12 December 2003

Quantitative Strategy

TOPIC 1: Bayesian Asset Allocation: BlackLitterman

• Continuing on our theme of a Bayesian approach to

Asset Allocation, we introduce the Black-Litterman

model.

• The Black-Litterman model introduces the concept

of market equilibrium as a starting point.

• In parallel, the investor forms views of relative value

portfolios and assigns an error term to his forecast

as well as a degree of confidence in each view.

• This provides a flexible, logical and consistent way

of deviating from the market benchmark.

The traditional mean-variance optimization methodology

is fraught with practical problems. The main problem is

that the M-V optimization procedure leads to biased

optimal portfolios, even when using estimators for

expected returns and the covariance matrix of asset

returns which are unbiased (see, for example, MeanVariance gone bad, Quantitative Strategies, FIW 19-Sep2003). Parameters are estimated with uncertainty and

as such M-V optimization ends up being an error

maximizing exercise. What is effectively the result of

estimation error is seen by our opportunistic optimizer

as a trading opportunity. The results are often

unintuitive and lead to unbalanced portfolios with high

turnover. In addition, there is implicitly a 100%

confidence in expected returns views

For a long time practitioners relied on constraints to

obtain more sensible results. In particular, minimum and

maximum allocation limits are used. Moreover, trading

costs are imposed to insure portfolios do not swing

violently from month-to-month. Even then, the optimal

portfolios are often corner solutions, conflicting with the

idea of diversification benefits. Other practitioners have

even turned away from M-V optimization and solve

linear programs subject to various constraints to

maximize returns independently of variance. In the

process such methods artificially pull the result away

from the mathematically optimal one to a more realistic

one.

In our recent article (Stubborn Bayes, Quantitative

Strategies, FIW 31-Oct-2003) we looked at Bayesian

methods for asset allocation. We develop this further

here by introducing the Black-Litterman model, an

essentially Bayesian approach to asset allocation.

Bayesian statistics is essentially a way to impose a

subjective view on some set of estimated parameters,

some outcome, etc. We generally will temper our view

somewhat since we are not altogether stubborn and as

we see more data, we will change our opinion.

Bayesian methods allow us to impose a prior view, and

then, upon the arrival of new data, to alter our view (to

get a posterior). In general, we can specify our degree

Global Markets Research

Deutsche Bank@

Fixed Income Weekly

of certainty in the prior-held view (our stubbornness).

Bayesian methods are often criticized for their

subjectivity. Yet, a Bayesian would generally respond

that every approach to model is essentially subjective,

since we usually do not bother testing every

combination of variables and only go for those that

make some intuitive “sense.” To paraphrase the father

of CAPM, William Sharpe, “all investors are Bayesians”

and we take this to heart.

