Axis Bank, 1Q FY 2014

Axis Bank, 1Q FY 2014

Uploaded by

Angel BrokingCopyright:

Available Formats

Axis Bank, 1Q FY 2014

Axis Bank, 1Q FY 2014

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Axis Bank, 1Q FY 2014

Axis Bank, 1Q FY 2014

Uploaded by

Angel BrokingCopyright:

Available Formats

1QFY2014 Result Update | Banking

July 18, 2013

Axis Bank

Performance Highlights

Particulars (` cr) NII Pre-prov. profit PAT 1QFY14 2,865 2,844 1,409 4QFY13 2,665 2,800 1,555 % chg (qoq) 7.5 1.6 (9.4) 1QFY13 2,180 1,964 1,154 % chg (yoy) 31.4 44.8 22.1

BUY

CMP Target Price

Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code Banking 58,072 1.2 1549/927 171,267 10 20,128 6,038 AXSB.BO AXSB@IN

`1,238 `1,441

12 Months

Source: Company, Angel Research

Axis Bank reported a 22.1% yoy earnings growth for the quarter, which was inline with our estimates. Key highlights from the result were improvement in NIMs (16bp qoq to 3.86%, though not sustainable as per the management) and stable NPA ratios (Gross NPA ratio at 1.1 %, and Net NPA at 0.35%). NIMs improve sequentially; Asset quality remains stable: During 1QFY2014, the bank reported a moderate growth in business, with advances and deposits registering a growth of 15.8% and 7.1% yoy, respectively. Loan book growth was primarily driven by strong traction in the retail and SME advances, which grew by 39.7% and 27.5% yoy, respectively. CASA deposits registered a healthy growth of 16.3% yoy, aided by a strong growth of 19.9% in savings deposits, despite a moderate 10.6% growth in volative current deposits. The bank registered a moderate growth in its non-interest income (excluding trading profits), largely driven by a healthy growth in fee income from the Retail & DCM segments. The bank registered trading gains of `440cr during the quarter as against `150cr in 1QFY2013. During the quarter, slippages and fresh restructuring taken together amounted to more than `1,350cr, higher than the managements guidance of around `1,000-1,200cr per quarter for the current fiscal. Along with sequentially higher slippages, the bank also reported sequentially lower recoveries and upgrades at `72cr compared to `205cr in 4QFY2013, which resulted in the sequential increase of 4.0% and 12.2%, respectively, in its gross and net NPA levels. The banks PCR increased by 100bp qoq to 80%. Restructuring book for the bank came down sequentially to `4,211cr, primarily due to upgrades on account of satisfactory performance and also due to repayments. Outlook and valuation: In our view, Axis Banks current valuations at 1.3x FY2015 ABV are below our longer term fair value estimates. In the near term, given the weak macro environment and cautious outlook for the sector, stocks such as Axis Bank may undershoot fair value estimates, but from a relative point-of-view compared to peers, it remains one of the preferred banks, in our view, from a medium term perspective. We maintain our Buy recommendation, with a target price of `1,441.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 33.9 8.8 48.9 8.4

Abs. (%) Sensex AXSB

3m 5.0

1yr 16.2

3yr 11.2 (8.9)

(13.4) 19.5

Key financials (Standalone)

Y/E March (` cr) NII % chg Net profit % chg NIM (%) EPS (`) P/E (x) P/ABV (x) RoA (%) RoE (%)

Source: Company, Angel Research

FY2012 8,018 22.2 4,242 25.2 3.1 102.7 12.1 2.2 1.6 20.3

FY2013 9,666 20.6 5,179 22.1 3.2 110.7 11.2 1.8 1.7 18.5

FY2014E 12,045 24.6 6,117 18.1 3.3 130.7 9.5 1.5 1.6 17.2

FY2015E 14,472 20.1 7,349 20.1 3.3 157.1 7.9 1.3 1.6 18.1

Vaibhav Agrawal

022 3935 7800 Ext: 6808 vaibhav.agrawal@angelbroking.com

Sourabh Taparia

022 3935 7800 Ext: 6872 sourabh.taparia@angelbroking.com

Harshal Patkar

022 3935 7800 Ext: 6847 harshal.patkar@angelbroking.com

Please refer to important disclosures at the end of this report

Axis Bank | 1QFY2014 Result Update

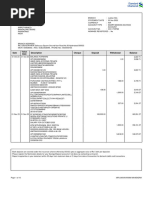

Exhibit 1: 1QFY2014 performance summary (Standalone)

Particulars (` cr) Interest earned - on Advances / Bills - on investments - on balance with RBI & others - on others Interest Expended Net Interest Income Other income Other income excl. treasury - Fee Income - Trading gains - Others Operating income Operating expenses - Employee expenses - Other Opex Pre-provision Profit Provisions & Contingencies - Provisions for NPAs - Other Provisions PBT Provision for Tax PAT

Source: Company, Angel Research

1QFY14 7,278 5,189 2,015 34 39 4,413 2,865 1,781 1,341 1,317 440 24 4,647 1,803 643 1,160 2,844 712 572 140 2,131 722 1,409

4QFY13 7,048 4,899 2,030 42 77 4,383 2,665 2,007 1,769 1,618 238 151 4,672 1,872 601 1,271 2,800 595 145 450 2,204 649 1,555

% chg (qoq) 3.3 5.9 (0.7) (18.1) (49.2) 0.7 7.5 (11.3) (24.2) (18.6) 84.7 (84.1) (0.5) (3.7) 6.9 (8.7) 1.6 19.6 294.5 (68.9) (3.3) 11.3 (9.4)

