1. Budgeting for Emergencies and Unforeseen Events

When it comes to budgeting, one of the most important aspects to consider is preparing for unexpected expenses. No matter how well we plan our finances, life has a way of throwing curveballs at us when we least expect it. Whether it's a sudden car repair, a medical emergency, or a job loss, these unforeseen events can wreak havoc on our financial stability if we're not prepared.

To effectively deal with unexpected expenses, it's crucial to incorporate them into our budgeting strategy. Here are a few key steps to consider:

1. Create an emergency fund: Building an emergency fund is the first line of defense against unexpected expenses. Set aside a portion of your income each month and allocate it specifically for emergencies. Aim to save at least three to six months' worth of living expenses, so you have a safety net to fall back on in challenging times.

For example, let's say your monthly expenses amount to $2,000. In this case, your emergency fund should ideally have a minimum of $6,000 to $12,000, depending on your risk tolerance and financial obligations.

2. Prioritize your expenses: When an unexpected expense arises, it's essential to reassess your budget and prioritize your spending accordingly. Take a close look at your discretionary expenses and identify areas where you can temporarily cut back. By reducing non-essential spending, you can free up funds to cover the unexpected costs without compromising your financial stability.

For instance, if you typically dine out multiple times a week, consider cooking at home more often until you've dealt with the unforeseen expense. This temporary adjustment will help you stay on track with your budget without sacrificing your financial goals.

3. Explore alternative funding options: In some cases, unexpected expenses may exceed the amount available in your emergency fund. During such times, it's crucial to explore alternative funding options wisely. Instead of relying solely on credit cards or taking out high-interest loans, consider other alternatives like personal loans from credit unions or borrowing from friends or family.

Remember, it's important to approach borrowing with caution and only consider options that are feasible and won't lead to further financial stress down the road.

4. Learn from your experiences: Dealing with unexpected expenses can be a learning opportunity. Reflect on the situation and identify any patterns or areas where you can improve your budgeting strategy. Maybe you realized that your emergency fund was insufficient, or perhaps you discovered that you need to allocate more funds to specific categories like healthcare or home maintenance.

By analyzing your experiences, you can fine-tune your budget and make necessary adjustments to better prepare for future unforeseen events.

In conclusion, unexpected expenses are an inevitable part of life, but with proper budgeting and planning, we can minimize their impact on our financial well-being. Building an emergency fund, prioritizing expenses, exploring alternative funding options, and learning from our experiences are all essential steps in dealing with the unexpected. By incorporating these strategies into our budgeting approach, we can navigate through unforeseen events with greater confidence and financial stability.

Budgeting for Emergencies and Unforeseen Events - Budgeting: Mastering Expense Tracking: The Ultimate Guide to Budgeting Success

2. Safeguarding Against Unforeseen Events and Cybersecurity Threats

Capital Buffers and Operational Risk: Safeguarding Against Unforeseen Events and Cybersecurity Threats

Operational risk is one of the most significant risks faced by banks. It is the risk of loss resulting from inadequate or failed internal processes, people, and systems, or from external events. Operational risk can arise from a range of factors, including human error, technology failures, fraud, and cyber attacks. In order to safeguard against unforeseen events and cybersecurity threats, banks need to maintain adequate capital buffers.

1. The Importance of Capital Buffers in Mitigating Operational Risk

Capital buffers play a critical role in mitigating operational risk. By maintaining adequate capital buffers, banks can absorb losses resulting from operational risk events without jeopardizing their solvency or liquidity. This is particularly important in the event of a severe operational risk event, such as a cyber attack or a major fraud incident, which could result in significant financial losses for the bank.

2. Types of Capital Buffers

There are several types of capital buffers that banks can maintain to mitigate operational risk. These include:

- Capital conservation buffer: This is an additional capital buffer required by regulatory authorities, which is designed to ensure that banks have sufficient capital to absorb losses during periods of financial stress.

- Countercyclical buffer: This is an additional capital buffer that can be imposed by regulatory authorities during periods of excessive credit growth, to ensure that banks have sufficient capital to absorb losses in the event of a downturn.

- Systemic risk buffer: This is an additional capital buffer that can be imposed on systemically important banks, to ensure that they have sufficient capital to absorb losses in the event of a systemic crisis.

3. Cybersecurity Threats and the Need for Adequate Capital Buffers

Cybersecurity threats pose a significant operational risk to banks. Cyber attacks can result in significant financial losses, reputational damage, and legal liability for banks. In order to mitigate the risk of cyber attacks, banks need to maintain adequate capital buffers to absorb potential losses. This is particularly important given the increasing frequency and sophistication of cyber attacks in recent years.

4. Options for Maintaining Adequate Capital Buffers

There are several options available to banks for maintaining adequate capital buffers to mitigate operational risk. These include:

- Retaining earnings: Banks can retain earnings to build up their capital buffers over time. This is a conservative approach, but it may not be sufficient in the event of a severe operational risk event.

- Issuing new equity: Banks can issue new equity to raise capital and build up their capital buffers. This approach may be more effective in the short term, but it may dilute existing shareholders' ownership in the bank.

- Reducing dividends: Banks can reduce or suspend dividends to conserve capital and build up their capital buffers. This approach may be unpopular with shareholders, but it can be an effective way to build up capital quickly.

5. Conclusion

Maintaining adequate capital buffers is critical for banks to mitigate operational risk, particularly in the face of cybersecurity threats. There are several options available to banks for building up their capital buffers, and each bank will need to determine the best approach based on its specific circumstances. Ultimately, however, the importance of maintaining adequate capital buffers cannot be overstated, as it is essential for ensuring the long-term resilience of banks in the face of unforeseen events and cybersecurity threats.

Safeguarding Against Unforeseen Events and Cybersecurity Threats - Capital Buffers: Building Resilience: The Role of Capital Buffers in Banks

