LIC Housing Finance: Steady As Ever

LIC Housing Finance: Steady As Ever

Uploaded by

Anonymous y3hYf50mTCopyright:

Available Formats

LIC Housing Finance: Steady As Ever

LIC Housing Finance: Steady As Ever

Uploaded by

Anonymous y3hYf50mTOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

LIC Housing Finance: Steady As Ever

LIC Housing Finance: Steady As Ever

Uploaded by

Anonymous y3hYf50mTCopyright:

Available Formats

RESULTS REVIEW 3QFY16

18 JAN 2016

LIC Housing Finance

BUY

INDUSTRY

CMP (as on 18 Jan 2016)

Target Price

NBFCs

Rs 464

Rs 550

Nifty

8,238

Sensex

27,215

KEY STOCK DATA

Bloomberg/Reuters

LICHF IN/LICH.BO

No. of Shares (mn)

505

MCap (Rs bn) / ($ mn)

250/3,848

6m avg traded value (Rs mn)

1,130

STOCK PERFORMANCE (%)

52 Week high / low

Rs 526/320

3M

6M

12M

Absolute (%)

6.8

9.7

51.0

Relative (%)

11.2

14.7

46.3

SHAREHOLDING PATTERN (%)

Promoters

FIs & Local MFs

40.31

7.58

FIIs

35.01

Public & Others

17.10

Source : BSE

Darpin Shah

darpin.shah@hdfcsec.com

+91-22-6171-7328

Siji Philip

siji.philip@hdfcsec.com

+91-22-6171-7324

Steady as ever

LIC Housing Finances (LICHF) 3Q core earnings beat

was driven by steady NIM and loan growth. With

higher competition, individual loan repayments were

at a multi-quarter high. Rising proportion of highyielding LAP and project finance, along with the

decline in CoF, supported steady spread/NIM. While

project loan disbursements continued their steady

run, the growth in individual loans was led by the

LAP segment. Asset quality, too, remained stable.

LICHFs focus on high-yielding LAP and project loans,

coupled with the fall in CoF, augur well for spreads.

However, given the rising competition (sharp base

rate reductions by banks), we have further

moderated our NIM expectations to ~2.4% vs. 2.5%

and book growth to ~16% CAGR vs. ~17%. Maintain

BUY with a revised TP of Rs 550 (2.4x 1-year forward

ABV of Rs 229).

Key takeaways

Slower Individual disbursements (12% YoY; ex LAP

at ~7% YoY) and higher repayments (4.4%) led to

individual loan growth of ~15% (vs. our estimate of

~16%). The high-yielding LAP portfolio grew ~17%

QoQ to form ~6.4%, and the project finance grew

~3% QoQ to ~2.6%. With rising competition, we

have lowered loan growth assumption to ~16%

CAGR vs. 17.5% over FY15-18E.

Decline in interest rates and shift in borrowing mix

led to 11bps decline in CoF. Despite rising

proportion of high-yielding loans, yields declined

~12bps QoQ, led by ~30bps reduction in PLR. This

lead to stable spread/NIM of ~1.57/2.58%.

While the continued decline in interest rates and

focus towards high-yielding loans will benefit

LICHF, we believe the competition will keep

yields under pressure. We lower NIM estimates

to 2.4% vs. 2.5% (earlier) over FY15-18E.

Financial Summary

(Rs mn)

Net Interest Income

PPOP

PAT

EPS (Rs)

ROAE (%)

ROAA (%)

Adj. BVPS (Rs)

P/ABV (x)

P/E (x)

3QFY16

7,469

6,804

4,189

8.3

3QFY15

5,486

5,283

3,443

6.8

YoY (%)

36.2

28.8

21.7

21.7

2QFY16

7,169

6,743

4,117

8.2

QoQ (%)

4.2

0.9

1.7

1.7

FY15

22,364

21,092

13,862

27.5

18.1

1.43

150.2

3.09

16.9

FY16E

29,254

27,377

17,080

33.8

20.1

1.52

176.1

2.63

13.7

FY17E

33,018

30,849

18,930

37.5

19.1

1.46

205.8

2.25

12.4

FY18E

37,121

34,507

21,077

41.7

18.3

1.40

236.9

1.96

11.1

Source: Company, HDFC sec Inst Research

HDFC securities Institutional Research is also available on Bloomberg HSLB <GO> & Thomson Reuters

LIC HOUSING FINANCE : RESULTS REVIEW 3QFY16

Asset quality remained stable over the past three

quarters with G/NNPA at 0.58/0.32% to Rs 6.8bn.

Individual GNPAs (Rs 3.65bn) marginally declined

to 32bps vs. 33bps. Project loans GNPAs, too,

were flat QoQ at Rs 3.2bn (10.2% of project

loans). Provisions cost jumped ~15% QoQ to Rs

344mn led by higher std. assets provisions

(towards LAP and project loan segments) and

shift in NPL buckets.

