Advanced Taxation: The Institute of Chartered Accountants of Pakistan

Advanced Taxation: The Institute of Chartered Accountants of Pakistan

Uploaded by

Ahmed Raza MirCopyright:

Available Formats

Advanced Taxation: The Institute of Chartered Accountants of Pakistan

Advanced Taxation: The Institute of Chartered Accountants of Pakistan

Uploaded by

Ahmed Raza MirOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Advanced Taxation: The Institute of Chartered Accountants of Pakistan

Advanced Taxation: The Institute of Chartered Accountants of Pakistan

Uploaded by

Ahmed Raza MirCopyright:

Available Formats

The Institute of Chartered Accountants of Pakistan

Advanced Taxation

Final Examinations

Module F Summer 2011

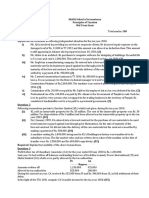

Q.1

June 9, 2011

100 marks 3 hours

Reading time 15 minutes

Mr. Khan has been working for a listed company Turtle Limited (TL) for the last many years. The

details of his emoluments during the tax year ended June 30, 20X4 are as under:

Basic salary (per month)

Conveyance allowance (per month)

Rupees

350,000

50,000

In addition to the above cash emoluments, Mr. Khan was also provided with the following:

(a)

(b)

(c)

A rent free furnished accommodation with a fair market rent of Rs. 100,000 per month.

An 1800cc company maintained car, both for business and private use. The car was

purchased by TL on July 1, 20X1 at a fair market value of Rs. 2,000,000.

On July 1, 20X3 he was provided with an interest free loan of Rs. 2,500,000 which is

repayable in lumpsum in December 20X4. The prescribed benchmark rate is 13% per annum.

On December 1, 20X3 Mr. Khan utilized 60% of the amount of loan for purchasing a double

storey bungalow. The total cost of the bungalow was Rs. 25,000,000. The bungalow, on its

ground floor, also had a suitable space for opening a departmental store.

In order to increase its operational efficiency, TL announced a redundancy scheme to its

employees. Mr. Khan opting for the scheme resigned from TL with effect from January 1, 20X4.

Upon resignation, 25% of his outstanding loan balance was waived by TL and the remaining loan

amount was adjusted from his final settlement. He received the following payments from TL:

Compensation under the redundancy scheme

Gratuity under unapproved scheme

Rupees

4,000,000

2,000,000

Following further information is also available:

(i)

(ii)

Tax of Rs. 1,837,000 was withheld by TL from the above payments.

Mr. Khan was allowed to purchase the 1800cc car at an accounting book value of

Rs. 1,000,000 which he sold in the open market at a price of Rs. 1,500,000.

(iii) On March 1, 20X4 Mr. Khan rented out the ground floor of his bungalow to Mr. Riaz, for

establishing a departmental store, at a monthly rent of Rs. 137,500. Due to the strategic

location of the store, he also received adjustable and non-adjustable deposits of Rs. 600,000

and Rs. 500,000 respectively.

(iv) On April 1, 20X4 he rented out the residential portion of the bungalow to a Commercial Bank

for their marketing executive. He received gross amount of Rs. 2,400,000 as two years

advance rent. The Bank deducted tax of Rs. 197,500 from such payment.

(v) A donation of Rs. 500,000 was made to an un-approved trust for the construction of mosque.

(vi) In July 20X1, Mr. Khan was issued shares in TL. The fair market value of shares at the time

of issue was Rs. 500,000. He disposed off these shares in June 20X4 at a gain of Rs. 500,000.

Required:

Compute the taxable income, tax liability and tax payable/ refundable, if any, to Mr. Khan for the

tax year 20X4. The average rate of tax of Mr. Khan for the last three years was 18%.

(20 marks)

Note: Show all exemptions, exclusions and disallowances where relevant. Tax rates are given on the last page.

AdvancedTaxation

Q.2

Page2 of4

Ms. Hina started her business on January 12, 2011 at a kiosk, located at Karachi Airport. She sells

an exclusive blend of coffee imported from Kenya and packed dates purchased from a company in

Khairpur. Ms. Hina though not registered with Inland Revenue Department, paid sales tax on all

taxable purchases.

