Weekly Commentary

Weekly Commentary

Uploaded by

api-150779697Copyright:

Available Formats

Weekly Commentary

Weekly Commentary

Uploaded by

api-150779697Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Weekly Commentary

Weekly Commentary

Uploaded by

api-150779697Copyright:

Available Formats

Weekly Market Update

Robert Davies, Patersons Securities

Follow me on Twitter @davies_robert

1/10/2012 10:42:49 AM Page 1 of 3

Weekly Commentary

Week ending 28 September 2012

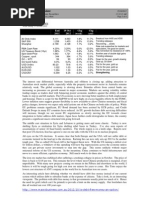

End 2011

All Ords Index S&P 500 Shanghai RBA Cash Rate US Treasury Bond (10yr) Spot Gold Price Copper, spot Oil WTI Oil/Gold Ratio USD Index AUDUSD EURUSD USDCNY 4,111 1,258 2,199 4.25% 1.88% 1,563 344 99 6.3% 80.23 1.022 1.294 6.299

28 Sept 2012

4,406 1,441 2,086 3.50% 1.64% 1,772 376 92 5.2% 80 1.04 1.29 6.29

Chg (week)

-0.5% -1.3% 3.0% 0.0% -6.7% 0.0% -0.8% 0.0% 0.0% 0.8% -0.7% -0.9% -0.4%

Chg (ytd)

7.2% 14.5% -5.1% -17.6% -12.9% 13.4% 9.4% -6.6% -17.6% -0.4% 1.6% -0.6% -0.2%

Still holding at 4400 QE Stimulus pushing on a string Bounce off 2000, still in downtrend Expect more rate cuts this year Yields turn and go lower again, risk off Gold continues to shine Oil over $100 is US recession signal Stable, but trending lower short term RBA to cut rates in attempt to lower A$ Euro..surviving This is significant more later on this

Barack Obama continues to lead in the polls in the USA presidential race and appears to be pulling away from Mitt Romney. Three debates are scheduled for the next month, but in my view its unlikely Romney (as skilled as he is) will be able to out-debate Barack Obama. The election is held in the second week of November. The proxy war between Saudi Arabia and Iran continues to rage in Syria but looks to have settled down to a slow burn. The Saudi royal family is fighting for its survival as the old guard has not successfully guaranteed its transition to a younger generation. With assasination taking place and the Petrodollar under threat from the Feds quantitative easing policies, the Saudi regime looks shaky. The Russians and Chinese are now trading crude oil outside of the US Dollar zone. Strikes continue in South Africa, materially effecting the world supply of precious metals. Australia and South Aftrica are the worlds swing producers and exporters of gold. Removal of a significant portion (estimated at up to 40%) of South Africas production will have an effect on the Gold price. The Australian economy continues to stagnate under the effects of the strong A$. Despite generationally low interest rates, I expect further rate cuts from the RBA over the course of the next 6-9 months. The next rate cut could come in early October. China has announced its leadership transition will take place in November (previously October). They now appear to have personality issues resolved and will move forward with growth and investment plans in a few months. Greece and Spain continue in the news with debt and spending problems. Riots have broken out repeatedly in both countries as workers continue to fight against benefit cuts in order for the country to repay its loans.

Economy

From Markit Economics German IFO Business Climate index down to 101.4 in Sept. Reuters consensus was 102.5 Italian retail sales were down -0.2% m/m in July, Fell -3.2% on the year UK retail sales improve slightly in September Spanish retail sales down -2.1% y/y in August, the 26th consecutive month of falls Austrian Manufacturing PMI down to 39 month low in September US GDP for Q2 is revised sharply lower to 1.3% q/q (annualised). Durable goods orders drop -13.2% in August. Largest drop in durable goods since January 2009 Japan manufacturing PMI at 48.0 in Sept, up from 47.7 in August. Eurozone inflation 2.7% in September, Italian inflation at 3.4% Greek retail sales fell -9.1% on the year to July. Inflation accelerates to 6.5%

Weekly Market Update

Robert Davies, Patersons Securities

Follow me on Twitter @davies_robert

1/10/2012 10:42:49 AM Page 2 of 3

Investment Strategy

Last week I wrote The market continues to inch higher, now over 4400 resistance, but not yet convincingly so. Monetary easing (money printing) in the US and Europe continue to provide support for risk markets. However, these market moves are on low volumes. Low volume rallies are typically a harbinger of corrections due to unstable foundations. This weeks comment, The market continues to trade sideways around the 4400 level. This is an almost unprecedented length of time that the market has been unable to break this level without a significant correction. In the last two years, we have hit this level more than 10 times without a breakthrough. Truly remarkable.

