0 ratings0% found this document useful (0 votes)

130 viewsChecklist of Every Loan File

Checklist of Every Loan File

Uploaded by

Dheeraj VarkhadeThe document lists various documents required for different types of loan applications. For salaried individuals, it requires the last 3 months salary slips, last 2 years IT returns/Form 16, and 6 months salary account statements. For self-employed professionals, it requires the last 3 years IT returns, audited balance sheets, profit and loss statements, sales/service tax returns, and 6 months of business bank statements along with continuity of business proofs. Additional documents may be needed for partnership firms like partnership deeds or for private/public companies like memorandums and articles of association. The document also lists property documents needed like search reports, valuation reports, possession letters if securing a loan against property. It provides a breakdown of loan

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Checklist of Every Loan File

Checklist of Every Loan File

Uploaded by

Dheeraj Varkhade0 ratings0% found this document useful (0 votes)

130 views1 pageThe document lists various documents required for different types of loan applications. For salaried individuals, it requires the last 3 months salary slips, last 2 years IT returns/Form 16, and 6 months salary account statements. For self-employed professionals, it requires the last 3 years IT returns, audited balance sheets, profit and loss statements, sales/service tax returns, and 6 months of business bank statements along with continuity of business proofs. Additional documents may be needed for partnership firms like partnership deeds or for private/public companies like memorandums and articles of association. The document also lists property documents needed like search reports, valuation reports, possession letters if securing a loan against property. It provides a breakdown of loan

Original Description:

Checklist of Every Loan File

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

The document lists various documents required for different types of loan applications. For salaried individuals, it requires the last 3 months salary slips, last 2 years IT returns/Form 16, and 6 months salary account statements. For self-employed professionals, it requires the last 3 years IT returns, audited balance sheets, profit and loss statements, sales/service tax returns, and 6 months of business bank statements along with continuity of business proofs. Additional documents may be needed for partnership firms like partnership deeds or for private/public companies like memorandums and articles of association. The document also lists property documents needed like search reports, valuation reports, possession letters if securing a loan against property. It provides a breakdown of loan

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

130 views1 pageChecklist of Every Loan File

Checklist of Every Loan File

Uploaded by

Dheeraj VarkhadeThe document lists various documents required for different types of loan applications. For salaried individuals, it requires the last 3 months salary slips, last 2 years IT returns/Form 16, and 6 months salary account statements. For self-employed professionals, it requires the last 3 years IT returns, audited balance sheets, profit and loss statements, sales/service tax returns, and 6 months of business bank statements along with continuity of business proofs. Additional documents may be needed for partnership firms like partnership deeds or for private/public companies like memorandums and articles of association. The document also lists property documents needed like search reports, valuation reports, possession letters if securing a loan against property. It provides a breakdown of loan

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 1

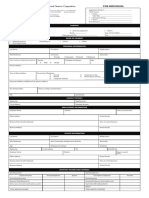

Perticulers Date of Submission

Duly Filed Application Forms /Gurantors Form

ID Proof: (Borrower & Guarantor)

Passport, Pan card, Voters ID Card and Driving License.

Address Proof (Borrower & Guarantor)

AADHAR CARD/ ELECTRICITY BILL/MAINTENANCE RECEIPT

Salaried: (Borrower & Guarantor)

Latest 3 months salary slips

Last 2 years IT Returns / Form 16

6 months Salary Account Statements

Self Employed Professionals: (Borrower & Guarantor)

Last 3 years IT Returns with computation of income, audited Balance Sheet and

Profit & Loss account

latest sales / service tax returns

Last 6 months bank statement of Business account

Proof of Continuity Of Business (Shop and Establishment Licence, Trade Licence)

Hypothecation Of Moveable assets/ Stock

Hypothecation Of Receivables (Sundry Debtors)

Stock Statement / Sundry Debtors Statement

Details of all existing loans (2 YEARS Bank account Statement)

Additional Documents in case of Partnership Firms:

Partnership Deed

Additional Documents in case of Private / Public Limited Company:

Memorandum & Article of Association and List of Directors & Shareholders

Sanction Letter Duly Accepted

Demand Promissory Note

Letter of Continuity

Letter of Undertaking for utilisation of fund

Loan Agreement

Letter of Guarantee

Article of Agreement

Property Documents

Search Report

Valuation Report

Chain of sale Agreement

possession letter, location sketch Plan of Property & Letter of allotment

Demand Letter with Architect Report

Property Maintenence Receipt / Electricity Bill

NOC from Society / Builder

NOC from Owener of the Property if Borrower and owner Different

Insurance Policy (if applicable)