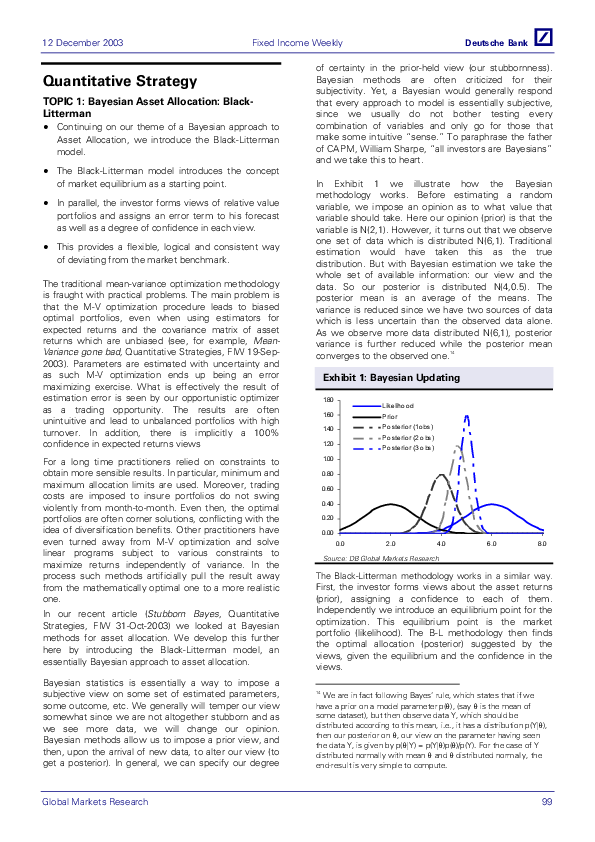

In Exhibit 1 we illustrate how the Bayesian

methodology works. Before estimating a random

variable, we impose an opinion as to what value that

variable should take. Here our opinion (prior) is that the

variable is N(2,1). However, it turns out that we observe

one set of data which is distributed N(6,1). Traditional

estimation would have taken this as the true

distribution. But with Bayesian estimation we take the

whole set of available information: our view and the

data. So our posterior is distributed N(4,0.5). The

posterior mean is an average of the means. The

variance is reduced since we have two sources of data

which is less uncertain than the observed data alone.

As we observe more data distributed N(6,1), posterior

variance is further reduced while the posterior mean

converges to the observed one.14

Exhibit 1: Bayesian Updating

1.80

Likeliho o d

1.60

P rio r

1.40

P o sterio r (1o bs)

P o sterio r (2 o bs)

1.20

P o sterio r (3 o bs)

1.00

0.80

0.60

0.40

0.20

0.00

0.0

2.0

4.0

6.0

8.0

Source: DB Global Markets Research

The Black-Litterman methodology works in a similar way.

First, the investor forms views about the asset returns

(prior), assigning a confidence to each of them.

Independently we introduce an equilibrium point for the

optimization. This equilibrium point is the market

portfolio (likelihood). The B-L methodology then finds

the optimal allocation (posterior) suggested by the

views, given the equilibrium and the confidence in the

views.

14

We are in fact following Bayes’ rule, which states that if we

have a prior on a model parameter p(θ), (say θ is the mean of

some dataset), but then observe data Y, which should be

distributed according to this mean, i.e., it has a distribution p(Y|θ),

then our posterior on θ, our view on the parameter having seen

the data Y, is given by p(θ|Y) = p(Y|θ)p(θ)/p(Y). For the case of Y

distributed normally with mean θ and θ distributed normally, the

end-result is very simple to compute.

99

�Deutsche Bank@

Fixed Income Weekly

This leads to more stable, tractable and intuitive

portfolios. In particular transaction costs are greatly

reduced since the effects of our views is mitigated by

the inclusion of the equilibrium.

Exhibit 2: Black-Litterman Methodology

Strategic

Tactical

• Global risk aversion

• Markert capitalization weights

• Covariance matrix (Σ)

• Investor‘s active views

• Confidence in views

12 December 2003

every single asset. On the other hand, with traditional

M-V analysis, one can only express absolute views and

has to do so for every single asset.

As such we have one absolute view on the 10+Y

bucket. In addition we have two relative views on the

steepness of the short term and medium term parts of

the curve. Table 2 summarises the views as relative

value portfolios.

Table 2: Investor Views

Market implied returns

Distribution of views

(Prior distribution)

Normal (Π, Σ)

Normal (V, Ω)

1-3 Y 3-5 Y 5-7 Y 7-10 Y 10+ Y Views Equilibrium

View 1

1.00

-1.00

0.00

0.00

0.00 -0.20%

-0.34%

View 2

0.00

0.00

1.00

-1.00

0.00 -0.25%

-0.25%

View 3

0.00

0.00

0.00

0.00

1.00 1.80%

1.91%

Source: DB Global Markets Research

Combining Views with the equilibrium

Posterior Distribution

The extent to which we deviate from the market

equilibrium will depend on how far our views are from it

and the degree of confidence we have in our views.

Normal (combined Π and V, combined Σ and Ω)

Source: DB Global Markets Research, K.Iordanis

The market equilibrium

To derive equilibrium returns, we make the assumption

that the market is efficient. It has often been

demonstrated that historically, the market portfolio was

very different from the ex-post optimal one. However

we pointed out in our recent articles that the market

portfolio was not statistically different from the optimal

one.

On this assumption, the equilibrium returns π are15:

π = δΣW

where:

δ is the global coefficient or risk aversion

Σ is the covariance matrix of asset returns

W are the market weights of the assets

For example, looking at the market for Bunds, we

derive the equilibrium returns given in table 1 (we

assume that δ=7).

The Black-Litterman returns are derived using the

standard Bayesian updating formula with the investor

views as the prior and the market equilibrium as the

observed data16.

