RCE Capital

RCE Capital

Uploaded by

James WarrenCopyright:

Available Formats

RCE Capital

RCE Capital

Uploaded by

James WarrenOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

RCE Capital

RCE Capital

Uploaded by

James WarrenCopyright:

Available Formats

RCE CAPITAL BERHAD

Annual Report 2006

02 06 07 08 09 10 15 21

Notice of Annual General Meeting Statement Accompanying Notice of Annual General Meeting Corporate Information Group Financial Highlights Corporate Structure Profile of Directors Chairmans Statement Penyata Pengerusi

RCE CAPITAL BERHAD

CONTENTS

27 34 36 38 45 107 Statement on Corporate Governance Additional Compliance Information Statement on Internal Control Audit Committee Report Financial Statements Analysis of Shareholdings Form of Proxy

RCE CAPITAL BERHAD 2

(2444-M) annual report 2006

Notice of

Annual General Meeting

NOTICE IS HEREBY GIVEN THAT the Fifty-Second Annual General Meeting of RCE Capital Berhad will be held at Dewan AmBank Group, 7th Floor, Bangunan AmBank Group, 55, Jalan Raja Chulan, 50200 Kuala Lumpur on Monday, 28 August 2006 at 10.30 a.m. to transact the following businesses:-

AGENDA AS ORDINARY BUSINESS 1. To receive the Audited Financial Statements for the financial year ended 31 March 2006 together with the Reports of the Directors and Auditors thereon. To re-elect the following Directors who retire by rotation pursuant to Article 106 of the Companys Articles of Association: (i) (ii) 3. Y. Bhg. Major General (Rtd) Dato Haji Fauzi bin Hussain Puan Shalina Azman Resolution 2 Resolution 3 Resolution 4 Resolution 1

2.

To re-elect Y. Bhg. Dato Che Md Nawawi bin Ismail who retires pursuant to Article 93 of the Companys Articles of Association. To re-appoint Messrs. Deloitte KassimChan as Auditors of the Company and to authorise the Directors to determine their remuneration.

4.

Resolution 5

AS SPECIAL BUSINESS 5. To consider and if thought fit, pass the following ordinary resolution: Payment of Directors Fees THAT the payment of Directors fees of RM91,250 in respect of the financial year ended 31 March 2006 be and is hereby approved. Resolution 6

Notice of Annual General Meeting

6.

To consider and if thought fit, pass the following ordinary resolution: Authority to Directors to Issue Shares THAT subject always to the Companies Act, 1965, provisions of the Companys Memorandum and Articles of Association and the approval from the relevant authorities, where such approval is necessary, full authority be and is hereby given to the Directors pursuant to Section 132D of the Companies Act, 1965 to issue shares in the Company at any time and upon such terms and conditions and for such purposes as the Directors may, in their absolute discretion deem fit, provided that the aggregate number of shares issued pursuant to this resolution does not exceed 10% of the issued capital of the Company for the time being and that the Directors be and are also empowered to obtain the approval for the listing of and quotation for the additional shares so issued on Bursa Malaysia Securities Berhad and that such authority shall continue in force until the conclusion of the next Annual General Meeting of the Company. Resolution 7

7.

To consider and if thought fit, pass the following ordinary resolution: Proposed New Shareholders Mandate for Recurrent Related Party Transactions of a Revenue or Trading Nature THAT, pursuant to Chapter 10, Paragraph 10.09 of the Listing Requirements of Bursa Malaysia Securities Berhad, the Company and its subsidiaries be and are hereby authorised to enter into and give effect to the recurrent related party transactions of a revenue or trading nature (Recurrent Transactions) with the related parties detailed in Section 2.2 of the Circular to Shareholders dated 4 August 2006, provided that the transactions are in the ordinary course of business and on normal commercial terms which are not more favourable to the related parties than those generally available to the public and are not detrimental to the interest of the minority shareholders of the Company. Resolution 8

RCE CAPITAL BERHAD 4

(2444-M) annual report 2006

Notice of Annual General Meeting

AND THAT authority conferred by the shareholders mandate shall continue to be in force until: (i) the conclusion of the next Annual General Meeting (AGM) of the Company, at which time it will lapse, unless by resolution passed at the AGM, the authority is renewed; the expiration of the period within which the next AGM of the Company after that date is required to be held pursuant to Section 143(1) of the Companies Act, 1965 (Act) (but shall not extend to such extension as may be allowed pursuant to Section 143(2) of the Act); or revoked or varied by resolution passed by the shareholders in general meeting,

(ii)

(iii)

whichever is the earlier; and the aggregate value of the Recurrent Transactions be disclosed in the annual report of the Company. AND THAT the Directors of the Company be authorised to complete and do all such acts and things as they may consider expedient or necessary or in the interests of the Company and/or its subsidiaries to give effect to the Recurrent Transactions contemplated and authorised by this Resolution. 8. To transact any other business for which due notice shall have been received.

By Order of the Board

JOHNSON YAP CHOON SENG (MIA 20766) SELENA LEONG SIEW TEE (MIA 7017630) Secretaries Kuala Lumpur 4 August 2006

Notice of Annual General Meeting

NOTES: 1. A member entitled to attend and vote at the meeting is entitled to appoint more than two (2) proxies to attend and vote in his stead. A proxy may but need not be a member of the Company and a member may appoint any person to be his proxy without limitation and the provisions of Section 149(1)(a) and (b) of the Companies Act, 1965 shall not apply to the Company. Where a member appoints two (2) or more proxies, he shall specify the proportion of his shareholdings to be represented by each proxy. Where a member is an authorised nominee as defined under the Securities Industry (Central Depositories) Act, 1991, it may appoint at least one (1) proxy in respect of each securities account it holds with ordinary shares of the Company standing to the credit of the said securities account. The instrument appointing a proxy shall be in writing under the hand of the appointer or his attorney duly authorised in writing or if the appointer is a corporation, either under its Common Seal or under the hand of the attorney. The instrument appointing a proxy and the power of attorney (if any) under which it is signed or a notarially certified copy thereof shall be deposited at the Registered Office of the Company situated at 7th Floor, Wisma Tan Kim San, No. 518A, 3rd Mile, Jalan Ipoh, 51200 Kuala Lumpur not less than forty-eight (48) hours before the time for holding the meeting or at any adjournment thereof. Explanatory notes on Special Business (i) Resolution 6 - Payment of Directors fees The Ordinary Resolution 6 proposed under item 5, if passed, will authorise the payment of Directors fees to the Non-Executive Directors of the Company for their services as Directors during the financial year ended 31 March 2006. (ii) Resolution 7 - Authority to Directors to issue shares The Ordinary Resolution 7 proposed under item 6, if passed, will give the Directors of the Company authority to issue and allot shares of not more than 10% of the total issued share capital of the Company for the time being, subject to the approvals of all relevant governmental/regulatory bodies, for such purposes as the Directors in their absolute discretion consider to be in the interest of the Company, without having to convene a general meeting. This authority will expire at the next Annual General Meeting of the Company. (iii) Resolution 8 - Proposed New Shareholders Mandate for Recurrent Related Party Transactions of a Revenue or Trading Nature The Ordinary Resolution 8 proposed under item 7, if passed, will allow RCE Group to enter into recurrent related party transactions of a revenue or trading nature pursuant to paragraph 10.09 of the Listing Requirements of Bursa Malaysia Securities Berhad. Further information on the proposed new shareholders mandate for recurrent related party transactions of a revenue or trading nature is set out in the Circular to Shareholders dated 4 August 2006 which is despatched together with the Companys 2006 Annual Report.

2. 3.

4.

5.

6.

RCE CAPITAL BERHAD 6

(2444-M) annual report 2006

Statement Accompanying

Notice of Annual General Meeting

1. DIRECTORS SEEKING RE-ELECTION AT THE FIFTY-SECOND ANNUAL GENERAL MEETING OF THE COMPANY The Directors retiring by rotation pursuant to Article 106 of the Companys Articles of Association and seeking re-election are as follows: Y. Bhg. Major General (Rtd) Dato Haji Fauzi bin Hussain. Puan Shalina Azman.

A Director who was appointed to the Board during the year, retiring pursuant to Article 93 of the Companys Articles of Association and seeking re-election is as follows: Y. Bhg. Dato Che Md Nawawi bin Ismail.

Details of Directors who are standing for re-election are set out in their respective profiles which appear in the Profile of Directors on pages 10 to 14 of the Annual Report. Their securities holdings in the Company are set out in the Analysis of Shareholdings which appear on page 108 of the Annual Report.

2.

DETAILS OF ATTENDANCE OF DIRECTORS AT BOARD MEETINGS During the financial year, four (4) Board Meetings were held. Details of attendance of Directors at Board Meetings are disclosed in the Statement on Corporate Governance on page 27 of the Annual Report.

3.

