US Fed FOMC Press Conference 18 September 2013 No Taper

US Fed FOMC Press Conference 18 September 2013 No Taper

Copyright:

Available Formats

US Fed FOMC Press Conference 18 September 2013 No Taper

US Fed FOMC Press Conference 18 September 2013 No Taper

Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

US Fed FOMC Press Conference 18 September 2013 No Taper

US Fed FOMC Press Conference 18 September 2013 No Taper

Copyright:

Available Formats

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

Transcript of Chairman Bernankes Press Conference September 18, 2013 CHAIRMAN BERNANKE. Good afternoon. The Federal Open Market Committee (FOMC) concluded a two-day meeting earlier today. As you already know from our statement, the Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and to make no change in either its asset purchase program or its forward guidance regarding the federal funds rate target. I will discuss the rationales for our decision in a moment. Economic growth has generally been proceeding at a moderate pace, with continued albeit somewhat unevenimprovement in labor market conditions. Of course, to say that the job market has improved does not imply that current conditions are satisfactory. Notably, at 7.3 percent, the unemployment rate remains well above acceptable levels. Long-term unemployment and underemployment remain high. And we have seen ongoing declines in labor force participation, which likely reflects discouragement on the part of many potential workers, as well as longer-term influences such as the aging of the population. In the Committees assessment, the downside risks to growth have diminished, on net, over the past year, reflecting, among other factors, somewhat better economic and financial conditions in Europe and increased confidence on the part of households and firms in the staying power of the U.S. recovery. However, the tightening of financial conditions observed in recent months, if sustained, could slow the pace of improvement in the economy and the labor market. In addition, federal fiscal policy continues to be an important restraint on growth and a source of downside risk. Apart from some fluctuations due primarily to changes in oil prices, inflation has continued to run below the Committees 2 percent longer-term objective. The Committee recognizes that inflation persistently below its objective could pose risks to economic

Page 1 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

performance, and we will continue to monitor inflation developments closely. However, the unwinding of some transitory factors has led to moderately higher inflation recently, as expected; and, with longer-term inflation expectations well-anchored, the Committee anticipates that inflation will gradually move back toward 2 percent. In conjunction with this meeting, the 17 participants in our policy discussions5 Board members and 12 Reserve Bank presidentssubmitted individual economic projections. As always, each participants projections are conditioned on his or her own view of appropriate monetary policy. Also, at this meeting, we extended the horizon of our projections through 2016. Generally, the projections of individual participants show that they continue to expect moderate economic growth, picking up over time, as well as gradual progress toward levels of unemployment and inflation consistent with the Federal Reserves statutory mandate to foster maximum employment and price stability. More specifically, participants projections for economic growth have a central tendency of 2.0 to 2.3 percent for 2013, rising to 2.9 to 3.1 percent in 2014 and 2.5 to 3.3 percent in 2016. For the unemployment rate, the central tendency of projections for the fourth quarter of each year is 7.1 to 7.3 percent for 2013, declining to 6.4 to 6.8 percent in 2014 and, by 2016, to 5.4 to 5.9 percentabout the longer-run normal level for the unemployment rate. Most participants see inflation gradually increasing from its current low level toward the Committees longer-run objective of 2 percent; the central tendency of their projections for inflation is 1.1 to 1.2 percent for this year, 1.3 to 1.8 percent in 2014, and 1.7 to 2.0 percent in 2016. With unemployment still elevated and inflation projected to run below the Committees longer-run objective, the Committee is continuing its highly accommodative policies. As you

Page 2 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

know, in normal times the Committee eases monetary policy by lowering its target for the shortterm policy interest rate, the federal funds rate. However, the target range for the federal funds rate, currently at 0 to 1/4 percent, cannot be lowered meaningfully further. Accordingly, the Committee has been providing policy support to the economy through two complementary methods: (1) by purchasing and holding Treasury securities and agency mortgage-backed securities, and (2) by communicating the Committees plans for setting the federal funds rate target over the medium term. Ill discuss these tools in turn, beginning with our program of asset purchases. In September 2012, the FOMC initiated a program of purchasing $40 billion per month in agency mortgage-backed securities, in addition to the $45 billion per month in longer-term Treasury securities that we were already acquiring as part of our Maturity Extension Program. We stated that, subject to our ongoing assessment of the efficacy and costs of the program, purchases would continue until we saw a substantial improvement in the outlook for the labor market in a context of price stability. In December 2012, we announced that we would continue to purchase $45 billion per month in longer-term Treasuries after the Maturity Extension Program ended later that month. Thus, our total purchases of longer-term securities were maintained at $85 billion per month, in addition to the reinvestment or rolling over of maturing securities on our balance sheet. The Committee agreed today to continue asset purchases at that rate, subject to the same conditions that we laid out a year ago. Because the Committee tied its asset purchases to the outlook for the labor market, it is important to assess how that outlook has evolved. As I noted earlier, conditions in the job market today are still far from what all of us would like to see. Nevertheless, meaningful progress has been made in the year since we announced the asset purchase program. For

Page 3 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

example, the unemployment rate has fallen from 8.1 percent at the time of our announcement to 7.3 percent today, and about 2.3 million private-sector jobs have been created over the same period. Over the past 12 months, aggregate hours of work are up by about 2.4 percent, weekly new claims for unemployment insurance have fallen by about 50,000, and surveys suggest that households perceive jobs as more readily available. Importantly, these gains were achieved despite substantial fiscal headwinds, which are likely slowing economic growth this year by a percentage point or more and reducing employment by hundreds of thousands of jobs. Not all labor market developments over the past year were positive, however; notably, the labor force participation rate fell by about 0.3 percentage points over the past year, and real wages remained about flat. In light of this cumulative progress, the FOMC concluded at our June meeting that the criterion of substantial improvement in the outlook for the labor market might well be met over the subsequent year or so. Accordingly, the Committee sought to provide more guidance on how the pace of purchases might be adjusted over time. The Committee anticipated in June that, subject to certain conditions, it might be appropriate to begin to moderate the pace of purchases later this year, continuing to reduce the pace of purchases in measured steps through the first half of next year, and ending purchases around midyear 2014. However, we also made clear at that time that adjustments to the pace of purchases would depend importantly on the evolution of the economic outlook, in particular, on the receipt of evidence supporting the Committees expectation that gains in the labor market will be sustained and that inflation is moving back toward its 2 percent objective over time. At the meeting concluded earlier today, the sense of the Committee was that the broad contours of the medium-term economic outlookincluding economic growth sufficient to