All Ords, 12 month view

Chart of the Week

Here is a chart of the USD x Renmimbi exchange rate over the last two years. For most of this period the Chinese were increasing the value of the RMB vs the dollar. In the middle of 2011 they stopped the currency appreciation because their export industries were hurting. It now looks like the RMB appreciation is back on and the USD is devaluing again. You would expect this to happen with Quantitative Easing. More paper money means it is worth less. A depreciating currency means consumers lose purchasing power and the economy stagnates. This is happening in the USA. Conversely, the Chinese are not printing money, their consumers are gaining purchasing power, and if they continue to appreciate the RMD, their economy should recover first as the consumer spends up big.

Weekly Market Update

Robert Davies, Patersons Securities

Follow me on Twitter @davies_robert

1/10/2012 10:42:49 AM Page 3 of 3

Weekly Stockwatch

I have many clients invested in the stock Orecobre (ORE). Orecobre is developing a lithium mine and processing facility in Argentina in a joint venture arrangement with Toyota Tshshu, and a part interest by the Argentinian government. This will be the first new major lithium resource in the world for decades. It is a low cost, lithium from brine operation. After hitting $4 in 2011, the stock fell heavily as they negotiated royalty arrangements, financing deals, and solidified their business plans. In the last few weeks they have solidified all the approvals they need and this project is going ahead. The share price has now broken above resistance at $2 and is moving up nicely. The stock remains a buy.

You might also like

- iAL Economics Unit 4 Specimen Paper QPDocument24 pagesiAL Economics Unit 4 Specimen Paper QPSamuel KiruparajNo ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Gold: - A Commodity Like No OtherDocument6 pagesGold: - A Commodity Like No OtherVeeresh MenasigiNo ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- 2014 October 17 Weekly Report UpdateDocument4 pages2014 October 17 Weekly Report UpdateAnthony WrightNo ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Regulators Shut 5 Banks As 2010 Tally Hits 78: 3 Fla. Banks, 1 Each in Nev., Calif. Shut Down (AP)Document15 pagesRegulators Shut 5 Banks As 2010 Tally Hits 78: 3 Fla. Banks, 1 Each in Nev., Calif. Shut Down (AP)Albert L. PeiaNo ratings yet

- Global Investor: Highlights of The International Arena: Executive SummaryDocument7 pagesGlobal Investor: Highlights of The International Arena: Executive SummarySulakshana De AlwisNo ratings yet

- Inside Debt: U.S. Markets Today Chart of The DayDocument8 pagesInside Debt: U.S. Markets Today Chart of The DaydmaximNo ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Market Update As of 31 Aug (Eng)Document10 pagesMarket Update As of 31 Aug (Eng)Alex KwokNo ratings yet

- 8-22-11 Breakout in Precious MetalsDocument4 pages8-22-11 Breakout in Precious MetalsThe Gold SpeculatorNo ratings yet

- Standard Jan042012Document6 pagesStandard Jan042012Mohmad AnsaryNo ratings yet

- Review & Focus: The Currencies at A GlanceDocument4 pagesReview & Focus: The Currencies at A GlanceSanjay SilwadiyaNo ratings yet

- Gold Public Monthly Commentary 2011 05Document3 pagesGold Public Monthly Commentary 2011 05Sara CostaNo ratings yet

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470No ratings yet

- Will Gold Continue To Shine?: MarketDocument6 pagesWill Gold Continue To Shine?: MarketdpbasicNo ratings yet

- Week in Review: Gold Fundamentals Are Intact. Current Prices Are A Buying Opportunity!Document26 pagesWeek in Review: Gold Fundamentals Are Intact. Current Prices Are A Buying Opportunity!Paolo GerosaNo ratings yet

- 2/01/2016 - Good Morning From Chicago - : Learn More About Our Metals ServicesDocument1 page2/01/2016 - Good Morning From Chicago - : Learn More About Our Metals ServicesJaeson Rian ParsonsNo ratings yet

