Project Synopsis

Project Synopsis

Uploaded by

Kaushik AdhikariCopyright:

Available Formats

Project Synopsis

Project Synopsis

Uploaded by

Kaushik AdhikariCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Project Synopsis

Project Synopsis

Uploaded by

Kaushik AdhikariCopyright:

Available Formats

Project Synopsis on Rural Banking in India

Submitted By:

Kausik Adhikari - 1001 Anil Anayath - 1005

Emamul Mallik - 1050

Submitted To: Prof. Krishnamurthy

MUMBAI INSTITUTE OF MANAGEMENT & RESEARCH, J.K.KNOWLEDGE CENTRE, WADALA (E)

A PROJECT ON RURAL BANKING IN INDIA

ABSTRACT Rural banking in India started since the establishment of banking sector in India. Rural Banks in those days mainly focused upon the agro sector. Today, commercial banks and Regional Rural Banks in India are penetrating every corner of the country are extending a helping hand in the growth process of the rural sector in the country. 'RURAL BANKING' throws light on the following aspects: * * * * * * * * Rural Banking an introduction Banks: functioning for development of rural areas Co-operative banks and rural credit Commercial banks and rural credit Regional rural banks and rural credit Role of RBI in rural credit Marketing of mutual fund units-RRBs Conclusion

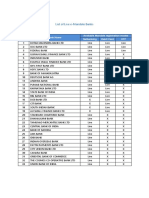

RURAL BANKING INTRODUCTION Rural banking in India started since the establishment of banking sector in India. Rural Banks in those days mainly focused upon the agro sector. Today, commercial banks and Regional rural banks in India are penetrating every corner of the country are extending a helping hand in the growth process of the rural sector in the country. BANKS: FUNCTIONING FOR THE DEVELOPMENT OF RURAL AREAS The area of operation of a majority of the RRBs is limited to a notified area comprising a few districts in a State.SBI has 30 Regional Rural Banks in India known as RRBs. The rural banks of SBI are spread in 13 states extending from Kashmir to Karnataka and Himachal Pradesh to North East. Apart from SBI, there are other few banks which functions for the development of the rural areas in India. Few of them are as follows. Haryana State Cooperative Apex Bank Limited NABARD Sindhanur Urban Souharda Co-operative Bank United Bank of India Syndicate Bank Co-operative bank

CO-OPERATIVE BANKS AND RURAL CREDIT The Co-operative bank has a history of almost 100 years. The Co-operative banks are an important constituent of the Indian Financial System, judging by the role assigned to them, the expectations they are supposed to fulfill, their number, and the number of offices they operate. Their role in rural financing continues to be important even today, and their business in the urban areas also has increased phenomenally in recent years mainly due to the sharp increase in the number of primary co-operative banks. Co-operative Banks in India are registered under the Co-operative Societies Act. The RBI also regulates the cooperative bank. They are governed by the Banking Regulations Act 1949 and Banking Laws (Co-operative Societies) Act, 1965. Co-operative banks in India finance rural areas under: Farming Cattle Milk Hatchery Personal finance

Institutional Arrangements for Rural Credit (Co-operatives) Short Term Co-operatives Long Term Co-operatives Short Term Co-operatives | District Central Co-operative Banks | State Co-operative Banks | Primary Agriculture Credit Co-operative Societies | Branches Long Term Cooperatives | State Agriculture & Rural Development Banks | Primary Agriculture & Rural Development Banks | Branches

Primary Agricultural Credit Societies (PACSs) An agricultural credit society can be started with 10 or more persons normally belonging to a village or a group of villages. The value of each share is generally nominal so as to enable even the poorest farmer to become a member. The members have unlimited liability, that is each member is fully responsible for the entire loss of the society, in the event of failure. Loans are given for short periods, normally for the harvest season, for carrying on agricultural operation, and the rate of interest is fixed. There are now over 92,000 primary agricultural credit societies in the country with a membership of over 100 million. The primary agricultural credit society was expected to attract deposits from among the well to-do members and non-members of the village and thus promote thrift and self-help. It should give loans and advances to needy members mainly out of these deposits. Central Co-operative Banks (CCBs) The central co-operative banks are located at the district headquarters or some prominent town of the district. These banks have a few private individuals also who provide both finance and management. The central co-operative banks have three sources of funds, Their own share capital and reserves Deposits from the public and Loans from the state co-operative banks