Page 4 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

support ongoing gains in the labor market, and inflation moving toward its objectivewere close to the views it held in June. But in evaluating whether a modest reduction in the pace of asset purchases would be appropriate at this meeting, however, the Committee concluded that the economic data do not yet provide sufficient confirmation of its baseline outlook to warrant such a reduction. Moreover, the Committee has some concern that the rapid tightening of financial conditions in recent months could have the effect of slowing growth, as I noted earlier, a concern that would be exacerbated if conditions tightened further. Finally, the extent of the effects of restrictive fiscal policies remains unclear, and upcoming fiscal debates may involve additional risks to financial markets and to the broader economy. In light of these uncertainties, the Committee decided to await more evidence that the recoverys progress will be sustained before adjusting the pace of asset purchases. The Committee will, of course, continue to monitor economic and financial developments closely. As noted in todays statement, in judging when to moderate the pace of asset purchases, the Committee will, at its coming meetings, assess whether incoming information continues to support the Committees expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective. However, as we have said and as todays decision underscores, asset purchases are not on a preset course. The Committees decisions about their pace will remain contingent on the economic outlook and on the Committees ongoing assessment of the likely efficacy and costs of the program. Let me turn now to the FOMCs forward guidance regarding the federal funds rate. The Committee again reaffirmed its expectation that the current exceptionally low range for the funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, so long as inflation and inflation expectations remain well-behaved (as described in our

Page 5 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

statement). As I have noted frequently, the economic conditions we have set out as preceding any future rate increase are thresholds, not triggers. For example, a decline in the unemployment rate to 6-1/2 percent would not lead automatically to an increase in the federal funds rate target, but would instead indicate only that it had become appropriate for the Committee to consider whether the broader economic outlook justified such an increase. The Committee would be unlikely to increase rates if inflation were projected to remain below our 2 percent objective for some time, for example; and, in making its assessment, the Committee would also take into account additional measures of labor market conditions, such as job gains. Thus, the first increases in short-term rates might not occur until the unemployment rate is considerably below 6-1/2 percent. The projections of the path of the federal funds rate by individual Committee participants are generally consistent with this guidance. Although the central tendency of the projected unemployment rate for the fourth quarter of next year encompasses 6-1/2 percent, 12 of the 17 participants expect the first rate increase to take place in 2015 and two expect it to occur in 2016. Most participants also see the funds rate target rising only very slowly after the process of removing policy accommodation begins. The median projected funds rate for the end of 2015 is 1 percent. And notably, although the central tendencies of the projections for both inflation and the unemployment rate in 2016 are close to the longer-run normal values of those variables, the median projection for the federal funds rate at the end of 2016 is 2 percent, well below the longer-run normal value for the federal funds rate of 4 percent or so projected by most participants. Committee participants generally believe that, because the headwinds to recovery will abate only gradually, achieving and maintaining maximum employment and price stability

Page 6 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

will require a patient policy approach that involves keeping the target for the federal funds rate below its longer-run normal value for some time. Let me close by noting that, although the FOMC is employing two instruments of policy, asset purchases and forward guidance about short-term interest rates, the overall stance of monetary policy is what matters for growth, jobs, and inflation. Our program of asset purchases was set up a year ago to help achieve a substantial improvement in the outlook for the labor market in a context of price stability, relative to conditions when the program was initiated, and we have made progress toward meeting that criterion. However, even after asset purchases are wound downwhich we will do in a manner that is both deliberate and dependent on the incoming economic datathe Federal Reserves rates guidance and its ongoing holdings of securities will ensure that monetary policy remains highly accommodative, consistent with an aggressive pursuit of our mandated objectives of maximum employment and price stability. Thank you. Id be glad to take your questions. PEDRO DA COSTA. Thanks, Mr. Chairman. Pedro da Costa from Reuters. You cite meaningful progress on the labor market both on the unemployment front and in terms of payroll growth. But much of the decline in the unemployment rate has been due as you know to the decline in participation. So my question to you is and also on the payroll front, some people would argue that, while there has been growth, it hasn't been strong enough to keep up with population growth and make up the gap that we have from the recession. So, how high do you think the jobless rate would be if it were not for the decline in participation? I've heard estimates as high as 10 to 11 percent. And could you put the labor market in that context? CHAIRMAN BERNANKE. Certainly. So, I think there is a cyclical component to participation and in that respect, the unemployment rate understates the amount of sort of true

Page 7 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

unemployment if you will in the economy. But on the other hand, there is also a downward trend in participation in our economy which is arising from factors that have been going on for some time including an aging population, lower participation by prime-age males, fewer women in the labor force, other factors which aren't really related to this recession. Over the last year, the unemployment rate has dropped by eight-tenths of a percentage point. The participation rate is dropped by three-tenths of a percentage point, which is pretty close to the trend. So in other words, I think it would be fair to say that most of the improvement in the unemployment rate, not all, but most of it in the last year is due to job creation rather than lower participation. I would also note that if you look at the broader measures of unemployment that the BLS publishes including part-time work, including discouraged workers and so on, you'll see that those rates have fallen about the same amount as the overall standard civilian unemployment rate. So, I think that there has been progress and it's obscure to some extent by the downward trend in participation. But I also would agree with you that the unemployment rate is, while perhaps the best single indicator of the state of labor market is not by itself a fully representative indicator. BINYAMIN APPELBAUM. Binya Appelbaum, the New York Times. To what extent do you regard yourself as responsible for the tightening in financial conditions that you noted? Was it a mistake to talk about tapering in the way that you did in June and do you stand by your guidance that it will be appropriate? Do you still expect that it will be appropriate to dial down asset purchases by the end of this year? CHAIRMAN BERNANKE. So, the answer of the first part of your question, I think, there's no alternative in making monetary policy, but to communicate as clearly as possible and that's what we tried to do. As of June, we had made meaningful progress in labor market

Page 8 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

conditions and the Committee thought that was the time to begin talking about how the eventual wind down of the program would take place and how it would be tied to the evolution of economic variables. And in particular, I talked about a proposed strategy that would take about a year for the total wind down to take place and which in turn was also fully contingent on the ratification so to speak of our outlook which included continued improvements in the labor market. So, all of that was very consistent with what we said when we began the program that our goal was to achieve a substantial improvement in the outlook for the labor market and we needed to communicate how that was going to be put into practice. Failing to communicate that information would have risk creating a large divergence between market expectations, public expectations, and what the Committee intentions were and that could have led to much more serious problems down the road. So, I think the communication was very important. The general framework, to answer the other part of your question, the general framework in which we're operating is still the same. We have a three-part baseline projection which involves increasing growth that's picking up overtime as fiscal drag is reduced, continuing gains in the labor market, and inflation moving back towards objective. Were looking to see in the coming meetings, we'll be looking to see if the data confirm that basic outlook. If it does, we'll take the first step at some point possibly later this year and then continue so long as the data are consistent with that continuing progress. And so that basic structure is still in place, but what I want to emphasize is really two things. First, as I've said, asset purchases are not on a preset course, they are conditional on the data. They've always been conditional on the data. And secondly, that even as we moved from asset purchases to rate policy as the principal tool of monetary policy is our intent to maintain a

