1. Types of Treasury Securities

When it comes to Treasury securities, there are different types of securities that the U.S. Department of the Treasury issues. Each type of security varies in terms of its maturity, interest rate, and the way it is sold. Understanding the different types of Treasury securities can be helpful for investors who are looking to invest in fixed-income securities. In this section, we will provide an overview of the different types of Treasury securities available in the market.

1. Treasury bills (T-bills): These are short-term securities that have a maturity of one year or less. They are typically issued with maturities of 4, 8, 13, 26, and 52 weeks. T-bills are sold at a discount to their face value and do not pay periodic interest. Instead, the investor earns the difference between the purchase price and the face value when the security matures. For example, an investor who purchases a $10,000 T-bill for $9,900 will receive $10,000 at maturity, earning a profit of $100.

2. Treasury notes (T-notes): These are intermediate-term securities that have a maturity of 2 to 10 years. They pay a fixed rate of interest every six months until maturity. T-notes are sold at face value and can be purchased in denominations of $100, $1,000, $5,000, and $10,000.

3. Treasury bonds (T-bonds): These are long-term securities that have a maturity of more than 10 years. They also pay a fixed rate of interest every six months. T-bonds are sold at face value and can be purchased in denominations of $100, $1,000, $5,000, and $10,000.

4. Treasury Inflation-Protected Securities (TIPS): These are securities that are designed to protect investors from inflation. TIPS pay a fixed rate of interest, but the principal value of the security is adjusted for inflation. TIPS are sold at face value and have maturities of 5, 10, and 30 years.

5. floating Rate notes (FRNs): These are notes with variable interest rates that are reset periodically. The interest rate is based on a reference rate plus a spread. FRNs are sold at face value and have maturities of 2 years or less.

In general, Treasury securities are considered to be safe investments because they are backed by the full faith and credit of the U.S. Government. They are also highly liquid, which means that they can be bought and sold easily in the secondary market. However, investors should still consider their investment objectives, risk tolerance, and time horizon before investing in Treasury securities.

Types of Treasury Securities - A Closer Look at Treasury Securities and FICC Opportunities

2. Types of Treasury Receipt Investments to Consider

When it comes to achieving financial security, one investment option that individuals often consider is Treasury Receipt Investments. These investments are backed by the U.S. Department of the Treasury and are considered to be low-risk, making them an attractive choice for those looking for stability in their portfolio. However, not all Treasury Receipt Investments are created equal, and it's important to understand the different types available before making any decisions.

1. Treasury Bills (T-Bills): T-Bills are short-term debt obligations issued by the U.S. Government with maturities ranging from a few days to one year. They are typically sold at a discount to their face value and do not pay periodic interest. Instead, investors earn a return by purchasing the bills at a discount and receiving the full face value upon maturity. For example, if you purchase a $1,000 T-Bill with a discount rate of 2%, you would pay $980 upfront and receive $1,000 when it matures.

2. Treasury Notes (T-Notes): T-Notes have longer maturities than T-Bills, typically ranging from two to ten years. They pay semi-annual interest payments to investors based on a fixed coupon rate determined at auction. At maturity, investors receive the full face value of the note. For instance, if you buy a $10,000 T-Note with a 3% coupon rate and a five-year maturity, you would receive $300 in interest payments each year for five years and then get back your initial investment of $10,000.

3. Treasury Bonds (T-Bonds): T-Bonds have the longest maturities among Treasury Receipt Investments, usually ranging from ten to thirty years. Like T-Notes, they pay semi-annual interest payments based on a fixed coupon rate determined at auction. At maturity, investors receive the full face value of the bond. For example, if you invest in a $50,000 T-Bond with a 4% coupon rate and a twenty-year maturity, you would receive $2,000 in interest payments each year for twenty years and then get back your initial investment of $50,000.

4. Treasury Inflation-Protected Securities (TIPS): TIPS are designed to protect investors against inflation. They have maturities ranging from five to thirty years and pay interest semi-annually based on a fixed coupon rate. What sets TIPS apart is that their principal value adjusts with changes in the consumer Price index (C

Types of Treasury Receipt Investments to Consider - Achieving Financial Security with Treasury Receipt Investments

3. Types of Treasury Bonds and Their Characteristics

When it comes to investing in Treasury bonds, there are several types of bonds to choose from. Each type of bond has its own unique characteristics, making it important for investors to understand the differences between them. In this section, we will discuss the various types of Treasury bonds and their characteristics.

1. Treasury Bills (T-Bills)

Treasury bills are short-term securities that have a maturity of one year or less. They are issued at a discount to their face value and do not pay interest. Instead, investors earn a return by purchasing the bill at a discount and receiving the face value at maturity. T-bills are considered the safest and most liquid of all Treasury securities.

2. Treasury Notes (T-Notes)

Treasury notes are medium-term securities that have a maturity of 2-10 years. They pay interest every six months and are issued in denominations of $1,000. T-notes are less liquid than T-bills but offer higher yields.

3. Treasury Bonds (T-Bonds)

Treasury bonds are long-term securities that have a maturity of 10-30 years. They pay interest every six months and are issued in denominations of $1,000. T-bonds are the least liquid of all Treasury securities but offer the highest yields.

4. Treasury Inflation-Protected Securities (TIPS)

TIPS are securities that are designed to protect investors from inflation. They are issued with a fixed interest rate, but the principal value is adjusted for inflation based on the consumer Price index (CPI). TIPS pay interest every six months and are available in maturities of 5, 10, and 30 years.

5. floating Rate notes (FRNs)

FRNs are securities that have a variable interest rate that is adjusted every quarter. The interest rate is based on a benchmark rate plus a spread. FRNs are available in maturities of 2 and 5 years.

When deciding which type of Treasury bond to invest in, it is important to consider several factors, including the investor's risk tolerance, investment goals, and time horizon. For investors who are looking for a safe and liquid investment, T-bills may be the best option. For those who are willing to take on more risk for higher yields, T-bonds may be the best choice. TIPS are a good option for investors who are concerned about inflation, while FRNs are a good choice for investors who want a variable interest rate.

Understanding the characteristics of each type of Treasury bond is crucial for making informed investment decisions. By considering factors such as risk tolerance, investment goals, and time horizon, investors can choose the type of Treasury bond that best fits their needs.

Types of Treasury Bonds and Their Characteristics - Analyzing the Par Yield Curve: A Guide to Treasury Bond Investing

4. Types of Treasury Bill Auctions

When participating in Treasury Bill auctions, it is important to understand the different types of auctions that are available. Depending on the type of auction, the bidding process and the rate at which the bills are sold can vary. There are several types of Treasury Bill auctions, including competitive auctions, non-competitive auctions, and auctions for Treasury Inflation-Protected Securities (TIPS). In this section, we will explore these different types of auctions and provide more information about each.

1. Competitive Auctions: In a competitive auction, investors place bids specifying the discount rate they are willing to accept. The highest bids are filled first until the amount of the auction is reached. Investors who bid above the highest accepted discount rate will not receive any bills. The discount rate is determined by the lowest accepted bid, which becomes the clearing price for the auction. Investors who bid at or below this rate will receive bills at the clearing price. For example, if the auction amount is $100 million and the lowest accepted bid is 2.5%, all investors who bid at or below 2.5% will receive bills.

2. Non-competitive Auctions: In a non-competitive auction, investors agree to accept the average rate of the competitive bids. This means that all non-competitive bidders receive the same rate and the same bills. Non-competitive bidders do not specify a discount rate and are guaranteed to receive bills up to a certain amount. For example, if the auction amount is $100 million and the non-competitive allotment is $5 million, all non-competitive bidders will receive bills at the average rate of the competitive bids for up to $5 million.

3. TIPS Auctions: Treasury Inflation-Protected Securities (TIPS) are a type of Treasury Bill that is indexed to inflation. In a TIPS auction, investors bid on the real yield they are willing to accept, which is the yield above inflation. The highest bids are filled first until the amount of the auction is reached. The real yield is determined by the lowest accepted bid, which becomes the clearing price for the auction. Investors who bid at or below this rate will receive TIPS at the clearing price.

