Alembic Pharma LTD (APL) Stock Update: Retail Research

Alembic Pharma LTD (APL) Stock Update: Retail Research

Uploaded by

Shashi KapoorCopyright:

Available Formats

Alembic Pharma LTD (APL) Stock Update: Retail Research

Alembic Pharma LTD (APL) Stock Update: Retail Research

Uploaded by

Shashi KapoorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Alembic Pharma LTD (APL) Stock Update: Retail Research

Alembic Pharma LTD (APL) Stock Update: Retail Research

Uploaded by

Shashi KapoorCopyright:

Available Formats

RETAIL RESEARCH

Scrip Code ALEPHAEQNR Industry Pharmaceuticals

Alembic Pharma Ltd (APL) Stock Update

CMP Rs.246.65 Recommended Action Buy at CMP and add on dips to Rs.215Rs.222 Target Rs.274

February 24, 2014

Time Horizon 12 quarters

Better than expected Q3FY14 numbers APL reported betterthanexpected Q3FY14 results led by strong performance in formulations segment. Given below are some of the key highlights, which we came across while reviewing the results and some other developments. Quarter Financials Consolidated:

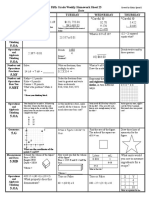

Particulars Gross Sales Domestic Exports Total Excise Duty Net Sales Other operating income Total Operating Income Expenditure Raw Materials Decrease/(increase) in stockintrade & WIP Purchase of traded goods Employees Cost R&D Expenditure Excise Duty Other Expenditure Total Opex Operating Profit OPM % Other Income Interest Exps Depreciation Profit after interest and dep before exceptional items PBTM % Tax Effective Tax Rate % PAT PATM % Q3FY14 274.9 211.8 486.7 1.9 484.9 0.8 485.7 151.4 24.2 48.0 64.2 29.0 0.8 114.3 383.4 102.2 21.1% 0.2 3.5 10.1 88.8 18.3% 22.9 25.8% 65.9 13.6% Q3FY13 254.7 117.4 372.1 3.3 368.8 0.4 369.2 124.2 22.2 48.7 49.5 21.7 3.0 81.0 299.9 69.4 18.8% 3.5 3.9 8.9 60.1 16.3% 11.8 19.7% 48.3 13.1% % Chg 7.9% 80.5% 30.8% 42.5% 31.5% 77.3% 31.5% 21.9% 9.0% 1.4% 29.6% 33.6% 125.2% 41.0% 27.9% 47.4% 94.2% 10.3% 14.4% 47.8% 93.7% 36.6% Q2FY14 286.6 201.1 487.7 1.8 485.9 0.5 486.4 137.6 7.4 59.3 59.3 33.8 2.1 108.9 393.7 92.7 19.1% 0.2 2.6 9.9 80.5 16.6% 18.9 23.4% 61.6 12.7% % Chg 4.1% 5.3% 0.2% 5.6% 0.2% 69.6% 0.1% 10.0% 225.8% 19.1% 8.2% 14.2% 63.5% 4.9% 2.6% 10.3% 0.0% 35.4% 2.7% 10.4% 21.5% 7.0% Q1FY14 244.0 184.8 428.8 2.2 426.6 0.6 427.2 136.0 13.0 49.5 56.4 22.4 0.8 103.7 355.7 71.5 16.8% 0.0 1.5 9.5 60.5 14.2% 13.9 22.9% 46.6 10.9% % Chg 17.4% 8.8% 13.7% 18.8% 13.9% 19.3% 13.9% 1.2% 42.9% 19.8% 5.2% 50.9% 163.3% 5.1% 10.7% 29.7% 900.0% 74.8% 3.4% 33.0% 36.0% 32.2% Q4FY13 236.2 142.1 378.4 1.8 376.6 1.5 378.1 108.1 25.5 33.5 50.8 22.0 1.7 70.9 312.5 65.6 17.4% 0.1 1.8 8.6 55.2 14.7% 11.5 20.9% 43.7 11.6% (Rs. in Cr) % Chg 3.3% 30.0% 13.3% 22.5% 13.3% 62.0% 13.0% 25.8% 151.1% 47.8% 11.0% 1.9% 53.8% 46.2% 13.8% 9.0% 71.4% 19.7% 10.3% 9.6% 20.2% 6.8%