Page 9 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

highly accommodative policy and to provide the support necessary for our economy to recover and to provide jobs for our citizens. JON HILSENRATH. Jon Hilsenrath from the Wall Street Journal. Just to follow up on Binya's question, Mr. Chairman, you said that you could pullback the purchases possibly later this year. You sound a little bit less certain that it's going to happen later this year. So I'd like you--to ask you to talk a little bit more about your conviction about whether these are like--the pullback is likely to start this year, where you stand on that. And I also don't think I heard you mentioned that 7 percent unemployment number that you've talked--you talked about back in June. That was the rate that was--the unemployment rate that was supposed to prevail when the Fed was done doing this, is that no longer operative? CHAIRMAN BERNANKE. So, there is no fixed calendara schedule, I really have to emphasize that. If the data confirm our basic outlook, if we gain more confidence in that outlook, and we believe that the three-part test that I mentioned is indeed coming to pass, then we could move later this year. We could begin later this year. But even if we do that, the subsequent steps will be dependent on continued progress in the economy. So we are tied to the data, we don't have a fixed calendar schedule, but we do have the same basic framework that I described in June. The criterion for ending the asset purchases program is a substantial improvement in the outlook for the labor market. Last time, I gave a 7 percent as an indicative number to give you some sense of, you know, where that might be. But as my first answer suggested, the unemployment rate is not necessarily a great measure in all circumstances of the--of the state of the labor market overall. For example, just last month, the decline in unemployment rate came about more than entirely because declining participation, not because of increased jobs. So, what

Page 10 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

we will be looking at is the overall labor market situation, including the unemployment rate, but including other factors as well. But in particular, there is not any magic number that we are shooting for. We're looking for overall improvement in the labor market. STEVE LIESMAN. Steve Liesman, with CNBC. Mr. Chairman, one question, just three parts if you don't mind. Have you indicated to President Obama you did not want to serve a third term? If so, when? Or did President Obama indicate to you he did not want you to serve a third term? And those two parts notwithstanding, would you serve a third term if they ask either wholly or in part? Thank you. CHAIRMAN BERNANKE. Well, it's convenient 'cause I have the same answer to all three parts of your question. If you will indulge me just a little longer, I prefer not to talk about my plans at this point. I hope to have more information for you at some reasonably soon date, but today, I want to focus on monetary policy. I'd prefer not to talk by my own plans. YLAN MUI. Ylan Mui, Washington Post. You mentioned that tighter fiscal conditions are a concern for the committee as you guys think about whether or not it's appropriate to reduce asset purchases. What do you all expect to be able to do in the future when you actually do begin to pullback in your asset purchases to manage expectations and manage the market reactions such that we don't see another increase in rates? CHAIRMAN BERNAKE. Well, what's the relationship between the pullback and the fiscal policy? YLAN MUI. Oh, I'm sorry, I meant financial conditions, for the financial conditions.

Page 11 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

CHAIRMAN BERNANKE. Oh, financial conditions, sure. Well, I think part of the reaction we've seen, and it comes from number of sources, part of it comes from improved economic news and this is part of the reason why rates have gone up in other countries as well as in the United States and that to the extent that tighter financial conditions reflect a better outlook, that's a good thing and it's not a problem at all. Part of it reflects the views about monetary policy and that we want to make sure we get straight and that's why to answer the earlier question, again, it's why communication is so important. We need to explain as best as we can how we're going to move and on what bases we're going to move. It's much more difficult today than it was 20 years ago because the tools are more complex so they're less familiar, but that's still very important. I think the other factor which was at play was an unwinding of excessively risky and leverage positions in the markets and insufficiencies of liquidity in some cases meant that those unwindings led to larger reactions in prices and rates than might otherwise have occurred. Now, the tightening associated with that is to some extent unwelcome, but on the other hand, to the extent that some of the riskier, more lever positions have been eliminated, I think that makes the situation more sustainable and reduces at least the risk that there will be as over-strong reaction to further announcements. So we will do our best to communicate clearly, that is our goal and our objective. The more clearly we communicate, the better the chance that markets will understand our intentions and that we can avoid any sharp movements. But again, we're dealing with tools that are less familiar, harder to quantify, and harder to communicate about than the traditional funds rate. ROBIN HARDING. Robin Harding, from the Financial Times. Mr. Chairman, the median Committee member expects 2 percent interest rates at the end of 2016 and in the long

Page 12 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

run, they expect interest rates to return to 4 percent. Can you give us any sense of when you and when the Committee expects interest rates to get back to that 4 percent again? CHAIRMAN BERNANKE. Let me first restate that I think the key point here which is that the large majority of the participants, the FOMC including voting and non-voting members who were asked to describe their own assessment of optimal policy, the large majority of them estimate that the appropriate target of the federal funds rate at the end of 2016 will be around 2 percent even though, at that time, the economy should be close to full employment according to our best projections. The reason for that, there may be possibly several reasons, but we did discuss this in the Committee today. The primary reason for that low value is that we expect that number of factors including the slow recovery of the housing sector, continued fiscal drag, perhaps continued effects from the financial crisis may still prove to be headwinds to the recovery. And even though, we can achieve full employment, doing so will be done by using rates lower than sort of the long-run normal. So in other words, in economics terms, the equilibrium rate, the rate that achieves full employment looks like it will be lower for a time because of these headwinds that will be slowing aggregate demand growth. So that's why we expect to see a growth that--I mean the rates at unusually low level. I imagine it would take a few more years after that to get to the 4 percent level. I couldn't be much more precise in that than we were already obviously stretching the bounds of credibility to talk about specific projections to 2016. But I think, you would expect to see the rates would gradually rise for the two or three years after 2016 and ultimately get to 4 percent. JOSH ZUMBRUN. Mr. Chairman, Josh Zumbrun from Bloomberg News. You indicated that you can see the Fed lowering the case of purchases once the economy starts to grow faster in line with what the Feds projected. For about the past four years, the Fed has been projecting that

