Rad Ha

Rad Ha

Uploaded by

Harisha HmCopyright:

Available Formats

Rad Ha

Rad Ha

Uploaded by

Harisha HmCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Rad Ha

Rad Ha

Uploaded by

Harisha HmCopyright:

Available Formats

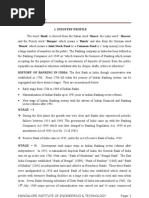

1

. INDUSTRY PROFILE

1.1 INTRODUCTION The term bank is derived from the word BANCO or BANUCS which means a bench or table. The tern bank was symbolically used to denote a money changer. But today, the bank represents an institution that borrows money from the public by way of deposit etc., at a lesser rate of interest and lends to the needy at a higher rate of interest. Banking in India has its origin as early as the Vedic period. If is believed that the transit in from money lending to banking must have accrued even before. Menu, the great Hindu Jurist who has devoted a section of his work to deposits and advances and laid down rules relating to rate of interest. In the present scenario, service sector plays an important role in the country. Among service sector, banking is one, which plays a vital role in economic development. The liberalization and economic reforms allowed banks to explore new business opportunity rather than generating revenues from borrowing and lending. The banking industry was regulated by The Indian banking Regulation Act of 1949 which defines the term Banking Industry as Any Industry, which transacts banking business in India. Banking means Accepting for purpose of lending all Investment of deposits of money from the public, repayable on demand or otherwise and withdrawal by cheque, draft or other wise. According to Sir John Paget, No person on body corporate or otherwise can be a banker who does not Take Deposit accounts Take Current accounts

Issue and pay cheques Collect cheques, crossed and non- crossed, for his customers. Banks play an important role in the economic development of a country.

There may be an economic crisis in the country if the banks stopped functioning even for a few days. In the first half of the 19th century the East India Company established three banks; the Bank of Bengal in 1809, the Bank of Bombay in 1846 and the Bank of Madras in 1843. These three banks also known as presidency Banks were independent units and functioned well. These 3 banks were amalgamated in 1920 and new bank, he imperial Bank of India was established on 27th January 1921. With the passing of the State Bank of India Act in 1955 the undertaking of the imperial bank of India was taken over by the newly constituted State Bank of India. The Reserve Bank, which is the central, was created in 1935 by passing Reserve Bank of India Act 1934. In the wake of the Swedish movement, number of banks with Indian Management were established in the country namely, Punjab National Bank Limited, Canara Bank Ltd., Indian bank Ltd. On July 19 th 1969, 14 Major Banks of the country were nationalized and in 15th April 1980, 6 more commercial private sector banks were also taken over by the government. Today the commercial banking system in India may be distinguished into: Public Sector Bank 1. State Bank of India and its associate banks called the state bank group 2. 20 Nationalized Banks 3. Regional Rural Banks mainly sponsored by public sector banks

Private Sector Banks 1. Old Generation private banks 2. New Generation private bank 3. Foreign Banks in India 4. Scheduled co-operative Banks 5. Non-scheduled Banks Development Banks 1. Industrial Finance Corporation of India (IFCI) 2. Industrial development bank of India (IDBI) 3. Industrial credit & Investment Corporation of India (ICICI) 4. Industrial Investment Bank of India (IIBI) 5. Small Industrial development Bank of India (SIDBI) 6. SCICI Ltd 7. National Bank for Agriculture and Rural Development (NABARD) 8. Export Import Bank of India 9. National Housing Bank Numbers of banks 1. Scheduled Commercial bank: 80 2. Regional Rural Bank: 20 3. Central co-operative banks: more than 350 4. Land Development banks: 20 5. Foreign banks: more than 25 Co-operative Banking India is a country where agriculture is still a predominant activity. Our

farmers by and large are poor and usually used to depend on money lenders Indigenous bankers and financiers etc. Till 1951-52 the money lenders were

providing 70% of the requirements of farmers and thus constituted the most important source of rural finance. However the share of Moneylenders in rural credit was reduced to 49%. This was due to high rates of interest, dishonesty and fraudulent practices followed by the money lenders. The co-operative Movement was started in India, in 1904 with the objective of providing finance to agriculturists for productive purpose at low rates of interest and thereby relieving agriculturists from the chetches of the Moneylenders. The cooperative society Act of 1912 contributed to the establishment of central co-operative banks and the state co-operative banks to provide refinance to primary credit societies which could not mobilize funds by their own efforts. The co-operative credit movement made food progress during and after the 1st world of 1914-18, but during the great depression of 1929-1933, it received a serious set back. With the out break of Second World War of 1939-45, the co-operative credit movement made considerable progress once again. Since then, the progress has been maintained. A co-operative bank promotes economic activity and provides banking facilities and service to the rural people. The significant role of co-operative banks in the agricultural economy imparts a lesson to commercial banks and dispels from their minds the age old inertia and the gloom of conservatism by shifting emphasis from credit worthiness of the purpose and from tangible security to the character of the business. Co-operative means a form of organization where in persons voluntarily associate together as human beings on the basis of equality for the promotion of the economic interest of themselves. So, co-operatives are characterized by voluntary association and open membership, democratic management, limited interest on capital, education and training equity of distribution of profits etc. Each for all and

all for each is the underlying principle of co-operatives. There are two models for co-operatives they are Raiffeisen Model societies Schulze Delitzsch model societies Raiffeisen societies are a type of rural co-operative societies. principles of these societies are Restricted membership to rural masses Limited area of operation No share capital Unlimited liability of the members The management of the society is honorary Schulze Delitzsch societies are a form of urban credit societies. The main principles of these are Membership is open to artisans, middle class people Living in towns and cities Large area of operation Limited liability of members Large share capital So, co-operative came as an answer to the problem of rural indebtedness which was rampant through act the country during the later decades of 19th century. It was an official remedy to be introduced on a voluntary basis, with the principles of self-help, thrift and mutual co-operation. This was supposed to be the beginning of genuine Indian co-operative movement. So the objective of co-operative movement The main

is actively implementing socio economic program with the ultimate aim of uplifting the living standard of economically backward and weaker section of society. In 1919 the government of India was passed the Act 1919 and co-operation became a state subject. So, several states passed their own acts for the development of the co-operative movement in their respective states. Through the co-operative movement in India was born at the beginning of century as an instrument of dealing with agricultural indebt ness, it was only after attaining independence that attaining independence that attention was paid in a big way to this issue. After independence the co-operative movement received added support from Government. So to sum up, the co-operative movement has made remarkable progress in terms of number, membership share capital and working capital. The progress of cooperative movement has been remarkable in the fields of agricultural credit, marketing and supply of farm inputs and processing. The Indian co-operative banking system is a 3-tier system. If consists of three sectors. Primary credit societies at the base Central co-operative Societies in the middle State co-operative Banks or Apex Banks at the top.

Primary credit societies It is an association of ten or more persons residing in a particular locality. The funds at primary credit societies consist of entrance fees, share capital, Reserve fund, Fixed Deposits from members and non-members and loans from central co-operative banks. The primary credit societies extend short and long term loans to the members. Generally, loans are given for a period of 6 months, one year and 2 years. Loans are

ordinarily given, on personal security of borrowers supported by personal security of borrowers supported by personal.

Central co-Operative Banks The primary credit societies failed to mobilize enough deposits from their members for meeting their requirements. They were in need for refinance from some agency. So the co-operatives societies Act of 1912, provided for the establishment of the central co-operative Bank to provide finance to primary credit societies. Central co-operative banks are federation of primary credit societies operating in a specific area. Generally they are located in the district head quarters and some prominent towns of the district. The funds of central co-operative Banks consist of share capital, reserve funds, deposits from members and non-members and loans and advanced form state co-operative Banks. commercial banks also. State Co-Operative Banks Every state has a state co-operative Bank at the top of the co-operative banking structure. If is known as Apex Bank as it controls and co-ordinates the working of all co-operative credit institutions in the state. If is found in the state capital. The table 1.1 shows the co-operative credit structure in the whole state of Karnataka. The funds of the state co-operative Banks consists of share capital, reserve funds, deposits from members and general public and loans from RBI, state Government and commercial Banks. However loans and advances from the RBI constitute a major part of their funds. Some times they raise loans from

District Central Co-Operative Bank (DCC Bank) Primary co-operative credit societies in a particular area, generally a district, federate and form a district central co-operative bank. Generally the DCC bank located of the head quarters of the district. Some DCC banks have branches in some towns in the particular district. The DCC Banks are of two types. In one type of DCC Banks the membership is confined to primary societies only. This type is therefore known as Banking Union. In the case of the second type of the DCC banks, there is mixed membership consisting of both primary societies and individual possessing some financial status as influence, some special business capacity and experience in the field of cooperative banking. The presence of some of these individuals in the DCC banks and thus on their board of management is deemed necessary because the organization and working of DCC Banks is supposed to be complex. And the representatives of primary societies on the board of management of DCC Banks may not have the necessary ability and experience required running the DCC Bank efficiently and thus inspiring confidence in the mind of the public.

