1. Tips for Mastering Bid Increment

As an auction participant, mastering bid increment is essential for your success. It is the difference between winning and losing an item, as well as the amount you pay for it. Bid increment refers to the minimum amount that a bidder must increase their bid by to remain in the auction. In this section, we will explore tips for mastering bid increment to help you win more auctions and save money.

1. Understand the Auction Rules

Before placing any bids in an auction, make sure you understand the rules. Each auction house or platform may have different rules regarding bid increments, and it is crucial to know them. Some auctions may have a fixed bid increment, while others may have a variable increment. Understanding the rules will help you determine your bidding strategy, and you won't be caught off guard during the auction.

2. Determine Your Maximum Bid

Before entering any auction, decide on your maximum bid. This is the maximum amount you are willing to pay for the item. Knowing your maximum bid will help you determine your bidding strategy and avoid overbidding. It is best to set your maximum bid before the auction starts and stick to it.

3. Bid Early and Often

Bidding early and often is a strategy that can help you win an auction. By placing an early bid, you establish yourself as a serious bidder, and other bidders may be discouraged from competing with you. Additionally, bidding often allows you to stay ahead of the competition and avoid being outbid at the last minute.

4. Avoid Bidding Wars

Bidding wars can quickly escalate the price of an item and lead to overbidding. To avoid bidding wars, bid confidently and aggressively early on in the auction. If you find yourself in a bidding war, take a step back and reassess your maximum bid. It may be best to let the other bidder win the item and move on to the next auction.

5. Use Proxy Bidding

Proxy bidding is a feature that allows you to set your maximum bid and let the auction platform bid on your behalf. This feature ensures that you remain in the auction until your maximum bid is reached, even if you are not actively bidding. Proxy bidding can be a useful tool for avoiding bidding wars and winning auctions at a lower price.

Mastering bid increment is essential for auction success. By understanding the auction rules, determining your maximum bid, bidding early and often, avoiding bidding wars, and using proxy bidding, you can increase your chances of winning auctions and save money. Remember to always bid confidently and strategically to achieve your auction goals.

Tips for Mastering Bid Increment - Bid increment: Mastering Bid Increment and Deduction for Auction Success

2. Tips for Mastering Volume Analysis with Candlestick Patterns

Volume analysis is a crucial aspect of technical analysis when it comes to trading in the stock market. It is a powerful tool that helps traders to identify patterns and trends that are not visible to the naked eye. The use of candlestick charts can be an effective way to identify these patterns and trends, which can provide traders with a significant advantage when making trading decisions. In this section, we will delve into some tips to help you master volume analysis with candlestick patterns.

1. Understand the Basics of Volume Analysis: The first step in mastering volume analysis is to understand the basics of how it works. Volume analysis is a technique that involves studying the volume of trading activity in a particular stock or security. By analyzing the volume of trading activity over a given period, traders can determine whether a particular stock is being bought or sold by investors. Understanding the basics of volume analysis is crucial as it forms the foundation for more advanced trading strategies.

2. Learn to Read Candlestick Charts: Candlestick charts are a popular tool used in technical analysis to visualize price and volume data. A candlestick chart displays the open, high, low, and closing prices for a particular security or stock. By learning to read candlestick charts, traders can identify patterns and trends that can help them make more informed trading decisions. For example, a bullish candlestick pattern may indicate that a stock is about to go up in price, while a bearish candlestick pattern may suggest that a stock is about to go down in price.

3. Look for Confirmation Signals: Confirmation signals are essential when it comes to volume analysis with candlestick patterns. Confirmation signals can help traders to confirm whether a particular pattern or trend is valid or not. For example, a bullish candlestick pattern may be confirmed if the trading volume is higher than usual, indicating that there is significant buying activity in the market.

4. Keep an Eye on Price and Volume Divergence: Divergence occurs when the price of a stock or security moves in the opposite direction of the trading volume. Price and volume divergence can be a powerful signal that a trend is about to reverse. For example, if a stock is trending upward, but the trading volume is decreasing, it may be an indication that the trend is about to reverse.

Mastering volume analysis with candlestick patterns requires an understanding of the basics of volume analysis, the ability to read candlestick charts, and the ability to identify confirmation signals and price and volume divergence. By following these tips, traders can gain a deeper insight into the market and make more informed trading decisions.

Tips for Mastering Volume Analysis with Candlestick Patterns - Candlestick patterns: Mastering Volume Analysis with Candlestick Patterns

3. Tips for Mastering Cardistry with Series 52 Playing Cards

Section 1: Choosing the Right Deck of Cards

The first step in mastering cardistry is choosing the right deck of cards. While any deck of playing cards can be used for cardistry, some decks are better suited for the art form than others. When it comes to cardistry, the Series 52 playing cards are a popular choice. These cards are specifically designed for cardistry and feature a unique design that enhances the visual impact of card flourishes.

1. Look for a deck with a unique design: One of the most important factors to consider when choosing a deck of cards for cardistry is the design. A unique design can help to make your flourishes more visually appealing and impressive. The Series 52 deck features a geometric design that is perfect for cardistry.

2. Consider the quality of the cards: The quality of the cards is also an important consideration. You want a deck of cards that can withstand the rigors of cardistry, including constant handling and shuffling. The Series 52 deck is made from high-quality materials and is designed to last.

3. Choose a deck that suits your style: Finally, it's important to choose a deck of cards that suits your personal style and preferences. The Series 52 deck is available in a range of colors, so you can choose the one that best matches your aesthetic.

Section 2: Learning Basic Cardistry Moves

Once you have chosen the right deck of cards, it's time to start learning some basic cardistry moves. These moves are the foundation of all card flourishes and are essential for mastering the art form.

1. Start with the basics: The first step in learning cardistry is to start with the basics. This means learning moves like the Charlier Cut, the Swivel Cut, and the Spring. These moves are relatively easy to learn and will help you to build a solid foundation for more advanced flourishes.

2. Practice regularly: Like any skill, cardistry takes practice to master. Make sure you practice regularly, even if it's just for a few minutes each day. This will help you to build muscle memory and improve your technique over time.

3. Film yourself: Filming yourself while practicing can be a great way to identify areas where you need to improve. You can watch the footage back and analyze your technique, making adjustments as needed.

Section 3: Developing Your Own Style

Once you have mastered some basic cardistry moves, it's time to start developing your own style. This is where you can really start to get creative and make your flourishes stand out.

1. Experiment with different moves: The first step in developing your own style is to experiment with different moves. Try combining different flourishes together or modifying existing moves to create something new and unique.

2. Find inspiration from others: Don't be afraid to draw inspiration from other cardists. Watch videos of other cardists and try to incorporate their moves into your own style.

3. Practice, practice, practice: Finally, it's important to practice your own moves regularly to refine your technique and make them as visually appealing as possible.

Overall, mastering cardistry with Series 52 playing cards takes time, patience, and dedication. By choosing the right deck of cards, learning basic moves, and developing your own style, you can create impressive

Tips for Mastering Cardistry with Series 52 Playing Cards - Cardistry: Mastering Cardistry with Series 52 Playing Cards

4. Essential Tips for Mastering Mechanical Comprehension

Mechanical comprehension is a crucial skill for those aspiring to join the military. The ability to understand and analyze the workings of military machinery is essential for success in various roles, from operating and maintaining equipment to troubleshooting and repairing it. In this section, we will explore some essential tips that can help you master mechanical comprehension and excel in the CFAT Mechanical exam.

1. Familiarize Yourself with Basic Mechanical Principles: Start by building a strong foundation of knowledge in mechanical principles. Understand concepts such as force, motion, energy, and different types of mechanical systems. This will enable you to grasp the underlying principles behind various military machinery and their operations. Consider studying basic physics and engineering principles to enhance your understanding.

2. Develop Spatial Reasoning Skills: Mechanical comprehension often involves visualizing and mentally manipulating three-dimensional objects. Developing your spatial reasoning skills can greatly aid in this process. Practice tasks such as assembling objects from diagrams or solving puzzles that require mental rotation. These exercises can sharpen your ability to understand the spatial relationships between different components of machinery.

3. Study Different Types of Military Machinery: Familiarize yourself with a wide range of military machinery, including vehicles, aircraft, weapons systems, and communication equipment. Learn about their components, functions, and how they interact with each other. Understanding the purpose and operation of different types of machinery will allow you to approach mechanical comprehension questions from a knowledgeable perspective.

4. Utilize Diagrams and Visual Aids: When studying military machinery, make use of diagrams, schematics, and visual aids. These visual representations can provide a clearer understanding of how various components fit together and how they function. Analyze these diagrams to identify the relationships between different parts and their roles within the overall system. For example, studying an aircraft's hydraulic system diagram can help you understand how the brakes, landing gear, and flight controls are interconnected.

5. Practice with Sample Questions: Regular practice with sample questions is key to mastering mechanical comprehension. Seek out practice exams or question banks specifically designed for the CFAT Mechanical exam. These resources will familiarize you with the types of questions you may encounter and help you identify areas where you need improvement. Aim to simulate exam conditions as closely as possible to develop the ability to solve problems efficiently under time constraints.

6. Seek Guidance and Feedback: Don't hesitate to seek guidance from experts or experienced individuals in the field of military machinery. They can provide valuable insights and advice on mastering mechanical comprehension. Additionally, consider forming study groups with peers who share the same goal. Collaborative learning can enhance your understanding and provide different perspectives on complex concepts.

7. Stay Updated with Technological Advancements: Military machinery is constantly evolving with advancements in technology. stay updated with the latest developments in the field, such as new equipment, systems, or manufacturing techniques. Understanding modern technologies will not only enhance your mechanical comprehension but also demonstrate your interest and commitment to military machinery.

By following these essential tips, you can enhance your mechanical comprehension skills and excel in the CFAT Mechanical exam. Remember to approach each question systematically, analyze the options carefully, and apply your knowledge effectively to arrive at the best possible answer. With practice and dedication, you can master the art of military machinery and pave the way for a successful military career.

Essential Tips for Mastering Mechanical Comprehension - CFAT Mechanical: Mastering the Art of Military Machinery

5. Techniques and Tips for Mastering Charcoal Art

1. Experiment with Different Types of Charcoal

One of the first steps to mastering charcoal art is to experiment with different types of charcoal. There are various types available, such as vine charcoal, compressed charcoal, and charcoal pencils. Each type has its own unique qualities and can produce different effects on the paper. For example, vine charcoal is softer and lighter, making it ideal for creating initial sketches and light shading. On the other hand, compressed charcoal is denser and darker, allowing for bolder lines and deeper shadows. By trying out different types of charcoal, you can discover which ones resonate with your artistic style and preferences.