RETAIL RESEARCH

Page | 1

Equity Capital EPS

37.7 3.5

37.7 2.6

0.0% 36.6%

37.7 3.3

0.0% 7.0%

37.7 2.5

0.0% 32.2%

37.7 2.3

0.0% 6.8%

(Source: Company, HDFC sec)

Some observations on Q3FY14 results: Break up of Revenue:

Particulars Formulations Branded Domestic Generic & NSA Branded International International Generics Total Formulation Sales API Sales Export Incentives Total Sales Q3FY14 229.6 27.4 19.7 129.6 406.3 75.6 4.8 486.7 Q3FY13 199.9 27.8 15.0 61.1 303.8 67.0 1.3 372.1 % Chg 14.9% 1.4% 31.3% 112.1% 33.7% 12.8% 269.2% 30.8% Q2FY14 241.0 33.8 14.0 113.7 402.5 78.2 6.6 487.3 % Chg 4.7% 18.9% 40.7% 14.0% 0.9% 3.3% 27.3% 0.1% Q1FY14 195.8 25.4 12.2 85.5 318.9 107.0 2.9 428.8 % Chg 23.1% 32.9% 14.7% 33.0% 26.2% 26.9% 127.6% 13.6% Q4FY13 182.3 25.2 12.9 77.7 298.0 78.7 1.7 378.4 % Chg 7.4% 0.9% 103.8% 156.5% 142.0% 135.4% 475.8% 142.1%

(Source: Company, HDFC sec)

Other Highlights: � Net sales up 31% yoy at Rs.486.7 cr. India Branded formulations sales up by 15% for the quarter at Rs.229.6 cr against Rs.200 cr in Q3FY13. International generics sales were up 112% yoy in Q3FY14 at Rs.129.6 cr. API recorded sales of Rs.75.6 cr in Q3FY14 against Rs.67 cr in Q3FY13, growth of 12.8% yoy. � Share of Specialty segment went up to 52% in Q3 FY 14 from 45% in Q3 FY 13. Growth of 22% in Specialty business came in due to various therapies like Ophthalmology 47% growth, Cardio 34% growth, Nephrology/ Urology 26% growth, Anti Diabetic 28% growth, Gynecology with 30%, Gastro with 14% growth and Orthopedics with 8% growth. Acute business remained stagnant with 9% growth in Cough and Cold and degrowth of 6 % in Anti infective due to NLEM impact. Share of Business on AntiInfective have gone down to 35% in Q3 FY14 from 41% in Q3 FY13 of total India formulation sales. Share of cough and cold have also gone down to 13% Q3 FY14 from 14% in Q3 FY13 of India formulation sales. � APL has grown faster than the industry in November MAT 2013 in all categories (except Cold and cough, anti infectives and orthopaedic). However as the latter categories form a big chunk of the total sales, its market share has improved by 1 bps to 1.76% yoy. However the mix is now inclined to better value added and higher margin products. � Operating margins in Q3FY14 expanded by 230 bps yoy to 21.1% mainly due to better product mix and increased generic sales in international markets. The company is executing structural changes in its portfolio, increasing the formulation contribution and concentrating only on select high margin APIs. � Net profit after tax up by 37% for the quarter at Rs. 659 million visvis Rs. 483 million in corresponding quarter last year. RETAIL RESEARCH Page | 2