Understanding the different types of Treasury Bill auctions is important for investors looking to participate in the auction process. Whether participating in a competitive or non-competitive auction, investors should carefully consider the discount rate they are willing to accept and the amount of bills they wish to purchase.

Types of Treasury Bill Auctions - Auction: Navigating the Treasury Bill Auction Process

5. Types of Treasury Bond Auctions

When it comes to Treasury bond auctions, there are a few different types that investors should be aware of. Each type has its own unique characteristics and can provide different benefits to buyers. Understanding the different types of auctions can help investors make more informed decisions about which bonds to buy and when to buy them.

1. Competitive Auctions: These are the most common type of Treasury bond auction. In a competitive auction, investors can submit bids for the bonds they want to buy and the price they are willing to pay. The auction is then awarded to the highest bidders until the entire issue is sold. The winning bidders pay the price they bid, which can be higher or lower than the face value of the bond. This type of auction allows investors to potentially get a better price for the bonds they want, but there is also the risk of overbidding and paying too much.

2. Non-Competitive Auctions: In a non-competitive auction, investors are guaranteed to receive the bonds they want at the average price of all winning bids. There is no need to submit a specific bid price, as all non-competitive bidders receive the same price. This type of auction is ideal for investors who want to buy Treasury bonds but do not have the time or resources to research market prices.

3. Dutch Auctions: Dutch auctions are less common but can be useful in certain situations. In a Dutch auction, the price of the bonds is set high, and then gradually lowered until all the bonds are sold. Investors can submit their bids at any point during the auction, and the bonds are awarded to the highest bidders. This type of auction can be useful for investors who want to buy Treasury bonds but are unsure of the market price.

4. When-Issued Trading: This is not strictly an auction, but it is an important aspect of treasury bond trading. When-issued trading allows investors to buy Treasury bonds before they are officially issued. This can be useful for investors who want to lock in a price before the bond is released, or who want to trade the bond before it is officially available.

Understanding the different types of Treasury bond auctions is an important part of investing in bonds. Each type has its own unique characteristics and can provide different benefits to buyers. By knowing the advantages and disadvantages of each type, investors can make more informed decisions about which bonds to buy and when to buy them.

Types of Treasury Bond Auctions - Auctions: Unveiling the Secrets of Treasury Bond Auctions

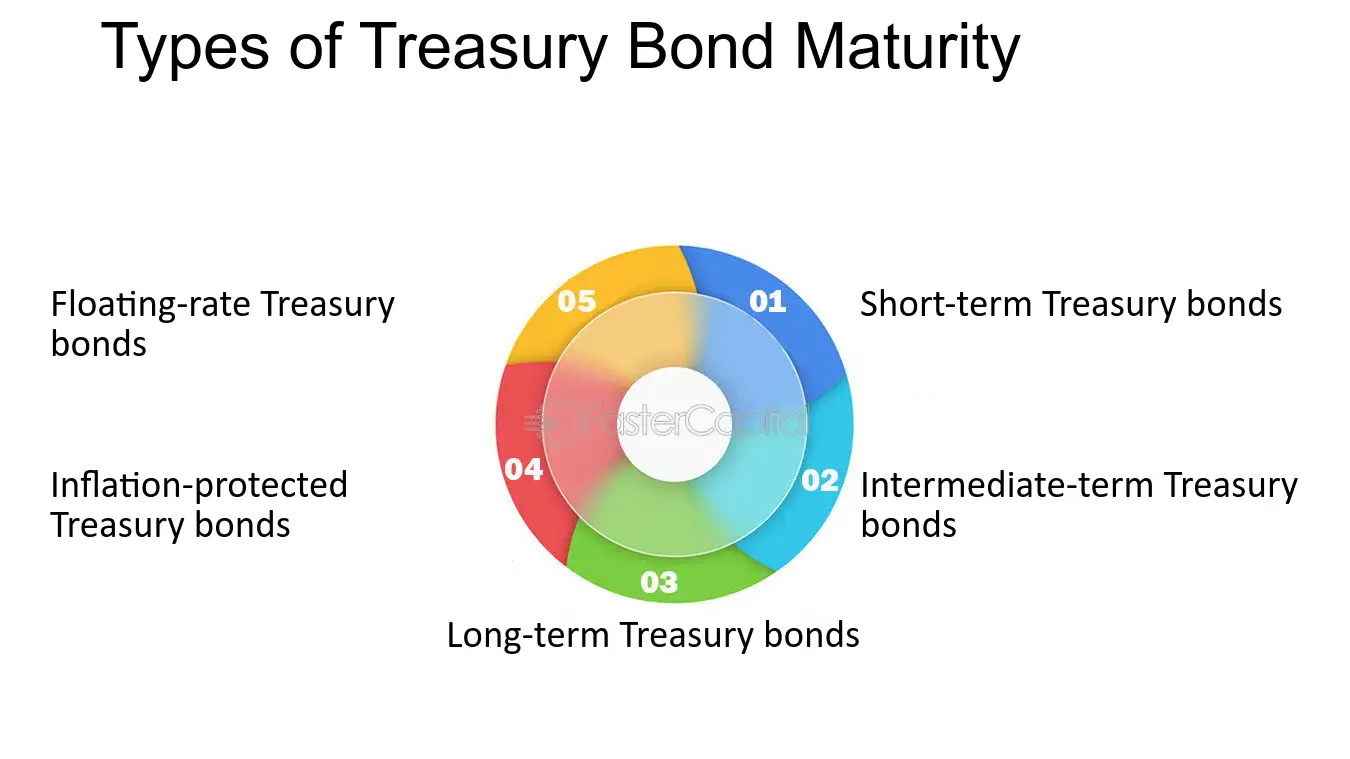

6. Types of Treasury Bond Maturity

Investors who are looking to invest in bonds will inevitably encounter the concept of bond maturity. treasury bond maturity in particular is a crucial factor to consider when choosing which bonds to invest in. The maturity date of a bond refers to the date on which the bond issuer (in this case, the US government) will repay the bondholder the principal amount that was borrowed. The length of time between the issuance of the bond and its maturity date is called the bond's term. Treasury bonds come in a variety of maturities, ranging from short-term to long-term. Understanding the different types of Treasury bond maturity can help investors make an informed decision based on their investment goals, risk tolerance, and time horizon.

Here are some types of Treasury bond maturity:

1. Short-term Treasury bonds: These bonds have a maturity of one year or less. They are often referred to as Treasury bills (T-bills) and are considered to be the safest of all Treasury bonds. They have a lower yield compared to other Treasury bonds, but they are a good option for investors who want to park their money for a short period of time.

2. Intermediate-term Treasury bonds: These bonds have a maturity of one to ten years. They are also known as Treasury notes (T-notes). They offer a higher yield than T-bills but are not as risky as long-term bonds. They are suitable for investors who have a medium-term investment horizon.

3. Long-term Treasury bonds: These bonds have a maturity of more than ten years. They are also known as Treasury bonds (T-bonds). They offer the highest yield among all Treasury bonds but are the riskiest. They are suitable for investors who have a long-term investment horizon and are willing to take on more risk.

4. Inflation-protected Treasury bonds: These bonds, also known as Treasury Inflation-Protected Securities (TIPS), are designed to protect investors from inflation. They offer a fixed interest rate, but the principal amount is adjusted based on changes in the consumer Price index (CPI). They are suitable for investors who are concerned about inflation eroding the purchasing power of their investments.

5. Floating-rate Treasury bonds: These bonds have an interest rate that is tied to a benchmark rate, such as the London interbank Offered rate (LIBOR). The interest rate is adjusted periodically, which means that the yield on these bonds can fluctuate. They are suitable for investors who want to earn a variable interest rate and are comfortable with the associated risks.

Treasury bond maturity is an important factor to consider when investing in bonds. Understanding the different types of Treasury bond maturity can help investors choose the right bonds based on their investment goals, risk tolerance, and time horizon. By diversifying across different maturities, investors can create a balanced bond portfolio that suits their needs.

