ch03 Part3

ch03 Part3

Uploaded by

Sergio HoffmanCopyright:

Available Formats

ch03 Part3

ch03 Part3

Uploaded by

Sergio HoffmanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

ch03 Part3

ch03 Part3

Uploaded by

Sergio HoffmanCopyright:

Available Formats

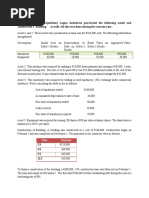

EXERCISE 3-2 (1015 minutes)

Wanda Landowska Company

Trial Balance

April 30, 2014

Debit

Cash ....................................................................... $ 4,800

Accounts Receivable ............................................

2,750

Prepaid Insurance ($700 + $100) ..........................

800

Equipment..............................................................

8,000

Accounts Payable ($4,500 $100) .......................

Property Taxes Payable ........................................

Owners Capital ($11,200 + $1,500) ...........................

Owners Drawing....................................................

1,500

Service Revenue....................................................

Salaries and Wages Expense ...............................

4,200

Advertising Expense ($1,100 + $300) ...................

1,400

Property Tax Expense ($800 + $100) ....................

900

$24,350

Credit

$ 4,400

560

12,700

6,690

$24,350

EXERCISE 3-3 (1520 minutes)

The ledger accounts are reproduced below, and corrections are shown in

the accounts.

Bal.

(1)

Cash

5,912 (4)

450

190

Accounts Receivable

Bal.

5,240 (1)

450

Bal.

Supplies

2,967

Copyright 2013 John Wiley & Sons, Inc.

Accounts Payable

Bal.

7,044

Common Stock

Bal.

8,000

Retained Earnings

Bal.

2,000

Kieso, Intermediate Accounting, 15/e, Solutions Manual

(For Instructor Use Only)

3-13

EXERCISE 3-3 (Continued)

Bal.

(2)

Equipment

6,100

3,200

Bal.

Service Revenue

Bal.

(3)

(5)

5,200

2,025

80

Office Expense

4,320 (2)

3,200

Blues Traveler Corporation

Trial Balance (corrected)

April 30, 2014

Debit

Cash ...................................................................... $ 6,172

Accounts Receivable ...........................................

4,790

Supplies ................................................................

2,967

Equipment .............................................................

9,300

Accounts Payable.................................................

Common Stock .....................................................

Retained Earnings ................................................

Service Revenue ...................................................

Office Expense .....................................................

1,120

$24,349

3-14

Copyright 2013 John Wiley & Sons, Inc.

Kieso, Intermediate Accounting, 15/e, Solutions Manual

Credit

$ 7,044

8,000

2,000

7,305

$24,349

(For Instructor Use Only)

EXERCISE 3-4 (1015 minutes)

Watteau Co.

Trial Balance

June 30, 2014

Debit

Cash ($2,870 + $180 $65 $65) ..................................... $ 2,920

Accounts Receivable ($3,231 $180) ..............................

3,051

Supplies ($800 $500) ......................................................

300

Equipment ($3,800 + $500) ...............................................

4,300

Accounts Payable ($2,666 $206 $260)........................

Unearned Service Revenue ($1,200 $325) ....................

Common Stock ..................................................................

Dividends ...........................................................................

575

Retained Earnings .............................................................

Service Revenue ($2,380 + $801 + $325)..........................

Salaries and Wages Expense ($3,400 + $670 $575) .....

3,495

Office Expense ..................................................................

940

$15,581

Credit

$ 2,200

875

6,000

3,000

3,506

$15,581

EXERCISE 3-5 (1015 minutes)

1.

2.

3.

4.

5.

Depreciation Expense ($250 X 3) .............................

Accumulated DepreciationEquipment ..........

750

Unearned Rent Revenue ($9,300 X 1/3)....................

Rent Revenue .....................................................

3,100

Interest Expense........................................................

Interest Payable .................................................

500

Supplies Expense......................................................

Supplies ($2,800 $850) ....................................

1,950

Insurance Expense ($300 X 3) ..................................

Prepaid Insurance ..............................................

900

Copyright 2013 John Wiley & Sons, Inc.

Kieso, Intermediate Accounting, 15/e, Solutions Manual

750

3,100

500

1,950

900

(For Instructor Use Only)

3-15

EXERCISE 3-6 (1015 minutes)

1.

2.

3.

4.

5.

Accounts Receivable .....................................................

Service Revenue .....................................................

750

Utilities Expenses ...........................................................

Accounts Payable ...................................................