� R & D expense for Q3FY14 is Rs.29 cr representing 6% of sales as against Rs.21.7 cr of sales in Q3FY13. � During the quarter 1 ANDA was filed. Cumulative filing of ANDA/NDA stood at 60. APL received 1 ANDA approval during Q3FY14 taking cumulative approvals to 31 (which includes 4 tentative approvals). During the quarter 2 DMFs were filed and cumulative filings of DMFs stood at 64. � The APL management has increased its guidance of growth in the domestic market from 15% to a range of 1518%, though it has refrained from giving growth guidance for the international generics business considering the robust growth seen this fiscal. The management expects at least 25% CAGR in topline over the next 3 years, with margin sustaining at 20% plus. The management is confident of maintaining the current momentum in the international business and doesnt foresee de growth in the same. � Desvenlafaxine rampup is much lower than expectations, but the management expect things to improve going forward as the company has started seeing followup demand. � Capex for the next 2 years is expected at Rs.100 cr mainly on account of maintenance capex. � APL plans to enter frontend business in the US market in future and expects entry by the end of FY15. � The management has indicated launch of at least 810 products in the US market for the next 23 years � According to management, new pricing policy is likely to have negative impact of Rs.2025 cr (22.5% of domestic formulations) on FY14 domestic formulations. � Despite aggressive growth and its relative small size, the company has delivered solid balance sheet performance. APL has already reduced its net Debt/Equity ratio to 0.3x at end of FY13 from 1.2x in FY11. � Domestic market is a key driver for the growth of company; it grew 13.2% yoy in FY13 & contributed ~58% of total revenue. Management expects this business to surpass the industry average growth of 1415% yoy for next few years. In the last 23 years, company has focused on the chronic therapies including Cardio, Diabetology, Gynaec and Ophthalmic. This has resulted in healthy growth of more than 2530% growth in chronic portfolio, which currently contributes almost 50% of domestic formulation business.

Concerns

� APL has been a late entrant in tapping the opportunities in the Regulated markets. Hence, intense competitive pressures could impact its performance. � Dependency on top 5 brands still high: Over the past 34 years the top 5 brands have contributed ~40% to the total sales. So degrowth in any of these brands could adversely impact its financials and profitability. � Forex fluctuations: ~43% of APLs sales comes through exports and any adverse foreign currency fluctuations could affect its earnings.

RETAIL RESEARCH

Page | 3

� New pricing policy: The management indicated that with the coverage of new products in the acute therapy segment, the percentage of products under the DPCO could increase to 35% and this in turn could hurt its financials. � Falling API sales: APLs API sales has been falling continuously over the last few quarters due to competition from China and other sources. This has impacted the API exports, which is also showing degrowth. However APL is making conscious efforts of exiting low margin API sales and instead concentrating on captive consumption (to increase to 50% over 35 years from current 30%) and/or tying up with ANDA & DMF holders for improving the margin profile of its API business. � The company has one approved formulation facility from USFDA (US) and MHRA (UK). Any adverse regulatory decision on this plant could massively impact the companys international business prospects. Conclusion & Recommendation APL reported sales growth of 31.5% yoy to Rs 484.3 cr in Q3FY14, which was above the expectations. Higher sales are attributed to the increased supply from its fully functional Panelav facility which eased the supply constraints. APL, a decade old pharmaceutical company, is a leader in several subsegments of the AntiInfective Therapeutic segment. APL, over the last two to three years, has invested heavily to build a huge pipeline of products for the regulated markets and increase its revenue share in total consolidated revenues. Furthermore, now with greater focus on the chronic segments of the domestic market APL is expected to expand its operating margins by changing its product mix. APL is expected to generate strong operating cash flows, and with no major capex planned, it could reduce its leverage and in turn improve its profitability, which makes it a good value play. It has recently launched Dermatology portfolio and expects to launch overall 2530 products every year in the domestic segment. It also plans to add some new products to its respiratory segment. APL has a pipeline of ANDA. The company has already built infrastructure conforming to the International standards. This is expected to aid the company tap opportunities in the CRAMS segment. 30% of its API capacity is currently used for captive formulations and APL plans to take only high margin API orders. The regulated generics business has lifted the performance in recent times and is expected to continue to do so in the foreseeable future. To ramp up revenues, the company is banking on expansion of its manufacturing capacities which cater to the international business and its generic version of Pfizer's drug Pristiq to gain traction in the US though the drug has recently lost market share. It is also looking at setting up a second US FDA approved facility in India to derisk its business. We are revising our FY14 and FY15 estimates upwards given strong 9MFY14 numbers. At the CMP of Rs.246.65, the stock is trading at 20.6x FY14RE EPS of Rs.12 and 18.3x FY15RE EPS of Rs.13.4. APLs domestic Specialty portfolio grew by ~24% CAGR over FY0813, which resulted in Specialtys contribution to total domestic sales increase to 46% in FY13 (50% in 9MFY14) from negligible levels in 2007. Following the transformation of its domestic portfolio and increasing thrust on exports, APLs stock has been rerated over the past few quarters and may continue to get rerated (albeit at a slower pace).