Types of Treasury Bond Maturity - Bond Maturity: Navigating Treasury Bond Maturity Choices for Investors

7. Exploring the Various Types of Treasury Receipts

When it comes to contributing to economic stability, one often overlooked tool is the issuance of treasury receipts. These financial instruments play a crucial role in government financing and are essential for maintaining a stable economy. In this section, we will delve into the different types of treasury receipts, examining their unique characteristics and exploring how they contribute to economic stability from various perspectives.

1. Treasury Bills (T-bills): T-bills are short-term debt instruments issued by governments to raise funds quickly. They have maturities ranging from a few days to one year and are typically sold at a discount to their face value. Investors purchase T-bills with the expectation of earning interest upon maturity. By issuing T-bills, governments can finance their short-term obligations, such as paying salaries or funding infrastructure projects. These receipts provide liquidity to the market while offering investors a safe and low-risk investment option.

2. Treasury Notes (T-notes): T-notes are medium-term debt instruments with maturities ranging from two to ten years. They pay periodic interest payments known as coupon payments until maturity when the principal amount is repaid. T-notes serve as an attractive investment option for individuals and institutions seeking steady income streams over a longer period. Governments utilize T-notes to fund long-term projects like education initiatives or healthcare infrastructure development.

3. Treasury Bonds (T-bonds): T-bonds are long-term debt instruments with maturities exceeding ten years. Similar to T-notes, they pay periodic coupon payments until maturity when the principal amount is repaid. T-bonds offer higher interest rates compared to shorter-term securities due to their longer duration and increased risk exposure. Governments issue T-bonds to finance large-scale projects such as national infrastructure development or defense expenditures.

4. Inflation-Indexed Treasury Securities: Inflation-indexed treasury securities, commonly known as Treasury Inflation-Protected Securities (TIPS), provide protection against inflation. These receipts adjust their principal value based on changes in the consumer Price index (CPI). TIPS offer investors a hedge against rising prices, ensuring that their investment retains its purchasing power over time. Governments issue TIPS to attract investors concerned about inflation and to finance projects that require long-term funding.

5. Savings Bonds: Savings bonds are non-marketable treasury securities designed for individual investors. They offer a safe and accessible way for individuals to save money while supporting government financing needs. Savings bonds have fixed interest rates and maturities ranging from one to thirty years.

Exploring the Various Types of Treasury Receipts - Contributing to Economic Stability through Treasury Receipts

8. Types of Treasury Bonds and Their Yields

Treasury bonds are known for their safety and reliability, and they are a popular investment option for many investors. However, not all treasury bonds are created equal. There are several types of treasury bonds, each with their own unique characteristics and yields. In this section, we will explore the different types of treasury bonds and their yields.

1. Treasury Bills (T-Bills)

Treasury bills are short-term debt securities issued by the US government. They have a maturity of one year or less, and they are sold at a discount to their face value. T-bills are considered to be the safest of all treasury bonds because they are backed by the full faith and credit of the US government. They are also highly liquid, meaning that they can be easily bought and sold in the secondary market. The yield on T-bills is determined by the discount rate at which they are sold, and it is often used as a benchmark for short-term interest rates.

2. Treasury Notes (T-Notes)

Treasury notes are medium-term debt securities issued by the US government. They have a maturity of 2 to 10 years, and they pay a fixed rate of interest every six months. T-notes are considered to be slightly more risky than T-bills because of their longer maturity, but they still have a very low risk of default. The yield on T-notes is determined by the prevailing market interest rates, and it is often used as a benchmark for medium-term interest rates.

3. Treasury Bonds (T-Bonds)

Treasury bonds are long-term debt securities issued by the US government. They have a maturity of 10 to 30 years, and they pay a fixed rate of interest every six months. T-bonds are considered to be the riskiest of all treasury bonds because of their long maturity, but they still have a very low risk of default. The yield on T-bonds is determined by the prevailing market interest rates, and it is often used as a benchmark for long-term interest rates.

4. Treasury Inflation-Protected Securities (TIPS)

Treasury Inflation-Protected Securities (TIPS) are treasury bonds that are designed to protect investors from inflation. They have a fixed interest rate, but their principal value is adjusted for inflation based on the consumer Price index (CPI). This means that if inflation goes up, the principal value of TIPS will increase, and if inflation goes down, the principal value of TIPS will decrease. The yield on TIPS is determined by the real interest rate, which is the nominal interest rate minus the expected inflation rate.

5. floating Rate notes (FRNs)

Floating Rate Notes (FRNs) are treasury bonds that have a variable interest rate. The interest rate on FRNs is adjusted periodically based on a benchmark rate, such as the London interbank Offered rate (LIBOR). FRNs are designed to protect investors from interest rate risk, as their interest rate will increase if market interest rates increase. The yield on FRNs is determined by the benchmark rate plus a spread, which represents the credit risk of the US government.

Each type of treasury bond offers different benefits and risks to investors. T-bills are the safest and most liquid, while T-bonds offer the highest yield but also the most risk. TIPS offer protection against inflation, while FRNs offer protection against interest rate risk. Ultimately, the best option will depend on an investor's individual goals and risk tolerance.

Types of Treasury Bonds and Their Yields - Decoding the Yield Curve: Analyzing Treasury Bond Yields

9. Exploring the Different Types of Treasury Locks

1. Treasury locks are financial instruments used by businesses and individuals to manage interest rate risk. They provide a fixed interest rate for a specified period of time, allowing borrowers to protect themselves from potential interest rate increases. However, not all treasury locks are created equal. In this section, we will explore the different types of treasury locks available, discussing their features, advantages, and potential drawbacks.

2. Fixed Rate Treasury Locks: One of the most common types of treasury locks is the fixed rate lock. With this type of lock, the borrower agrees to pay a fixed interest rate for a specific period, regardless of any changes in market interest rates. Fixed rate locks provide certainty and stability, making them an attractive option for borrowers who prefer a predictable payment schedule. For example, a business taking out a loan to finance a long-term project may opt for a fixed rate lock to ensure a consistent cost of borrowing over several years.

3. Floating Rate Treasury Locks: In contrast to fixed rate locks, floating rate locks have an interest rate that adjusts periodically based on a reference rate, such as LIBOR (London Interbank Offered Rate) or the U.S. Prime Rate. These locks provide borrowers with the flexibility to benefit from potential decreases in interest rates. However, they also expose borrowers to the risk of rising interest rates, which could lead to higher borrowing costs. For instance, a borrower who expects interest rates to decline may choose a floating rate lock to take advantage of potential cost savings.

4. Cap and Collar Treasury Locks: Cap and collar locks combine features of both fixed and floating rate locks. A cap lock sets a maximum interest rate that the borrower will pay, providing protection against interest rate increases beyond a certain level. On the other hand, a collar lock sets both a maximum and a minimum interest rate, creating a range within which the interest rate will fluctuate. These types of locks offer a balance between stability and flexibility, appealing to borrowers who want to limit their exposure to interest rate volatility. For example, a borrower may opt for a collar lock to ensure that their borrowing costs remain within a specific range, while still benefiting from potential interest rate decreases.

5. Evaluating the Best Option: When choosing a treasury lock, it is essential to consider various factors, such as the borrower's risk tolerance, market conditions, and the specific needs of the borrowing entity. While fixed rate locks provide stability, they may not be ideal for borrowers who anticipate declining interest rates. Conversely, floating rate locks offer flexibility, but borrowers must be prepared for potential increases in interest rates. Cap and collar locks offer a middle ground, providing both protection and room for potential cost savings. Ultimately, the best option will depend on the borrower's unique circumstances and objectives.

6. It is important to note that treasury locks are complex financial instruments, and borrowers should seek advice from financial professionals to fully understand their implications and determine the most suitable option. By carefully evaluating the different types of treasury locks and considering individual needs and market conditions, borrowers can effectively manage interest rate risk and make informed decisions to support their financial goals.

Exploring the Different Types of Treasury Locks - Demystifying Treasury Locks and Derivatives: What You Need to Know

10. Exploring Different Types of Treasury Receipts

When it comes to diversifying your investment portfolio, exploring different types of treasury receipts can be a valuable strategy. treasury receipts are financial instruments issued by the government that represent ownership in US Treasury securities. They offer investors a low-risk investment option with guaranteed returns, making them an attractive choice for those seeking stability and security in their investments.