We expect LICHFs NII to grow at 18% CAGR over

FY15-18E, driven by loan growth of ~16% CAGR

and avg. NIM of 2.4% (vs. 2.2% in FY15). With

rising provisions cost (std. assets related and

base effect), we expect PAT to grow at ~15%

CAGR. LICHFs return ratios are expected to

remain stable with RoA of ~1.5% and RoE of

~19%.

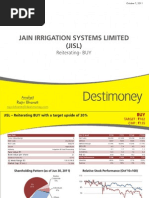

PABV Band Chart

3.5

600

500

2.5x

400

2.0x

3.0

+2SD

2.5

300

1.5x

200

1.0x

100

+1SD

2.0

Avg.

1.5

-1SD

1.0

-2SD

0.5

Jan-08

Jul-08

Jan-09

Jul-09

Jan-10

Jul-10

Jan-11

Jul-11

Jan-12

Jul-12

Jan-13

Jul-13

Jan-14

Jul-14

Jan-15

Jul-15

Jan-16

Jan-08

Jul-08

Jan-09

Jul-09

Jan-10

Jul-10

Jan-11

Jul-11

Jan-12

Jul-12

Jan-13

Jul-13

Jan-14

Jul-14

Jan-15

Jul-15

Jan-16

Source: Company

Page | 2

LIC HOUSING FINANCE : RESULTS REVIEW 3QFY16

Five Quarters At A Glance

(Rs mn)

Net Interest Income

Non-interest Income

Operating income

Operating expenses

Pre-provision profits

Provisions and contingencies

PBT

Provision for Tax

PAT

Balance Sheet items

Disbursements (Rs bn)

Individual (Rs bn)

Projects (Rs bn)

Loan Book (Rs bn)

Individual (Rs bn)

Projects (Rs bn)

Borrowings (Rs bn)

Profitability

Yield on Advances (%)

Cost of Funds (%)

Spreads

NIM (%)

Cost-Income ratio (%)

Tax rate (%)

Asset quality

Gross NPA (Rsmn)

Net NPA (Rsmn)

Gross NPAs (%)

Net NPAs (%)

Individual Gross NPAs (%)

Coverage ratio (%)

Led by loan growth of 15% and NIM

improvement of ~38bps to 2.58%

3QFY15

5,486

680

6,166

882

5,283

68

5,215

1,772

3,443

4QFY15

6,498

604

7,102

1,246

5,856

103

5,753

1,971

3,782

1QFY16

6,589

481

7,069

835

6,234

443

5,790

1,969

3,821

2QFY16

7,169

633

7,803

1,060

6,743

301

6,442

2,325

4,117

3QFY16

7,469

549

8,018

1,214

6,804

344

6,460

2,271

4,189

76.3

71.8

4.5

1,019.4

993.6

25.8

906

99.4

95.5

3.9

1,083.6

1,056.3

27.3

965

61.2

59.4

1.8

1,104.1

1,077.0

27.1

977

82.7

79.4

3.2

1,140.7

1,110.8

29.9

1,016

84.2

80.7

3.5

1,174.0

1,143.1

30.9

1,038

10.3%

12.3%

-21.0%

15.2%

15.0%

19.7%

14.6%

1.9%

1.5%

9.9%

2.9%

2.9%

3.3%

2.1%

10.70

9.49

1.21

2.20

14.3

34.0

10.65

9.19

1.46

2.47

17.5

34.3

10.84

9.38

1.46

2.41

11.8

34.0

10.87

9.29

1.58

2.56

13.6

36.1

10.75

9.18

1.57

2.58

15.1

35.2

5 bps

-31 bps

36 bps

38 bps

83 bps

119 bps

-12 bps

-11 bps

-1 bps

2 bps

155 bps

-93 bps

Incremental spreads at 2.1% (led by

~43bps lower CoF (vs. the reported

nos) and yield s ~10bps higher vs.

the reported nos.

5,795

3,166

0.57

0.31

0.33

45.4

4,947

2,344

0.46

0.22

0.24

52.6

6,591

3,598

0.60

0.33

0.36

45.4

6,830

3,690

0.60

0.32

0.33

46.0

6,820

3,740

0.58

0.32

0.32

45.2

17.7%

18.1%

1 bps

1 bps

-1 bps

-22 bps

-0.1%

1.4%

-2 bps

0 bps

-1 bps

-81 bps

Project loans NPLs at Rs 3.2bn and

individual at Rs 3.7bn

Old

29,725

28,164

17,431

179.2

FY16E

New

29,254

27,377

17,080

176.1

YoY Growth QoQ Growth

36.2%

4.2%

-19.2%

-13.2%

2.8%

30.0%

14.5%

37.6%

0.9%

28.8%

406.0%

14.6%

23.9%

0.3%

28.2%

-2.3%

21.7%

1.7%

Processing fees grew +16% YoY

Led by staff (19% YoY and QoQ) and

advertising expenses

Higher provisions led by Std assets

provisions on LAP and project loans

LAP/project loan portfolio stood at

6.4/2.6%. Repayment ratio further

inched up to 4.4% vs. 3.1% YoY and

4.2% QoQ

Bank borrowings declined to 12.5%

Individual GNPA at 32bps vs. 33bps

QoQ

Change In Estimates

Rs mn

NII

PPOP

PAT

Adj. BVPS (Rs)

