1. Calling a Bond Before Maturity

When it comes to investing, callable bonds can be both an attractive and complicated option. They are attractive because they often offer higher yields than non-callable bonds. However, callable bonds also come with a unique risk: the bond issuer may choose to call the bond before its maturity date. This means that the investor may receive their principal back earlier than expected, which can be a good thing in some scenarios, but it can also be a problem for investors who were counting on the bond to provide a steady stream of income. The investor's dilemma is whether to invest in a callable bond, knowing that it may be called early, or to invest in a non-callable bond, which may offer a lower yield.

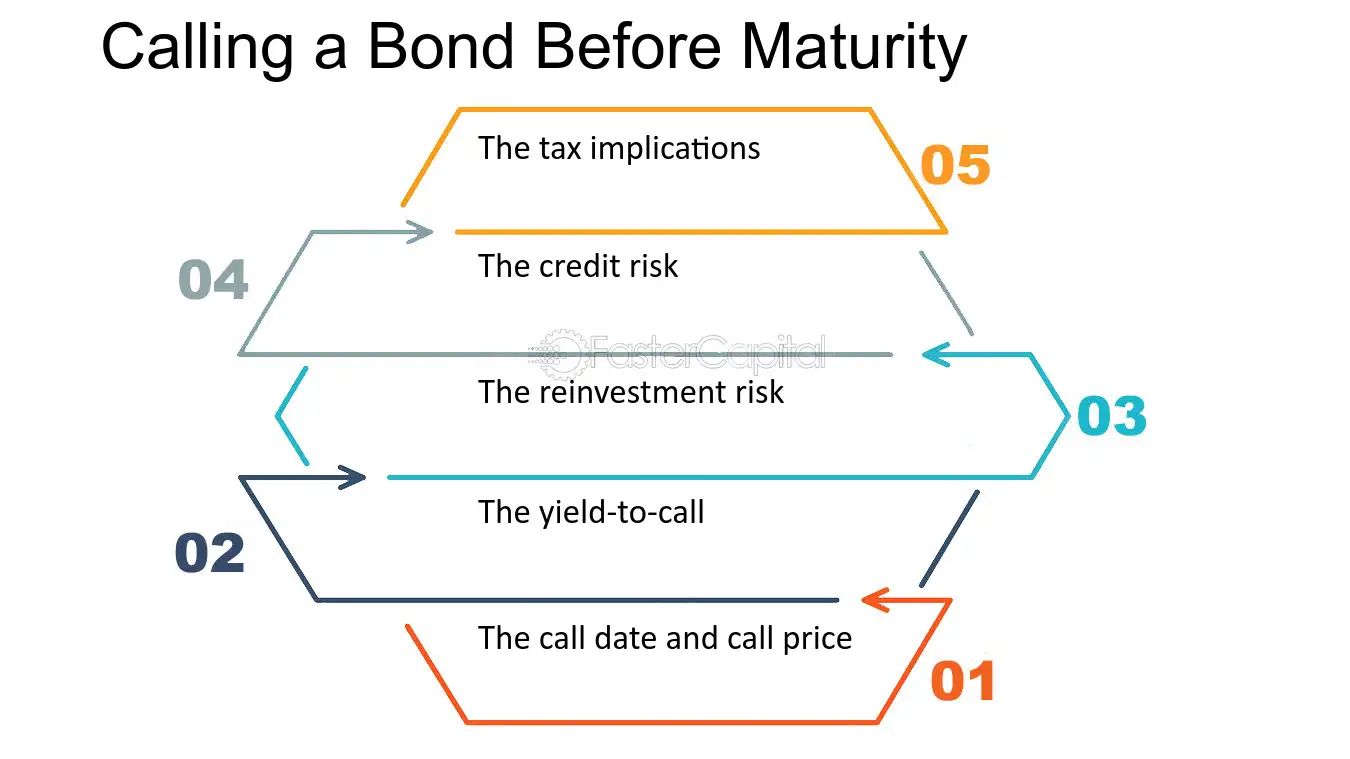

Here are some key points to consider when faced with a callable bond:

1. The call date and call price: When investing in a callable bond, it's important to look at the call date and call price. The call date is the earliest date that the bond issuer can call the bond. The call price is the price at which the bond will be called. If the call price is lower than the current market price, the issuer is more likely to call the bond. On the other hand, if the call price is higher than the current market price, the issuer is less likely to call the bond.

2. The yield-to-call: The yield-to-call is the yield that the investor will receive if the bond is called at the first possible date. This is an important factor to consider when investing in callable bonds, as it can impact the investor's return. Investors should compare the yield-to-call to the yield-to-maturity, which is the yield that the investor will receive if the bond is held until maturity.

3. The reinvestment risk: If a callable bond is called early, the investor will have to find a new investment to replace the income from the bond. This can be a problem if interest rates have fallen since the bond was originally purchased, as the investor may have to accept a lower yield on a new investment.

4. The credit risk: Callable bonds are often issued by companies with lower credit ratings. This means that there is a higher risk of default, which can result in the investor losing their principal investment.

5. The tax implications: Investors should also consider the tax implications of investing in callable bonds. If a bond is called before its maturity date, the investor may have to pay taxes on any capital gains earned from the investment.

In summary, callable bonds can be a good investment option for investors looking for higher yields. However, they also come with a unique set of risks and challenges. Before investing in a callable bond, it's important to carefully consider the call date and price, the yield-to-call, the reinvestment risk, the credit risk, and the tax implications. By doing so, investors can make an informed decision about whether a callable bond is the right investment for their portfolio.

Calling a Bond Before Maturity - Accrued Interest and Callable Bonds: The Investor s Dilemma

2. Introduction to Bond Maturity Dates

When investing in bonds, it is crucial to understand the concept of maturity dates. A bond's maturity date refers to the date on which the issuer of the bond will repay the principal amount to the bondholder. This means that the bond will no longer be in effect after its maturity date, and the bondholder will receive the full face value of the bond.

2. Understanding Maturity Dates

Maturity dates are an essential aspect of bond investing as they determine the length of time an investor will hold the bond before receiving the principal amount. bonds can have various maturity dates, ranging from short-term to long-term. Short-term bonds typically have maturity dates within one to three years, while long-term bonds can have maturity dates that extend up to 30 years or more.

For instance, let's consider a hypothetical bond with a maturity date of 10 years. If an investor purchases this bond, they will hold it for the entire duration of the 10-year period. Once the maturity date is reached, the investor will receive the full face value of the bond. However, it is important to note that bond prices may fluctuate during the holding period, which can impact the overall return on investment.

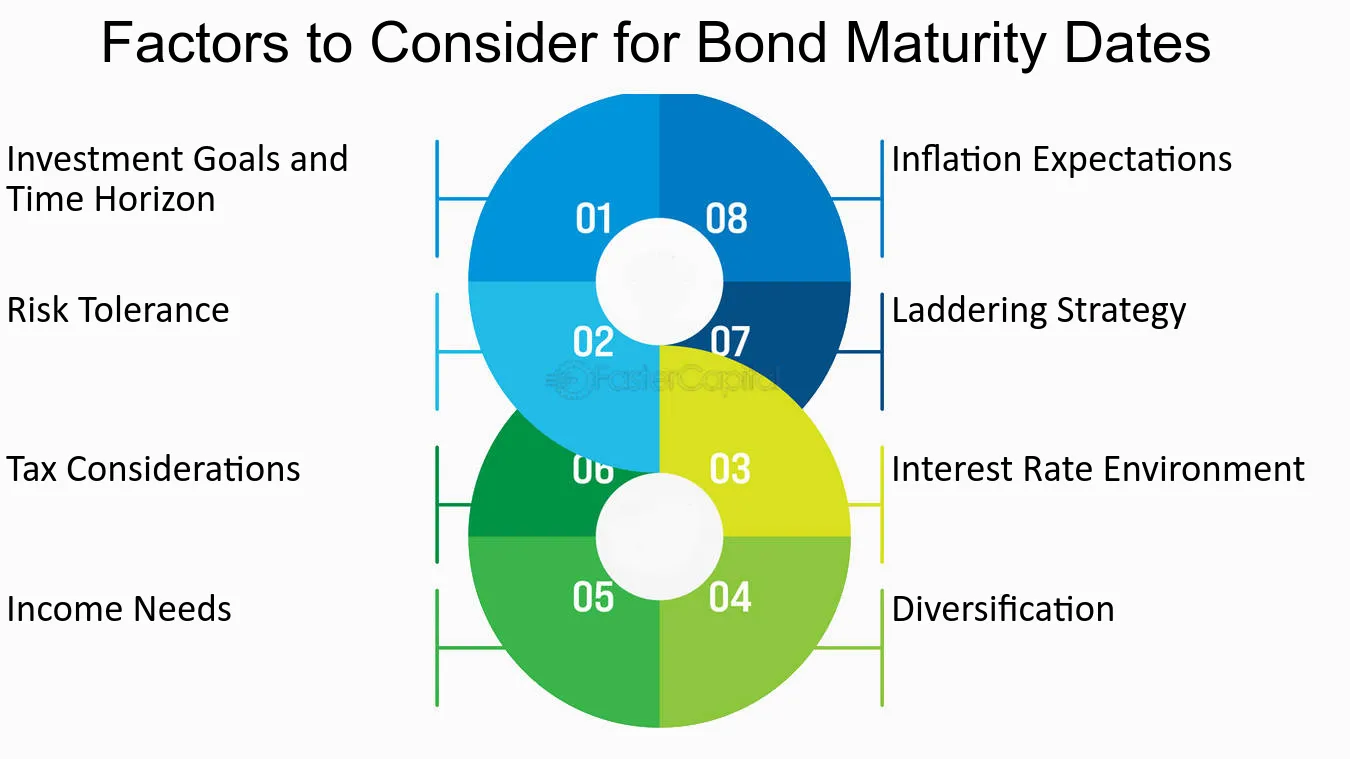

3. Tips for Bond Maturity Dates

When considering bond maturity dates, here are a few tips to keep in mind:

- Match your investment goals: Choose bonds with maturity dates that align with your investment goals. If you have a short-term financial goal, opting for bonds with shorter maturity dates may be more suitable. On the other hand, if you have a long-term investment horizon, longer-term bonds may be a better fit.

