Why Does The Yield Curve Predict Output and Inflation?

Why Does The Yield Curve Predict Output and Inflation?

Uploaded by

indrakuCopyright:

Available Formats

Why Does The Yield Curve Predict Output and Inflation?

Why Does The Yield Curve Predict Output and Inflation?

Uploaded by

indrakuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Why Does The Yield Curve Predict Output and Inflation?

Why Does The Yield Curve Predict Output and Inflation?

Uploaded by

indrakuCopyright:

Available Formats

February 2004

Why Does the Yield Curve Predict Output and Inflation?

Arturo Estrella*

Federal Reserve Bank of New York

JEL Codes: E52, E43, E37

Keywords: term structure, business cycle forecasting

Abstract: The slope of the yield curve has been shown empirically to be a significant predictor of

inflation and real economic activity, but there is no standard theory as to why the relationship

exists. This paper constructs an analytical rational expectations model to investigate the reasons

for the empirical results. The model suggests that the relationships are not structural but are

instead influenced by the monetary policy regime. However, the yield curve should have

predictive power for output and inflation in most circumstances. Various implications of the

theoretical model are tested and confirmed empirically.

The views expressed in this paper are those of the author and do not necessarily represent those

of the Federal Reserve Bank of New York or the Federal Reserve System.

* 33 Liberty Street, New York, NY 10045. Tel.: 1-212-720-5874. Fax: 1-212-720-1582. E-mail:

arturo.estrella@ny.frb.org.

Why Does the Yield Curve Predict Output and Inflation?

Abstract

The slope of the yield curve has been shown empirically to be a significant predictor of inflation

and real economic activity, but there is no standard theory as to why the relationship exists. This

paper constructs an analytical rational expectations model to investigate the reasons for the

empirical results. The model suggests that the relationships are not structural but are instead

influenced by the monetary policy regime. However, the yield curve should have predictive

power for output and inflation in most circumstances. Various implications of the theoretical

model are tested and confirmed empirically.

1

Why Does the Yield Curve Predict Output and Inflation?

1. Introduction

The slope of the yield curve is empirically a significant predictor of inflation and real

economic activity. Specifically, the spread between long-term and short-term government bond

rates appears frequently in the literature as a significant regressor in equations that predict

inflation particularly with long horizons and in equations that predict various measures of

future economic activity, such as real GDP growth, industrial production growth, and recession

indices. These predictive relationships appear to be robust over time and across different

countries, with particularly strong results obtained using data for economies in Europe and North

America.

1

Nevertheless, even in the face of this large body of empirical evidence, there is no

standard theory as to why the relationship exists. Most of the empirical papers have advanced

informal explanations for the results. A reason frequently cited, for instance, is that the yield

curve tends to flatten when there is a tightening of monetary policy, and that a slowdown in

economic activity and inflation typically follows such a policy move with a lag. On the whole,

however, the explanations have been mostly heuristic, rather than based on explicit models.

This paper constructs a rational expectations model that is rich enough to capture the

relationships in question, but simple enough to be solved analytically so that the relationships

may be more clearly observed. In contrast to earlier models, the present model has both an

explicit term structure of interest rates and a closed-form solution. Moreover, the model has the

flexibility to accommodate various approaches to the modeling of macroeconomic relationships,

1

Recent experience suggests that the yield curve is still a good predictor. An inversion of the U.S. Treasury yield

curve in December 2000 was followed by a recession within a year. The NBER dated the business cycle peak in

March 2001.

2

so that we may avoid dependence on a single paradigm. A few results will be seen to be model-

dependent, but several important results hold across a variety of formulations.

Empirical evidence of the predictive power of the yield curve dates back at least to the

late 1980s. For instance, Harvey (1988) noted a predictive relationship between the slope of the

yield curve and consumption, and Laurent (1988) used the yield curve as an indicator of

monetary policy, which was statistically associated with the subsequent pace of output growth.

Estrella and Hardouvelis (1991) performed tests of the predictive power of the spread between

10-year and 3-month U.S. Treasury rates for growth in aggregate GNP and its components, and

for NBER-dated recessions in the United States. The yield curve performed well in most of these

tests, with significant results found for predicting aggregate GNP, consumption, investment, and

recessions. The most significant results corresponded roughly to horizons of four to six quarters.

More recently, Estrella and Mishkin (1997) and Bernard and Gerlach (1998) found strong results

for various other countries, particularly in Europe.

With regard to inflation, Mishkin (1990a) used the difference between an n-month

interest rate and an m-month interest rate to predict the difference between average inflation rates

over n-months and m-months into the future, where m < n 12. The results were poor for small

values of n and m, but they were somewhat better for larger values. In fact, Mishkin (1990b)

obtained stronger results with maturities extending between one and five years. In these papers,

the results were motivated by invoking the Fisher equation, which decomposes a nominal interest

rate into a real rate and expected inflation, and by assuming rational expectations. Schich (1996)

found comparable results for Germany, which were even stronger than in the United States for

some maturity combinations.

3

The theoretical basis for the statistical evidence with regard to both output and inflation is

limited. In the case of inflation, we noted that the results have been attributed to a simple model

based on the Fisher equation. However, strict statistical tests of the Fisher equation with rational

expectations frequently lead to rejections, even when there is empirical predictive power.

In the case of real activity, the menu of explanations has been broader and typically more

heuristic. Estrella and Hardouvelis (1991) and Dotsey (1998) attribute at least some of the

predictive power to the effects of countercyclical monetary policy. Estrella and Hardouvelis

(1991) and Berk (1998) refer to simple dynamic IS-LM models, which are not fully worked out

in those papers. A few empirical papers refer to explicit models to motivate statistical results. For

instance, Harvey (1988) uses a consumption capital asset pricing model (CCAPM), and Chen

(1991) and Plosser and Rouwenhorst (1994) allude to real business cycle (RBC) models to

explain the relationship between the term structure and real activity. One problem with the

interpretation of these models is that the theoretical results apply to the real term structure,

whereas the empirical results are based on the nominal term structure. Thus, the results are

equivalent only if inflation expectations play a secondary role.

In contrast to the earlier literature, the model of this paper combines elements of the

various explanations in a single framework. There is a macroeconomic component consisting of

a Phillips curve and an IS equation. We will consider both a backward-looking version, which

corresponds to simple dynamic IS-LM models, and a forward-looking version, which is related

to the CCAPM and RBC models. To these macroeconomic equations, we add the Fisher

equation, a term structure of interest rates, and a monetary policy reaction function.

A useful feature of the model is that it may be solved analytically, resulting in closed

form expressions relating the slope of the term structure to expectations of real activity and

4

inflation. As argued by Campbell (1994), this type of approach makes the mechanics of the

solution as transparent as possible. We can tell which features of the model are associated with

the predictive power of the yield curve, and we can determine the circumstances under which

this predictive power exists.

So, why does the yield curve predict output and inflation? The main implication of the

model is that monetary policy has a lot to do with the predictive power, particularly for output,

but that it is not the only factor. If monetary policy is essentially reactive to deviations of

inflation from target and of output from potential, the predictive relationships for output and

inflation depend primarily on the magnitudes of the reaction parameters. If the monetary

authority optimizes systematically to achieve certain goals with regard to inflation and output

variability, the predictive power of the yield curve is more directly dependent on the structure of

the macroeconomy.

The model is presented and solved in Section 2. Section 3 highlights the relationships that

indicate how the yield curve predicts output and inflation. Section 4 examines more closely the

role of monetary policy in the predictive results. Section 5 contains empirical tests of the model

and some of its implications, and Section 6 concludes.

