100%(1)100% found this document useful (1 vote)

Eric Arroyo

Eric Arroyo

Uploaded by

eearroyoEric Arroyo seeks a managerial role that utilizes his financial accounting skills. He has a B.A. in Business Administration/Accounting from California State University, Fullerton. His experience includes senior accountant roles at CommerceWest Bank from 2006-2010 and project accountant at Renaissance Senior Living from 2003-2006. His responsibilities included financial reporting, analysis, reconciliations, and more. He is proficient in various financial software programs.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

Eric Arroyo

Eric Arroyo

Uploaded by

eearroyo100%(1)100% found this document useful (1 vote)

Eric Arroyo seeks a managerial role that utilizes his financial accounting skills. He has a B.A. in Business Administration/Accounting from California State University, Fullerton. His experience includes senior accountant roles at CommerceWest Bank from 2006-2010 and project accountant at Renaissance Senior Living from 2003-2006. His responsibilities included financial reporting, analysis, reconciliations, and more. He is proficient in various financial software programs.

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Eric Arroyo seeks a managerial role that utilizes his financial accounting skills. He has a B.A. in Business Administration/Accounting from California State University, Fullerton. His experience includes senior accountant roles at CommerceWest Bank from 2006-2010 and project accountant at Renaissance Senior Living from 2003-2006. His responsibilities included financial reporting, analysis, reconciliations, and more. He is proficient in various financial software programs.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

100%(1)100% found this document useful (1 vote)

Eric Arroyo

Eric Arroyo

Uploaded by

eearroyoEric Arroyo seeks a managerial role that utilizes his financial accounting skills. He has a B.A. in Business Administration/Accounting from California State University, Fullerton. His experience includes senior accountant roles at CommerceWest Bank from 2006-2010 and project accountant at Renaissance Senior Living from 2003-2006. His responsibilities included financial reporting, analysis, reconciliations, and more. He is proficient in various financial software programs.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1/ 2

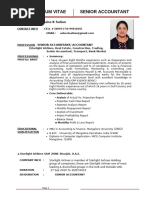

Eric Arroyo

11751 Puryear Lane ♦ Garden Grove ♦ CA ♦ 92840 ♦ (714) 345-9729 ♦ eearroyo@gmail.com

Objective:

To employ my financial accounting skills at a higher level and further expand into a managerial role.

Education:

California State University, Fullerton June 2003

B.A. Business Administration/Accounting

Employment History:

CommerceWest Bank, N.A. June 2006 – January 2010

Senior Accountant

• Post month-end closing entries and prepare financial statements

• Prepare daily cash position and financial reports for upper management

• Perform variance analysis on a daily basis

• Manage daily cash position and available funds to be distributed for overnight borrowing/ fed funds

• Prepare and submit quarterly Call Report to FDIC

• Assist in the preparation of the Annual Report and related footnotes

• Audit accounts payable on a weekly basis

• Approve prepaid, fixed asset, & depreciation/amortization entries made by staff accountant

• Prepare and submit Collateral Reports to FHLB and FRB

• Reconcile the safekeeping of portfolio investments

• Perform Deposit Reclassification (CETO)

• Reconcile balance sheet accounts on a monthly basis

• Reconcile correspondent bank accounts on a daily basis

• Map general ledger accounts to system reports

Renaissance Senior Living, LLC June 2003 – June 2006

Project Accountant

• Prepare monthly financial statements, forecasts and variance reports

• Post month-end closing entries and accruals

• Prepare closing entries related to the sale of real and personal property

• Calculate cash flow projections and monthly distributions to investors/owners

• Meet with investors/owners on a monthly basis to review operational and financial variances

• Assist in the preparation of annual budgets

• Audit Accounts Receivable and Accounts Payable on a weekly basis

• Prepare year-end Working Papers

• Prepare personal property tax schedules (571-L)

• Maintain fixed assets schedule, and update depreciation and amortization schedules

• Calculate and reconcile workers’ compensation on a monthly basis

• Reconcile Common Area Maintenance (CAM)

