In The United States Bankruptcy Court Eastern District of Michigan Southern Division

In The United States Bankruptcy Court Eastern District of Michigan Southern Division

Uploaded by

Chapter 11 DocketsCopyright:

Available Formats

In The United States Bankruptcy Court Eastern District of Michigan Southern Division

In The United States Bankruptcy Court Eastern District of Michigan Southern Division

Uploaded by

Chapter 11 DocketsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

In The United States Bankruptcy Court Eastern District of Michigan Southern Division

In The United States Bankruptcy Court Eastern District of Michigan Southern Division

Uploaded by

Chapter 11 DocketsCopyright:

Available Formats

IN THE UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION In re: ) ) COLLINS & AIKMAN CORPORATION,

et al.1 ) ) Debtors. ) ) ) ) ) ) _________________________________________) Chapter 11 Case No. 05-55927 (SWR) (Jointly Administered) (Tax Identification #13-3489233) Honorable Steven W. Rhodes

THE COLLINS & AIKMAN LITIGATION TRUSTS EIGHTEENTH OMNIBUS OBJECTION TO CLAIMS (MULTIDEBTOR DUPLICATE CLAIMS) The Collins & Aikman Litigation Trust (the Trust), as successor to the above-captioned Debtors (collectively, the Debtors) pursuant to the First Amended Joint Plan of Reorganization of Collins & Aikman Corporation and its Debtor Subsidiaries as confirmed by order of the Bankruptcy Court, hereby files this omnibus objection (the Eighteenth Omnibus Objection) to the claims listed on Exhibit B as Claim to be Disallowed because the claims to be disallowed are identical to and duplicates of another claim filed by the claimant against another Debtor

The Debtors in the jointly administered cases include: Collins & Aikman Corporation; Amco Convertible Fabrics, Inc., Case No. 05-55949; Becker Group, LLC (d/b/a/ Collins & Aikman Premier Mold), Case No. 05-55977; Brut Plastics, Inc., Case No. 05-55957; Collins & Aikman (Gibraltar) Limited, Case No. 05-55989; Collins & Aikman Accessory Mats, Inc. (f/k/a the Akro Corporation), Case No. 05-55952; Collins & Aikman Asset Services, Inc., Case No. 05-55959; Collins & Aikman Automotive (Argentina), Inc. (f/k/a Textron Automotive (Argentina), Inc.), Case No. 05-55965; Collins & Aikman Automotive (Asia), Inc. (f/k/a Textron Automotive (Asia), Inc.), Case No. 0555991; Collins & Aikman Automotive Exteriors, Inc. (f/k/a Textron Automotive Exteriors, Inc.), Case No. 05-55958; Collins & Aikman Automotive Interiors, Inc. (f/k/a Textron Automotive Interiors, Inc.), Case No. 05-55956; Collins & Aikman Automotive International, Inc., Case No. 05-55980; Collins & Aikman Automotive International Services, Inc. (f/k/a Textron Automotive International Services, Inc.), Case No. 05-55985; Collins & Aikman Automotive Mats, LLC, Case No. 05-55969; Collins & Aikman Automotive Overseas Investment, Inc. (f/k/a Textron Automotive Overseas Investment, Inc.), Case No. 05-55978; Collins & Aikman Automotive Services, LLC, Case No. 05-55981; Collins & Aikman Canada Domestic Holding Company, Case No. 05-55930; Collins & Aikman Carpet & Acoustics (MI), Inc., Case No. 05-55982; Collins & Aikman Carpet & Acoustics (TN), Inc., Case No. 05-55984; Collins & Aikman Development Company, Case No. 05-55943; Collins & Aikman Europe, Inc., Case No. 05-55971; Collins & Aikman Fabrics, Inc. (d/b/a Joan Automotive Industries, Inc.), Case No. 05-55963; Collins & Aikman Intellimold, Inc. (d/b/a M&C Advanced Processes, Inc.), Case No. 05-55976; Collins & Aikman Interiors, Inc., Case No. 05-55970; Collins & Aikman International Corporation, Case No. 05-55951; Collins & Aikman Plastics, Inc., Case No. 05-55960; Collins & Aikman Products Co., Case No. 05-55932; Collins & Aikman Properties, Inc., Case No. 0555964; Comet Acoustics, Inc., Case No. 05-55972; CW Management Corporation, Case No. 05-55979; Dura Convertible Systems, Inc., Case No. 05-55942; Gamble Development Company, Case No. 05-55974; JPS Automotive, Inc. (d/b/a PACJ, Inc.), Case No. 05-55935; New Baltimore Holdings, LLC, Case No. 05-55992; Owosso Thermal Forming, LLC, Case No. 05-55946; Southwest Laminates, Inc. (d/b/a Southwest Fabric Laminators Inc.), Case No. 05-55948; Wickes Asset Management, Inc., Case No. 05-55962; and Wickes Manufacturing Company, Case No. 05-55968.