RETAIL RESEARCH

Page | 4

In our earlier stock updated dated October 4, 2013, we had recommended investors to buy the stock at the then CMP of Rs.142.2 and add on dips to Rs.124136 for a target of Rs.167 over 12 quarters. Post the issue of the report, the stock made a low of Rs.146.75 on October 7, 2013 and achieved the target on October 10, 2013. It made a lifetime high of Rs.253.8 on February 21, 2014. We feel investors could buy the stock at the CMP and add on dips between Rs.215 Rs.222 (14.515x FY15RE EPS) for a target of Rs.274 (18.5x FY15RE EPS) over the next 12 quarters.

Financial Estimates Consolidated:

Particulars Operating Income PBIDT PBIDTM% PAT PATM% EPS PE (x)

* OE Original Estimates, RE Revised Estimates

FY11 1202.1 160.3 13.3% 85.4 7.1% 4.5 54.4

FY12 1466.4 220.4 15.0% 130.1 8.9% 6.9 35.7

FY13 1517.3 252.0 16.6% 165.3 10.9% 8.8 28.1

FY14 (OE)* 1737.3 312.7 18.0% 208.5 12.0% 11.1 22.3

FY14 (RE)* 1820.7 345.9 19.0% 225.8 12.4% 12.0 20.6

FY15 (OE)* 1980.5 352.5 17.8% 233.7 11.8% 12.4 19.9

FY15 (RE)* 2148.4 416.8 19.4% 253.5 11.8% 13.4 18.3

(Source: Annual Report, HDFC sec Estimates)

Analyst: Sneha Venkatraman Automobiles, Cement, Pharmaceuticals & Midcaps

RETAIL RESEARCH Tel: (022) 3075 3400 Fax: (022) 2496 5066 Corporate Office

Email ID: sneha.venkatraman@hdfcsec.com

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Phone: (022) 3075 3400 Fax: (022) 2496 5066 Website: www.hdfcsec.com Email: hdfcsecretailresearch@hdfcsec.com Disclaimer: This document has been prepared by HDFC Securities Limited and is meant for sole use by the recipient and not for circulation. This document is not to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We may have from time to time positions or options on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment banking, or other services for, any company mentioned in this document. This report is intended for non-Institutional Clients

RETAIL RESEARCH

Page | 5

You might also like

- Ogunda MejiDocument14 pagesOgunda Mejicarlosogun89% (27)

- 50 URDU POETRY BOOKS - Best Urdu Books - PDF Format Free Download PDFDocument2 pages50 URDU POETRY BOOKS - Best Urdu Books - PDF Format Free Download PDFcutehina74% (27)

- Tata Steel Application Form PDFDocument4 pagesTata Steel Application Form PDFShashi Kapoor0% (2)

- CLC HR Shared Services Competency Model GuideDocument6 pagesCLC HR Shared Services Competency Model GuideShashi KapoorNo ratings yet

- Alembic Pharmaceuticals Ltd. (APL) (CMP: Rs.142.20) : Stock Update October 04, 2013Document4 pagesAlembic Pharmaceuticals Ltd. (APL) (CMP: Rs.142.20) : Stock Update October 04, 2013A. VenugopalNo ratings yet

