1. Introduction to Breakout Momentum Trading

Breakout Momentum Trading is a popular trading technique used by traders to capture the momentum of a stock or security when it breaks out of a range. This technique is based on the idea that when a stock breaks out of a range, it is likely to continue moving in the same direction with increased momentum. Breakout Momentum Trading can be a profitable strategy if executed correctly, but it requires patience, discipline, and careful risk management.

1. What is Breakout Momentum Trading?

Breakout Momentum Trading is a trading technique that involves buying a stock or security when it breaks out of a range and selling it when it reaches a predetermined profit target or stop loss. The key to successful Breakout Momentum Trading is identifying stocks or securities that are about to break out of a range and have strong momentum behind them. Traders typically look for stocks that are trading near their support or resistance levels, have high trading volume, and have positive news or earnings reports.

2. How to Identify Breakout Opportunities?

Traders can use various technical indicators to identify breakout opportunities, such as moving averages, Bollinger Bands, and relative Strength index (RSI). Moving averages can help traders identify the direction of the trend, while Bollinger Bands can help traders identify the volatility of the stock. The RSI can help traders identify the strength of the momentum behind the stock. Additionally, traders can use chart patterns, such as triangles, flags, and pennants, to identify potential breakouts.

3. How to Manage Risk?

Managing risk is crucial when trading Breakout Momentum Trading. Traders should always use stop-loss orders to limit their losses in case the trade goes against them. Traders should also use a trailing stop to lock in profits as the stock continues to move in their favor. Additionally, traders should avoid trading during volatile market conditions or news events that can cause sudden price movements.

4. What are the Advantages and Disadvantages of Breakout Momentum Trading?

The advantages of Breakout Momentum Trading include the potential for high profits and the ability to capture strong momentum in the stock. However, the disadvantages of this strategy include the risk of false breakouts and the need for careful risk management. Traders should also be aware that Breakout Momentum Trading can be time-consuming and requires patience and discipline.

5. What are the Best Tools for Breakout Momentum Trading?

There are various tools that traders can use to improve their Breakout Momentum Trading strategy, such as stock screeners, technical analysis software, and trading platforms with advanced charting features. Traders should also stay up-to-date with market news and earnings reports to identify potential breakout opportunities.

Breakout Momentum Trading can be a profitable trading strategy if executed correctly. Traders should focus on identifying stocks with strong momentum and use technical indicators and chart patterns to identify breakout opportunities. Additionally, traders should always use stop-loss orders and careful risk management to limit their losses. By using the right tools and staying disciplined, traders can ride the momentum and capture profits in the market.

Introduction to Breakout Momentum Trading - Breakout momentum: Riding the Momentum: Breakout Trading Techniques

2. Managing Risk in Breakout Momentum Trading

Managing risk is an important aspect of any trading strategy, and breakout momentum trading is no exception. While breakout momentum trading can be a profitable strategy, it is also associated with higher risks. Therefore, it is essential to manage risk effectively while trading.

1. Set Stop Losses

Stop losses are an essential tool for managing risk in breakout momentum trading. Stop losses are predetermined levels at which a trader will exit a trade if the market moves against them. setting stop losses can help limit potential losses and protect the trader's capital.

For instance, suppose a trader enters a breakout trade with a stop-loss order at 2% below the entry price. In that case, the trader will exit the trade if the market moves against them by 2%. This strategy ensures that the trader doesn't lose more than 2% of their capital.

2. Use Position Sizing

Position sizing is another critical factor in managing risk in breakout momentum trading. Position sizing refers to the amount of capital a trader allocates to a trade. Proper position sizing can help a trader limit their losses and maximize their gains.

For example, suppose a trader has a $100,000 trading account and decides to allocate 2% of their capital to each trade. In that case, the trader will only risk $2,000 on each trade. This strategy ensures that the trader doesn't lose more than 2% of their capital on any trade.

3. Diversify Your Portfolio

Diversifying your portfolio can help manage risk in breakout momentum trading. Diversification involves spreading your trades across different markets, assets, or sectors. By doing this, you can limit your exposure to any single trade or market.

For instance, suppose a trader only trades the technology sector. In that case, they are exposed to the risks associated with that sector, such as regulatory changes, technological advancements, and market volatility. However, if the trader diversifies their portfolio across different sectors, they can limit their exposure to any single sector's risks.

4. Use Technical Analysis

Technical analysis is a critical tool for managing risk in breakout momentum trading. Technical analysis involves analyzing price charts and using technical indicators to identify potential trade setups.

For example, suppose a trader uses technical analysis to identify a breakout trade setup. In that case, they can use technical indicators such as moving averages, relative strength index (RSI), or stochastic oscillators to confirm the trade setup. This strategy can help the trader enter the trade with more confidence and manage their risk more effectively.

Managing risk is a critical aspect of breakout momentum trading. By setting stop losses, using position sizing, diversifying your portfolio, and using technical analysis, you can manage your risk more effectively and increase your chances of success.

Managing Risk in Breakout Momentum Trading - Breakout momentum: Riding the Momentum: Breakout Trading Techniques

3. Technical Indicators for Intraday Momentum Trading

When it comes to intraday momentum trading, using technical indicators can be a valuable strategy to capture quick profits. Technical indicators are mathematical calculations based on the price and/or volume of a security, which can help traders identify potential buy or sell opportunities. There are a variety of technical indicators that are popular among intraday traders, each with their own strengths and weaknesses.

One popular technical indicator for intraday momentum trading is the Relative Strength Index (RSI). The RSI is a momentum oscillator that measures the speed and change of price movements. It oscillates between 0 and 100 and is typically plotted on a chart below the price action. Traders often use the RSI to identify overbought or oversold conditions in a security. An RSI reading above 70 indicates an overbought condition, while a reading below 30 indicates an oversold condition. When using the RSI for intraday momentum trading, traders may look for buy signals when the RSI crosses above 30 and sell signals when it crosses below 70.

Another technical indicator frequently used in intraday momentum trading is the Moving average Convergence divergence (MACD). The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security's price. The MACD is calculated by subtracting the 26-period exponential moving average (EMA) from the 12-period EMA. A nine-period EMA of the MACD, called the signal line, is then plotted on top of the MACD line, which can act as a trigger for buy and sell signals. Traders may look for buy signals when the MACD line crosses above the signal line and sell signals when it crosses below.

Other technical indicators that may be useful for intraday momentum trading include Bollinger Bands, Fibonacci retracements, and volume indicators such as On-Balance Volume (OBV) or chaikin Money flow. However, it's important to note that no single technical indicator is foolproof and traders should always use a combination of indicators and perform thorough analysis before making a trade.

Using technical indicators can be a valuable strategy for intraday momentum traders looking to capture quick profits. The Relative Strength Index, Moving Average Convergence Divergence, Bollinger Bands, Fibonacci retracements, and volume indicators are just a few examples of the many technical indicators available to traders. It's important to remember that technical indicators should always be used in conjunction with other analysis techniques and that no single indicator should be relied on exclusively.

4. Managing Risk in Intraday Momentum Trading

Intraday momentum trading is a popular trading strategy that involves buying and selling securities within the same trading day, with the aim of capitalizing on short-term market movements. However, this trading style involves a high level of risk, given the fast-paced nature of the market and the need to make quick decisions. To succeed in intraday momentum trading, traders need to manage their risk effectively.

There are different ways of managing risk in intraday momentum trading, and each trader may have their own preferred approach. However, some of the most common risk management strategies include:

1. Setting stop-loss orders: A stop-loss order is a type of order that is placed with a broker to sell a security when it reaches a certain price point. Traders can set stop-loss orders to limit their potential losses in case the market moves against their position. For example, if a trader buys a stock at $50 and sets a stop-loss order at $48, the trade will be automatically closed if the stock price falls to $48, limiting their losses to $2 per share.

