0 ratings0% found this document useful (0 votes)

103 viewsHinopak Motors Limited Balance Sheet As at March 31, 2013

Hinopak Motors Limited Balance Sheet As at March 31, 2013

Uploaded by

nomi_425This document is the balance sheet, profit and loss account, cash flow statement, and statement of changes in equity for Hinopak Motors Limited as of March 31, 2013. It shows the company's assets, liabilities, equity, income, expenses, and cash flows for the fiscal year ending March 31, 2013. Key figures include total assets of Rs. 5,060,978, total equity of Rs. 1,561,964, net profit of Rs. 27,083, and net cash generated from operating activities of Rs. 712,147.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Hinopak Motors Limited Balance Sheet As at March 31, 2013

Hinopak Motors Limited Balance Sheet As at March 31, 2013

Uploaded by

nomi_4250 ratings0% found this document useful (0 votes)

103 views40 pagesThis document is the balance sheet, profit and loss account, cash flow statement, and statement of changes in equity for Hinopak Motors Limited as of March 31, 2013. It shows the company's assets, liabilities, equity, income, expenses, and cash flows for the fiscal year ending March 31, 2013. Key figures include total assets of Rs. 5,060,978, total equity of Rs. 1,561,964, net profit of Rs. 27,083, and net cash generated from operating activities of Rs. 712,147.

Original Description:

financials

Original Title

HINO_Q4_2013

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is the balance sheet, profit and loss account, cash flow statement, and statement of changes in equity for Hinopak Motors Limited as of March 31, 2013. It shows the company's assets, liabilities, equity, income, expenses, and cash flows for the fiscal year ending March 31, 2013. Key figures include total assets of Rs. 5,060,978, total equity of Rs. 1,561,964, net profit of Rs. 27,083, and net cash generated from operating activities of Rs. 712,147.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

103 views40 pagesHinopak Motors Limited Balance Sheet As at March 31, 2013

Hinopak Motors Limited Balance Sheet As at March 31, 2013

Uploaded by

nomi_425This document is the balance sheet, profit and loss account, cash flow statement, and statement of changes in equity for Hinopak Motors Limited as of March 31, 2013. It shows the company's assets, liabilities, equity, income, expenses, and cash flows for the fiscal year ending March 31, 2013. Key figures include total assets of Rs. 5,060,978, total equity of Rs. 1,561,964, net profit of Rs. 27,083, and net cash generated from operating activities of Rs. 712,147.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 40

HINOPAK MOTORS LIMITED

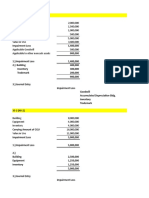

BALANCE SHEET AS AT MARCH 31, 2013

Note 2013 2012

ASSETS

Non-current assets

Property, plant and equipment 3 1,714,507 1,779,457

Intangible assets 4 438 1,089

Long-term investments 5 4,434 2,391

Long-term loans and advances 6 13,704 10,400

Long-term deposits 6,025 6,015

1,739,108 1,799,352

Current assets

Stores, spares and loose tools 7 21,549 19,194

Stock-in-trade 8 2,161,904 2,410,682

Trade debts 9 276,904 1,823,092

Loans and advances 10 12,244 37,739

Trade deposits and prepayments 11 23,436 34,680

Refunds due from the government 12 206,002 87,893

Other receivables 13 9,619 31,839

Taxation - payments less provision 436,865 324,901

Cash and bank balances 14 173,347 124,526

3,321,870 4,894,546

Total assets 5,060,978 6,693,898

EQUITY AND LIABILITIES

Share capital and reserves

Share capital 15 124,006 124,006

Reserves 1,437,958 1,405,508

1,561,964 1,529,514

SURPLUS ON REVALUATION OF FIXED ASSETS 16 1,002,990 1,026,250

LIABILITIES

Non-current liabilities

Deferred taxation 17 42,235 69,390

Retirement benefits obligations 18 71,412 67,235

113,647 136,625

Current liabilities

Trade and other payables 19 1,703,736 2,721,889

Short-term borrowings 20 645,948 1,238,331

Accrued mark-up 21 32,693 41,289

2,382,377 4,001,509

Total liabilities 2,496,024 4,138,134

Contingency and commitments 22

Total equity and liabilities 5,060,978 6,693,898

Managing Director & Chairman

Chief Executive Officer

Rupees '000

The annexed notes 1 to 39 form an integral part of these financial statements.

HINOPAK MOTORS LIMITED

PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED MARCH 31, 2013

Note 2013 2012

Sales 23 7,528,140 8,766,997

Cost of sales 24 (6,720,619) (7,858,919)

Gross profit 807,521 908,078

Distribution costs 24 (295,694) (328,212)

Administration expenses 24 (206,738) (192,013)

Other income 25 71,085 113,982

Other expenses 26 (6,293) (9,858)

Profit from operations 369,881 491,977

Finance cost 27 (324,999) (318,541)

Profit before taxation 44,882 173,436

Taxation 28 (17,799) (147,726)

Profit after taxation 27,083 25,710

Other comprehensive income

Change in value of available-for-sale financial

assets - net of deferred tax 5 1,328 1,554

Total comprehensive income 28,411 27,264

Basic and diluted earnings per share 29 Rs 2.18 Rs 2.07

Managing Director & Chairman

Chief Executive Officer

The annexed notes 1 to 39 form an integral part of these financial statements.

Rupees '000

HINOPAK MOTORS LIMITED

CASH FLOW STATEMENT FOR THE YEAR ENDED MARCH 31, 2013

2013 2012

Note

CASH FLOWS FROM OPERATING ACTIVITIES

Cash generated from / (used in) operations 30 1,023,352 (287,523)

Mark-up paid on short-term borrowings (119,787) (140,198)

Return on savings accounts 1,673 1,211

Income taxes paid - net (157,633) (306,879)

Retirement benefits obligations paid (32,144) (38,552)

Increase in long-term deposits (10) (134)

Increase in long-term loans and advances (3,304) (6,492)

Net cash generated from / (used in) operating activities 712,147 (778,567)

CASH FLOWS FROM INVESTING ACTIVITIES

Fixed capital expenditure incurred (71,781) (116,517)

Proceeds from sale of property, plant and equipment 19,968 14,179

Net cash used in investing activities (51,813) (102,338)

CASH FLOWS FROM FINANCING ACTIVITIES

Dividend paid (19,130) (6)

Net increase / (decrease) in cash and cash equivalents 641,204 (880,911)

Cash and cash equivalents at the beginning of the year (1,113,805) (232,894)

Cash and cash equivalents at the end of the year 31 (472,601) (1,113,805)

Managing Director &

Chief Executive Officer Chairman

The annexed notes 1 to 39 form an integral part of these financial statements.

Rupees 000

HINOPAK MOTORS LIMITED

STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED MARCH 31, 2013

Reserves - Revenue

General Unappro-

priated profit

Balance at April 1, 2011 124,006 291,000 1,064,480 -

Realisation of surplus on revaluation of

fixed assets on disposal - net of deferred tax - - 2,255 -

Transferred from surplus on revaluation of

fixed assets on account of incremental

depreciation - net of deferred tax - - 20,509

-

Profit for the year - - 25,710 -

Other comprehensive income for the year - - - 1,554

Balance at March 31, 2012 124,006 291,000 1,112,954 1,554

Final dividend for the year ended

M h 31 2012 @R 1 55 h (19 221)

Share

Capital

Rupees '000

Fair value

reserve

March 31, 2012 @ Rs. 1.55 per share - - (19,221) -

Transferred from surplus on revaluation of

fixed assets on account of incremental

depreciation - net of deferred tax - - 23,260 -

Profit for the year - - 27,083 -

Other comprehensive income for the year - - - 1,328

Balance at March 31, 2013 124,006 291,000 1,144,076 2,882

Managing Director &

Chief Executive Officer Chairman

The annexed notes 1 to 39 form an integral part of these financial statements.

1,479,486

2,255

20,509

25,710

1,554

1,529,514

(19 221)

Total

(19,221)

23,260

27,083

1,328

1,561,964

HINOPAK MOTORS LIMITED

NOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED MARCH 31, 2013

1. THE COMPANY AND ITS OPERATIONS

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

2.1 Basis of preparation

2.1.1 Changes in accounting standards and interpretations

(a)

Hinopak Motors Limited is incorporated in Pakistan as a public limited Company

and listed on Karachi and Lahore stock exchanges.

These financial statements have been prepared in accordance with approved

accounting standards as applicable in Pakistan. Approved accounting standards

comprise of such International Financial Reporting Standards (IFRS) issued by the

International Accounting Standards Board as are notified under the Companies

Ordinance, 1984, provisions of and directives issued under the Companies

Ordinance, 1984. In case requirements differ, the provisions or directives of the

Companies Ordinance, 1984 have been followed.

The financial statements are presented in Pak Rupee, which is the Company's

functional and presentation currency.

The Company's principal activity is the assembly, progressive manufacturing and

sale of Hino buses and trucks. The registered office of the Company is at D-2,

S.I.T.E., Manghopir Road, Karachi.