Page 13 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

growth would quicken to about 3 percent and it never has. So, at what point are you decide-going to decide that other costs and benefits are the reason that you're making the decision. Are we getting close to that having to be a deciding factor even if you don't get the growth forecast the way you have it in the past four years? And does the complication of this--This is kind of a second question, but let me do anyway. Does the complication of this, I mean that you need a press conference to make a tapering decision? CHAIRMAN BERNANKE. Well, you're certainly right that we have been overoptimistic about out a year growth. There are number of reasons for that. One reason for though is that it appears, and I talked about this in the speech last year, it appears that as part of the aftermath of the financial crisis and at least temporarily, the potential growth rate of the economy has been slowed perhaps because new businesses are not being formed at the same rate, innovation may not be translated into new technologies at the same rate, investment is slower, et cetera. So, it appears again that the potential rate of growth of the economy has been slowed somewhat at least temporarily by the recession and the financial crisis and you can see that in the slower productivity figures. Now, we have, you know, we haven't anticipated that slowdown in productivity and that's one of the main reasons why we haven't anticipated the relatively slow growth. Now, it's important to recognize though that what monetary policy affects is not the potential rate of growth, long run rate of growth, but rather the cyclical part, the deviation of output and employment from its normal level. And in predicting the amount of slack in the economy so to speak, we've done a little better. Our predictions of unemployment for example had been better than our predictions of growth, and in particular, one thing that's been quite striking is that unemployment, we were too pessimistic on unemployment for this year. Unemployment has

Page 14 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

fallen faster than we anticipated. So in that respect, we were too pessimistic rather than too optimistic. So, we'll continue to do the best we can. We're looking again to see confirmation of our broader scenario which basically is that we'll continue to see progress in the labor market. The growth will be sufficient to support that progress and then inflation will be moving back towards target and that's what we'll determine our policy decisions. In terms of press conferences, I think it's important to say that there's an understanding in the committee that we've had for a while that there are eight "real meetings" every year, that every meeting is a meeting in which any policy decision can be taken. And should anything occur at a meeting without a scheduled press conference that requires additional explanation, we certainly could arrange a public on the record conference call or some other way of answering the media's questions. GREG IP. Greg Ip of the Economist. You said that you--the Committee would be unlikely to raise federal funds rate if inflation remains below target, but your own projections have inflation, thats the midpoint, of your inflation projections are below your 2 percent target through 2016, so that inconsistent with the lift off in the federal funds rate in that period. And related, is there a case to be made that your threshold should be supplemented with a lower bound inflation rate, i.e. you won't tighten if inflation is out or below some lower bound? CHAIRMAN BERNANKE. So on the latter part, you know, of course, you're seeing interest rate projections and inflation projections separately. You're not seeing them combined by individuals. Each individual is making their own projection. I think you're right, I mean, that we should be very reluctant to raise rates if inflation remains persistently below target and that's one of the reasons that I think we can be very patient in raising the federal funds rates since we have

Page 15 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

not seen any inflation pressure. On having an inflation floor that would be in addition to the guidance, we are discussing how we might clarify the guidance on the federal funds rate. That is certainly one possibility. I guess an interesting question there is whether we need additional guidance on that given that we do have a target. And of course implicit in our policy strategy is trying to reach that target for inflation, but that an inflation floor is certainly something that, you know, could be a sensible modification or addition to the guidance. VICTORIA McGRANE. Victoria McGrane, Dow Jones Newswires. Many investors were expecting the Fed to move at least a little bit in pulling back the bond buying program today. Given that you all decided not to do that, or--do you have any concerns that once again, the Fed is confusing investors and sending mixed signals? CHAIRMAN BERNANKE. Well, I don't recall stating that we would do any particular thing in this meeting. What we are going to do is the right thing for the economy. And our assessment of the data, since June, is that taken collectively, that it didn't quite meet the standard of satisfying our--or of ratifying or confirming our basic outlook for, again, increasing growth, improving labor markets in inflation moving back towards target. We try our best to communicate to markets--we'll continue to do that--but we can't let market expectations dictate our policy actions. Our policy actions have to be determined by our best assessment of what's needed for the economy. PETER BARNES. Peter Barnes, Fox Business, sir. You mentioned fiscal issues in the statement today. Are you concerned about a government shutdown? Were hearing more about that possibility. Did that come up in your discussions at this meeting? Of what do you think will

Page 16 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

be the impact of a government shutdown on the economy, and what could the Feds be--or, would the Fed be prepared to respond to that and help the economy with additional accommodation--for example, additional asset purchases? Thank you. CHAIRMAN BERNANKE. Well, a factor that did concern us as in our discussion was some upcoming fiscal policy decisions. I would include both the possibility of a government shutdown but also the debt limit issue. These are obviously, you know, part of a very complicated set of legislative decisions, strategies, battles, et cetera, which I won't get into. But it is the case, I think, that a government shutdown and perhaps, even more so, a failure to raise the debt limit could have very serious consequences for the financial markets and for the economy, and the Federal Reserve's policy is to do whatever we can to keep the economy on course. And so, if these actions led the economy to slow, then we would have to take that into account, surely. So, this is one of the risks that we are looking at as we think about policy. That being said, you know, again, our ability to offset these shocks is very limited, particularly at that limit shock. And I think it's extraordinarily important that Congress and the administration work together to find a way to make sure that the government is funded, public services are provided, that the government pays its bills, and that we avoid any kind of event like 2011, which had, at least for a time, a noticeable adverse effect on confidence on the economy. ANNALYN KURTZ. Annalyn Kurtz with CNNMoney. This week marks five years since the financial crisis began, and Hank Paulson, who you worked very closely with, has said his biggest regret was that he wasn't able to convince the American people that what was done-the bank bailouts--weren't from Wall Street, they were from Main Street. What is your biggest regret as you reflect on the five-year anniversary? And do you believe that the Fed, Congress,

Page 17 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

and the President have put the necessary measures in place to prevent another deep financial crisis? CHAIRMAN BERNANKE. Well, on regrets, as Frank Sinatra says, I have many. I think my--you know, reasonably, the biggest regret I have is that we didn't forestall the crisis. I think once the crisis got going, it was extremely hard to prevent. You know, I think we did what we could, given the powers that we had, and I would agree with Hank that we were motivated entirely by the interest of the broader public, that our goal was to stabilize the financial system so that it would not bring the economy down, so that it would not create massive unemployment and economic hardship that was even more--that would be--would have been even more severe by many times than what we actually saw. So, I agree with him on that, and I guess, since you gave me the opportunity, I would mention that, of course, all the money that was used in those operations has been paid back with interest. And so, it hasn't been costly even from a fiscal point of view. Now, in terms of progress, that's a good question. I think we made a lot of progress. We had, of course, the Dodd-Frank law passed in 2010, and then we recently, you know, have come to agreement internationally on a number of measures, including Basel III and other agreements relating to the shadow banking system and other aspects of the financial system. I think that our-today, our large financial firms, for example, are better capitalized by far than they were certainly during the crisis and even before the crisis. Supervision is tougher. We do stress testing to make sure that firms can withstand not only normal shocks but very, very large shocks, similar to those they experienced in 2008. And very importantly, of course, we now have a tool that we didn't have in 2008--which would have made, I think, a significant difference if we had had it-which is the Orderly Liquidation Authority that the Dodd-Frank bill gave to the FDIC in collaboration with the Fed. Under the Orderly Liquidation Authority, the FDIC, with other