1QFY13 6,483 4,625 1,806 23 29 4,303 2,180 1,336 1,185 1,154 150 31 3,515 1,552 583 969 1,964 259 261 (2) 1,705 551 1,154

% chg (yoy) 12.3 12.2 11.6 48.8 35.2 2.5 31.4 33.4 13.2 14.1 192.8 (22.3) 32.2 16.2 10.4 19.7 44.8 175.2 119.2 NA 25.0 31.0 22.1

FY2013 27,183 19,166 7,747 111 158 17,516 9,666 6,551 5,796 5,521 755 275 16,217 6,914 2,377 4,537 9,303 1,750 1,138 612 7,553 2,373 5,179

FY2012 21,995 15,379 6,394 98 123 13,977 8,018 5,420 5,059 4,727 362 332 13,438 6,007 2,080 3,927 7,431 1,143 861 282 6,288 2,046 4,242

% chg 23.6 24.6 21.2 13.0 29.0 25.3 20.6 20.9 14.6 16.8 108.8 (17.0) 20.7 15.1 14.3 15.5 25.2 53.1 32.2 117.2 20.1 16.0 22.1

Exhibit 2: 1QFY2014 Actual vs. Angel estimates

Particulars (` cr) Net interest income Other income Operating income Operating expenses Pre-prov. profit Provisions & cont. PBT Prov. for taxes PAT

Source: Company, Angel Research

Actual 2,865 1,781 4,647 1,803 2,844 712 2,131 722 1,409

Estimates 2,802 1,638 4,440 1,918 2,522 415 2,107 695 1,411

Var. (%) 2.3 8.7 4.6 (6.0) 12.7 71.5 1.2 3.9 (0.2)

July 18, 2013

Axis Bank | 1QFY2014 Result Update

Exhibit 3: 1QFY2014 performance analysis (Standalone)

Particulars Balance sheet Advances (` cr) Deposits (` cr) Credit-to-Deposit Ratio (%) Current deposits (` cr) Saving deposits (` cr) CASA deposits (` cr) CASA ratio (%) CAR (%) Tier 1 CAR (%) Profitability Ratios (%) Cost of funds Reported NIM Cost-to-income ratio Asset quality Gross NPAs (` cr) Gross NPAs (%) Net NPAs (` cr) Net NPAs (%) Provision Coverage Ratio (%) Slippage ratio (%) Loan loss provision to avg. assets (%)

1QFY14 198,151 238,441 83.1 37,798 63,298 101,096 42.4 16.9 12.4 6.3 3.9 38.8 2,490 1.1 790 0.4 80.0 1.4 0.7

4QFY13 196,966 252,614 78.0 48,332 63,778 112,110 44.4 17.0 12.2 6.5 3.7 40.1 2,393 1.1 704 0.3 79.0 0.9 0.2

% chg (qoq) 0.6 (5.6) 513bp (21.8) (0.8) (9.8) (198)bp (10)bp 12bp (19)bp 16bp (127)bp 4.0 4bp 12.2 3bp 100bp 45bp 50bp

1QFY13 171,146 222,631 76.9 34,165 52,777 86,942 39.1 13.0 9.0 6.7 3.4 44.1 2,092 1.1 605 0.3 79.0 1.1 0.4

% chg (yoy) 15.8 7.1 623bp 10.6 19.9 16.3 335bp 387bp 333bp (44)bp 49bp (534)bp 19.0 4bp 30.6 4bp 100bp 31bp 32bp

Source: Company, Angel Research

Moderate growth in Balance sheet continues

During 1QFY2014, the bank reported a healthy advance growth of 15.8% yoy, while the deposits growth was deliberately contained at 7.1% yoy, as the bank had raised capital in 4QFY2013 which was to be deployed. Loan book growth was primarily aided by strong traction witnessed in the retail and SME loan book, which grew by 39.7% and 27.5% yoy, respectively. Within retail advances, Auto loans grew by 19.7% yoy and now constitute around 3.5% of the total loan book. Growth in the large and mid-corporate segment remained moderate at 7.5% yoy. During FY2014, the management has reiterated its guidance of above industryaverage loan growth, which would be driven by retail (home, auto) followed by SME.

July 18, 2013

Axis Bank | 1QFY2014 Result Update

Exhibit 4: Strong yoy growth in retail loans aided healthy adv. growth

Particulars (` cr) Corporate SME Agri Retail - Housing - Auto - Others Total advances 4QFY13 99,818 28,021 13,606 56,706 36,859 6,805 13,042 198,151 3QFY13 98,239 29,922 14,845 53,960 35,074 7,554 11,332 196,966 % chg (qoq) 1.6 (6.4) (8.3) 5.1 5.1 (9.9) 15.1 0.6 4QFY12 92,887 21,985 15,683 40,591 26,384 5,683 8,524 171,146 % chg (yoy) 7.5 27.5 (13.2) 39.7 39.7 19.7 53.0 15.8 % to total 50.4 14.1 6.9 28.6 18.6 3.4 6.6 100.0

Source: Company, Angel Research

CASA deposits registered a healthy growth of 16.3% yoy, aided by a strong growth of 19.9% yoy in savings deposits, even as growth in current deposits came in moderate at 10.6% yoy. On a daily average basis, the overall CASA deposits grew by 17% yoy, within which saving deposits grew by 20% yoy. Period-end CASA ratio improved by 198bp sequentaily to 42.4%. The bank registered a 18% yoy growth in its retail term deposits franchise, which reflects its focus of building a stronger retail term deposits portfolio. As of 1QFY2014, retail term deposits constitute 46% of total term deposits as against 42% as of 4QFY2013.