0W[;($-

0555927080413000000000001

!1

entity. To the extent the claimant is entitled to any recovery, such claimant is entitled to only one recovery. Thus, the Trust requests the entry of an order, substantially in the form of Exhibit A, disallowing the claims set forth in the first column of Exhibit B and preserving the surviving claim set forth in the second column of Exhibit B.2 Pursuant to Rule 3007(e)(1) of the Federal Rules of Bankruptcy Procedure, Claimants receiving this Eighteenth Omnibus Objection should locate their names and claims in the objection and the attached exhibits. In support of the Eighteenth Omnibus Objection, the Trust respectfully represents as follows: Jurisdiction 1. The Court has subject matter jurisdiction to consider and determine the

Eighteenth Omnibus Objection pursuant to Paragraph 41(a) of the Order Confirming First Amended Joint Plan Of Collins & Aikman Corporation And Its Debtor Subsidiaries (the Order). 2. 3. Venue is proper before the Court pursuant to 28 U.S.C. 1408 and 1409. The statutory basis for the relief requested by the Eighteenth Omnibus Objection

is section 502 of the Bankruptcy Code, 11 U.S.C. 101-1330 and Rule 3007 of the Federal Rules of Bankruptcy Procedure. Background 4. On July 9, 2007, Debtors filed the First Amended Joint Plan of Collins & Aikman

Corporation and Its Debtor Subsidiaries (the Plan). 5. On July 18, 2007, the Court entered the Order confirming the Plan. The Order

provided the mechanism by which claimants would submit claims and the process by which the Trusts would File, settle, compromise, withdraw or litigate to judgment objections to Claims.

The Eighteenth Omnibus Objection is without prejudice to the Trusts ability to otherwise object to the Surviving Claims set forth in Exhibit B.

(Order at 38.) Thus, consistent with the Orders directive regarding disposition of the Claims, this Eighteenth Omnibus Objection is timely filed. (Order at 49.) Objection to Duplicate Claims Filed Against Multiple Debtors 6. The Debtors and the Trust are in the process of reviewing and evaluating the

claims that have been filed. In that process, many claims have been identified as having been filed against multiple Debtor entities for an identical claim. The Trust has confirmed that each claim to be disallowed listed on Exhibit B does not have any support in the books and records of Debtors, and thus, each claim to be disallowed listed on Exhibit B should be expunged from the system preserving only the claim to survive listed on Exhibit B. 7. Pursuant to Article XII.A of the Plan, the Trust is entitled to the relief sought by

this Eighteenth Omnibus Objection. Notice 8. Pursuant to Article VII.A.1 of the Plan, the Eighteenth Omnibus Objection (with

exhibits) and a notice thereof will be served upon the Holders of such Claims and the United States Trustee.3 A copy of the Eighteenth Omnibus Objection has also been filed with the CM/ECF system which will serve a copy of this pleading on all attorneys registered to receive such filings. 9. No prior request for the relief sought in the Eighteenth Omnibus Objection has

been made to this or any other Court.

Capitalized terms used in this paragraph not otherwise defined herein shall have the meanings set forth in the Plan and the Order.

WHEREFORE, the Trust respectfully requests entry of an order, substantially in the form attached hereto as Exhibit A, (a) disallowing the duplicate, identical claims filed against multiple Debtor entities identified on Exhibit B, and preserving only the surviving claims listed on Exhibit B; and (b) granting such other and further relief as is just and proper. Respectfully submitted, BOYLE BURDETT By:s/H. William Burdett, Jr. Eugene H. Boyle, Jr. (P42023) H. William Burdett, Jr. (P63185) 14950 East Jefferson, Suite 200 Grosse Pointe Park, Michigan 48230 (313) 344-4000 (313) 344-4001 (facsimile) burdett@boyleburdett.com Attorneys for the Collins & Aikman Litigation Trust

Dated: April 13, 2008

IN THE UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION In re: ) ) COLLINS & AIKMAN CORPORATION, et al.1 ) ) Debtors. ) ) ) ) ) ) _________________________________________) Chapter 11 Case No. 05-55927 (SWR) (Jointly Administered) (Tax Identification #13-3489233) Honorable Steven W. Rhodes

NOTICE AND OPPORTUNITY TO RESPOND TO THE COLLINS & AIKMAN LITIGATION TRUSTS EIGHTEENTH OMNIBUS OBJECTION TO CLAIMS (MULTIDEBTOR DUPLICATE CLAIMS) PLEASE TAKE NOTICE THAT the Collins & Aikman Litigation Trust (the Trust), as successor to the above-captioned Debtors (collectively, the Debtors) pursuant to the First Amended Joint Plan of Reorganization of Collins & Aikman Corporation and its Debtor Subsidiaries as confirmed by the order of the Bankruptcy Court, have filed its Eighteenth Omnibus Objection to Claims (Multidebtor Duplicate Claims) (the Eighteenth Omnibus Objection).

