Chap 1 Mathscape

Chap 1 Mathscape

Uploaded by

Harry LiuCopyright:

Available Formats

Chap 1 Mathscape

Chap 1 Mathscape

Uploaded by

Harry LiuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Chap 1 Mathscape

Chap 1 Mathscape

Uploaded by

Harry LiuCopyright:

Available Formats

Consumer arithmetic

1

Consumer arithmetic

1

This chapter at a glance

Stage 5.1/5.2/5.3 After completing this chapter, you should be able to:

calculate the simple interest earned on an investment calculate the principal and interest rate in problems involving simple interest explain the difference between simple interest and compound interest calculate compound interest by repeated use of the simple interest formula calculate compound interest by use of the compound interest formula calculate compound interest by repeated multiplication on a calculator calculate compound interest where the interest does not compound annually calculate the principal given the interest rate, number of interest payments and interest earned apply the compound interest formula to solve practical problems involving appreciation calculate the depreciated value of an item by repeated use of percentage reduction calculate the depreciated value of an item by use of the depreciation formula calculate the depreciated value of an item by repeated multiplication on a calculator calculate the original value of a depreciating item solve problems involving consecutive discounts calculate and compare the cost of purchasing goods by paying cash, lay-by, deferred payment and buying on terms convert between annual and monthly or daily rates of simple interest solve problems that involve the purchase of items by use of a credit card calculate the monthly repayments and interest on a loan using a given table compare the cost of loans using flat and reducible interest.

Mathscape

10

extension

1.1

Simple interest

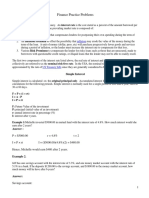

Interest is money that a bank or other financial institution pays to its customers for lending the bank their money. Banks also lend money to other customers as home loans or personal loans so that they can buy a house, car, computer or take a holiday. The bank charges the borrower interest on the loan. The borrower must repay the amount of the loan plus the interest. Banks always charge higher interest rates for loans than they pay on savings? Why? The terms principal and capital refer to an amount of money that has been invested (or borrowed) for a period of time and on which interest is paid or charged. Interest that is calculated on the principal only is called simple interest. The amount of simple interest $I to be paid on an investment or loan at r% p.a. is given by the formula: I = PRT where $P is the amount invested or borrowed r R is the percentage rate of interest, i.e. R = -------100 T is the time period of the investment or loan, in years. Example 1 a Calculate the simple interest earned on an investment of $350 at 6% p.a. over 7 years. b Find the total balance of the account after 7 years. Solutions a P = $350,

6 R = -------- , T = 7 100 = 0.06

EG +S

I = PRT = $350 0.06 7 = $147 The simple interest earned is $147.

Balance = principal + interest = $350 + $147 = $497

EG +S

Example 2 Calculate the amount of simple interest that must be paid on a loan of $400 at 5.4% p.a. simple interest over 7 months. Solution 5.4 7 P = $400, R = -------- , T = ----- (since the time must be given in years and 7 months is 100 12 = 0.054 I = PRT 7 = $400 0.054 ----12 = $12.60

7 ----12

of a year)

Chapter

1:

Consumer arithmetic

Exercise

1.1

1 Calculate the simple interest earned on savings of: a $200 at 7% p.a. for 1 year b $800 at 5% p.a. for 6 years c $650 at 4% p.a. for 3 years d $450 at 8% p.a. for 5 years 1 -e $1040 at 5% p.a. for 3 -- years f $1200 at 4% p.a. for 5 1 years 2 2 g

-$1540 at 7% p.a. for 6 1 years 4 -h $2780 at 9% p.a. for 2 3 years 4

2 Find the total balance of an account after: a 3 years if $1500 is invested at 6% p.a.

b 5 years if $2720 is invested at 8% p.a.

3 Calculate the simple interest that would be earned on the following investments. a $4000 at 1.5% per month for 7 months b $2700 at 0.95% per month for 4 months c $5500 at 0.023% per day for 65 days d $9475 at 0.049% per day for 213 days 4 Calculate the amount of interest that would be earned on the following investments. a $800 at 4% p.a. for 6 months b $900 at 5% p.a. for 4 months c $1300 at 9% p.a. for 7 months d $1725 at 7% p.a. for 18 months

Consolidation

5 Find the total balance of an account if the following amounts were invested. -a $720 for 3 years at 8.5% p.a. b $940 for 5 years at 6 1 % p.a. 2 1 c $1680 for 8 months at 7 -- % p.a. d $2695 for 4 months at 4.6% p.a. 4 6 Calculate the simple interest earned on the following investments. a $3800 at 7.1% p.a. for 98 days b $15 270 at 5.9% p.a. for 125 days 1 -- % p.a. for 240 days -c $920 at 3 2 d $13 850 at 4 3 % p.a. for 202 days 4 7 Calculate the simple interest earned on these investments. a $6210 at 1.6% per quarter for 15 months -b $8040 at 1.35% per quarter for 2 1 years 2 8 Laurie borrowed $9000 from a finance company at 12% p.a. simple interest over 3 years to buy some new furniture for his house. a How much interest will Laurie pay on this loan? b How much will he repay altogether? 9 Leanne invested $500 with the Eastpac bank for 3 years and earned simple interest at the rate of 4% p.a. At the end of the 3 years, she transferred the entire amount (i.e. capital plus interest) into a new account with the St Patrick bank for 3 more years at 5% p.a. a How much will Leanne have in the account after the first 3 years? b How much will Leanne have in the account at the end of the 6 years? c How much interest did she earn altogether? 10 Carlos invested $5400 for 6 years at 5.2% p.a. simple interest. At the end of the 6 years, he withdrew the capital and reinvested the interest only for another 4 years. How much interest did he receive in total over this 10 year period?

Mathscape

10

extension

11 Liam deposited a sum of money into a new credit union account. The account paid simple interest at the rate of 6% p.a. and after 3 years he had earned $129.60 interest. How much money did Liam invest in the account? 12 Mateya invested a sum of money in a savings account on which simple interest was paid at the rate of 7.5% p.a. After 4 years, Mateya had earned $180 in interest. How much money did she invest? 13 Meryn earned $140 simple interest on an investment of $500 at 4% p.a. For how many years was the money invested? 14 Brett invested $360 at 5% p.a. and earned simple interest of $13.50. For how many months was the money invested? 15 Wade was paid $300 simple interest on an investment of $2000 over 5 years. Calculate the annual rate of interest. 16 Greta invested $850 for 5 years and earned simple interest of $276.25. What was the interest rate per annum?

Further applications

17 Terry invested an amount of money for 6 years at 4% p.a. simple interest. What would the interest rate need to be in order for Terry to earn the same amount of interest in: a 1 year? b 2 years? c 3 years? d 12 years? 18 For how many months would I need to invest $2500 at 7.2% p.a. simple interest to earn interest of $75? 19 Rhonda invested $1750 at 6.4% p.a. simple interest. For how many days was the money invested if she earned $56.15 interest?

1.2

Compound interest

Compound interest tables

When simple interest is calculated on an investment, the interest is only calculated on the principal. The amount of interest earned in each time period, therefore, is always the same. When compound interest is calculated on an investment, the interest is calculated on the principal as well as on any interest that has been earned previously. The amount of interest earned in each time period increases, because the value of the investment on which it is being calculated is increasing. To calculate the compound interest that will accrue on an investment: calculate the interest on the principal add the interest to the principal to give the new balance calculate the interest on the new balance then add this to the previous balance repeat this procedure for each time period that the interest is to be paid.

Chapter

1:

Consumer arithmetic

For example, $5000 is invested at 8% p.a. compound interest for 3 years with the interest compounding annually. Use a table to find the final value of the investment and the amount of interest that will accrue. Year 1st 2nd 3rd Opening balance $5000 $5400 $5832 Interest $5000 0.08 = $400 $5400 0.08 = $432 $5832 0.08 = $466.56 Closing balance $5400 $5832 $6298.56

After 3 years, the original investment of $5000 has grown to $6298.56. Interest = $6298.56 $5000 = $1298.56 or Interest = $400 + $432 + $466.56 = $1298.56

The compound interest formula

In the previous example, the value of the investment after each year could have been calculated as follows: Value after 1 year = $5000(1 + 0.08)1 = $5400 Value after 2 years = $5000(1 + 0.08)2 = $5832 Value after 3 years = $5000(1 + 0.08)3 $6298.56 From this example, we can see that if $P was invested at r% p.a. compounding annually, then r n its value $A, after n years, would be given by the formula A = P 1 + -------- . This formula can 100 more simply be written as A = P(1 + R)n, where the interest rate is expressed as a decimal, r i.e. R = -------- . 100 If the interest is paid half-yearly, quarterly or monthly instead of annually, then we must adjust the values of R and n accordingly. If an amount of money is invested and earns compound interest for a period of time, then its value at the end of this time is given by: A = P(1 + R)n where P is the principal, or amount invested R is the interest rate per time period, expressed as a decimal n is the number of time periods A is the value of the investment after n time periods.

