Glossary: Edit Ok: D: K03 Edit Pass SRL/TKB 102 Score 13 CDS

Glossary: Edit Ok: D: K03 Edit Pass SRL/TKB 102 Score 13 CDS

Uploaded by

FUCKYOU2117Copyright:

Available Formats

Glossary: Edit Ok: D: K03 Edit Pass SRL/TKB 102 Score 13 CDS

Glossary: Edit Ok: D: K03 Edit Pass SRL/TKB 102 Score 13 CDS

Uploaded by

FUCKYOU2117Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Glossary: Edit Ok: D: K03 Edit Pass SRL/TKB 102 Score 13 CDS

Glossary: Edit Ok: D: K03 Edit Pass SRL/TKB 102 Score 13 CDS

Uploaded by

FUCKYOU2117Copyright:

Available Formats

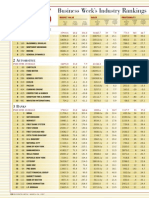

BW DOM

BW INT

D: C M Y K 03 EDIT PASS

X X

RECENT SHARE PRICE

Share price on Feb. 29, 1996,

multiplied by latest available

common shares outstanding

Price for a single share of a

companys most widely traded

issue of common stock as of

the close of trading Feb. 29,

1996

PROFITS

HIGH/LOW PRICE

MARKET VALUE

Net income from continuing

operations before extraordinary

items

Trading range for companys

common stock, February,

1995, to February, 1996

MARGINS

BOOK VALUE PER SHARE

Profits as a percent of sales

RETURN ON INVESTED

CAPITAL

Profits plus minority interest

and interest expense (adjusted

by tax rate) as a percent of

debt and equity funds

RETURN ON COMMON EQUITY

Net income available for common shareholders divided by

common equity

ASSETS

Total assets as reported at end

of companys latest available

1995 quarter

Sum of common stock, capital

surplus, and retained earnings

divided by most recently available common shares

outstanding

P-E RATIO

Price-earnings ratio based on

1995 earnings and Feb. 29,

1996 stock price

most recent annual earnings

per share

TOTAL RETURN

Annual dividend per share plus

latest available month-end

price, as a percent of year-ago

month-end price per share

INSTITUTIONAL HOLDINGS

Percent of outstanding shares

of stock held by banks, colleges, pension funds, insurance

companies, and investment

companies as calculated by

Vickers Stock Research Corp.

SHARES OUTSTANDING

Millions of common shares outstanding as of the companys

latest available financial report

TURNOVER

Annual dividend rate as a percent of the Feb. 29 stock price

Percent of outstanding common shares changing hands in

the latest year

PAYOUT

EARNINGS PER SHARE

Latest annualized dividend rate

as a percent of the companys

Primary earnings per share,

excluding extraordinary profit or

YIELD

PE

DAD

SRL/TKB

CDS

SCORE 13

102

Glossary

EDIT OK

loss, divided by number of

common and common equivalent shares

EARNINGS PER SHARE

ESTIMATES

Analysts consensus estimates

for 1996 compiled as of Feb.

22 by I/B/E/S International

Inc., New York (I/B/E/S is a

registered trademark of I/B/E/S

International Inc.)

VARIATION

Percentage by which two-thirds

of the 1996 earnings estimates

are above or below the average

estimate calculated by I/B/E/S

FY

Number of the month in which

companys fiscal year ends

DATA

Unless otherwise indicated, all

data in the following tables

have been provided by Standard & Poors Compustat, a

division of The McGraw-Hill

Companies

Footnotes

(a) Latest available data. (b) Actual and estimated figures are

fully diluted. (c) Estimated earnings data. (d) Earnings data from

I/B/E/S. (e) Earnings data from S&P ACE. (x) Sales include excise

taxes. (y) Sales include other income. (z) Sales include excise

taxes and other income. NA=not available. NM=not meaningful.

NR=not ranked in BUSINESS WEEK 1000 in 1995. NEG=negative

book value per share. DEF=earnings deficit in dividend payout.

Because BUSINESS WEEK is owned by McGraw-Hill, the BUSINESS

1000 does not include a forecast of the companys earnings. Data do not include full 12 months results. Note: Data

compiled by Standard & Poors Compustat from sources such as

statistical services, registration statements, and company reports

that SPC believes to be reliable but that are not guaranteed by SPC

or BUSINESS WEEK as to correctness or completeness. This material

is not an offer to buy or sell any security. Additional data:

I/B/E/S, I/B/E/S International, Vickers Stock Research Corp.

WEEK

102 BUSINESS WEEK / MARCH 25, 1996

DISTRIBUTION: Reingold Sasseen Vamos

Bartlett

6A

dd......

126

CMYK 03

BW

BWDOM

INT

96BW1000

EDIT PASS

PE

DAD

???/!!!

XX

EDIT OK

THE BUSINESS WEEK 1000

COMPANY

MARKET VALUE

YEAR

AGO

RANK

12

MONTHS

1995

$ MIL.

PROFITS

CHANGE

FROM

1994

%

12

MONTHS

1995

$ MIL.

CHANGE

FROM

1994

%

MARGINS

12

MONTHS

1995

%

12

MONTHS

1994

%

RETURN

ON

INVESTED

CAPITAL

%

ASSETS

$ MIL.

501

NIPSCO INDUSTRIES

2355

17

465

1722

184.5

10.7

10.4

10.0

15.4

4000

502

PARAMETRIC TECHNOLOGY

2347

424

448

53

91.0

24

20.3

25.1

21.9

21.8

497

31

503

ASHLAND

2344

19

476

11491

17

76.0

56

0.7

1.8

6.8

3.9

7035

18

504

VIKING OFFICE PRODUCTS

2342

93

685

921

37

52.7

37

5.7

5.7

22.4

22.3

365

39

505

LITTON INDUSTRIES

2339

39

544

3412

143.7

129

4.2

1.9

16.5

17.3

2601

15

506

MARSHALL & ILSLEY

2338

22

474

966a

13

189.0

110

19.6

10.5

14.7

15.9

12959

507

M C KESSON

2333

44

553

13582y

137.0

NM

1.0

NM

11.0

12.8

3674

508

MANPOWER

2331

432

5484

28

128.0

53

2.3

2.0

NA

36.6

1544

29

509

MYLAN LABORATORIES

2328

393

409

15

117.8

12

28.8

29.6

21.2

21.2

613

21

ON

COMMON

EQUITY

%

12

MONTHS

1995

$ MIL.

