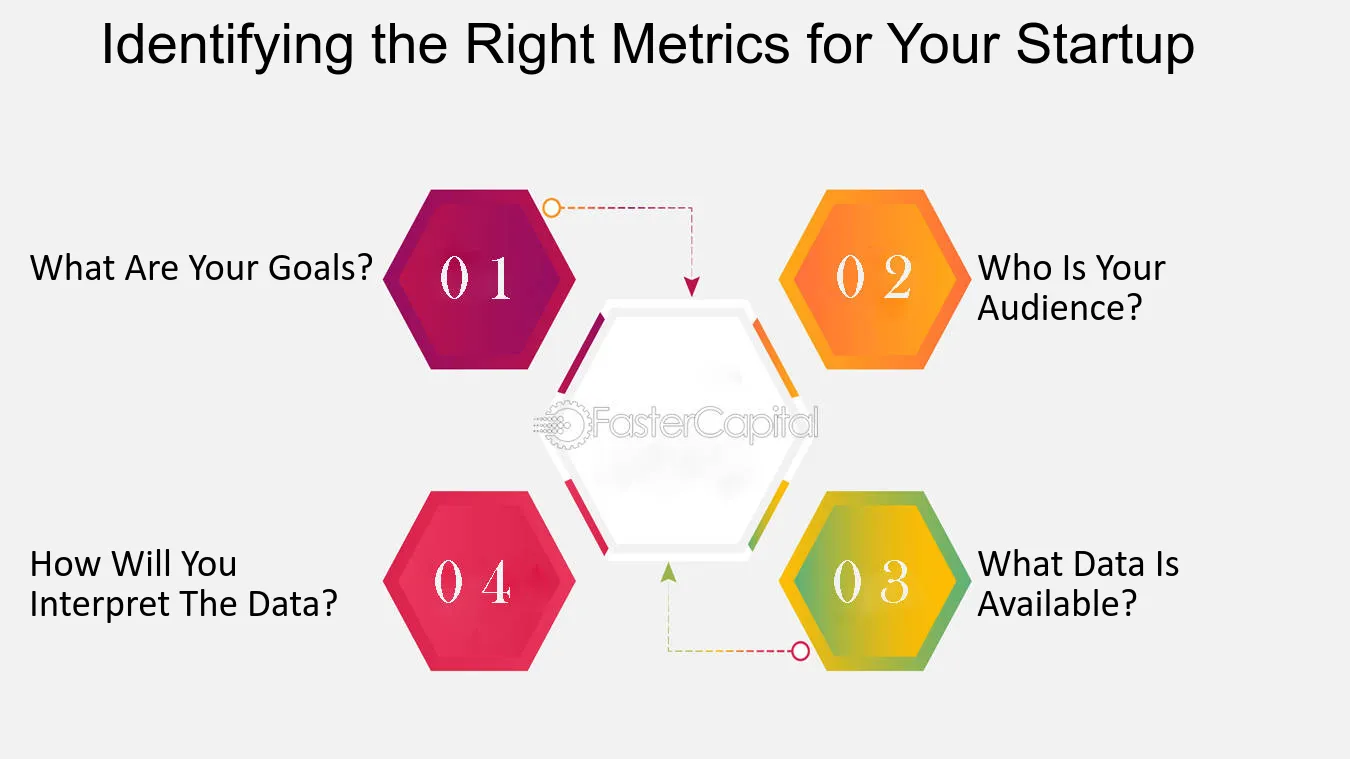

11. Identifying the Right Metrics for Your Startup

In order to make a big impact as a startup, it is essential to identify the right metrics to measure your success. By tracking the right metrics, you can better determine the effectiveness of your efforts, identify areas for improvement, and measure your progress towards achieving your goals.

When selecting the right metrics for your startup, its important to consider the following factors:

1. What Are Your Goals?

The first step in selecting the right metrics is to clearly define your goals. What are you aiming to achieve? Are you looking to increase customer acquisition? increase customer loyalty? Increase sales? Once you have a clear understanding of your goals, you can begin to identify which metrics will best measure your progress towards them.

2. Who Is Your Audience?

Its also important to consider who your audience is and what kind of data they will be looking for. Different audiences may be interested in different types of metrics. For example, investors may be more interested in financial metrics such as revenue and profits, while customers may be more interested in metrics related to customer satisfaction or product usage.

3. What Data Is Available?

Once you know what type of data you need, its important to determine what data is available. You might need to put systems in place to collect the data or use existing tools to measure it. Its also important to consider how up-to-date the data needs to be in order for it to be useful.

4. How Will You Interpret The Data?

Finally, its important to consider how you will interpret the data you collect. What does it tell you about your business and how can you use this information to make decisions and take action?

By taking these factors into consideration when selecting the right metrics for your startup, you can ensure that your efforts are focused on measuring the most relevant data that will give you valuable insights into your business performance and help you make a big impact as a startup.

Identifying the Right Metrics for Your Startup - What metrics to track when making a big impact as a startup