Exhibit 5: Average CASA deposits grew by 17% yoy

30 25 20 15 10 5 0 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 16 16 15 17 14 Reported yoy growth in average CASA balances (%)

Exhibit 6: Period-end CASA ratio decreased to 42.4%

(%) 46.0 44.0 42.0 40.0 38.0 36.0 34.0 32.0 30.0 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14

Source: Company, Angel Research

44.4 42.4 40.5 39.1 40.0

Source: Company, Angel Research

NIMs improve sequentially

During the quarter, the banks overall reported NIM improved by 16bp qoq to 3.86%, mainly due to a decline witnessed in cost of funds. Cost of funds declined by 19bp to 6.26%, primarily on account of fresh capital raising done in February 2013 and also due to healthy growth in average CASA balances.

July 18, 2013

Axis Bank | 1QFY2014 Result Update

Exhibit 7: Cost of funds lower sequentially by 19bp...

(%) 6.70 6.5 5.5 4.5 3.5 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 6.54 6.52 6.45 6.26

Exhibit 8: ....hence, NIMs higher by 16bp qoq

(%) 4.2 3.9 3.6 3.3 3.0 2.7 2.4 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 3.37 3.46 3.57 3.70 3.86

Source: Company, Angel Research

Source: Company, Angel Research

Moderate growth in non-interest income excluding trading profits, aided by strong growth in DCM; Trading profits witness huge spike

During 1QFY2014, growth in fee income for the bank was moderate at 14.1% yoy, which was largely aided by robust growth in fee income from segments such as DCM and Retail. Fee income from the DCM (Debt Capital Markets) segment grew strongly at 38.3% yoy, while Fee income from Retail segment grew by 22.7% yoy which can be attributed to healthy loan book growth in this segment. Fee Income from Corporate segment de-grew by 6.6% yoy. Trading profits came in much higher at `440cr during the quarter as against `238cr in 4QFY2013 and `150cr in 1QFY2013. Overall, the non-interest income excluding trading profits registered a moderate growth of 13.2% yoy during 1QFY2014.

Exhibit 9: Fee income grew at moderate pace on a yoy basis

Particulars (` cr) Fee Income Corporate DCM Agri & SME Business banking Capital markets Retail Trading profit Others Other income Other income excl. Trading Profits

Source: Company, Angel Research

1QFY14 4QFY13 % chg (qoq) 1QFY13 % chg (yoy) 1,317 382 329 66 132 13 395 440 24 1,781 1,341 1,618 469 356 129 129 16 518 238 151 2,007 1,769 (18.6) (18.6) (7.5) (49.1) 1.7 (18.6) (23.7) 84.7 (84.1) (11.3) (24.2) 1,154 409 238 63 110 12 322 150 31 1,336 1,185 14.1 (6.6) 38.3 4.5 19.7 9.7 22.7 192.8 (22.3) 33.4 13.2

July 18, 2013

Axis Bank | 1QFY2014 Result Update

Higher slippages and lower recoveries/upgrades affect asset quality performance

On the asset quality front, the bank reported slippages of `681cr during the quarter (annualized slippage rate of 1.4%), as against `398cr reported in 4QFY2013. During the quarter, slippages and fresh restructuring taken together amounted to more than `1,350cr, higher than the managements guidance of around `1,000-1,200cr per quarter in the current fiscal. Along with sequentially higher slippages, the bank also reported sequentially lower recoveries and upgrades at `72cr compared to `205cr in 4QFY2013, which resulted in the sequential increase of 4.0% and 12.2%, respectively, in its gross and net NPA levels. Gross and Net NPA ratio were largely stable sequentially at 1.1% and 0.35%, respectively. The banks PCR increased by 100bp qoq to 80%. Restructuring book for the bank came down sequentially to `4,211cr, primarily due to upgrades on account of satisfactory performance and also due to repayments. During FY2013, the management had guided for credit costs of around 85-90bp, but ended the year with credit costs of 75bp. For FY2014, the management has reiterated its guidance for credit costs of around 85-90bp, but having regards to the asset quality performance in 1QFY2014 and considering current weak macro developments, we have increased the provisioning estimates for FY2014 by 15%.

Exhibit 10: Slippages Ratio rise

(%) 1.60 1.20 0.80 0.40 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 1.07 1.48 1.27 0.94 1.38

Exhibit 11: ...leading to greater net NPA ratio

Gross NPAs (%) 1.3 1.0 0.8 0.5 79.0 80.0 Net NPAs (%) 81.0 79.0 NPA coverage (%, RHS) 80.0 85.0 77.5 70.0 62.5

1.1 0.3

1.1 0.3

1.1 0.3

1.1 0.3

1.1 0.4

55.0 1QFY14

0.3 -

1QFY13

2QFY13

3QFY13

4QFY13

Source: Company, Angel Research

Source: Company, Angel Research; Note: PCR including tech. write-offs

July 18, 2013

Axis Bank | 1QFY2014 Result Update

Exhibit 12: Steady Network expansion continues

Branches 2,400 2,000 1,600 1,200 10,337 10,297 10,363 ATMs (RHS) 11,245 11,488 12,500 10,000 7,500 5,000

Exhibit 13: Cost-to-income ratio moderates to 38.8%

Opex to avg. assets (%) 2.4 2.3 2.2 2.1 2.0 2.2 2.4 2.3 44.1 44.4 42.5 40.1 2.3 38.8 2.1 44.0 CIR (%, RHS) 47.0