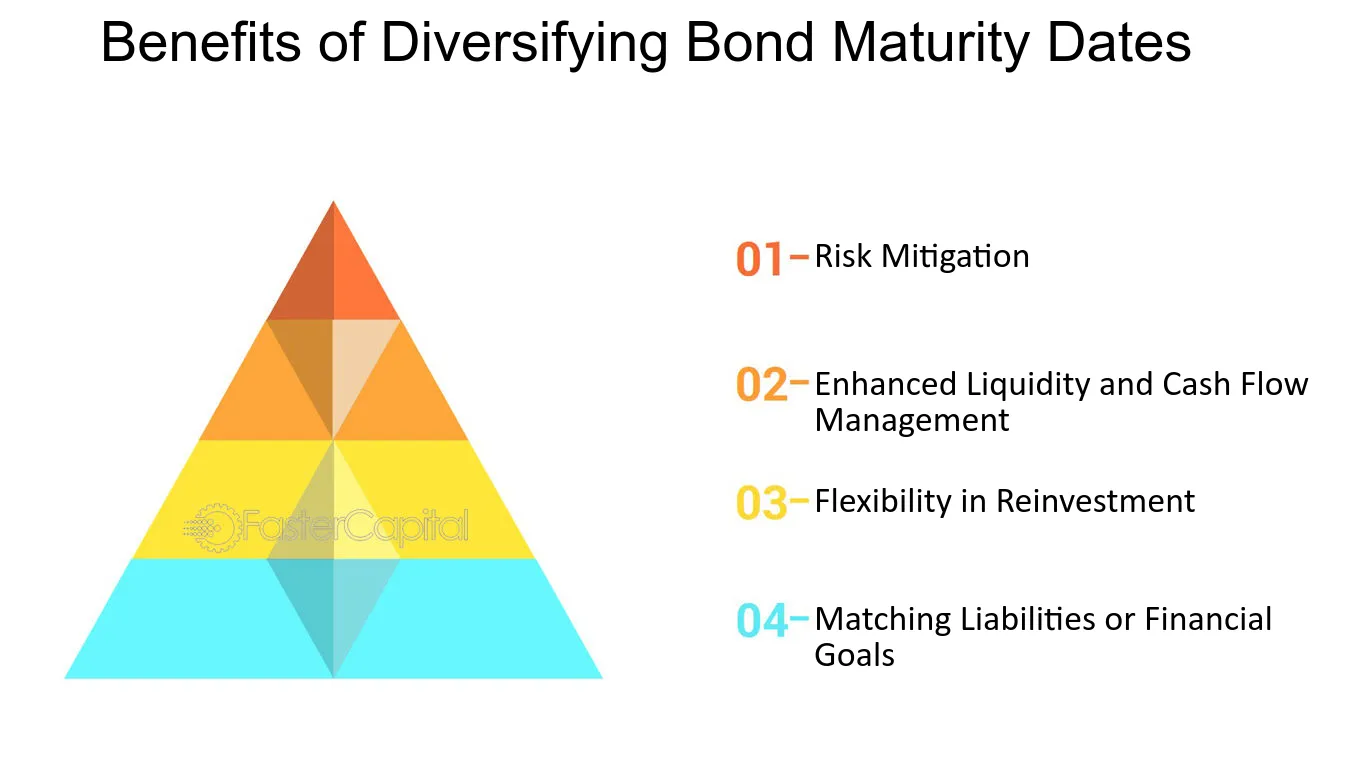

- diversify your bond portfolio: Spread your investments across bonds with different maturity dates. This diversification strategy helps mitigate risk and ensures that you have a mix of short-term and long-term bonds in your portfolio.

- Consider reinvestment risk: When investing in bonds with shorter maturity dates, be aware of the reinvestment risk. Once the bond matures, you will need to reinvest the principal amount, and the prevailing interest rates at that time may be lower than what you initially earned. This can impact your overall return on investment.

4. Case Study: Bond Maturity Dates in Practice

To illustrate the importance of bond maturity dates, let's consider a case study. Imagine an investor who purchases two bonds: one with a maturity date of five years and another with a maturity date of 20 years. After five years, the bond with the shorter maturity date matures, and the investor receives the principal amount. However, the bond with the longer maturity date continues to accrue interest for another 15 years. This case study highlights how bond maturity dates impact the timing of receiving principal amounts and the duration of investment.

In conclusion, understanding bond maturity dates is crucial for bond investors. It helps determine the length of time an investor will hold a bond before receiving the principal amount. By aligning maturity dates with investment goals, diversifying bond portfolios, and considering reinvestment risks, investors can make informed decisions and maximize their returns in bond investing.

Introduction to Bond Maturity Dates - Bond: Understanding Maturity Date in Bond Investing

3. Types of Bond Maturity Dates

Short-term maturity dates refer to bonds that have a relatively short duration, typically ranging from a few months to a few years. These bonds are suitable for investors who prefer a quick return on their investment or have a shorter investment horizon. Short-term bonds are generally considered to be less risky compared to long-term bonds, as they are less susceptible to interest rate fluctuations and market volatility. For instance, Treasury bills (T-bills) are a popular example of short-term bonds, with maturities ranging from a few days to one year. These bonds are issued by the government and are considered to be one of the safest investment options available.

2. Medium-term Maturity Dates:

Medium-term maturity dates refer to bonds that have an intermediate duration, typically ranging from 5 to 10 years. These bonds are suitable for investors who are looking for a balance between risk and return. Medium-term bonds offer a higher yield compared to short-term bonds, as investors are committing their funds for a longer period. However, they also come with a degree of interest rate and inflation risk. Examples of medium-term bonds include corporate bonds and municipal bonds. Corporate bonds are issued by companies to raise capital, while municipal bonds are issued by state and local governments to fund public projects.

3. Long-term Maturity Dates:

Long-term maturity dates refer to bonds with longer durations, typically exceeding 10 years. These bonds are suitable for investors with a long-term investment horizon and a higher risk tolerance. Long-term bonds offer the potential for higher returns, but they also come with a higher level of risk. One of the key risks associated with long-term bonds is interest rate risk, as changes in interest rates can significantly impact the market value of these bonds. Examples of long-term bonds include government bonds, such as Treasury bonds and inflation-protected securities (TIPS).

Tips for Bond Investors:

- Diversify your portfolio: It is important to diversify your bond investments across different maturity dates. This helps to spread the risk and reduce the impact of interest rate fluctuations on your overall portfolio.

- Consider your investment goals: Before investing in bonds, consider your investment goals and time horizon. short-term bonds may be more suitable for investors with short-term goals, while long-term bonds may be better for those with long-term goals.

- Stay updated on market conditions: Keep an eye on interest rate movements and economic indicators that can impact bond prices. Understanding market conditions can help you make informed investment decisions.

Case Study:

Let's consider an example to illustrate the impact of bond maturity dates on investment returns. Suppose you have $10,000 to invest and are torn between investing it in a short-term bond with a maturity of one year and a long-term bond with a maturity of 20 years. The short-term bond offers an annual yield of 2%, while the long-term bond offers an annual yield of 4%.

If you invest in the short-term bond, you would earn $200 in interest over the course of one year. On the other hand, if you invest in the long-term bond, you would earn $400 in interest each year for 20 years, totaling $8,000 in interest over the bond's lifespan.

In this case, while the long-term bond carries more risk, it offers a significantly higher return compared to the short-term bond. However, it is important to consider your risk tolerance and investment goals before making a decision.

Remember, understanding the different types of bond maturity dates is crucial in bond investing. It allows you to align your investment strategy with your financial goals and risk tolerance.

Types of Bond Maturity Dates - Bond: Understanding Maturity Date in Bond Investing

4. Understanding the concept of bond maturity and its importance in portfolio stability

Understanding the concept of bond maturity and its importance in portfolio stability:

When it comes to investing in bonds, one of the key factors to consider is the bond maturity. Bond maturity refers to the length of time until the bond issuer repays the principal amount to the bondholder. It is an essential aspect to understand as it greatly affects the stability and performance of a portfolio. By comprehending the concept of bond maturity, investors can make informed decisions and effectively manage their risk exposure.

1. Importance of Bond Maturity:

Bond maturity plays a crucial role in determining the stability of a portfolio. It allows investors to assess the time horizon of their investments and align them with their financial goals. Understanding the importance of bond maturity helps investors gauge the potential risks and rewards associated with different investment options.

2. Short-Term vs. long-Term bonds:

One of the primary considerations when it comes to bond maturity is the choice between short-term and long-term bonds. Short-term bonds typically have maturities ranging from one to five years, while long-term bonds can have maturities of ten years or more. Each option has its own advantages and disadvantages.

- Short-term bonds provide investors with more liquidity and flexibility. They offer relatively lower interest rate risk, as the principal is repaid sooner. This makes them suitable for investors who have near-term financial obligations or prefer a more conservative approach.

- On the other hand, long-term bonds generally offer higher interest rates, compensating investors for the extended maturity period. They can provide a steady stream of income over a longer period and may be suitable for investors with a longer time horizon and higher risk tolerance.

It is important to carefully consider one's financial goals and risk tolerance when deciding between short-term and long-term bonds.

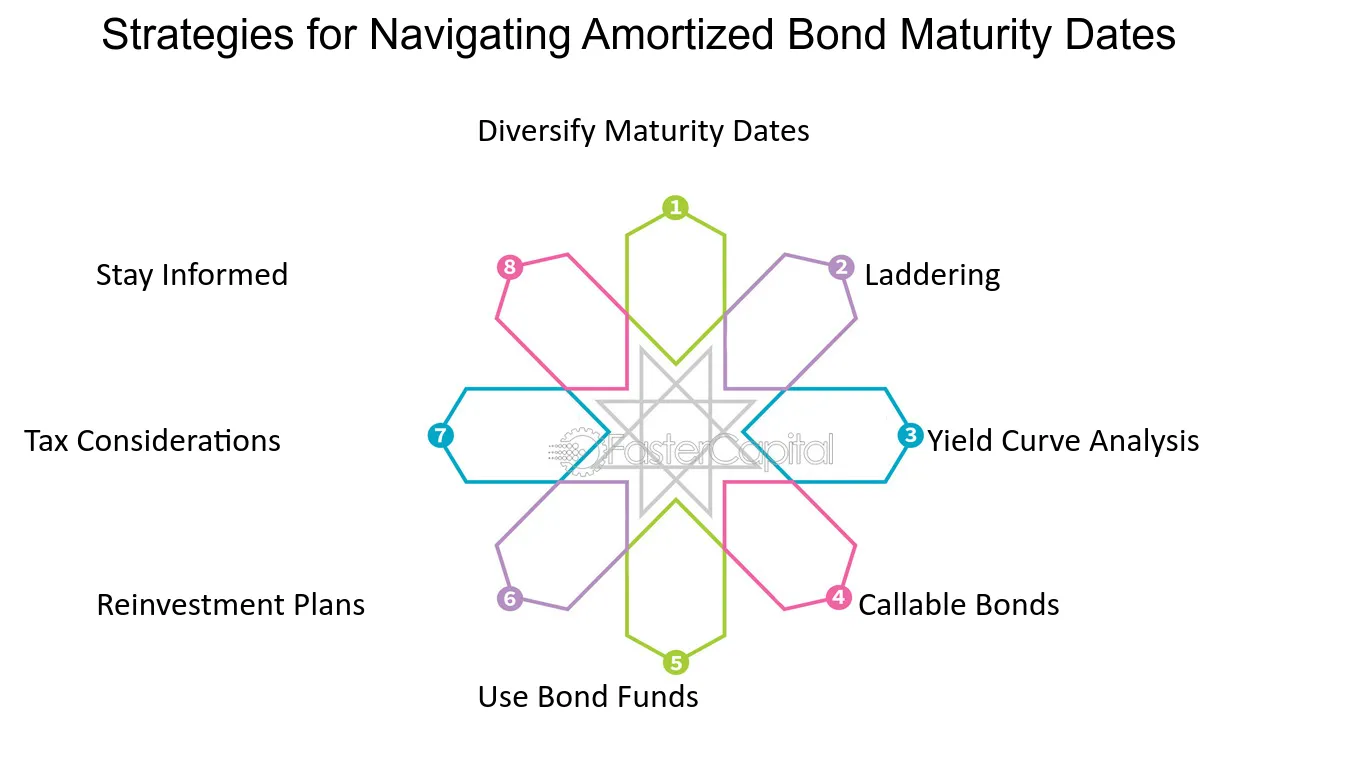

Bond laddering is a strategy that involves diversifying bond investments across various maturities. This approach helps mitigate the impact of interest rate fluctuations and provides a consistent income stream. By spreading investments across different maturities, investors can reduce the risk of reinvesting all their funds at once when a bond matures.