Mathscape

10

extension

Repeated multiplication

The value of an investment that earns compound interest over a period of time can be found by performing repeated multiplications on a calculator. Again, using the above example, we could find the value of the investment by multiplying the principal, $5000, by 1.08 for each year that it earns interest. That is, the value of the investment after 3 years = $5000 1.08 1.08 1.08 = $5000 1.083 = $6298.56

EG +S

Example 1 Craig invested $20 000 at 7% p.a. compound interest, with interest compounding annually. Find: a the value of this investment after 4 years A = P(1 + R)n = $20 000(1 + 0.07)4 = $20 000(1.07)4 $26 215.92 b b the amount of interest earned. Interest = $26 215.92 $20 000 = $6215.92 Solutions a P = $20 000 R = 0.07 n=4

EG +S

Example 2 A sum of $10 000 is invested at 8% p.a. compound interest. Find the value of this investment after 3 years if the interest is compounded: a half-yearly b quarterly Solutions The amount does not compound annually; therefore, we need to adjust the interest rate, R, and the number of time periods, n. a The interest compounds every 6 months. The annual interest rate of 8% p.a. is equivalent to a rate of 4% every 6 months. Interest is paid twice a year for 3 years, therefore there are 6 time periods. P = $10 000 A = P(1 + R)n R = 0.04 = $10 000(1 + 0.04)6 n=6 = $10 000(1.04)6 $12 653.19 b The interest compounds every 3 months. The annual interest rate of 8% p.a. is equivalent to a rate of 2% every 3 months. Interest is paid 4 times a year for 3 years, therefore there are 12 time periods. P = $10 000 A = P(1 + R)n R = 0.02 = $10 000(1 + 0.02)12 n = 12 = $10 000(1.02)12 $12 682.42

Chapter

1:

Consumer arithmetic

Exercise

1.2

Give all answers in this exercise correct to the nearest cent, unless otherwise directed. 1 A sum of $10 000 was invested for 3 years at 6% p.a., compounded annually. a Copy and complete this table. Year 1st 2nd 3rd b Find the interest that is earned on this investment. 2 Draw up a table similar to that in question 1 to find the account balance and compound interest earned on these investments, if the interest is compounded annually. a $800 at 5% p.a. for 3 years b $2000 at 3.5% p.a. for 2 years 3 Use a compound interest table to find the amount of compound interest that will accrue on each investment, if the interest is compounded monthly. [HINT: First change the annual interest rate to a monthly rate]. a $500 at 12% p.a. for 3 months b $3000 at 6% p.a. for 2 months 4 Use the compound interest formula to find the final value of each investment if the interest is compounded annually. a $1000 at 5% p.a. for 2 years b $750 at 4% p.a. for 3 years c $1300 at 6% p.a. for 5 years d $1950 at 8% p.a. for 4 years e $3000 at 3% p.a. for 8 years f $12 000 at 9% p.a. for 5 years g $9500 at 7% p.a. for 4 years h $15 000 at 6% p.a. for 10 years

Consolidation

Opening balance $10 000

Interest $10 000 0.06 = $600

Closing balance $10 600

5 Use the compound interest formula to find the amount of interest earned on each investment if the interest is compounded annually. a $7000 at 8.5% p.a. for 3 years b $12 000 at 6.3% p.a. for 4 years c $10 500 at 7.1% p.a. for 6 years d $9200 at 5.8% p.a. for 10 years 1 -e $25 000 at 9 -- % p.a. for 5 years f $18 000 at 7 1 % p.a. for 6 years 2 2 g

-$31 500 at 6 1 % p.a. for 11 years 4 -h $52 750 at 8 3 % p.a. for 15 years 4

6 Bridie invests $3500 at 12% p.a. compound interest. Find the value of her investment after 4 years if the interest is compounded: a annually b half-yearly c quarterly d monthly 7 Use the compound interest formula to calculate the amount of interest that will accrue on the following investments. a $2000 at 8% p.a. for 1 year, compounded every 6 months b $1500 at 10% p.a. for 7 years, compounded every 6 months

Mathscape

10

extension

c d e f g h i

-$2400 at 12% p.a. 5 1 for years, compounded every 6 months 2 $4000 at 8% p.a. for 1 year, compounded quarterly $7200 at 12% p.a. for 2 years, compounded quarterly -$3800 at 4% p.a. 3 1 for years, compounded quarterly 2 $9000 at 12% p.a. for 2 years, compounded monthly $15 000 at 3% p.a. for 5 years, compounded monthly $50 000 at 9% p.a. for 3 years, compounded monthly

8 Heath invested $8000 at 6% p.a. compounded monthly. Find: a the value of the investment after 5 years b the amount of interest earned 9 Paul invested $150 000 at 9% p.a. for 5 years, with the interest compounding every 4 months. How much interest will he earn? 10 A finance company invested $250 000 at a daily interest rate of 0.02%. Find: a the value of the investment after 20 days b the amount of interest earned c the equivalent annual rate of interest. 11 Merv invested $1000 at 7% p.a. simple interest for 4 years, while Christine invested $1000 at 7% p.a. compound interest for 4 years, compounding annually. Who received the greater amount of interest, and by how much? 12 Which of the following pays more interest on an investment of $4000? A 8% p.a. simple interest for 9 years, or B 6% p.a. compound interest for 10 years, compounded annually 13 A building society advertises the following investment plans: A 7.2% p.a. compounded quarterly, or B 6.6% p.a compounded monthly Which plan will provide the greater amount of interest on an investment of $30 000 for 5 years and by how much? 14 On her first birthday, Emmas parents invested $5000 in a 20 year savings bond. The bond pays interest at 9.2% p.a., compounding every 6 months. What will be the value of the bond when it matures on Emmas 21st birthday? 15 A woman invested $40 000 at 7.5% p.a. simple interest for 3 years. At the end of this term, she re-invested the capital and interest at 6% p.a. compound interest for 4 years, compounding half-yearly. Calculate the final value of the investment and the total amount of interest earned over the 7 years. 16 House prices in a certain suburb are appreciating in value by an average of 9% per year. If a house is purchased today for $820 000, find, correct to the nearest dollar, its expected value in: a 2 years b 5 years c 10 years 17 If the national inflation rate is 3.5% p.a., find, correct to the nearest 5 cents, the expected cost of: a a 90c carton of milk in 3 years time b a $2 bag of potatoes in 5 years time c a $3 loaf of bread in 2 years time d a $40 tank of petrol in 10 years time

Chapter

1:

Consumer arithmetic

18 The population of a country town was 8000 at the end of 2003. If, on average, the towns population is increasing at the rate of 3% per year, find the expected population at the end of 2010. 19 The present population of a country is 25.7 million people. If this is expected to increase by 1.8% p.a. over the next decade, find the population of the country in 10 years time. 20 A painting was purchased in 2001 for $34 000. If it appreciates in value by 4.5% p.a., what would be its value in 2006? Answer correct to the nearest dollar. 21 Samantha earns $400 per week as a personal assistant. Her employer has agreed to increase her salary by 3% each year. Calculate her annual salary in 5 years time, correct to the nearest dollar.

Further applications

22 Barry invested a sum of money at 5% p.a., compounded annually. After 3 years his investment had grown to $694.58. Find the amount of money that he invested, correct to the nearest dollar. 23 Calculate the amount of money, correct to the nearest dollar, that will grow to: a $676.63 if invested for 7 years at 6% p.a., compounded annually b $2478.61 if invested for 5 years at 14% p.a., compounded half-yearly c $1902.36 if invested for 3 years at 8% p.a., compounded quarterly -d $3868.62 if invested for 2 1 years at 18% p.a., compounded monthly 2

TRY THIS

Inflation

Michelle, a year 10 student, is 15 years-old and has just begun her first part-time job. When she tells her grandmother that she is to be paid $15 per hour her grandmother recalls that for her first job she only received 2 pence an hour (about --1 1 cents). Michelle wonders what the wages will be when she is 75 years-old and 2 has 15 year-old grandchildren. Assuming an inflation rate of 5% per annum, what amount will $15 have grown to in 60 years? How much difference would it make if the inflation rate was 3% or 10%?

1.3

Depreciation

Depreciation tables

If an item loses value over a period of time, then it is said to depreciate in value. The rate at which it depreciates is often expressed as a percentage. In most cases the depreciating value of an item is calculated annually. Therefore, the depreciating value of an item each year is related to its value in the previous year.

10

Mathscape

10

extension

To calculate the depreciating value of an item: calculate the loss during the first year subtract the loss from the original value of the item to give its new value calculate the loss on this value during the second year, then subtract this from the value in the previous year repeat this procedure for each year that the item depreciates. For example, a car is bought for $20 000 and depreciates at the rate of 15% p.a. Find the expected value of the car after 3 years. Answer correct to the nearest dollar. Year 1st 2nd 3rd Opening balance $20 000 $17 000 $14 450 Loss $20 000 0.15 = $3000 $17 000 0.15 = $2550 $14 450 0.15 = $2167.50 Closing balance $17 000 $14 450 $12 282.50

After 3 years, the car would have a value of $12 283, correct to the nearest dollar.