- Ajanta Pharma May2015Document15 pagesAjanta Pharma May2015Ajit AjitabhNo ratings yet

- Ajanta Pharma ReportDocument15 pagesAjanta Pharma Reportmayankpant1No ratings yet

- Cipla 4Q FY 2013Document11 pagesCipla 4Q FY 2013Angel BrokingNo ratings yet

- Jubilant Life Sciences (VAMORG) : Margins Solid But Revenue Growth Slips AgainDocument13 pagesJubilant Life Sciences (VAMORG) : Margins Solid But Revenue Growth Slips AgainumaganNo ratings yet

- Target: Rs.185. Alembic Pharmaceuticals LTDDocument8 pagesTarget: Rs.185. Alembic Pharmaceuticals LTDnikunjNo ratings yet

- Marico: Performance HighlightsDocument12 pagesMarico: Performance HighlightsAngel BrokingNo ratings yet

- Aurobindo Pharma: Performance HighlightsDocument11 pagesAurobindo Pharma: Performance HighlightsAngel BrokingNo ratings yet

- Aurobindo Pharma Result UpdatedDocument10 pagesAurobindo Pharma Result UpdatedAngel BrokingNo ratings yet

- Marico Result UpdatedDocument10 pagesMarico Result UpdatedAngel BrokingNo ratings yet

- Alembic Pharma, 1Q FY 2014Document10 pagesAlembic Pharma, 1Q FY 2014Angel BrokingNo ratings yet

- Aurobindo PharmaDocument11 pagesAurobindo PharmaAngel BrokingNo ratings yet

- Jubilant Life Sciences (VAMORG) : Strong Margins Amid Flat RevenuesDocument13 pagesJubilant Life Sciences (VAMORG) : Strong Margins Amid Flat RevenuesumaganNo ratings yet

- Alembic Pharma: Performance HighlightsDocument11 pagesAlembic Pharma: Performance HighlightsAngel BrokingNo ratings yet

- Aurobindo Pharma: Performance HighlightsDocument10 pagesAurobindo Pharma: Performance HighlightsAngel BrokingNo ratings yet

- Aurobindo-1QFY2013RU 10th AugDocument11 pagesAurobindo-1QFY2013RU 10th AugAngel BrokingNo ratings yet

- Aurobindo 4Q FY 2013Document10 pagesAurobindo 4Q FY 2013Angel BrokingNo ratings yet

- Aurobindo, 12th February 2013Document11 pagesAurobindo, 12th February 2013Angel BrokingNo ratings yet

- Research Report SunPharma ICICI DirectDocument13 pagesResearch Report SunPharma ICICI DirectDev MishraNo ratings yet

- Sun Pharma 1QFY2013Document11 pagesSun Pharma 1QFY2013Angel BrokingNo ratings yet

- Sun Pharma: Performance HighlightsDocument11 pagesSun Pharma: Performance HighlightsAngel BrokingNo ratings yet

- Aurobindo Pharma (AURPHA) : in Line Results US Driven Growth ContinuesDocument15 pagesAurobindo Pharma (AURPHA) : in Line Results US Driven Growth Continuesjitendrasutar1975No ratings yet

- Lupin: Performance HighlightsDocument11 pagesLupin: Performance HighlightsAngel BrokingNo ratings yet

- Radico Khaitan: CMP: Inr97 TP: INR 115 BuyDocument6 pagesRadico Khaitan: CMP: Inr97 TP: INR 115 BuyDeepak GuptaNo ratings yet

- Dishman PharmaDocument8 pagesDishman Pharmaapi-234474152No ratings yet

- Alembic Pharma: Performance HighlightsDocument10 pagesAlembic Pharma: Performance HighlightsTirthajit SinhaNo ratings yet

- Aurobindo, 1Q FY 2014Document11 pagesAurobindo, 1Q FY 2014Angel BrokingNo ratings yet

- Rallis India: Performance HighlightsDocument10 pagesRallis India: Performance HighlightsHitechSoft HitsoftNo ratings yet

