0 ratings0% found this document useful (0 votes)

352 viewsExercises Chapter1

1) The document contains sample journal entries for various investments including purchases of bonds and stocks, recording of interest received, and adjustments for fair value changes.

2) Sample entries include recording of bond purchases and interest received over multiple years using straight-line and effective interest methods.

3) Entries also show purchases of various stocks, the sale of one stock, and the year-end adjustment to record unrealized gains and losses on the investment portfolio.

Uploaded by

Huyen Siu NhưnCopyright

© © All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0 ratings0% found this document useful (0 votes)

352 viewsExercises Chapter1

1) The document contains sample journal entries for various investments including purchases of bonds and stocks, recording of interest received, and adjustments for fair value changes.

2) Sample entries include recording of bond purchases and interest received over multiple years using straight-line and effective interest methods.

3) Entries also show purchases of various stocks, the sale of one stock, and the year-end adjustment to record unrealized gains and losses on the investment portfolio.

Uploaded by

Huyen Siu NhưnCopyright

© © All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

You are on page 1/ 4

Exercises_chapter 1 : INVESTMENTS

Name: Nguyễn Thị Thanh Huyền

Class: 42K06.1

******************

E17-2:(Entries for Held-to-Maturity Securities) On January 1, 2013, Dagwood

Company purchased at par 12% bonds having a maturity value of $300,000. They

are dated January 1, 2013, and mature January 1, 2018, with interest receivable

December 31 of each year. The bonds are classified in the held-to-maturity category.

Instructions

(a) Prepare the journal entry at the date of the bond purchase.

(b) Prepare the journal entry to record the interest received for 2013.

(c) Prepare the journal entry to record the interest received for 2014.

Answer :

a) DR: Debt Investments 300,000

CR: Cash 300,000

b) DR: Cash 36,000 (300,000*12%)

CR: Interest Revenue 36,000

c) DR: Cash 36,000

CR: Interest Revenue 36,000

E17-5:(Effective-Interest versus Straight-Line Bond Amortization) On January

1,2013, Phantom Company acquires $200,000 of Spiderman Products, Inc., 9%

bonds at a price of $185,589. The interest is payable each December 31, and the

bonds mature December 31, 2015. The investment will provide Phantom Company a

12% yield. The bonds are classified as held-to-maturity.

Instructions

(a) Prepare a 3-year schedule of interest revenue and bond discount amortization,

applying the straight-line method.

(b) Prepare a 3-year schedule of interest revenue and bond discount amortization,

applying the effective-interest method.

(c) Prepare the journal entry for the interest receipt of December 31, 2014, and the

discount amortiza-tion under the straight-line method.

(d) Prepare the journal entry for the interest receipt of December 31, 2014, and the

discount amortiza-tion under the effective-interest method.

Answer:

a)

Date Cash received Interest Bond discount Carrying amount

revenue amortization of bonds

Jan 1, 2013 185,589

Dec 31, 2013 18,000 22,804 4,804 190,393

Dec 31, 2014 18,000 22,804 4,804 195,197

Dec 31, 2015 18,000 22,803 4,803 200,000

b)

Date Cash Interest Bond discount Carrying amount

received revenue amortization of bonds

Jan 1, 2013 185,589

Dec 31, 2013 18,000 22,270.68 4,270.68 189,859.68

Dec 31, 2014 18,000 22,783.16 4,783.16 194,642.84

Dec 31, 2015 18,000 23,357.16 5,357.16 200,000

c)

DR: Cash 18,000

DR: Debt Investment- Held to Maturity 4,804

CR: Intrest Revenue 22,804

d)

DR: Cash 18,000

DR: Debt Investment- Held to Maturity 4,783.16

CR: Intrest Revenue 22,783.16

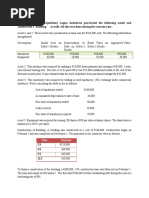

E17-7: (Trading Securities Entries) On December 21, 2013, Bucky Katt Company

provided you with the following information regarding its trading securities.