2. Description of the model

The model expands on a simple general structure that has become fairly standard in the

recent macroeconomics literature. A macroeconomic model consisting of an IS equation and a

Phillips curve is combined with a monetary policy rule or reaction function. One departure from

this literature is the inclusion of a term structure in the model.

2

Whereas earlier models typically

2

A recent exception is Eijffinger, Schaling and Verhagen (2000), which includes a one period bond and a consol,

and focuses on inflation forecast targeting in a backward-looking model.

5

contain a single short-term interest rate, the present model allows for one- and two-period bonds,

whose yields are subject to the expectations hypothesis and the Fisher equation. In the IS

equation, output responds to the two-period real interest rate.

Another departure is that both the IS equation and the Phillips curve are allowed to be

either backward-looking (functions of lagged output or inflation) or forward-looking (functions

of expected output or inflation). Thus, the results of the analysis, particularly those results that

are independent of the form of the macroeconomic component, will be robust to different views

of macroeconomic modeling.

3

The reaction function will also be allowed to be forward-looking.

In this section, we first define the equations of the model, and then present solutions of the

backward-looking and forward-looking cases, respectively.

2.1. Definition of equations

The backward-looking macroeconomic equations are similar to those in Svensson (1997)

and Rudebusch and Svensson (1999). The IS curve is of the form

1 1 2 1 t t t t

y b y b

= + , (1)

where

t

y is the output gap (the log difference between actual and potential output),

t

is the

long-term (two-period) real interest rate,

t

is an i.i.d. shock, and the parameter values are in the

ranges

1

0 1 b < and

2

0 b > .

4

The Phillips curve is

1 1 t t t t

ay

= + + , (2)

where

t

is the one-period inflation rate,

t

is an i.i.d. shock, and 0 a > .

3

The idea of using alternative models to insure the robustness of results has been introduced earlier, e.g., by

McCallum (1988).

4

The longer maturity in this paper is two periods (years), whereas much of the empirical literature on predicting real

activity has looked at 10-year rates. Note, however, that results in Estrella, Rodrigues and Schich (2003) and in

Section 5 here suggest that empirical results with 2-year rates are almost as strong as with 10-year rates.

6

As in Svensson (1997), the form of equations (1) and (2) is intended to reflect time-series

properties of the macroeconomic variables that are consistent with results of various VAR

studies. Specifically, the monetary authority has imperfect control of inflation through a policy

instrument, the short-term interest rate, which influences the cost of capital. Output and inflation

react with a lag to changes in the cost of capital (and the policy instrument), with a longer lag for

inflation than for output. By construction, these equations tend to represent well the time-series

properties of the data. However, the connection between the parameters in the equations and

stable deep parameters is not explicitly drawn. For this reason, some of the earlier literature has

shown a preference for forward-looking equations, which are more clearly grounded in theory.

We define an alternative set of forward-looking macroeconomic equations following

Roberts (1995), Woodford (1997), and McCallum and Nelson (1999). The IS curve is essentially

the same as that in Woodford (1997),

1 t t t t

y E y

+

= , (3)

where 0 > , but with the output gap responding to the two-period real interest rate instead of a

single-period rate. Woodford (1997) shows that this equation may be derived from explicit

utility-maximization. More precisely, equation (3) is obtained by log-linearizing the standard

Euler equation for the marginal utility of consumption, which arises from calculating the optimal

saving decision under a budget constraint.

Similarly, the forward-looking Phillips curve may be derived from explicit optimization

in a number of ways, as demonstrated by Roberts (1995). Roberts provides four alternative

justifications for an equation of the general form we use here: a quadratic cost adjustment model

as in Rotemberg (1982), staggered contracts models as in Taylor (1979) and Calvo (1983), and a

7

New Keynesian Phillips curve, which synthesizes the key elements of the other three models.

The particular form of the equation we use here is

1 t t t t

E y

+

= + , (4)

where 0 > . This form corresponds to McCallum and Nelson (1999), who also employ an IS

curve very similar to (3).

5

The tradeoff in the use of the foregoing alternative models is that the forward-looking

versions have a solid theoretical footing, whereas the backward-looking versions fit the time

series better. In particular, when equations like (3) and (4) are estimated empirically, the

coefficients and tend to have the wrong sign. This phenomenon was pointed out by Gali

and Gertler (1999) in the case of equation (4) and analyzed in detail for a class of models that

includes both the IS and Phillips equations by Estrella and Fuhrer (2002).

6

Like the macroeconomic equations, the monetary policy reaction function may also have

one of two forms. In one form, the monetary authority sets the short-term nominal interest rate in

reaction to the current gap between actual and target inflation, and to the current output gap.

There is also a term in the lagged nominal rate to account for the observed persistence in the

short-term rate. This form of the reaction function is

1

(1 ) *

t r t t y t r

r g r g g y g g

= + + + , (5)

where * is the inflation target or equilibrium level of inflation. For convenience, the

coefficient of the target inflation rate makes the equation linear homogenous in the interest and

inflation rates, so that the implied equilibrium real interest rate is zero.

5

Roberts (1995) and McCallum and Nelson (1999) also include in their equations exogenous disturbances, which do

not materially alter the theoretical analysis. As, e.g., in Woodford (2001) exogenous disturbances are omitted here

for simplicity.

6

Estrella and Fuhrer (2002) suggest that more realistic models with theoretical foundations may be obtained by

combining backward- and forward-looking components or by introducing habit formation. Unfortunately, analytical

8

The coefficients in (5) are generally expected to satisfy 0 1

r

g , 0 g

> , and 0

y

g > ,

though we do not impose such restrictions at this stage. The expected signs of the reactions to

inflation and output are consistent with leaning against the wind in that the monetary authority

tightens policy when inflation exceeds its target or when output exceeds its sustainable level.

When 0

r

g = , 1.5 g

= , and .5

y

g = , equation (5) is equivalent to the well-known Taylor (1993)

rule. Alternatively, when 1

r

g = , the equation assumes the form adopted by Fuhrer and Moore

(1995), in which the monetary authority adjusts the change in the short-term interest rate, rather

than its level.

In forward-looking models, it is often assumed that the monetary authority reacts to the

difference between an inflation forecast (rather than the current level) and the target rate. For

instance, Clarida, Gali and Gertler (1999) propose a reaction function of the form

1 1

(1 ) *

t r t t t y t r

r g r g E g y g g

+

= + + + . (6)

In the present model, there is a simple transformation between equations (5) and (6). For

example, with the forward-looking macroeconomic equations, substituting (4) into (6) shows that

r r

g g

= , g g

= , and

y y

g g g

= + . A similar result is obtained with the backward-looking

macroeconomic equations. Clarida, Gali and Gertler (1999) justify the use of expected inflation

in (6) by generating their reaction function from an explicit forward-looking optimization

problem for the monetary authority. However, expected inflation in their model is the product of

a single scalar parameter and current inflation, so that the transformation between the current-

information and forward-looking reaction functions is particularly simple.

solutions to such models are difficult, if at all possible. Note also that Gal and Gertler (1999) and McCallum and

Nelson (1999) have obtained positive coefficient estimates using measures of slack other that the output gap.

9

Note also that Clarida, Gertler and Gali (2000) arrive at an equation like (5) or (6) in two

steps. They first define a desired level of the short-term interest rate as a function of inflation and

output deviations only, say,

* * ( *)

t t y t

r g g y

= + + , (7)

and then specify a partial adjustment each period to the desired level:

1 1

(1 )( * )

t t r t t

r r g r r

= . (8)

This two-step formulation is exactly equivalent to rule (5), where the long run coefficients in

(7) correspond to /(1 )

r

g g g

= and /(1 )

y y r

g g g = .