2. Using technical analysis: Technical analysis involves analyzing past market data to identify patterns and trends that can help predict future price movements. Traders can use technical indicators such as moving averages, Bollinger Bands, and Relative Strength Index (RSI) to identify potential entry and exit points for their trades. By using technical analysis, traders can make more informed decisions and reduce their exposure to risk.

3. Diversifying their portfolio: Intraday momentum traders can diversify their portfolio by trading multiple securities across different sectors. This helps to spread their risk and minimize the impact of any single security on their overall portfolio. For example, if a trader only trades technology stocks, they may be exposed to more risk if there is a negative news event that impacts the entire technology sector. However, if they also trade healthcare, consumer goods, and energy stocks, they can reduce their overall risk exposure.

4. Staying up-to-date with news and events: Intraday momentum traders need to stay informed about news and events that can impact the market. For example, if there is a major economic report scheduled to be released, traders need to be aware of the potential impact on the market and adjust their trading strategy accordingly. By staying up-to-date with news and events, traders can make more informed decisions and reduce their risk exposure.

Managing risk is a crucial aspect of intraday momentum trading. Traders need to be aware of the potential risks involved and implement effective risk management strategies to minimize their losses. By setting stop-loss orders, using technical analysis, diversifying their portfolio, and staying up-to-date with news and events, traders can increase their chances of success in this fast-paced trading style.

Managing Risk in Intraday Momentum Trading - Capturing Intraday Momentum: Strategies for Quick Profits

5. Examples of Intraday Momentum Trading

Intraday momentum trading can be a lucrative strategy for traders looking to capture quick profits. However, it requires a keen eye for market movements and a willingness to take calculated risks. There are several different approaches to intraday momentum trading, each with its own pros and cons. In this section, we will explore some examples of intraday momentum trading strategies, including insights from different points of view.

1. Breakout Trading: One of the most popular intraday momentum trading strategies is breakout trading. This involves identifying key levels of support and resistance and waiting for a breakout above or below these levels. Traders can use technical indicators such as moving averages and Bollinger Bands to help identify potential breakouts. For example, if a stock has been trading within a tight range for several hours, a breakout above the upper Bollinger Band could signal a buying opportunity.

2. News Trading: Another approach to intraday momentum trading is to focus on news events that can cause sudden price movements. This could include earnings reports, economic data releases, or geopolitical events. Traders can use tools such as news feeds and economic calendars to stay up-to-date on these events and make quick trades based on the news. For example, if a company reports better-than-expected earnings, traders may look to buy the stock on the expectation of a price increase.

3. Scalping: Scalping is a high-frequency trading strategy that involves making a large number of small trades throughout the day. This strategy is particularly popular among day traders due to its low risk and high potential reward. Scalpers typically look for small price movements and aim to capture a few cents or pips on each trade. For example, a scalper might buy a stock at $10.00 and sell it at $10.05 a few minutes later, making a profit of 5 cents per share.

4. Technical Analysis: Finally, technical analysis can be a useful tool for intraday momentum traders. This involves studying past market data to identify patterns and trends that can help predict future price movements. Traders can use tools such as candlestick charts and trendlines to identify potential buying and selling opportunities. For example, if a stock has been in a long-term uptrend and is currently experiencing a short-term pullback, a trader may look to buy the stock on the expectation of a continuation of the long-term trend.

There are several different intraday momentum trading strategies that traders can use to capture quick profits. Each strategy has its own strengths and weaknesses, and traders should choose the one that best fits their individual trading style and risk tolerance. By staying up-to-date on market news and trends and using the right tools and indicators, traders can increase their chances of success in the fast-paced world of intraday momentum trading.

Examples of Intraday Momentum Trading - Capturing Intraday Momentum: Strategies for Quick Profits

6. Top Tools for Intraday Momentum Trading

Intraday momentum trading is a popular strategy among traders who are looking for quick profits. It is a type of trading where a trader takes advantage of the price movements in the market that occur within a day. To be successful in intraday momentum trading, traders need to have a set of tools that can help them identify profitable trades. These tools can include technical indicators, chart patterns, and other trading tools. In this section, we will explore some of the top tools for intraday momentum trading. We will look at these tools from different points of view and provide in-depth information on each tool.

1. moving averages: Moving averages are a popular technical indicator used in intraday momentum trading. They are used to identify the direction of the trend and potential support and resistance levels. Traders can use different types of moving averages, including simple moving averages (SMA) and exponential moving averages (EMA), depending on their trading style. For example, a trader who prefers short-term trades may use a 5-period SMA, while a trader who prefers longer-term trades may use a 200-period SMA.

2. Relative Strength Index (RSI): The RSI is another popular technical indicator used in intraday momentum trading. It is used to identify overbought and oversold conditions in the market. Traders can use the RSI to identify potential entry and exit points. For example, if the RSI is above 70, it may indicate an overbought condition, and a trader may consider selling. Conversely, if the RSI is below 30, it may indicate an oversold condition, and a trader may consider buying.

3. Candlestick Patterns: Candlestick patterns are used to identify potential trend reversals and continuation patterns. Traders can use candlestick patterns to identify potential entry and exit points. For example, a bullish engulfing pattern may indicate a potential trend reversal, and a trader may consider buying. Conversely, a bearish engulfing pattern may indicate a potential trend reversal, and a trader may consider selling.

4. Volume: Volume is an important factor in intraday momentum trading. Traders can use volume to confirm price movements and identify potential breakouts. For example, if the price of a stock is increasing, and the volume is also increasing, it may indicate a potential breakout.

Intraday momentum trading requires a set of tools that can help traders identify profitable trades. These tools can include technical indicators, chart patterns, and other trading tools. Traders should use these tools in conjunction with their trading strategy to increase their chances of success.

Top Tools for Intraday Momentum Trading - Capturing Intraday Momentum: Strategies for Quick Profits

7. The Importance of VI in Momentum Trading

When it comes to momentum trading, traders need to have a deep understanding of market trends and the ability to identify potential entry and exit points. The Vortex Indicator (VI) is a technical indicator that can enhance trading performance by providing traders with a clear picture of market trends, allowing them to make informed trading decisions. In this blog section, we will explore the importance of VI in momentum trading and how it can help traders achieve better results.

1. understanding the Vortex indicator (VI)

The Vortex Indicator (VI) is a technical indicator that was developed by Etienne Botes and Douglas Siepman. The VI is designed to identify the start of a new trend and to measure the strength of an existing trend. The VI is composed of two lines: the Positive Vortex Indicator (+VI) and the Negative Vortex Indicator (-VI). The +VI measures the strength of the uptrend, while the -VI measures the strength of the downtrend. The VI can be used to identify potential entry and exit points, as well as to confirm the direction of the trend.

2. Importance of VI in Momentum Trading

The VI is an important tool for momentum traders because it can help them identify potential entry and exit points. Momentum traders rely on market trends to make trading decisions, and the VI can help them identify when a new trend is starting or when an existing trend is losing momentum. The VI can also help traders confirm the direction of the trend, which can be especially important when trading in volatile markets.

3. Benefits of Using VI in Momentum Trading

There are several benefits to using the VI in momentum trading. Firstly, the VI can help traders identify potential entry and exit points, which can increase profitability. Secondly, the VI can help traders confirm the direction of the trend, which can reduce the risk of making a wrong trade. Finally, the VI can help traders avoid false breakouts and whipsaws, which can be detrimental to trading performance.

4. Comparing VI to Other Technical Indicators

There are many technical indicators that traders can use to enhance their trading performance, but the VI stands out for its ability to identify trends and measure their strength. Other technical indicators, such as Moving Averages and Relative Strength Index (RSI), can also be useful for momentum trading, but they may not provide the same level of accuracy as the VI. Traders should consider using a combination of technical indicators to achieve the best results.

