Axis Bank: Taking It On The Chest

Axis Bank: Taking It On The Chest

Uploaded by

Anonymous y3hYf50mTCopyright:

Available Formats

Axis Bank: Taking It On The Chest

Axis Bank: Taking It On The Chest

Uploaded by

Anonymous y3hYf50mTOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Axis Bank: Taking It On The Chest

Axis Bank: Taking It On The Chest

Uploaded by

Anonymous y3hYf50mTCopyright:

Available Formats

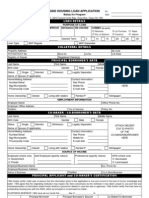

RESULTS REVIEW 2QFY16

28 OCT 2015

Axis Bank

BUY

INDUSTRY

CMP (as on 27 Oct 2015)

Target Price

BANKS

Rs 522

Rs 618

Nifty

8,233

Sensex

27,253

KEY STOCK DATA

Bloomberg

AXSB IN

No. of Shares (mn)

2,378

MCap (Rs bn) / ($ mn)

1,241/19,094

6m avg traded value (Rs mn)

4,219

STOCK PERFORMANCE (%)

52 Week high / low

Rs 655/420

3M

6M

12M

Absolute (%)

(6.1)

(0.5)

22.3

Relative (%)

(5.0)

(0.7)

20.4

SHAREHOLDING PATTERN (%)

Promoters

29.54

FIs & Local MFs

14.53

FIIs

42.13

Public & Others

13.80

Source : BSE

Darpin Shah

darpin.shah@hdfcsec.com

+91-22-6171-7328

Siji Philip

siji.philip@hdfcsec.com

+91-22-6171-7324

Taking it on the chest

Axis Banks (AXSB) reported in line earnings and

asset quality. Asset quality was optically stable

following the sale to ARC (Rs 18.2bn). The sale was at

~65% haircut, with a Rs 3.4bn hit on P&L and Rs

8.5bn from contingent provisions. Including this

cleanup, slippages stood at Rs 24bn (3.3% ann.) vs.

the reported 0.8% ann.

AXSBs conservative approach of building up

contingent provisions through wind fall gains has

provided a handy cushion this quarter. While the B/S

continues towards increasing granularity and

diversification, the corporate book's baggage is

hitting asset quality. Still, AXSB remains ahead of

comparable peers on coverage ratio.

AXSB continues to remain our preferred bet given its

strong liability franchise, improving granularity,

healthy B/S and superior return ratios. Maintain BUY

with a revised TP of Rs 618 (2.5x FY17E ABV).

Highlights of the quarter

AXSB classified two power sector exposures (Rs

18.2bn) as NPAs and sold them to ARC for a

haircut of ~65%. The bank provided Rs 3.4bn

(through P&L) for the impairment and utilised

Rs 8.5bn (from its contingent provisions vs.

amortising losses over eight quarters).

With the sale to ARC, AXBSs asset quality was

stable with G/NNPA increasing by a mere 5/6%

QoQ. Gross stressed additions for 1H (including

assets sold to ARC) stood at Rs 48bn (3.3% ann.),

which were higher than expectation, given the

management's guidance of gross stressed

additions of <Rs 57bn in FY16.

AXSB restructured assets worth Rs 4.6bn and

moved a couple of ACs (worth Rs 15bn) to the the

5:25 scheme (vs. one AC of Rs 5bn in 1QFY16).

Financial Summary

(Rs mn)

Net Interest Income

PPOP

PAT

EPS (Rs)

ROAE (%) (ex revaluations)

ROAA (%)

Adj. BVPS (Rs)

P/ABV (x)

P/E (x)

2QFY16

40,621

36,280

19,156

8.1

2QFY15

35,249

31,623

16,107

6.8

YoY (%)

15.2%

14.7%

18.9%

18.0%

1QFY16 QoQ (%)

FY14

FY15

FY16E

FY17E

40,562

0.1% 119,516 142,241 171,068 199,086

40,921 -11.3% 114,561 133,854 162,287 188,671

19,784

-3.2% 62,177 73,578 86,846 102,367

8.3

-3.3%

26.5

31.0

36.6

43.2

17.4

17.8

18.0

18.2

1.72

1.74

1.75

1.74

158.3

182.9

212.0

247.3

3.30

2.85

2.46

2.11

19.7

16.8

14.2

12.1

Source: Bank, HDFC sec Inst Research

HDFC securities Institutional Research is also available on Bloomberg HSLB <GO> & Thomson Reuters

AXIS BANK : RESULTS REVIEW 2QFY16

Five Quarter At A Glance

(Rs mn)

Net Interest Income

Non-interest Income

Operating Income

Operating Expenses

Pre provision Profits

Provisions and Contingencies

NPA Provisions

PBT

Provision for Tax

PAT

OTHER DETAILS

Balance Sheet items/ratios

Deposits (Rs bn)

CASA Deposits (Rs bn)

Advances (Rs bn)

CD Ratio (%)

CAR (%)

Tier I (%)

Profitability

Yield on Advances (%)

Cost of Deposits (%)

NIM (%)

Cost-Income Ratio (%)

Tax Rate (%)

Asset quality

Gross NPA (Rs bn)

Net NPA (Rs bn)

Gross NPAs (%)

Net NPAs (%)

Delinquency Ratio (ann, %)

O/s restructured book (%)

Coverage Ratio (%)