The depreciation formula

In the example above, the value of the car after each year could have been calculated as follows: Value after 1 year = $20 000(1 0.15)1 = $17 000 Value after 2 years = $20 000(1 0.15)2 = $14 450 Value after 3 years = $20 000(1 0.15)3 = $12 283 (to the nearest dollar). From this example, we can see that if an item with an initial value of $P depreciates by r% p.a., r n then its value, $V, after n years would be given by the formula V = P 1 -------- . This formula 100 n, where the interest rate is expressed as a decimal, can more simply be written as V = P(1 R) r i.e. R = -------- . 100 If an item depreciates over a period of time, then its value at the end of this time is given by: V = P(1 R)n where P is the original value of the item R is the annual rate of depreciation, expressed as a decimal n is the number of years the item depreciates V is the value of the item after n years.

Chapter

1:

Consumer arithmetic

11

EG +S

Example 1 A machine was purchased in 2004 for $80 000 and depreciates by 12% p.a. Find the expected value of the machine in 2010. Give your answer correct to the nearest dollar. Solution P = $80 000 R = 0.12 n=6 V = P(1 R)n = $80 000(1 0.12)6 = $80 000(0.88)6 $37 152

EG +S

Example 2 A school purchased a new photocopier. The photocopier depreciated by 25% p.a. and had a value of $3006 after 4 years. Find the purchase price of the photocopier, correct to the nearest dollar. Solution P=? R = 0.25 n=4 V = $3006 V = P(1 R)n 3006 = P(1 0.25)4 3006 P ( 0.75 ) 4 ------------ = -------------------0.75 4 0.75 4 3006 P = -----------0.75 4 $9500

1.3

Exercise

In this exercise, give all answers correct to the nearest dollar, unless otherwise indicated. 1 A new car was purchased for $30 000. If it depreciates at a rate of 20% p.a., use a depreciation table to find the value of the car after 3 years. 2 Use the depreciation formula to find the value of a computer that was purchased for: a $4000 and depreciated at a rate of 10% p.a. for 3 years b $2700 and depreciated at a rate of 12% p.a. for 4 years c $5900 and depreciated at a rate of 15% p.a. for 6 years d $7450 and depreciated at a rate of 25% p.a. for 5 years 3 Paul paid $16 500 to buy equipment for his new glass repair business. If the rate of depreciation is 14% p.a., find the value of the equipment after 6 years. 4 Find the value of a teachers professional library in 4 years time, if the present value is $3200, and the books are depreciating at the rate of 30% p.a. 5 The population of Warraga is falling at the rate of 5% p.a. due to the closure of the local zinc mine. In January 2005, the town had a population of 9170. What is the population of the town expected to be in January 2012?

12

Mathscape

10

extension

Consolidation

6 The number of serious crimes reported in a suburb fell by 7.5% each year for the previous 5 years. If 800 crimes were reported in 2000, find the number of crimes that are expected to be reported in 2005. 7 Reanne bought exercise equipment valued at $1100 and estimated that it would depreciate in value at the rate of 12.5% p.a. What price should Reanne ask for the equipment if she wanted to sell it after 4 years? 8 A DVD player purchased for $750 depreciates at the rate of 16% p.a. a What would be the value of the DVD player after 5 years? b By how much would the DVD player depreciate during this time? 9 A pond in a large suburban park held 50 000 kilolitres of water after a period of sustained rainfall. The volume of water in the pond then decreased by 2% per week. a Find the volume of water in the pond after 10 weeks. b How much water was lost during that time? 10 A farmer had 6000 head of cattle on his property. During a severe drought, 8% of the herd died each month. How many head of cattle died during the first year of the drought? 11 A stockholder purchased $400 000 worth of shares in Consolidated Iron. The shares fell in value by 5% during the first month after the purchase, and continued to fall by 2% per month after that. a Calculate the value of the shares after 6 months. b How much money did the stockholder lose on this investment? 12 Keith purchased a share portfolio for $3000 at the start of the year. The shares rose in value by 5% per month for the first 6 months, then fell in value by 5% per month for the next 6 months. Find the value of the shares at the end of the year. 13 A machine purchased for $400 000 depreciates at a rate of 20% p.a. After how many years will the machine have a value of $131 072? 14 Enrique bought a secondhand car for $9000. After how many years will the value of the car first fall below $3000, if the annual rate of depreciation is 18%? 15 Marianne bought a diamond ring for $1600. If the ring depreciates by 10% p.a., how long is it before the ring loses half its value? Give your answer correct to the nearest year. 16 Yuris car depreciated at the rate of 16% p.a. If he sold it for $4500, how much did Yuri pay for the car when he bought it 7 years ago? 17 A textile machine with a present value of $15 000 has been depreciating at the rate of 5% p.a. for 6 years. What was the value of the machine at the time of purchase? Answer correct to the nearest $100.

Chapter

1:

Consumer arithmetic

13

Further applications

18 A lawnmower was purchased for $480 and 4 years later its value had depreciated to $275. Find the annual rate of depreciation. 19 A fleet of dump trucks depreciated in value by r% p.a. from $1.2 million to $425 000 in 11 years. a Find the annual rate of depreciation. b Hence, find the value of the fleet at the end of the 5th year, correct to the nearest $10 000.

TRY THIS

Depreciating value

The furnitures value is currently $7200. If it has been depreciating at 10% p.a. for the last 4 years, find its original purchase price, if we assume: a linear depreciation b reducing balance depreciation. NOTE: With reducing balance depreciation, the value of the item depreciates by a percentage of the previous years value, whereas with linear depreciation the item depreciates by a percentage of the original value.

1.4

Buying major items

Ways of paying

There are many ways by which major items can be purchased. Cash: Goods are paid for and received immediately. Discounts are sometimes given for cash purchases. Lay-by: A deposit is paid up-front, and the balance of the purchase price is paid in instalments over a period of time. The goods are not received until the entire purchase price is paid off. Interest is not charged on lay-by purchases. On terms: A deposit is paid up-front and the balance is paid by regular instalments over a period of time. The goods are received immediately. Interest is usually charged on the balance owing and is included in each of the instalments. Deferred payment: A deposit is usually required. The goods can then be taken, with the balance to be paid before some agreed time in the future. Interest is paid if the balance is not paid on time.

14

Mathscape

10

extension

Credit card: The card has a set credit limit, or amount that can be spent. It is a form of loan from a nancial institution, which can be used at any time to purchase goods. High rates of interest are usually charged on the outstanding debt. An interest-free period may be available. Goods can be taken immediately when purchased by a credit card. Loans: Money is borrowed from a nancial institution such as a bank, building society or credit union. Interest is charged on the outstanding debt, which must be paid off by regular instalments. There may be a waiting time before the loan is approved, as credit checks need to be made.

Consecutive discounts

Retail items in stores are discounted for many reasons, such as to sell excess or out-of-date stock to make room for new stock. A further discount is sometimes offered to customers who pay for their purchases by cash. Two discounts offered one after the other on an item are called consecutive discounts. When consecutive discounts are given on an item, they must be worked out one at a time; the percentages cannot be added to give a single equivalent discount. For example, consecutive discounts of 10% and 5% on an item are not equivalent to a single 15% discount. This is because the second discount of 5% is calculated on a different value than the first discount of 10%.

Finding the annual interest rate

When paying for an item on terms, it is important to note that interest is only charged on the outstanding balance of the purchase price of the item. For example, if a deposit of $50 is paid on a table priced at $200, the outstanding balance is $150. In a sense, the purchaser is borrowing the $150 and repaying it and the interest by making regular instalments. Interest is only charged on the $150, not on the entire purchase price of $200. To calculate the annual interest rate on a loan or hire purchase: calculate the amount borrowed or outstanding, after any deposit is paid calculate the amount of interest that is paid each year on the amount borrowed express the interest paid per year as a percentage of the amount borrowed. Example 1 A sewing machine is priced for sale at $480. The sewing machine is discounted by 15% during the mid-year sale, and a customer is given a further 5% discount for paying by cash. Find the purchase price of the sewing machine. Solution i 85% $480 = 0.85 $480 = $408 ii 95% $408 = 0.85 $408 = $387.60

EG +S

Chapter

1:

Consumer arithmetic

15

EG +S

Example 2 Samantha bought a surround-sound television and stereo system valued at $12 000. She paid a deposit of 20%, followed by equal monthly payments of $320 over 4 years. a b c d Find the deposit and the balance owing. Calculate the total amount that Samantha paid for the sound system. How much interest did she pay? What is the annual interest rate that Samantha was charged? Balance owing = cash price deposit = $12 000 $2400 = $9600

Solutions a Deposit = 20% $12 000 = 0.2 $12 000 = $2400 b Total paid = deposit + monthly instalments = $2400 + (48 $320) = $17 760 c Interest = total paid cash price = $17 760 $12 000 = $5760 d One years interest = $5760 4 = $1440

one year's interest Interest rate = ------------------------------------------ 100% balance owing 1440 = ----------- 100% 9600 = 15% p.a.