2. Understand the Importance of Value

Value refers to the range of lightness and darkness in a drawing. It is crucial to understand and master value when working with charcoal, as it can greatly enhance the depth and realism of your artwork. To create a wide range of values, you can vary the pressure applied to the charcoal, use different types of charcoal, and experiment with different techniques such as blending and cross-hatching. Paying attention to the value of different areas in your composition can help you achieve a three-dimensional effect and bring your artwork to life.

3. Utilize Different Techniques for Shading

Shading is an essential aspect of charcoal art, as it helps to create depth and dimension in your drawings. There are several techniques you can use to achieve different shading effects. One common technique is called hatching, where you create parallel lines to indicate shading. Cross-hatching involves layering intersecting lines to create darker areas. Another technique is stippling, which involves creating small dots or dashes to build up texture and tone. By practicing and experimenting with these techniques, you can develop your own unique style and create visually striking charcoal artwork.

4. Embrace the Power of Contrast

Contrast plays a significant role in charcoal art, as it adds visual interest and drama to your drawings. By juxtaposing light and dark values, you can create a strong sense of contrast that grabs the viewer's attention. One way to achieve contrast is by using different types of charcoal, as mentioned earlier. Additionally, you can experiment with blending and erasing techniques to create smooth transitions between light and dark areas. By consciously incorporating contrast into your charcoal artwork, you can elevate the overall impact and make your drawings more captivating.

5. Study and Learn from Other Artists

Learning from other artists is an excellent way to enhance your charcoal art skills. Take the time to study the works of renowned charcoal artists and analyze their techniques and approaches. Look for online tutorials, workshops, or art classes that focus on charcoal art. Engage with other artists in online communities or local art groups to share tips, ask for feedback, and gain inspiration. By immersing yourself in the world of charcoal art and learning from others, you can continue to grow and refine your skills.

Mastering charcoal art requires practice, experimentation, and a willingness to learn. By exploring different types of charcoal, understanding the importance of value, utilizing various shading techniques, embracing contrast, and studying the works of other artists, you can unlock the full potential of charcoal and create captivating and visually stunning artwork. So,

Techniques and Tips for Mastering Charcoal Art - Charcoal: Charcoal Charisma: Unleashing the Artistic Potential of Black

6. Tips for Mastering Credit Opportunities with a Thin File

1. Understand what a thin file is: Before diving into tips for mastering credit opportunities with a thin file, it's important to understand what a thin file actually means. A thin file refers to a limited credit history or a lack of credit history altogether. This can happen to individuals who are new to credit, have recently moved to a new country, or have simply not utilized credit in the past. Lenders often rely on credit reports to assess a borrower's creditworthiness, but with a thin file, it can be challenging to demonstrate a track record of responsible borrowing.

2. Start with a secured credit card: One of the most effective ways to build credit from scratch is by obtaining a secured credit card. With a secured card, you'll need to provide a cash deposit as collateral, which serves as your credit limit. By using the secured card responsibly and making timely payments, you can gradually establish a positive credit history. After a period of consistent payment history, you may be eligible to upgrade to an unsecured credit card, which doesn't require a deposit.

3. Consider becoming an authorized user: If you have a trusted friend or family member with a good credit history, you may want to explore the option of becoming an authorized user on one of their credit cards. This allows you to piggyback off their credit history, giving you a potential boost in your own credit score. It's important to note that not all credit card issuers report authorized user activity to credit bureaus, so make sure to confirm this before pursuing this option.

4. Explore credit-builder loans: Credit-builder loans are specifically designed for individuals with thin files or no credit history. These loans work by borrowing a small amount of money, typically held in a savings account, which you'll then repay over a set period of time. The payments are reported to credit bureaus, helping you establish a positive payment history and build credit. While the interest rates on credit-builder loans may be higher than traditional loans, the long-term benefits of building credit outweigh the short-term costs.

5. Pay all bills on time: This may seem like common sense, but it's crucial to emphasize the importance of paying all bills on time when you have a thin file. This includes not only credit card bills but also utility bills, rent, and any other financial obligations. Late payments can have a negative impact on your credit score, making it even more challenging to build credit. Set up automatic payments or reminders to ensure you never miss a due date.

6. Monitor your credit report: Regularly monitoring your credit report is essential for anyone, but it becomes even more crucial when you have a thin file. By keeping a close eye on your credit report, you can quickly identify any errors or discrepancies that may be negatively impacting your credit. If you spot any inaccuracies, be sure to dispute them with the credit bureaus to have them corrected.

7. Be patient and persistent: Building credit with a thin file takes time and patience. Remember that credit history is not built overnight, and it requires consistent responsible borrowing habits. Stick to your credit-building strategies, make timely payments, and avoid taking on excessive debt. Over time, your thin file will transform into a robust credit history, opening up more credit opportunities for you.

Remember, everyone's credit journey is unique, and what works for one person may not work for another. It's essential to evaluate your individual circumstances and choose the strategies that align with your financial goals. With determination and discipline, you can crack the thin file algorithm and master credit opportunities.

Tips for Mastering Credit Opportunities with a Thin File - Cracking the Thin File Algorithm: Mastering Credit Opportunities

7. Tips for Mastering Decimal Division

Mastering decimal division is a critical skill that everyone should have, especially when tackling complex mathematical problems. Decimal division involves dividing one decimal number by another, and it is essential for everyday life, including budgeting, cooking, and many other tasks. In this section, we will provide some tips to help you master decimal division quickly and easily. These tips will provide you with different perspectives to approach decimal division problems, and they can be used in various scenarios.

1. Practice, practice, practice: As with any other skill, practice is essential when it comes to mastering decimal division. The more you practice, the better you become at it. Start with simple problems and gradually move to more complex ones. Use online resources, worksheets, or textbooks to get a variety of problems to practice.

2. Know your multiplication tables: Decimal division is closely related to multiplication. Knowing your multiplication tables will make it easier to solve division problems. For instance, if you are dividing 0.5 by 0.1, you can convert both numbers to fractions and then multiply them. 0.5/0.1 = 5/1 * 1/0.1 = 5/0.1 = 50.

3. Use estimation: Estimation can be a handy tool when dealing with decimal division problems. You can round the numbers to the nearest whole number, or to one decimal place, and then perform the division. For example, if you are dividing 4.56 by 0.23, you can round them to 5 and 0.2, respectively, and then divide 5 by 0.2 to get an estimate of the answer.

4. Remember the rules: Decimal division follows the same rules as whole number division. For instance, when dividing by a decimal, you move the decimal point to the right in both the divisor and the dividend. When dividing by a whole number, you move the decimal point to the left in the dividend.

5. Use long division: Long division is a helpful tool when dealing with complex decimal division problems. It allows you to break down the problem into smaller, more manageable parts. For example, if you are dividing 0.456 by 0.02, you can use long division to get the answer.

Mastering decimal division is a valuable skill that requires practice, knowledge of multiplication tables, estimation, remembering the rules, and using long division. By following these tips, you can easily tackle any decimal division problem that comes your way.

Tips for Mastering Decimal Division - Decimal division: Simplifying 1 12b 1fees and its Value

8. Tips for Mastering Estimated Taxes

Estimated taxes can be a source of stress for many Americans, especially those who are self-employed or have additional sources of income. However, mastering estimated taxes can help alleviate that stress and ensure that you are on top of your financial responsibilities. Here are some tips to help you with this process:

1. Understand what estimated taxes are: Estimated taxes are quarterly tax payments that individuals must make to the IRS throughout the year. These payments are based on your expected income and tax liability for the year. If you don't pay enough estimated taxes throughout the year, you may be subject to penalties and interest on the unpaid amount.

2. Know your filing requirements: Not everyone is required to pay estimated taxes. If you are an employee and have taxes withheld from your paycheck, you may not need to make estimated tax payments. However, if you are self-employed or have income from other sources that is not subject to withholding, you may need to make estimated tax payments. You can use the IRS's Form 1040-ES to determine your estimated tax liability and payment schedule.

3. Keep accurate records: To determine your estimated tax liability, you will need to keep accurate records of your income and expenses throughout the year. This will help you estimate your tax liability and ensure that you are making the correct payments.

4. Consider using the safe harbor rule: The safe harbor rule allows taxpayers to avoid penalties for underpayment of estimated taxes if they meet certain criteria. If you pay at least 90% of your current year tax liability or 100% of your prior year tax liability (110% if your adjusted gross income was over $150,000), you may be eligible for the safe harbor rule.

5. Adjust your estimated tax payments as needed: Your estimated tax payments should be adjusted throughout the year as your income and expenses change. If you expect to earn more or less income than you originally estimated, you should adjust your estimated tax payments accordingly.

6. Use electronic payment options: The IRS offers several electronic payment options for estimated taxes, including credit card payments, direct debit payments, and online payment options. These options can be more convenient and may help you avoid errors in your payment.

Overall, mastering estimated taxes requires understanding your filing requirements, keeping accurate records, and adjusting your payments as needed. By following these tips, you can stay on top of your financial responsibilities and avoid penalties and interest on unpaid taxes.

Tips for Mastering Estimated Taxes - Estimated taxes: Mastering Estimated Taxes on Declaration Date