The principal accounting policies applied in the preparation of these financial

statements are set out below:

There are no amended standards and interpretations that are effective for the first

time in the current year that would be expected to have a material impact on the

Company.

Standards, interpretations and amendments to published approved

accounting standards effective in 2012

The Company is a subsidiary of Hino Motors Limited J apan and the ultimate parent

of the Company is Toyota Motors Corporation J apan.

(b)

2.2 Basis of measurement

2.3 Property, plant and equipment

2.4 Intangible assets - computer softwares

2.5 Impairment

These financial statements have been prepared under the historical cost

convention except as disclosed in the accounting policies below.

Computer software licenses acquired by the Company are stated at cost less

accumulated amortisation. Cost represents the cost incurred to acquire the

software licenses and bring them to use. The cost of computer software is

amortised over the estimated useful life i.e. 2 to 3 years.

These are stated at cost less accumulated depreciation / amortisation and

impairment losses, if any, except land and buildings which are stated at revalued

amount less accumulated depreciation and impairment loss, if any; and capital

work-in-progress which is stated at cost.

Depreciation is charged to profit and loss account applying the straight line

method, whereby the depreciable amount of an asset, if any, is written off over its

estimated useful life. The revalued amount of leasehold land and building is

amortised / depreciated equally over the remaining life fromthe date of revaluation.

Depreciation is charged on additions fromthe month the asset is available for use

and on disposals upto the month preceding the month of disposal.

The carrying values of non-current assets are reviewed for impairment when

events or changes in circumstances indicate that the carrying value may not be

recoverable. If any such indication exists and where the carrying values exceed the

estimated recoverable amount, the assets or cash-generating units are written

down to their recoverable amount.

IAS 19 (Amendment), 'Employee benefits', is effective for the accounting periods

beginning on or after 1 J anuary 2013. It eliminates the corridor approach and

recognises all actuarial gains and losses in other comprehensive income as they

occur, immediately recognises all past service costs and replaces interest cost and

expected return on plan assets with a net interest amount that is calculated by

applying the discount rate to the net defined benefit liability / asset. The change for

the next year will be retrospectively recorded taking into account unrecognised

actuarial gains and losses.

Standards, interpretations and amendments to published approved

accounting standards that are not yet effective but relevant to the Company

2

Gain or loss on disposal or retirement of property, plant and equipment is included

in profit and loss account.

Costs associated with maintaining computer softwares are charged to profit and

loss account.

2.6 Investments

i) Held to maturity

ii)

iii)

2.7 Taxation

i. Current

3

Available for sale

These are investments designated at fair value through profit and loss account

at inception. Investments in this category are classified as current assets if

they are expected to be realised within twelve months of the balance sheet

date.

Charge for current taxation is based on taxable income at the current rates of

taxation after taking into account tax credits and rebates available, if any, and

taxes paid under the final tax regime.

Available for sale investments are initially recognised at fair value plus

transaction costs, and are subsequently carried at fair value. Changes in the

fair value are recognised in other comprehensive income.

These are investments with fixed or determinable payments and fixed maturity

with the Company having positive intent and ability to hold to maturity. These

are initially recognised at fair value plus transaction cost, and subsequently at

amortised cost using the effective interest method.

The investments of the Company are classified into the following categories:

Investments at fair value through profit and loss account are initially

recognised at fair value, and transaction costs are expensed in the profit and

loss account. These are subsequently carried at fair value. Gains or losses

arising fromchanges in the fair value are taken to profit and loss account in

the period in which they arise.

The Company assesses at each balance sheet date whether there is objective

evidence that an investment is impaired. Impairment loss on all investments is

recognised in the profit and loss account. Whereas, reversal of impairment loss is

recognised in other comprehensive income.

These represent non derivative investments that are either designated in this

category or not classified in any other category. They are included as non-

current assets unless the investment matures or management intends to

dispose off the investments within twelve months of the balance sheet date.

At fair value through profit and loss account

ii. Deferred

2.8 Stores, spares and loose tools

2.9 Stock in trade

2.10 Trade and other debts

2.11 Cash and cash equivalents

These are valued at lower of cost and net realisable value. Cost is determined by

first-in first-out method except for materials for fabrication of bus bodies,

consumable stores, locally manufactured parts, spares for sale and stock in transit.

4

The Company accounts for deferred taxation using the liability method on

temporary differences arising between the tax base of assets and liabilities

and their carrying amounts in the financial statements. Deferred tax liability is

recognised for taxable temporary differences and deferred tax asset is

recognised to the extent that it is probable that taxable profits will be available

against which the deductible temporary differences, unused tax losses and tax

credits can be utilised. Deferred tax is charged or credited to the profit and

loss account except for deferred tax arising on surplus on revaluation of fixed

assets and on change in fair value of investments categorised as available for

sale which is charged to the surplus on revaluation and fair value reserve

respectively.

Cost of material for fabrication of bus bodies, consumable stores, locally

manufactured parts and spares for sale is determined on moving average method.

Cost of stock in transit comprises of invoice value plus other charges incurred

thereon.

Net realisable value is determined on the basis of estimated selling price of the

product in the ordinary course of business less cost of completion and estimated

costs necessarily to be incurred to make the sale.

These are valued at cost determined on moving average basis less provision for

slowmoving and obsolete stores and spares. Items in transit are valued at invoice

value plus other charges incurred thereon.

Cost of work in process and finished goods include direct material, labour and

appropriate portion of manufacturing expenses.

Trade and other debts are carried at original invoice amount being the fair value.

Provision is made against debts considered doubtful of recovery whereas debts

considered irrecoverable are written off.

Cash and cash equivalents are carried at cost. For the purposes of cash flow

statement, cash and cash equivalents comprise cash, cheques in hand, balances

with banks on current, savings and deposit accounts and short term borrowings

under mark-up arrangements.

2.12 Staff retirement benefits

Defined benefit plans

Defined contribution plan

2.13 Compensated absences

2.14 Provisions

Latest actuarial valuations of the schemes were carried out as at March 31, 2013

using the projected unit credit method. The present values of the obligations are

determined by discounting the estimated future cash outflows using interest rates

of high quality government securities that have terms to maturity approximating to

the terms of the related obligations.

Actuarial gains and losses arising from experience adjustments and changes in

actuarial assumptions in excess of the greater of 10%of the value of plan assets or

10%of the obligations are charged or credited to profit and loss account separately

for each scheme over the employees' expected average remaining working life.

The liabilities recognised in respect of gratuity and pension schemes are the

present values of the Company's obligations under each scheme at the balance

sheet date less the fair values of respective plan assets, together with adjustment

for unrecognised actuarial gains or losses.

5

Provisions are recognised when the Company has a present legal or constructive

obligation as a result of past events, it is probable that an outflowof resources will

be required to settle the obligation and a reliable estimate of the amount can be

made.

The Company also operates an approved contributory provident fund for all its

permanent employees to which equal monthly contributions are made, both by the

Company and the employees, to the fund at the rate of 10% of basic salary.

The Company accounts for compensated absences of its employees on unavailed

balance of leave in the period in which the leave is earned.

Contribution to pension fund is made by both, the Company based on actuarial

recommendation, and by employees at 2% and 3% of the basic monthly salary in

case of management and non-management staff respectively.

The Company operates approved funded gratuity and pension schemes for all its

permanent employees. The schemes define the amounts of benefit that an

employee will receive on or after retirement subject to a minimumqualifying period

of service under the schemes. The amounts of retirement benefits are usually

dependent on one or more factors such as age, years of service and salary.

2.15 Borrowings and their costs

2.16 Warranty obligations

2.17 Financial instruments

2.18 Trade and other payables

2.19 Revenue recognition

2.20 Research and development cost

Research and development cost except to the extent that an intangible asset is

recognised, is charged in the year in which it is incurred. Development costs

previously charged to income are not recognised as an asset in the subsequent

period.

Borrowing costs are recognised as an expense in the period in which these are

incurred except to the extent of borrowing costs that are directly attributable to the

acquisition, construction or production of a qualifying asset. Such borrowing costs,

if any, are capitalised as part of the cost of that asset.

Return on bank deposits and short term investments is recognised on accrual

basis.

Trade and other payables are initiallymeasured at cost which is the fair value of the

consideration to be paid for goods and services, whether or not billed to the

Company.

The Company recognises the estimated liability, on an accrual basis, to repair or

replace products under warranty at the balance sheet date, and recognises the

estimated product warranty costs in the profit and loss account when the sale is

recognised.

Commission on handling Complete Built Up (CBU) vehicles and spare parts is

recognised on accrual basis.

Revenue is measured at the fair value of the consideration received or receivable,

and represents amount receivable for goods supplied, stated net of discounts,

returns and value added taxes. Revenue from sale of goods is recognised on

delivery of goods to customers i.e. when the significant risks and reward of

ownership have been transferred to the customer.

Financial instruments include loans and advances, deposits, trade and other debts,

cash and bank balances, borrowings, trade and other payables and accrued mark-

up. The particular recognition methods adopted are disclosed in the individual

policy statements associated with each item.

Borrowings are recognised initially at fair value, net of transaction costs incurred

and are subsequently measured at amortised cost using the effective interest

method.