The last two equations of the model specify the link between the two-period real rate that

appears in the IS curve and the one-period nominal rate that appears in the reaction function.

These equations model the term structure of interest rates, from which the yield curve slope and

its predictive relationships are extracted. The Fisher equation for the two-period nominal rate

t

R

is

( )

1

1 2 2 t t t t t t

R E E

+ +

= + + , (9)

which defines the two-period real rate

t

, and the expectations hypothesis is given by

( )

1

1 2 t t t t

R r E r

+

= + . (10)

The Fisher equation expresses the nominal two-period rate as the sum of a real rate and

expected inflation over the two periods. A similar relationship may be written for the one-period

rates, but we do not need to use it here. The expectations hypothesis expresses the two-period

nominal rate as an average of current and future expected one-period rates.

Empirical analysis has cast some doubt on the validity of the expectations hypothesis.

Statistical rejections have been attributed to various factors: time-varying risk premia, the

10

complexities of movements in the real rate, influences of monetary policy, and uncertainty about

policy goals.

7

Although it might be desirable in principle to model term premia, they would

complicate the model substantially, and the points made in this paper are largely independent of

them.

8

The other complicating factors are explicitly modeled in the paper.

The full model consists of five equations. The backward-looking version of the model

comprises equations (1), (2), (5), (9), and (10), whereas the forward-looking version replaces (1)

and (2) with (3) and (4). In principle, we could replace the reaction function with equation (6) in

the forward-looking model, but we have seen that the two reaction functions are equivalent and

that the results will be related by a simple transformation.

2.2. Solution of the backward-looking case

The solution to the backward-looking model is an expression for the stationary process

followed by

t

,

t

y , and

t

r . The form of the model makes it convenient to express this process as

a vector autoregression. Equation (2) implies both

1 t t t t

E ay

+

= + and (11)

2 1 1 t t t t t t

E E aE y

+ + +

= + . (12)

Moreover, from equations (1) and (5), respectively, we obtain

1 1 2 t t t t

E y b y b

+

= and (13)

1 1 1

(1 ) *

t t r t t t y t t r

E r g r g E g E y g g

+ + +

= + + + . (14)

Finally, equations (9) and (10) together imply

7

For a summary of this literature, see, e.g., Campbell (1995). See also Kozicki and Tinsley (2001), who suggest that

unobservable policy goals or lack of credible targets may contribute to departures from the expectations hypothesis.

8

Dotsey and Otrok (1995) examine the interaction between policy rules, term premia, and rejections of the

expectations hypothesis.

11

( )

1

1 1 2 2 t t t t t t t t

r E r E E

+ + +

= + . (15)

The five equations (11)-(15) may be solved for the four expectations and

t

, in terms of

the three contemporaneous variables

t

,

t

y ,

t

r and the inflation target * .

9

The expressions for

these expectations may then be substituted in equations (11), (13), and (14) to obtain the

autoregressive representation. Note that the model is in equilibrium when 0 y = = and

* R r = = = . For convenience, we may work with the variables as deviations from these

equilibrium levels.

Thus, define ( ) *, , *

t t t t

s y r

= as the vector of basic variables adjusted for their

equilibrium values and

( )

, ,

t t t t y t

g g

= + as the vector of shocks. The autoregressive

representation is of the form

1 t t t

s T s

= + , (16)

where the elements of the 3 3 matrix T are derived from the expressions for the expectations in

terms of

t

s . Exact expressions for the elements of T are given in the Appendix.

The stationarity of the solution (16) depends on the values of the parameters. Making

minimal requirements on the parameters of the macroeconomic equations, we can express the

stationarity conditions for (16) as four restrictions on the parameters of the monetary policy

reaction function. We derive these restrictions by applying the Schur-Cohn conditions to the

characteristic polynomial of the matrix T.

10

9

The five equations may be written as

1 t t

CX Bs

+

= , where

1 1 2 1 1

( *, *, , *, )

t t t t t t t t t t

X E E E y E r

+ + + + +

=

and ( *, , *)

t t t t

s y r = . The condition for the system to be solvable is that the matrix C must be invertible.

The determinant of C is

2

1 ( ) / 2

y

D g a b = + and the parameter restrictions introduced below for stationarity,

specifically (17) and (19), imply that

1

0 D b > > .

10

See, e.g., Barnett (1990) for a discussion of the Schur-Cohn theorem. Note that with the assumed ranges of

parameter values, one of the four restrictions, expression (19), is implied by (18) and is thus mathematically

12

When 0 a > and

2

0 b > , the process (16) is stationary if and only if

1

r

g > , (17)

1 ( , )

r r y

g g B g g

< < , and (18)

( )

y y r

g B g > . (19)

Exact expressions for ( , )

r y

B g g

and ( )

y r

B g are given in the Appendix.

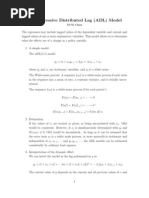

The stationary values of the parameters of the reaction function tend to be in the expected

ranges. For instance, suppose that .2 a = ,

1

1 b = , and

2

.4 b = . Then for 0

r

g = , expression (19)

implies that .2

y

g > and (18) implies that 1 10 1

y

g g

< < . This case is illustrated in Figure 1A,

in which the area of stationarity is bounded by conditions (18) and (19).

11

The larger the value of

y

g , the wider the range of values of g

for which the model is stationary. Figure 1A also

indicates that when 1 g

< , the matrix T has one large root (exactly one eigenvalue outside the

unit circle), whereas when 1 g

> and 10 1

y

g g

> , it has two large roots. Points in both those

regions correspond to explosive behavior. The values suggested by Taylor (1993), 0

r

g = ,

1.5 g

= , and .5

y

g = , are consistent with stationarity under the assumed parameter values.

2.3. Solution of the forward-looking case

We now derive the solution of the forward-looking version of the model.

12

Of the five

equations ((11) to (15)) used to solve the model above, only the first three are derived from the

macroeconomic equations, and they have to be replaced by their forward-looking counterparts,

redundant. We keep track of it, however, since it identifies the range of stable values for

y

g and is therefore of

economic interest.

11

The boundary conditions are linear only when 0

r

g = . Points labeled optimum are discussed in Section 4.

12

The solution method is analogous to that employed by Woodford (2001) in a simpler model.

13

1 t t t t

E y

+

= , (20)

2 1 1 t t t t t t

E E E y

+ + +

= , and (21)

1 t t t t

E y y

+

= . (22)

Using these in place of (11) to (13), we obtain a system

1 t t t

E s T s

+

= , (23)

in which the transition matrix T is formally identical to the backward-looking case, but with the

following substitutions: a = ,

1

1 b = , and

2

b = .

The restriction on

1

b is not important qualitatively, but the other two changes effectively

reverse the signs of the key coefficients in the reduced form Phillips and IS equations. These

differences are consistent with the empirical results reported by Gali and Gertler (1999) and

Estrella and Fuhrer (2002). For present purposes, the practical import of the formal equivalence

between the backward- and forward-looking models is that we can use the properties of the

transition matrix T in (16) to derive solutions to both models, with a suitable reinterpretation of

the parameters.

In contrast to the backward-looking model, the solution to the forward-looking version

requires that the transition matrix T have two large roots for a forward solution to exist. In

response to exogenous disturbances, the variables

t

and

t

y jump to the saddle path, which

produces a unique stationary solution to the model. In order to obtain two large roots, we need

essentially a violation of conditions (17) to (19) for the stability of the backward-looking model.