1

The Debtors in the jointly administered cases include: Collins & Aikman Corporation; Amco Convertible Fabrics, Inc., Case No. 05-55949; Becker Group, LLC (d/b/a/ Collins & Aikman Premier Mold), Case No. 05-55977; Brut Plastics, Inc., Case No. 05-55957; Collins & Aikman (Gibraltar) Limited, Case No. 05-55989; Collins & Aikman Accessory Mats, Inc. (f/k/a the Akro Corporation), Case No. 05-55952; Collins & Aikman Asset Services, Inc., Case No. 05-55959; Collins & Aikman Automotive (Argentina), Inc. (f/k/a Textron Automotive (Argentina), Inc.), Case No. 05-55965; Collins & Aikman Automotive (Asia), Inc. (f/k/a Textron Automotive (Asia), Inc.), Case No. 0555991; Collins & Aikman Automotive Exteriors, Inc. (f/k/a Textron Automotive Exteriors, Inc.), Case No. 05-55958; Collins & Aikman Automotive Interiors, Inc. (f/k/a Textron Automotive Interiors, Inc.), Case No. 05-55956; Collins & Aikman Automotive International, Inc., Case No. 05-55980; Collins & Aikman Automotive International Services, Inc. (f/k/a Textron Automotive International Services, Inc.), Case No. 05-55985; Collins & Aikman Automotive Mats, LLC, Case No. 05-55969; Collins & Aikman Automotive Overseas Investment, Inc. (f/k/a Textron Automotive Overseas Investment, Inc.), Case No. 05-55978; Collins & Aikman Automotive Services, LLC, Case No. 05-55981; Collins & Aikman Canada Domestic Holding Company, Case No. 05-55930; Collins & Aikman Carpet & Acoustics (MI), Inc., Case No. 05-55982; Collins & Aikman Carpet & Acoustics (TN), Inc., Case No. 05-55984; Collins & Aikman Development Company, Case No. 05-55943; Collins & Aikman Europe, Inc., Case No. 05-55971; Collins & Aikman Fabrics, Inc. (d/b/a Joan Automotive Industries, Inc.), Case No. 05-55963; Collins & Aikman Intellimold, Inc. (d/b/a M&C Advanced Processes, Inc.), Case No. 05-55976; Collins & Aikman Interiors, Inc., Case No. 05-55970; Collins & Aikman International Corporation, Case No. 05-55951; Collins & Aikman Plastics, Inc., Case No. 05-55960; Collins & Aikman Products Co., Case No. 05-55932; Collins & Aikman Properties, Inc., Case No. 0555964; Comet Acoustics, Inc., Case No. 05-55972; CW Management Corporation, Case No. 05-55979; Dura Convertible Systems, Inc., Case No. 05-55942; Gamble Development Company, Case No. 05-55974; JPS Automotive, Inc. (d/b/a PACJ, Inc.), Case No. 05-55935; New Baltimore Holdings, LLC, Case No. 05-55992; Owosso Thermal Forming, LLC, Case No. 05-55946; Southwest Laminates, Inc. (d/b/a Southwest Fabric Laminators Inc.), Case No. 05-55948; Wickes Asset Management, Inc., Case No. 05-55962; and Wickes Manufacturing Company, Case No. 05-55968.

PLEASE TAKE FURTHER NOTICE THAT your rights may be affected. Pursuant to Rule 3007(e)(1) of the Federal Rules of Bankruptcy Procedure, Claimants receiving this Eighteenth Omnibus Objection should locate their names and claims in the objection and the attached exhibits. You may wish to review the Objection and discuss it with your attorney, if you have one in these cases. If you do not have an attorney, you may wish to consult one. PLEASE TAKE FURTHER NOTICE THAT if you wish to object to the Court granting the relief sought in the Eighteenth Omnibus Objection, or if you want the Court to otherwise consider your views on the Objection, no later than May 12, 2008, or such shorter time as the Court may order and of which you may receive subsequent notices, you or your attorney must file with the Court a written response explaining your position at: United States Bankruptcy Court 211 West Fort Street, Suite 2100 Detroit, Michigan 48226 PLEASE TAKE FURTHER NOTICE THAT if you mail your response to the Court for filing, you must mail it early enough so the Court will receive it on or before the date above. PLEASE TAKE FURTHER NOTICE THAT you must also serve your response so that it is received on or before May 12, 2008 by the undersigned attorney.

PLEASE TAKE FURTHER NOTICE THAT if no response to the Objection is timely filed and served, the Court may grant the Objection and enter the order without a hearing as set forth in Rule 9014-1 of the Local Rules for the United States Bankruptcy Court for the Eastern District of Michigan. Respectfully submitted, BOYLE BURDETT By:s/H. William Burdett, Jr. Eugene H. Boyle, Jr. (P42023) H. William Burdett, Jr. (P63185) 14950 East Jefferson, Suite 200 Grosse Pointe Park, Michigan 48230 (313) 344-4000 (313) 344-4001 (facsimile) burdett@boyleburdett.com Attorneys for the Collins & Aikman Litigation Trust

Dated: April 13, 2008

IN THE UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION In re: ) ) COLLINS & AIKMAN CORPORATION, et al.1 ) ) Debtors. ) ) ) ) ) ) _________________________________________) Chapter 11 Case No. 05-55927 (SWR) (Jointly Administered) (Tax Identification #13-3489233) Honorable Steven W. Rhodes