41.0

1,665

1,741

1,787

1,947

800 400

2,021

2,500 -

38.0

1QFY13 2QFY13 3QFY13 4QFY13 1QFY14

Source: Company, Angel Research;

1QFY13 2QFY13 3QFY13 4QFY13 1QFY14

Source: Company, Angel Research

July 18, 2013

Axis Bank | 1QFY2014 Result Update

Investment arguments

Strong Retail & DCM businesses continue to support earnings growth

Over the past ten years, Axis Bank has aggressively expanded its branch network at around 30% CAGR (~2,000 branches now), which has not only aided the bank in steadily growing its retail liabilities profile, but has also laid a strong platform for building up a sustainable retail assets portfolio. As of 1QFY2014, its CASA ratio stands at around 42.4%, amongst the best in the industry; the share of retail deposits (CASA + retail term) to total deposits stands at around 69% for the bank. On the assets side, the retail advances to total loans for the bank stands at a healthy 28.6%, up from ~20% as of FY2011. Axis Bank has been able to sustain its healthy growth on the non-interest income front and maintain the fee income contribution at a meaningful 1.9% of total assets, primarily on account of 1) the strong traction in retail business which helps it to generate a healthy fee income from the retail segment; and 2) robust growth in fee income from the DCM (Debt Capital Markets) business. Hence, strong traction in Retail & DCM business continues to support healthy earnings momentum for the bank, despite current macro challenges.

even as corporate business remains subdued

Considering the current macro headwinds, Axis bank has adopted a consolidation approach in its corporate loan portfolio. During 1QFY2014, its mid and Large corporate book grew at a moderate pace of 7.4% yoy, which also resulted in degrowth of 7.2% yoy in its fee income from the corporate segment. Few sectors like Engineering, Iron & Steel, Infrastructure (incl. Power) and Textile have contributed a large part of the incremental asset quality concerns for the banking industry. Despite having around 30% of its loan book exposed to these sectors, Axis bank has been able to contain its quantum of stressed assets (NPA and restructured assets). However, as indicated by the Management, nearly 70% of its power exposure (ie ~6% of its total loan book) is towards projects which are yet-to-be-commissioned over the next two years. This poses a concern on the quality of these assets, unless there is a positive policy action on part of the government.

Healthy capital adequacy

Axis Bank's tier-I capital adequacy came in at 12.35% as of 1QFY2014. The capital infusion of `5,537cr in February, 2013 gives it enough headroom for credit growth for the next three years. We expect the Management to meet its guidance of above-industry average loan growth and improve its credit market share.

Outlook and valuation

Axis Banks aggressive branch expansion (at a CAGR of ~24%) over the past five years, has not only aided it to steadily grow its retail liabilities profile, but has also helped it build a sustainable retail assets portfolio. Healthy fee income from the retail segment considering its strong retail business growth, coupled with robust fee income from the DCM (Debt Capital Markets) business, aid it to maintain fee income contribution at a meaningful 1.9% of total assets and support healthy

July 18, 2013

Axis Bank | 1QFY2014 Result Update

earnings momentum for the bank. Consequently, notwithstanding moderate concerns on the corporate book asset quality, we expect the retail business to drive earnings at a healthy CAGR of 19.1% over FY2013-15E. In our view, the current valuations at 1.3x FY2015 ABV are below our longer term fair value estimates. In the near term, given the weak macro environment and cautious outlook for the sector, stocks such as Axis Bank may undershoot fair value estimates, but from a relative point-of-view compared to peers, it remains one of the preferred banks, in our view, from a medium term perspective. We maintain our Buy recommendation, with a target price of `1,441.

Exhibit 14: Key assumptions

Particulars (%) Credit growth Deposit growth CASA ratio NIMs Other income growth Growth in staff expenses Growth in other expenses Slippages Coverage ratio

Source: Angel Research

Earlier estimates FY2014 21.0 21.0 43.5 3.2 13.7 18.1 18.1 1.3 80.0 FY2015 23.0 23.0 43.4 3.2 19.3 21.3 21.3 1.3 80.0

Revised estimates FY2014 20.0 18.0 44.3 3.3 10.4 18.0 18.0 1.4 80.0 FY2015 22.0 24.0 43.9 3.3 16.3 18.8 18.8 1.4 80.0

Exhibit 15: Change in estimates

FY2014 Particulars (` cr) NII Non-interest income Operating income Operating expenses Pre-prov. profit Provisions & cont. PBT Prov. for taxes PAT

Source: Angel Research

FY2015 Earlier Var. (%) estimates 2.2 (2.8) 0.2 (0.0) 0.4 15.0 (2.3) (2.3) (2.3) 14,379 8,883 23,261 9,897 13,365 2,084 11,281 3,723 7,558 Revised estimates 14,472 8,414 22,886 9,689 13,198 2,229 10,969 3,620 7,349 Var. (%) 0.7 (5.3) (1.6) (2.1) (1.2) 6.9 (2.8) (2.8) (2.8)

Earlier estimates 11,791 7,446 19,237 8,162 11,075 1,731 9,344 3,084 6,261

Revised estimates 12,045 7,234 19,280 8,159 11,121 1,990 9,130 3,013 6,117

Exhibit 16: Angel EPS forecast vs. consensus

Year FY2014E FY2015E Source: Bloomberg, Angel Research Angel forecast 130.7 157.1 Bloomberg consensus 131.1 154.4 Var. (%) (0.2) 1.7

July 18, 2013

Axis Bank | 1QFY2014 Result Update

Exhibit 17: P/ABV band

3,200 2,800 2,400 2,000 1,600 1,200 800 400 0

Oct-08 Feb-07 Nov-10 Sep-06 Feb-12 Sep-11 May-08 May-13 Dec-07 Aug-09 Dec-12 Oct-13 Jan-10 Jun-10 Apr-06 Apr-11 Jul-07 Jul-12 Mar-09 Mar-14