Page 18 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

agencies, has the ability to wind down a failing financial firm in a way that minimizes the direct impact on the financial markets and on the economy. Now, I should say, I don't want to overstate the case, I think there's a lot more work to be done. In the case of resolution regimes, for example, the United States has set the course internationally. Other countries and international bodies like the FSB are setting up standards for resolution regimes, which are very similar to those of the United States, which is going to make for better cooperation across borders. But we're still some distance from being fully geared up to work with foreign counterparts to successfully wind down international--multinational financial firm. And that's--we've made progress in that direction, but we need to do more, I think. So, I think there's more to be done. There's more to be done on derivatives, although a lot has been done to make them more transparent and to make the trading of derivative safer. But it's going to be probably some time before, you know, all of this stuff that has been undertaken, all of these measures are fully implemented. And we can assess, you know, the ultimate impact on the financial system. STEVE BECKNER. Steve Beckner of MNI. Mr. Chairman, a number of economists, and indeed, some of your Fed colleagues, have argued that the effectiveness of quantitative easing has greatly diminished, if not disappeared, and they point to the recent performance of the economy as proof of that. And there have been a number of people who have argued that there are regulatory and other impediments to growth beyond the reach of monetary policy. To what extent are these valid arguments? And if the economy does not speed up, that does not reach your objectives, how will you ever get out of quantitative easing? CHAIRMAN BERNANKE. Well, on the effectiveness of our asset purchases, it's difficult to get a precise measure. There's a large academic literature on this subject, and they have a range of results, some suggesting that this is a quite powerful tool, some that its less

Page 19 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

powerful. My own assessment is that it has been effective. If you look at the recovery, you see that some of the strongest sectors, the leading sectors like housing and autos, have an interest sensitive sectors. And that these policies have been successful in strengthening financial conditions, lowering interest rates, and thereby promoting recovery. So I do think that they have been effective. You mentioned that there hasn't been any progress. There has been a lot of progress, as I said at the beginning. Labor market indicators, while still not where we'd like them to be, are much better today than they were when we began this latest program a year ago. And importantly, as actually is referenced in our FOMC statement, that happened notwithstanding a set of fiscal policies which the CBO said would cost between one and one and a half percentage points of real growth and hundreds of thousands of jobs. So, the fact that we have maintained improvements in the labor market that are as good or better than the previous year, notwithstanding this fiscal drag, is some indication that there is at least a partial offset from monetary policy. Now, just as you say, there are a lot of things in the economy that monetary policy cant address. They include the effectiveness of regulation, they include fiscal policy, they include developments in the private sector. We do what we can do and what--if we can get help, we're delighted to have help from other policymakers and from the private sector and we hope that that will happen. The criterion for ending asset purchases is not, you know, some very high rate of growth. What it is, is the criterion--let me just remind you, the criterion is a substantial improvement in the outlook for the labor market and we have made significant improvement. Ultimately, we will reach that level of substantial improvement and at that point, we will be able to wind down the asset purchases. Again, you know, and I think people don't fully appreciate that we have two tools: We have asset purchases and we have rate policy and guidance about rates. It's our view that the latter, the rate policy, is actually the stronger, more reliable tool. And when

Page 20 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

we get to the point where we can, you know, where we are close enough to full employment, that rate policy will be sufficient, I think that we will still be able to provide--even if asset purchases have reduced--we will still be able to provide a highly accommodative monetary background that will allow the economy to continue to grow and move towards full employment. DONNA BORAK. Chairman, Donna Borak with American Banker. The Financial Stability Oversight Council has already designated two non-bank firms as SIFIs, as you know, and potentially a third very soon, and presumably others to follow. However, little has been said in terms of how specifically these firms will be regulated by the Fed, which has been a chief criticism of the entire process. Given that, can you provide us any guidance at this point in terms of how far along the Fed is in terms of letting the banks know how they will be regulated besides, you know, tailoring the plans. CHAIRMAN BERNANKE. Well, the two firms that had been designated, AIG and GE Capital, actually are--had been regulated by the Fed, because both of them are savings and loan thrift holding companies. So we have a lot of already experience with those firms and a lot of contact with those firms. We will--I want to use the word tailored because we want to design a regime that is appropriate for the business model of the particular firm. But our other objective, and what makes a designation by the FSOC particularly noteworthy, is that the primary goal of the consolidated supervision by the Fed is to make sure that the firms--the firm doesn't in any way endanger the stability of the broad financial system. So we'll be looking at not just the usual safety and soundness-type matters or supervision, which both can be, again, tailored to the types of assets and liabilities that the firm has, but also we're going to want to focus on things like resolution authority, practices relating to derivatives and other exposures, interconnecting this, et cetera, to make sure that the firm in its structure and in its operations doesn't pose a threat to the

Page 21 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

wider system. And that's what is going to be distinctive about our oversight, not only of these designated firms but also of the large bank holding companies that we already oversee and which we are already subjecting to tougher supervision, higher capital, stress tests, and all the rest. PETER COOK. Peter Cook at Bloomberg Television. Mr. Chairman, one of my colleagues was remarking as we came in here, we don't often get surprises from the Federal Reserve. This was a surprise, you talked about--you hadn't telegraphed anything specifically, but you've seen the market reaction, I'm sure. My question for you is, were you intending a surprise today, and did you get the intended result judging from the market reaction? And related to that, by taking this action today, continuing the bond purchases going forward. At what point do you believe you're starting to complicate the exit strategy? Simply by continuing to keep the Fed's foot on the gas pedal, do you make life more complicated for the Federal Reserve down the road? CHAIRMAN BERNANKE. Well, it's our intention to try to set policy as appropriate for the economy, as I said earlier. We are somewhat concerned. I wont overstate it, but we do want to see the effects of higher interest rates on the economy, particularly in mortgage rates on housing. So to the extent that our policy makes conditions--our policy decision today makes conditions just a little bit easier, that's desirable. We want to make sure that the economy has adequate support and in particular, is less surprising the market or easing policy as it is avoiding a tightening until we can be comfortable that the economy is in fact growing, you know, the way we want it to be growing. So, this was a step--it was a step, a precautionary step if you will. It was a--the intention is to wait a bit longer and to try to get confirming evidence whether to these-to whether or not the economy is, in fact, conforming to this general outlook that we have. I don't think that we are complicating anything for future FOMCs. It's true that the assets that