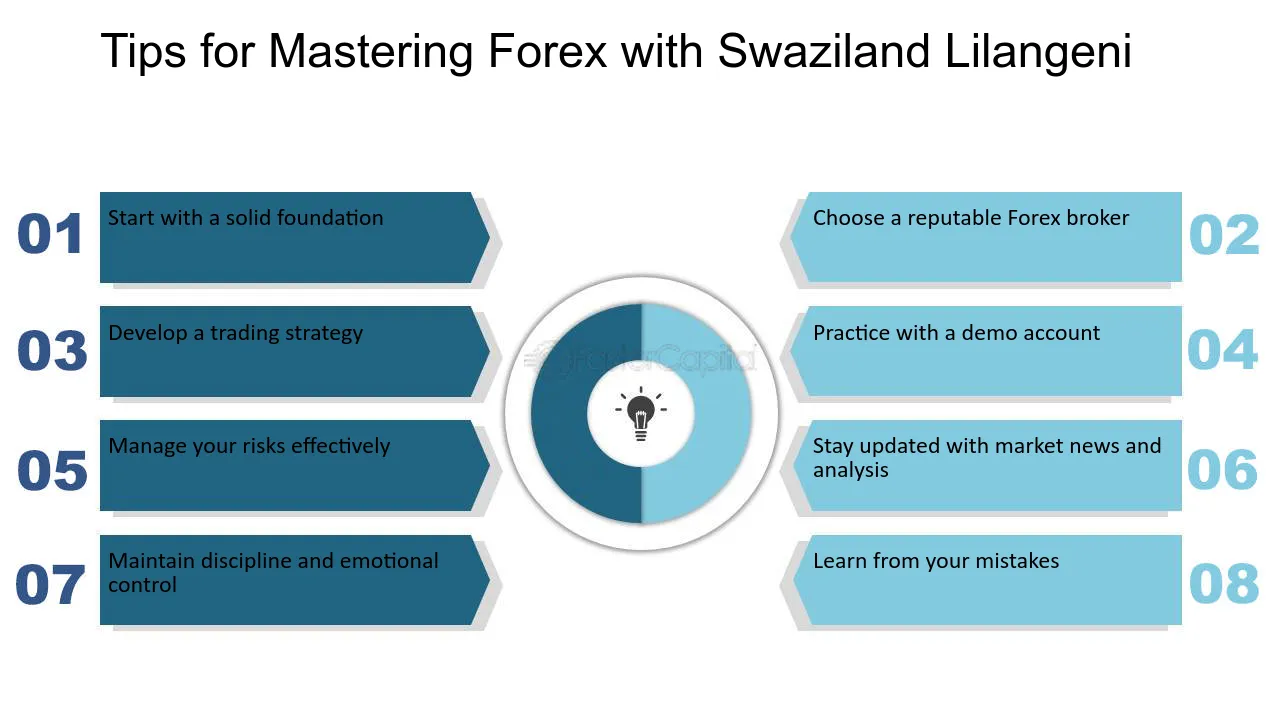

9. Tips for Mastering Forex with Swaziland Lilangeni

1. Start with a solid foundation: Before diving into Forex trading with Swaziland lilangeni, it's crucial to have a strong understanding of the basic principles of foreign exchange trading. Familiarize yourself with key concepts such as currency pairs, pips, leverage, and margin. This knowledge will serve as the building blocks for your success in the Forex market.

2. Choose a reputable Forex broker: Selecting the right broker is essential for your trading journey. Look for a broker that is regulated, offers competitive spreads, has a user-friendly trading platform, and provides reliable customer support. A trustworthy broker will ensure that your funds are secure and that you have access to the necessary tools and resources to make informed trading decisions.

3. Develop a trading strategy: A well-defined trading strategy is vital for consistent profitability in Forex trading. Determine your risk tolerance, trading style, and goals, and then create a plan that aligns with these factors. Consider utilizing technical analysis tools, such as charts and indicators, to identify potential entry and exit points. Regularly review and refine your strategy as market conditions evolve.

4. Practice with a demo account: Before risking your hard-earned money, it's advisable to practice trading with a demo account. Most reputable brokers offer demo accounts that allow you to trade with virtual funds in real market conditions. Utilize this opportunity to familiarize yourself with the trading platform, test your strategies, and gain confidence in your trading abilities without any financial risk.

5. Manage your risks effectively: Risk management is a crucial aspect of successful Forex trading. Set realistic stop-loss and take-profit levels for each trade to limit potential losses and secure profits. Additionally, avoid overtrading and ensure that your position sizes are appropriate based on your account balance and risk tolerance. implementing risk management techniques will help protect your capital and prevent significant losses.

6. Stay updated with market news and analysis: Keep yourself informed about the latest economic and political developments that impact the Forex market. Stay updated with relevant news, economic indicators, and central bank announcements. This information can provide valuable insights into potential market movements and help you make informed trading decisions.

7. Maintain discipline and emotional control: Forex trading can be emotionally challenging, especially during periods of market volatility. It's essential to remain disciplined and avoid making impulsive decisions based on fear or greed. Stick to your trading plan, manage your emotions, and don't let temporary setbacks discourage you. Successful traders understand that losses are inevitable and focus on long-term profitability.

8. Learn from your mistakes: Every trader makes mistakes, but what sets successful traders apart is their ability to learn from them. Keep a trading journal to record your trades, including the rationale behind each decision and the outcome. Regularly review your journal to identify patterns, strengths, and weaknesses in your trading strategy. By analyzing your past mistakes, you can make adjustments and continuously improve your trading skills.

Remember, mastering Forex trading with Swaziland Lilangeni takes time, patience, and dedication. By following these tips and continuously educating yourself, you can increase your chances of success in the dynamic world of Forex trading.

Tips for Mastering Forex with Swaziland Lilangeni - Foreign exchange trading: Mastering Forex with Swaziland Lilangeni

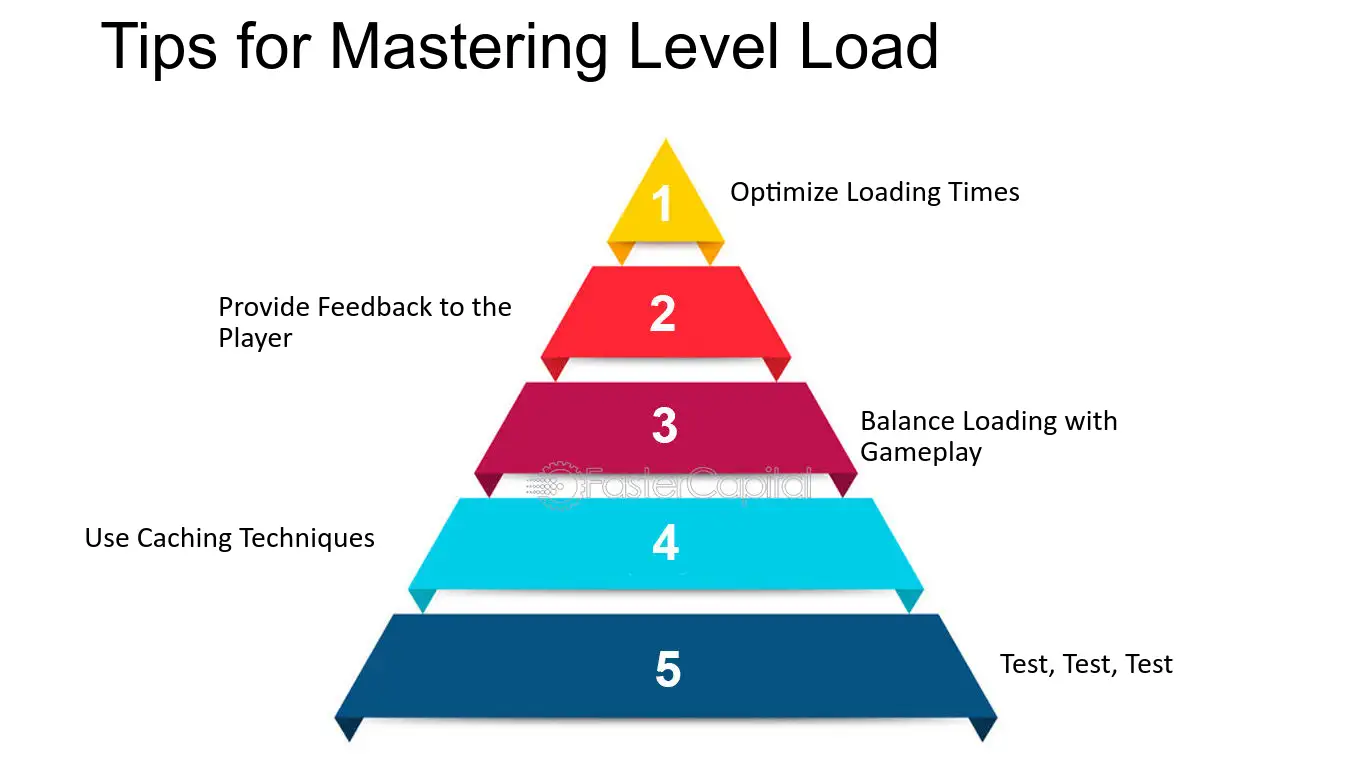

10. Tips for Mastering Level Load

Mastering level load is an essential part of any game, as it is the foundation on which the entire game is built. Level load is the process of loading the next level or area of the game once the player has completed the current level. This process can be complex and time-consuming, and it is essential that game developers find ways to make it as smooth and seamless as possible. In this section, we will explore some tips for mastering level load from different perspectives. We will look at things from the game developer's point of view, the player's point of view, and the technical point of view. By considering all of these perspectives, we can gain a better understanding of how to master level load and create a more enjoyable gaming experience for everyone involved.

1. Optimize Loading Times

One of the most important things to consider when mastering level load is loading times. Players want to get into the game as quickly as possible, so it is essential to optimize loading times as much as possible. There are several ways to do this, such as using preloading techniques to load assets in advance, reducing the number of assets that need to be loaded, and compressing assets to reduce file size. By optimizing loading times, you can ensure that players spend more time playing the game and less time waiting for it to load.

2. Provide Feedback to the Player

Another crucial aspect of mastering level load is providing feedback to the player. Players want to know what is happening, so it is essential to provide feedback on the progress of level load. This can be done in several ways, such as using loading bars, progress indicators, and animations. By providing feedback to the player, you can keep them engaged and informed while the game is loading.

3. Balance Loading with Gameplay

It is essential to balance loading with gameplay to create a seamless gaming experience. Players do not want to be taken out of the game by long loading screens or interruptions in gameplay. One way to balance loading with gameplay is to use loading screens that are part of the game's narrative. For example, if the player is entering a new area, the loading screen could be an animation of the player entering that area. By integrating loading screens with gameplay, you can create a more immersive gaming experience.

4. Use Caching Techniques

Caching techniques can also be used to master level load. Caching involves storing data in memory so that it can be quickly accessed later. By using caching techniques, you can reduce the amount of data that needs to be loaded, which can improve loading times and reduce the strain on the player's computer or console. For example, you could cache frequently used assets or data that is needed for multiple levels.

5. Test, Test, Test

Finally, it is essential to test, test, test when mastering level load. Testing is the only way to ensure that the game is loading correctly and that there are no bugs or issues that could impact the player's experience. It is important to test the game on different devices to ensure that it works correctly on all platforms and that loading times are optimized for each device. By testing the game thoroughly, you can ensure that it is stable, reliable, and enjoyable for players.

Mastering level load is essential for creating a smooth and seamless gaming experience. By optimizing loading times, providing feedback to the player, balancing loading with gameplay, using caching techniques, and testing thoroughly, game developers can create games that are enjoyable for players and technically sound.