NOTICE OF HEARING PLEASE TAKE NOTICE that a hearing on The Collins & Aikman Litigation Trusts (the Trust) Eighteenth Omnibus Objection to Claims (the Eighteenth Omnibus Objection) is scheduled to be heard before the Honorable Steven W. Rhodes on May 22, 2008 at 2:00 p.m., or as soon thereafter as counsel may be heard, in his courtroom in the United States Bankruptcy Court, 211 West Fort Street, Detroit, Michigan 48226. PLEASE TAKE FURTHER NOTICE that the May 22, 2008 hearing (the Hearing) may be adjourned thereafter from time to time without further notice to claimants and other

1

The Debtors in the jointly administered cases include: Collins & Aikman Corporation; Amco Convertible Fabrics, Inc., Case No. 05-55949; Becker Group, LLC (d/b/a/ Collins & Aikman Premier Mold), Case No. 05-55977; Brut Plastics, Inc., Case No. 05-55957; Collins & Aikman (Gibraltar) Limited, Case No. 05-55989; Collins & Aikman Accessory Mats, Inc. (f/k/a the Akro Corporation), Case No. 05-55952; Collins & Aikman Asset Services, Inc., Case No. 05-55959; Collins & Aikman Automotive (Argentina), Inc. (f/k/a Textron Automotive (Argentina), Inc.), Case No. 05-55965; Collins & Aikman Automotive (Asia), Inc. (f/k/a Textron Automotive (Asia), Inc.), Case No. 0555991; Collins & Aikman Automotive Exteriors, Inc. (f/k/a Textron Automotive Exteriors, Inc.), Case No. 05-55958; Collins & Aikman Automotive Interiors, Inc. (f/k/a Textron Automotive Interiors, Inc.), Case No. 05-55956; Collins & Aikman Automotive International, Inc., Case No. 05-55980; Collins & Aikman Automotive International Services, Inc. (f/k/a Textron Automotive International Services, Inc.), Case No. 05-55985; Collins & Aikman Automotive Mats, LLC, Case No. 05-55969; Collins & Aikman Automotive Overseas Investment, Inc. (f/k/a Textron Automotive Overseas Investment, Inc.), Case No. 05-55978; Collins & Aikman Automotive Services, LLC, Case No. 05-55981; Collins & Aikman Canada Domestic Holding Company, Case No. 05-55930; Collins & Aikman Carpet & Acoustics (MI), Inc., Case No. 05-55982; Collins & Aikman Carpet & Acoustics (TN), Inc., Case No. 05-55984; Collins & Aikman Development Company, Case No. 05-55943; Collins & Aikman Europe, Inc., Case No. 05-55971; Collins & Aikman Fabrics, Inc. (d/b/a Joan Automotive Industries, Inc.), Case No. 05-55963; Collins & Aikman Intellimold, Inc. (d/b/a M&C Advanced Processes, Inc.), Case No. 05-55976; Collins & Aikman Interiors, Inc., Case No. 05-55970; Collins & Aikman International Corporation, Case No. 05-55951; Collins & Aikman Plastics, Inc., Case No. 05-55960; Collins & Aikman Products Co., Case No. 05-55932; Collins & Aikman Properties, Inc., Case No. 0555964; Comet Acoustics, Inc., Case No. 05-55972; CW Management Corporation, Case No. 05-55979; Dura Convertible Systems, Inc., Case No. 05-55942; Gamble Development Company, Case No. 05-55974; JPS Automotive, Inc. (d/b/a PACJ, Inc.), Case No. 05-55935; New Baltimore Holdings, LLC, Case No. 05-55992; Owosso Thermal Forming, LLC, Case No. 05-55946; Southwest Laminates, Inc. (d/b/a Southwest Fabric Laminators Inc.), Case No. 05-55948; Wickes Asset Management, Inc., Case No. 05-55962; and Wickes Manufacturing Company, Case No. 05-55968.

parties in interest other than the announcement of the adjourned date at the Hearing or any other hearing thereafter. PLEASE TAKE FURTHER NOTICE that you need not appear at the Hearing if you do not object to the relief requested in the Eighteenth Omnibus Objection. PLEASE TAKE FURTHER NOTICE that if no responses to the Eighteenth Omnibus Objection are timely filed and served, the Court may grant the Eighteenth Omnibus Objection and enter the order without a hearing as set forth in Rule 9014-1 of the Local Rules for the United States Bankruptcy Court for the Eastern District of Michigan. Respectfully submitted, BOYLE BURDETT By:s/H. William Burdett, Jr. Eugene H. Boyle, Jr. (P42023) H. William Burdett, Jr. (P63185) 14950 East Jefferson, Suite 200 Grosse Pointe Park, Michigan 48230 (313) 344-4000 (313) 344-4001 (facsimile) burdett@boyleburdett.com Attorneys for the Collins & Aikman Litigation Trust

Dated: April 13, 2008

EXHIBIT A

IN THE UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION In re: ) ) COLLINS & AIKMAN CORPORATION, et al.1 ) ) Debtors. ) ) ) ) ) ) _________________________________________) Chapter 11 Case No. 05-55927 (SWR) (Jointly Administered) (Tax Identification #13-3489233) Honorable Steven W. Rhodes