6

2.21 Foreign currency translation

2.22 Dividend distribution

2.23 Accounting estimates and judgements

(a)

(b) Staff retirement benefits - note 18

(c) Deferred taxation - note 17

(d) Warranty obligations - note 19.1

Note 2013 2012

Rupees 000

3. PROPERTY, PLANT AND EQUIPMENT

Operating assets 3.1 1,708,258 1,755,202

Capital work-in-progress 3.4 6,249 24,255

1,714,507 1,779,457

Dividend distribution to shareholders is recognised as liability in the financial

statements in the period in which the dividend is approved.

7

There have been no critical judgements made by the Company's management in

applying the accounting policies that would have significant effect on the amounts

recognised in the financial statements.

The preparation of financial statements in conformity with approved accounting

standards requires the use of certain critical accounting estimates. It also requires

management to exercise its judgement in the process of applying the Company's

accounting policies. The matters involving a higher degree of judgement or

complexity, or areas where assumptions and estimates are significant to the

financial statements are as follows:

Foreign currency transactions are recorded in Pak Rupee using the exchange rates

prevailing at the dates of the transactions. Monetary assets and liabilities in foreign

currencies are translated into Pak Rupee at the rates of exchange prevailing at the

balance sheet date. Exchange gains and losses are taken to profit and loss

account.

Estimates and judgements are continually evaluated and are based on historical

experience and other factors, including expectations of future events that are

believed to be reasonable under the circumstances.

Provision for stock obsoloscence and doubtful debts - note 8 and 9

3.1 Operating assets

Year ended

March 31, 2013

Opening net book value (NBV) 876,964 562,739 194,687 3,902 84,520 14,419 17,971

Additions - 9,176 28,263 478 44,083 843 6,794

Disposals - at NBV - - (73) - (13,516) - * -

Depreciation / amortisation

charge for the year (20,329) (20,664) (48,731) (873) (17,777) (5,451) (9,167)

Closing net book value 856,635 551,251 174,146 3,507 97,310 9,811 15,598

At March 31, 2013

Cost or revaluation 890,500 591,331 567,290 13,213 167,992 78,152 101,423

Accumulated depreciation /

amortisation (33,865) (40,080) (393,144) (9,706) (70,682) (68,341) (85,825)

Net book value 856 635 551 251 174 146 3 507 97 310 9 811 15 598

8

Furniture

and

fittings

Leasehold

Land

(Revalued -

note 3.2)

Rupees '000

Electrical

Installations

Office and

other

equipments

Vehicles Buildings

on

leasehold

land

(Revalued -

note 3.2)

Plant and

machinery

Net book value 856,635 551,251 174,146 3,507 97,310 9,811 15,598

Year ended

March 31, 2012

Opening net book value (NBV) 890,500 478,441 216,441 4,757 78,135 7,069 16,919

Additions - 108,016 28,949 81 29,327 11,824 9,870

Disposals - at NBV - (4,244) (401) - (8,394) - * -

Depreciation/amortisation

charge for the year (13,536) (19,474) (50,302) (936) (14,548) (4,474) (8,818)

Closing net book value 876,964 562,739 194,687 3,902 84,520 14,419 17,971

At March 31, 2012

Cost or revaluation 890,500 582,154 546,921 12,735 150,934 77,310 97,116

Accumulated depreciation /

amortisation (13,536) (19,415) (352,234) (8,833) (66,414) (62,891) (79,145)

Net book value 876,964 562,739 194,687 3,902 84,520 14,419 17,971

Useful life (years) 76 to 79 40 2 to 10 2 to 10 4 to 5 5 3 to 7

* Assets disposed off having nil net book value

3.2

Had there been no revaluation, the net book values of land and build

leasehold land as at March 31, 2013 would have been Rs. 31 million (2012: Rs. 34 million)

306 million (2012: Rs 305 million) respectively

The Company's land measuring 10.61 acres and 6 acres located at Plot Nos. D-2 and D-136

Karachi respectively and buildings thereon were revalued by an independent valuer - M/

Nanjee &Co. (Pvt) Limited on March 31, 2011 on the basis of present market values for sim

plots in the near vicinityfor land and replacement values of similar type of buildings based o

cost of construction.

1,755,202

89,637

(13,589)

(122,992)

1,708,258

2,409,901

(701,643)

1 708 258

Total

1,708,258

1,692,262

188,067

(13,039)

(112,088)

1,755,202

2,357,670

(602,468)

1,755,202

dings on

and Rs.

6, S.I.T.E,

/s Iqbal A.

milar sized

on present

3.3 Details of operating assets sold

9

The details of operating assets sold, having net book value in excess of

Rs. 50,000 each are as follows:

Description Cost Book Mode of Particulars of purchaser

val ue disposal

Rupees '000

Motor Vehicle 1,529 291 1,238 1,316 Company Policy Mr. Zafar Iqbal - Ex Executive

" 980 659 321 382 " Mr. Muhammad Akram - Executive

" 969 651 318 378 " Mr. Zafar Ali - Executive

" 908 549 359 377 " Mr. Shahab Anwar - Ex Executive

" 893 600 293 495 " Mr. Shams Naveed - Executive

" 651 430 221 336 " Mr. Waqas - Employee

" 636 428 208 341 " Mr. Irfan Ahmed - Executive

" 636 428 208 331 " Mr. Syed Muhammad Aftab -

Executive

" 620 417 203 325 " Mr. Zahid Hassan - Executive

" 620 417 203 325 " Mr. J awahar Lal - Ex Employee

" 620 417 203 325 " Mr. Sirajuddin - Executive

" 590 390 200 275 " Mr. Tahir - Employee

" 478 316 162 162 " Mr. Masihur Rehman - Executive

" 469 315 154 179 " Mr. Badr-ul-Hassan - Executive

" 469 315 154 177 " Mr. Misbahuddin - Executive

" 469 310 159 154 " Mr. Khaliluddin - Executive

" 469 310 159 154 " Mr. Saleem Ismail - Employee

" 469 310 159 154 " Mr. Tariq Haleem - Employee

" 434 292 142 143 " Mr. Salman Abdul Wahab - Employee

" 93 12 81 86 " Mr. Wahid Khan - Employee

" 67 8 59 65 " Mr. Shahid Pervez - Employee

" 1,880 233 1,647 1,636 Insurance Claim EFU General Insurance Limited

Central Division Karachi

" 1,529 240 1,289 1,358 " "

" 1,529 223 1,306 1,351 " "

" 66 10 56 62 " "

" 93 5 88 95 " "

" 93 5 88 96 " "

" 66 12 54 60 " "

Sale

proceeds

Accumulated

depreciation

Description Cost Book Mode of Particulars of purchaser

val ue disposal

Rupees '000

Motor Vehicle 1,529 291 1,238 1,316 Company Policy Mr. Zafar Iqbal - Ex Executive

" 980 659 321 382 " Mr. Muhammad Akram - Executive

" 969 651 318 378 " Mr. Zafar Ali - Executive

" 908 549 359 377 " Mr. Shahab Anwar - Ex Executive

" 893 600 293 495 " Mr. Shams Naveed - Executive

" 651 430 221 336 " Mr. Waqas - Employee

" 636 428 208 341 " Mr. Irfan Ahmed - Executive

" 636 428 208 331 " Mr. Syed Muhammad Aftab -

Executive

" 620 417 203 325 " Mr. Zahid Hassan - Executive

" 620 417 203 325 " Mr. J awahar Lal - Ex Employee

" 620 417 203 325 " Mr. Sirajuddin - Executive

" 590 390 200 275 " Mr. Tahir - Employee

" 478 316 162 162 " Mr. Masihur Rehman - Executive

" 469 315 154 179 " Mr. Badr-ul-Hassan - Executive

" 469 315 154 177 " Mr. Misbahuddin - Executive

" 469 310 159 154 " Mr. Khaliluddin - Executive

" 469 310 159 154 " Mr. Saleem Ismail - Employee

" 469 310 159 154 " Mr. Tariq Haleem - Employee

" 434 292 142 143 " Mr. Salman Abdul Wahab - Employee

" 93 12 81 86 " Mr. Wahid Khan - Employee

" 67 8 59 65 " Mr. Shahid Pervez - Employee

" 1,880 233 1,647 1,636 Insurance Claim EFU General Insurance Limited

Central Division Karachi

" 1,529 240 1,289 1,358 " "

" 1,529 223 1,306 1,351 " "

" 66 10 56 62 " "

" 93 5 88 95 " "

" 93 5 88 96 " "

" 66 12 54 60 " "

Sale

proceeds

Accumulated

depreciation

10

Description Cost Book Mode of Particulars of purchaser

value disposal

Rupees '000

Motor Vehicle 66 12 54 60 Insurance Claim EFU General Insurance Limited

Central Division Karachi

" 90 20 70 80 " "

" 67 6 61 68 " "

" 67 6 61 70 " "

" 67 8 59 65 " "

" 67 8 59 64 " "

" 67 8 59 60 " "

" 1,458 16 1,442 1,853 Negotiation Butt Brothers

" 479 322 157 539 Tender Mr. Raza Khan - House # 1229,

University Road, Karachi

" 886 549 337 855 " Mr. Ziauddin - D-741, Block R,

Usman Ghani Colony, North

Nazimabad, Karachi

" 879 545 334 777 " Mr. Farrukh Amjad Shah Taimori -

House R-25, Gulshan-e-Rizwan, 5-L,

North Karachi

" 367 247 120 401 " Mr. Ajab Khan - Machar Colony,

Sohrab Goth, Karachi

" 427 287 140 426 " Mr. Sanaullah - House 34-E, PECHS,

Block 6, Karachi

Plant and Machinery 466 399 67 41 Auction Mr. Muhammad Umar - Flat 306,

Hangora House, Moosa Lane, Karachi.