CHANGE

FROM

1994

%

SUNDSTRAND

2322

60

590

1473

79.0

17

5.4

7.0

14.0

17.0

1593

511

BIOGEN

2321

70

618

135

5.7

NM

4.2

NM

1.4

1.5

469

24

512

LIZ CLAIBORNE

2312

86

663

2082

126.9

53

6.1

3.8

12.5

12.9

1331

513

ARROW ELECTRONICS

2306

20

488

5919

27

202.5

81

3.4

2.4

14.5

16.9

2701

32

514

AMSOUTH BANCORPORATION

2303

36

535

1371a

28

128.4

18

9.4

14.6

12.2

12.6

17004

515

HILLENBRAND INDUSTRIES

2290

15

471

1625

89.9

5.5

5.7

10.7

12.1

3069

13

516

CINTAS

2283

28

518

674

19

68.4

19

10.1

10.2

14.2

17.1

639

21

517

CONSOLIDATED PAPERS

2279

439

1579

54

229.2

164

14.5

8.4

17.2

20.8

1933

29

518

SYBASE

2279

349

957

16

19.5

NM

NM

10.5

NA

4.4

766

33

519

KOHLS

2277

52

583

1783a

23

64.4

3.6

4.3

11.4

17.6

935

29

SOUTHTRUST

2275

35

542

1708y

30

199.0

15

11.7

13.2

13.1

13.9

20787

18

521

DQE

2268

29

524

1220

176.9

14.5

13.3

NA

12.9

4405

522

C-CUBE MICROSYSTEMS

2265

766

NR

125

177

24.9

397

20.0

11.1

34.3

34.9

523

PACIFIC ENTERPRISES

2265

469

2343

12

197.0

8.4

6.8

8.7

13.9

524

BHC COMMUNICATIONS

2265

23

491

455

37.1

60

8.2

20.3

2.8

525

UAL

2265

92

705

14943

378.0

391

2.5

0.6

15.8

526

CABOT

2262

75

646

1845

181.4

88

9.8

5.7

20.6

26.3

1720

527

SYNOVUS FINANCIAL

2259

69

626

924

25

114.6

28

12.4

12.1

NA

17.2

7928

10

528

TEMPLE-INLAND

2258

18

357

3461

18

281.0

114

8.1

4.5

8.6

14.4

13064

529

INTEGRA FINANCIAL

2249

60

606

1183

11

128.4

24

10.9

15.9

13.0

11.2

14346

530

FOUNDATION HEALTH

2242

32

534

2757

20

156.1

748

5.7

0.8

16.4

18.5

2107

16

531

BRUNSWICK

2240

18

493

3041

13

134.2

4.4

4.8

11.8

13.5

2361

11

532

REPUBLIC INDUSTRIES

2236

NM

NR

260

434

23.2

173

8.9

17.4

6.0

6.0

533

PUBLIC SERVICE CO. OF COLORADO

2233

17

492

2111

178.9

8.5

8.3

10.7

12.6

4312

534

JAMES RIVER CORP. OF VIRGINIA

2230

11

468

6800

26

126.4

NM

1.9

NM

5.2

4.5

7259

535

BAUSCH & LOMB

2224

14

480

1933

112.0

260

5.8

1.6

9.3

11.7

2500

536

UJB FINANCIAL*

2203

42

572

1215

13

170.4

29

14.0

12.3

15.4

13.3

15886

537

BIOMET

2193

17

498

509

28

86.2

16

16.9

18.6

17.8

17.8

558

12

538

HEALTH MANAGEMENT ASSOCIATES

2192

79

680

568

26

67.1

29

11.8

11.5

18.0

21.1

493

19

539

MAXIM INTEGRATED PRODUCTS

2187

125

816

345

79

76.1

151

22.1

15.7

33.5

33.5

332

67

4

510

520

204 200

5259

2.1

2193

NM

11710

429 176

SUPERVALU

2187

19

513

16530

161.0

206

1.0

0.3

9.4

13.5

4339

541

SUN

2185

30

320

10419z

227.0

134

2.2

1.0

12.5

19.6

5191 22

542

CINCINNATI BELL

2185

58

612

1336

25.3

NM

NM

6.2

1.0

4.9

1592

543

HUBBELL

2173

22

519

1143

13

121.9

14

10.7

10.5

19.6

18.7

1055

544

AMERICAN STANDARD

2168

74

NR

5221

17

142.4

NM

2.7

NM

17.0

NM

3524

12

545

ARMSTRONG WORLD INDUSTRIES

2160

27

530

2085

13.6

93

0.7

9.3

NM

0.7

2356

546

LYONDELL PETROCHEMICAL

2160

13

487

4936

28

389.0

74

7.9

5.8

27.6

102.4

2606

57

547

AVNET

2160

37

566

4798

26

171.5

50

3.6

3.0

9.7

12.0

2462

26

548

AVX

2156

NA

NR

1179

NA

121.1

NA

10.3

NA

21.4

21.5

808

20

549

ILLINOVA

2156

22

523

1641

175.3

10.7

11.1

7.5

9.7

5610

WASHINGTON MUTUAL

2154

73

686

1625

24

190.6

11

11.7

13.1

NA

10.8

21633

17

540

550

126 BUSINESS WEEK / MARCH 25, 1996

SALES

CHANGE

FROM

1995

%

*Acquired Summit Bancorp. on March 1, 1996. New name is Summit Bancorp.

ALPHABETICAL INDEX OF COMPANIES BEGINS ON PAGE 146

LARGE: Jespersen, Mims, J. Mandel, Rosenberg, Morrison

Bartlett, Vamos, Sasseen, Reingold, Bongiorno, Leonhardt, +2

127

CMYK 03

BW

BWDOM

INT

96BW1000

ALUATION

ECENT

HARE

PRICE

$

EDIT PASS

DIVIDENDS

12-MONTH

HIGH/

LOW

$

PRICE

AS % OF

BOOK

VALUE

P-E

RATIO

YIELD

%

PAYOUT

%

EDIT OK

SHARES

TOTAL

RETURN

%

INSTITUTIONS

HOLDING

%

EARNINGS PER SHARE

SHRS.

OUT.

MIL.

TURNOVER

%

FY

1994

ACTUAL

$

1995

ACTUAL

$

PE

DAD

???/!!!

XX

INDUSTRY GROUP

ANALYSTS ESTIMATES

1996

VARIEST.