10

Table 1.1 The Co-Operative Credit Structure in The Whole State of Karnataka for the Year 2003-04. S.No 1 2 3 4 5 Particulars Number No. of Branches No. of Staff Total Membership Borrowing Membership SCB 1 30 498 77 79 DCCB 22 628 4931 34645 5234 PACS 4532 10567 5549000 873793

Note: SCB = State Co-operative Bank DCCB = District Central CO-operative Bank PACS = Primary Agricultural Credit Societies

11

II. COMPANY PROFILE

2.1 PROFILE OF SCDCC BANK LIMITED MANGALORE Co-operative Movement was started in India in 1904 under Co-operative Act 1904, later Key found difficulties in implementation of this act. Therefore, amendment has been done coming into existence in Dakshina Kannada district and started to save the people during 1912. In 1912 many Co-operative societies come into existence and around puttur. Their main aim was to help formers. In the same year another organization named Rural credit societies was formed in Puttur in order to generate the money income required experience in Co-operative movement really compelled to launch a DCC Bank. The concentration of societies in and around Puttur made it as the natural ground for this establishment of head further of DCC Bank in Puttur, the Rao Bailer. But the person who injected lifeblood into the institution was Sri Shiva Rao Molahalli. Shiva Rao Molahalli was instrumental in bringing together various conscious people to spread head the movement in all post of the district. He had first believed that by Popularizing the Co-operative Movement, it is definitely possible to achieve the development of common masses of the society in general formers in particular. The SCDCC Bank Ltd, Mangalore registered under the Co-operative societies Act 1912 on 30th November 1913 started working on 24th January. The Registration No.1113.

12

The SCDCC Bank started its working in Puttur for the first time, under the leadership of Late. Sri. Shiva Rao Molahalli. Later it shifted its main office to Mangalore in 1927 because of wide scope and operation trough out direct. The Bank was registered as 7th District central C0-operative Bank under the administration of former madras. After its years of incredible service to the Co-operative setting in the district it celebrated of golden jubilee in 1964 and Diamond Jubilee in 1982 and platinum Jubilee in 1991 with the speculator & eventful history of almost 92 years. The Bank is going great strength in the Co-operative area. In the course of time as the dealings of the SCDCC Bank increased, it was found necessary to open branches. So in 1964, on the occasion of its golden Jubilee, a branch was opened its home town Puttur, now the bank has 50 branches in the District to south Canara. 2.2 COMPANY PROFILE WITH REFERENCE TO MCKINSEY 7-S FRAMEWORK The 7-S framework was developed by the consultant at the Mckinsey to a very well known management consultancy form in United States towards the end of 70s problems and to formulate programs for improvement. The 7-S framework of its components given by is shown in fig 2.1 2.2.1 Strategy A set of discussion and actions aimed at gaining a sustainable competitive advantage. It includes vision, missions, objectives and major action plans.

13

Goals of the SCDCC Bank Goals refers to a set of values and aspirations that goes beyond the conventions format statement of corporate objectives Goal are the mission and fundamental ideas around which a business is built SCDCC bank has incorporated around the following Goals: To generated funds for the purpose of financing co-operative societies. To Running the bank with Profile. To arrange for the supervision inspection of societies. To maintain high standard of recovery position. To implement scheme sponsored by the Govt. To control over branches. To carry out all works to promote Co-operative banking.

Purposes and objectives of the SCDCC Bank Ltd Bank has adopted the following general objectives for the development of the formers and weaker sections of the society. To provide all financials help to needs formers and other categories. To provide all banking facilities. To finance Co-operative societies registered or deemed to be registered under the Karnataka Co-operative societies Act 11, of 1959. To develop asset and co-ordinate the work of affiliated societies and unions. To arrange for the supervision and inspection of societies. To implement new social goal and technique of Management.

14

Action Plans Action plan refers to the measures taken to achieve the goals and objectives of the organization. SCDCC Bank is also formulated its objective the predetermined Goals objectives. The following are the major action plan. To strength the PACS for the uplipment of weaker section of society through business development to improve the standard of living of formers through selfHelp group. To mitigate the problems and achieve & success in all fields. The bank has introduced Development Action plan to increase efficiency, effectiveness. To advance loans to competent person for different purposes, the bank has introduced swarnajayanthi SwaRojgar Yojana. To advances loans to non-firms sector. To provide special financial aid, service facilities to women for their economic development Bank introduced women development department. Future Plan Following are the future plans of the bank. 1. Planning is to increase deposits to Rs.430 crore through various deposits. 2. Under Kissan credit Card if the planned to gives 100% membership to 3. Planning to build new building costing Rs. 300lakh. 4. Education und: To help financially backwards students to has planned to collage education purely. 5. Planned to start a co-operative training centre to the newly employed officials. 6. To computerize all the branches. 7. To provide quick & prompt service to customers.

15

2.2.2 Structure The ultimate authority in the affairs of the bank lies with general body of bank. The board of directors elected by the General Body will manage the affairs of the Bank. The board of management consists of 14 elected director representing the various categories of the member societies and one nominee each of state Government and Apex Bank and managing Director. The board will elect the president & vice president annually. The Managing Directors is the chief of the Bank which controls the day to day affairs of the bank. Four Mangaers who are Heads of four departments at the Head office viz, Administration & establishment, Banking accounts & statistics, loans and operational, planning & developments will assist him. Each department is having one superintend and required number of lower level staff. The Bank is having 50 branches headed by Branch Managers who are assisted by Assistant Branch Managers and other staff. The bank supervisors and bank inspectors will do the supervision & control of the affiliated societies. The branch inspects and Branch superintendents etc. the inspection of branches. 2.2.3 Systems System in the 7-S framework refers to all the rules regulation and procedure both formal & informal Rat complements the organization structure. It includes planning and control system, capital budgeting system, recruitment training & development system, and performance evolution system Planning & Control System in SCDCC Bank This is very important function in SCDCC Bank, which is done by top management. If prepares plan every year by considering the potentiality,

16

infrastructure facility and past performance. It is a master plan which consisting plan of all departments like EST &ADM, loans, NFS & A/C section. While dreaming plan top management considers bank as a while unit. Thus plan is the standard course of action prescribed for one year. The actual performance can be compared with this plan and reviewed by the Board of directors, MD to take decision on any investment/ expansion plan. Capital Budgeting System in SCDCC Bank Capital budgeting may be defined as the firms decisions to invest its convert funds most efficiently in long term assets. It includes expansion or acquisition. Modernization & replacement of long term assets. In SCDCC Bank annual budget are prepared by the top management. It is prepared on the basis of past performance & future prospective. This annual budget should be approved in annual general meeting. Recruitment and Selection System The administration & establishment department in SCDCC Bank follows the written roles for the purpose of recruitment & selection. It follows the government obligation in case of reservation to the backward class people, women in the bank for the purpose of recruitment. The SCDCC bank gives importance to the workers who are in the bank for a long period. Promotion and the lower position that is Clark post will filled like the new takes the people as and when needed. The board of director & MD will be in the selection committee when recruitment & selection become necessary. Training & Development System in SCDCC Bank The Apex bank & NABARD is conduct training programs regularly for all the members of the PACS at training center Bangalore. In addition to this selected bank officers are sent for training conducted by Apex bank for the period of 3-6 days.

17

The training includes program on retail banking for clerk of DCC bank. Program on financing self helps group. In addition of this Bank conducts training in method of growing new crops for formers.