2QFY15

35,249

19,476

2,708

23,102

31,623

7,250

6,400

24,373

8,266

16,107

3QFY15

35,896

20,391

3,290

23,140

33,146

5,072

3,630

28,075

9,077

18,998

4QFY15

37,992

26,873

2,749

24,737

40,128

7,098

3,710

33,030

11,225

21,805

1QFY16

40,562

22,983

6,460

22,624

40,921

11,218

7,960

29,703

9,919

19,784

2QFY16

40,621

20,414

1,675

24,755

36,280

7,072

6,190

29,208

10,051

19,156

YoY Growth

15.2%

4.8%

-38.1%

7.2%

14.7%

-2.5%

-3.3%

19.8%

21.6%

18.9%

QoQ Growth

0.1%

-11.2%

-74.1%

9.4%

-11.3%

-37.0%

-22.2%

-1.7%

1.3%

-3.2%

2,837

1,264

2,422

85.4

15.9

12.5

2,912

1,256

2,606

89.5

15.6

12.4

3,224

1,444

2,811

87.2

15.1

12.1

3,078

1,316

2,846

92.5

15.1

12.2

3,241

1,434

2,981

92.0

15.4

12.2

14.2%

13.5%

23.1%

660 bps

-48 bps

-33 bps

5.3%

9.0%

4.7%

-52 bps

37 bps

6 bps

10.6

6.2

4.0

42.2

33.9

10.3

6.2

3.9

41.1

32.3

10.4

6.3

3.8

38.1

34.0

10.0

6.1

3.8

35.6

33.4

10.1

6.0

3.9

40.6

34.4

-50 bps

-20 bps

-12 bps

-165 bps

50 bps

8 bps

-13 bps

4 bps

496 bps

102 bps

36.1

11.8

1.3

0.4

1.5

2.8

78.0

39.0

12.5

1.3

0.4

1.1

2.6

78.0

41.1

13.2

1.3

0.4

0.9

2.9

78.0

42.5

14.6

1.4

0.5

1.7

3.0

78.0

44.5

15.4

1.4

0.5

0.8

2.8

78.0

23.2%

30.8%

4 bps

4 bps

-74 bps

6 bps

0 bps

4.7%

5.6%

0 bps

0 bps

-88 bps

-16 bps

0 bps

Change In Estimates

(Rs mn)

NII

PPOP

PAT

Adj. BVPS (Rs)

Source: HDFC sec Inst Research

FY16E

Old

172,672

161,843

88,497

214

New

171,068

162,287

86,846

212

FY17E

Change

-0.9%

0.3%

-1.9%

-0.8%

Old

202,279

189,849

106,565

252

New

199,086

188,671

102,367

247

Change

-1.6%

-0.6%

-3.9%

-1.8%

In line with estimates with

marginally better NIM

PPOP miss of 5% was led by

higher-than-estimated other

opex and lower treasury gains

Includes provisions of Rs 3.36bn

for the impairment of two ACs

sold to ARC

Contingent provisions of Rs

8.5bn utilised , thus not having

an impact on PAT

Driven by retail (+27%), fourth

consecutive quarter of strong

YoY growth in corporate (+26%)

Domestic NIM at 4.11% and

foreign at 1.6%

Sale to ARC (Rs 18.2bn) cushioned

headline GNPAs

Slippages were higher than

expected at Rs 24bn (3.3% ann.)

including the sale to ARC; fresh

restructuring was lower at

Rs 4.6bn vs. Rs 7.4bn QoQ

Page | 2

AXIS BANK : RESULTS REVIEW 2QFY16

Business momentum continues

improvement with 61% book in A to AAA

category vs. 60% QoQ. A break-up of funded

exposure shows QoQ rise in infra (37bps, 7.2%

share) and metals (+30bps, 6.2% share).

However, a QoQ decline was seen in power

(-76bps, 5.9% share) and real estate (13bps,

3.1%).

The retail segment's share is steady at 40.1%.

Within the segment, mortgage loan share was

Source: Company, HDFC sec Inst Research

borrowings (+51% YoY) over deposits (+14%

YoY). Thus, C-D ratio is elevated at ~92%

(domestic at 78%), +660bps YoY. The low-cost

deposits (44.2% share; +~150ps) grew 9% QoQ

(13.5% YoY), driven by CA growth of ~15% YoY (&

QoQ as well) and saving deposits growth of

~13/6% YoY/QoQ. Average CASA ratio, too, was

stable at ~40%. This, coupled with retail TD

(+18% YoY), resulted in the highest retail

deposit share at ~80%.

Retail

SME

Corporate

24 26 27 27 34

35 38 38 40 39 38 40 40 40

13

14

14

15

15

16

16

17

15

16

15

15

13

13

2QFY16

1QFY16

4QFY15

3QFY15

2QFY15

1QFY15

4QFY14

3QFY14

2QFY14

1QFY14

3QFY13

54 53 53 50

50 48 46 44 44 45 47 45 46 46

2QFY13

32.5

30.5

28.5

26.5

24.5

22.5

20.5

18.5

16.5

14.5

12.5

1QFY13

2QFY16

1QFY16

4QFY15

3QFY15

2QFY15

4QFY14

3QFY14

2QFY14

1QFY15

Growth (YoY, %)

%

Rs bn

1QFY14

On the funding front, the bank opted for

Retail Segment Remains Growth Driver

Advances (Rs bn)

3,250

3,050

2,850

2,650

2,450

2,250

2,050

1,850

1,650

1,450

1,250

flat QoQ at 48% (+500bps YoY). The banks

unsecured retail portfolio stood at 14%, which

the bank intends to increase over the next few

quarters. With pickup in the corporate book,

continued momentum in retail portfolio,

coupled with a well-capitalised B/S, we have

factored loan growth of 20% over FY15-17E.

4QFY13

Advances Grew 23% YoY

4QFY13

We have factored loan

growth of 20% over FY15-17E

In the corporate segment, we saw a marginal

3QFY13

Sequentially, funded

exposures increased in sectors

like infra and metals, while

that for power and real estate

declined

of 9-10% driven by corporate (+26% YoY, ~46.5%

share) and retail (+27%, 40% share). However,

the SME segment (+5%, 13% of loans) grew at a

moderate rate. The corporate segment's share

improved with 2QFY16 being the fourth

consecutive quarter of 26+% growth vs. the

earlier trend of high single-digit growth.

2QFY13

Retail book, too, grew ~27%

YoY to form ~40.1% of total

loans

Loans grew ~23% YoY, ahead of industry average

1QFY13

For the fourth consecutive

quarter, corporate growth

was healthy (+26%)

Source: Company, HDFC sec Inst Research

Page | 3

AXIS BANK : RESULTS REVIEW 2QFY16

Within the retail segment,

unsecured loans form ~14% of

the total retail loans

CA grew 15% YoY and QoQ,

while the SA deposits grew

~6% QoQ to form 44% of the

total deposits

On an average, daily balance

CASA ratio was steady at 40%

Sharp drop in cost of deposits

and stable yields led to 4bps

rise in NIM vs. our estimate

decline

We have factored NIM of

average 3.6% over FY16-17E

82% of the domestic book

linked to base rate

Retail Loan Mix: Secured Book At 86%

(%)

Housing

Personal & CC

Auto

Non -Schematic

Retail Agri

LAP

1QFY14

65

10

12

5

8

2QFY14

64

10

11

7

8

3QFY14

64

10

11

6

9

4QFY14

63

10

12

6

9

1QFY15

53

9

10

5

15

8

2QFY15

53

9

9

6

15

8

3QFY15

50

9

9

10

15

7

4QFY15

48

9

8

12

16

7

1QFY16 2QFY16

48

48

10

10

8

8

11

11

15

15

8

8

Source : Bank HDFC sec Inst Research

Deposit Mix : Avg CASA Balance At ~40%

(%)

CA

SA

Retail TD

Others

1QFY14

16

27

27

30

2QFY14

17

26

27

31

3QFY14

16

27

31

26

4QFY14

17

28

30

25

1QFY15

15

27

34

23

2QFY15

16

28

34

21

3QFY15

16

27

35

22

4QFY15

17

27

33

22

1QFY16

15

28

36

21

2QFY16

17

28

36

20

Source : Bank HDFC sec Inst Research

Superior NIM and fee performance

AXSB again surprised with a superior NIM

performance (3.85%, +4bps QoQ) with domestic

NIM at 4.1%. This was largely because of (1)

Steady yields, (2) Sharp decline in the cost of

deposits, and (3) Elevated CD ratio. We have

lowered our NIM assumption to factor in the

recent sharp reduction in base rate and the

move towards the new RBI regulations

(marginal cost of funds). We factor NIM of 3.6%

over FY15-17E.