Source: HDFC sec Inst Research

Change

-1.6%

-2.8%

-2.0%

-1.8%

Old

34,383

32,514

20,154

210.7

FY17E

New

33,018

30,849

18,930

205.8

Change

-4.0%

-5.1%

-6.1%

-2.3%

Page | 3

LIC HOUSING FINANCE : RESULTS REVIEW 3QFY16

Projects

Individual (LHS)

Rs bn

35

25

80

20

15

60

10

40

20

Overall disbursement grew 10%

YoY and 2% QoQ

-5

Source: Company

Loan Growth Book Driven By Individual Segment

Project Loans (%) Stable QoQ At 2.6%

1,400

20.0

1,200

10.0

1,000

800

(10.0)

600

400

(30.0)

200

(40.0)

Source: Company

3QFY16

2QFY16

2QFY16

1QFY16

4QFY15

3QFY15

2QFY15

1QFY15

4QFY14

3QFY14

0

1QFY13

1QFY13

2QFY13

3QFY13

4QFY13

1QFY14

2QFY14

3QFY14

4QFY14

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

(20.0)

Individual

2QFY14

The management is hinting at

increasing the share of highyielding segments to form ~10%

of loans

10

15

30.0

350

300

250

200

150

100

50

0

-50

-100

-150

Rs bn

1QFY14

% YoY

25

20

Projects

Developer (RHS)

4QFY13

30

% YoY

1QFY16

4QFY15

3QFY15

2QFY15

1QFY15

4QFY14

3QFY14

2QFY14

1QFY14

4QFY13

3QFY13

1QFY13

3QFY16

2QFY16

1QFY16

4QFY15

3QFY15

2QFY15

1QFY15

Source: Company

LAP book stood at ~6.4% vs. 5.6%

QoQ

Floating loans ~40%; re-pricing of

Rs 80bn in 4QFY16 and Rs 150bn

each in FY17 and FY18.

4QFY14

3QFY14

2QFY14

1QFY14

4QFY13

3QFY13

2QFY13

1QFY13

Individual (LHS)

Share of project loans was stable

QoQ at2.6%

% YoY

30

100

Ex. LAP, individual disbursements

grew ~7% YoY

Loan growth remains driven by

individual loans (97.4% of book)

up 15% YoY and 3% QoQ

Developer (RHS)

% YoY

3QFY13

LAP disbursements (~Rs 14bn)

drove the individual

disbursements (+12/1.5%

YoY/QoQ)

Individual

2QFY13

120

Overall Disbursals Grew 10/2% YoY/QoQ

3QFY16

Individual Disbursements Led By LAP

2QFY13

Disbursements for project loans

up 10% QoQ to Rs 3.2bn

Source: Company

Page | 4

LIC HOUSING FINANCE : RESULTS REVIEW 3QFY16

8.0

7.0

2.80

6.0

2.30

5.0

4.0

1.80

3.0

2.0

1.30

1.0

Project loan NPAs were flat QoQ

at Rs 3.16bn (10.2% of loans).

Source: Company

2QFY15

1QFY15

4QFY14

3QFY14

2QFY14

1QFY14

4QFY13

0.0

3QFY13

3QFY16

2QFY16

1QFY16

4QFY15

3QFY15

2QFY15

1QFY15

4QFY14

3QFY14

2QFY14

1QFY14

3QFY13

4QFY13

1QFY13

Individual GNPAs stood at 32bps

vs. 33bps in 2Q

2QFY13

0.80

2QFY13

Stable asset quality with

GNPA/NNPA at 0.6%/0.32%

1QFY13

NIM improved 38bps YoY and

2bps QoQ to 2.56%

3QFY16

3.30

Net NPA

Net NPA (%) - RHS

%

0.9

0.8

0.7

0.6

0.5

0.4

0.3

0.2

0.1

2QFY16

Gross NPA

Gross NPA (%) - RHS

Rs bn

NIM

1QFY16

Spread

Asset Quality Stable QoQ

4QFY15

NIM Continues To Improve Sequentially

3QFY15

Led by rising proportion of highyielding LAP and project finance

book, coupled with decline in CoF,

spreads improved 36bpsYoY

Source: Company

Peer Valuations

NBFC

CIFC

LICHF

MMFS

SCUF

SHTF

Mcap

(Rs bn)

93

234

122

92

174

CMP

(Rs)

599

464

216

1,402

767

Reco

BUY

BUY

NEU

BUY

BUY

TP

(Rs)

718

550

261

1,974

1,034

FY16E

187

176

87

634

397

ABV (Rs)

FY17E FY18E

220

259

206

237

97

105

718

809

449

480

FY16E

17.9

13.7

15.1

14.3

14.2

P/E (x)

FY17E

14.5

12.4

12.0

11.7

11.9

FY18E

12.1

11.1

11.2

10.1

10.3

P/ABV (x)