Page 22 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

we've been buying add to the size of our balance sheet. But we have developed a variety of tools, and we think we have numerous tools that we--can be used to both manage interest rates and to ultimately unwind the balance sheet when the time comes. So I, you know, I'm--I feel quite comfortable that we can, in particular, that we can raise interest rates at the appropriate time, even if the balance sheet remains large for an extended period. And that will be true of course for, you know, future FOMCs as well. KATE DAVIDSON. Mr. Chairman, Kate Davidson from Politico. Do you think that all of the recent attention being paid to who will be your replacement has had any immediate effect on the Fed and could it have any lingering effect on your successor? And also, do you think the process has just become too politicized or is this part of a healthy debate? CHAIRMAN BERNANKE. I think the Federal Reserve has strong institutional credibility. And it is a strong institution, highly competent institution, and it's independent, it's non-partisan, and I'm not particularly concerned about the political environment for the Federal Reserve. I think the Fed will be--continue to be an important institution in the United States and that it will maintain its independence going forward. GREG ROBB. Thank you, Mr. Chairman. Greg Robb, MarketWatch. Was there a discussion among the Committee today about changing the forward guidance, the 6.5 percent jobless rate? And could you say why the Committee decided to hold that steady in light of the weaker economy? CHAIRMAN BERNANKE. Well, as I mentioned earlier, the Committee has regularly reviewed the forward guidance and there are a number of ways in which the forward guidance could be strengthened. For example, Mr. Craig mentioned the inflation floor. There are other

Page 23 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

steps that we could take. We could provide more information about what happens after we get the 6.5 percent and those sorts of things, and to the extent that we could provide precise guidance, I think, that would be desirable. Now, it's very important that we not take any of these steps lightly, that we make sure we understand all the implications and that we are comfortable that it will be--that any modifications of the guidance will be credible to markets and to the public. So, we continue to think about options. There are a number of options that we have talked about. But today, we--as of today, we didn't choose to make any changes to the guidance. DON LEE. Don Lee, L.A. Times. As you may know, the Census Bureau reported yesterday that poverty rate and the median household income saw no improvement last year. And I wonder when you see median income is turning up significantly for most people, and in light of the fact that people in the middle and the bottom have seen very little of the gains relative to higher income households, how would you assess the--both quantitative easing and Fed policies? CHAIRMAN BERNANKE. Sure. So that's certainly the case that there are too many people in poverty. There are a lot of complex issues involved. There are complex measurement issues, I would just have to mention that. There are a lot of issues that are really long-term issues as well. For example, it might seem a puzzle that U.S. economy gets richer and richer, and yet there are more poor people. And the explanation, of course, is that our economy is becoming more unequal. The more, very rich people and more people in the lower half who are not doing well, these are--there's a lot of reasons behind this trend, which have been going on for decades, and economists disagree about the relative importance of things like technology and international trade and unionization and other factors that have contributed to that. But I guess my first point is that these long run trends, it's important to address these trends but the Federal Reserve doesn't

Page 24 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

really have the tools to address these long run distributional trends. They can only be addressed really by Congress and by the Administration. And it's up to them, I think, to take those steps. The Federal Reserve is--we are doing our part to help the median family, the median American, because one of our principal goals, are--we have two principal goals, one is maximum employment, jobs; the best way to help families is to create employment opportunities. We're still not satisfied, obviously, with where the labor market, the job market is. We'll continue to try to provide support for that. And then the other goal is price stability, low inflation, which, of course, also helps make the economy work better for people in the middle and the lower parts of the distribution. So, we use the tools that we have. It would be better to have a mix of tools at work, not just monetary policy but fiscal policy and other policies as well. But the Federal Reserve, we can, you know, we only have a certain set of tools and those are the ones that we use. Again, our objective, our objectives of creating jobs and maintaining price stability, I think, are quite consistent with helping the average American, but there's limits to what we can do about long run trends and I think those are very important issues that Congress and the Administration, you know, need to look at and decide, you know, what needs to be done there. JEREMY TORDJMAN. Hi, Jeremy Tordjman with AFP. Some emerging countries are blaming the Fed policies for the financial distress that they are experiencing. I wanted to have your take on that. And also, how did you judge the way their markets reacted to your tapering announcement back in June. Thank you very much. CHAIRMAN BERNANKE. Well, let me just talk about--talk a little bit about the communication in June. Let me talk of, just about the emerging markets, which I think is an important issue. Let me just first say that we have a lot of economists who spend all of their time looking at international aspects of monetary policy, and we spend a lot of time looking at

Page 25 of 26

September 18, 2013

Chairman Bernankes Press Conference

PRELIMINARY

emerging markets. I spend a lot of time talking to my colleagues in emerging markets. So we're watching that very carefully. The United States is part of a globally integrated economic and financial system, and problems in emerging markets--or in any country, for that matter--can affect the United States as well. And so, again, we are watching those developments very carefully. It is true that changes in longer-term interest rates in the United States--but also in other advanced economies--does have some effect on emerging markets, particularly those who are trying to peg their exchange rate, and can lead to some capital inflows or outflows, but there are also other factors that affect inflows and outflows, those include changes in risk preference by investors, changes in growth expectations, different perceptions of institutional strength within emerging markets across different countries. So there are a lot of factors that are there playing a role and that's one reason why different emerging markets have had different experiences. They have different institutional structures and different policies. But, just to come to the bottom line here, we think it's very important that emerging markets grow and are prosperous. We pay close attention to what's happening in those countries, it affects the United States. The main point, I guess, I would end with, though, is that what we're trying to do with our monetary policy here is, I think, my colleagues in the emerging markets recognize, is trying to create a stronger U.S. economy. And a stronger U.S. economy is one of the most important things that could happen to help the economies of emerging markets. And, again, I think my colleagues in many of the emerging markets appreciate that, notwithstanding some of the effects that they may have felt, that efforts to strengthen the U.S. economy and other advanced economies in Europe and elsewhere, ultimately redounds to the benefit of the global economy including emerging markets as well. Thank you.