Performance Evaluation System The immediate superiors oppress or evaluate the performance of the employees. In SCDCC bank respective Assistance general manager evaluate their subordinates. General Manager evaluates Assistant General Manager. Which managing director should approve. 2.2.4 Style Style is one of the seven levels which top managers can use to bring about organizational change. Organizational different frames each other in their style of working. The style of on organization according to McKinsey framework becomes evident through the pattern of action taken by member of top management the over a period of term. Reporting relationship may also covers the style of on organization. Information from M.D to Other Sections Daily letters received by the bank from carious institutions, Government, Apex bank, NABARD societies & from general public are placed papers to the concerned departments with suitable instructions for further need full action. Information from Sections to MD All papers received from outside which are forwarded to the section by M.D will be processed at the concerned sections and placed the action to be taken for final decision. If the M.D. is competent to take the decisions on the issue he will pass the

18

necessary order on it. Otherwise he will endorse the paper to the president with his remarks for final way on the issue by the president or the board of the case maybe. Suppose a department links any matter to be brought to the notice of the M.D. connected to the affair of the bank they will bring the same to the notice of the M.D and to the need full with consent of the M.D. 2.2.5 Staff Staffing is the process of acquiring human resources for the organization and assuring that they have the potential to contribute to the achievement of the organization goals. In the McKinsey 7-S frame work the term Staff has a specific connotation. According to waterman and his colleagues the term Staff refers to the way of organization introduce young recruits in to the mainstream of their activities and the manner in which they manage their careers as the new entrants develop into future manager. Recruitment System in SCDCC Bank Recruitment & selection will be done according to the guidelines issued by the government. It follows the government obligation in case of reservation to the backward community and women. Higher position will be filled by promotion and the lower position will be filled with new candidates through interview selection will be on the basis of interview performance & academic records. Career Development Program in SCDCC Bank Successful candidates placed on the jobs need training to perform their duties effectively raining and development constitutes an outgoing process in any organization.

19

The various executive developments & training program undergone by the middle level management & Job level management are: Training program on financing self-help group Training program on internal audit of branches & concurrent audit for inspection officers & internal auditor of SCDS Bank. Workshop on self help group development program for field supervisor to improves the skill & efficiency. Training program on development action plan for chief executive officers of SCDCC Bank. 2.2.6 Skill In the Mckinsey 7-S framework, says the skill as one of the most crucial attribute or capabilities of an organization. The term skill includes those characteristics, which most people use to describe a company. In other words skill refers to dominant skills or distinctive competence of an organization. Dominate Skills or Distinctive are having competence of SCDCC Bank: People of district are having good faith towards SCDCC Bank. Hard working & efficient staff. Autonomy in Decision-Making. Providing agriculture loan at low rate of interest. Leadership infrastructures. Working with own funds. Rural orientation.

2.2.7 Shared Values A shared value refers to commonly held beliefs mindsets & assumptions that shape how an organization is have its corporate culture.

20

Shared Values of SCDCC Bank Making profit is the aim Team work & development of employee Welfare of the weaker section of society Integrity % highest ethical standard in all transaction. Mutual respect & trust in working relationship Providing required service is the main motto Providing market for the agriculture goods produce farmers.

21

III. SERVICE PROFILE

3.1 VALUE CHAIN ANALYSIS Michael Porter of Harvard University proposed the value chain, as a tool for identifying way to create more customer value. Every firm is a synthesis of activities that are performed to design produce, market deliver, and support and render its service. The value chain identifies a strategically relevant activity that creates values and cost in specific business. These value-creating activities consist of 5 primary activities and four support activities. The value chain diagram is shown in Fig 3.1. 3.2.1 Primary Activities Inbound Logistics Inbound logistic refers to sequence of bringing money into banking for the purpose of lending by four way i.e. Accepting Deposits Issuing share capital Using its own-accumulated profit and resources Loans from NABARD and Apex Bank.

Sequences of Raising Funds by Accepting Deposits The SCDCC bank has 50 branches spread all over the district; all the branches accept deposits from customers and from PACS as shown in Table. 3.1

22

Table 3.1 Deposits from Customers and From PACS Types of deposits Deposits under saving bank a/c Deposit under current a/c Deposits under pigmy a/c Recovering Deposits & fixed deposits (3year above) 6.25% (2years to 5year) Interest rate 3.5% 1.5 6.5% Senior citizen Senior citizen 8.25% 8%

23

Deposits are accepted from agriculturist, business people & other customers, SCDCC bank is popular in the district & commands highest faith and confidence among the people in district. It has outstanding experience of 91 years of working. If has sufficient resources to fulfill credit. As on 31-03-05 total deposits of the bank was Rs 40, 411.07 lakhs. Sequences of Bringing Share Capital It issue shares to eligible individual members nominal member, associates (91 membership) Societies:

Primary Agricultural credit societies : 172 Marketing co-operative societies : 8 Urban co-operative Banks including Non-agricultural credit societies: 178 Other and miscellaneous types of societies: 432 Societies under liquidation : 48 For the year ending 31.03.2005 the SCDCC Bank has raised share capital worth of 787.83 lakhs. Sequences of using Accumulated Profit & Own Resource SCDCC Bank is earning sufficient profit from its business. It is one of the efficient & better-managed DCC Bank in the state. On 31/03/05 on net profit is Rs. 456.71lakh. It is Rs. 1,539.87 lakhs undistributed profits in the form of reserves. This will be utilized in lending.

24

Sequence of Borrowing:

Under 3 tier co-operative system the district central co-operative bank can borrow funds from Apex co-operative Bank and NABARD, and raise funds on 31-0305. Bank has borrowed Rs. 4719.17 lakhs from apex bank and other sources. Usually SCDCC bank must credit requirements of formers from its own reverse Operation: Operations involved in processing and sanctioning loans are Receiving application from eligible member Scrutiny of application Recommendation of supervisors Unification of documents Office note Sanctioning of loan Disbursement

Eligibility for Applying Loan: Agriculturist can apply for loan for agricultural purpose if he is a nominate member of PACS. He should have landholders, for cultivation of land, protection of crop, purchase of equipment, development of land or to provide irrigation facility and other agricultural purposes. He can apply for loan. For non-agricultural loan one should become a nominal members of the bank, he should be on A/c holder and bring two scarifies. Scrutiny of Application:

The management, on the basis of following criteria scrutinizes applications for loan pre members of PACS. He should be nominal member of the society. He should be a land holder

25

He must assure repayment capacity Scale of finance must be suitable It management is satisfied it can recommend for grant of loan.

For non-agriculture application are scrutinized on the base of following criteria. He should be a nominal member of the bank Viable project Report Repayment capacity Cash flow and profit margin. Recommendation of the Supervisors:

After receiving application and scrutiny by management of the PACS, The application is forwarded with recommendation to the branch of SCDCC bank. The bank will depute a supervisor to verify genuine of the application record of rights, scale of finance, security and purpose for which loan is required. Supervision will visit personally and verify all the submitted. Information and then recommends amount of loan to sanctioned. On the basis of his recommendation loan will be sanctioned by bank. Sanctioning of the Loan:

Loan sub committee of SCDCC bank will sanction the loan on the basis of office verification of document and supervisions recommendation.

Disbursement:

On the receipt of sanction order the respective PACS will provide bond. After receiving the bond bank will arrange for disbursement of loan through changes. Thus bank will operated the fund in order term profit over deposits. In case of installment loan found will be disbursed in installment only.

26

Outbound Logistic: If refers to activity costs dealing with physically distributing the funds to the customers. In general outbound logistic refers to way or means in which the funds reaches to the end users it is nothing but physical distribution of funds physical distribution is the management of all activities, which facilitate movement and coordination of supply and demand in the creation of time and place utility in funds. If funds are not effective management not only customers suffers from poor service but losses also occur to organization through loss of business and increased cost of holding deposits. Various distribution channels of funds of SCDCC bank are shown in the Fig 3.2. Distribution/ Disbursement of Loan:

The SCDCC bank grants loan to agricultural activity and non-agricultural activity of the district. Loans are granted to the members of PACS on the basis of requirements of the farmers scale of finance, repaying capacity and security of land and other assets. SCDCC Bank grants 2 types of agricultural loan i.e. crop loan and medium term loan. SCDCC Bank also grants loan to non-form sector. It provides 3 types of loan. Long term loans, medium term loans and short term loans to the customer who are under taking different types of non agricultural activities i.e. service, industry, business, while loans and personal loan etc. To avail the loan from SCDCC bank a former should submit the application to the concerned PACS by becoming a member and specifying the purpose for which loan are required. After scrutinizing application management of PACS will forward their application with their recommendation to the branch of SCDCC bank. The head office executives further scrutinize application. Loans are granted considering all norms of the banks. Then the sanction order is sent to PACS to fulfill further formality. PACS will inform borrow money from bank and distribute to the ultimate customer through cheques.