Tips for Mastering Level Load - Game mechanics: Mastering Levelload: Exploring Game Mechanics

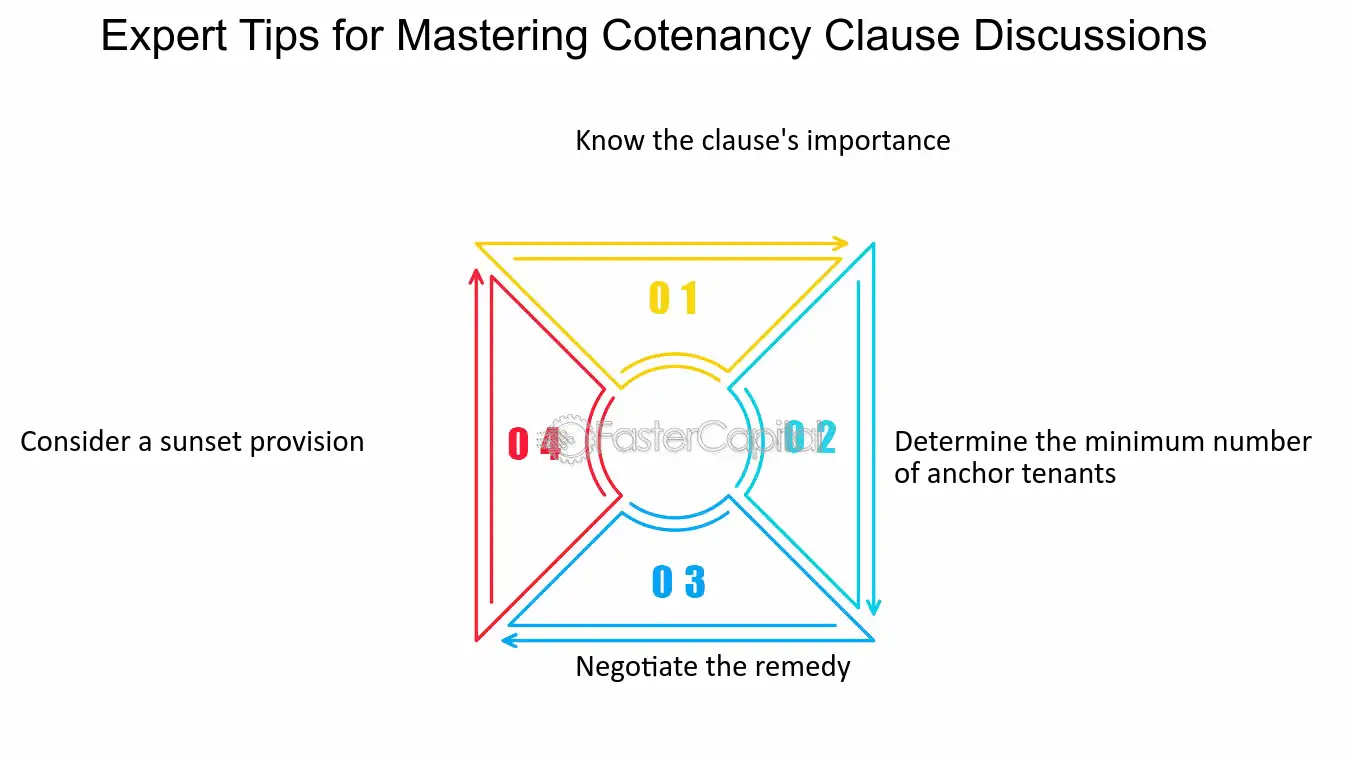

11. Expert Tips for Mastering Cotenancy Clause Discussions

When it comes to lease negotiations, the cotenancy clause is one of the most critical issues that landlords and tenants must work through. The clause can be complex, and negotiations can be difficult, but it is essential to get it right to ensure the success of the business. A cotenancy clause requires that a specific number of anchor tenants be present in a shopping center in order for other tenants to remain in the center or to have the right to terminate their lease. In this section, we will explore some expert tips for mastering cotenancy clause discussions that can be helpful for both landlords and tenants.

1. Know the clause's importance: Before beginning any negotiations, it is essential to understand the importance of the cotenancy clause. For tenants, the clause ensures that they will have a steady stream of traffic coming to the shopping center. For landlords, the clause ensures that the center will be able to attract and retain tenants who are essential to the success of the center. Knowing the importance of the clause can help both parties find common ground during negotiations.

2. Determine the minimum number of anchor tenants: The minimum number of anchor tenants required to activate the cotenancy clause is a crucial point of negotiation. The number can vary from center to center, and it is important to know what the number is for the center in question. In some cases, there may be a dispute over what constitutes an anchor tenant. For example, if a shopping center has a large grocery store and a small drugstore, some tenants may argue that the drugstore does not qualify as an anchor tenant. It is important to have a clear definition of what qualifies as an anchor tenant before negotiations begin.

3. Negotiate the remedy: If the cotenancy clause is triggered, there needs to be a remedy in place. Tenants may want the right to terminate their lease or receive a rent reduction if the clause is triggered. Landlords may want to have the right to replace the lost anchor tenant within a certain amount of time. Negotiating the remedy can be complex, and it is essential to have legal counsel on both sides to ensure that the remedy is fair and equitable.

4. Consider a sunset provision: A sunset provision is a clause that can be included in the lease that terminates the cotenancy clause after a certain amount of time. This can be beneficial for landlords who may want to attract tenants who are hesitant to sign a long-term lease with a cotenancy clause. It can also be beneficial for tenants who may be hesitant to sign a lease with a cotenancy clause that has no end date.

Mastering cotenancy clause discussions can be challenging, but it is essential for both landlords and tenants to get it right. By understanding the importance of the clause, determining the minimum number of anchor tenants, negotiating the remedy, and considering a sunset provision, both parties can come to an agreement that is fair and equitable.

Expert Tips for Mastering Cotenancy Clause Discussions - Lease Negotiations: Mastering the Art of Cotenancy Clause Discussions

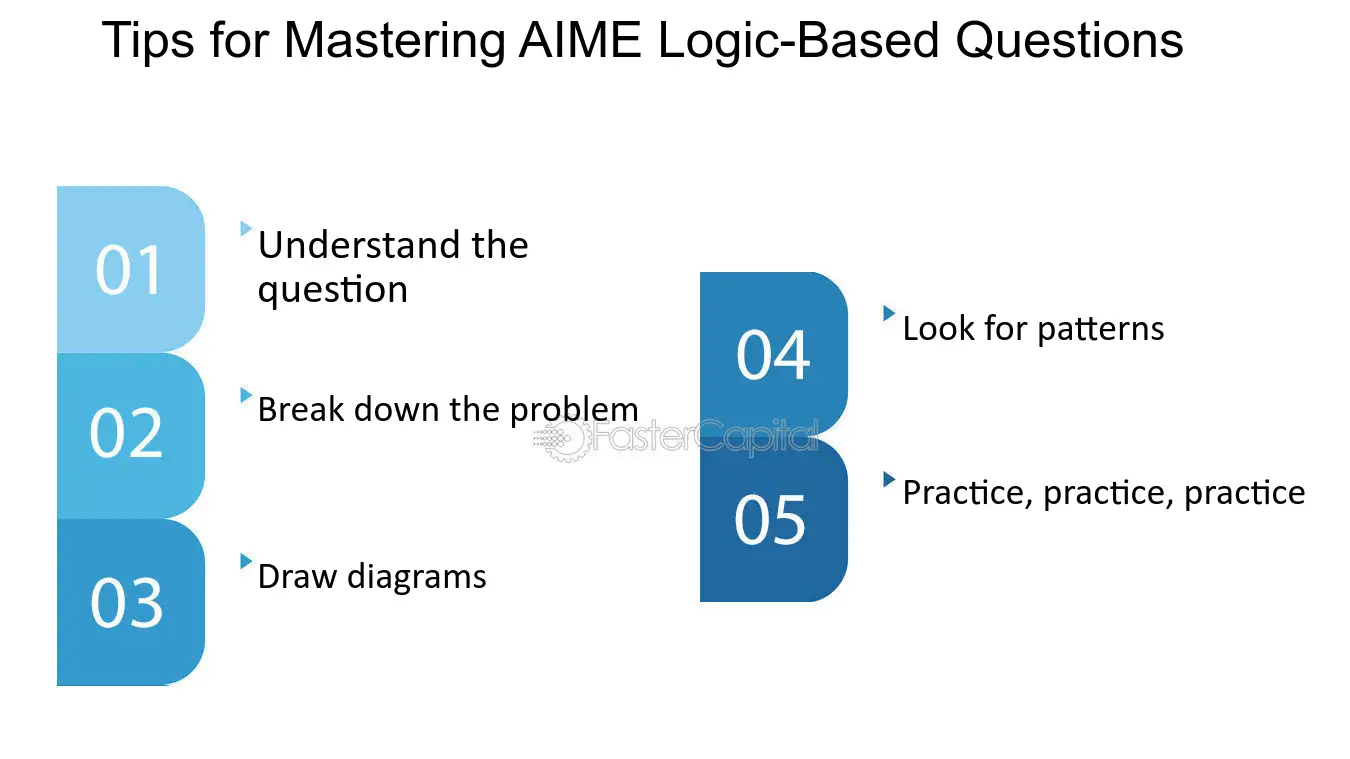

12. Tips for Mastering AIME Logic-Based Questions

When it comes to mastering AIME Logic-Based questions, there are a few tips that can help you improve your skills and approach the questions with more confidence. Logical reasoning is crucial for tackling these types of questions, as they often require out-of-the-box thinking and the ability to spot patterns and connections. In this section, we'll provide some insights and strategies from different perspectives to help you tackle these challenging questions.

1. Understand the question: Before you start solving the problem, make sure you understand what it's asking. Read the question carefully and identify the key concepts and terms. You may need to rephrase the question in your own words to ensure you fully comprehend what it's asking.

2. Break down the problem: Once you understand the question, break it down into smaller, more manageable parts. Identify any patterns, relationships, or connections between the different elements of the question. This can help you identify a strategy for solving the problem.

3. Draw diagrams: Many AIME Logic-Based questions involve geometric shapes, graphs, or other visual representations. Sketching out a diagram or visualizing the problem can help you better understand the question and identify potential solutions. For example, if the question involves angles, draw out the angles and label them to help you visualize the problem.

4. Look for patterns: Many AIME Logic-Based questions involve patterns or sequences. Look for any patterns or trends in the question, such as repeating numbers or sequences of shapes. This can help you identify a strategy for solving the problem.

5. Practice, practice, practice: The more you practice AIME Logic-Based questions, the better you'll become at solving them. Seek out practice problems online or in test prep books, and practice solving them under timed conditions. This will help you build your skills and improve your confidence when it comes time to take the test.

Mastering AIME Logic-Based questions requires a combination of logical reasoning, analytical skills, and practice. By following these tips and strategies, you can improve your skills and approach these challenging questions with more confidence.

