Ch01 Introduction To Accounting and Business

Uploaded by

Gelyn CruzCopyright:

Available Formats

Ch01 Introduction To Accounting and Business

Uploaded by

Gelyn CruzOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Ch01 Introduction To Accounting and Business

Uploaded by

Gelyn CruzCopyright:

Available Formats

Chapter 1

Introduction to Accounting and Business

OBJECTIVES

Obj 1

Obj 2

Obj 3

Obj 4

Obj 5

Describe the nature of a business and the role of ethics and accounting in business.

Summarize the development of accounting principles and relate them to practice.

State the accounting equation and define each element of the equation.

Describe and illustrate how business transactions can be recorded in terms of the

resulting change in the basic elements of the accounting equation.

Describe the financial statements of a proprietorship and explain how they

interrelate.

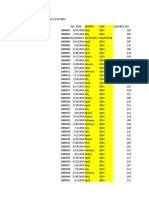

QUESTION GRID

True / False

No Objective

.

1

01-01

2

01-01

3

01-01

4

01-01

5

01-01

6

01-01

7

01-01

8

01-01

9

01-01

10

01-01

11

01-01

12

01-01

13

01-01

14

01-01

15

01-01

16

01-01

17

01-01

18

01-01

19

01-01

20

01-01

21

01-01

22

01-01

Difficulty

No.

Objective

Difficulty

No.

Objective

Difficulty

Moderate

Moderate

Easy

Easy

Moderate

Easy

Moderate

Easy

Easy

Moderate

Easy

Easy

Moderate

Easy

Easy

Easy

Easy

Moderate

Easy

Moderate

Easy

Easy

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

01-01

01-01

01-01

01-01

01-01

01-01

01-02

01-02

01-02

01-02

01-02

01-02

01-03

01-03

01-03

01-03

01-03

01-03

01-03

01-03

01-04

01-04

Easy

Easy

Easy

Easy

Easy

Easy

Moderate

Easy

Easy

Moderate

Easy

Easy

Easy

Difficult

Easy

Moderate

Moderate

Moderate

Moderate

Moderate

Difficult

Moderate

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-05

01-05

01-05

01-05

01-05

01-05

01-05

01-05

Easy

Moderate

Difficult

Moderate

Moderate

Moderate

Easy

Moderate

Moderate

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Moderate

Easy

Chapter 1/Introduction to Accounting and Business 2

Matching

No Objective

.

1

01-04

2

01-04

3

01-04

4

01-04

5

01-04

6

01-04

7

01-04

Multiple Choice

No Objective

.

1

01-01

2

01-01

3

01-01

4

01-01

5

01-01

6

01-01

7

01-01

8

01-01

9

01-01

10

01-01

11

01-01

12

01-01

13

01-01

14

01-01

15

01-01

16

01-01

17

01-01

18

01-01

19

01-01

20

01-01

21

01-01

22

01-01

23

01-01

24

01-01

25

01-01

26

01-01

27

01-02

28

01-02

29

01-02

30

01-02

31

01-02

Difficulty

No.

Objective

Difficulty

No.

Objective

Difficulty

Moderate

Moderate

Moderate

Moderate

Moderate

Moderate

Moderate

8

9

10

11

12

13

14

01-04

01-04

01-04

01-05

01-05

01-05

01-05

Moderate

Moderate

Moderate

Easy

Easy

Easy

Easy

15

16

17

18

19

20

01-05

01-05

01-05

01-05

01-05

01-05

Easy

Easy

Easy

Easy

Easy

Easy

Difficulty

No.

Objective

Difficulty

No.

Objective

Difficulty

Easy

Easy

Easy

Easy

Easy

Moderate

Moderate

Easy

Easy

Easy

Moderate

Easy

Moderate

Easy

Easy

Moderate

Easy

Easy

Easy

Moderate

Moderate

Moderate

Moderate

Moderate

Moderate

Moderate

Moderate

Easy

Easy

Moderate

Difficult

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

01-02

01-02

01-02

01-02

01-02

01-02

01-02

01-03

01-03

01-03

01-03

01-03

01-03

01-03

01-03

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

Difficult

Difficult

Difficult

Easy

Easy

Moderate

Moderate

Easy

Easy

Easy

Moderate

Easy

Easy

Moderate

Moderate

Moderate

Moderate

Moderate

Easy

Moderate

Moderate

Easy

Easy

Easy

Moderate

Easy

Easy

Moderate

Moderate

Moderate

Moderate

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-04

01-05

01-05

01-05

01-05

01-05

01-05

01-05

01-05

01-05

01-05

01-05

01-05

Moderate

Moderate

Difficult

Difficult

Moderate

Difficult

Difficult

Difficult

Easy

Moderate

Difficult

Moderate

Easy

Easy

Moderate

Moderate

Moderate

Moderate

Difficult

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Chapter 1/Introduction to Accounting and Business 3

32

01-02

Exercise/Other

No Objective

.