During 2014, Colorado Company stock was sold for $9,400. The fair value of the

stock on December 31, 2014, was Clemson Corp. stock—$19,100; Buffaloes Co.

stock—$20,500.

Instructions

(a) Prepare the adjusting journal entry needed on December 31, 2013.

(b) Prepare the journal entry to record the sale of the Colorado Company stock

during 2014.

(c) Prepare the adjusting journal entry needed on December 31, 2014.

Answer:

a) December 31, 2017

DR: Unrealized Holding Gain or Loss-Income 1,400

CR: Fair Value Adjustment 1,400

b) During 2018

DR: Cash 9,400

DR: Loss on Sale of Investments 600

CR: Equity Investments 10,000

c) December 31, 2018

Unrealized

Securities Cost Fair Value Gain (loss)

Clemson Corp. stock $20,000 $19,100 $(900)

Buffaloes Co. Stock 20,000 20,500 500

Total of portfolio $40,000 $39,600 (400)

Previous fair value (1,400)

adjustment balance – Cr

Fair value adjustment - Dr $1,000

DR: Fair Value Adjustment 1,000

CR: Unrealized Holding Gain or Loss-Income 1,000

E17-11: (Equity Securities Entries) Arantxa Corporation made the following cash

purchases of securities during 2014, which is the first year in which Arantxa

invested in securities.

1. On January 15, purchased 10,000 shares of Sanchez Company’s common stock at

$33.50 per share plus commission $1,980.

2. On April 1, purchased 5,000 shares of Vicario Co.’s common stock at $52.00 per

share plus commis-sion $3,370.

3. On September 10, purchased 7,000 shares of WTA Co.’s preferred stock at $26.50

per share plus commission $4,910.

On May 20, 2014, Arantxa sold 4,000 shares of Sanchez Company’s common stock

at a market price of $35 per share less brokerage commissions, taxes, and fees of

$3,850. The year-end fair values per share were Sanchez $30, Vicario $55, and WTA

$28. In addition, the chief accountant of Arantxa told you that Arantxa Corporation

plans to hold these securities for the long term but may sell them in order to earn

profits from appreciation in prices.

Instructions

(a) Prepare the journal entries to record the above three security purchases.

(b) Prepare the journal entry for the security sale on May 20.

(c) Compute the unrealized gains or losses and prepare the adjusting entries for

Arantxa on December 31, 2014.

Answer:

a)

(1) DR: Equity Investments 335,000

CR: Cash 335,000

DR: Equity Investment 1,980

CR: Cash 1,980

(2) DR: Equity Investments 260,000

CR: Cash 260,000

DR: Equity Investment 3,370

CR: Cash 3,370

(3) DR: Equity Investments 185,500

CR: Cash 185,500

DR: Equity Investment 4,910

CR: Cash 4,910

b)

DR: Cash 136,150

CR: Equity Investment 134,792

CR: Gain On Sale of Investment 1,358

c)

Unrealized

Securities Cost Fair Value Gain (loss)

Sanchez Co. stock $202,188 $180,000 $(22,188)

Vicario Co. Stock 263,370 275,000 11,630

WTA Co. Stock 190,410 196,000 5,590

Total of portfolio value $655,968 $651,000 (4,968)

Previous fair value

adjustment balance 0

Fair value adjustment $(4,968)

DR: Unrealized Holding Gain or Loss-Income 4,968

CR: Fair Value Adjustment 4,968

You might also like

- Practice Guide To Organizational Budgeting100% (1)Practice Guide To Organizational Budgeting10 pages

- Cost Accounting by William K. Carter Edisi 14e Buku 1-362-388No ratings yetCost Accounting by William K. Carter Edisi 14e Buku 1-362-38827 pages

- Warren Buffett Arguably The Most Famous Investor in The United StatNo ratings yetWarren Buffett Arguably The Most Famous Investor in The United Stat4 pages

- Latihan Soal Sesi 3 - Nastiti Kartika DewiNo ratings yetLatihan Soal Sesi 3 - Nastiti Kartika Dewi26 pages