Led by strong growth in retail fees (Rs 7.2bn,

+19/18% YoY/QoQ) and corporate fees (+27/2%

QoQ/YoY), fee income grew 17/15% YoY/QoQ.

However, lower treasury gains (Rs 1.7bn,

-74/38% QoQ/YoY) and lower forex income

(Rs 612mn, -40/-30% YoY/QoQ) led to muted

below estimates non-interest income (Rs 20.4bn,

-11% QoQ).

With pickup in corporate loans and steady retail

loans, we expect fee income traction to

continue. We have factored non-interest

income growth of 16% CAGR with fee growth of

~17% CAGR

Cost And Yield Movement

%

NIM

Cost of fund

Yield on fund (calc.)

CD Ratio (RHS)

1QFY14

3.86

6.26

8.91

83.1

2QFY14

3.79

6.25

9.18

78.8

3QFY14

3.71

6.29

9.06

80.6

4QFY14

3.89

6.20

8.86

81.9

1QFY15

3.88

6.21

8.97

84.8

2QFY15

3.97

6.19

9.19

85.4

3QFY15

3.93

6.17

8.99

89.5

4QFY15

3.81

6.26

9.04

87.2

1QFY16

3.85

5.99

9.20

92.0

Source : Bank

Page | 4

AXIS BANK : RESULTS REVIEW 2QFY16

2QFY15

15.9

2.69

2.7

0.9

19.5

10.3

3QFY15

16.9

2.68

3.3

0.2

20.4

24.0

4QFY15 1QFY16 2QFY16

21.2

15.5

18.1

3.14

2.19

2.49

2.7

6.5

1.7

2.9

1.0

0.6

26.9

23.0

20.4

21.4

35.9

4.8

25

29

25

28

19 19

3.0

2.0

1.0

Source : Bank

Source : Bank

C-I Ratio Jumped QoQ

Other Provisions Declined 37% QoQ

C-I ratio (%, RHS)

47.0

25.0

10.0

Source : Bank

8.0

20.0

6.0

15.0

4.0

10.0

2.0

2QFY16

1QFY16

3QFY15

2QFY15

1QFY15

4QFY14

3QFY14

2QFY14

5.0

1QFY14

2QFY16

1QFY16

4QFY15

35.0

3QFY15

0.90

2QFY15

37.0

1QFY15

0.95

4QFY14

39.0

3QFY14

1.00

2QFY14

41.0

1QFY14

1.05

4QFY13

1.10

43.0

4QFY13

45.0

1.15

2QFY16

49.0

% Operating Profit

12.0

3QFY13

1.20

Other provision (Rs bn, RHS)

2QFY13

1.25

30.0

1QFY13

Opex/Other income (x)

1.30

1QFY16

4QFY15

26

3QFY15

24

2QFY15

4QFY14

30

4QFY15

31

3QFY14

30

29

2QFY14

29

1QFY14

33

4QFY13

32

10

1QFY15

4QFY14

40

3QFY14

39

2QFY14

10

39

1QFY14

39

4QFY13

38

3QFY13

4.0

37

2QFY13

10

Retail fee % Retail loan (ann., %)

Corp. fee % Corp. loan (ann., %)

1QFY13

34

2QFY16

33

Sharp Improvement in Fee Income Contribution

5.0

1QFY16

32

4QFY15

30

3QFY15

32

2QFY15

32

1QFY15

31

1QFY13

Other provisions were 26%

below estimates at Rs 7.1bn

(-37% QoQ), with a decline in

LLP (-22% QoQ)

4QFY14 1QFY15

17.8

13.8

3.23

2.39

2.2

2.6

2.2

0.5

22.1

16.9

10.3

(5.1)

Business banking

Treasury

28

1QFY13

However, the core C-I ratio

jumped 210bps QoQ to 41.7%

Retail Banking

Agri and SME banking

Large and Mid Corp

35

Addition of 154 branches,

coupled with lower other

income, pushed up C-I ratio by

~500bps QoQ to 40.6%

3QFY14

14.6

2.82

0.3

1.5

16.4

1.8

Fee Income Break-up: Retail Segment Dominates

3QFY13

Aggregate fees % of loans

jumped to 2.5% ann. vs. 2.2%

in 1Q

1QFY14 2QFY14

13.2

14.3

2.67

2.87

4.4

0.0

0.2

3.3

17.8

17.7

33.4

10.9

Source : Bank

3QFY13

Corporate fees saw a

sequential jump of 27%

Rs bn

Fee

% Loan book (ann.)

Trading

Others

Total

Growth (YoY, %)

2QFY13

Retail fees grew ~19% to

Rs 7.2bn and third-party fees

grew ~6% to Rs 2bn

Non-Interest Income: Retail Fees Remain Healthy

2QFY13

Lower treasury gains

(Rs ~1.7bn) and forex income

led to lower-than-estimated

non-interest income

Source : Bank

Page | 5

AXIS BANK : RESULTS REVIEW 2QFY16

AXSB classified two power

sector exposures (Rs 18.2bn)

as NPA and sold to ARC

The bank took haircut of

~65% on these assets

Consideration received Rs

6.5bn (including Rs 1bn in

cash)

AXSB provided Rs3.4bn

(through P&L) for the

impairment of these assets

and utilised Rs 8.5bn from the

contingent provisions vs.

amortising the loss over the

next eight quarters

Slippages incl. the sale to ARC

stood at Rs 24bn (3.3%)

Slippages include Rs 900mn

from restructured pool

G/NNPA increased 5/6% QoQ

to form 1.4/0.5% of loans

Asset sale cushions headline asset quality

AXSB sold two power sector exposures

(belonging to the single corp) worth Rs 18.2bn

for a haircut of ~65%. The bank provided

Rs 3.4bn (through P&L) for the impairment and

utilised Rs 8.5bn from its contingent provisions.