1

01-01

2

01-02

3

01-03

4

01-04

Problem

No Objective

.

1

01-01

2

01-01

3

01-02

4

01-02

5

01-03

6

01-04

7

01-04

Moderate

64

01-04

Moderate

Difficulty

No.

Objective

Difficulty

No.

Objective

Difficulty

Easy

Easy

Moderate

Difficult

5

6

7

8

01-05

01-05

01-05

01-05

Moderate

Moderate

Moderate

Difficult

9

10

01-05

01-05

Easy

Easy

Difficulty

No.

Objective

Difficulty

No.

Objective

Difficulty

Moderate

Moderate

Easy

Easy

Easy

Moderate

Moderate

8

9

10

11

12

13

14

01-05

01-05

01-05

01-05

01-05

01-05

01-05

Easy

Easy

Difficult

Difficult

Difficult

Difficult

Difficult

15

16

17

18

19

20

01-05

01-05

01-05

01-05

01-05

01-05

Difficult

Difficult

Moderate

Difficult

Moderate

Difficult

Chapter 1Introduction to Accounting and Business

TRUE/FALSE

4 Chapter 1/Introduction to Accounting and Business

1. The main objective of a not-for-profit business is not to make a profit.

ANS: F

DIF: Moderate

OBJ: 01-01

2. An example of a business stakeholder is the government.

ANS: T

DIF: Moderate

OBJ: 01-01

3. A corporation is a business that is legally separate and distinct from its owners.

ANS: T

DIF: Easy OBJ: 01-01

5. Primary users of accounting information are accountants.

ANS: F

DIF: Moderate

OBJ: 01-01

6.

Accounting is thought to be the "language of business" because business information is

communicated to stakeholders.

ANS: T

DIF: Easy OBJ: 01-01

7.

The role of accounting is to provide many different users with financial information to

make economic decisions.

ANS: T

DIF: Moderate

OBJ: 01-01

8. Proprietorships are owned by one owner and provide only services to their customers.

ANS: F

DIF: Easy OBJ: 01-01

9.

Large corporations such as Wal-Mart, Coca-Cola, and Nike operate as manufacturing

businesses.

ANS: F

DIF: Easy OBJ: 01-01

11. A business stakeholder is a person or entity that has an economic interest in the company.

ANS: T

DIF: Easy OBJ: 01-01

12. Senior executives cannot be criminally prosecuted for the wrong doings they commit on

behalf of the companies where they work.

ANS: F

DIF: Easy OBJ: 01-01

13. The primary role of accounting is to determine the amount of taxes a business will be

required to pay to taxing entities.

ANS: F

DIF: Moderate

OBJ: 01-01

14. Stakeholders use only accounting reports as the source of information to base all of their

business decisions.

ANS: F

DIF: Easy OBJ: 01-01

15. Accounting reports are designed with the information needs of the stakeholders in mind.

ANS: T

DIF: Easy OBJ: 01-01

17. Managerial accounting information is used by external and internal users equally.

Chapter 1/Introduction to Accounting and Business 5

ANS: F

DIF:

Easy

OBJ: 01-01

18. Financial accounting provides information to all of the business stakeholders, while the main

focus for managerial accounting is to provide information to the management.

ANS: T

DIF: Moderate

OBJ: 01-01

19. Proper ethical conduct implies that you only consider what's in your best interest.

ANS: F

DIF: Easy OBJ: 01-01

20. Some of the major fraudulent acts by senior executives started as what they considered to be

small ethical lapses which grew out of control.

ANS: T

DIF: Moderate

OBJ: 01-01

21. CMA is an acronym that stands for Certified Manufacturing Accountant.

ANS: F

DIF: Easy OBJ: 01-01

22. Individuals who wish to practice public accounting as a CPA must meet the requirements of

the state in which they reside.

ANS: T

DIF: Easy OBJ: 01-01

23. A business is an organization that provides goods or services to their customers in exchange

for money or other items of value.