- Pert 11 Tugas Dividend and Retained Earnings PDF100% (1)Pert 11 Tugas Dividend and Retained Earnings PDF1 page

- Finance Assisgnment 2 - Princy Priyadarshini JohnNo ratings yetFinance Assisgnment 2 - Princy Priyadarshini John39 pages

- Yohanes Bosko Arya B - 041711333195 - AKM E23.11, P23.4No ratings yetYohanes Bosko Arya B - 041711333195 - AKM E23.11, P23.43 pages

- Tugas Akubi 4112111043 Ribka Rosari Nababan AM3BMLMNo ratings yetTugas Akubi 4112111043 Ribka Rosari Nababan AM3BMLM19 pages

- Tugas Sesi 12 - Advance Accounting - Clement JonathanNo ratings yetTugas Sesi 12 - Advance Accounting - Clement Jonathan11 pages

- Revenue Recognition: Assignment Classification Table (By Topic)No ratings yetRevenue Recognition: Assignment Classification Table (By Topic)32 pages

- Specimen For Qiuz & Assignment .........................................No ratings yetSpecimen For Qiuz & Assignment .........................................3 pages

- 3-27 (Objectives 3-1, 3-2, 3-4, 3-6, 3-7)No ratings yet3-27 (Objectives 3-1, 3-2, 3-4, 3-6, 3-7)7 pages

- Forum 02 AKL - Resty Arum Pambayu P - 43218010091No ratings yetForum 02 AKL - Resty Arum Pambayu P - 4321801009120 pages

- Chapter 12. Derivatives and Foreign Currency - Concepts and Common TransactionsNo ratings yetChapter 12. Derivatives and Foreign Currency - Concepts and Common Transactions9 pages

- Chapter 5 Non-Current Liabilities-Kieso IfrsNo ratings yetChapter 5 Non-Current Liabilities-Kieso Ifrs67 pages

- IVplast Is Still Debating Whether It Should Introduce Y28No ratings yetIVplast Is Still Debating Whether It Should Introduce Y282 pages

- Financial Accounting - Tugas 5 - 18 Sep - REVISI 123No ratings yetFinancial Accounting - Tugas 5 - 18 Sep - REVISI 1233 pages

- Comprehensive Problems Solution Answer Key Mid TermNo ratings yetComprehensive Problems Solution Answer Key Mid Term5 pages

- Belinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To TheNo ratings yetBelinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To The1 page

- FR342. AFR (AL-I) Solution CMA January-2025 Exam.No ratings yetFR342. AFR (AL-I) Solution CMA January-2025 Exam.7 pages

- Accounts Receivable Management in Nonprofit Organizations: Grzegorz MichalskiNo ratings yetAccounts Receivable Management in Nonprofit Organizations: Grzegorz Michalski14 pages

- Financial Statements For The Construction Industry: Understanding The Requirements What Are Key BenchmarksNo ratings yetFinancial Statements For The Construction Industry: Understanding The Requirements What Are Key Benchmarks41 pages

- Financial Statement Analysis: K R Subramanyam John J WildNo ratings yetFinancial Statement Analysis: K R Subramanyam John J Wild35 pages

- Pas 1 Quizzer 2 With Answer Keydocx CompressNo ratings yetPas 1 Quizzer 2 With Answer Keydocx Compress13 pages

- Enager Industries, Inc.: The Crimson Press Curriculum Center The Crimson Group, IncNo ratings yetEnager Industries, Inc.: The Crimson Press Curriculum Center The Crimson Group, Inc5 pages

- Accounting Entries For DEPB & Target Plus Scheme PDFNo ratings yetAccounting Entries For DEPB & Target Plus Scheme PDF7 pages

- The Balance Sheet and Profit and Loss StatementNo ratings yetThe Balance Sheet and Profit and Loss Statement28 pages

- Abv-Indian Institute of Information Technology and Management Entrepreneurship and Innovation Assignment Business PlanNo ratings yetAbv-Indian Institute of Information Technology and Management Entrepreneurship and Innovation Assignment Business Plan34 pages

