1. Alternative funding models

There are a number of alternative funding models for startups. Some examples include equity crowdfunding, corporate venture capital, and angel investment. Equity crowdfunding is when investors contribute money to a startup in exchange for shares of the company. Corporate venture capital is when a company invests money in a startup in order to gain an equity stake in the company. Angel investment is when someone provides money, usually in the form of angel investments, to support a startup's early stages.

2. The Power of Collaboration in Refugee Integration Startups:Collaborative Funding Models: Crowdfunding and Impact Investment for Refugee Integration Startups

1. Crowdfunding: Empowering Refugee Integration Startups

Crowdfunding has emerged as a powerful tool for supporting refugee integration startups, allowing individuals and communities to come together to fund innovative projects and initiatives. This collaborative funding model has the potential to create significant impact by enabling refugees to access the financial resources they need to start and grow their businesses.

One notable example of a successful crowdfunding campaign for a refugee integration startup is the project "Refugee Bike" in Germany. This initiative aimed to provide bicycles to refugees, helping them overcome transportation challenges and improve their mobility and independence. Through a crowdfunding campaign, the project raised over €85,000, enabling them to distribute bicycles to hundreds of refugees across the country.

2. Impact Investment: driving Social change through Refugee Integration Startups

Impact investment, on the other hand, focuses on generating both financial returns and positive social or environmental impact. This funding model aligns perfectly with the mission of refugee integration startups, as it seeks to support ventures that aim to create sustainable solutions for refugee integration.

One inspiring example of impact investment in the refugee integration space is the Social Impact Fund for Refugees and Migrants (SIRUM). SIRUM is a social enterprise that connects surplus unused medication from healthcare facilities to patients who cannot afford their prescriptions. By leveraging impact investment, SIRUM has been able to expand its operations, reaching more patients and reducing healthcare waste, while also generating financial returns for its investors.

3. Combining Crowdfunding and Impact Investment: Amplifying Refugee Integration Startups

The power of collaboration truly comes to life when crowdfunding and impact investment are combined. This innovative funding approach allows individuals, communities, and impact investors to pool their resources and support refugee integration startups in a more comprehensive and sustainable manner.

A great example of this collaborative funding model is the Refugee Investment Network (RIN). RIN brings together impact investors, philanthropists, and refugee integration startups to create a global network dedicated to mobilizing capital for refugee and host community entrepreneurs. By facilitating connections and providing financial support through both crowdfunding campaigns and impact investment opportunities, RIN is helping to amplify the impact of refugee integration startups worldwide.

In conclusion, collaborative funding models such as crowdfunding and impact investment play a pivotal role in supporting refugee integration startups. Through these funding approaches, individuals, communities, and impact investors can come together to empower refugees, drive social change, and create a more inclusive and prosperous future for all.

The Power of Collaboration in Refugee Integration Startups:Collaborative Funding Models: Crowdfunding and Impact Investment for Refugee Integration Startups - Coming Together: The Power of Collaboration in Refugee Integration Startups

3. Advantages of ICORs over Traditional Funding Models

The world of startup financing has seen a significant shift over the past few years, with the emergence of new funding models that have disrupted the traditional venture capital (VC) landscape. One such model that has gained traction in recent times is Initial Coin Offerings (ICOs) or Initial Coin Offering for Regulation (ICOR). These models are a form of crowdfunding that allows startups to raise funds in exchange for tokens or coins, which can be traded on cryptocurrency exchanges. While traditional funding models have been in use for decades, they have several limitations that ICORs can overcome.

One of the main advantages of ICORs over traditional funding models is the speed at which they can raise capital. Unlike traditional funding models, which can take several months or even years to secure, ICORs can raise funds in a matter of weeks or even days. This is because ICORs are open to a global pool of investors who can participate in the offering via the internet, making it easier for startups to reach a large audience quickly.

Another advantage of ICORs is that they are more accessible to small investors than traditional funding models. In traditional funding models, only accredited investors with a high net worth can participate in funding rounds, which limits the pool of potential investors. In contrast, ICORs are open to anyone with an internet connection and a small amount of capital to invest, making it easier for startups to attract a larger number of investors.

ICORs also offer greater flexibility than traditional funding models. With ICORs, startups can set their own terms for the offering, including the price and number of tokens on offer. This flexibility allows startups to tailor the offering to their specific needs and goals, rather than having to conform to the requirements of traditional funding models.

ICORs also provide startups with more control over their funding rounds. In traditional funding models, investors often have significant influence over the direction of the company, as they may require a seat on the board or other forms of control. In contrast, ICORs allow startups to retain greater control over their company, as the investors do not have the same level of control over the direction of the company.

Lastly, ICORs offer startups a more transparent way of raising funds. With traditional funding models, the details of the funding round may be kept confidential, making it difficult for investors to assess the value of their investment. In contrast, ICORs are often more transparent, as the details of the offering and the tokens themselves are publicly available on the blockchain. This transparency can help to build trust between investors and startups, which is essential for long-term success.

While traditional funding models have been in use for decades, they have several limitations that ICORs can overcome. ICORs offer startups greater speed, accessibility, flexibility, control, and transparency than traditional funding models, making them an attractive option for startups looking to raise capital quickly and efficiently.

4. Funding Models

There are a variety of funding models that startups can use to finance their businesses. This section will provide a short summary of the four most common models for startup financing.

1. Equity: Equity is a form of investment that allows investors to participate in a company's success. Equity is typically given to startups that have a high risk and high potential.

2. Seed: seed funding is an investment model in which venture capitalists invest money in early-stage startups. Seed funding can be used for companies with a low market cap and no current customers.

3. Angel: angel funding is a type of equity investment that is given to startups that have raised more than $100,000 from individual investors. Angel funding can be used for companies with a high risk and high potential.