ANS: T

DIF: Easy OBJ: 01-01

24. Profits are the difference between the amounts received from customers and the amounts

paid to provide the goods or services.

ANS: T

DIF: Easy OBJ: 01-01

25. The main objective for all businesses is to maximize profits.

ANS: F

DIF: Easy OBJ: 01-01

26. Manufacturing and merchandising companies are similar because they purchase products

from other companies to sell to their customers.

ANS: F

DIF: Easy OBJ: 01-01

27. Managerial accounting is primarily concerned with the recording and reporting of economic

data and activities of an entity for use by owners, creditors, governmental agencies, and the

public.

ANS: F

DIF: Easy OBJ: 01-01

28. The International Accounting Standards Board (IASB) is the authoritative body that has

primary responsibility for developing accounting principles.

ANS: T

DIF: Easy OBJ: 01-01

29. The cost concept is the basis for entering the exchange price into the accounting records.

ANS: T

DIF: Moderate

OBJ: 01-02

6 Chapter 1/Introduction to Accounting and Business

30. Without the cost concept, accounting reports would become unstable and unreliable.

ANS: T

DIF: Easy OBJ: 01-02

31. The unit of measurement concept requires that economic data be recorded in a common unit

of measurement.

ANS: T

DIF: Easy OBJ: 01-02

32. If a building is appraised for $90,000, offered for sale at $95,000, and the buyer pays

$85,000 cash for it, the buyer would record the building at $90,000.

ANS: F

DIF: Moderate

OBJ: 01-02

33. GAAP stands for General Accepted Accounting Protocols.

ANS: F

DIF: Easy OBJ: 01-02

34. Generally accepted accounting principles regulate how and what financial information is

reported by businesses.

ANS: T

DIF: Easy OBJ: 01-02

35. The accounting equation can be expressed as Assets - Liabilities = Stockholders' Equity.

ANS: T

DIF: Easy OBJ: 01-03

36. The rights or claims to the assets of a business may be subdivided into rights of creditors and

rights of stockholders.

ANS: T

DIF: Difficult

OBJ: 01-03

37. The stockholders rights to the assets rank ahead of the creditors' rights to the assets.

ANS: F

DIF: Easy OBJ: 01-03

38. If the liabilities owed by a business total $500,000 and stockholders equity is equal to

$500,000, then the assets also total $500,000.

ANS: F

DIF: Moderate

OBJ: 01-03

39. If total assets decreased by $40,000 during a specific period and stockholders' equity

decreased by $45,000 during the same period, the period's change in total liabilities was an

$85,000 increase.

ANS: F

DIF: Moderate

OBJ: 01-03

40. If the assets owned by a business total $500,000, and stockholders' equity totals $400,000,

liabilities total $100,000.

ANS: T

DIF: Moderate

OBJ: 01-03

41. If the assets owned by a business total $100,000 and liabilities total $50,000, the total for

stockholders' equity is $150,000.

ANS: F

DIF: Moderate

OBJ: 01-03

Chapter 1/Introduction to Accounting and Business 7

42. If total assets increased by $175,000 during a specific period and liabilities decreased by

$10,000 during the same period, the period's change in total stockholders' equity was a

$185,000 increase.

ANS: T

DIF: Moderate

OBJ: 01-03

43. If net income for a corporation was $25,000, the dividends paid in cash of $10,000, and the

stockholders invested $5,000 in cash, the stockholders equity increased by $20,000.

ANS: T

DIF: Difficult

OBJ: 01-04

44. If net income for a corporation was $175,000, dividends were $40,000 in cash, and the

stockholders made no additional investment, the stockholders equity increased $215,000.

ANS: F

DIF: Moderate

OBJ: 01-04

45. An account receivable is a claim against a customer arising from a sale on account.

ANS: T

DIF: Easy OBJ: 01-04

46. Paying an account payable increases liabilities and decreases assets.

ANS: F

DIF: Moderate

OBJ: 01-04

47. Receiving payments on an account receivable increases both stockholders equity and assets.

ANS: F

DIF: Difficult

OBJ: 01-04

48. Cash investments by stockholders increase both stockholders equity and assets.

ANS: T

DIF: Moderate

OBJ: 01-04

49. Cash dividends decrease assets and increase stockholders equity.

ANS: F

DIF: Moderate

OBJ: 01-04

50. Purchasing supplies on account increases liabilities and decreases stockholders equity.

ANS: F

DIF: Moderate

OBJ: 01-04

51. The dividends paid to stockholders are from the profits made by the corporation.

ANS: T

DIF: Easy OBJ: 01-04

52. Receiving a bill or otherwise being notified that an amount is owed is not recorded until the

amount is paid.

