Weekly Overview

Weekly Overview

Uploaded by

api-150779697Copyright:

Available Formats

Weekly Overview

Weekly Overview

Uploaded by

api-150779697Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Weekly Overview

Weekly Overview

Uploaded by

api-150779697Copyright:

Available Formats

Weekly Market Update

Robert Davies, Patersons Securities

Follow me on Twitter @davies_robert

3/09/2012 11:54:16 AM Page 1 of 4

Weekly Overview

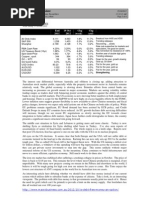

Week ending 31 August 2012

End 2011

All Ords Index S&P 500 Shanghai RBA Cash Rate US Treasury Bond (10yr) Spot Gold Price Copper, spot Oil WTI Oil/Gold Ratio USD Index AUDUSD EURUSD USDCNY 4,111 1,258 2,199 4.25% 1.88% 1,563 344 99 6.3% 80.23 1.022 1.294 6.299

31 Aug 2012

4,339 1,406 2,047 3.50% 1.55% 1,691 346 96 5.7% 81.22 1.032 1.257 6.350

Chg (week)

-0.8% -0.4% -2.2% 0.0% -8.1% 1.3% -0.8% 0.3% -0.9% -0.5% -0.8% 0.6% -0.1%

Chg (ytd)

5.5% 11.8% -6.9% -17.6% -17.4% 8.2% 0.6% -2.4% -9.8% 1.2% 1.0% -2.9% 0.8%

Peaked at 4400 again Rally has been on low volume (weak) Not a good signal for Chinese economy

Rally in equties not confirmed by bonds Breakout from 12 month consolidation Consolidating

Steady, despite QE, but watch Gold High dollar hurting Australian industry Despite problems, currency doing OK Weak Renmimbi, Fed not happy

Chinese PMI came in at 49.2 over the weekend, signalling contraction in manufacturing (under 50). This confirms a string of other data and anecdotal information that the Chinese economy is substantially weakening. Now the catalyst for this may be largely a result of the political uncertainty going into the power changeover at the Politburo in October. While its known who will be chosen at the highest level, its largely unknown who acquires the next 2-4 levels of power. Therefore, without this political certainty, projects are not commenced, some projects are halted, business doesnt make decisions until they know where they stand in the power heirarchy. The price of Iron Ore has collapsed due to lack of demand from China (as projects are cancelled). Thirty percent of world production comes in at over $100/ ton and most of that is from China. With the price now $90/ton most of the Chinese production is sub-economic. However as it is 50% state owned, its likely they will keep producing. For the Aussie producers, Rio holds the lowest costs (under $50/ton) and will be the last man standing if the price drops from here. The Aussie producers will survive this price collapse, but the long term price is likely to now stay between $80-$100, squeezing margins and making growth and investment strategies unrealistic. Im hoping to see a bottoming out of this market in September. More on this thematic below. Ben Bernanke gave his much anticipated speech at the Central Bankers conference in Jackson Hole on Friday. He basically rehashed the history of cerntral bank interventions over the post 2008 period without commiting himself to more Quantitative Easing (also not saying he wouldnt do it). So the market is basically left to wander without direction, until the election in November. Gold spiked up following the speech and has now broken out of the 12m consolidation zone. The Republican National Convention in Tampa, Florida came to an end. Obama still appears to have a slight lead in the polls with the Democratic convention coming up where they will have a turn at picking apart their opponents (as the Republicans just did). One of the interesting platform positions the Republicans took was the establishment of a Gold Commission to look into returning the US monetary system to a hard currency or sound money basis. When they look at the numbers Im sure if will scare them off, the US Gold reserves vs M1 money supply would be well over $5000 per oz, a level which no politician would want to deliver the bad news to holders of US Dollars, although the Gold bugs would be very happy. Europe is inching towards its next catalyst, the German constitutional court ruling (12 September) on the validity of German participation in the Eurozone bailouts and bank restructurings. Bond yields and Credit Default swaps are in a holding pattern at the moment. I cant see anything happending before the 12 of September in Europe. I expect the plans to go forward. Im hearing the Italians have already threatened to exit the Euro and devalue the Lira if they dont get debt relief. This would cause a significant problem for German industry (more competitition) and a nasty outcome for European solidarity.