4. private equity: Private Equity is a type of venture capital investment that is focused on large companies. Private Equityfunding can be used for companies with a high market cap and no current customers.

Funding Models - Financial Models You Can Use to Financially Model Your Startup

5. Grassroots Organizing Startups Driving Global Change:Financing the Revolution: Funding Models for Sustainable Global Impact

1. Crowdfunding: Empowering the Masses

Crowdfunding has emerged as a popular funding model for grassroots organizing startups aiming to drive global change. This approach allows individuals from all over the world to contribute small amounts of money towards a specific cause or project. platforms like Kickstarter and indiegogo have played a significant role in enabling these startups to raise the necessary funds. For example, a startup focused on providing clean drinking water to remote villages in developing countries can create a crowdfunding campaign to gather support and resources. By leveraging the power of collective action, grassroots organizations can finance their revolutions and make a sustainable global impact.

2. Impact Investing: Aligning Financial Returns with Social Good

Impact investing has gained momentum in recent years as investors seek opportunities to generate both financial returns and positive social or environmental outcomes. This funding model allows investors to support grassroots organizing startups that are driving global change while also earning a financial return on their investments. For instance, a venture capital firm may choose to invest in a startup that is developing affordable and sustainable housing solutions for underserved communities. By providing financial resources to these startups, impact investors can contribute to the revolution while also diversifying their investment portfolios.

3. Grants and Foundations: Catalyzing Change

Grants and foundations have long been instrumental in financing grassroots organizing startups with the aim of creating sustainable global impact. These organizations provide financial support through various programs and initiatives, enabling startups to develop and scale their operations. For example, a foundation focused on environmental conservation may offer grants to startups working towards reforestation or reducing carbon emissions. By partnering with grants and foundations, grassroots organizations can access the necessary resources to drive their revolutions and make a lasting difference.

4. Corporate Partnerships: Leveraging Business for Good

Corporate partnerships can be a powerful funding model for grassroots organizing startups, allowing them to tap into the resources and expertise of established companies. Through strategic collaborations, startups can secure financial support, mentorship, and access to new markets. For instance, a tech startup focused on improving access to education in underserved communities can partner with a corporate sponsor to receive funding and support for their initiatives. By leveraging the resources and networks of corporate partners, grassroots organizations can accelerate their impact and drive meaningful change on a global scale.

5. government Grants and programs: Public Support for Global Change

Government grants and programs can play a crucial role in financing grassroots organizing startups that are driving global change. These funding opportunities allow startups to access public resources and support, enabling them to scale their operations and reach a wider audience. For example, a startup focused on empowering marginalized communities through entrepreneurship may receive a government grant to fund their training and mentorship programs. By leveraging government support, grassroots organizations can amplify their impact and create sustainable change that benefits society as a whole.

In conclusion, financing the revolution for sustainable global impact requires innovative funding models that empower individuals, align financial returns with social good, catalyze change through grants and foundations, leverage corporate partnerships, and tap into government support. By utilizing these diverse funding approaches, grassroots organizing startups can secure the resources they need to drive their revolutions and create a lasting impact on a global scale.

Grassroots Organizing Startups Driving Global Change:Financing the Revolution: Funding Models for Sustainable Global Impact - From Local to Global: Grassroots Organizing Startups Driving Global Change

6. The Success of Philanthropic Startups:Innovative Funding Models: Blending Profit and Purpose

1. Crowdfunding: A Revolutionary Approach to Funding

One of the most popular and innovative funding models that has emerged in recent years is crowdfunding. This model allows startups to raise capital by collecting small amounts of money from a large number of individuals, typically through online platforms. Crowdfunding has gained traction in the social impact space, as it offers a way for philanthropic startups to engage the community and mobilize support for their cause.

For example, Kiva, a non-profit organization, utilizes crowdfunding to provide microloans to entrepreneurs in developing countries. By allowing individuals to lend as little as $25, Kiva has enabled millions of people to access capital that they otherwise would not have been able to obtain. This innovative funding model not only supports business growth but also contributes to poverty alleviation and economic development.

2. Impact Investing: Aligning Financial Returns with Social Impact

Impact investing is another funding model that has gained popularity in the realm of philanthropic startups. This model involves making investments in companies, organizations, or funds with the intention of generating measurable social or environmental impact alongside financial returns. Impact investors actively seek out opportunities that align with their values and prioritize the "double bottom line" of profit and purpose.

One notable example of impact investing is Acumen, a non-profit venture fund that invests in companies tackling poverty and addressing social challenges. Acumen's investments have supported businesses in sectors such as healthcare, energy, and agriculture, with the aim of creating sustainable solutions to some of the world's most pressing problems. By blending profit and purpose, impact investing has the potential to drive meaningful change while generating financial returns for investors.

3. social Impact bonds: Pay for Success

Social Impact Bonds (SIBs), also known as Pay for Success contracts, are an innovative funding model that brings together governments, investors, and service providers to address social issues. In this model, private investors provide upfront capital to fund social programs, and the government repays the investors with a return on investment only if predetermined social outcomes are achieved.

One example of the successful implementation of SIBs is the Rikers Island Social Impact Bond project in New York City. This initiative aimed to reduce recidivism rates among inmates by providing comprehensive support and services upon their release from prison. By leveraging private funding, the government was able to test and scale innovative interventions that led to significant reductions in recidivism rates, ultimately saving taxpayer dollars.

In conclusion, innovative funding models that blend profit and purpose are revolutionizing the world of philanthropic startups. Crowdfunding, impact investing, and social impact bonds are just a few examples of the creative approaches that are driving social change while also generating financial returns. These models not only provide alternative sources of funding but also empower individuals and organizations to make a meaningful difference in the world.