FY16E FY17E FY18E

3.21

2.73

2.31

2.63

2.25

1.96

2.40

2.14

1.98

2.21

1.95

1.73

1.93

1.71

1.60

ROAE (%)

FY16E FY17E FY18E

16.6

16.6

17.3

20.1

19.0

18.3

13.1

14.9

14.4

14.7

15.7

15.9

12.5

13.4

13.8

ROAA (%)

FY16E FY17E FY18E

2.05

2.18

2.21

1.52

1.46

1.40

2.09

2.32

2.17

3.29

3.43

3.37

2.02

2.18

2.27

Source: Company, HDFC sec Inst Research

Page | 5

LIC HOUSING FINANCE : RESULTS REVIEW 3QFY16

Income Statement

(Rs mn)

FY14

Interest Earned

90,858

Interest Expended

71,744

Net Interest Income

19,114

Other Income

2,488

Total Income

21,602

Total Operating Exp

3,133

Employee Expense

1,038

PPOP

18,470

Provisions & Contingencies

215

PBT

18,255

Provision for Tax

5,083

PAT

13,172

Source: Bank, HDFC sec Inst Research

Balance Sheet

FY15

105,467

83,102

22,364

2,520

24,884

3,792

1,293

21,092

72

21,020

7,158

13,862

FY16E

128,526

99,272

29,254

2,907

32,161

4,783

1,481

27,377

1,499

25,878

8,799

17,080

FY17E

144,766

111,748

33,018

3,344

36,362

5,513

1,717

30,849

1,948

28,901

9,971

18,930

FY18E

164,317

127,196

37,121

3,836

40,957

6,450

2,009

34,507

2,329

32,178

11,101

21,077

(Rs mn)

FY14

FY15

FY16E

FY17E

SOURCES OF FUNDS

Share capital

1,010

1,010

1,010

1,010

Reserves and surplus

74,319

77,174

90,640

105,564

Shareholders Funds

75,329

78,184

91,650

106,573

Long-term debt

677,123

805,186

924,353 1,070,401

Current maturity of long term 119,902

141,104

161,988

187,582

Short term

37,381

26,980

30,973

35,867

Total debt

834,407

973,270 1,117,314 1,293,849

Long-term provisions

7,954

10,194

11,204

12,480

Total

917,690 1,061,648 1,220,168 1,412,903

APPLICATION OF FUNDS

Fixed Assets & WIP

756

797

836

878

Non-current investments

1,991

2,371

2,371

2,371

Current investments

2.3

0.0

0.0

0.0

Cash and cash equivalents

30,224

29,331

23,548

17,190

Advances

915,303 1,085,117 1,242,459 1,441,252

Other current assets

6,929

7,835

8,293

8,796

Total current assets (ex-cash)

6,931

7,835

8,293

8,796

Other current liabilities

40,081

57,112

57,340

57,583

Net Current Assets

(33,149) (49,277) (49,047) (48,788)

Net Deferred tax

2,566

(6,690)

Total assets

917,690 1,061,648 1,220,168 1,412,903

Source: Bank, HDFC sec Inst Research

FY18E

1,010

122,180

123,190

1,247,017

218,533

41,785

1,507,335

14,053

1,644,578

922

2,371

0.0

3,753

1,686,265

9,110

9,110

57,844

(48,733)

1,644,578

Page | 6

LIC HOUSING FINANCE : RESULTS REVIEW 3QFY16

Key Ratios

FY14

VALUATION RATIOS

EPS

Earnings Growth (%)

BVPS

Adj. BVPS (100% cover)

ROAA (%)

ROAE (%)

P/E (x)

P/ABV (x)

P/PPOP (x)

Dividend Yield (%)

PROFITABILITY

Yield on Advances (%)

Cost of Funds (%)

Core Spread (%)

NIM (%)

OPERATING EFFICIENCY

Cost/Avg. Asset Ratio (%)

Cost-Income Ratio

BALANCE SHEET STRUCTURE

RATIOS

Loan Growth (%)

Borrowing Growth (%)

Equity/Assets (%)

Equity/Loans (%)

Total Capital Adequacy Ratio

(CAR)

Tier I CAR

FY15

FY16E

FY17E

FY18E

26.1

28.7

149.2

142.2

1.6

18.8

17.8

3.3

12.7

1.0

27.5

5.2

154.8

150.2

1.4

18.1

16.9

3.1

11.1

1.1

33.8

23.2

181.5

176.1

1.5

20.1

13.7

2.6

8.6

1.3

37.5

10.8

211.0

205.8

1.5

19.1

12.4

2.3

7.6

1.5

41.7

11.3

243.9

236.9

1.4

18.3

11.1

2.0

6.8

1.6

10.70

9.51

1.19

2.20

10.54

9.31

1.24

2.17

10.34

8.96

1.39

2.46

10.04

8.71

1.34

2.42

9.74

8.51

1.24

2.36

0.4

14.5

0.4

15.2

0.4

14.9

0.4

15.2

0.4

15.7

17.4

19.3

8.4

9.2

18.6

17.7

7.5

8.1

14.5

14.8

7.6

8.3

16.0

15.8

7.7

8.3

17.0

16.5

7.6

8.2

16.4

15.3

16.0

15.5

15.0

12.2

11.8

12.2

12.3

12.2

FY14

ASSET QUALITY

Gross NPLs (Rsm)