Specifically, we must have that

1

r

g g

< and ( , )

r y

g B g g

> . (24)

14

These conditions are illustrated in Figure 1B for parameter values corresponding to Figure 1A,

but with the signs of a and

2

b reversed. Note that Figure 1B is essentially a mirror image of 1A

rotated along the horizontal axis. Note also that the boundaries of the two conditions (24)

intersect at the point 1 g

= and 0

y

g a = = < , so that any positive value of

y

g leads to a

stationary solution as long as 1 g

> .

13

As in the backward-looking case, the Taylor (1993) rule

with 0

r

g = , 1.5 g

= , and .5

y

g = is consistent with stationarity.

3. The yield curve as predictor of output and inflation

The solutions of the model presented in the previous section do not explicitly define the

predictive relationship between the yield curve and the macroeconomic variables, which is the

main focus of this paper. We require expressions that relate the yield curve slope (that is, the

difference between the two-period and one-period rates

t t

R r ) to expectations of future output

and inflation. Such predictive equations account first for the predictive power of the yield curve,

and then for any remaining information that may be required to obtain an optimal prediction.

To obtain the requisite expressions, the first step is to use equation (9) to substitute out

for

t

and restate the five-equation system (11)-(15) (or the equivalent forward-looking system)

in terms of the two-period nominal rate

t

R instead of the real rate

t

.

14

The second step is to

solve the restated system recursively to obtain expressions for the expectations, which can then

be written as functions of

t

R and

t

r , or alternatively of

t

r and

t t

R r .

Define

13

Woodford (2001) and Svensson (2003) denote this last condition as the Taylor principle, in reference to Taylor

(1999).

14

As noted in Section 2.3, the system of expectational equations is formally the same in the backward- and forward-

looking models, so the analysis of this section applies to both.

15

( )

1 1 2 1

*, *, *, , *

t t t t t t t t t t

x E r E E E y R

+ + + +

= . (25)

Then the restated equations (11)-(15) may be written in matrix form as

t t

Ax Bs = , (26)

where

t

s is defined as in the previous section. Since A is of full rank (see footnote 6), there is a

unique matrix M such that MA is upper triangular with ones in the diagonal, yielding a recursive

solution

t t

M Ax M Bs = (27)

in which

t

R is expressed in terms of

t

s only,

1 t t

E y

+

is expressed in terms of

t

R and

t

s ,

2 t t

E

+

in

terms of

1 t t

E y

+

,

t

R and

t

s , and so on.

15

This solution provides the desired relationships between the yield spread and the

expectations of output and inflation, namely

( ) ( ) ( )

1

2 1

* *

r

t t t t t t t

y y y

g g

E y R r r ay

g g g

= + + and (28)

( ) ( ) ( )

2

1 (1 )

* *

2 2 2

r

t t t t t t t

y y y

ag a a g

E R r r ay

g g g

= + + . (29)

The particular form of equation (29) is motivated by the fact that

( )

2 1 2 1

1 1

2 2

t t t t t t t t

E E E E

+ + + +

= + is the variable that Mishkin (1990a, b) predicts using the

spread between two- and one-period nominal interest rates. Mishkin (1990a) argues that if the

real term spread is constant, the coefficient of

t t

R r in (29) should be 1 and the rest of the

15

The matrix M corresponds to the application of Gaussian elimination and is composed of elementary operations.

See, e.g., Barnett (1990). The ordering of the last three elements of (25) is the unique form that expresses

1 t t

E y

+

and

2

*

t t

E

+

as functions of only

t t

R r and

t

s .

16

equation should be constant. The argument derives from the Fisher equation and rational

expectations, which are maintained in the present model, so it also applies here.

How likely is it that the real term spread is constant? In the present context, the real term

spread is

1

( )

t t t t

r E

+

, that is, the difference between the two-period and one-period ex ante

real rates. If the policy reaction to inflation is positive, the restrictions 0

r

g = , 1 g

= ,

y

g a =

and

1

0 b = are necessary and sufficient for the real term spread to be constant. These values are

implausible, however. Even if the mild policy reactions to inflation and output were desirable,

the lack of output persistence implied by

1

0 b = would be unlikely.

Examination of equations (28) and (29) leads to a number of observations regarding the

predictive role of the yield curve spread. First, the equations suggest that, in general, the spread

contains useful information about future output and inflation. The exact weight of the spread in

the equations depends on a policy parameter (

y

g ), but the appearance of the spread seems

robust. However, the spread is not in general a sufficient statistic for the expectations. After

accounting for the yield curve, the lagged short-term interest rate has predictive power (as long

as 1

r

g < ), and both lagged inflation and output appear in the equations as well. Comparable

results are found empirically with VARs.

16

Second, the coefficient of the spread in the output equation (28) does not depend directly

on the macroeconomic parameters. A caveat to this point is that under some circumstances, the

monetary authority may set

y

g as a function of the macroeconomic parameters. This point is

revisited in the following section.

16

See, e.g., Stock and Watson (2003).

17

Third, the coefficient of the spread in the inflation equation (29) depends explicitly on the

Phillips curve parameter a. This means that the predictive power of the yield curve for inflation

hinges directly on the predictive power of the output gap in the Phillips equation. The caveat

about the possible dependence of

y

g on the macroeconomic parameters applies in this case as

well.

Fourth, the parameters of the IS curve (

1

b and

2

b ) do not enter explicitly in either (28) or

(29). These parameters are clearly important in the transmission of monetary policy, and their

values should affect the behavior of a monetary authority that engages in explicit optimization,

as we see in the next section. However, the parameters affect the predictive equations only to the

extent that the policy parameters are set in a way that makes them dependent on

1

b and

2

b .

Fifth, the yield curve predicts output and inflation for similar reasons. In the model, the

expectations (28) and (29) differ only by a scalar multiple:

2 1

1

2 2

t t t t

a

E E y

+ +

| |

=

|

\ .

. Hence, as

long as the Phillips curve parameter is well-behaved, the two expectations are closely related.

Note, however, that the uncertainty around these two expectations is different. As in equation

(16), define

1 t t t t

E

and

1 t t t t

y E y

to be the one-step ahead rational expectations

errors for inflation and output, with variances

2

and

2

, respectively. Iterating (16), we also

calculate that

2 2 1 2 t t t t t

E a

+ + + +

= + . Thus, the uncertainty associated with the

expectations in (28) and (29), adjusted for the multiplicative factor 2 a , is related by

2 2

2 2 2

2 1

1 1

2 2 4 2 2

t t

a a a

Var Var y

+ +

| | | | | | | | | |

= + > =

| | | | |

\ . \ . \ . \ . \ .

. (30)

18

The greater uncertainty associated with forecasting inflation, as compared with output, is

consistent with the weaker results obtained in the literature on inflation and the yield curve,

discussed briefly in Section 1.

Sixth, the empirical literature has found consistently positive relationships between the

yield curve slope and future output and inflation. The sign of the coefficient of the yield curve

spread in the output equation (28) is consistent with the empirical findings, regardless of whether

the model is backward- or forward-looking, since 0

y

g > in both cases. If the model is

backward-looking ( 0 a > ), the yield curve coefficient in the inflation equation (29) is also

positive. If the model is forward-looking, then 0 a < and the yield curve coefficient in (29) is

negative, in contrast to standard empirical results.

Finally, all three parameters of the policy rule appear in equations (28) and (29), even if

only

y

g appears in the term containing the yield curve spread. Thus, the relative importance of

the yield curve spread in the predictive equations is affected by all three policy parameters.

4. The role of monetary policy

In this section, we take a closer look at the influence of the parameters of the policy rule

on the predictive power of the yield curve. We first focus on two special cases in which different

policies produce extreme results with regard to predictive power. We then consider the

implications of explicit optimization on the part of the monetary authority and of the Taylor

(1993) rule.