5. Examples of VI in Momentum Trading

To illustrate the importance of VI in momentum trading, let's look at an example. Suppose a trader is following a stock that has been in a downtrend for several weeks. The trader notices that the VI is showing a strong -VI, indicating that the downtrend is likely to continue. The trader decides to wait for the VI to show a reversal before entering a long position. A few days later, the VI shows a crossover, with the +VI crossing over the -VI, indicating a potential reversal. The trader enters a long position and makes a profit when the stock starts to move higher.

The Vortex Indicator (VI) is a powerful tool for momentum traders. It can help traders identify potential entry and exit points, confirm the direction of the trend, and avoid false breakouts and whipsaws. Traders should consider using a combination of technical indicators to achieve the best results, but the VI should be a key component of any momentum trading strategy.

The Importance of VI in Momentum Trading - Enhancing Trading Performance with Vortex Indicator VI

8. The Role of Technical Analysis in Island Reversal Momentum Trading

Technical analysis is an essential tool for traders who wish to succeed in the financial markets. It is a method of analyzing market data, such as price and volume, to identify patterns and trends that can be used to make informed trading decisions. Technical analysis is particularly useful in momentum trading, where traders seek to profit from short-term market shifts. Island reversal patterns are a type of momentum shift that can be identified using technical analysis. In this section, we will explore the role of technical analysis in island reversal momentum trading.

1. Identifying Island Reversal Patterns

The first step in trading island reversal patterns is to identify them using technical analysis. An island reversal pattern occurs when a gap appears on a chart, followed by a period of consolidation, and then another gap in the opposite direction. This pattern indicates a shift in momentum and can provide an opportunity for traders to profit. Traders can use technical indicators, such as moving averages and trend lines, to identify island reversal patterns.

2. Confirming Island Reversal Patterns

Once an island reversal pattern has been identified, traders must confirm it using technical analysis. This involves looking for additional signals that support the pattern, such as a change in volume or a break in a trend line. Traders can also use other technical indicators, such as the relative Strength index (RSI) or the moving Average Convergence divergence (MACD), to confirm the pattern.

3. Entering and Exiting Trades

After an island reversal pattern has been identified and confirmed, traders can enter a trade by buying or selling depending on the direction of the pattern. Traders should also set stop-loss orders to limit their losses in case the trade does not go as planned. When exiting a trade, traders should look for signs that the momentum is shifting again, such as a break in a trend line or a change in volume.

4. Using Technical Analysis Tools

Traders can use a variety of technical analysis tools to identify and confirm island reversal patterns. Some popular tools include:

- Moving averages: These indicators help traders identify trends and potential reversal points.

- Trend lines: These lines connect highs or lows in a chart and can help traders identify key support and resistance levels.

- Relative Strength Index (RSI): This indicator measures the strength of a trend and can help traders identify potential reversal points.

- Moving average Convergence divergence (MACD): This indicator measures the difference between two moving averages and can help traders identify potential trend changes.

5. Conclusion

Technical analysis is an essential tool for traders who wish to profit from island reversal momentum trading. By identifying and confirming island reversal patterns, traders can enter and exit trades with confidence. Using technical analysis tools such as moving averages, trend lines, RSI, and MACD can help traders make informed trading decisions. However, it is important to remember that technical analysis is not foolproof and should be used in conjunction with other forms of analysis, such as fundamental analysis and market sentiment.

The Role of Technical Analysis in Island Reversal Momentum Trading - Island Reversal Momentum: Riding the Wave of Market Shifts

9. Tips and Tricks for Island Reversal Momentum Trading

Island Reversal Momentum trading is a popular strategy that involves identifying a market shift and then capitalizing on it. In order to be successful at this type of trading, there are a number of tips and tricks that you should keep in mind. In this section, we will explore some of the most important ones.

1. Understand the Basics of Island Reversal Momentum Trading

Before you begin trading using this strategy, it's important that you have a solid understanding of what it entails. Essentially, Island Reversal Momentum trading involves identifying a market shift and then jumping on board to ride the wave of that shift. This can be done by identifying gaps in the market, looking for patterns in price movements, and monitoring trading volume. The key is to be able to spot the shift early on and then move quickly to capitalize on it.

2. Use Technical Analysis Tools

One of the best ways to identify a market shift is to use technical analysis tools. There are a number of different tools available, including moving averages, Bollinger Bands, and Fibonacci retracements. By using these tools, you can get a better sense of what's happening in the market and make more informed trading decisions.

3. Pay Attention to News and Events

Another important tip for Island Reversal Momentum trading is to pay attention to news and events that could impact the market. This could include things like economic reports, political events, or even natural disasters. By staying on top of these developments, you can be better prepared to react to any shifts in the market.

4. Have a Plan for Exiting Trades

When you're using the Island Reversal Momentum trading strategy, it's important to have a plan for exiting trades. This could involve setting stop-loss orders to limit your losses, or taking profits when you've hit a certain target. The key is to have a plan in place before you enter a trade, so that you can make informed decisions about when to exit.

5. Practice Good Risk Management

Finally, it's important to practice good risk management when you're trading using this strategy. This could involve things like diversifying your portfolio, using proper position sizing, and avoiding over-leveraging your trades. By managing your risk effectively, you can help to minimize your losses and maximize your profits.

Overall, Island Reversal Momentum trading can be a great way to capitalize on market shifts and generate profits. By following these tips and tricks, you can improve your chances of success and become a more skilled trader.

Tips and Tricks for Island Reversal Momentum Trading - Island Reversal Momentum: Riding the Wave of Market Shifts

10. A Powerful Tool for Momentum Trading

When it comes to momentum trading, one of the most powerful tools in a trader's arsenal is the MACD (Moving Average Convergence Divergence) indicator. This technical analysis tool is used to identify changes in momentum and trend, and can be particularly effective when used in conjunction with other indicators and analysis techniques.

One of the key ways to use the MACD for momentum trading is through crossovers. A crossover occurs when the MACD line (the difference between two moving averages) crosses over the signal line (a 9-day moving average of the MACD line). This can signal a change in momentum, with a bullish crossover indicating a potential uptrend and a bearish crossover indicating a potential downtrend.

Here are some key insights and tips for using MACD crossovers in your momentum trading strategy:

1. Look for confirmation from other indicators and analysis techniques. While MACD crossovers can be a powerful signal on their own, it's always a good idea to look for confirmation from other indicators and analysis techniques. For example, you might look for confirmation from a trend line, support or resistance levels, or other technical indicators.

2. Use different time frames to confirm crossovers. You can also use different time frames to confirm MACD crossovers. For example, if you see a bullish crossover on the daily chart, you might look for confirmation on the hourly chart to ensure that the momentum is strong enough to support a trade.

3. Consider using a histogram. The MACD histogram is another tool that can be useful for momentum trading. It shows the difference between the MACD line and the signal line, and can help you identify changes in momentum more clearly.

4. Be aware of false signals. MACD crossovers can sometimes give false signals, so it's important to be aware of this and use other indicators and analysis techniques to confirm your trades. For example, a crossover that occurs during a period of low volume or volatility may not be as reliable as one that occurs during a period of high volume or volatility.

5. Experiment with different settings. The default settings for the MACD are 12, 26, and 9, but you can experiment with different settings to find what works best for you. For example, you might try using a shorter or longer time frame for the moving averages, or adjusting the smoothing factor for the signal line.

Overall, MACD crossovers can be a powerful tool for momentum trading, but it's important to use them in conjunction with other indicators and analysis techniques to confirm your trades. By following these tips and experimenting with different settings, you can find the approach that works best for your trading style and risk tolerance.