PLACE, DATE AND TIME OF THE FIFTY-SECOND ANNUAL GENERAL MEETING OF THE COMPANY Place : Dewan AmBank Group 7th Floor, Bangunan AmBank Group 55, Jalan Raja Chulan 50200 Kuala Lumpur Monday, 28 August 2006 at 10.30 a.m.

Date & Time

Corporate

Information

BOARD OF DIRECTORS

Tan Sri Dato Azman Hashim

Non-Independent Non-Executive Chairman

Soo Kim Wai

Non-Independent Non-Executive Director

Major General (Rtd) Dato Haji Fauzi bin Hussain

Independent Non-Executive Director

Shalina Azman

Non-Independent Non-Executive Director

Datuk Mohd Zaman Khan @ Hassan bin Rahim Khan

Independent Non-Executive Director

Chew Keng Yong

Non-Independent Non-Executive Director

Dato Che Md Nawawi bin Ismail

Independent Non-Executive Director

COMPANY SECRETARIES

Johnson Yap Choon Seng (MIA 20766) Selena Leong Siew Tee (MAICSA 7017630)

AUDITORS

Deloitte KassimChan

Chartered Accountants

REGISTERED OFFICE

7th Floor, Wisma Tan Kim San No. 518A, 3rd Mile, Jalan Ipoh 51200 Kuala Lumpur Tel : 603-4042 8788 Fax : 603-4042 8877

Level 19, Uptown 1 1 Jalan SS 21/58 Damansara Uptown 47400 Petaling Jaya Selangor Darul Ehsan Tel : 603-7723 6500 Fax : 603-7726 3986

SHARE REGISTRAR

PFA Registration Services Sdn Bhd 1301, Level 13, Uptown 1 No. 1, Jalan SS 21/58 Damansara Uptown 47400 Petaling Jaya Selangor Darul Ehsan Tel : 603-7725 4888 Fax : 603-7722 2311

BUSINESS ADDRESS

2nd Floor, AMCORP Tower AMCORP Trade Centre No. 18, Jalan Persiaran Barat 46050 Petaling Jaya Selangor Darul Ehsan Tel : 603-7966 2600 Fax : 603-7966 2611 Website : www.rce.com.my

STOCK EXCHANGE LISTING

Bursa Malaysia Securities Berhad Second Board (listed since 20 September 1994) Stock name : RCECAP Stock code : 9296

RCE CAPITAL BERHAD 8

(2444-M) annual report 2006

Group

Financial

Highlights

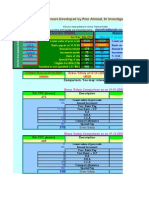

Consolidated Balance Sheets As at 31st March (RM000) Property, plant and equipment Loan and hire purchase receivables - Non-current portion Investments Deferred tax asset Current assets Long term and deferred liabilities Current liabilities Share capital Shareholders funds Goodwill on consolidation Net assets (NA) NA per share (sen) Consolidated Income Statements Year ended 31st March (RM000) Revenue Profit before taxation Profit/(Loss) after taxation Net profit/(loss) attributable to shareholders Earnings per share (sen)

* # Adjusted for share split Adjusted for bonus issue and share split

2006 3,115 220,284 61,170 6,597 83,119 (272,992) (36,694) 46,893 92,942 28,344 92,942 19.82 2006 57,478 23,512 22,315 19,791 4.86

2005 10,079 59,598 29,199 4,000 35,019 (72,614) (22,782) 40,151 58,368 19,002 58,368 14.54 2005 40,596 18,912 17,001 14,888 3.71

2004 14,500 57,203 5,294 66,293 (3,216) (48,388) 40,151 44,470 44,470 11.08* 2004 54,633 29,125 23,476 21,921 5.46*

2003 24,356 36,490 (2,721) (36,681) 18,675 21,121 269 21,121 5.26# 2003 44,873 371 (1,272) (1,100) (0.27)#

2002 27,286 18,657 (3,931) (15,713) 18,675 22,222 539 22,222 5.53# 2002 44,271 2,145 998 439 0.11#

Corporate

Structure

as of June 30, 2006

RCE CAPITAL BERHAD 10

(2444-M) annual report 2006

Profile of

Directors

Tan Sri Dato Azman is President of the Malaysia South-South Association, Malaysia-Japan Economic Association, Malaysian Prison FRIENDS Club and Non-Aligned Movements (NAM) Business Council. He is a member of the APEC Business Advisory Council, The Trilateral Commission (Asia-Pacific Group), the MalaysiaBritish and Malaysia-China Business Councils, and the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP) Business Advisory Council. He is also the Leader of the ASEAN-Japanese Business Meeting (Malaysia Committee, Keizai Doyukai) and is on the Board of Advisors, AIM Centre for Corporate Social Responsibility. He was recently appointed ProChancellor, Open University of Malaysia and Member, Governing Body of the Asian Productivity Organisation, Executive Committee of the Malaysian Crime Prevention Foundation and International Advisory Panel, Bank Negara Malaysia International Centre for Education in Islamic Finance (INCEIF). Tan Sri Dato Azman is the Non-Executive Chairman of AMMB Holdings Berhad (AHB) and Chairman of the Board of several subsidiaries of AHB, namely AmInvestment Group Berhad, AMFB Holdings Berhad, AmBank (M) Berhad, AmMerchant Bank Berhad, AmIslamic Bank Berhad, AmProperty Trust Management Berhad and AmAssurance Berhad. Apart from the AHB group of companies, he is also the Executive Chairman of AmcorpGroup Berhad and the Chairman of AMDB Berhad, Malaysian South-South Corporation Berhad, MCM Technologies Berhad and serves as a Director of Pembangunan MasMelayu Berhad and Islamic Banking & Finance Institute Malaysia Sdn Bhd. He is also involved in several charitable organisations as Chairman of AmGroup Foundation and Perdana Leadership Foundation, and Trustee for ECM Libra Foundation, Better Malaysia Foundation and the Malaysian Liver Foundation.

TAN SRI DATO AZMAN HASHIM

Non-Independent Non-Executive Chairman

Y. Bhg. Tan Sri Dato Azman Hashim, a Malaysian, aged 67, was appointed to the Board on 2 December 1988. Tan Sri Dato Azman, a Chartered Accountant, a Fellow of the Institute of Chartered Accountants and a Fellow of the Institute of Chartered Secretaries and Administrators, has been in the banking industry since 1960 when he joined Bank Negara Malaysia and served there until 1964. He practised as a Chartered Accountant in Azman Wong Salleh & Co from 1964 to 1971. He then joined the Board of Malayan Banking Berhad (MBB) from 1966 until 1980 and was its Executive Director from 1971 until 1980. He was the Executive Chairman of Kwong Yik Bank Berhad, a subsidiary of MBB, from 1980 until April 1982 when he acquired AmMerchant Bank Berhad. Tan Sri Dato Azman is the Chairman of the Malaysian Investment Banking Association, the National Productivity Corporation, East Asia Business Council and the Pacific Basin Economic Council (PBEC) International and Co-Chairman of Malaysia-Singapore Roundtable.

11

Profile of Directors

MAJOR GENERAL (RTD) DATO HAJI FAUZI BIN HUSSAIN

Independent Non-Executive Director

Y. Bhg. Major General (Rtd) Dato Haji Fauzi bin Hussain, a Malaysian, aged 66, was appointed to the Board on 25 April 2003. He is a graduate of the Command and Staff College of Indonesia and the Joint Services Staff College of Australia. He also attended management training courses in South Korea and the United States of America. Dato Haji Fauzi has since 1960 served in the Malaysian Army and the Royal Malaysian Air Force, and held various positions in the command and staff appointments before retiring in November 1994 as Deputy Chief of Air Force. He was Joint-Chairman of the planning and execution committee of air exercises with Thailand and Indonesia and was also involved in the training and operations along the border of Malaysia and Thailand. Dato Haji Fauzi currently serves on the Board of Atis Corporation Berhad, Genetec Technology Berhad and MCM Technologies Berhad.

DATUK MOHD ZAMAN KHAN @ HASSAN BIN RAHIM KHAN

Independent Non-Executive Director

Y. Bhg. Datuk Mohd Zaman Khan @ Hassan bin Rahim Khan, a Malaysian, aged 63, was appointed to the Board on 26 March 1998. He graduated from the Royal College of Defense Studies, United Kingdom and also holds a Graduate Certificate in Management from the Monash Mt. Eliza Business School. He served the Malaysian Police Force for 35 years and had held several key positions, namely as Commissioner of Police, Director of Criminal Investigation and Director-General for the Prisons Department. Datuk Mohd Zaman Khan currently sits on the Board of Tricubes Berhad.

RCE CAPITAL BERHAD 12

(2444-M) annual report 2006

Profile of Directors

SOO KIM WAI

Non-Independent Non-Executive Director

Mr. Soo Kim Wai, a Malaysian, aged 45, was appointed to the Board on 11 August 1997. Mr. Soo Kim Wai is a Chartered Accountant (Malaysian Institute of Accountants) and a Certified Public Accountant (Malaysian Institute of Certified Public Accountants).