O/S contingent provisions stood at Rs 4.5bn.

management's guidance of

additions of <Rs 57bn in FY16.

stressed

While AXSB has been able to manage the risk in a

challenging macro environment by building

granularity, the corporate book's historical

baggage continues to result in higher gross

stressed additions. With slower-than-expected

recovery, we have revised upwards our average

slippages assumption to 1.22% from 1% earlier

over FY16-17E

With these sales, AXBSs asset quality was stable

with GNPA at Rs 44.5bn (+23/5% YoY/QoQ) and

NNPA increase of ~6% QoQ to Rs 15.4 (0.5%).

Further, PCR was maintained at ~78%. While the

reported slippages were a mere Rs 5.8bn (0.8%

ann.), slippages including sale to ARC stood at Rs

24bn (3.3% ann.).

gross

Loan loss provisions stood at Rs 6.2bn (85bps

ann.), including Rs 3.36bn towards these

impaired assets. The strategy to create a

contingent buffer has cushioned the P&L impact

for AXSB. The bank utilised Rs 8.5bn of

contingent liability towards the losses on sale of

these assets vs. amortisation over the next eight

quarters. We factor non-tax provisions of

110bps over FY15-17E vs. 90bps in FY15.

AXSB restructured assets worth Rs 4.6bn and

sanctioned a couple of ACs worth Rs 15bn under

the 5:25 scheme (vs. one AC of Rs 5bn in 1Q).

Gross stressed additions for 1H (including assets

sold to ARC) stood at Rs 48bn (3.3% ann.), which

were higher than expectation, given the

Provision Break-Up: LLP AT 0.85% ann.

Rs bn

NPA

% loan (ann)

MTM Loss

Others

Total

YoY %

1QFY14

5.7

1.16

1.2

0.2

7.1

175%

2QFY14

2.9

0.57

0.4

3.6

6.9

35%

3QFY14

2.9

0.57

(1.7)

0.8

2.0

-48%

4QFY14

1.4

0.26

(0.9)

4.5

5.1

-15%

1QFY15

3.4

0.58

(0.2)

0.7

3.9

-46%

2QFY15

6.4

1.08

0.9

7.3

5%

3QFY15

3.6

0.58

(0.2)

1.6

5.1

150%

4QFY15

3.7

0.55

(0.1)

3.5

7.1

40%

1QFY16 2QFY16

8.0

6.2

1.13

0.85

0.3

0.7

3.0

0.2

11.2

7.1

190%

-2%

Source : Bank, HDFC sec Inst Research

Fresh restructuring was

Rs4.6bn vs. Rs 7.4bn QoQ

O/s std. restructured pool

now stands at Rs 84.6bn,

Page | 6

AXIS BANK : RESULTS REVIEW 2QFY16

Slippages

3.2

2.7

1.4

1.3

2QFY16

1QFY16

4QFY15

3QFY15

2QFY15

1QFY15

4QFY14

3QFY14

2QFY14

3QFY13

0.0

1QFY13

Source : Bank

2.0

1.0

2QFY16

1QFY16

4QFY15

3QFY15

2QFY15

1QFY15

4QFY14

3QFY14

2QFY14

1QFY14

4QFY13

3QFY13

2QFY13

1QFY13

2.5

1.9

5.0

0.6

10.0

3.0

0.5

10.0

0.5

2QFY13

20.0

15.0

0.6

30.0

2.5

20.0

1.0

2.6

40.0

%

4.0

Rs bn

3.3

25.0

Gross stress addition % loan book (RHS)

2.4

1.5

Restructuring

1QFY14

50.0

Impaired asset formation elevated

NNPA (Rs bn)

NNPA (%, RHS)

4QFY13

GNPA (Rs bn)

GNPA (%, RHS)

2.8

Headline asset quality continue to be stable

Source : Bank

Higher Provision Hit RoAA During The Quarter

NII

Other income

Opex

Other provision

Tax provision

RoAA (RHS)

2.20

6.0

2.10

4.0

2.00

2.0

1.90

1.80

1.70

(2.0)

1.60

2QFY16

1QFY16

4QFY15

3QFY15

2QFY15

1QFY15

4QFY14

3QFY14

2QFY14

1QFY14

4QFY13

3QFY13

2QFY13

1.50

1QFY13

(4.0)

Source : Bank

Page | 7

AXIS BANK : RESULTS REVIEW 2QFY16

P/ABV Band Chart

4.5

800

4.0

3.0x

700

3.5

2.5x

600

Oct-15

Oct-07

Oct-15

Oct-14

Oct-13

Oct-12

0

Oct-11

0.0

Oct-10

100

Oct-09

0.5

Oct-08

200

Oct-07

1.0

1.5x

Oct-14

-1SD

300

Oct-13

400

Oct-12

Avg.

2.0x

Oct-11

1.5

500

Oct-10

2.0

+1SD

Oct-09

2.5

Oct-08

3.0

Source: Bank, HDFC sec Inst Research

Peer Valuations

BANK

CMP

(Rs)

AXSB

DCBB

FB

ICICIBC #

IIB

BOB

OBC

PNB

SBIN #

UNBK

522

91

57

284

954

168

140

134

249

167

Mcap

TP

(Rs Rating

(Rs)

bn)

1,237 BUY

618

26

NEU

98

97

BUY

78

1,645 BUY

382

505

BUY 1,040

373

BUY

196

42

BUY

249

249

BUY

167

1,882 BUY

344

106

BUY

205

ABV (Rs)

P/E (x)

FY15 FY16E FY17E

183

52

43

108

189

139

278

120

122

180

212

57

47

120

290

146

268

137

140

195

247

61

52

138

336

163

312

167

163

228

P/ABV (x)

ROAE (%)

ROAA (%)