In order to increase the efficiency and profit margin of her business, she decided to get herself

registered with the sales tax authorities enabling her to reclaim the input tax on her purchases. She

made an application for voluntary registration under the Sales Tax Act, 1990 on April 25, 2011 and

was registered with effect from May 2, 2011. Following was the position of her unsold stock of

coffee and dates at April 25, 2011:

S. No.

(i)

(ii)

(iii)

(iv)

Description

25 kg of coffee imported

125 packets of dates purchased

42 kg of coffee imported

458 packets of dates purchased

Date of purchase

January 15, 2011

February 2, 2011

February 25, 2011

March 28, 2011

Sales Tax paid (Rs.)

23,750

12,325

39,900

41,325

Required:

In the light of the provisions of Sales Tax Act, 1990.

(a) Explain whether and under what circumstances Ms. Hina could reclaim the amount of tax

paid on the unsold stock acquired before registration.

(b) Calculate the amount of input tax, if any, which she can reclaim with her sales tax return for

the month of May 2011.

(07 marks)

Q.3

Beetle Limited (BL), an industrial undertaking, is engaged in the manufacture and supply of

pesticides. The company manufactures its products from the raw material imported from Malaysia.

BL also imports certain pesticides from Dubai, which are supplied to the local distributors without

any further processing.

After scrutiny of the tax return filed by BL for the tax year 20X4, the Additional Commissioner has

issued a notice under section 122(5A) in which he has raised the following issues:

(i)

Tax collected on the import of certain plant and machinery installed at BLs factory has been

claimed as an adjustment in the return. The Commissioner is of the view that such tax should

instead be treated as a final tax.

(ii) While computing the taxable income, BL has not apportioned the Cost of goods

manufactured between its income from sale of manufactured products and income from sale

of commercial imports. The Commissioner wants such costs to be apportioned between the

two revenue streams.

(iii) The audited financial statements show a gain of Rs. 50 million on the disposal of an

immovable property comprising office in a commercial building. This property was purchased

by the company for Rs. 90 million and was sold for Rs. 120 million. Its tax written down

value at the time of disposal was Rs. 70 million. The gain has not been offered to tax by BL.

The Commissioner wants to add the amount of Rs. 50 million to the companys taxable

income.

(iv) The financial statements also disclose an outstanding liability on account of royalty of

Rs. 250 million. This amount payable to BL Dubai Plc. is outstanding for the last four years,

pending approval from the State Bank of Pakistan. The expense was claimed by BL in the tax

year 20X0. The Commissioner wants to add back the amount to the taxable income of BL.

(v) Bad debts written off during the year include an amount of Rs. 10 million which was

provided to a distributor as a loan who has now been declared insolvent. The Commissioner

wants to add this amount to the taxable income of BL.

Required:

Under the provisions of Income Tax Ordinance, 2001 explain, giving reasons, as to whether or not

the Commissioners contention with regard to each of the above situation is valid.

(12 marks)

AdvancedTaxation

Q.4

Page3 of4

Gadget Limited (GL) is registered at the Large Taxpayer Unit (LTU) of Inland Revenue

Department, Islamabad. It is engaged in the manufacture and supply of electrical appliances.

Following information has been extracted from GLs records for the month of May 2011.

Rupees

Purchases:

Steel sheets, copper wire, aluminum and allied raw materials

Lubricants, spare parts and stores (include cash purchases of Rs. 900,000)

Gift items for customers - carpets, fancy watches etc.

Supplies:

Electric switch-gears and electric motors to diplomatic mission in Islamabad

Air Coolers to customers based in Lahore, Islamabad and Faisalabad

Electric air coolers to customers in Spain and Zanzibar

2,500,000

5,400,000

700,000

1,900,000

7,000,000

3,800,000

Following information is also available:

(i)

Technical fee of Rs. 1,400,000 was paid to Mr. Michael in Finland for the grant of right,

under a contract, to use the latest Humidifier Process for the production of air coolers.

(ii) Rs. 700,000 was paid against bill board advertisement to Z Inc. which is registered with LTU.

(iii) Motors and switches of Rs. 650,000 were supplied for consumption on board a container ship

with gross tonnage of 150 LDT. The ship was proceeding to the port of Antwerp.