• Reconcile balance sheet accounts on a monthly basis

• Reconcile bank statements on a monthly basis

Computer Skills:

MS Office Suite , Jack Henry 20/20, Jack Henry Call Report Pro, Jack Henry 4|sight, Fedline Advantage,

Synergy, BNA Fixed Assets, BankTel, MAS 90

You might also like

- Auditing & Assurance Concepts and Applications: Audit of CashNo ratings yetAuditing & Assurance Concepts and Applications: Audit of Cash44 pages

- VP Investors Relations in New York City Resume Marlin ReyesNo ratings yetVP Investors Relations in New York City Resume Marlin Reyes1 page

- Work Experience Watiga & Co. (S) Pte LTD: IgnatiusNo ratings yetWork Experience Watiga & Co. (S) Pte LTD: Ignatius3 pages

- Robers P. Armand: Bay State College Boston, MANo ratings yetRobers P. Armand: Bay State College Boston, MA2 pages

- MD Nasiruddin Miah: Objective Highlights of Skills & QualificationsNo ratings yetMD Nasiruddin Miah: Objective Highlights of Skills & Qualifications2 pages

- Finance Officer Head Office Based - Hyderabad: Academic/TechnicalNo ratings yetFinance Officer Head Office Based - Hyderabad: Academic/Technical2 pages

- Project Accountant or Staff Accountant or Financial AnalystNo ratings yetProject Accountant or Staff Accountant or Financial Analyst3 pages

- Accountant or Staff Accountant or Senior Accountant or AccountinNo ratings yetAccountant or Staff Accountant or Senior Accountant or Accountin2 pages

- Controller or Assistant Controller or Accounting Manager or FinaNo ratings yetController or Assistant Controller or Accounting Manager or Fina3 pages

- Mr. Newmann K. A. Anane-Aboagye: Career ObjectiveNo ratings yetMr. Newmann K. A. Anane-Aboagye: Career Objective4 pages

- Summary of Qualifications: Catrina M. KingNo ratings yetSummary of Qualifications: Catrina M. King3 pages

- M.saqib, Accounts& Finance, 6 Yrs Experience.No ratings yetM.saqib, Accounts& Finance, 6 Yrs Experience.3 pages

- SAP S4 Hana ERP Financial Accounting Training Contents and ScheduleNo ratings yetSAP S4 Hana ERP Financial Accounting Training Contents and Schedule3 pages

- Japanese Guidelines For Internal Control Reporting Finalized Differences in Requirements Between The U.S. Sarbanes-Oxley Act and JNo ratings yetJapanese Guidelines For Internal Control Reporting Finalized Differences in Requirements Between The U.S. Sarbanes-Oxley Act and J10 pages

- Conceptually-Based Financial Reporting Quality Assessment. An Empirical Analysis On Quality Differences Between UK Annual Reports and US 10-K ReportsNo ratings yetConceptually-Based Financial Reporting Quality Assessment. An Empirical Analysis On Quality Differences Between UK Annual Reports and US 10-K Reports35 pages

- Application For Admission and Residence As A Start-Up' Working On A Self-Employed BasisNo ratings yetApplication For Admission and Residence As A Start-Up' Working On A Self-Employed Basis9 pages

- Tutorial Letter 102/3/2021: Legal Aspects in AccountancyNo ratings yetTutorial Letter 102/3/2021: Legal Aspects in Accountancy46 pages

- RG Guide Financial Statements NFP Organizations Questions Directors 2nd EdNo ratings yetRG Guide Financial Statements NFP Organizations Questions Directors 2nd Ed78 pages

- F A A H C: Awaz Bdulaziz L Okair and OmpanyNo ratings yetF A A H C: Awaz Bdulaziz L Okair and Ompany158 pages

- Adjustments For Consolidated Financial Statements (Basic)No ratings yetAdjustments For Consolidated Financial Statements (Basic)7 pages

- Adoption and Application of IFRS in PakistanNo ratings yetAdoption and Application of IFRS in Pakistan7 pages