- Buzz (Metal) Oct28 11Document3 pagesBuzz (Metal) Oct28 11Mishra Anand PrakashNo ratings yet

- Base Metals Weekly - 03102011Document6 pagesBase Metals Weekly - 03102011luckydhruvNo ratings yet

- MRE120106Document3 pagesMRE120106naudaslietas_lvNo ratings yet

- ANZ Commodity Daily 605 180412Document5 pagesANZ Commodity Daily 605 180412ChrisBeckerNo ratings yet

- Daily Metals Newsletter - 01-29-16Document1 pageDaily Metals Newsletter - 01-29-16Jaeson Rian ParsonsNo ratings yet

- IBT Markets Outlook 31 January 2012Document3 pagesIBT Markets Outlook 31 January 2012Lawrence VillamarNo ratings yet

- Weekly Commodity Review - 7 - 11 May 2012Document1 pageWeekly Commodity Review - 7 - 11 May 2012gordjuNo ratings yet

- The Commodity Investor S 102885050Document33 pagesThe Commodity Investor S 102885050Parin Chawda100% (1)

- Goldtrades - Info Your Gold Information Portal Daily Gold Report Know - Learn - Trade 1Document7 pagesGoldtrades - Info Your Gold Information Portal Daily Gold Report Know - Learn - Trade 1Muhammad Billal ButtNo ratings yet

- Australian Dollar Outlook 07/12/2011Document1 pageAustralian Dollar Outlook 07/12/2011International Business Times AUNo ratings yet

- Commodity and CurrencyDocument5 pagesCommodity and Currencyvinay_leo11No ratings yet

- Beta Times Markets Edition11Document4 pagesBeta Times Markets Edition11VALLIAPPAN.PNo ratings yet

- ANZ Commodity Daily 720 081012Document8 pagesANZ Commodity Daily 720 081012anon_370534332No ratings yet

- Daily Metals Newsletter - 01-27-16Document1 pageDaily Metals Newsletter - 01-27-16Jaeson Rian ParsonsNo ratings yet

- Slightly Tighter Norwegian Credit Standards: Morning ReportDocument3 pagesSlightly Tighter Norwegian Credit Standards: Morning Reportnaudaslietas_lvNo ratings yet

- U.S. Economy Continued To Expand: Morning ReportDocument3 pagesU.S. Economy Continued To Expand: Morning Reportnaudaslietas_lvNo ratings yet

- All That Glitters... The Financial Market Implications of Competitive DevaluationDocument12 pagesAll That Glitters... The Financial Market Implications of Competitive DevaluationJohn ButlerNo ratings yet

- ANZ Commodity Daily 599 050412Document5 pagesANZ Commodity Daily 599 050412ChrisBeckerNo ratings yet

- SNL Metals & Mining - State of The Market Mining and Finance ReportDocument46 pagesSNL Metals & Mining - State of The Market Mining and Finance ReportInvestor Relations Vancouver100% (1)

- CTM 201205Document31 pagesCTM 201205ist0No ratings yet

- Copper Drops To 9 Month Low Level On Europe Concerns: Commodities-Copper, Crude Oil Lead Commodities LowerDocument4 pagesCopper Drops To 9 Month Low Level On Europe Concerns: Commodities-Copper, Crude Oil Lead Commodities LowerNityanand GopalikaNo ratings yet

- Market Outlook Report 18 March 2013Document4 pagesMarket Outlook Report 18 March 2013zenergynzNo ratings yet

- LINC Week 10Document8 pagesLINC Week 10Anonymous pgsgpgwvxiNo ratings yet

- Swedish Inflation Drops: Morning ReportDocument3 pagesSwedish Inflation Drops: Morning Reportnaudaslietas_lvNo ratings yet

- Gold and Bitcoin 2018Document5 pagesGold and Bitcoin 2018Ankur ShardaNo ratings yet

- The Mystery of Rising Commodity Prices: in This EditionDocument6 pagesThe Mystery of Rising Commodity Prices: in This EditionalphathesisNo ratings yet

- SEB's Commodities Monthly: Crude Oil Back On The Radar ScreenDocument20 pagesSEB's Commodities Monthly: Crude Oil Back On The Radar ScreenSEB GroupNo ratings yet