Tips for Mastering AIME Logic Based Questions - Logical reasoning: AIME Logic: The Key to Out of the Box Thinking

13. Tips for Mastering Momentum Trading with MACD Indicator

Momentum trading is a popular trading strategy among traders who want to take advantage of the market's short-term price movements. One of the most widely used indicators for momentum trading is the Moving Average Convergence Divergence (MACD) indicator. This indicator is a trend-following momentum indicator that helps traders identify potential trend changes and trade signals. In this section, we will discuss some tips and tricks that can help traders master momentum trading with the MACD indicator.

1. Understanding the MACD Indicator:

Before mastering momentum trading with the MACD indicator, it is essential to understand how the indicator works. The MACD indicator comprises two moving averages, the MACD line, and the signal line. The MACD line is the difference between the 12-day exponential moving average (EMA) and the 26-day EMA. The signal line is the 9-day EMA of the MACD line. Traders use the crossover of the MACD line and the signal line to identify potential trend changes and trade signals.

2. Using Divergence:

Divergence is a powerful tool that traders can use to identify potential trend changes. Divergence occurs when the price of an asset moves in the opposite direction of the MACD indicator. For example, if the price of an asset is making higher highs, but the MACD indicator is making lower highs, it is a bearish divergence, indicating a potential trend change. On the other hand, if the price of an asset is making lower lows, but the MACD indicator is making higher lows, it is a bullish divergence, indicating a potential trend change.

3. Setting the Right Parameters:

The MACD indicator's default parameters are 12, 26, and 9, but traders can adjust these parameters to suit their trading style and preferences. Shorter-term traders may prefer to use shorter periods, while longer-term traders may prefer longer periods. It is essential to test different parameters using historical data to find the best settings for the MACD indicator.

4. Combining the MACD Indicator with Other Indicators:

The MACD indicator is a powerful tool on its own, but traders can enhance its effectiveness by combining it with other indicators. For example, traders can combine the MACD indicator with the Relative Strength Index (RSI) to identify overbought and oversold conditions. Traders can also use the MACD histogram to confirm trend changes identified by the MACD line and the signal line.

5. Using Stop Loss Orders:

Momentum trading is a high-risk strategy that can result in significant losses if not managed correctly. Traders must use stop-loss orders to limit their losses in case the trade goes against them. A stop-loss order is a predetermined price level at which the trader exits the trade to limit their losses. Traders can place their stop-loss orders below the support level or above the resistance level.

Mastering momentum trading with the MACD indicator requires a solid understanding of the indicator, its parameters, and how to use it in combination with other indicators. Traders must also use stop-loss orders to limit their losses and manage their risk effectively. By following these tips and tricks, traders can increase their chances of success and profitability in momentum trading.

Tips for Mastering Momentum Trading with MACD Indicator - MACD indicator: Trade Signals and MACD: Mastering Momentum Trading

14. Tips for Mastering Fibonacci Extensions

One of the key tools that traders use to predict future price movements is Fibonacci extensions. These extensions are based on the Fibonacci sequence, a mathematical pattern that appears in many natural phenomena. By applying these patterns to financial markets, traders can identify potential price targets and make more informed trading decisions. However, mastering Fibonacci extensions can be challenging, especially for those who are new to technical analysis. In this section, we will provide some tips for mastering Fibonacci extensions and using them to achieve precision price targets.

1. Understand the basics of Fibonacci extensions

Before you can start using fibonacci extensions in your trading, it's important to understand the basics of how they work. Essentially, Fibonacci extensions are a series of levels that represent potential price targets based on the Fibonacci sequence. These levels are calculated by measuring the distance between two points on a price chart and then applying Fibonacci ratios to that distance. The most commonly used ratios are 1.618, 2.618, and 4.236, although other ratios such as 0.382 and 0.618 can also be used.

2. Use Fibonacci extensions in conjunction with other technical analysis tools

While Fibonacci extensions can be a powerful tool on their own, they are even more effective when used in conjunction with other technical analysis tools. For example, you might use Fibonacci extensions alongside trend lines, support and resistance levels, or moving averages to confirm potential price targets and identify areas of high probability trades.

3. Pay attention to key levels and ratios

When using Fibonacci extensions, it's important to pay attention to key levels and ratios that are likely to have a significant impact on price movements. For example, the 1.618 ratio is often seen as a key level that can act as a major support or resistance level. Similarly, the 2.618 ratio is often used to identify potential price targets for major trend reversals.

4. Use Fibonacci extensions to identify potential entry and exit points

One of the most powerful ways to use Fibonacci extensions is to identify potential entry and exit points for trades. By identifying key levels and ratios, you can set price targets for your trades and use these targets to determine when to enter or exit a position. For example, if you are bullish on a stock and identify a key Fibonacci extension level as a potential price target, you might set a buy order at that level.

5. Experiment with different time frames and instruments

Finally, it's important to experiment with different time frames and instruments when using Fibonacci extensions. While these tools can be effective on any time frame or instrument, they may work better on some than others. By experimenting with different settings, you can find the best way to use Fibonacci extensions for your trading style and preferences.

Mastering Fibonacci extensions can take time and practice, but it can be a valuable tool for traders who want to achieve precision price targets. By understanding the basics of Fibonacci extensions, using them in conjunction with other technical analysis tools, paying attention to key levels and ratios, using them to identify potential entry and exit points, and experimenting with different time frames and instruments, you can improve your trading results and make more informed decisions.

Tips for Mastering Fibonacci Extensions - Mastering Fibonacci Extensions for Precision Price Targets

15. Tips for Mastering Forex Trading with a Forex Trading House

Forex trading can be a lucrative venture when done right. However, it can also be a daunting task for beginners. That's where forex trading houses come in. They provide a platform for traders to buy and sell currencies, offer educational resources, and provide support for traders. In this section, we will be discussing tips for mastering forex trading with a forex trading house.

1. Choose the right forex trading house

The first step to mastering forex trading with a forex trading house is choosing the right one. There are many forex trading houses out there, but not all of them are created equal. Some offer better trading conditions, while others have better educational resources. When choosing a forex trading house, consider factors such as trading costs, spreads, leverage, and regulatory compliance.

2. Understand the market

To be successful in forex trading, you need to understand the market. This includes knowing the factors that affect currency prices, such as economic data, geopolitical events, and central bank policies. stay up-to-date with the latest news and trends in the forex market to make informed trading decisions.

3. Develop a trading strategy

A trading strategy is a set of rules that guide your trading decisions. It should include entry and exit points, risk management, and profit targets. A good trading strategy should also be flexible enough to adapt to changing market conditions. Develop a trading strategy that suits your trading style and stick to it.

4. Practice with a demo account

Before trading with real money, practice with a demo account. This will give you an opportunity to test your trading strategy and get familiar with the trading platform. Most forex trading houses offer demo accounts that simulate real market conditions.

5. Manage your risk

Risk management is an essential part of forex trading. Never risk more than you can afford to lose. Use stop-loss orders to limit your losses and take-profit orders to lock in profits. Be disciplined and stick to your risk management plan.

6. Learn from your mistakes

Even the most experienced traders make mistakes. The key is to learn from them. Keep a trading journal to track your trades and analyze your performance. Identify your strengths and weaknesses and use this information to improve your trading strategy.

Mastering forex trading with a forex trading house requires choosing the right trading house, understanding the market, developing a trading strategy, practicing with a demo account, managing your risk, and learning from your mistakes. Follow these tips to increase your chances of success in forex trading.

Tips for Mastering Forex Trading with a Forex Trading House - Mastering Forex Trading: How Forex Trading Houses Lead the Way

Mastering Investment Analysis with the Help of the Rating Toolkit

Investment analysis is a critical process for anyone looking to make informed decisions in the financial market. It involves evaluating various factors and assessing the risks and potential returns associated with an investment opportunity. While this task may seem daunting, there are tools available to simplify the process and enhance accuracy. One such tool is the rating toolkit, which provides investors with invaluable insights and helps them make better-informed decisions.In this article, we will explore the rating toolkit and how it can be utilized to master investment analysis. We will discuss the importance of investment analysis, provide an overview of the rating toolkit, delve into various analysis techniques, and explore real-world examples to demonstrate the practical application of the toolkit. So let's dive in!

17. Tips for Mastering Market Orders in Secondary Stock Trading

As a trader, mastering market orders in secondary stock trading is essential for success in the stock market. It is important to understand the different types of market orders and how to use them effectively. In this section, we will provide tips for mastering market orders in secondary stock trading.

1. Understand the Different Types of Market Orders

There are various types of market orders, including market orders, limit orders, stop orders, and stop-limit orders. A market order is an order to buy or sell at the best available price. A limit order is an order to buy or sell at a specific price or better. A stop order is an order to buy or sell when the stock reaches a specific price. A stop-limit order is an order to buy or sell when the stock reaches a specific price, but only if the order can be executed at a specific price or better. Understanding the different types of market orders is crucial in knowing which one to use in specific situations.

2. Set Realistic Expectations

Market orders can execute quickly, but they may not always fill at the exact price you want. It is important to set realistic expectations and understand that the price may fluctuate. It is also essential to be patient and wait for the right opportunity to execute your trade.

3. Use Stop-Loss Orders

Stop-loss orders are a great tool to limit your losses in case the market moves against you. It is essential to set a stop-loss order at a price that you are comfortable losing. A stop-loss order can help you avoid significant losses and protect your investment.

4. Monitor Market Conditions

Monitoring market conditions is crucial in knowing when to execute a market order. It is important to keep an eye on news, earnings reports, and other market-moving events. These events can significantly impact the stock market, and it is essential to know when to execute a market order.

5. Use a Broker with a Good Execution Record

Using a broker with a good execution record can make a significant difference in executing market orders. It is essential to research brokers and choose one with a strong reputation for executing trades quickly and accurately.

Mastering market orders in secondary stock trading is essential for success in the stock market. Understanding the different types of market orders, setting realistic expectations, using stop-loss orders, monitoring market conditions, and using a broker with a good execution record are all essential tips for mastering market orders. By following these tips, traders can increase their chances of success in secondary stock trading.

Tips for Mastering Market Orders in Secondary Stock Trading - Mastering Market Orders in Secondary Stock Trading

18. Tips for Mastering Mixed Strategies

Mastering mixed strategies can be a challenging task, but it is also an essential one. When it comes to game theory, mixed strategies allow us to achieve Nash equilibrium, a state in which no player has an incentive to change their strategy, given their opponent's strategy. In this section, we'll explore some tips that can help you master mixed strategies and achieve Nash equilibrium.

1. Understand the concept of expected value: In game theory, the expected value of a strategy is the weighted average of the payoffs associated with each possible outcome. To calculate the expected value, you need to multiply each payoff by its probability and then sum the results. By understanding the concept of expected value, you can determine the best strategy to take in each situation.