Page 26 of 26

You might also like

- Eclipse Download and Installation InstructionsDocument15 pagesEclipse Download and Installation InstructionsPrem KumarNo ratings yet

- Eli Lilly FinalDocument30 pagesEli Lilly FinalKarthik K Janardhanan0% (1)

- AMS 48 - 2000-n - D0114354 - 055 - 00Document116 pagesAMS 48 - 2000-n - D0114354 - 055 - 00wanhall100% (1)

- Fomc Pres Conf 20130918Document7 pagesFomc Pres Conf 20130918helmuthNo ratings yet

- Yellen TestimonyDocument7 pagesYellen TestimonyZerohedgeNo ratings yet

- SystemDocument8 pagesSystempathanfor786No ratings yet

- Fomc Pres Conf 20141217Document23 pagesFomc Pres Conf 20141217JoseLastNo ratings yet

- FOMCpresconf 20230614Document5 pagesFOMCpresconf 20230614Jhony SmithYTNo ratings yet

- Fomc Pres Conf 20160615Document21 pagesFomc Pres Conf 20160615petere056No ratings yet

- FOMCpresconf 20230503Document25 pagesFOMCpresconf 20230503Edi SaputraNo ratings yet

- Transcript of Chair Powell's Press Conference Opening Statement March 20, 2024Document4 pagesTranscript of Chair Powell's Press Conference Opening Statement March 20, 2024andre.torresNo ratings yet

- Yellen HHDocument7 pagesYellen HHZerohedgeNo ratings yet

- FOMC Word For Word Changes. 05.01.13Document2 pagesFOMC Word For Word Changes. 05.01.13Pensford FinancialNo ratings yet

- Fed TalkDocument2 pagesFed TalkTelegraphUKNo ratings yet

- FOMCpresconf 20220615Document27 pagesFOMCpresconf 20220615S CNo ratings yet

- Transcript of Chairman Bernanke's Press Conference April 25, 2012Document23 pagesTranscript of Chairman Bernanke's Press Conference April 25, 2012CoolidgeLowNo ratings yet

- Comptabilité Tle G3 Et G2Document24 pagesComptabilité Tle G3 Et G2albertvalk2.0No ratings yet

- FOMC Word For Word Changes 03.20.13Document2 pagesFOMC Word For Word Changes 03.20.13Pensford FinancialNo ratings yet

- FOMC Redline MarchDocument2 pagesFOMC Redline MarchZerohedgeNo ratings yet

- Fomc Pres Conf 20231101Document26 pagesFomc Pres Conf 20231101Quynh Le Thi NhuNo ratings yet

- FOMCpresconf 20220316Document26 pagesFOMCpresconf 20220316marchmtetNo ratings yet

- Oct FOMC RedlineDocument2 pagesOct FOMC RedlineZerohedgeNo ratings yet

- Fomc Pres Conf 20241218Document27 pagesFomc Pres Conf 20241218Yoniwo Edward TsemiNo ratings yet

- Fomc Pres Conf 20240501Document4 pagesFomc Pres Conf 20240501gustavo.kahilNo ratings yet

- The Market's Shocking Shock at The Fed's Non-Taper Shock: Economic ResearchDocument9 pagesThe Market's Shocking Shock at The Fed's Non-Taper Shock: Economic Researchapi-227433089No ratings yet

- PowellDocument4 pagesPowellandre.torres.dinheiramaNo ratings yet

- Fomc StatmentDocument1 pageFomc Statmentapi-280585983No ratings yet

- monetary-policy-summary-and-minutes-november-2024Document9 pagesmonetary-policy-summary-and-minutes-november-2024parsaNo ratings yet

- FOMCpresconf 20240501Document26 pagesFOMCpresconf 20240501David SimõesNo ratings yet

- Tassi BCE 17.10.2024 IngDocument6 pagesTassi BCE 17.10.2024 IngMaurizio VetereNo ratings yet

- Press Release: For Release at 2:00 P.M. EDTDocument2 pagesPress Release: For Release at 2:00 P.M. EDTTREND_7425No ratings yet

- December 17, 2014 Compared With October 29, 2014 Jeremie Cohen-SettonDocument3 pagesDecember 17, 2014 Compared With October 29, 2014 Jeremie Cohen-Settonapi-273992067No ratings yet

- Transcript of Chair Powell's Press Conference May 4, 2022Document24 pagesTranscript of Chair Powell's Press Conference May 4, 2022Learning的生活No ratings yet

- Fed 09212011Document2 pagesFed 09212011andrewbloggerNo ratings yet

- ResconfDocument4 pagesResconfgothurded24No ratings yet

- Fed SideDocument1 pageFed Sideannawitkowski88No ratings yet

- Macro Economics and Business Environment Assignment: Submitted To: Dr. C.S. AdhikariDocument8 pagesMacro Economics and Business Environment Assignment: Submitted To: Dr. C.S. Adhikarigaurav880No ratings yet

- Fomc Pres Conf 20241107Document22 pagesFomc Pres Conf 20241107sushilaoswal8378No ratings yet

- FOMC Rate Decision 04.25.12Document1 pageFOMC Rate Decision 04.25.12Pensford FinancialNo ratings yet

- Fomc Pres Conf 20241107Document23 pagesFomc Pres Conf 20241107Anyaji ChukwudiebubeNo ratings yet

- Fomc Pres Conf 20220727Document4 pagesFomc Pres Conf 20220727Jessica A. BotelhoNo ratings yet

- Critical Analysis GROUP-2Document6 pagesCritical Analysis GROUP-2Angelo MagtibayNo ratings yet

- Minutes Feb 2017Document12 pagesMinutes Feb 2017mahajanomicsNo ratings yet

- Jerome Powell's Written TestimonyDocument5 pagesJerome Powell's Written TestimonyTim MooreNo ratings yet

- FOMC Side by Side 11022011Document2 pagesFOMC Side by Side 11022011andrewbloggerNo ratings yet

- Federal Reserve Issues FOMC Statement: ShareDocument2 pagesFederal Reserve Issues FOMC Statement: ShareTREND_7425No ratings yet

- Monetary Policy Summary: Publication Date: 3 August 2017Document3 pagesMonetary Policy Summary: Publication Date: 3 August 2017TraderNo ratings yet

- Powell 20180717 ADocument6 pagesPowell 20180717 AZerohedgeNo ratings yet

- First Quarter Review of Monetary Policy 2012-13 Press Statement by Dr. D. SubbaraoDocument5 pagesFirst Quarter Review of Monetary Policy 2012-13 Press Statement by Dr. D. SubbaraoUttam AuddyNo ratings yet

- Monetary PolicyDocument18 pagesMonetary PolicyAnimNo ratings yet

- Monitory-Policy-Strategy, Case Study - RBADocument9 pagesMonitory-Policy-Strategy, Case Study - RBAoutbox175No ratings yet

- Paydata LTD - Do Inflation Expectations Currently Pose A Risk To The EconomyDocument2 pagesPaydata LTD - Do Inflation Expectations Currently Pose A Risk To The EconomyBenjamin RamirezNo ratings yet

- Fed Side by Side 20120125Document3 pagesFed Side by Side 20120125andrewbloggerNo ratings yet