Intimation to Registrar regarding Mortgage

Share Certificate of Housing Society

Equitable mortgage deed

Irrevocable Power Of Attorney

Affidavite cum declaration

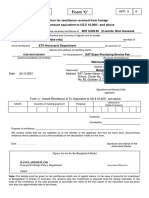

Loan Amount 200000

Charges

Share Capital 2.5% (Unsecured Loan 5%) 0 10000

Processing Charges 250/- per lacs 0 500

Service Chargss 1% 0 2000

Gurantors Shares 110/- each 220 220

Advance installment 5570

Legal Charges 0

Insurance Charges 0

Intimation Charges 0

Advocate Charges (Preparation of Documents) 0

Franking Charges of Property / Loan Documents 330

Service Tax payble 309

TOTAL 18929

2. Address Proof

4. Bank Statement 6 Months

5. Board Resolution (If pvt ltd co. is co-borrower/Partnership Authorization Letter {if

partnership firm is co-borrower}

6. ITR & Statement Of Computation of Income for last 2 Years

7. CA Certified or Audited P/L Acc Statement and for >40 Lacs cases Audit report

along with schedules of P&L and Balance Sheet for last 2 years

8. Latest ITR of Co-Applicants For last 2 Years

9. Ownership Proof of Residence or Office

You might also like

- The Following Is The Unadjusted Trial Balance For Rainbow LodgeDocument3 pagesThe Following Is The Unadjusted Trial Balance For Rainbow LodgeCharlotteNo ratings yet

- MP2 FAQ April15Document3 pagesMP2 FAQ April15rieann09No ratings yet

- Mortgage Loans Check List For SalariedDocument2 pagesMortgage Loans Check List For SalariedVelagala Lokeshwara ReddyNo ratings yet

- Application Form PNB 1166 Upto 1 Crore MsmeDocument7 pagesApplication Form PNB 1166 Upto 1 Crore MsmeChristopher GarrettNo ratings yet

- The Electronic Clearing Service in IndiaDocument3 pagesThe Electronic Clearing Service in Indiamax_dcostaNo ratings yet

- Criteria Documents For Salaried Documents For Self-Employed Documents For ExpatDocument5 pagesCriteria Documents For Salaried Documents For Self-Employed Documents For Expatkaran182No ratings yet

- GL PL Code ChartDocument12 pagesGL PL Code ChartengrlumanNo ratings yet

- Account Closure and Term Deposit Premature Withdrawal FormDocument2 pagesAccount Closure and Term Deposit Premature Withdrawal FormSonali Sarkar100% (1)

- Non Face To Face Account Opening FormDocument10 pagesNon Face To Face Account Opening FormAlvin Samuel PandianNo ratings yet

- Verification of AdvancesDocument12 pagesVerification of AdvancesAvinash SinyalNo ratings yet

- Bank Loans: Market Dynamics Poised To Deliver Attractive Risk-Adjusted ReturnsDocument6 pagesBank Loans: Market Dynamics Poised To Deliver Attractive Risk-Adjusted ReturnsSabin NiculaeNo ratings yet

- Lesson 1: What Is A Bank?Document37 pagesLesson 1: What Is A Bank?FlyEngineerNo ratings yet

- Account Tariff Structure Basic Savings AccountDocument1 pageAccount Tariff Structure Basic Savings Accountgaddipati_ramuNo ratings yet

- RODocument37 pagesROscribdaashishNo ratings yet

- Account Opening FormDocument9 pagesAccount Opening FormTej AsNo ratings yet

- DCB NRE Account OpeningDocument8 pagesDCB NRE Account OpeningAbhay AgrawalNo ratings yet

- Home Loan AgreementDocument3 pagesHome Loan AgreementJnanamNo ratings yet

- Credit Application Forms - Individual and CorporationDocument4 pagesCredit Application Forms - Individual and Corporationjjjandm lpgtradingNo ratings yet

- Salary Loan ApplicationformDocument1 pageSalary Loan ApplicationformNorjana Otto Medal-MadaleNo ratings yet

- Electronic Bank TransferDocument6 pagesElectronic Bank Transfergeorgebates1979100% (1)

- Axis Bank Product: Term DepositDocument35 pagesAxis Bank Product: Term DepositSaroj Kumar PandaNo ratings yet

- Part 3Document29 pagesPart 3Rajib DattaNo ratings yet

- National Electronic Funds Transfer (NEFT) Is A Nation-Wide System That FacilitatesDocument5 pagesNational Electronic Funds Transfer (NEFT) Is A Nation-Wide System That FacilitatesMounika TadikondaNo ratings yet