Weekly Market Update

Robert Davies, Patersons Securities

Follow me on Twitter @davies_robert

3/09/2012 11:54:16 AM Page 2 of 4

France nationalised its second largest home lender over the weekend, Credit Immobilier, as the European banking system continues its problems. While I believe the Euro will survive the current problems in Europe, the banks, stuck with billions of government bonds, are another story. Angela Merkel was in China this week sealing a deal for the German and Chinese financial systems to work directly without utilising the US Dollar in trade transactions. This is another nail in the coffin for the US Dollar as worlds reserve currency. We now have most of Asia, Germany, Japan, Brazil, and many other countries well on their way to fortifying alternative arrangements without the US$.

Economy

From Markit Economics US Factory orders for July rise 2.8% Chicago area PMI at 53.2, growing Japan Manufacturing PMI down to 16-month low in August, at 47.7 German Unemployment steady at 6.8% US second quarter economic growth revised higher to 1.7% from 1.5% US PMI came in at 51.9 continuing to show weak expansion of the US economy. From Dow Jones China Non-Mfg PMI at 56.3 vs 55.6 in July. Non mfg economy growing, mfg slowing Japanese July industrial output down -1.2% on prior month Korean Industrial Output -1.6% on prior month, July industrial output +0.3% on year Other US Case Shiller house price index prints with a annual gain of 0.5%, the first monthly yearon-year gain in two years Spanish GDP falls 0.4% in Quarter 2 from the previous quarter. (Sky news) US Weekly jobless claims rise to 372,000 (reuters). Stagnant labor market

All Ords Charting

Last week I wrote We pushed up to the 4400 level and failed (once again) to push through. Valuations in some sectors are now stretched (banks) while resource stocks are under pressure due to economic stagnation around the world. The catalyst to push through 4400 would be a favourable ruling from the German Constitutional Court on 12 September in support of the bailout bonanza. A negative ruling would see a selloff from here. Expect a ranging market until the ruling. Resources stocks continue to get belted by the collapsing Iron Ore price while banks are drifting lower. Weve now fallen well off the 4400 resistance level and look to be going lower this week as the bad news about the Australian economy persists.

Weekly Market Update

Robert Davies, Patersons Securities

Follow me on Twitter @davies_robert

3/09/2012 11:54:16 AM Page 3 of 4

Weekly Stockwatch

As noted above and in previous newsletters, the Iron Ore price has collapsed below the $100 mark which had been seen as the floor price due to 30% of world production which has a higher costs base. The below chart (from Atlas Iron) shows the iron ore cost curve. Rio Tinto occupies the large green area at the left side of the curve. The Chinese and Indian producers are to the right.

Here is the Iron Ore price chart, which now has the spot price at $90

So is it time to buy yet? Considering the collapse in commodity prices and the high Australian dollar, positions in iron ore stocks can now be considered. However, in the short term, its likely stocks go lower. Heres the 5 year chart of Rio Tinto below. Long term investors should be getting ready.

Weekly Market Update

Robert Davies, Patersons Securities

Follow me on Twitter @davies_robert

3/09/2012 11:54:16 AM Page 4 of 4

Chart of the Week AUSTRALIAN DOLLAR LOOKS OVERVALUED

The Australian dollar continues to look overvalued against the US dollar held in place by foreign fund inflow chasing higher yields in our Bond and other markets. Foreign ownership of Australian Government Bonds is approximately 79%. Generally, the Australian dollar has a reasonable correlation with the Industrial metals market (the chart below shows this - Industrial Metals against the A$). With coal and iron ore prices under pressure, and Residential construction off 1.9% in the June QTR back to 2002 levels, high household debt and housing prices, generally trending lower, scope exists for the Australian dollar to trade lower as the RBA is pressured to move rates down from 3.5% into 2013. Likewise the All Ordinaries (XAO) is up against the ten times tested 4400 level, while global financial risks remain considerable. I see scope for stimulatory expectations from foreign central banks to disappoint. Ways to partially cover Australian exposure and global debt risk include an allocation to Gold Bullion through either a purchase of phyiscal bullion or through and Exchange trades fund. The ETFs: GOLD.ASX, PMGOLD.AXW, ETPMAG.AXW, and USD.AXW.