In the general model, the yield curve spread appears as a predictor of both output and

inflation. Examination of equations (28) and (29), however, suggests the existence of special

cases in which the yield curve is either the optimal predictor of output and inflation, or has little

19

predictive power for those variables. These limiting cases are not necessarily realistic, but they

provide a sense of how the relative usefulness of the yield curve as a predictor may vary as a

function of monetary policy decisions.

Consider first the case in which the yield curve spread is the optimal predictor of both

output and inflation. Inspection of equations (28) and (29) shows that if 1

r

g = , 0 g

= , and

0

y

g > , then all terms vanish with the exception of the one containing

t t

R r . Therefore,

expectations of output and inflation can be expressed solely in terms of the yield curve spread.

However, the absence of a reaction to inflation in the policy rule is implausible. As we see later,

even if the monetary authority cares only about output deviations, inflation receives a positive

weight in the optimal policy rule.

A case with opposite predictive results occurs when both g

and

y

g are positive, very

large, and of comparable magnitude. That is, the monetary authority reacts very vigorously to

gaps in both inflation and output. Let both g

and

y

g approach infinity, while

y

g g k

,

where k is a constant. Then, the first two terms in (28) vanish, including the one containing the

yield curve spread. The coefficient of the third term, however, approaches k, so that the inflation

and output gaps may be used to forecast output.

Apart from these extreme cases, the yield curve is a useful predictor of output and

inflation that is optimally supplemented with other information. This conclusion holds even if the

monetary authority sets explicit objectives with regard to inflation and output and chooses the

parameters of the reaction function optimally. For example, suppose that the monetary authority

wishes to minimize deviations of inflation from target and of output from potential. A suitable

objective function is of the form

20

( )

{ }

2

2

1

1

min (1 ) *

2

{ , , }

i

t t i t i

i

E w wy

g g g

r y

+ +

=

+

, (31)

where is a positive discount factor and 0 1 w is a constant relative weight for deviations of

output from potential. When 0 w = , only inflation matters and we have what Svensson (1999)

calls strict inflation targeting. When 0 1 w < < , the monetary authority is willing to trade off

some degree of expected deviation of inflation from its target in order to have a more stable

relationship between actual and potential output. Svensson (1999) calls this type of approach

flexible inflation targeting.

We now characterize the solution to (31) for arbitrary w, subject to the backward-looking

model as defined in equations (1), (2), (5), (9), and (10). The text focuses on the key results with

regard to the predictive power of the yield curve, and an outline of the full derivation is presented

in the Appendix.

A general result that is useful in interpreting the solution is that, under the optimal rule,

[ ]

2 1

* ( ) *

t t t t

E w E

+ +

= , (32)

where 0 ( ) 1 w , with ( ) 0 w > , (0) 0 = and (1) 1 = . An exact expression for ( ) w is

provided in the Appendix. In the strict inflation targeting case with 0 w = , (32) implies that the

solution satisfies

2

*

t t

E

+

= . Expected inflation two periods ahead, which is the earliest value

of inflation that can be affected by a change in the policy variable in period t, is aligned with the

inflation target. Iterating on the expectations operator implies more generally that *

t t i

E

+

= for

2 i .

When 0 w > , expression (32) indicates that the divergence between expected inflation

and the inflation target is expected to decline geometrically by a factor . The larger the value of

21

the weight w that is applied to output deviations, the smaller the expected reduction in the

divergence of inflation from target, allowing for greater smoothness in the expected output gap

series. When 1 w = = , deviations of inflation from target are fully accommodated and expected

to persist.

We can also derive explicit expressions for the optimal values of the policy parameters

stemming from (31), as well as their implications for the expectational equations involving the

yield curve spread. In the general case, the optimal parameter values are

1 1 1

2 2 2

2(1 ) 2(1 2 ) 2

0, 1 (1 ), (1 )

r y

b b b

g g g a

ab b b

+ +

= = + = + + , (33)

where 2 /(1 ) + is a monotonic transformation of with the same values at 0 and 1 as

and w. Figure 2 shows and as functions of the relative output weight w in the objective

function. Both and , particularly the latter, increase quite rapidly as the output weight is

increased from zero. Figure 1A also shows the optimal values of the policy parameters in the

illustrative case, with 0 w = and .1 w = .

We note a few interesting features of the solution (33). First, 0

r

g = , which in the context

of the Clarida, Gali and Gertler (2000) partial adjustment formulation implies that adjustment is

immediate. Second, an increase in (hence in the weight given to output stabilization)

decreases the optimal values of both g

and

y

g , though the magnitude of the effect on g

is

larger and the ratio /

y

g g

falls. Third, strict inflation targeting ( 0 w = = ) leads to the largest

values of optimal g

and

y

g , given the values of the parameters of the Phillips and IS equations.

As argued earlier, large values of the policy reaction parameters imply a reduction in the weight

of the yield spread in the prediction of output and inflation.

Substituting the optimal values in (28), we obtain that

22

( )

2 1

1

2 1 1

2

2(1 2 ) (1 ) 2

t t t

t t

b R r b y

E y

ab b b

+

+

=

+ + +

. (34)

Note that the coefficients of the macroeconomic equations appear in the expressions for the

policy parameters, and hence in the predictive equations corresponding to (28) and (29). In (34),

also note that altering the weight w in the policy objective function (and therefore and )

changes only the weighting of the terms in the denominator, but not the relative weights of

t t

R r and

t

y in the full expression for expected output. As indicated earlier, an increase in w

reduces the coefficient of the spread. Similar results are obtained for inflation, since

2 1

1

2 2

t t t t

a

E E y

+ +

| |

=

|

\ .

.

With strict inflation targeting ( 0 w = = ), both the inflation gap and the output gap

require nonzero weights in the reaction function, even though the monetary authority only cares

about inflation. The principal reason is that the Phillips curve may be used to forecast inflation in

terms of the output gap. This solution is always stationary, regardless of the values of the

macroeconomic parameters.

Consider now the forward-looking model in which (31) is solved subject to equations (3),

(4), (5), (9), and (10). Section 2.3 shows that there is a unique saddle path solution to the

forward-looking model for 0

r

g = and any given pair of reaction coefficients such that 1 g

>

and 0

y

g > . However, optimization fails to narrow down the set of desirable values of the

reaction coefficients. Any set of policy coefficients in the foregoing ranges leads to a transition

matrix T that has two large eigenvalues and a zero eigenvalue. For any exogenous disturbances,

there is immediate adjustment to the saddle path, which is consistent with the minimum possible

23

value of the objective function. Thus, more stringent criteria would be required to narrow the

field further.

17

Finally, we take a look at the implications of the Taylor rule, which is not explicitly based

on optimization, but was shown by Taylor (1993) to be roughly consistent with the policies of

the U.S. Federal Reserve from 1987 to 1992. If 0

r

g = , 1.5 g

= , and .5

y

g = , then

( )

1

4 (1 3 )

t t t t t

E y R r a y

+

= + . (35)

Both the yield curve spread and the output gap appear as predictors in this expression. Note,

however, that the coefficient of the output gap could be very small if a is close to 1/3. In contrast

to the cases in which the monetary authority optimizes explicitly (Cf., equation (34)), the weight

on output in this equation tends to be small relative to the weight on the yield curve spread. For

instance, if we apply the illustrative parameter values that were used earlier ( .2 a = ,

1

1 b = , and

2

.4 b = ), the spread receives 91% of the weight in the Taylor case, but only 44% of the weight in

the optimization case.