FY15 FY16E FY17E

FY15 FY16E FY17E

FY15 FY16E FY17E

FY15 FY16E FY17E

16.8

13.4

9.6

12.2

28.2

11.0

8.4

8.1

11.1

5.9

2.85

1.73

1.32

2.18

5.04

1.21

0.50

1.12

1.60

0.93

17.8

14.0

13.7

14.8

19.0

9.2

3.8

8.5

11.4

10.1

1.74

1.32

1.28

1.80

1.83

0.49

0.34

0.53

0.69

0.48

14.2

15.7

13.0

10.3

23.4

8.7

4.5

6.8

8.6

4.7

12.1

17.5

10.2

8.3

18.1

6.9

3.2

5.1

6.7

3.7

2.46

1.60

1.21

1.89

3.28

1.15

0.52

0.98

1.35

0.85

2.11

1.48

1.09

1.59

2.84

1.03

0.45

0.80

1.12

0.73

18.0

9.8

9.1

14.9

17.4

10.6

6.9

9.4

13.2

11.8

18.2

8.0

10.5

15.9

16.6

12.2

9.1

11.4

14.6

13.4

1.75

0.90

0.84

1.85

1.95

0.57

0.39

0.57

0.77

0.57

1.74

0.65

0.95

1.96

2.02

0.65

0.51

0.68

0.85

0.64

Source: Company, HDFC sec Inst Research, # Adjusted for subsidiaries value

Page | 8

AXIS BANK : RESULTS REVIEW 2QFY16

Income Statement

Balance Sheet

(Rs mn)

FY13

FY14

FY15

FY16E

FY17E

Interest Earned

271,826 306,412 354,786 410,774 479,554

Interest Expended

175,163 186,895 212,545 239,706 280,468

Net Interest Income

96,663 119,516 142,241 171,068 199,086

Other Income

65,511 74,052 83,650 97,599 114,012

Fee Income (CEB)

50,251 53,938 61,211 71,234 85,691

Treasury Income

5,863

3,276

9,949 12,436 12,747

Total Income

162,174 193,569 225,892 268,666 313,099

Total Operating Exp

69,142 79,008 92,037 106,379 124,427

Employee Expense

23,770 26,013 31,150 37,138 44,048

PPOP

93,031 114,561 133,854 162,287 188,671

Provisions & Contingencies

17,501 21,074 23,286 33,914 37,912

Prov. for NPAs (incl. std prov.) 13,759 15,862 20,788 30,108 35,489

PBT

75,531 93,487 110,568 128,373 150,759

Provision for Tax

23,733 31,310 36,990 41,527 48,392

PAT

51,798 62,177 73,578 86,846 102,367

(Rs mn)

SOURCES OF FUNDS

Share Capital

Reserves

Shareholders' Funds

Savings

Current

Term Deposit

Total Deposits

Borrowings

Other Liabilities &

Provisions

Total Liabilities

Source: Bank, HDFC sec Inst Research,

FY13

FY14

FY15

FY16E

FY17E

4,680

4,698

4,741

4,741

4,741

326,399 377,506 442,024 514,981 602,070

331,079 382,205 446,765 519,722 606,811

637,777 777,759 882,921 1,041,847 1,229,379

483,221 486,864 561,082 631,217 725,900

1,405,138 1,544,822 1,780,416 1,976,834 2,557,184

2,526,136 2,809,446 3,224,419 3,649,898 4,512,463

439,511 502,909 797,583 956,561 1,151,138

108,881

137,889

150,557

169,914

194,448

3,405,607 3,832,449 4,619,324 5,296,094 6,464,862

APPLICATION OF FUNDS

Cash & Bank Balance

204,350 282,387 360,990 324,417 427,112

Investments

1,137,375 1,135,484 1,323,428 1,517,069 1,834,489

G-Secs

725,182 696,004 812,460 910,544 1,114,447

Advances

1,969,660 2,300,668 2,810,830 3,316,780 4,046,471

Fixed Assets

23,556

24,102

25,127

26,132

27,439

Other Assets

70,666

89,808

98,932 111,696 129,351

Total Assets

3,405,607 3,832,449 4,619,308 5,296,094 6,464,862

Source: Bank, HDFC sec Inst Research,

Page | 9

AXIS BANK : RESULTS REVIEW 2QFY16

Key Ratios

FY13

VALUATION RATIOS

EPS

Earnings Growth (%)

BVPS (ex reval.)

Adj. BVPS

ROAA (%)

ROAE (%) (ex reval.)

P/E (x)

P/ABV (x)

P/PPOP (x)

Dividend Yield (%)

PROFITABILITY

Yield on Advances (%)

Yield on Investment (%)

Cost of Funds (%)

Cost of Deposits (%)

Core Spread (%)

NIM (%)

OPERATING EFFICIENCY

Cost/Avg. Asset Ratio (%)

Core Cost-Income Ratio (%)

BALANCE SHEET STRUCTURE

Loan Growth (%)

Deposit Growth (%)

C/D Ratio (%)

Equity/Assets (%)

Equity/Advances (%)

CASA (%)

Capital Adequacy Ratio (CAR, %)

W/w Tier I CAR (%)

FY14

FY15

FY16E

FY17E

22.1

22.1

141.5

138.5

1.7

18.5

18.5

23.6

3.8

2.6

26.5

20.0

162.7

158.3

1.7

17.4

17.4

19.7

3.3

2.1

31.0

18.3

188.5

182.9

1.7

17.8

17.8

16.8

2.85

1.8

36.6

18.0

219.2

212.0

1.8

18.0

18.0

14.2

2.46

1.5

43.2

17.9

256.0

247.3

1.7

18.2

18.2

12.1

2.11

1.3

10.5

7.5

6.4

6.4

4.1

3.3

10.3

7.3

6.0

5.8

4.3

3.6

10.1

7.4

5.8

5.7

4.3

3.6

9.9

7.2

5.6

5.6

4.3

3.7

9.6

7.1

5.5

5.5

4.2

3.6

ASSET QUALITY

Gross NPLs (Rsm)

Net NPLs (Rsm)

Gross NPLs (%)

Net NPLs (%)

Coverage Ratio (%)

Provision/Avg. Loans (%)

ROAA TREE

Net Interest Income

Non-interest Income

Treasury Income

Operating Cost

Provisions

Provisions for NPAs

Tax

ROAA

Leverage (x)

