0 ratings0% found this document useful (0 votes)

3K viewsPayslip Form

Payslip Form

Uploaded by

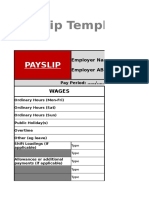

samuelkwofieThis pay slip document provides details of an employee's wages for a specific pay period, including their name, employer, job title, hours worked, pay rates, tax deductions, other deductions, and net wages. It lists ordinary hours, overtime, allowances, holiday pay, superannuation contributions, gross wage, total deductions, and net wages. The note at the bottom provides contact information for assistance and confirms the payslip complies with legal requirements.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Payslip Form

Payslip Form

Uploaded by

samuelkwofie0 ratings0% found this document useful (0 votes)

3K views1 pageThis pay slip document provides details of an employee's wages for a specific pay period, including their name, employer, job title, hours worked, pay rates, tax deductions, other deductions, and net wages. It lists ordinary hours, overtime, allowances, holiday pay, superannuation contributions, gross wage, total deductions, and net wages. The note at the bottom provides contact information for assistance and confirms the payslip complies with legal requirements.

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

This pay slip document provides details of an employee's wages for a specific pay period, including their name, employer, job title, hours worked, pay rates, tax deductions, other deductions, and net wages. It lists ordinary hours, overtime, allowances, holiday pay, superannuation contributions, gross wage, total deductions, and net wages. The note at the bottom provides contact information for assistance and confirms the payslip complies with legal requirements.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

3K views1 pagePayslip Form

Payslip Form

Uploaded by

samuelkwofieThis pay slip document provides details of an employee's wages for a specific pay period, including their name, employer, job title, hours worked, pay rates, tax deductions, other deductions, and net wages. It lists ordinary hours, overtime, allowances, holiday pay, superannuation contributions, gross wage, total deductions, and net wages. The note at the bottom provides contact information for assistance and confirms the payslip complies with legal requirements.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 1

PAY SLIP

Date of Payment: Pay Period: From To

Employee’s Name: Employer’s Name:

Name of Award/Agreement (optional): Employer’s ABN:

Classification/Job Title: Employment Status (full-time, part-time, casual):

Super Fund/Scheme: Employer Super Contribution:

$

Wages – Ordinary hours – Mon-Fri hrs @ (rate) $

Wages – Ordinary hours – Saturday hrs @ (rate) $

Wages – Ordinary hours – Sunday hrs @ (rate) $

Public holiday(s) hrs @ (rate) $

Shift loadings hrs @ (rate) $

hrs @ (rate) $

hrs @ (rate) $

Overtime hrs @ (rate) $

hrs @ (rate) $

hrs @ (rate) $

Allowances Type $

Type $

Holiday Pay (casual 1/12th) Type $

Gross Wage $

Tax Deductions $

Other Deductions (purpose) (details) $

Total Deductions $

Net Wages $

Note: payslips must be issued to employees at the time of payment.

Need assistance? Call the Office of Industrial Relations on 131 628 or visit

www.industrialrelations.nsw.gov.au. Online services: Awards Online,

Pay Rate Updates by email, Check Your Pay wages calculator.

This payslip complies with State and Federal requirements.

More copies can be printed from our web site.

You might also like

- Your Walmart Offer LetterDocument5 pagesYour Walmart Offer LetterJaime GirardNo ratings yet

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFfpenalozal100% (1)

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFCarl SoriaNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementGejehNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- BTME HSE PlanDocument122 pagesBTME HSE PlanNibu P ShajiNo ratings yet

- Fair Work Payslip TemplateDocument1 pageFair Work Payslip Templatekhael21No ratings yet

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFfpenalozalNo ratings yet

- Pay Stub Tmplates 9Document1 pagePay Stub Tmplates 9Lekan iskilu AbdulkareemNo ratings yet

- Payslip TemplateDocument1 pagePayslip TemplatemashipooNo ratings yet

- Time and Wages Record Template 1016 0Document1,026 pagesTime and Wages Record Template 1016 0jhedmendoza9No ratings yet

- PaysliptemplateDocument9 pagesPaysliptemplateSyaffiqLajisNo ratings yet

- Agency Payment Report: Emp NoDocument3 pagesAgency Payment Report: Emp NoDeerawkNo ratings yet

- Inancial Lanning Orksheet: Statement of Net WorthDocument9 pagesInancial Lanning Orksheet: Statement of Net WorthKevin Baladad100% (1)

- Profit-And-Loss-Statement WELLS FARGODocument2 pagesProfit-And-Loss-Statement WELLS FARGOSamantha JahansouzshahiNo ratings yet

- Example Pay SlipDocument1 pageExample Pay Slipsharu14100% (2)