6,090

Net NPLs (Rsm)

3,536

Gross NPLs (%)

0.67

Net NPLs (%)

0.39

Coverage Ratio (%)

41.9

Provision/Avg. Loans (%)

0.03

RoAA TREE (%)

Net Interest Income

2.32

Non Interest Income

0.30

Operating Cost

0.38

Provisions

0.03

Tax

0.62

ROAA

1.60

Leverage (x)

11.8

ROAE

18.8

Source: Company, HDFC sec Inst Research

FY15

FY16E

FY17E

FY18E

4,947

2,344

0.46

0.22

52.6

0.01

6,834

2,732

0.55

0.22

60.0

0.13

7,206

2,656

0.50

0.18

63.1

0.15

8,431

3,552

0.50

0.21

57.9

0.15

2.31

0.26

0.39

0.01

0.74

1.43

12.6

18.1

2.61

0.26

0.43

0.13

0.78

1.52

13.2

20.1

2.55

0.26

0.43

0.15

0.77

1.46

13.1

19.1

2.47

0.26

0.43

0.15

0.74

1.40

13.1

18.3

Page | 7

LIC HOUSING FINANCE : RESULTS REVIEW 3QFY16

RECOMMENDATION HISTORY

LIC Housing Finance

Date

15-Jan-15

20-Apr-15

21-Jul-15

16-Oct-15

18-Jan-16

TP

650

600

550

CMP

465

442

465

495

464

Reco

BUY

BUY

BUY

BUY

BUY

Target

520

528

528

569

550

500

450

400

Jan-16

Dec-15

Nov-15

Oct-15

Sep-15

Aug-15

Jul-15

Jun-15

May-15

Apr-15

Mar-15

Feb-15

Jan-15

350

Rating Definitions

BUY

: Where the stock is expected to deliver more than 10% returns over the next 12 month period

NEUTRAL : Where the stock is expected to deliver (-)10% to 10% returns over the next 12 month period

SELL

: Where the stock is expected to deliver less than (-)10% returns over the next 12 month period

Page | 8

LIC HOUSING FINANCE : RESULTS REVIEW 3QFY16

Disclosure:

We, Darpin Shah, MBA & Siji Philip, MBA, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views

about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this

report.

Research Analyst or his/her relative or HDFC Securities Ltd. does not have any financial interest in the subject company. Also Research Analyst or his relative or HDFC Securities Ltd. or its

Associate may have beneficial ownership of 1% or more in the subject company at the end of the month immediately preceding the date of publication of the Research Report. Further

Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any material conflict of interest.

Any holding in stock No

Disclaimer:

This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have been compiled or

arrived at, based upon information obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of

warranty, express or implied, is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. This document is for information

purposes only. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as an

offer or solicitation of an offer, to buy or sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or located in any

locality, state, country or other jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject HDFC Securities

Ltd or its affiliates to any registration or licensing requirement within such jurisdiction.

If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This document may not

be reproduced, distributed or published for any purposes without prior written approval of HDFC Securities Ltd .

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the income derived

from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HDFC Securities Ltd may from time to time solicit from, or perform broking, or other services for,

any company mentioned in this mail and/or its attachments.

HDFC Securities and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies)

mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the

company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and

other related information and opinions.

HDFC Securities Ltd, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any action

taken on basis of this report, including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the dividend or

income, etc.

HDFC Securities Ltd and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in the report, or

may make sell or purchase or other deals in these securities from time to time or may deal in other securities of the companies / organizations described in this report.

HDFC Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other

assignment in the past twelve months.

HDFC Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report

for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or

specific transaction in the normal course of business.

HDFC Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research

report. Accordingly, neither HDFC Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is not

based on any specific merchant banking, investment banking or brokerage service transactions. HDFC Securities may have issued other reports that are inconsistent with and reach different

conclusion from the information presented in this report. Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an

officer, director or employee of the subject company. We have not received any compensation/benefits from the subject company or third party in connection with the Research Report. HDFC

Securities Ltd. is a SEBI Registered Research Analyst having registration no. INH000002475

HDFC securities

Institutional Equities

Unit No. 1602, 16th Floor, Tower A, Peninsula Business Park,

Senapati Bapat Marg, Lower Parel, Mumbai - 400 013

Board : +91-22-6171 7330 www.hdfcsec.com

Page | 9

You might also like

- The Apothecary Diaries v05 (2022) (Digital) (1r0n)No ratings yetThe Apothecary Diaries v05 (2022) (Digital) (1r0n)178 pages

- Formal Report On Partial Molar Volume Experiment100% (5)Formal Report On Partial Molar Volume Experiment9 pages