- TRI Consulting, The Middle East Hotel Market Review 2017 PDFNo ratings yetTRI Consulting, The Middle East Hotel Market Review 2017 PDF21 pages

- Chapter - One Overview of Cost AccountingNo ratings yetChapter - One Overview of Cost Accounting31 pages

- Essentials of Accounting For Governmental and Not For Profit Organizations 11th Edition by Copley ISBN Solution Manual100% (43)Essentials of Accounting For Governmental and Not For Profit Organizations 11th Edition by Copley ISBN Solution Manual9 pages

- 1 Accounting Policies and Notes To Financial Statements - Nationa ConsolidatedNo ratings yet1 Accounting Policies and Notes To Financial Statements - Nationa Consolidated13 pages

- Cost Accounting by William K. Carter Edisi 14e Buku 1-362-388Cost Accounting by William K. Carter Edisi 14e Buku 1-362-388

- Warren Buffett Arguably The Most Famous Investor in The United StatWarren Buffett Arguably The Most Famous Investor in The United Stat

- Yohanes Bosko Arya B - 041711333195 - AKM E23.11, P23.4Yohanes Bosko Arya B - 041711333195 - AKM E23.11, P23.4

- Tugas Akubi 4112111043 Ribka Rosari Nababan AM3BMLMTugas Akubi 4112111043 Ribka Rosari Nababan AM3BMLM

- Tugas Sesi 12 - Advance Accounting - Clement JonathanTugas Sesi 12 - Advance Accounting - Clement Jonathan

- Revenue Recognition: Assignment Classification Table (By Topic)Revenue Recognition: Assignment Classification Table (By Topic)

- Specimen For Qiuz & Assignment .........................................Specimen For Qiuz & Assignment .........................................

- Chapter 12. Derivatives and Foreign Currency - Concepts and Common TransactionsChapter 12. Derivatives and Foreign Currency - Concepts and Common Transactions

- IVplast Is Still Debating Whether It Should Introduce Y28IVplast Is Still Debating Whether It Should Introduce Y28

- Financial Accounting - Tugas 5 - 18 Sep - REVISI 123Financial Accounting - Tugas 5 - 18 Sep - REVISI 123

- Comprehensive Problems Solution Answer Key Mid TermComprehensive Problems Solution Answer Key Mid Term

- Belinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To TheBelinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To The

- Accounts Receivable Management in Nonprofit Organizations: Grzegorz MichalskiAccounts Receivable Management in Nonprofit Organizations: Grzegorz Michalski

- Financial Statements For The Construction Industry: Understanding The Requirements What Are Key BenchmarksFinancial Statements For The Construction Industry: Understanding The Requirements What Are Key Benchmarks

- Financial Statement Analysis: K R Subramanyam John J WildFinancial Statement Analysis: K R Subramanyam John J Wild

- Enager Industries, Inc.: The Crimson Press Curriculum Center The Crimson Group, IncEnager Industries, Inc.: The Crimson Press Curriculum Center The Crimson Group, Inc

- Accounting Entries For DEPB & Target Plus Scheme PDFAccounting Entries For DEPB & Target Plus Scheme PDF

- Abv-Indian Institute of Information Technology and Management Entrepreneurship and Innovation Assignment Business PlanAbv-Indian Institute of Information Technology and Management Entrepreneurship and Innovation Assignment Business Plan

- TRI Consulting, The Middle East Hotel Market Review 2017 PDFTRI Consulting, The Middle East Hotel Market Review 2017 PDF

- Essentials of Accounting For Governmental and Not For Profit Organizations 11th Edition by Copley ISBN Solution ManualEssentials of Accounting For Governmental and Not For Profit Organizations 11th Edition by Copley ISBN Solution Manual

- 1 Accounting Policies and Notes To Financial Statements - Nationa Consolidated1 Accounting Policies and Notes To Financial Statements - Nationa Consolidated