520

Depreciation Expense ....................................................

Accumulated Depreciation Equipment ...............

400

Interest Expense .............................................................

Interest Payable.......................................................

500

Insurance Expense ($12,000 X 1/12) .............................

Prepaid Insurance ...................................................

1,000

Supplies Expense ($1,600 $500) .................................

Supplies ...................................................................

1,100

750

520

400

500

1,000

1,100

EXERCISE 3-7 (1520 minutes)

(a)

Ending balance of supplies

Add: Adjusting entry

Deduct: Purchases

Beginning balance of supplies

(b)

Total prepaid insurance

Amount used (6 X $400)

Present balance

$700

950

850

$800

$4,800

2,400

$2,400

($400 X 12)

The policy was purchased six months ago (August 1, 2013)

(c)

The entry in January to record salary and wages expense was

Salaries and Wages Expense ..............................

Salaries and Wages Payable ...............................

Cash ................................................................

3-16

Copyright 2013 John Wiley & Sons, Inc.

1,800

700

Kieso, Intermediate Accounting, 15/e, Solutions Manual

2,500

(For Instructor Use Only)

EXERCISE 3-7 (Continued)

The T account for salaries payable is

Salaries and Wages Payable

Paid

700 Beg. Bal.

?

January

End Bal.

800

The beginning balance is therefore

(d)

Ending balance of salaries and wages payable

Plus: Reduction of salaries and wages payable

Beginning balance of salaries and wages payable

$ 800

700

$1,500

Service revenue

Cash received

Unearned revenue reduced

$2,000

1,600

$ 400

Ending unearned revenue January 31, 2014

Plus: Unearned revenue reduced

Beginning unearned revenue December 31, 2013

$ 750

400

$1,150

EXERCISE 3-8 (1015 minutes)

1.

2.

3.

4.

Salaries and Wages Expense .........................................

Salaries and Wages Payable ...................................

1,900

Utilities Expense..............................................................

Accounts Payable ....................................................

600

Interest Expense ($30,000 X 8% X 1/12) .........................

Interest Payable .......................................................

200

Telephone and Internet Expense ...................................

Accounts Payable ....................................................

117

Copyright 2013 John Wiley & Sons, Inc.

Kieso, Intermediate Accounting, 15/e, Solutions Manual

1,900

600

200

(For Instructor Use Only)

117

3-17

EXERCISE 3-9 (1520 minutes)

(a)

10/15

10/17

10/20

(b)

10/31

10/31

10/31

10/31

3-18

Salaries and Wages Expense...........................

Cash ...........................................................

(To record payment of October 15

payroll)

800

Accounts Receivable ........................................

Service Revenue ........................................

(To record revenue for services

performed for which payment has

not yet been received)

2,400

Cash ...................................................................

Unearned Service Revenue ......................

(To record receipt of cash for

services not yet performed)

650

Supplies Expense .............................................

Supplies .....................................................

(To record the use of supplies during

October)

470

Accounts Receivable ........................................

Service Revenue ........................................

(To record revenue for services

performed for which payment has

not yet been received)

1,650

Salaries and Wages Expense...........................

Salaries and Wages Payable ....................

(To record liability for accrued payroll)

600

Unearned Service Revenue ..............................

Service Revenue ........................................

(To reduce the Unearned Service

Revenue account for service that

has been performed)

400

Copyright 2013 John Wiley & Sons, Inc.

Kieso, Intermediate Accounting, 15/e, Solutions Manual

800

2,400

650

470

1,650

600

400

(For Instructor Use Only)

You might also like

- Liquor Licence ProceduresDocument4 pagesLiquor Licence Proceduresrovinswamy7714100% (1)

- Group Assigment CA MATCHA CREATIONSDocument8 pagesGroup Assigment CA MATCHA CREATIONSHoàng Hải Quyên100% (1)

- ch03 Part9Document6 pagesch03 Part9Sergio HoffmanNo ratings yet

- Cost Accounting Quiz 3Document4 pagesCost Accounting Quiz 3Tayyaba KhalidNo ratings yet

- HW Session 5Document3 pagesHW Session 5Tiffany KimNo ratings yet

- Soal Quiz 2020Document6 pagesSoal Quiz 2020Rifka Novriani0% (1)

- Chapter 5 - Activity Based Costing ProblemsDocument18 pagesChapter 5 - Activity Based Costing ProblemsAmir ContrerasNo ratings yet

- Weygandt FA PPB Ch3 v2 PDFDocument34 pagesWeygandt FA PPB Ch3 v2 PDFMuhammad SherazNo ratings yet