ATION

$

%

38

39/30

210

14

4.45

62

24

51

62

53.0

12

2.48

2.72

2.76

1.8

Utilities

37

38/18

565

62

0.00

94

89

63

722.5

09

0.57

0.60

2.28

4.4

Software/services

37

40/30

163

NM

3.00 1375

17

56

64

68.9

09

2.94

0.08

2.63

9.5

Fuel

57

57/25

993

53

0.00

90

86

41

169.5

06

0.76

1.08

1.36

2.2

Retailing

51

51/33

283

18

0.00

38

79

46

57.4

07

1.10

2.84

3.14

1.6

Electrical & electronics

25

27/20

192

13

2.65

35

23

33

94

30.6

12

0.93b

1.90

2.14

2.8

Banks

52

55/36

218

18

1.91

34

44

54

45

76.5

03

4.51

2.98d 3.37

2.7

Health care

31

34/24

721

19

0.45

91

74

122.9

12

1.12

1.65

1.91

1.6

Services

20

25/18

418

21

0.82

17

50

119

143.6

03

1.01

0.95d 1.17

9.4

Health care

75

78/46

500

30

1.59

48

67

84

31

86.1

12

2.92

2.50

4.64

2.4

Aerospace & defense

65

77/37

606

NM

0.00

58

75

36

530.2

12

0.15

0.16

0.98

34.7

31

34/14

234

19

1.43

27

97

92

74

128.1

12

1.06

1.69

1.84

4.3

Consumer products

49

60/35

193

12

0.00

19

93

47

138.5

12

2.40

4.21

4.79

2.9

Services

39

41/29

166

13

4.06

53

40

39

58

58.1

12

2.25

3.00

3.27

1.8

Banks

33

34/27

309

26

1.90

49

18

36

70

25.4

11

1.26

1.27

1.88

3.2

Manufacturing

49

51/34

570

30

0.41

13

28

40

47

59.3

05

1.34

1.60d 1.89

1.1

Services

51

65/48

207

10

3.29

33

27

45

36.7

12

1.97

5.16

6.06

13.0

Paper

31

46/20

518

NM

0.00

23

62

73

866.4

12

1.38

0.27

0.95

13.7

Software/services

62

62/40

623

28

0.00

51

78

37

100.1

01

1.87

2.19d 2.70

2.2

Retailing

26

27/20

159

11

3.40

37

29

36

88

42.4

12

2.15

2.36

2.61

1.2

Banks

29

32/21

172

13

4.38

58

36

36

78

38.9

12

1.99

2.20

2.22

2.7

Utilities

70

74/ 7

3171

97

0.00

724

34

32

698.4

12

0.16

0.72

1.37

12.4

27

30/22

180

13

5.08

64

15

54

85

44.9

12

1.95

2.12

2.15

0.9

1.51

2.08

28.8

Publishing/TV

21.86 23.31

3.9

Transportation

Health care

Software/services

Utilities

92

95/72

127

61

0.00

26

22

25

10.2

12

3.71

79

212/90

NEG

0.00

89

99

13

281.5

12

0.76

61

61/34

335

15

1.19

18

80

58

37

69.3

09

1.84b

4.04

4.32

2.8

Chemicals

29

30/19

340

20

1.85

36

51

25

77

12.7

12

1.29

1.50

1.71

2.3

Banks

40

56/40

116

2.98

24

15

77

56

99.2

12

2.35

5.01

3.80

28.9

68

69/41

196

18

3.17

56

64

47

33

62.8

12

5.01

3.88

5.23

2.9

Banks

39

47/27

266

43

0.00

31

84

57

190.0

06

2.84

0.90

2.96

1.7

Health care

23

25/16

225

16

2.19

36

18

79

98

98.3

12

1.35

1.39

1.89

5.3

Leisure

30

36/ 3

442

80

0.00

809

12

58

221.5

12

0.31

0.37

0.83

10.8

Services

35

37/29

169

13

5.79

77

22

36

63

40.9

12

2.57

2.65

2.71

2.2

Utilities

26

37/22

147

33

2.27

74

18

79

85

165.5

12

0.72

0.81

1.84

16.8

39

45/32

232

20

2.68

54

21

66

57

115.6

12

0.23

1.94

2.40

2.5

Health care

38

40/27

174

13

3.36

43

39

39

58

84.5

12

2.38

2.99

3.28

1.5

Banks

19

21/13

452

23

0.00

151.8

689

36

0.00

77

96

70

83.7

09

0.69

0.88

1.08

1.9

Health care

36

44/16

962

62

0.00

121

91

60

281.9

06

0.38

0.59

1.75

1.1

Electrical & electronics

32

33/26

184

13

3.04

40

29

69

68

52.4

02

0.61

2.43d 2.63

1.9

Food

29

33/25

209

13

3.43

45

55

75

108.3

12

0.91

2.24

2.07

15.0

Fuel

33

35/21

423

NM

2.44

DEF

60

40

67

38.4

12

1.15

0.38

1.99

4.0

Telecommunications

66

70/52

333

18

2.85

52

26

55

33

21.4

12

3.20

3.65

4.06

1.5

Electrical & electronics

28

32/20

NEG

15

0.00

38

52

77

60.7

12

1.29

1.90

2.56

2.7

Housing

59

65/43

287

NM

2.46

DEF

31

84

37

95.5

12

4.64b 0.02

4.96

4.0

Consumer products

27

29/21

568

3.33

19

16

54

80

72.7

12

2.78

4.86

2.96

33.4

50

56/38

152

15

1.20

18

30

81

43

121.0

06

2.16

3.32

4.35

1.8

Services

25

38/21

383

NA

0.82

NA

NA

NA

88

NA

03

0.87

NA

NA

NA

Electrical & electronics

29

30/22

141

15

3.93

57

26

65

76

57.3

12

2.01

1.96

2.47

2.0

Utilities

30

32/19

135

12

2.80

32

53

57

72

106.9

12

2.46b

2.59

3.03

3.6

Nonbank financial

50

05

0.69

0.83d 0.99

4.0

Health care

115

32/17

17

Paper

31

FOOTNOTES TO TABLES APPEAR ON PAGE 102

Containers

Chemicals

BUSINESS WEEK / MARCH 25, 1996 127

LARGE: Jespersen, Mims, J. Mandel, Rosenberg, Morrison

Bartlett, Vamos, Sasseen, Reingold, Bongiorno, Leonhardt, +2

128

CMYK 03

BW

BWDOM

INT

96BW1000

EDIT PASS

PE

DAD

???/!!!

XX

EDIT OK

THE BUSINESS WEEK 1000

COMPANY

MARKET VALUE

PROFITS

YEAR

AGO

RANK

12

MONTHS

1995

$ MIL.

CHANGE

FROM

1994

%

12

MONTHS

1995

$ MIL.

CHANGE

FROM

1994

%

MARGINS

12

MONTHS

1995

%

12

MONTHS

1994

%

RETURN

ON

INVESTED

CAPITAL

%

ASSETS

$ MIL.

551

COUNTRYWIDE CREDIT INDUSTRIES

2142

44

588

1426

44

157.5

36

11.0

11.7

10.2

12.4

7928

25

552

GATEWAY 2000

2141

61

630

3676

36

173.0

80

4.7

3.6

30.5

31.1

1124

46

553

COOPER TIRE & RUBBER

2133

404

1494

112.8

12

7.6

9.2

14.5

15.1

1144

10

554

NALCO CHEMICAL

2131

405

1215

135.7

85

11.2

5.9

17.8

21.8

1370

555

BOSTON CHICKEN

2121

164

932

159

66

33.6

108

21.0

16.8

4.1

4.7

556

FIRST TENNESSEE NATIONAL

2116

60

629

1319y

14

164.9

12

12.5

12.7

23.6

20.0

12077

557

CADENCE DESIGN SYSTEMS

2103

115

810

548

28

97.3

165

17.7

8.5

65.8

72.5

374

558

LONG ISLAND LIGHTING

2094

11

494

3075

303.3

9.9

9.8

7.5

10.2

13063

559

COLUMBIA GAS SYSTEM

2091

59

638

2635

432.3

NM

NM

9.0

NM

38.8

ON

COMMON

EQUITY

%

12

MONTHS

1995

$ MIL.

