The Oil Market 2030

The Oil Market 2030

Uploaded by

Arjun GuglaniCopyright:

Available Formats

The Oil Market 2030

The Oil Market 2030

Uploaded by

Arjun GuglaniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

The Oil Market 2030

The Oil Market 2030

Uploaded by

Arjun GuglaniCopyright:

Available Formats

This article copyrighted by the International Association for Energy Economics The article first appeared in Economics of Energy

& Environmental Policy (Vol. 1, No. 1).

Visit this paper online at http://www.iaee.org/en/publications/eeepjournal.aspx

The Oil Market to 2030Implications for

Investment and Policy

Mark Finleya

abstract

Oil is (an important) part of a larger global energy market, which is expected to

see continued consumption growth (largely in emerging markets) and a continued

shift toward natural gas and renewable forms of energy. While oil continues to lose

market share, overall consumption and production are likely to continue growing

though more slowly than they have in the past due to expected policy changes aimed

at slowing oils growth as well as the impact of higher prices seen in recent years.

Consumption in OECD countries has likely peaked; the growth in global oil use will

be entirely due to continued growth in emerging economies, most importantly

China. Oil supply growth will be dominated by OPEC, although non-OPEC supply

should continue rising modestly due to biofuels and other unconventional sup

plies. This outlook suggests that the centers of gravity for both consumption and

production will shiftto Asia for consumption and to Middle-East OPEC for pro

duction. Continued investment will be required for supply to meet expected demand

growth; energy security will remain an important driver of policy (though U.S.

import dependence should improve); and CO2 emissions appear likely to continue

rising. Market-oriented policies can help address the twin challenges of sustainability and security.

Keywords: Oil, Outlook, Policy, Investment

http://dx.doi.org/10.5547/2160-5890.1.1.4

INTRODUCTION

The oil market outlook is not just a matter for energy companies: its an issue for all of us.

Will oil demand continue to grow? What are the prospects for other fuels to displace oil,

especially in transportation? Will supply be able to keep up. . .and from where? What are the

implications of these trends for climate change and energy security? And what are the oppor

tunities for consumers, industry, and governments to impact these trends?

Around the world, there is a lively and important conversation taking place on the choices

that face us allas consumers, producers, investors and policy-makers. By sharing this out

look, based on BPs Energy Outlook 2030, we hope to contribute to that discussion. Our

starting point in contributing to this debate has been BPs Statistical Review of World Energy,

which this year celebrated its 60th anniversary.1 We feel it is our responsibility as a company

1. The BP Energy Outlook 2030 may be found at www.bp.com/energyoutlook2030; the Statistical Review of World Energy

may be found at www.bp.com/statisticalreview.

a

General Manager, Global Energy Markets & U.S. Economics, BP, 1101 New York Avenue, NW, Suite 700, Washington,

DC 20005. E-mail: mark.nley@bp.com.

The views expressed are solely those of the author and do not represent the position of his employer.

Economics of Energy & Environmental Policy, Vol. 1, No. 1. Copyright 2012 by the IAEE. All rights reserved.

25

26

Economics of Energy & Environmental Policy

to make information and analysis available for public debateall the more so if the issue at

hand is as vital to all of us as is the oil market, including its relation to key issues such as

energy security, economic development, and climate change.

A BRIEF HISTORY

Oil is the worlds dominant fuel (at 33% of current global primary energy consumption), but

it has been losing market share since the 1970s. The pace of oils market share erosion mirrors

the price cycleoil lost share rapidly in the 1970s and early 1980s when prices where high;

lost share slowly from the mid 1980s to the late 1990s when prices were low; and accelerated

again when prices began to go up over the past decade. Oil has lost market share globally for

11 consecutive years, and oils share of U.S. energy consumption is near the lowest levels ever

recorded.2 Demand has grown, but predominantly outside the OECD, with non-OECD

countries accounting for 47% of global consumption, up from 25% in 1970 (OECD con

sumption has fallen by 3.6 Mb/d or 7% since 2005.). Sectorally, oil consumption is dominated

by transport (more than 50% of global consumption and roughly 60% of OECD consump

tion); oil has lost signicant market share in the power and industrial sectors. As with other

fuels, demand and supply have been impacted over the years, primarily by the rate and dis

tribution of global economic growth, but also by technological change (such as the emergence

of nuclear power or advances in deepwater exploration, development, and production capa

bility); competition from other fuels (cheap natural gas currently, especially in North America);

and government policy (such as consumption taxes/subsidies, fuel efciency standards, and

resource nationalism).

On the supply side, OPEC holds a heavy majority (77%) of global proved reserves, but

has not gained market shareindeed, OPECs market share in 2010 (42%) was well below

the 47% share seen in 1970 (OPECs global share peaked at 51% in 1973). Outside of OPEC,

production continues to increase despite mature declines in the North Sea, Mexico, parts of

the U.S., and elsewhere: Output has grown in recent years in Russia and Central Asia; the

deepwaters of the U.S. GoM, West Africa, and Brazil; and in the oil sands of Alberta. In

addition, onshore production in the U.S. has begun to increase due to innovations in the

development of shale resources (both oil and natural gas-related liquids); biofuels have been

another key source of liquids supply growth (primarily the U.S. and Brazilboth enabled by

rising oil prices in recent years with the U.S. also receiving a boost from tax credits and

mandates).

