0 ratings0% found this document useful (0 votes)

36 viewsLecture 7

Company A claims its average time to replace four tires is 65 minutes. To verify this, a quality auditor collected service times for 100 customers totaling 6832 minutes. The largest time was 312 minutes.

The document discusses using this data to evaluate the company's claim under the assumptions that service times are exponentially distributed and asks the reader to consider: (1) whether a 312 minute service time invalidates the claim; (2) if the total time of 6832 minutes agrees with the theoretical distribution; and (3) what decision the auditor should make about accepting or rejecting the claim.

It also discusses insurance for beachfront properties and calculating: (1) the probability of a homeowner experiencing a hurricane during a 30

Uploaded by

Anonymous T02GVGzBCopyright

© © All Rights Reserved

Available Formats

Download as PDF, TXT or read online on Scribd

0 ratings0% found this document useful (0 votes)

36 viewsLecture 7

Company A claims its average time to replace four tires is 65 minutes. To verify this, a quality auditor collected service times for 100 customers totaling 6832 minutes. The largest time was 312 minutes.

The document discusses using this data to evaluate the company's claim under the assumptions that service times are exponentially distributed and asks the reader to consider: (1) whether a 312 minute service time invalidates the claim; (2) if the total time of 6832 minutes agrees with the theoretical distribution; and (3) what decision the auditor should make about accepting or rejecting the claim.

It also discusses insurance for beachfront properties and calculating: (1) the probability of a homeowner experiencing a hurricane during a 30

Uploaded by

Anonymous T02GVGzBCopyright

© © All Rights Reserved

Available Formats

Download as PDF, TXT or read online on Scribd

You are on page 1/ 2

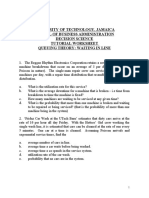

Lecture February, 22, 2012

Case studies to illustrate use of some common distributions

1. Company A is in the business of auto repairs, offering express services.

The star service is replacement of four tires, which the company claims

it is done in time averaging to 65 minutes. When company A applies

for a quality assurance certificate, you are selected to perform a quality

audit and, among other things, verify their 65-minute mean service time

claim.

You know from experience (and company A is willing to confirm) that

service time is exponentially distributed. Unable to check all times for

all customers, you collect at random one hundred service times, and find

that the total adds up to 6832 minutes. Further, the largest happens to

be 312 minutes. With this evidence on hand, you must decide whether

the claimed 65-minute mean service time is plausible or not.

(a) If service time is indeed exponentially distributed, exp(), with

m = 65 minutes, what is ?

(b) With said , how likely is a service time as large, or larger, as

312 minutes? Do yo think this large service time invalidates the

companys claim?

(c) Always with as in (a), what would be the probability of no

times of 312 minutes, or above, among the one hundred times

examined? Do yo think now a 312-minute service time invalidates

the companys claim?

(d) Always with as in (a), what is the distribution of the total service

time for 100 customers?

(e) Is the observed total time of 6832 minutes in good agreement with

the theoretical distribution in (1d)?

(f) What would be your decision? Would you accept the company

claim, or reject it as implausible given the available evidence?

2. Coastal Insurance Company underwrites insurance for beachfront properties along the Virginia, Carolina and Georgia coasts. It uses the

estimate that the probability of a Category III hurricane (sustained

winds of more than 110 mph or higher) striking a location of the coast

in any one year is 0.05. We will assume the probability of more than

one is negligible.

1

(a) What is the probability that a homeowner purchasing a property

with a 30-year mortgage will experience at least one hurricane

of Category III during the mortgage period? Use both the binomial and Poisson approximation approach. Would a normal

approximation be adequate here?

(b) If Coastal Insurance Company contracts insurance for 1,000 homeowners, in a fairly small area, what is the expected number of

claims per year caused by hurricanes of Category III?

(c) What is the distribution of the number of claims caused by Category

III hurricanes? (Remember all homeowners are in a fairly small

area.)

(adapted from Lind et al. (2011))

Things to investigate on your own.

1. Case 1 makes some assumptions (and raise some questions) that deserve

further thought.

(a) Service times are assumed to be exponentially distributed. This is

a rather bizarre assumption, in view of the memoryless property

exponential.

(b) Two possible ways of deciding about the companys claim are

sketched: one looks only at the largest service time, other at the

sum of service times. In both cases, we attempt to assess whether

they are plausible given the companys claim.

This raises some questions: which of the two methods is better?

Is there something still better than either? In both cases we are

looking at a summary of the sample: the largest and the sum of

the service times. Would looking at each service time individually

provide some more information?

You will see systematic treatment of these questions in a few weeks,

as we deal with so-called sufficient statistics. For now, squeeze

your intuition, see what it tells you.

References

D. A. Lind, W. G. Marchal, and S. A. Wathen. Statistical Techniques in

Business and Economics. McGraw Hill Higher Education, 2011.