CHANGE

FROM

1994

%

1074 152

10

6057 15

REGIONS FINANCIAL

2085

40

587

1101

29

172.8

18

15.7

17.1

13.7

15.4

561

MAYTAG

2082

17

517

3040

10

15.0

NM

NM

4.5

NM

2.4

2125 15

562

ECHLIN

2072

460

2822

21

155.8

21

5.5

5.5

12.4

16.5

2049

24

563

HOST MARRIOTT

2067

22

540

28

62.0

NM

NM

NM

NM

9.3

3557

564

OWENS CORNING

2064

39

586

3612

231.0

212

6.4

2.2

37.5

NM

3261

565

SANTA FE PACIFIC GOLD

2053

44

601

350

39.8

30

11.4

15.1

6.3

7.2

1018

19

566

BAYBANKS

2051

72

700

974a

20

130.3

30

13.4

12.4

NA

15.2

11525

567

YORK INTERNATIONAL

2049

42

594

2930

21

96.1

NM

NM

3.7

6.4

12.0

2022

28

568

C. R. BARD

2049

47

607

1138

86.8

15

7.6

7.1

13.6

16.0

1091

14

569

OLIN

2044

87

742

3150

19

139.9

54

4.4

3.4

13.4

15.5

2272

12

AMERICAN GREETINGS

2043

428

1958

113.1

22

5.8

7.9

9.9

9.4

2032

17

571

ANDREW

2030

37

422

648

12

72.3

47

11.2

8.5

18.1

19.7

519

23

572

STERLING SOFTWARE

2026

142

901

610

25

92.2

NM

15.1

NM

20.2

25.4

703

24

573

ADVANCED MICRO DEVICES

2023

30

340

2430

14

300.5

12.4

14.3

13.0

14.3

3031

24

574

FIRST SECURITY

2017

61

669

1201y

24

120.0

14

10.0

14.4

NA

11.8

12675

575

APACHE

2012

31

576

743y

26

20.2

56

2.7

7.7

NA

1.9

2636

54

576

WESTERN RESOURCES

2011

478

1572

181.7

11.6

11.6

8.6

10.1

5491

577

B. F. GOODRICH

2000

74

714

2409

10

118.0

80

4.9

3.0

10.8

12.9

2490

578

POLAROID

1998

45

608

2237

140.2

NM

NM

5.1

NM

17.3

2272

579

DANAHER

1988

16

529

1487

33

105.8

46

7.1

6.5

15.4

19.1

1508

53

RYDER SYSTEM

1988

509

5167

10

155.4

3.0

3.3

7.4

13.0

5708

18

560

570

580

485y

13709

581

CENTURY TELEPHONE ENTERPRISES

1988

20

546

645

14

114.8

15

17.8

17.8

NA

13.4

1862

13

582

ADVANTA

1976

46

622

616y

38

136.7

29

22.2

23.7

11.0

21.5

4524

45

583

REEBOK INTERNATIONAL

1973

33

335

164.8

35

4.7

7.8

14.8

16.8

1669

584

GENERAL NUTRITION

1969

114

850

29

61.4

50

7.6

6.5

14.9

20.8

660

12

585

DARDEN RESTAURANTS

1968

NA

NR

3209

11.9

90

0.4

3.8

NA

1.0

2090

586

ECOLAB

1965

26

568

1341

11

99.2

17

7.4

7.0

20.3

22.9

1061

587

MILLIPORE

1964

60

677

594

20

85.4

43

14.4

12.0

28.2

37.7

531

588

OLSTEN

1958

37

604

2519y

90.5

27

3.6

3.1

NA

20.1

842

17

589

LEGGETT & PLATT

1958

15

543

2059

11

134.9

17

6.6

6.2

16.1

18.9

1218

PERKIN-ELMER

1955

63

684

1114

75.2

6.8

6.8

21.9

22.1

921

13

34

590

3481

807a

591

PAINEWEBBER GROUP

1955

13

528

5320y

34

80.8

155

1.5

0.8

NM

3.5

49545

592

GIANT FOOD

1953

39

605

3801

97.8

2.6

2.5

11.5

12.5

1427

593

WORTHINGTON INDUSTRIES

1952

510

1454

110.7

12

7.6

7.0

16.4

18.0

930

594

INFINITY BROADCASTING

1948

74

723

326

19

54.5

64

16.7

12.1

18.6

NM

590

595

OWENS-ILLINOIS

1943

55

671

3763

169.1

116

4.5

2.2

12.0

34.2

5481

596

AT&T CAPITAL

1937

59

689

1577

14

127.6

27

8.1

7.3

7.0

11.4

9541

19

597

MERCANTILE STORES

1930

26

577

2944y

123.2

18

4.2

3.7

7.9

8.8

2078

598

HORMEL FOODS

1928

461

3040

105.6

21

3.5

4.3

14.2

14.4

1234

599

FRUIT OF THE LOOM

1926

520

2403

227.3

NM

NM

2.6

NM

25.4

2920

NATIONAL SEMICONDUCTOR

1919

452

2652

16

291.5

11.0

11.9

15.7

18.3

2613

45

600

128 BUSINESS WEEK / MARCH 25, 1996

SALES

CHANGE

FROM

1995

%

ALPHABETICAL INDEX OF COMPANIES BEGINS ON PAGE 146

LARGE: Jespersen, Mims, J. Mandel, Rosenberg, Morrison

Bartlett, Vamos, Sasseen, Reingold, Bongiorno, Leonhardt, +2

129

CMYK 03

BW

BWDOM

INT

96BW1000

ALUATION

ECENT

HARE

PRICE

$

EDIT PASS

DIVIDENDS

12-MONTH

HIGH/

LOW

$

PRICE

AS % OF

BOOK

VALUE

P-E

RATIO

YIELD

%

PAYOUT

%

EDIT OK

SHARES

TOTAL

RETURN

%

INSTITUTIONS

HOLDING

%

EARNINGS PER SHARE

SHRS.

OUT.

MIL.

TURNOVER

%

FY

1994

ACTUAL

$

1995

ACTUAL

$

PE

DAD

???/!!!

XX

INDUSTRY GROUP

ANALYSTS ESTIMATES

1996

VARIEST.