For example, let's consider an investor who allocates a certain amount of funds to bonds with maturities of one year, three years, and five years. As each bond matures, the investor can reinvest the proceeds into a new bond with a longer maturity, maintaining a consistent income stream while minimizing the impact of interest rate changes.

Bond laddering offers the advantage of balancing the potential benefits of both short-term and long-term bonds. It provides stability through the consistent income generated by short-term bonds while taking advantage of the potentially higher yields offered by long-term bonds.

4. Consideration of interest Rate environment:

The prevailing interest rate environment is a crucial factor to consider when evaluating bond maturity options. In a rising interest rate environment, shorter-term bonds may be more favorable as they allow investors to reinvest at higher rates sooner. Conversely, in a declining interest rate environment, longer-term bonds may be more attractive as they lock in higher rates for an extended period.

It is important to monitor interest rate trends and adjust bond maturity allocations accordingly to optimize portfolio stability and returns.

Understanding the concept of bond maturity and its impact on portfolio stability is essential for investors seeking to build a well-diversified bond portfolio. By considering factors such as short-term vs. Long-term bonds, implementing a bond laddering strategy, and analyzing the interest rate environment, investors can make informed decisions that align with their financial goals and risk tolerance.

Understanding the concept of bond maturity and its importance in portfolio stability - Bond maturity: Enhancing Portfolio Stability through Bond Laddering

5. Introduction to Bond Maturity and Risks

Bond maturity is an essential concept when it comes to understanding the risks and returns of bond investments. It is the length of time until the bond issuer pays back the principal amount of the bond to the investor. Maturity can range from a few months to several decades and plays a crucial role in determining the bond's price and yield. Investors need to understand the concept of bond maturity to make informed decisions when investing in bonds. There are risks associated with investing in bonds, such as interest rate risk, credit risk, and liquidity risk. Understanding bond maturity helps investors manage these risks and maximize returns.

Here is an in-depth look at bond maturity and its associated risks:

1. Bond Maturity: It is the length of time until the issuer pays back the principal amount of the bond to the investor. The maturity date is specified in the bond's prospectus. Bonds with longer maturities are generally riskier than those with shorter maturities. This is because longer-term bonds are more exposed to the potential changes in interest rates that could affect their price and yield.

2. Interest Rate Risk: It is the risk that the bond's price will decrease when interest rates rise. When interest rates rise, bond prices generally fall, and when interest rates decline, bond prices generally rise. The longer the bond's maturity, the more significant the interest rate risk. For example, consider a 10-year bond with a 2% yield. If interest rates rise to 3%, new bonds will be issued with higher yields, making the 2% bond less attractive. As a result, the price of the bond will decrease.

3. credit risk: It is the risk that the bond issuer will default on its payments. This risk is higher for bonds issued by companies with low credit ratings or those in financial distress. When investing in bonds, investors need to consider the creditworthiness of the issuer to minimize credit risk. For example, a bond issued by a company with a high credit rating, such as Microsoft, is less likely to default than a bond issued by a company with a low credit rating.

4. Liquidity Risk: It is the risk that the investor will not be able to sell the bond when they want to or at a fair price. This risk is higher for bonds that are less actively traded or issued by companies with low credit ratings. The longer the bond's maturity, the higher the liquidity risk. For example, if an investor needs to sell a bond before its maturity date, they may have to sell it at a discount to attract buyers.

Understanding bond maturity and its associated risks is crucial for investors. While the bond market can be complex, investors can manage risks and maximize returns by investing in bonds with appropriate maturities and credit ratings. It is essential to conduct thorough research and analysis before investing in bonds to make informed decisions.

Introduction to Bond Maturity and Risks - Bond maturity: Managing Risk and Returns with Weighted Average Maturity

6. Understanding Bond Maturity

When it comes to investing in bonds, understanding bond maturity is essential. Bond maturity refers to the length of time from when the bond is issued to when it reaches its maturity date, at which point the issuer will pay back the principal amount to the bondholder. As an investor, it's important to understand how bond maturity works and how it affects your investment strategy. Different investors have different preferences for bond maturity, depending on their financial goals, risk tolerance, and investment horizon.

Here are some key points to consider when looking at bond maturity:

1. Short-term vs. long-term bonds: short-term bonds have a maturity of less than five years, while long-term bonds have a maturity of 10 years or more. Short-term bonds are generally considered less risky than long-term bonds because they are less exposed to interest rate fluctuations. However, long-term bonds offer higher yields and may be more appropriate for investors with a longer investment horizon.

2. yield curve: The yield curve is a graph that shows the relationship between bond yields and bond maturity. In a normal yield curve, longer-term bonds have higher yields than shorter-term bonds. However, when the yield curve is inverted, short-term bonds have higher yields than long-term bonds, which can be a sign of an impending recession. It's important to keep an eye on the yield curve when investing in bonds.

3. Reinvestment risk: Reinvestment risk refers to the risk that when a bond matures, the investor will not be able to reinvest the principal at the same rate of return. This risk is greater for short-term bonds because the investor has to constantly reinvest the principal, while long-term bonds have a fixed rate of return.

4. Call provisions: Some bonds have call provisions, which allow the issuer to call back the bond before maturity. This can be beneficial for the issuer if interest rates have fallen since the bond was issued, but it can be detrimental for the investor who loses out on future interest payments. It's important to check whether a bond has a call provision before investing.

In summary, understanding bond maturity is crucial for investors who want to make informed decisions about their bond investments. Short-term bonds are generally less risky, but long-term bonds can offer higher yields. The yield curve, reinvestment risk, and call provisions are all important factors to consider when investing in bonds. By taking these factors into account, investors can create a bond portfolio that aligns with their financial goals and risk tolerance.

Understanding Bond Maturity - Bond Maturity: Navigating Treasury Bond Maturity Choices for Investors

7. Types of Treasury Bond Maturity

Investors who are looking to invest in bonds will inevitably encounter the concept of bond maturity. treasury bond maturity in particular is a crucial factor to consider when choosing which bonds to invest in. The maturity date of a bond refers to the date on which the bond issuer (in this case, the US government) will repay the bondholder the principal amount that was borrowed. The length of time between the issuance of the bond and its maturity date is called the bond's term. Treasury bonds come in a variety of maturities, ranging from short-term to long-term. Understanding the different types of Treasury bond maturity can help investors make an informed decision based on their investment goals, risk tolerance, and time horizon.

Here are some types of Treasury bond maturity:

1. Short-term Treasury bonds: These bonds have a maturity of one year or less. They are often referred to as Treasury bills (T-bills) and are considered to be the safest of all Treasury bonds. They have a lower yield compared to other Treasury bonds, but they are a good option for investors who want to park their money for a short period of time.

2. Intermediate-term Treasury bonds: These bonds have a maturity of one to ten years. They are also known as Treasury notes (T-notes). They offer a higher yield than T-bills but are not as risky as long-term bonds. They are suitable for investors who have a medium-term investment horizon.

3. Long-term Treasury bonds: These bonds have a maturity of more than ten years. They are also known as Treasury bonds (T-bonds). They offer the highest yield among all Treasury bonds but are the riskiest. They are suitable for investors who have a long-term investment horizon and are willing to take on more risk.

4. Inflation-protected Treasury bonds: These bonds, also known as Treasury Inflation-Protected Securities (TIPS), are designed to protect investors from inflation. They offer a fixed interest rate, but the principal amount is adjusted based on changes in the consumer Price index (CPI). They are suitable for investors who are concerned about inflation eroding the purchasing power of their investments.

5. Floating-rate Treasury bonds: These bonds have an interest rate that is tied to a benchmark rate, such as the London interbank Offered rate (LIBOR). The interest rate is adjusted periodically, which means that the yield on these bonds can fluctuate. They are suitable for investors who want to earn a variable interest rate and are comfortable with the associated risks.

Treasury bond maturity is an important factor to consider when investing in bonds. Understanding the different types of Treasury bond maturity can help investors choose the right bonds based on their investment goals, risk tolerance, and time horizon. By diversifying across different maturities, investors can create a balanced bond portfolio that suits their needs.

Types of Treasury Bond Maturity - Bond Maturity: Navigating Treasury Bond Maturity Choices for Investors

8. Introduction to Bond Maturity and Serial Bonds

Bond Maturity and Serial Bonds

Bond maturity refers to the length of time that a bond will exist before it is repaid to the bondholder. It is important to understand the concept of bond maturity because it helps an investor to make informed decisions about their investments. For instance, an investor can determine whether a bond is suitable for their investment portfolio based on the bond maturity date. One type of bond that is important to understand is a serial bond.

Serial bonds are a type of bond where the issuer repays a portion of the bond's principal each year. This means that the bond will have a series of maturity dates, with a portion of the bond being repaid each year until the final maturity date. Serial bonds are commonly used by municipalities and other government entities to finance large projects.

Here are some important things to know about bond maturity and serial bonds:

1. Bond Maturity Dates

Bond maturity dates can range from a few months to several decades. short-term bonds typically have a maturity date of less than five years, while long-term bonds can have a maturity date of 30 years or more. The longer the maturity date, the higher the risk associated with the bond. This is because there is a greater chance that the issuer will default on the bond before it reaches maturity.

2. Yield to Maturity

The yield to maturity (YTM) is an important concept to understand when investing in bonds. The YTM is the total return anticipated on a bond if it is held until it matures. It takes into account the bond's current market price, the coupon rate, and the time left until the bond matures. The YTM can help investors determine whether a bond is a good investment based on its potential return.