The Success of Philanthropic Startups:Innovative Funding Models: Blending Profit and Purpose - From Silicon Valley to Social Impact: The Success of Philanthropic Startups

7. The Role of Venture Capital in Supporting Foodtech Startups:Venture capital funding models for foodtech startups

1. Seed Funding:

Seed funding is the initial investment received by foodtech startups to help them prove their concept and develop a minimum viable product (MVP). This stage typically involves raising relatively smaller amounts of capital, usually from angel investors or early-stage venture capital firms. Seed funding allows startups to conduct market research, build a prototype, and test their business model.

For example, Impossible Foods, a plant-based meat company, raised $75 million in seed funding to develop its flagship product, the Impossible Burger. This funding helped them refine their recipe, scale up production, and create a strong brand presence.

2. Series A Funding:

Once a foodtech startup has successfully validated its concept and achieved some level of market traction, it may seek Series A funding. This stage involves raising a larger round of funding to support product development, expand the team, and scale operations.

For instance, Memphis Meats, a cell-based meat company, raised $17 million in series A funding to accelerate its research and development efforts. This funding allowed them to refine their cell-culturing techniques, reduce production costs, and ultimately bring their lab-grown meat products closer to commercialization.

3. Series B Funding:

At the Series B stage, foodtech startups are typically looking to scale their operations and capture a larger market share. This funding round enables startups to invest in marketing, expand their distribution channels, and strengthen their supply chain.

One notable example is Blue Apron, a meal-kit delivery service that raised $50 million in Series B funding. With this capital injection, Blue Apron was able to expand its customer base, improve its delivery logistics, and enhance its menu offerings.

4. Series C Funding:

Series C funding is often sought by foodtech startups that have achieved significant market traction and are looking to further accelerate their growth. This stage involves raising substantial amounts of capital to expand into new markets, invest in research and development, and potentially prepare for an initial public offering (IPO).

A prime example is Beyond Meat, a plant-based meat company that raised $55 million in Series C funding. This funding allowed Beyond Meat to expand its product line, increase production capacity, and enter international markets. It also positioned the company for a successful IPO in 2019.

5. Strategic Partnerships and Acquisitions:

In addition to traditional venture capital funding, foodtech startups may also explore strategic partnerships or acquisitions as a means of securing capital and gaining access to new resources and expertise. These partnerships can provide startups with not only financial support but also valuable industry insights and distribution channels.

For instance, Nestlé, a multinational food and beverage company, acquired Sweet Earth Foods, a plant-based food startup. This strategic acquisition provided Sweet Earth Foods with the financial backing and distribution network of a global food industry leader, enabling them to expand their reach and accelerate their growth.

In conclusion, venture capital funding plays a crucial role in fueling innovation and supporting the growth of foodtech startups. From seed funding to strategic partnerships, these funding models provide startups with the necessary resources to develop groundbreaking technologies, disrupt traditional food systems, and create a more sustainable and inclusive food future.

The Role of Venture Capital in Supporting Foodtech Startups:Venture capital funding models for foodtech startups - Fueling Innovation: The Role of Venture Capital in Supporting Foodtech Startups

8. Startups need to find new funding models

In the past, startup funding they need to get off the ground. However, in recent years, there have been a number of new funding models that have emerged, which can be used to get startup funding without going into debt.

One of the most popular new funding models is crowdfunding. With crowdfunding, startups can raise money from a large number of people, often through an online platform. This can be a great way to get funding from people who believe in your idea and want to help you get your business off the ground.

Another new funding model that has emerged is called equity crowdfunding. With equity crowdfunding, investors provide funding in exchange for a share of equity in the company. This can be a great way to raise money from investors who are interested in your company and want to have a stake in its success.

There are also a number of government programs that provide funding for startups. In the United States, the small Business administration provides loans and grants to small businesses. There are also a number of state-level programs that provide funding for startups.

Finally, another option for getting startup funding is to bootstrap your business. This means that you use your own personal savings or money from friends and family to get your business off the ground. While this can be a riskier option, it can also be a great way to get your business started without going into debt.

No matter which funding model you choose, it is important to remember that you will need to have a strong business plan and track record to attract investors. However, with the right approach, you can find the funding you need to get your startup off the ground without going into debt.

I realized that, after tasting entrepreneurship, I had become unfit for the corporate world. There was no turning back. The only regret I had was having wasted my life in the corporate world for so long.

9. Exploring Different Funding Models

1. Introduction

In the realm of alternative funding models, lottery bonds have emerged as a unique approach that combines financial investment with social responsibility. With the aim of generating funds for public projects, lottery bonds have gained attention for their potential to address societal needs while offering investors an opportunity for financial gain. In this section, we will explore lottery bonds as one of the alternative approaches to funding public projects, highlighting their benefits, drawbacks, and ethical implications.

2. The Concept of Lottery Bonds

Lottery bonds, also known as prize-linked savings accounts or social impact bonds, operate on the principle of pooling funds from investors to finance public projects. These bonds offer investors the chance to win prizes or receive interest payments, while the funds raised are utilized to support various initiatives such as education, healthcare, or infrastructure development. By combining the allure of potential winnings with the objective of societal betterment, lottery bonds aim to attract a wider pool of investors who may not typically engage in traditional investment opportunities.

3. Benefits of Lottery Bonds

One of the key advantages of lottery bonds is their potential to mobilize significant funds for public projects that may otherwise struggle to secure financing. traditional funding methods, such as tax increases or government borrowing, often face resistance from the public or budget constraints. Lottery bonds provide an alternative avenue for generating funds, leveraging the excitement and popularity of lotteries to attract investors. Additionally, lottery bonds can help diversify funding sources, reducing reliance on a single revenue stream and promoting financial stability for public projects.