(iv) Printed stationery of Rs. 500,000 was purchased from registered suppliers for the maintenance

of factory records. These suppliers are however not registered with LTU.

(v) Rs. 500,000 was paid to bank on account of L/C opening charges and Rs. 100,000 on

account of safe custody fees.

(vi) Sub-standard supplies of Rs. 900,000 were returned to vendors. Proper debit/credit notes

were raised in this regard.

All payments for the purchase of goods and services have been made through crossed cheque or

crossed pay order/credit card except as otherwise indicated. Sales tax is payable at the rate of 17%.

All the above figures are exclusive of federal excise duty (FED) and sales tax wherever applicable.

The goods manufactured by GL are not subject to duty under the Federal Excise Act, 2005.

Required:

In the light of the provisions of Sales Tax Act, 1990 and Federal Excise Act, 2005 compute the

following for filing the sales tax-cum-federal excise return for the tax period May 2011.

Q.5

(a)

(b)

Sales tax payable/refundable.

FED payable, assuming the rate of duty is 10% on all excisable items/ services.

(a)

Describe the benefits available under the Income Tax Ordinance, 2001 to persons who are

registered under the Sales Tax Act, 1990. Also state the conditions which such persons are

required to fulfill in order to be eligible for claiming such benefits.

(05 marks)

(b)

Skilled (Pvt.) Limited (SPL) wants to form a joint venture with Expert Consultants (Pvt.)

Limited (ECPL) for providing disaster management services to corporate clients.

(18 marks)

Required:

Under the provisions of Income Tax Ordinance, 2001 advise the CEO of the two companies

about the tax treatment of the following:

(i)

(ii)

(c)

Income / loss derived by the joint venture; and

Share of venturers profit / loss from such venture.

(09 marks)

Who may be regarded as short-term resident individual under the Income Tax Ordinance,

2001? Discuss the provisions relating to the taxability of foreign source income of such

individuals.

(04 marks)

AdvancedTaxation

Q.6

Page4 of4

Al Maratib, a large group of companies is contemplating to avail the benefits of Group Taxation by

offering it to be taxed as one fiscal unit.

Required:

In the light of the provisions of Income Tax Ordinance, 2001 explain the provisions of Group

Taxation to the chairman of the group.

(08 marks)

Q.7

(a)

Under the provisions of Sales Tax Act, 1990 and Rules made thereunder, certain restrictions

have been placed on the adjustment of input tax. Explain those provisions in respect of each

of the following situations.

(i)

(ii)

(iii)

(iv)

(b)

Q.8

X Limited is registered with Inland Revenue Department. It purchased copper wires of

Rs. 24 million on credit, for the manufacture of electric fans. The payment was made

after 210 days of the issuance of tax invoice by way of a crossed pay order drawn on the

business bank account of the company.

Mr. Baba is working with Y Limited as director procurement. He paid Rs. 698,456 on

behalf of the company for the purchase of lubricants using his own credit card.

Z Limited acquired new machinery for its manufacturing department at a price of

Rs. 150 million. Sales tax paid at the time of purchase amounted to Rs. 25.5 million.

Mr. Haq is registered as a wholesaler under the Sales Tax Act, 1990. He paid sales tax

of Rs. 88,750 including extra tax of Rs. 3,750 on the purchase of certain specified

electric appliances from a manufacturer in Lahore.

(07 marks)

The Commissioner may amend an assessment order for a tax year only on the basis of

definite information acquired from an audit or otherwise. What do you understand by the

term Definite information as described in the Income Tax Ordinance, 2001?

(03 marks)

Explain the provisions of Federal Excise Act, 2005 with regard to the following:

(a)

(b)

Excess duty collected from the customer.

Duty on services provided free of charge.

(05 marks)

(02 marks)

(THE END)

EXTRACTS FROM THE FIRST SCHEDULE OF THE INCOME TAX ORDINANCE, 2001

Division I Rate of Tax for Salaried Individuals

S. No.

(1)

16.

17.

18.

Taxable Income

(2)

Where the taxable income exceeds Rs. 2,850,000 but does not exceed Rs. 3,550,000,

Where the taxable income exceeds Rs. 3,550,000 but does not exceed Rs. 4,550,000,

Where the taxable income exceeds Rs. 4,550,000.