A Powerful Tool for Momentum Trading - MACD indicator: Trade Signals and MACD: Mastering Momentum Trading

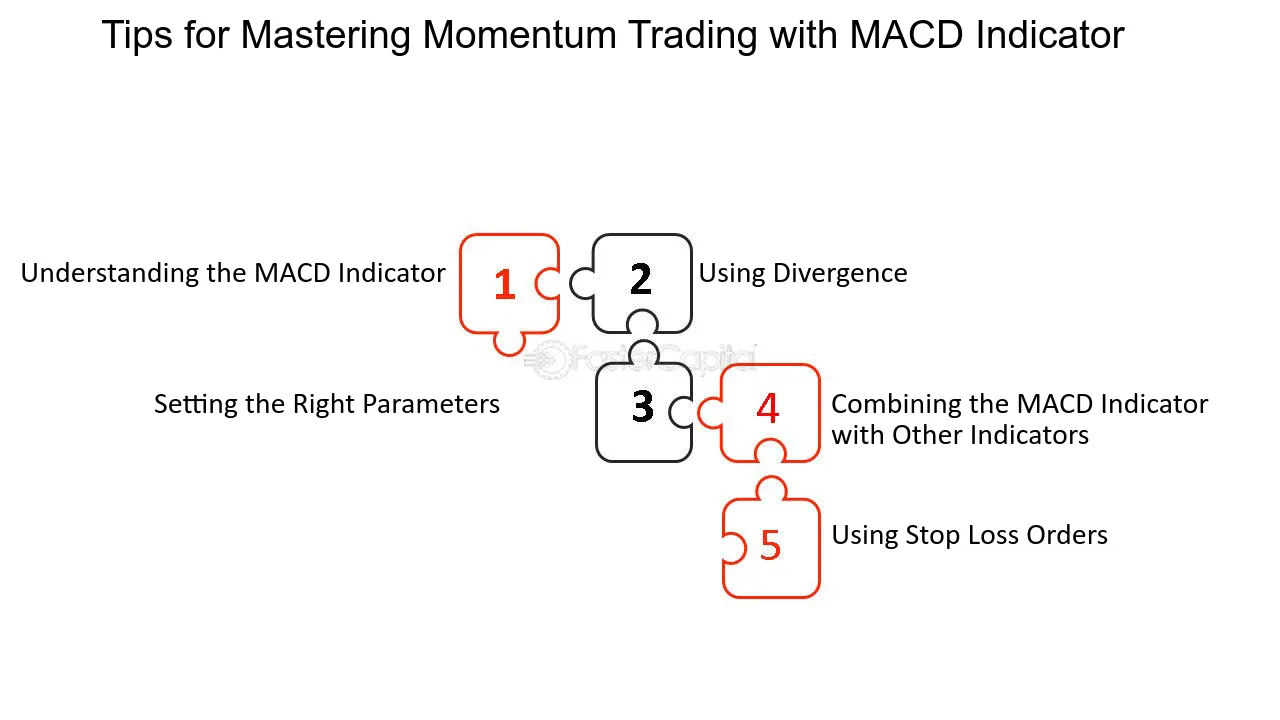

11. Tips for Mastering Momentum Trading with MACD Indicator

Momentum trading is a popular trading strategy among traders who want to take advantage of the market's short-term price movements. One of the most widely used indicators for momentum trading is the Moving Average Convergence Divergence (MACD) indicator. This indicator is a trend-following momentum indicator that helps traders identify potential trend changes and trade signals. In this section, we will discuss some tips and tricks that can help traders master momentum trading with the MACD indicator.

1. Understanding the MACD Indicator:

Before mastering momentum trading with the MACD indicator, it is essential to understand how the indicator works. The MACD indicator comprises two moving averages, the MACD line, and the signal line. The MACD line is the difference between the 12-day exponential moving average (EMA) and the 26-day EMA. The signal line is the 9-day EMA of the MACD line. Traders use the crossover of the MACD line and the signal line to identify potential trend changes and trade signals.

2. Using Divergence:

Divergence is a powerful tool that traders can use to identify potential trend changes. Divergence occurs when the price of an asset moves in the opposite direction of the MACD indicator. For example, if the price of an asset is making higher highs, but the MACD indicator is making lower highs, it is a bearish divergence, indicating a potential trend change. On the other hand, if the price of an asset is making lower lows, but the MACD indicator is making higher lows, it is a bullish divergence, indicating a potential trend change.

3. Setting the Right Parameters:

The MACD indicator's default parameters are 12, 26, and 9, but traders can adjust these parameters to suit their trading style and preferences. Shorter-term traders may prefer to use shorter periods, while longer-term traders may prefer longer periods. It is essential to test different parameters using historical data to find the best settings for the MACD indicator.

4. Combining the MACD Indicator with Other Indicators:

The MACD indicator is a powerful tool on its own, but traders can enhance its effectiveness by combining it with other indicators. For example, traders can combine the MACD indicator with the Relative Strength Index (RSI) to identify overbought and oversold conditions. Traders can also use the MACD histogram to confirm trend changes identified by the MACD line and the signal line.

5. Using Stop Loss Orders:

Momentum trading is a high-risk strategy that can result in significant losses if not managed correctly. Traders must use stop-loss orders to limit their losses in case the trade goes against them. A stop-loss order is a predetermined price level at which the trader exits the trade to limit their losses. Traders can place their stop-loss orders below the support level or above the resistance level.

Mastering momentum trading with the MACD indicator requires a solid understanding of the indicator, its parameters, and how to use it in combination with other indicators. Traders must also use stop-loss orders to limit their losses and manage their risk effectively. By following these tips and tricks, traders can increase their chances of success and profitability in momentum trading.

Tips for Mastering Momentum Trading with MACD Indicator - MACD indicator: Trade Signals and MACD: Mastering Momentum Trading

12. Introduction to Momentum Trading

Momentum trading is a popular trading strategy that involves buying and selling securities based on the strength of recent price trends. This strategy is based on the idea that securities that have been trending in a particular direction for a period of time are likely to continue to do so. While momentum trading can be profitable when executed correctly, it can also be risky, and it is important to have a solid understanding of the strategy and the associated risks before getting started.

Here are some key insights into momentum trading:

1. Momentum trading is all about following trends. Traders using this strategy will typically look for securities that have been trending in a particular direction for a period of time.

2. The ultimate oscillator indicator is a popular tool used by momentum traders. This indicator takes into account three different time periods and can help traders identify potential buy and sell signals.

3. One of the biggest risks associated with momentum trading is the potential for a sudden reversal in price trends. Traders need to be prepared for the possibility of a sudden change in market conditions and have a plan in place for managing risk.

4. One way to manage risk when momentum trading is to use stop-loss orders. These orders can help limit potential losses by automatically selling a security if it reaches a certain price point.

5. It's important for momentum traders to stay disciplined and stick to their strategy. This means having a clear set of rules for entering and exiting trades, and not deviating from those rules based on emotions or market conditions.

Overall, momentum trading can be a powerful strategy for traders looking to profit from short-term price trends. By understanding the risks and using the right tools and techniques, traders can increase their chances of success.

Introduction to Momentum Trading - Mastering Momentum Trading with the Ultimate Oscillator Indicator

13. Importance of Timeframes in Momentum Trading

Momentum trading is a popular trading strategy that involves buying securities that are trending upwards and selling them when they start to trend downwards. The ultimate oscillator indicator is a valuable tool that can help traders identify when securities are overbought or oversold and are likely to experience a reversal. However, using this indicator alone is not enough to guarantee successful trades. One important factor that traders must consider when using momentum trading strategies is the timeframe of the trades.