ROAE

FY13

FY14

FY15

FY16E

FY17E

23,934

7,041

1.1

0.3

70.6

0.64

31,464

10,246

1.2

0.4

67.4

0.61

41,102

13,167

1.5

0.5

68.0

0.70

51,668

17,106

1.6

0.5

66.9

0.91

61,334

20,488

1.5

0.5

66.6

0.87

3.09%

2.09%

0.19%

2.21%

0.56%

0.38%

0.76%

1.65%

11.2

18.53%

3.30%

2.05%

0.09%

2.18%

0.58%

0.36%

0.87%

1.72%

10.1

17.43%

3.37%

1.98%

0.24%

2.18%

0.55%

0.42%

0.88%

1.74%

10.2

17.75%

3.45%

1.97%

0.25%

2.15%

0.68%

0.56%

0.84%

1.75%

10.3

17.97%

3.39%

1.94%

0.22%

2.12%

0.64%

0.55%

0.82%

1.74%

10.4

18.17%

Source: Bank, HDFC sec Inst Research,

2.2

44.2

2.2

41.5

2.2

42.6

2.1

41.5

2.1

41.4

16.0

14.8

78.0

9.7

16.8

44.4

17.0

12.2

16.8

11.2

81.9

10.0

16.6

45.0

16.1

12.6

22.2

14.8

87.2

9.7

15.9

44.8

15.1

12.1

18.0

13.2

90.9

9.8

15.7

45.8

15.0

12.4

22.0

23.6

89.7

9.4

15.0

43.3

14.1

11.9

Page | 10

AXIS BANK : RESULTS REVIEW 2QFY16

RECOMMENDATION HISTORY

Axis Bank

750

Date

20-Oct-14

19-Jan-15

23-Mar-15

30-Apr-15

25-Jul-15

28-Oct-15

TP

700

650

600

550

500

CMP

402

515

556

552

580

522

Reco

BUY

BUY

BUY

BUY

BUY

BUY

Target

470

600

630

632

655

618

450

400

350

Oct-15

Sep-15

Aug-15

Jul-15

Jun-15

May-15

Apr-15

Mar-15

Feb-15

Jan-15

Dec-14

Nov-14

Oct-14

300

Rating Definitions

BUY

: Where the stock is expected to deliver more than 10% returns over the next 12 month period

NEUTRAL : Where the stock is expected to deliver (-)10% to 10% returns over the next 12 month period

SELL

: Where the stock is expected to deliver less than (-)10% returns over the next 12 month period

Page | 11

AXIS BANK : RESULTS REVIEW 2QFY16

Disclosure:

We, Darpin Shah, MBA, & Siji Philip, MBA, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views

about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this

report.

Research Analyst or his/her relative or HDFC Securities Ltd. does not have any financial interest in the subject company. Also Research Analyst or his relative or HDFC Securities Ltd. or its

Associate may have beneficial ownership of 1% or more in the subject company at the end of the month immediately preceding the date of publication of the Research Report. Further

Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any material conflict of interest.

Any holding in stock No

Disclaimer:

This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have been compiled or

arrived at, based upon information obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of

warranty, express or implied, is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. This document is for

information purposes only. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be

construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or located in any

locality, state, country or other jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject HDFC

Securities Ltd or its affiliates to any registration or licensing requirement within such jurisdiction.

If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This document may

not be reproduced, distributed or published for any purposes without prior written approval of HDFC Securities Ltd .

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the income derived

from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HDFC Securities Ltd may from time to time solicit from, or perform broking, or other services

for, any company mentioned in this mail and/or its attachments.

HDFC Securities and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies)

mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the

company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and

other related information and opinions.

HDFC Securities Ltd, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any

action taken on basis of this report, including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the

dividend or income, etc.

HDFC Securities Ltd and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in the report,

or may make sell or purchase or other deals in these securities from time to time or may deal in other securities of the companies / organizations described in this report.

HDFC Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any

other assignment in the past twelve months.

HDFC Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report

for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or

specific transaction in the normal course of business.

HDFC Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research

report. Accordingly, neither HDFC Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is

not based on any specific merchant banking, investment banking or brokerage service transactions. HDFC Securities may have issued other reports that are inconsistent with and reach

different conclusion from the information presented in this report.

Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an officer, director or employee of the subject company. We

have not received any compensation/benefits from the subject company or third party in connection with the Research Report.

HDFC securities

Institutional Equities

Unit No. 1602, 16th Floor, Tower A, Peninsula Business Park,

Senapati Bapat Marg, Lower Parel, Mumbai - 400 013

Board : +91-22-6171 7330 www.hdfcsec.com

Page | 12

You might also like

- GO2Bank Template 2Document5 pagesGO2Bank Template 2Roger kelly100% (9)

- Mutual Fund Internal Audit PresentationDocument80 pagesMutual Fund Internal Audit PresentationRam MutkuleNo ratings yet

- Icici Bank: Wholesale Pain, Retail DelightDocument12 pagesIcici Bank: Wholesale Pain, Retail DelightumaganNo ratings yet

- Indusind Bank: Picture PerfectDocument12 pagesIndusind Bank: Picture PerfectumaganNo ratings yet

- Cholamandalam Investment & Finance: Revving Up On The TarmacDocument12 pagesCholamandalam Investment & Finance: Revving Up On The TarmacAnonymous y3hYf50mTNo ratings yet

- Oriental Bank of Commerce: Undemanding ValuationsDocument11 pagesOriental Bank of Commerce: Undemanding ValuationsAnonymous y3hYf50mTNo ratings yet

- Oriental Bank of Commerce: No Respite From StressDocument11 pagesOriental Bank of Commerce: No Respite From StressDinesh ChoudharyNo ratings yet

- Cholamandalam Investment & Finance: Momentum Building UpDocument12 pagesCholamandalam Investment & Finance: Momentum Building UpumaganNo ratings yet

- Indusind Bank (Indba) : Consistent Performance On All Fronts..Document12 pagesIndusind Bank (Indba) : Consistent Performance On All Fronts..arun_algoNo ratings yet

- IDFC Research Motilal OswalDocument12 pagesIDFC Research Motilal OswalRohit GuptaNo ratings yet

- Majesco: Muted Show, Thesis UnchangedDocument11 pagesMajesco: Muted Show, Thesis UnchangedAnonymous y3hYf50mTNo ratings yet

- Axis Bank Q2FY25 ISECDocument10 pagesAxis Bank Q2FY25 ISECNavin GoyalNo ratings yet

- Ujjivan Financial Services: Cruising Strong!Document10 pagesUjjivan Financial Services: Cruising Strong!umaganNo ratings yet

- 26042013131311axis Bank LTD Q4FY13 Result UpdateDocument7 pages26042013131311axis Bank LTD Q4FY13 Result UpdateDrBishnu Prasad MahalaNo ratings yet

- 2011 Apr EdelweissDocument10 pages2011 Apr EdelweissSaurabh DokaniaNo ratings yet

- Union Bank, 1Q FY 2014Document11 pagesUnion Bank, 1Q FY 2014Angel BrokingNo ratings yet

- UnitedBoI-1QFY2013RU 10 TH AugDocument11 pagesUnitedBoI-1QFY2013RU 10 TH AugAngel BrokingNo ratings yet

- Samp Softlogic 2016 Q1Document4 pagesSamp Softlogic 2016 Q1SupunDNo ratings yet

- Indian Bank, 1Q FY 2014Document11 pagesIndian Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Allahabad Bank, 1Q FY 2014Document11 pagesAllahabad Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Indian Bank 4Q FY 2013Document11 pagesIndian Bank 4Q FY 2013Angel BrokingNo ratings yet