- RPT AFC2 ND PayrollDocument4 pagesRPT AFC2 ND Payrollpisey povNo ratings yet

- IC Pay Stub With Hourly Wage Template Updated 8903Document2 pagesIC Pay Stub With Hourly Wage Template Updated 8903jntdomainNo ratings yet

- Appendix B Sample Budget FormatDocument1 pageAppendix B Sample Budget FormatSamuel KachumiNo ratings yet

- Income Statement Template: Click Here To Create in SmartsheetDocument2 pagesIncome Statement Template: Click Here To Create in SmartsheetGomiNo ratings yet

- Poa Format Simple FSDocument6 pagesPoa Format Simple FSKelvin SagadayaNo ratings yet

- Retirement Planning WorkbookDocument8 pagesRetirement Planning Workbooktwankfanny100% (3)

- IC Payroll Statement Template1Document1 pageIC Payroll Statement Template1Matthew NiñoNo ratings yet

- Small Business ExpensesDocument1 pageSmall Business ExpensesMaude Angeli BaldiviaNo ratings yet

- Salary Settlement ModelDocument1 pageSalary Settlement ModelScribdTranslationsNo ratings yet

- Multiurban Infra Services Pvt. Ltd. Salary Slip: This Is A Computer Generated Document and Does Not Require Any SignatureDocument1 pageMultiurban Infra Services Pvt. Ltd. Salary Slip: This Is A Computer Generated Document and Does Not Require Any Signaturesurya gtiblyNo ratings yet

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFArifNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementKakz KarthikNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementUtiyyalaNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementCarl SoriaNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementKNNo ratings yet

- CASHFLOW JuegoDocument1 pageCASHFLOW JuegoRebeca Valverde DelgadoNo ratings yet

- EXCEL-P&L Mid MonthDocument2 pagesEXCEL-P&L Mid Monthrutley1No ratings yet

- PayslipDocument1 pagePayslipnajams81No ratings yet

- Frofit and Loss Statement of BankDocument2 pagesFrofit and Loss Statement of BankAvtar SNo ratings yet

- Landscaping Invoice 14Document2 pagesLandscaping Invoice 14mrfurqonaziziNo ratings yet

- Financial AnalysisDocument7 pagesFinancial AnalysisJason TangNo ratings yet

- Generic Life Insurance Needs Analysis Worksheet 2014-10Document3 pagesGeneric Life Insurance Needs Analysis Worksheet 2014-10Christophe BernardNo ratings yet

- Payment Plan Application - AdultDocument2 pagesPayment Plan Application - AdultnikkinicholaoujdNo ratings yet

- Business Name: Address Line 1 Phone Address Line 2 Email City, State, Zip WebDocument2 pagesBusiness Name: Address Line 1 Phone Address Line 2 Email City, State, Zip WebJear ComerosNo ratings yet

- PFP ProjectDocument16 pagesPFP Projectapi-404880733No ratings yet

- Sample Microsoft Salary Certificate TemplateDocument1 pageSample Microsoft Salary Certificate TemplateDani StanisorNo ratings yet

- Inancial Lanning Orksheet: Statement of Net WorthDocument8 pagesInancial Lanning Orksheet: Statement of Net WorthDu Baladad Andrew MichaelNo ratings yet

- FY20 Budget For Mini GrantDocument4 pagesFY20 Budget For Mini GrantGabriel OmotaNo ratings yet

- Six Sigma Project Charter TemplateDocument7 pagesSix Sigma Project Charter TemplateBhuvan B.SNo ratings yet

- نموذج حساب تكليف موظفDocument7 pagesنموذج حساب تكليف موظفrachedtnNo ratings yet

- IC Balance Sheet Template 8897Document2 pagesIC Balance Sheet Template 8897bagirNo ratings yet

- Budget Template FINALDocument5 pagesBudget Template FINALRaden RoyishNo ratings yet

- Project Budgeting v3Document1 pageProject Budgeting v3Taufiq ArifinNo ratings yet

- 1yr Cash FlowDocument1 page1yr Cash FlowShrikant KajaleNo ratings yet

- IC Six Sigma Project CharterDocument6 pagesIC Six Sigma Project CharterBhuvan B.SNo ratings yet

- Income Calculation WorksheetDocument1 pageIncome Calculation Worksheetrush2serveNo ratings yet

- The Actors Fund Financial Wellness Program: Budgeting Nuts & Bolts WorkbookDocument10 pagesThe Actors Fund Financial Wellness Program: Budgeting Nuts & Bolts WorkbookKyrie CourterNo ratings yet

- Six Sigma Project CharterDocument6 pagesSix Sigma Project CharterBhuvan B.SNo ratings yet