- BOC Account Opening FormDocument2 pagesBOC Account Opening FormCyberpoint Internet Cafe and Computer ShopNo ratings yet

- Bank@Campus Account - ICICI Bank LTDDocument1 pageBank@Campus Account - ICICI Bank LTDKumar RanjanNo ratings yet

- Multiple Bank Account Registration FormDocument2 pagesMultiple Bank Account Registration FormprasadkarkareNo ratings yet

- Mock Loan LetterDocument1 pageMock Loan LetterAravindNo ratings yet

- Customer Risk Profile FormDocument8 pagesCustomer Risk Profile Formraja durai100% (1)

- Schedule Charges City BankDocument11 pagesSchedule Charges City BankSumon Emam HossainNo ratings yet

- Steward Bank Individual Loan Application Form - (Customer Section)Document3 pagesSteward Bank Individual Loan Application Form - (Customer Section)Wilsfun100% (3)

- Account Opening Form BOIDocument4 pagesAccount Opening Form BOIhrocking1100% (1)

- DBS Mortgage All-In-One Application Form 2016Document3 pagesDBS Mortgage All-In-One Application Form 2016Viola HippieNo ratings yet

- AC010 Unit 6 - Bank AccountingDocument17 pagesAC010 Unit 6 - Bank AccountingExie CostalesNo ratings yet

- Commercial BankDocument15 pagesCommercial BankKristel Denise TansiongcoNo ratings yet

- Bank of India Loan Against Property Through LoanmoneyDocument10 pagesBank of India Loan Against Property Through LoanmoneyMAYUURESH RAVALENo ratings yet

- Very Easy Money Transfer: E-ChequeDocument15 pagesVery Easy Money Transfer: E-ChequeKartheek AldiNo ratings yet

- Varo BankDocument8 pagesVaro BankRedi ZenebeNo ratings yet

- Unified Forms - General Customer InformationDocument4 pagesUnified Forms - General Customer InformationAhmad NazrinNo ratings yet

- LoansDocument17 pagesLoansPia Samantha DasecoNo ratings yet

- Account Opening Form: Personal Banking CustomersDocument4 pagesAccount Opening Form: Personal Banking CustomersmikeNo ratings yet

- E-Banking in BangladeshDocument32 pagesE-Banking in BangladeshNusrat Saragin NovaNo ratings yet

- E-Sahulat Branchless Banking 9500Document1 pageE-Sahulat Branchless Banking 9500Shoaib AhmadNo ratings yet

- Change of Address FormDocument1 pageChange of Address FormgenesissinghNo ratings yet

- Loan App Pre ApprovalDocument3 pagesLoan App Pre Approvalapi-288487208No ratings yet

- Digital Payments: Step by Step Instructions For Various Modes of Payment: Upi, Wallets, Pos, and Sms Banking (Ussd)Document28 pagesDigital Payments: Step by Step Instructions For Various Modes of Payment: Upi, Wallets, Pos, and Sms Banking (Ussd)SpandanNandaNo ratings yet

- Documentation of Bank (Bank of Baroda)Document40 pagesDocumentation of Bank (Bank of Baroda)Devesh Verma100% (1)

- SAT Remittance Form For BRAC BankDocument1 pageSAT Remittance Form For BRAC BankArman Hossain100% (1)

- Steps To Process Wire Payments: Generate PaymentDocument5 pagesSteps To Process Wire Payments: Generate PaymentchinbomNo ratings yet

- Cheque ManagementDocument13 pagesCheque ManagementsapchevronNo ratings yet

- Credit ScoringDocument23 pagesCredit ScoringAnand KrNo ratings yet

- H LoanDocument136 pagesH LoanElango PaulchamyNo ratings yet

- Loan CalculatorDocument15 pagesLoan CalculatorMahrukh ZubairNo ratings yet

- Buyers CreditDocument2 pagesBuyers Creditrao_gmailNo ratings yet

- Credit Management - Reading MaterialsDocument10 pagesCredit Management - Reading Materialsmesba_17No ratings yet

- Customer Declaration FormDocument2 pagesCustomer Declaration FormAbhinanth Mj90% (10)

- Buy Verified Stripe AccountDocument9 pagesBuy Verified Stripe AccountBuy verified Payoneer account100% (1)

- Overview of Lending Activity: by Dr. Ashok K. DubeyDocument19 pagesOverview of Lending Activity: by Dr. Ashok K. DubeySmitha R AcharyaNo ratings yet