Accumulated Sal e

depreciation proceeds

3.4

2013 2012

Rupees 000

4. INTANGIBLE ASSETS - Computer Softwares

Opening balance

Cost 21,130 20,942

Accumulated amortisation (20,041) (18,904)

Net book value 1,089 2,038

Year ended March 31, 2013

Opening net book value 1,089 2,038

Additions 150 188

Amortisation (801) (1,137)

Closing net book value 438 1,089

Closing balance

Cost 21,280 21,130

Accumulated amortisation (20 842) (20 041)

Capital work-in-progress includes costs incurred in respect of plant and machinery

at Body Manufacturing Division amounting to Rs. 3.6 million. Prior year balance

includes Rs. 21.61 million in respect of assembly facility at Chassis Assembly

Division capitalised during the current year.

Description Cost Book Mode of Particulars of purchaser

value disposal

Rupees '000

Motor Vehicle 66 12 54 60 Insurance Claim EFU General Insurance Limited

Central Division Karachi

" 90 20 70 80 " "

" 67 6 61 68 " "

" 67 6 61 70 " "

" 67 8 59 65 " "

" 67 8 59 64 " "

" 67 8 59 60 " "

" 1,458 16 1,442 1,853 Negotiation Butt Brothers

" 479 322 157 539 Tender Mr. Raza Khan - House # 1229,

University Road, Karachi

" 886 549 337 855 " Mr. Ziauddin - D-741, Block R,

Usman Ghani Colony, North

Nazimabad, Karachi

" 879 545 334 777 " Mr. Farrukh Amjad Shah Taimori -

House R-25, Gulshan-e-Rizwan, 5-L,

North Karachi

" 367 247 120 401 " Mr. Ajab Khan - Machar Colony,

Sohrab Goth, Karachi

" 427 287 140 426 " Mr. Sanaullah - House 34-E, PECHS,

Block 6, Karachi

Plant and Machinery 466 399 67 41 Auction Mr. Muhammad Umar - Flat 306,

Hangora House, Moosa Lane, Karachi.

Accumulated Sal e

depreciation proceeds

2013 2012

Rupees 000

5. LONG-TERM INVESTMENTS

Available for sale

Arabian Sea Country Club Limited - note 5.1 5,000 5,000

Provision for impairment (639) (2,705)

4,361 2,295

Automotive Testing & Training Centre

(Private) Limited - note 5.2 500 500

Provision for impairment (427) (404)

73 96

4,434 2,391

5.1

5 2

This represents cost of 500,000 (2012: 500,000) fully paid-up unquoted ordinary

shares of Rs. 10 each. Company holds 6.45% of the shares of the investee

Company. The fair value of the investment is indeterminable.

This represents cost of 50 000 (2012: 50 000) fully paid-up unquoted ordinary

11

5.2

5.3

2013 2012

Rupees 000

6. LONG-TERM LOANS AND

ADVANCES considered good

Loans and advances to:

- executives 10,206 8,654

- other employees 8,484 6,764

18,690 15,418

Less: Recoverable within one year - note 10 (4,986) (5,018)

13,704 10,400

6.1

This represents cost of 50,000 (2012: 50,000) fully paid-up unquoted ordinary

shares of Rs. 10 each. Company holds 2.77% of the shares of the investee

Company. The fair value of these shares is indeterminable.

The loans and advances are provided to employees under their terms of

employment on interest free basis.

Loans under the schemes have been provided to facilitate purchase of motor

vehicles and purchase / construction of house and are repayable over a period of

five to twelve years. The motor vehicle loans are secured by joint registration of

the vehicle in the name of the Company and employee. The loan for purchase /

construction of house is secured against employees' retirement fund balances.

The provision for impairment reversed during the year is based on the break-up

value computed through latest audited financial statements of investee companies.

2013 2012

Rupees 000

6.2 Reconciliation of carrying amount of loans and

advances to executives:

Opening balances 8,654 3,675

Add: Disbursements 5,531 8,699

14,185 12,374

Less: Repayments (3,979) (3,720)

Closing balances 10,206 8,654

7. STORES, SPARES AND LOOSE TOOLS

Stores and spares

21,315 16,778

Loose tools

7,107 8,531

28,422 25,309

Less: Provision for obsolescence (6,873) (6,115)

21,549 19,194

8. STOCK-IN-TRADE

Raw Materials and components - note 8.1

[including in transit Rs. 46 million

(2012: Rs. 407 million)] 1,454,073 1,409,434

Less: Provision for obsolescence (51,355) (43,945)

1,402,718 1,365,489

Work-in-process 22,729 164,669

Finished goods - note 8.1

[including in transit Rs. Nil

(2012: Rs. 9 million)] 659,360 776,852

Less: Provision for obsolescence (17,479) (21,930)

641,881 754,922

Trading stock - Spare parts

[including in transit Rs. 4 million

(2012: Rs. 3 million)] 144,660 166,608

Less: Provision for obsolescence (50,084) (41,006)

94,576 125,602

2,161,904 2,410,682

8.1 Raw materials and finished goods include stocks held with suppliers and Company's

authorised dealers amounting to Rs. 48.99 million (2012: Rs. 22.61 million) and

Rs. 34.13 million (2012: Rs. 27.22 million) respectively.

12

Advances to employees are in respect of house rent assistance and these are

repayable upto a period of five years. These are secured against employees'

retirement fund balances.

2013 2012

9. TRADE DEBTS

Considered good - unsecured

Related parties - note 9.2

Indus Motor Company Limited 43,425 12,665

Orix Leasing Pakistan Limited - 7,700

Others - note 9.3 233,479 1,802,727

276,904 1,823,092

Considered doubtful

Others 137,076 58,977

413,980 1,882,069

Less: Provision for doubtful debts - note 9.4 (137,076) (58,977)

276,904 1,823,092

13

Rupees 000

9.1

2013 2012

Not yet due 121,377 1,110,034

Past due

- Up to 3 months 65,415 615,036

- 3 to 6 months 42,436 67,720

- 6 to 12 months 117,672 46,339

- More than one year 67,080 42,940

292,603 772,035

413,980 1,882,069

9.2

9.3

As at March 31, 2013, trade debts fromrelated parties were outstanding for not more

than 45 days which were cleared subsequent to year end.

As of March 31, 2013, the age analysis of trade debts is as follows:

Rupees 000

This includes amount receivable from government institutions amounting to

Rs. 174 million (2012: Rs. 1.71 billion).

2013 2012

9.4 Balance at the beginning of the year 58,977 62,108

Charge during the year 82,598 15,242

Written off against provision (4,499) (18,373)

Balance at the end of the year 137,076 58,977

10. LOANS AND ADVANCES

Current maturity of long term loans and advances to:

- executives 2,965 3,156

- other employees 2,021 1,862

4,986 5,018

Advances to:

th l 1 104 863

14

Rupees 000

- other employees 1,104 863

- suppliers 9,789 31,858

10,893 32,721

15,879 37,739

Provision for doubtful advances to suppliers (3,635) -

12,244 37,739

11. TRADE DEPOSITS AND PREPAYMENTS

Trade deposits 17,090 39,314

Provision for doubtful deposits - note 11.1 (5,325) (10,605)

11,765 28,709

Prepayments 11,671 5,971

23,436 34,680

11.1 Balance at the beginning of the year 10,605 14,496

Reversed during the year (884) (3,058)

Written off against provision (4,396) (833)

Balance at the end of the year 5,325 10,605

2013 2012

12. REFUNDS DUE FROM THE GOVERNMENT

Sales tax refundable - note 12.1 233,531 105,170

Custom duty and excise duty refundable 2,710 7,962

236,241 113,132

Less: Provision for doubtful refundables - note 12.2 (30,239) (25,239)

206,002 87,893

12.1 This includes sales tax refundable of Rs. 167 million (2012: Rs. 187 million), net of

provisional refunds of Rs. 519.05 million (2012: Rs. 519.05 million) received against

bank guarantees and undertakings, the recovery of which is dependent upon the

fulfilment of the requirements of standing order no. 1 of 2010 issued by the Federal

Board of Revenue and verification of related sales tax records. The Company is in the

process of complying with the regulatory requirements.