DATO CHE MD NAWAWI BIN ISMAIL

Independent Non-Executive Director

Y. Bhg. Dato Che MD Nawawi bin Ismail, a Malaysian, aged 56, was appointed to the Board on 28 February 2006. Dato Nawawi holds a Bachelor of Laws (Hons) Degree from the International Islamic University of Malaysia and practiced as an advocate and solicitors in a legal firm between 1990 and 1991. Dato Nawawi was the Deputy Commissioner of Police of the Malaysian Police Force until his recent retirement in February 2006. He had held several key positions during his 36 years of service with the Malaysian Police Force including the position of Head of Criminal Investigation Department in the State of Sabah and Perlis, OCPD Cheras, Deputy Director Commercial Crime Division and Deputy Director, Criminal Investigation Department in Bukit Aman. Dato Nawawi also serves on the Board of AmcorpGroup Berhad and Suremax Group Berhad.

He joined AmcorpGroup Berhad (AMCORP) in 1989 as Senior Manager, Finance and has since held various positions. He was appointed as a Director of AMCORP on 13 March 1996 and subsequently as Managing Director on 1 January 1999. Before joining AMCORP, he was in the accounting profession for 5 years with Deloitte KassimChan from 1980 to 1985 and with Plantation Agencies Sdn Bhd from 1985 to 1989. Presently, he is a Board member of AMMB Holdings Berhad, AmProperty Trust Management Berhad, AMCORP and MCM Technologies Berhad.

13

Profile of Directors

SHALINA AZMAN

Non-Independent Non-Executive Director

Puan Shalina Azman, a Malaysian, aged 39, was appointed to the Board on 6 January 2000. She holds a Bachelor of Science in Business Administration majoring in Finance and Economics from the Chapman University in California and in 1993 she obtained her Masters in Business Administration from the University of Hull in United Kingdom.

CHEW KENG YONG

Puan Shalina Azmans involvement with the Company dates back to 1990 where she first gained invaluable experience in the media industry as a Business Development Officer. Prior to re-joining the Company, she was with AmcorpGroup Berhad (AMCORP) from 1995 to 1999 as a Senior Manager, Corporate Planning. She was subsequently appointed as the Managing Director of the Company on 1 September 2000. On 31 July 2002, Puan Shalina resigned as the Managing Director of the Company to re-join AMCORP and on 1 August 2002, she was appointed as the Deputy Managing Director of AMCORP. Apart from the Company and AMCORP, Puan Shalina Azman is also a Director of AMMB Holdings Berhad and MCM Technologies Berhad.

Non-Independent Non-Executive Director

Mr. Chew Keng Yong, a Malaysian, aged 51, was appointed to the Board on 17 April 2001. Mr. Chew Keng Yong obtained his Diploma in Management from the Malaysian Institute of Management in 1985. He is the founder and the Managing Director of PosAd Sdn Bhd, the first in-store advertising company in Asia. He has extensive experience in the business of in-store adver tising which specialises in promoting and marketing fast-moving consumer goods for companies and supermarkets in East and West Malaysia. He is a board member of Focus-On-The-Family (M) Sdn Bhd, a non-profit organisation dedicated with a clear vision to strengthen the preservation of family. In 1998, he was elected as one of the winners of the 1998 Chivas Regal Achievement Award to Malaysian businessmen in recognition of their excellence accomplishments in business.

RCE CAPITAL BERHAD 14

(2444-M) annual report 2006

Profile of Directors

DETAILS OF MEMBERSHIP IN BOARD COMMITTEES

COMMITTEES OF THE BOARD Audit Committee Tan Sri Dato Azman Hashim Major General (Rtd) Dato Haji Fauzi bin Hussain Datuk Mohd Zaman Khan @ Hassan bin Rahim Khan Dato Che Md Nawawi bin Ismail Soo Kim Wai Shalina Azman Chew Keng Yong Member Chairman Member Member Member Member Member Chairman Member Chairman Remuneration Committee Nomination Committee

None of the Directors have any family relationship with any Director and/or major shareholder of the Company, except for Tan Sri Dato Azman Hashim and Puan Shalina Azman who are father and daughter. Tan Sri Dato Azman Hashim is the Executive Chairman and a major shareholder of AmcorpGroup Berhad, which in turn is a major shareholder of the Company. None of the Directors have any conflict of interest with the Company, other than as announced or as set out in Note 20 to the Financial Statements under Related Company Transactions. None of the Directors have been convicted for offences within the past 10 years.

15

Chairmans

Statement

Dear Shareholders,

I am pleased to present to you, on behalf of the Board of Directors of RCE Capital Berhad (RCE), the Annual Report and Audited Financial Statements of the Group and the Company for the financial year ended 31 March 2006.

ECONOMIC REVIEW

The year 2005 saw the Malaysian economy growing at a slower pace of 5.2% compared with 7.2% in 2004. While the external environment has remained highly challenging, amidst escalating oil prices, higher interest rates and uncertain geo-political conditions, Malaysia is expected to sustain a growth of above 5.0% in 2006. This would be supported largely by the domestic demand, led by the private sector.

FINANCIAL REVIEW

For the financial year under review, the Group continued its good performance by recording double digit growth in both top-line and bottomline figures. For the 12 months ended 31 March 2006, our revenue grew by 29% to RM57.5 million compared to RM44.6 million recorded in the previous financial year. Profit after tax (PAT) was significantly higher at RM22.3 million which represented an increase of 31% over the previous years PAT of RM17.0 million. Correspondingly, our basic earnings per share rose from 3.7 sen to 4.9 sen, bringing our net assets per share to 20 sen.

RCE CAPITAL BERHAD 16

(2444-M) annual report 2006

Chairmans Statement

...the Group continued its good performance by recording double digit growth in both top-line and bottom-line figures.

...Profit after tax (PAT) was significantly higher at RM22.3 million which represented an increase of 31% over the previous years PAT of RM17.0 million.

...Going forward, we will continue to explore viable business opportunities and further enhancement to our technological infrastructure and human capital resources to improve delivery to our customers, support our distribution network more efficiently and consequently bring greater value to our shareholders.

17

Chairmans Statement

BUSINESS DEVELOPMENT

In order for the Group to fully benefit from the strong assets and earnings growth of RCE Marketing Sdn Bhd (RCEM), the Groups main profit contributor for the coming years, we have completed the acquisition of the remaining 12.5% stake in RCE Enterprise Sdn Bhd (RCEE) in March 2006. As a result, RCEM has become an indirect wholly-owned subsidiary of RCE through RCEE. We continue to focus on growing RCEMs business relationships with the various co-operatives. As a result, our co-operative business partners now have more than 50 distribution channels throughout Malaysia, compared with approximately 40 channels the previous financial year. They continue to support our consumer credit business in providing financial solutions in the form of consumer loans to their members who primarily consist of civil servants. Going forward, we will continue to explore viable business opportunities and further enhancement to our technological infrastructure and human capital resources to improve delivery to our customers, support our distribution network more efficiently and consequently bring greater value to our shareholders.

CORPORATE DEVELOPMENT

Besides organic growth, the Group has also undertaken several corporate exercises with the aim of placing it in a better position to face the challenges ahead. We completed our acquisition of an additional 29.1 million units in AmFirst Property Trust (AMFPT) on 13 September 2005, increasing our total stake to 58.3 million units. The investment continues to provide the Group with a stable income stream averaging 7.5% annually. In addition, pursuant to the proposed restructuring and rebranding exercise announced by AMFPT in March 2006, which involves the establishment of a new Real Estate Investment Trust to be known as AmFirst REIT, the Group is expected to record a gain of approximately RM20.4 million for the financial year ending 31 March 2007 from its investment in AMFPT. In October 2005, the Group through its wholly-owned subsidiary company, RCE Advance Sdn Bhd, was given approval by the Securities Commission to issue up to RM420.0 million Fixed Rate Medium Term Notes (MTNs). The issue of the MTNs would allow the Group to tap on the debt markets to fund the growth of RCEM, the Groups main profit contributor. The MTNs comprised RM240.0 million Class A MTNs, RM120.0 million Class B MTNs and RM60.0 million Class C MTNs and rated A+, A and BBB+ respectively by Malaysian Rating Corporation Berhad. This funding programme allows the Group to manage its funding cost in the current rising interest rate environment and to date, a total of RM210.0 million MTNs has been issued.

RCE CAPITAL BERHAD 18

(2444-M) annual report 2006

Chairmans Statement

...we remain focused on improving our productivity and efficiency, strengthening our credit risk management practices and reducing the overall cost of funding through innovative fund-raising exercises.