Our views imply lower returns in general. Indeed, our

only absolute view states that the 10+Y bucket will not

perform as well as implied by the market. Because

assets are positively correlated, this view will negatively

affect returns of other assets. Indeed, even though

view 2 is in line with the equilibrium, the other views

imply lower returns for 5-7Y and 7-10Y buckets.

Because view 1 is relative, it does not affect absolute

return levels to the same extent. It implies that the 1-3Y

bucket will outperform the 3-5Y bucket more than is

implied by the market. For that reason the expected

return of the 1-3Y bucket, decreases much less than

that of the 3-5Y bucket. We see in Exhibit 3 that these

effects are greater, the higher our confidence in our

views.

Table 1: Market Equilibrium

Buckets

Weight

1-3 Y

3-5 Y

5-7 Y

7-10 Y

10+ Y

27.94% 20.62% 14.01% 23.39% 14.04%

Volatility

1.21%

2.60%

3.63%

4.65%

8.35%

Excess Return

0.26%

0.60%

0.87%

1.13%

1.91%

Source: DB Global Markets Research

Investor’s Views

One of the main advantages of the Black-Litterman

approach is in the formulation of own views. Views can

be relative or absolute (view on the return of only one

asset). In addition we do not have to express a view for

15

If the market is efficient, the market maximises the following

utility function with respect to the weights W:

U(W) = W*π - ½δ W’ΣW

This implies that U’(W) = 0 or

π - δΣW = 0

⇒ π = δΣW

100

16

Formally we have Bayes’ rule applied to our expected returns:

pdf(E(r)/π) = pdf(π/E(r)) pdf(E(r)) / pdf(π)

Global Markets Research

�12 December 2003

Fixed Income Weekly

Exhibit 3: Black-Litterman

varying degree of confidence

Returns

with

1.60%

1.40%

1.20%

transparency of construction. Necessarily, it means we

will only be forming optimal portfolios in Euroland.

Our views are not extreme and merely a summary of

our strategy and RV calls on Euroland yield curves and

asset classes. Essentially, we have the following views:

2.00%

1.80%

Equilibrium

•

Lo w-Co nf

M id-Co nf

•

Hi-Co nf

•

1.00%

•

0.80%

0.60%

•

0.40%

0.20%

0.00%

1-3 Year

3-5 Year

5-7 Year

7-10 Year

10+ Year

Source: DB Global Markets Research

Consistent with these expected returns, we see that

funds flow mainly to the 1-3Y bucket. Funds flow

mainly out of the 3-5Y and 5-7Y buckets since their

expected returns decrease a lot with our confidence

(especially in relative terms). Exhibit 4 shows the full

picture.

Exhibit 4: Optimal Weights with varying

degree of confidence

50%

B enchmark

45%

Lo w-Co nf

40%

M id-Co nf

35%

Hi-Co nf

30%

25%

20%

15%

10%

5%

0%

1-3 Year

3-5 Year

5-7 Year

7-10 Year

10+ Year

Source: DB Global Markets Research

The Black-Litterman model therefore provides a method

to obtain expected returns that take into account the

uncertainty in the investor’s view and the market

equilibrium.

It offers a greater degree of flexibility since we can

express different degrees of confidence in the different

views. As already mentioned one can express relative

and absolute views on any combination of assets.

Because it introduces the market equilibrium it provides

investors with neutral implied expected returns on

assets for which he does not have views.

Optimal portfolios

We concentrate on the set of assets for which we have

an abundance of data. In particular, we will use the

iBoxx indices for Euro-denominated bonds due to their

ease of use, relatively long time-series, and

Global Markets Research

Deutsche Bank@

•

•

•

•

•

•

Neutral on duration,

Long 2-10 steepeners

Neutral on 10-30 steepeners

Long 5Y vs 2Y and 10Y

Long the condor: 2Y-30Y flatteners vs 5Y-10Y

steepeners

Wideners on Bund ASW

Wideners on Bund-OAT spreads

Wideners on Bund-BTP spreads

Neutral on Bund-SPGB Spreads

Wideners on Bund-Jumbo Pfandbriefe spreads

Tighteners on Bund-Corporate spreads

While this may seem an abundance of views, due to

our relative confidence in each, we are able to balance

them to output a portfolio.

Each of our views on spreads will be combined with the

carry of the given index or portfolio of indices to give us

an expected return, which is in turn combined with the

equilibrium expected return according to the BlackLitterman method. We then optimise with budget

constraints, no-short constraints and a tracking-error

target.