- HDFC Bank Rs 485: All Around Strong Performance HoldDocument8 pagesHDFC Bank Rs 485: All Around Strong Performance HoldP VinayakamNo ratings yet

- Vijaya Bank, 1Q FY 2014Document11 pagesVijaya Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Indusind Bank (Indba) : Healthy Quarter Growth Momentum To SustainDocument12 pagesIndusind Bank (Indba) : Healthy Quarter Growth Momentum To Sustainarun_algoNo ratings yet

- South Indian Bank, 1Q FY 2014Document12 pagesSouth Indian Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Corporation Bank Q3FY13 Result UpdateDocument5 pagesCorporation Bank Q3FY13 Result UpdateDarshan MaldeNo ratings yet

- UCO Bank: Performance HighlightsDocument11 pagesUCO Bank: Performance HighlightsAngel BrokingNo ratings yet

- Canara Bank 2612024 MotiDocument10 pagesCanara Bank 2612024 MotiBHAVYA PANDYANo ratings yet

- Banking ResultReview 2QFY2013Document24 pagesBanking ResultReview 2QFY2013Angel BrokingNo ratings yet

- Sib 4Q Fy 2013Document12 pagesSib 4Q Fy 2013Angel BrokingNo ratings yet

- Equitas Small Finance 2912024 MotiDocument12 pagesEquitas Small Finance 2912024 MotibzzziNo ratings yet

- Allahabad Bank: 15.8% Growth in Loan BookDocument4 pagesAllahabad Bank: 15.8% Growth in Loan Bookcksharma68No ratings yet

- Banking: Near Term Headwinds To Stay Remain SelectiveDocument13 pagesBanking: Near Term Headwinds To Stay Remain SelectiveumaganNo ratings yet

- AU Small Finance Bank 26 04 2023 MotiDocument12 pagesAU Small Finance Bank 26 04 2023 MotisrinivasNo ratings yet

- Motilal REc ResearchDocument10 pagesMotilal REc ResearchhdanandNo ratings yet

- LIC Housing Finance: Steady As EverDocument9 pagesLIC Housing Finance: Steady As EverAnonymous y3hYf50mTNo ratings yet

- Bank of Maharashtra, 1Q FY 2014Document10 pagesBank of Maharashtra, 1Q FY 2014Angel BrokingNo ratings yet

- HDFC Bank, 1Q FY 2014Document13 pagesHDFC Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Dena Bank, 1Q FY 2014Document11 pagesDena Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Bank of Maharashtra Result UpdatedDocument11 pagesBank of Maharashtra Result UpdatedAngel BrokingNo ratings yet

- IDFC Bank: CMP: Inr50 TP: INR65 (+30%)Document12 pagesIDFC Bank: CMP: Inr50 TP: INR65 (+30%)darshanmaldeNo ratings yet

- Vijaya Bank: Performance HighlightsDocument12 pagesVijaya Bank: Performance HighlightsAngel BrokingNo ratings yet

- Axis Bank Q4FY12 Result 30-April-12Document8 pagesAxis Bank Q4FY12 Result 30-April-12Rajesh VoraNo ratings yet

- Federal Bank, 1Q FY 2014Document11 pagesFederal Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Axis Bank, 1Q FY 2014Document14 pagesAxis Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Dewan Housing: CMP: INR331 TP: INR540 BuyDocument6 pagesDewan Housing: CMP: INR331 TP: INR540 BuySUKHSAGAR1969No ratings yet

- ICICI KotakDocument4 pagesICICI KotakwowcoolmeNo ratings yet

- Idbi, 1Q Fy 2014Document12 pagesIdbi, 1Q Fy 2014Angel BrokingNo ratings yet

- Indian Bank - MotilalDocument12 pagesIndian Bank - MotilalRishi ChitlangiaNo ratings yet

- Indusind Bank (Indba) : Core Strength SustainsDocument12 pagesIndusind Bank (Indba) : Core Strength Sustainsarun_algoNo ratings yet

- Syndicate Bank 4Q FY 2013Document11 pagesSyndicate Bank 4Q FY 2013Angel BrokingNo ratings yet

- Axis Bank: Performance HighlightsDocument13 pagesAxis Bank: Performance HighlightsAngel BrokingNo ratings yet

- Andhra Bank, 1Q FY 2014Document11 pagesAndhra Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Yes Bank: Emergin G StarDocument5 pagesYes Bank: Emergin G StarAnkit ModaniNo ratings yet

- IDBI Bank Result UpdatedDocument13 pagesIDBI Bank Result UpdatedAngel BrokingNo ratings yet

- Federal Bank ResultDocument5 pagesFederal Bank ResultYADVINDER SINGHNo ratings yet

- Banking Sector UpdateDocument27 pagesBanking Sector UpdateAngel BrokingNo ratings yet

- Federal Bank: Performance HighlightsDocument11 pagesFederal Bank: Performance HighlightsAngel BrokingNo ratings yet

- Allahabad Bank - SPA - 1 SeptDocument4 pagesAllahabad Bank - SPA - 1 SeptanjugaduNo ratings yet

- Union Bank 4Q FY 2013Document11 pagesUnion Bank 4Q FY 2013Angel BrokingNo ratings yet

- Asian Economic Integration Report 2018: Toward Optimal Provision of Regional Public Goods in Asia and the PacificFrom EverandAsian Economic Integration Report 2018: Toward Optimal Provision of Regional Public Goods in Asia and the PacificNo ratings yet

- BLS International - 2QFY18 - HDFC Sec-201711112030262626379Document11 pagesBLS International - 2QFY18 - HDFC Sec-201711112030262626379Anonymous y3hYf50mTNo ratings yet

- Birla Corp - 2QFY18 - HDFC Sec-201711131327011015336Document12 pagesBirla Corp - 2QFY18 - HDFC Sec-201711131327011015336Anonymous y3hYf50mTNo ratings yet

- Sanghi Industries - 2QFY18 - HDFC Sec-201711132133302229263Document9 pagesSanghi Industries - 2QFY18 - HDFC Sec-201711132133302229263Anonymous y3hYf50mTNo ratings yet

- Oil India - 2QFY18 - HDFC Sec-201711140922171564104Document8 pagesOil India - 2QFY18 - HDFC Sec-201711140922171564104Anonymous y3hYf50mTNo ratings yet

- Coal India - 2QFY18 - HDFC Sec-201711132155166709214Document10 pagesCoal India - 2QFY18 - HDFC Sec-201711132155166709214Anonymous y3hYf50mTNo ratings yet