ANS: F

DIF: Moderate

OBJ: 01-04

53. Revenue is earned only when money is received.

ANS: F

DIF: Moderate

OBJ: 01-04

54. Expenses are expired costs of doing business.

ANS: T

DIF: Easy OBJ: 01-04

55. The excess of revenue over the expenses incurred in earning the revenue is called capital.

ANS: F

DIF: Easy OBJ: 01-04

8 Chapter 1/Introduction to Accounting and Business

56. Expenses increase stockholders equity.

ANS: F

DIF: Easy OBJ: 01-04

57. The excess of expenses over revenues is called net income.

ANS: F

DIF: Easy OBJ: 01-05

59. A balance sheet is a list of the assets, liabilities, and stockholders equity of a business for a

period of time.

ANS: F

DIF: Easy OBJ: 01-05

60. An income statement is a summary of the revenues and expenses of a business as of a

specific date.

ANS: F

DIF: Easy OBJ: 01-05

62. The statement of cash flows consists of an operating section, an income section, and a

stockholders equity section.

ANS: F

DIF: Easy OBJ: 01-05

63. The financial statements of a corporation should include the stockholders personal assets

and liabilities.

ANS: F

DIF: Moderate

OBJ: 01-05

64. The Balance Sheet represents the accounting equation.

ANS: T

DIF: Easy OBJ: 01-05

MATCHING

Match the following transactions with their affects to the accounting equation.

a. Increase assets, increase liabilities

b. Increase liabilities, decrease stockholders equity

c. Increase assets, increase stockholders equity

d. No affect

e. Decrease assets, decrease liabilities

f. Decrease assets, decrease stockholders equity

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Received cash for services provided

Received utility invoice to be paid next month

Investment of land by stockholder

Paid part of an amount owed to a creditor

Paid cash for the purchase of a one year insurance policy

Received payment from a customer for an invoice that was billed last month

Dividends paid

Provided a service to a customer on account

Purchased supplies on credit

Paid wages

Chapter 1/Introduction to Accounting and Business 9

1. ANS:

C

DIF: Moderate

OBJ: 01-04

NAT: AACSB Analytic | AICPA FN-Measurement

2. ANS:

B

DIF: Moderate

OBJ: 01-04

NAT: AACSB Analytic | AICPA FN-Measurement

3. ANS:

C

DIF: Moderate

OBJ: 01-04

NAT: AACSB Analytic | AICPA FN-Measurement

4. ANS:

E

DIF: Moderate

OBJ: 01-04

NAT: AACSB Analytic | AICPA FN-Measurement

5. ANS:

D

DIF: Moderate

OBJ: 01-04

NAT: AACSB Analytic | AICPA FN-Measurement

6. ANS:

D

DIF: Moderate

OBJ: 01-04

NAT: AACSB Analytic | AICPA FN-Measurement

7. ANS:

F

DIF: Moderate

OBJ: 01-04

NAT: AACSB Analytic | AICPA FN-Measurement

8. ANS:

C

DIF: Moderate

OBJ: 01-04

NAT: AACSB Analytic | AICPA FN-Measurement

9. ANS:

A

DIF: Moderate

OBJ: 01-04

NAT: AACSB Analytic | AICPA FN-Measurement

10. ANS:

F

DIF: Moderate

OBJ: 01-04

NAT: AACSB Analytic | AICPA FN-Measurement

Match the following accounts to the financial statement where they can be found.