- FED-POWEL-FOMCpresconf20240131Document4 pagesFED-POWEL-FOMCpresconf202401314200ethNo ratings yet

- Monetary20160316a1 PDFDocument3 pagesMonetary20160316a1 PDFHarissalamNo ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEandrewbloggerNo ratings yet

- Powell 20230621 ADocument5 pagesPowell 20230621 ADaily Caller News FoundationNo ratings yet

- A New Chapter For The FOMC Monetary Policy FramewDocument2 pagesA New Chapter For The FOMC Monetary Policy FramewsheeginNo ratings yet

- FOMCpresconf 20221102Document23 pagesFOMCpresconf 20221102Nava PourtaghiNo ratings yet

- Bce Introductory StatementDocument3 pagesBce Introductory StatementPietro ScarpaNo ratings yet

- KBC Flash - FOMC Statement: No Hints About TaperingDocument3 pagesKBC Flash - FOMC Statement: No Hints About TaperingKBC EconomicsNo ratings yet

- FOMC RedLineDocument2 pagesFOMC RedLineEduardo VinanteNo ratings yet

- Transparency in Financial Reporting: A concise comparison of IFRS and US GAAPFrom EverandTransparency in Financial Reporting: A concise comparison of IFRS and US GAAPRating: 4.5 out of 5 stars4.5/5 (3)

- MSMEs or Micro Small and Medium Enterprses Share in India Exports 2013-2014Document4 pagesMSMEs or Micro Small and Medium Enterprses Share in India Exports 2013-2014Jhunjhunwalas Digital Finance & Business Info LibraryNo ratings yet

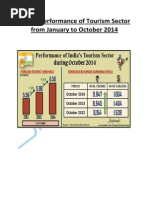

- India's Tourism Sector Performance For January and October 2014Document15 pagesIndia's Tourism Sector Performance For January and October 2014Jhunjhunwalas Digital Finance & Business Info LibraryNo ratings yet

- India's Import and Export Update For September and December 2014Document16 pagesIndia's Import and Export Update For September and December 2014Jhunjhunwalas Digital Finance & Business Info LibraryNo ratings yet

- India Tax Collection From April To November 2014Document11 pagesIndia Tax Collection From April To November 2014Jhunjhunwalas Digital Finance & Business Info LibraryNo ratings yet

- Indian Currency Rupee Exchange Rate of 19 Foreign Currencies Relating To Import and Export Goods From July To September 2014Document5 pagesIndian Currency Rupee Exchange Rate of 19 Foreign Currencies Relating To Import and Export Goods From July To September 2014Jhunjhunwalas Digital Finance & Business Info LibraryNo ratings yet

- India's Crude Oil and Natural Gas Production For Month of April, May and June 2014Document6 pagesIndia's Crude Oil and Natural Gas Production For Month of April, May and June 2014Jhunjhunwalas Digital Finance & Business Info LibraryNo ratings yet

- India's Index of 8 Core Industry Performance For May 2014Document5 pagesIndia's Index of 8 Core Industry Performance For May 2014Jhunjhunwalas Digital Finance & Business Info LibraryNo ratings yet

- Guidelines Format For JOURNAL OF MINERAL Processing and Engineering (20 PT, Bold)Document2 pagesGuidelines Format For JOURNAL OF MINERAL Processing and Engineering (20 PT, Bold)ikamelyaastutiNo ratings yet

- Assist Gas For Laser Cutting: For Internal Use OnlyDocument8 pagesAssist Gas For Laser Cutting: For Internal Use OnlymansoorlatifNo ratings yet

- Typical Soil Resistivity ValuesDocument5 pagesTypical Soil Resistivity ValueseduardoNo ratings yet

- Signal Degradation in Optical FibersDocument5 pagesSignal Degradation in Optical FibersijeteeditorNo ratings yet

- Interface Mass TraDocument26 pagesInterface Mass TraWahid AliNo ratings yet

- SGI Bulletin August 2013 1Document5 pagesSGI Bulletin August 2013 1Dumegã KokutseNo ratings yet

- Argumentative EssayDocument4 pagesArgumentative Essayapi-403488027No ratings yet

- Basf ProductsDocument2 pagesBasf ProductsequinoxoneNo ratings yet

- American Animation at First World WarDocument16 pagesAmerican Animation at First World WarSylwia KaliszNo ratings yet

- BIOLOGY EX 4Document15 pagesBIOLOGY EX 4micromaxsudaNo ratings yet

- Chapter 5 Motorola R56!09!01 05 Internal Grounding & BondingDocument72 pagesChapter 5 Motorola R56!09!01 05 Internal Grounding & BondingAnonymous V6y1QL6hn100% (1)

- Demand PagingDocument3 pagesDemand Pagingopbitu855No ratings yet

- Salaries - Rock Falls, East Coloma SD 12Document2 pagesSalaries - Rock Falls, East Coloma SD 12saukvalleynewsNo ratings yet

- Air Ground CSV SelectableDocument93 pagesAir Ground CSV SelectableNgan NguyenNo ratings yet

- Adobe Scan 25 Sep 2023Document6 pagesAdobe Scan 25 Sep 2023Linh LêNo ratings yet

- Book of Space 7th Edition NealDocument49 pagesBook of Space 7th Edition NealbuzycorryNo ratings yet

- lc3 IntroDocument17 pageslc3 IntroJustine Rome ArdepuelaNo ratings yet

- Python Prog pbl1Document11 pagesPython Prog pbl1SAI PRANEETHNo ratings yet

- M L A S: Topic: The Language of MathematicsDocument15 pagesM L A S: Topic: The Language of MathematicsRosen Anthony100% (1)

- Thermodynamics Multiple Choice Questions and AnswersDocument21 pagesThermodynamics Multiple Choice Questions and AnswersPadmavathi C50% (2)

- Dokumen - Tips Descriptive Comparative Historical LinguisticsDocument20 pagesDokumen - Tips Descriptive Comparative Historical LinguisticsSmt 355No ratings yet

- Strength and of Pond Ash ConcreteDocument29 pagesStrength and of Pond Ash ConcreteNaveed BNo ratings yet

- Lte Arch. and AifDocument14 pagesLte Arch. and AifMohsin AshrafNo ratings yet

- Manual Xbox 360 Slim 4gb PDFDocument78 pagesManual Xbox 360 Slim 4gb PDFodali batistaNo ratings yet

- Reflection Paper 1Document1 pageReflection Paper 1elizabeth clare yabutNo ratings yet

- Chapter 1 The Problem and Its BackgroundDocument7 pagesChapter 1 The Problem and Its BackgroundMr Dampha50% (2)