Avt Naturals (Qtly 2011 06 30) PDF

Avt Naturals (Qtly 2011 06 30) PDF

Uploaded by

Karl_23Copyright:

Available Formats

Avt Naturals (Qtly 2011 06 30) PDF

Avt Naturals (Qtly 2011 06 30) PDF

Uploaded by

Karl_23Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Avt Naturals (Qtly 2011 06 30) PDF

Avt Naturals (Qtly 2011 06 30) PDF

Uploaded by

Karl_23Copyright:

Available Formats

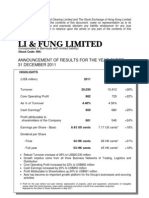

AVT NATURAL PRODUCTS LIMITED

Regd. Office : 60, Rukmani Lakshmipathy Salai, Egmore, Chennai - 600 008 UNAUDITED FINANCIAL RESULTS FOR THE FIRST QUARTER ENDED 30TH JUNE 2011 AND THE AUDITED FINANCIAL RESULTS FOR THE YEAR ENDED 31ST MARCH 2011 Sl. No.

Rs. in Lakhs Year ended Three months ended 30.06.2011 30.06.2010 31.03.2011 31.03.2010 (Audited) (Un-Audited)

Particulars

1 Net Sales / Income from operations 2 Expenditure a.(Increase)/Decrease in Stock in Trade b.Consumption of Raw Materials c. Purchase of Traded Goods d.Employees Cost e.Power and Fuel f. Depreciation g.Other Expenditure Total Expenditure 3 Profit from Operations before other income & interest 4 Other Income 5 Profit before interest and Exceptional Items (3+4) 6 Interest 7 Profit after Interest 8 Tax Expenses - Current Tax - Deferred Tax 9 Net Profit (+) / Loss (-) for the period 10 Paid up Equity Share Capital (Face value Rs.10/- each) 11 Reserves excluding Revaluation Reserves 12 Basic and Diluted EPS (not annualised) - Rs. 13 Public Shareholding - Number of Shares - Percentage of Shareholding 14 Promoters and promoter group Shareholding a.Pledged / Encumbered - Number of shares - Percentage of shareholding of Promoter & Promoter Group - Percentage of share capital of the company b.Non-encumbered - Number of shares - Percentage of shareholding of Promoter & Promoter Group - Percentage of share capital of the company

4813 (712) 2420 0 394 236 90 520 2948 1865 3 1868 86 1782 623 Nil 1158 761

1884 296 769 111 326 111 84 252 1949 (65) 2 (63) 61 (124) Nil Nil (124) 761

13890 594 6203 550 1193 866 321 2102 11829 2061 15 2076 431 1645 570 (7) 1081 761 4818 14.20

8313 197 2717 700 918 574 290 1617 7013 1300 35 1335 323 1012 320 40 652 761 4179 8.56

15.21

(1.63)

1935421 2314533 2314533 2314533 25.42 30.40 30.40 30.40

Nil Nil Nil

Nil Nil Nil

Nil Nil Nil

Nil Nil Nil

5678779 5299667 5299667 5299667 100 74.58 100 69.60 100 69.60 100 69.60

STATEMENT OF ASSETS & LIABILITIES Sl. No.

Particulars Year Ended 31.3.2011 31.3.2010 (Audited)

1 2 3 4 1 2 3

Shareholders funds Capital Reserves and Surplus Loan Funds Deferred Tax Liability (Net) Total Fixed Assets Investments Current Assets, Loans and Advances (a) Inventories (b) Sundry debtors (c) Cash and bank balances (d) Other current assets (e) Loans and Advances Total Less: Current Liabilities and Provisions (a) Liabilities (b) Provisions Total Miscellaneous expenditure (not written off or Adjusted) Total

761 4818 5177 425 11182 3568 282 2855 5326 217 36 1159 9593 943 1319 2262 Nil 11182