a. Balance Sheet

b. Income Statement

c. Statement of Cash Flows

d. Statement of Retained Earnings

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

Dividends

Revenues

Supplies

Land

Accounts Payable

Accounts Receivable

Operating Activities

Wages Expense

Net Income

Cash

11. ANS:

D

DIF: Easy OBJ: 01-05

NAT: AACSB Analytic | AICPA FN-Measurement

10 Chapter 1/Introduction to Accounting and Business

12. ANS:

B

DIF: Easy OBJ: 01-05

NAT: AACSB Analytic | AICPA FN-Measurement

13. ANS:

A

DIF: Easy OBJ: 01-05

NAT: AACSB Analytic | AICPA FN-Measurement

14. ANS:

A

DIF: Easy OBJ: 01-05

NAT: AACSB Analytic | AICPA FN-Measurement

15. ANS:

A

DIF: Easy OBJ: 01-05

NAT: AACSB Analytic | AICPA FN-Measurement

16. ANS:

A

DIF: Easy OBJ: 01-05

NAT: AACSB Analytic | AICPA FN-Measurement

17. ANS:

C

DIF: Easy OBJ: 01-05

NAT: AACSB Analytic | AICPA FN-Measurement

18. ANS:

B

DIF: Easy OBJ: 01-05

NAT: AACSB Analytic | AICPA FN-Measurement

19. ANS:

D

DIF: Easy OBJ: 01-05

NAT: AACSB Analytic | AICPA FN-Measurement

20. ANS:

A

DIF: Easy OBJ: 01-05

NAT: AACSB Analytic | AICPA FN-Measurement

Chapter 1/Introduction to Accounting and Business 11

MULTIPLE CHOICE

1.

Profit is the difference between

a. assets and liabilities

b. the incoming cash and outgoing cash

c. the assets purchased with cash contributed by the owner and the cash spent to operate the

business

d. the assets received for goods and services and the amounts used to provide the goods and

services

ANS: D

DIF: Easy OBJ: 01-01

2.

Most businesses are

a. sole proprietorships

b. partnerships

c. corporations

d. separate entities

ANS: A

DIF: Easy

OBJ: 01-01

3.

Which of the items below is not a business organization form?

a. entrepreneurship

b. proprietorship

c. partnership

d. corporation

ANS: A

DIF: Easy OBJ: 01-01

4.

An entity that is organized in which ownership is divided into shares of stock is a

a. proprietorship

b. corporation

c. partnership

d. governmental unit

ANS: B

DIF: Easy OBJ: 01-01

5.

Financial reports are used by

a. management

b. creditors

c. investors

d. all are correct

ANS: D

DIF: Easy OBJ: 01-01

6.

Which of the following best describes accounting?

a. records economic data but does not communicate the data to users according to any

specific rules

b. is an information system that provides reports to stakeholders

c. is of no use by individuals outside of the business

12 Chapter 1/Introduction to Accounting and Business

d. is used only for filling out tax returns and for financial statements for various type of

governmental reporting requirements

ANS: B

DIF: Moderate

OBJ: 01-01

7.

Which of the following is not a step in providing accounting information to stakeholders?

a. design the accounting information system

b. prepare accounting surveys

c. identify stakeholders

d. record economic data

ANS: B

DIF: Moderate

OBJ: 01-01

8.

The two most common specialized fields of accounting in practice are

a. forensic accounting and financial accounting

b. managerial accounting and financial accounting

c. managerial accounting and environmental accounting

d. financial accounting and tax accounting systems

ANS: B

DIF: Easy OBJ: 01-01

9.

Public accountants are normally

a. Certified Public Accountants

b. Forensic accountants

c. Certified Internal Auditors

d. Certified Management Accountants

ANS: A

DIF: Easy OBJ: 01-01

10. Which of the following is a specialized field of accounting?

a. social accounting

b. tax accounting

c. environmental accounting

d. all are correct

ANS: D

DIF: Easy OBJ: 01-01

11. Which of the following is not true about a manufacturing business?

a. They change inputs to products which are sold to their customers.

b. Their primary goal is to maximize profits.

c. Only large business can be considered a manufacturing business.

d. All are true.

ANS: C

DIF: Moderate

OBJ: 01-01

14. Select the type of business that is most likely to obtain large amounts of resources by issuing

stock.

a. Partnership

b. Corporation

c. Proprietorship

d. None are correct.

ANS: B

DIF: Easy OBJ: 01-01

Chapter 1/Introduction to Accounting and Business 13

16. Capital market stakeholders have an interest in the company because

a. they provide incentives for the company to market their products.

b. they are part of the Marketing Department that is responsible for promoting the products

or services to increase the business profits.

c. they help market their products to customers or find vendors to supply needed inputs.

d. they provide major financing for the business.