Different traders may have different opinions on the ideal timeframe for momentum trading. Some traders may prefer short-term trades that last a few minutes or hours, while others may prefer longer-term trades that last several days or weeks. Ultimately, the timeframe that a trader chooses will depend on their personal preferences, risk tolerance, and trading goals. However, regardless of the timeframe chosen, there are several important considerations that traders should keep in mind when using momentum trading strategies:

1. Timeframes affect the strength of momentum: The strength of momentum can vary depending on the timeframe of the trade. Short-term trades may experience stronger momentum, but also come with more volatility and risk. Longer-term trades may experience weaker momentum, but are generally more stable and less risky.

2. Timeframes affect the frequency of trades: Traders who prefer short-term trades will likely make more trades than those who prefer longer-term trades. This can be both an advantage and a disadvantage. On the one hand, more trades can lead to more profits. On the other hand, more trades can also lead to more losses and higher transaction costs.

3. Timeframes affect the amount of analysis required: Traders who prefer short-term trades will need to perform more analysis and make decisions quickly, as the market can change rapidly. Traders who prefer longer-term trades may have more time to analyze market trends and make informed decisions.

Choosing the right timeframe is an important part of mastering momentum trading. While there is no one-size-fits-all approach, traders should consider their personal preferences, risk tolerance, and trading goals when deciding on a timeframe. By keeping these considerations in mind and using tools like the ultimate oscillator indicator, traders can increase their chances of success in the fast-paced world of momentum trading.

Importance of Timeframes in Momentum Trading - Mastering Momentum Trading with the Ultimate Oscillator Indicator

14. Risk Management Techniques for Momentum Trading

Momentum trading is an active trading strategy that involves buying stocks that are showing an upward trend and selling stocks that are showing a downward trend. Although momentum traders can make significant profits, this type of trading also comes with a high level of risk. Therefore, it is essential to have a comprehensive risk management plan in place that can help minimize losses and maximize gains.

There are several risk management techniques that momentum traders can use to help mitigate the risks associated with this type of trading. Here are some of the most effective techniques:

1. Set Stop-Loss Orders: One of the most important risk management techniques for momentum traders is to use stop-loss orders. A stop-loss order is an instruction to sell a stock when it reaches a particular price point. This can help limit potential losses by automatically exiting a trade when the price starts to drop.

2. Use trailing Stop-loss Orders: Another risk management technique that can be effective is to use trailing stop-loss orders. Unlike regular stop-loss orders, trailing stop-loss orders allow traders to set a percentage or dollar amount below the market price, which means that the stop-loss level will move up as the price of the stock increases. This can help lock in profits while still allowing for potential gains.

3. Diversify Your Portfolio: Diversification is another essential risk management technique for momentum traders. By spreading your investments across different sectors, industries, and stocks, you can help minimize the impact of any single stock or sector on your portfolio. This can help reduce overall risk and increase the potential for long-term gains.

4. Manage Your Position Size: Another critical risk management technique is to manage your position size. This means that you should only invest a small percentage of your portfolio in any single stock or trade. By limiting your exposure, you can help prevent significant losses if a trade goes against you.

Momentum trading can be a profitable trading strategy, but it also comes with a high level of risk. By using effective risk management techniques, momentum traders can help minimize losses and maximize gains.

Risk Management Techniques for Momentum Trading - Mastering Momentum Trading with the Ultimate Oscillator Indicator

15. Understanding the Basics of Momentum Trading

1. Momentum trading is a popular strategy among traders seeking to capitalize on short-term price movements in the market. It involves identifying stocks or other financial instruments that are exhibiting strong upward or downward trends and entering trades to profit from these momentum swings. This approach is based on the belief that assets that have been performing well in the recent past are likely to continue performing well in the near future. However, it is important to understand the basics of momentum trading before diving into this strategy.

2. One of the key aspects to consider when engaging in momentum trading is the time frame. Traders can choose between short-term or long-term momentum trading strategies, depending on their preferences and risk tolerance. Short-term momentum traders focus on capturing quick gains from short-lived price movements, often holding positions for a few days or even just a few hours. On the other hand, long-term momentum traders aim to identify and ride major trends over a longer period, with positions often held for weeks or months.

3. Another crucial factor to consider is the selection of instruments for momentum trading. Traders can choose from a wide range of assets, including individual stocks, exchange-traded funds (ETFs), or even currencies and commodities. It is essential to analyze and understand the market dynamics of the chosen instrument, as well as its historical performance, to make informed trading decisions. For example, if a trader is interested in momentum trading with stocks, they may focus on identifying stocks with strong earnings growth, positive news catalysts, or technical indicators signaling an uptrend.

4. Timing is everything in momentum trading. Traders need to identify the optimal entry and exit points to maximize their profits. This can be achieved through technical analysis, which involves studying price charts, trend lines, moving averages, and other indicators. For instance, a trader may utilize the relative strength index (RSI) to determine if a stock is overbought or oversold, indicating a potential reversal in momentum. Additionally, understanding market sentiment and news events can help identify the best timing for entering or exiting a trade.

5. Risk management is paramount in momentum trading. While the potential for high returns may be appealing, it is important to set strict stop-loss orders to limit potential losses. A stop-loss order is an instruction to sell a security once it reaches a certain predetermined price, protecting traders from significant downside risks. Additionally, diversification across multiple instruments or sectors can help spread out risk and reduce exposure to any single asset.

6. To enhance the effectiveness of momentum trading, traders may consider combining it with other strategies or tools. For example, trend-following indicators like moving averages can help confirm the direction of the momentum and provide additional entry or exit signals. Additionally, incorporating fundamental analysis, such as evaluating a company's financial health or industry trends, can provide a more comprehensive perspective on the potential success of a momentum trade.

7. Ultimately, the best option for momentum trading will vary depending on individual trading styles, risk tolerance, and market conditions. Some traders may find success with short-term momentum trading, taking advantage of quick price movements and high trading volume. Others may prefer the stability and potentially larger gains associated with long-term momentum trading. It is essential to experiment, learn from experience, and adapt strategies to find the optimal approach that aligns with personal goals and preferences.

8. In conclusion, understanding the basics of momentum trading is crucial for traders looking to master this strategy. By considering factors such as time frame, instrument selection, timing, risk management, and the integration of other strategies, traders can increase their chances of success. However, it is important to remember that no trading strategy is foolproof, and thorough research, continuous learning, and disciplined execution are key to navigating the volatile world of momentum trading.

Understanding the Basics of Momentum Trading - Mastering the Art of Trading with Momentum Funds

16. Implementing Effective Risk Management Techniques in Momentum Trading

Implementing Effective Risk Management Techniques in Momentum Trading

In the world of trading with momentum funds, it is crucial to have a strong risk management strategy in place. Momentum trading involves capitalizing on the upward or downward movement of a stock or market trend, with the aim of profiting from short-term price fluctuations. While it can be highly lucrative, it also carries its fair share of risks. Therefore, traders must be equipped with effective risk management techniques to safeguard their investments and maximize their chances of success.

1. Diversify Your Portfolio:

One of the key risk management techniques for momentum trading is diversifying your portfolio. By spreading your investments across different sectors, industries, and asset classes, you can minimize the impact of any single investment's poor performance on your overall portfolio. For example, instead of solely focusing on technology stocks, consider diversifying into other sectors like healthcare, consumer goods, or energy. This way, if one sector experiences a downturn, your other investments can potentially offset the losses.

2. Set Stop-Loss Orders:

Stop-loss orders are an essential tool for managing risk in momentum trading. These orders automatically trigger a sale when a stock reaches a predetermined price level. setting a stop-loss order ensures that you limit your potential losses and prevent significant drawdowns. For instance, if you purchase a stock at $50 and set a stop-loss order at $45, the order will execute a sell trade if the stock price drops to or below $45, protecting you from further losses.