761 4179 4395 432 9768 3652 282 2895 3413 216 27 969 7520 886 801 1686 Nil 9768

Notes : 1. The Company operates in solvent extracted products which is the primary reportable segment. Therefore, Segment reporting is not applicable. 2. Previous periods figures have been regrouped wherever necessary to conform to current periods classification. 3. The above results were reviewed by the Audit Committee and approved at the meeting of the Board of Directors of the Company held on 22nd July 2011. 4. The Statutory auditors have carried out a Limited Review of the above financial results. 5. The Board of Directors in their meeting held on 22nd July 2011 recommended a dividend of 50% (Rs.5 per equity share) amounting to Rs.380.71 Lakhs for the financial year 2010-11. 6. Number of investor complaints for the quarter ended 30.06.2011: Received - 1; Disposed of - 1; Pending - Nil (At the Beginning - Nil)

Place : Chennai Date : 22nd July 2011

AJIT THOMAS Chairman

You might also like

- SBLC租賃雙簽版V3 1Document23 pagesSBLC租賃雙簽版V3 1Sembilan DewaNo ratings yet

- Q&A-Business Communication (Optional Included)Document54 pagesQ&A-Business Communication (Optional Included)Madan G Koushik100% (3)

- Avt Naturals (Qtly 2011 09 30) PDFDocument1 pageAvt Naturals (Qtly 2011 09 30) PDFKarl_23No ratings yet

- Avt Naturals (Qtly 2011 12 31) PDFDocument1 pageAvt Naturals (Qtly 2011 12 31) PDFKarl_23No ratings yet

- Q2 Fy2011-12 PDFDocument2 pagesQ2 Fy2011-12 PDFTushar PatelNo ratings yet

- Avt Naturals (Qtly 2012 12 31)Document1 pageAvt Naturals (Qtly 2012 12 31)Karl_23No ratings yet

- Avt Naturals (Qtly 2011 03 31) PDFDocument1 pageAvt Naturals (Qtly 2011 03 31) PDFKarl_23No ratings yet

- Avt Naturals (Qtly 2010 03 31) PDFDocument1 pageAvt Naturals (Qtly 2010 03 31) PDFKarl_23No ratings yet

- Avt Naturals (Qtly 2010 12 31) PDFDocument1 pageAvt Naturals (Qtly 2010 12 31) PDFKarl_23No ratings yet

- HCL Technologies LTD 170112Document3 pagesHCL Technologies LTD 170112Raji_r30No ratings yet

- Consolidated Balance Sheet: As at 31st December, 2011Document21 pagesConsolidated Balance Sheet: As at 31st December, 2011salehin1969No ratings yet

- Result Q-1-11 For PrintDocument1 pageResult Q-1-11 For PrintSagar KadamNo ratings yet

- Consolidated AFR 31mar2011Document1 pageConsolidated AFR 31mar20115vipulsNo ratings yet

- Sebi MillionsDocument2 pagesSebi MillionsNitish GargNo ratings yet

- Unaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Document1 pageUnaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Amar Mourya MouryaNo ratings yet

- HUL MQ 12 Results Statement - tcm114-286728Document3 pagesHUL MQ 12 Results Statement - tcm114-286728Karunakaran JambunathanNo ratings yet

- 2009-10 Annual ResultsDocument1 page2009-10 Annual ResultsAshish KadianNo ratings yet

- Segment Reporting (Rs. in Crore)Document8 pagesSegment Reporting (Rs. in Crore)Tushar PanhaleNo ratings yet

- Karnataka Bank Results Sep12Document6 pagesKarnataka Bank Results Sep12Naveen SkNo ratings yet

- Q1FY2013Document1 pageQ1FY2013Suresh KumarNo ratings yet

- Bil Quarter 2 ResultsDocument2 pagesBil Quarter 2 Resultspvenkatesh19779434No ratings yet

- New Listing For PublicationDocument2 pagesNew Listing For PublicationAathira VenadNo ratings yet

- Standalone Consolidated Audited Financial Results For The Year Ended March 31, 2011Document1 pageStandalone Consolidated Audited Financial Results For The Year Ended March 31, 2011Santosh VaishyaNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Updates On Financial Results For Sept 30, 2015 (Result)Document4 pagesUpdates On Financial Results For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Results Q1FY11 12Document1 pageResults Q1FY11 12rao_gsv7598No ratings yet