ORDER GRANTING THE COLLINS & AIKMAN LITIGATION TRUSTS EIGHTEENTH OMNIBUS OBJECTION TO CLAIMS (MULTIDEBTOR DUPLICATE CLAIMS) Upon the Collins & Aikman Litigation Trusts (the Trust) Eighteenth Omnibus Objection, dated April 13, 2008; and upon consideration of the supporting papers and the files and records in these cases and upon the arguments and testimony presented at a hearing before the Court; and any responses to the Eighteenth Omnibus Objection having been withdrawn or overruled on the merits; and it appearing that the Court has jurisdiction over the subject matter of the Eighteenth Omnibus Objection and the relief requested therein; and it appearing that notice

1

The Debtors in the jointly administered cases include: Collins & Aikman Corporation; Amco Convertible Fabrics, Inc., Case No. 05-55949; Becker Group, LLC (d/b/a/ Collins & Aikman Premier Mold), Case No. 05-55977; Brut Plastics, Inc., Case No. 05-55957; Collins & Aikman (Gibraltar) Limited, Case No. 05-55989; Collins & Aikman Accessory Mats, Inc. (f/k/a the Akro Corporation), Case No. 05-55952; Collins & Aikman Asset Services, Inc., Case No. 05-55959; Collins & Aikman Automotive (Argentina), Inc. (f/k/a Textron Automotive (Argentina), Inc.), Case No. 05-55965; Collins & Aikman Automotive (Asia), Inc. (f/k/a Textron Automotive (Asia), Inc.), Case No. 0555991; Collins & Aikman Automotive Exteriors, Inc. (f/k/a Textron Automotive Exteriors, Inc.), Case No. 05-55958; Collins & Aikman Automotive Interiors, Inc. (f/k/a Textron Automotive Interiors, Inc.), Case No. 05-55956; Collins & Aikman Automotive International, Inc., Case No. 05-55980; Collins & Aikman Automotive International Services, Inc. (f/k/a Textron Automotive International Services, Inc.), Case No. 05-55985; Collins & Aikman Automotive Mats, LLC, Case No. 05-55969; Collins & Aikman Automotive Overseas Investment, Inc. (f/k/a Textron Automotive Overseas Investment, Inc.), Case No. 05-55978; Collins & Aikman Automotive Services, LLC, Case No. 05-55981; Collins & Aikman Canada Domestic Holding Company, Case No. 05-55930; Collins & Aikman Carpet & Acoustics (MI), Inc., Case No. 05-55982; Collins & Aikman Carpet & Acoustics (TN), Inc., Case No. 05-55984; Collins & Aikman Development Company, Case No. 05-55943; Collins & Aikman Europe, Inc., Case No. 05-55971; Collins & Aikman Fabrics, Inc. (d/b/a Joan Automotive Industries, Inc.), Case No. 05-55963; Collins & Aikman Intellimold, Inc. (d/b/a M&C Advanced Processes, Inc.), Case No. 05-55976; Collins & Aikman Interiors, Inc., Case No. 05-55970; Collins & Aikman International Corporation, Case No. 05-55951; Collins & Aikman Plastics, Inc., Case No. 05-55960; Collins & Aikman Products Co., Case No. 05-55932; Collins & Aikman Properties, Inc., Case No. 0555964; Comet Acoustics, Inc., Case No. 05-55972; CW Management Corporation, Case No. 05-55979; Dura Convertible Systems, Inc., Case No. 05-55942; Gamble Development Company, Case No. 05-55974; JPS Automotive, Inc. (d/b/a PACJ, Inc.), Case No. 05-55935; New Baltimore Holdings, LLC, Case No. 05-55992; Owosso Thermal Forming, LLC, Case No. 05-55946; Southwest Laminates, Inc. (d/b/a Southwest Fabric Laminators Inc.), Case No. 05-55948; Wickes Asset Management, Inc., Case No. 05-55962; and Wickes Manufacturing Company, Case No. 05-55968.

of the Eighteenth Omnibus Objection was sufficient and no other or further notice need be provided; and after due deliberation and sufficient cause appearing therefore, it is ORDERED: 1. 2. The Eighteenth Omnibus Objection is granted in its entirety. The duplicate, identical Claims identified on Exhibit B to the Eighteenth

Omnibus Objection are disallowed for all purposes because they were filed against multiple Debtor entities for the same debt. 3. This Order is without prejudice to the Trusts ability to otherwise object to the

surviving claims listed on Exhibit B to the Eighteenth Omnibus Objection. 4. 5. This Order is effective without further action of the Debtors and the claimants. The Debtors, the Trust, and Kurtzman Carson Consultants, LLC are authorized to

take all actions necessary to effectuate the relief granted pursuant to this Order in accordance with the Eighteenth Omnibus Objection. 6. The terms and conditions of this Order shall be immediately effective and

enforceable upon its entry. 7. The Court retains jurisdiction with respect to all matters arising from or relating to

the implementation of this Order.