Oil prices have increased in recent years, averaging about $80 in 2010 and well above

$100 so far this year, which would be the highest (nominal) price on record. Oil prices have

increased in absolute terms and relative to other fuels, with a record premium to natural gas

prices in North America in 2010 (and so far this year). The oil market has been prone to

disruptions, with major shocks to supply and prices in the early and late 1970s, 1990, and

several times in the past decade. In response, both consuming- and producing countries have

adopted strategies for dealing with unexpected outages, including the maintenance of spare

capacity as well as investment in strategic stockpiles (which have recently been put to use).

2. See U.S. Energy Information Administration (2010).

Copyright 2012 by the IAEE. All rights reserved.

The Oil Market to 2030Implications for Investment and Policy

f

BUILDING THE OUTLOOK

27

Of course, the oil market outlook does not take place in a vacuum; oil is (an important) part

of the global energy mix. To set the stage for the oil market discussion, it is therefore appro

priate to briey sketch out the broader global energy market outlook. The BP outlook seeks

to identify long term energy trends based on the expected evolution of the worlds population

and economy, adding our best judgments of policy and technology to develop a projection

for world energy markets to 2030. The outlook is a projection, not a proposition, and this is

an important distinction. For example, our outlook expects global CO2 emissions to continue

rising, along with import dependence in many key consuming regions. This does not mean

BP downplays the importance of climate change or the role of energy security in international

relations. Rather, it reects a to the best of our knowledge assessment of the worlds likely

path from todays vantage point.

This outlook is not a business as usual extrapolation, nor an attempt at modelling policy

targets. Instead it is built to the best of our knowledge, reecting our judgement of the most

likely path for global energy markets to 2030. Assumptions on changes in policy, technology

and the economy are based on extensive internal and external consultations. Key assumptions

as they pertain to the oil market outlook will be discussed in the narrative to follow. In

addition, a Policy Case (a fully built-up alternative case) is developed based on more aggressive

policies to address climate change, assessing the impact of possible policy changes on energy

consumption and production. We use this caseand other sensitivitiesto explore the un

certainties of the Energy Outlook, a critical part of the exercise given the tremendous range

of possible outcomes under any long-term forecasting exercise. We do not attempt to forecast

long term energy prices as part of this Outlook.

The outlook highlights the central role markets and well-designed policy can play to

meet the dual challenges of solving the energy needs of billions of people who aspire

to better lifestyles, as well as the opportunities and challenges of doing so in a way that

is sustainable and secure.

Population and income growth are the two most powerful driving forces behind the

demand for energy.3 The next 20 years are likely to see continued global integration, and

rapid growth of low- and medium-income economies. Population growth is slowing, but

income growth is trending up: Over the last 20 years world population has increased by 1.6

billion people, and it is projected to rise by 1.4 billion over the next 20 years; the worlds real

income has risen by 87% over the past 20 years and it is likely to rise by 100% over the next

20 years. Energy consumption per capita to 2030 is likely to grow at about the same rate as

in 197090 (0.7% p.a.), but energy intensitymeasured very broadly as energy per unit of

GDPcontinues to improve globally, and at an accelerating rate. In 201030 this is expected

to remain the case for the global average and for almost all of the key countries and regions.

This expected continued acceleration in energy intensity improvement is important: It re

strains the overall growth of primary energy. Energy intensity gains and a long-term structural

shift away from industry and toward less energy intensive activitiesrst in rich and then in

newly industrialized economiesunderpin this trend.

3. Population and GDP estimates are drawn, respectively, from the UN (2009) and Oxford Economics Ltd (2010).

Copyright 2012 by the IAEE. All rights reserved.

28

Economics of Energy & Environmental Policy

Billion toe

18

Billion toe

18

16

16

14

14

Renew ables

12

12

Hydro

10

10

Nuclear

Coal

Non-OECD

2

0

1990

OECD

Gas

Oil

2

0

2000

2010

2020

2030

1990 2000

2010 2020 2030

* Includes biofuels

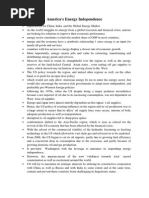

FIGURE 1

Energy 2030: Non-OECD economies drive consumption growth

Another key factor is the resource base. Our work is based on an assessment of global

proved reserves for oil, gas, and coalthose quantities that geological and engineering infor

mation indicates with reasonable certainty can be recovered in the future from known reser

voirs under existing economic and operating conditions.4 While it is important to recognize

that sovereign nations do not all apply the same standards in reporting proved reserves, the

ndings are generally consistent with other assessments of proved reserves, and the data clearly

show that global proved reserves of fossil fuels are sufcient to meet expected consumption

growth in the decades to come. For oil, world proved reserves at the end of 2010 stood at

1.38 trillion barrelsthe highest gure on record (with data going back to 1980) and sufcient

to meet current production for just over 46 years (for natural gas, that gure is 59 years, and

for coal it is over 100 years). Estimates of oil proved reservesboth in barrel terms and

expressed as a reserves/production ratiohave tended to grow over time as new discoveries

and improved recovery rates have more than offset volumes produced. OPEC countries possess

the heavy majority (77%) of global proved reserves, but both OPEC and non-OPEC proved

reserves have tended to grow over time, with each increasing by about 25% over the past

decade. We conclude that globally, resources are not likely to be a constraint for oil supply

availability over the coming decades; above-ground considerations such as investment regimes,

access policies, and industrial capacity are separately factored into the supply outlook discussed

below.

f

KEY FINDINGS: REFERENCE CASE

In our reference case (Figure 1), world primary energy consumption is expected to grow by

39% over the next 20 years, slightly slower than the 45% increase seen from 1990-2010.