You might also like

- 1920s and 1930s Unit Test - FinalDocument5 pages1920s and 1930s Unit Test - Finalapi-249168521100% (1)

- BioPharma Case Discussion QuestionsDocument3 pagesBioPharma Case Discussion QuestionsBonchoBoncho50% (2)

- Case Marriott A and Flinder ValvesDocument6 pagesCase Marriott A and Flinder ValvesGerardo FumagalNo ratings yet

- Weekly CommentaryDocument3 pagesWeekly Commentaryapi-150779697No ratings yet

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Copper Drops To 9 Month Low Level On Europe Concerns: Commodities-Copper, Crude Oil Lead Commodities LowerDocument4 pagesCopper Drops To 9 Month Low Level On Europe Concerns: Commodities-Copper, Crude Oil Lead Commodities LowerNityanand GopalikaNo ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Base Metals Weekly - 03102011Document6 pagesBase Metals Weekly - 03102011luckydhruvNo ratings yet

- Regulators Shut 5 Banks As 2010 Tally Hits 78: 3 Fla. Banks, 1 Each in Nev., Calif. Shut Down (AP)Document15 pagesRegulators Shut 5 Banks As 2010 Tally Hits 78: 3 Fla. Banks, 1 Each in Nev., Calif. Shut Down (AP)Albert L. PeiaNo ratings yet

- 8-15-11 Steady As She GoesDocument3 pages8-15-11 Steady As She GoesThe Gold SpeculatorNo ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Gold: - A Commodity Like No OtherDocument6 pagesGold: - A Commodity Like No OtherVeeresh MenasigiNo ratings yet

- LINC Week 10Document8 pagesLINC Week 10Anonymous pgsgpgwvxiNo ratings yet

- 8-22-11 Breakout in Precious MetalsDocument4 pages8-22-11 Breakout in Precious MetalsThe Gold SpeculatorNo ratings yet

- Global Investor: Highlights of The International Arena: Executive SummaryDocument7 pagesGlobal Investor: Highlights of The International Arena: Executive SummarySulakshana De AlwisNo ratings yet

- 3 Signs of A Sucker Rally Simon Maierhofer After ExaminingDocument28 pages3 Signs of A Sucker Rally Simon Maierhofer After ExaminingAlbert L. PeiaNo ratings yet

- August 162010 PostsDocument259 pagesAugust 162010 PostsAlbert L. PeiaNo ratings yet

- The Forecasts:: Bank of England: Usa Faces Same Problems As Greece The Crisis Is On!Document10 pagesThe Forecasts:: Bank of England: Usa Faces Same Problems As Greece The Crisis Is On!Albert L. PeiaNo ratings yet

- Standard Jan042012Document6 pagesStandard Jan042012Mohmad AnsaryNo ratings yet

- Come On! The Familiar B S Story From The Frauds On Wall StreetDocument12 pagesCome On! The Familiar B S Story From The Frauds On Wall StreetAlbert L. PeiaNo ratings yet

- Come On! The Familiar B S Story From The Frauds On Wall StreetDocument11 pagesCome On! The Familiar B S Story From The Frauds On Wall StreetAlbert L. PeiaNo ratings yet

- 2014 October 17 Weekly Report UpdateDocument4 pages2014 October 17 Weekly Report UpdateAnthony WrightNo ratings yet

- Buzz (Metal) Oct28 11Document3 pagesBuzz (Metal) Oct28 11Mishra Anand PrakashNo ratings yet

- May 122010 PostsDocument13 pagesMay 122010 PostsAlbert L. PeiaNo ratings yet

- 1/13/2016 - Good Morning From Chicago - : Learn More About Our Metals ServicesDocument1 page1/13/2016 - Good Morning From Chicago - : Learn More About Our Metals ServicesJaeson Rian ParsonsNo ratings yet