We give a portfolio for a very modest tracking error of

10bp annually (reflecting our modest experience in the

use of our model). As the year proceeds, we will

increase our allocation, but the discerning should be

able to scale our views to attain a more risky portfolio

allocation.

As can be seen, the results are not entirely surprising

but should require some further clarification. The fact

that Austria, Ireland, Portugal benefit from relatively low

correlations to other asset classes, should make them

preferred to some extent, for diversification benefit, yet

these advantages can be counterbalanced by the

relative attractiveness of other sectors. Netherlands and

Finland each have much higher correlations (especially

to the 1-3Y, 3-5Y, and 5-7Y buckets in Germany, France

and Italy). The fact that they correlate better with the

short-end effectively supports our steepening view

(although it is not reflected in our maturity bucketing in

Exhibit 4, which only reflects the maturity buckets of

the core sovereigns and the jumbos). Spain is more

highly correlated to the short-end of France and thus

the underweight of Spain can be linked to the

underweight in France. Finally, Italy is overweight

101

�Deutsche Bank@

Fixed Income Weekly

merely because of the attractive spread pickup, in spite

of the relative widening of Bund-BTP spreads.

Exhibit 3: Sector Under/Overweights

Austria

-0.434%

Belgium

0.398%

Finland

0.034%

France

-0.083%

Germany

0.027%

Ireland

-0.022%

Italy

2.215%

Netherlands

1.277%

Portugal

-0.062%

Spain

-1.030%

Sub Sov

0.033%

Jumbo

-3.348%

Corporates

1.000%

Source: DB Global Markets Research

The correlation between Subsovereigns and Jumbos

means that the underweight of Jumbos will generally

have a small resulting underweight on Subsovereigns

(unless we had had a conflicting view, of course).

As we mentioned above, due to the fact that the

standard iBoxx indices will only break down core

Euroland sovereigns and Jumbos by maturity means

that we have only reported them in Exhibit 4.

Exhibit 4: Maturity Under/Overweights (Core

Sovereigns and Jumbos)

Bucket

1-3Y

3-5Y

5-7Y

7-10Y

10+Y

Weights -2.862% 4.344% 0.642% -3.514% 0.201%

12 December 2003

directions include a more religious application of Bayes’

rule, where we juggle a tactical prior given by our RV

views (combined with data to give a posterior) and our

strategic prior given by our equilibirum model

(combined with data to give a posterior), finally

combining the two models via Bayesian Model

Averaging.

Appendix: The Black-Litterman formula

The market implied expected Returns (ER) are uncertain

since they are unobserved:

ER = π + ν

Where ν ~ MVN(0, τΣ). It represents the confidence in

the equilibrium. τ is a (small) scaling factor such that 0 <

τ < 1reflecting the fact that the variance in the expected

returns is smaller than the variance of the actual

returns.

Our views are expressed as relative value portfolios to

which we assign a return and a variance.

P’(ER) = Q + ε

Where

P is an nxk matrix of linear restrictions. They give

the combinations (portfolios) of assets for which

we have a view. We have k≤n views.

Q is a kx1 vector of our view of expected returns

ε is a kx1 vector of errors. ε ~MVN(0, Ω)

Ω is a diagonal kxk matrix of confidences in our

views. Each entry represents the confidence in

each of our views. A lower entry represents a

higher confidence

Source: DB Global Markets Research

Focusing on the core and Jumbo weights by maturity,

we see that the butterfly tends to have a larger

influence. We note of course, as we mentioned above,

that our overweights in Netherlands and Belgium will

effectively change the relative maturity weighting of the

entire portfolio towards a much more short position.

This to a small extent can be seen in the duration of the

optimal portfolio, which at 5.00 yrs vs 5.05 yrs for the

index, indicates that, in spite of our neutral duration

stance, our steepener tends to favour slightly shorter

duration asset classes.

We might mention that some of our outcomes may be

a result of having too few views, and the fact that any

one asset class can be favoured mostly from correlation

effects rather than an explicit view may be a deficit of

the approach and force us to take more explicit views

on individual sovereign spreads.