In this section, we will delve into the various types of treasury receipts available to investors. By understanding the differences between these options, you can make informed decisions about which ones align with your investment goals and risk tolerance.

1. Treasury Bills (T-Bills): These are short-term debt obligations issued by the US government with maturities ranging from a few days to one year. T-Bills are typically sold at a discount to their face value and do not pay periodic interest. Instead, investors earn a return by purchasing them at a discount and receiving the full face value upon maturity. For example, if you purchase a $1,000 T-Bill with a discount rate of 2%, you would pay $980 upfront and receive $1,000 at maturity.

2. Treasury Notes: Unlike T-Bills, Treasury Notes have longer maturities ranging from two to ten years. They pay semi-annual interest payments to investors based on a fixed coupon rate determined at auction. Upon maturity, investors receive the full face value of the note. For instance, if you buy a $10,000 Treasury Note with a 3% coupon rate, you would receive $150 every six months until maturity when you would also receive the $10,000 principal.

3. Treasury Bonds: Similar to Treasury Notes, Treasury Bonds have longer maturities exceeding ten years. They also pay semi-annual interest payments based on a fixed coupon rate but offer investors more extended periods to earn interest before maturity. These bonds provide an opportunity for long-term investment strategies and can be particularly appealing during times of low-interest rates.

4. Treasury Inflation-Protected Securities (TIPS): TIPS are designed to protect investors from inflation by adjusting the principal value of the security based on changes in the consumer Price index (CPI). This means that as inflation rises, the principal value of TIPS increases, resulting in higher interest payments. Upon maturity, investors receive either the adjusted principal or the original principal, whichever is greater. TIPS can be an effective hedge against inflation and provide a reliable income stream.

5. floating Rate notes (FRNs): FRNs are unique treasury receipts whose

Exploring Different Types of Treasury Receipts - Diversify Your Investment Portfolio with Treasury Receipts

11. Types of Treasury Stock

When it comes to maximizing the dividend yield, one strategy that companies can use is to buy back their own shares, which is referred to as treasury stock. There are different types of treasury stock, and each type has its own implications for the company and its shareholders. Understanding the different types of treasury stock can help investors make informed decisions when it comes to investing in a company.

1. Issued but not outstanding stock: This refers to shares that have been authorized and issued by the company but are not held by any shareholders. This type of treasury stock is typically held by the company for future use, such as for employee stock options or for acquisitions.

2. Purchased stock: This refers to shares that have been bought back by the company from shareholders. This type of treasury stock can be used to increase earnings per share (EPS) and return on equity (ROE) by reducing the number of outstanding shares.

3. Reissued stock: This refers to shares that have been bought back by the company and then reissued to shareholders. This type of treasury stock can be used to raise capital or to satisfy stock option plans.

It’s important to note that not all treasury stock is created equal. For example, if a company buys back shares at a premium price, it may reduce the potential return for shareholders. On the other hand, if a company buys back shares at a discount, it may increase the potential return for shareholders. Additionally, if a company buys back shares and then issues them at a lower price, it may dilute the value of existing shares.

Understanding the different types of treasury stock is an important part of maximizing the dividend yield. By understanding how companies use treasury stock, investors can make informed decisions when it comes to investing in a company.

Types of Treasury Stock - Dividends: Maximizing Dividend Yield with Treasury Stock

12. Types of Treasury Stock

When analyzing earnings per share (EPS), it is important to consider the impact of treasury stock. Treasury stock is the portion of shares that a company buys back from the market. This can occur for a variety of reasons, such as to reduce the number of outstanding shares or to have shares available for employee stock-based compensation plans. The purchase of treasury stock reduces the number of outstanding shares, which in turn can increase EPS. However, the impact of treasury stock on EPS can vary depending on the type of treasury stock that is purchased. There are two main types of treasury stock:

1. Cost method treasury stock: This is the most common type of treasury stock. Under the cost method, the shares of treasury stock are recorded on the balance sheet at their historical cost. When the company sells the treasury stock back into the market, any difference between the sale price and the historical cost is recorded as a gain or loss on the income statement. From an EPS perspective, the impact of cost method treasury stock depends on whether the shares are retired or held in treasury. If the shares are retired, they are removed from the outstanding shares calculation, which can increase EPS. If the shares are held in treasury, they are still considered outstanding, which can decrease EPS.

2. Par value method treasury stock: Under the par value method, the shares of treasury stock are recorded on the balance sheet at their par value. When the company sells the treasury stock back into the market, any difference between the sale price and the par value is recorded as additional paid-in capital on the balance sheet. From an EPS perspective, the impact of par value method treasury stock is similar to cost method treasury stock. If the shares are retired, they are removed from the outstanding shares calculation, which can increase EPS. If the shares are held in treasury, they are still considered outstanding, which can decrease EPS.

Overall, the impact of treasury stock on EPS depends on the specific circumstances of the company and the type of treasury stock that is purchased. For example, if a company repurchases shares of cost method treasury stock and then retires those shares, EPS may increase. However, if the same company holds the shares in treasury, EPS may decrease. Therefore, it is important to carefully analyze the impact of treasury stock on EPS in order to fully understand a company's financial performance.

Types of Treasury Stock - Earnings per share: Analyzing Earnings per Share with Treasury Stock

13. Exploring Different Types of Treasury Locks for Debt Management

1. Introduction to Treasury Locks for Debt Management

When it comes to effective debt management, treasury locks have emerged as a game changer. These financial instruments provide organizations with the ability to hedge against interest rate fluctuations, thereby reducing the risk associated with borrowing. However, not all treasury locks are created equal. In this section, we will explore different types of treasury locks and delve into their benefits and drawbacks, offering insights from various perspectives.

2. Traditional Fixed Rate Treasury Locks

The traditional fixed rate treasury lock is the most common type used for debt management. It allows borrowers to lock in a specific interest rate for a predetermined period, typically ranging from one to ten years. This type of lock provides stability and predictability, as borrowers know exactly what their interest rate will be for the duration of the lock. However, it also limits the potential for savings if interest rates decrease during the lock period.

3. Floating Rate Treasury Locks

Floating rate treasury locks, also known as variable rate locks, offer borrowers the flexibility to benefit from potential interest rate decreases. Unlike fixed rate locks, the interest rate on a floating rate lock is tied to a benchmark rate, such as LIBOR or the U.S. Treasury rate, plus a predetermined spread. This means that if interest rates decrease, borrowers can enjoy a lower rate, resulting in potential savings. However, floating rate locks also come with the risk of interest rate increases, which could lead to higher borrowing costs.

4. Forward Starting Treasury Locks

Forward starting treasury locks provide borrowers with the ability to secure a future interest rate for a specified period. This type of lock allows organizations to plan ahead and mitigate potential interest rate risks. For example, if a company anticipates the need for borrowing in the future, it can enter into a forward starting lock to secure a favorable rate before market conditions change. This strategy provides peace of mind and allows for better financial planning. However, it may not be suitable for all organizations, as it requires accurate forecasting and the ability to commit to a fixed rate in the future.

5. Combination Locks

Combination locks offer borrowers the best of both worlds by combining fixed and floating rate features. With a combination lock, borrowers can secure a fixed rate for a specific period, followed by a floating rate for the remaining term. This type of lock provides initial stability and predictability, while also allowing for potential interest rate savings in the future. For organizations that want to hedge against interest rate fluctuations while still benefiting from potential decreases, combination locks can be an attractive option.

6. Evaluating the Best Option

Determining the best type of treasury lock for debt management depends on various factors, including an organization's risk tolerance, financial goals, and market conditions. It is crucial to carefully analyze and compare the benefits and drawbacks of each type of lock. For example, if an organization prefers stability and wants to avoid interest rate risk, a traditional fixed rate lock may be the best option. On the other hand, if an organization is comfortable with some level of risk and wants to take advantage of potential savings, a floating rate or combination lock might be more suitable.