- Core Banking System Strategy A Complete Guide - 2020 EditionFrom EverandCore Banking System Strategy A Complete Guide - 2020 EditionNo ratings yet

- Checklist Housing LoanDocument2 pagesChecklist Housing LoanDevendra ChavhanNo ratings yet

- BPI Family Housing Loans Requirements & ProcessDocument2 pagesBPI Family Housing Loans Requirements & ProcessAdrian FranciscoNo ratings yet

- Internship Report of Askari BankDocument111 pagesInternship Report of Askari BankAnonymous yYfTY1No ratings yet

- List of Insurance Companies in IndiaDocument11 pagesList of Insurance Companies in IndiaSushil GuptaNo ratings yet

- 0452/23/M/J/23 © Ucles 2023Document9 pages0452/23/M/J/23 © Ucles 2023Lisha JainNo ratings yet

- SS2 Financial Accounting 3rd Term HandoutDocument11 pagesSS2 Financial Accounting 3rd Term HandoutHerdeyemi SlimfreshNo ratings yet

- EMIS PDF ChaptersDocument18 pagesEMIS PDF Chaptersleonardo niñoNo ratings yet

- George Gingo - in The 5th District Florida Court of AppealsDocument34 pagesGeorge Gingo - in The 5th District Florida Court of AppealsForeclosure FraudNo ratings yet

- Accounting Chap 2Document7 pagesAccounting Chap 2yen linhNo ratings yet

- AAMI Car CancellationDocument1 pageAAMI Car CancellationDan NarNo ratings yet

- Beginners Guide To Mutual Funds 2019 UnovestDocument41 pagesBeginners Guide To Mutual Funds 2019 UnovestBDE HolisticNo ratings yet

- Wey AP 8e Ch04Document54 pagesWey AP 8e Ch04tamimNo ratings yet

- ACCT 101 Wild 7e CH06 AccessibleDocument77 pagesACCT 101 Wild 7e CH06 AccessibleShielaNo ratings yet

- Internship Report On FSIBL Cloud & SMS Based Banking - A Performance Indicator of FSIBLDocument22 pagesInternship Report On FSIBL Cloud & SMS Based Banking - A Performance Indicator of FSIBLnahidNo ratings yet

- 0000 TEMPLATE Written Consent FormDocument2 pages0000 TEMPLATE Written Consent FormRose Cano-AmbuloNo ratings yet

- 300+ TOP Financial Statements of Companies Class 12 MCQsDocument13 pages300+ TOP Financial Statements of Companies Class 12 MCQsBhagat DeepakNo ratings yet

- Maila Rosario College: College of Business Administration Major in Financial ManagementDocument6 pagesMaila Rosario College: College of Business Administration Major in Financial ManagementEleine AlvarezNo ratings yet

- 10 - Consolidations - Changes in Ownership InterestsDocument42 pages10 - Consolidations - Changes in Ownership InterestsLukas PrawiraNo ratings yet

- Tata Metaliks Limited - R - 24112020 PDFDocument3 pagesTata Metaliks Limited - R - 24112020 PDFHitesh ModiNo ratings yet

- Basic Financial StatementsDocument50 pagesBasic Financial StatementsK KNo ratings yet

- 3rd List CombineDocument18 pages3rd List CombineYugant RajNo ratings yet

- Eliodoro Virruete LetterDocument1 pageEliodoro Virruete Letterblancabeal100% (1)

- Unhedged 31.12.2019Document2 pagesUnhedged 31.12.2019NOOR E MOHAMMAD SHAIKNo ratings yet

- Insurance SKU156265639436GBZIDocument5 pagesInsurance SKU156265639436GBZIRaj HarshaNo ratings yet

- KASP One PagerDocument1 pageKASP One PagerDeep JoshiNo ratings yet

- FDIC Core Deposits White PaperDocument18 pagesFDIC Core Deposits White PaperDouglas FunkNo ratings yet

- Chap 5 ComputationDocument6 pagesChap 5 ComputationAileen Mifranum IINo ratings yet

- NO. Chapter Name Page No.: Content of TableDocument58 pagesNO. Chapter Name Page No.: Content of TableSuraj JadhavNo ratings yet

- ACREV 426 - AP 02 ReceivablesDocument5 pagesACREV 426 - AP 02 ReceivablesEve Jennie Rose MagnificoNo ratings yet

- PPS Content - WebsiteDocument11 pagesPPS Content - WebsiteManoj Kumar SettNo ratings yet