EXHIBIT B

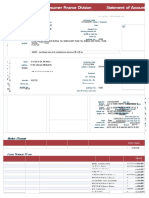

Multi-Debtor Duplicative Claim Objections

Claim # to be disallowed 5447 5571 6141 6185 6261 6289 6324 6361 6414 6473 6513 6566 6641 6886 6976 7052 7072 7082 Claim # to survive Final Name Final Claim Amount UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED Nature Debtor Name Comet Acoustics, Inc. Collins & Aikman Fabrics, Inc. (f/k/a Joan Automotive Industries, Inc.) Collins & Aikman Automotive Exteriors, Inc. (f/k/a Textron Automotive Exteriors, Inc.) Collins & Aikman Automotive International, Inc. CW Management Corporation Becker Group, LLC (d/b/a Collins & Aikman Premier Mold) Owosso Thermal Forming, LLC Southwest Laminates, Inc. (d/b/a Southwest Fabric Laminators Inc.) Collins & Aikman Automotive Overseas Investment, Inc. Collins & Aikman Carpet & Acoustics (TN), Inc. Collins & Aikman Carpet & Acoustics (MI), Inc. Gamble Development Company Brut Plastics, Inc. Wickes Asset Management, Inc. Collins & Aikman Europe, Inc. Collins & Aikman Automotive Services, LLC Collins & Aikman Automotive (Asia), Inc. (f/k/a Textron Automotive (Asia), Inc.) Dura Convertible Systems, Inc.

Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH

General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured

In re Collins Aikman Corporation, et al. Case No. 05-55927 (SWR)

Page 1 of 5

4/12/2008 3:55 PM

Multi-Debtor Duplicative Claim Objections

Claim # to be disallowed 7162 7209 7284 7327 7365 7504 7577 7610 7641 7671 7741 7793 7877 7929 8173 8195 7244 Claim # to survive Final Name Final Claim Amount UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED Nature Debtor Name Collins & Aikman Automotive Mats, LLC Wickes Manufacturing Company Collins & Aikman (Gibraltar) Limited Collins & Aikman Automotive Interiors, Inc. (f/k/a Textron Automotive Interiors, Inc.) Collins & Aikman Properties, Inc. Collins & Aikman International Corporation Collins & Aikman Interiors, Inc. Collins & Aikman Development Company Collins & Aikman Products Co. New Baltimore Holdings, LLC Collins & Aikman Intellimold, Inc. (f/k/a M&C Advanced Processes, Inc.) Collins & Aikman Automotive (Argentina), Inc. (f/k/a Textron Automotive (Argentina), Inc.) Collins & Aikman Automotive International Services, Inc. Amco Convertible Fabrics, Inc. Collins & Aikman Plastics, Inc. Collins & Aikman Canada Domestic Holding Company Collins & Aikman Corporation

Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH Collins & Aikman Products GmbH

General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured

In re Collins Aikman Corporation, et al. Case No. 05-55927 (SWR)

Page 2 of 5

4/12/2008 3:55 PM

Multi-Debtor Duplicative Claim Objections

Claim # to be disallowed 5470 5552 6088 6184 6247 6271 6304 6340 6399 6469 6494 6532 6589 6676 6853 6920 7003 7055 Claim # to survive Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Final Name Final Claim Amount UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED Nature Debtor Name Comet Acoustics, Inc. Collins & Aikman Fabrics, Inc. (f/k/a Joan Automotive Industries, Inc.) Collins & Aikman Automotive Exteriors, Inc. (f/k/a Textron Automotive Exteriors, Inc.) Collins & Aikman Automotive International, Inc. CW Management Corporation Becker Group, LLC (d/b/a Collins & Aikman Premier Mold) Owosso Thermal Forming, LLC Southwest Laminates, Inc. (d/b/a Southwest Fabric Laminators Inc.) Collins & Aikman Automotive Overseas Investment, Inc. Collins & Aikman Carpet & Acoustics (TN), Inc. Collins & Aikman Carpet & Acoustics (MI), Inc. Gamble Development Company Collins & Aikman Accessory Mats, Inc. (f/k/a the Akro Corporation) Brut Plastics, Inc. Wickes Asset Management, Inc. Collins & Aikman Europe, Inc. Collins & Aikman Automotive Services, LLC Dura Convertible Systems, Inc.