For example, suppose you are playing a game of rock-paper-scissors. If you choose rock with a probability of 1/3, paper with a probability of 1/3, and scissors with a probability of 1/3, then your expected payoff will be zero. This means that your opponent cannot exploit your strategy, and you have achieved Nash equilibrium.

2. Use mixed strategies to avoid predictability: In many games, players tend to choose the same strategy repeatedly, which can make them predictable and exploitable. By using a mixed strategy, you can introduce randomness into your decision-making process and make it more difficult for your opponent to predict your moves.

For instance, let's consider a game of matching pennies. If you always choose heads, your opponent can easily exploit your strategy by always choosing tails. However, if you choose heads with a probability of 0.5 and tails with a probability of 0.5, your opponent cannot predict your move, and you have achieved Nash equilibrium.

3. Consider your opponent's possible reactions: When choosing a mixed strategy, it's essential to consider how your opponent might react to your moves. By anticipating your opponent's possible reactions, you can adjust your strategy to maximize your expected payoff.

For example, suppose you're playing a game of battle of the sexes with your partner. If you always choose the opera, your partner might choose the football game to spite you. However, if you choose the opera with a probability of 0.8 and the football game with a probability of 0.2, you're more likely to get your preferred outcome, and your partner is less likely to retaliate.

Mastering mixed strategies is essential in achieving Nash equilibrium and winning at game theory. By understanding the concept of expected value, using mixed strategies to avoid predictability, and considering your opponent's possible reactions, you can become a skilled game theorist and make optimal decisions in any situation.

Tips for Mastering Mixed Strategies - Mastering Mixed Strategies: Unveiling Nash Equilibrium

Mastering text generation techniques tips and tricks

In today's digital age, text generation techniques have become crucial in various fields, ranging from content creation to virtual assistants. The ability to generate high-quality text that is coherent, contextually relevant, and engaging has become a sought-after skillset for many professionals. In this comprehensive guide, we will delve into the world of text generation techniques, exploring the importance, tools, algorithms, and best practices for mastering this art. Whether you are a writer, a data scientist, or an AI enthusiast, this article will provide you with valuable insights and practical tips to enhance your text generation skills.Mastering the Art of Lead Nurturing in Your Sales Funnel

In today's competitive business landscape, mastering the art of lead nurturing is essential for long-term success and sustainable growth. A well-implemented lead nurturing strategy allows businesses to engage with their potential customers at various touchpoints and guide them through the sales funnel until they are ready to make a purchase. This article will cover everything you need to know about lead nurturing, from understanding its importance to implementing effective strategies for converting nurtured leads into paying customers.21. Tips for Mastering Time Series Analysis with Linearly Weighted Moving Averages

When it comes to time series analysis, there are different techniques and methods to choose from, each with its own benefits and drawbacks. One particularly useful technique is the linearly weighted moving average, which can help smooth out data fluctuations, identify trends, and make accurate predictions. However, mastering this technique is no small feat, and there are several tips and tricks that can help you get the most out of it. In this section, we'll explore some of the essential tips for mastering time series analysis with linearly weighted moving averages, from the basics to more advanced concepts.

1. Understand the basics of linearly weighted moving averages: Before diving into the details of time series analysis with linearly weighted moving averages, it's essential to understand the basics of this technique. Linearly weighted moving averages use a sliding window to calculate the average of a series of data points, with the most recent data points having a higher weight than the older ones. This weight is determined by a linear formula, hence the name. By adjusting the window size and the weight values, you can control the smoothness and sensitivity of the moving average, allowing you to filter out noise and extract meaningful trends from the data.

2. Choose the right window size: The window size is one of the most critical parameters in linearly weighted moving averages. It determines how many data points are included in the calculation of the moving average, and hence how much smoothing is applied to the data. Choosing the right window size depends on the specific characteristics of your data, such as the frequency, seasonality, and noise level. In general, a larger window size provides more smoothing but may also introduce more lag and reduce the sensitivity to short-term changes. Conversely, a smaller window size provides less smoothing but may be more responsive to short-term changes.

3. Optimize the weight values: Another crucial parameter in linearly weighted moving averages is the weight values. These values determine the contribution of each data point to the moving average, with the most recent data points having a higher weight. The weight values can be adjusted to achieve different levels of smoothing and sensitivity, depending on the characteristics of your data. For example, if your data has a strong trend, you may want to give more weight to the recent data points to capture the trend accurately. Conversely, if your data has a lot of noise, you may want to give less weight to the recent data points to reduce the impact of the noise.

4. Check for seasonality and trends: Linearly weighted moving averages can be useful for identifying and smoothing out seasonal patterns and trends in the data. By applying different window sizes and weight values, you can extract the underlying trends and seasonality from the data, allowing you to make more accurate predictions. However, it's essential to be aware of the limitations of this technique, as it may not be suitable for all types of data. For example, if your data has abrupt changes or irregular patterns, linearly weighted moving averages may not be effective in capturing these nuances.

5. Combine with other techniques: Linearly weighted moving averages can be a valuable tool in your time series analysis toolkit, but they are not the only technique available. To get the most out of your data, you may want to combine linearly weighted moving averages with other techniques, such as exponential smoothing, autoregressive integrated moving average (ARIMA), or machine learning algorithms. By using a combination of techniques, you can leverage the strengths of each approach and create more robust and accurate models.

Mastering time series analysis with linearly weighted moving averages requires a combination of theoretical knowledge, practical experience, and experimentation. By following these tips and exploring different approaches, you can gain a deeper understanding of your data and make more informed decisions based on accurate predictions and insights.

Tips for Mastering Time Series Analysis with Linearly Weighted Moving Averages - Mastering Time Series Analysis with Linearly Weighted Moving Averages

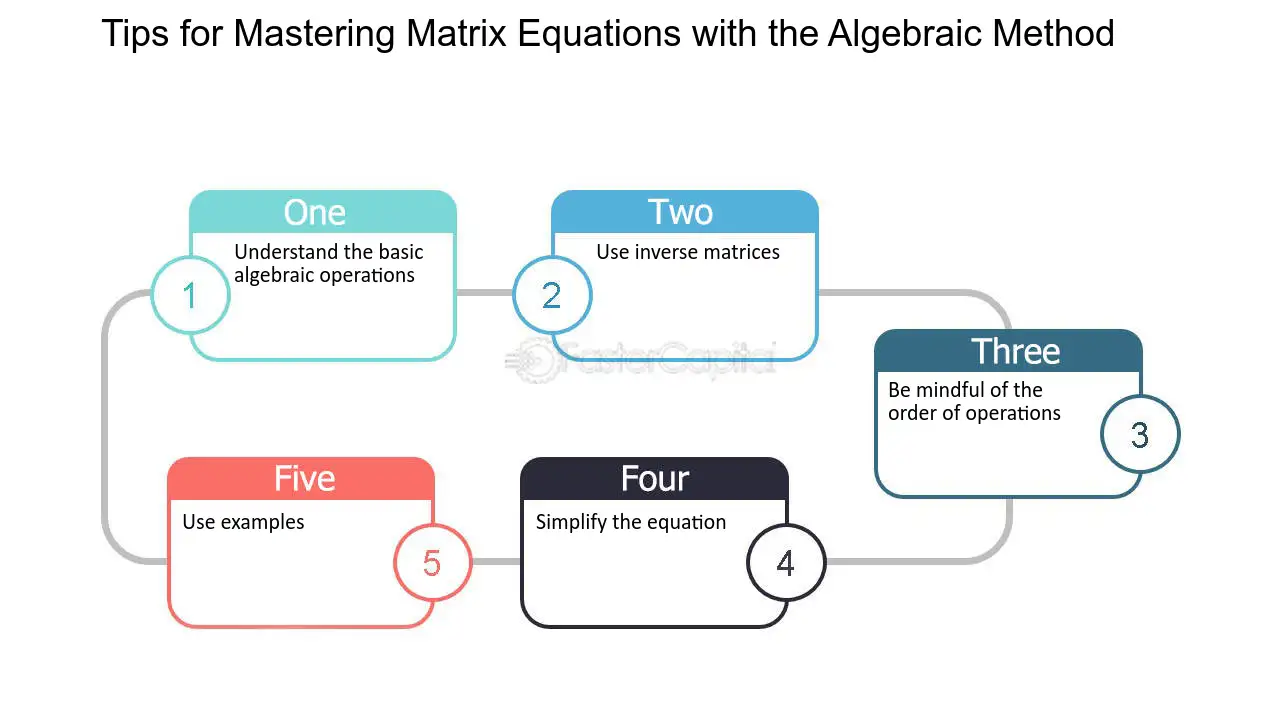

22. Tips for Mastering Matrix Equations with the Algebraic Method

When it comes to solving matrix equations, there are different methods that one can use. However, the algebraic method remains one of the most popular methods used by mathematicians. It involves using algebraic operations to isolate the variable in the equation. By mastering this method, you can easily solve complex matrix equations within a short time.

Here are some tips for mastering matrix equations with the algebraic method:

1. Understand the basic algebraic operations: Before you can use the algebraic method to solve matrix equations, you need to have a good understanding of basic algebraic operations such as multiplication, addition, and subtraction. This will help you to manipulate the equations effectively.

2. Use inverse matrices: When solving matrix equations, you can use inverse matrices to isolate the variable. To find the inverse of a matrix, you need to use the formula: A^-1 = 1/det(A) adj(A), where det(A) is the determinant of matrix A and adj(A) is the adjugate of matrix A.

3. Be mindful of the order of operations: When using the algebraic method to solve matrix equations, it is important to be mindful of the order of operations. This means that you need to perform the operations in the correct order to avoid making mistakes. For example, you need to perform multiplication before addition or subtraction.

4. Simplify the equation: To make it easier to isolate the variable, you should simplify the equation as much as possible. This involves combining like terms and reducing fractions where possible.

5. Use examples: To improve your understanding of the algebraic method, you should practice with different examples. This will help you to identify patterns and develop problem-solving skills.

By following these tips, you can improve your ability to solve matrix equations using the algebraic method. Remember that practice is key to mastering this method. The more you practice, the more confident you will become.

Tips for Mastering Matrix Equations with the Algebraic Method - Matrices: Solving Matrix Equations with the Algebraic Method

23. Tips for Mastering Mental Shortcuts

Mental shortcuts are a great way to save time and effort when making decisions or judgments. They are cognitive strategies that help us make quick decisions based on limited information. However, these shortcuts can also lead to bias and errors in judgment. In order to master mental shortcuts, it is important to understand how they work and how to use them effectively. Here are some tips for mastering mental shortcuts:

1. Understand your biases

One of the biggest pitfalls of mental shortcuts is that they can lead to biases. Our brains are wired to take shortcuts based on our past experiences and beliefs, which can lead to inaccurate judgments. It is important to recognize your own biases and work to overcome them. This can be done by exposing yourself to different perspectives and challenging your own assumptions.