4. Drawbacks and Ethical Considerations

While lottery bonds offer potential benefits, they also raise ethical considerations that should be carefully examined. Critics argue that such bonds can exploit vulnerable individuals by capitalizing on their desire for easy winnings. The temptation of lotteries may entice individuals to invest money they cannot afford to lose, potentially exacerbating financial hardships. Moreover, the allocation of funds through lottery bonds may not always align with societal priorities, as the projects supported are often determined by the investors' preferences rather than comprehensive needs assessments.

5. Case Study: The United Kingdom's National Lottery Community Fund

A notable example of lottery bonds in action is the National Lottery Community Fund in the United Kingdom. Established in 1994, the fund channels proceeds from the National Lottery into various projects that benefit communities across the country. The National Lottery Community Fund has supported a wide range of initiatives, including funding for community centers, environmental conservation projects, and programs aimed at improving mental health services. This case study demonstrates the potential impact of lottery bonds in addressing societal needs and fostering community development.

6. Tips for Implementing Ethical Lottery Bond Programs

To ensure the ethical implementation of lottery bond programs, several key considerations should be taken into account. First and foremost, transparency is crucial. Clear communication regarding the allocation of funds, the odds of winning, and the impact of investments is essential to maintain trust and accountability. Additionally, investor protection measures, such as setting investment limits and providing financial education, can help mitigate the risk of individuals investing beyond their means. Lastly, ongoing evaluation and reassessment of the projects supported by lottery bonds are necessary to ensure alignment with societal needs and ethical standards.

Lottery bonds offer an alternative approach to funding public projects, combining financial investment with social responsibility. While they have the potential to generate significant funds and diversify revenue streams, ethical considerations must be carefully addressed to prevent exploitation and ensure the allocation of funds aligns with societal priorities. By implementing transparency, investor protection measures, and thorough evaluation processes, lottery bond programs can contribute to positive social impact while maintaining ethical standards.

Exploring Different Funding Models - Lottery Bonds and Social Responsibility: An Ethical Debate

10. The Future of Museum Funding Models

As museums continue to evolve, so do their funding models. The need for museums to be financially sustainable has led to an exploration of different funding options. While government funding has been the traditional source for museums, there has been a push towards self-sufficiency through the establishment of user fees. However, this approach has been met with mixed reactions from the public, with some considering it a barrier to access and others seeing it as a way to support the institution. In addition to user fees, museums have also explored other funding options such as donations and corporate sponsorships.

Here are some insights on the future of museum funding models:

1. User fees: While there is a growing trend towards user fees, museums need to be mindful of the potential impact on accessibility. For example, the National Museum of African American History and Culture in Washington DC offers free admission but requires timed passes. This approach guarantees access to all visitors while limiting the number of people in the museum at any given time.

2. Donations: Donations have always been a part of museum funding, but some institutions are taking a more proactive approach to fundraising. The Metropolitan Museum of Art in New York City recently announced that it will no longer charge out-of-state visitors a mandatory admission fee, instead relying on donations to support the museum.

3. Corporate sponsorships: Museums have also explored corporate sponsorships as a way to supplement funding. The Museum of Modern Art in New York City has partnered with Uniqlo, a Japanese clothing brand, for a series of exhibitions and events. While corporate sponsorships can provide a substantial source of funding, museums need to be careful about maintaining their integrity and not appearing to endorse any particular company or product.

The future of museum funding models is likely to be a combination of these and other options, as museums strive to balance financial sustainability with accessibility and integrity.

The Future of Museum Funding Models - Museum admissions: Unveiling History: User Fees and the Future of Museums

11. Exploring Alternative Funding Models for Pension Reforms

Exploring alternative funding models for pension reforms is a crucial aspect of addressing the challenges faced by pay-as-you-go systems. As these systems rely on current workers' contributions to fund the pensions of retirees, demographic shifts and increasing life expectancy have put immense strain on their sustainability. To ensure the long-term viability of pension schemes, governments and policymakers are actively seeking innovative funding models that can alleviate financial burdens and provide adequate retirement benefits for future generations.

1. Diversification of investment portfolios: One approach to secure additional funding for pension reforms is through diversifying investment portfolios. By expanding the range of assets in which pension funds invest, such as stocks, bonds, real estate, or even infrastructure projects, there is potential for higher returns and increased revenue streams. For instance, some countries have successfully invested in renewable energy projects, generating both financial returns and contributing to sustainable development goals.

2. public-private partnerships: Collaborating with the private sector can offer an alternative funding model for pension reforms. Governments can establish partnerships with private companies to create supplementary pension plans or contribute to existing ones. This not only injects additional funds into the system but also spreads the risk across multiple stakeholders. For example, in Chile, the introduction of privately managed individual retirement accounts alongside the public pay-as-you-go system has helped diversify funding sources and improve overall pension coverage.

3. Mandatory employer contributions: Requiring employers to contribute a certain percentage of their employees' salaries towards pension funds can significantly boost funding levels. This approach ensures a more equitable distribution of responsibility between workers and employers while providing a stable source of income for retirement benefits. Countries like Australia have implemented mandatory employer contributions through their superannuation system, resulting in substantial accumulations of retirement savings over time.

4. Voluntary individual contributions: Encouraging individuals to make voluntary contributions towards their pensions can supplement traditional pay-as-you-go systems. Governments can incentivize citizens to save for retirement by offering tax breaks or matching contributions. For instance, the United States' individual Retirement account (IRA) allows individuals to contribute a portion of their income tax-free, providing an additional source of retirement income.

5. Intergenerational solidarity: Fostering intergenerational solidarity can be an effective funding model for pension reforms. This involves redistributing resources between generations to ensure fairness and sustainability. For example, some countries have implemented policies that link pension benefits to the average wage or inflation rate, ensuring that retirees' incomes keep pace with economic growth while maintaining affordability for future workers.