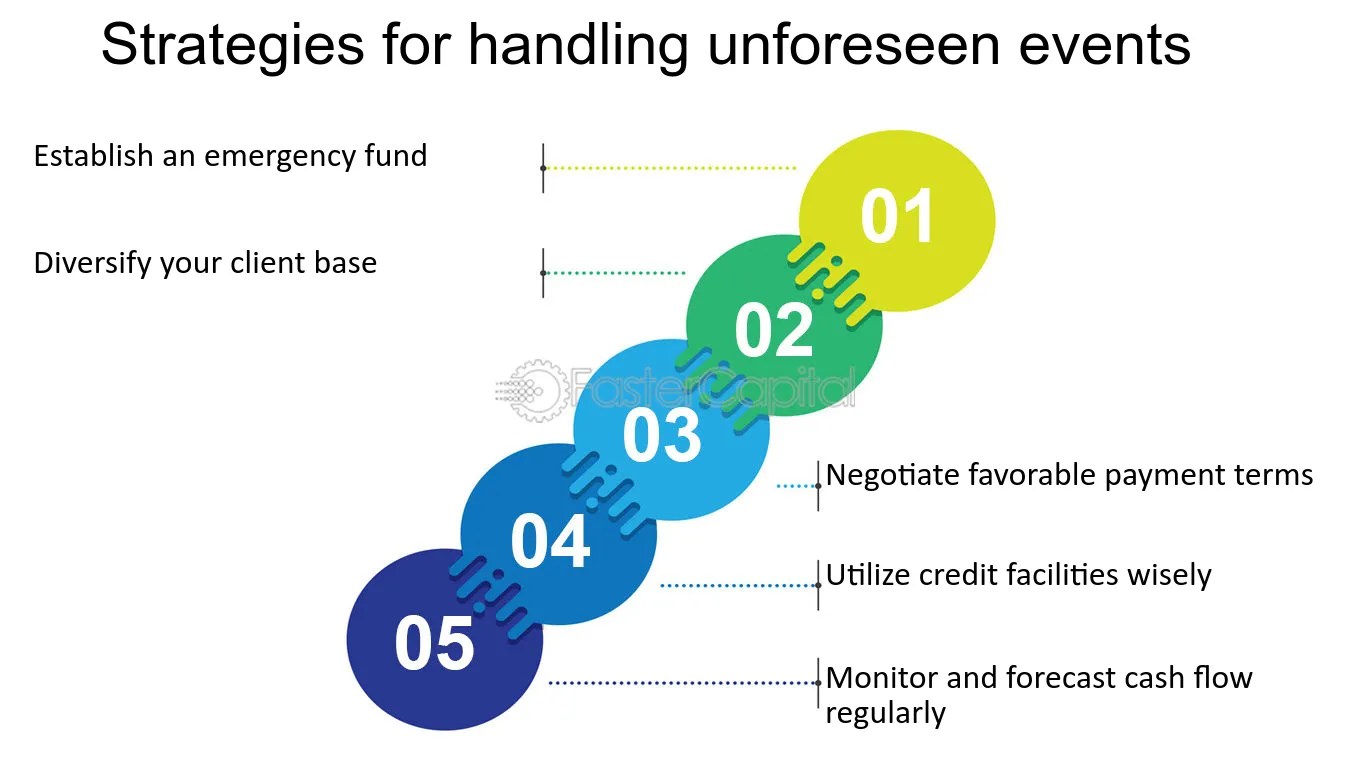

3. Strategies for handling unforeseen events

1. Establish an emergency fund

One of the most effective strategies for mitigating cash flow risks is to establish an emergency fund. This fund acts as a safety net during unforeseen events and provides a buffer to cover any unexpected expenses or fluctuations in income. By setting aside a portion of your profits into this fund regularly, you can ensure that you have the necessary funds to handle any financial emergencies that may arise. For example, if you run a small business, having an emergency fund can help you cover unexpected repairs, temporary closures, or sudden drops in sales.

2. Diversify your client base

Relying too heavily on a single client or a few major customers can expose your business to significant cash flow risks. If one client experiences financial difficulties or terminates their contract, it can have a severe impact on your cash flow. By diversifying your client base and attracting a wider range of customers, you can reduce the reliance on any single source of income. This diversification helps to spread the risk and protect your cash flow in the event of unexpected client losses.

3. Negotiate favorable payment terms

Negotiating favorable payment terms with your suppliers and clients can play a crucial role in managing cash flow risks. For instance, you can request extended payment terms from your suppliers to match the payment terms you have agreed upon with your clients. This way, you can have more time to collect payment from your clients before the funds are due to be paid to your suppliers. By aligning payment terms, you can minimize the risk of running into cash flow issues due to timing mismatches.

4. Utilize credit facilities wisely

Maintaining a good relationship with your bank and utilizing credit facilities wisely can be a valuable strategy for handling unforeseen events. A line of credit or an overdraft facility can provide you with quick access to funds when needed, allowing you to manage cash flow gaps during challenging times. However, it is important to use these credit facilities judiciously and only when necessary, as excessive borrowing can lead to increased interest costs and potential debt burdens.

5. Monitor and forecast cash flow regularly

Regularly monitoring and forecasting your cash flow is essential for identifying potential risks and taking proactive measures to mitigate them. By analyzing historical data and projecting future cash flows, you can anticipate periods of low cash flow and plan accordingly. This may involve adjusting your expenses, seeking additional funding, or implementing cost-cutting measures to maintain a healthy cash flow. Utilizing cash flow management tools and software can streamline this process, providing you with accurate and up-to-date information to make informed decisions.

Mitigating cash flow risks requires a proactive approach and a combination of strategies. Establishing an emergency fund, diversifying your client base, negotiating favorable payment terms, utilizing credit facilities wisely, and regularly monitoring and forecasting cash flow are all effective ways to handle unforeseen events. By implementing these strategies, you can protect your business's financial stability and ensure smooth operations even in times of uncertainty.

Strategies for handling unforeseen events - Cash flow management: Utilizing Money at Call for Smooth Operations

4. Added Protection for Unforeseen Events

We never know when our time will come, and it's essential to have a plan in place to protect our loved ones when that happens. That's why life insurance is crucial to secure the financial future of those who depend on us. While a guaranteed death benefit policy provides the necessary coverage to ensure your loved ones' financial stability, there are ways to customize your coverage to suit your unique needs. That's where riders come in. Riders are add-ons to your life insurance policy that provide additional benefits to your policy for a cost. One type of rider that can provide invaluable protection is the Accidental Death benefit Rider.

The Accidental Death Benefit Rider is a type of coverage that pays out an additional death benefit if the policyholder dies by an accident. While no one wants to think about an unexpected death, accidents can and do happen. And in the event of an accidental death, the Accidental Death Benefit Rider can provide an added layer of protection for your loved ones.

Here are some key points to understand about the Accidental Death Benefit Rider:

1. Accidental Death Benefit Rider is an add-on to your life insurance policy that provides an extra death benefit if the policyholder dies due to an accident.

2. The rider is designed to provide additional coverage beyond the guaranteed death benefit in the event of an accidental death.

3. The amount of the additional benefit can vary depending on the insurer and the policy.

4. The rider typically comes with specific exclusions, such as deaths resulting from drug or alcohol abuse, aviation accidents, and hazardous hobbies or occupations.

5. The accidental Death Benefit Rider is generally more affordable than a standalone accidental death insurance policy.

For example, let's say you have a guaranteed death benefit policy with a death benefit of $500,000 and add an Accidental Death Benefit Rider for an additional $100,000. If you were to die in a car accident, your loved ones would receive a total death benefit of $600,000. Without the rider, they would only receive the guaranteed death benefit of $500,000.

The Accidental Death Benefit Rider is an excellent way to provide additional protection for your loved ones in the event of an accidental death. While we can't predict the future, we can take steps to ensure our loved ones are taken care of when we're no longer around.

Added Protection for Unforeseen Events - Customizing Your Coverage with Riders in Guaranteed Death Benefit Policies

5. Understanding Unforeseen Events

Unforeseen events are a common occurrence in both personal and professional lives. When it comes to binding agreements, these events can have significant implications and can even lead to contract disputes. It is crucial to understand the concept of unforeseen events and how they are addressed in a binding agreement to navigate the complexities that may arise. In this section, we will delve deeper into this topic, providing examples, tips, and case studies to help shed light on understanding unforeseen events.

1. Examples of Unforeseen Events

Unforeseen events can encompass a wide range of circumstances that are beyond the control of the parties involved in a binding agreement. Some common examples include natural disasters such as earthquakes, hurricanes, or floods, political unrest, economic crises, health emergencies, labor strikes, and technological failures. These events can disrupt the normal course of business operations, rendering the fulfillment of contractual obligations impossible or impracticable.

2. Tips for Addressing Unforeseen Events in a Binding Agreement

When drafting a binding agreement, it is essential to consider and address the possibility of unforeseen events. Here are some tips to help navigate this aspect effectively:

- Define Force Majeure: Clearly define the term "force majeure" within the agreement to include a comprehensive list of events that will be considered as unforeseen events. This will provide clarity and avoid ambiguity in case of any disputes.

- Specify Consequences: Clearly outline the consequences and obligations of the parties in the event of a force majeure event. This may include the suspension or termination of the agreement, the allocation of risks, and the process for renegotiating terms.

- Mitigation Efforts: Include provisions that require the parties to take reasonable steps to mitigate the impact of a force majeure event. This may involve exploring alternative solutions, seeking substitute performance, or adjusting timelines.

- Notice Requirements: Establish clear notice requirements for the parties to inform each other promptly about the occurrence of a force majeure event. This will enable timely communication and allow the parties to take necessary actions.