2. Use multiple mental shortcuts

There are many different types of mental shortcuts, each with their own strengths and weaknesses. By using multiple mental shortcuts, you can get a more well-rounded view of a situation. For example, if you are trying to evaluate a job candidate, you might use both the halo effect (where you judge someone based on one positive trait) and the horns effect (where you judge someone based on one negative trait) to get a more balanced view.

3. Don't rely solely on mental shortcuts

While mental shortcuts can be a useful tool, it is important not to rely on them exclusively. They should be used in conjunction with other information and data to make a more informed decision. For example, if you are trying to decide whether to invest in a company, you might use the mental shortcut of the availability heuristic (where you judge the likelihood of something based on how easily it comes to mind) but also look at financial data and market trends.

4. Be aware of context

Mental shortcuts can be influenced by the context in which they are used. It is important to be aware of the context and adjust your mental shortcuts accordingly. For example, if you are trying to judge the trustworthiness of a person, you might use the mental shortcut of the similarity bias (where you trust people who are similar to you) but be aware that this may not be as relevant if you are in a different cultural context.

5. Practice, practice, practice

Like any skill, mastering mental shortcuts takes practice. The more you use them, the better you will become at recognizing when and how to use them. However, it is also important to be aware of when mental shortcuts are not appropriate and to be able to switch to a more analytical approach when necessary.

Mental shortcuts can be a powerful tool for making quick decisions and judgments. However, they can also lead to bias and errors if not used correctly. By understanding your biases, using multiple mental shortcuts, not relying solely on them, being aware of context, and practicing, you can master mental shortcuts and make more informed decisions.

Tips for Mastering Mental Shortcuts - Mental Shortcut: Mastering Mental Shortcuts: Rule of Thumb Techniques

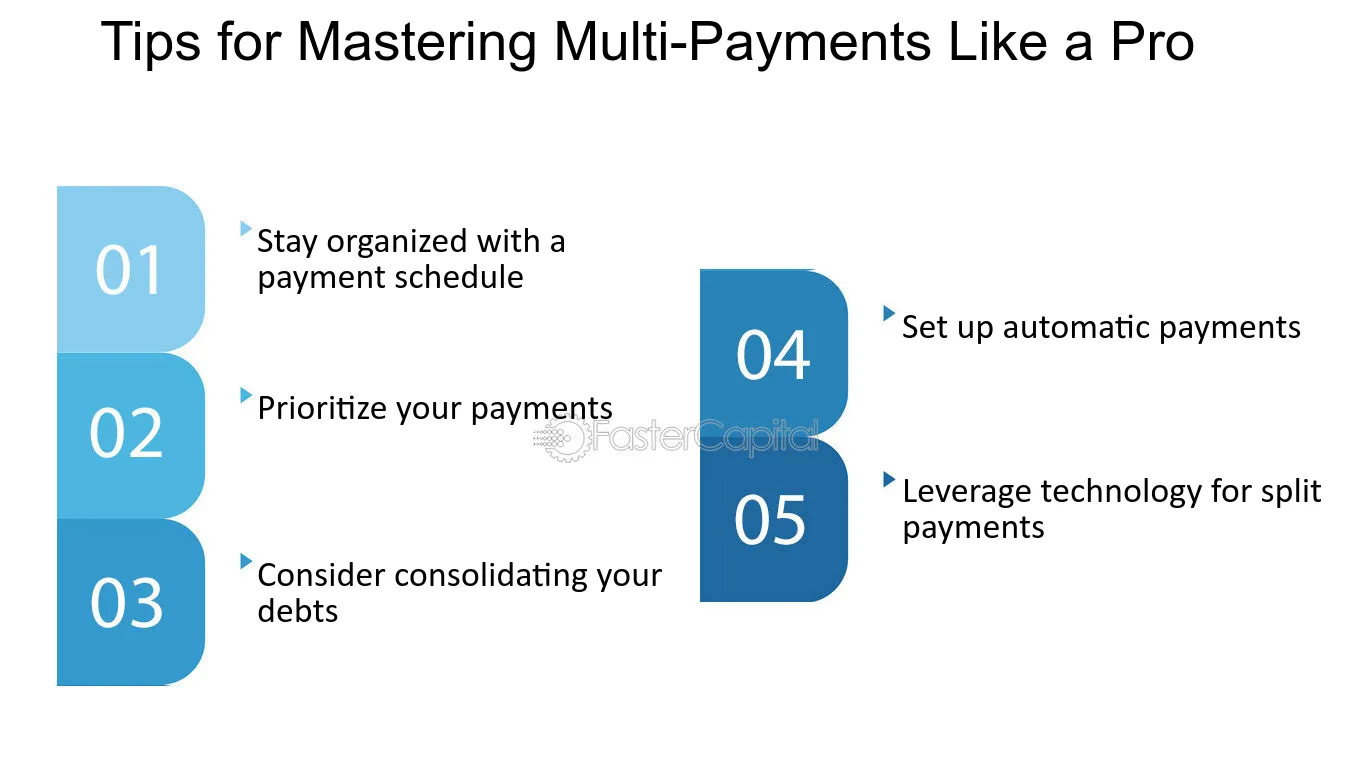

24. Tips for Mastering Multi-Payments Like a Pro

1. Stay organized with a payment schedule

One of the key challenges when it comes to managing multi-payments is staying organized. It can be overwhelming and confusing to keep track of multiple due dates, amounts, and payment methods. To tackle this, create a payment schedule that outlines all your payment obligations, including the due dates and the amounts. This will help you stay on top of your payments and avoid missing any deadlines. Additionally, consider using payment management tools or apps that can automate the process and send you reminders when payments are due.

2. Prioritize your payments

When dealing with multiple payments, it's crucial to prioritize them based on their importance and urgency. Start by identifying your essential payments, such as rent or mortgage, utilities, and loan repayments. These should be your top priority, as missing them can have severe consequences. Next, focus on payments that may incur late fees or penalties if not paid on time. By prioritizing your payments, you can ensure that you allocate your resources effectively and avoid unnecessary financial setbacks.

3. Consider consolidating your debts

If you find yourself struggling to keep up with multiple payments and their associated interest rates, it may be worth considering debt consolidation. This involves combining multiple debts into a single loan with a lower interest rate or more manageable monthly payments. By consolidating your debts, you simplify your payment process and potentially save money on interest payments. However, it's crucial to carefully evaluate the terms and conditions of any consolidation options to ensure they align with your financial goals.

4. Set up automatic payments

Automating your payments can be a game-changer when it comes to mastering multi-payments. By setting up automatic payments, you can avoid the hassle of manually initiating each payment and reduce the risk of forgetting or missing any deadlines. Many banks and credit card companies offer this feature, allowing you to schedule recurring payments for bills, loans, and other regular expenses. Just ensure that you have sufficient funds in your account to cover these payments and review your bank statements regularly to spot any discrepancies.

5. Leverage technology for split payments

In some cases, you may need to split payments among different parties or contribute to a shared expense with others, such as when organizing a group trip or splitting the bill at a restaurant. Fortunately, various mobile payment apps and platforms make this process seamless. Apps like Splitwise, Venmo, or PayPal allow you to split bills, request payments, and keep track of who owes what. By leveraging these technologies, you can simplify the process of splitting payments and avoid awkward conversations about money with friends or family.

Case study:

Meet Sarah, a young professional juggling multiple financial responsibilities. Sarah found herself overwhelmed with various monthly payments, including rent, student loans, credit card bills, and utility bills. She decided to implement the tips mentioned above to master multi-payments like a pro.

First, Sarah created a payment schedule using a spreadsheet, noting down each payment's due date, amount, and payment method. She also set up automatic payments for her rent, utilities, and student loans to ensure they were paid on time without fail. By automating these payments, she could focus her attention on managing the remaining bills.

Next, Sarah prioritized her payments based on urgency and importance. She made sure to pay her rent and student loans first, followed by credit card bills and utilities. By allocating her resources effectively, she avoided late fees and penalties.

To simplify her payment process further, Sarah decided to consolidate her credit card debts into a single loan with a lower interest rate. This allowed her to make a single monthly payment, saving her both time and money.

Finally, when it came to splitting bills with friends or sharing expenses, Sarah used mobile payment apps like Venmo. These apps made it easy for her to split costs, request payments, and keep track of who owed her money.

By implementing these tips, Sarah successfully mastered multi-payments, reducing stress and ensuring her financial obligations were met efficiently.

Tips for Mastering Multi Payments Like a Pro - Multi Payments: Multi Payments Made Simple: Mastering the Art of Splitting