- Icici Bank: Wholesale Pain, Retail DelightNo ratings yetIcici Bank: Wholesale Pain, Retail Delight12 pages

- Cholamandalam Investment & Finance: Momentum Building UpNo ratings yetCholamandalam Investment & Finance: Momentum Building Up12 pages

- Cholamandalam Investment & Finance: Revving Up On The TarmacNo ratings yetCholamandalam Investment & Finance: Revving Up On The Tarmac12 pages

- Oriental Bank of Commerce: No Respite From StressNo ratings yetOriental Bank of Commerce: No Respite From Stress11 pages

- First Source Solutions LTD - Karvy Recommendation 11 Mar 2016No ratings yetFirst Source Solutions LTD - Karvy Recommendation 11 Mar 20165 pages

- Infosys (INFTEC) : Strong Execution in Q2, Caution AheadNo ratings yetInfosys (INFTEC) : Strong Execution in Q2, Caution Ahead13 pages

- Indusind Bank (Indba) : Consistent Performance On All Fronts..No ratings yetIndusind Bank (Indba) : Consistent Performance On All Fronts..12 pages

- Indusind Bank (Indba) : Healthy Quarter Growth Momentum To SustainNo ratings yetIndusind Bank (Indba) : Healthy Quarter Growth Momentum To Sustain12 pages

- Indusind Bank (Indba) : Treading Well Relative To PeersNo ratings yetIndusind Bank (Indba) : Treading Well Relative To Peers12 pages

- Larsen & Toubro 4QF16 Result Review 26-05-16 PDFNo ratings yetLarsen & Toubro 4QF16 Result Review 26-05-16 PDF8 pages

- Unitech Ltd. INR: 35: Rising Input Cost Hampers Margins!No ratings yetUnitech Ltd. INR: 35: Rising Input Cost Hampers Margins!5 pages

- Investment Idea HDFCLTD Hold 101021001914 Phpapp01No ratings yetInvestment Idea HDFCLTD Hold 101021001914 Phpapp012 pages

- Sintex Analysis Report From Motilal 28 Jan 2015No ratings yetSintex Analysis Report From Motilal 28 Jan 201512 pages

- HDFC Bank Rs 485: All Around Strong Performance HoldNo ratings yetHDFC Bank Rs 485: All Around Strong Performance Hold8 pages

- Des Ti Money Research JISL Reiterating BUYNo ratings yetDes Ti Money Research JISL Reiterating BUY13 pages

- Allahabad Bank: 15.8% Growth in Loan BookNo ratings yetAllahabad Bank: 15.8% Growth in Loan Book4 pages

- Bluedart Express (Bludar) : Best Financial Year Momentum Remains KeyNo ratings yetBluedart Express (Bludar) : Best Financial Year Momentum Remains Key12 pages

- Persistent Systems LTD.: IT Services - Q3 FY12 Result Update 27 January 2012No ratings yetPersistent Systems LTD.: IT Services - Q3 FY12 Result Update 27 January 20124 pages

- Agricultural Bank of China Hold: Asset Restructuring Takes TimeNo ratings yetAgricultural Bank of China Hold: Asset Restructuring Takes Time17 pages

- SITI Cable Network: CMP: Inr37 TP: INR48 (+30%) BuyNo ratings yetSITI Cable Network: CMP: Inr37 TP: INR48 (+30%) Buy10 pages

- Ashok Leyland: Robust Q2 Upgrade estimates/TP - BUYNo ratings yetAshok Leyland: Robust Q2 Upgrade estimates/TP - BUY6 pages

- All Round Progress: Highlights of The QuarterNo ratings yetAll Round Progress: Highlights of The Quarter9 pages

- Oriental Bank of Commerce: Undemanding ValuationsNo ratings yetOriental Bank of Commerce: Undemanding Valuations11 pages

- NBCC LTD (NBCC) : Orderbook Solid Strong Inflows AnticipatedNo ratings yetNBCC LTD (NBCC) : Orderbook Solid Strong Inflows Anticipated17 pages

- Radico Khaitan: CMP: Inr97 TP: INR 115 BuyNo ratings yetRadico Khaitan: CMP: Inr97 TP: INR 115 Buy6 pages

- Jubilant Foodworks: Keeping Good Faith For Long RunNo ratings yetJubilant Foodworks: Keeping Good Faith For Long Run9 pages

- CMP: INR353 TP: INR420 (+19%) Buy: Muted Volumes Not The New NormalNo ratings yetCMP: INR353 TP: INR420 (+19%) Buy: Muted Volumes Not The New Normal12 pages

- Linc Pen & Plastics LTD.: CMP INR 161.0 Target Inr 218 Result Update - BuyNo ratings yetLinc Pen & Plastics LTD.: CMP INR 161.0 Target Inr 218 Result Update - Buy6 pages

- Icici Bank: CMP: INR396 TP: INR520 (+31%)No ratings yetIcici Bank: CMP: INR396 TP: INR520 (+31%)22 pages