Price (`)

0.8x

1.4x

2x

2.6x

3.2x

Source: Company, Angel Research

Exhibit 18: Discount to HDFC Bank (%)

-

Jun-08

Jun-09

Jun-10

Jun-11

Jun-12

Dec-07

Dec-08

Dec-09

Dec-10

Dec-11

(15.0)

(30.0)

(%)

(45.0)

(60.0)

(75.0)

Source: Company, Angel Research

July 18, 2013

Dec-12

Jun-13

10

Axis Bank | 1QFY2014 Result Update

Exhibit 19: Recommendation summary

Company Reco. AXSB FEDBK HDFCBK ICICIBK SIB YESBK ALLBK ANDHBK BOB BOI BOM CANBK CENTBK CRPBK DENABK IDBI INDBK IOB J&KBK OBC PNB SBI SYNBK UCOBK UNBK UTDBK VIJAYA Buy Neutral Accumulate Buy Neutral Neutral Accumulate Neutral Accumulate Accumulate Accumulate Neutral Neutral Accumulate Neutral Neutral Neutral Neutral Neutral Accumulate Accumulate Accumulate Accumulate Reduce Accumulate Neutral Neutral CMP (`) 1,238 379 684 985 23 440 88 79 566 218 50 330 63 329 69 70 108 49 1,243 179 637 1,824 111 74 163 46 46 Tgt. price (`) 1,441 745 1,160 95 642 236 54 360 203 718 2,077 121 63 178 Upside (%) 16 9 18 8 13 8 7 10 13 13 14 8 (14) 9 FY2015E FY2015E Tgt. P/ABV (x) P/ABV (x) 1.3 0.8 3.2 1.4 0.9 1.8 0.4 0.5 0.6 0.5 0.6 0.5 0.5 0.4 0.4 0.4 0.4 0.3 0.9 0.4 0.6 1.0 0.6 0.8 0.5 0.3 0.5 1.6 3.5 1.7 0.4 0.7 0.5 0.6 0.5 0.4 0.7 1.2 0.6 0.7 0.6 FY2015E P/E (x) 7.9 6.7 15.2 9.9 5.4 8.9 2.7 3.5 3.9 3.2 3.9 3.8 3.3 3.1 2.8 3.1 2.6 2.5 5.9 2.9 3.6 6.4 4.0 4.7 3.5 2.3 4.3

#

FY13-15E EPS CAGR (%) 19.1 7.5 26.3 17.4 5.7 17.1 18.3 (0.3) 16.8 21.6 10.0 15.4 52.3 5.7 3.7 27.1 7.0 78.9 (1.7) 17.0 14.5 17.5 (8.5) 67.5 14.7 54.6 9.5

FY2015E RoA (%) 1.6 1.1 1.9 1.6 0.9 1.3 0.7 0.7 0.9 0.7 0.6 0.8 0.6 0.7 0.7 0.8 0.9 0.6 1.2 0.8 1.1 1.0 0.6 0.6 0.7 0.6 0.4

FY2015E RoE (%) 18.1 13.1 22.8 16.2 16.2 22.8 13.6 13.2 16.0 15.1 15.3 14.2 14.3 14.2 14.7 13.5 14.7 13.0 16.8 12.9 16.5 17.0 14.6 13.6 15.2 14.7 11.5

Source: Company, Angel Research; Note:*Target multiples=SOTP Target Price/ABV (including subsidiaries), Without adjusting for SASF

Company Background

Axis Bank is India's third-largest private sector bank after ICICI Bank and HDFC Bank. The bank was promoted by government institutions, led by UTI (SUUTI holds 20.8% stake currently, which will eventually be divested). The bank has an extensive network of 2,021 branches and 11,488 ATMs spread across 1,300 centers (~55% in metro and urban regions). The bank's strong growth has been backed by robust retail branch expansion, strong corporate relationships and a wide range of fee income products.

July 18, 2013

11

Axis Bank | 1QFY2014 Result Update

Income statement (Standalone)

Y/E March (` cr) Net Interest Income - YoY Growth (%) Other Income - YoY Growth (%) Operating Income - YoY Growth (%) Operating Expenses - YoY Growth (%) Pre - Provision Profit - YoY Growth (%) Prov. & Cont. - YoY Growth (%) Profit Before Tax - YoY Growth (%) Prov. for Taxation - as a % of PBT PAT - YoY Growth (%) FY09 3,686 42.6 2,834 57.8 6,520 48.8 2,858 32.6 3,662 64.5 877 51.3 2,785 69.2 970 34.8 1,815 69.5 FY10 5,004 35.8 3,946 39.2 8,950 37.3 3,710 29.8 5,241 43.1 1,389 58.5 3,851 38.3 1,337 34.7 2,515 38.5 FY11 6,563 31.1 4,632 17.4 11,195 25.1 4,779 28.8 6,416 22.4 1,280 (7.9) 5,136 33.3 1,747 34.0 3,388 34.8 FY12 8,018 22.2 5,420 17.0 13,438 20.0 6,007 25.7 7,431 15.8 1,143 (10.7) 6,288 22.4 2,046 32.5 4,242 25.2 FY13 9,666 20.6 6,551 20.9 16,217 20.7 6,914 15.1 9,303 25.2 1,750 53.1 7,553 20.1 2,373 31.4 5,179 22.1 FY14E 12,045 24.6 7,234 10.4 19,280 18.9 8,159 18.0 11,121 19.5 1,990 13.7 9,130 20.9 3,013 33.0 6,117 18.1 FY15E 14,472 20.1 8,414 16.3 22,886 18.7 9,689 18.8 13,198 18.7 2,229 12.0 10,969 20.1 3,620 33.0 7,349 20.1