Rate of

Tax

(3)

17.50%

18.50%

20.00%

Division VI Income from property

S. No.

Gross amount of rent

(1)

(2)

1.

Where the gross amount of rent does not exceed

Rs. 150,000.

2.

Where the gross amount of rent exceeds Rs. 150,000

but does not exceed Rs. 400,000.

3.

Where the gross amount of rent exceeds Rs. 400,000

but does not exceed Rs. 1,000,000.

4.

Where the gross amount of rent exceeds Rs. 1,000,000.

NIL

Rates of tax

(3)

5 percent of the gross amount exceeding Rs.

150,000.

Rs. 12,500 plus 7.5 percent of the gross

amount exceeding Rs. 400,000.

Rs. 57,500 plus 10 percent of the gross

amount exceeding Rs. 1,000,000.

You might also like

- Adyen Pricing Overview 08022013Document13 pagesAdyen Pricing Overview 08022013Aleksandar TasevNo ratings yet

- Blue Ocean Question and AnswerDocument3 pagesBlue Ocean Question and AnswerMansha Lal Giri0% (1)

- ACA Principles of Tax Expenses NotesDocument3 pagesACA Principles of Tax Expenses Noteswguate0% (1)

- A Brief Introduction of MVAT - : by Chinmay GangwalDocument28 pagesA Brief Introduction of MVAT - : by Chinmay GangwalAmolaNo ratings yet

- Mcqs For Second Year of Articleship: © The Institute of Chartered Accountants of IndiaDocument11 pagesMcqs For Second Year of Articleship: © The Institute of Chartered Accountants of IndiaSajal GoyalNo ratings yet

- FAC2602 - Generally Accepted Accounting Stds Valuation of Financial InstrumentsDocument32 pagesFAC2602 - Generally Accepted Accounting Stds Valuation of Financial InstrumentsAhmed Raza MirNo ratings yet

- Paper 1Document7 pagesPaper 1Khulood Essa100% (3)

- Presidential Decree No - 1151Document1 pagePresidential Decree No - 1151jun_andresNo ratings yet

- Form A Form A - Annual Return of Company Having Share CapitalDocument4 pagesForm A Form A - Annual Return of Company Having Share CapitalAimanNo ratings yet

- Question-1 I) : SKANS School of Accountancy Principles of Taxation Mid Term ExamDocument4 pagesQuestion-1 I) : SKANS School of Accountancy Principles of Taxation Mid Term ExamMuhammad ArslanNo ratings yet

- Course Outline Taxation PakistanDocument4 pagesCourse Outline Taxation PakistanrehanshervaniNo ratings yet

- The Rigours of TDS - An OverviewDocument31 pagesThe Rigours of TDS - An OverviewShaleenPatniNo ratings yet

- Numericals On MAT-115JBDocument2 pagesNumericals On MAT-115JBReema Laser100% (1)

- Maharashtra Value Added Tax Act 2Document27 pagesMaharashtra Value Added Tax Act 2Minal ShethNo ratings yet

- Test Paper 6 With Suggested AnswersDocument5 pagesTest Paper 6 With Suggested Answersdivyaagrawal701No ratings yet

- RMC No. 20-2022Document3 pagesRMC No. 20-2022Jey VlackNo ratings yet

- The Effect of Changes in Foreign Exchange RatesDocument17 pagesThe Effect of Changes in Foreign Exchange Ratesrazor100% (1)

- Ruling On Income Payment To NRFC For Services Outside PhilsDocument32 pagesRuling On Income Payment To NRFC For Services Outside PhilsJomz ArvesuNo ratings yet

- Activating GST For Your Company: Tally ERP Material Unit - 3 GSTDocument47 pagesActivating GST For Your Company: Tally ERP Material Unit - 3 GSTMichael Wells100% (1)

- Company Law by Luqman Baig PDFDocument2 pagesCompany Law by Luqman Baig PDFYounas Ali KhanNo ratings yet

- 53 Summary On Vat CST and WCTDocument16 pages53 Summary On Vat CST and WCTYogesh DeokarNo ratings yet

- BIR Ruling No. 317-18 (BVI Law)Document3 pagesBIR Ruling No. 317-18 (BVI Law)Liz100% (1)