Global energy consumption growth is expected to average 1.7% p.a. from 2010 to 2030, with

4. See BP (2011a).

Copyright 2012 by the IAEE. All rights reserved.

The Oil Market to 2030Implications for Investment and Policy

29

growth decelerating gently beyond 2020. The outlook for energy consumption growth is more

rapid than the International Energy Agencys World Energy Outlook (Existing Policies

scenario), driven by the continued rapid industrialization of developing economies; at the

same time, switching to lower carbon fuels (from coal to gas, and from fossil fuels to renewables

and nuclear) drives a slightly slower growth rate for CO2 emissions.5

Non-OECD energy consumption is expected to be 68% higher by 2030, averaging 2.6%

p.a. growth from 2010, and accounts for 93% of global energy growth. OECD energy con

sumption in 2030 is just 6% higher than today, with growth averaging 0.3% p.a. to 2030.

From 2020, OECD energy consumption per capita is on a declining trend (-0.2% p.a.).

The fuel mix changes relatively slowly, due to long asset lifetimes, but gas and non-fossil

fuels gain share at the expense of coal and oil. The fastest growing fuels are renewables (in

cluding biofuels) which are expected to grow at 8.2% p.a. 201030; among fossil fuels, natural

gas grows the fastest (2.1% p.a.). The three fossil fuels are expected to converge on market

shares of 2627%, and the major non-fossil fuel groups on market shares of around 7% each.

In our outlook, oil continues to suffer a long run decline in market share (falling from 46%

of total energy consumption in 1970 to 39% in 1990 and 34% in 2010), while natural gas

steadily gains. Coals recent gains in market share, on the back of rapid industrialisation in

China and India, are reversed by 2030. Taken together, the contribution of all non-fossil fuels

to growth over the next twenty years (36%) is, for the rst time, likely to be larger than that

of any single fossil fuel. Renewables (including biofuels) account for 18% of the growth in

energy to 2030. The rate at which renewables are expected to penetrate the global energy

market is similar to the emergence of nuclear power in the 1970s and 1980s. Sectorally, power

generation is the key driver of energy consumption, accounting for 57% of growth 201030,

and raising its share of global energy consumption from 41% currently to 47% by 2030.

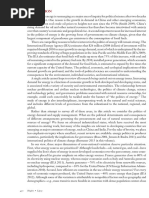

Oil (Figure 2) is expected to be the slowest-growing fuel over the next 20 years. Global

liquids demand (oil, biofuels, and the other liquids conversion technologies) nonetheless is

likely to rise by 16.5 Mb/d, exceeding 102 Mb/d by 2030. As is the case in the IEA outlook,

consumption growth comes exclusively from rapidly-growing non-OECD economies. Con

sistent with our intention to develop a most likely outlook, our reference case global oil

consumption growth rate is less rapid than the IEAs Current Policies Scenario and slightly

more rapid than the New Policies Scenario. Non-OECD Asia accounts for more than threequarters of the net global increase, rising by nearly 13 Mb/d. The Middle East and South &

Central America will also grow signicantly. OECD demand has likely peaked (in 2005), and

consumption is expected to decline by just over 4 Mb/d by 2030.

Rising supply to meet expected demand growth should come primarily from OPEC

again a conclusion broadly consistent with the IEA outlookwhere output is projected to

rise by 13 Mb/d. In essence, the growth in non-OECD Asian consumption will be met by

OPEC supply. The largest increments of new OPEC supply will come from natural gas liquids

(NGLs), as well as conventional crude in Iraq and Saudi Arabia. Non-OPEC supply will

continue to rise, albeit modestly. A large increase in biofuels supply, along with smaller incre

ments from Canadian oil sands, deepwater Brazil, and the FSU should offset continued de

clines in a number of mature provinces.

5. The IEA stresses that none of the WEO scenarios should be viewed as forecasts; rather, they represent outcomes based on

specic policy assumptions, with no assessment made on the likelihood of those policy assumptions. The BP outlook, by contrast,

seeks to construct a most likely path, including judgments on future policy changes.

Copyright 2012 by the IAEE. All rights reserved.

30

Economics of Energy & Environmental Policy

M b/d

Dem and

Supply

105

Other

100

95

90

85

2030 level

Other

S& C Am

Iraq

M id East

Oil Sands

Saudi

Other

Asia

Biofuels

NGLs

China

Brazil

FSU

80

75

2010

OECD

Declines

NonOECD

Grow th

2010

NonOPEC

Grow th

NonOPEC

OPEC

Grow th

Declines

FIGURE 2

The liquids supply-demand balance to 2030

Liquids demand by region

Liquids demand by sector

Mb/d

M b/d

105

105

Non-OECD Ind

& Other

Other

90

90

FSU

Non-OECD

Transport

75

75

M iddle East

60

60

Other nonOECD Asia

45

OECD Ind &

Other

45

China

30

30

OECD

Transport

US

15

15

Other OECD

1990

Pow er

0

0

2010

2030

1990

2010

2030

FIGURE 3

Demand growth driven by non-OECD transport and industry

Oil Consumption

Overall oil consumption growthor rather, total liquids consumption as described

abovewill be restrained by the increases in crude oil prices seen in recent years; the contin

ued, gradual reduction of subsidies in non-OECD oil-importing countries; and new policies

that seek to improve the efciency of consumption, most notably in the transport sector.