Balance sheet (Standalone)

Y/E March (` cr) Share Capital Reserve & Surplus Deposits - Growth (%) Borrowings Tier 2 Capital Other Liab. & Prov. Total Liabilities Cash Balances Bank Balances Investments Advances - Growth (%) Fixed Assets Other Assets Total Assets - Growth (%) FY09 359 9,855 33.9 10,185 5,334 4,613 9,419 5,598 46,330 36.7 1,073 3,744 34.8 FY10 405 15,639 20.4 10,014 7,156 6,134 9,482 5,722 55,975 27.9 1,222 3,906 22.3 FY11 411 18,588 33.9 19,275 6,993 8,209 13,886 7,522 71,992 36.5 2,273 4,632 34.4 FY12 413 22,395 16.3 23,498 10,574 8,643 10,703 3,231 FY13 468 32,640 14.8 31,412 12,540 10,888 14,792 5,643 FY14E 468 37,359 18.0 41,893 12,226 12,787 13,414 6,042 FY15E 468 43,035 24.0 57,863 11,920 15,907 16,633 7,482

117,374 141,300 189,238 220,104 252,614 298,084 369,624

147,721 180,648 242,713 285,628 340,561 402,816 498,818

93,192 113,738 135,940 172,748 19.2 2,259 6,483 17.7 16.0 2,356 7,067 19.2 20.0 2,703 8,358 18.3 22.0 3,246 10,350 23.8

81,557 104,341 142,408 169,760 196,966 236,359 288,358

147,721 180,648 242,713 285,628 340,561 402,816 498,818

July 18, 2013

12

Axis Bank | 1QFY2014 Result Update

Ratio analysis (Standalone)

Y/E March Profitability ratios (%) NIMs Cost to Income Ratio RoA RoE B/S ratios (%) CASA Ratio Credit/Deposit Ratio CAR - Tier I Asset Quality (%) Gross NPAs Net NPAs Slippages Loan Loss Prov. /Avg. Assets Provision Coverage Per Share Data (`) EPS ABVPS (75% cover.) DPS Valuation Ratios PER (x) P/ABVPS (x) Dividend Yield DuPont Analysis NII (-) Prov. Exp. Adj. NII Treasury Int. Sens. Inc. Other Inc. Op. Inc. Opex PBT Taxes RoA Leverage RoE 2.9 0.7 2.2 0.2 2.4 2.0 4.4 2.2 2.2 0.8 1.4 13.6 19.1 3.0 0.8 2.2 0.4 2.7 2.0 4.6 2.3 2.3 0.8 1.5 12.5 19.2 3.1 0.6 2.5 0.2 2.7 2.0 4.7 2.3 2.4 0.8 1.6 12.1 19.3 3.0 0.4 2.6 0.0 2.6 2.0 4.7 2.3 2.4 0.8 1.6 12.6 20.3 3.1 0.6 2.5 0.2 2.7 1.9 4.6 2.2 2.4 0.8 1.7 11.2 18.5 3.2 0.5 2.7 0.1 2.8 1.8 4.7 2.2 2.5 0.8 1.6 10.5 17.2 3.2 0.5 2.7 0.1 2.8 1.8 4.6 2.1 2.4 0.8 1.6 11.1 18.1 24.5 4.4 0.8 20.0 3.1 1.0 15.0 2.7 1.1 12.1 2.2 1.3 11.2 1.8 1.5 9.5 1.5 2.1 7.9 1.3 2.5 50.6 281.6 10.0 62.1 393.8 12.0 82.5 462.5 14.0 102.7 551.5 16.0 110.7 705.2 18.0 130.7 808.3 25.5 157.1 929.7 30.5 1.1 0.4 1.5 0.6 63.6 1.3 0.4 2.2 0.8 72.4 1.1 0.3 1.4 0.5 80.9 1.1 0.3 1.3 0.3 81.0 1.2 0.4 1.2 0.4 79.0 1.9 0.5 1.4 0.4 80.0 2.4 0.5 1.4 0.4 80.0 43.1 69.5 13.7 9.3 46.7 73.8 15.8 11.2 41.1 75.3 12.7 9.4 41.5 77.1 13.7 9.4 44.4 78.0 17.0 12.2 44.3 79.3 15.9 11.9 43.9 78.0 14.3 11.1 3.0 43.8 1.4 19.1 3.1 41.4 1.5 19.2 3.2 42.7 1.6 19.3 3.1 44.7 1.6 20.3 3.2 42.6 1.7 18.5 3.3 42.3 1.6 17.2 3.3 42.3 1.6 18.1 FY09 FY10 FY11 FY12 FY13 FY14E FY15E

July 18, 2013

13

Axis Bank | 1QFY2014 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Axis Bank No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to -15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

July 18, 2013

14

You might also like

- Subhash Dey'S - Business Studies-XI Exam Handbook-2024Document39 pagesSubhash Dey'S - Business Studies-XI Exam Handbook-2024Yoyo Hello80% (5)

- ICT Market Maker Model - PDF 1Document1 pageICT Market Maker Model - PDF 1AmanNo ratings yet

- Supermarket Business Plan TemplateDocument3 pagesSupermarket Business Plan TemplateVinayak Nayak100% (1)