Their main function is to lend to primary credit society apart from that, central coopertive banks have been undertaking normal commercial banking business also, such as attracting deposits from the general public and lending to the needy against proper securities. There are now 367 central co-operative banks. State Co-operative Banks (SCBs) The state Co-operative Banks, now 29 in number, they finance, co-ordinate and control the working of the central Co-operative Banks in each state. They serve as the link between the Reserve bank and the general money market on the one side and the central co-operative and primary societies on the other. They obtain their funds mainly from the general public by way of deposits, loans and advances from the Reserve Bank and they are own share capital and reserves. COMMERCIAL BANKS AND RURAL CREDIT The commercial banks at present provide short term crop loans account for nearly 45 to 47% of the total loans given and disbursed by the commercial banks. Term loans for varying periods are given for purchasing pump sets, tractors and other agricultural machinery, for construction of wells and tube well, for development of fruit and garden crops, for leveling and development of land, for purchase of ploughs, animals, etc. commercial banks also extend loans for allied activities viz., for dairying, poultry, piggery, bee keeping, fisheries and others. These loans come

to 15 to 16%. Commercial Banks and Small Farmers The commercial banks identifying the small farmers through Small Farmers Development Agencies (SFDA) set up in various districts and group them into various categories for credit support so as to enable them to become bible cultivators. As regard small cultivators near urban areas and irrigation facilities, commercial banks can help them to go in for vegetable cultivation or combine it with small poultry farming and maintaing of one or two milch cattle. IRDP and commercial banks Since October 1980, the Integrated Rural Development Programme (IRDP) has been extended to all the blocks in the country and the commercial banks have been asked by the government of India to finance IRDP. The lead banks have to prepare banking plans and allocate the responsibility of financing the identified beneficiaries among the participating banks. Commercial banks have been asked to finance all economically backward people identified by government agencies. REGIONAL RURAL BANKS AND RURAL CREDIT The Narasimham committee on rural credit recommended the establishment of Regional Rural Banks (RRBs) on the ground that they would be much better suited than the commercial banks or co-operative banks in meeting the needs of rural areas. Accepting the recommendations of the Narasimham committee, the government passed the Regional Rural Banks Act, 1976. The main objective of RRBs is to provide credit and other facilities particularly to the small and marginal farmers, agricultural laborers, artisians and small entrepreneurs and develop agriculture, trade, commerce, industry and other productive activities in the rural areas. The progress of RRBs in the initial stage was quite rapid. For instance, the Sixth Five-year plan(1980-85) had envisaged the setting up of 170 RRBs covering 270 districts by the end of march 1985.The target was exceeded. There are now 196 RRBs in 23 states of the country with 14,200 branches. Structure of regional rural bank

The establishment of the Regional Rural Banks (RRBs) was initiated in 1975 under the provisions of the ordinance promulgated on 26.9.1975 and thereafter Section 3(1) of the RRB Act, 1976. The issued capital of RRBs is shared by Central Government, sponsor bank and the State Government in the proportion of 50%, 35% and 15% respectively. RRBs established with the explicit objective of: * Bridging the credit gap in rural areas * Check the outflow of rural deposits to urban areas