To summarize, the model suggests that the yield curve is in general a useful predictor of

both output and inflation, though other predictors may be used as well. This result is robust in

that it holds quite generally, unless the policy reactions to both inflation and output approach

infinity. Nevertheless, the precise weight (absolute and relative) of the yield curve in the

predictive relationships is a function of the parameters of the monetary policy rule. Hence, the

predictive power of the yield curve cannot be said to be structural. The analysis suggests that

empirical estimates of equations similar to (28) and (29) should be more stable if the data

correspond to a period in which the monetary policy function is relatively stable.

17

There is also an optimal backward solution corresponding to expressions (33), with 0

y

g < . However, the forward

solutions are presumably more consistent with the spirit the forward-looking model.

24

The foregoing conclusions are consistent with the empirical results of Estrella, Rodrigues

and Schich (2003), who test for breaks in the coefficients of standard equations that use the yield

curve to predict output and inflation. They find evidence of consistent predictive power in both

Germany and the United States. However, they also find some modest evidence of instability in

the parameter estimates, with breaks that correspond to important changes in the conduct of

monetary policy in the two countries.

5. Empirical estimates and tests of model implications

In this section, we use annual data from the United States to estimate the model and to

test some of its implications. We use annual data because the time lags in the model are designed

to correspond to the stylized facts for a periodicity of one year. The variables are constructed as

follows. The output gap is 100 times the log difference between annual chain-weighted real GDP

and potential GDP as measured by the CBO. Inflation is 100 times the log difference between

the fourth quarter GDP deflator and the fourth quarter deflator the year before. One- and two-

year interest rates are fourth-quarter averages of daily zero-coupon Treasury yields, computed as

in McCulloch and Kwon (1993). The estimation period runs from 1962 to 2001.

18

Before proceeding to the empirical estimates, Figure 3 provides a graphical illustration of

the predictive results that have been found in the earlier empirical literature. The top panel

compares the change in the output gap with the first lag of the term spread, and the bottom panel

compares the change in inflation with the second lag of the term spread. Even though these

bivariate relationships do not condition on variables other than the spread, both panels clearly

suggest positive relationships, particularly in the case of output.

18

All data are available at http://www.newyorkfed.org/research/economists/estrella/index.html.

25

Estimates of the macroeconomic equations of the backward- and forward-looking models

appear in Table 1. The backward-looking Phillips curve is straightforward and is estimated by

ordinary least squares.

19

The backward-looking IS equation is estimated by using the ex post

two-year real rate as a regressor, instrumented with the contemporaneous output gap, two-year

nominal rate, and yield curve spread. A likely candidate missing from this list is current inflation.

Hansen (1982) tests suggest that it is not a good instrument, perhaps because there is some serial

correlation in the residuals.

The forward-looking equations are estimated using the techniques in McCallum and

Nelson (1999). Equations involving

1 t t

E

+

,

1 t t

E y

+

, and

t

use the ex post values of these

variables, and instrumental variables for them. For the forward IS equation,

1 t

R

,

1 1 t t

R r

and

lagged government defense spending are used as instruments and

1 t

R

,

1 1 t t

R r

, lagged federal

government purchases and growth in oil prices (annual average of West Texas Intermediate) are

used in the forward Phillips equation. The latter set of instruments is consistent with Roberts

(1995).

Empirical results show that over the full sample period, the backward-looking

macroeconomic parameters have values of .20 a = ,

1

.61 b = and

2

.51 b = . Each of these

estimates is significantly different from zero at standard confidence levels. The estimated

forward-looking parameters are of .13 = ,

1

.30 b = and .45 = . None of these is significant,

although the last two have the expected sign. The negative sign of is consistent with the

findings of Gal and Gertler (1999).

19

Note that the coefficient on lagged inflation is estimated rather than set to 1, but that it is not significantly

different from 1.

26

In Table 2, the reaction function is estimated by ordinary least squares, since GDP growth

and inflation over a full year are essentially predetermined relative to fourth quarter interest

rates. Over the full sample, the reaction function parameters are .77

r

g = , .36 g

= , and

.20

y

g = , which correspond to long run values of 1.56 g

= , and .85

y

g = . The parameter of the

lagged interest rate is much larger than is consistent with unconstrained optimization, suggesting

some predilection for moving gradually. The inflation reaction parameter is consistent with some

positive weight placed on inflation over the full period.

There is no clear statistical evidence of instability over this period in any of the equations,

perhaps in part because of the relatively small sample. For instance, Lagrange multiplier tests for

an unknown breakpoint, as in Andrews (1993), and for a known breakpoint at 1980 or 1987, as

in Andrews and Fair (1988), fail to detect a break in any of the equations. The subsample point

estimates for the Phillips curve and the IS equation are in fact fairly stable. However, if the

reaction function is estimated over several subsamples that correspond to key changes in the

chair of the Federal Reserve Board, differences in the point estimates are economically

significant.

20

Table 2 examines these differences over four subperiods: pre and post 1980

(Volcker) and pre and post 1987 (Greenspan). The periods are listed roughly from past to

present.

Moving toward the present, we observe the following stylized patterns. First,

r

g tends to

fall, from around .8 in the early periods to insignificant levels since 1987. The reaction to

inflation tends to increase, both in absolute terms and in proportion to the reaction to output. The

20

Using quarterly U.S. data from 1966 to 1997, Estrella and Fuhrer (2003) find little evidence of instability in

backward-looking IS and Phillips equations. However, a Chow test finds evidence of a break in the monetary policy

function in 1979. The breakpoint tests here are generally consistent with those results, except that evidence of

instability in the reaction function is not statistically significant.

27

reaction to output also tends to increase, although the pattern is a bit less clear. Finally, both long

run reactions tend to decline.

21

To test of the empirical implications of the model, we look at predictive equations

corresponding to (34) and its inflation counterpart over the full sample and over the subsamples

considered earlier. The point estimates of the reaction function over the subperiods suggest that

there is a fair degree of economically significant variation in the policy parameters, even if the

differences are not statistically significant. Overall, the results in Table 3 indicate that the

coefficient of the yield curve spread is positive and that it is significant in most cases. However,

the role of the spread seems to decline as the relative policy weight shifts to inflation, as

predicted by the model. The output gap coefficient is also consistently positive and significant, as

predicted by the theory. We now examine the correspondence between the empirical estimates

and some of the detailed implications of the model.

Consider the list of implications of the model given at the end of Section 3. First, the

model suggests that the yield curve spread should generally be useful in predicting output and

inflation, even though the exact weight may vary. This result is clearly consistent with Table 3,

in which the yield spread coefficient tends to be positive and mostly significant, but with time

variation in the point estimates. The one exception with regard to significance is the post-1987

period, in which the coefficient of the spread in both equations is positive, but not significant.

The discussion in Section 4 suggests that these results, like the insignificant coefficient of the

lagged interest rate in the reaction function, are not unexpected with strict inflation targeting.

21

These patterns are consistent with a version of the theoretical model in which the persistence of the interest rate

(

r

g ) is selected exogenously and declines over the period, and in which the weight assigned to output fluctuations

in the objective function also declines.

28

Second, the model implies that the coefficient of the yield spread in both equations (see

(28) and (29)) should vary inversely with

y

g . This policy parameter is estimated to be highest in

the post-1987 period, when the predictive coefficients are insignificant.

Third, if 0 2 a < < in the backward-looking model, each coefficient in the inflation

equation should be smaller than the coefficient of the corresponding variable in the output

equation. More specifically, the ratio should be / 2 a . The ordinal relationship clearly holds for

the coefficients of both variables, although the ratio of the spread coefficients tends to be higher.

Part of this discrepancy may be due to estimation error. Mechanically, there is also some

evidence that the spread has predictive power for the error term in the Phillips equation, which

increases its coefficient in the inflation prediction equation.