Exploring different types of treasury locks for debt management is essential to make informed financial decisions. Each type has its own advantages and disadvantages, and organizations must carefully assess their specific needs and goals before choosing the most suitable option. By understanding the intricacies of each type of lock and considering market conditions, organizations can effectively manage their debt and minimize risk.

Exploring Different Types of Treasury Locks for Debt Management - Effective Debt Management through Treasury Locks: A Game Changer

14. Types of Treasury Receipts

When it comes to government securities, one cannot overlook the significance of Treasury Receipts. These receipts are a form of debt issued by the government to finance its operations and meet its financial obligations. They serve as a means for the government to borrow money from individuals, corporations, and other entities. Treasury Receipts are considered safe investments due to their low risk and guaranteed returns, making them an attractive option for investors seeking stability in their portfolios.

From a broader perspective, there are several types of Treasury Receipts available in the market. Each type offers unique features and benefits, catering to different investor preferences and requirements. Let's delve into these types to gain a better understanding:

1. Treasury Bills (T-Bills): T-Bills are short-term debt instruments with maturities ranging from a few days to one year. They are sold at a discount from their face value and do not pay periodic interest payments. Instead, investors earn a return by purchasing T-Bills at a discount and receiving the full face value upon maturity. For example, if an investor purchases a $1,000 T-Bill with a discount rate of 2%, they would pay $980 upfront and receive $1,000 at maturity.

2. Treasury Notes (T-Notes): T-Notes have longer maturities compared to T-Bills, typically ranging from two to ten years. These debt instruments pay semi-annual interest payments to investors based on a fixed coupon rate determined at issuance. Upon maturity, investors receive the full face value of the note. For instance, if an investor buys a $10,000 T-Note with a coupon rate of 3%, they would receive $300 every six months until maturity when they would also receive the principal amount.

3. Treasury Bonds (T-Bonds): T-Bonds have the longest maturities among Treasury Receipts, usually ranging from ten to thirty years. Similar to T-Notes, T-Bonds pay semi-annual interest payments based on a fixed coupon rate. Investors receive the full face value of the bond upon maturity. For example, if an investor purchases a $50,000 T-Bond with a coupon rate of 4%, they would receive $2,000 every six months until maturity when they would also receive the principal amount.

4. Treasury Inflation-Protected Securities (TIPS): TIPS are unique Treasury Receipts designed to protect investors against inflation. The principal value of these securities adjusts with changes in

Types of Treasury Receipts - Government Securities: A Closer Look at Treasury Receipts

15. Exploring Different Types of Treasury Locks

Exploring Different Types of Treasury Locks

When it comes to guarding against inflation, Treasury locks are often considered a smart move. These financial instruments allow investors to protect their investments from the negative effects of rising inflation rates. However, not all Treasury locks are created equal, and understanding the different types available can help investors make informed decisions about their financial strategies.

1. Fixed Rate Treasury Locks:

Fixed rate Treasury locks offer a guaranteed interest rate for a specified period of time. These locks provide certainty and stability, as the interest rate remains constant regardless of any fluctuations in the market. For example, if an investor purchases a fixed rate Treasury lock at 3% for a five-year term, they will receive a fixed 3% interest rate on their investment for the entire duration. This type of lock is ideal for conservative investors who prioritize stability and predictable returns.

2. Inflation-Indexed Treasury Locks:

Inflation-indexed Treasury locks, also known as TIPS (Treasury Inflation-Protected Securities), are designed to protect against inflation by adjusting the principal value of the investment in accordance with changes in the Consumer Price Index (CPI). This means that investors are ensured a real return on their investment, as the principal value increases with inflation. For instance, if an investor purchases an inflation-indexed Treasury lock with a principal value of $10,000 and the CPI increases by 2% over the year, the principal value will be adjusted to $10,200. Inflation-indexed locks are a suitable option for investors concerned about the erosion of purchasing power due to inflation.

3. Floating Rate Treasury Locks:

Floating rate Treasury locks offer a variable interest rate that adjusts periodically based on a reference rate, such as the London interbank Offered rate (LIBOR). These locks provide investors with the opportunity to benefit from rising interest rates in a potentially inflationary environment. For example, if an investor purchases a floating rate Treasury lock with an initial interest rate of 2% plus LIBOR, and LIBOR increases to 1%, the investor will receive a revised interest rate of 3%. Floating rate locks can be advantageous for investors who believe that interest rates will rise in the future.

4. Combination Locks:

Some investors may find that a combination of different types of Treasury locks suits their investment goals and risk tolerance. By diversifying their Treasury lock portfolio, investors can benefit from the unique advantages offered by each type. For instance, an investor may choose to allocate a portion of their portfolio to fixed rate locks for stability, while also investing in inflation-indexed locks to protect against inflation. Combination locks allow investors to tailor their investment strategy according to their specific needs.

Comparing the Options:

When comparing the different types of Treasury locks, it is important to consider factors such as risk tolerance, investment goals, and market conditions. Fixed rate locks provide stability but may not offer protection against inflation. Inflation-indexed locks safeguard against inflation but may have lower nominal interest rates. Floating rate locks offer the potential for higher returns in a rising interest rate environment but come with increased risk. Ultimately, the best option will depend on an investor's individual circumstances and preferences.

Exploring the various types of Treasury locks can empower investors to make informed decisions about guarding against inflation. Whether opting for fixed rate locks, inflation-indexed locks, floating rate locks, or a combination of these options, understanding the unique advantages and risks associated with each type is crucial. By carefully considering their investment goals and market conditions, investors can choose the most suitable Treasury lock strategy to protect and grow their wealth.

Exploring Different Types of Treasury Locks - Guarding Against Inflation with Treasury Locks: A Smart Move

16. Types of Treasury Receipts

When it comes to Treasury Receipts, there are several types available to investors. Each type of receipt has its own unique features, benefits, and risks. Understanding the different types of Treasury Receipts can help investors make informed decisions about their investments. In this section, we will discuss the different types of Treasury Receipts available to investors.

1. Treasury Bills (T-Bills): These are short-term securities that mature in one year or less. T-Bills are issued at a discount from their face value and do not pay interest. Instead, investors earn a return by buying the T-Bill at a discount and then receiving the full face value at maturity. For example, an investor could buy a $1,000 T-Bill for $950 and then receive $1,000 when the T-Bill matures.

2. Treasury Notes (T-Notes): These are intermediate-term securities that mature in one to ten years. T-Notes pay interest every six months, and their face value is paid at maturity. T-Notes are issued in denominations of $1,000 or more and are available for purchase in the primary market through auctions.

3. Treasury Bonds (T-Bonds): These are long-term securities that mature in more than ten years. T-Bonds pay interest every six months, and their face value is paid at maturity. T-Bonds are also issued in denominations of $1,000 or more and are available for purchase in the primary market through auctions.

4. Treasury Inflation-Protected Securities (TIPS): These are securities that are designed to protect investors from inflation. TIPS pay a fixed rate of interest, but the principal value of the security is adjusted for inflation. This means that if inflation increases, the principal value of the TIPS will increase as well.

5. floating Rate notes (FRNs): These are securities that have a variable interest rate that is adjusted periodically based on a benchmark rate. FRNs are typically issued with a maturity of two years or less and are designed to provide investors with protection against rising interest rates.

Investors should carefully consider the risks and benefits of each type of Treasury Receipt before making an investment. Additionally, investors should be aware of the tax implications of investing in Treasury Receipts, as they are subject to federal income tax but exempt from state and local income taxes.

Types of Treasury Receipts - Interest Rates and Treasury Receipts: What You Need to Know

17. Types of Treasury Bonds

When it comes to investing in Treasury bonds, understanding the different types available can be crucial to making informed decisions. Treasury bonds are issued by the U.S. Government to raise funds for various purposes. They are considered one of the safest investments available in the market. The types of Treasury bonds are distinguished based on their maturity period, interest rate, and coupon payment frequency. Depending on your investment goals, you may choose to invest in short-term, medium-term, or long-term Treasury bonds. Each type has its own characteristics and benefits that suit different investment strategies.