- CH - 10 Tax Invoice, Credit and Debit Notes Que by ICAIDocument3 pagesCH - 10 Tax Invoice, Credit and Debit Notes Que by ICAIk kakkarNo ratings yet

- CAF 6 TAX All Past Papers Upto 2019 CA Study MaterialDocument47 pagesCAF 6 TAX All Past Papers Upto 2019 CA Study MaterialRais AhmedNo ratings yet

- CA Inter Paper 6 All Question PapersDocument116 pagesCA Inter Paper 6 All Question PapersNivedita SharmaNo ratings yet

- Isa 500Document7 pagesIsa 500sumeer khan100% (1)

- International TaxationDocument35 pagesInternational Taxationbiswajoyg98No ratings yet

- Past Paper Tax PDFDocument102 pagesPast Paper Tax PDFUmar AkhtarNo ratings yet

- Special Economic ZoneDocument4 pagesSpecial Economic ZoneDhruvesh ModiNo ratings yet

- History of FBRDocument26 pagesHistory of FBRFatima Shahid100% (1)

- Accounting Standard SummaryDocument17 pagesAccounting Standard Summarymegha.mm56No ratings yet

- Presention On: One Person Company (OPC)Document18 pagesPresention On: One Person Company (OPC)Prience 1213No ratings yet

- 62983rmo 5-2012Document14 pages62983rmo 5-2012Mark Dennis JovenNo ratings yet

- DT Icai MCQ 3Document5 pagesDT Icai MCQ 3Anshul JainNo ratings yet

- Test Series: October, 2019 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument12 pagesTest Series: October, 2019 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionANIL JARWALNo ratings yet

- Sales Tax (Module C) Short Notes by Kashif Nawaz PDFDocument24 pagesSales Tax (Module C) Short Notes by Kashif Nawaz PDFsohail merchant33% (3)

- Concept of Goods & Services Tax ? or Introduction To Goods & Services Tax ? or Explain Goods & Services Tax Act 2017 ?Document2 pagesConcept of Goods & Services Tax ? or Introduction To Goods & Services Tax ? or Explain Goods & Services Tax Act 2017 ?Ranjan BaradurNo ratings yet

- 16 FemaDocument25 pages16 Fema2022pbm5034No ratings yet

- DIRECT TAX Finalold p7Document5 pagesDIRECT TAX Finalold p7VIHARI DNo ratings yet

- Form CHG-1-16032017 Signe Cfil CDocument6 pagesForm CHG-1-16032017 Signe Cfil CsunjuNo ratings yet

- VAT Full CasesDocument253 pagesVAT Full CasesJCapskyNo ratings yet

- Recognition and MeasurementDocument44 pagesRecognition and MeasurementRabiq Muradi DjamalullailNo ratings yet

- IAS 16 and 40 PDFDocument11 pagesIAS 16 and 40 PDFWaqas Younas BandukdaNo ratings yet

- CA. Pankaj Saraogi: by Visiting Faculty - ICAI FCA, B. Com. (H) - SRCC, B. Ed., Licentiate ICSI, M. Com., DISA (ICAI)Document36 pagesCA. Pankaj Saraogi: by Visiting Faculty - ICAI FCA, B. Com. (H) - SRCC, B. Ed., Licentiate ICSI, M. Com., DISA (ICAI)Velayudham ThiyagarajanNo ratings yet

- Ca Audit PDFDocument154 pagesCa Audit PDFsandesh1506No ratings yet

- Partnership Deed EngDocument3 pagesPartnership Deed EngShajana ShahulNo ratings yet

- Lecture Note-Foreign SubsidiaryDocument10 pagesLecture Note-Foreign Subsidiaryptnyagortey91No ratings yet

- Articleship RulesDocument80 pagesArticleship RulesVeevaeck Swami100% (1)

- 4 Direct Tax RevisionDocument149 pages4 Direct Tax RevisionDeep MehtaNo ratings yet

- 64.double Taxation ReliefDocument14 pages64.double Taxation ReliefMohit MalhotraNo ratings yet

- About Composition Scheme in GSTDocument3 pagesAbout Composition Scheme in GSTArpit GuptaNo ratings yet

- Transfer Pricing (Inter Divisional)Document7 pagesTransfer Pricing (Inter Divisional)Sujeet_kmrNo ratings yet