3. Case Studies

To further illustrate the complexities and importance of understanding unforeseen events in a binding agreement, let's examine a few case studies:

- Case Study 1: A manufacturing company had a contract to supply goods to a client. Due to a severe flood in the area, the company's facilities were damaged, making it impossible to fulfill the order. However, the contract did not include a force majeure clause, leading to a dispute between the parties regarding liability and compensation.

- Case Study 2: A software development company had a contract with a client to deliver a customized software solution within a specified timeline. Unfortunately, a key software component they relied on was discontinued by the manufacturer, causing a delay in the project. However, the contract included a well-defined force majeure clause that allowed for an extension of the timeline and alternative solutions to be explored.

These case studies highlight the importance of addressing unforeseen events in a binding agreement to avoid potential conflicts and ensure a fair and reasonable resolution.

In conclusion, understanding unforeseen events and their implications in a binding agreement is crucial for all parties involved. By considering examples, following tips, and learning from case studies, individuals can navigate the complexities of unforeseen events effectively and protect their interests in contractual arrangements.

Understanding Unforeseen Events - Force majeure: Unforeseen Events: Navigating Force Majeure in a Binding Agreement

6. Enhanced Coverage for Unforeseen Events

Accidents happen when we least expect them, and the consequences can be devastating. The Accidental Death and Dismemberment (AD&D) Rider is a type of insurance rider that provides extra coverage for unforeseen events that result in dismemberment or death. This coverage is especially important for those who work in high-risk jobs or engage in high-risk activities.

This rider offers a lump sum payment to the beneficiary in the unfortunate event that the policyholder suffers from accidental dismemberment or death. The amount of coverage provided by AD&D insurance varies, but it typically ranges from $25,000 to $500,000 or more. The rider can be added to a variety of insurance policies, including life insurance, disability insurance, and health insurance.

Here are some key points to keep in mind about the AD&D Rider:

1. Enhanced coverage for dismemberment or death: The AD&D Rider provides additional coverage for unforeseen events that result in dismemberment or death. This can include accidents that result in the loss of limbs, fingers, or toes, as well as accidents that result in the death of the policyholder.

2. Flexibility: The AD&D Rider can be added to a variety of insurance policies, including life insurance, disability insurance, and health insurance. This allows policyholders to customize their coverage to fit their needs.

3. Low cost: The AD&D Rider is typically very affordable, with premiums that are much lower than other types of insurance. For example, a $100,000 AD&D policy may only cost a few dollars per month.

4. No medical exam required: Unlike other types of insurance, the AD&D Rider typically does not require a medical exam. This makes it easy for policyholders to add this coverage to their existing policies.

5. Exclusions: It is important to note that the AD&D Rider typically has exclusions. For example, it may not cover accidents that occur while the policyholder is under the influence of drugs or alcohol. It is important to carefully review the policy to understand what is and is not covered.

The AD&D Rider is a valuable type of insurance that provides enhanced coverage for unforeseen events that result in dismemberment or death. It is a flexible, affordable, and easy-to-add rider that can be customized to fit your needs. While it does have exclusions, it is an important type of coverage to consider for those who work in high-risk jobs or engage in high-risk activities.

Enhanced Coverage for Unforeseen Events - Insurance Riders: Customizing Your VADD Policy to Fit Your Needs

7. Claiming Losses from Unforeseen Events

1. Casualty and Theft Losses: Claiming Losses from Unforeseen Events

When it comes to investing, unforeseen events can sometimes result in casualty and theft losses. These losses can be devastating, both emotionally and financially. However, the good news is that the IRS provides guidelines on how to claim these losses and potentially mitigate the impact on your investments. In this section, we will explore the various aspects of casualty and theft losses, offering insights from different perspectives to help you navigate this challenging situation.

From an investor's point of view, casualty and theft losses can be particularly distressing as they often involve the loss of tangible assets or property. For example, imagine you have invested in a rental property that gets damaged due to a natural disaster or is burglarized. In such cases, it is crucial to understand the options available to claim your losses and potentially recoup some of the financial damage.

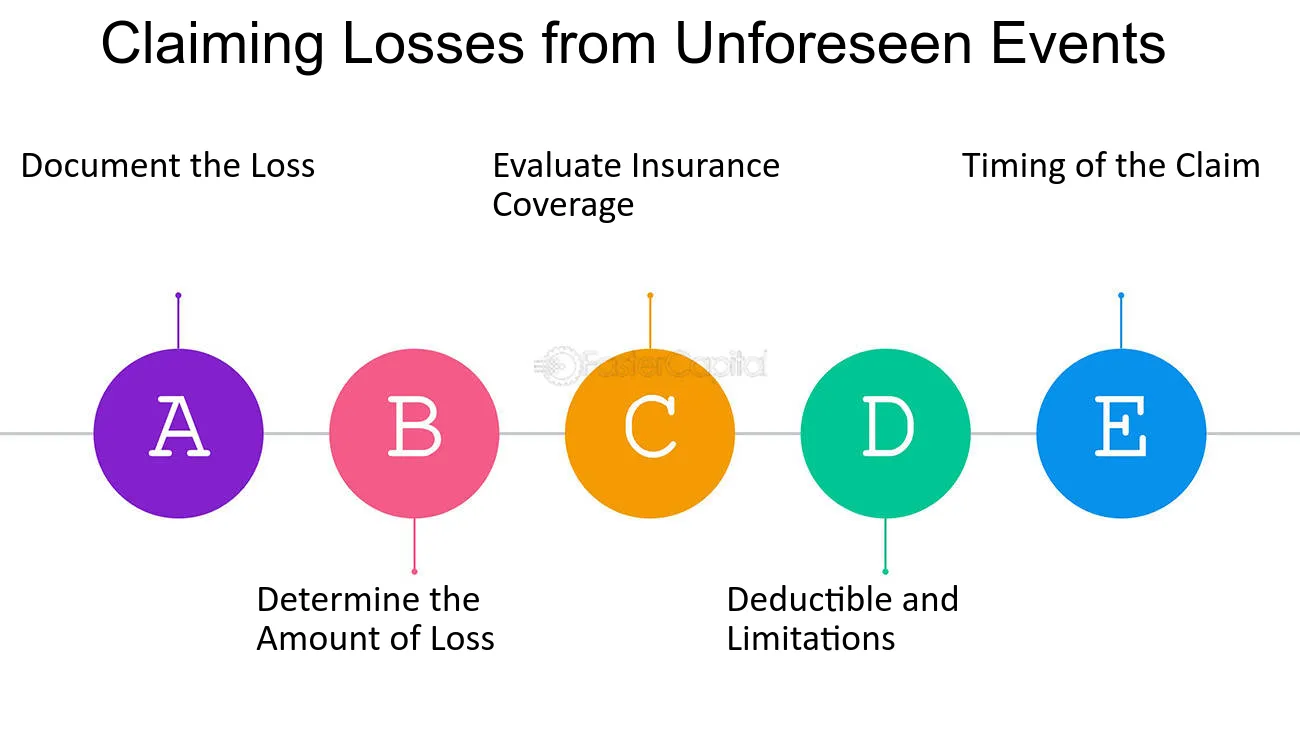

Here are some key insights to consider when dealing with casualty and theft losses:

1. Document the Loss: The first step in claiming a casualty or theft loss is to thoroughly document the event and its impact. This includes gathering evidence such as photographs, police reports, insurance claims, and any other relevant documentation. The more comprehensive your documentation, the stronger your case will be when filing a claim.

2. Determine the Amount of Loss: Calculating the amount of loss can be a complex task, especially when it comes to determining the fair market value of damaged or stolen property. In such cases, it is advisable to consult with professionals like appraisers or tax advisors who can help assess the value accurately. Remember, you can only claim the actual loss suffered, which might be less than the property's initial cost.

3. Evaluate Insurance Coverage: Before filing a claim with the IRS, it is essential to assess your insurance coverage. In some instances, insurance policies might cover a portion or the entirety of your losses. Make sure to review your policy and consult with your insurance provider to understand the extent of coverage and any deductibles.