Conclusions

We will seek to utilize the Black-Litterman framework

over coming months in Europe. Since this is not the

final chapter in asset allocation methods, we will we

will also seek to improve upon the method. Indications

are that by expressing uncertainty over the covariance,

we can gain some more flexibility and make our

assumptions somewhat more intuitive. Other possible

102

We therefore have the following system of equations:

π = ER + ν

Q = P’ER + ε

π

Y = ,

Q

Setting:

I

X = ,

P'

u ~ MVN (0,V ),

τΣ 0

V =

0 Ω

We have: Y = X(ER) + u, so using GLS (Generalised

Least Squares)17:

-1

-1

-1

ER = (X’V X) X’V Y

ER = (I

(

τΣ 0

P )

0 Ω

ER = (τΣ) −1

[

PΩ

−1

)

I

P'

I

P '

−1

] [(τΣ)

ER = (τΣ) −1 + PΩ −1 P '

17

−1

−1

−1

((τΣ)

−1

τΣ 0

P )

0 Ω

(I

−1

)

−1

π

PΩ −1

Q

π + PΩ −1Q

]

π

Q

Satchell and Showcroft (1997) derive the full pdf of ER using

bayes theorem:

pdf(ER|π) = pdf(π|ER)pdf(ER)/pdf(π)

Global Markets Research

�12 December 2003

Deutsche Bank@

Fixed Income Weekly

We comment that these updating formulas are the

same as the standard Bayes’ rule where we have a

prior on some elements of a regression beta, given by

ER (our prior, P' ER ~ N (Q, Ω) ), and we observe normally

distributed data (in this case ER ~ N (π , τΣ) ) and can

determine the posterior mean (as reported above) and

variance as needed by standard formulas.

Exhibit 1: Equal weighted butterflies do not

exhibit mean reversion

Daniel Blamont (44) 20 7547 5106

Nick Firoozye (44) 20 7545 3081

TOPIC 2: Butterflies: just another way of

taking a view on slopes?

• We have already established that equally

weighted butterflies, especially in Euroland, do

not exhibit mean reversion, thus taking views on

these butterflies is difficult.

• In this article, we establish the link between

forward slopes and butterflies, with moneymarket slopes linked to 2-5-10 and a whole host

of related butterflies and long-end butterflies

related to forward steepeners/flatteners.

• Thus, taking views on the intricacies of curve

shape is entirely taking views on the course of

the central bank’s policy (for short-butterflies)

and on the slope (for long-term butterflies). Also,

butterflies and slopes sometimes do go out of

line, and we present RV strategies for taking

advantage of their relative mispricings.

• We present a few views as elaboration of our

USD

EUR

2-4-7

-1.69

-2.48*

2-5-10

-1.72

-2.08

2-7-12

-1.15

-1.00

3-7-12

-1.30

-1.06

4-9-12

-0.97

-1.21

5-9-12

-1.09

-1.53

5-10-15

-1.39

-1.54

5-15-30

-0.71

-1.49

7-9-12

-6.49***

-4.50***

7-10-15

-6.02***

-2.68*

10-15-30

-0.89

-2.16

10-20-30

-0.70

-1.77

Note

*** Mean reverts at 1% confidence level

** Mean reverts at 5% confidence level

* Mean reverts at 10% confidence level

• We find that taking a view on 2-5-10 and 10-2030 butterfly is usually sufficient to take a view on

the entire spectrum of butterflies.

Butterfly

We also showed that market-neutral butterflies showed

some more hope of mean-reversion, especially in the

US. In Europe, unfortunately, even these market-neutral

butterflies proved non-mean-reverting, save for a few

extremely closely spaced “flyettes” (e.g., 2-4-5, 3-4-5,

or involve the specialness of the 7Y point).

Nonetheless, even in the case of the US, we would

probably be unwise to expect mean-reversion of most

market-neutral butterflies to occur over all periods and

histories. In fact, most research tends to indicate that

there are three common trends18 or principal

components which drive yields. We find, admittedly a

bit surprisingly, a fundamental difference between the

US and Euroland - the third principal component has

been mean reverting in the US but not in Euroland –

strategic overweight 5Y versus 2-10 in Euroland.

18

In our last Quantitative Strategy (FIW 21-Nov-03), we

established that almost all equal weighted butterflies,

both in the US and Europe failed to be mean-reverting

in any meaningful way. In other words, while we could

establish half-lives, the uncertainty indicated that within

a 95% or 99% confidence interval, the half-life could

have been infinite. The table below shows the results of

the Dickey-Fuller test on some of the commonly traded

butterflies, where only large test-statistics indicate that

mean-reversion parameters are significant.