- NFL Results March 2010Document3 pagesNFL Results March 2010Siddharth ReddyNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Audited Results 31.3.2012 TVSMDocument2 pagesAudited Results 31.3.2012 TVSMKrishna KrishnaNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Infosys LimitedDocument3 pagesInfosys Limitedjyoti_jazzzNo ratings yet

- Financial Results For The Quarter Ended 30 June 2012Document2 pagesFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaNo ratings yet

- MSSL Results Quarter Ended 31st December 2011Document4 pagesMSSL Results Quarter Ended 31st December 2011kpatil.kp3750No ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Statement of Assets & Liabilties As On September 30, 2016 (Result)Document2 pagesStatement of Assets & Liabilties As On September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Result)Document5 pagesFinancial Results & Limited Review For March 31, 2015 (Result)Shyam SunderNo ratings yet

- ICI Pakistan Limited Condensed Interim Unconsolidated Balance Sheet (Unaudited) As at March 31, 2011Document9 pagesICI Pakistan Limited Condensed Interim Unconsolidated Balance Sheet (Unaudited) As at March 31, 2011Sehrish HumayunNo ratings yet

- Sebi MillionsDocument3 pagesSebi MillionsShubham TrivediNo ratings yet

- Annual ReportDocument1 pageAnnual ReportAnup KallimathNo ratings yet

- Indiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010Document1 pageIndiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010hk_warriorsNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- 494.Hk 2011 AnnReportDocument29 pages494.Hk 2011 AnnReportHenry KwongNo ratings yet

- Alok Result 30 Sept 2011Document24 pagesAlok Result 30 Sept 2011Mohnish KatreNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument2 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Result)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Result)Shyam SunderNo ratings yet

- Dabur Balance SheetDocument30 pagesDabur Balance SheetKrishan TiwariNo ratings yet

- Financial Results For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Document3 pagesAnnounces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Document4 pagesAnnounces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- MRF PNL BalanaceDocument2 pagesMRF PNL BalanaceRupesh DhindeNo ratings yet

- June 2015Document2 pagesJune 2015Aarush VermaNo ratings yet

- Q3 Results 201112Document3 pagesQ3 Results 201112Bishwajeet Pratap SinghNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- SEBI Results Mar13Document2 pagesSEBI Results Mar13Mansukh Investment & Trading SolutionsNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Abb (Ar 1997 12 31)Document68 pagesAbb (Ar 1997 12 31)Karl_23No ratings yet

- Vaccine Group Not VaccinatedDocument12 pagesVaccine Group Not VaccinatedKarl_23No ratings yet

- Singrauli (Coal Capital - Env Issues)Document11 pagesSingrauli (Coal Capital - Env Issues)Karl_23No ratings yet

- Savita Oil (AR 2010 03 31)Document56 pagesSavita Oil (AR 2010 03 31)Karl_23No ratings yet

- Savita Oil (Qtly 2009 09 30)Document2 pagesSavita Oil (Qtly 2009 09 30)Karl_23No ratings yet

- SOP & Essay GuidelinesDocument10 pagesSOP & Essay GuidelinesKarl_23No ratings yet

- Savita Oil (AR 2004 03 31)Document42 pagesSavita Oil (AR 2004 03 31)Karl_23No ratings yet

- Savita Oil (Qtly 2009 06 30)Document2 pagesSavita Oil (Qtly 2009 06 30)Karl_23No ratings yet

- Avt Naturals (Qtly 2010 12 31) PDFDocument1 pageAvt Naturals (Qtly 2010 12 31) PDFKarl_23No ratings yet

- Money CreationDocument3 pagesMoney CreationKarl_23No ratings yet

- Avt Naturals (Qtly 2010 03 31) PDFDocument1 pageAvt Naturals (Qtly 2010 03 31) PDFKarl_23No ratings yet