ATION

$

%

21

27/16

169

11

1.52

17

31

81

102

139.1

02

0.96

1.91d 2.32

5.2

Nonbank financial

30

38/16

385

13

0.00

61

25

73

320.9

12

1.22

2.19

2.82

3.2

Computers

26

30/22

285

19

1.18

22

64

84

86.0

12

1.54

1.35

1.72

9.3

Automotive

32

39/28

374

19

3.15

58

74

67

49.9

12

1.19b

1.71

1.99

4.0

Chemicals

36

36/15

296

54

0.00

99

49

59

322.9

12

0.38

0.66

0.92

2.2

Leisure

32

33/21

257

13

3.37

44

56

21

67

103.4

12

2.28

2.43

2.85

2.8

Banks

45

46/17

1569

28

0.00

159

91

47

191.7

12

0.56

1.57

1.76

4.5

Software/services

10.17

85

18

18/13

85

44

45/26

188

46

47/33

20

22/15

34

40/33

13

41

16

14/10

47/33

18/10

103.0

48

73.3

12

3.93

1.8

Banks

1.54

2.6

Consumer products

3.5

Automotive

35

43

30

45

57.1

12

3.40

3.75

2.84

DEF

22

59

105

89.5

12

1.42

0.14

220

13

2.42

32

77

61

98.2

08

2.06

2.60

2.87

0.13

0.39

1.66b

4.40

NEG

370

0.00

52

0.32

21

17

44

81

58

63.6

51

90.5

131

115.8

12

12

12

0.46

0.30

Utilities

Utilities

2.88

159

5.3

4.2

12

67

8.57

2.09

NM

31

4.87

2.10

327

12

2.15

185

0.00

70

120

0.34

NM

69

35

NM

309

DEF

21

3.13

0.05 160.0

4.85

0.38

Leisure

5.6

Housing

21.1

Metals

2.30

34

70

72

20

225.2

12

5.65

7.01

7.33

2.0

Banks

NM

0.50

DEF

25

83

43

59.8

12

2.40

2.36

3.31

2.4

Housing

23

1.78

42

36

67

57

63.6

12

1.44

1.53

2.06

5.8

Health care

260

15

2.90

44

67

77

25

137.2

12

3.65

5.50

6.41

8.4

Chemicals

33/26

170

14

2.34

32

84

75

205.2

02

2.00

2.00d 2.26

3.1

Leisure

52

65/28

554

30

0.00

34

61

39

221.4

09

1.13

1.73

2.14

1.4

Electrical & electronics

67

71/33

582

NM

0.00

84

73

30

156.4

09

2.54

0.39

3.46

0.3

Software/services

23.3

Electrical & electronics

Banks

05

107/61

226

15

48

49/37

255

36

37/26

377

83

85/48

27

19

39/16

96

0.00

36

62

104

369.5

12

2.92b

2.81

1.72

27

28/16

198

17

3.13

53

64

35

75

83.1

12

1.87

1.57

2.31

4.8

26

31/23

184

93

1.08

100

71

77

117.9

12

0.70

0.28

0.77

26.0

32

35/30

131

12

6.44

76

35

63

46.2

12

2.82

2.71

2.69

2.6

Utilities

76

77/42

229

18

2.89

51

76

82

26

93.2

12

2.24

4.30

4.21

5.9

Chemicals

44

49/30

246

NM

1.36

DEF

49

87

45

113.5

12

2.49

3.09

2.60

6.5

Leisure

34

35/26

359

19

0.24

16

68

58

24.1

12

1.40

1.77

2.07

2.4

Manufacturing

25

28/22

166

13

2.39

31

10

94

79

66.3

12

1.95

1.96

2.27

6.6

Transportation

34

36/27

232

17

1.07

18

10

81

59

72.8

12

1.88

1.97

2.19

3.2

Telecommunications

48

50/31

312

15

0.75

11

43

22

41

87.0

12

2.58

3.20

3.84

1.6

Nonbank financial

26

38/24

202

13

1.14

15

27

74

75

152.8

12

3.02

2.07

2.76

8.3

Consumer products

23

27/12

666

29

0.00

89

85

87

238.4

01

0.57

0.78d 0.99

1.0

Food

12

13/ 9

167

16

0.00

NA

61

159

NA

05

0.33

0.79d 0.91

3.3

Fuel

Leisure

30

33/23

453

20

1.84

37

34

46

65

24.7

12

1.25

1.50

1.71

1.2

Consumer products

44

47/26

867

23

0.72

17

68

84

44

84.3

12

1.09

1.90

2.23

4.0

Electrical & electronics

46

48/28

435

23

0.61

14

34

61

43

80.0

12

1.61b

2.00

2.38

1.7

Services

23

27/19

274

15

1.88

28

16

55

84

47.4

12

1.39

1.59

1.78

2.8

Consumer products

46

49/28

573

29

1.47

43

64

79

42

130.1

06

1.66

1.57

2.05

4.4

Electrical & electronics

20

23/16

133

38

2.42

92

17

42

98

66.5

12

0.41b

0.52

2.22

11.7

33

35/23

249

19

2.25

43

42

44

59

27.2

02

1.59

1.71d 1.83

1.6

Food

22

23/17

317

19

2.05

38

55

91

81.8

05

1.29

1.16d 1.37

8.8

Metals

41

42/24

NEG

52

0.00

76

84

47

112.0

12

0.49

0.79

16

17/10

397

12

0.00

55

50

120

27.7

12

0.64

1.40

1.00

1.57

12.0

2.5

Nonbank financial

Publishing/TV

Containers

41

45/24

174

15

1.07

16

61

47

16.0

12

2.14

2.70

3.15

5.4

Nonbank financial

52

54/40

137

16

2.02

32

28

43

37

49.4

01

2.84

3.35

3.41

3.8

Retailing

25

28/23

263

16

2.39

38

23

77

23.1

10

1.54

1.57

1.66

5.4

Food

25

28/17

215

NM

0.00

73

76

119.0

12

0.79

2.99

1.75

3.4

Consumer products

11.2

Electrical & electronics

16

34/15

125

FOOTNOTES TO TABLES APPEAR ON PAGE 102

0.00

92

123

349.9

05

1.92b

2.01d 2.51

BUSINESS WEEK / MARCH 25, 1996 129

LARGE: Jespersen, Mims, J. Mandel, Rosenberg, Morrison

Bartlett, Vamos, Sasseen, Reingold, Bongiorno, Leonhardt, +2

130

CMYK 03

BW

BWDOM

INT

96BW1000

EDIT PASS

PE

DAD

???/!!!

XX

EDIT OK

THE BUSINESS WEEK 1000

COMPANY

MARKET VALUE

CHANGE

FROM

1994

%

12

MONTHS

1995

$ MIL.

CHANGE

FROM

1994

%

MARGINS

12

MONTHS

1995

%

12

MONTHS

1994

%

RETURN

ON

INVESTED

CAPITAL

%

ASSETS

$ MIL.

NELLCOR PURITAN BENNETT

1907

238

NR

463

13

18.3

NM

NM

7.6

NA

5.6

602

UNION BANK

1900

58

697

1595y

27

207.3

228

13.0

5.0

14.9

14.6

603

VULCAN MATERIALS

1897

490

1461

17

166.2

70

11.4

7.8

19.6

20.9

1216

604

UNITRIN

1886

18

410

1447

150.6

10.4

10.9

9.8

9.9

4819

605

TIG HOLDINGS

1884

45

647

1886y

118.0

127

6.3

2.9

8.4

9.1

6683

606

KANSAS CITY SOUTHERN INDUSTRIES

1883

17

561

775y 29

236.7

126

30.5

9.6

16.3

34.3

2507

18

607

CAREMARK INTERNATIONAL

1882

50

667

2374

34

20.2

63

0.9

3.1

NA

5.6

1264

608

STAR BANC

1880

48

659

836

24

136.6

17

16.3

17.3

18.4

16.7

9573

609

MURPHY OIL

1872

479

1711y

118.6

NM

NM

6.3

NA

9.2

2316

610

YEAR

AGO

RANK

12

MONTHS

1995

$ MIL.

PROFITS

601

ON

COMMON

EQUITY

%

12

MONTHS

1995

$ MIL.

CHANGE

FROM

1994

%

537 121

19518

REVCO D. S.