Global consumption growth in this outlook (Figure 3) is projected to slow to 0.9% p.a. (from

1.3% in 1990-2010); with other fuels growing more rapidly, oil continues to lose market

share to other fuels & is matched by coal around 2015, and by natural gas around 2030.

Copyright 2012 by the IAEE. All rights reserved.

The Oil Market to 2030Implications for Investment and Policy

31

OECD consumption will fall to 41.5 Mb/d, roughly the 1990 level. Non-OECD consump

tion is projected to overtake the OECD by 2015, and to approach 61 Mb/d by 2030more

than double the 1990 level. However, excluding the FSU (where demand collapsed along with

the economies of the Former Soviet republics in the 1990s) non-OECD growth is likely to

be slower than 1990-2010 (2.2% vs 3.8% p.a.). With rapid growth of biofuels (discussed

below), the oil portion of liquid fuels demand is expected to grow even less rapidly, by 0.6%

p.a.

Under our outlook, OECD consumption has already peakedit most likely will never

again reach the level seen in 2005. Consumption will be impacted by a combination of

economic maturity, consumer reactions to the higher oil prices seen in recent years, and

additional policies aimed at reducing consumptionmotivated by a combination of revenue

requirements, energy security concerns and a desire to reduce CO2 emissions. For example,

we expect both new fuel taxes and greater fuel efciency standards for vehicles in the OECD

countries. With natural gas currently priced competitively, we also see some displacement of

oil by gas in power generation, industrial applications, and residential/commercial use.

By sector, liquids demand growth should come from non-OECD transport (nearly 13

Mb/d), with non-OECD industry also contributing (nearly 7 Mb/d, largely for petrochemi

cals). Price impacts in these cases are outweighed by continued rapid economic growth, al

though the continued removal of subsidies in many non-OECD oil-importing countries will

begin to weigh on consumption patterns, as will policies aimed at improving fuel efciency

(such as the targets already adopted in China). Expected OECD declines are concentrated

outside the transport sector, in sectors where oil can be displaced by gas and renewables; post

2015, OECD transport demand is also expected to fall as technology and policy lead to

improved engine efciency and more efcient vehicles begin to enter the eet.

Energy used for transport will continue to be dominated by oil, but the transport sector

should see its share of global energy use decline as other sectors grow more rapidly. Growth

of energy consumption in the transport sector is expected to slow over the next twenty years

to average 1.1% p.a. vs 1.8% p.a. during 1990-2010, with OECD demand slowing and then

declining post-2015. The slowing of growth in total energy in transport is related to higher

oil prices and improving fuel economy, vehicle saturation in mature economies, and expected

increases in taxation and subsidy reduction in developing economies. The growth of oil in

transport slows even more dramatically, largely because of displacement of oil by biofuels, and

is likely to plateau in the mid-2020s. Currently, biofuels contribute 3% on an energy equiv

alent basis and this is forecast to rise to 9% at the expense of oils share. Rail, electric vehicles

and plug-in hybrids, along with compressed natural gas in transport, are likely to grow, in

part due to policy support. But the cost of these options (including batteries and/or refuelling

infrastructure) combined with the long economic lives of the existing transportation stock

mean that these alternatives are unlikely to make a material contribution to total transportsector energy consumption before 2030.

China is the largest source of oil consumption growth in our outlook, with consumption

forecast to grow by 8 Mb/d to reach 17.5 Mb/d by 2030, overtaking the U.S. to become the

worlds largest oil consumer. Growth is expected to remain concentrated in the industrial and

transport sectors through 2020. Industrial growth slows post-2020 as industrial expansion

becomes less energy-intensive and population growth slows; transport will then be the dom

inant growth driver. Despite contributing almost half of net global oil consumption growth

to 2030, our outlook projects a slower increase in Chinese per capita consumption than seen

Copyright 2012 by the IAEE. All rights reserved.

32

Economics of Energy & Environmental Policy

Liquids supply by region

Liquids supply by type

M b/d

105

M b/d

105

Asia Pacif ic

90

Af rica

75

M iddle East

60

FSU

45

OPEC NGLs

90

OPEC crude

75

60

Biof uels

45

Oil Sands

Europe

30

30

Other nonOPEC

S & C Am erica

15

15

Non-OPEC

conventional

North Am erica

0

1990

0

2010

2030

1990

2010

2030

FIGURE 4

Supply growth comes primarily from OPEC

historically in other Asian economies. China is much less dependent on oil in its overall fuel

mix (18% in 2010) than many other emerging economies at similar points in their devel

opment. In addition, China is likely to implement policies to slow oil consumption growth

such as modestly increasing taxes on transport fuels, raising vehicle efciency standards, and

maximising use of other fuels. Finally, oil prices are higher than faced historically by other

emerging economies; and rising import dependence is a policy concern.

Oil Production

Globally, liquids production of course is expected to increase to meet the growth in

consumption, though the sources of growth will change the global balance. As is the case for

consumption, global liquids supply is set to rise by about 16.5 Mb/d by 2030 (Figure 4).

OPEC accounts for over 75% of global supply growth in our outlook, with OPEC NGLs

expected to grow by more than 4 Mb/dthe largest increment to OPEC supply in our

outlookdriven in part by rapid growth of natural gas production in our outlook. Iraqi crude

output is projected to grow from about 2.5 Mb/d currently to more than 5.5 Mb/d; Saudi

output is likely to expand by nearly 3 Mb/d.