4. Deductible and Limitations: It is important to note that casualty and theft losses are subject to certain limitations and deductibles. For example, you can only claim losses that exceed 10% of your adjusted gross income (AGI) for the tax year. Additionally, the IRS allows you to deduct casualty and theft losses only to the extent they exceed $100 per event. Understanding these limitations can help you plan your tax strategy accordingly.

5. Timing of the Claim: The timing of your claim is crucial when it comes to casualty and theft losses. Generally, you have to file a claim in the tax year the loss occurred, but the IRS provides options for amending prior-year returns or carrying forward losses in certain circumstances. Consulting with a tax professional can help you determine the most advantageous timing for your claim.

Overall, when faced with casualty and theft losses, it is crucial to act swiftly, diligently document the loss, and understand the options available to you. While it can be a challenging experience, knowing the IRS guidelines and seeking professional advice can help mitigate the financial impact and potentially recover some of the losses incurred.

Claiming Losses from Unforeseen Events - Investment losses: Mitigating Investment Losses: Insights from IRS Pub 536

8. Protecting yourself and your loved ones from unforeseen events

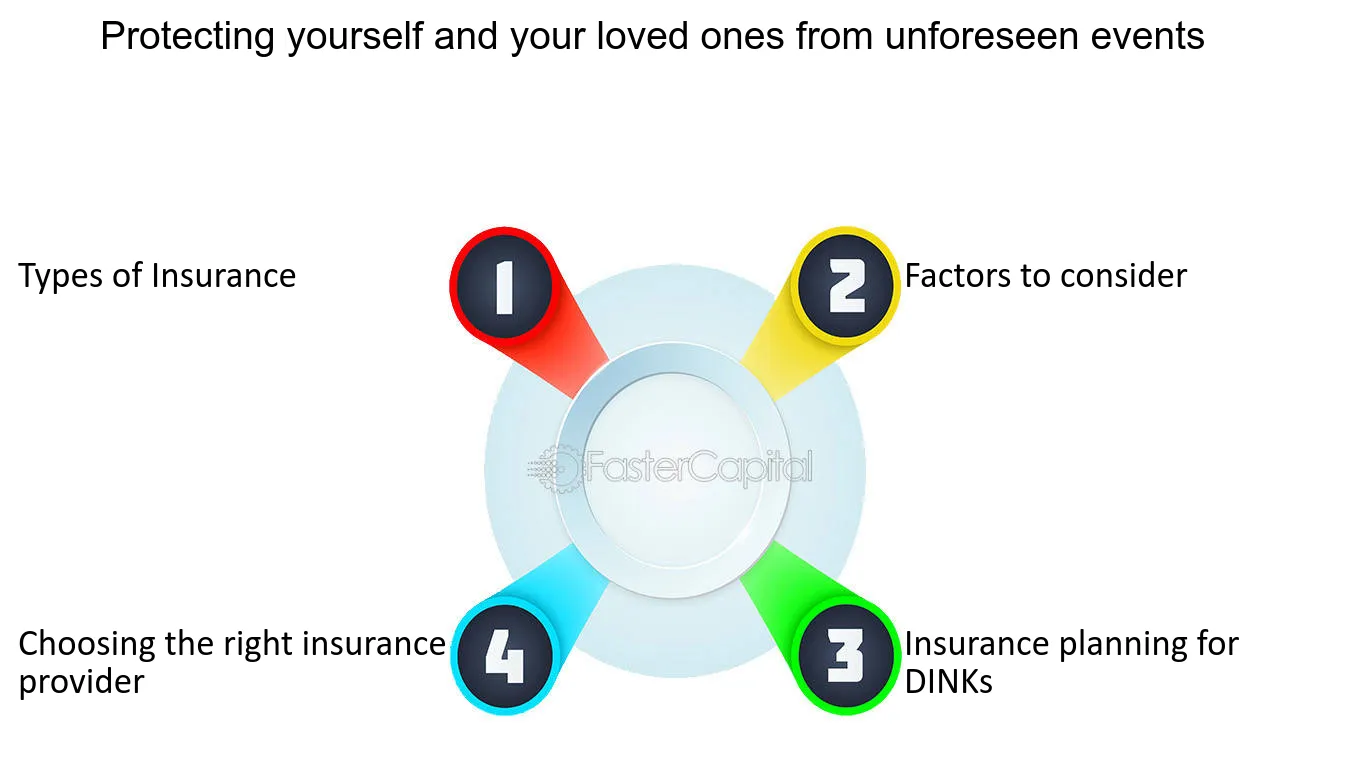

When it comes to planning for the future, insurance is an essential aspect that should not be overlooked. It is a way of protecting yourself and your loved ones from unexpected events that could have a significant impact on your finances and wellbeing. Insurance planning involves assessing your risks and choosing the right policies to mitigate them.

1. Types of Insurance:

There are different types of insurance policies that you can consider depending on your needs. Some of the common types of insurance include life insurance, health insurance, disability insurance, and long-term care insurance. Each policy serves a specific purpose, and it is essential to understand the coverage and benefits before making a decision.

For instance, life insurance is designed to provide financial support to your beneficiaries in case of your death. It can help cover expenses such as funeral costs, outstanding debts, and living expenses. On the other hand, health insurance covers medical expenses, including doctor visits, hospitalization, and prescription drugs. Disability insurance provides income replacement in case you become disabled and cannot work. Lastly, long-term care insurance covers expenses related to long-term care, such as nursing homes or home care.

2. Factors to consider:

When choosing an insurance policy, several factors should be considered. Some of these factors include your age, health status, occupation, family history, and financial situation. These factors can affect the type of policy you choose, the coverage amount, and the premiums you pay.

For example, if you are young and healthy, you may opt for a term life insurance policy that provides coverage for a specific period. However, if you have a pre-existing medical condition, you may need to consider a policy that covers your condition. Your occupation can also affect the premiums you pay, especially if it is a high-risk job.

3. Insurance planning for DINKs:

DINKs (Dual Income No Kids) couples may have different insurance needs compared to couples with children. Since they do not have dependents, they may not need life insurance to cover their beneficiaries. However, they may need disability insurance to protect their income in case of an injury or illness that prevents them from working.

Additionally, DINKs may want to consider long-term care insurance to cover their future care expenses when they retire. Since they do not have children to provide care, long-term care insurance can help cover the costs of a nursing home or home care.

4. Choosing the right insurance provider:

Choosing the right insurance provider is also crucial when it comes to insurance planning. It is essential to research and compare different providers to find the best policy that suits your needs and budget. Look for providers with a good reputation, financial stability, and excellent customer service.

Insurance planning is an essential aspect of planning for the future. It can help protect you and your loved ones from unforeseen events that could affect your finances and wellbeing. Consider the different types of insurance policies available, the factors to consider when choosing a policy, and the insurance needs of DINKs. Lastly, choose the right insurance provider to ensure that you get the best policy and customer service.