Fourth, the parameters of the IS equation should affect predictive power only to the

extent that they are taken in consideration by an optimizing monetary authority. As noted above,

variations in the coefficients of the predictive equations can be explained largely by reference to

changes in policy regime.

Fifth, prediction errors in the inflation equation should be larger than in the output

equation, adjusting for the scaling of the dependent variables. One interpretation of this result is

that the output equation should have a higher

2

R , which is the case in the full sample and in

every subsample.

Sixth, if a is positive, as the backward-looking estimate in Table 1 indicates, stationarity

requires that

y

g also be positive, which is seen in Tables 1 and 2. In this case, the coefficient of

the yield spread should be positive in both predictive equations. The coefficient estimates are

indeed all positive, though not all significant.

29

All in all, the empirical estimates tend to confirm the predictions of the model. In fact,

since the model implies that the relationships are not structural, the estimates shed some light on

the connection between monetary policy and the varying predictive relationship between the

yield spread, output and inflation. Particularly notable are the estimates in the post-1987 period,

which seems to be consistent with strict inflation targeting and in which the predictive power of

the yield spread, though not entirely absent, is certainly diminished.

6. Conclusions

The model developed in this paper can serve as a tool for tracing the roots of the

predictive power of the yield curve for both output and inflation. In contrast to numerical

techniques, the analytical approach adopted here allows for the examination of the relationships

without constraining the parameters to particular values. Moreover, by including forward- and

backward-looking versions of the model, the results become less sensitive to a particular view of

macroeconomic modeling.

The analytical results show that the yield curve should help predict output and inflation

under most circumstances. Moreover, the positive relationships observed almost universally in

the empirical work are seen in the theoretical equations for output and inflation in the backward-

looking form of the model, and for output in the forward-looking form. In most cases, other

information beyond the yield curve spread can be useful in forecasting output and inflation.

Another clear conclusion is that the extent to which the yield curve is a good predictor

depends on the form of the monetary policy reaction function, which in turn may depend on

explicit policy objectives. Thus, the predictive relationships, though robust, are not structural.

For instance, when the monetary authority reacts only to output fluctuations and focuses on the

30

change in the interest rate, rather than its level, the yield curve is the optimal predictor of future

output. At the other extreme, if the policy reactions to both inflation and output deviations

approach infinity, the predictive power of the yield curve disappears.

In all other cases, information in the yield curve can be combined with other data to form

optimal predictors of output and inflation. The yield curve has predictive power, for example, if

the monetary authority follows strict or flexible inflation targeting, as defined by Svensson

(1999). The yield curve also has predictive power, and in fact a large relative weight, if policy

follows the Taylor (1993) rule.

Empirical estimates using annual U.S. data confirm the implications of the model and

shed some light on changes in monetary policy regime. In particular, the period since 1987

seems to be consistent empirically with the implications of strict inflation targeting in the

theoretical model.

31

Appendix: Detailed expressions and derivations

A.1. Elements of the transition matrix

Exact expressions for the elements of the 3 3 transition matrix T of Section 2 are given

below.

2 2 1 2

2 2 2

2 2 2 2 1 2 2

2 2 2

1 0

(2 ) (2 ) 2 (1 )

2 ( ) 2 ( ) 2 ( )

(2 ) 2 (2 ) 2 ( ) (2 )

2 ( ) 2 ( ) 2 ( )

r

y y y

y y r y

y y y

a

g b g b a b g b

T

g a b g a b g a b

g ab g b ag ab g ab b g ab g b

g a b g a b g a b

(

(

(

(

+ +

(

=

+ + + (

(

+ + +

(

(

+ + +

A.2. Bounds for inflation and output reaction parameters

Bounds for g

and

y

g required for the system to be stationary, ( , )

r y

B g g

and ( )

y r

B g ,

have the following forms.

2

1 1 2 1 2 1 2 2

2 2 1 2 2

2 2 1 2

2 (2 2 ) (2 2 )(2 2 )

(2 )(2 2 2 )

(2 2 )

r y r

y y

r y

b b ab g b ab b ab b g g

ab b g b ab b g

B

ab ab b g b g

+ + + +

+ + +

=

+ +

1

2

(1 )(1 )

r

y

g b

B a

b

=

A.3. Derivation of optimal policy rule

This section sketches the solution to the monetary authoritys general optimization

problem (accommodating either strict or flexible inflation targeting) in the backward-looking

case. To simplify the solution procedure, we first recognize the following features of the

problem. First, the optimal values of the policy parameters (

r

g , g

and

y

g ) in the general

solution to the problem with uncertainty are the same as under certainty (certainty equivalence),

32

so we assume the deterministic case.

22

Second, the optimal policy parameters are independent of

the inflation target, which we set to zero. Third, the optimal value of the loss function at time t is

a quadratic function of the endogenous variables. Fourth, there are no adjustment costs, so

adjustment to the desired level of the interest rate is instantaneous, hence 0

r

g = . Finally note

that the optimal feedback rule (

t

r as a function of the endogenous variables) for this problem is

linear, so the reaction function given in (5) has the optimal linear form.

In the model, a change in the policy instrument

t

r affects output in the next period, which

in turn affects inflation with a further one-period lag. This structure allows for sequential

optimization, first setting output to control inflation, and then the interest rate to control both

output and inflation.

To find the solution with respect to output, express the optimization problem in terms of

the following Bellman equation,

2 2

1

1

min (1 )

2

t t t t

t

L w wy L

y

+

(

= + +

`

)

, (36)

where

t

L is the minimum loss function. As noted above, the optimal

t

L is quadratic in the

endogenous variable, which in this case is

t

. Let

2

1

2 t t

L q = . (37)

The first order condition is then

1

0

t t

wy qa

+

+ = . (38)

22

See Chow (1975, Chapters 7 and 8) for a complete discussion of the solution to linear-quadratic optimal control

problems, including the features listed here.

33

Since q is unknown, we use the envelope theorem to construct a second relationship from

which to calculate q. Specifically { } / / | *

t t t t

L y = , where the brackets correspond to

the bracketed expression in (36) and | *

t

y indicates evaluation at the optimal value of

t

y . Thus,

1

(1 )

t t t

q w q

+

= + . (39)

The Phillips curve relationship

1 t t t

ay

+

= + from equation (2) may be substituted in

expressions (38) and (39), respectively, to obtain

2

(1 ) (1 )

*

t t t t

aq q w

y m

w a q aq

= =

+

. (40)

The coefficients of

t

must be equal and this equality may be used to solve for q and m.

Expression (39) may also be solved directly for

1 t

+

to obtain

1 2 t t t

w

w a q

+

=

+

. (41)

After solving for q using (40), we have

( )( )

( )

2 2 2

2 2

2 2 2 4

2

1 2 1 2

(1 )

1 2

w

a a a a w

a w a

a a w a

=

+

+ + +

+ + +

(42)

and

1

m

a

= . Inspection of (42) shows that 0 ( ) 1 w , ( ) 0 w > , (0) 0 = , and (1) 1 = , as

noted in the text.

We now equate two expressions for

1 t

y

+

, namely the optimal rule from (40) and the IS

equation from (1):

( )

1

1 1 2 1 1 2 2 t t t t t t

m b y b r r

+ + + +

= + . (43)

34

Use the solution of the five-equation system (11)-(15) to substitute for

1 t

+

,

2 t

+

and

1 t

r

+

in

terms of

t

,

t

y and

t

r , and solve the resulting expression for

t

r , obtaining an equation of the

form

t t y t

r c c y

= + . At the optimum, c g

= and

y y

c g = , and these two equations may be

used to obtain the optimal values of the two parameters,

1 1 1

2 2 2

2(1 ) 2(1 2 ) 2

1 (1 ), (1 )

y

b b b

g g a

ab b b

+ +

= + = + + , (44)

where 2 /(1 ) + .