Exploring alternative funding

Exploring Alternative Funding Models for Pension Reforms - Pension Reforms: Exploring Pension Reforms for Pay as You Go Systems

12. The Top Funding Models for Marketplace Startups

There are a variety of ways to raise money for your marketplace startup, but the most common way is through online campaigns. This is because online campaigns are easy to set up and manage, and they generate a large amount of traffic that can be used to generate leads and sales.

Another common way to raise money for your marketplace startup is through grants and scholarships. Grants and scholarships are often offered to start-ups that have innovative ideas or that have passed an assessment test. Grants and scholarships can also be offered in specific amounts, so entrepreneurs can find the right funding model that fit their business needs.

There are also a number of other funding options available to entrepreneurs when starting a marketplace business. These include angel investors, venture capitalists, and private equity firms. Angel investors are typically interested in early stage businesses and can providefunding up to $250,000. Venture capitalists are typically interested in companies that have been in business for less than two years and can invest up to $100 million. Private equity firms are usually interested in companies that have been in business for more than 10 years and can invest up to $1 billion.

Each of these Funding models has its own advantages and disadvantages, so entrepreneurs should carefully consider which one would fit their specific business needs. In addition, each funding model has its own set of taxes associated with it, so entrepreneurs should also be aware of these factors when choosing which funding model to pursue.

Overall, online campaigns are the most common way to raise money for your marketplace startup, but there are otherfunding models available if you need more money than what you can get through online campaigns. Be sure to research each funding model before launching an online campaign so that you know what type of investment would be best for your specific business needs.

13. Frequently Asked Questions About Startup Funding Models

1. What are the most common startup funding models?

There are a few different ways that startups typically raise money. The most common are through friends and family, angel investors, and venture capitalists.

2. How do friends and family investments work?

Friends and family are often the first to invest in a startup. They do so because they believe in the company and the founder, not because they expect to make a lot of money. These investments are typically smaller than those from angels or VCs.

3. How do angel investors work?

Angel investors are individuals who invest their own money in startups. They do so because they believe in the company and the founder, and they hope to make a lot of money if the company is successful. Angel investors typically invest more money than friends and family, but less than VCs.

4. How do venture capitalists work?

Venture capitalists (VCs) are firms that invest other people's money in startups. They do so because they believe in the company and the founder, and they hope to make a lot of money if the company is successful. VCs typically invest more money than angels or friends and family.

5. How do crowdfunding platforms work?

Crowdfunding platforms allow anyone to invest small amounts of money in startups. The platforms typically take a percentage of the money raised. Crowdfunding is a good option for startups that have a large number of small investors, such as those with a large social media following.

6. How do incubators and accelerators work?

Incubators and accelerators are organizations that invest money and resources in startups. They do so in order to help the companies grow and be successful. Incubators and accelerators typically take a small equity stake in the startups they invest in.

Frequently Asked Questions About Startup Funding Models - Startup Funding Model Excel Template Make Your Business Plan Shine

14. The ABCs of VC A Comprehensive Guide to the Most Popular Funding Models

The funding process for startups can be a confusing and daunting task. There are many different types of funding, each with their own set of rules and regulations. However, understanding the different types of funding is essential for any startup looking to raise capital.

One of the most popular types of funding for startups is venture capital. venture capital is a type of private equity that is typically used to finance early-stage, high-growth companies. Venture capitalists are typically looking for companies that have the potential to generate large returns through rapid growth.

There are three main types of venture capital funding: seed funding, Series A funding, and Series B funding. Seed funding is the earliest stage of venture capital funding. This type of funding is typically used to finance the initial stages of a companys development, such as research and development, product development, and initial marketing expenses.

Series A funding is the second stage of venture capital funding. This type of funding is typically used to finance a companys growth, such as expanding into new markets or hiring new employees. series B funding is the third stage of venture capital funding. This type of funding is typically used to finance a companys expansion, such as opening new offices or expanding into new product lines.

Venture capitalists typically invest in companies that they believe have high growth potential. However, there are also a number of other factors that venture capitalists consider when making an investment decision, such as the teams experience and track record, the size of the market opportunity, the competitive landscape, and the companys business model.

Venture capitalists typically invest in companies that are located in Silicon Valley, New York City, Boston, and Los Angeles. However, there are a number of venture capitalists that are located outside of these major metropolitan areas.

Venture capitalists typically invest in companies that are in the technology, healthcare, and life sciences industries. However, there are a number of venture capitalists that invest in other industries, such as consumer goods, energy, and financial services.

Venture capitalists typically invest in companies that are early-stage companies. However, there are a number of venture capitalists that invest in late-stage companies.

Venture capitalists typically invest in companies that are privately held companies. However, there are a number of venture capitalists that invest in publicly traded companies.

Venture capitalists typically invest in companies that are based in the United States. However, there are a number of venture capitalists that invest in companies that are based outside of the United States.

The funding process for startups can be a confusing and daunting task. However, understanding the different types of funding is essential for any startup looking to raise capital. Venture capital is a type of private equity that is typically used to finance early-stage, high-growth companies. There are three main types of venture capital funding: seed funding, Series A funding, and Series B funding. Seed funding is the earliest stage of venture capital funding. Series A funding is the second stage of venture capital funding. Series B funding is the third stage of venture capital funding. Venture capitalists typically invest in companies that they believe have high growth potential.