Exercise

1.4

1 Denise wants to reserve on lay-by a hat priced at $52. The store requires a deposit of $17.50. How much more does Denise have to pay before she can take the hat home? 2 Matthew bought a $350 surfboard on lay-by. He paid a deposit of $50 and paid off the balance at $25 per week. After how many weeks will Matthew be able to take the surfboard home? 3 Leanne saw a table for sale at $145. The store required a lay-by deposit of 15%. The balance must then be paid off in five equal weekly payments before Leanne may take the table home. a Calculate the size of the lay-by deposit. b Find the amount of the weekly payments. 4 A store offers refrigerators for sale for a cash price of $720 on the following interest-free terms: one-third down, with the balance owing to be paid in three equal instalments, the first payment due 12 months after the date of purchase. Each subsequent payment is due 4 months after the previous payment. A penalty fee equivalent to 5% of the balance owing applies for late payments. a How much is required as a deposit? b Calculate the penalty fee payable if the second instalment after the deposit is late.

16

Mathscape

10

extension

5 The retail price of a washing machine was $700. A discount of 15% was offered on the sale because the machine had some minor scratches. A further discount of 5% was offered to customers who paid cash. a Can the cash price of the washing machine be calculated by discounting the marked price by 20%? Explain. b Calculate the cash price of the washing machine. 6 A recliner chair was advertised for sale with a marked price of $1150. All items of furniture in the store were discounted by 20% during January, and a further 3% discount was offered to customers who paid cash. How much would a customer pay for this chair in January, if they paid cash? 7 Simon bought an air-conditioning unit priced at $1800. He paid a deposit of $600 followed by 12 equal monthly payments of $120. a How much did he pay altogether for the air-conditioner? b How much interest did he pay?

Consolidation

8 Gina purchased a digital camera priced at $450, to take photos on her overseas holiday. She paid a deposit of 20% of the cash price and $70 per month for 6 months. a How much interest did she pay? b Express the interest as a percentage of the cash price. Answer correct to 1 decimal place. 9 How much interest would Michaela pay on the purchase of a sewing machine priced at $520, if she paid a deposit of $150 followed by equal monthly payments of $25 over 2 years? 10 A car is advertised for sale at $17 990. A customer wants to purchase the car on terms and is given a choice of two payment plans. Plan A: a deposit of $3500 and equal monthly payments of $450 for 4 years, or Plan B: a deposit of 20% and equal monthly payments of $350 over 5 years Which is the cheaper payment plan, and by how much? 11 Luke borrowed $15 000 over 3 years to renovate his kitchen. He was charged simple interest of 9% p.a. on this amount. The loan and interest was to be repaid in 36 equal monthly instalments. a Calculate the interest that was charged on this loan. b How much will Luke repay altogether? c Find the size of his monthly instalments. 12 A woman borrowed $9500 from a finance company to build a swimming pool. She was charged 10.5% p.a. interest and agreed to repay the loan plus interest over 2 years. Calculate: a the total amount to be repaid b the amount of each monthly instalment.

Chapter

1:

Consumer arithmetic

17

13 A plasma screen TV was advertised for sale at $9200. A customer decided to purchase the TV on terms by paying a deposit of 15%, with interest charged on the balance at 12% p.a. over 3 years. a Calculate the size of the deposit. b Find the balance owing after the deposit has been paid. c Calculate the interest charged on the balance. d How much will the customer pay altogether in monthly instalments? e Find the amount of each monthly instalment. 14 Eamon bought on terms a surround-sound system with a marked price of $11 000. He paid a 20% deposit, with interest charged on the balance at 9.6% p.a. over 4 years. a How much is the deposit? b Find the balance owing after the deposit has been paid. c How much interest does Eamon pay on this purchase? d Calculate the total amount to be repaid in monthly instalments. e Find the amount of each monthly instalment.

Further applications

15 A man was quoted $5600 for the construction of a garage at the front of his house. He decided to pay for the construction on terms by paying equal monthly instalments of $294 for 2 years. a How much did he pay for the construction of the garage? b How much interest did he pay? c Find the annual interest rate that was charged. 16 Anjee bought a boat priced at $25 000, and paid it off by making equal monthly payments of $615 over 5 years. Find the annual interest rate that was charged. 17 A car with a sale price of $23 990 was purchased on the following terms: a deposit of 20% with equal monthly instalments of $632 over 5 years. Find the annual interest rate charged, correct to 1 decimal place. Note: Interest is only charged on the balance owing.

1.5

Credit cards

Credit cards are issued by financial institutions such as banks, building societies and credit unions, as well as by private credit providers such as American Express. They provide people with a source of credit that can be used to purchase goods or pay bills.

18

Mathscape

10

extension

High rates of interest are usually charged on outstanding debts; however, many cards come with an interest-free period. This is usually up to a maximum period of 55 days. The amount on which the interest is charged varies between financial institutions. For example, some credit providers may only charge interest on the amount that is outstanding, while others may charge interest on the entire debt, even though some of it may have been repaid within the interest-free period. Credit cards have a set credit limit. This is the maximum amount that can be outstanding at any time. Credit limits are put in place in order to prevent people from running up very large debts that they cannot afford to repay. Customers receive a monthly statement, which provides a complete list of all transactions that occurred during the previous month, the balance owing and the minimum payment due. The minimum payment must be made by the due date, otherwise further interest or charges may be applied.

EG +S

Example 1 Find the equivalent annual interest rate for each of the following. a 0.034% per day b 0.85% per month Solutions a 0.034% 365 = 12.41% p.a. b 0.85% 12 = 10.2% p.a.

EG +S

Example 2 Anitas credit card comes with a 55 day interest-free period. Interest is charged on the balance outstanding after this period at an interest rate of 14% p.a. Anita used her credit card to pay for her holiday to Hamilton Island, which cost $1260. She repaid $450 of this amount within the interest-free period and the balance after 75 days. How much interest will she pay? Solution i The credit card debt after the interest-free period = $1260 $450 = $810 ii The credit card has an interest-free period. Therefore interest is only calculated for the final 20 days. 20 Interest = $810 0.14 -------365 $6.21

Chapter

1:

Consumer arithmetic

19

Exercise

1.5

1 Here is a copy of Mrs Walshs monthly credit card statement. Some of the details have been left out. Monthly credit statement Account number Date 1 Apr 4 Apr 5 Apr 9 Apr 12 Apr 17 Apr 20 Apr 23 Apr 28 Apr Credit limit $3000 1344 2956 0012 7849 Transaction details Opening balance Payment thank you Motor registry Bondi Junction Salary ABC Radio Woolworths Double Bay El Nino Restaurant Grace Bros Bondi Junction Salary ABC Radio Shell service station Edgecliffe Credit charges 21.65% p.a. 0.0593% daily $47.35 Closing balance Available credit Due date 15 May 2004 $105.70 $83.55 $839 $1056 $212.60 $344 $1056 $25 Statement date Debits 1 May 2004 Credits Balance $930 $905 $1249 $193 $298.70 $382.25 $1221.25

Overdue amount $0.00 a b c d e f g h i j

Minimum payment due

During which month did the transactions in this statement occur? How many days after the statement date is the minimum payment due? What is the daily interest rate? What is Mrs Walshs credit limit? What was her account balance at the end of the previous month? Find the account balance on 23 April. What was the closing balance at the end of this month. What is the available credit at the end of this month? The minimum payment due is 5% of the closing balance or $15, whichever is the greater amount. What is the minimum payment due? Calculate the interest charged if Mrs Walsh paid the account 5 days after the due date?

2 Find the equivalent annual interest rate for each of the following. a 0.036% per day b 0.0456% per day c 0.055 48% per day d 0.65% per month e 0.705% per month f 0.8495% per month

20

Mathscape

10

extension

Consolidation

3 Calculate the amount of simple interest that is payable on each of these credit card debts. a $80 for 10 days at 0.06% per day b $125 for 21 days at 0.054% per day c $392 for 38 days at 0.052 25% per day d $1040 for 53 days at 0.058 72% per day 4 Calculate the amount of simple interest that is payable on each of these credit card debts. a $150 for 20 days at 21% p.a. b $575 for 46 days at 18% p.a. c $1610 for 14 days at 20.25% p.a. d $3725 for 45 days at 23.75% p.a. 5 Tim bought a jumper priced at $120 on 5 July, using his credit card which has no interest free period. He paid this off on 27 July and was charged interest at the rate of 0.056 44% per day from the date of purchase. How much interest did he pay on this purchase? 6 Freda accumulated a credit card debt of $870 on 12 October. She was charged interest on this debt at the rate of 0.062% per day from the date of purchase. On 3 December, Freda paid off her debt and the interest charge. a Calculate the amount of interest that she was required to pay. b How much did she pay altogether on 3 December? 7 Jacinta has a credit card with no annual fee. Interest is charged at 15.33% p.a. on all purchases at a daily rate, from the date of purchase. a Calculate the equivalent daily rate of interest. b Jacinta used her credit card on 17 June to pay for her car registration. The cost of registering the car was $318. She paid the credit card account on 8 July. How many days was she charged interest? c How much did she pay altogether, including the interest charge? 8 Joshs credit card has no interest-free period and interest is charged at 0.048% per day, from the date of purchase. He used his credit card on 13 November to buy a coffee table for $115. He used the card again on 21 November to pay for petrol. The petrol cost $53. Josh paid the account in full on 3 December. a How much interest was he charged for the coffee table purchased on 13 November? b How much interest was he charged for the petrol purchased on 21 November? c How much did Josh pay altogether on 3 December? 9 The ABC credit card offers customers a 55 day interest-free credit period. That is, if the balance is paid in full before the due date, no interest will be charged. If the account is not paid by the due date, the following conditions will apply: Interest is charged at the rate of 16.5% p.a. One months interest is charged immediately on the balance owing. Daily interest is charged on the balance until the balance is paid. The due date on Lees credit card statement was 15 September and the balance owing was $285. a If Lee paid the account on 12 September, how much interest would he have been charged? b Calculate the interest charged if Lee paid the account on 20 September.