- Case 1 - Financial Statements 2014 Using Financial Ratios To Identify Companies PDFDocument3 pagesCase 1 - Financial Statements 2014 Using Financial Ratios To Identify Companies PDFFarhanie NordinNo ratings yet

- Axis Bank: Performance HighlightsDocument13 pagesAxis Bank: Performance HighlightsRahul JagdaleNo ratings yet

- Oriental Bank, 1Q FY 2014Document11 pagesOriental Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Federal Bank, 1Q FY 2014Document11 pagesFederal Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Syndicate Bank 4Q FY 2013Document11 pagesSyndicate Bank 4Q FY 2013Angel BrokingNo ratings yet

- IDBI Bank Result UpdatedDocument13 pagesIDBI Bank Result UpdatedAngel BrokingNo ratings yet

- ICICI Bank Result UpdatedDocument15 pagesICICI Bank Result UpdatedAngel BrokingNo ratings yet

- UnitedBoI-1QFY2013RU 10 TH AugDocument11 pagesUnitedBoI-1QFY2013RU 10 TH AugAngel BrokingNo ratings yet

- Andhra Bank, 1Q FY 2014Document11 pagesAndhra Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Corporation Bank 4Q FY 2013Document11 pagesCorporation Bank 4Q FY 2013Angel BrokingNo ratings yet

- Allahabad Bank, 1Q FY 2014Document11 pagesAllahabad Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Axis Bank: Performance HighlightsDocument13 pagesAxis Bank: Performance HighlightsAngel BrokingNo ratings yet

- Axis Bank 4Q FY 2013Document13 pagesAxis Bank 4Q FY 2013Angel BrokingNo ratings yet

- Canara Bank, 1Q FY 2014Document11 pagesCanara Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Bank of Baroda, 1Q FY 2014Document12 pagesBank of Baroda, 1Q FY 2014Angel BrokingNo ratings yet

- Jammu and Kashmir Bank: Performance HighlightsDocument11 pagesJammu and Kashmir Bank: Performance HighlightsAngel BrokingNo ratings yet

- Central Bank, 4th February, 2013Document10 pagesCentral Bank, 4th February, 2013Angel BrokingNo ratings yet

- Bank of Maharashtra, 1Q FY 2014Document10 pagesBank of Maharashtra, 1Q FY 2014Angel BrokingNo ratings yet

- Dena Bank, 1Q FY 2014Document11 pagesDena Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Syndicate Bank Result UpdatedDocument11 pagesSyndicate Bank Result UpdatedAngel BrokingNo ratings yet

- Idbi, 1Q Fy 2014Document12 pagesIdbi, 1Q Fy 2014Angel BrokingNo ratings yet

- Union Bank of India Result UpdatedDocument11 pagesUnion Bank of India Result UpdatedAngel BrokingNo ratings yet

- Syndicate Bank, 1Q FY 2014Document11 pagesSyndicate Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Vijaya Bank, 1Q FY 2014Document11 pagesVijaya Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Bank of Maharashtra: Performance HighlightsDocument11 pagesBank of Maharashtra: Performance HighlightsAngel BrokingNo ratings yet

- UCO Bank: Performance HighlightsDocument11 pagesUCO Bank: Performance HighlightsAngel BrokingNo ratings yet

- Union Bank of India: Performance HighlightsDocument11 pagesUnion Bank of India: Performance HighlightsAngel BrokingNo ratings yet

- UCO Bank: Performance HighlightsDocument11 pagesUCO Bank: Performance HighlightsAngel BrokingNo ratings yet

- Canara Bank, 12th February 2013Document11 pagesCanara Bank, 12th February 2013Angel BrokingNo ratings yet

- Jammu and Kashmir Bank: Performance HighlightsDocument10 pagesJammu and Kashmir Bank: Performance HighlightsAngel BrokingNo ratings yet

- Andhra Bank: Performance HighlightsDocument11 pagesAndhra Bank: Performance HighlightsAngel BrokingNo ratings yet

- Sbi, 1Q Fy 2014Document14 pagesSbi, 1Q Fy 2014Angel BrokingNo ratings yet

- Union Bank, 1Q FY 2014Document11 pagesUnion Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Axis Bank Result UpdatedDocument13 pagesAxis Bank Result UpdatedAngel BrokingNo ratings yet

- State Bank of India: Performance HighlightsDocument14 pagesState Bank of India: Performance HighlightsAngel BrokingNo ratings yet

- Sib 4Q Fy 2013Document12 pagesSib 4Q Fy 2013Angel BrokingNo ratings yet

- Syndicate Bank: Performance HighlightsDocument11 pagesSyndicate Bank: Performance HighlightsAngel BrokingNo ratings yet

- IDBI Bank Result UpdatedDocument13 pagesIDBI Bank Result UpdatedAngel BrokingNo ratings yet

- Union Bank 4Q FY 2013Document11 pagesUnion Bank 4Q FY 2013Angel BrokingNo ratings yet

- Federal Bank: Performance HighlightsDocument11 pagesFederal Bank: Performance HighlightsAngel BrokingNo ratings yet

- Dena Bank: AccumulateDocument11 pagesDena Bank: AccumulateAngel BrokingNo ratings yet

- Axis Bank: Performance HighlightsDocument13 pagesAxis Bank: Performance HighlightsAngel BrokingNo ratings yet

- HDFC Bank, 1Q FY 2014Document13 pagesHDFC Bank, 1Q FY 2014Angel BrokingNo ratings yet

- IDBI Bank: Performance HighlightsDocument13 pagesIDBI Bank: Performance HighlightsAngel BrokingNo ratings yet