- Steps by Steps For Filling GST Return 3BDocument23 pagesSteps by Steps For Filling GST Return 3BBala VinayagamNo ratings yet

- The The The The The: Published by AuthorityDocument92 pagesThe The The The The: Published by Authorityrahulchow2No ratings yet

- On Trust Day 1 Second SessionDocument58 pagesOn Trust Day 1 Second SessionVikas BhaduNo ratings yet

- Circular No. 681 Dated 8-3-94Document41 pagesCircular No. 681 Dated 8-3-94ArshadNo ratings yet

- GST STeps To File ReturnDocument22 pagesGST STeps To File ReturnAnnu KashyapNo ratings yet

- Audit Report Caro in ExcelDocument14 pagesAudit Report Caro in ExcelNikhil KasatNo ratings yet

- 715 CircularDocument4 pages715 CircularDhananjay KulkarniNo ratings yet

- All Sections of Income Tax Act 1961Document37 pagesAll Sections of Income Tax Act 1961Prasad IyengarNo ratings yet

- Handling BIR Tax Examination For COOPS EVR PDFDocument133 pagesHandling BIR Tax Examination For COOPS EVR PDFGracel Joy Galeno100% (1)

- RMC 72-2004 Issues On Withholding RatesDocument9 pagesRMC 72-2004 Issues On Withholding RatesEva HubadNo ratings yet

- Alhamd Taxation Tests and SolutionDocument35 pagesAlhamd Taxation Tests and Solutionshahnawaz243No ratings yet

- Autumn 2011 QuestionsDocument4 pagesAutumn 2011 Questionsn_a852726No ratings yet

- Advanced Taxation: Certified Finance and Accounting Professional Stage ExaminationsDocument5 pagesAdvanced Taxation: Certified Finance and Accounting Professional Stage ExaminationsRamzan AliNo ratings yet

- Caf-6 TaxDocument4 pagesCaf-6 TaxaskermanNo ratings yet

- Ifrs11 Joint ArrangementsDocument1 pageIfrs11 Joint ArrangementsAhmed Raza MirNo ratings yet

- Financial AccountingDocument42 pagesFinancial AccountingAhmed Raza MirNo ratings yet

- Grant Thornton Ifrs 10 Financial StatementsDocument104 pagesGrant Thornton Ifrs 10 Financial StatementsAhmed Raza MirNo ratings yet

- p4 Summary BookDocument35 pagesp4 Summary BookAhmed Raza MirNo ratings yet

- Advanced Accounting and Financial ReportingDocument6 pagesAdvanced Accounting and Financial ReportingAhmed Raza MirNo ratings yet

- E Voting Guide (ICAP - Overseas Members)Document10 pagesE Voting Guide (ICAP - Overseas Members)Ahmed Raza MirNo ratings yet

- 4.albania Frosina GjinoDocument7 pages4.albania Frosina GjinoAhmed Raza MirNo ratings yet

- Section e - AnswersDocument7 pagesSection e - AnswersAhmed Raza MirNo ratings yet

- Section e - QuestionsDocument4 pagesSection e - QuestionsAhmed Raza MirNo ratings yet

- Solution: Part (A)Document12 pagesSolution: Part (A)Ahmed Raza MirNo ratings yet

- Solution: Part (A)Document12 pagesSolution: Part (A)Ahmed Raza MirNo ratings yet

- PC EDocument24 pagesPC EAhmed Raza MirNo ratings yet

- December 2010 TC4A1Document10 pagesDecember 2010 TC4A1Ahmed Raza MirNo ratings yet

- Exchange GainsDocument1 pageExchange GainsAhmed Raza MirNo ratings yet

- Suggested Answers Intermediate Examination - Spring 2012: Realization AccountDocument7 pagesSuggested Answers Intermediate Examination - Spring 2012: Realization AccountAhmed Raza MirNo ratings yet

- Introduction To Economics & Finance: Page 1 of 8Document8 pagesIntroduction To Economics & Finance: Page 1 of 8Ahmed Raza MirNo ratings yet

- December 2010 FA3Q1Document4 pagesDecember 2010 FA3Q1Ahmed Raza MirNo ratings yet