Protecting yourself and your loved ones from unforeseen events - Leaving a Lasting Legacy: DINKs and Planning for the Future

9. Dealing with Unforeseen Events

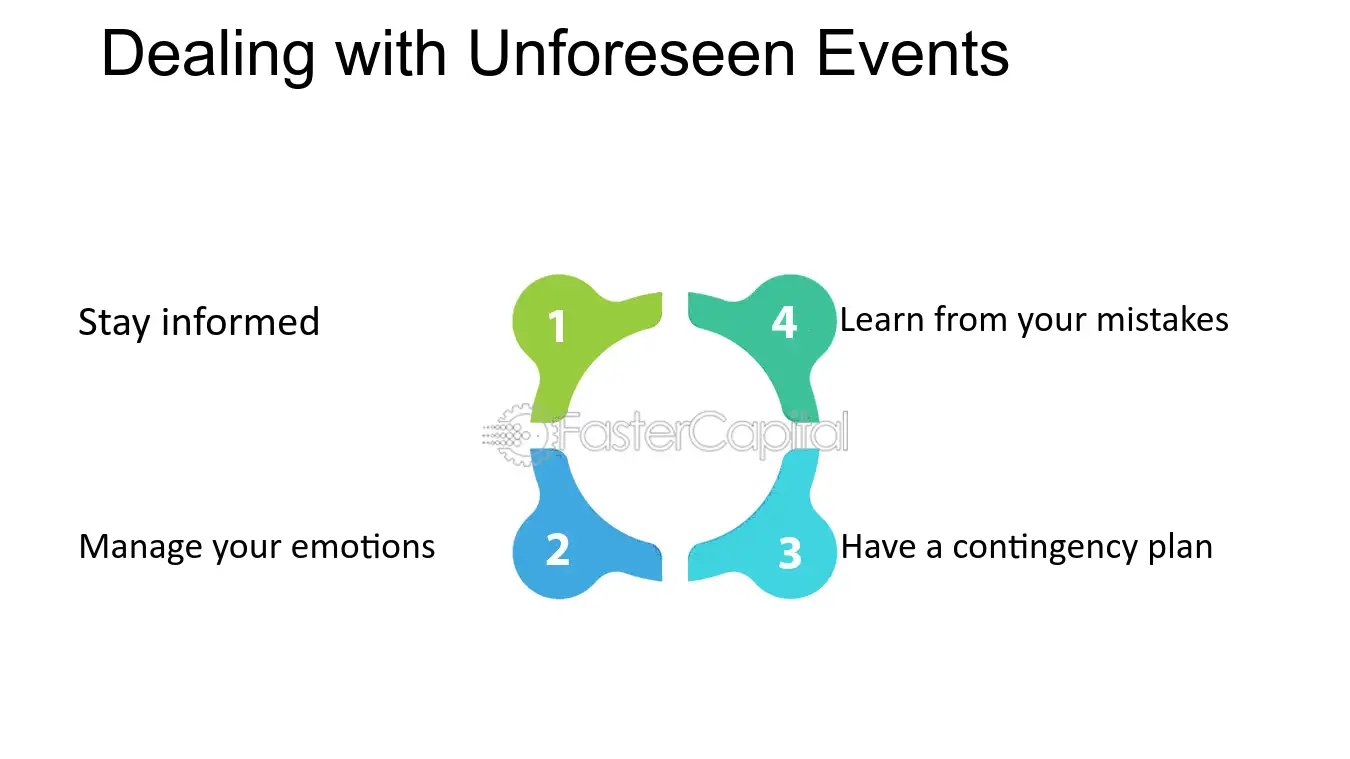

In the world of trading, there are always unforeseen events that can cause the market to behave in unpredictable ways. As an investor, it is important to be prepared for these events and have a solid strategy in place to deal with them. Whether it's a natural disaster, a political crisis, or a sudden shift in the market, having a plan for how to handle these situations can mean the difference between success and failure.

One important strategy for dealing with unforeseen events is to have a diversified portfolio. By investing in a variety of assets, you can spread your risk and reduce your exposure to any one particular event. For example, if you have a portfolio that consists of stocks, bonds, and commodities, a sudden drop in the stock market may not have as significant an impact on your overall portfolio as it would if you were only invested in stocks.

Another important strategy is to have a plan in place for exiting trades quickly. This can be especially important if you are trading options, which can be highly volatile and can lose value quickly if the market moves against you. By having a predetermined exit strategy, you can limit your losses and protect your capital.

Here are some additional tips for dealing with unforeseen events:

1. Stay informed: Keeping up-to-date with the latest news and trends can help you anticipate potential market shifts and adjust your strategy accordingly.

2. Manage your emotions: It can be easy to panic or make impulsive decisions when the market is in turmoil. However, it is important to remain calm and make rational decisions based on your strategy.

3. Have a contingency plan: In some cases, it may be necessary to have a backup plan in case your initial strategy fails. For example, if you are trading a particular stock, you may want to have a plan in place for shorting the stock if it starts to decline rapidly.

4. Learn from your mistakes: Every unforeseen event provides an opportunity to learn and improve your strategy. Take the time to analyze what went wrong and how you can adjust your approach in the future.

Dealing with unforeseen events is an inevitable part of trading. However, by having a solid strategy in place and being prepared for potential market shifts, you can minimize your risk and increase your chances of success.

Dealing with Unforeseen Events - MaxPain and Out of the Money Options: Strategies for Comebacks

10. Preparing for Unforeseen Events

Insurance and contingency planning are crucial components of any comprehensive risk management strategy, especially when it comes to safeguarding repatriable funds. Unforeseen events such as natural disasters, political instability, economic downturns, or even cyber-attacks can have a significant impact on the financial stability of individuals or businesses operating in foreign markets. By proactively preparing for these contingencies through insurance coverage and contingency planning, one can mitigate potential risks and ensure the smooth repatriation of funds.

1. importance of Insurance coverage:

Insurance serves as a safety net that provides financial protection against unexpected events. It helps individuals and businesses recover from losses incurred due to unforeseen circumstances. When it comes to repatriable funds, having appropriate insurance coverage is essential to safeguard against potential risks that may arise during the process of transferring funds back to one's home country.

For instance, consider a multinational corporation with operations in a politically unstable region. In the event of civil unrest or government expropriation, political risk insurance can provide coverage for any losses incurred during the repatriation of funds. This type of insurance protects against political risks such as currency inconvertibility, contract frustration, or even war.

2. Contingency Planning:

Contingency planning involves developing strategies and action plans to address potential risks and minimize their impact. It is essential to identify potential threats and vulnerabilities that could affect the repatriation of funds and devise contingency plans accordingly.

For example, if an individual plans to repatriate a significant amount of money from a foreign investment, they should consider diversifying their portfolio across different asset classes and geographical regions. By spreading their investments, they can reduce the risk associated with any single investment or market downturn.

Currency fluctuations can significantly impact the value of repatriated funds. To mitigate this risk, individuals and businesses can employ various strategies such as hedging techniques or utilizing currency exchange options.

For instance, a company repatriating funds from a foreign subsidiary can enter into forward contracts to lock in exchange rates at a predetermined level. This allows them to protect against adverse currency movements and ensure the value of repatriated funds remains stable.

4. business Interruption insurance:

Business interruption insurance provides coverage for financial losses incurred due to unexpected disruptions in operations. This type of insurance is particularly relevant for businesses operating in regions prone to natural disasters or political instability.

For example, if a manufacturing facility is damaged by a hurricane, business interruption insurance can cover the loss of income during the period of

Preparing for Unforeseen Events - Mitigating Risks: Strategies for Safeguarding Repatriable Funds