* Reduce regional imbalances and increase rural employment generation ROLE OF RBI IN RURAL CREDIT Since it was set up in 1934, RBI has been taking keen interest in expanding credit to the rural sector. After NABARD was set up as the apex bank for agriculture and rural development, RBI has been taking a series of steps for providing timely and adequate credit through NABARD. Scheduled commercial banks excluding foreign banks have been forced to supplement NABARDs efforts-through the stipulation that 40percent of net bank credit should go to the priority sector, out of which at least 18 percent of net bank credit should flow to agriculture. Besides, it is mandatory that any shortfall in fulfilling the 40 percent target or the 18 percent sub-target would have to go to the corpus Rural Infrastructure Development Fund(RIDF).RBI has also taken steps in recent years to strengthen institutional mechanisms such as recapitalisation of Regional Rural Banks (RRBs) and setting up of local area banks(LABs). Micro-Finance Micro-finance is a novel approach to "banking with poor"as they attempt to combine lower transaction costs and high degree of repayments.The major thrust of these micro-finance initiatives is through the setting up of Self Help Groups (SHGs),Non-Governmental organizations(NGOs),Credit Unions etc. Kisan(Farmers') Credit Card Another notable development in recent years is the introduction of Kisan Credit Cards(KCC) in 1998-99.The purpose of the Kisan Credit Cards(KCC) scheme is to facilities short term credit to farmers.The scheme has gained popularity and its implementation has been taken up by 27 commercial banks, 187 RRBs and 334 Central cooperative banks. Agricultural Insurance As Agricultural is highly susceptible to risks such as drought, flood, pests etc.It is necessary to protect the farmers from natural calamities and ensure their credit eligibility from the next season. Towards this purpose, the Government of India introduced a comprehensive crop insurance scheme throught the country in 1985 covering major cereal crops, oilseeds and pulses. Among commercial crops, seven crops viz., sugarcane potato, cotton, ginger, onion, turmeric and chillies are presently covered. MARKETING OF MUTUAL FUND UNITS RRBS

With a view to expanding the scope of business of RRBs and considering that marketing of Mutual Fund (MF) units provides a profitable avenue for banks, it has been decided by RBI on 17th May 2006 to allow Regional Rural Banks (RRBs) to undertake marketing of units of Mutual Funds, as agents. Accordingly, RRBs may, with approval of their Board of Directors, enter into

agreements with Mutual Funds for marketing their units subject to the following terms and conditions: * The bank should only act as an agent of the customers, forwarding applications of the investors for purchase / sale of MF units to the Mutual Fund / Registrar Transfer Agents. * The purchase of MF units should be at the risk of customers and without the bank guaranteeing any assured return. * The bank should not acquire such units of Mutual Fund from the secondary market. * The bank should not buy back units of Mutual Funds from their customers. * The bank holding custody of MF units on behalf of their customers should ensure that its own investment and investments belonging to their customers are kept distinct from each other. * Retailing of units of Mutual Funds may be confined to some select branches of the bank to ensure better control. * The bank should comply with the extant KYC/ AML guidelines in respect of the applicants. * The RRBs should put in place adequate and effective control mechanisms in consultation with their sponsor banks. CONCLUSION RRBs' performance in respect of some important indicators was certainly better than that of commercial banks or even cooperatives. RRBs have also performed better in terms of providing loans to small and retail traders and petty non-farm rural activities. In recent years, they have taken a leading role in financing SelfHelp Groups (SHGs) and other micro-credit institutions and linking such groups with the formal credit sector. RRBs should really be strengthened and provided with more resources with which they can undertake more of these important activities. And most certainly they should be kept apart from a profit-oriented corporate motivation that would reduce their capacity to provide much needed financial services to the rural areas, including to agriculture. Ideally, the best use of the resources raised by RRBs through deposits would be through extensive cross-subsidisation. This, in turn, really requires an apex body that would cover and oversee all the RRBs, something like a National Rural Bank of India (NRBI). The number of rural branches should be increased rather than reduced; they should be encouraged to develop more sophisticated methods of credit delivery to meet the changing needs of farming; and most of all, there should be greater coordination between district planning authorities, panchayati raj institutions and the banks operating in rural areas. Only then will the RRBs fulfill the promise that is so essential for rural development.