3. Advantages of Serial Bonds

Serial bonds have several advantages over other types of bonds. First, they allow issuers to spread out their debt payments over time, which can help to reduce the financial burden of a large project. Second, serial bonds can offer investors a predictable stream of income over the life of the bond. Finally, serial bonds can be easier to sell than other types of bonds because they have a series of maturity dates.

4. Disadvantages of Serial Bonds

While serial bonds have some advantages, they also have some disadvantages. One disadvantage is that they can be more complex than other types of bonds, which can make them harder for investors to understand. Additionally, serial bonds can have higher interest rates than other types of bonds because they are riskier. Finally, serial bonds can be more difficult to sell than other types of bonds because they have a series of maturity dates.

Understanding bond maturity and serial bonds is important for investors who are looking to diversify their investment portfolios. While serial bonds have some advantages, they also have some disadvantages. Investors should carefully consider their investment goals and risk tolerance before investing in serial bonds or any other type of bond.

Introduction to Bond Maturity and Serial Bonds - Bond maturity: Serial Bonds and Maturity: A Closer Look at Bond Terms

9. Factors that Influence Bond Maturity and Serial Bond Structures

Factors that Influence Bond Maturity

When a bond is issued, the issuer specifies the maturity date, which is the date on which the principal amount of the bond must be repaid. The maturity date of a bond is influenced by several factors that the issuer must consider. These factors include:

1. interest rates: The interest rates prevailing in the market at the time of issuance of the bond play a significant role in determining its maturity. If interest rates are low, the issuer may want to issue a longer-term bond to take advantage of the low rates. Conversely, if rates are high, the issuer may issue a shorter-term bond to avoid paying high interest rates for a long period.

2. credit rating: The credit rating of the issuer also plays a role in determining the maturity of the bond. If the issuer has a good credit rating, it may be able to issue longer-term bonds at lower interest rates. This is because investors have more confidence in the issuer's ability to repay the bond. Conversely, if the issuer has a poor credit rating, it may have to issue shorter-term bonds at higher interest rates to attract investors.

3. Purpose of the Bond: The purpose of the bond also influences its maturity. If the bond is issued to fund a long-term project, such as the construction of a new facility, the issuer may want to issue a longer-term bond to match the project's duration. Conversely, if the bond is issued to fund a short-term project, such as the purchase of inventory, the issuer may issue a shorter-term bond.

Serial Bond Structures

Serial bonds are a type of bond structure where the principal amount of the bond is repaid in installments over a period of time. This structure is often used by issuers who have a large amount of debt to repay but do not want to issue a single, large bond. Serial bonds have several advantages, including:

1. Lower Interest Rates: Because serial bonds are repaid over a period of time, they are considered less risky by investors. This means that issuers can issue serial bonds at lower interest rates than they would be able to for a single, large bond.

2. Flexibility: Serial bonds offer greater flexibility to issuers than other bond structures. Issuers can tailor the repayment schedule to match their cash flow needs, which can help them manage their debt more effectively.

3. Diversification: Serial bonds allow investors to diversify their portfolios by investing in bonds with different maturities. This helps to spread the risk across different time periods and can lead to more stable returns.

Conclusion

Overall, the maturity of a bond and its structure are important considerations for both issuers and investors. By understanding the factors that influence bond maturity and the advantages of different bond structures, investors can make more informed investment decisions. Likewise, issuers can use this knowledge to structure their debt in a way that meets their financing needs while minimizing their cost of capital.

Factors that Influence Bond Maturity and Serial Bond Structures - Bond maturity: Serial Bonds and Maturity: A Closer Look at Bond Terms

10. Exploring the concept of bond maturity

Bond maturity refers to the length of time until the principal amount of a bond is repaid to the bondholder. It is an important concept to understand when investing in bonds, as it can have significant implications on the overall return and risk associated with the investment. In this section, we will explore the concept of bond maturity in detail, examining its various aspects and discussing the implications for investors.

1. Definition of Bond Maturity:

Bond maturity is typically expressed in terms of the number of years until the bond's principal is repaid. It represents the timeline for the bond's cash flows, including periodic interest payments and the final repayment of the principal. For example, a bond with a maturity of 10 years will make interest payments to the bondholder annually or semi-annually over the course of the 10-year period, with the principal amount being repaid at the end.

2. Impact on Yield and Price:

The maturity of a bond has a direct impact on its yield and price. Generally, longer-term bonds tend to offer higher yields compared to shorter-term bonds due to the increased risk associated with a longer time horizon. This is because longer-term bonds are exposed to a greater degree of interest rate risk, as changes in interest rates can significantly affect the present value of the bond's future cash flows. As a result, investors demanding higher yields for longer-term bonds drives the price down, making them more attractive.

3. Considerations for Investors:

When choosing a bond maturity, investors need to consider their investment objectives, risk tolerance, and market conditions. Shorter-term bonds, such as those with maturities of one to five years, are generally considered less risky and provide more liquidity. These bonds are suitable for investors with a shorter investment horizon or those seeking more stable income. On the other hand, longer-term bonds, with maturities of ten years or more, offer higher yields but are more exposed to interest rate fluctuations. They may be suitable for investors with a longer time horizon and a higher risk appetite.

4. Comparing Options:

To illustrate the impact of bond maturity, let's consider two hypothetical bonds issued by the same entity with different maturities. Bond A has a maturity of five years and offers a yield of 3%, while Bond B has a maturity of ten years and offers a yield of 4.5%.

- Bond A: With a shorter maturity, Bond A provides more certainty of cash flows over a shorter time period. This makes it an attractive option for conservative investors seeking stable income and greater liquidity.

- Bond B: On the other hand, Bond B offers a higher yield, compensating investors for the increased risk associated with the longer maturity. This option may be more suitable for investors with a longer investment horizon and a higher risk tolerance.

5. Best Option:

Determining the best option between Bond A and Bond B ultimately depends on the investor's individual circumstances and preferences. It is essential to carefully assess one's investment goals, risk tolerance, and market conditions before making a decision. While Bond A offers more stability, Bond B provides a higher yield potential. Investors should weigh these factors and consider diversifying their bond portfolio to include a mix of different maturities to manage risk effectively.

Understanding the concept of bond maturity is crucial for bond investors as it directly affects the return and risk associated with their investments. By considering various factors, such as investment objectives and market conditions, investors can make informed decisions about bond maturities that align with their financial goals.

Exploring the concept of bond maturity - Bond maturity: Understanding Bond Lifecycles and Guaranteed Income Bonds

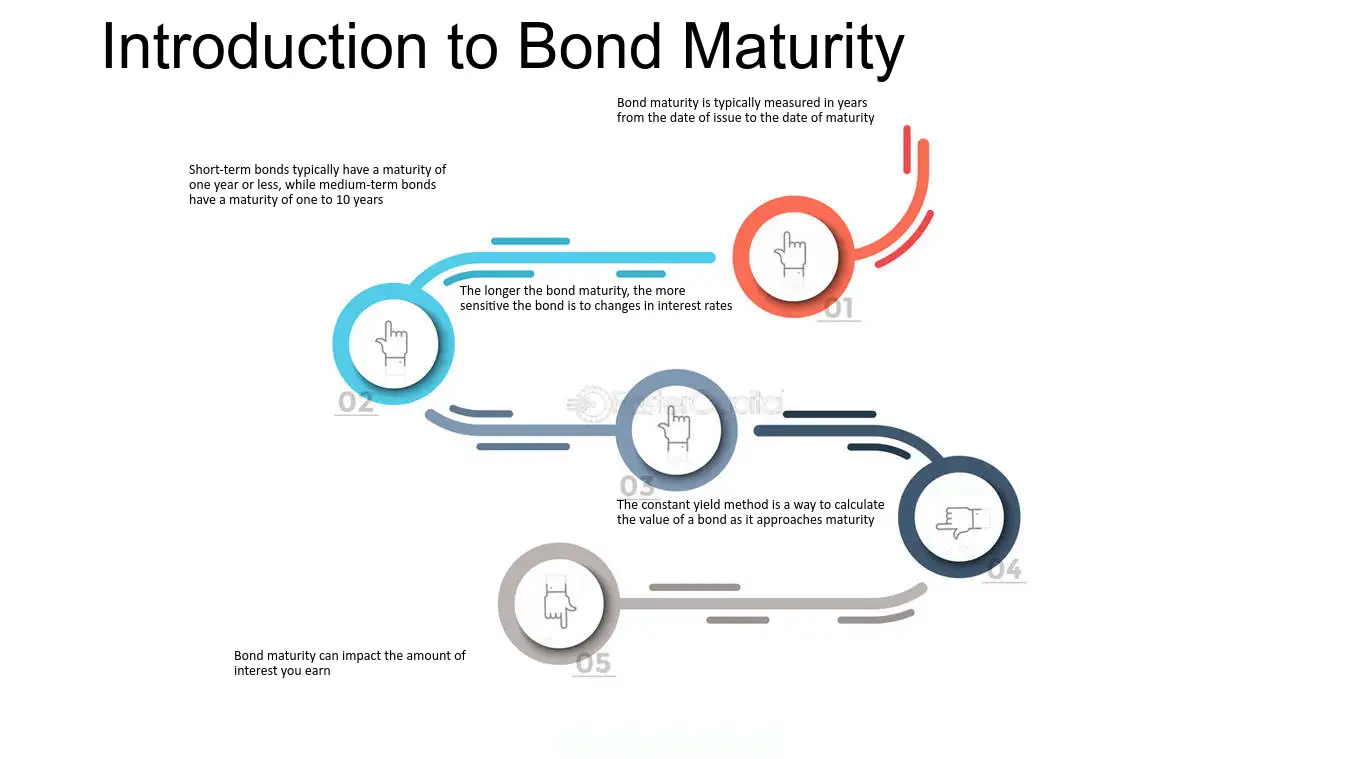

11. Introduction to Bond Maturity

When it comes to investing in bonds, one of the key factors to consider is bond maturity. Bond maturity refers to the length of time it takes for a bond to reach its full face value, at which point the bond issuer will repay the bondholder. understanding bond maturity is important because it can impact the value of your investment, as well as the amount of interest you earn. There are different types of bond maturity, including short-term, medium-term, and long-term.

To help you understand bond maturity and the factors that can impact it, we've put together a list of key insights:

1. Bond maturity is typically measured in years from the date of issue to the date of maturity. For example, if you buy a bond with a maturity date of 10 years from now, the bond will mature in 10 years.

2. short-term bonds typically have a maturity of one year or less, while medium-term bonds have a maturity of one to 10 years. long-term bonds have a maturity of more than 10 years.

3. The longer the bond maturity, the more sensitive the bond is to changes in interest rates. This means that if interest rates rise, the value of a long-term bond may decrease more than the value of a short-term bond.