2

You might also like

- Chapter Outline: Failure Fracture: How Do Materials Break?No ratings yetChapter Outline: Failure Fracture: How Do Materials Break?9 pages

- The Process Flowchart at Arnold Palmer Hospital100% (1)The Process Flowchart at Arnold Palmer Hospital3 pages

- lecture 8; continuous probability distributionNo ratings yetlecture 8; continuous probability distribution7 pages

- 2016 Statistics For Engineers Exam With Formulae SheetNo ratings yet2016 Statistics For Engineers Exam With Formulae Sheet17 pages

- De La Salle University - Dasmariñas: Mathematics and Statistics Department100% (1)De La Salle University - Dasmariñas: Mathematics and Statistics Department2 pages

- EE3110: Tutorial - Renewal Process: Ij Ij 12 23 31 32 12 23 31 32No ratings yetEE3110: Tutorial - Renewal Process: Ij Ij 12 23 31 32 12 23 31 321 page

- 統計學 Midterm Exam 2018/11/30 系級: - - - - - - - - - - - - 學號: - - - - - - - - - - - - 姓名: - - - - - - - - - - - - -No ratings yet統計學 Midterm Exam 2018/11/30 系級: - - - - - - - - - - - - 學號: - - - - - - - - - - - - 姓名: - - - - - - - - - - - - -6 pages

- De La Salle University - Dasmariñas: Mathematics and Statistics DepartmentNo ratings yetDe La Salle University - Dasmariñas: Mathematics and Statistics Department5 pages

- Problem Set on Special Distribution advanceNo ratings yetProblem Set on Special Distribution advance2 pages

- De La Salle University - Dasmariñas: Mathematics and Statistics DepartmentNo ratings yetDe La Salle University - Dasmariñas: Mathematics and Statistics Department6 pages

- Decision Sciences 1: Some Problems From Sessions 7 & 8No ratings yetDecision Sciences 1: Some Problems From Sessions 7 & 85 pages

- Business Statistics A First Course 2nd Edition Sharpe Test Bank Download100% (26)Business Statistics A First Course 2nd Edition Sharpe Test Bank Download16 pages

- Top 5 Reasons For A Roof Consultant To Conduct Your InspectionFrom EverandTop 5 Reasons For A Roof Consultant To Conduct Your InspectionNo ratings yet

- Burdukova Et Al. 2006. Effect of CMC and PH On The Rheology of Suspensions of Isotropic and Anisotropic MineralsNo ratings yetBurdukova Et Al. 2006. Effect of CMC and PH On The Rheology of Suspensions of Isotropic and Anisotropic Minerals15 pages

- Copper Flotation: Metals and Minerals IndustryNo ratings yetCopper Flotation: Metals and Minerals Industry2 pages

- Exploration Analysis: Evaluation of Geochemical Data C. JNo ratings yetExploration Analysis: Evaluation of Geochemical Data C. J2 pages

- Kinetics of Solidification 3: 13.1 Solid-Liquid Interface StructureNo ratings yetKinetics of Solidification 3: 13.1 Solid-Liquid Interface Structure7 pages

- Heat Transfer: Graduate Institute of Ferrous Technology, POSTECH Rongshan Qin (R. S. Qin)No ratings yetHeat Transfer: Graduate Institute of Ferrous Technology, POSTECH Rongshan Qin (R. S. Qin)8 pages

- Case Study: Flow Models: 16.1 Lattice-Gas Automata ModelNo ratings yetCase Study: Flow Models: 16.1 Lattice-Gas Automata Model9 pages

- Phase Field Models: Graduate Institute of Ferrous Technology, POSTECH Rongshan Qin (R. S. Qin)No ratings yetPhase Field Models: Graduate Institute of Ferrous Technology, POSTECH Rongshan Qin (R. S. Qin)10 pages

- Solidification Processing: Lecture 10: Thermodynamics 3No ratings yetSolidification Processing: Lecture 10: Thermodynamics 317 pages

- Organized Labor and the Black Worker, 1619-1981 Philip S. Foner - Own the ebook now with all fully detailed content100% (1)Organized Labor and the Black Worker, 1619-1981 Philip S. Foner - Own the ebook now with all fully detailed content50 pages

- TLE GRADE 7 4TH QUARTER INDUSTRIAL ARTS - TOPIC 1234No ratings yetTLE GRADE 7 4TH QUARTER INDUSTRIAL ARTS - TOPIC 12343 pages

- 9MA0 01 9MA0 02 A Level Pure Mathematics Practice Set 13No ratings yet9MA0 01 9MA0 02 A Level Pure Mathematics Practice Set 135 pages

- Export Mktg. PPT Slides (18!10!2020) (Dr. DHOND)No ratings yetExport Mktg. PPT Slides (18!10!2020) (Dr. DHOND)94 pages

- Published by - Bapi Saha, Mobile-9088857120No ratings yetPublished by - Bapi Saha, Mobile-90888571204 pages

- Idiomatic Rust - Matthias Endler - FOSDEM 2018No ratings yetIdiomatic Rust - Matthias Endler - FOSDEM 201843 pages

- 22 - AE - 111 - Module - 3 - Recording - Business - TransactionsNo ratings yet22 - AE - 111 - Module - 3 - Recording - Business - Transactions23 pages

- Addition & Subtraction To The Hundred ThousandsNo ratings yetAddition & Subtraction To The Hundred Thousands11 pages

- 05 Automatic Fan Control and Intensity Control by Using Microcontroller ProjectNo ratings yet05 Automatic Fan Control and Intensity Control by Using Microcontroller Project39 pages

- Knowledge, Attitudes, and Practices (Kap) Surveys During Cholera Vaccination Campaigns: Guidance For Oral Cholera Vaccine Stockpile CampaignsNo ratings yetKnowledge, Attitudes, and Practices (Kap) Surveys During Cholera Vaccination Campaigns: Guidance For Oral Cholera Vaccine Stockpile Campaigns41 pages

- 1686631159.8276825 - RINGSHINE 2021-2022 AnnualNo ratings yet1686631159.8276825 - RINGSHINE 2021-2022 Annual82 pages

- Cbse Xi SQP MC-03 by Deepika Bhati (2023-24)No ratings yetCbse Xi SQP MC-03 by Deepika Bhati (2023-24)16 pages