27

Marketing and Sales: Marketing and sales involves the activities, cost and assets related to sales force efforts, advertising and promotion market research hand planning. For the purpose of sanctioning the loan and to provide banking service to all the people of the district the SCDCC bank has opened 50 branches including one mahila branch and 34 rural branches. These are 172 primary agricultural credit societies afflicted to SCDCC bank. SCDCC bank has covered 92.97% of the agriculture families. Under cooperative orbit and 85% at schedule cost families in the district. Banks introduce all the new schemes under the guidance of NABARD through PACS. Supervisory and branch manager and bank executive. If will provide loan and other facilities to all the end users through PACS, branch etc. In addition it will arrange to provide chemical fertilizer organic fertilizer, pesticide, customs durable etc trough PACS. They co-operative movement is successful in this district through dynamic played by this bank. The statistical highlights for the past 7-8 years would certainly prove the performance of the bank. The table 3.2 shows the statistical highlights of the SCDCC bank. Service: Service is the last element analysis. Primary activities of the value chain associated with providing assistance to buyers such as installation technical assistance etc. Safe deposit locker facility and safe custody of article. ATM facility Any where banking Extra interest on deposit of senior citizens. Early redress of complaints.

28

Table 3.2: Statistical Highlights. (Rs. In lakhs) No Details 1 Membership a)Government b) Societical c) Associate 2. Share capital 3. Reserves 4. Deposits 5. Borrowings 6. Working 7. 8. Capital Loans outstanding Percentage of Recovery 9 10 (June) Profit Branches 143.58 (+) 41 258.38 (+) 44 259.89 (+) 404.48 (+) 44 44 405.16 (+) 49 456.71 (+) 50 1999-2000 803 716.50 409.95 24,322.10 1,901.84 28,696.15 17,863.79 97.4% 2000-01 785 730.31 464.54 28,928.82 2,035.83 21,794.11 21,794.11 94.3% 2001-02 783 5 743.20 533.78 38,189.27 2,972.05 44,670.94 25,253.10 93.6% 2002-03 777 41 759.51 903.15 37,397.58 4.322.46 4,957.65 27,110.30 91.1% 2003-04 838 90 755.85 1188.20 38,36.61 5549.38 47,471.08 28,736.20 85.8% 2004-05 836 133 787.83 1539.87 40,411.07 4,719.17 49,697.29 29,962.52 59.62%

29

Safe Deposit Locker Facility and Safe Custody of Articles: Facility of safe deposit locker is an ancillary service offered by the bank. One can now experience peace of mind with his entire valuable under the security of lockers. These lockers are available of any branches. ATM Facility: The bank has started ATM to give quick service to the customers. In order to face competition among the bankers this facility is a necessity even to improve the business. This facility is the first in the whole of Karnataka as for as Apex Bank, District Central Co-operative Bank is concerned. All the push button 24 hours a day 365 days a year. Any Where Banking: The Bank has computerized almost all its branches and proposed to introduce the anywhere banking to give effective service to the customers. Extra Interest on Deposit to Senior Citizens: Citizens who are above 60 years of age the bank & giving additional interest of 1% on various deposit schemes. Thus helping the senior citizen of the country. Early Redress of complaint: The SCDCC Bank plays an important in redressal of complaints. Wherever there is a complaint from the customers regarding safe deposit lockers, interest rate etc, the bank immediately helps the customers in those problems. 3.2.2 Supportive Activities: General administration, Human resource management, technology

development and procurement represent the four major categories of support

30

activities in the value chain model. These provide support for primary activities and also support each other. General Administration:General administration of SCDCC bank comprise of following activities. Management Membership and share capital Executive committee and its function Supervision committee Staff pattern

a. Management: The Management is constituted of 1. 2. 3. 4. 5. 6. 7. 8. 9. One representative representing PACS from each bank. One representative of co-operative of co-operative Marketing One representative from consumer co-operative societies. One representative representing Dairy societies. One representative representing industrial co-operative societies. One representative from other types of societies Managing Directors of DCC Bank Deputy Register of CS of District. Government nominee not exceeding 3 or 1/ 3 Act the total number of members, which even, is less. 10. One nominee of Karnataka State-co-operative Apex Bank b. Membership and Share Capital: The authorized share capital is 1100 lakhs. The total paid up share capita is shown in table 3.3.

31

Table 3.3 Membership and Share Capital (Rs in lakh) 31-03-2003 Membership Share capital A. Government B. Society 777 756.56 C. Associates 41 2.95 Total 818 759.51 31-03-2004 Membership Share capital 838 748.80 91 7.05 929 755.85 31-03-2005 Membership Share capital 836 133 969 776.93 10.90 787.83

32

Management: The management of SCDCC Bank vests in a board consisting of 14 director. Elected of above Managing Director Apex Bank Nominee Government Nominee Total Procedure of Election: Representatives are to be elected from among the delegates of such societies for a period five years. Election of president and vice president is held once in 21/ 2 years. c. Executive Committee and its Function:In SCDCC Bank of members are elected for organized committee. The main functions of this committee are: To raise funds in the form of deposits, loans etc To grant loans and advances to members To make investment of funds of the bank Admission of new members. Allotment of salary To sanction extension of the period for loans which become due for payment. Examination of all cased of overdue loans and taking proper for their recovery. Preparation of annual report and budget for the Bank. : : : : : 11 1 1 1 14

Supervision Committee:

33

This committee organized by 6 members. The main functions of this committee are: To develop, assist and co-ordinate the work of affiliated societies and unions. To arrange for the supervision and inspection societies.

d. Staff Pattern: The staff structure and strength of the SCDCC Bank below: Managing Director (CEO) General Manager Deputy General Manger Assistant General Manger Senior Branch manager Junior Branches manager Senior Supervisor clerks Junior supervisor clerk Second Division clerk Computer division clerks Others Sub staff Total Human Resource Management: This is one of the major aspects in an organization. In value chain analysis it is considered as one of the supportive activity. HRM mainly concerned with recruitment and selection training and development, career development and relation with trade union. The procedure for recruitment and selection will be followed according to the guidelines issued by NABAARD government. The higher position will be filed by promotion and other jobs will be filled through recruitment and selection. At present SCDCC bank is not following the manpower planning. It takes the people as and when needed by the organization. For the purpose of continues development of the personal the Apex bank conduct training regularly conducts training programs for all : : : : : : : : : : : : : 1 2 4 13 26 42 34 158 72 1 9 72 434

34

the members of the bank. I addition to the selected staff of the bank, members are also given training. Measures of Motivating the Employee: Bonus: Every year bonus is paid to all the employees. Leave Facility: In one year the employee can apply for casual leave of 15 days, earned leave of 30 days. Government holding wages: Workers with certain day scale are also given government holding wages. Trade Union: In SCDCC bank by only one union in working according to the bank employees union procedure there is neither separate union for workers and not for management. Both management and workers have only one union.

35

Technology Development: The present business world is competitive to set competitive advantages and complete effectively business organization must develop a technology. As new technology adopted in the organization the made of communication become easier and these factors helps to reduce the burden of work. At present SCDCC Bank is not fully sophisticated. All most all departments are computerized. But some workers are carrying out through manually. But account section is fully computerized trough computer only. The bank has installed computer in the head office on department basis and also in kodialbail, branch and computerized may areas of the work. As result, the bank is providing better. Procurement: SCDCC Bank has its own way of getting impact. The impact are deposits, receipts received as department of loan and advances, commission charged. Other than those banks have other liquid funds like call money which are used Apex bank & other banks. SCDCC bank borrows from Apex bank & the SCDCC bank having check bank facility collects amount as deposits from other local banks. The establishments and administration department procures the stationary and materials needs for the clerical work of the bank. The bank prepares an indent and it is clarified for details and documents. After verification it move towards enquired to registered vendors. The registered vendors are requested to send quotation. After complete all these producers the establishment and administration department will take delivery. SCDCC Bank maintains a close relationship with the reliable sources and evaluation of their sources is alone.