- Chapter 7Document28 pagesChapter 7Shibly SadikNo ratings yet

- Contoh-Soal-Managerial-Accounting BinusDocument7 pagesContoh-Soal-Managerial-Accounting Binuswiwinsusiani1991No ratings yet

- Belinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To TheDocument1 pageBelinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To ThebelindaNo ratings yet

- Exercises Chapter1Document4 pagesExercises Chapter1Huyen Siu NhưnNo ratings yet

- Ex 16 - 5 SolutionDocument1 pageEx 16 - 5 SolutionWepa AkiyewNo ratings yet

- Assignment Week 4 Hal 205Document1 pageAssignment Week 4 Hal 205Pinarasrayan HaqueNo ratings yet

- Spoilage, Rework, and Scrap 18-21 (30 Min.) Weighted-Average Method, SpoilageDocument8 pagesSpoilage, Rework, and Scrap 18-21 (30 Min.) Weighted-Average Method, SpoilageMichael Christsanto ImanuelNo ratings yet

- Chapter4 Cost AllocationDocument14 pagesChapter4 Cost AllocationNetsanet BelayNo ratings yet

- Mock Test 201 KeyDocument12 pagesMock Test 201 Keydengdeng2211No ratings yet

- Disposals and DepreciationDocument31 pagesDisposals and DepreciationKatarame LermanNo ratings yet

- CH 10 SMDocument17 pagesCH 10 SMapi-267019092No ratings yet

- Tugas Managerial Accounting Sesi 4Document3 pagesTugas Managerial Accounting Sesi 4Breneta TanNo ratings yet

- Cost-Volume-Profit: Prepared by Meifida IlyasDocument64 pagesCost-Volume-Profit: Prepared by Meifida IlyasDixi AndriantoNo ratings yet

- Akuntansi Biaya - Tugas E4-23Document3 pagesAkuntansi Biaya - Tugas E4-23Rizkya Ajrin ArtameviaNo ratings yet

- Accounting 1Document11 pagesAccounting 1Audie yanthiNo ratings yet

- Bab 8 Costing by Product and Joint ProductDocument4 pagesBab 8 Costing by Product and Joint ProductBudy_Arto_6600No ratings yet

- Exercise Chap 10Document5 pagesExercise Chap 10JF FNo ratings yet

- Akn p5 3a Pa1Document10 pagesAkn p5 3a Pa1Alche MistNo ratings yet

- Chapter 1 Beams 13ed RevisedDocument32 pagesChapter 1 Beams 13ed RevisedEvan AnwariNo ratings yet

- Solutions Ch. 7 ABCDocument11 pagesSolutions Ch. 7 ABCThanawat PHURISIRUNGROJNo ratings yet

- CH 14 SMDocument21 pagesCH 14 SMRyan James B. Aban100% (1)

- Tugas Hutang Jangka Panjang - Nur Vina 2011070599Document3 pagesTugas Hutang Jangka Panjang - Nur Vina 2011070599muhammad fadillahNo ratings yet

- UntitledDocument7 pagesUntitledVijay SinghNo ratings yet

- LoBianco Company's Record of Transactions For The Month of April Was As Follows.Document4 pagesLoBianco Company's Record of Transactions For The Month of April Was As Follows.quizlet710No ratings yet

- Chapter 3Document6 pagesChapter 3Pauline Keith Paz ManuelNo ratings yet

- Warren SM - Ch.01 - Final PDFDocument54 pagesWarren SM - Ch.01 - Final PDFyoshe lauraNo ratings yet

- FACTORY OVERHEAD Discussion-DDocument11 pagesFACTORY OVERHEAD Discussion-DMaviel SuaverdezNo ratings yet

- Exercise Chap 3Document28 pagesExercise Chap 3JF FNo ratings yet

- 2009-12-06 064119 StarkeyDocument5 pages2009-12-06 064119 StarkeyAnne KatNo ratings yet

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Document3 pagesBINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Audrey NataliaNo ratings yet

- Latihan Soal Materi Final TestDocument24 pagesLatihan Soal Materi Final TestCarissaNo ratings yet

- Chapter 2 The Is - LM ModelDocument73 pagesChapter 2 The Is - LM ModelHải Yến NguyễnNo ratings yet