- KotakSecuritiesLtd India Daily Results HDFC, IndusIndBankUpdates Strategy 2011-7-11No ratings yetKotakSecuritiesLtd India Daily Results HDFC, IndusIndBankUpdates Strategy 2011-7-1141 pages

- Economic Indicators for East Asia: Input–Output TablesFrom EverandEconomic Indicators for East Asia: Input–Output TablesNo ratings yet

- BLS International - 2QFY18 - HDFC Sec-201711112030262626379No ratings yetBLS International - 2QFY18 - HDFC Sec-20171111203026262637911 pages

- Finolex Industries - 2QFY18 - HDFC Sec-201711132222474829691No ratings yetFinolex Industries - 2QFY18 - HDFC Sec-20171113222247482969110 pages

- Birla Corp - 2QFY18 - HDFC Sec-201711131327011015336No ratings yetBirla Corp - 2QFY18 - HDFC Sec-20171113132701101533612 pages

- Coal India - 2QFY18 - HDFC Sec-201711132155166709214No ratings yetCoal India - 2QFY18 - HDFC Sec-20171113215516670921410 pages

- Sanghi Industries - 2QFY18 - HDFC Sec-201711132133302229263No ratings yetSanghi Industries - 2QFY18 - HDFC Sec-2017111321333022292639 pages

- Oil India - 2QFY18 - HDFC Sec-201711140922171564104No ratings yetOil India - 2QFY18 - HDFC Sec-2017111409221715641048 pages

- GMDC - 2QFY18 - HDFC Sec-201711141533578171264No ratings yetGMDC - 2QFY18 - HDFC Sec-20171114153357817126411 pages

- AU Small Finance Bank - IC - HDFC Sec-201710030810174398816No ratings yetAU Small Finance Bank - IC - HDFC Sec-20171003081017439881630 pages

- Proof of Pudding: Highlights of The QuarterNo ratings yetProof of Pudding: Highlights of The Quarter9 pages

- Hindustan Petroleum Corporation: Proxy For Marketing PlayNo ratings yetHindustan Petroleum Corporation: Proxy For Marketing Play9 pages

- Technical Stock Idea: Private Client GroupNo ratings yetTechnical Stock Idea: Private Client Group2 pages

- Your Helper Will Soon Be Connected To YouNo ratings yetYour Helper Will Soon Be Connected To You8 pages

- Revised - Legal English II Assignment Jan.10 FinalNo ratings yetRevised - Legal English II Assignment Jan.10 Final2 pages

- The Gods of Padre Faura Crossing MeridiansNo ratings yetThe Gods of Padre Faura Crossing Meridians15 pages

- BAF664: Financial Statement Analysis: Summary of Q2 2021 Kohl's Corporation's Earning Conference CallNo ratings yetBAF664: Financial Statement Analysis: Summary of Q2 2021 Kohl's Corporation's Earning Conference Call3 pages

- A48970353 - 28750 - 6 - 2023 - QTT201 Ca3No ratings yetA48970353 - 28750 - 6 - 2023 - QTT201 Ca34 pages

- Sequential Circuit: Shreyas Patel M.Tech VLSI Design (VIT, Vellore) SVNIT, SuratNo ratings yetSequential Circuit: Shreyas Patel M.Tech VLSI Design (VIT, Vellore) SVNIT, Surat21 pages

- A-STUDY-TO-ASSESS-THE-KNOWLEDGE-ON-HARMFUL-EFFECTS-OF-JUNK-FOOD-AMONG-HIGH-SCHOOL-STUDENTS-AT-SELECTED-SCHOOLS-KARAIKALNo ratings yetA-STUDY-TO-ASSESS-THE-KNOWLEDGE-ON-HARMFUL-EFFECTS-OF-JUNK-FOOD-AMONG-HIGH-SCHOOL-STUDENTS-AT-SELECTED-SCHOOLS-KARAIKAL4 pages

- Final Chapter 7 - Aristotle and St. Thomas' Virtue EthicsNo ratings yetFinal Chapter 7 - Aristotle and St. Thomas' Virtue Ethics3 pages

- The Apothecary Diaries v05 (2022) (Digital) (1r0n)The Apothecary Diaries v05 (2022) (Digital) (1r0n)

- Cholamandalam Investment & Finance: Momentum Building UpCholamandalam Investment & Finance: Momentum Building Up

- Cholamandalam Investment & Finance: Revving Up On The TarmacCholamandalam Investment & Finance: Revving Up On The Tarmac

- First Source Solutions LTD - Karvy Recommendation 11 Mar 2016First Source Solutions LTD - Karvy Recommendation 11 Mar 2016

- Infosys (INFTEC) : Strong Execution in Q2, Caution AheadInfosys (INFTEC) : Strong Execution in Q2, Caution Ahead

- Indusind Bank (Indba) : Consistent Performance On All Fronts..Indusind Bank (Indba) : Consistent Performance On All Fronts..