Rupees 000

15

2013 2012

12.2 Balance at the beginning of the year (25,239) (5,239)

Charge during the year (5,000) (20,000)

Balance at the end of the year (30,239) (25,239)

13. OTHER RECEIVABLES

Considered good

Receivable from related parties

Toyota Tsusho Corporation, J apan 5,430 28,183

Hino Motors Limited, J apan 228 2,633

Employees' Provident Fund - 187

Workers Profits Participation Fund - note 13.1 2,495 -

Others 1,466 836

9,619 31,839

Rupees 000

2013 2012

13.1 Workers Profits Participation Fund

Opening liability (8,835) (2,173)

Allocation for the year (2,505) (8,835)

(11,340) (11,008)

Interest on funds utilised in the Companys business - (60)

(11,340) (11,068)

Amount paid to the Fund 13,835 2,233

Closing asset / (liability) 2,495 (8,835)

14. CASH AND BANK BALANCES

Balances with banks:

- on current accounts 117,211 28,013

- on PLS savings accounts 55,160 24,738

Cheques in hand 619 71,641

Cash in hand 357 134

173,347 124,526

14.1

2013 2012

15. SHARE CAPITAL

15.1 Authorised share capital

20,000,000 ordinary shares of Rs. 10 each 200,000 200,000

15.2 Issued, subscribed and paid-up capital

Ordinary shares of Rs. 10 each

shares issued for consideration

62,003 62,003

shares issued for consideration otherwise

than in cash - fixed assets 41,335 41,335

shares issued as bonus shares 20,668 20,668

12,400,560 124,006 124,006

2,066,760

Rupees 000

6,200,280

paid in cash

2,066,760

Rupees 000

16

4,133,520

At March 31, 2013, the rates of mark-up on savings accounts is 6% per annum

(2012: ranging from 5% to 6% per annum).

15.3

2013 2012

16. SURPLUS ON REVALUATION OF FIXED ASSETS

Opening balance 1,026,250 1,049,014

Realisation on disposal of fixed asset

during the year - net of deferred tax - (2,255)

Transferred to unappropriated profit on account

of incremental depreciation for the

year - net of deferred tax (23,260) (20,509)

Closing balance 1,002,990 1,026,250

17. DEFERRED TAXATION

Credit balances arising in respect of:

- accelerated tax depreciation allowances 89,929 90,946

- surplus arising on revaluation of fixed assets 82,293 86,150

- others 1,552 14,002

173,774 191,098

Debit balances arising in respect of:

- provision for stores and stocks obsolescence (42,706) (38,253)

- provision for doubtful trade debts, deposits

advances and other receivables (60,239) (32,133)

- provision for warranty (28,594) (43,081)

- recoupable carried forward tax losses - (8,241)

(131,539) (121,708)

42,235 69,390

17.1

At March 31, 2013 and March 31, 2012 Hino Motors Ltd, J apan - holding company

and Toyota Tsusho Corporation, J apan - associated company respectively held

7,357,665 and 3,678,833 ordinary shares of Rs. 10 each.

At March 31, 2013 and March 31, 2012 Hino Motors Ltd, J apan - holding company

and Toyota Tsusho Corporation, J apan - associated company respectively held

7,357,665 and 3,678,833 ordinary shares of Rs. 10 each.

17

Rupees 000

Deferred tax of Rs. 229.95 million on minimumtax paid in prior years has not been

recognised as based on latest projections it is not probable that taxable profits will be

available to offset the unrecognised balance.

2013 2012

18. STAFF RETIREMENT BENEFITS

Gratuity Fund 2,257 1,545

Pension Fund 4,408 299

Unfunded Gratuity - Contractual Staff 64,747 65,391

71,412 67,235

18

Rupees 000

Unfunded Unfunded

Gratui ty Pension Gratuity Gratuity Pension Gratuity

Fund Fund Fund Fund

Rupees '000

18.1 Movement in asset / (l iabi li ty)

Opening balance (1,545) (299) (65,391) 25 (16,200) (56,905)

Charge for the year (7,907) (13,555) (14,859) (7,993) (10,508) (14,206)

Payments during the year 6,863 7,645 15,503 6,423 24,754 5,720

Employee contributions - 1,765 - - 1,655 -

Benefits paid on behalf of Fund 332 36 - - - -

Closing balance (2,257) (4,408) (64,747) (1,545) (299) (65,391)

18.2 Balance sheet reconcil iation as at

March 31, 2013

Fair value of plan assets 75,505 104,376 - 63,026 86,222 -

Present value of obligations (99,768) (154,378) (65,665) (75,555) (118,976) (64,673)

Deficit (24,263) (50,002) (65,665) (12,529) (32,754) (64,673)

U i d t i l l / ( i ) 22 006 44 288 918 10 984 30 823 (1175)

Funded

2013 2012

Funded Unfunded Unfunded

Gratui ty Pension Gratuity Gratuity Pension Gratuity

Fund Fund Fund Fund

Rupees '000

18.1 Movement in asset / (l iabi li ty)

Opening balance (1,545) (299) (65,391) 25 (16,200) (56,905)

Charge for the year (7,907) (13,555) (14,859) (7,993) (10,508) (14,206)

Payments during the year 6,863 7,645 15,503 6,423 24,754 5,720

Employee contributions - 1,765 - - 1,655 -

Benefits paid on behalf of Fund 332 36 - - - -

Closing balance (2,257) (4,408) (64,747) (1,545) (299) (65,391)

18.2 Balance sheet reconcil iation as at

March 31, 2013

Fair value of plan assets 75,505 104,376 - 63,026 86,222 -

Present value of obligations (99,768) (154,378) (65,665) (75,555) (118,976) (64,673)

Deficit (24,263) (50,002) (65,665) (12,529) (32,754) (64,673)

Unrecognised actuarial loss / (gain) 22,006 44,288 918 10,984 30,823 (1,175)

Transitional liability not yet reognised - - - - - 457

Past service cost - non vested - 1,306 - - 1,632 -

(2,257) (4,408) (64,747) (1,545) (299) (65,391)

18.3 Charge for the year

Current service cost 5,980 6,582

9,411

6,260 5,993 6,055

Interest cost 9,138 14,478

7,115

8,542 12,269 7,694

Expected return on plan assets (7,701) (10,535)

-

(7,429) (8,278) -

490 2,704 - 620 198 -

Curtailment gain

- - (2,124) - - -

Recognised transitional liability

- - 457 - - 457

Past service cost - vested - 326

-

- 326 -

7,907 13,555 14,859 7,993 10,508 14,206

18.4 Movement in the present value of

obli gati on

Opening balance 75,555 118,976 64,673 62,350 87,633 57,819

Current service cost 5,980 6,582 9,411 6,260 5,993 6,055

Interest cost 9,138 14,478 7,115 8,542 12,269 7,694

Curtailment gain - - (2,124) - - -

Actuarial loss / (gain) 13,993 20,647 2,093 1,069 18,765 (1,175)

Benefits paid (4,898) (6,305) (15,503) (2,666) (5,684) (5,720)

Closing balance 99,768 154,378 65,665 75,555 118,976 64,673

18.5 Movement in fai r val ue of plan assets

Opening balance 63,026 86,222 - 51,185 59,132 -

Expected return on plan assets 7,701 10,535 - 7,429 8,278 -

Actuarial gain / (loss) 2,481 4,478 - 655 (1,913) -

Employer contributions 6,863 7,645 - 6,423 24,754 -

Employee contributions - 1,765 - - 1,655 -

Benefits paid on behalf of Fund 332 36 - - - -

Benefits paid (4,898) (6,305) - (2,666) (5,684) -

Closing balance 75,505 104,376 - 63,026 86,222 -

18.6 Actual return on plan assets 10,182 15,013 - 8,084 6,365 -

Actuarial loss recognised

during the year

Funded

2013 2012

Funded

19

2012

Unfunded Unfunded

Gratuity Pension Gratuity Gratuity Pension Gratuity

Fund Fund Fund Fund

18.7 Plan assets comprise of:

Equity (%) 7 2 - 5 2 -

Debt (%) 76 64 - 75 56 -

Others (%) 17 34 - 20 42 -

100 100 - 100 100 -

18.8

Expected rate of return on investments (%) 11.5 11.5 - 12.0 12.0 -

Expected rate of increase in salaries (%) 10.5 10.5 11.5 11.5 11.5 12.5

Discount factor used (%) 11.5 11.5 11.5 12.5 12.5 12.5

60 60 60 60 60 60

2013

Key actuarial assumpti ons used:

Retirement age (years)

Funded Funded

18.9 Comparison for fi ve years:

March 31, March 31, March 31, March 31, March 31,

2013 2012 2011 2010 2009

18.10

18.11

The expected return on plan assets is based on the market expectations and depends

upon the asset portfolio of the plan, at the beginning of the period, for returns over the

entire life of the related obligation.

Based on actuary's advice, the amount of expected contribution to gratuity and pension

funds in 2013-14 will be Rs. 9.37 million and Rs. 13.21 million respectively.