You might also like

- Moneylending Agreement (Secured Loan)Document5 pagesMoneylending Agreement (Secured Loan)Che Ta100% (1)

- Rural Banking ProjectDocument55 pagesRural Banking ProjectDelisa Misquitta0% (1)

- Rural Banking and Agricultural FinancingDocument17 pagesRural Banking and Agricultural FinancingNilanshi MukherjeeNo ratings yet

- Project Cash Flow Statement Analysis of AXIS BankDocument44 pagesProject Cash Flow Statement Analysis of AXIS BankShubashPoojari100% (1)

- Banking PPT Group 1 - Structure of Indian Banking SystemDocument53 pagesBanking PPT Group 1 - Structure of Indian Banking Systemrohit75% (4)

- This Paper Entitled 'RURAL FINANCING' Throws Light On The Following AspectsDocument6 pagesThis Paper Entitled 'RURAL FINANCING' Throws Light On The Following AspectshazursaranNo ratings yet

- Proect Rural Banking in IndiaDocument108 pagesProect Rural Banking in IndiaRohitRana100% (5)

- Ms. E. Jeevitha: Rural BankingDocument16 pagesMs. E. Jeevitha: Rural Bankingpravin_kotecha7383100% (1)

- Rural Banking - SCRIPTDocument16 pagesRural Banking - SCRIPTArchisha GargNo ratings yet

- Report 2Document31 pagesReport 2AravindNo ratings yet

- Insurance & Banking ProjectDocument15 pagesInsurance & Banking Projectfundoo16No ratings yet

- Finincial Analysis of Tumkur Grain Merchants Co-Operative BankDocument110 pagesFinincial Analysis of Tumkur Grain Merchants Co-Operative BankPrashanth PB50% (2)

- Co-Operative Banks and Rural CreditDocument8 pagesCo-Operative Banks and Rural CreditIrfan KhaziNo ratings yet

- Role of Cooperative Bank in AgriculturalDocument65 pagesRole of Cooperative Bank in Agriculturalkaushal244280% (5)

- Regional Rural BankDocument26 pagesRegional Rural BankVijayeta Nerurkar100% (1)

- Origin of Banking and Banking Structure in IndiaDocument32 pagesOrigin of Banking and Banking Structure in IndiaShashank TiwariNo ratings yet

- Origin of Banking and Banking Structure in IndiaDocument32 pagesOrigin of Banking and Banking Structure in IndiaShashank TiwariNo ratings yet

- Agriculture FinanceDocument8 pagesAgriculture Financeramanpreet kaurNo ratings yet

- Co Operative BanksDocument4 pagesCo Operative BanksstarkishNo ratings yet

- BankingDocument37 pagesBankingTanya GoelNo ratings yet

- Regional Rural BanksDocument6 pagesRegional Rural Banksdranita@yahoo.comNo ratings yet

- The Role of Regional Rural Banks inDocument4 pagesThe Role of Regional Rural Banks inAnonymous bIDNbP9Z3No ratings yet

- Rural BankingDocument22 pagesRural BankingGungun KumariNo ratings yet

- Regional Rural BanksDocument4 pagesRegional Rural BanksSiddhartha BindalNo ratings yet

- Project Report On Regional Rural Banks (RRBS)Document14 pagesProject Report On Regional Rural Banks (RRBS)Dhairya JainNo ratings yet

- Chapter 2Document28 pagesChapter 2ningegowdaNo ratings yet

- Ankan Saha ProjectDocument29 pagesAnkan Saha Projectankans2004No ratings yet

- Banking Practical 1 InformationDocument4 pagesBanking Practical 1 InformationMadhur AbhyankarNo ratings yet

- Rural Banking: Presented By: Hema SinghDocument34 pagesRural Banking: Presented By: Hema SinghRitika HiiNo ratings yet

- Banking Awarness Meritshine MaterialDocument162 pagesBanking Awarness Meritshine MaterialRagavi JoNo ratings yet

- Bba ProjectDocument47 pagesBba ProjectAayush SomaniNo ratings yet

- Introduction of CoDocument13 pagesIntroduction of Cotarun_25augustNo ratings yet

- Project On Rural Banking in India 15-01-2023Document74 pagesProject On Rural Banking in India 15-01-2023Praveen ChaudharyNo ratings yet