36

IV. ORGANISATION STRUCTURE

This chapter clears defines the functions, responsibilities and hierarchy of the organization. All departments functional areas are very well defined with broad responsibility which has to be discharged in accordance with policies authorized by the management. The Fig. 4.1 shows the organizational structure of SCDCC Bank Ltd. Mangalore. Department of the SCDCC Bank: SCDCC Bank consists of the following departments Administration and Establishment (A & E) Banking and Accounting & Statistics (B & S) Loans and Operations (L & O) Planning and Branch Control (P & S)

4.1 PROVISIONALLY ALLOTMENT OF WORK AMONG VARIOUS DEPARTMENTS: 4.1.1 Administration and Establishment: This department headed by Deputy General Manager (A & E) , D.G.Ms (A & E) functions are : Work is connected with the meeting of general body, board, Executive Committee, Supervision committee and other sub committee including the work relating to the elections and disqualification of director, custody of minute book etc.

37

Communication of decision of General body, Board and other committees for execution to the concerned department. Establishment staffs regulations, Maintenance of leaves register and leave accounts. Maintenance of approved list of staff service registers and personal files. Distribution of Tappals to various sections in the Bank. Maintenance of Stock of stationary, books and forms arrangements for printing etc. Initiating taking disciplinary action against the staff members. Maintenance of Circular files Maintenance of computers and all other machineries. Maintenance of Library. Maintenance of furnitures and fixtures in Head office, supply of furniture etc. to the branches.

4.1.2 Banking and Accounts & Statistics (B&S) This department headed by Deputy General Manager (B&S). D.G.M (B&S) S functions are: Investment of surplus funds of the Banking with Ape Bank and other approved Bank reconciliation. Maintenance of registered Books of accounts & reports. Operation of accounts with other Banks Issues of DDs (Demand Draft). Arranging Insurance of Cash, buildings, furniture & fixtures, Vehicles etc. In H.O and branches & Cash in transit, renewal etc. Custody & Maintenance of Government trustee securities collection of interest on various Investments. Admission of members allotment of Shares, Issue of Share certificates removal of members etc.

38

Preparation of DCB statements etc. Compilation of Branch accounts and reconciliation. Preparation of various statements statistical data for board, General body Meetings. Preparation of Pay bills, disbursement of staff salary and connected work. Maintenance of Accounts relating to borrowings and advancing of all type of loans- ST, MT, LT, CCL, Individual Finance etc.

4.1.3

Loans and Operation (L&O) This department headed by Deputy General Manager (L&O). D.G.M (L&O)s functioning. Issue of Intimation to the societies and arrangements for disbursements follow up of action. Verification of proper utilization of loans. Review of DCB statements on a monthly bases and proposing action etc. Arrangement for timely renewal of cash credit loans. Arrangement for inquiry of petitions etc. Arrangement for stock verification, annual statements. Linking of credit with marketing. Technical, Monitoring & Evolution Cell & Vigilance Cell. Correspondence with the societies regarding loan application recovery etc. Exercise the control over the supervisors and Bank Inspectors Convening the meeting-review of their work fixing the target for recovery etc. Linking credit with marketing. All matter relating to interest subsiding schemes. Advances to self Help Group (SHG). Planning and Branch Control (P & BC)

4.1.4

39

This department headed by Deputy General Manager (P & BC). D.G.M (P & BC) S function are: Control of all the Branches of the Bank. Deposit Mobilization. Settlement of death claims of depositors. Balancing the Books of accounts of Branches. Work relating to common cadre Authority. Deposit Insurance Schemes of PACS. Branch Expansion Program. Such other work entrusted from time to time. Service area credit planning & follow up. Initiating disciplinary action against staff up to the stages of franking charges and assisting for further action. Arrangements for Inspection of Branches review of reports compliance follow up. Collection of various returns relating to the progress of the Branch, Scrutiny, reconciliation, analysis etc.

40

V. ACCOUNTING AND FINANCIAL PRACTICES

This chapter contains finance analysis for evaluating the relationship between components parts of a financial statement to obtain a better understand of a firms position and performance. 5.1 ACCOUNTING PRACTICES: As like in every organization if is the deity of financial department to keep all the books of accounts properly and present it for auditing and analysis. The various types of books maintained by the banks are: Membership register Deposit register Borrowing register Cash book General ledger Loan ledger Ledger balance registers Investment register Stock register Sunday Debtors and Sunday Creditor Register Cash and liquid asset register Suspense assets and suspense liability registers In ward bills receivable register and In ward bill payable register

5.2 ACCOUNTING POLICY OF SCDCC BANK: Method of Accounting: The financial statement have been prepared under the historical cost convention and in accordance with generally accepted accounting principles.

41

Revenue of recognition Expenses are accounted their accrual with necessary provisions for all known liabilities and losses. Fixed Assets and Depreciation: Fixed assets are stated at cost of acquisition inclusive of inward fright, duties and any other directly attributable cost of bringing the assets to its intended use. Depreciation is clanged according to straight line method. Investment: SCDCC Bank made its investment and State Government Securities, other trustee Securities, Shares in Co-operative institutions and other investments. 5.3 SUMMARY OF ANNUAL REPORTS: 5.3.1 Summary of Balance Sheet: The table 5.1 table 5.2 shows the balance sheet of SCDCC Bank. Share Capital: SCDCC bank led Rs. 755.85 lakhs share capital in its year 2003-04, it has been increased up to Rs. 787.83 lakhs in the year 2004-05. Reserves: The reserves of SCDCC bank were Rs. 1188.20 lakhs in the year 2003-04. Which has increased to Rs. 1539.87 lakhs in the year 2004-05. That shows the profitability of the bank. Fixed Assets SCDCC bank has Rs. 601.83 lakhs of fixed assets in 2004-05 when compared to Rs. 341.31 lakhs in 2003-04. Cash Balance SCDCC Bank possessed a cash balance of Rs. 3516.36 lakhs in 2003-04 but balance increased to Rs. 3880.83 lakhs in 2004-05.

42

Profit SCDCC bank showed a profit of Rs. 405.16 lakhs in the year 2003-04 and increase to Rs. 459.96 lakhs in 2004-05. Current Assets The current assets of the bank in the year 2003-04 was Rs. 406.43 lakhs and increased of Rs. 536.68 lakhs in the year 2004-05. 5.3.2 Summary of Profit and Loss Account The Table 5.3 and Table 5.4 show the profit and loss account of SCDCC Bank. Salaries and Allowances Bank has paid Rs. 579.85 lakhs towards salary in 2003-04 and Rs. 593.05 lakhs in the year 2004-05. Interest as Deposit and Borrowing Bank paid interest on deposit Rs. 2826.62 lakhs in the year 2003-04 and Rs. 2537.79 lakhs in the year 2004-05. Depreciation on Furniture, Building and Vehicles Depreciation is charged in the year 2003-04 was Rs. 60.71 lakhs and in the year 2004-05 it is Rs. 128.10. Income on Interest Realized Bank earned interest Rs. 4386.11 lakhs in 2003-04 and in the year 2004-05 Rs. 4236.37 lakhs.