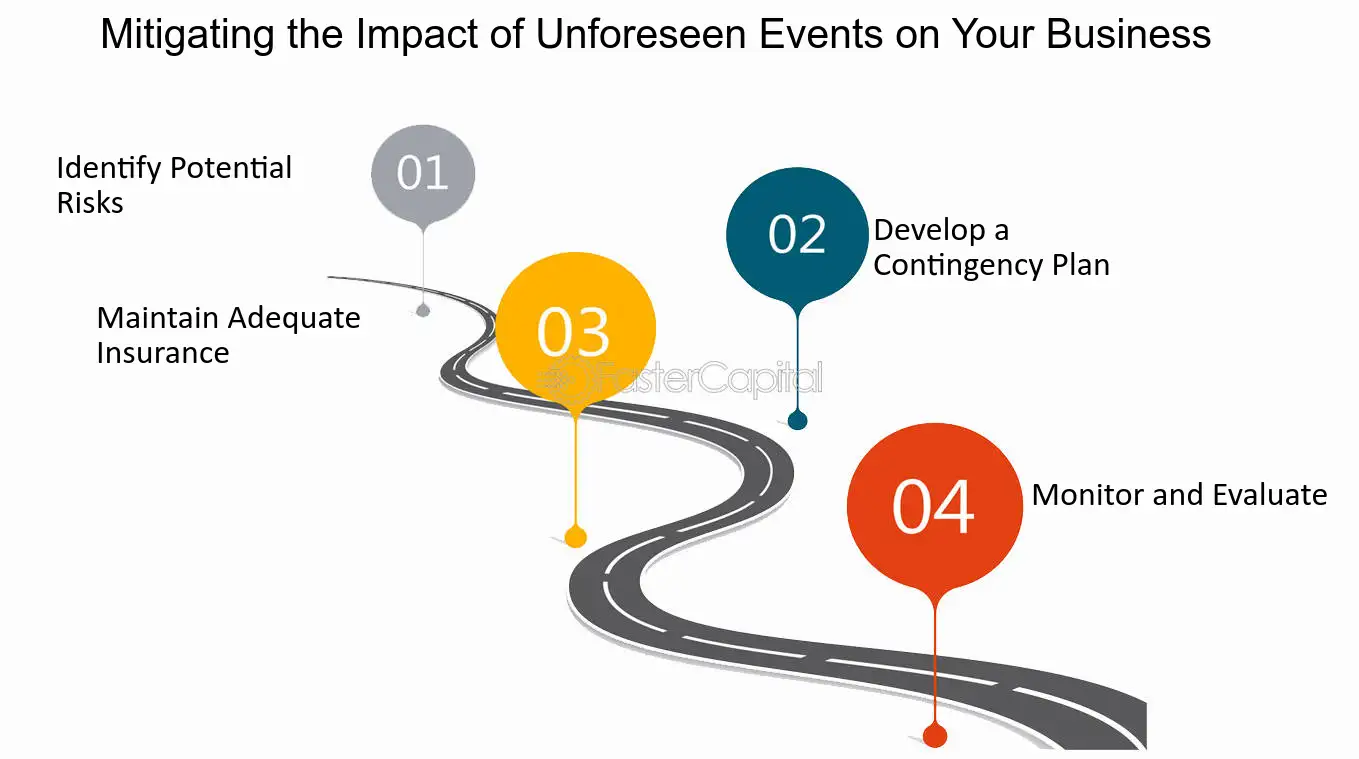

11. Mitigating the Impact of Unforeseen Events on Your Business

When running a business, it is crucial to be prepared for any unforeseen events that may occur. The COVID-19 pandemic has demonstrated how quickly the economic climate can shift, and how businesses that are not prepared to manage risk and uncertainty can be severely impacted. Managing risk and uncertainty requires a proactive approach that involves identifying potential threats to your business and implementing strategies to mitigate their impact.

1. Identify Potential Risks: The first step in managing risk and uncertainty is to identify potential threats to your business. This can include natural disasters, supply chain disruptions, or changes in consumer behavior. By identifying these risks, you can develop strategies to mitigate their impact. For example, if your business relies on a single supplier, you may want to consider diversifying your supply chain to reduce the risk of disruptions.

2. Develop a Contingency Plan: Once potential risks have been identified, it is important to develop a contingency plan to manage them. A contingency plan outlines the steps your business will take in the event of an unforeseen event. For example, if your business relies on in-person sales, you may want to develop an online sales channel to ensure that you can continue to generate revenue if your physical store is forced to close.

3. Maintain Adequate Insurance: Insurance can be a valuable tool in managing risk and uncertainty. By maintaining adequate insurance coverage, you can transfer the risk of certain events to an insurance provider. For example, if your business is located in an area prone to natural disasters, you may want to consider purchasing business interruption insurance to protect your revenue in the event of a disaster.

4. Monitor and Evaluate: Finally, it is important to monitor and evaluate your risk management strategies on an ongoing basis. This can help you identify new risks and adjust your strategies accordingly. For example, if your business relies on a specific product or service, changes in consumer behavior may require you to adjust your marketing strategy to maintain sales.

Managing risk and uncertainty is a critical component of running a successful business. By identifying potential risks, developing a contingency plan, maintaining adequate insurance, and monitoring and evaluating your strategies, you can mitigate the impact of unforeseen events on your business.

Mitigating the Impact of Unforeseen Events on Your Business - Navigating the W Shaped Recovery: Surviving the Economic Downturn

12. Protecting Against Unforeseen Events

When it comes to running a business, risk management is crucial to ensure long-term economic profitability. One of the critical components of risk management is insurance. It provides protection against unforeseen events that can be detrimental to a business's success. Insurance is a contract between an insurer and a policyholder, where the insurer guarantees compensation for specified loss, damage, illness, or death. The policyholder pays a premium to receive this protection. Insurance helps mitigate financial risks by offering a safety net to businesses and individuals in times of need.

There are various types of insurance that businesses can opt for, depending on their risk profile. Here are some of the most common ones:

1. Property Insurance: This type of insurance provides protection against damage or loss of property due to natural disasters, theft, or vandalism. For example, if a fire breaks out in a manufacturing plant, property insurance can cover the damages and help the business get back on its feet.

2. Liability Insurance: Liability insurance covers businesses against legal liabilities arising from accidents, injuries, or damages to third-party property. For instance, if a customer slips and falls in a retail store, liability insurance can cover the legal fees and compensation.

3. Workers' Compensation Insurance: This insurance covers the medical expenses and lost wages of employees who suffer work-related injuries or illnesses. It's mandatory in most states and helps businesses avoid costly lawsuits.

4. business Interruption insurance: This insurance provides coverage for lost income and expenses incurred during a disaster or unforeseen event that disrupts business operations. For instance, if a hurricane damages a hotel, business interruption insurance can cover the lost revenue business recover.

Insurance is an essential aspect of risk management for businesses. It provides protection against unforeseen events that can cause financial ruin. By opting for the right insurance policies, businesses can safeguard their assets, employees, and customers, and ensure long-term economic profitability.

Protecting Against Unforeseen Events - Risk management: Mitigating Risks for Long term Economic Profitability

13. Protecting assets and wealth from unforeseen events

1. The Importance of insurance in Protecting assets and Wealth

When it comes to managing risks and safeguarding one's wealth, insurance plays a crucial role in mitigating unforeseen events that could potentially result in financial loss. Whether it is protecting a home, vehicle, business, or even one's own life, insurance acts as a safety net, offering financial protection and peace of mind. From the perspective of individuals, families, and businesses alike, insurance serves as a vital tool in maintaining financial stability and ensuring long-term prosperity.

2. types of Insurance coverage for Asset Protection

There are various types of insurance coverage available, each designed to cater to specific needs and safeguard different assets. Let's explore some of the most common types:

- Property Insurance: This type of insurance provides coverage for physical assets such as homes, buildings, and personal belongings. It protects against perils like fire, theft, and natural disasters. For instance, homeowners insurance not only covers the structure of a house but also provides liability coverage in case someone is injured on the property.

- auto insurance: Auto insurance offers protection against damage or loss to vehicles, as well as liability coverage in the event of accidents. It is mandatory in many countries and can provide financial assistance for vehicle repairs, medical expenses, and legal costs.

- Life Insurance: Life insurance is a crucial component of financial planning, particularly for individuals with dependents. It provides a lump sum payment to beneficiaries upon the policyholder's death, offering financial support to cover expenses such as mortgage payments, education costs, and daily living expenses.

3. The Benefits of Insurance

Insurance not only provides financial protection but also offers numerous benefits that contribute to overall risk management and wealth preservation. Some advantages of having insurance coverage include:

- Financial Security: Insurance ensures that individuals, families, and businesses are financially protected against unexpected events. By transferring the risk to an insurance company, policyholders can avoid significant financial setbacks that could otherwise deplete their savings or assets.