Non-OPEC output will rise by nearly 4 Mb/d. Unconventional supply growth should

more than offset declining conventional output, with biofuels adding nearly 5 Mb/d and

Canadian oil sands rising by nearly 2 Mb/d. Declining conventional crude supply in Europe,

Asia Pacic and North America is partly offset by growth in deepwater Brazil and the FSU,

resulting in a net decline of just over 3 Mb/d. In this outlook, Russia and Saudi Arabia will

each sustain their current market share of roughly 12% over the next 20 years.

Biofuels production (largely ethanol) is expected to exceed 6.5 Mb/d by 2030, up from

1.8 Mb/d in 2010contributing 30% of global supply growth over the next 20 years, and

all of the net growth in non-OPEC supply. Continued policy support, high oil prices in recent

years, and technological innovations all contribute to the rapid expansion. The U.S. and Brazil

will continue to dominate production; together they account for 68% of total output in 2030

Copyright 2012 by the IAEE. All rights reserved.

The Oil Market to 2030Implications for Investment and Policy

33

(down from 76% in 2010). First-generation biofuels are expected to account for most of the

growth, with improved yields helping to avoid pressure on the world food system. After 2020,

roughly 40% of global liquids demand growth will be met by biofuelsup from 13% in

2010with the U.S. and Europe leading consumption growth. By 2030, this gure ap

proaches 60%.

The importance of OPEC is expected to grow. On our projections, OPECs share of

global production would increase from 42% in 2010 to 46% in 2030 (a level not reached

since 1977). In the early years of the outlook, OPEC production growth can be met by

utilizing current spare capacity.6 Over time, production capacity must expand to meet expected

demand growth. In addition to growth in NGLs production, we project an increase in crude

oil production capacity of nearly 5 Mb/d by 2030to nearly 40 Mb/dlargely in Iraq and

Saudi Arabia. Prospects for growth in other OPEC countries are conservative, partly due to

the expectation that investment regimes in many countries will remain restrictive. These

projections imply that Saudi production capacity, currently at 12.5 Mb/d, is likely to be

sufcient to meet demand and maintain a reasonable buffer of spare capacity until around

2020; thereafter a modest expansion appears likely. While we do not attempt to forecast longterm energy prices, the ability and willingness of OPEC members to expand capacity and

production clearly is one of the main factors determining the path of the oil market.

The pace of Iraqi capacity expansionand production growthis another key source of

uncertainty for this outlook. Iraq is expected to account for 20% of global supply growth

from 2010 to 2030. Service contracts awarded since mid-2009 have signaled the notional

(contractual) possibility that Iraqi capacity could reach 12 Mb/d by 2020. However, limited

project development capacity and infrastructure constraints may result in project delays and

cost ination. Key challenges exist in developing export pipelines, terminals and water injec

tion infrastructure. Security challenges, as well as political constraints, are also likely to weigh

on capacity expansion plans. A rapid increase in Iraqi output could have an impact on oil

prices, and OPEC is likely over time to seek to reintegrate Iraq into the quota system, which

is an additional source of uncertainty. While substantial capacity growth is likely, a number

of factors should constrain the pace of expansion. Weighing these factors, we assume Iraqi

production exceeds 4.5 Mb/d by 2020 and 5.5 Mb/d by 2030, but the range of possible

outcomes is large.

Growth in the call on renery throughput will be impacted by the supply growth of

biofuels (5 Mb/d) and non-rened NGLs (2 Mb/d). Increases in processing gains and growth

in supplies of liquids derived from gas and coal are likely to add another 1 Mb/d to product

supplies that do not require rening. All of these supply sources will compete directly with

reneries to meet total liquids demand growth of 17 Mb/d, suggesting that the call on renery

throughput could grow by only 9 Mb/d over the next 20 years. Existing spare capacity will

accommodate some of the future growth in renery throughput. Moreover, about half of

global liquids demand growth is expected to be in China, and that countrys renery expansion

plans will affect product balances globally. A continuation of Chinas strategy to be selfsufcient in rened products would severely limit crude run increases for reners outside of

China.

6. This outlook was prepared in early 2011, before the disruption of Libyan oil exports. The extended loss of Libyan production

would have adverse implications for the buffer of spare capacity assumed in this outlook. We have not yet assessed the implications

of widespread unrest in the region for the pace of investment in production capacity, price objectives, or attitudes toward private

investment.

Copyright 2012 by the IAEE. All rights reserved.

34

Economics of Energy & Environmental Policy

f

KEY FINDINGS: POLICY CASE AND SENSITIVITIES

Our Policy Case explores the implications of more aggressive policies to address climate

change. We assume that a wide range of policy tools are deployed, including putting a price

on carbon (particularly in OECD countries). Richer countries achieve signicant cuts in

carbon emissions, while developing countries focus on reducing the carbon intensity of their

economies. In this case, global CO2 emissions would peak just after 2020 and be 14% lower

than the Base Case by 2030, but still 21% above 2005 levels. The emission reduction is

achieved through a combination of more rapid efciency gains and switching to lower carbon

fuels. Oil consumption by 2030 is 5% below the base case; natural gas consumption is reduced

by 4%, while coal use is reduced by 23%. There is limited scope for fuel switching in transport,

although electric vehicles start to make an impact by 2030, so the main effect here comes

through greater vehicle efciency. The greatest scope for fuel switching is in power generation,

where renewables are the big winner (up 33% versus the base case in 2030) and coal the big

loser. Globally, natural gas gains share even as it loses volume overall.