19

Chairmans Statement

To raise additional funding for the Groups core business, we completed the disposal of the 14 continuous parcels of land along Jalan Pahang, Kuala Lumpur owned by our subsidiary, Effusion.Com Sdn Bhd, for a cash consideration of RM7.7 million in February 2006. As part of our continuous efforts to enhance value and reward our shareholders, we have on 19 May 2006 announced the proposal to issue one (1) bonus share for every three (3) existing shares held and to undertake a Special Issue of up to 21.1 million new RCE shares to be issued to qualified Bumiputera investors. With the approval of the shareholders in an Extraordinary General Meeting held on 7 July 2006, the proposal is expected to be completed by end August 2006. In the same announcement, the Board also proposed to transfer the listing status of RCE from the Second Board to the Main Board of Bursa Malaysia Securities Berhad. The transfer will better reflect our current size of operations and is expected to enhance the Groups profile among both our bankers as well as potential investors. The proposed transfer was approved by the Securities Commission on 25 July 2006 and is also expected to be completed by end August 2006.

INVESTOR RELATIONS

As part of our ongoing initiative to provide readily available information to our shareholders and the investing public, we have embarked on establishing a comprehensive and informative website. The website (http:// www.rce.com.my) also provides a convenient channel for fund managers, research houses and potential investors to obtain information on the Group with just the click of a button.

OUTLOOK / PROSPECTS

Inflation and rising interest rates remain a main concern for the Group as these will have an impact on consumer spending patterns. Nevertheless, the Malaysian economy is still expected to sustain a GDP growth of more than 5% for 2006. Accordingly, we expect to see a further expansion of the Groups activities and an improvement in its financial performance. Besides expanding our distribution and marketing network, we remain focused on improving our productivity and efficiency, strengthening our credit risk management practices and reducing the overall cost of funding through innovative fund-raising exercises.

RCE CAPITAL BERHAD 20

(2444-M) annual report 2006

Chairmans Statement

DIRECTORATE

During the financial year ended 31 March 2006, we bid farewell to two of our Directors, Mr. Wong Bin Chen and Encik Azmi Hashim and on behalf of the Board, I would like to take this opportunity to thank them for their contribution and many years of dedication to the Group. I would also like to welcome Y. Bhg. Dato Che Md Nawawi bin Ismail to the Board. With his wealth of experience, I am confident that he will provide invaluable support to the Group.

ACKNOWLEDGEMENT

On behalf of the Board of Directors, I would like to record my appreciation to the management and staff for their contribution and commitment to the Group in achieving another year of success. Their professionalism, integrity and diligence are all core values that the Group cultivate as we set our course to face the challenges ahead. To our shareholders, business associates, partners, and the relevant authorities, we would like to thank all of you for your strong and continuing support, without which our progress over the years would not have been possible. I would like to thank my Fellow Directors on the Board for their guidance and contribution to the Group. The Group has progressed strongly over the years and with the impending transfer to the Main Board of Bursa Malaysia Securities Berhad, we remain excited about the opportunities and challenges ahead, and are optimistic about our prospects for further growth.

Yours sincerely,

Tan Sri Dato Azman Hashim Chairman 1 August 2006

21

Penyata

Pengerusi

Kepada Pemegang Saham,

Bagi pihak Lembaga Pengarah RCE Capital Berhad (RCE), saya dengan sukacitanya membentangkan Laporan Tahunan dan Penyata Kewangan Teraudit Kumpulan dan Syarikat bagi tahun kewangan berakhir 31 Mac 2006.

TINJAUAN EKONOMI

Tahun 2005 menyaksikan ekonomi Malaysia berkembang pada kadar yang lebih perlahan pada 5.2% berbanding dengan 7.2% pada tahun 2004. Manakala persekitaran luar masih sangat mencabar di tengah-tengah kenaikan harga minyak, kadar faedah yang lebih tinggi dan ketidakpastian keadaan geopolitik, Malaysia dijangka akan mengekalkan pertumbuhan melebihi 5.0% pada tahun 2006. Ini akan disokong terutamanya oleh permintaan dalam negeri, diterajui oleh sektor swasta.

TINJAUAN KEWANGAN

Bagi tahun kewangan di bawah kajian, Kumpulan meneruskan prestasi yang baik dengan mencatat pertumbuhan dua angka dalam kedua-dua jumlah dagangan dan keuntungan. Bagi tempoh 12 bulan berakhir 31 Mac 2006, hasil Kumpulan meningkat sebanyak 29% kepada RM57.5 juta berbanding dengan RM44.6 juta yang dicatat dalam tahun kewangan yang lepas. Keuntungan selepas cukai (PAT) meningkat dengan ketara sebanyak RM22.3 juta yang mewakili peningkatan sebanyak 31% berbanding PAT tahun lepas sebanyak RM17.0 juta. Selaras dengan itu, perolehan asas kami bagi setiap saham meningkat daripada 3.7 sen kepada 4.9 sen, meningkatkan aset-aset bersih setiap saham kami kepada 20 sen.

RCE CAPITAL BERHAD 22

(2444-M) annual report 2006

Penyata Pengerusi

...Kumpulan meneruskan prestasi yang baik dengan mencatat pertumbuhan dua angka dalam kedua-dua jumlah dagangan dan keuntungan.

...Keuntungan selepas cukai (PAT) meningkat dengan ketara sebanyak RM22.3 juta yang mewakili peningkatan sebanyak 31% berbanding PAT tahun lepas sebanyak RM17.0 juta.

...Maju ke hadapan, kami akan terus mencari peluang-peluang perniagaan yang berdaya maju dan meningkatkan lagi infrastruktur teknologi dan sumber modal manusia kami untuk meningkatkan penyerahan kepada pelanggan-pelanggan kami, menyokong rangkaian pengedaran kami dengan lebih cekap dan seterusnya memberi nilai yang lebih tinggi kepada pemegangpemegang saham kami.

23

Penyata Pengerusi

PERKEMBANGAN PERNIAGAAN

Bagi membolehkan Kumpulan mendapat manfaat sepenuhnya daripada pertumbuhan kukuh aset dan perolehan RCE Marketing Sdn Bhd (RCEM), penyumbang keuntungan utama Kumpulan bagi tahuntahun akan datang, kami telah menyelesaikan pengambilalihan 12.5% kepentingan selebihnya dalam RCE Enterprise Sdn Bhd (RCEE) pada Mac 2006. Akibatnya, RCEM secara tidak langsung telah menjadi anak syarikat milik penuh RCE melalui RCEE. Kami terus memberikan tumpuan pada perkembangan perhubungan perniagaan RCEM dengan beberapa koperasi. Akibatnya, rakan-rakan kongsi perniagaan koperasi kami kini mempunyai lebih daripada 50 saluran pengedaran di seluruh Malaysia, berbanding dengan lebih kurang 40 saluran pengedaran pada tahun kewangan yang lepas. Mereka terus menyokong perniagaan kredit pengguna kami dalam menyediakan penyelesaian kewangan dalam bentuk pinjaman pengguna kepada ahli-ahli mereka yang terutamanya terdiri daripada kakitangan kerajaan. Maju ke hadapan, kami akan terus mencari peluang-peluang perniagaan yang berdaya maju dan meningkatkan lagi infrastruktur teknologi dan sumber modal manusia kami untuk meningkatkan penyerahan kepada pelanggan-pelanggan kami, menyokong rangkaian pengedaran kami dengan lebih cekap dan seterusnya memberi nilai yang lebih tinggi kepada pemegang-pemegang saham kami.

PERKEMBANGAN KORPORAT

Selain daripada pertumbuhan organik, Kumpulan juga telah melaksanakan beberapa langkah korporat dengan tujuan menempatkannya dalam kedudukan yang lebih baik untuk menghadapi cabaran masa hadapan. Kami telah menyelesaikan pengambilalihan tambahan kami sebanyak 29.1 juta unit dalam AmFirst Property Trust (AMFPT) pada 13 September 2005, meningkatkan jumlah pegangan kami kepada 58.3 juta unit. Pelaburan tersebut terus menyediakan Kumpulan dengan aliran pendapatan yang stabil dengan purata 7.5% setiap tahun. Selain daripada itu, selaras dengan cadangan langkah penyusunan dan penjenamaan semula yang diumumkan oleh AMFPT pada Mac 2006, yang melibatkan penubuhan sebuah Amanah Saham Pelaburan Hartanah baru yang akan dikenali sebagai AmFirst REIT, Kumpulan dijangka akan mencatat satu rekod keuntungan sebanyak lebih kurang RM20.4 juta bagi tahun kewangan berakhir 31 Mac 2007 daripada pelaburannya dalam AMFPT. Pada Oktober 2005, Kumpulan melalui anak syarikat milik penuhnya, RCE Advance Sdn Bhd, telah diberi kelulusan oleh Suruhanjaya Sekuriti untuk menerbitkan RM420.0 juta Nota Jangka Sederhana Kadar Tetap (MTN). Terbitan MTN akan membolehkan Kumpulan memasuki pasaran hutang untuk membiayai pertumbuhan RCEM, penyumbang keuntungan utama Kumpulan. MTN terdiri daripada RM240.0 juta MTN Kelas A, RM120.0 juta MTN Kelas B dan RM60.0 juta MTN Kelas C dan masing-masing dikategorikan A+, A dan BBB+ oleh Malaysian Rating Corporation Berhad. Program pendanaan ini membolehkan Kumpulan menguruskan kos pendanaannya dalam persekitaran peningkatan kadar faedah semasa dan sehingga kini, sejumlah RM210.0 juta MTN telah diterbitkan.