43

Table 5.1: Balance Sheet as on 31-03-2004 & 31-03-2005 (Liabilities) Capital And Liabilities 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. Total Capital Reserve fund & other reserves Principle/subsidiary state partnership fund a/c. Deposits and other accounts Borrowings Bills for collection being bills lodged as per contra Branch adjustments Overdue interest reserves Interest payable Other liabilities Profit and loss 31-03-2004 Total 17,55,85,300.00 11,88,20,172.88 383,36,60,767,46 55,49,37,551.00 1,05,60,162.82 1,66,06,617.00 1,02,82,970.63 11,33,03,785.70 4,05,16,285.47 477,42,73,612.96 31-03-2005 Total 7,87,83,000.00 15,39,86,753.74 4,04,00,45,577.07 47,19,17,200.00 1,08,57,720.98 12,54,51,000.00 93,43,161.17 16,79,82,373.00 4,59,96,890.36 5,10,43,63,677.12

44

Table 5.2: Balance Sheet as on 31-03-2004 and 31-03-2005 (Assets) Property And Assets 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. Total Cash Balance with other banks Money at call and short notice Investments Investment out of principal/ Subsidiary state partnership fund Advances Interest receivable Bills receivable Branch adjustments Bank premises and buildings Other assets Sundry assets Non banking assets acquired in satisfaction of claims Profit and loss 31-03-2004 Total 35,16,36,557.60 95,74,96,243.02 48,57,92,350.00 287,36,19,996.89 1,66,06,617.00 1,05,60,162.82 37,86,560.37 1,12,89,796.87 2,28,42,048.76 4,06,43,279.63 477,42,73,612.96 31-03-2005 Total 38,80,83,066.82 88,99,75,118.80 -Nil57,54,65,855.00 2,99,51,90,453.31 12,54,51,000.00 1,08,57,720.98 34,87,923.12 1,70,00,404.47 4,31,83,554.56 5,56,68,580.06 5,10,43,63,677.12

45

Table 5.3 Profit and Loss Account for the Year 2003-04 and 2004-05 (Expenditure) Expenditure 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. Interest on Deposit and 31-03-2004 Amount 28,26,62,871.49 5,79,85,576.30 2,30,741.00 73,54,523.22 18,800.00 21,97,796.23 7,27,765.00 60,71,115.00 41,12,446.575 31-03-2005 Amount 25,37,79,544.77 5,93,05,364.60 189,514.26 97,26,105.96 50,528.00 21,45,834.92 6,77,776.00 1,28,10,163.13 42,43,477.64 -

Borrowings Salaries and Allowances Directories and Local Committee Members Fees and Allowances Rent, Taxed, Insurance & Lighting Law Charges Postage, Telegram & Telephone charges Audit Cost Depreciation

on

Furniture, Printing,

Buildings and Vehicles Stationery,

Advertisement Charges Loss From Sale of or dealing with non-banking assets Other Expenditure: 1. Bonus and ex-gratia to staff 2. Cost of Recovery and sale Officers 3. Other Expenditures 4. Provisions made Net Profit Grand Total

34,00,000.00 1,16,96,779.04 3,60,06,912.06 4,05,16,285.47 45,29,81,611.56

40,00,000.00 1,58,52,498.38 3,42,56,963.29 4,59,96,890.36 44,30,34,661.31

46

Table 5.4: Profit And Loss Account for the Year 2003-04 and 2004-05 (Income) Income 1. 2. 3. 4. Interest Realized Commission, Brokerage Subsidy and Donations Income from non banking assets Profit from sale of or dealing with 31-03-2004 Amount 43,86,11,484.31 48,83,914.02 1,96,190.90 92,90,022.33 45,29,81,611.56 31-03-2005 Amount 42,36,37,674.11 45,94,753.41 1,42,741.30 1,46,59,492.49 44,30,34,661.31

Exchange,

such assets (Rent on Buildings) 5. Other Receipts Grand Total

5.4 FINANCIAL RATIO ANALYSIS Ratio analysis is a powerful tool of financial analysis. A ratio is defined as The indicated quotient of two mathematical expressions and as the relationship between two or more things. In financial analysis, a ratio is used as an index or yard

47

stick for evaluating the financial position and performance of a firm. The absolute accounting figures reported in the financial statements do not provide a meaningful understanding of the performance and financial position of a firm. The relationship between two accounting figures expressed mathematically is known as financial ratio. Ratios help to large quantities of financial data and make qualitative judgement to be formed about the firms to meet its current obligations. Financial Ratio Analysis: Liquidity Ratio: These are the ratio that measures short-term solvency position of a firm. These are calculating to comment upon short term paying capacity of a concern or the firm ability to meet its current obligations. Long Term Solvency and Average Ratio: Long term solvency ratios convey a firms ability to meet the interest costs and repayment schedules of its long-term obligations. Leverage ratios show the proportions of debt and equity in financing of the firm. These ratios measure the contribution of financing by owners as compared to financing by outsiders.

1.

Debt-Equity Ratios: Debt equity ratios, also known as external internal equity ratio is calculated to

measures the relative claims of outsiders against the firms assets. The debt equity ratio in the year 2004 is 7.34:1. But if is decreased in the year 2005 i.e. 5:99:1

48

2. Government Security-to-Investments The standard ratio is 0.50:1. Government securities are higher than standard. This shows the nil risk for government securities and the risk weightage. It determines the safety of customers. In 2004, i5t is 3.3 and in 2005, it is 2.88. 3. Government Security-to-Assets The standard ratio is 0.25:1. For the year 2004 the ratio is 0.34, but in 2005 it decrease to 0.32. It indicators banks aggressiveness in improving its credit-deposit ratio by keeping investments lower. .4. Fixed Asset to Total Long Term Funds: The ratio indicates the extent to which the totals of fixed assets are financial by long term funds of the bank. In the year 2004 the ratio 5.41%. But it increases in the year 2005 ie 10.92% 5. Solvency Ratio This ratio is a small variant of equity ratio the solvency ratio of the bank in the year 2004 is 0.98:1 and in the year 2005 it is constant as 0.98:1. The standard ratio is 1.5:1. 6 Advances to Asset Ratio It shows banks aggressiveness in improving its credit deposit ratio by higher advances, which determine profitability. There is no standard ratio. This ratio is same for two years. It determines the profitability level. Resource Deployed Resources deployed are those ratios, which indicate the asset utilization or the asset turnover. Higher the ratio indicates better position and efficiency of banks.

49

1. Investment to Asset Ratio: The standard ratio is 0.25:1. The investment to asset ratio is in the year 2004, is 0.10& in 2005, is 0.112. 2. Fixed Assets Ratio There is no standard. The ratios in the years 2004, is 5.41 and 2005, is 10.92. This indicates the proportion of resources deployed in fixed assets, thus contributing indirectly to profitability. 3. Other Assets Ratio There is no standard. It indicates the proportion of resources deployed in other assets, which generate relatively low yields. The ratio in 2004, is 0.04, in 2005, is 0.09.. So, we can say that it is a good position. 4. Fixed Asset to Net Worth Ratio: The ratio establishes the relationship between fixed asset and shareholders fund. The ratio of the fixed asset to network indicates the extent to which share holders funds are sunk into the fixed assets. In the year 2004 ratio is 17%. But if increases to .25% in the year 2005.

50

5. Current Liability to Proprietary Ratio This ratio establishes relationship between current liability and proprietory fund. There is no standard ratio.The ratio is 0.58 in the year 2004. It is 0.72 in the year 2005. Profitability Ratio: These ratios measure the results of business operations or overall performance and effectiveness of the firm.

1.

Return on Equity Capital: It is the relationship between earnings of the bank and it is equity capital.

Price earning ratio in the year 2004 is 19.35. But it will increases in the year 2005 i.e., 17.04. Because of, increase in profits of the SCDCC bank.

2.

Earning Per Share: It is calculated by dividing the net profit after taxes and total number of

shares. The EPS in the year 2004 is 516.71. But it will increase in the year 2005 ie 586.61. 3. Price Earning Ratio: It is the ratio between market price of share & earning per share. The P/C ratio in the year 2004 is 0.54. But it is increased in the year 2005 ie 0.58. 4. Net profit Per Employee: There is no standard. It can be found through employees productive ratio by using net profit dividing by no. of employees. During 2004, Rs. 99,062,it increased in2005, Rs. 1,12,461. Financial ratio of the company is shown in table 5.5

51

Table 5.5 Ratio Analysis Ratios 1.Long-term Solvency and Leverage ratio Debt equity ratio Advance to Asset Ratio G-sec-to-investment ratio G-sec-to-total asset ratio Solvency ratio Total investment to long term liability 2. Resources Deployed Investment Asset Ratio Fixed asset ratio Other Asset Ratio Fixed asset to networth ratio Current liability to proprietary ratio 3. Profitability ratio Price earning ratio Return on equity capital Profit Per employee Ratio (Rs.) Net Profit To Total Average Asset Ratio Earning Per Share: B Class Shares D Class Shares Standard 8:1 5:1 0.25:1 1.25:1 0.25:1 0.67% 2005 5.99 0.59 2.88 0.32 0.98 1.167 0.112 10.92% 0.09 25.85% 0.72 17.04 0.58 1,12,461 0.82 519 2595 2004 7.34 0.60 3.30 0.34 0.98 1.14 0.10 5.41% 0.04 17.56% 0.58 19.35 0.54 99,062 0.99 494.52 2472.60