- Bank of Maharashtra 4Q FY 2013Document11 pagesBank of Maharashtra 4Q FY 2013Angel BrokingNo ratings yet

- Bank of Baroda, 7th February, 2013Document12 pagesBank of Baroda, 7th February, 2013Angel BrokingNo ratings yet

- Dena Bank Result UpdatedDocument10 pagesDena Bank Result UpdatedAngel BrokingNo ratings yet

- PNB 4Q Fy 2013Document12 pagesPNB 4Q Fy 2013Angel BrokingNo ratings yet

- State Bank of IndiaDocument16 pagesState Bank of IndiaAngel BrokingNo ratings yet

- Axis Bank Result UpdatedDocument13 pagesAxis Bank Result UpdatedAngel BrokingNo ratings yet

- Central Bank of India Result UpdatedDocument10 pagesCentral Bank of India Result UpdatedAngel BrokingNo ratings yet

- Bank of Maharashtra Result UpdatedDocument11 pagesBank of Maharashtra Result UpdatedAngel BrokingNo ratings yet

- Dena BankDocument11 pagesDena BankAngel BrokingNo ratings yet

- BUY Bank of India: Performance HighlightsDocument12 pagesBUY Bank of India: Performance Highlightsashish10mca9394No ratings yet

- Bank of India Result UpdatedDocument12 pagesBank of India Result UpdatedAngel BrokingNo ratings yet

- IDBI Bank: Performance HighlightsDocument13 pagesIDBI Bank: Performance HighlightsAngel BrokingNo ratings yet

- Mindtree, 1Q FY 2014Document12 pagesMindtree, 1Q FY 2014Angel BrokingNo ratings yet

- UCO Bank: Performance HighlightsDocument12 pagesUCO Bank: Performance Highlightspathanfor786No ratings yet

- Collection Agency Revenues World Summary: Market Values & Financials by CountryFrom EverandCollection Agency Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Practical Finance for Operations and Supply Chain ManagementFrom EverandPractical Finance for Operations and Supply Chain ManagementNo ratings yet

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Executive Body 2019 - Application QuestionnaireDocument26 pagesExecutive Body 2019 - Application QuestionnaireShrutei ShreeNo ratings yet

- Chapter 5 Accounting For Disbursements and Related TransactionsDocument2 pagesChapter 5 Accounting For Disbursements and Related TransactionsJaps100% (1)

- CMBS - A:B Tranching of Commercial Real Estate-Secured Loans: An OverviewDocument45 pagesCMBS - A:B Tranching of Commercial Real Estate-Secured Loans: An Overviewpierrefranc100% (1)

- Tugas Ch.14Document6 pagesTugas Ch.14Chupa HesNo ratings yet

- Mediclaim ReceiptDocument1 pageMediclaim ReceiptParthiban KNo ratings yet

- Investments, Risks, Rates of Returns and LeveragesDocument43 pagesInvestments, Risks, Rates of Returns and LeveragesJhay Lorraine Sadian PalacpacNo ratings yet

- Ecs2602 Tests Bank 1Document107 pagesEcs2602 Tests Bank 1wycliff brancNo ratings yet

- Members LaDocument68 pagesMembers Laaayeshamirza1995No ratings yet

- Accountancy Academic Organization: PartnershipDocument21 pagesAccountancy Academic Organization: Partnershipsehun ohNo ratings yet

- Factors Influencing Invetsment in Mutual Funds of Nepal FinalDocument147 pagesFactors Influencing Invetsment in Mutual Funds of Nepal Finalanuj koiralaNo ratings yet

- E StatementDocument10 pagesE StatementMahendra LakkavaramNo ratings yet

- United Utilities Case SolutionDocument11 pagesUnited Utilities Case SolutionAfrin JahanNo ratings yet

- Presentation1 Business Plan Jameel PathanDocument12 pagesPresentation1 Business Plan Jameel PathanPooja ChavanNo ratings yet

- ACW366 - Tutorial Exercises 3 PDFDocument2 pagesACW366 - Tutorial Exercises 3 PDFMERINA100% (1)

- Actividad 1 - CasoDocument6 pagesActividad 1 - CasoValentina GOMEZ CORTESNo ratings yet

- Margarita S. Monilla - Resume PDFDocument2 pagesMargarita S. Monilla - Resume PDFFBG- KinNo ratings yet

- Obsa Ahmed Research 2013Document55 pagesObsa Ahmed Research 2013Ebsa AdemeNo ratings yet

- Champaran Gurukul: Banking Made EasyDocument5 pagesChamparan Gurukul: Banking Made EasybiplabmajumderNo ratings yet

- Economic Returns To Higher EducationDocument22 pagesEconomic Returns To Higher EducationNicu tarnaNo ratings yet

- GIS April 11, 2023 Annual StockholdersDocument11 pagesGIS April 11, 2023 Annual StockholdersammendNo ratings yet

- Financial Statements - Sept13 - 1stmake Up ClassDocument8 pagesFinancial Statements - Sept13 - 1stmake Up Classkeith niduelanNo ratings yet

- QUIZDocument21 pagesQUIZSol Andallo100% (1)

- World Bank Briefing BookDocument4 pagesWorld Bank Briefing Bookapi-554844732No ratings yet

- Practical Questions: Ca - IpccDocument8 pagesPractical Questions: Ca - IpccazharnadviNo ratings yet

- HDFC Life Annual Report FY 2015 16Document347 pagesHDFC Life Annual Report FY 2015 16sunnyNo ratings yet

- Republic Act No Rental LawDocument8 pagesRepublic Act No Rental LawAdrian FranzingisNo ratings yet