Chapter

1:

Consumer arithmetic

21

10 Tracy has a credit limit of $2500 on her credit card. If she exceeds this limit at any time, the card company charges an extra fee of $25 plus 0.0584% per day on the amount owing above her credit limit. On 16 May, Tracy had a credit card debt of $2370. The following day, she used the card to pay her car insurance of $560. a Has she exceeded her credit limit? If so, by how much? b If she pays this amount 7 days later, calculate the extra fee that she will be charged.

Further applications

11 Sean has a credit card with no interestfree period. Interest is charged at 18% p.a. from the date of purchase. Sean made the following purchases during January. Calculate the total amount of interest charged if Sean paid the account in full on 15 February.

Date 1 Jan 5 Jan 16 Jan 23 Jan 31 Jan

Item Purchased Petrol CD Player Shoes Dinner Groceries

Cost $54.00 $285.00 $104.00 $83.50 $75.20

1.6

Loans

A loan is an amount of money that is borrowed, usually from a bank, credit union or finance company. Interest on loans is usually charged as reducible interest. That is, interest is only charged on the amount of the loan that is still outstanding. The amount of interest that will be paid can be minimised by paying off the loan as soon as possible. The borrower repays the loan and interest by making regular payments called instalments. Each instalment includes a portion of the original loan amount as well as an interest payment. Home loans can be taken out at variable rates or at fixed rates. For variable rate loans, the financial institution can vary or change the interest rate at any time, as changes in the economy occur. Fixed rates are slightly higher than variable rates, but cannot change for the agreed period. This gives the borrower certainty that their repayments will not rise. Applicants are charged a number of fees and charges by the financial institution and by the government when a loan is taken out. These charges may amount to several hundred dollars. The table shows the monthly repayments required to repay each $1000 of a home loan at various monthly reducible interest rates. Interest 10 years 15 years 20 years 25 years 30 years rate p.a. 5% 5.25% 5.5% 5.75% 6% 10.61 10.73 10.85 10.98 11.10 7.91 8.04 8.17 8.30 8.44 6.60 6.74 6.88 7.02 7.16 5.85 5.99 6.14 6.29 6.44 5.37 5.52 5.68 5.84 6.00

22

Mathscape

10

extension

EG +S

Example A couple borrowed $350 000 from a bank to buy a house. The bank charged reducible interest on the loan at the rate of 5.25% p.a. monthly. The borrowers agreed to repay the loan and interest over a period of 20 years. Use the table above to answer the following questions. a b c d What are the monthly repayments? How much will they repay altogether on this loan? How much interest will they pay? Calculate the equivalent flat yearly interest rate, correct to 1 decimal place.

Solutions a To calculate the monthly repayments on a loan of $350 000, first look up the monthly repayments on $1000 at 5.25% p.a. over 20 years, then multiply this by 350. Monthly repayments = $6.74 350 = $2359 b Total repaid over 20 years = $2359 12 20 = $566 160 c Interest = amount repaid amount borrowed = $566 160 $350 000 = $216 160 one years interest d One years interest = $216 160 20 Flat interest rate = ------------------------------------------- 100% amount borrowed = $10 808 10 808 = ------------------ 100% 350 000 = 3.1% p.a. (to 1 decimal place)

Exercise 1.6

The table below shows the monthly payments required to repay a loan of $1000 over periods of 1 to 5 years at monthly reducible interest rates. Use this table to answer questions 1 to 3. Interest rate p.a. 9% 9.5% 10% 10.5% 11% 11.5% 12% 1 year 87.45 87.68 87.92 88.15 88.38 88.62 88.85 2 years 45.68 45.91 46.14 46.38 46.61 46.84 47.07 3 years 31.80 32.03 32.27 32.50 32.74 32.98 33.21 4 years 24.89 25.12 25.36 25.60 25.85 26.09 26.33 c f 5 years 20.76 21.00 21.25 21.49 21.74 21.99 22.24

1 Find the monthly repayments for a loan of $1000 at: a 11% p.a. for 1 year b 9.5% p.a. for 1 year d 11.5% p.a. for 4 years e 10.5% p.a. for 3 years

10% p.a. for 2 years 12% p.a. for 5 years

Chapter

1:

Consumer arithmetic

23

2 Find the monthly repayments on each of the following loans. a $3000 at 10% p.a. for 1 year b $7000 at 9% p.a. for 2 years c $12 000 at 11.5% p.a. for 5 years d $15 000 at 9.5% p.a. for 1 year e $2500 at 12% p.a. for 2 years f $6400 at 10.5% p.a. for 4 years 3 For each of the loans below, find: i the total amount to be repaid a $1000 at 10.5% p.a. for 3 years c $20 000 at 11% p.a. for 5 years

Consolidation

ii the amount of interest charged b $5000 at 9% p.a. for 4 years d $35 000 at 12% p.a. for 2 years

The table below shows the monthly repayments required to repay each $1000 of a housing loan at various monthly reducible rates of interest. Use this table to answer questions 4 to 10. Interest rate p.a. 4.5% 4.75% 5% 5.25% 5.5% 5.75% 6% 6.25% 6.5% 10 years 10.36 10.48 10.61 10.73 10.85 10.98 11.10 11.23 11.35 15 years 7.65 7.78 7.91 8.04 8.17 8.30 8.44 8.57 8.71 20 years 6.33 6.46 6.60 6.74 6.88 7.02 7.16 7.31 7.46 25 years 5.56 5.70 5.85 5.99 6.14 6.29 6.44 6.60 6.75 30 years 5.07 5.22 5.37 5.52 5.68 5.84 6.00 6.16 6.32

4 Peter borrows $200 000 to buy a home unit. The bank charges 5% p.a. monthly reducible interest and the term of the loan is 15 years. a What are Peters monthly repayments? b How much will he repay altogether on this loan? c How much interest will he pay? d Express the interest charged as a percentage of the amount borrowed. 5 Keira borrows $280 000 from a building society to buy a townhouse. She is charged 6.25% p.a. monthly reducible interest over 25 years. a How much will Keira repay altogether on this loan? b How much interest will she pay? c Calculate the flat yearly interest rate, correct to 2 decimal places 6 Sinead and Patrick borrowed $350 000 from a bank to build a house on their block of land. The loan was taken over a period of 30 years and the interest rate quoted was 5.75% p.a. monthly reducible. a How much interest will they pay on this loan? b Express the interest as a percentage of the amount borrowed. c Calculate the flat yearly interest rate, correct to 2 decimal places.

24

Mathscape

10

extension

7 Xander wanted to borrow $400 000 to buy a house and land package in a new housing estate. He compared the home loans on offer from two financial institutions. Sunshine Bank offered a loan at 6% p.a. monthly reducible interest over 25 years, while the Cape York Building Society loan was at 4.25% p.a. simple interest over 25 years. Which institution offered the cheaper loan, and by how much? 8 A couple borrowed $270 000 at 4.75% p.a. monthly reducible interest over 15 years. A week later, the interest rate was increased to 5% p.a. How much more will this couple have to pay over the term of the loan as a result of the rate rise? 9 Geraldine borrowed $185 000 at 5.25% p.a. monthly reducible interest to buy a half share in a home unit with her sister. How much money would Geraldine save if she paid off the loan over 15 years rather than over 20 years? 10 William took out a housing loan at 6.5% p.a. monthly reducible interest over 20 years. Over the term of the loan, he repaid the bank $572 928. a How much did William borrow? b How much interest did he pay? c Find the equivalent flat yearly interest rate. 11 The graphs on the next page show the benefit of making more frequent repayments on a loan. In each case, the loan amount is $100 000 and the interest rate is 9.25% p.a. monthly reducible. Chris makes one payment of $822 per month, while his sister Rita makes separate payments of $411 each fortnight. a Does each person repay the same amount each month? $100 000 b How much sooner than Chris does Rita pay off her loan? $75 000 c How much interest does she save Chris over the term of the loan? $50 000 d What is the effect of making Rita fortnightly rather than monthly $25 000 repayments?

Balance 0 Further applications 4 8 12 16 20 24 28 Years 30 years 21 years 6 months

12 Maree borrows $250 000 at 0.5% per month, monthly reducible interest. At the end of each month, the interest on the outstanding amount is added, then Maree makes a payment of $1500. a How much does Maree still owe on the loan after the following periods? i 1 month ii 2 months iii 3 months iv 4 months b Will she eventually pay off this loan? Why? c If her monthly repayments were only $1200, would she eventually pay off this loan? Why?