2012

Unfunded Unfunded

Gratuity Pension Gratuity Gratuity Pension Gratuity

Fund Fund Fund Fund

18.7 Plan assets comprise of:

Equity (%) 7 2 - 5 2 -

Debt (%) 76 64 - 75 56 -

Others (%) 17 34 - 20 42 -

100 100 - 100 100 -

18.8

Expected rate of return on investments (%) 11.5 11.5 - 12.0 12.0 -

Expected rate of increase in salaries (%) 10.5 10.5 11.5 11.5 11.5 12.5

Discount factor used (%) 11.5 11.5 11.5 12.5 12.5 12.5

60 60 60 60 60 60

2013

Key actuarial assumpti ons used:

Retirement age (years)

Funded Funded

18.9 Comparison for fi ve years:

March 31, March 31, March 31, March 31, March 31,

2013 2012 2011 2010 2009

Gratuity fund

Fair value of plan assets 75,505 63,026 51,185 76,711 73,784

Present value of defined benefit

obligation (99,768) (75,555) (62,350) (98,321) (83,592)

(Deficit) / surplus (24,263) (12,529) (11,165) (21,610) (9,808)

Experience adjustment

Actuarial loss on obligation 13,993 1,069 1,226 1,227 9,350

Actuarial (gain) / loss on plan assets (2,481) (655) 1,507 2,542 5,828

Pension fund

Fair value of plan assets 104,376 86,222 59,132 82,761 65,290

Present value of defined benefit

obligation (154,378) (118,976) (87,633) (105,088) (94,797)

(Deficit) / surplus (50,002) (32,754) (28,501) (22,327) (29,507)

Experience adjustment

Actuarial loss / (gain) on obligation 20,647 18,765 7,377 (7,752) 2,216

Actuarial (gain) / loss on plan assets (4,478) 1,913 (3,213) (3,370) (18,911)

Rupees '000

2013 2012

19. TRADE AND OTHER PAYABLES

Creditors 87,207 134,597

Bills payable to

- Toyota Tsusho Corporation, J apan

- associated company 169,239 1,405,931

- Hino Motors Limited, J apan - holding company 839 5,778

Accrued liabilities 189,759 245,886

Provision for warranty services - note 19.1 84,225 127,258

Advances from customers 855,778 448,563

Provision for compensated absences - note 19.2 43,549 37,013

Custom duties payable - note 19.3 158,750 157,969

Payable to Hino Motors, Ltd. J apan - holding company

- royalty 16,305 44,721

- other - 9,592

Security deposits from dealers 32,000 32,000

Provision for infrastructure cess 23,249 23,249

Employees related obligation - note 19.4 27,672 22,357

Tax deducted at source and payable to

statutory authorities 4,108 6,860

Workers profits participation fund - note 13.1 - 8,835

Workers welfare fund 933 -

Excise duty payable 630 4,472

Unclaimed dividend 2,056 1,965

Others 7,437 4,843

1,703,736 2,721,889

19.1 Provision for warranty services

Balance at the beginning of the year 127,258 85,579

Recognised during the year 4,542 100,907

Expenses against provision (47,575) (59,228)

Balance at the end of the year 84,225 127,258

Rupees 000

20

2013 2012

19.2 Provision for compensated absences

Balance at the beginning of the year 37,013 24,977

Net charge during the year 16,962 19,437

Payments made (10,426) (7,401)

Balance at the end of the year 43,549 37,013

19.3

19.4

2013 2012

20. SHORT-TERM BORROWINGS

Short-term loans 350,000 950,000

Running finance 295,948 288,331

645,948 1,238,331

The facilities for short term borrowings under mark-up arrangements with various

banks amounted to Rs. 3.75 billion (2012: Rs. 3.73 billion) of which the amount

remaining unutilised at the year end was Rs. 3.11 billion (2012: Rs. 2.49 billion).

Rupees 000

The short termloans have been obtained fromvarious banks and carry mark-up at

rates ranging from 9.60% per annum to 9.97% per annum (2012: 12.33% per

annum to 12.46% per annum). The loans are repayable by April 24, 2013.

These include contributions made by employees towards the sale price of vehicles

provided to them by the Company in accordance with the Company's vehicle policy.

21

The facilities for opening the letters of credit and guarantees as at

March 31, 2013 amounted to Rs. 6.83 billion (2012: Rs. 6.77 billion) of which

the amount remaining unutilised at the year end was Rs. 5.16 billion

(2012: Rs. 4.07 billion).

Rupees 000

The above facilities are secured by way of hypothecation charge on stock-in-trade.

These represent demands raised by Collector of customs in respect of customduty

payable on CKD kits imported in 1993 and between 1998 to 2006. The same have

been appealed against at appropriate levels and reply from authorities is awaited.

2013 2012

21. ACCRUED MARK-UP

Short-term loans 17,900 25,641

Running finance 14,793 15,648

32,693 41,289

22. CONTINGENCY AND COMMITMENTS

22.1

22.2

2013 2012

23. SALES

Gross sales 8,882,255 10,310,798

Sales tax and excise duty (1,210,726) (1,377,440)

7,671,529 8,933,358

Commission and discounts (103,209) (109,337)

Sale returns (40,180) (57,024)

7,528,140 8,766,997

23.1 Sales to Government institutions of Rs. 2.12 billion (2012: Rs. 3.23 billion) account

for over 28 percent (2012: 36 percent) of the net sales.

22

Rupees 000

Commitments for capital expenditures as at March 31, 2013 amounted to

Rs. 4.08 million (2012: Rs. 2.07 million).

As at March 31, 2013 the Company has received provisional refunds of

Rs. 519.05 million (2012: Rs. 519.05 million) fromthe sales tax department against

undertakings and bank guarantees.

Rupees 000

The rates of mark-up applicable on running finance are based on KIBOR and range

from 10.21% per annum to 10.71% per annum (2012: 12.67% per annum to

15.53% per annum).

24 TOTAL COST OF SALES, DISTRIBUTION COSTS AND ADMINISTRATION EXPENSES

2013 2012 2013 2012 2013 2012 2013 2012

Raw materials consumed 5,648,039 7,233,127 - - - - 5,648,039 7,233,127

Staff costs - note 24.1 371,237 398,003 104,824 104,820 88,559 79,042 564,620 581,865

Depreciation and amortisation 102,008 93,107 8,521 8,573 13,264 11,545 123,793 113,225

Rent, rates and taxes 5,232 10,033 3,872 2,710 3,288 2,396 12,392 15,139

Insurance 3,890 4,436 770 722 3,987 4,010 8,647 9,168

Vehicle running and maintenance 12,583 12,682 14,757 13,660 10,135 10,722 37,475 37,064

Fuel and power 36,231 43,935 2,320 2,018 8,611 9,170 47,162 55,123

Travelling and entertainment 5,109 8,172 8,219 7,411 8,132 5,596 21,460 21,179

Repairs and maintenance 21,003 23,321 1,192 1,906 9,849 9,384 32,044 34,611

Communication and stationery 3,920 3,635 4,075 5,867 4,416 5,743 12,411 15,245

Royalty and technical assistance 75,055 88,845 - - - - 75,055 88,845

Provision / (Reversal) for obsolete

3,717 (2,977) - - - - 3,717 (2,977)

Legal and professional charges 2,554 - 1,584 - 10,676 11,733 14,814 11,733

Auditors' remuneration - note 24.2 - - - - 2,723 2,498 2,723 2,498

Security and maintenance - - 1,398 - 39,622 35,312 41,020 35,312

Outward freight and handling - - 1,325 6,927 - - 1,325 6,927

Advertising and sales promotion - - 21,205 16,523 - - 21,205 16,523

Product maintenance charges - - 23,940 20,948 - - 23,940 20,948

stock-in-trade, stores and spares

23

TOTAL COST OF

SALES

DISTRIBUTION

COSTS

ADMINISTRATION

EXPENSES

Rupees '000

Warranty services - - 4,542 100,907 - - 4,542 100,907

Provision for doubtful receivables,

- - 85,349 12,184 - - 85,349 12,184

Provision for doubtful sales tax

- - 5,000 20,000 - - 5,000 20,000

- - 541 - - 997 541 997

Other expenses 7,041 8,915 2,260 3,036 3,476 3,865 12,777 15,816

6,297,619 7,925,234 295,694 328,212 206,738 192,013 6,800,051 8,445,459

Opening stock of work in process 164,669 280,809

Closing stock of work in process (22,729) (164,669)

Cost of goods manufactured 6,439,559 8,041,374

Opening stock of finished goods 754,922 421,470

Closing stock of finished goods (641,881) (754,922)