- Full Info of Coperative BanksDocument15 pagesFull Info of Coperative BanksAkash ShirsatNo ratings yet

- Cooperative Banks: School of Law, Narsee Monjee Institute of Management Studies, BangaloreDocument13 pagesCooperative Banks: School of Law, Narsee Monjee Institute of Management Studies, BangaloreHIMANSHU GOYALNo ratings yet

- Cooperative BankingDocument8 pagesCooperative BankingvmktptNo ratings yet

- Analyzing Deposits and Loans 7 (AutoRecovered)Document18 pagesAnalyzing Deposits and Loans 7 (AutoRecovered)samritisaini1No ratings yet

- Sources of Agriculture FinanceDocument4 pagesSources of Agriculture Financeanjaligupta23102003No ratings yet

- RRBsDocument19 pagesRRBsProf S P GargNo ratings yet

- 22 Role of RBI in Rural CreditDocument7 pages22 Role of RBI in Rural CreditAman SinghNo ratings yet

- Banking System in India1Document7 pagesBanking System in India1Srikanth Prasanna BhaskarNo ratings yet

- Regional Rural Banking in India - 230326 - 110221Document72 pagesRegional Rural Banking in India - 230326 - 110221Shubham YadavNo ratings yet

- Regulation of Rural BankDocument11 pagesRegulation of Rural Bank9722274593No ratings yet

- Ppt. Regional Rural BanksDocument13 pagesPpt. Regional Rural BanksRuchi Arora Arora73% (11)

- Banking Awareness - Unique IAS Academy CoimbatoreDocument51 pagesBanking Awareness - Unique IAS Academy CoimbatoreLH KhiangteNo ratings yet

- Chapter IIDocument15 pagesChapter IIbhagathnagarNo ratings yet

- Structure of The Indian Banking Industry: Commercial BanksDocument2 pagesStructure of The Indian Banking Industry: Commercial BanksMayank AhujaNo ratings yet

- Rad HaDocument80 pagesRad HaHarisha HmNo ratings yet

- Banking in IndiaDocument13 pagesBanking in IndiaMurahari NANo ratings yet

- Function of BusinessDocument5 pagesFunction of BusinessPrafulkumar HolkarNo ratings yet

- Theoretical Framework of Treasury ManagementDocument146 pagesTheoretical Framework of Treasury ManagementPrithviraj Kumar100% (1)

- Authored By: VM Sai Kamalesh Edida, PGDM, Mats, Bangalore, Co-Authored By: Jitendra Mehta, Mats, BangaloreDocument9 pagesAuthored By: VM Sai Kamalesh Edida, PGDM, Mats, Bangalore, Co-Authored By: Jitendra Mehta, Mats, BangaloreKamalesh EdidaNo ratings yet

- Executive Summary (Autosaved) .Docx 1Document9 pagesExecutive Summary (Autosaved) .Docx 1Mahesh AllannavarNo ratings yet

- Structure of The Indian Banking System Sem IDocument2 pagesStructure of The Indian Banking System Sem IAshitosh ChavanNo ratings yet

- Development and ApprochDocument25 pagesDevelopment and ApprochVyshnavNo ratings yet

- Dharini DocxDocument19 pagesDharini DocxThamizhan Cyber SolutionsNo ratings yet

- Report On Sutex BankDocument55 pagesReport On Sutex Bankjkpatel221No ratings yet

- Co Operative BanksDocument13 pagesCo Operative Banksamyncharaniya100% (4)

- A Presentation ON Regional Rural Bank: Presented By: Presented ToDocument20 pagesA Presentation ON Regional Rural Bank: Presented By: Presented ToVîçký BårdêNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Po 016 - SSBDocument1 pagePo 016 - SSBAs-Syaff ResourcesNo ratings yet

- Series XXII-Fixed Income Securities-Ver-May 2021Document182 pagesSeries XXII-Fixed Income Securities-Ver-May 2021RyNo ratings yet

- BDO FORMS With GUIDELINESDocument6 pagesBDO FORMS With GUIDELINESCrisant DemaalaNo ratings yet