35

References

Andrews, D.W.K., 1993. Tests for parameter instability and structural change with unknown

change point. Econometrica 61, 821-856.

Andrews, D.W.K., Fair, R.C., 1988. Inference in non-linear econometric models with structural

change. Review of Economic Studies 55, 615-640.

Barnett, S., 1990. Matrices: Methods and applications. Oxford University Press, Oxford.

Berk, J.M., 1998. The information content of the yield curve for monetary policy: A survey. De

Economist 146, 303-320.

Bernard, H., Gerlach, S., 1998. Does the term structure predict recessions? The international

evidence. Discussion Paper No. 1892, Centre for Economic Policy Research, London.

Calvo, G.A., 1983. Staggered contracts in a utility-maximizing framework. Journal of Monetary

Economics 12, 383-398.

Campbell, J.Y., 1994. Inspecting the mechanism: an analytical approach to the stochastic growth

model. Journal of Monetary Economics 33, 463-506.

Campbell, J.Y., 1995. Some lessons from the yield curve. Journal of Economic Perspectives 9,

129-152.

Chen, N.F., 1991. Financial investment opportunities and the macroeconomy. Journal of Finance

46, 529-554.

Chow, G.C., 1975. Analysis and control of dynamic economic systems. Wiley, New York.

Clarida, R., Gali, J., Gertler, M., 1999. The science of monetary policy: A New Keynesian

perspective. Journal of Economic Literature 37, 1661-1707.

Clarida, R., Gali, J., Gertler, M., 2000. Monetary rules and macroeconomic stability: evidence

and some theory. Quarterly Journal of Economics 115, 147-180.

36

Dotsey, M., 1998. The predictive content of the interest rate term spread for future economic

growth. Federal Reserve Bank of Richmond Economic Quarterly 84, 31-51.

Dotsey, M., Otrok, C., 1995. The rational expectations hypothesis of the term structure,

monetary policy, and time-varying term premia. Federal Reserve Bank of Richmond

Economic Quarterly 81, 65-81.

Eijffinger, S., Schaling, E. and Verhagen, W., 2000. The term structure of interest rates and

inflation forecast targeting. Centre for Economic Policy Research Discussion Paper No.

2375.

Estrella, A., Fuhrer, J.C., 2002. Dynamic inconsistencies: Counterfactual implication of a class

of rational expectations models. American Economic Review 92, 1013-1028.

Estrella, A., Fuhrer, J.C., 2003. Monetary policy shifts and the stability of monetary policy

models. Review of Economics and Statistics 85, 94-104.

Estrella, A., Hardouvelis, G., 1991. The term structure as a predictor of real economic activity.

Journal of Finance 46, 555-576.

Estrella, A., Mishkin, F.S., 1997. The term structure of interest rates and its role in monetary

policy for the European Central Bank. European Economic Review 41, 1375-1401.

Estrella, A., Rodrigues, A.P., Schich, S., 2003. How stable is the predictive power of the yield

curve? Evidence from Germany and the United States. Review of Economics and

Statistics 85, 629-644.

Fuhrer, J.C., Moore, G.R., 1995. Monetary policy trade-offs and the correlation between

nominal interest rates and real output. American Economic Review 85, 219-239.

Gali, J., Gertler, M., 1999. Inflation dynamics: A structural econometric analysis. Journal of

Monetary Economics 44, 195-222.

37

Harvey, C, 1988. The real term structure and consumption growth. Journal of Financial

Economics 22, 305-333.

Hansen, L.P., 1982. Large sample properties of generalized method of moments estimators.

Econometrica 50, 1029-1054.

Kozicki, S., Tinsley, P.A., 2001. Shifting endpoints in the term structure of interest rates. Journal

of Monetary Economics 47, 613-652.

Laurent, R.D., 1988. An interest rate-based indicator of monetary policy. Federal Reserve Bank

of Chicago Economic Perspectives 12, 3-14.

McCallum, B.T., 1988. Robustness properties of a rule for monetary policy. Carnegie-Rochester

Conference Series on Public Policy 29, 173-204.

McCallum, B.T., Nelson, E., 1999. Performance of operational policy rules in an estimated semi-

classical structural model. In Taylor, J.B. (Ed.) Monetary policy rules. University of

Chicago Press, Chicago, 15-45.

McCulloch, J.H., Kwon, H.C, 1993. U.S. term structure data, 1947-1991. Working Paper No. 93-

6, Ohio State University.

Mishkin, F.S., 1990a. What does the term structure tell us about future inflation? Journal of

Monetary Economics 25, 77-95.

Mishkin, F.S., 1990b. The information in the longer-maturity term structure about future

inflation. Quarterly Journal of Economics 55, 815-28.

Plosser, C.I., Rouwenhorst, K.G., 1994. International term structures and real economic growth.

Journal of Monetary Economics 33, 133-155.

Roberts, J.M., 1995. New Keynesian economics and the Phillips curve. Journal of Money,

Credit, and Banking 27, 975-84.

38

Rotemberg, J.J., 1982. Sticky prices in the United States. Journal of Political Economy 60, 1187-

1211.

Rudebusch, G.D., Svensson, L.E.O., 1999. Policy rules for inflation targeting. In Taylor, J.B.

(Ed.) Monetary policy rules. University of Chicago Press, Chicago, 203-246.

Schich, S.T., 1996. Alternative specifications of the German term structure and its information

content regarding inflation. Discussion Paper 8/96, Economic Research Group of the

Deutsche Bundesbank, October.

Stock, J.H. and M.W. Watson, 2003. Forecasting output and inflation: The role of asset prices.

Journal of Economic Literature 41, 788-829.

Svensson, L.E.O., 1997. Inflation forecast targeting: Implementing and monitoring inflation

targets. European Economic Review 41, 1111-1146.

Svensson, L.E.O., 1999. Inflation targeting: Some extensions, Scandinavian Journal of

Economics 101, 337-361.

Svensson, L.E.O., 2003. What is wrong with Taylor rules? Using judgment in monetary policy

through targeting rules. Journal of Economic Literature 41, 426-477.

Taylor, J.B., 1979. Staggered contracts in a macro model. American Economic Review 69, 108-

113.

Taylor, J.B., 1993. Discretion versus policy rules in practice. Carnegie-Rochester Conference

Series on Public Policy 39, 195-214.

Taylor, J.B., 1999. A historical analysis of monetary policy rules. In Taylor, J.B. (Ed.) Monetary

policy rules. University of Chicago Press, Chicago, 319-344.

Woodford, M., 1997. Control of the public debt: A requirement for price stability? In Calvo, G.,

King, M. (Eds.), The debt burden and monetary policy. MacMillan, London.

39

Woodford, M. 2001. The Taylor rule and optimal monetary policy. Princeton University

Working Paper.

40

Table 1. Full Sample Estimates of Macroeconomic Equations

Backward

IS Equation

(1)

Backward

Phillips

Equation (2)

Forward

IS Equation

(3)

Forward

Phillips

Equation (4)

Dependent

variable

1 t

y

+ 1 t

+ t

y

t

Constant 3.92

(.86)

-.75

(.55)

5.27

(2.42)

-.35

(.95)

t

.91

(.08)

1 t t

E

+

1.28

(.17)

t

y .61

(.11)

.20

(.07)

-.13

(.09)

1 t t

E y

+

.30

(.27)

t

-.51