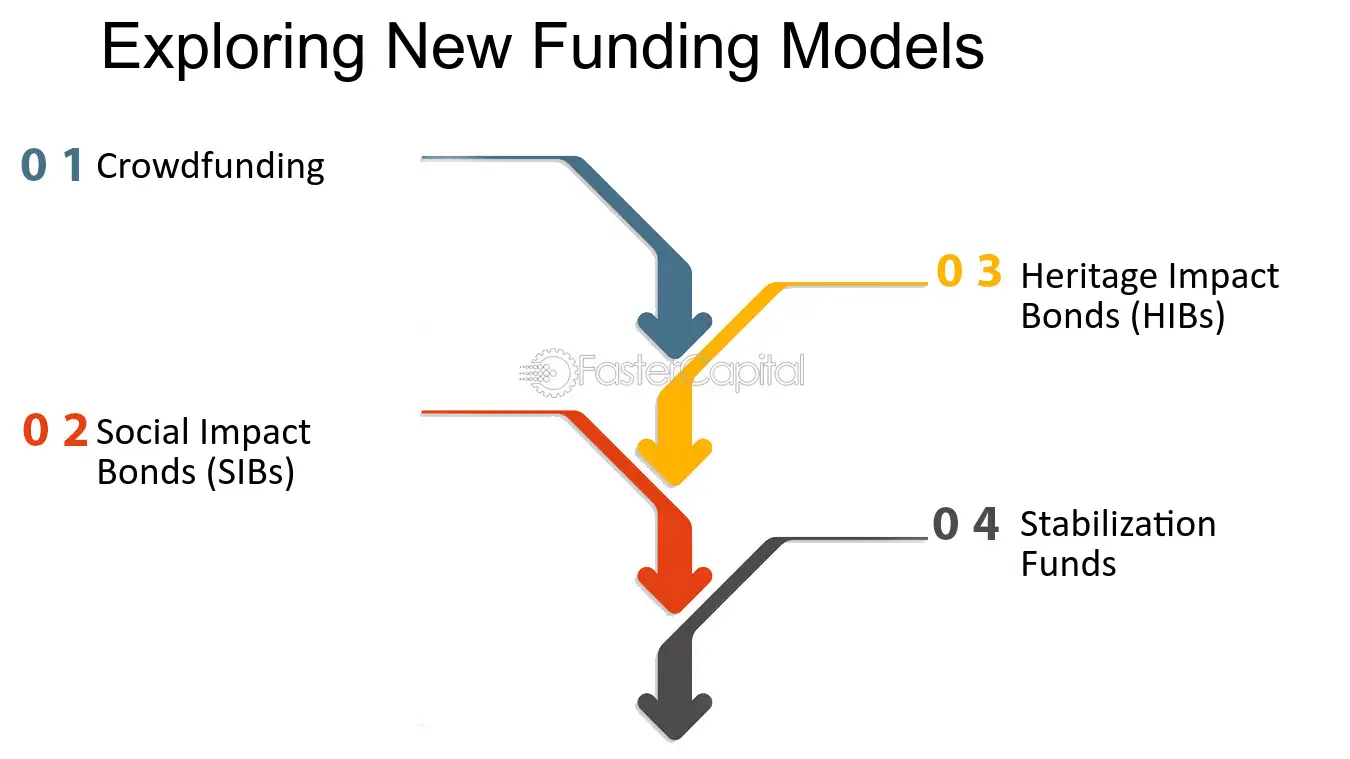

15. Exploring New Funding Models

In recent years, there has been a growing interest in exploring new funding models for heritage projects. With the traditional funding sources being limited and often insufficient, heritage finance has become a crucial aspect of heritage preservation and restoration. Innovations in Heritage Finance have become a pressing need as the world is facing unprecedented challenges due to the COVID-19 pandemic. The pandemic has had a significant impact on the cultural and heritage sectors, with many projects being put on hold or cancelled. However, this has also led to new opportunities for innovative funding models that can provide support for heritage projects during these challenging times.

Here are some insights into the Innovations in Heritage Finance: Exploring New Funding Models:

1. Crowdfunding: Crowdfunding has emerged as a popular funding model for heritage projects. It involves raising funds from a large number of people who are interested in supporting a particular project. crowdfunding platforms such as Kickstarter and indiegogo have been used to fund various heritage projects. For example, the restoration of the iconic Crystal Palace in London was funded through a crowdfunding campaign.

2. social Impact bonds (SIBs): SIBs are a form of outcome-based financing that involves private investors providing upfront capital to fund social projects. The investors are then repaid based on the success of the project. SIBs have been used to fund heritage projects such as the restoration of historic buildings.

3. Heritage Impact Bonds (HIBs): HIBs are similar to SIBs but are specifically designed for heritage projects. HIBs involve private investors providing upfront capital to fund a heritage project, with the investors being repaid based on the success of the project. The National Trust in the UK has recently launched a pilot project to explore the potential of HIBs.

4. Stabilization Funds: Stabilization Funds are a form of heritage finance that involves setting aside funds to be used in case of emergencies or unforeseen circumstances. Stabilization Funds can be used to provide support for heritage projects during times of crisis such as the COVID-19 pandemic. For example, the UK Government has recently announced a £92 million Culture Recovery Fund to support the heritage sector during the pandemic.

Innovations in Heritage Finance have become a crucial aspect of heritage preservation and restoration. With the emergence of new funding models, heritage projects can be supported in new and innovative ways. These new funding models have the potential to provide better financial stability for heritage projects, which is essential for the preservation and restoration of our cultural heritage.

Exploring New Funding Models - The Intersection of Heritage and Finance: Unveiling Stabilization Funds

16. Cultural Heritage Startups Redefining Historical Exploration:Innovative Funding Models: Financing Cultural Heritage Startups

1. Crowdfunding: A Community-Powered Approach

Crowdfunding has revolutionized the way cultural heritage startups raise funds. platforms like Kickstarter and indiegogo provide a space for entrepreneurs to pitch their innovative ideas to a global audience. By offering rewards or equity in exchange for financial support, startups can tap into the power of the crowd to bring their projects to life.