RCE CAPITAL BERHAD 24

(2444-M) annual report 2006

Penyata Pengerusi

...Kami tetap memberikan tumpuan pada peningkatan produktiviti dan kecekapan kami, mengukuhkan amalan pengurusan risiko kredit kami dan mengurangkan kos pendanaan keseluruhan melalui langkah-langkah penghasilan dana yang inovatif.

25

Penyata Pengerusi

Untuk menghasilkan pendanaan tambahan bagi perniagaan teras Kumpulan, kami telah menjual 14 bidang tanah berselanjar sepanjang Jalan Pahang, Kuala Lumpur yang dimiliki oleh anak syarikat kami, Effusion.Com Sdn Bhd, bagi balasan tunai sebanyak RM7.7 juta pada Februari 2006. Sebagai sebahagian daripada usaha-usaha berterusan kami untuk meningkatkan nilai dan memberi ganjaran kepada pemegang-pemegang saham kami, kami telah pada 19 Mei 2006 mengumumkan cadangan untuk menerbitkan satu (1) saham bonus bagi setiap tiga (3) saham sedia ada dan untuk melaksanakan Terbitan Khas sehingga 21.1 juta saham RCE baru untuk diterbitkan kepada pelaburpelabur Bumiputera yang layak. Dengan kelulusan pemegang-pemegang saham dalam Mesyuarat Agung Luar Biasa yang diadakan pada 7 Julai 2006, cadangan tersebut dijangka akan selesai dilaksanakan menjelang akhir Ogos 2006. Dalam pengumuman yang sama, Lembaga Pengarah juga bercadang untuk memindahkan status penyenaraian RCE daripada Papan Kedua kepada Papan Utama Bursa Malaysia Securities Berhad. Pemindahan status penyenaraian tersebut akan mencerminkan saiz operasi semasa kami dengan lebih baik dan dijangka akan meningkatkan profil Kumpulan di kalangan jurubank serta bakal-bakal pelabur. Cadangan pemindahan telah diluluskan oleh Suruhanjaya Sekuriti pada 25 Julai 2006 dan juga dijangka akan selesai dilaksanakan menjelang akhir Ogos 2006.

HUBUNGAN PELABUR

Sebagai sebahagian daripada inisiatif berterusan kami untuk menyediakan maklumat yang mudah diperolehi kepada pemegang-pemegang saham kami dan pelabur-pelabur awam, kami telah menubuhkan laman web yang komprehensif dan bermaklumat. Laman web ini (http://www.rce.com.my) juga menyediakan saluran mudah bagi pengurus-pengurus dana, analisa pelaburan dan bakal-bakal pelabur untuk mendapatkan sebarang maklumat mengenai Kumpulan dengan hanya menekan satu butang.

HARAPAN / PROSPEK

Inflasi dan kadar faedah yang semakin meningkat menjadi kebimbangan utama bagi Kumpulan memandangkan ini akan memberi kesan ke atas corak perbelanjaan pengguna. Namun demikian, ekonomi Malaysia masih lagi dijangka akan mengekalkan pertumbuhan KDNK sebanyak lebih daripada 5.0% bagi tahun 2006. Selaras dengan itu, kami menjangka akan menyaksikan pengembangan selanjutnya kegiatan Kumpulan dan peningkatan dalam prestasi kewangannya. Di samping mengembangkan rangkaian pengedaran dan pemasaran, kami tetap memberikan tumpuan pada peningkatan produktiviti dan kecekapan kami, mengukuhkan amalan pengurusan risiko kredit kami dan mengurangkan kos pendanaan keseluruhan melalui langkah-langkah penghasilan dana yang inovatif.

RCE CAPITAL BERHAD 26

(2444-M) annual report 2006

Penyata Pengerusi

DIREKTORAT

Dalam tahun kewangan berakhir 31 Mac 2006, kami mengucapkan salam perpisahan kepada dua Pengarah kami, Encik Wong Bin Chen dan Encik Azmi Hashim dan bagi pihak Lembaga Pengarah, saya ingin mengambil kesempatan ini untuk mengucapkan terima kasih kepada mereka atas sumbangan dan dedikasi mereka terhadap kepada Kumpulan. Saya juga ingin mengalu-alukan perlantikan Y. Bhg. Dato Che Md Nawawi bin Ismail sebagai Pengarah. Dengan pengalaman beliau yang luas, saya yakin bahawa beliau akan memberikan sumbangan tidak ternilai kepada Kumpulan.

PENGHARGAAN

Bagi pihak Lembaga Pengarah, saya ingin merakamkan penghargaan saya kepada pengurusan dan kakitangan atas sumbangan dan komitmen kepada Kumpulan kerana sekali lagi Kumpulan dapat mencapai kejayaan. Profesionalisme, integriti dan kepintaran mereka kesemuanya menjadi nilai teras yang Kumpulan pupuk apabila kami mempersiapkan diri untuk menghadapi cabaran-cabaran mendatang. Kepada pemegang-pemegang saham, sekutu perniagaan, dan pihak-pihak berkuasa kerajaan, kami ingin mengucapkan terima kasih kepada anda semua atas sokongan padu dan berterusan anda, yang tanpanya kemajuan kami selama ini tidak mungkin dapat dicapai. Saya ingin mengucapkan terima kasih kepada rakan-rakan Pengarah saya atas bimbingan dan sumbangan mereka kepada Kumpulan. Kumpulan telah mencapai kemajuan yang pesat untuk sekian lama dan dengan jangkaan pemindahannya ke Papan Utama Bursa Malaysia Securities Berhad, kami teruja dengan peluang dan cabaran mendatang, dan optimis terhadap prospek kami bagi pertumbuhan selanjutnya.

Yang benar,

Tan Sri Dato Azman Hashim Pengerusi 1 Ogos 2006

27

Statement on

Corporate Governance

The Board of Directors of RCE Capital Berhad (RCE or the Company) has always been supportive of the adoption of the principles and best practices as set out in the Malaysian Code on Corporate Governance (Code). The Board believes that a high standard of corporate governance is imperative in safeguarding the best interests of all stakeholders and enhancing stakeholders value continually. The Board is therefore pleased to set out below a statement outlining the main corporate governance practices of the RCE Group and the manner in which RCE has applied and complied with the best practices of the Code throughout the financial year.

BOARD OF DIRECTORS

Board Composition and Balance The Board, which consists of members from different backgrounds and diverse expertise, is effective and competent in leading and directing RCE Groups business operations. The Directors together as a team set the values and standards of the Company and ensures that it meets its obligations to shareholders and other stakeholders. A brief description on the background of each current Director is presented on pages 10 to 14 of the Annual Report. The Board has seven (7) Non-Executive Directors, of whom three (3) are independent as defined under the Bursa Malaysia Securities Berhad (Bursa Securities) Listing Requirements (LR). This composition has complied with the requirement prescribed in the LR where at least two (2) directors or one-third (1/3) of the Board, whichever is the higher, are to be independent directors. The independent directors play a crucial role in the exercise of independent assessment and objective participation in Board deliberations and the decision-making process. Y. Bhg. Tan Sri Dato Azman Hashim, the Non-Eexecutive Chairman, is primarily responsible for the orderly conduct and working of the Board. There is no appointment of Chief Executive Officer/Managing Director in the Company. The day-to-day running of the business of the Company is the responsibilities of the Heads of RCEs business and operating units, whose functions are separate and distinct from the NonExecutive Chairman. The Board has not identified any independent director as the Senior Independent Non-Executive Director. Any concerns relating to the Group may be conveyed by the stakeholders to any of the independent directors. Duties and Responsibilities The Boards principal focus is the overall strategic direction, development and control of the Group. In support of this focus, the Board maps out and reviews the Groups medium and long term strategic plans on an annual basis, so as to align the Groups business directions and goals with the prevailing economic and market conditions. It also reviews the management performance and ensures that necessary financial and human resources are available to meet the Groups objectives. The Boards other main duties include regular oversight of the Groups business performance, and ensuring that the internal controls and risk management processes of the Group are well in place and are implemented consistently.