1867

53

681

4924

56

70.2

61

1.4

1.4

6.8

8.8

2308

611

INTERNATIONAL GAME TECHNOLOGY

1867

504

618

10

94.7

30

15.3

19.8

16.4

17.2

1021

13

612

ST. JOE PAPER

1860

512

335

51

29.3

30

8.8

6.1

2.5

2.9

1531

613

M C CORMICK

1858

514

1859

10

97.5

59

5.2

3.6

15.3

18.8

1614

614

TOTAL SYSTEM SERVICES

1850

62

721

250

33

27.7

23

11.1

12.0

20.2

20.3

190

23

615

WENDYS INTERNATIONAL

1844

16

563

1728y

26

110.1

13

6.4

7.1

12.5

14.2

1116

616

LUBRIZOL

1841

15

430

1664

151.6

14

9.1

11.0

14.8

17.5

1492

617

PACCAR

1836

532

4830

252.8

24

5.2

4.5

NA

19.1

4309

13

618

WITCO

1836

14

559

1985

100.3

5.1

5.1

NA

9.6

1985

619

GENETICS INSTITUTE

1829

91

821

172

31

22.5

NM

NM

NM

5.5

5.5

434

MIDAMERICAN ENERGY

1826

26

930

1554

130.4

8.4

9.0

6.7

9.9

4446

620

621

TIDEWATER

1820

74

775

574

64.4

51

11.2

8.1

10.2

10.6

848

622

SNAP-ON

1813

24

592

1292y

113.3

15

8.8

8.2

NA

15.1

1361

10

623

OLD KENT FINANCIAL

1810

41

652

1096y

20

141.8

12.9

15.0

18.4

14.2

12003

624

CLAYTON HOMES

1808

35

623

839

21

95.9

26

11.4

11.0

15.7

16.8

801

15

625

AMERICAN NATIONAL INSURANCE

1807

37

633

1471

206.4

14.0

15.4

NA

9.2

6845

18

626

AMERICAN RE

1806

12

560

1797

87.3

NM

NM

5.8

NM

10.3

7814

17

627

DIEBOLD

1797

67

760

863

14

76.2

20

8.8

8.4

15.2

15.5

719

628

GENERAL SIGNAL

1795

536

1863

22

100.1

5.4

6.8

11.2

18.9

1613

19

629

PEP BOYSMANNY, MOE & JACK

1794

467

1520a

11

81.2

5.3

5.6

9.8

12.6

1393

11

USF&G

1794

31

616

3459

209.0

12

6.0

7.2

NA

12.1

14651

631

LEAR SEATING

1792

86

820

4714

50

94.2

58

2.0

1.9

8.6

17.4

3061

79

632

THERMO CARDIOSYSTEMS

1789

228

NR

19a 130

5.5

332

29.7

15.8

5.9

7.3

106

12

633

OLD REPUBLIC INTERNATIONAL

1786

40

655

1696

212.5

41

12.5

9.0

11.3

13.6

6550

634

TRITON ENERGY

1782

60

730

107

226

6.5

NM

6.1

NM

2.5

2.5

827

NA

635

LOCTITE

1781

551

785

12

83.9

10.7

11.7

19.9

18.8

716

636

MEDAPHIS

1777

109

935

468

47

2.7

89

0.6

7.6

1.2

0.8

719

37

637

PENNZOIL

1774

19

426

2490y

305.1

NM

NM

NM

NM

35.7

4308

638

TAMBRANDS

1772

12

564

683

85.5

12.5

13.9

53.9

88.4

422

11

639

CAPITAL ONE FINANCIAL

1770

47

692

1010

54

126.5

33

12.5

14.5

8.2

21.1

4759

54

OFFICEMAX

1769

39

NR

2543

38

NA

NA

NA

1.6

NA

11.8

1568

47

630

640

641

HARNISCHFEGER INDUSTRIES

1769

38

631

2388y

42

112.1

213

4.7

2.1

13.8

20.0

2041

42

642

PETSMART

1767

73

797

1031

26

2.8

NM

NM

NM

NA

1.4

510

14

643

AMERICAN FINANCIAL GROUP

1762

55

720

3649y

74

190.4

907

5.2

0.9

NA

16.7

644

HEALTH SYSTEMS INTERNATIONAL

1761

34

639

2732

18

89.6

3.3

3.8

19.4

34.6

645

IDEXX LABORATORIES

1754

193

NR

189

49

21.5

61

11.4

10.6

7.9

7.9

646

RELIASTAR FINANCIAL

1751

72

662

2090

33

169.1

57

8.1

6.9

12.2

13.3

15519

647

CLEAR CHANNEL COMMUNICATIONS

1750

79

803

283y

41

32.0

45

11.3

11.0

9.4

21.2

520

79

648

UNION TEXAS PETROLEUM HOLDINGS

1732

539

852y

14

102.0

52

12.0

9.0

11.5

24.4

1881

41

649

HEALTHCARE COMPARE

1731

60

753

214

15

66.5

31

31.0

27.2

25.6

25.6

297

38

BOISE CASCADE OFFICE PRODUCTS

1729

NA

NR

1316

45

43.2

63

3.3

2.9

13.3

13.3

544

54

650

130 BUSINESS WEEK / MARCH 25, 1996

SALES

CHANGE

FROM

1995

%

13943 235

1021

23

313 157

50

ALPHABETICAL INDEX OF COMPANIES BEGINS ON PAGE 146

LARGE: Jespersen, Mims, J. Mandel, Rosenberg, Morrison

Bartlett, Vamos, Sasseen, Reingold, Bongiorno, Leonhardt, +2

131

CMYK 03

BW

BWDOM

INT

96BW1000

ALUATION

ECENT

HARE

PRICE

$

EDIT PASS

DIVIDENDS

12-MONTH

HIGH/

LOW

$

PRICE

AS % OF

BOOK

VALUE

P-E

RATIO

YIELD

%

PAYOUT

%

EDIT OK

SHARES

TOTAL

RETURN

%

INSTITUTIONS

HOLDING

%

EARNINGS PER SHARE

SHRS.

OUT.

MIL.

TURNOVER

%

FY

1994

ACTUAL

$

1995

ACTUAL

$

PE

DAD

???/!!!

XX

INDUSTRY GROUP

ANALYSTS ESTIMATES

1996

VARIEST.