- Cipla: Performance HighlightsDocument11 pagesCipla: Performance HighlightsAngel BrokingNo ratings yet

- FY16 Mid CapDocument5 pagesFY16 Mid CapAnonymous W7lVR9qs25No ratings yet

- Dishman Pharmaceuticals: Performance HighlightsDocument10 pagesDishman Pharmaceuticals: Performance HighlightsAngel BrokingNo ratings yet

- Indoco Remedies: Performance HighlightsDocument11 pagesIndoco Remedies: Performance HighlightsAngel BrokingNo ratings yet

- Cipla LTD: Key Financial IndicatorsDocument4 pagesCipla LTD: Key Financial IndicatorsMelwyn MathewNo ratings yet

- Alembic Pharma Result UpdatedDocument9 pagesAlembic Pharma Result UpdatedAngel BrokingNo ratings yet

- Cadila Healthcare, 12th February 2013Document12 pagesCadila Healthcare, 12th February 2013Angel BrokingNo ratings yet

- ITC - HDFC Securities - May 2011Document6 pagesITC - HDFC Securities - May 2011Arpit TripathiNo ratings yet

- Godrej Consumer Products: Performance HighlightsDocument11 pagesGodrej Consumer Products: Performance HighlightsAngel BrokingNo ratings yet

- Cipla: Performance HighlightsDocument11 pagesCipla: Performance HighlightsAngel BrokingNo ratings yet

- Sun Pharma: Performance HighlightsDocument12 pagesSun Pharma: Performance HighlightsAngel BrokingNo ratings yet

- V-Guard Industries: CMP: INR523 TP: INR650 BuyDocument10 pagesV-Guard Industries: CMP: INR523 TP: INR650 BuySmriti SrivastavaNo ratings yet

- UPL, 30th January 2013Document11 pagesUPL, 30th January 2013Angel BrokingNo ratings yet

- Cadila Healthcare Result UpdatedDocument12 pagesCadila Healthcare Result UpdatedAngel BrokingNo ratings yet

- Marico 4Q FY 2013Document11 pagesMarico 4Q FY 2013Angel BrokingNo ratings yet

- Tata Motors (TELCO) : Domestic Business Reports Positive Margins!Document12 pagesTata Motors (TELCO) : Domestic Business Reports Positive Margins!pgp28289No ratings yet

- Ipca Labs: Performance HighlightsDocument11 pagesIpca Labs: Performance HighlightsAngel BrokingNo ratings yet

- Hul 2qfy2013ruDocument12 pagesHul 2qfy2013ruAngel BrokingNo ratings yet

- Cadila Healthcare: Performance HighlightsDocument12 pagesCadila Healthcare: Performance HighlightsAngel BrokingNo ratings yet

- Ratio Analysis Project On Lupin Pharmaceutical CompanyDocument93 pagesRatio Analysis Project On Lupin Pharmaceutical CompanyShilpa Reddy50% (2)

- Asian Paints 4Q FY 2013Document10 pagesAsian Paints 4Q FY 2013Angel BrokingNo ratings yet

- Unichem Fullerton April 13Document8 pagesUnichem Fullerton April 13vicky168No ratings yet

- Market Outlook 9th August 2011Document6 pagesMarket Outlook 9th August 2011Angel BrokingNo ratings yet

- Cadila Healthcare Result UpdatedDocument12 pagesCadila Healthcare Result UpdatedAngel BrokingNo ratings yet

- Dr. Reddy's Laboratories Result UpdatedDocument11 pagesDr. Reddy's Laboratories Result UpdatedAngel BrokingNo ratings yet

- Cadila, 1Q FY 2014Document12 pagesCadila, 1Q FY 2014Angel BrokingNo ratings yet

- Dishman 4Q FY 2013Document10 pagesDishman 4Q FY 2013Angel BrokingNo ratings yet

- Vivimed Labs: Good Times Ahead, Attractive Valuations Initiating, With A BuyDocument20 pagesVivimed Labs: Good Times Ahead, Attractive Valuations Initiating, With A Buyapi-234474152No ratings yet