RCE CAPITAL BERHAD 28

(2444-M) annual report 2006

Statement on Corporate Governance

Board Meetings and Supply of Information The Board meets at least four (4) times annually. Additional meetings are held as and when required. During the financial year, the Board met four (4) times where it deliberated and considered a variety of matters including the Groups financial results, corporate proposals and strategic issues that affect the Groups business operations. The agenda for each Board meeting and papers relating to the matters to be deliberated at the meeting are delivered to all Directors for perusal prior to the date of the Board meeting. The Board papers are comprehensive and include all aspects of the matters to be considered to enable the Board to make informed decision. The Board has complete and unrestricted access to information relating to the Groups businesses and affairs. The Board may require to be provided with further details on the matters to be considered. Senior Management members are invited to attend the Board meetings to brief the Directors on issues to be considered by the Board. Professional advisers appointed by the Company for corporate proposals to be undertaken by the Company would also be invited to render their advice and opinion to the Directors. The Directors, whether acting as a full board or in their individual capacity, have the liberty to seek independent professional advice at the Companys expense if so required by them. Every Director has direct access to the advice and services of the Company Secretaries. The Company Secretaries are responsible in ensuring that Board procedures are met and constantly advise the Directors on compliance issues. The attendance of Directors at Board meetings are as follows: Name of Director Tan Sri Dato Azman Hashim (Non-Independent Non-Executive Chairman) Major General (Rtd) Dato Haji Fauzi Hussain (Independent Non-Executive Director) Datuk Mohd Zaman Khan @ Hassan bin Rahim Khan (Independent Non-Executive Director) Dato Che Md Nawawi bin Ismail (Independent Non-Executive Director, appointed on 28.02.2006) Soo Kim Wai (Non-Independent Non-Executive Director) Shalina Azman (Non-Independent Non-Executive Director) Chew Keng Yong (Non-Independent Non-Executive Director) Azmi Hashim (Non-Independent Non-Executive Director, resigned on 05.10.2005) Wong Bin Chen (Independent Non-Executive Director, resigned on 05.10.2005) No. of Meetings Attended 4/4 4/4 4/4 Not Applicable 4/4 3/4 3/4 2/2 2/2

29

Statement on Corporate Governance

Appointment to the Board The proposed appointment of new Board members as well as the proposed re-election of existing Directors who are seeking re-election at the annual general meeting are first considered and evaluated by the Nomination Committee. Upon its evaluation, the Nomination Committee will make recommendations on the proposal(s) to the Board for approval. The Board makes the final decision on the proposed appointment or re-election to be presented to shareholders for approval. Re-election of Directors Pursuant to the Articles of Association of RCE, all Directors are subject to re-election by rotation at least once every three (3) years and a re-election of Directors shall take place at each annual general meeting. Directors who are appointed by the Board are subject to election by the shareholders at the annual general meeting held following their appointments. Directors Training The Board acknowledges the importance of continuous training in order to broaden ones perspective and to keep abreast with the latest regulatory and industry developments. All the Directors have completed the Mandatory Accreditation Programme (MAP) and attended various training programmes under the Continuing Education Programmes (CEP) for Directors pursuant to the requirements of Bursa Securities. They have also accumulated a minimum of 72 CEP points as required under the provisions of Practice Note 15/2003 (repealed with effect from 1 January 2005). During the financial year, the Directors attended various executive workshops and seminars on relevant topics to keep abreast with the latest market developments in relation to the Groups business and new regulatory requirements on corporate governance, risk management and financial reporting. Y. Bhg. Dato Che Md Nawawi bin Ismail, an Independent Non-Executive Director who was appointed to the Board on 28 February 2006, had completed his MAP in April 2006. The Nomination Committee had reviewed and is satisfied that the Directors have received the necessary training during the financial year ended 31 March 2006 which enhanced their effectiveness and contribution to the Board. Directors Remuneration The Board as a whole reviews and determines the level of fees of the Non-Executive Directors to ensure that it is sufficient to attract and retain the services of the Directors which are vital to the Company. The annual Directors fees payable to Non-Executive Directors are subject to shareholders approval at the Annual General Meeting based on recommendation of the Board. Additional allowances are paid to NonExecutive Directors in accordance with the number of meetings attended during the financial year.

RCE CAPITAL BERHAD 30

(2444-M) annual report 2006

Statement on Corporate Governance

Details of the remuneration of the Directors for the financial year ended 31 March 2006 are as follows: Aggregate Remuneration Category Fees and allowances Analysis of Remuneration Range of Remuneration RM25,000 & below RM25,000 - RM50,000 No. of Non-Executive Directors 7 1 Non-Executive Directors (RM) 134,841

The disclosure of Directors remuneration is made in accordance with Appendix 9C, Part A, item 10 of Bursa Securities Listing Requirements. The Board is of the opinion that the disclosure through band disclosure is sufficient to meet the objectives of the Code. Separate and detailed disclosure of individual Directors remuneration would not add significantly to the understanding of shareholders and other interested persons in this aspect.

BOARD COMMITTEES

The Board has delegated certain responsibilities to Board committees, namely, the Audit Committee, Nomination Committee and Remuneration Committee to assist the Board in discharging its fiduciary duties and responsibilities. Each of this committee operates within the defined constitution or terms of reference approved by the Board. Minutes of each committee meeting are tabled to the Board so that the Board is informed of the deliberations and resolutions made. Additionally, the committees will present their recommendations to the Board for approval, where necessary. The Board committees in RCE are as follows: Audit Committee The Audit Committee is made up of four (4) Non-Executive Directors, three (3) of whom are independent. The members of the Audit Committee are as follows: 1. 2. 3. 4. Major General (Rtd) Dato Haji Fauzi bin Hussain (Independent Non-Executive Director) - Chairman Soo Kim Wai (Non-Independent Non-Executive Director) Datuk Mohd Zaman Khan @ Hassan bin Rahim Khan (Independent Non-Executive Director, appointed as member on 05.10.2006) Dato Che Md Nawawi bin Ismail (Independent Non-Executive Director, appointed as member on 28.02.2006)

31

Statement on Corporate Governance

The Audit Committees principal role is to review the Companys financial statements and the system of internal control to ensure that it adequately identifies and manages corporate-responsibility-related risks. They may also consider whether procedures on internal audit are effective at monitoring adherence to the Companys standards and values. A full Audit Committee Report enumerating its membership, terms of reference and activities during the financial year is set out on pages 38 to 44 of this Annual Report. Nomination Committee The Nomination Committee is made up entirely of Non-Executive Directors. The members of the Nomination Committee are as follows: 1. 2. 3. Datuk Mohd Zaman Khan @ Hassan bin Rahim Khan (Independent Non-Executive Director) - Chairman Major General (Rtd) Dato Haji Fauzi bin Hussain (Independent Non-Executive Director) Shalina Azman (Non-Independent Non-Executive Director, appointed as member on 05.10.2006)

The Nomination Committee reviews the required mix of skills, experience and other qualities, including core competencies, which Directors should bring to the Board on an on-going basis. It also recommends candidate for directorship to the Board and membership to Board committees as well as carries out formal assessment on the effectiveness of the Board as a whole and the committees of the Board, and the contribution of each individual Director. The Nomination Committee held two (2) meetings during the year under review. Remuneration Committee The Remuneration Committee is made up entirely of Non-Executive Directors. The members of the Remuneration Committee are as follows: 1. 2. 3. Datuk Mohd Zaman Khan @ Hassan bin Rahim Khan (Independent Non-Executive Director) - Chairman Major General (Rtd) Dato Haji Fauzi bin Hussain (Independent Non-Executive Director) Chew Keng Yong (Non-Independent Non-Executive Director, appointed as member on 05.10.2006)

The Remuneration Committee is primarily responsible in setting the policy framework and to make recommendations to the Board on all elements of the remuneration, terms of employment, reward structure and fringe benefits for the Directors and other members of the staff of the Group with the aim to attract, retain and motivate high caliber individuals. The Remuneration Committee shall meet as and when required.

RCE CAPITAL BERHAD 32

(2444-M) annual report 2006

Statement on Corporate Governance

ACCOUNTABILITY AND AUDIT

Financial Reporting The Board endeavours to present a balanced and comprehensive assessment of the Groups financial performance through the annual audited financial statements and quarterly financial results to shareholders. The Board is assisted by the Audit Committee to oversee the Groups financial reporting processes and the quality of its financial reporting. Directors Responsibility Statement The Directors are required by the Companies Act, 1965 to ensure that the financial statements prepared for each financial year give a true and fair view of the state of affairs of the Group and the Company as at the end of the financial year, and of the results of their operations and cash flows for the financial year. The Directors consider that in preparing the financial statements, the Directors have consistently used and applied the appropriate and relevant accounting policies and made judgments and estimates that are reasonable and prudent. The Directors have a general responsibility in ensuring that the Company and the Group keep proper accounting records in accordance with the provisions of the Companies Act, 1965 to enable the preparation of the financial statements with reasonable accuracy. The Directors are also responsible for taking reasonable steps to safeguard the assets of the Company and the Group to prevent and detect fraud and other irregularities. Internal Control The Board acknowledges its overall responsibility in maintaining an internal control system that provides reasonable assurance of effective and efficient operations, and compliance with laws and regulations, as well as internal procedures and guidelines. However, the Groups system of internal control is designed to manage and not eliminate the risk of failure to achieve the Groups objectives, hence the internal control system can only provide reasonable and not absolute assurance against the risk of material errors, fraud or loss. The Statement on Internal Control, which provides an overview of the state of internal control within the Group, is set out in page 36 of this Annual Report. Audit Committee The Audit Committee conducts review of the Internal Audit Function in terms of its authority, resources and scope as defined in the Internal Audit Charter adopted by the Group. The minutes of the Audit Committee meetings are tabled to the Board for perusal and for action where appropriate. Highlights of activities carried out by the Audit Committee during the year are detailed in the Audit Committee Report on pages 38 to 44.