ATION

$

%

67

69/33

587

30

0.00

97

90

28

225.9

06

1.22

2.20

2.70

0.7

Health care

52

58/33

142

10

2.69

26

59

84

37

36.5

12

1.80

5.38

5.62

6.8

Banks

54

60/52

238

12

3.10

36

57

35

28.4

12

2.67

4.63

4.80

3.1

Housing

49

52/45

124

13

4.49

59

28

38

33.3

12

2.96

3.73

3.53

8.2

Nonbank financial

32

33/19

147

17

0.63

11

53

91

60

71.4

12

0.79

1.89

2.42

6.6

Nonbank financial

46

49/36

273

0.86

27

75

41

90.7

12

2.32

5.41

3.08

3.6

Transportation

26

28/17

519

94

0.16

15

46

69

74

126.0

12

1.08

0.27

1.23

1.6

Health care

63

67/41

229

14

2.54

35

52

33

30

21.7

12

3.89

4.55

5.22

1.5

Banks

42

44/38

145

NM

3.11

DEF

68

45

52.4

12

2.37

2.64

1.62

14.8

28

29/18

234

23

0.00

51

69

67

107.0

05

0.95

1.22d 1.38

2.9

15

17/11

339

21

0.81

17

37

127

164.6

09

1.07

0.71

0.84

4.8

Fuel

Health care

Manufacturing

61

68/53

186

64

0.33

21

90

31

11.2

12

1.38

0.96

NA

NA

Containers

23

27/20

358

19

2.45

47

49

81

96.4

11

0.75

1.20

1.36

6.6

Food

29

32/13

1354

67

0.31

21

63

65

3.9

12

0.35

0.43

0.55

NM

Software/services

59

102

131.9

18

23/15

238

29

37/26

213

47

55/39

33

36/27

68

70/31

18

19/14

20

1.32

27

18

12

0.93

0.90

1.31

Chemicals

4.66

4.7

Automotive

2.01

11.4

0.68

5.9

3.28

41

10

69

63

97.4

12

2.67

2.37

2.17

138

8.47

62

16

42

39

86.9

12

5.26

6.50

175

18

3.43

63

18

80

56

52.2

12

1.92

1.78

447

NM

0.00

90

23

27

70.2

12

0.71

0.84

15

6.62

98

33

14

101

20.6

12

1.28

1.22

Leisure

7.4

12

148

3.8

1.41

6.4

Chemicals

Health care

Utilities

34

36/18

300

24

1.47

35

76

82

53

123.7

03

0.80

1.41d 1.85

5.9

Fuel

45

47/34

242

16

2.41

39

35

72

41

58.2

12

2.30

2.76

3.12

2.2

Manufacturing

40

42/29

181

13

3.21

41

37

29

45

58.5

12

3.19

3.11

3.70

1.6

Banks

19

21

69/50

87

3.69

32

40

19

26

17.5

12

8.12

7.79

NA

NA

Nonbank financial

38

45/33

213

NM

0.83

DEF

13

33

47

49.7

12

2.01

1.85

3.84

6.0

Nonbank financial

39

41/23

364

24

1.63

38

68

67

46

90.8

12

1.39

1.67

1.91

3.1

Office equipment

36

43/28

339

18

2.64

47

81

49

84.4

12

2.20

2.03

2.60

2.3

Electrical & electronics

30

34/22

278

22

0.63

14

62

60

138.5

01

1.32

1.35d 1.63

3.7

Retailing

15

23/12

20/13

120

0.42

10

1.33

32

13

65

53

96

120

65.7

82.8

06

12

0.76

1.86b

0.92

1.53

1.09

1.60

1.8

Housing

317

68

5.6

Nonbank financial

32

33/17

332

18

0.00

53

83

56

52.5

12

1.26

1.79

2.47

2.0

Automotive

74

83/24

2363

NM

0.00

211

23

24

57.6

12

0.08

0.28d 0.56

14.3

Health care

34

37/24

119

10

1.52

15

40

75

52

42.1

12

2.44b

3.42

3.27

4.9

50

59/31

778

NM

0.00

59

78

36

118.2

12

1.74

0.16

0.40

35.0

53

54/43

399

22

1.89

42

17

44

34

37.6

12

2.33

2.40

3.10

2.9

Chemicals

39

43/20

487

NM

0.00

38

85

46

397.5

12

0.58

0.05

1.05

2.9

Services

38

51/35

208

NM

2.61

DEF

15

57

46

55.4

12

6.16

6.60

1.28

18.8

48

53/40

1832

21

3.81

79

16

68

37

97.7

12

2.43

2.33

2.74

2.6

Consumer products

27

30/18

295

14

1.20

17

48

54

66

116.8

12

1.44

1.90

2.33

1.7

Nonbank financial

22

27/15

184

31

0.00

29

87

82

137.7

01

0.40

0.70d 0.90

1.1

Retailing

38

41/27

316

19

1.06

20

37

73

47

125.5

10

0.74

1.99

2.86

7.7

Manufacturing

35

36/21

711

NM

0.00

50

68

51

195.5

01

0.09

0.07

0.86

1.2

Retailing

32

35/23

160

3.14

26

34

30

55

29.1

12

0.02

3.87

3.24

2.8

Nonbank financial

37

37/25

681

20

0.00

35

18

48

43.7

12

1.77

1.83

2.37

4.2

Services

48

54/19

648

79

0.00

153

90

37

159.7

12

0.40

0.61

0.85

NM

Health care

48

52/33

145

12

2.07

24

44

70

36

50.0

12

3.08b

4.10

4.56

2.6

Nonbank financial

51

53/27

1161

56

0.00

78

52

35

47.4

12

0.64

0.91

1.20

5.0

Publishing/TV

20

24/17

412

17

1.01

17

75

88

75.3

12

0.76

1.17

1.14

11.4

49

52/28

667

26

0.00

54

68

36

386.3

12

1.45

1.89

2.23

1.3

Nonbank financial

56

61/22

533

40

0.00

NA

16

31

NA

12

NA

1.40

1.88

4.8

Services

FOOTNOTES TO TABLES APPEAR ON PAGE 102

Nonbank financial

Fuel

Fuel

Fuel

BUSINESS WEEK / MARCH 25, 1996 131

LARGE: Jespersen, Mims, J. Mandel, Rosenberg, Morrison

Bartlett, Vamos, Sasseen, Reingold, Bongiorno, Leonhardt, +2

132

CMYK 03

BW

BWDOM

INT

96BW1000

EDIT PASS

PE

DAD

???/!!!

XX

EDIT OK

THE BUSINESS WEEK 1000

COMPANY

MARKET VALUE

$ MIL.

YEAR

AGO

RANK

12

MONTHS

1995

$ MIL.

PROFITS

CHANGE

FROM

1994

%

12

MONTHS

1995

$ MIL.

CHANGE

FROM

1994

%

ASSETS

MARGINS

12

MONTHS

1995

%

12

MONTHS

1994

%

RETURN

ON

INVESTED

CAPITAL

%

ON

COMMON

EQUITY

%

12

MONTHS

1995

$ MIL.