- Additional Work Order TemplateDocument2 pagesAdditional Work Order TemplateJonathan ManuelNo ratings yet

- Partnership Calculator and Answer 23 - 24Document6 pagesPartnership Calculator and Answer 23 - 24Sheikh NaumanNo ratings yet

- Washington Ave WSP InvoicesDocument21 pagesWashington Ave WSP InvoicesmegankshannonNo ratings yet

- 3-Year Cash Flow Statement: User To Complete Non-Shaded Fields, OnlyDocument5 pages3-Year Cash Flow Statement: User To Complete Non-Shaded Fields, OnlySabeoNo ratings yet

- Abong, Arnold, TDocument1 pageAbong, Arnold, TROGER APOSTOLNo ratings yet

- Unabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2From EverandUnabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2No ratings yet

- Release 13 20D Implementing Absence ManagementDocument182 pagesRelease 13 20D Implementing Absence ManagementTimothy BaileyNo ratings yet

- Minimum Wages in PuducherryDocument4 pagesMinimum Wages in PuducherryVidhiya AmbigapathyNo ratings yet

- 04-Case Study On Air Products CorporationDocument3 pages04-Case Study On Air Products Corporationtirthanp0% (1)

- 2017erciyes10464822dpa PDFDocument334 pages2017erciyes10464822dpa PDFAbeerAlgebaliNo ratings yet

- HR Report - AdidasDocument21 pagesHR Report - Adidasapi-31320291483% (6)

- HR Manager ChennaiDocument10 pagesHR Manager ChennaiSunsmart SstplNo ratings yet

- Prs Staff Retention Reward 2021Document57 pagesPrs Staff Retention Reward 2021Hasan AyoubNo ratings yet

- About The Charts: CA Pooja Kamdar DateDocument8 pagesAbout The Charts: CA Pooja Kamdar DatekbalakarthikaNo ratings yet

- Unfair Labor Practices CASESDocument106 pagesUnfair Labor Practices CASESRitch LibonNo ratings yet

- ESMP ReportDocument11 pagesESMP ReportAshebir100% (1)

- A Study On The Positive and Negative Impacts of Social Stratification in Urban and Rural AreasDocument6 pagesA Study On The Positive and Negative Impacts of Social Stratification in Urban and Rural AreasEditor IJRITCCNo ratings yet

- 1800flowers PMG - SS and Email Only PDFDocument8 pages1800flowers PMG - SS and Email Only PDFKimCanillasVincereNo ratings yet

- HRM4003-Course Outline - Fall 2023Document4 pagesHRM4003-Course Outline - Fall 2023Enosh JOyNo ratings yet

- How To Become A Public RelationsDocument6 pagesHow To Become A Public RelationsNessa NessaNo ratings yet

- Human Resource Planning and Employee Productivity in Nigeria Public OrganizationDocument13 pagesHuman Resource Planning and Employee Productivity in Nigeria Public OrganizationKassaf Chowdhury100% (2)

- Abante Vs La MadridDocument2 pagesAbante Vs La MadridJanelle ManzanoNo ratings yet

- Policies & Procedures - RITU KUMARDocument36 pagesPolicies & Procedures - RITU KUMARSharmila Dutta100% (2)

- Payroll: Migo Construction Alegria 4 StoreyDocument7 pagesPayroll: Migo Construction Alegria 4 StoreyLexid Pero GrisolaNo ratings yet

- Senior Counsel or Associate General Counsel or Assistant GeneralDocument3 pagesSenior Counsel or Associate General Counsel or Assistant Generalapi-76922317No ratings yet

- Aris Phils. Inc. Vs NLRCDocument2 pagesAris Phils. Inc. Vs NLRCthesarahkristin100% (2)

- Application Form PT NSIADocument5 pagesApplication Form PT NSIAarifNo ratings yet

- Pinku 123Document91 pagesPinku 123bharat sachdevaNo ratings yet

- JovindDocument4 pagesJovindGopaul UshaNo ratings yet

- Fundamental AnalysisDocument89 pagesFundamental AnalysisSoufiane ChaterNo ratings yet

- Policy of Integrated Management SystemDocument1 pagePolicy of Integrated Management SystemssssaleNo ratings yet

- Eureka Forbes LimitedDocument77 pagesEureka Forbes LimitedDipanjan DasNo ratings yet

- The Millennial Connection: Sensors Control Interoperability Ethernet IntelligenceDocument63 pagesThe Millennial Connection: Sensors Control Interoperability Ethernet IntelligenceMohamedNo ratings yet

- النساجونDocument104 pagesالنساجونMoustafa MagdyNo ratings yet