- Amino Acids & Intermediates Applications World Summary: Market Values & Financials by CountryFrom EverandAmino Acids & Intermediates Applications World Summary: Market Values & Financials by CountryNo ratings yet

- Chemicals & Allied Products Miscellaneous Wholesale Lines World Summary: Market Values & Financials by CountryFrom EverandChemicals & Allied Products Miscellaneous Wholesale Lines World Summary: Market Values & Financials by CountryNo ratings yet

- Cosmetology & Barber School Revenues World Summary: Market Values & Financials by CountryFrom EverandCosmetology & Barber School Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Chemical Analysis & Testing World Summary: Market Values & Financials by CountryFrom EverandChemical Analysis & Testing World Summary: Market Values & Financials by CountryNo ratings yet

- 11 Years of Supreme Court On Employer-Employee Relations About 400 One Liner Judgments (1990-2007Document33 pages11 Years of Supreme Court On Employer-Employee Relations About 400 One Liner Judgments (1990-2007Shashi KapoorNo ratings yet

- Wockhardt: CMP: INR440Document4 pagesWockhardt: CMP: INR440Shashi KapoorNo ratings yet

- Eicher Sells 2244 Units in Nov 2013: The Following Are The Key Highlights For Nov 2013Document1 pageEicher Sells 2244 Units in Nov 2013: The Following Are The Key Highlights For Nov 2013Shashi KapoorNo ratings yet

- ICICI Securities Limited: ParticularsDocument2 pagesICICI Securities Limited: ParticularsShashi KapoorNo ratings yet

- A Study of Talent Management As A Strategic Tool For The Organization in Selected Indian IT CompaniesDocument10 pagesA Study of Talent Management As A Strategic Tool For The Organization in Selected Indian IT CompaniesShashi KapoorNo ratings yet

- DM QuestionnaireDocument2 pagesDM QuestionnaireShashi KapoorNo ratings yet

- PMS Quiz On 24 Leadership Mail To Mulla Mulla Assignment Pending On This Thursday Sarla Assignment Deadline 3 MarchDocument1 pagePMS Quiz On 24 Leadership Mail To Mulla Mulla Assignment Pending On This Thursday Sarla Assignment Deadline 3 MarchShashi KapoorNo ratings yet

- Tentative Schedule12062013Document1 pageTentative Schedule12062013Shashi KapoorNo ratings yet

- Farewell Party:) : Assignment Date/DeadlineDocument2 pagesFarewell Party:) : Assignment Date/DeadlineShashi KapoorNo ratings yet

- Q.1. Critically Discuss Gandhi and Nehru's Idea of India'Document11 pagesQ.1. Critically Discuss Gandhi and Nehru's Idea of India'Shashi KapoorNo ratings yet

- Indianivesh Securities Private Limited: Balanced Aggressive ConservativeDocument9 pagesIndianivesh Securities Private Limited: Balanced Aggressive ConservativeShashi KapoorNo ratings yet

- Shri Ram Centre For Industrial Relations and Human ResourcesDocument21 pagesShri Ram Centre For Industrial Relations and Human ResourcesShashi KapoorNo ratings yet

- 04 Simple AnovaDocument9 pages04 Simple AnovaShashi KapoorNo ratings yet

- WWW Sociologyguide Com 3Document1 pageWWW Sociologyguide Com 3Shashi KapoorNo ratings yet

- Department of Education: Schools Division of Puerto Princesa CityDocument5 pagesDepartment of Education: Schools Division of Puerto Princesa Cityjinky p.paloma100% (1)

- Finance and Development - December 2021 IssueDocument72 pagesFinance and Development - December 2021 IssueNamitha ThomasNo ratings yet

- Region Xiii and Barmm CuisineDocument5 pagesRegion Xiii and Barmm Cuisinejingalejo13No ratings yet

- Tourism Product DevelopmentDocument4 pagesTourism Product DevelopmentK GreyNo ratings yet

- Times Leader 09-02-2012Document75 pagesTimes Leader 09-02-2012The Times LeaderNo ratings yet