Chapter

1:

Consumer arithmetic

25

TRY THIS

Housing loans

Each month the Reserve Bank of Australia announces any change to its rate of interest. The rate adopted is very important because it influences all other banks and lending agencies, most of which adjust their rates by the same margin as the Reserve Bank. The day of the announcement is eagerly awaited by financiers and shareholders, as even small changes can result in major changes to their financial position. Rises or falls are also of considerable importance to many families who have home loans to repay. Investigate the effect of a small interest rate increase, say 0.25%, on a couple who plan to borrow $500 000 to allow them to purchase a house. Use the tables on pages 23 and 24 to check how much extra the house would cost them. This will vary according to the length of the loan and the interest rate, so you should do your calculations using several different scenarios to enable you to form a general view of the results of interest rate changes.

0FF

THE

Introduction

O C U S O N W 0 R K I N G M AA T H E M A T CC A L L Y THEMATII ALLY ORKING S ON OCU

COST OF LIVING IN AUSTRALIA

The focus in this activity is on the ways in which your savings and the goods you own depreciate, that is, lose their value. The value of money generally depreciates through inflation. What you can actually buy for your dollar decreases over time, so you need more money to maintain your standard of living. Governments try to limit inflation by various methods including control of interest rates.

FOCUS

ON

WORKING

In this chapter you have learned about earning and saving money. You have learned the different ways to earn interest from your savings and how to make wise choices in the purchase of goods to get the best buy.

A F O C U S O N W O R K I N G M AL LH E M A T I C A L L Y TY

13 Wendy borrows $300 000 at 9% p.a. monthly reducible interest over 25 years. At the end of each month, the interest on the outstanding amount is added, then Wendy makes a payment of $2500. a How much of the loan will she have paid off after 6 months? b What could she do to improve this situation?

MATHEMAT IC

26

Mathscape

10

extension

In Australia, interest rates were increased twice in 2003 and again in March 2005 to try to discourage people from borrowing too much. Nevertheless, inflation in Australia is low and we have a very strong economy.

F O C U S O N W O R K I H E G A T I CA L L H E M A T I C A L L Y NM M AT Y

2L

EARNING

ACTIVITIES

How do we measure inflation?

The first activities are designed for discussion in class or in small groups. 1 The Consumer Price Index (CPI) is the official measure of inflation in Australia. The CPI is measured every 3 months and published by the Australian Bureau of Statistics. It is a measure of the cost of living based on the prices of goods and services in 10 main groups. Three of these groups are food, clothing and footwear, and transport. Discuss other items you would include in the CPI and make a list. What might the other main groups be? 2 Every item in a group has a weighting based on its relative importance. For example in the food category, takeaway and fast foods might have a weighting of 1.2%, while vegetables might be 0.4%. What might this imply about the relative importance of these two items in the CPI at that time? 3 The price index of an item in any group is given by the formula new price price index = ---------------------- 100 old price Find the price index of a cheeseburger which cost $2.50 in 2004 and $3.50 in 2005. 4 In question 3, the year in which the old price was taken is the base year. What was the base year for the price index of the cheeseburger? Explain why the price index of an item in the base year is always 100. 5 The Australian Bureau of Statistics computes the CPI every quarter for each capital city and then computes a national weighted average. It is the change in the CPI that measures inflation, and it may be up or down on the base year. Here is the published percentage change in the CPI for the March quarter 2004 to the March quarter 2005. Weighted average of eight capital cites % change in CPI Mar 20042005 Food Alcohol & tobacco Clothing & footwear Housing Household furnishings, supplies & services Health Transportation Communication Recreation Education Miscellaneous All groups 0.8 3.7 1.9 4.0 0.8 5.7 2.9 1.5 1.6 6.2 2.6 2.4

FOCUS

ON

WORKING

MAT

Chapter

1:

Consumer arithmetic

27

What was the rate of inflation for this period? What particular groups contributed most to the change? How might you account for the rise of the CPI for some items and a fall for others?

HALLENGE ACTIVITIES

A F O C U S O N W O R K I N G M AL LH E M A T I C A L L Y TY

8C

1

The effect of inflation on savings In 2002 Finn invested $5000 for 3 years at 4.5% compound interest. Assuming an inflation rate of 2.4% p.a. over the 3 years, what was the real value of her investment at maturity? Compare the solutions to the problem below and argue a case for your choice. Solution 1 Using the compound interest formula A = P(1 + R)n, P = 5000, R = 0.045, n = 3 By calculator: A = $5705.83 However, because of inflation the value of her money is worth less by 2.4%. So the real value is only 97.6% of $5705.83. By calculator, A = $5568.89 Solution 2 Finn earns 4.5% interest each year but loses 2.4% each year because of inflation. Her overall gain is only 2.1%. Using the formula, P = 5000, R = 0.021, n = 3 A = $5321.66 Solution 3 Finns balance on paper at the end of 3 years is $5705.83 (see solution 1). However over 3 years $5000 depreciates 2.4% each year. The depreciation is given by the formula A = P(1 R)n where P = 5000, R = 0.024 and n = 3. By calculator this comes to $4648.57. Her loss due to inflation is therefore $351.43 Answer: A = $5705.83 $351.43 = $5354.40 Visit the Australian Bureau of Statistics website <www.abs.gov.au> and click on Consumer Price Index Australia. Compare the capital cities for inflation rates and the items which had the most effect on the CPI for the latest data available. Why does it cost more to live in some cities than others?

L ETS

COMMUNICATE

It is really important to understand how you can use mathematics to manage your finances. How you manage your income and your spending will determine your lifestyle, whether you earn a lot or have a modest income. Your future happiness will depend on it.

FOCUS

%R

EFLECTING

ON

Make a class poster to illustrate what you have learned about inflation in this exercise. Summarise the important points in your workbook.

WORKING

MATHEMAT IC

28

Mathscape

10

extension

1 Without using formulas explain simply the difference between simple and compound interest. 2 What is a credit card? Is the interest charged simple or compound? 3 What is the CPI? What does it measure? 4 What is the difference between a wage and a salary? Name two occupations where people are paid wages, and two that are paid salaries. 5 Read the Macquarie Learners Dictionary entry for budget:

budget noun 1. a plan showing how much money a person, organisation or country will earn and how it will be spent verb 2. to make such a plan: We budgeted on the basis that we would both have full-time jobs next year. adjective 3. not costing much: budget clothes. Word Family: budgetary adjective

Does the mathematical meaning differ from that in everyday speech?

1 Calculate the simple interest earned on the following investments. a $300 at 5% p.a. for 2 years -b $450 at 7.5% for 3 1 years 2 c $785 at 6.2% p.a. for 8 years --d $1200 at 4 3 % for 5 1 years 4 2 2 Find the total balance of an account after 4 years if $2000 is invested at 6% p.a. simple interest. 3 Calculate the simple interest that would be earned on the following investments. a $700 at 8% p.a. for 6 months b $840 at 6.5% p.a. for 9 months c $1500 at 7.25% p.a. for 5 months 4 Brian invested $600 with a building society for 3 years, with simple interest paid at 5% p.a. He then transferred the principal and interest to a bank account

for 2 years and was paid simple interest at the rate of 5.8% p.a. a How much money did Brian have at the end of the 5th year? b How much interest did he earn altogether? 5 Louise invested an amount of money for 6 years at 4% p.a. simple interest. She earned $192 in interest on this investment. How much did she invest? 6 Rachel deposited $12 000 in a savings account. After 8 years she had earned $6720 in simple interest. Find the annual interest rate. 7 A sum of $20 000 was invested for 3 years at 5% p.a. compounded annually. Draw up a compound interest table and hence find the account balance after: a 1 year b 2 years c 3 years

VIEW CHAPTER RE

CHAPTER REVIEW

Chapter

1:

Consumer arithmetic

29

13

14

-$40 000 at 6 3 % p.a. for 8 years 4

15

10 Bill invests $7500 at 12% p.a. compound interest. Find the value of this investment after 5 years if the interest compounds: a annually b half-yearly c quarterly d monthly 11 Find the value of the following investments. a $4000 after 2 years at 5% p.a., compounded half-yearly b $6500 after 3 years at 6% p.a., compounded half-yearly c $10 000 after 2 years at 8% p.a., compounded quarterly d $25 000 after 7 years at 6% p.a., compounded quarterly e $15 000 after 2 years at 12% p.a., compounded monthly -f $32 000 after 1 1 years at 6% p.a., 2 compounded monthly. 12 An investor deposited $150 000 at 7% p.a., with interest compounding annually. a How much interest will have accrued after 4 years?