33

Statement on Corporate Governance

Relationship with Auditors The Company, through its Audit Committee, has established a transparent and appropriate relationship with the Companys auditors, both internal and external. It is the policy of the Audit Committee to meet the external auditors to discuss their audit plan, audit findings and the financial statements. The Audit Committee also meets the external auditors without the presence of the Management at least once a year and whenever deemed necessary. The roles of both the internal and external auditors are further described in the Audit Committee Report.

RELATIONSHIP AND COMMUNICATION WITH SHAREHOLDERS AND INVESTORS

Communication with Shareholders The Board is committed to providing shareholders and investors accurate, useful and timely information about the Company, its businesses and its activities. The Company has regularly communicated with shareholders and investors in conformity with the disclosure requirements. The Companys annual general meeting is an important forum for dialogue and interaction with shareholders. Shareholders are encouraged to participate in the question and answer session and to raise any questions relating to the proposed resolutions as well as Groups business operations and affairs. The Group ensures that timely disclosures are made to the public with regard to the Groups corporate proposals, financial results and other required announcements. Up-to-date corporate and financial information on the Group are also made available to the public through the Groups website at www.rce.com.my. Investor Relations The Group values dialogues with its shareholders and investors. Briefings and open discussions with local analysts and fund managers are organised on a regular basis to update the investors on the Groups operations and financial results. Primary contact for investor relations matters: Loh Kam Chuin Executive Director, Corporate Affairs Contact Details Telephone number E-mail : : 603-40470888 IR@rce.com.my

This Statement on Corporate Governance is made in accordance with the resolution of the Board of Directors dated 19 May 2006.

RCE CAPITAL BERHAD 34

(2444-M) annual report 2006

Additional

1.

Compliance

Information

MATERIAL CONTRACTS

There were no material contracts entered into by the Company and/or its subsidiary companies involving the Companys Directors and/or major shareholders interests either still subsisting at the end of the financial year, or which were entered into since the end of the previous financial year.

2.

SHARE BUY-BACK

There were no share buy-back exercises undertaken by the Company during the financial year under review.

3.

OPTIONS, WARRANTS OR CONVERTIBLE SECURITIES

There were no options, warrants or convertible securities issued by the Company during the financial year under review.

4.

AMERICAN DEPOSITORY RECEIPT (ADR) OR GLOBAL DEPOSITORY RECEIPT (GDR)

There were no ADR or GDR programmes sponsored by the Company during the financial year under review.

5.

NON-AUDIT FEES

The amount of non-audit fees paid to external auditors for the financial year ended 31 March 2006 is RM15,000/-.

6.

PROFIT GUARANTEES

There were no profit guarantees given by the Company during the financial year under review.

7.

IMPOSITION OF SANCTIONS AND/OR PENALTIES

There were no sanctions and/or penalties imposed on the Company and/or its subsidiary companies, Directors or Management by any of the regulatory authorities.

8.

VARIATION IN RESULTS

There was no variation in results (differing by 10% or more) from the unaudited results announced.

35

Additional Compliance Information

9.

UTILISATION OF PROCEEDS

The proceeds totalling RM127.7 million from the following corporate proposals: (a) (b) the disposal of 14 parcels of land referred to as the Jalan Pahang Land by Effusion.Com Sdn Bhd, a subsidiary of RCE, for a cash consideration of RM7.7 million; and the issuance of RM140.0 million out of a total of RM420.0 million 10-year Fixed Rate Medium Term Notes (MTNs) by RCE Advance Sdn Bhd, a subsidiary of RCE (out of which RM20.0 million MTNs were taken up by a subsidiary within the Group, RCE Equity Sdn Bhd (formerly known as Indigenous Capital Sdn Bhd))

were utilised as follows: Description Gross proceeds Payment of expenses Working capital Settlement of bank borrowings Cash retained in sinking fund Balance as at 31 March 2006 RM000 127,717 (3,358) (116,886) (2,860) (4,613) Nil

10. LIST OF PROPERTIES AND REVALUATION POLICY

The details of the Groups property are as follows: Age of Building (Years) 9 Net Book Value (RM000) 1,771 Date of Acquisition 03/12/2004 Expiry Date 11/09/2088

Location

Tenure

Area 5,511 sq. ft.

Description Office

Unit No. 1502 Leasehold Level 15, Menara PJ Pusat Perdagangan AMCORP No. 18, Jalan Persiaran Barat 46050 Petaling Jaya Selangor Darul Ehsan

Other than as disclosed above, the Company does not have any landed properties. The Company has not adopted any revaluation policy.

RCE CAPITAL BERHAD 36

(2444-M) annual report 2006

Statement on

Internal Control

The Board of Directors (Board) is responsible for the Groups system of internal control and for reviewing its adequacy and integrity. However, the Groups system of internal control is designed to manage and not eliminate the risk of failure to achieve the Groups objectives, hence it can only provide reasonable and not absolute assurance against material misstatement or loss. The Board of RCE Capital Berhad is pleased to disclose that: (i) there is an on-going process for identifying, evaluating and managing the significant risks faced by the Group throughout the financial year; and the said process is regularly reviewed by the board and accords with the Statement on Internal Control: Guidance for Directors of Public Listed Companies.

(ii)

The Board summarises below the process it has applied in reviewing the adequacy and the integrity of the system of internal control: (i) The Board has appointed the Audit Committee to examine the effectiveness of the Groups systems of internal control on behalf of the Board. This is accomplished through the review of the internal audit departments work, which focuses on areas of priority as identified by risk analysis and in accordance with audit plan approved by the Audit Committee. The Groups Risk Management framework is outlined in the Groups Risk Management Policy. The Audit Committee shall assist the Board in evaluating the adequacy of the Groups Risk Management framework. A Risk Management Committee comprising members of senior management monitors the risks faced by the Group and the Risk Management Committee reports to the Audit Committee. The framework of the Groups system of internal control and key procedures include:

(ii)

(iii)

A management structure exists with clearly defined lines of responsibility and the appropriate levels of delegation. Key functions such as accounts, tax, treasury, insurance and legal matters are controlled centrally. The management determines the applicability of risk monitoring and reporting procedures and is responsible for the identification and evaluation of significant risks applicable to their areas of business together with the design and operation of suitable internal controls. Policies and procedures are clearly documented in the Corporate Policy Manual and Standard Operating Procedures of most of the Operating Units in the Group with which its operations must comply.

37

Statement on Internal Control

Corporate values, which emphasis ethical behavior, quality products and services, are set out in the Groups Employee Handbook.

(iv)

The Group also practices Annual Budgeting and monitoring process as follows:

There is an annual budgeting process for each area of business and approval of the annual budget by the Board. Actual performance compared with budget is reviewed monthly with detailed explanation of any major variances and budget for the current year is reviewed at least once in 6 months.

There were no material losses incurred during the current financial year as a result of weaknesses in internal control.

RCE CAPITAL BERHAD 38

(2444-M) annual report 2006

Audit Committee

Report

MEMBERSHIP

The Audit Committee of RCE consists of: Name Major. General (Rtd) Dato Haji Fauzi bin Hussain Soo Kim Wai * Datuk Mohd Zaman Khan @ Hassan bin Rahim Khan (appointed on 05.10.2005) Dato Che Md Nawawi bin Ismail (appointed on 28.02.2006) Wong Bin Chen (resigned on 05.10.2005)

*

Designation Chairman Member Member Member Member

Directorship Independent Non-Executive Director Non-Independent Non-Executive Director Independent Non-Executive Director Independent Non-Executive Director Independent Non-Executive Director

Mr. Soo Kim Wai is a member of the Malaysian Institute of Accountants

MEETINGS AND ATTENDANCE

During the financial year ended 31 March 2006, the Audit Committee held four (4) meetings. The details of attendance of the Audit Committee members are as follows: Name Major. General (Rtd) Dato Haji Fauzi bin Hussain Soo Kim Wai Datuk Mohd Zaman Khan @ Hassan bin Rahim Khan Dato Che Md Nawawi bin Ismail Wong Bin Chen (resigned on 05.10.2005) No. of Meetings Attended 4/4 4/4 2/2 Not Applicable 2/2

The representative of the Internal Audit attended all the meetings held during the financial year. Other senior management members and the representatives of the external auditors also attended these meetings upon invitation to brief the Audit Committee on specific issues.