3. Use position Sizing techniques:

Position sizing is another crucial aspect of risk management in momentum trading. It involves determining the appropriate amount of capital to allocate to each trade, taking into account your risk tolerance and the potential volatility of the stock or market you are trading. One commonly used technique is the percentage risk model, where you allocate a fixed percentage of your portfolio to each trade. This approach ensures that you don

Implementing Effective Risk Management Techniques in Momentum Trading - Mastering the Art of Trading with Momentum Funds

17. Analyzing Market Trends and Indicators for Successful Momentum Trading

1. understanding Market trends and Indicators

When it comes to successful momentum trading, analyzing market trends and indicators is crucial. By studying these factors, traders can identify potential opportunities for profitable trades. Market trends can be broadly categorized as either bullish (upward) or bearish (downward), while indicators provide specific data that help traders gauge the strength and direction of these trends.

Insights from different perspectives:

- Technical Analysis: Technical analysts emphasize the use of charts and indicators to predict future price movements. They believe that historical price data can reveal patterns that repeat over time. For example, the moving Average Convergence divergence (MACD) indicator can help identify trend reversals or confirm existing trends.

- Fundamental Analysis: Fundamental analysts, on the other hand, focus on the underlying factors that drive market trends. They analyze financial statements, economic indicators, and news events to assess the intrinsic value of a security. For instance, a positive earnings report may indicate a potential uptrend in a company's stock.

2. Key Market Trend Indicators

To effectively analyze market trends, traders often rely on a combination of indicators. Here are some key indicators commonly used in momentum trading:

- moving averages: Moving averages smooth out price fluctuations over a specific period, providing a visual representation of the trend. For example, a 50-day moving average crossing above a 200-day moving average may signal a bullish trend. Conversely, a bearish trend would be indicated by the opposite crossover.

- Relative Strength Index (RSI): The RSI measures the speed and change of price movements. It ranges from 0 to 100 and is often used to identify overbought or oversold conditions. A reading above 70 suggests an overbought market, while a reading below 30 indicates an oversold market.

- Volume: Analyzing trading volume can help confirm a trend's strength. Higher volume during an uptrend suggests strong buying pressure, while higher volume during a downtrend indicates significant selling pressure.

3. Comparing Technical and Fundamental Analysis

While both technical and fundamental analysis have their merits, combining them can provide a more comprehensive view of market trends. Technical analysis helps identify entry and exit points based on price patterns and indicators, while fundamental analysis provides insights into the underlying value and potential catalysts for a security.

For example, a technical analyst may identify a bullish trend using moving averages and RSI, while a fundamental analyst may find supporting evidence through positive earnings growth and favorable industry conditions. By combining these perspectives, traders can make more informed trading decisions.

4. Best Practices for Analyzing Market Trends

To effectively analyze market trends for successful momentum trading, consider the following best practices:

- Use a combination of indicators: Relying on a single indicator can be risky, as no indicator is foolproof. Combining multiple indicators can provide more reliable signals and reduce the risk of false positives or negatives.

- Stay updated on news and events: News and events can significantly impact market trends. Stay informed about economic reports, earnings releases, and geopolitical developments that may influence the markets.

- Continuously adapt your strategy: Market trends are dynamic, and what works today may not work tomorrow. Regularly review and adapt your trading strategy based on changing market conditions.

Analyzing market trends and indicators is a crucial aspect of successful momentum trading. By understanding and utilizing various indicators, combining technical and fundamental analysis, and following best practices, traders can enhance their ability to identify profitable trading opportunities in dynamic markets.

Analyzing Market Trends and Indicators for Successful Momentum Trading - Mastering the Art of Trading with Momentum Funds

18. Tips and Strategies for Maximizing Profits with Momentum Trading

1. Understanding Momentum Trading:

Momentum trading is a popular strategy among traders looking to maximize profits in the financial markets. It involves taking advantage of the upward or downward trends of a particular stock or asset, with the belief that these trends will continue in the short term. However, successfully implementing momentum trading requires a deep understanding of market dynamics and the ability to identify and act upon profitable opportunities.

2. identifying Strong Market trends:

The first step in maximizing profits with momentum trading is to identify strong market trends. This can be done through technical analysis, which involves studying price charts and indicators to identify patterns and trends. Traders often use tools like moving averages, relative strength index (RSI), and MACD to confirm the strength of a trend. By identifying a strong trend, traders can enter trades with a higher probability of success.

3. Setting Clear Entry and Exit Points:

One of the keys to maximizing profits with momentum trading is setting clear entry and exit points. Traders should have a well-defined plan for when to enter a trade, based on their analysis of market trends and indicators. Similarly, they should determine the point at which they will exit the trade, either to take profits or cut losses. Setting these points in advance helps traders avoid emotional decision-making and ensures they stick to their trading strategy.

4. utilizing Stop-Loss orders:

Stop-loss orders are an essential tool for managing risk and maximizing profits in momentum trading. A stop-loss order is an instruction to sell a security when it reaches a certain price level, limiting potential losses. By setting a stop-loss order, traders can protect their capital and reduce the impact of unexpected market movements. It is crucial to place stop-loss orders at strategic levels that allow for potential market fluctuations while still protecting profits.

5. Employing trailing Stop orders:

Trailing stop orders are another effective strategy for maximizing profits in momentum trading. Unlike traditional stop-loss orders, trailing stop orders automatically adjust the stop price as the market moves in the trader's favor. This allows traders to lock in profits while still giving the trade room to potentially capture additional gains. For example, if a trader sets a trailing stop order at 5%, the stop price will move up as the stock price increases, protecting profits along the way.

6. Diversifying Your Portfolio:

Diversification is a fundamental principle in any trading strategy, including momentum trading. By diversifying their portfolio, traders can spread their risk and increase the potential for profits. This can be achieved by trading multiple stocks or assets from different sectors or industries. Diversification helps mitigate the impact of any single stock's performance on the overall portfolio and allows traders to capture opportunities in various market segments.

7. Staying Informed and Adapting:

To maximize profits with momentum trading, it is essential to stay informed about market news, economic indicators, and company-specific events. Being aware of potential catalysts or events that could impact a stock's price can provide valuable insights for making informed trading decisions. Additionally, successful momentum traders are adaptable and willing to adjust their strategies based on changing market conditions. They understand that no strategy works indefinitely and are open to modifying their approach when necessary.

Mastering the art of trading with momentum funds requires a combination of technical analysis, risk management, and adaptability. By understanding market trends, setting clear entry and exit points, utilizing stop-loss and trailing stop orders, diversifying their portfolio, staying informed, and adapting to changing market conditions, traders can maximize their profits and achieve success in momentum trading.

Tips and Strategies for Maximizing Profits with Momentum Trading - Mastering the Art of Trading with Momentum Funds

19. Introduction to Momentum Trading

Momentum trading is a popular strategy used by traders to take advantage of the market's current trend. It is based on the principle that once a trend is established, it is likely to continue. Momentum traders look for stocks that are moving in a particular direction, and they try to ride the trend as long as possible. This type of trading can be profitable, but it requires a lot of discipline and skill. In this section, we will discuss the basics of momentum trading and how to use the Demarker Indicator to gauge market strength.

Here are some key points to keep in mind when it comes to momentum trading:

1. Identify the trend: The first step in momentum trading is to identify the trend. This can be done by looking at the price action of a stock or market. If the stock is moving higher, then the trend is up, and if it is moving lower, then the trend is down. It is important to remember that trends can change quickly, so it is important to have a plan in place.

2. Use the Demarker Indicator: The Demarker Indicator is a technical indicator that can be used to gauge market strength. It is based on the concept of overbought and oversold conditions. When the Demarker Indicator is above a certain level, it is considered to be overbought, and when it is below a certain level, it is considered to be oversold.