16

17

18

CHAPTER REVIEW

CHAPTER RE VIEW

8 Theo invested $50 000 at 4.5% p.a. interest, compounding annually. Draw up a compound interest table and hence determine the account balance and interest earned after 4 years. 9 Use the compound interest formula to find the value of each investment and the amount of interest earned, if the interest compounds annually. a $2000 at 4% p.a. for 2 years b $1500 at 6% p.a. for 4 years c $3750 at 8.5% p.a. for 5 years d $16 000 at 7.25% p.a. for 3 years -e $25 000 at 5 1 % p.a. for 6 years 2

b Find the equivalent simple interest rate, correct to 2 decimal places. Which pays the greater amount of interest on an investment of $5000 and by how much? A 9% p.a. simple interest for 7 years B 8.5% p.a. compound interest for 6 years, compounded annually A bank advertises the following savings plans: A 8.8% p.a. compounded half-yearly B 8.4% p.a. compounded quarterly Which plan will provide the greater interest on an investment of $10 000 for 3 years, and by how much? House prices in a certain suburb are expected to rise by an average of 12% per year for the next 5 years. Penny bought a house in 2005 for $360 000. What will be the expected value of the house in 2010? If the national inflation rate is 3.8% p.a., find the expected cost of a $3 loaf of bread in 10 years time. Answer correct to the nearest 5 cents. Find the amount of money, correct to the nearest dollar, that will grow to: a $1072 if invested for 6 years at 5% p.a., compounded annually b $7110.77 if invested for 4 years at 7% p.a., compounded half-yearly c $22 289.21 if invested for 5 years at 8% p.a., compounded quarterly A new car is purchased for $20 000 and depreciates by 10% p.a. Find, to the nearest dollar, the value of the car after: a 1 year b 2 years c 5 years d 10 years

30

Mathscape

10

extension

VIEW CHAPTER RE

19 A printing machine purchased for $55 000 depreciates at the rate of 7% p.a. Find, to the nearest dollar, the value of the printing machine after 6 years. 20 A stockholder purchased 300 000 shares at $1.80 each. The shares rose in value by 5% during the first month, then fell in value by 3% each month after that. Find, to the nearest dollar, the value of the shares after: a 1 month b 6 months 21 Karen bought a computer scanner for $1500. It depreciated by 5% p.a. After how many years will the scanner have lost more than half its value? 22 A television was advertised for sale with a marked price of $800. The store offered a discount of 10%, plus an additional discount of 5% on the discounted price to customers who paid cash. a Find the cash purchase price. b Are the successive discounts equivalent to a single discount of 15%? 23 Shaun bought a new bed priced at $980. He paid a deposit of $140, followed by 12 equal monthly instalments of $78.75. a How much did he pay altogether for the bed? b How much interest did he pay? c What was the rate of simple interest charged? 24 Anthony borrowed $18 000 at 11% p.a. simple interest to build a new pool and garage. The loan plus interest was to be repaid in equal monthly instalments over 4 years. a How much interest was charged on the loan?

25

26

27

28

b How much will Anthony repay altogether? c Calculate the monthly repayments. A couple purchased new carpet to the value of $12 000 for their house. They paid a deposit of 30%, with interest charged on the balance at 10% p.a. The balance plus interest is to be repaid in equal monthly instalments over 3 years. a Calculate the deposit. b Find the balance owing. c Calculate the interest charged. d Find the amount of each monthly instalment. Melissa borrowed $6000 to renovate her kitchen. She repaid the loan by making monthly payments of $290 over 2 years. a How much will she repay altogether on this loan? b Calculate the interest charged. c Find the annual interest rate. Find the amount of interest payable on a credit card debt of: a $520 for 13 days at 0.052% per day b $952 for 38 days at 15.4% p.a. Ray bought a jumper and three pairs of pants on 8 August for $390 using his credit card. He paid this off on 4 September and was charged interest at the rate of 0.051 72% per day. How much interest did he pay? Rays credit card has no interest-free period.

The table on the next page shows the monthly repayments on a loan of $1000 at monthly reducible interest rates. Use the table to answer questions 29 and 30.

CHAPTER REVIEW

Chapter

1:

Consumer arithmetic

31

Interest rate p.a. 9% 9.5% 10% 10.5% 11% 11.5% 12%

1 year 87.45 87.68 87.92 88.15 88.38 88.62 88.85

2 years 45.68 45.91 46.14 46.38 46.61 46.84 47.07

3 years 31.80 32.03 32.27 32.50 32.74 32.98 33.21

29 Find the monthly repayments on a loan of: a $1000 at 10.5% p.a. for 1 year b $7000 at 9% p.a. for 3 years c $4600 at 11.5% p.a. for 2 years d $21 300 at 10% p.a. for 3 years 30 For each loan below, find the amount of interest charged a $1000 at 9% p.a. for 1 year b $5000 at 12% p.a. for 2 years c $8300 at 10.5% p.a. for 3 years The table below shows the monthly payments required to repay each $1000 of a housing loan at monthly reducible interest rates. Use this table to answer questions 3133. Interest rate p.a. 4.5% 4.75% 5% 5.25% 5.5% 5.75% 6% 6.25% 6.5% 20 years 6.33 6.46 6.60 6.74 6.88 7.02 7.16 7.31 7.46 25 years 5.56 5.70 5.85 5.99 6.14 6.29 6.44 6.60 6.75 30 years 5.07 5.22 5.37 5.52 5.68 5.84 6.00 6.16 6.32

31 A couple borrowed $400 000 over 25 years at 5.75% p.a. monthly reducible interest, to buy a house. a What are the monthly repayments on this loan? b How much will the couple repay altogether? c How much interest will they pay? d Calculate the equivalent flat yearly interest rate. 32 Amanda borrowed $270 000 over 20 years at 6% p.a., monthly reducible interest. Later that day, the interest rate rose to 6.5% p.a. How much extra will she have to pay over the course of the loan as a result of the rate rise? 33 Gabriel took out a housing loan over 30 years at 5.25% p.a., monthly reducible interest. Over the term of the loan he will repay $476 928. a How much did Gabriel borrow? b How much interest will he pay? c Calculate the equivalent flat yearly interest rate, correct to 1 decimal place.

CHAPTER REVIEW

CHAPTER RE VIEW

You might also like

- Week 7 Homework SP 20Document4 pagesWeek 7 Homework SP 20Michael OlsonNo ratings yet

- Isi B.Stat/B.Math Objective Questions & Solutions Set - 1: WWW - Ctanujit.inDocument12 pagesIsi B.Stat/B.Math Objective Questions & Solutions Set - 1: WWW - Ctanujit.inastNo ratings yet

- Mat Ntse 2019 Stage 1 Solutions TelanganaDocument20 pagesMat Ntse 2019 Stage 1 Solutions TelanganaSunil SinghNo ratings yet

- Re IntegrationDocument300 pagesRe IntegrationUm TiagoNo ratings yet

- PMO15 Qualifyingstage QuestionsDocument5 pagesPMO15 Qualifyingstage QuestionsAntonire N. DosmiadoNo ratings yet

- Straight Lines Question Paper For JEE Advanced 2019Document6 pagesStraight Lines Question Paper For JEE Advanced 2019misostudyNo ratings yet

- Cat-A Jee Main, Jee Advanced Maths Paper BDocument2 pagesCat-A Jee Main, Jee Advanced Maths Paper Bsapabapjava2012No ratings yet

- Practice Test 08-Mathematical AptitudeDocument11 pagesPractice Test 08-Mathematical AptituderajatguptNo ratings yet

- XII Area Under Curves AssignmentDocument1 pageXII Area Under Curves AssignmentCRPF School0% (1)

- Inverse Trigonometric FunctionsDocument23 pagesInverse Trigonometric FunctionsVijay JainNo ratings yet

- Maths3 PDFDocument5 pagesMaths3 PDFKunal KaranNo ratings yet

- Class 12th Maths Chapter 5 (Continuity and Differentiability) UnsolvedDocument9 pagesClass 12th Maths Chapter 5 (Continuity and Differentiability) UnsolvedabhishekNo ratings yet

- AITS FT I (Paper 2) PCM (Ques) JEE (Advanced)Document23 pagesAITS FT I (Paper 2) PCM (Ques) JEE (Advanced)RahulDevOjha100% (1)

- Abstract AlgebraDocument78 pagesAbstract Algebracat100percentileNo ratings yet

- Assignment SA 1Document1 pageAssignment SA 1OP GuptaNo ratings yet

- Log WorkbookDocument5 pagesLog WorkbookAbhisek ChoudhuryNo ratings yet

- USA Harvard MIT Mathematics Tournament 2011 139Document5 pagesUSA Harvard MIT Mathematics Tournament 2011 139Dedy KurniawanNo ratings yet

- NCERT Exemplar Solutions For Class 11 Maths Chapter 5 Complex Numbers and Quadratic Equations PDFDocument12 pagesNCERT Exemplar Solutions For Class 11 Maths Chapter 5 Complex Numbers and Quadratic Equations PDFanonymousalwayzz1234No ratings yet

- 11th STD Maths Vol 1 EM 10-02-2020Document320 pages11th STD Maths Vol 1 EM 10-02-202020P331NAGESHWAR CSE CNo ratings yet

- Aits FT-5 Jee Main 06.02.2022 Question PaperDocument19 pagesAits FT-5 Jee Main 06.02.2022 Question PapervisheshNo ratings yet

- Partial Fractions: Syllabus RequirementsDocument9 pagesPartial Fractions: Syllabus RequirementsChandini ManoharanNo ratings yet

- Mathematics TDocument62 pagesMathematics TRosdy Dyingdemon100% (1)

- Inequality - Yong SuDocument24 pagesInequality - Yong SuAthlonDekanyNo ratings yet

- Calculus Linear Algebra Model Question Paper 1 2018 PDFDocument2 pagesCalculus Linear Algebra Model Question Paper 1 2018 PDFChaithanya ShettyNo ratings yet

- Materi PolynomialDocument20 pagesMateri PolynomialnormasulasaNo ratings yet

- Worksheet 4 .7 Polynomials: Section 1Document11 pagesWorksheet 4 .7 Polynomials: Section 1atiggy05No ratings yet