A stochastic common trends model (a la Stock-Watson)

indicates that yields are linear combinations of a set of unit-root

(random walk) factors plus a (stationary) error term ε, which are

either iid or mean-reverting:

y = LFt + ε t

Ft = Ft −1 + δ t

where δ is assumed to be independent of ε, and this is typically

estimated by Kalman-Filters. Estimating a stochastic common

trends is is essentially like doing PCA in levels (i.e.,

)

Ft ≈ ( L' L) −1 L' yt ). In almost all studies the yield curve is thought

to be driven by three trends: level slope and curvature, or the first,

second and third modes of yields, and that only fourth and higher

modes are truly mean-reverting. Stochastic common trends

models are just another form of a cointegration or vector-errorcorrection model (Engle-Granger, Johannsen)

∆yt = αβ ' yt −1 + ε t

(with a different ε) where attention is now on the mean-reverting

component β’yt-1, which is orthogonal to the common trends (i.e.,

β ' yt ⊥Ft ), or in other words, the cointegration relations are just

the higher modes and are mean-reverting. The condor trade (see

When good condors turn bad, Quantitative Strategy, FIW 8-Nov02, and this week’s EUR Government Bonds section) is an

example of a trade which depends only on the cointegration

relation, i.e., it is subject only to the fourth principle component

and thus is known to be mean-reverting.

Global Markets Research

103

�Deutsche Bank@

Fixed Income Weekly

thus explaining the relatively well behaved nature of

butterflies in the US.

12 December 2003

Fed funds rate (lhs inverted)

0

2-10 slope

Jan-94

Butterflies: just another call on slopes?

Source: DB Global Markets Research

While there has been much said about the relationship

of equally-weighted butterflies, the 2-5-10 in particular,

with the slope of the money market curve, the reasons

for the connection are still somewhat nebulous.

Exhibit 2: 2-5-10 butterfly – is it just money

market slope?

MM slope 3Mx1Y - 3Mx3M (lhs)

120

250

2

200

3

150

4

100

5

50

6

0

7

-50

Dec-95

Nov-97

Nov-99

Oct-01

The butterfly, on the other hand, mostly takes the

absolute level of rates out of the picture. We can see

that as well from Exhibit 3, where butterfly spreads

seem to exhibit no exact correspondence to absolute

levels. A similar relationship holds for Euroland.

Exhibit 4: 2-5-10 butterfly and the level of rates

–not as strong a relationship

Fed funds rate (lhs inverted)

0

15

2-5-10 butterfly

10

40

2

60

5

40

30

3

0

20

20

4

10

-5

0

5

0

-10

-20

6

Aug-00

Mar-01

Oct-01

May-02

Dec-02

Jul-03

Source: DB Global Markets Research

Essentially, we can think of the five year as a leveraged

bet on the direction of rates. While 2Y-10Y slopes are

steeper when the output gap is higher (or generally

when absolute level of short-rates are low—a striking

correspondence in the case of the US, see Exhibit 3),

the slope tells little about the market’s implied

expectations over the direction of short rates. Yes,

steep slopes, typically coincident with poor economic

conditions, tend to flatten in time and short rates come

back to normal levels (see Treasury Slope and

Economics, FIW, Quantitative Strategies, 23-Aug-02, for

a link between slope and economic fundamentals, e.g.,

the output gap). Yet, slope is exceptionally persistent

and steep slopes tend to be followed by steep slopes

(another manifestation of the forward bias). Indeed,

steep slopes indicate that rates are expected to rise,

somewhat, but also that term premia are high in

general.

Exhibit 3: US 2-10 slope, just another view on

levels?

104

-10

-15

-40

Jan-00

60

50

1

80

Sep-03

20

2-5-10 butterfly

100

300

1

But all is not lost, as showed in the previous publication,

a view on just a few simple butterflies (e.g., 2-5-10, and

10-15-20), either equally weighted or market-neutral, is

sufficient to take a view on every other commonly

traded butterfly. The problem of how to establish views

on these few butterflies is easily overcome as we show

below that most butterflies are in fact, calls on slopes or

money-markets. To the extent that one disagrees with

the risk-neutral or market perception of the direction of

rates, one would necessarily have a corresponding view

on a wide range of butterflies.