3. Set entry and exit points: Once you have identified the trend and have a good understanding of market strength, it is time to set your entry and exit points. This is where you will buy or sell the stock. It is important to have a plan in place and to stick to it. Remember, momentum trading is all about riding the trend, so you want to make sure you are in the trade for as long as possible.

4. Risk management: As with any trading strategy, risk management is key. You need to have a plan in place for managing your risk. This can be done by setting stop-loss orders or using other risk management techniques.

To illustrate how momentum trading works, let's look at an example. Let's say you identify a stock that is in an uptrend. You use the Demarker Indicator to gauge market strength, and it is indicating that the stock is overbought. You set your entry point and buy the stock. You ride the trend for as long as possible, but then the trend starts to reverse. You have a plan in place for managing your risk, so you sell the stock and take your profits.

Momentum trading can be a profitable strategy if done correctly. It requires discipline, skill, and a good understanding of market trends. By using the Demarker Indicator to gauge market strength, you can increase your chances of success. Remember to always have a plan in place and to stick to it.

Introduction to Momentum Trading - Momentum: Leveraging the Demarker Indicator to Gauge Market Strength

20. Understanding the Power of Momentum in Trading

Understanding the Power of Momentum in Trading

In the fast-paced world of trading, understanding and harnessing the power of momentum can be the key to success. Momentum refers to the strength and speed of price movements in a particular direction, and being able to identify and ride the momentum wave can lead to profitable trades. This section will delve into the concept of momentum in trading, exploring its significance and providing insights from different perspectives.

1. The Significance of Momentum: Momentum is a crucial factor in trading as it reflects the behavior of market participants. When a stock or market exhibits strong momentum, it suggests that there is a consensus among traders, creating a self-reinforcing cycle that can result in substantial price movements. By recognizing and capitalizing on momentum, traders can ride the wave and profit from these movements.

2. Identifying Momentum: There are various ways to identify momentum in trading. One popular approach is through technical analysis indicators such as moving averages, MACD (Moving Average Convergence Divergence), or the relative Strength index (RSI). These indicators can help traders spot trends and gauge the strength of momentum in a particular security or market. For example, if a stock's price is consistently making higher highs and higher lows, it indicates a bullish momentum.

3. Different Perspectives on Momentum: Traders often have different approaches to harnessing momentum. Some prefer to trade breakouts, which involve entering a trade when the price breaks through a significant level of support or resistance. This strategy aims to capture strong momentum as the price moves beyond key levels. On the other hand, some traders prefer to trade pullbacks, looking for temporary retracements against the prevailing momentum. This strategy allows them to enter trades at better prices, potentially maximizing profits when the momentum resumes.

4. riding the Momentum wave: To effectively ride the momentum wave, traders need to have a clear plan and disciplined execution. They should set specific entry and exit points based on their analysis of momentum and risk tolerance. Additionally, implementing proper risk management techniques, such as setting stop-loss orders, is crucial to protect capital in case momentum reverses unexpectedly. It's essential to remember that momentum can be fleeting, so traders must stay vigilant and adapt their strategies accordingly.

5. Comparing Options: When it comes to trading momentum, there is no one-size-fits-all approach. Each trader must find a strategy that aligns with their trading style, risk appetite, and time commitment. While breakout trading can offer significant profit potential, it may also result in false breakouts and increased risk. On the other hand, pullback trading allows traders to enter at potentially lower-risk levels but may require patience and a keen eye for identifying trend reversals. Ultimately, the best option depends on an individual trader's preferences and skills.

Understanding and harnessing the power of momentum is a vital skill for traders. By recognizing and capitalizing on momentum, traders can increase their chances of success in the dynamic world of trading. Whether through breakout trading or pullback trading, the ability to ride the momentum wave can lead to profitable trades and sustainable trading strategies. So, embrace the power of momentum and ride the wave to trading success.

Understanding the Power of Momentum in Trading - Momentum: Riding the Momentum Wave: Tape Reading Strategies for Traders

21. Understanding Momentum Trading

Momentum trading is a popular trading strategy among investors, which involves buying stocks that have shown an upward trend in recent times. The strategy is based on the assumption that if a stock has been performing well in the past, it is likely to continue to do so in the future. momentum trading can be a key component of a successful average up strategy. While momentum trading can be profitable, it is important to understand the risks involved.

1. Understanding Momentum Trading: Momentum trading is based on the idea that stocks that have been performing well in the past will continue to do so in the future. The momentum trader buys stocks that have shown an upward trend and sells them when the trend starts to reverse. This strategy can be profitable as long as the trader can accurately predict when the trend will change.

2. Risks Involved in Momentum Trading: One of the biggest risks of momentum trading is that it is based on the assumption that past performance will continue in the future. However, this is not always the case, as market conditions can change quickly. Another risk is that momentum traders often buy stocks that are already overvalued, which can lead to significant losses if the trend reverses.

3. Identifying Momentum Stocks: To identify momentum stocks, traders often use technical analysis tools such as moving averages and relative strength indicators. These tools can help traders identify stocks that are trending upward and have a high probability of continuing to do so in the future.

4. Example of Momentum Trading: Let's say a trader identifies a stock that has been on an upward trend for the past few weeks. The trader buys the stock and sets a stop loss order to limit potential losses. The stock continues to rise for a few more weeks, and the trader sells the stock for a profit. However, if the stock had started to decline shortly after the trader bought it, the stop loss order would have been triggered, limiting the trader's losses.

Momentum trading can be a profitable trading strategy, but it is important to understand the risks involved. Traders should use technical analysis tools to identify momentum stocks and set stop loss orders to limit potential losses. By understanding momentum trading, traders can incorporate it into their overall trading strategy and increase their chances of success.

Understanding Momentum Trading - Momentum trading: A key component of a successful averageup strategy

22. Introduction to Momentum Trading

Momentum trading is a popular trading strategy that focuses on the idea that stocks that are performing well will continue to perform well, while those performing poorly will continue to decline. This strategy involves identifying stocks that are trending in a particular direction and taking a position in the hopes of profiting from the trend. Momentum traders typically use technical analysis to identify potential trades, looking at charts and indicators to identify trends and entry and exit points.

1. What is momentum trading?

Momentum trading is a strategy that involves buying stocks that are performing well and selling those that are performing poorly. This approach is based on the idea that stocks that are trending in a particular direction will continue to do so, and that traders can profit by taking advantage of these trends. Momentum traders typically use technical analysis to identify potential trades, looking at charts and indicators to identify trends and entry and exit points.

2. How does momentum trading work?

Momentum trading works by identifying stocks that are trending in a particular direction and taking a position in the hopes of profiting from the trend. Traders typically use technical analysis to identify potential trades, looking at charts and indicators to identify trends and entry and exit points. Once a trade is identified, traders will typically use a stop order to limit their losses in case the trade goes against them.

3. What are the advantages of momentum trading?

One of the main advantages of momentum trading is that it allows traders to take advantage of trends in the market, potentially generating significant profits. Additionally, momentum trading can be a relatively simple strategy to implement, as it relies heavily on technical analysis and does not require a deep understanding of a company's fundamentals.

4. What are the risks of momentum trading?

The main risk of momentum trading is that it relies on the assumption that trends will continue, which is not always the case. If a stock suddenly reverses course, momentum traders can suffer significant losses. Additionally, momentum trading can be a high-risk strategy, as traders may need to take on significant leverage to generate meaningful returns.

5. How can buy stop orders be used in momentum trading?

Buy stop orders can be used in momentum trading to limit losses and protect profits. A buy stop order is a type of order that is placed at a specific price level above the current market price. If the stock reaches that price level, the order is triggered and the trader buys the stock. This can be useful in momentum trading, as it allows traders to enter a trade at a specific price point, while limiting their losses if the trade goes against them.