4. The constant yield method is a way to calculate the value of a bond as it approaches maturity. This method takes into account the current market interest rates and the remaining time until maturity to determine the bond's present value.

5. Bond maturity can impact the amount of interest you earn. Generally speaking, longer-term bonds offer higher interest rates than shorter-term bonds. This is because longer-term bonds carry more risk, as the issuer could default on the bond over a longer period of time.

Overall, understanding bond maturity is an important part of investing in bonds. By considering factors such as the length of time until maturity, the type of bond, and the constant yield method, you can make informed decisions about your investments and potentially earn higher returns.

Introduction to Bond Maturity - Bond maturity: Understanding Bond Maturity and the Constant Yield Method

12. Factors that Affect Bond Maturity

When it comes to investing in bonds, one of the most important considerations is their maturity date. The maturity of a bond indicates the amount of time until the bond issuer repays the principal amount to the bondholder. The maturity date is an essential factor in determining the bond's value and the yield that the investor will earn. However, there are many factors that can affect bond maturity, and understanding these factors is crucial for any investor looking to make informed investment decisions.

Here are some of the factors that can affect bond maturity:

1. coupon rate: The coupon rate is the interest rate that the bond issuer pays to the bondholder. If a bond has a high coupon rate, it will generally mature quicker than a bond with a lower coupon rate. This is because the issuer will be paying more interest to the bondholder, which means that they will want to pay back the principal as soon as possible to avoid additional interest payments.

2. credit rating: The credit rating of the bond issuer can also affect bond maturity. If a bond issuer has a low credit rating, it may take longer for them to repay the principal amount, as they may have difficulty raising funds to repay the bondholders. This can result in longer maturity dates for bonds issued by companies with lower credit ratings.

3. Market Conditions: The overall market conditions can also affect bond maturity. For example, if interest rates are rising, it may take longer for bonds to mature, as the issuer will want to hold onto the funds for as long as possible to avoid having to issue new bonds at higher interest rates.

4. Call Provisions: Call provisions give the issuer the right to call the bond before the maturity date. If a bond has a call provision, it may mature earlier than expected if the issuer decides to call the bond.

5. Yield to Maturity: The yield to maturity is the total return anticipated on a bond if the bond is held until it matures. It takes into account the coupon rate, the price paid for the bond, and the time to maturity. Generally, bonds with higher yields to maturity will have longer maturity dates.

Understanding the factors that can affect bond maturity is essential for any investor looking to make informed investment decisions. By considering these factors, investors can better understand the risks and potential returns associated with investing in bonds.

Factors that Affect Bond Maturity - Bond maturity: Understanding Bond Maturity and the Constant Yield Method

13. Bond Maturity vs Duration

Bond maturity and duration are two important concepts in the world of bond investments. While both terms are used to describe the length of time until a bond's payout, they represent different aspects of the bond's behavior. Bond maturity refers to the specific date when the bond issuer will repay the principal amount borrowed, while duration is a measure of how sensitive a bond's price is to changes in interest rates. Understanding the difference between these two concepts is critical to making informed investment decisions.

To start with, it is important to note that bond maturity and duration can be viewed from two different perspectives: that of the bond issuer and that of the bond investor. From the issuer's perspective, bond maturity is simply the length of time until they must repay the principal amount borrowed. For example, if a company issues a 10-year bond with a face value of $1,000, the bond matures in 10 years and the company will repay the $1,000 to the bondholder at that time.

From the investor's perspective, however, bond maturity is just one factor to consider when evaluating a bond investment. The other important factor is duration, which measures how much the bond's price is likely to change in response to changes in interest rates. A bond with a longer duration will be more sensitive to changes in interest rates than a bond with a shorter duration. This is because the longer the duration, the more time there is for interest rate changes to impact the bond's cash flows and, therefore, its value.

Here are some key points to keep in mind when considering bond maturity vs duration:

1. Bond maturity is an absolute value that represents the length of time until a bond's principal is repaid. Duration, on the other hand, is a measure of how sensitive a bond's price is to changes in interest rates.

2. Bonds with longer maturities tend to have higher yields, but they are also riskier investments because they are more sensitive to changes in interest rates.

3. The relationship between bond prices and interest rates is inverse. When interest rates rise, bond prices fall, and vice versa. The longer the duration of a bond, the greater its price sensitivity to changes in interest rates.

4. Short-term bonds tend to have lower yields than long-term bonds, but they are also less risky because they are less sensitive to changes in interest rates.

5. Bonds with shorter maturities and lower durations are often favored by investors who are looking for stable, predictable income streams without taking on too much risk.

Understanding the difference between bond maturity and duration is critical to making informed investment decisions. While bond maturity represents the absolute length of time until a bond's payout, duration is a measure of how sensitive the bond's price is to changes in interest rates. By considering both factors, investors can make more informed decisions about which bonds to invest in and how to manage their bond portfolios.

Bond Maturity vs Duration - Bond maturity: Understanding Bond Maturity and the Constant Yield Method

14. Types of Corporate Bond Maturity Dates

When investing in corporate bonds, one of the most important factors to consider is the maturity date. The maturity date refers to the date on which the bond issuer is required to pay back the principal amount to the bondholder. Depending on the maturity date of the bond, investors can evaluate the risk and yield associated with it. Different types of corporate bond maturity dates offer different advantages and disadvantages for investors. In this section, we will discuss the different types of corporate bond maturity dates.

1. Short-term Maturity Dates: These bonds have a maturity period of less than three years. They typically offer lower yields but are considered less risky than long-term bonds. Short-term bonds are suitable for investors who are looking for a low-risk investment option with a steady income stream. For example, a company may issue a short-term bond to finance a specific project or to meet its short-term cash flow requirements.

2. Intermediate-term Maturity Dates: These bonds have a maturity period of three to ten years. They offer a moderate yield and a moderate level of risk. Intermediate-term bonds are suitable for investors who are willing to take on a little more risk in exchange for a higher yield. For example, a company may issue an intermediate-term bond to finance a major expansion project.

3. Long-term Maturity Dates: These bonds have a maturity period of more than ten years. They offer a higher yield but may be riskier than short-term or intermediate-term bonds. Long-term bonds are suitable for investors who are willing to take on a higher level of risk for the potential of a higher return. For example, a company may issue a long-term bond to finance a major acquisition or to fund its research and development activities.

The maturity date of a corporate bond is an important factor to consider when evaluating the risk and yield associated with it. Investors should carefully consider their investment objectives and risk tolerance before investing in any type of corporate bond.

Types of Corporate Bond Maturity Dates - Corporate bond: Corporate Bond Maturity Dates: Evaluating Risk and Yield

15. Factors that Affect Corporate Bond Maturity Dates

Corporate bond maturity dates play a critical role in determining the risk and yield of a bond. The maturity date refers to the date when the bond issuer is required to pay back the principal amount to the bondholder. The maturity date can vary significantly depending on the type of bond, issuer, and market conditions. Typically, a longer maturity date implies a higher level of risk and a higher yield, while a shorter maturity date implies a lower level of risk and a lower yield.

There are several factors that affect corporate bond maturity dates, including:

1. Issuer credit risk: The creditworthiness of the bond issuer is a critical factor that can influence the maturity date of a corporate bond. Bond issuers with a higher credit rating are likely to have lower borrowing costs and can issue longer-term bonds. In contrast, bond issuers with a lower credit rating may face higher borrowing costs and may issue shorter-term bonds to reduce their risk exposure.

2. Market conditions: Market conditions such as interest rates, inflation, and economic growth can significantly impact the maturity date of a corporate bond. When interest rates are low, bond issuers may issue longer-term bonds at a lower cost. In contrast, when interest rates are high, bond issuers may issue shorter-term bonds to avoid the risk of rising interest rates.

3. Investor demand: Investor demand for a particular type of bond can impact its maturity date. If investors are willing to invest in longer-term bonds, bond issuers may issue longer-term bonds to meet this demand. Similarly, if investors prefer shorter-term bonds, bond issuers may issue shorter-term bonds to meet this demand.

4. Bond covenants: Bond covenants refer to the terms and conditions of a bond issue, including the maturity date. Bond covenants can vary significantly depending on the type of bond and issuer. For example, some bonds may have call provisions that allow the issuer to redeem the bond before the maturity date. In contrast, other bonds may have put provisions that allow the bondholder to sell the bond back to the issuer before the maturity date.

In summary, corporate bond maturity dates play a critical role in determining the risk and yield of a bond. Understanding the factors that affect maturity dates can help investors evaluate the risk and return of a bond investment and make informed investment decisions.

Factors that Affect Corporate Bond Maturity Dates - Corporate bond: Corporate Bond Maturity Dates: Evaluating Risk and Yield

16. Examples of Corporate Bond Maturity Dates and Yield Calculation

When investing in corporate bonds, one of the most important factors to consider is the maturity date. The maturity date is the date when the bond issuer will repay the bond's principal to the bondholder. It is important to evaluate the risk and yield associated with a bond based on its maturity date. Some investors prefer short-term bonds, while others prefer long-term bonds. It is important to know the different types of corporate bond maturity dates and how they are calculated to make informed investment decisions. In this section, we will discuss examples of corporate bond maturity dates and yield calculation.

1. Short-term bonds: These bonds have a maturity date of less than one year. They are considered less risky than long-term bonds as they are less susceptible to interest rate changes. However, they typically have lower yields than long-term bonds. For example, a bond with a maturity date of six months and a yield of 2% would provide a return of 1% over a three-month period.

2. Medium-term bonds: These bonds have a maturity date of one to ten years. They are considered to have moderate risk and moderate yield. The yield on these bonds is typically higher than short-term bonds but lower than long-term bonds. For example, a bond with a maturity date of five years and a yield of 4% would provide a return of 20% over the life of the bond.

3. Long-term bonds: These bonds have a maturity date of greater than ten years. They are considered to have the highest risk and the highest yield. The yield on these bonds is typically higher than short-term and medium-term bonds. However, they are more susceptible to interest rate changes and inflation. For example, a bond with a maturity date of twenty years and a yield of 6% would provide a return of 120% over the life of the bond.

4. Yield calculation: The yield on a bond is the return an investor will receive over the life of the bond. It is calculated by dividing the annual interest payment by the price of the bond. For example, if a bond has a face value of $1,000, a coupon rate of 5%, and is currently trading at $950, the yield would be 5.26%. This calculation assumes that the bond will be held until maturity and that all interest payments will be reinvested at the same rate.

Understanding the different types of corporate bond maturity dates and yield calculation is important for making informed investment decisions. It is important to consider the risk and yield associated with each type of bond and to have a diversified portfolio to mitigate risk.