350

7

Jan-94

-20

Dec-95

Nov-97

Nov-99

Oct-01

Sep-03

Source: DB Global Markets Research

Rather than revealing the absolute level of rates or the

market’s take on the economic outlook, the butterfly

tells more about the market’s implied view on the

direction of short-term interest rates.

The five year is, in some ways, a proxy for the entire

market, since the duration of both US and EUR bond

markets are each close to that of the 5Y bonds. If this is

entirely the rationale, of course, we should see the

specialness of the 5Y point being shifted to shorter

maturities as the US retires its 30Y or as the MBS

market duration contracted during the not-so-distant

days of rallying bond markets. This is not easy to either

verify or reject. Nonetheless, the 5Y seems a focal point

and buyers of the market tend to focus on the 5Y

before they shift attention to the entirety of the rest of

the market. The same goes for sellers. Thus the relative

richness/cheapness of the 5y sector should reflect

markets expectation of the future movement of rates.

The link between butterflies and market expectations is

evident when comparing to the short end of the curve,

where the butterfly premium shows a very large

Global Markets Research

�Deutsche Bank@

Fixed Income Weekly

correlation to the slope of the money market curve.

And, while steep money-market curves do indicate the

presence of a term-premium, (see Euroland Strategies,

FIW 16-May-2003, for a discussion of the termpremium in money-markets), the effect is much more

muted than in longer-slopes and money-markets can be

used to a large degree to discern the market’s view on

the direction of rates.

Our interest then is to establish which slopes are most

closely related to some of the more-frequently traded

butterflies. And, the results should be two-fold: a)

Establish view or measure risks on butterflies through

our views on the outlook of rates b) to establish

dislocations in the relationship between butterflies and

slope and look for trading opportunities.

In Europe in particular, we believe the money-market

curve is far too cheap at the long end and our view is

that the ECB will have to remain on hold (with risks of a

cut due to an appreciating Euro). We can monetise this

view through our 2-5-10 butterfly position. This is

especially relevant for real money accounts who can

express a long money market view through a 2-5-10

butterfly.

Exhibit 5 shows the correlation between money-market

slopes and some commonly traded butterflies. Although

the 3Mx3M versus the 1Yx3M has been the source of

some focus in its relation to the 2-5-10, at 88%

correlation in US and 84% in EUR, it is far from the

most attractive combination (all figures quoted below

are from 2000 onwards).

Exhibit 5: Short butterflies relate to slopes of

forwards*

forward slopes (e.g., 3M forwards of 2Y-10Y, etc) to

longer butterflies and find the correspondence is high

Exhibit 6: Long butterflies relate to forward

slopes

5-10 slope

10-30

spot

slope spot

3M fwd

3M fwd

5-10-15

0.99

0.93

0.98

0.91

5-10-20

0.89

0.76

0.87

0.94

10-20-30

0.98

0.99

0.99

0.99

12-20-30

0.97

0.99

0.98

0.98

5-10-15

0.94

0.60

0.91

0.59

5-12-15

1.00

0.79

0.99

0.78

10-20-30

0.90

0.94

0.93

0.95

12-20-30

0.84

0.91

0.88

0.95

US

Source: DB Global Markets Research

In fact, we see the 10-20-30 butterfly shows a very

strong relationship with the 10Y-30Y slope 3M forward

(see Exhibit 7).

Exhibit 7: Correlation between the EUR 10-2030 butterfly and the forward slope

50

y = 0.3574x + 3.5282

R2 = 0.9022

40

30

20

10

0

-10

-50

US

6M-2Y

3M-1Y

3M-2Y

1Y-2Y

3-5-7

0.95

0.74

0.93

0.96

2-5-10

0.91

0.88

0.93

0.84

2-4-7

0.78

0.88

0.82

0.65

4-7-10

0.91

0.86

0.81

0.96

EUR

3-5-7

0.87

0.67

0.89

0.76

2-5-10

0.71

0.84

0.87

0.25

2-4-7

0.56

0.84

0.72

0.70

4-7-10

0.85

0.74

0.81

0.89

*The underlying for the above table is the 3M rate

Source: DB Global Markets Research

But, if 2-5-10 is linked to this short-end slope of money

markets, we should expect that something like 4-7-12

should be related to a slightly longer slope, for example,

a 2Yx3M vs a 3Yx3M. This is to some extent the case,

but, as we mentioned earlier, looking at long forwards

with a 3M underlying will, probably be more an indicator

of the level of term premium than just the market’s

view of the direction of short rates.