- SMO 2005 Senior SolutionDocument11 pagesSMO 2005 Senior SolutionwmdsgNo ratings yet

- Ellipse 2012Document10 pagesEllipse 2012Santosh100% (1)

- 2010 HMMT Algebra Practice SolutionsDocument3 pages2010 HMMT Algebra Practice SolutionsAlex YuNo ratings yet

- MATH1251 Mathematics For Actuarial Studies and Finance Complex NumbersDocument35 pagesMATH1251 Mathematics For Actuarial Studies and Finance Complex NumbersY ANo ratings yet

- Esolutions Manual - Powered by CogneroDocument15 pagesEsolutions Manual - Powered by CogneroAbusakur Hamsani0% (1)

- Lecture 2 (Trigonometric Integrals)Document27 pagesLecture 2 (Trigonometric Integrals)Clarisson Rizzie P. CanluboNo ratings yet

- Complex Numbers-1Document55 pagesComplex Numbers-1Umer Iftikhar AhmedNo ratings yet

- Determinants Important Questions UnsolvedDocument10 pagesDeterminants Important Questions UnsolvedSushmita Kumari PoddarNo ratings yet

- 08 Sequence Series Revision Notes QuizrrDocument36 pages08 Sequence Series Revision Notes Quizrrsarvpriyam4No ratings yet

- Jozsef Wildt 2014Document7 pagesJozsef Wildt 2014viosirelNo ratings yet

- BAHAN MATRIKULASI RevisiDocument8 pagesBAHAN MATRIKULASI RevisiIsolihatun NurciptoNo ratings yet

- Complex Numbers-Assignment 1Document2 pagesComplex Numbers-Assignment 1Mukesh100% (1)

- 1sequences and SeriesDocument34 pages1sequences and SeriesHelen Gail EmbudoNo ratings yet

- Forest School 13 Plus Maths Sample Paper 1Document12 pagesForest School 13 Plus Maths Sample Paper 1Moncy ZachariahNo ratings yet

- BINOMIAL SeriesDocument25 pagesBINOMIAL SeriesBench AminNo ratings yet

- Chapter 05Document54 pagesChapter 0510026722No ratings yet

- Lesson 2-01 Probability STATDocument13 pagesLesson 2-01 Probability STATallan.manaloto23100% (1)

- Question Bank - Permutation and Combination - IIT JEE - Toppr1Document4 pagesQuestion Bank - Permutation and Combination - IIT JEE - Toppr1AshutoshYelgulwarNo ratings yet

- Sets DPP-1Document2 pagesSets DPP-1Kartik ModiNo ratings yet

- Book 32 - Sequence and Series - Class 11Document35 pagesBook 32 - Sequence and Series - Class 11sudhir_kumar_33No ratings yet

- INMOTC Polynomial and FEDocument8 pagesINMOTC Polynomial and FEKomal GhadigaonkarNo ratings yet

- ACJC 2011 PrelimDocument14 pagesACJC 2011 PrelimUmehara EriNo ratings yet

- Stanford University EPGY Summer Institutes 2008 Math Olympiad Problem SolvingDocument4 pagesStanford University EPGY Summer Institutes 2008 Math Olympiad Problem Solvingคณิต ครูซัน ซีดานNo ratings yet

- Roots of Complex NumbersDocument3 pagesRoots of Complex NumbersntimalsinaNo ratings yet

- Hyperbolic FunctionsDocument9 pagesHyperbolic Functionstresa mariaNo ratings yet

- Algebra SDocument7 pagesAlgebra Sสฮาบูดีน สาและNo ratings yet

- NJC Sequence and Series Lecture Notes and Tutorial Teachers EditionDocument20 pagesNJC Sequence and Series Lecture Notes and Tutorial Teachers EditionbhimabiNo ratings yet

- RMO Solved PaperDocument8 pagesRMO Solved PaperAbhishek SinghNo ratings yet

- EAMCET 2013 Question Paper With Answer Keys and SolutionsDocument48 pagesEAMCET 2013 Question Paper With Answer Keys and SolutionsPremKumarKalikiri83% (6)

- Ppfin PDFDocument9 pagesPpfin PDFAhmed HussainNo ratings yet

- Financial Math - TopicDocument24 pagesFinancial Math - TopicNiño Mark MoradaNo ratings yet

- Export DocumentDocument38 pagesExport DocumentAshley Angel GuintaasonNo ratings yet

- Simple and Compound Interests: Objective: To Calculate Interest Earned and Account BalancesDocument8 pagesSimple and Compound Interests: Objective: To Calculate Interest Earned and Account Balancesrmm0415No ratings yet

- Compound Interest (Week 9) - AguilarDocument7 pagesCompound Interest (Week 9) - AguilarCherry AguilarNo ratings yet

- Compound Interest: PeriodDocument5 pagesCompound Interest: PeriodClydeLisboaNo ratings yet

- Clingly Company (Eric Madia)Document4 pagesClingly Company (Eric Madia)Eric MadiaNo ratings yet

- Monthly Statement Apr 2024 - CL0000023180Document3 pagesMonthly Statement Apr 2024 - CL0000023180menglei19880920No ratings yet

- Environment of Financial Accounting and Reporting: FalseDocument6 pagesEnvironment of Financial Accounting and Reporting: Falsekris mNo ratings yet

- Im MCQDocument42 pagesIm MCQChammy TeyNo ratings yet

- CS Executive Capital Market and Securities Laws Important Topics CSCARTINDIADocument10 pagesCS Executive Capital Market and Securities Laws Important Topics CSCARTINDIAjesurajajosephNo ratings yet

- Abm 2 Evaluation Week 1Document3 pagesAbm 2 Evaluation Week 1Christel Fermia RosimoNo ratings yet

- Pmkisan - Gov.in BeneficiaryStatus New - Aspx2Document1 pagePmkisan - Gov.in BeneficiaryStatus New - Aspx2ghodake.licNo ratings yet

- NIRAV M. SCAMDocument3 pagesNIRAV M. SCAMshannonlainezttNo ratings yet

- 21 Problems For CBDocument10 pages21 Problems For CBNguyễn QuỳnhNo ratings yet

- Assignment 3: Jayesh Kukreti 63 - YDocument2 pagesAssignment 3: Jayesh Kukreti 63 - YJayesh KukretiNo ratings yet

- 1980-19 Guaranteed Loan Closing ReportDocument4 pages1980-19 Guaranteed Loan Closing ReportthenjhomebuyerNo ratings yet

- ARIAS17 Fall OnsiteProgram Web ReadyDocument184 pagesARIAS17 Fall OnsiteProgram Web Readyelassaadkhalil_80479No ratings yet

- BU.231.710. - Financial Institutions - Page 1 of 5Document5 pagesBU.231.710. - Financial Institutions - Page 1 of 5Jahanzaib AhmedNo ratings yet

- NMR ASEDocument13 pagesNMR ASEcyhuang2009No ratings yet

- 2 Lecture 2 (Auditing 2) CH 17 (2024)Document40 pages2 Lecture 2 (Auditing 2) CH 17 (2024)Luna JesmeraeNo ratings yet

- Income Statement Part 2Document9 pagesIncome Statement Part 2THE FLASHNo ratings yet

- SME Seminar 7 March Morning SlidesDocument99 pagesSME Seminar 7 March Morning Slidesallenyap233No ratings yet

- CA Notes Concept and Accounting of Depreciation PDFDocument36 pagesCA Notes Concept and Accounting of Depreciation PDFBijay Aryan Dhakal100% (2)

- Shipping IFSCA Presentation Tokyo Oct 27Document36 pagesShipping IFSCA Presentation Tokyo Oct 27Rajaraman KalyanaramanNo ratings yet

- Micro Finance in EgyptDocument40 pagesMicro Finance in EgyptdinamadkourNo ratings yet

- Document From Jagjeet SinghDocument65 pagesDocument From Jagjeet SinghJagjeet SinghNo ratings yet

- Most Essential Learning Competencies Learning Objectives:: ABM - BM11BS-11a-14)Document4 pagesMost Essential Learning Competencies Learning Objectives:: ABM - BM11BS-11a-14)Symphony DiazNo ratings yet

- Invoice No 10511Document2 pagesInvoice No 10511sithole.ngamlaNo ratings yet

- SBS-Project Report On Bajaj Finance Ltd-2022Document50 pagesSBS-Project Report On Bajaj Finance Ltd-2022Dnyaneshwar Karhale100% (4)

- Chapter 5 Financial MarketsDocument63 pagesChapter 5 Financial MarketsGuda GudetaNo ratings yet

- 6840 - PAS 37 Provisions Contingent Liabilities and Contingent AssetsDocument6 pages6840 - PAS 37 Provisions Contingent Liabilities and Contingent AssetsAhmad Noainy AntapNo ratings yet

- 2022-01-Optimal Blending of Smart Beta and Multifactor PortfoliosDocument14 pages2022-01-Optimal Blending of Smart Beta and Multifactor PortfoliosZezhou XuNo ratings yet

- Debt DestroyersDocument2 pagesDebt DestroyersMark WatneyNo ratings yet

- Chargeback PresentationDocument10 pagesChargeback PresentationDaniel PireNo ratings yet