- Mythology and Folklore DDocument10 pagesMythology and Folklore DNhor Halil QuibelNo ratings yet

- 3 13 17weekly Homework Sheet Week 25 - 5th Grade - CcssDocument2 pages3 13 17weekly Homework Sheet Week 25 - 5th Grade - Ccssapi-328344919No ratings yet

- READING CompilationDocument46 pagesREADING CompilationIshan IsmethNo ratings yet

- Norris (Harry) - Ibn Battuta On Muslims and Christians in The Crimean Peninsula (Iran & The Caucasus 8:1, 2004, 7-14)Document9 pagesNorris (Harry) - Ibn Battuta On Muslims and Christians in The Crimean Peninsula (Iran & The Caucasus 8:1, 2004, 7-14)juanpedromolNo ratings yet

- Admixtures For Concrete, Mortar and Grout - Part 2: Concrete Admixtures - Definitions, Requirements, Conformity, Marking and LabellingDocument7 pagesAdmixtures For Concrete, Mortar and Grout - Part 2: Concrete Admixtures - Definitions, Requirements, Conformity, Marking and LabellingKELVIN NGUGINo ratings yet

- Cream Rather, Quantity by Marketplace. So Many Buyers and So Many Sellers That Each Has Offering Going and He WillDocument2 pagesCream Rather, Quantity by Marketplace. So Many Buyers and So Many Sellers That Each Has Offering Going and He WillROHIT GOYAL 2123531No ratings yet

- FortiManager 7.4 Administrator Exam DescriptionDocument3 pagesFortiManager 7.4 Administrator Exam DescriptionEdmar Souza0% (1)

- SC ST ActDocument3 pagesSC ST ActaadityaNo ratings yet

- Who Is Consumer - David Oughton Dan John LowryDocument11 pagesWho Is Consumer - David Oughton Dan John LowryHelga ImadaNo ratings yet

- Pine Q6Document4 pagesPine Q6Keith WaldenNo ratings yet

- Chad Black Incident ReportDocument21 pagesChad Black Incident ReportWilliam N. GriggNo ratings yet

- Review Exercise: Problem 1-15: Ananda Maharani Xii - Ips 3 B. InggrisDocument2 pagesReview Exercise: Problem 1-15: Ananda Maharani Xii - Ips 3 B. InggrisAnanda MaharaniNo ratings yet

- Interventionism in Angola, The Role of IdeologyDocument13 pagesInterventionism in Angola, The Role of IdeologyAlexandre ReisNo ratings yet

- Filipino First PolicyDocument3 pagesFilipino First PolicyEileen Eika Dela Cruz-LeeNo ratings yet

- Ingles SenatiDocument1 pageIngles SenatiKevin HuatayNo ratings yet

- Equine RadiographyDocument39 pagesEquine RadiographyGarry LasagaNo ratings yet

- Agent/ Intermediary Name and Code:POLICYBAZAAR INSURANCE BROKERS PRIVATE LIMITED BRC0000434Document3 pagesAgent/ Intermediary Name and Code:POLICYBAZAAR INSURANCE BROKERS PRIVATE LIMITED BRC0000434hiteshmohakar15No ratings yet

- Jirga System in Tribal LifeDocument11 pagesJirga System in Tribal Lifegurbatt100% (2)

- Dur - Ernakulam ReportDocument141 pagesDur - Ernakulam ReportArun SasiNo ratings yet

- Powerpoint Grade 5Document41 pagesPowerpoint Grade 5Cheenee RiveraNo ratings yet

- đề định kìDocument6 pagesđề định kìNgọc Liên VănNo ratings yet

- Taller Capítulo I, Inglés I (10) Marcell Piraquive Gómez 80002983 24 de Abril de 2013Document5 pagesTaller Capítulo I, Inglés I (10) Marcell Piraquive Gómez 80002983 24 de Abril de 2013erickdavidg100% (1)

- Abenezer PaperDocument31 pagesAbenezer Paperabayneh aberaNo ratings yet