General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured

In re Collins Aikman Corporation, et al. Case No. 05-55927 (SWR)

Page 3 of 5

4/12/2008 3:55 PM

Multi-Debtor Duplicative Claim Objections

Claim # to be disallowed 7102 7190 7224 7287 7335 7347 7388 7445 7513 7570 7594 7630 7688 7749 7772 7851 7927 8175 Claim # to survive Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Collins & Aikman Turkey Final Name Final Claim Amount UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED UNLIQUIDATED Nature Debtor Name Collins & Aikman Automotive (Asia), Inc. (f/k/a Textron Automotive (Asia), Inc.) Collins & Aikman Automotive Mats, LLC Wickes Manufacturing Company Collins & Aikman (Gibraltar) Limited Collins & Aikman Automotive Interiors, Inc. (f/k/a Textron Automotive Interiors, Inc.) Collins & Aikman Properties, Inc. Collins & Aikman Asset Services, Inc. JPS Automotive, Inc. (d/b/a PACJ, Inc.) Collins & Aikman International Corporation Collins & Aikman Interiors, Inc. Collins & Aikman Development Company Collins & Aikman Products Co. New Baltimore Holdings, LLC Collins & Aikman Intellimold, Inc. (f/k/a M&C Advanced Processes, Inc.) Collins & Aikman Automotive (Argentina), Inc. (f/k/a Textron Automotive (Argentina), Inc.) Collins & Aikman Automotive International Services, Inc. Amco Convertible Fabrics, Inc. Collins & Aikman Plastics, Inc.

General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured General Unsecured

In re Collins Aikman Corporation, et al. Case No. 05-55927 (SWR)

Page 4 of 5

4/12/2008 3:55 PM

Multi-Debtor Duplicative Claim Objections

Claim # to be disallowed 8183 7237 Claim # to survive Collins & Aikman Turkey Collins & Aikman Turkey Final Name Final Claim Amount UNLIQUIDATED UNLIQUIDATED Nature Debtor Name Collins & Aikman Canada Domestic Holding Company Collins & Aikman Corporation

General Unsecured General Unsecured

97 71

Florine W Lee Florine W Lee

$150,000.00 $150,000.00

General Unsecured General Unsecured

Collins & Aikman Products Co. Collins & Aikman Corporation

83 7

Fred G Cook Jr Fred G Cook Jr

$250,000.00 $250,000.00

General Unsecured General Unsecured

Collins & Aikman Products Co. Collins & Aikman Corporation

126 48

Fred N Linder Fred N Linder

$150,000.00 $150,000.00

General Unsecured General Unsecured

Collins & Aikman Products Co. Collins & Aikman Corporation

8607 8627

General Electric Capital Corp General Electric Capital Corp

UNLIQUIDATED UNLIQUIDATED

General Unsecured General Unsecured

Becker Group, LLC (d/b/a Collins & Aikman Premier Mold) Collins & Aikman Products Co.

4513 5391

George Green Sr George Green Sr

UNLIQUIDATED UNLIQUIDATED

General Unsecured General Unsecured

Collins & Aikman Automotive Interiors, Inc. (f/k/a Textron Automotive Interiors, Inc.) Collins & Aikman Products Co.

In re Collins Aikman Corporation, et al. Case No. 05-55927 (SWR)

Page 5 of 5

4/12/2008 3:55 PM

You might also like

- A Simple Solution For Starting A Profitable Cannabis BusinessDocument18 pagesA Simple Solution For Starting A Profitable Cannabis BusinessMartin TrifonovNo ratings yet

- Analysis of Financial Statements Of: Presented by AyeshaDocument30 pagesAnalysis of Financial Statements Of: Presented by AyeshaaaaaNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument17 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument18 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument17 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument18 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument18 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument20 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument18 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument18 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument17 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument22 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument20 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument16 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument16 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument20 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument18 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument17 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument16 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument18 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument18 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument17 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument17 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument15 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument21 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument16 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument17 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument27 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument27 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument26 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- Supreme Court Eminent Domain Case 09-381 Denied Without OpinionFrom EverandSupreme Court Eminent Domain Case 09-381 Denied Without OpinionNo ratings yet

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 pagesAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document69 pagesAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 pagesAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Wochos V Tesla OpinionDocument13 pagesWochos V Tesla OpinionChapter 11 DocketsNo ratings yet

- Roman Catholic Bishop of Great Falls MTDocument57 pagesRoman Catholic Bishop of Great Falls MTChapter 11 DocketsNo ratings yet

- National Bank of Anguilla DeclDocument10 pagesNational Bank of Anguilla DeclChapter 11 DocketsNo ratings yet

- Energy Future Interest OpinionDocument38 pagesEnergy Future Interest OpinionChapter 11 DocketsNo ratings yet

- NQ LetterDocument2 pagesNQ LetterChapter 11 DocketsNo ratings yet

- SEC Vs MUSKDocument23 pagesSEC Vs MUSKZerohedge100% (1)

- PopExpert PetitionDocument79 pagesPopExpert PetitionChapter 11 DocketsNo ratings yet

- NQ Letter 1Document3 pagesNQ Letter 1Chapter 11 DocketsNo ratings yet

- Home JoyDocument30 pagesHome JoyChapter 11 DocketsNo ratings yet

- Zohar AnswerDocument18 pagesZohar AnswerChapter 11 DocketsNo ratings yet

- Kalobios Pharmaceuticals IncDocument81 pagesKalobios Pharmaceuticals IncChapter 11 DocketsNo ratings yet

- Quirky Auction NoticeDocument2 pagesQuirky Auction NoticeChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsNo ratings yet

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 pagesDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsNo ratings yet