- Peace of Mind: Knowing that you have insurance coverage in place can bring peace of mind, reducing anxiety and stress associated with potential risks. This allows individuals and businesses to focus on their goals and objectives without constantly worrying about the unknown.

- Risk Mitigation: Insurance serves as a risk management tool, enabling individuals and businesses to transfer potential losses to an insurance company. By paying premiums, policyholders effectively share the risk with the insurer, minimizing the impact of unforeseen events on their financial well-being.

4. Comparing Insurance Options and Choosing the Best Fit

When it comes to selecting insurance coverage, it is essential to evaluate different options and choose the best fit based on individual needs and circumstances. Factors to consider include coverage limits, deductibles, premiums, and the reputation of the insurance provider. Let's consider an example:

For homeowners insurance, comparing quotes from multiple insurers can help identify the best option. Company A offers coverage with a lower premium but higher deductibles, while Company B has slightly higher premiums but lower deductibles. By assessing the potential risks, budgetary constraints, and personal preferences, individuals can make an informed decision based on their unique circumstances.

Insurance serves as a fundamental tool in protecting assets and wealth from unforeseen events. By understanding the various types of insurance coverage available, recognizing the benefits it offers, and comparing different options, individuals and businesses can effectively manage risks and safeguard their financial well-being.

Protecting assets and wealth from unforeseen events - Risk Management: Mitigating Risks to Safeguard Wealth Effect

14. Developing a Plan for Dealing with Unforeseen Events

In investing, risk is inevitable and it is important for investment companies to have a plan in place for dealing with unexpected events. This plan should be developed before any risk occurs, and should be regularly reviewed and updated. Responding to risk can be challenging, especially if the event is significant and unexpected. However, having a plan in place can help investment companies to minimize the impact of the event and protect their portfolio.

1. Identify the risk: The first step in developing a plan for dealing with unforeseen events is to identify the risks that are most likely to affect the portfolio. This can include risks related to market volatility, changes in regulations, geopolitical events, and natural disasters. By identifying these risks, investment companies can develop a better understanding of the potential impact they could have on their portfolio.

2. Evaluate the risk: Once the risks have been identified, the next step is to evaluate them. This involves assessing the likelihood of the risk occurring, as well as the potential impact it could have on the portfolio. This evaluation should take into account the current market conditions, as well as any changes that may be occurring in the broader economy.

3. Develop a plan: Based on the evaluation of the risks, investment companies should develop a plan for how they will respond to each one. This plan should include specific actions that can be taken to minimize the impact of the risk on the portfolio. For example, if the risk is related to market volatility, the plan might include strategies for hedging against losses or diversifying the portfolio.

4. Test the plan: Once the plan has been developed, it is important to test it to ensure that it is effective. This can involve running simulations or stress tests to see how the plan would perform in different scenarios. This testing can help to identify any weaknesses in the plan and allow for adjustments to be made before an actual event occurs.

5. Communicate the plan: It is important to communicate the plan to all relevant stakeholders, including investors, employees, and partners. This can help to ensure that everyone understands their role in responding to the risk and can work together to minimize the impact on the portfolio.

6. Review and update the plan: Finally, it is important to regularly review and update the plan to ensure that it remains effective. This can involve assessing whether any new risks have emerged, as well as evaluating the effectiveness of the plan in responding to previous events.

In responding to risk, investment companies have a number of options available to them. These can include strategies such as hedging, diversification, and active management. Ultimately, the best option will depend on a variety of factors, including the nature of the risk, the size of the portfolio, and the investment objectives of the company. However, by developing a plan for dealing with unforeseen events and regularly reviewing and updating it, investment companies can better protect their portfolio and minimize the impact of any unexpected events.

For example, during the COVID-19 pandemic, many investment companies were faced with unexpected market volatility and economic uncertainty. Those that had developed a plan for responding to such events were better equipped to navigate the crisis and protect their portfolio. This might have included strategies such as diversification, active management, and hedging against losses. By having a plan in place, investment companies were able to respond quickly and effectively to the risks posed by the pandemic, minimizing the impact on their portfolio and investors.

Developing a Plan for Dealing with Unforeseen Events - Risk Management in Investment Companies: Safeguarding Your Portfolio

15. Dealing with Unforeseen Events and Reputation Damage

In the fast-paced and competitive world of the term paper industry, risk management is crucial to protect profits and maintain a solid reputation. One of the key aspects of risk management is crisis management, which involves effectively dealing with unforeseen events and reputation damage. In this section, we will explore the importance of crisis management in the term paper industry and discuss strategies to mitigate the impact of crises.

1. Understanding the Importance of Crisis Management:

Crisis management is essential in any industry, but it holds particular significance in the term paper industry due to its sensitive nature. A crisis can arise from various factors, such as plagiarism allegations, data breaches, or unethical practices. Failing to handle a crisis promptly and effectively can lead to severe reputation damage, loss of customers, and legal consequences. Therefore, term paper companies need to be proactive in their crisis management approach.

2. Building a Crisis Management Plan:

To effectively deal with unforeseen events and reputation damage, term paper companies should have a well-defined crisis management plan in place. This plan should outline the roles and responsibilities of key personnel, establish communication protocols, and define strategies for damage control. By having a structured plan, companies can respond swiftly and minimize the negative impact of a crisis.

3. Monitoring and Early Detection:

One of the key aspects of crisis management is monitoring and early detection of potential crises. Term paper companies should invest in tools and technology to monitor online platforms, social media, and academic communities for any negative mentions or potential threats. By identifying issues at an early stage, companies can take proactive measures to address them before they escalate into full-blown crises.

4. Swift and Transparent Communication:

During a crisis, effective communication is paramount. Term paper companies should prioritize swift and transparent communication with all stakeholders, including customers, employees, and the public. Transparency helps build trust and credibility, while timely communication can help mitigate the spread of misinformation. Companies should have designated spokespersons who are trained to handle crisis communication and provide accurate information to all parties involved.

5. Rebuilding Trust and Reputation:

In the aftermath of a crisis, term paper companies must focus on rebuilding trust and reputation. This can be achieved by taking responsibility for any wrongdoing, implementing corrective measures, and demonstrating a commitment to ethical practices. Companies should also engage in proactive measures, such as offering apologies, refunds, or free revisions, to regain the trust of affected customers. Rebuilding reputation takes time and effort, but it is crucial for long-term success in the term paper industry.

6. Learning from Past Crises:

Every crisis presents an opportunity for learning and improvement. Term paper companies should conduct thorough post-crisis evaluations to identify shortcomings in their crisis management approach. By analyzing the root causes and impact of the crisis, companies can implement preventive measures to minimize the likelihood of similar events in the future. Learning from past crises ensures continuous improvement and strengthens the overall risk management strategy.

Crisis management plays a vital role in the term paper industry to protect profits and maintain a reputable image. By understanding the importance of crisis management, building a comprehensive plan, monitoring for early detection, communicating effectively, and focusing on rebuilding trust, term paper companies can navigate through unforeseen events and reputation damage with resilience.

Dealing with Unforeseen Events and Reputation Damage - Risk Management in the Term Paper Industry: Protecting Profits

16. Developing Contingency Plans for Unforeseen Events

Developing contingency plans for unforeseen events is a crucial aspect of risk management strategies that organizations must adopt to safeguard their internal capital generation rate. Unforeseen events can range from natural disasters and economic downturns to technological failures and cyber-attacks, all of which have the potential to disrupt business operations and impact financial stability. By proactively identifying potential risks and developing contingency plans, businesses can minimize the negative consequences of such events and ensure continuity in their operations.

From a strategic perspective, developing contingency plans allows organizations to anticipate potential risks and devise appropriate responses. This proactive approach enables businesses to mitigate the impact of unforeseen events on their internal capital generation rate by minimizing downtime, reducing financial losses, and maintaining customer trust. Moreover, having well-defined contingency plans in place enhances an organization's ability to respond swiftly and effectively during times of crisis, thereby minimizing disruption and ensuring business continuity.