The oil market path in the Policy Case will depend crucially on the degree of OPECs

accommodation of lower demand to manage prices. Based on historical experience, we assume

that OPEC members reduce output to match only a portionnot the entiredecline in

consumption, resulting in prices that are lower than our reference case (but not as low as they

would have been with no OPEC response). As with other fuels, lower oil prices (because of

lower demand) partly counteract the initial demand response to stricter policies. Netting out

these feedback effects, global liquids demand is expected to reach just 97.5 Mb/d (+0.6%

p.a.) in 20305 Mb/d below the base case. Consumption declines are likely to be concen

trated in the OECD (with the most aggressive policies) and the Middle East and FSU (where

oil intensity is highest). Again, the reaction of OPEC producers to sharply lower demand

would be a key driver of the price path in such a scenario.

Recognizing the large range of uncertainty that comes with any long-term forecasting

exercise, we further examine the sensitivity of energyincluding oildemand to alternative

paths for economic growth. A high-growth case takes an optimistic view on globalisation:

expanding international trade ows would support widely-shared long-run growth in produc

tivity and incomes. Adding 0.9% to the long-run growth rate leaves global GDP in 2030

18% higher than in the base case. With income elasticity of energy demand being less than

one, and holding all other factors equal, total energy demand would be 11% higher than in

the base case, and oil consumptionbeing slightly more sensitive to changes in GDP than

energy overallwould be 13% higher. The low GDP growth case assumes that protectionism

and other interventions reduce long-run trend growth rates. This cuts one percentage point

from the long-run growth rate, leaving global GDP 18% below the base case level; energy

demand would be 13% lower than the base case, and oil consumption would be 14% lower.

f

IMPLICATIONS . . .

. . . for Investment

Even though oil is expected to lose global market share to other forms of energy in this

outlook, consumption is still expected to grow signicantly. Accordingly, producers will be

required to make substantial investments to increase outputin addition to the very large

investments needed merely to offset decline rates. While resources are not constrained globally,

Copyright 2012 by the IAEE. All rights reserved.

The Oil Market to 2030Implications for Investment and Policy

35

this outlook suggests that national policies governing access and investment terms have the

potential to signicantly impact the trajectory of production (and therefore prices); clearly,

the investment decisions of OPEC memberswith 77% of current global proved oil re

serveswill be critical. Given the measured pace of investment expected in this outlook among

many OPEC countries, prospects for development of higher-cost resources elsewhere appear

likely to remain attractive. Given the preponderance of proved reserves under their control

(or inuence), the role of National Oil Companies appears likely to continue growing in

importance; consuming country NOCs offering access to rapidly-growing markets also appear

likely to increase their inuence.

For rening, investment prospects appear likely to remain challenging, due to the com

bination of modest growth in global consumptionand declining consumption in mature

OECD marketscombined with robust growth from liquids that are not rened, such as

biofuels and non-rened NGLs.

. . . for CO2 Emissions

In our reference case, global CO2 emissions from energy consumption continue growing

through 2030, driven by strong growth in non-OECD energy consumption, especially of coal.

The growth of global CO2 emissions from energy averages 1.2% p.a. over the next twenty

years (compared to 1.9% p.a. 19902010), leaving emissions in 2030 27% higher than today.

CO2 emissions from oil consumption rise by about 14%, with all of the increase coming from

non-OECD countries; OECD emissions from oil consumption decline in both the reference

and policy cases. With oil losing market share to other fuels, oils share of global CO2 emissions

falls from about 37% currently to about 33% by 2030. Under a more aggressive climate policy

case, global CO2 emissions from energy consumptionand for oilbegin to decline, though

the level of CO2 emissions from energy use by 2030 remain above 2010 levels. Clearly the

trajectory of energy consumption and CO2 emissions will depend on the outlook for economic

growth. Also clearly, the robust availability of global proved reserves of oil and other fossil

fuels means that growth of CO2 emissions is unlikely to be constrained by resource availability

over the next 20 years (although, as discussed earlier, above-ground considerations will sig

nicantly impact the development of future production capacity).

. . . for Import Dependence

There are some positive implications under the reference case outlook. While global

dependence on OPEC supply rises as discussed above, U.S. import dependencein both

volume and percentage termsfalls to levels not seen since the 1980s, due falling consumption

and rising domestic production of ethanol and shale-related liquids, which displace oil imports.

In contrast, import dependence for the EU and China rises. In the EU, import dependence

in percentage terms continues rising as domestic production falls, although import volumes

decline in the face of rapid declines in consumption. In Chinawhich was a net oil exporter

in the early 1990simport dependence rises signicantly, from just over 50% currently to

nearly 80%.

In the more aggressive policy case, import dependence in the U.S. and EU falls relative

to the reference case due to reductions in consumption of roughly 1 million b/d and 700 kb/

d, respectively, by 2030in each case about 6% of reference case oil consumption. (Chinese

oil consumption in the policy case is not signicantly impacted.)

Copyright 2012 by the IAEE. All rights reserved.