Examples of Corporate Bond Maturity Dates and Yield Calculation - Corporate bond: Corporate Bond Maturity Dates: Evaluating Risk and Yield

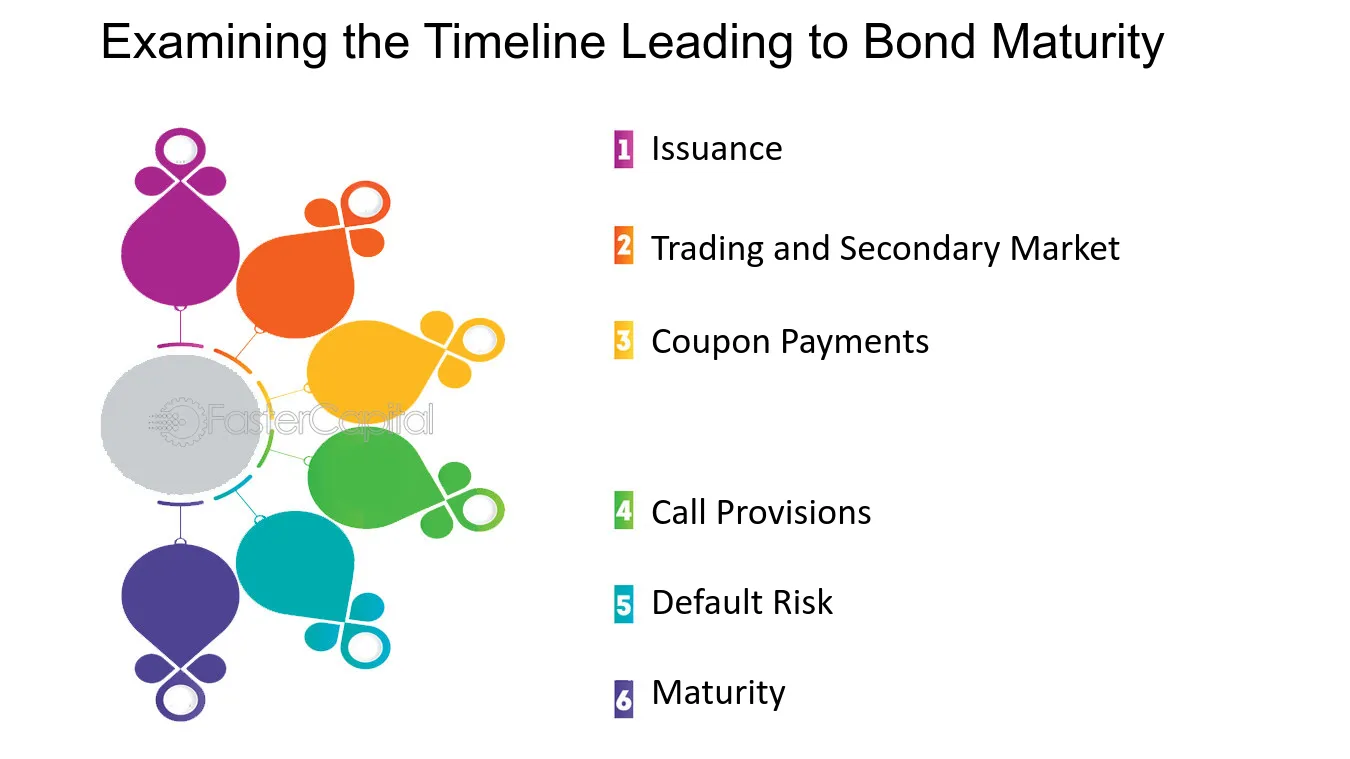

17. Examining the Timeline Leading to Bond Maturity

As bondholders eagerly anticipate the expiration of their investments, it is crucial to understand the timeline leading to bond maturity. This section delves into the various stages of a bond's lifecycle, shedding light on the significance of each step and the implications for both issuers and investors.

1. Issuance: The first step in the countdown to bond maturity is the issuance of the bond. This occurs when a company or government entity seeks to raise funds by issuing debt securities to investors. The terms of the bond, including the maturity date, coupon rate, and principal amount, are established during this stage. For example, a corporation may issue a 10-year bond with an annual coupon rate of 5% and a face value of $1,000.

2. trading and Secondary market: Once a bond is issued, it can be traded in the secondary market. Investors who wish to liquidate their positions or acquire additional bonds can do so through exchanges or over-the-counter transactions. The price of a bond in the secondary market fluctuates based on various factors such as interest rates, credit risk, and market conditions. For instance, if interest rates rise, the price of a bond with a fixed coupon rate may decline as new bonds with higher yields become available.

3. Coupon Payments: Throughout the life of a bond, periodic coupon payments are made to bondholders. These payments represent the interest owed to investors based on the coupon rate and the face value of the bond. For instance, if an investor holds a bond with a 5% coupon rate, they will receive $50 annually for every $1,000 face value of the bond. These coupon payments provide investors with a steady stream of income until the bond reaches maturity.

4. Call Provisions: Some bonds may include call provisions, which allow the issuer to redeem the bond before its maturity date. This gives issuers the flexibility to refinance their debt if interest rates decline or if they no longer require the funds raised. However, from an investor's perspective, call provisions can be a double-edged sword. On one hand, they provide the opportunity for early redemption and potentially higher returns if the bond is called at a premium. On the other hand, they introduce uncertainty and the risk of reinvesting the proceeds at a lower interest rate.

5. Default Risk: One crucial aspect of bond maturity is the risk of default. Default occurs when the issuer fails to meet its obligations, either by missing coupon payments or failing to repay the principal amount at maturity. Investors assess the default risk by considering factors such as the issuer's credit rating, financial health, and industry dynamics. Bonds with higher default risk typically offer higher yields to compensate investors for the added risk. For example, a corporate bond issued by a financially troubled company may have a higher yield compared to a government bond with a lower default risk.

6. Maturity: Finally, the countdown culminates in the maturity date, the point at which the bond expires, and the principal amount is repaid to bondholders. At this stage, investors have the option to reinvest the proceeds or pursue other investment opportunities. Maturity can be a significant event for both issuers and investors, as it marks the end of the contractual obligations and potential changes in financial strategies for both parties.

As the timeline leading to bond maturity unfolds, investors and issuers must navigate the various stages with careful consideration. Understanding each step allows investors to make informed decisions based on their risk appetite and investment objectives. On the other hand, issuers must manage their debt obligations effectively, considering factors such as refinancing opportunities, market conditions, and investor expectations. Ultimately, the countdown to bond maturity serves as a reminder of the dynamic nature of the bond market and the importance of diligent analysis and decision-making.

Examining the Timeline Leading to Bond Maturity - Countdown to Maturity: Trust Indenture s Impact on Bond Expiration

18. Understanding Bond Maturity

Bonds are a popular investment vehicle for investors, but understanding the different aspects of bonds can be confusing. One of the key components of a bond is its maturity. understanding bond maturity is crucial to making informed investment decisions.

1. What is bond maturity?

Bond maturity refers to the length of time until the bond reaches its full face value. When a bond is issued, it has a set maturity date. This date is the point at which the issuer of the bond will repay the bondholder the full face value of the bond.

2. How does bond maturity affect the bond’s price?

The longer the time until maturity, the more volatile the bond’s price will be. This is because the longer the bond’s maturity, the greater the risk of changes in interest rates affecting the bond’s price. As interest rates rise, the price of a bond with a longer maturity will decrease more than the price of a bond with a shorter maturity. This is because the bondholder will be locked into a lower interest rate for a longer period of time.

3. What are the different types of bond maturity?

Bonds can have different types of maturity dates, including short-term, medium-term, and long-term. short-term bonds have a maturity of one to three years, medium-term bonds have a maturity of four to ten years, and long-term bonds have a maturity of ten years or more.

4. What are the advantages and disadvantages of investing in bonds with different maturities?

Short-term bonds are less volatile than long-term bonds, making them a good option for investors who want stability and predictability. However, short-term bonds typically offer lower yields than long-term bonds. Long-term bonds offer higher yields, but they are more volatile and carry a greater risk of interest rate changes affecting the bond’s price.

5. What are some strategies for managing bond maturity risk?

One strategy for managing bond maturity risk is to create a bond ladder. This involves buying bonds with different maturities and staggering their maturity dates. This helps to spread out the risk of interest rate changes affecting the bond’s price. Another strategy is to invest in bond funds, which hold a diversified portfolio of bonds with different maturities.

6. What is the best option for investing in bonds?

The best option for investing in bonds depends on the investor’s individual goals and risk tolerance. For investors who want stability and predictability, short-term bonds may be the best option. For investors who want higher yields and are willing to take on more risk, long-term bonds may be a better option. Ultimately, it is important to do research and consult with a financial advisor to determine the best bond investment strategy for individual needs.

Understanding Bond Maturity - Ex Coupon Bonds: Understanding Maturity and Its Implications