6. What are the best practices for using buy stop orders in momentum trading?

When using buy stop orders in momentum trading, it is important to set the order at the appropriate price level. Traders should also be mindful of the potential risks associated with using leverage, as well as the potential for sudden reversals in the market. Additionally, traders should consider using trailing stops, which can help lock in profits as the stock price rises.

Overall, momentum trading can be a powerful strategy for generating profits, but it is not without risks. By using buy stop orders and other risk management techniques, traders can limit their losses and protect their profits, potentially maximizing their returns over the long-term.

Introduction to Momentum Trading - Momentum trading: Harnessing Momentum Trading with Buy Stop Orders

23. Advantages of Using Buy Stop Orders in Momentum Trading

When it comes to momentum trading, it's important to have a good understanding of the different types of orders available to you. One type of order that can be particularly useful in this style of trading is the buy stop order. In this section, we'll explore the advantages of using buy stop orders in momentum trading, and why they can be a valuable tool for traders.

1. Helps Capture Momentum

One of the key advantages of using buy stop orders in momentum trading is that they can help capture momentum. This is because a buy stop order is placed above the current market price, and is triggered when the price reaches a certain level. This means that when the market is moving in a particular direction, a buy stop order can help you get in on the action and capture some of the momentum.

For example, let's say you're trading a stock that has been steadily increasing in price over the past few days. You believe that the momentum will continue, so you place a buy stop order above the current market price. When the price reaches that level, your order is triggered and you're able to get in on the upward momentum.

2. Reduces Emotional Trading

Another advantage of using buy stop orders in momentum trading is that they can help reduce emotional trading. Emotional trading is when you make decisions based on fear or greed, rather than logic and analysis. This can often lead to poor trading decisions, and can result in losses.

By using a buy stop order, you can take the emotion out of your trading decisions. You set your order at a certain level, and if the market reaches that level, your order is triggered. This means that you don't have to make a decision in the heat of the moment, and you can avoid emotional trading.

3. Provides Protection

Another advantage of using buy stop orders in momentum trading is that they can provide protection. When you place a buy stop order, you're essentially setting a stop loss at the same time. This means that if the market moves against you, your order will be triggered and you'll be taken out of the trade.

This can be particularly useful in volatile markets, where prices can move quickly and unpredictably. By using a buy stop order, you can limit your potential losses and protect your capital.

4. Improves Efficiency

Finally, using buy stop orders in momentum trading can improve efficiency. This is because buy stop orders can be placed in advance, and can be triggered automatically when the market reaches a certain level. This means that you don't have to monitor the market constantly, and you can focus on other aspects of your trading strategy.

For example, let's say you're a day trader who uses momentum trading strategies. You can place your buy stop orders in the morning, and they will be triggered automatically if the market reaches the desired level. This means that you can focus on other trades or analysis, rather than constantly watching the market.

Using buy stop orders in momentum trading can be a valuable tool for traders. They can help capture momentum, reduce emotional trading, provide protection, and improve efficiency. If you're a momentum trader, it's worth considering incorporating buy stop orders into your trading strategy.

Advantages of Using Buy Stop Orders in Momentum Trading - Momentum trading: Harnessing Momentum Trading with Buy Stop Orders

24. Risks and Limitations of Buy Stop Orders in Momentum Trading

Momentum trading can be a risky strategy, especially when it comes to using buy stop orders. While buy stop orders can be a useful tool for momentum traders, there are several risks and limitations that traders should be aware of before using them.

1. Slippage

One of the biggest risks of using buy stop orders in momentum trading is slippage. Slippage occurs when the price of an asset moves so quickly that the order is filled at a different price than the one specified. This can be particularly problematic in volatile markets, as prices can move rapidly and unpredictably.

2. False Breakouts

Another risk of using buy stop orders in momentum trading is the possibility of false breakouts. A false breakout occurs when the price of an asset briefly moves above a resistance level or below a support level, triggering a buy or sell order, but then quickly reverses course. This can result in traders buying at a higher price than they intended or selling at a lower price than they intended.

3. Limited Control

A limitation of using buy stop orders in momentum trading is that they offer limited control over the execution of the trade. Once a buy stop order is triggered, the trade is executed automatically, regardless of other market conditions or the trader's preferences. This can be problematic if the market suddenly shifts, as the trader may be stuck with a position that they no longer want.

4. Overreliance on Technical Analysis

Another limitation of using buy stop orders in momentum trading is that they rely heavily on technical analysis. Momentum traders often use technical indicators, such as moving averages and relative strength index (RSI), to identify trends and entry and exit points. However, technical analysis is not foolproof, and relying too heavily on it can lead to missed opportunities or bad trades.

5. Not Suitable for All Traders

Finally, it's important to note that buy stop orders may not be suitable for all traders. They require a certain level of experience and knowledge to use effectively, and novice traders may find them overwhelming or confusing. Additionally, traders with smaller accounts may not be able to afford the potential losses associated with using buy stop orders.

While buy stop orders can be an effective tool for momentum traders, they also come with several risks and limitations. Traders should be aware of these risks and limitations before using buy stop orders and should carefully consider whether they are the right choice for their trading strategy. Ultimately, the best approach is to use a variety of tools and strategies to minimize risk and maximize returns.

Risks and Limitations of Buy Stop Orders in Momentum Trading - Momentum trading: Harnessing Momentum Trading with Buy Stop Orders

25. Factors to Consider When Placing Buy Stop Orders in Momentum Trading

The placement of buy stop orders is a critical aspect of momentum trading. This is because the placement of these orders can significantly influence the outcome of a trade. It is, therefore, essential to consider various factors before placing a buy stop order. This section explores some of the factors to consider when placing buy stop orders in momentum trading.

1. Market Conditions

The market conditions play a significant role in determining when and where to place a buy stop order. In a fast-moving market, the buy stop order should be placed closer to the market price to ensure that the order is triggered before the price moves significantly. On the other hand, in a slow-moving market, the buy stop order can be placed further away from the market price.

2. Volatility

Volatility is another factor that should be considered when placing a buy stop order. Higher volatility means that the price is likely to move significantly, and the buy stop order should be placed closer to the market price to ensure that the order is triggered before the price moves too far away. Lower volatility means that the buy stop order can be placed further away from the market price.

3. Risk Management

Risk management is a crucial factor in momentum trading. The placement of a buy stop order should be done with the aim of limiting potential losses. This means that the buy stop order should be placed at a level that the trader is comfortable with, and the risk-reward ratio should be considered. The stop loss level should be placed at a level that limits losses to an acceptable level.

4. Technical Analysis

Technical analysis is a critical tool in momentum trading, and it can provide valuable insights into when and where to place a buy stop order. Traders should use technical indicators such as moving averages, trend lines, and support and resistance levels to determine the best level to place a buy stop order.

5. Timeframe

The timeframe is another factor that should be considered when placing a buy stop order. Traders should consider the timeframe they are trading in and the level of volatility in that timeframe. For example, a trader trading on a 5-minute chart may need to place a buy stop order closer to the market price than a trader trading on a 1-hour chart.

6. Order Type

There are different types of buy stop orders, and traders should choose the one that best suits their trading strategy. The most common types of buy stop orders are the market order, limit order, and stop limit order. The market order is executed immediately at the best available price. The limit order is executed at a specific price or better, while the stop limit order is executed at a specific price or better after the stop price has been reached.

The placement of buy stop orders is a critical aspect of momentum trading, and traders should consider various factors before placing these orders. Traders should consider market conditions, volatility, risk management, technical analysis, timeframe, and order type when placing buy stop orders. By considering these factors, traders can increase their chances of success and limit potential losses.

Factors to Consider When Placing Buy Stop Orders in Momentum Trading - Momentum trading: Harnessing Momentum Trading with Buy Stop Orders