- GreenPro Certified Products Materials and Technologies DirectoryDocument181 pagesGreenPro Certified Products Materials and Technologies DirectoryParesh Tadas100% (1)

- Ubs Recruitment Readiness Tool 1Document20 pagesUbs Recruitment Readiness Tool 1JasminToromanovićNo ratings yet

- Mas Preweek Hndouts Batch 92Document26 pagesMas Preweek Hndouts Batch 92Mark Anthony CasupangNo ratings yet

- Types of Control in The Supply Chain.Document7 pagesTypes of Control in The Supply Chain.Lesly SalinasNo ratings yet

- TOO4TO Module 5 / Sustainable Resource Management: Part 3Document22 pagesTOO4TO Module 5 / Sustainable Resource Management: Part 3TOO4TONo ratings yet

- Finance Chapter 1Document11 pagesFinance Chapter 1MayNo ratings yet

- ReportDocument41 pagesReportNithin SanthoshNo ratings yet

- Com 5 CDocument2 pagesCom 5 CShamima AkterNo ratings yet

- SEO and Its Importance For BusinessDocument3 pagesSEO and Its Importance For Businessenjeela subediNo ratings yet

- Valmet Sundsvall-SiteDocument99 pagesValmet Sundsvall-SiteMaryvonne Le GourzadecNo ratings yet

- Cash Remittance PrecautionsDocument8 pagesCash Remittance Precautionsaakash sahaNo ratings yet

- Decentralized InsuranceDocument19 pagesDecentralized Insurancejatin sewaniNo ratings yet

- Some Tips On How To Make Money Online EcommerceDocument1 pageSome Tips On How To Make Money Online Ecommercenarumichiniann2019No ratings yet

- Unobservable Effort Objective Consistency and The Efficiencies of The Principal and The Top Management TeamDocument17 pagesUnobservable Effort Objective Consistency and The Efficiencies of The Principal and The Top Management TeamKatherine LinNo ratings yet

- Daedalus Sp22 19 BrynjolfssonDocument16 pagesDaedalus Sp22 19 Brynjolfssonm7med2007.amerNo ratings yet

- Availability Check (ATP) and Transfer of Requirement (TOR) - ERP Operations - SCN WikiDocument3 pagesAvailability Check (ATP) and Transfer of Requirement (TOR) - ERP Operations - SCN WikiNikhil RaviNo ratings yet

- Patxbt MSB OB Strat ExamplesDocument12 pagesPatxbt MSB OB Strat ExamplespatzebmxNo ratings yet

- Essential Modernities 4Document54 pagesEssential Modernities 4ChrisNo ratings yet

- Recruiting in The Age of Googlization 2019 SHRM NEPDocument51 pagesRecruiting in The Age of Googlization 2019 SHRM NEPsatish vNo ratings yet

- The Acid Test of What Is A Benami Property?Document2 pagesThe Acid Test of What Is A Benami Property?nasima abidiNo ratings yet

- Solomon cb12 Inppt 12Document32 pagesSolomon cb12 Inppt 12ShirMozNo ratings yet

- Commentary On Oman Securities LawDocument2 pagesCommentary On Oman Securities LawafrahNo ratings yet

- Weekly Account Statement - PC7420Document5 pagesWeekly Account Statement - PC7420TusharNo ratings yet

- Xpress Credit Sanction IrregularitiesDocument3 pagesXpress Credit Sanction IrregularitieskingsNo ratings yet

- Uber Case StudyDocument2 pagesUber Case StudySagar GuptaNo ratings yet

- Intercompany Matrix 23 (20WP01)Document44 pagesIntercompany Matrix 23 (20WP01)Paulo BelenNo ratings yet

- Revised Syllabus For GDMM/PGDMM: Indian Institute of Materials ManagementDocument91 pagesRevised Syllabus For GDMM/PGDMM: Indian Institute of Materials ManagementVanita GanthadeNo ratings yet

- Ict Data Entry UnopsDocument6 pagesIct Data Entry UnopsShams QiamNo ratings yet