36

Economics of Energy & Environmental Policy

f

CONCLUSIONS

Oil consumption appears likely to continue growing, driven by rapidly-growing emerging

economies and despite the likelihood that OECD consumption has peaked. That said, oil is

likely to grow less rapidly than other fuels, due to a combination of consumer reactions to

higher prices and government policies aimed at slowing oils growth. Global resources are

adequate to meet the expected growth in consumption, but the policies of countries that own

the majority of the resources are likely to constrain the pace of development, leaving highcost supply options viable. Oil (and biofuels) will likely remain dominant in the transport

sector to 2030, with cost and the long economic lives of oil-consuming equipment limiting

prospects for other fuels to win substantial market share over the next 20 years.

Policy choices made by governments matter. For supply, policy will govern the ability of

investment (whether by NOCs or private companies) to access prospective resources, as well

as the incentives to develop alternatives such as biofuels. For demand, policies appear likely

to slow consumption growth (whether motivated by concerns for climate, security, or budgets).

Budget constraints may challenge subsidies (for consumption in many emerging economies

and for biofuels and other renewables in mature OECD economies).

Markets matter as well. Consumers and producers alike clearly respond to price signals

where they are able to do so. Production is rising in U.S. on the back of a rapid increase in

drillingand technological innovationmotivated by higher prices. Consumption in the

OECD countries was declining even before the recession due to higher prices. Shifting relative

prices between fuels is driving changes to both the supply and demand picture. However,

there are critical areas where policy and markets are not (yet) connected, such as CO2 emissions

from energy usea classic example of an externality. And unfortunately there are also many

instances of government policy hindering the ability of market participants to response to

price signalssuch as subsidy regimes that shield consumers from recent price increases, and

restrictions on access to resources in many countries. Those interested in sustainable and secure

oil market solutions should give greater weight to policies aimed at expanding, rather than

constraining, the reach ofappropriately designed and overseenmarket forces.

References

BP (2011). BP Energy Outlook 2030.

BP (2011a). BP Statistical Review of World Energy. 60th edition.

International Energy Agency (2010). World Energy Outlook 2010.

Oxford Economics Ltd (2010). Data source for world GDP forecast.

United Nations (2009). UN World Population Prospects: 2008 Revision.

U.S. Energy Information Administration (2010). Annual Energy Review.

Copyright 2012 by the IAEE. All rights reserved.

You might also like

- BP Statistical Review of World Energy 2014 Full ReportDocument48 pagesBP Statistical Review of World Energy 2014 Full ReportNutrition WonderlandNo ratings yet

- 2012 2030 Energy Outlook BookletDocument88 pages2012 2030 Energy Outlook Bookletpkeranova07No ratings yet

- Energy Outlook 2035 BookletDocument98 pagesEnergy Outlook 2035 BookletManjunathNo ratings yet

- 2030 Energy Outlook BookletDocument80 pages2030 Energy Outlook BookletSungho KimNo ratings yet

- Oil Producers vs. Oil Users.7.1Document2 pagesOil Producers vs. Oil Users.7.1tekhed77No ratings yet

- 2012 WorldenergyoutlookDocument6 pages2012 WorldenergyoutlookLavu Anil ChowdaryNo ratings yet

- 02pa MK 3 5 PDFDocument11 pages02pa MK 3 5 PDFMarcelo Varejão CasarinNo ratings yet

- Liquid Fuel Remains The King: Oil Supply ChainDocument1 pageLiquid Fuel Remains The King: Oil Supply ChainPraveen JaiswalNo ratings yet

- XOM 2012 Energy OutlookDocument43 pagesXOM 2012 Energy OutlookBrett PevenNo ratings yet

- World Energy Outlook 2006 Summaryin EnglishDocument11 pagesWorld Energy Outlook 2006 Summaryin EnglishMohamed Ilyasse MellakhNo ratings yet

- Americas Energy SecurityDocument5 pagesAmericas Energy SecurityJai GuptaNo ratings yet

- BP Statistical Review of World Energy 2016 Full ReportDocument48 pagesBP Statistical Review of World Energy 2016 Full ReportKiranPadmanNo ratings yet

- Business Environment PraveshDocument11 pagesBusiness Environment PraveshKaran GuptaNo ratings yet

- Sarofim Energy White Paper 2012Document14 pagesSarofim Energy White Paper 2012hkm_gmat4849No ratings yet

- OPEC Oil Outlook 2030Document22 pagesOPEC Oil Outlook 2030Bruno Dias da CostaNo ratings yet

- Chapter 4 - GeopoliticsDocument18 pagesChapter 4 - GeopoliticsOana AlexandruNo ratings yet

- WEO2007SUMDocument12 pagesWEO2007SUMBen JacobyNo ratings yet

- World Energy Outlook: Executive SummaryDocument10 pagesWorld Energy Outlook: Executive SummaryJean Noel Stephano TencaramadonNo ratings yet

- Busby STAIR 2 1Document23 pagesBusby STAIR 2 1josh busbyNo ratings yet

- Me Review Assignent - Arunima Viswanath - m200046msDocument4 pagesMe Review Assignent - Arunima Viswanath - m200046msARUNIMA VISWANATHNo ratings yet

- Crude Oil Market & Factors Impacting PricesDocument7 pagesCrude Oil Market & Factors Impacting PricesrohitNo ratings yet

- Sample Essay: 1 " Resources Like Oil and Gas Seriously Affect The Economy."Document4 pagesSample Essay: 1 " Resources Like Oil and Gas Seriously Affect The Economy."rsjavkhedkar09No ratings yet

- Chapter 1 Energy, Commodities, and Water - Major Business and Technology Trends Shaping The Contemporary WorldDocument21 pagesChapter 1 Energy, Commodities, and Water - Major Business and Technology Trends Shaping The Contemporary Worldmonaliza.macapobre001No ratings yet