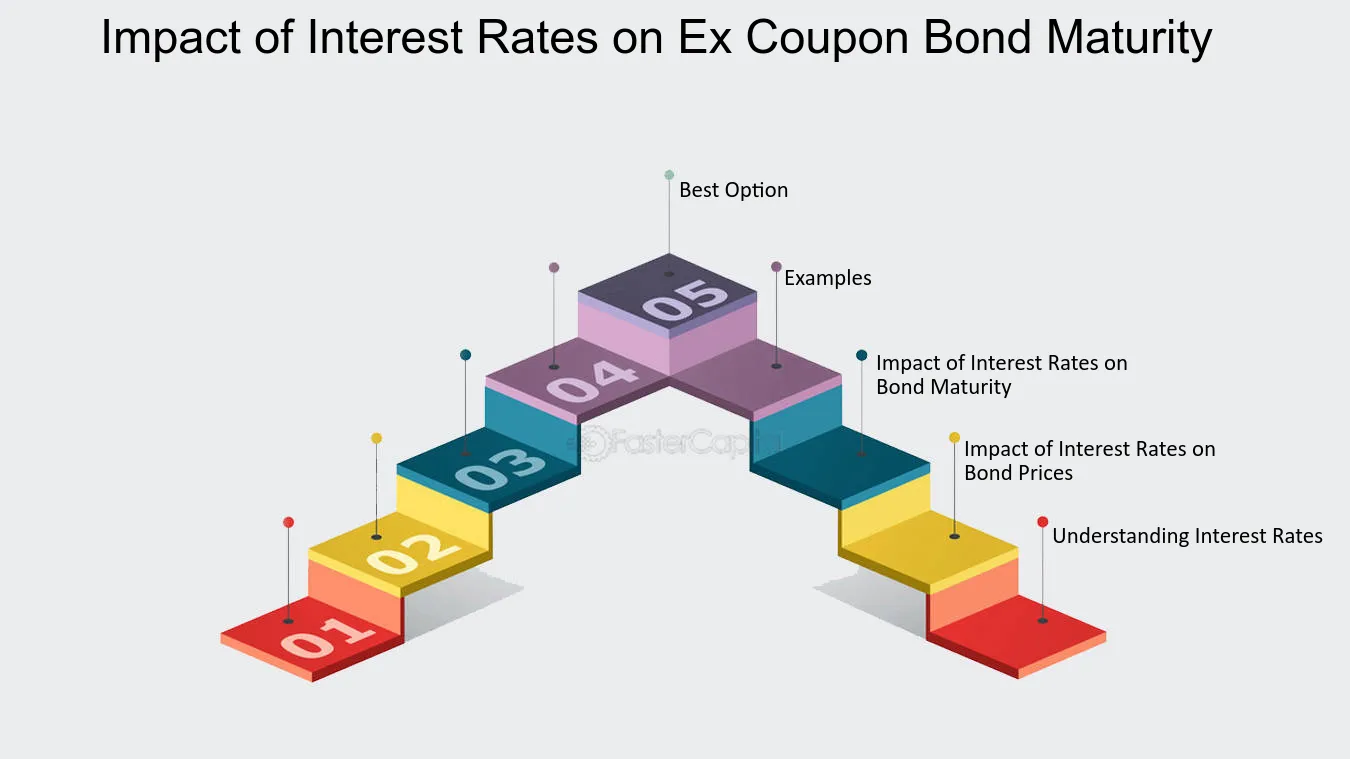

19. Impact of Interest Rates on Ex Coupon Bond Maturity

Interest rates have a significant impact on ex coupon bond maturity. As interest rates rise, the value of a bond decreases, and its maturity date becomes longer. On the other hand, when interest rates fall, the bond's value rises, and its maturity date shortens. This inverse relationship between interest rates and bond maturity is crucial for investors to understand when considering ex coupon bonds.

1. understanding Interest rates:

Interest rates are the cost of borrowing money. When interest rates are high, it means that the cost of borrowing money is high, and when they are low, the cost of borrowing is low. The central bank of a country sets interest rates. It is responsible for managing the economy, and one of its tools is to adjust interest rates to control inflation and stimulate economic growth.

2. impact of Interest rates on Bond Prices:

Bond prices and interest rates have an inverse relationship. When interest rates rise, bond prices fall, and when interest rates fall, bond prices rise. This relationship is because investors will always seek the highest return on their investment. If interest rates rise, new bonds will offer a higher return, and older bonds with lower returns will decrease in value.

3. Impact of interest Rates on bond Maturity:

The maturity of a bond is the length of time until the bond reaches its final payment. When interest rates rise, the bond's maturity date becomes longer because the bond is less valuable. This means that the bond will take longer to reach its final payment. Conversely, when interest rates fall, the bond's maturity date shortens, and the bond will reach its final payment sooner.

4. Examples:

Suppose an investor purchases an ex coupon bond with a maturity date of ten years and an interest rate of 5%. If interest rates rise to 6%, the bond's value will decrease, and its maturity date will become longer. The investor will have to wait longer to receive their final payment. If interest rates fall to 4%, the bond's value will increase, and its maturity date will shorten, and the investor will receive their final payment sooner.

5. Best Option:

Investors should consider interest rates when purchasing ex coupon bonds. If interest rates are high, it may be better to wait for them to fall before investing in bonds. Conversely, if interest rates are low, it may be a good time to invest in bonds. It is also important to consider the bond's maturity date and whether it fits into the investor's long-term investment strategy.

Interest rates have a significant impact on ex coupon bond maturity. Investors should understand the inverse relationship between interest rates and bond prices and use this knowledge to make informed investment decisions. By considering interest rates and bond maturity, investors can choose the best investment strategy for their needs.

Impact of Interest Rates on Ex Coupon Bond Maturity - Ex Coupon Bonds: Understanding Maturity and Its Implications

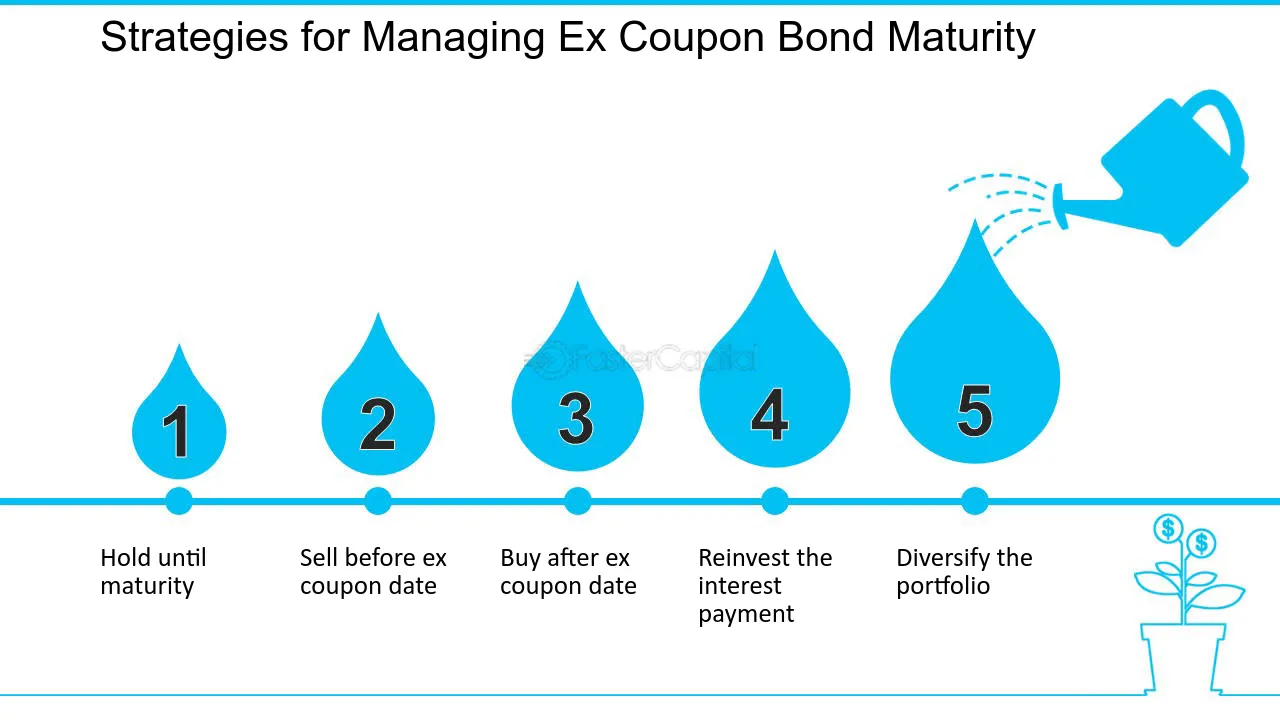

20. Strategies for Managing Ex Coupon Bond Maturity

Ex coupon bonds have a unique characteristic that requires special attention when managing their maturity. Unlike regular bonds, the ex coupon bond's price does not include the interest payment that has already been paid to the previous holder. This means that the price of the bond drops once the interest payment has been made, and the bond becomes ex coupon. Managing the maturity of ex coupon bonds requires a strategic approach that takes into account the bond's unique characteristics and the investor's goals.

1. Hold until maturity

One option for managing ex coupon bond maturity is to hold the bond until maturity. This strategy is suitable for investors who do not need immediate cash flow and can wait until the bond reaches its maturity date. By holding the bond until maturity, investors can benefit from the full interest payment and the final principal payment. This strategy is less risky because it avoids the fluctuations in the bond's price and ensures that the investor receives the full value of the bond.

2. Sell before ex coupon date

Another option for managing ex coupon bond maturity is to sell the bond before the ex coupon date. This strategy is suitable for investors who want to realize their investment before the bond becomes ex coupon. By selling the bond before the ex coupon date, investors can avoid the drop in the bond's price and receive the full value of the bond. This strategy is more risky because it requires the investor to predict the market's behavior and the bond's price movements.

3. Buy after ex coupon date

A third option for managing ex coupon bond maturity is to buy the bond after the ex coupon date. This strategy is suitable for investors who are looking for a bargain and can wait until the bond's price drops after the ex coupon date. By buying the bond after the ex coupon date, investors can benefit from the lower price of the bond and the full interest payment. This strategy is more risky because it requires the investor to predict the market's behavior and the bond's price movements.

4. Reinvest the interest payment

Investors can also reinvest the interest payment received from the ex coupon bond. This strategy is suitable for investors who want to maximize their return on investment and can afford to reinvest the interest payment. By reinvesting the interest payment, investors can benefit from the compounding effect and increase their investment's value over time.

5. Diversify the portfolio

Investors can also manage the maturity of ex coupon bonds by diversifying their portfolio. This strategy is suitable for investors who want to reduce their risk exposure and increase their return on investment. By diversifying the portfolio, investors can spread their investment across different asset classes and reduce the impact of any single investment's performance on their overall portfolio.

Managing the maturity of ex coupon bonds requires a strategic approach that takes into account the bond's unique characteristics and the investor's goals. Investors can choose to hold the bond until maturity, sell before the ex coupon date, buy after the ex coupon date, reinvest the interest payment, or diversify their portfolio. Each strategy has its advantages and disadvantages, and investors should carefully consider their options before making a decision.

Strategies for Managing Ex Coupon Bond Maturity - Ex Coupon Bonds: Understanding Maturity and Its Implications

21. Risks Associated with Ex Coupon Bond Maturity

Ex coupon bonds are popular among investors who want to receive interest payments upfront. However, these bonds also come with risks, particularly when they reach maturity. The risks associated with ex coupon bond maturity are crucial to understand for investors who want to make informed decisions about their investments. In this section, we will discuss these risks in detail.

1. Interest Rate Risk: One of the primary risks associated with ex coupon bond maturity is interest rate risk. When interest rates rise, the value of bonds decreases, and investors may face a loss if they sell their bonds before maturity. This risk is particularly significant for ex coupon bonds because they do not pay interest throughout their term. Therefore, if interest rates rise before maturity, investors may not be able to sell their bonds at a profit.

2. Reinvestment Risk: Another risk associated with ex coupon bond maturity is reinvestment risk. This risk arises when investors reinvest their principal after the bond matures. Since ex coupon bonds do not pay interest throughout their term, investors may not have a steady stream of income to reinvest. Therefore, when the bond matures, investors may have to reinvest their entire principal in a new bond, which may have a lower interest rate.

3. Default Risk: Ex coupon bonds are issued by companies and governments, and there is always a risk that they may default on their obligations. If a company or government defaults on an ex coupon bond, investors may lose their entire investment. Therefore, investors must carefully evaluate the creditworthiness of the issuer before investing in ex coupon bonds.

4. Market Risk: Market risk is another risk associated with ex coupon bond maturity. This risk arises when there is a change in market conditions that affects the value of the bond. For example, if there is a sudden increase in supply or a decrease in demand for ex coupon bonds, the price of the bond may fall. Therefore, investors must stay updated on market conditions and be prepared to adjust their investment strategy accordingly.