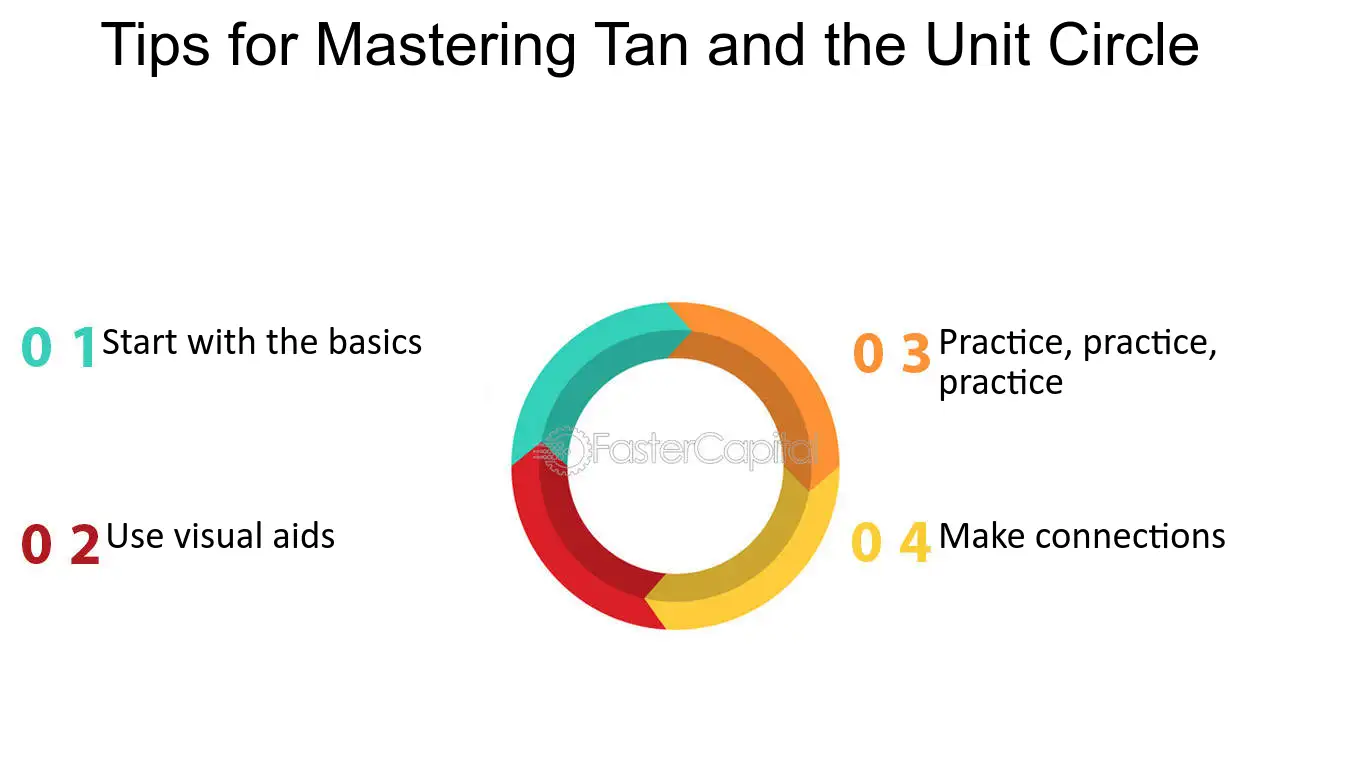

25. Tips for Mastering Tan and the Unit Circle

When it comes to mastering the concept of tan and the unit circle, there are a few tips that can help you navigate this complex topic with greater ease. From understanding the basic principles of the unit circle to memorizing the key angles, there are a number of different strategies you can use to improve your understanding of tan and its role in trigonometry. Whether you are a visual learner who benefits from diagrams and graphs, or a more analytical thinker who prefers to break down complex concepts into discrete parts, there are a variety of ways to approach this topic. Here are some tips to help you get started:

1. Start with the basics: Before diving into the more complex aspects of tan and the unit circle, make sure you have a solid understanding of the basic principles. This includes understanding the unit circle itself, as well as the key angles and their corresponding coordinates. Spend time reviewing these concepts until you feel confident in your understanding.

2. Use visual aids: For many learners, visual aids such as diagrams, graphs, and images can be incredibly helpful in understanding abstract concepts like the unit circle. Look for resources that provide clear visual representations of the unit circle, as well as diagrams that illustrate the relationship between angles, coordinates, and trigonometric functions like tan.

3. Practice, practice, practice: Like any skill, mastering the unit circle and tan requires practice. Spend time working through practice problems and exercises, and try to apply your knowledge in real-world scenarios. For example, if you are studying physics, think about how you can use the unit circle to solve problems related to motion, velocity, and acceleration.

4. Make connections: To truly master the unit circle and tan, it's important to understand how these concepts fit into the larger world of trigonometry and mathematics. Look for connections between different concepts and ideas, and try to build a comprehensive understanding of how everything fits together. For example, you might explore the relationship between tan and other trigonometric functions like sine and cosine, or look for connections between the unit circle and other geometric shapes like circles and triangles.

By following these tips, you can improve your understanding of tan and the unit circle, and navigate this complex topic with greater ease. Remember to take your time, ask questions, and seek out resources and support when you need it. With persistence and practice, you can master this fundamental aspect of mathematics and unlock new insights into the world around you.

Tips for Mastering Tan and the Unit Circle - Navigating the Unit Circle: Unveiling the Secrets of Tan

26. Tips for Mastering the Art of Countermove in Negotiation

Negotiation is a critical part of any business deal, and mastering the art of countermove is essential for success. A countermove is a strategic response to a proposal or offer made by the other party during a negotiation. It is a way to protect your interests and achieve your goals while maintaining a positive relationship with the other party. In this section, we will discuss some tips for mastering the art of countermove in negotiation.

1. Understand the Other Party's Motivations

The first step in mastering the art of countermove is to understand the other party's motivations. What are their goals? What are their interests? What are their priorities? By understanding these things, you can create countermoves that address their concerns while still protecting your interests. For example, if the other party is motivated by cost savings, you could offer a countermove that reduces costs while still achieving your goals.

2. Prepare Multiple Countermove Options

It is essential to have multiple countermove options prepared before entering into a negotiation. This allows you to be flexible and adapt to the other party's proposals as they arise. By having multiple options, you can choose the countermove that best addresses the other party's concerns while still achieving your goals. For example, if the other party proposes a price increase, you could counter with a lower price, a longer-term contract, or additional services.

3. Use the "If-Then" Strategy

The "if-then" strategy is a powerful

Tips for Mastering the Art of Countermove in Negotiation - Negotiation Dynamics: The Power of Countermove in Deal Making

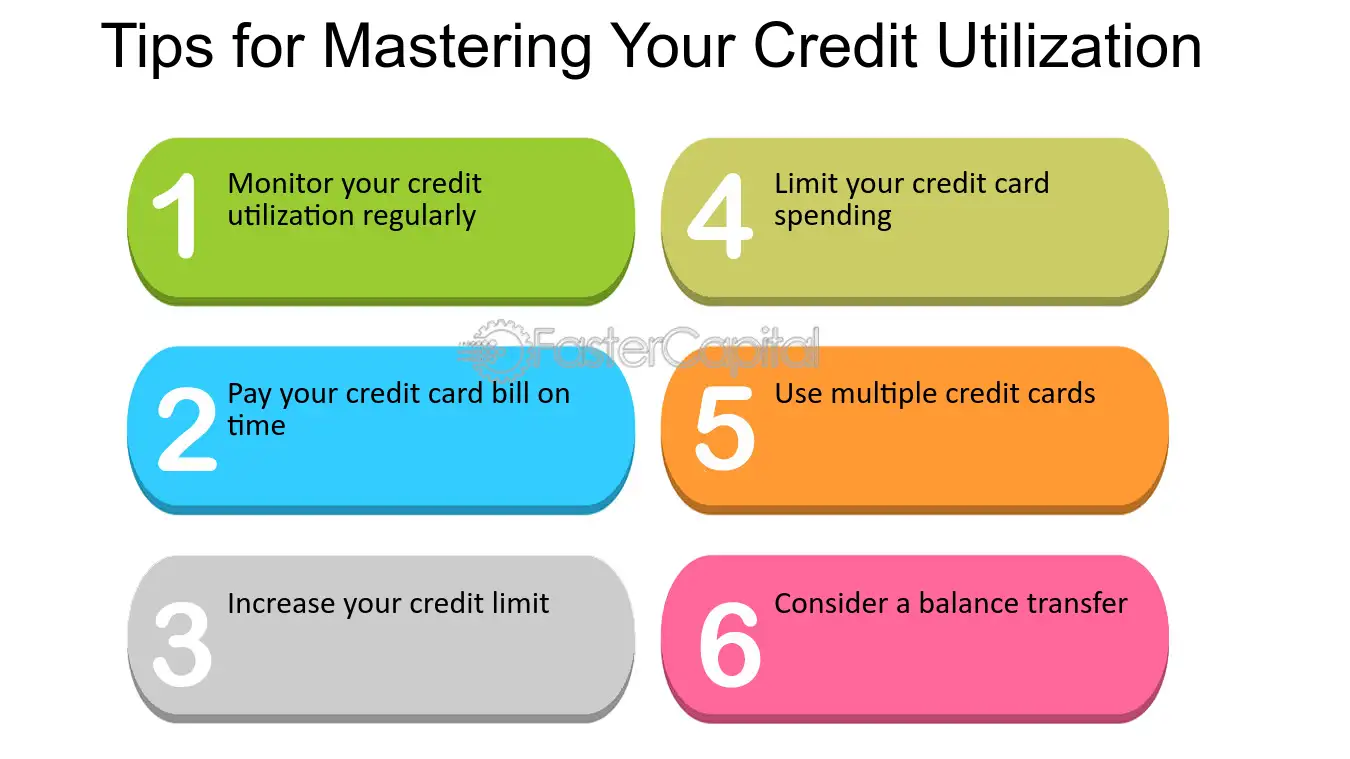

27. Tips for Mastering Your Credit Utilization

Credit utilization refers to the amount of credit you use compared to your credit limit. It’s a significant factor that affects your credit score because it indicates how well you manage your credit. Ideally, you should aim to keep your credit utilization ratio below 30%. When you exceed this threshold, it can hurt your credit score and make it harder for you to access credit in the future. On the other hand, a low credit utilization ratio shows that you use credit responsibly and can help boost your credit score. In this section, we will share some tips on how to master your credit utilization to optimize your Fako score.

1. Monitor your credit utilization regularly: One of the best ways to master your credit utilization is to monitor it regularly. You can keep track of your credit utilization by checking your credit card statements each month. Make sure that your credit utilization ratio is below 30% and take steps to reduce it if it is higher than this threshold.

2. Pay your credit card bill on time: Late payments can not only lead to late fees and interest charges but can also increase your credit utilization ratio. This is because your credit card balance will be higher if you carry over a balance from month to month. Set up automatic payments or reminders to ensure you pay your credit card bill on time each month.

3. Increase your credit limit: Another way to reduce your credit utilization ratio is to increase your credit limit. For example, if you have a credit card with a $10,000 credit limit and a $5,000 balance, your credit utilization ratio is 50%. However, if you increase your credit limit to $15,000, your credit utilization ratio drops to 33%.

4. limit your credit card spending: Be mindful of your credit card spending and try to limit it to essential purchases only. This can help you keep your credit utilization ratio low and avoid carrying over a balance from month to month.

5. Use multiple credit cards: Using multiple credit cards can help you spread out your credit utilization across different accounts and keep your credit utilization ratio low. However, be careful not to apply for too many credit cards at once, as this can hurt your credit score.

6. Consider a balance transfer: If you have high balances on your credit cards, you may want to consider a balance transfer. This involves moving your high-interest credit card balances to a credit card with a lower interest rate. By doing this, you can reduce your interest charges and pay off your debt faster.

Mastering your credit utilization is an essential step in optimizing your Fako score. By monitoring your credit utilization regularly, paying your credit card bill on time, increasing your credit limit, limiting your credit card spending, using multiple credit cards, and considering a balance transfer, you can keep your credit utilization ratio low and improve your credit score over time.

Tips for Mastering Your Credit Utilization - Optimizing Your Fako Score: Mastering Credit Utilization

28. Tips for Mastering Option Expiration in Covered Call Trading