- Indusind Bank (Indba) : Healthy Quarter Growth Momentum To SustainIndusind Bank (Indba) : Healthy Quarter Growth Momentum To Sustain

- Indusind Bank (Indba) : Treading Well Relative To PeersIndusind Bank (Indba) : Treading Well Relative To Peers

- Unitech Ltd. INR: 35: Rising Input Cost Hampers Margins!Unitech Ltd. INR: 35: Rising Input Cost Hampers Margins!

- Investment Idea HDFCLTD Hold 101021001914 Phpapp01Investment Idea HDFCLTD Hold 101021001914 Phpapp01

- HDFC Bank Rs 485: All Around Strong Performance HoldHDFC Bank Rs 485: All Around Strong Performance Hold

- Bluedart Express (Bludar) : Best Financial Year Momentum Remains KeyBluedart Express (Bludar) : Best Financial Year Momentum Remains Key

- Persistent Systems LTD.: IT Services - Q3 FY12 Result Update 27 January 2012Persistent Systems LTD.: IT Services - Q3 FY12 Result Update 27 January 2012

- Agricultural Bank of China Hold: Asset Restructuring Takes TimeAgricultural Bank of China Hold: Asset Restructuring Takes Time

- SITI Cable Network: CMP: Inr37 TP: INR48 (+30%) BuySITI Cable Network: CMP: Inr37 TP: INR48 (+30%) Buy

- Ashok Leyland: Robust Q2 Upgrade estimates/TP - BUYAshok Leyland: Robust Q2 Upgrade estimates/TP - BUY

- NBCC LTD (NBCC) : Orderbook Solid Strong Inflows AnticipatedNBCC LTD (NBCC) : Orderbook Solid Strong Inflows Anticipated

- Jubilant Foodworks: Keeping Good Faith For Long RunJubilant Foodworks: Keeping Good Faith For Long Run

- CMP: INR353 TP: INR420 (+19%) Buy: Muted Volumes Not The New NormalCMP: INR353 TP: INR420 (+19%) Buy: Muted Volumes Not The New Normal

- Linc Pen & Plastics LTD.: CMP INR 161.0 Target Inr 218 Result Update - BuyLinc Pen & Plastics LTD.: CMP INR 161.0 Target Inr 218 Result Update - Buy

- KotakSecuritiesLtd India Daily Results HDFC, IndusIndBankUpdates Strategy 2011-7-11KotakSecuritiesLtd India Daily Results HDFC, IndusIndBankUpdates Strategy 2011-7-11

- Economic Indicators for East Asia: Input–Output TablesFrom EverandEconomic Indicators for East Asia: Input–Output Tables

- BLS International - 2QFY18 - HDFC Sec-201711112030262626379BLS International - 2QFY18 - HDFC Sec-201711112030262626379

- Finolex Industries - 2QFY18 - HDFC Sec-201711132222474829691Finolex Industries - 2QFY18 - HDFC Sec-201711132222474829691

- Birla Corp - 2QFY18 - HDFC Sec-201711131327011015336Birla Corp - 2QFY18 - HDFC Sec-201711131327011015336

- Coal India - 2QFY18 - HDFC Sec-201711132155166709214Coal India - 2QFY18 - HDFC Sec-201711132155166709214

- Sanghi Industries - 2QFY18 - HDFC Sec-201711132133302229263Sanghi Industries - 2QFY18 - HDFC Sec-201711132133302229263

- Oil India - 2QFY18 - HDFC Sec-201711140922171564104Oil India - 2QFY18 - HDFC Sec-201711140922171564104

- AU Small Finance Bank - IC - HDFC Sec-201710030810174398816AU Small Finance Bank - IC - HDFC Sec-201710030810174398816

- Hindustan Petroleum Corporation: Proxy For Marketing PlayHindustan Petroleum Corporation: Proxy For Marketing Play

- Revised - Legal English II Assignment Jan.10 FinalRevised - Legal English II Assignment Jan.10 Final

- BAF664: Financial Statement Analysis: Summary of Q2 2021 Kohl's Corporation's Earning Conference CallBAF664: Financial Statement Analysis: Summary of Q2 2021 Kohl's Corporation's Earning Conference Call

- Sequential Circuit: Shreyas Patel M.Tech VLSI Design (VIT, Vellore) SVNIT, SuratSequential Circuit: Shreyas Patel M.Tech VLSI Design (VIT, Vellore) SVNIT, Surat

- A-STUDY-TO-ASSESS-THE-KNOWLEDGE-ON-HARMFUL-EFFECTS-OF-JUNK-FOOD-AMONG-HIGH-SCHOOL-STUDENTS-AT-SELECTED-SCHOOLS-KARAIKALA-STUDY-TO-ASSESS-THE-KNOWLEDGE-ON-HARMFUL-EFFECTS-OF-JUNK-FOOD-AMONG-HIGH-SCHOOL-STUDENTS-AT-SELECTED-SCHOOLS-KARAIKAL

- Final Chapter 7 - Aristotle and St. Thomas' Virtue EthicsFinal Chapter 7 - Aristotle and St. Thomas' Virtue Ethics