6,552,600 7,707,922

Consumption of trading goods 168,019 150,997

6,720,619 7,858,919

24.1 Staff costs

advances and deposits

Receivables written off

refundable

2013 2012 2013 2012 2013 2012 2013 2012

341,522 371,224 96,412 97,129 81,515 73,201 519,449 541,554

24,523 22,257 6,421 5,858 5,377 4,592 36,321 32,707

5,192 4,522 1,991 1,833 1,667 1,249 8,850 7,604

371,237 398,003 104,824 104,820 88,559 79,042 564,620 581,865

Charge for defined

contribution plan

Rupees '000

COST OF

SALES

DISTRIBUTION

EXPENSES

ADMINISTRATION

EXPENSES

TOTAL

Salaries, wages, allowances

and staff welfare

Charge for defined

benefit plans

2013 2012

Rupees 000

24.2 Auditors' remuneration

Audit fee 1,370 1,250

Fee for limited review of half yearly financial

statements and other certifications 1,030 925

Out of pocket expenses 323 323

2,723 2,498

25. OTHER INCOME

Income from financial assets

Return on PLS savings accounts 1,673 1,211

Income from non financial assets

24

Income from non-financial assets

Gain on disposal of non-current assets 6,379 1,140

Others

Scrap sales 22,708 31,839

Commission from an associated company 28,068 71,714

Liabilities no longer required written back 10,026 766

Others 2,231 7,312

71,085 113,982

26. OTHER EXPENSES

Donations and charities - note 26.1 2,855 1,023

Workers' Profits Participation Fund 2,505 8,835

Workers' Welfare Fund 933 -

6,293 9,858

26.1 None of the directors or their spouses had any interest in the donees.

2013 2012

Rupees 000

27. FINANCE COST

Mark-up on short-term borrowings 111,191 171,724

Exchange loss - net 203,057 133,774

Bank charges and others 10,751 13,043

324,999 318,541

28. TAXATION

Current - for the year 51,169 99,314

- for prior years (5,500) 27,231

Deferred (27,870) 21,181

17,799 147,726

28.1

Profit before taxation 44,882 173,436

Tax calculated at the rate of 35% (2012: 35%) 15,709 60,703

Effect of final tax regime (1,795) (13,337)

(Reversal) / Charge of prior years' tax provision (5,500) 27,231

Tax effect of other than temporary differences 9,385 73,129

Tax charge for the year 17,799 147,726

29. BASIC AND DILUTED EARNINGS PER SHARE

27,083 25,710

Number of ordinary shares (in '000s) issued and

subscribed at the end of the year 12,401 12,401

Earnings per share Rs 2.18 Rs 2.07

29.1

25

A diluted earnings per share has not been presented as the Company does not have any

convertible instruments in issue as at March 31, 2013 and March 31, 2012 which would

have any effect on the earnings per share if the option to convert is exercised.

Profit after taxation attributable to

ordinary shareholders

Relationship between tax expense and

accounting profit

2013 2012

Rupees 000

30. CASH GENERATED FROM OPERATIONS

Profit before taxation 44,882 173,436

Depreciation and amortisation 123,793 113,225

Gain on disposal of operating fixed assets (6,379) (1,140)

Retirement benefits charge 36,321 32,707

Mark-up on short-term borrowings 111,191 171,724

Return on PLS savings accounts (1,673) (1,211)

Profit before working capital changes 308,135 488,741

EFFECT ON CASH FLOW DUE TO WORKING

CAPITAL CHANGES

Decrease / (Increase) in current assets

Stores, spares and loose tools (2,355) 600

Stock-in-trade 248,778 (733,157)

Trade debts 1,546,188 (1,340,522)

Loans and advances 25,495 45,643

Trade deposits and prepayments 11,244 (7,427)

Refunds due from the government (118,109) 137,586

Other receivables 22,220 (2,988)

1,733,461 (1,900,265)

Increase / (Decrease) in current liabilities

Trade and other payables (1,018,244) 1,124,001

715,217 (776,264)

1,023,352 (287,523)

31. CASH AND CASH EQUIVALENTS

Cash and bank balances - note 14 173,347 124,526

Short-term borrowings - note 20 (645,948) (1,238,331)

(472,601) (1,113,805)

26

Add / (less): Adjustments for non cash charges

and other items

32.

27

The amounts charged in these financial statements for remuneration of the Managing

Director, Directors and Executives of the Company are as follows:

REMUNERATION OF MANAGING DIRECTOR / CHIEF

EXECUTIVE, DIRECTORS AND EXECUTIVES

MANAGING DIRECTOR /

CHIEF EXECUTIVE DIRECTORS EXECUTIVES

2013 2012 2013 2012 2013 2012

Managerial remuneration

and allowances 6,425 5,154 11,388 8,781 63,804 61,020

Bonus 2,108 1,470 3,699 2,493 20,559 14,287

Retirement benefits - - - - 10,392 8,416

Rent and utilities 466 2,432 3,355 4,113 23,446 20,393

Leave passage 418 369 768 624 3,636 2,989

Club expenses - - - - 371 385

Medical expenses 154 146 332 291 3,960 3,215

9,571 9,571 19,542 16,302 126,168 110,705

Number of persons 1 1 3 2 39 33

Rupees '000

32.1

32.2

2013 2012

Units

33. PLANT CAPACITY AND PRODUCTION

Plant capacity (single shift without overtime)

- Chassis 6,000 6,000

- Bodies 1,800

1,800

Actual production

- Chassis 1,359 2,222

- Bodies 305 1,067

33.1

Consultancy fee of Rs. 5.27 million (2012: Rs. 4.58 million) is paid to the Chairman and

he is also provided with free use of Company maintained car.

The Managing Director, Executive Directors and certain executives of the Company are

provided with free use of Company maintained cars and housing facilities in accordance

with their terms of employment.

Low chassis and bodies production during the year was consequent to low market

demand.

MANAGING DIRECTOR /

CHIEF EXECUTIVE DIRECTORS EXECUTIVES

2013 2012 2013 2012 2013 2012

Managerial remuneration

and allowances 6,425 5,154 11,388 8,781 63,804 61,020

Bonus 2,108 1,470 3,699 2,493 20,559 14,287

Retirement benefits - - - - 10,392 8,416

Rent and utilities 466 2,432 3,355 4,113 23,446 20,393

Leave passage 418 369 768 624 3,636 2,989

Club expenses - - - - 371 385

Medical expenses 154 146 332 291 3,960 3,215

9,571 9,571 19,542 16,302 126,168 110,705

Number of persons 1 1 3 2 39 33

Rupees '000

34. RELATED PARTY DISCLOSURES

Disclosure of transactions between the Company and related parties:

Relationship Nature of transaction 2013 2012

i. Holding company - Purchase of goods 63,642 129,562

- Royalty charge 67,279 78,085

- Technical assistance fee 7,776 10,760

- Dividend paid 11,404 -

9,592 -

ii. Associated companies - Purchase of goods 4,145,561 5,374,813

- Sale of goods 728,083 633,451

21,013 24,941

- Commission earned 28,068 71,714

- Dividend paid 5,702 -

iii.

34,861 37,254

Rupees 000

Staff retirement funds

- Payments to retirement

benefit plans

28

- Purchase of property,

plant and equipment

- Liability written back

, ,

34.1

34.2

35. PROVIDENT FUND RELATED DISCLOSURES

The following information is based on latest un-audited financial statements of the Fund:

2013 2012

Size of the fund - Total assets 126,504 122,711

Percentage of investments made 99% 100%

Fair value of investments 125,405 122,712

35.1 The cost of above investments amounted to Rs. 112 million (2012: 113 million).

35.2 The break-up of fair value of investments is:

2013 2012 2013 2012

Percentage

National savings scheme 28% 58% 34,945 70,596

Bank deposits 20% 14% 24,861 17,742

Government securities 25% 25% 31,641 30,416

Debt securities 3% 3% 3,886 3,958

Mutual funds 24% 0% 30,072 -

100% 100% 125,405 122,712

35 3 The investments out of provident fund have been made in accordance with the provisions of

Rupees 000

Outstandingbalances with related parties as at year end have been included in trade debts, other

receivables and trade and other payables respectively. These are settled in ordinary course of

business.

Rupees 000

Details of compensation to key management personnel comprising of Managing Director and

Directors is disclosed in note 32 above.

p

36. FINANCIAL INSTRUMENTS AND RELATED DISCLOSURES

Financial assets and liabilities

Maturity Maturity Sub-total Maturity Maturity Sub-total

up to one after one up to one after one

year year year year

Financial assets

Available for sale

Long term investments - - - - 4,434 4,434 4,434

Loans and receivables

Loans and advances - - - 4,986 13,704 18,690 18,690

Deposits - - 11,765 6,025 17,790 17,790

Trade debts - - - 276,904 - 276,904 276,904

Other receivables - - - 9,619 - 9,619 9,619

Cash and bank balances 55,160 - 55,160 118,187 - 118,187 173,347

55,160 - 55,160 421,461 24,163 445,624 500,784

24,738 - 24,738 1,988,312 18,806 2,007,118 2,031,856

Financial liabilities

Rupees 000

29

Interest / Mark-up bearing Non Interest / Mark-up bearing Total

2013

2012

At amortised cost

Trade and other payables - - - 532,514 - 532,514 532,514

Short-term borrowings 645,948 - 645,948 - - - 645,948

Accrued mark-up - - - 32,693 - 32,693 32,693

645,948 - 645,948 565,207 - 565,207 1,211,155

1,238,331 - 1,238,331 1,948,959 - 1,948,959 3,187,290

On balance sheet gap

(590,788) - (590,788) (143,746) 24,163 (119,583) (710,371)

(1,213,593) - (1,213,593) 39,353 18,806 58,159 (1,155,434)

OFF BALANCE SHEET FINANCIAL INSTRUMENTS

Commitments for capital

expenditure

4,077

Letters of credit

291,356

Letters of guarantee 1,376,711

1,672,144

2,700,445

(i) Interest / Mark-up rate risk

2012

The Companys interest rate / mark-up risk arises fromborrowings as the Company has no

significant interest-bearing assets. Borrowings issued at variable rates expose the Company

to cash flow interest rate risk.