- Finolex Industries - 2QFY18 - HDFC Sec-201711132222474829691Document10 pagesFinolex Industries - 2QFY18 - HDFC Sec-201711132222474829691Anonymous y3hYf50mTNo ratings yet

- Eicher Motors: Whethering The StormDocument11 pagesEicher Motors: Whethering The StormAnonymous y3hYf50mTNo ratings yet

- GMDC - 2QFY18 - HDFC Sec-201711141533578171264Document11 pagesGMDC - 2QFY18 - HDFC Sec-201711141533578171264Anonymous y3hYf50mTNo ratings yet

- Proof of Pudding: Highlights of The QuarterDocument9 pagesProof of Pudding: Highlights of The QuarterAnonymous y3hYf50mTNo ratings yet

- AU Small Finance Bank - IC - HDFC Sec-201710030810174398816Document30 pagesAU Small Finance Bank - IC - HDFC Sec-201710030810174398816Anonymous y3hYf50mTNo ratings yet

- Report - Divis LabDocument7 pagesReport - Divis LabAnonymous y3hYf50mTNo ratings yet

- Atul Auto: Rural Uptick Holds The KeyDocument10 pagesAtul Auto: Rural Uptick Holds The KeyAnonymous y3hYf50mTNo ratings yet

- CMD MesgDocument2 pagesCMD MesgAnonymous y3hYf50mTNo ratings yet

- ReportDocument1 pageReportAnonymous y3hYf50mTNo ratings yet

- Majesco: Muted Show, Thesis UnchangedDocument11 pagesMajesco: Muted Show, Thesis UnchangedAnonymous y3hYf50mTNo ratings yet

- Technical Stock Idea: Private Client GroupDocument2 pagesTechnical Stock Idea: Private Client GroupAnonymous y3hYf50mTNo ratings yet

- Team Travel World Cup T 20.Document7 pagesTeam Travel World Cup T 20.Anonymous y3hYf50mTNo ratings yet

- Ashoka Buildcon: Worth A WaitDocument13 pagesAshoka Buildcon: Worth A WaitAnonymous y3hYf50mTNo ratings yet

- Hindustan Petroleum Corporation: Proxy For Marketing PlayDocument9 pagesHindustan Petroleum Corporation: Proxy For Marketing PlayAnonymous y3hYf50mTNo ratings yet

- Horizontal and Vertical AnalysisDocument3 pagesHorizontal and Vertical AnalysisJazzy CozyNo ratings yet

- Risk Management - RM CHEAT SHEET MAYBEDocument9 pagesRisk Management - RM CHEAT SHEET MAYBEEdithNo ratings yet

- Summer Internship Project Kartik DuggalDocument17 pagesSummer Internship Project Kartik DuggalSuryansh MunjalNo ratings yet

- Almahera-Tugas Excel ManufakturDocument3 pagesAlmahera-Tugas Excel ManufakturalmaheraNo ratings yet

- This Study Resource Was: SolutionDocument6 pagesThis Study Resource Was: SolutionChris Jay LatibanNo ratings yet

- 2023 - Tutorial 8 Cost of CapitalDocument3 pages2023 - Tutorial 8 Cost of CapitalVanh QuáchNo ratings yet

- Analysis of Financial Performance of State Bank of India Using Camels ApproachDocument4 pagesAnalysis of Financial Performance of State Bank of India Using Camels ApproachpriyankaNo ratings yet

- ACC501 Final Term Formulas by AC 03222254114Document6 pagesACC501 Final Term Formulas by AC 03222254114academicconsultant786No ratings yet

- Solutions - Chapter 6Document4 pagesSolutions - Chapter 6haidaNo ratings yet

- BKPloanapplicationDocument3 pagesBKPloanapplicationcunninghumNo ratings yet

- Lesson 3Document167 pagesLesson 3Marjorie BalboaNo ratings yet

- BritanniaDocument20 pagesBritanniahelpdsrealtyNo ratings yet

- 02122020Document5 pages02122020Kumar FanishwarNo ratings yet

- Oda Bultum University College of Business and Economics Department of Accounting and FinanceDocument28 pagesOda Bultum University College of Business and Economics Department of Accounting and FinanceFiraol Umer100% (1)

- OCW23Pre-reg ListDocument16 pagesOCW23Pre-reg Listtanwarhimanshi00No ratings yet

- Fund Services Brochure TrustmemooreDocument8 pagesFund Services Brochure TrustmemooreJose M AlayetoNo ratings yet

- Chapter 1 (Negotiable Instruments)Document10 pagesChapter 1 (Negotiable Instruments)Mohammad Minhaz Hossain RiyadNo ratings yet

- Elias ResearchDocument56 pagesElias Researchtamrat lisanwork100% (2)

- Accounting 101Document6 pagesAccounting 101Joyce CariñoNo ratings yet

- Devaksha Rampersadh Ftnqngi2 ArchivedDocument2 pagesDevaksha Rampersadh Ftnqngi2 ArchiveddevaksharamharakhNo ratings yet

- IAS 7 - Statement of Cash FlowsDocument3 pagesIAS 7 - Statement of Cash FlowsCaia VelazquezNo ratings yet

- Investors Suing Chase - Includes List of Mortgage Backed Securities - Various Originators Like New Century, WAMU, Wells Fargo, ResMae, Greenpoint, Countrywide, Ownit, Accredited Home Lenders Etc.Document124 pagesInvestors Suing Chase - Includes List of Mortgage Backed Securities - Various Originators Like New Century, WAMU, Wells Fargo, ResMae, Greenpoint, Countrywide, Ownit, Accredited Home Lenders Etc.83jjmack100% (1)

- Kuldeep StatementsDocument5 pagesKuldeep StatementsAmrit DhillonNo ratings yet

- Chapter 2 Recording Business Transactions: Acid)Document29 pagesChapter 2 Recording Business Transactions: Acid)Farhan Osman ahmedNo ratings yet

- ACC 124 HO 6 Accounts ReceivableDocument3 pagesACC 124 HO 6 Accounts ReceivableJames Cañada GatoNo ratings yet

- Ankit .M. Tripathi: University of MumbaiDocument47 pagesAnkit .M. Tripathi: University of MumbaipradeepbandiNo ratings yet

- Royal Bank of Canada - Earnings Call 2015-5-28 FS000000002213155827Document19 pagesRoyal Bank of Canada - Earnings Call 2015-5-28 FS000000002213155827Nicholi ShiellNo ratings yet

- Commercial Real Estate Interview PrepDocument8 pagesCommercial Real Estate Interview PrepciccioNo ratings yet