- Gold and Silver Opportunity July 2011Document8 pagesGold and Silver Opportunity July 2011chiefNo ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- IBT Markets Outlook 31 January 2012Document3 pagesIBT Markets Outlook 31 January 2012Lawrence VillamarNo ratings yet

- Lane Asset Management Stock Market Commentary October 2011Document9 pagesLane Asset Management Stock Market Commentary October 2011Edward C LaneNo ratings yet

- Buying Opportunity or Sucker Rally?: Simon Maierhofer (Archived On Website), On Tuesday June 22, 2010, 3:57 PM EDTDocument26 pagesBuying Opportunity or Sucker Rally?: Simon Maierhofer (Archived On Website), On Tuesday June 22, 2010, 3:57 PM EDTAlbert L. PeiaNo ratings yet

- Week Summary: Macro StrategyDocument10 pagesWeek Summary: Macro StrategyNoel AndreottiNo ratings yet

- Daily Metals Newsletter - 01-27-16Document1 pageDaily Metals Newsletter - 01-27-16Jaeson Rian ParsonsNo ratings yet

- 2/01/2016 - Good Morning From Chicago - : Learn More About Our Metals ServicesDocument1 page2/01/2016 - Good Morning From Chicago - : Learn More About Our Metals ServicesJaeson Rian ParsonsNo ratings yet

- August 232010 PostsDocument293 pagesAugust 232010 PostsAlbert L. PeiaNo ratings yet

- Bull, Bear, Bullion and Prediction Analysis: Dr. D. R. Rajashekhara Swamy & Rangaswamy A.SDocument6 pagesBull, Bear, Bullion and Prediction Analysis: Dr. D. R. Rajashekhara Swamy & Rangaswamy A.SrnaganirmitaNo ratings yet

- 2/10/2016 - Good Morning From Chicago - : Learn More About Our Metals ServicesDocument1 page2/10/2016 - Good Morning From Chicago - : Learn More About Our Metals ServicesJaeson Rian ParsonsNo ratings yet

- January 272010 PostsDocument7 pagesJanuary 272010 PostsAlbert L. PeiaNo ratings yet

- May 112010 PostsDocument10 pagesMay 112010 PostsAlbert L. PeiaNo ratings yet

- Gold Forecast 2010Document12 pagesGold Forecast 2010Mohamed Said Al-QabbaniNo ratings yet

- Breakfast With Dave: While You Were SleepingDocument12 pagesBreakfast With Dave: While You Were Sleepingrichardck61No ratings yet

- March 152010 PostsDocument11 pagesMarch 152010 PostsAlbert L. PeiaNo ratings yet

- May 252010 PostsDocument14 pagesMay 252010 PostsAlbert L. PeiaNo ratings yet

- FDIC Call Stress Tests "Sham", at Least Someone Is Honest: April 9, 2009Document10 pagesFDIC Call Stress Tests "Sham", at Least Someone Is Honest: April 9, 2009Ari BabakNo ratings yet

- Market Update As of 31 Aug (Eng)Document10 pagesMarket Update As of 31 Aug (Eng)Alex KwokNo ratings yet

- Lane Asset Management Stock Market Commentary September 2011Document10 pagesLane Asset Management Stock Market Commentary September 2011eclaneNo ratings yet

- Daily Metals Newsletter - 01-29-16Document1 pageDaily Metals Newsletter - 01-29-16Jaeson Rian ParsonsNo ratings yet

- Goldtrades - Info Your Gold Information Portal Daily Gold Report Know - Learn - Trade 1Document7 pagesGoldtrades - Info Your Gold Information Portal Daily Gold Report Know - Learn - Trade 1Muhammad Billal ButtNo ratings yet

- Aden ForecastDocument2 pagesAden ForecastClaus DettelbacherNo ratings yet

- Roubini: Get Ready For The Double Dip!Document12 pagesRoubini: Get Ready For The Double Dip!Albert L. PeiaNo ratings yet