- Hadrian BriefDocument11 pagesHadrian Briefspace238No ratings yet

- Global Macro Daily LONDON Open (2014!01!16)Document14 pagesGlobal Macro Daily LONDON Open (2014!01!16)BlundersNo ratings yet

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697No ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- ME Class 11-12Document25 pagesME Class 11-12Dixith GandheNo ratings yet

- Global MigrationDocument2 pagesGlobal MigrationAngela RicafortNo ratings yet

- Module 4 Lesson 1 To 3 Globalization of Economic RelationsDocument47 pagesModule 4 Lesson 1 To 3 Globalization of Economic RelationsDan Czar T. JuanNo ratings yet

- IB Economics: International Economics CommentaryDocument8 pagesIB Economics: International Economics CommentaryMomina Amjad94% (16)

- Group 10... FedEx IndiaDocument3 pagesGroup 10... FedEx Indiaamit_vaghelaNo ratings yet

- Conclusion On Bpo Industry IndiaDocument1 pageConclusion On Bpo Industry IndiapardeepkayatNo ratings yet

- Prezentare Competitivitate FinDocument18 pagesPrezentare Competitivitate FinAndrei ComandariNo ratings yet

- Instruments of Trade PolicyDocument8 pagesInstruments of Trade PolicyBhupendra SengarNo ratings yet

- MGT520 Mid Term MCQS Downloaded Form VurankDocument12 pagesMGT520 Mid Term MCQS Downloaded Form Vurankcute26855No ratings yet

- Lapisan Gross UpDocument15 pagesLapisan Gross UpRizki ArvitaNo ratings yet

- Indian Banking SystemDocument10 pagesIndian Banking SystemSony ChandranNo ratings yet

- Build Illinois Homes Tax Credit Fact SheetDocument2 pagesBuild Illinois Homes Tax Credit Fact SheetDean OlsenNo ratings yet

- Bags - CLNDocument1 pageBags - CLNRiane Mae CastilloNo ratings yet

- QA-23. Valuation of An MNCDocument1 pageQA-23. Valuation of An MNChy_saingheng_7602609No ratings yet

- 1905 SMGR0519Document1,010 pages1905 SMGR0519RiptaRatuDjuwitaNo ratings yet

- IRL 3109 - Lecture 3 (2020-11-19)Document6 pagesIRL 3109 - Lecture 3 (2020-11-19)nolissaNo ratings yet

- New Era For The Philippines - Membership in The BEPS Inclusive FrameworkDocument6 pagesNew Era For The Philippines - Membership in The BEPS Inclusive FrameworkEllis Louise LansanganNo ratings yet

- CHAPTER 3 Structuring The Global EconomyDocument4 pagesCHAPTER 3 Structuring The Global Economysharief.aa90No ratings yet

- Tax Invoice: Enertech Electric Enterprises PVT LTD No S-2201073Document1 pageTax Invoice: Enertech Electric Enterprises PVT LTD No S-2201073karthik achudhanNo ratings yet

- Notification 11 2021Document2 pagesNotification 11 2021sudhagar palaniNo ratings yet

- 1A Macro Environmental Analysis WorksheetDocument8 pages1A Macro Environmental Analysis WorksheetshepimentelNo ratings yet

- Lesson 3 Market IntegrationDocument28 pagesLesson 3 Market IntegrationAngelique ChuaNo ratings yet

- On Housing Backlog: Rising DemandDocument4 pagesOn Housing Backlog: Rising DemandAB AgostoNo ratings yet

- Data Sets For MLRDocument9 pagesData Sets For MLRkarthika sureshNo ratings yet

- Relief From Double TaxationDocument6 pagesRelief From Double TaxationvikkyNo ratings yet

- Summary Balance of PaymentsDocument14 pagesSummary Balance of PaymentsFaisal JalalNo ratings yet

- Ireland Financial CrisisDocument15 pagesIreland Financial Crisissantaukura2No ratings yet

- Presentations 2024Document4 pagesPresentations 2024carlaNo ratings yet

- Tax Invoice/Bill of Supply/Cash MemoDocument1 pageTax Invoice/Bill of Supply/Cash MemoShivam bohemia raja harzaiNo ratings yet