2013

2012

The effective interest / mark-up rates for the monetary financial assets and liabilities are

mentioned in respective notes to the financial statements.

2013

2012

2013

Interest / mark-up rate risk is the risk that the value of a financial instrument will

fluctuate due to changes in the market interest / mark-up rates. As at

March 31, 2013 the Company's interest bearing financial liabilities of

Rs. 645.95 million (2012: Rs. 1,238.33 million) represent the short-termborrowings

at floating rate to manage the working capital requirements of the Company. These

borrowings are repriced at a maximum period of three months. Hence the

management believes that the Company is not materially exposed to interest rate

changes. The effective mark-up rates for financial assets and liabilities are

mentioned in respective notes to the financial statements.

For the above mentioned interest bearing financial liabilities, had the interest rates

varied by 200 basis points with all the other variables held constant, profit

before tax for the year would have been approximately lower / higher by

Rs. 12.92 million (2012: lower / higher by Rs. 24.77 million), mainly as a result of

higher / lower interest expense on floating rate borrowings.

30

The sensitivityof 200 basis points movement in the interest rates has been used as

historically (five years) floating interest rates have moved by an average of 200

basis points per annum.

(ii) Credit risk

(iii) Liquidity risk

The Company attempts to control credit risk by monitoring credit exposure, limiting

transactions with specific counterparties and continually assessing the

creditworthiness of counterparties.

Credit risk represents the accounting loss that would be recognised if counterparts

failed to performas contracted. The financial assets exposed to credit risk amount

to Rs. 500.43 million (2012: Rs. 2,031.86 million). The Company believes that it is

not materially exposed to credit risk as major part of these financial assets

comprises of receivable from government institutions and bank balances which

represent low credit risk as they are placed with banks and other financial

institutions having good credit ratings assigned by credit rating agencies.

Liquidity risk reflects the Company's inability in raising funds to meet its

commitments. The Company manages liquidity risk by maintaining sufficient cash

and bank balances and the availability of financing through banking arrangements.

Management monitors rolling forecast of the Company's liquidity reserve which

comprises undrawn borrowing facility and cash and cash equivalents on the basis

of expected cash flow.

The other financial assets are neither material to the financial statements nor

exposed to any significant credit risk.

(iv) Foreign exchange risk

The sensitivity of foreign exchange rate looks at the outstanding foreign exchange

balances of the Company as at the balance sheet date and assumes this is the

position for a full twelve-month period The volatility percentage for movement in

31

Foreign exchange risk arises mainly when receivables and payables exist due to

transactions based on currencies other than Pak Rupee. As at March 31, 2013

payable exposed to foreign exchange risk is of Rs. 186.38 million

(2012: Rs. 1,466.02 million).

As at March 31, 2013, if the Pak Rupee had weakened / strengthened by 10%

against US Dollar withall other variables held constant, profit before taxfor the year

would have been lower / higher by Rs. 17.01 million (2012: Nil), mainly as a result

of foreign exchange losses / gains on translation of J apanese Yen denominated

financial assets and liabilities.

As at March 31, 2013, if the Pak Rupee had weakened / strengthened by 16%

against J apanese Yen with all other variables held constant, profit before tax for the

year would have been lower / higher by Rs. 2.61 million (2012: Rs. 234.56 million),

mainly as a result of foreign exchange losses / gains on translation of J apanese

Yen denominated financial assets and liabilities.

(v) Fair values of financial assets and liabilities

37. CAPITAL RISK MANAGEMENT

2013 2012

Total Borrowings 678,641 1,279,620

Cash and Bank (173,347) (124,526)

Net debt 505,294 1,155,094

Total equity 1,561,964 1,529,514

Total capital 2,067,258 2,684,608

Gearing ratio 24% 43%

position for a full twelve-month period. The volatility percentage for movement in

foreign exchange rates has been used due to the fact that historically (5 years) rate

has moved on average basis by the mentioned percentage per annum.

During the year, the Company's strategy was to maintain leveraged gearing. The

gearing ratio as at March 31 is as follows:

The carrying values of all financial assets and liabilities reflected in the financial

statements approximate their fair values.

The Companys objectives when managing capital are to safeguard the entitys

ability to continue as a going concern, so that it can continue to provide adequate

returns to shareholders and benefits to other stakeholders and to maintain an

optimal capital structure to reduce cost of capital.

Rupees 000

38. NUMBER OF EMPLOYEES

2013 2012

Number of employees at March 31

- Permanent 302 289

- Contractual 698 902

Average number of employees during the year

- Permanent 305 291

- Contractual 752 916

39. SUBSEQUENT EVENTS AND DATE OF AUTHORISATION FOR ISSUE

The capital structure of the Company is equity based with no financing throughlong

term borrowings. Company avails short-term borrowings for working capital

purposes only.

32

39. SUBSEQUENT EVENTS AND DATE OF AUTHORISATION FOR ISSUE

39.1

39.2

Managing Director & Chairman

Chief Executive Officer

The Board of Directors in its meeting held on May 23, 2013 proposed a cash

dividend of Rs. 1.638 per share (2012: 1.550 per share) amounting to Rs. 20.31

million (2012: 19.22 million) subject to the approval of the members at the

forthcoming annual general meeting of the Company.

These financial statements were approved and authorised for issue in the Board of

Directors meeting held on May 23, 2013.

You might also like

- MU PLC Annual Report 2002 Financial StatementsDocument21 pagesMU PLC Annual Report 2002 Financial StatementsNurlisaAlnyNo ratings yet

- Honda Balance SheetDocument2 pagesHonda Balance SheetSyed Nabeel Hassan JafferyNo ratings yet

- Turkish Airlines Financial Statements Exel (Hamada SH)Document89 pagesTurkish Airlines Financial Statements Exel (Hamada SH)hamada1992No ratings yet

- Fixed Assets Interview Questions in R12Document21 pagesFixed Assets Interview Questions in R12Balaji Shinde100% (1)

- Chapter 9: Substantive Test of Receivables and Sales The Audit of Receivables and Revenue Represents Significant Audit Risk BecauseDocument4 pagesChapter 9: Substantive Test of Receivables and Sales The Audit of Receivables and Revenue Represents Significant Audit Risk BecauseGirlie SisonNo ratings yet

- PCC - Financial Stahtements 2013 - Final by RashidDocument56 pagesPCC - Financial Stahtements 2013 - Final by RashidFahad ChaudryNo ratings yet

- Consolidated Financial Statements Dec 312012Document60 pagesConsolidated Financial Statements Dec 312012Inamullah KhanNo ratings yet

- Third Quarter March 31 2014Document18 pagesThird Quarter March 31 2014major144No ratings yet

- 2014 IFRS Financial Statements Def CarrefourDocument80 pages2014 IFRS Financial Statements Def CarrefourawangNo ratings yet

- Matahari Department StoreDocument59 pagesMatahari Department StoreResti0805_DyoNo ratings yet

- Comman Size Analysis of Income StatementDocument11 pagesComman Size Analysis of Income Statement4 7No ratings yet

- 2023 q1 Consolidated Audit Report enDocument61 pages2023 q1 Consolidated Audit Report enduyhuynhworkkNo ratings yet

- Afm PDFDocument5 pagesAfm PDFBhavani Singh RathoreNo ratings yet

- Nigeria German Chemicals Final Results 2012Document4 pagesNigeria German Chemicals Final Results 2012vatimetro2012No ratings yet

- Auditors Report Financial StatementsDocument57 pagesAuditors Report Financial StatementsSaif Muhammad FahadNo ratings yet

- 2024 q1 Consolidated Audit Report enDocument70 pages2024 q1 Consolidated Audit Report ensaigo.telestoNo ratings yet

- Chinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012Document50 pagesChinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012alan888No ratings yet

- HUL Stand Alone StatementsDocument50 pagesHUL Stand Alone StatementsdilipthosarNo ratings yet

- Airbus Annual ReportDocument201 pagesAirbus Annual ReportfsdfsdfsNo ratings yet

- 18 Financial StatementsDocument35 pages18 Financial Statementswsahmed28No ratings yet

- MSC-Audited FS With Notes - 2014 - CaseDocument12 pagesMSC-Audited FS With Notes - 2014 - CaseMikaela SalvadorNo ratings yet

- 2021 Con Quarter01 AllDocument61 pages2021 Con Quarter01 AllMohammadNo ratings yet

- FY2015 English ReportDocument109 pagesFY2015 English Reportredevils86No ratings yet

- TSAU - Financiero - ENGDocument167 pagesTSAU - Financiero - ENGMonica EscribaNo ratings yet

- 4.1-Hortizontal/Trends Analysis: Chapter No # 4Document32 pages4.1-Hortizontal/Trends Analysis: Chapter No # 4Sadi ShahzadiNo ratings yet

- Consolidated2010 FinalDocument79 pagesConsolidated2010 FinalHammna AshrafNo ratings yet