CHANGE

FROM

1994

%

651

AES

1715

24

613

685

29

106.6

15.6

18.5

10.0

21.9

2226

17

652

DST SYSTEMS

1713

NA

NR

NA

NA

NA

NA

NA

NA

NA

NA

662

40

653

CENTOCOR

1705

57

748

79

17

57.1

NM

NM

NM

NM

NM

654

TERADYNE

1704

29

635

1191

53

159.3

109

13.4

9.8

20.6

21.0

1030

57

655

MEDITRUST

1702

34

660

209

21

120.0

49

57.3

46.5

NA

11.7

1892

19

656

CUMMINS ENGINE

1693

11

495

5245

11

224.0

11

4.3

5.3

18.0

19.3

3056

13

657

AMBAC

1692

19

599

167.6

19

66.0

59.8

11.3

11.9

5309

24

658

NEW YORK STATE ELECTRIC & GAS

1689

10

575

2010

196.7

9.8

9.9

7.6

10.3

5093

659

NATIONAL SERVICE INDUSTRIES

1687

27

634

1982

96.3

14

4.9

4.4

12.6

12.7

1140

2

19

254y

260 15

660

CALLAWAY GOLF

1684

47

715

553

23

97.7

25

17.7

17.4

48.4

48.4

290

661

BOISE CASCADE

1684

36

676

5074

23

351.9

NM

6.9

NM

13.8

25.0

4656

662

HARSCO

1671

53

745

1495

10

97.4

13

6.5

6.4

14.5

15.6

1316

663

CALIBER SYSTEM

1667

22

438

2448

92.4

3.8

4.1

9.4

9.4

2064

664

OKLAHOMA GAS & ELECTRIC

1665

17

603

1302

125.3

9.6

9.1

9.6

13.1

2755

665

MCN

1665

52

738

1585

106.4

33

6.7

5.2

8.9

15.2

2365

19

666

TOSCO

1654

55

763

7284

14

77.1

1.1

1.3

9.2

12.9

2000

11

667

FLIGHTSAFETY INTERNATIONAL

1644

18

609

326

84.5

13

25.9

24.7

14.0

14.4

844

668

AUTODESK

1640

12

503

534y

18

87.8

55

16.4

12.5

24.2

24.2

518

669

UCAR INTERNATIONAL

1632

NA

NR

901

19

25.0

75

2.8

13.2

9.9

NM

864

11

10

MGM GRAND

1622

25

632

722

46.6

37

6.5

9.9

NA

8.5

1252

671

ADTRAN

1620

68

NR

181

47

29.5

58

16.2

15.1

21.1

24.1

166

76

672

PHYCOR

1620

213

NR

442

82

21.9

87

5.0

4.8

NA

5.8

650

85

673

ALUMAX

1618

27

656

2926

237.4

408

8.1

1.7

13.7

16.9

3135

674

U. S. SURGICAL

1615

35

699

1022

11

79.2

313

7.7

2.1

9.8

8.1

1266

15

675

VARIAN ASSOCIATES

1615

31

674

1581

18

113.5

54

7.2

5.5

24.4

28.0

954

676

TRANSATLANTIC HOLDINGS

1612

22

636

1165

14

131.9

30

11.3

10.0

14.1

14.1

3899

13

677

TJX

1611

65

812

3805a

678

BEMIS

1610

16

610

1523

679

PMI GROUP

1608

NA

NR

MAPCO

1608

549

670

680

62.8

40

1.7

3.0

8.4

11.6

1903

10

85.2

17

5.6

5.2

13.6

16.6

1031

12

390a

127.8

29

32.8

27.5

15.6

16.5

1290

16

3310y

74.7

2.3

2.6

8.0

11.5

2231

681

STORAGE TECHNOLOGY

1606

67

826

1929

142.3

NM

NM

1.7

NM

16.0

682

LEUCADIA NATIONAL

1600

22

642

1485a

11

78.5

5.3

5.4

4.9

7.4

5136

10

683

PUGET SOUND POWER & LIGHT

1599

17

617

1179

135.7

13

11.5

10.1

8.3

10.2

3269

684

WOOLWORTH

1597

21

466

8347a

33.0

NM

0.4

NM

5.7

2.4

4444 10

685

ALLMERICA PROPERTY & CASUALTY

1594

32

694

2077a

143.6

43

6.9

5.1

9.8

9.7

5700

686

DOLLAR GENERAL

1592

505

1674a

24

82.1

31

4.9

4.7

22.2

21.0

769

39

687

UNIFI

1591

17

485

1597

10

96.2

16

6.0

5.7

13.1

16.6

1011

688

OUTBACK STEAKHOUSE

1590

42

724

664

39

53.7

36

8.1

8.3

24.5

24.3

337

47

689

KOMAG

1582

174

NR

512

31

106.8

83

20.9

14.9

19.1

18.6

686

62

FOSTER WHEELER

1578

35

708

3042

36

28.5

56

0.9

2.9

NA

5.7

2556

35

4

690

1889 12

691

KANSAS CITY POWER & LIGHT

1571

589

886

122.6

17

13.8

12.1

8.6

13.2

2883

692

TELEDYNE

1569

22

651

2568

162.0

NM

6.3

NM

23.4

40.5

1606

693

ECKERD

1568

86

899

4798

93.0

34

1.9

1.6

19.7 2631.1

1539

694

MANVILLE

1568

42

732

2777a

14

154.8

216

5.6

2.0

NA

12.7

4025

695

REYNOLDS & REYNOLDS

1565

37

719

936

13

81.1

15

8.7

8.6

NA

24.4

775

20

696

PORTLAND GENERAL

1562

52

781

984

90.8

13

9.2

10.8

6.7

9.3

3448

697

WEATHERFORD ENTERRA

1561

234

NR

402a

35.8

17

8.9

8.3

10.9

11.4

1300

13

698

LEXMARK INTERNATIONAL GROUP

1553

NA

NR

2158

17

48.0

2.2

2.4

18.1

14.8

1143

19

699

SECURITY CAPITAL PACIFIC TRUST

1553

84

897

265

42

84.3

80

31.8

25.1

6.2

6.5

1724

39

WATSON PHARMACEUTICALS

1551

252

NR

153

61

47.9

31

31.3

38.5

18.0

16.6

322

23

700

132 BUSINESS WEEK / MARCH 25, 1996

SALES

CHANGE

FROM

1995

%

ALPHABETICAL INDEX OF COMPANIES BEGINS ON PAGE 146

LARGE: Jespersen, Mims, J. Mandel, Rosenberg, Morrison

Bartlett, Vamos, Sasseen, Reingold, Bongiorno, Leonhardt, +2

133

CMYK 03

BW

BWDOM

INT

96BW1000

ALUATION

ECENT

HARE

PRICE

$

EDIT PASS

DIVIDENDS

12-MONTH

HIGH/

LOW

$

PRICE

AS % OF

BOOK

VALUE

P-E

RATIO

YIELD

%

PAYOUT

%

EDIT OK

SHARES

TOTAL

RETURN

%

INSTITUTIONS

HOLDING

%

EARNINGS PER SHARE

SHRS.

OUT.

MIL.

TURNOVER

%

FY

1994

ACTUAL

$

1995

ACTUAL

$

PE

DAD

???/!!!

XX

INDUSTRY GROUP

ANALYSTS ESTIMATES

1996

VARIEST.

ATION

$

%

1.60

2.5

Utilities

0.94d 1.43

1.4

Services

2.55

0.98

0.01

NM

Health care

0.96

1.89

2.65

4.9

Electrical & electronics

12

2.28

2.52

NA

NA

Housing

106.7

12

6.11

5.52

4.31

13.2

35

49.7

12

4.01

4.78

4.95

2.2

Nonbank financial

41

72

56.3

12

2.37

2.49

2.54

4.3

Utilities

34

60

48

40.3

08

1.67

1.93

2.13

0.9

Electrical & electronics

17

42

37

71

352.0

12

1.07

1.40

1.63

3.7

Leisure

11

11

75

48

212.3

12

3.08b

5.39

3.53

38.5

2.30

39

56

54

25

39.9

12

3.45

3.86

4.59

2.8

Manufacturing

18

3.31

60

46

39

103.9

12

0.50

2.34

2.50

10.0

Transportation

178

14

6.45

87

24

22

40

45.6

12

3.01

3.05

3.14

2.2

Utilities

26/18

261

17

3.70

62

42

49

66

37.6

12

1.31

1.49

1.63

1.8

Utilities

45

49/28

276

22

1.43

31

57

95

37

99.9

12

2.24b

2.04

3.19

9.7

Fuel

53

54/44

280

20

1.05

21

21

54

31

30.0

12

2.35

2.71

3.05

2.3

Transportation

35

53/28

452

20

0.68

14

84

46

381.5

01

1.14

1.76

2.17

6.0

Software/services

36

36/25

NEG

68

0.00

NA

35

46

NA

12

2.09

0.52

2.82

2.8

Electrical & electronics

33

34/23

297

35

0.00

23

16

49

62.8

12

1.50

0.96

1.51

9.9

Leisure

43

56/25

1327

58

0.00

62

14

37

117.7

12

0.63

0.75

0.97

2.1

Telecommunications

46

56/18

428

75

0.00

122

90

36

308.3

12

0.48

0.61

0.83

3.6

Health care

36

40/24

120

0.00

26

90

45

134.2

12

NA

4.33

3.98

20.6

28

28/19

218

27

0.28

35

51

57

214.0

12

0.08

1.05

1.28

6.3

Health care

52

57/37

398

17

0.54

43

78

31

139.3

09

2.22

3.01

3.97

2.3

Electrical & electronics

70

75/57

172

12

0.57

23

87

23

30.3

12

4.44

5.75

6.07

2.5

Nonbank financial

22

23/11

335

22

1.26

28

68

85

72

133.3

01

1.03

0.99d 1.28

10.9

31

34/25

314

19

2.35

44

15

50

53

36.7

12

1.40

1.63

1.84

2.2

Containers

46

54/36

196

12

0.44

NA

75

35

NA

12

3.03

3.85

4.19

1.4

Nonbank financial

55

59/49

247

22

1.83

40

74

30

57.7

12

2.64

2.51

4.55

2.0

Fuel

30

32/18

167

NM

0.00

40

48

53

270.2

12

0.66

2.91

2.33

7.7

Computers

27

30/21

151

NA

0.94

NA

15

14

60

30.4

12

1.22

NA

NA

NA

Nonbank financial

25

26/20

136

13

7.32

97

25

25

64

36.1

12

1.64

1.89

1.92

2.1

Utilities

133

144.9

20.9

Retailing

25

25/16

353

18

0.00

32

41

70

49.9

12

1.30

34

NA/NA

NA

NA

NA

NA

NA

NA

50

NA

12

NA

29

35/10

NEG

NM

0.00

53

52

59

428.0

12

21

43/18

224

11

0.00

13

89

83

247.9

12

33

37/29

166

13

8.18

108

12

53

51

60.4

42

49/34

146

2.37

18

74

40

48

49/39

121

10

1.24

13

20

90

24

27/20

98

5.93

56

16

35

35/26

223

18

3.33

60

24

25/11

834

17

1.01

35

48/31

129

1.70

66

67/42

267

17

42

57/35

170

41

44/33

25

12

19/ 9

117

41

0.00

21

50

01

0.36

1.40

0.29d 0.86

Automotive

Paper

Metals

Retailing

26

27/18

110

11

0.62

33

87

62

15.2

12

1.64

2.28

2.58

6.6

Nonbank financial

28

34/19

417

22

0.72

16

78

58

157.4

01

1.06

1.26d 1.54

3.2

Retailing

24

28/21

275

15

2.14

31

12

69

66

51.7

06

1.08

1.67

1.58

5.7

Manufacturing

36

38/23

721

31

0.00

36

58

45

230.7

12

0.89

1.15

1.51

2.7

Leisure

31

37/12

275

15

0.00

149

85

50

845.5

12

1.27

2.14

2.92

4.1

Computers

44

46/31

317

56

1.77

99

37

66

36

106.3

12

1.83

0.79

2.42

2.1

Services

25

27/22

175

13

6.15

81

13

24

62

42.8

12

1.64

1.92

1.95

2.6

Utilities

28

29/22

397

10

1.42

14

26

42

56

58.0

12

0.15

2.88

2.49

4.0