- GenesisDocument12 pagesGenesisGaurav SinghNo ratings yet

- Managing and Mitigating Global RisksDocument17 pagesManaging and Mitigating Global RisksAndre KudelskiNo ratings yet

- Proposal Draft 2Document9 pagesProposal Draft 2ashfNo ratings yet

- Energy Presentation33 PowerandOrdertheEnergyDimension RSkinner 2006Document9 pagesEnergy Presentation33 PowerandOrdertheEnergyDimension RSkinner 2006LTE002No ratings yet

- Oil ProjectionsDocument24 pagesOil ProjectionsalphathesisNo ratings yet

- ? ? Is The Branch of Economics That Studies The Relation of Culture ToDocument29 pages? ? Is The Branch of Economics That Studies The Relation of Culture ToPratibha MundhraNo ratings yet

- Macroeconomic Environment, Commodity Markets:: A Longer Term OutlookDocument32 pagesMacroeconomic Environment, Commodity Markets:: A Longer Term OutlookRodriguez Fredy AlbertoNo ratings yet

- Crude Oil Price, Monetary Policy and Output: Case of PakistanDocument15 pagesCrude Oil Price, Monetary Policy and Output: Case of PakistanƁiLдL дhmed RajpootNo ratings yet

- Research ReportDocument13 pagesResearch ReportShahroz AslamNo ratings yet

- 2023 - Energy Demand - Three Drivers - ExxonMobilDocument30 pages2023 - Energy Demand - Three Drivers - ExxonMobilAyla ElibolNo ratings yet

- Academic Research Essay On Oil Prices: Prakhar GuptaDocument13 pagesAcademic Research Essay On Oil Prices: Prakhar GuptaPrakhar GuptaNo ratings yet

- HUGHES LIPSCY - The Politics of OilDocument16 pagesHUGHES LIPSCY - The Politics of OilBajak AndrasNo ratings yet

- BP Energy Outlook 2016 Focus On North AmericaDocument64 pagesBP Energy Outlook 2016 Focus On North AmericaMikeJbNo ratings yet

- Comparison of Historic Energy Projections and Current DataDocument7 pagesComparison of Historic Energy Projections and Current DatashafahatNo ratings yet

- Introduction To Cultural EconomicsDocument30 pagesIntroduction To Cultural EconomicsPratibha MundhraNo ratings yet

- World Energy Outlook 2008Document578 pagesWorld Energy Outlook 2008Jordy StarkNo ratings yet

- Iv. Oil Price Developments: Drivers, Economic Consequences and Policy ResponsesDocument29 pagesIv. Oil Price Developments: Drivers, Economic Consequences and Policy Responsesdonghao66No ratings yet

- Meeting 2 Oil and Gas TodayDocument4 pagesMeeting 2 Oil and Gas TodayzllsNo ratings yet

- From Them Makers IntroductionDocument20 pagesFrom Them Makers IntroductionsayogiyogeshwarNo ratings yet

- Financing The World Petroleum Industry A Talk by John D. Emerson Chase Bank, New YorkDocument24 pagesFinancing The World Petroleum Industry A Talk by John D. Emerson Chase Bank, New YorkIbrahim SalahudinNo ratings yet

- WEO2013 Executive Summary EnglishDocument12 pagesWEO2013 Executive Summary EnglishLucio CruzNo ratings yet

- E&P-Industry Analysis PaperDocument9 pagesE&P-Industry Analysis Paper10manbearpig01No ratings yet

- Critique PaperDocument4 pagesCritique PaperKaye Annzelle SALAMATNo ratings yet

- The Rise and Fall of Black Gold: Reasons and ImpactDocument5 pagesThe Rise and Fall of Black Gold: Reasons and ImpactPhalguni AnejaNo ratings yet

- SubsidyDocument22 pagesSubsidySam SaNo ratings yet

- BP Peak Oil Demand and Long Run Oil PricesDocument20 pagesBP Peak Oil Demand and Long Run Oil PricesKokil JainNo ratings yet

- Sprott On OilDocument10 pagesSprott On OilMariusz Skonieczny100% (1)

- Foundations of Energy Risk Management: An Overview of the Energy Sector and Its Physical and Financial MarketsFrom EverandFoundations of Energy Risk Management: An Overview of the Energy Sector and Its Physical and Financial MarketsNo ratings yet

- The Economist Guide to Commodities 2nd edition: Producers, players and prices; markets, consumers and trendsFrom EverandThe Economist Guide to Commodities 2nd edition: Producers, players and prices; markets, consumers and trendsRating: 3 out of 5 stars3/5 (1)

- Conversations about Energy: How the Experts See America's Energy ChoicesFrom EverandConversations about Energy: How the Experts See America's Energy ChoicesRating: 5 out of 5 stars5/5 (1)

- How America Can Stop Importing Foreign Oil & Those Preventing It From HappeningFrom EverandHow America Can Stop Importing Foreign Oil & Those Preventing It From HappeningNo ratings yet

- The Complete Idiot's Guide to the Politics Of OilFrom EverandThe Complete Idiot's Guide to the Politics Of OilRating: 4 out of 5 stars4/5 (2)

- Fueling Up: The Economic Implications of America's Oil and Gas BoomFrom EverandFueling Up: The Economic Implications of America's Oil and Gas BoomNo ratings yet