52

I. INTRODUCTION

Development of agriculture with rural orientation is the main aim of cooperative system. The SCDCC bank if rendering its service to achieve overall development of the district. In the context a study of credit appraisal and monitoring to agriculture loan is relevant. To reduce the burden of rural indebtedness and to avoid exploitation of poor peasants the co-operative credit has opened many agencies. The co-operative credit has been the instrument of agriculture development and social justice. In this context credit appraisal of SCDCC bank will help to assess the performance of DCC bank in Rs. field of rural credit and rural development. To meet the requirement of farmers the SCDCC bank provides two types of agricultural credit i.e., crop loan and medium term loan. It is relevant in this context to study the appraisal of credit requirement of farmers including scrutiny of application sanction, disbursement utilization and recovery of credit is essential. In this study comparison of agricultural credit and non-agricultural credit, comparison of Kisan credit with MT loan, difference between sanction of loan and disbursement of loan, percentage of agricultural credit with aggregate lending etc., are included. The study can reveal the hidden strength and weakness of SCDCC bank in the field of agriculture credit. 1.1 REASON FOR SELECTING THIS PROBLEM:SCDCC bank advances loan both agriculture and non-agricultural purpose in this district. If charges lower interest to agricultural loan when compared to nonagriculture loan on account of this bank incurs some loss in its agriculture advances. To meet the social objectives and agricultural development, bank has to find out

53

available credit policy in order to earn adequate profit and achieve the goals of cooperative system. Bank has diverted more of its funds to non-agricultural sector in the district to analyze the reason, the study will help the bank to adopt suitable policy measures. The allocation of funds to agriculture sector shall be made on scientific basis. The study will reveal the methods of enhancing the find allocation to agriculture sector. 1.2 OBJECTIVES OF THE STUDY To understand the method of credit appraisal of SCDCC bank. To know the different type of agriculture loan and the rate of interest charged to those loans. To know the different schemes provided by the bank. To know the repayment period and recovery procedure and to analyze recovery position of bank. To analyze the amount of total agriculture loans advanced, comparison of Kissan credit loan, and medium term loans as against total loan advanced, procedure followed by bank for granting loan. 1.3 SCOPE OF AGRICULTURE CREDIT APPRAISAL By the analysis of agriculture credit appraisal the DCC bank can find out ways and means to increase agricultural credit without incurring much losses. By adopting scientific norms bank can advance more number of farmers in the district and bank can also adopt easy procedure to recover the loan. It can fix maximum amount of loan based on yield per acre and level of income.

54

By widening the scope of agricultural credit the farmer in the district can avail adequate quantity of loan of a right time to improve their standard of living and enhance their replacing capacity. Besides bank can help diversification of agricultural crop and rural development. Bank achieves its goals by diverting its funds from non-agricultural sector to agriculture sector and meet social objectives. SCDCC bank has already achieved goodwill and satisfaction among the agriculturist in the district. By modifying its credit policy under the light of this study bank can become a "Role model" in the state by advancing adequate leans to farmers. This study will stimulate the bank to calculate the actual loss/profit by charging differential rate of interest for agriculture purpose and diverting some funds especially for agriculture and take suitable action to reduce its loss and improve its profitability.

55

II. REVIEW OF LITERATURE

2.1 DOUBLING FARM CREDIT IN 3 YEARS APPEARS DIFFICULT The planning commission has expressed its apprehension over doubling of credit flow to the agriculture sector in the remaining 3 years of the 10 th plan. The direct agricultural advances of the commercial banks ranges 11-12% of their net bank credit as against the original 18% target for the whole plan. For are mending agricredit flow it said innovations were require for mitigating risks and lowering transaction costs, agent banking & micro finance. (Source: Bank Bulletin) 2.2 SECOND GREEN REVOLUTION: A CATALYST FOR RURAL UPLIFT India agriculture is at cross roads. The path of development is not smooth. About 72% of over a billion total populations live in rural areas. The second Green revolution conceived should be able to put agriculture as well as agriculture related industry on fast track to provide jobs with higher wages. During the second Green Revolution, productivity improvements should come from sources that are ecologically friendly. Government has to ensure that there is no income loss to the farmers and it is compensated by the realization of appropriate market price to the crops. (Source: Yojana). 2.3 FINANCING AGRIBUSINESS A significant void in this literature is the financing of large-scale farming and agri-business operations. Unlike the farm sector where thousands of commercial banks, Farm credit System, life insurance, Farm Service Agency, and trade credit lenders exists to serve the needs of farmers and ranchers, agribusiness lending is

56

highly concentrated and dominated by five major firms. Recent market share data of the five largest agribusiness lenders indicates that this segment exceeds $ 10 billion. (Source: www.agri.com) 2.4 CREDIT APPRAISAL: ELIGIBILITY FOR A HOME LOAN Crucial process before your request for a home loan is actually sanctioned by any bank is the credit appraisal process, which is a three-fold securitisation process that decides your loan eligibility. This is to determine your loan repayment capability and with increasing loan applications, banks can definitely run into credit risk when doling out lakhs of rupees to borrowers. Hence, evaluation of home loan applicants becomes critical. 2.5 AGRICULTURAL POLICIES In this Policy Brief I challenge the conventional wisdom that small farms are backward and unproductive. Using evidence from Southern and Northern countries I demonstrate that small farms are "multi-functional" more productive, more efficient, and contribute more to economic development than large farms. Small farmers can also make better stewards of natural resources, conserving biodiversity and safeguarding the future sustainability of agricultural production. (Peter M. Rosset) 2.6 APPRAISAL RULE HITS HOME As more credit unions are attracted to real estate lending, questions arise about appraisals, when they're required, and who must perform them. The National Credit Union Administration (NCUA) revised its Appraisal Rule, Part 722, in 2001 (clarified in 2002) to make it more flexible and similar to appraisal requirements bank regulatory agencies impose. The rule applies to consumer and member business loans made by both federal and state-chartered, (Kavita Sriram)

57

federally insured credit unions. Different standards, however, might apply to statechartered credit unions. The appraisal rule carves out some important exceptions that are particularly important as credit unions try to remain competitive and responsible in the refinancing market (Credit Union Magazine, July 2003 by Jolly, Bruce) 2.7 HISTORY AND UNIQUE FEATURES OF THE FARM CREDIT SYSTEM The proposed buyout of Farm Credit Services of America (FCSA) by Rabobank in late July 2004, and the subsequent rejection of the offer by the FCSA board in late October 2004, focused attention on the uniqueness of the Farm Credit System as a national cooperative lender to agriculture, on congressional expectations for the system (inasmuch as the system was created by successive congressional acts), and on the very unusual tax status of the Farm Credit System, especially the Federal Land Bank segment. The proposed Rabobank buyout posed the policy question of whether a buyout of a component of the Farm Credit System was inconsistent with the statutory and regulatory framework of the system. (Neil E. Harl) 2.8 EFFECT OF THE AGRICULTURAL CREDIT ACT OF 1987 ON FLB The FLB and FLBA exemptions were called into question by the IRS following the enactment of authority in the Agricultural Credit Act of 1987, allowing the merger of Federal Land Banks into an Agricultural Credit Association (ACA). The Internal Revenue Service ruled on three occasions that Agricultural Credit Associations (created upon the merger of Federal Land Banks and Production Credit Associations under the Agricultural Credit Act of 1987) were not exempt from income tax from long-term lending activities previously carried on by a predecessor Federal Land Bank or Federal Land Bank Association. (Neil E. Harl)

58

2.9 CHANGING FACE OF AGRICULTURAL LENDING In this issue of Choices, examine a broad range of issues changing the face of agricultural lending. The agricultural lending decision making process is becoming much more complex as a result of contractual and ownership arrangement issues, location issues, and management quality and risk management issues. The Farm Credit System, with its unique structure, faces a number of issues as it attempts to maintain its competitive position in light of the evolving farm customer base and activities of competitors providing loans and services in this market. The degree of competition in agricultural lending will influence quantity and quality of loans made. (David M. Kohl and John B. Penson,)