39

Audit Committee Report

TERMS OF REFERENCE

The terms of reference of the Audit Committee are as set out below: 1.0 Composition 1.1 The Audit Committee shall be appointed by the Board of Directors from among their number and shall consist of not less than three (3) members, the majority of whom shall be independent non-executive Directors of the Company. The Board shall at all times ensures that at least one (1) member of the Audit Committee: must be a member of the Malaysian Institute of Accountants (MIA); or if he or she is not a member of the MIA, he must have at least 3 years working experience and: (a) he or she must have passed the examinations specified in Part I of the 1st Schedule of the Accountants Act, 1967; or he or she must be a member of one of the associations of accountants specified in Part II of the 1st Schedule of the Accountants Act 1967; or

1.2

(b)

1.3

fulfils such other requirements as prescribed by the Exchange.

If a member of the Committee resigns, dies or for any reason ceases to be a member with the result that the number of members is reduced to below three (3), the Board of Directors shall, within 3 months of that event, appoint such number of new members as may be required to make up the minimum number of three (3) members. The Chairman of the Audit Committee shall be approved by the Board of Directors and shall be an independent non-executive director. No alternate director is to be appointed as a member of the Audit Committee. The term of office and performance of the Committee and each of its members shall be reviewed by the Board at least once every three (3) years.

1.4

1.5 1.6

RCE CAPITAL BERHAD 40

(2444-M) annual report 2006

Audit Committee Report

2.0

Quorum and Procedures of Meetings 2.1 2.2 Meetings shall be held not less than four (4) times in a financial year. The quorum of meetings of the Audit Committee shall consist of not less than three (3) members; the majority of those present must be Independent Directors. In the absence of the Chairman, the members present shall elect a Chairman for the meeting from among the members present. The Company Secretary shall act as Secretary of the Audit Committee. The Head of Finance, the Head of Internal Audit and a representative of the external auditors shall normally attend meetings. The Audit Committee may, as and when deemed necessary, invite other Board members, senior management personnel and external independent professional advisers to attend the meetings. The Audit Committee shall meet with the external auditor without executive board members presence, at least once in a financial year. Minutes of each meeting shall be kept and distributed to each member of the Audit Committee and the Board.

2.3 2.4

2.5

2.6

3.0

Authority 3.1 The Audit Committee is authorised to seek any information if requires from any employee of the Group and all employees are directed to co-operate with any request made by the Audit Committee. The Audit Committee shall have full and unrestricted access to any information pertaining to the Company and the Group. The Audit Committee shall have direct communication channels with the internal and external auditors, and with the management of the Group, and shall be able to convene meetings with the external auditors, whenever deemed necessary. The Audit Committee shall have the resources that are required to perform its duties. The Committee can obtain, at the expense of the Company, external legal or other independent professional advice it considers necessary. Where the Audit Committee is of the view that a matter reported by it to the Board has not been satisfactorily resolved resulting in a breach of the Listing Requirements, the Audit Committee shall promptly report such matter to the Exchange.

3.2

3.3

3.4

3.5

41

Audit Committee Report

4.0

Duties and Responsibilities The Audit Committee shall review and, where appropriate, report to the Board of Directors the following: (a) Risk Management and Internal Control (b) The adequacy and effectiveness of risk management, internal control and governance systems instituted in the Company and the Group The Groups risk management policy and implementation of the risk management framework The appointment or termination of members of the risk management committee The report of the risk management committee

Internal Audit The adequacy of the internal audit scope and plan, functions and resources of the internal audit function and that it has the necessary authority to carry out its work Any appraisal or assessment of the performance of members of the internal audit function, including the Head of Internal Audit; and approve any appointment or termination of senior members of the internal audit function

(c)

External Audit The external auditors audit plan and scope of their audits, including any changes to the planned scope of the audit plan The appointment and performance of external auditors, the audit fee and any question of resignation or dismissal before making recommendations to the Board The assistance given by the employees to the external auditors, and any difficulties encountered in the course of the audit work

(d)

Audit Reports Internal and external audit reports to ensure that appropriate and prompt remedial action is taken by the management on major deficiencies in controls or procedures that are identified Major internal and external audit findings and management responses, including status of previous audit recommendations

RCE CAPITAL BERHAD 42

(2444-M) annual report 2006

Audit Committee Report

(e)

Financial Reporting The quarterly results and the year end financial statements of the Company and the Group for recommendation to the Board of Directors for approval, focusing particularly on: changes in or implementation of accounting policies and practices significant adjustments arising from the audit significant and unusual events going concern assumption compliance with accounting standards and other legal requirements

(f)

Related Party Transactions Any related party transaction and conflict of interest situation that may arise within the Company or the Group.

(g)

Allocation of Share Options Verification on the allocation of share options to ensure compliance with the criteria for allocation of share options pursuant to the share scheme for employees of the Group at the end of each financial year.

(h)

Other Functions Any such other functions as the Audit Committee considers appropriate or as authorised by the Board of Directors.

SUMMARY OF ACTIVITIES

The Audit Committee had carried out the following activities during the financial year: Financial Results a. Reviewed the quarterly unaudited financial results of the Group prior to recommending them for the approval by the Board. Reviewed the annual financial statements of the Group with the external auditors prior to submission to the Board for their consideration and approval. The review was focusing particularly on changes of accounting policy, significant and usual event and compliance with applicable approved accounting standards in Malaysia and other legal and regulatory requirements.

b.

43

Audit Committee Report

Internal Audit a. Reviewed the annual audit plan for adequacy of scope and comprehensive coverage on the activities of the Group. Reviewed the audit programmes, resource requirements for the year and assessed the performance of the internal audit function. Reviewed the internal audit reports, audit recommendations made and management responses to these recommendations and actions taken to improve the system of internal control and procedures. Monitored the implementation of the audit recommendations to ensure that all key risks and controls have been addressed. Reviewed the Control Self-Assessment ratings submitted by the respective operations management.

b.

c.

d.

e.

External Audit a. Reviewed with the external auditors: the audit planning memorandum, audit strategy and scope of work for the year. the results of the annual audit, their audit report and management letter together with managements responses to the findings of the external auditors.

b.

Reviewed the performance of the external auditors and made recommendations to the Board on their appointment and remuneration.

Related Party Transactions Reviewed the related party transactions entered into by the Group. Reviewed the recurrent related party transactions of a revenue or trading nature on quarterly basis.

RCE CAPITAL BERHAD 44

(2444-M) annual report 2006

Audit Committee Report

INTERNAL AUDIT FUNCTION

The Company engaged the services of the internal audit department of AmcorpGroup Berhad (formerly known as Arab-Malaysian Corporation Berhad), a major shareholder of the Company, to perform its internal audit functions. The scope of internal audit functions performed by the internal audit encompasses audit visits to all relevant subsidiaries and associates of the Group on a regular basis. The objectives of such audit visits are to determine whether adequate controls have been established and are operating in the Group, to provide reasonable assurance that: business objectives and policies are adhered to operations are cost effective and efficient assets and resources are safeguarded and effectively used integrity of records and information is protected applicable laws and regulations are complied with

The emphasis of such audit visits encompass critical areas of the Group such as revenue, cost of sales, expenditure, assets, internal controls, operating performance and financial statement review. Audit reports are issued to highlight any deficiency or findings requiring the managements attention. Such reports also include practical and cost effective recommendations as well as proposed corrective actions to be adopted by the management. The audit reports and managements responses are circulated to the Audit Committee and the Group Chairman for review and comments. Follow-up audits are then carried out to determine whether corrective actions have been taken by the management.

45

Financial Statements

for the year ended March 31, 2006

46

Directors Report 51 Report of the Auditors to the members of RCE Capital Berhad 52 53 55 57 60 Income Statements Balance Sheets Statements of Changes in Equity Cash Flow Statements Notes to the Financial Statements Statement by Directors Declaration by the Officer Primarily Responsible for the Financial Management of the Company

106 106

RCE CAPITAL BERHAD 46

(2444-M) annual report 2006

Directors Report

The directors of RCE CAPITAL BERHAD have pleasure in submitting their report and the audited financial statements of the Group and of the Company for the financial year ended March 31, 2006.

PRINCIPAL ACTIVITIES The Companys principal activities are investment holding and provision of management services. The principal activities of the subsidiary companies are as disclosed in Note 13 to the Financial Statements. There have been no significant changes in the nature of the principal activities of the Company and its subsidiary companies during the financial year.

RESULTS OF OPERATIONS The results of operations of the Group and of the Company for the financial year are as follows: The Group RM Profit before tax Income tax expense Profit after tax Minority interest Net profit for the year 23,512,154 (1,196,865) 22,315,289 (2,524,341) 19,790,948 The Company RM 8,755,001 (597,879) 8,157,122 8,157,122

In the opinion of the directors, the results of the operations of the Group and of the Company during the financial year have not been substantially affected by any item, transaction or event of a material and unusual nature.

DIVIDENDS No dividends have been paid or declared by the Company since the end of the previous financial year. The directors also do not recommend any dividend payment in respect of the current financial year.

47

Directors Report

RESERVES AND PROVISIONS There were no material transfers to or from reserves or provisions during the financial year other than those disclosed in the financial statements.