5. Liquidity Risk: Ex coupon bonds may also face liquidity risk, which arises when investors are unable to sell their bonds quickly and at a fair price. This risk is particularly significant for ex coupon bonds because they do not pay interest throughout their term. Therefore, if investors need to sell their bonds before maturity, they may not be able to find a buyer or may have to sell at a lower price.

Ex coupon bond maturity comes with several risks that investors must be aware of. These risks include interest rate risk, reinvestment risk, default risk, market risk, and liquidity risk. Investors must carefully evaluate these risks before investing in ex coupon bonds and consider diversifying their portfolio to mitigate these risks.

Risks Associated with Ex Coupon Bond Maturity - Ex Coupon Bonds: Understanding Maturity and Its Implications

22. Introduction to G7 Bond Maturity

1. Understanding G7 Bond Maturity

When it comes to investing in fixed-income securities, it is crucial for investors to have a comprehensive understanding of various factors that can impact their investment decisions. One such factor is bond maturity, which plays a significant role in determining the risk and return profile of a bond. In this section, we will delve into the concept of G7 bond maturity, exploring its significance for fixed-income investors.

2. Defining G7 Bond Maturity

G7 bond maturity refers to the length of time until a bond reaches its final payment date, at which point the principal amount is repaid to the bondholder. It represents the period over which an investor can expect to receive periodic interest payments and the return of their initial investment. Maturity is typically expressed in years and can range from short-term (less than 1 year) to long-term (over 10 years) in the case of G7 bonds.

3. Impact on Risk and Return

The maturity of a bond has a direct impact on its risk and return characteristics. Generally, longer maturity bonds tend to offer higher yields to compensate investors for the increased risk associated with a longer time horizon. This is because longer-term bonds are exposed to a greater degree of interest rate risk, as changes in interest rates can significantly affect their value. On the other hand, shorter-term bonds typically have lower yields but are considered less risky due to their shorter duration.

For example, consider two G7 bonds with similar credit quality and coupon rates, but different maturities. Bond A has a maturity of 5 years, while Bond B has a maturity of 20 years. Bond B, with its longer maturity, is likely to offer a higher yield to attract investors who are willing to take on the additional risk associated with a longer time horizon.

4. Evaluating Investor Objectives

Investors should carefully evaluate their investment objectives and risk tolerance when considering G7 bond maturity. Those with a shorter time horizon or a lower risk tolerance may prefer shorter-term bonds, as they offer more stability and liquidity. Shorter-term bonds also provide investors with the flexibility to reinvest their funds at higher interest rates if rates rise.

Conversely, investors with a longer time horizon or a higher risk tolerance may opt for longer-term bonds, which offer the potential for higher yields. These investors are typically focused on generating income over an extended period and are willing to accept the inherent interest rate risk associated with longer maturities.

5. Case Study: Impact of Maturity on Bond Performance

To illustrate the impact of maturity on bond performance, let's consider a hypothetical case study. Suppose an investor purchases two G7 bonds with identical coupon rates but different maturities. Bond X has a maturity of 2 years, while Bond Y has a maturity of 10 years.

If interest rates remain unchanged, both bonds will provide the investor with the same yield. However, if interest rates increase, Bond Y will experience a greater decline in value compared to Bond X due to its longer duration. On the other hand, if interest rates decrease, Bond Y will appreciate more than Bond X.

This case study highlights the importance of considering bond maturity in relation to interest rate expectations and the investor's risk profile.

6. Tips for Evaluating G7 Bond Maturity

- Conduct thorough research on the current interest rate environment and future rate projections to gauge the potential impact on bond prices.

- Assess your investment objectives and risk tolerance to determine the appropriate maturity profile for your fixed-income portfolio.

- Diversify your bond holdings across various maturities to balance risk and potential returns.

- Regularly review and reassess your bond investments to ensure they align with your evolving investment goals and market conditions.

Understanding G7 bond maturity is crucial for fixed-income investors as it directly influences the risk and return characteristics of their investments. By considering the impact of maturity on bond performance and evaluating their investment objectives and risk tolerance, investors can make informed decisions when constructing their fixed-income portfolios.

Introduction to G7 Bond Maturity - G7 Bond Maturity: Evaluating the Significance for Fixed Income Investors

23. Understanding Bond Maturity and Its Importance

1. Bond maturity is a crucial concept that fixed-income investors must understand in order to make informed investment decisions. It refers to the length of time until a bond's principal amount is repaid to the investor. Bond maturity plays a significant role in determining the risk and potential return associated with a bond investment. In this section, we will delve deeper into the importance of bond maturity and explore its implications for fixed-income investors.

2. Understanding bond maturity is essential because it directly affects the timing of cash flows received from a bond investment. Bonds can have various maturity periods, ranging from short-term (less than one year) to long-term (up to 30 years or more). The maturity period influences the stability and predictability of cash flows, which is a crucial consideration for investors with specific financial goals or income needs.

3. One important aspect to consider when evaluating bond maturity is the relationship between maturity and interest rates. Generally, longer-term bonds tend to offer higher interest rates compared to shorter-term bonds. This is because longer-term bonds expose investors to greater interest rate risk, as market conditions and inflation can significantly impact bond prices and yields over an extended period. Investors seeking higher yields may be willing to accept this increased risk by investing in longer-term bonds.

4. On the other hand, shorter-term bonds typically have lower interest rates but offer more stability in terms of their price and yield. These bonds are less affected by interest rate fluctuations and are considered less risky. Shorter-term bonds are often favored by conservative investors or those with shorter investment horizons who prioritize capital preservation over higher returns.

5. Let's consider an example to illustrate the importance of bond maturity. Suppose an investor has a specific financial goal of purchasing a house in five years. In this case, investing in a five-year bond would align with their investment horizon and cash flow needs. By selecting a bond with a maturity that matches their goal, the investor can reasonably expect to receive the principal amount at the desired time, facilitating the house purchase.

6. It's worth noting that bond maturity also affects a bond's liquidity. Generally, shorter-term bonds are more liquid than longer-term bonds. Liquidity refers to the ease with which a bond can be bought or sold in the market without significantly impacting its price. Investors who prioritize liquidity may prefer shorter-term bonds as they offer more flexibility to sell the investment before maturity if needed.

7. Lastly, investors should be aware of the concept of average bond maturity in bond funds or ETFs. Bond funds typically hold a portfolio of bonds with varying maturities. The average bond maturity of a fund provides an indication of the overall interest rate risk and potential volatility of the fund. Investors with a low-risk tolerance may opt for bond funds with shorter average maturities to mitigate interest rate risk.

Understanding bond maturity is essential for fixed-income investors to align their investment goals, risk tolerance, and cash flow needs. The maturity of a bond affects the timing and stability of cash flows, the relationship with interest rates, and the liquidity of the investment. By carefully considering bond maturity, investors can make informed investment decisions that align with their financial objectives.

Understanding Bond Maturity and Its Importance - G7 Bond Maturity: Evaluating the Significance for Fixed Income Investors

24. Evaluating the Impact of G7 Bond Maturity on Fixed-Income Investors

1. evaluating the Impact of G7 bond Maturity on Fixed-Income Investors

When it comes to investing in fixed-income securities, one key factor that investors need to consider is the maturity of the bonds they are investing in. The maturity of a bond refers to the length of time until the bond's principal is repaid in full. In the case of G7 bonds, which are issued by the governments of the seven largest advanced economies in the world, evaluating the impact of bond maturity becomes even more crucial for fixed-income investors.

2. Understanding the Relationship between Bond Maturity and Interest Rates

One of the primary ways in which bond maturity impacts fixed-income investors is through its relationship with interest rates. Generally, longer-maturity bonds tend to be more sensitive to changes in interest rates compared to shorter-maturity bonds. This is because the longer the bond's maturity, the more time there is for interest rates to fluctuate. As a result, when interest rates rise, the value of longer-maturity bonds tends to decline more significantly than shorter-maturity bonds. Conversely, when interest rates fall, longer-maturity bonds tend to experience greater price appreciation.

For example, let's consider a fixed-income investor who holds a 10-year G7 bond with a fixed interest rate of 3%. If interest rates rise by 1%, the value of the bond is likely to decline as new bonds with higher yields become available in the market. On the other hand, if interest rates decrease by 1%, the value of the bond is likely to increase as the fixed interest rate becomes more attractive relative to the prevailing rates.

3. balancing Risk and Return with bond Maturity

When evaluating the impact of G7 bond maturity on fixed-income investors, it's important to strike a balance between risk and return. Generally, longer-maturity bonds offer higher yields to compensate investors for the additional risk they assume due to interest rate fluctuations. However, this also means that longer-maturity bonds carry a higher degree of interest rate risk compared to shorter-maturity bonds.

Fixed-income investors with a lower risk tolerance may opt for shorter-maturity G7 bonds, as they offer more stability and protection against interest rate volatility. On the other hand, investors seeking higher yields and are willing to tolerate greater fluctuations in bond prices may choose longer-maturity bonds.

4. Case Study: Evaluating the Impact of G7 Bond Maturity

To illustrate the significance of bond maturity for fixed-income investors, let's consider a case study. Imagine an investor who purchased a 30-year G7 bond with a 4% fixed interest rate. Over the course of 10 years, interest rates in the market have declined significantly, resulting in new bonds with lower yields. As a result, the value of the investor's bond has increased due to its attractive fixed interest rate compared to prevailing rates.

In this case, the longer bond maturity allowed the investor to benefit from the declining interest rate environment, resulting in capital appreciation. However, it's important to note that had interest rates risen, the investor would have experienced a decline in the bond's value.

5. Tips for Evaluating G7 Bond Maturity

When evaluating the impact of G7 bond maturity on fixed-income investors, here are some tips to consider:

- Understand your risk tolerance: Assess your risk tolerance and investment objectives to determine whether shorter-maturity or longer-maturity bonds align better with your financial goals.

- Monitor interest rate trends: Stay informed about changes in interest rates and their potential impact on the value of your bonds. This will help you make informed decisions about bond maturities.

- diversify your bond portfolio: Consider diversifying your bond portfolio by investing in a mix of shorter and longer-maturity G7 bonds. This can help mitigate the impact of interest rate fluctuations on your overall fixed-income investments.

Evaluating the impact of G7 bond maturity is crucial for fixed-income investors. Understanding the relationship between bond maturity and interest rates, balancing risk and return, and considering real-life case studies can help investors make informed decisions about their fixed-income portfolios. By following these tips, investors can navigate the bond market with greater confidence and potentially enhance their investment returns.

Evaluating the Impact of G7 Bond Maturity on Fixed Income Investors - G7 Bond Maturity: Evaluating the Significance for Fixed Income Investors

25. Factors Affecting G7 Bond Maturity and Their Implications