For example, a startup called "ArchaeoQuest" used crowdfunding to finance an interactive mobile app that allows users to virtually explore ancient archaeological sites. By offering backers early access to the app and exclusive behind-the-scenes content, ArchaeoQuest successfully raised the funds needed to develop their groundbreaking technology.

2. venture capital: Fueling Growth and Expansion

Venture capital firms are increasingly recognizing the potential of cultural heritage startups and are investing in their growth and expansion. These firms provide startups financial support but also valuable expertise and networks that can help propel their businesses forward.

One notable example is "Artivive," a startup that combines augmented reality technology with art. Artivive's app allows users to experience digital art come to life when viewed through their smartphone or tablet. With the backing of venture capitalists, Artivive has been able to scale its operations, secure partnerships with renowned art institutions, and reach a global audience.

3. grants and Government funding: Preserving and Promoting Cultural Heritage

Government funding and grants play a crucial role in financing cultural heritage startups that focus on preserving and promoting our historical treasures. These funding sources often prioritize projects that contribute to cultural preservation, education, and tourism.

A standout example is the "Virtual Museum of Ancient Artifacts" project, which received a substantial grant from the Department of Cultural Affairs. This startup uses cutting-edge technology to create virtual replicas of ancient artifacts, allowing people from around the world to explore and learn about these treasures without compromising their physical integrity.

4. Corporate Sponsorship: Showcasing Corporate Social Responsibility

Corporate sponsorship provides an opportunity for cultural heritage startups to align themselves with companies that share their values and goals. By partnering with corporations through sponsorship agreements, startups can access financial resources, marketing support, and collaborative opportunities.

One inspiring example is the partnership between "Heritage Trails" and a leading travel company. Heritage Trails develops immersive guided tours that uncover hidden historical sites. With the financial backing and marketing assistance of the travel company, Heritage Trails has been able to expand its offerings and reach a wider audience of history enthusiasts.

Innovative funding models are reshaping the landscape of cultural heritage startups, empowering entrepreneurs to bring their creative ideas to life. Whether it's through crowdfunding, venture capital, grants, or corporate sponsorship, these financing options are enabling startups to preserve and promote our rich cultural heritage in unprecedented ways.

Cultural Heritage Startups Redefining Historical Exploration:Innovative Funding Models: Financing Cultural Heritage Startups - Unlocking Hidden Gems: Cultural Heritage Startups Redefining Historical Exploration

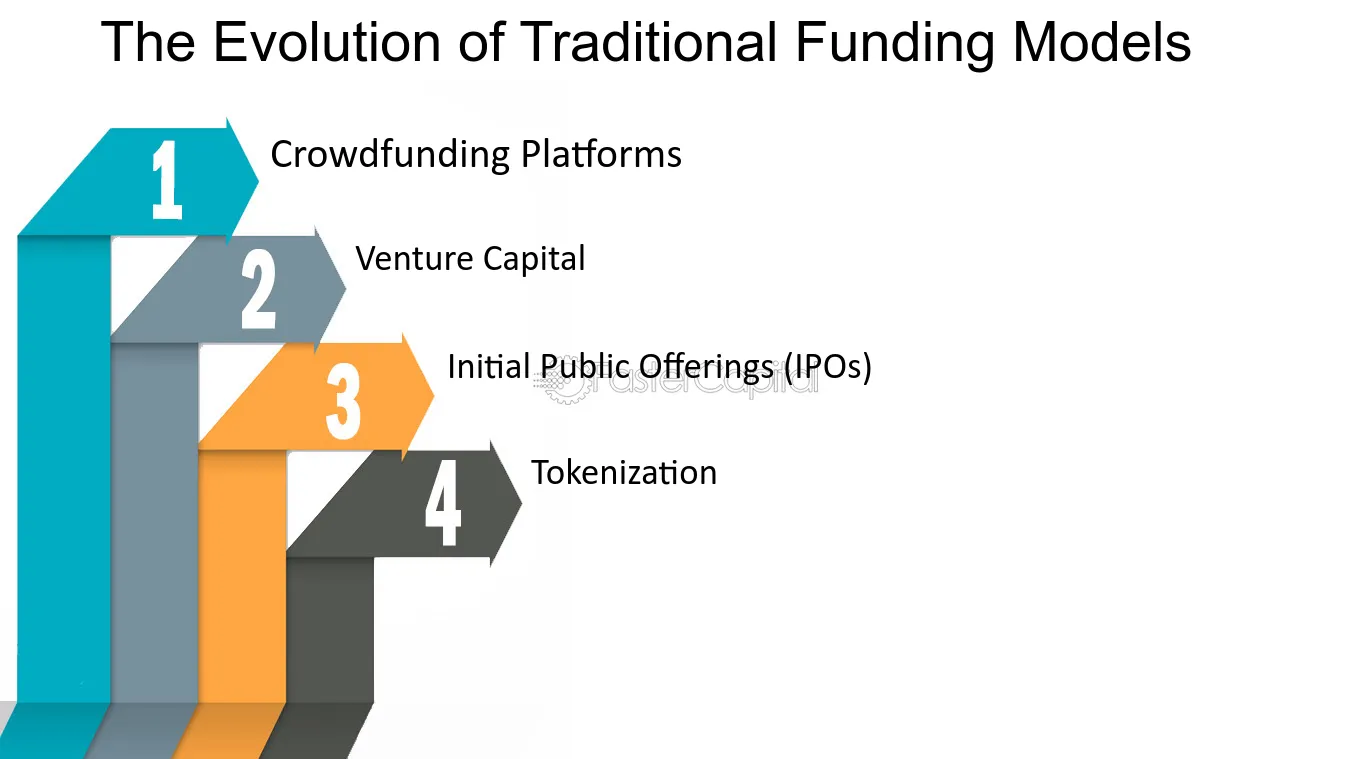

17. The Evolution of Traditional Funding Models

Traditional funding models have long been the go-to option for startups and businesses looking to secure capital for their ventures. However, with the emergence of blockchain technology and the rise of Initial Coin Offerings (ICOs), the landscape of funding models has undergone a significant evolution. In this section, we will explore the various ways in which traditional funding models have evolved to adapt to the changing needs and preferences of entrepreneurs and investors.