- Tugas 13 InvestmentDocument6 pagesTugas 13 InvestmentLenrik AbcNo ratings yet

- An Introduction To Cost Terms and Purposes Homework 2-42, 46 2-42 Income Statement and Schedule of Cost of Goods Manufactured. Chan's ManufacturingDocument3 pagesAn Introduction To Cost Terms and Purposes Homework 2-42, 46 2-42 Income Statement and Schedule of Cost of Goods Manufactured. Chan's ManufacturingCheuk Wai YEUNGNo ratings yet

- Soal AKMDocument4 pagesSoal AKMIlham Syukrillah0% (1)

- Corporate FinanceDocument5 pagesCorporate FinancejahidkhanNo ratings yet

- Assignment No.2 206Document5 pagesAssignment No.2 206Halimah SheikhNo ratings yet

- Revision ch3 1thDocument18 pagesRevision ch3 1thYousefNo ratings yet

- Evan and Brett Are Students at Berkeley CollegeDocument3 pagesEvan and Brett Are Students at Berkeley CollegeElliot RichardNo ratings yet

- Assume The FollowingDocument3 pagesAssume The FollowingElliot RichardNo ratings yet

- Group # Name:: 3 Lucy VanDocument16 pagesGroup # Name:: 3 Lucy VanNgoc Tram VanNo ratings yet

- Mind Map Job Order CostingDocument1 pageMind Map Job Order CostingAndhika Bella PrawitasariNo ratings yet

- Soal Dapit TGL 4Document6 pagesSoal Dapit TGL 4Novi RofaNo ratings yet

- Kunjaw AkbDocument6 pagesKunjaw AkbdindaNo ratings yet

- Bab 4 Cost System and Cost AccumulationDocument6 pagesBab 4 Cost System and Cost AccumulationAndi SupenoNo ratings yet

- Solution Manual For Accounting Tools For Business Decision Makers 4th Edition by KimmelDocument18 pagesSolution Manual For Accounting Tools For Business Decision Makers 4th Edition by KimmelKristine AstilleroNo ratings yet

- Forum 02 AKL - Resty Arum Pambayu P - 43218010091Document20 pagesForum 02 AKL - Resty Arum Pambayu P - 43218010091Nayla LukitaNo ratings yet

- E10 16Document1 pageE10 16september manisNo ratings yet

- Chapter 3- WORKSHEET 2 (1)Document3 pagesChapter 3- WORKSHEET 2 (1)lilianjammal2005No ratings yet

- Extra Applications - Lecture Week 8 - Part 1Document8 pagesExtra Applications - Lecture Week 8 - Part 1monatalat.4iNo ratings yet

- Chapter 3 Act310Document26 pagesChapter 3 Act310Shibly SadikNo ratings yet

- Accounting Applications - Part 9 - Lecture 6Document7 pagesAccounting Applications - Part 9 - Lecture 6Ahmed Mostafa ElmowafyNo ratings yet

- ch03 Part4Document6 pagesch03 Part4Sergio HoffmanNo ratings yet

- 8Document3 pages8Sergio HoffmanNo ratings yet

- Sociology DefinitionsDocument21 pagesSociology DefinitionsSergio HoffmanNo ratings yet

- 5Document3 pages5Sergio HoffmanNo ratings yet

- 7Document3 pages7Sergio HoffmanNo ratings yet

- 3Document4 pages3Sergio HoffmanNo ratings yet

- ch03 Part6Document6 pagesch03 Part6Sergio HoffmanNo ratings yet

- 4Document4 pages4Sergio HoffmanNo ratings yet

- 2Document4 pages2Sergio HoffmanNo ratings yet

- 1Document4 pages1Sergio HoffmanNo ratings yet

- ch03 Part10Document6 pagesch03 Part10Sergio HoffmanNo ratings yet

- MKT 301 CH 5 Quiz ReviewDocument4 pagesMKT 301 CH 5 Quiz ReviewSergio HoffmanNo ratings yet

- ch03 Part7Document6 pagesch03 Part7Sergio HoffmanNo ratings yet

- ch02 Part4Document6 pagesch02 Part4Sergio HoffmanNo ratings yet

- ch6 MKT 301 Quiz ReviewDocument4 pagesch6 MKT 301 Quiz ReviewSergio HoffmanNo ratings yet

- ch03 Part1Document6 pagesch03 Part1Sergio HoffmanNo ratings yet

- ch9 MKT 301 Quiz ReviewDocument4 pagesch9 MKT 301 Quiz ReviewSergio HoffmanNo ratings yet

- MKT 301 CH 5 Quiz ReviewDocument4 pagesMKT 301 CH 5 Quiz ReviewSergio HoffmanNo ratings yet