- Examination No. - The Public Accountants Examination Council of Malawi 2010 Examinations Foundation Stage Paper 4: Organisational FrameworkDocument11 pagesExamination No. - The Public Accountants Examination Council of Malawi 2010 Examinations Foundation Stage Paper 4: Organisational FrameworkAhmed Raza MirNo ratings yet

- December 2010 FA3ADocument7 pagesDecember 2010 FA3AAhmed Raza MirNo ratings yet

- December 2010 TC6ADocument7 pagesDecember 2010 TC6AAhmed Raza MirNo ratings yet

- December 2010 FA2ADocument9 pagesDecember 2010 FA2AAhmed Raza MirNo ratings yet

- December 2010 FA1ADocument5 pagesDecember 2010 FA1AAhmed Raza MirNo ratings yet

- Test 3 of Ise II Boo1Document5 pagesTest 3 of Ise II Boo1Ana Martinez AzorinNo ratings yet

- BRR District Report Aceh BesarDocument87 pagesBRR District Report Aceh Besaryahwa ahyarNo ratings yet

- Himachal PradeshDocument8 pagesHimachal Pradeshdy620783No ratings yet

- Summer Internship Project ReportDocument49 pagesSummer Internship Project ReportKhushi Chadha100% (1)

- JCB in IndiaDocument2 pagesJCB in IndiaAnnie100% (2)

- Fiji - Greater Suva Urban ProfileDocument20 pagesFiji - Greater Suva Urban ProfileUnited Nations Human Settlements Programme (UN-HABITAT)No ratings yet

- Owwa Ofw Information SheetDocument1 pageOwwa Ofw Information SheetHarold monroyoNo ratings yet

- Itulip - Fire Economy in Crisis Part IDocument16 pagesItulip - Fire Economy in Crisis Part Idonnal47No ratings yet

- Startup/growth Consultant or Business Plan WriterDocument4 pagesStartup/growth Consultant or Business Plan Writerapi-121632587No ratings yet

- Prashant P. Tripathi: E-Mail: 8446047488 (M)Document4 pagesPrashant P. Tripathi: E-Mail: 8446047488 (M)PrashantTripathiNo ratings yet

- Module 6 Group Project AnswersDocument7 pagesModule 6 Group Project AnswersMasterShadicNo ratings yet

- Class 11 Business Studies 1009 2019Document15 pagesClass 11 Business Studies 1009 2019Suraj RajputNo ratings yet

- 6 Pricing Understanding and Capturing Customer ValueDocument27 pages6 Pricing Understanding and Capturing Customer ValueShadi JabbourNo ratings yet

- 1 347294427628 - 2019 03 14 - 1 PDFDocument11 pages1 347294427628 - 2019 03 14 - 1 PDFSiddiqueJoiyaNo ratings yet

- By: Group 3: Dian Vitasari Ayu Lestari Ari Pandowo Anasta Ensenanda WDocument34 pagesBy: Group 3: Dian Vitasari Ayu Lestari Ari Pandowo Anasta Ensenanda WIrfan Rakhman HidayatNo ratings yet

- Top PruebaDocument41 pagesTop Pruebarenzo hilarioNo ratings yet

- The Red and The BlackDocument60 pagesThe Red and The BlackDavid DonahouNo ratings yet

- Latp New Resident ChecklistDocument1 pageLatp New Resident Checklistapi-22492260No ratings yet

- InvoiceDocument1 pageInvoiceSahil GawandeNo ratings yet

- Mendelssohn - O Rest in The LordDocument3 pagesMendelssohn - O Rest in The Lordpedrolopes92100% (1)

- Covering Letter of Goyal (Tolaram)Document3 pagesCovering Letter of Goyal (Tolaram)Welcome Real Estate ServicesNo ratings yet

- Corporate Social ResponsibilityDocument3 pagesCorporate Social ResponsibilityLyn EscanoNo ratings yet

- Mankiew Chapter 1Document32 pagesMankiew Chapter 1nazmulmahee23No ratings yet

- V3 File 1 - 2nd Vendor Conference AnnouncementDocument2 pagesV3 File 1 - 2nd Vendor Conference AnnouncementYuli SetiawanNo ratings yet

- Test 1 3 As Fake BagsDocument5 pagesTest 1 3 As Fake BagsmeriemNo ratings yet