From an operational standpoint, contingency planning involves a systematic assessment of potential risks and vulnerabilities across various aspects of the organization. This includes evaluating the impact of different scenarios on critical functions such as supply chain management, production processes, IT infrastructure, and workforce availability. By conducting thorough risk assessments, businesses can identify areas that are most susceptible to disruption and prioritize their efforts accordingly.

To develop effective contingency plans for unforeseen events, organizations should consider the following key steps:

1. Risk identification: Conduct a comprehensive analysis to identify potential risks that could impact the internal capital generation rate. This may involve assessing external factors such as market volatility or regulatory changes, as well as internal factors like operational weaknesses or inadequate disaster recovery measures.

2. Impact assessment: Evaluate the potential consequences of each identified risk on the organization's financial stability and internal capital generation rate. This step helps prioritize risks based on their severity and likelihood of occurrence.

3. Response planning: Develop specific strategies and actions to address each identified risk. This may include implementing preventive measures, establishing alternative supply chains or backup systems, and defining communication protocols to ensure effective crisis management.

For example, a manufacturing company may develop a contingency plan to address the risk of supply chain disruption due to a natural disaster. This plan could involve identifying alternative suppliers, establishing stockpiles of critical raw materials, and implementing robust logistics strategies to minimize downtime and maintain production levels.

4. Testing and training: Regularly test the effectiveness of contingency plans through simulations or drills. This allows organizations to identify any gaps or weaknesses in their response strategies and make necessary adjustments. Additionally, providing training to employees on their roles and responsibilities during a crisis

Developing Contingency Plans for Unforeseen Events - Risk Management Strategies: Safeguarding Internal Capital Generation Rate

17. Developing a Contingency Plan for Unforeseen Events

Developing a contingency plan for unforeseen events is an essential aspect of safeguarding unrestricted net assets. In today's unpredictable world, organizations must be prepared to face unexpected challenges that could potentially impact their financial stability. By proactively identifying potential risks and developing strategies to mitigate them, nonprofits can ensure the long-term sustainability of their operations and protect their valuable assets.

From the perspective of risk management experts, a contingency plan serves as a roadmap to navigate through uncertain times. It provides a structured approach to deal with emergencies, such as natural disasters, economic downturns, or even pandemics like the recent COVID-19 crisis. By having a well-thought-out plan in place, organizations can minimize disruptions to their operations and maintain financial stability during challenging periods.

Insights from financial advisors emphasize the importance of conducting a thorough risk assessment before developing a contingency plan. This involves identifying potential threats that could impact the organization's financial health and evaluating their likelihood and potential impact. For example, if an organization heavily relies on government grants for funding, changes in political priorities or budget cuts could pose a significant risk. By understanding these risks upfront, nonprofits can develop targeted strategies to address them effectively.

To provide comprehensive information about developing a contingency plan for unforeseen events, here are some key points to consider:

1. Identify potential risks: Conduct a risk assessment to identify all possible threats that could impact your organization's financial stability. Consider both internal factors (e.g., operational vulnerabilities) and external factors (e.g., economic fluctuations).

2. Evaluate likelihood and impact: Assess the probability of each identified risk occurring and determine its potential impact on your organization's unrestricted net assets. This evaluation will help prioritize risks and allocate resources accordingly.

3. Develop response strategies: Once risks are identified and evaluated, develop specific strategies to address each one effectively. These strategies may include diversifying funding sources, creating cash reserves, or establishing partnerships with other organizations for shared resources during emergencies.

4. Establish communication protocols: Effective communication is crucial during times of crisis. Develop a communication plan that outlines how information will be disseminated to stakeholders, including staff, board members, donors, and the public. Clear and timely communication can help maintain trust and confidence in your organization's ability to navigate through unforeseen events.

5. Test and update the plan: Regularly review and test your contingency plan to ensure its effectiveness. Conducting drills or simulations can help identify any gaps or weaknesses that need to be addressed. Additionally, update the plan as new risks emerge or existing

Developing a Contingency Plan for Unforeseen Events - Safeguarding Unrestricted Net Assets: Risk Management Strategies

18. Preparing for Unforeseen Events through Comprehensive Financial Planning

Contingency planning is a critical aspect of financial planning in business budgeting. It involves preparing for unforeseen events and developing strategies to mitigate their impact. Here's how comprehensive financial planning helps businesses in contingency planning:

1. Identifying potential risks: Financial planning enables businesses to identify potential risks and uncertainties that can impact their financial performance. By conducting risk assessments and scenario analysis, companies can anticipate potential challenges and develop contingency plans to address them. This helps in budgeting by ensuring that the allocated funds include provisions for risk management and contingency planning.

2. Developing alternative scenarios: Financial planning involves developing alternative scenarios and strategies to address potential risks. By considering various options and evaluating their feasibility, companies can develop contingency plans that can be implemented in case of unforeseen events. For example, a manufacturing company may develop alternative sourcing strategies to address supply chain disruptions.

3. Allocating resources for contingencies: Financial planning allows businesses to allocate financial resources for contingencies effectively. By considering the potential impact and likelihood of different risks, companies can determine the amount of funds that should be allocated for risk management and contingency planning. This helps in budgeting by ensuring that the company has sufficient resources to address unexpected events.

4. Regular review and adjustment: Financial planning includes regular review and adjustment of contingency plans. By monitoring the business environment and evaluating the effectiveness of existing strategies, companies can make necessary adjustments to their contingency plans. This helps in budgeting by ensuring that the allocated funds are utilized efficiently and that the company is prepared to respond to unforeseen events.

By incorporating contingency planning into their financial planning process, businesses can identify potential risks, develop strategies to mitigate them, allocate resources effectively, and ensure business continuity in the face of unexpected events.

Preparing for Unforeseen Events through Comprehensive Financial Planning - The Importance of Financial Planning in Business Budgeting

19. Types of Unforeseen Events That Can Affect Your Business

Running a business is not only about making profits and achieving your goals. It also involves risks and challenges that can come in many forms. Unforeseen events can happen at any time, and if your business is not prepared to handle them, they can severely impact your operations, financial status, and reputation. These events can be natural disasters, economic crises, political instability, or cybersecurity attacks. While it is impossible to predict when these events will occur, you can anticipate them by developing a cushion to help mitigate the impact. Here are some types of unforeseen events that can affect your business:

1. Natural Disasters: Natural disasters such as floods, hurricanes, earthquakes, and wildfires can cause physical damage to your business property, disrupt your supply chain, and affect your employees' safety. For example, Hurricane Katrina in 2005 caused significant damage to many businesses in New Orleans, resulting in billions of dollars in losses.

2. Economic Crises: Economic crises can result from a recession, inflation, deflation, or changes in the market demand for your products or services. These can cause a reduction in revenue, cash flow problems, and even bankruptcy. For instance, the 2008 global financial crisis had a significant impact on many businesses, particularly those in the financial sector.

3. Political Instability: Political instability can arise due to changes in government policies, regulations, or international trade agreements. These can lead to increased taxes, tariffs, or sanctions that can affect your bottom line. For example, the ongoing trade war between the US and China has impacted many businesses that depend on imports and exports.

4. Cybersecurity Attacks: Cybersecurity attacks such as hacking, malware, and phishing can compromise your data, intellectual property, and customer information. These can result in reputational damage, legal liabilities, and financial losses. For instance, the 2017 Equifax data breach affected over 140 million customers, resulting in significant losses for the company.

These unforeseen events can significantly impact your business, and it's crucial to have a cushion to mitigate their effects. By anticipating these risks and developing a plan to handle them, you can ensure that your business remains resilient and can quickly recover from any unexpected event.

Types of Unforeseen Events That Can Affect Your Business - Unforeseen events: Accounting Cushion: Preparing for Unforeseen Events