Here are the main types of Treasury bonds:

1. Treasury bills (T-bills): These are short-term bonds with maturities ranging from a few days to 52 weeks. They are issued at a discount to their face value and do not pay interest. Instead, investors earn a return by buying them at a discount and holding them until maturity, when they are redeemed at their face value. T-bills are ideal for investors who want a safe, short-term investment with low risk and high liquidity.

2. Treasury notes (T-notes): These are medium-term bonds with maturities ranging from 2 to 10 years. They pay interest every six months and are issued at their face value. T-notes are suitable for investors who want a stable income stream and are willing to take on a moderate amount of risk.

3. Treasury bonds (T-bonds): These are long-term bonds with maturities ranging from 10 to 30 years. They pay interest every six months and are issued at their face value. T-bonds are ideal for investors who want a long-term, fixed-income investment and are willing to take on a higher level of risk.

4. Treasury Inflation-Protected Securities (TIPS): These bonds are designed to protect investors from inflation. They are issued with a fixed interest rate but the principal value is adjusted for inflation based on the consumer Price index (CPI). TIPS are suitable for investors who want to protect their purchasing power from inflation.

Understanding the types of Treasury bonds and their characteristics is crucial to making informed investment decisions. Depending on your investment goals and risk tolerance, you may choose to invest in short-term, medium-term, or long-term Treasury bonds. Consider consulting with a financial advisor to determine which type of Treasury bond is suitable for your investment portfolio.

Types of Treasury Bonds - Maturity Date: Planning Your Financial Future with Treasury Bond Maturity

18. Types of Treasury Receipt Investments to Consider

When it comes to maximizing tax efficiency with treasury receipt investments, understanding the different types of investments available is crucial. Treasury receipts are a popular investment option for individuals and businesses alike, offering a safe and reliable way to grow wealth while minimizing tax liabilities. However, not all treasury receipt investments are created equal, and it's important to consider various factors before making a decision. In this section, we will explore the types of treasury receipt investments to consider, providing insights from different points of view and offering in-depth information to help you make informed choices.

1. Treasury Bills (T-Bills): These short-term debt securities issued by the government have maturities ranging from a few days to one year. T-Bills are considered one of the safest investments as they are backed by the full faith and credit of the government. They offer competitive interest rates and are typically sold at a discount to their face value, with the difference representing the investor's return. For example, if you purchase a $10,000 T-Bill with a discount rate of 2%, you would pay $9,800 upfront and receive $10,000 at maturity.

2. Treasury Notes (T-Notes): T-Notes are medium-term debt securities with maturities ranging from two to ten years. They pay semi-annual interest payments based on a fixed coupon rate determined at auction. T-Notes provide investors with regular income streams while preserving capital. For instance, if you invest in a 5-year T-Note with a coupon rate of 3%, you would receive $150 in interest annually for five years.

3. Treasury Bonds (T-Bonds): T-Bonds are long-term debt securities issued by the government with maturities exceeding ten years. Like T-Notes, they pay semi-annual interest based on a fixed coupon rate set at auction. T-Bonds offer higher yields compared to shorter-term treasury receipts but come with longer lock-in periods. For example, if you purchase a 20-year T-Bond with a coupon rate of 4%, you would receive $400 in interest annually for two decades.

4. Treasury Inflation-Protected Securities (TIPS): TIPS are designed to protect investors against inflation by adjusting their principal value based on changes in the consumer Price index (CPI). These securities provide a fixed interest rate, paid semi-annually, and the adjusted principal value ensures that the purchasing power of your investment remains intact. For instance, if you invest $10,

Types of Treasury Receipt Investments to Consider - Maximizing Tax Efficiency with Treasury Receipt Investments

19. Types of Treasury Bills Available

When it comes to investing in Treasury Bills, there are different types of bills available. Each type has its own maturity date, yield, and minimum investment amount. It's important to understand the differences between them to make an informed decision. In this section, we'll break down the different types of Treasury Bills available.

1. 4-Week Bills: These bills have a maturity period of 4 weeks and are usually sold at a discount to their face value. For example, you might buy a 4-week bill for $9,800 that will be worth $10,000 at maturity. The yield is the difference between the purchase price and the face value, which in this case is $200. The minimum investment for 4-week bills is $100.

2. 13-Week Bills: Also known as a "3-month bill," these bills have a maturity period of 13 weeks and are sold at a discount like the 4-week bills. The minimum investment for 13-week bills is $100.

3. 26-Week Bills: Also known as a "6-month bill," these bills have a maturity period of 26 weeks and are sold at a discount like the other bills. The minimum investment for 26-week bills is $100.

4. 52-Week Bills: Also known as a "1-year bill," these bills have a maturity period of 52 weeks and are sold at a discount like the others. The minimum investment for 52-week bills is $100.

It's important to note that Treasury Bills are considered to be very safe investments, as they are backed by the full faith and credit of the U.S. Government. Additionally, the interest income earned on Treasury Bills is exempt from state and local taxes, making them a great option for investors looking to minimize their tax burden.

Overall, the type of Treasury Bill you choose to invest in will depend on your investment goals and risk tolerance. While all Treasury Bills are considered safe investments, the longer the maturity period, the higher the yield. It's up to you to decide which type of Treasury Bill is the best fit for your investment portfolio.

Types of Treasury Bills Available - Treasury bill: Unearned Interest and Treasury Bills: A Winning Combination

20. Different Types of Treasury Bills

Treasury bills are short-term debt securities issued by the government to finance its short-term financial needs. They are considered one of the safest investments as they are backed by the full faith and credit of the government. Treasury bills are issued in various maturities ranging from a few days to a year. In this section, we will discuss the different types of Treasury bills available.

1. Regular Treasury bills:

Regular Treasury bills are the most common type of Treasury bill. They are issued for a period of 4, 8, 13, 26, or 52 weeks. They are sold at a discount to face value and mature at face value. For example, if a $10,000 Treasury bill is issued at a discount of 1%, it will be sold for $9,900 and will mature at $10,000.

2. Cash management bills:

Cash management bills are issued by the government to manage its short-term cash needs. They are issued for a period of 4, 13, or 26 weeks. The minimum denomination for cash management bills is $1 million. These bills are sold at a discount to face value, and the interest rate is determined by auction.

3. Treasury inflation-protected securities (TIPS):

TIPS are Treasury bills that protect investors from inflation. They are issued for a period of 5, 10, or 30 years. The interest rate on TIPS is fixed, but the principal amount is adjusted for inflation. For example, if an investor buys a TIPS with a principal amount of $10,000 and an interest rate of 2%, and the inflation rate is 3%, the principal amount will be adjusted to $10,300.

4. floating-rate notes (FRNs):

FRNs are Treasury bills that have a variable interest rate. The interest rate on FRNs is adjusted every 13 weeks based on the 13-week Treasury bill rate. FRNs are issued for a period of 2 years or more.

5. Zero-coupon bonds:

Zero-coupon bonds are Treasury bills that are sold at a deep discount to face value. They do not pay interest, but the investor receives the face value of the bond at maturity. For example, if an investor buys a zero-coupon bond with a face value of $10,000 for $8,000, they will receive $10,000 at maturity.

When choosing between different types of Treasury bills, it is important to consider your investment goals and risk tolerance. Regular Treasury bills are the safest option, but they offer lower returns than other types of Treasury bills. Cash management bills are suitable for institutional investors who have a large amount of cash to invest. TIPS are suitable for investors who are concerned about inflation. FRNs are suitable for investors who want to earn a variable interest rate. Zero-coupon bonds are suitable for investors who want to lock in a fixed return.

Different Types of Treasury Bills - Treasury bill rate: The Referencerate Puzzle: Decoding Treasury Bill Rates

21. Types of Treasury Bills

When it comes to investing in Treasury Bills, it is important to understand the different types available. Each type offers unique features that may suit your investment strategy and financial goals differently. The United States Treasury issues four different types of Treasury bills: regular T-bills, cash management bills, auction bills, and re-opening bills. understanding the differences between these types can help you make informed decisions about your investments.

1. Regular T-bills: These Treasury bills are the most common and are issued every week. They come with maturities of four, eight, 13, 26, and 52 weeks. Regular T-bills are issued at a discount to the par value, and the investor receives the full par value at maturity. For example, if you purchase a $1,000 T-bill at a discount for $950, you will receive $1,000 when the bill matures.