- Advert Assistant Branch Manager Mto Wa Mbu 2Document5 pagesAdvert Assistant Branch Manager Mto Wa Mbu 2Rashid BumarwaNo ratings yet

- Affidavit of Good FaithDocument1 pageAffidavit of Good FaithGerrick BalberanNo ratings yet

- Garcia vs. Court of AppealsDocument12 pagesGarcia vs. Court of AppealsJoannah SalamatNo ratings yet

- Alamayri v. Pabale ESCRADocument25 pagesAlamayri v. Pabale ESCRAMHERITZ LYN LIM MAYOLANo ratings yet

- Tootgarook Garland ProjectDocument1 pageTootgarook Garland Projectlea720louNo ratings yet

- Nit 2018 PWD 157971 1Document244 pagesNit 2018 PWD 157971 1Anil KumarNo ratings yet

- Commercial Property Rental Agreement FormatDocument5 pagesCommercial Property Rental Agreement FormatDivya ChettiyarNo ratings yet

- Fire CertificateDocument1 pageFire CertificatevijaycarewaNo ratings yet

- Moro ProblemDocument56 pagesMoro ProblemIcas Phils100% (1)

- WP 5819 PDFDocument18 pagesWP 5819 PDFgheodanNo ratings yet

- Grupo Bimbo Investor Presentation 1Q18Document21 pagesGrupo Bimbo Investor Presentation 1Q18LauraNo ratings yet

- ColregDocument1 pageColregabd manafNo ratings yet

- Fidic Short Product List: Soft - Eur Hard - EurDocument2 pagesFidic Short Product List: Soft - Eur Hard - EurEticala RohithNo ratings yet

- Week 2 - Fabm 1 - Accounting Cycle of A Merchandising BusinessDocument19 pagesWeek 2 - Fabm 1 - Accounting Cycle of A Merchandising BusinessSheila Marie Ann Magcalas-Galura100% (1)

- Unity Cloud Analytics PDFDocument1 pageUnity Cloud Analytics PDFEnder PınarbaşıNo ratings yet

- Accounting (7707) Topic WiseDocument3 pagesAccounting (7707) Topic WisehafsahNo ratings yet

- Odisha Development Authorities (Common Application Form) Rules, 2016Document59 pagesOdisha Development Authorities (Common Application Form) Rules, 2016Sambit ShovanNo ratings yet

- Bankers Adda - Quiz On Currency & Capital For IBPS PO 4 ExamDocument8 pagesBankers Adda - Quiz On Currency & Capital For IBPS PO 4 Examsoumya1234paniNo ratings yet

- KYC FormDocument3 pagesKYC Formkrsujit385No ratings yet

- Affidavit - Cum - Undertaking: DeponentDocument1 pageAffidavit - Cum - Undertaking: Deponentarjun 2008No ratings yet

- Philippine Laws On ConservationDocument2 pagesPhilippine Laws On ConservationDanize Kate GimenoNo ratings yet

- Quintanar V Cocacola G.R. No. 210565 June 28 2016Document6 pagesQuintanar V Cocacola G.R. No. 210565 June 28 2016Rovemy LabistoNo ratings yet

- Acca FeesDocument3 pagesAcca Feesdude devilNo ratings yet

- Uttar Pradesh Shops & Commercial Est ActDocument12 pagesUttar Pradesh Shops & Commercial Est ActRajeev ChaudharyNo ratings yet

- Class Case 2 - Browning Manufacturing CompanyDocument5 pagesClass Case 2 - Browning Manufacturing Company9ry5gsghybNo ratings yet

- Associated Labor Unions V. Pura Ferrer-Calleja, Et Al. G.R. No. 85085 November 6, 1989Document1 pageAssociated Labor Unions V. Pura Ferrer-Calleja, Et Al. G.R. No. 85085 November 6, 1989EdvangelineManaloRodriguezNo ratings yet

- LATHAM & WATKINS LLP v. EVERSON - Document No. 3Document5 pagesLATHAM & WATKINS LLP v. EVERSON - Document No. 3Justia.comNo ratings yet

- Transfer of An Actionable ClaimDocument5 pagesTransfer of An Actionable Claimusman soomroNo ratings yet

- (Temporary Draft) Republican Party of Texas Rules Report - (2014 Republican Party of Texas State Convention)Document33 pages(Temporary Draft) Republican Party of Texas Rules Report - (2014 Republican Party of Texas State Convention)Anonymous JrBgIxNo ratings yet