2.10 SELLING A PIECE OF THE FARM CREDIT SYSTEM: The Directors of Farm Credit Services of America (FCSA), an association of the farmer-owned cooperative Farm Credit System (FCS), announced that they had agreed to a purchase offer from Rabobank, an international financial services company headquartered in the Netherlands. This announcement set off howls of protest from within the FCS and from some FCSA members and public officials. It was also greeted with restrained glee by some bankers and other FCSA members. Three months later, the FCSA Board terminated the sale negotiation. Shortly thereafter, their CEO resigned and the board followed up with several full-page ads in local newspapers pledging their (and management's) commitment to members and to the principles of cooperation. In demonstration of their renewed commitment, the Board recently announced patronage programs for 2004 and 2005the first ever by this association. (Robert W. Jolly and Josh D. Roe)

59

2.11 CO-OPERATIVE BANKS: AN APPRAISAL Through the cooperatives cover almost 75% of the entire countryside, the membership I still only 45% of the rural artisans constitute only 10% of the total membership of cooperatives. Besides the significant regional disparities in credit availability, the cooperative banks have not been able to ensure an increasing flow of production loans and investment credit in tribal, hilly and backward areas. (Deepali Pant Joshi) 2.12 INDIAN OVERSEAS BANKS HIGHEST-EVER CREDIT GROWTH: During the year ended March 31, 1005, Indian Overseas Bank (IOB) recorded the highest-ever credit growth of Rs.4, 981 crores. This, coupled with efficient asset liability management enabled it to post perceptible improvement in profitability and other key areas of operations. The credit-deposit ratio peaked to 58.96 percent (49.82 percent), a rise of nearly 1000 basis points during the year. Gross advances moved up to Rs.26, 274 crores from Rs.21,293 crores, while gross deposits increased to Rs.44,241 crores from Rs.41,482 crores. (Industrial Herald) 2.13 KISSAN CREDIT FOR THE NEEDS FARMERS SOON The Government, to the needy farmers has distributed Kissan Credit cards throughout the rural area. The card is issued to farmers for the overall development of former. Kissan card scheme has been implemented to ensure timely credit for the farmers on the basis of their land holding. (Source: Bank bulletin)

60

III. METHODOLOGY

This chapter gives methodology used in "credit appraisal and monitoring to agriculture loan" at SCDCC bank. This report was prepared with the help of both primary and secondary data. 3.1 LOCATION OF THE STUDY: The study was conducted in South Canara District Central Co-operative Bank Ltd., Kodialibail. 3.2 DATA COLLECTION METHOD: In order to fulfill the objective of the study the data was collected from both the primary and secondary source. 3.2.1 Secondary Data Secondary data was collected from the following sources. Text book News paper Journal

3.2.2. Primary Data: Primary data was collected through personal interaction with employee at SCDCC bank.

61

3.3 TOOLS AND TECHNIQUE FOR COLLECTION AND ANALYSIS The data collected through personal interaction employees and using secondary data. 3.4 DURATION OF THE STUDY The duration of study is 6 weeks. 3.5 LIMITATIONS Study was conducted only on the basis of data provided by bank. Time was limited to conduct a detail study. Parameters taken for review of performance are limited. Findings and suggestion drawn are applicable only to SCDCC bank and this can't be generalized.

62

IV. RESULTS AND DISCUSSIONS

4.1 INTRODUCTION The SCDCC Bank provides agriculture credits to farmers of the district through PAC's. It sanctions crop loan and medium term loan for various purposes to the agriculturist depending on their necessity and repaying capacity. The farmers need to apply for different types of loan through concerned primary agriculture cooperative societies by becoming the nominal members. The bank provides loan at concessional rate of interest to different farmers depending on size of agriculture holding and viability. Small farmers and marginal farmers get preferences in sanctioning the loan at lower rate of interest SCDCC bank also provided credit facilities to PACs for various purposes. 4.2 TYPES OF LOANS PROVIDED BY BANK: The bank provides following types of loan under Kissan credit card. Crop loan for the entire district. Crop loan for plantation crops like, areca nut, pepper, cardamom, banana etc., Other crop loan for the entire district. Bank also provides MT loan for Specified and unspecified purposes, under the direction of NABARD MT loans for specified purposes are: Pump set Tractor, Power tiller and agriculture implements Well repair, Gobar gas, irrigation etc. Bank also provides MT loan for different purpose other than above specified.

63

4.3 RATE OF INTEREST Bank changed differential rate of interest for PACs and farmers depending on purpose and the amount. The table 4.1 shows the rate of interest for kisan credit card loan. 4.4 APPLICATION For the purpose of acquiring agriculture loan, application from members of PACs must be submitted in the prescribed from to the respective societies. Application contains following details: Name and age, address of the applicant. Details of membership and amount of shares. Details of land holding and crops. Details of repayment of loan through marketing. Details at loan acquired from other sources. Details of amount required. These applications from the members are accepted, scrutinize and recommended by the managing committee of respective society and forwarded to branches of SCDCC bank. The bank will appoint supervisors to verify the application on the basis of repaying capacity land records and genuineness of the purpose etc. Depending on their observation loan amount is recommended by supervisors and send to head office for sanction. Application will be placed for sanctioning in loan sub committee of head office and sanction order if approved will be sent to PACs through respective branches. Loans will be disbursed from PACS depending on nature of crop either in one installment for crop loan or up specified by bank.

64

Table 4.1 The Present Rate of Interest on Loans 1. 2. 3. 4. 5. 6. KCC Loan to co-op societies MTA loan to co-op societies Non Agricultural purpose loan Cash credit loans CCL (Weavers CS) Direct loans Housing/Vehicles/Business Salary Earners/Consumer durables Travel loans Educational loans Note: KCC - Kisan credit card MTA - Medium Tern Agriculture 14% 12.5% 11.5% 8% to 11.75% 10.5% to 12.5% 12.5% 11.5% to 14.5% 11% 11% to 14%

65

4.5 DOCUMENT TO BE ATTACHED TO THE SOCIETY Members applying for loan should enclose following documents along with their application.

Record of rights obtained from village accountant containing area of land, survey no. etc., Normal credit statement Cultivation register Estimation of income from crops Promissory note Agreement form No due certificate etc.,

4.6 SECURITY FOR LOAN For crop loan following securities are accepted: Land Crop 1 or 2 sureties

For Medium Term Loan Land

Normally level is accepted as security from concerned member of PACS. In case of default agriculture income and land are attached till the amount is recovered. 4.7 MAXIMUM LIMIT FOR CROP LOAN Maximum amount of loan granted to the members. Following is the details of loan that can be sanctioned for different crops under Kissan credit loan for 1 acre of land. The table 4.2 Scale of finance for crop loan.

66

Table 4.2. Scale of Finance for Crop Loan Types of Crops 1. Paddy 2. Plantation crop [Arecanut] 3. Coconut 4. Sugarcane 5. Banana Crop Amount per Acres Rs. 6500 Rs. 20,000 Rs. 6000 Rs. 12,000 Rs. 16,000

67

OBJECTIVE 3 4.8 SPECIAL SCHEMES OF THE BANK Special schemes that are provided by the Bank:

1.

Insurance Linked Current/ Savings Deposits Scheme: This scheme is applicable to the account holders who are in the age group of

10 to 70 years. The account is applicable to the individuals only. The salient features of the scheme are: (a) The Individual account holder who has to maintain balance in the account at the minimum of Rs. 10,000/- regularly for 90 days before the occurrence of the accident. (b) In case of accidents the account holder or his nominee will get up to Rs. 15,000/- hospitalization expenditure Rs. 75,000/- for permanent disability and Rs. 1.5 lakhs in case of death.

2.

Students Savings Deposit Scheme: This scheme is applicable to the students of any age groups provided they can

withdraw themselves from their accounts, if they are not less than age of 12 years. The minimum deposit to open their account is Rs. 25/- the officer of the Bank will go to school and collect the deposit from the students regularly. 3. Women Development Cell: It was established in the year 1997 with the financial support of NABARD with the main aim of financial development of the women to set up their own selfemployment units. 31415 women have obtained loan to the tune of Rs. 8506 lakhs

68