2. Cash Management Bills: These Treasury bills are also known as CMBs and are issued on an as-needed basis. CMBs are used to cover unexpected short-term financing needs of the U.S. Government. They come with maturities of five days to 45 days, and they are issued at a discount to the par value.

3. Auction Bills: These Treasury bills are issued on a schedule that is determined by the U.S. Treasury. They are sold at auction, and the interest rate is determined by the market demand for the bills. Auction bills come with maturities of four weeks, 13 weeks, 26 weeks, and 52 weeks.

4. Re-opening Bills: These Treasury bills are reopened for sale in the middle of their original term. Re-opening bills can help investors add to their holdings of a particular bill without having to wait for a new bill to be issued. They are sold at the same price as the original bill and come with the same maturity date.

In summary, understanding the different types of Treasury bills can help investors make informed decisions about their investments. Regular T-bills are the most common and come with maturities of four, eight, 13, 26, and 52 weeks. Cash management bills are issued on an as-needed basis to cover unexpected short-term financing needs. Auction bills are sold at auction and come with maturities of four weeks, 13 weeks, 26 weeks, and 52 weeks. Re-opening bills are reopened for sale in the middle of their original term and are sold at the same price as the original bill.

Types of Treasury Bills - Treasury bills: Demystifying Treasury Bills: A Comprehensive Guide

22. Different Types of Treasury Bills

When it comes to investing in Treasury bills, it's important to understand the different types available. Each type of Treasury bill has its own unique characteristics and benefits, and understanding these differences can help you make more informed investment decisions. In this section, we'll explore the different types of Treasury bills available and what sets them apart from one another.

1. Regular T-bills: These are the most common type of Treasury bill, with maturities ranging from a few days to 52 weeks. Regular T-bills are issued at a discount to their face value, and investors earn a return by buying the bills at a discount and receiving the full face value at maturity. For example, if you purchase a $1,000 Treasury bill with a 12-month maturity at a discount price of $950, you would earn a return of $50 at maturity.

2. Cash management bills: These are similar to regular T-bills but are issued to help the government manage its cash flow. Cash management bills are typically issued with maturities of 30 to 60 days and are used to bridge any gaps in the government's cash balance. These bills are also issued at a discount to their face value and earn a return for investors.

3. Zero-coupon bonds: These are T-bills that are issued at a deep discount to their face value and do not pay any interest payments. Instead, investors earn a return by buying the bonds at a discount and receiving the full face value at maturity. Zero-coupon bonds are often used for long-term financial planning, such as saving for college or retirement.

4. Inflation-indexed T-bills: These bills are designed to protect investors from inflation. The return on inflation-indexed T-bills is tied to the consumer Price index (CPI), which measures the cost of living. If the CPI rises, the return on the bill will also rise, ensuring that investors are protected from the effects of inflation.

Understanding the different types of Treasury bills available can help you make more informed investment decisions. Whether you're looking for short-term investments or long-term financial planning, there's a Treasury bill that can meet your needs.

Different Types of Treasury Bills - Treasury Bills: Short term Government Debt Investments

23. Types of Treasury Bills

When it comes to Treasury Bills, there are different types that investors can choose from. Each type has its unique characteristics and offers different benefits to the investor. Understanding the various types of Treasury Bills and their features is essential to make an informed investment decision. In this section, we will discuss the different types of Treasury Bills that investors can consider.

1. Regular Treasury Bills: These are the most common types of Treasury Bills. They are issued for a minimum denomination of $100 and a maximum of $5 million, with a maturity period of 4, 8, 13, 26, or 52 weeks. Regular Treasury Bills are highly liquid, and investors can buy or sell them on the secondary market.

2. Cash Management Bills: These Treasury Bills are issued for a minimum denomination of $10,000 and a maximum of $5 million, with a maturity period of 28 days. Cash management Bills are issued to manage the government's short-term borrowing needs. They are auctioned every Thursday and are highly liquid.

3. Cash-Management Bill-Linked Notes: These are notes that are linked to the Cash Management Bills. They have a minimum denomination of $100,000 and a maturity period of 28 days. The interest rate on these notes is linked to the prevailing rate of the Cash Management Bills, making them an attractive investment option for investors who want to earn higher returns.

4. Zero-Coupon Treasury Bills: These Treasury Bills are issued at a discount to their face value and do not pay interest. Instead, investors earn a return by buying them at a discount and holding them until maturity when they can redeem them at face value. Zero-Coupon Treasury Bills have a maturity period of one year or less, making them an attractive investment option for investors who want to earn a fixed return over a short period.

Treasury Bills are a safe and secure investment option for investors who want to earn a fixed return over a short period. Each type of Treasury Bill has its unique features and benefits, and investors must consider their investment objectives and risk tolerance before investing in them.

Types of Treasury Bills - Treasury bills: The Power of Treasury Bills as Cash Equivalents

24. Types of Treasury Bills

Treasury bills are short-term debt instruments issued by the government of India to meet its short-term financial requirements. These bills are issued for a period of 91 days, 182 days, and 364 days and are considered to be one of the safest investment options available in the market. There are different types of treasury bills available in the market, each with its own unique features and benefits. In this section, we will discuss the different types of treasury bills in detail.

1. Regular Treasury Bills

Regular treasury bills are the most common type of treasury bills issued by the government of India. These bills are issued for a period of 91 days, 182 days, and 364 days, and are issued at a discount to the face value. The interest earned on these bills is the difference between the face value and the discounted price at which they are issued. These bills are issued through an auction process, and the yield is determined by market demand and supply.

2. Cash Management Bills

Cash management bills are short-term debt instruments issued by the government of India to meet its immediate cash requirements. These bills are issued for a period of 14 days and are issued at a discount to the face value. The interest earned on these bills is the difference between the face value and the discounted price at which they are issued. These bills are issued through an auction process and are used to manage the cash flow of the government.

3. Treasury Bills with Call Option

Treasury bills with call option are a type of treasury bill that gives the government the option to call back the bill before its maturity date. These bills are issued for a period of 91 days and are issued at a discount to the face value. The interest earned on these bills is the difference between the face value and the discounted price at which they are issued. The call option on these bills gives the government the flexibility to manage its cash flow and meet its financial requirements.

4. Zero Coupon Treasury Bills

Zero coupon treasury bills are a type of treasury bill that does not pay any interest. These bills are issued at a discount to the face value and are redeemed at the face value on maturity. The difference between the discounted price and the face value is the return earned on these bills. These bills are issued for a period of 91 days, 182 days, and 364 days and are considered to be one of the safest investment options available in the market.

5. Floating Rate Treasury Bills

Floating rate treasury bills are a type of treasury bill that pays a variable interest rate. The interest rate on these bills is linked to a benchmark rate, which is usually the 91-day treasury bill yield. These bills are issued for a period of 364 days and are issued at a discount to the face value. The interest earned on these bills is the difference between the face value and the discounted price at which they are issued.

When it comes to choosing the best type of treasury bill, it depends on the investor's financial goals and risk appetite. Regular treasury bills are suitable for investors who are looking for a safe and low-risk investment option. Cash management bills are suitable for investors who are looking for a short-term investment option to manage their cash flow. Treasury bills with call option are suitable for investors who are looking for flexibility in managing their cash flow. Zero coupon treasury bills are suitable for investors who are looking for a safe and long-term investment option. Floating rate treasury bills are suitable for investors who are looking for a variable interest rate investment option.

Treasury bills are a safe and low-risk investment option available in the market. There are different types of treasury bills available, each with its own unique features and benefits. It is important to choose the right type of treasury bill based on the investor's financial goals and risk appetite.

Types of Treasury Bills - Treasury bills: Unraveling the MIBOR Mystery: Treasury Bills and More

25. Different Types of Treasury Bonds

1. Treasury bonds are a popular investment option for individuals looking for a safe and reliable way to grow their money. These bonds are issued by the U.S. Department of the Treasury and are considered to be one of the most secure investments available. However, not all treasury bonds are created equal. In this section, we will explore the different types of treasury bonds that investors can choose from, each with its own unique characteristics and benefits.