- Local Corp Chapter 11 Bankruptcy PetitionDocument18 pagesLocal Corp Chapter 11 Bankruptcy PetitionChapter 11 DocketsNo ratings yet

- My Views On Whether Customers Are Treated Fairly in Retailer BankruptciesDocument3 pagesMy Views On Whether Customers Are Treated Fairly in Retailer BankruptciesChapter 11 DocketsNo ratings yet

- 303-Sales - invoice-ADDTEQ SOFTWARE INDIA PRIVATE LIMITEDDocument1 page303-Sales - invoice-ADDTEQ SOFTWARE INDIA PRIVATE LIMITEDRaheel KaziNo ratings yet

- Construction - AlliedDocument6 pagesConstruction - AlliedSyed Ghulam MahdiNo ratings yet

- Grievance Management: Shweta Chauhan Assistant Professor Shweta.j1525@cgc - Ac.in Bcom-6 SemDocument27 pagesGrievance Management: Shweta Chauhan Assistant Professor Shweta.j1525@cgc - Ac.in Bcom-6 Semlakshay dagarNo ratings yet

- It GDPR RACI ChartDocument9 pagesIt GDPR RACI ChartShivesh RanjanNo ratings yet

- Energies: Used Cooking Oils in The Biogas Chain: A Technical and Economic AssessmentDocument13 pagesEnergies: Used Cooking Oils in The Biogas Chain: A Technical and Economic AssessmentVano NonikashviliNo ratings yet

- Money and Banking - Handwritten Notes - (Kautilya)Document20 pagesMoney and Banking - Handwritten Notes - (Kautilya)samriddhiverma16No ratings yet

- FALCON 2 Page Brief 30012021Document2 pagesFALCON 2 Page Brief 30012021Baskaren RamachandranNo ratings yet

- Sess 1Document4 pagesSess 1khanhnguyenfgoNo ratings yet

- Spanish Vocabulary-Meeting PeopleDocument1 pageSpanish Vocabulary-Meeting PeopleShubham BansalNo ratings yet

- 003 Background Scope of Works - AMD3Document41 pages003 Background Scope of Works - AMD3Shesh ManiNo ratings yet

- Bem4063 C4@Document18 pagesBem4063 C4@Seo ChangBinNo ratings yet

- KNOW YOUR FACILITATOR-Andrew Msope PDFDocument24 pagesKNOW YOUR FACILITATOR-Andrew Msope PDFdwayne.bettNo ratings yet

- Methodology Document of Nifty Cpse Index: January 2020Document13 pagesMethodology Document of Nifty Cpse Index: January 2020Sai Samapath KarumudiNo ratings yet

- Mapping 2018Document73 pagesMapping 2018Mira AhmadNo ratings yet

- Assignment 2Document2 pagesAssignment 2Johnson Yeu NzokaNo ratings yet

- Pay Guide - General Retail Industry Award (MA000004) : DisclaimerDocument29 pagesPay Guide - General Retail Industry Award (MA000004) : DisclaimerWaseem AhmedNo ratings yet

- MQC00190DDocument5 pagesMQC00190DGaneshkumar AmbedkarNo ratings yet

- Globalization, or Globalisation (: "Globalize" Redirects Here. For The Javascript Library, See - For Other Uses, SeeDocument1 pageGlobalization, or Globalisation (: "Globalize" Redirects Here. For The Javascript Library, See - For Other Uses, SeeDipesh NepalNo ratings yet

- Gross Estate PDFDocument20 pagesGross Estate PDFSweet EmmeNo ratings yet

- Sbi RFP On Empanelment of Research AgentsDocument76 pagesSbi RFP On Empanelment of Research AgentsishanreadonNo ratings yet

- ConclusionDocument2 pagesConclusionFeker H. MariamNo ratings yet

- Wiggly Softbill Mix - Wiggly WigglersDocument1 pageWiggly Softbill Mix - Wiggly WigglersRamon ArgudoNo ratings yet

- The Role of Trainings For State Civil Apparatus (ASN) To Support The Complete Systematic Land RegistrationDocument5 pagesThe Role of Trainings For State Civil Apparatus (ASN) To Support The Complete Systematic Land RegistrationAbitha RangkayaNo ratings yet

- Bank of The Philippine Islands V. Lifetime Marketing Corporation G.R. NO. 176434 JUNE 25, 2008 FactsDocument2 pagesBank of The Philippine Islands V. Lifetime Marketing Corporation G.R. NO. 176434 JUNE 25, 2008 FactsRamon Khalil Erum IVNo ratings yet

- 2021 Cocolife Audited Financial Statements PDFDocument101 pages2021 Cocolife Audited Financial Statements PDFHoyo VerseNo ratings yet

- FR Lci Qar08.0003 15 015Document2 pagesFR Lci Qar08.0003 15 015Jesús PérezNo ratings yet

- The Ideas That I Trade by & Space WarsDocument102 pagesThe Ideas That I Trade by & Space WarsTim GelukNo ratings yet

- Business Plan Alternative MedicineDocument8 pagesBusiness Plan Alternative Medicineafwfzrhbj100% (1)