What about the butterflies at the long end?

Interestingly, we find that a view on long end butterflies

is again a view on the slope. In Exhibit 6, we relate the

Global Markets Research

5-10 slope 10-30 slope

EUR

10-30 slope 3m fwd

12 December 2003

0

50

100

150

10-20-30 butterfly

Source: DB Global Markets Research

The above chart speaks for itself – a view on the 10-2030 butterfly is, essentially, a view on the forward 10-30

slope. As we had shown in the Quantitative Strategies

of FIW 21-Nov-03, other commonly traded butterflies

are found to be cointegrated either with the 2-5-10 or

the 10-20-30 butterfly. Thus having a view on the 2-5-10

or the 10-20-30 butterfly is normally sufficient to have a

view on the entire butterfly spectrum.

As a risk-taker, this should be enough. One should

generally have views on the directions of rates relative

to forwards or perhaps on the directions of slopes

relative to given forwards. It also enables any

professional risk-manager the ability to dissect a trade

into a set of calls on spot slope and levels. For instance,

10-20-30, a call on 3Mx10Y vs 3Mx30Y, can be thought

of as a call on 10Y-30Y slope and on short-rates. A

bearish duration call combined (since 10-30 slope

flattens when the 10Y sells off in Europe) combined

with an ECB on hold should necessarily mean 20Y

richening relative to the wings.

105

�Deutsche Bank@

Fixed Income Weekly

Trading the dislocation: can we monetise it?

Next, we explore the relative value opportunities

between butterfly and slope trades. The table below

shows the half life of dislocations between butterfly and

slopes. The low half lives makes these attractive

contenders for relative value trades. The fact that, in

spite of the high R-squares, dislocations can actually be

large enough to monetise, leads us to believe that this

is a valid set of relative value trading strategies.

Exhibit 8: Half lives of dislocations between

butterflies and slope

Butterfly

Slope

Half life of residuals (days)

US

EUR

2-5-10

3mx1Y – 3mx3m

15

10

2-4-7

3mx1Y – 3mx3m

15

7

10-20-30

30Y – 10Y spot

5

21

5-10-15

3Mx10Y – 3Mx5Y

8

22

12 December 2003

A view on equally weighted butterflies is essentially a

view on the slope. We find that the short to medium

tenor butterflies exhibit strong correlations with the

slope of the money market curve. Thus a view on the 25-10 butterfly is essentially a view on the slope of the

money market curve. The long end butterflies tend to

be correlated with the 10-30 slope, either spot or

forward, thus enabling a trading view for these

butterflies.

Nick Firoozye (44) 20 7545-3081

Mohit Kumar (44) 20 7545-4387

Source: DB Global Markets Research

In Exhibit 9, we see that residuals from our level

regressions, as in the 2-5-10 vs the money-market

curve, that the dislocations have a standard deviation of

3bp. Assuming a 1bp bid-offer on 2-5-10, and a 0.5bp

bid-offer on each Euribor future, we should still be

provided with sufficient opportunities for trades even if

this indicator does not lead us to take positions every

day.

Exhibit 9: In spite of high R-squares,

mispricings can still be advantageous

10

8

resdiuals (bp)

6

4

2

0

-2

-4

-6

-8

Jan-00

Dec-00

Dec-01

Nov-02

Nov-03

Source: DB Global Markets Research

So what can we conclude?

In our two articles on butterfly trades, we have outlined

a methodology for taking view on butterfly trades. We

showed in the last article, that for market neutral

butterflies, we need to take into account the half life, its

standard error (i.e., whether or not it is mean-reverting),

and the standard deviation of the residuals in order to

evaluate the attractiveness of a butterfly19.

19

We showed that the attractiveness of a butterfly can be

measured by looking at the ex-ante Sharpe ratio defined as

E[ Dislocation] + carry

Sharpe ratio =

σ

106

Where E[Dislocation] is the expected mean reversion in the

butterfly residuals, carry is the butterfly carry over the investment

horizon and σ is the standard deviation of the butterfly residuals.

Global Markets Research

�

Nikan (Nick) B Firoozye

Nikan (Nick) B Firoozye