1. Crowdfunding Platforms:

One of the earliest shifts in traditional funding models was the rise of crowdfunding platforms. platforms like Kickstarter and indiegogo allowed individuals to fund projects they believed in, often in exchange for rewards or early access to products. This model offered a new way for entrepreneurs to raise capital without relying on traditional investors or financial institutions. However, crowdfunding platforms had limitations in terms of scalability and regulatory compliance.

2. venture capital:

Venture capital has long been a popular option for startups seeking funding. Venture capitalists provide funding in exchange for equity in the company, often playing an active role in the growth and development of the business. While venture capital has been successful in funding many innovative startups, it can be a lengthy and competitive process, with limited access to funding for early-stage companies. ICOs have presented an alternative funding option that allows companies to raise capital directly from a global pool of investors.

3. Initial Public Offerings (IPOs):

IPOs have traditionally been the ultimate goal for many startups, as they provide access to public markets and substantial funding. However, the IPO process is complex, costly, and time-consuming, making it a challenge for many smaller companies. Additionally, IPOs are often limited to accredited investors, excluding a significant portion of the population from participating. ICOs have opened up the opportunity for companies of all sizes to raise capital from a diverse range of investors, without the need for intermediaries or extensive regulatory requirements.

4. Tokenization:

Tokenization is a concept that has gained traction with the advent of blockchain technology. It involves the creation of digital tokens that can represent ownership in an asset, such as real estate, art, or intellectual property. By tokenizing assets, companies can fractionalize ownership and enable investors to buy and trade these tokens on blockchain platforms. This model allows for greater liquidity, accessibility, and transparency, offering a new way for investors to diversify their portfolios and support innovative projects.

Case Study: Brave Browser

One notable example of the evolution of traditional funding models is the Brave Browser's ICO. Brave Browser, a privacy-focused web browser, raised $35 million in just 30 seconds through their ICO in 2017. By offering Basic Attention Tokens (BAT) to investors, Brave Browser was able to secure funding for their project and build a community of supporters who believed in their vision. This successful ICO demonstrated the potential of ICOs to disrupt traditional fundraising methods and empower companies to connect directly with their user base.

Tip: Due Diligence is Key

As with any investment opportunity, conducting thorough due diligence is crucial when considering participating in an ICO or any alternative funding model. It is important to research the project, team, and underlying technology to assess its viability and potential for success. Additionally, understanding the regulatory landscape and compliance requirements is essential to ensure the legality and legitimacy of the investment.

In conclusion, the evolution of traditional funding models has been driven by the need for more accessible, efficient, and inclusive funding options. ICOs have emerged as a disruptive force, offering companies a way to raise capital directly from a global pool of investors, while also providing individuals with new investment opportunities. As blockchain technology continues to advance, it is likely that we will see further innovation in funding models, unlocking the potential for even greater access to capital and investment opportunities.

The Evolution of Traditional Funding Models - Unlocking the Potential of ICOs in Funding Rounds

18. Examining Alternative Funding Models for Social Programs

When it comes to the sustainability of social programs within the welfare state, one crucial aspect that needs careful consideration is the funding model. Traditionally, social programs have been financed through taxes, with governments relying on a portion of citizens' income or consumption to fund these initiatives. However, as societies evolve and face new challenges, it becomes imperative to explore alternative funding models that can ensure the long-term viability of social programs while maintaining solidarity among citizens.

1. public-Private partnerships (PPPs): One alternative funding model gaining traction is the establishment of public-private partnerships. In this model, governments collaborate with private entities to finance and deliver social programs. For instance, a government may partner with a private healthcare provider to offer affordable medical services to low-income individuals. This approach not only diversifies funding sources but also leverages the expertise and efficiency of private organizations.

2. social Impact bonds (SIBs): Social impact bonds are another innovative funding mechanism that has gained attention in recent years. SIBs involve private investors providing upfront capital for social programs, which are then implemented by non-profit organizations or service providers. If the program achieves predetermined outcomes, such as reducing homelessness or improving educational attainment, the government repays the investors with a return on their investment. SIBs incentivize efficiency and effectiveness in delivering social services while shifting some financial risk from taxpayers to investors.

3. Crowdfunding: With the rise of digital platforms and social media, crowdfunding has emerged as a potential funding avenue for social programs. Individuals or organizations can create online campaigns to raise funds for specific causes or initiatives. This approach allows citizens to directly contribute to causes they care about, fostering a sense of ownership and engagement within communities. For example, crowdfunding campaigns have successfully supported projects related to disaster relief efforts or community development initiatives.

4. corporate Social responsibility (CSR): Encouraging corporations to contribute financially to social programs through their corporate social responsibility initiatives is another viable funding model. Many companies already allocate a portion of their profits towards philanthropic endeavors, and expanding this commitment to support social programs can have a significant impact. Governments can incentivize CSR contributions through tax breaks or other benefits, ensuring that corporations actively participate in addressing societal challenges.

5. Wealth Redistribution: A more radical approach to funding social programs involves wealth redistribution. This model entails imposing higher taxes on the wealthy or implementing progressive taxation systems to generate additional revenue for social initiatives. By redistributing wealth, governments aim to reduce income inequality and ensure

Examining Alternative Funding Models for Social Programs - Welfare state: Solidarity Tax and the Sustainability of Social Programs