- Agreement: Affidavit 2 (To Be Notarized On Rs.100/-Stamp Paper and Should Be Submitted in Original)Document4 pagesAgreement: Affidavit 2 (To Be Notarized On Rs.100/-Stamp Paper and Should Be Submitted in Original)sujleoNo ratings yet

- Checklist of Eligibility & Technical Components During Opening of Bids (Infrastructure)Document5 pagesChecklist of Eligibility & Technical Components During Opening of Bids (Infrastructure)bobosNo ratings yet

- Bank Al HabibDocument26 pagesBank Al HabibAsif Rasool ChannaNo ratings yet

- Atm - ApplicationDocument2 pagesAtm - ApplicationŽoHřa NīšA ŚỹEð67% (3)

- SAP Business ByDesign 1302 Product Documentation WN - BBD - enDocument45 pagesSAP Business ByDesign 1302 Product Documentation WN - BBD - enLeontin LeonNo ratings yet

- Negotiable Instruments Law ReviewerDocument10 pagesNegotiable Instruments Law ReviewerEdwin VillaNo ratings yet

- Account: 18720100025744 From: 23-05-2020 To: 13-10-2020 Date Description Amount TypeDocument7 pagesAccount: 18720100025744 From: 23-05-2020 To: 13-10-2020 Date Description Amount Typemanish panwarNo ratings yet

- Final ReportDocument43 pagesFinal ReportAmy GreenNo ratings yet

- Chapter 7 Self TestDocument7 pagesChapter 7 Self TestMichelleNo ratings yet

- Bank StatementDocument1 pageBank Statementcodex hdNo ratings yet

- Icpo Draft 50k Ic45 Rbu 09 SeptDocument3 pagesIcpo Draft 50k Ic45 Rbu 09 Septabohosamelmasry850No ratings yet

- Hargeisa Discussion Paper 04 2019 Hargeisa Somaliland Invisible CityDocument26 pagesHargeisa Discussion Paper 04 2019 Hargeisa Somaliland Invisible CityWarda DheemanNo ratings yet

- Annual Report 2012-2013 Federal BankDocument192 pagesAnnual Report 2012-2013 Federal BankMoaaz AhmedNo ratings yet

- Ebill 024313735 202211 23 1Document3 pagesEbill 024313735 202211 23 1yung daisydaisyNo ratings yet

- Project ReportDocument96 pagesProject ReportRRajath ShettyNo ratings yet

- Unit 1 WBsolutionFormation Acctba2Document28 pagesUnit 1 WBsolutionFormation Acctba2justinNo ratings yet

- List of Live Emandate BanksDocument1 pageList of Live Emandate BanksI. SarithaNo ratings yet

- Daily Balance SheetsDocument184 pagesDaily Balance SheetsAhmad JoyiaNo ratings yet

- Sample Tayab SaleemDocument2 pagesSample Tayab SaleemTayyab SaleemNo ratings yet

- Summary For The Preparation of Bank Reconciliation StatementDocument5 pagesSummary For The Preparation of Bank Reconciliation StatementGhalib HussainNo ratings yet

- Description: Tags: FFELLendersNov2007Document50 pagesDescription: Tags: FFELLendersNov2007anon-405484No ratings yet

- Trial Balance To Profit & Loss A/c and Balance Sheet For Corporate & Non-Corporate EntitiesDocument24 pagesTrial Balance To Profit & Loss A/c and Balance Sheet For Corporate & Non-Corporate EntitiesChintan PatelNo ratings yet

- IBD Presentaion SummaryDocument58 pagesIBD Presentaion SummaryMahammed UsmailNo ratings yet

- Case Digests - Nego - FinalsDocument25 pagesCase Digests - Nego - FinalsSteve Rojano ArcillaNo ratings yet

- CDBDocument35 pagesCDBAnonymous eLy0WHoJN5No ratings yet

- CaldwellGordon InternalControlCaseStudies 2015Document29 pagesCaldwellGordon InternalControlCaseStudies 2015Ashanti GruberovaNo ratings yet