2. The first type of treasury bond is the Treasury Inflation-Protected Securities (TIPS). As the name suggests, TIPS are designed to protect investors against inflation. These bonds provide a fixed interest rate that is adjusted for inflation, ensuring that the purchasing power of your investment remains intact. For example, if you invest in a TIPS with a 2% interest rate and inflation is 3%, your investment will be adjusted to reflect the 3% increase.

3. Another type of treasury bond is the Treasury Constant Maturity (TCM) bond. TCM bonds are sold at a fixed interest rate and have varying maturity dates. These bonds are often used as benchmarks for other fixed-income securities and are commonly traded on the secondary market. Investors who prefer more flexibility in terms of maturity dates may find TCM bonds to be a suitable option.

4. Moving on, we have the Treasury STRIPS (Separate Trading of Registered Interest and Principal Securities). STRIPS are unique treasury bonds that are created by separating the interest and principal payments of a treasury bond. These individual components are then traded as separate securities. STRIPS are often favored by investors who want to receive a fixed income stream from their investment without the risk of fluctuating interest rates.

5. Lastly, we have the Treasury floating Rate notes (FRNs). Unlike other treasury bonds, FRNs have variable interest rates that are adjusted periodically according to a specific index. This makes FRNs an attractive option for investors who want to benefit from potential interest rate increases. The interest payments on FRNs are typically made quarterly, providing investors with a regular income stream.

Tips:

- Consider your investment goals and risk tolerance when choosing between different types of treasury bonds.

- diversify your bond portfolio by investing in a mix of treasury bonds with varying characteristics.

- Stay updated on current market trends and economic indicators that may impact the performance of treasury bonds.

Case Study:

Let's take a look at a hypothetical case study to illustrate the differences between treasury bonds. Investor A is nearing retirement and is looking for a safe investment option that provides a steady income stream. They decide to invest in TIPS to protect their investment against inflation. On the other hand, Investor B is a more risk-tolerant individual who wants to capitalize on potential interest rate increases. They choose to invest in FRNs to take advantage of the variable interest rates.

Understanding the different types of treasury bonds is essential for making informed investment decisions. Whether you prioritize inflation protection, flexibility, fixed income streams, or potential interest rate gains, there is a treasury bond that aligns with your goals. By considering your investment preferences and staying informed, you can make the most of these secure and reliable investment opportunities.

Different Types of Treasury Bonds - Treasury bond: The Basics of Treasury Bonds: A BondBuyer s Handbook

26. Different Types of Treasury Bonds

When it comes to investing, treasury bonds are one of the safest options available, as they are backed by the full faith and credit of the U.S. Government. But not all treasury bonds are created equal. There are several types of treasury bonds available, each with its own unique features and benefits. In this section, we will explore the different types of treasury bonds and what sets them apart.

1. Treasury Bills: Also known as T-bills, these bonds are short-term investments with maturities ranging from a few days to one year. They are sold at a discount to their face value, and the investor earns the full face value when the bond matures. T-bills are considered to be the safest of all treasury bonds, as they have the shortest maturity and are backed by the U.S. Government.

2. Treasury Notes: These bonds have longer maturities than T-bills, ranging from two to ten years. They pay interest every six months and are sold in denominations of $1,000. Treasury notes are considered to be a good option for investors who are looking for a steady stream of income.

3. Treasury Bonds: Also known as T-bonds, these bonds have the longest maturities of all treasury bonds, ranging from ten to thirty years. They pay interest every six months and are sold in denominations of $1,000. Treasury bonds are a good option for investors who are looking for a long-term investment with a guaranteed rate of return.

4. Treasury Inflation-Protected Securities (TIPS): These bonds are designed to protect investors from inflation. The principal value of TIPS is adjusted based on the consumer Price index (CPI), so the investor is protected from inflation. TIPS pay interest every six months and are sold in denominations of $100.

In summary, treasury bonds are a safe investment option for those looking to safeguard their investments. The different types of treasury bonds offer varying maturities, interest rates, and levels of risk. Depending on your investment goals, one type of treasury bond may be more suitable than the others. It's important to do your research and consult with a financial advisor to determine which type of treasury bond is right for you.

Different Types of Treasury Bonds - Treasury Bond: Understanding Treasury Bonds: Safeguarding Your Investments

27. Types of Treasury Bonds

When it comes to investing in Treasury bonds, it's important to understand the different types that are available. Treasury bonds are considered one of the safest investments because they're backed by the full faith and credit of the U.S. Government. They're also attractive to investors because they offer a fixed rate of return and are exempt from state and local taxes.

There are several types of Treasury bonds available, each with its own unique characteristics. Here's a breakdown of the different types of Treasury bonds:

1. Treasury Bills (T-bills): These are short-term securities that mature in one year or less. They're sold at a discount from their face value and pay no interest until maturity. For example, if you buy a $1,000 T-bill at a discount of $980, you'll receive $1,000 when it matures in three months. The difference between the purchase price and face value is your interest.

2. Treasury Notes (T-notes): These are intermediate-term securities that mature in two to 10 years. They pay interest every six months and are sold at face value. For example, if you buy a $1,000 T-note that pays 2% interest, you'll receive $20 every six months until it matures.

3. Treasury Bonds (T-bonds): These are long-term securities that mature in 10 to 30 years. They pay interest every six months and are sold at face value. For example, if you buy a $1,000 T-bond that pays 3% interest, you'll receive $30 every six months until it matures.

4. Treasury Inflation-Protected Securities (TIPS): These are bonds that are indexed to inflation, which means the principal and interest payments are adjusted for inflation. They're available in five-, 10-, and 30-year maturities. For example, if you buy a $1,000 TIPS with a 2% coupon rate and inflation is 3%, your principal will be adjusted to $1,030 and your interest payment will be $20.60.

5. floating Rate notes (FRNs): These are notes that have a variable interest rate that's adjusted every 13 weeks. The interest rate is based on the 13-week treasury bill rate plus a spread. For example, if the 13-week Treasury bill rate is 1% and the spread is 0.5%, the interest rate on the FRN would be 1.5%.

Understanding the different types of Treasury bonds can help you make an informed decision about which ones to invest in based on your investment goals and risk tolerance.

Types of Treasury Bonds - Treasury bond: Unearned Interest Made Safe: Investing in Treasury Bonds

28. Types of Treasury Bonds

When it comes to investing in Treasury bonds, it's important to understand the different types available. Each type of bond has its own unique characteristics, benefits, and drawbacks. As a bond broker, I've seen how choosing the right type of bond can make a significant difference in an investor's portfolio.

Firstly, there are three main types of Treasury bonds: bills, notes, and bonds. bills are short-term investments, with maturities of one year or less. They are typically sold at a discount to their face value, and the investor receives the full face value when the bill matures. Notes, on the other hand, have maturities of two, three, five, seven, or ten years. They pay a fixed interest rate every six months until maturity, at which point the investor receives the face value of the note. Finally, bonds have maturities of 20 or 30 years and pay interest every six months until maturity. They are sold at face value and the investor receives the full face value when the bond matures.

Secondly, it's important to understand the difference between fixed-rate and inflation-protected bonds. fixed-rate bonds have a set interest rate that remains the same throughout the life of the bond. Inflation-protected bonds, also known as TIPS (Treasury Inflation-Protected Securities), have a fixed interest rate, but the principal value of the bond adjusts to keep pace with inflation. This means that if inflation goes up, the principal value of the bond increases, and vice versa.

Thirdly, some investors may be interested in zero-coupon bonds. These bonds do not pay interest, but are sold at a discount to their face value. The investor receives the full face value of the bond when it matures. Zero-coupon bonds are often used as a way to save for a specific goal, such as college tuition or a down payment on a home.

In summary, understanding the different types of treasury bonds available can help investors make informed decisions about their portfolios. Whether you're looking for short-term or long-term investments, fixed or inflation-protected bonds, or a way to save for a specific goal, there is a Treasury bond out there that can meet your needs.

29. Exploring Different Types of Treasury Bonds