- The Global Crash of 2015 and What You Can Do to Protect YourselfFrom EverandThe Global Crash of 2015 and What You Can Do to Protect YourselfNo ratings yet

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697No ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Capital Budgeting: Kiran ThapaDocument34 pagesCapital Budgeting: Kiran ThapaRajesh ShresthaNo ratings yet

- Name:: Assessment of Working Capital Requirements Form Ii - Operating Statement M/S Amounts in RsDocument12 pagesName:: Assessment of Working Capital Requirements Form Ii - Operating Statement M/S Amounts in RsprajeshguptaNo ratings yet

- Oracle Complex PO RetainageDocument19 pagesOracle Complex PO RetainageabiyeasamenewNo ratings yet

- Portuguese Economic Performance 1250-2000Document17 pagesPortuguese Economic Performance 1250-2000Paula Danielle SilvaNo ratings yet

- Rate of Return Analysis: Week 11Document25 pagesRate of Return Analysis: Week 11Sonia FausaNo ratings yet

- Unit I - Working Capital PolicyDocument16 pagesUnit I - Working Capital Policyjaskahlon92No ratings yet

- Thinking About MacroeconomicsDocument30 pagesThinking About MacroeconomicsChi-Wa CWNo ratings yet

- November 2015Document16 pagesNovember 2015Κλαίρη Πρωτοπαπά100% (1)

- Doles Vs AngelesDocument2 pagesDoles Vs AngelesMariaKristinaJihanBana100% (1)

- TA Form (Format)Document1 pageTA Form (Format)Punjab Agro Juices LimitedNo ratings yet

- Overview of Russian EconomyDocument5 pagesOverview of Russian EconomyYbrantSachinNo ratings yet

- Maryland Articles of IncorporationDocument4 pagesMaryland Articles of IncorporationkevinNo ratings yet

- Examples of Loan TransactionsDocument2 pagesExamples of Loan TransactionsVimal Anbalagan100% (1)

- Impact of Fdi in Insurance Sector in IndiaDocument3 pagesImpact of Fdi in Insurance Sector in IndiaAamir Saleem50% (2)

- Country Risk AnalysisDocument37 pagesCountry Risk AnalysisKibria UtshobNo ratings yet

- Bog Ut Bank Capital Bank GCB PDFDocument3 pagesBog Ut Bank Capital Bank GCB PDFJulius YawsonNo ratings yet

- AP Macroeconomics: Fun!!! With The MPC, MPS, and MultipliersDocument29 pagesAP Macroeconomics: Fun!!! With The MPC, MPS, and MultipliersHonya ElfayoumyNo ratings yet

- Exercise 2.2Document18 pagesExercise 2.2Stephanie Xie100% (1)

- Reserve Bank of India: Young Scholars' AwardDocument3 pagesReserve Bank of India: Young Scholars' AwardManu BhatNo ratings yet

- Ch-7 13e - Fund Analysis, Cash-Flow Analysis, and Financial Planning L5Document66 pagesCh-7 13e - Fund Analysis, Cash-Flow Analysis, and Financial Planning L5Adeel Rana100% (1)

- Book Review - What Has Government Done To Our Money?Document2 pagesBook Review - What Has Government Done To Our Money?Anda IrimiaNo ratings yet

- Status Report No. 1 BorrowerDocument6 pagesStatus Report No. 1 BorrowergavinjayanandNo ratings yet

- U.S. and Global Imbalances: Can Dark Matter Prevent A Big Bang?Document11 pagesU.S. and Global Imbalances: Can Dark Matter Prevent A Big Bang?Pao SalazarNo ratings yet

- Capital StructureDocument10 pagesCapital StructureVivekNo ratings yet

- TallyDocument6 pagesTallySayandip MondalNo ratings yet

- Lecture 5 Capital Budgeting StuDocument13 pagesLecture 5 Capital Budgeting StuHuynhAnhNguyenNo ratings yet

- FX Cfa ProblemsDocument8 pagesFX Cfa ProblemsMỹ Trâm Trương ThịNo ratings yet