ANS: D

DIF: Moderate

OBJ: 01-01

17. ____ are considered to be product or service market stakeholders.

a. Employees and customers

b. Customers and vendors

c. Owners and managers

d. Government and banks

ANS: B

DIF: Easy OBJ: 01-01

18. The following are examples of internal stakeholders except:

a. Managers

b. Owners

c. Employees

d. all of the above

ANS: B

DIF: Easy OBJ: 01-01

19. Due to various fraudulent business practices and accounting coverups in the early 2000s,

Congress enacted the Sarbanes-Oxley Act of 2002. The act was responsible for establishing

a new oversight board for public accountants called the

a. Generally Accepted Accounting Practices for Public Accountants Board.

b. Public Company Accounting Oversight Board.

c. Congressional Accounting Oversight Board.

d. None are correct.

ANS: B

DIF: Easy OBJ: 01-01

20. Which of the following is the best description of accountings role in business?

a. Accounting provides stockholders with information regarding the market value of the

companys stocks.

b. Accounting provides information to managers to operate the business and to other

stakeholders to make decisions regarding the economic condition of the company.

c. Accounting provides creditors and banks with information regarding the credit risk rating

of the company.

d. Accounting is not responsible for providing any form of information to stakeholders.

That is the role of the Information Systems Department.

ANS: B

DIF: Moderate

OBJ: 01-01

21. Managerial accountants would be responsible for providing the following information:

a. Tax reports to government agencies.

b. Profit reports to owners and management.

14 Chapter 1/Introduction to Accounting and Business

c. Expansion of a product line report to management.

d. Consumer reports to customers.

ANS: C

DIF: Moderate

OBJ: 01-01

22. Which of the following is not a certification for accountants?

a. CIA

b. CMA

c. CISA

d. All are true.

ANS: D

DIF: Moderate

OBJ: 01-01

23. Which of the following is not a characteristic of a corporation?

a. Corporations are organized as a separate legal taxable entity

b. Ownership is divided into shares of stock.

c. Corporations experience an ease in obtaining large amounts of resources by issuing stock.

d. A corporations resources are limited to their individual owners resources.

ANS: D

DIF: Moderate

OBJ: 01-01

24. Which of the following is not a role of accounting in business?

a. To provide reports to stakeholders about the economic activities and conditions of a

business.

b. To personally guarantee loans of the business.

c. To provide information for managers to use in operating the business.

d. To assess the various informational needs of stakeholders and design its accounting

system to meet those needs.

e. To provide information to other stakeholders to use in assessing the economic

performance and condition of the business.

ANS: B

DIF: Moderate

OBJ: 01-01

25. Which of the following is one of the sound principles for ethical behavior?

a. avoiding small ethical lapses

b. focusing on long-term reputation

c. possibly suffering adverse consequences for holding to an ethical position

d. all are correct

ANS: D

DIF: Moderate

OBJ: 01-01

27. The initials GAAP stand for

a. General Accounting Procedures

b. Generally Accepted Plans

c. Generally Accepted Accounting Principles

d. Generally Accepted Accounting Practices

ANS: C

DIF: Moderate

OBJ: 01-02

29. The business entity concept means that

a. the owner is part of the business entity

b. an entity is organized according to state or federal statutes

Chapter 1/Introduction to Accounting and Business 15

c. an entity is organized according to the rules set by the IASB

d. the entity is an individual economic unit for which data are recorded, analyzed, and

reported

ANS: D

DIF: Easy OBJ: 01-02

30. For accounting purposes, the business entity should be considered separate from its owners

if the entity is

a. a corporation

b. a proprietorship

c. a partnership

d. all of the above

ANS: D

DIF: Moderate

OBJ: 01-02

31. Smith Company purchased $105,000 of computer equipment from Brown Company. Smith

Company paid for the equipment using cash that had been obtained from the initial

investment by Connie Smith. The transaction involving the computer equipment should be

recorded on the accounting records of which of the following entities?

a. Smith Company and Connie Smith's personal records

b. Brown Company and Connie Smith's personal records

c. Brown Company

d. Smith Company and Brown Company

ANS: D

DIF: Difficult

OBJ: 01-02

32. The objectivity principle requires that

a. business transactions must be consistent with the objectives of the entity

b. the International Accounting Standards Board must be fair and unbiased in its

deliberations over new accounting standards

c. accounting principles must meet the objectives of the SEC

d. amounts recorded in the financial statements must be based on independently verifiable

evidence

ANS: D

DIF: Moderate

OBJ: 01-02

33. The Reynolds Company estimated that the value of its land had increased from $10,000 to

$16,000 and therefore wrote up the land account to $16,000. Which accounting concept(s)

was (were) violated?

a. cost concept

b. objectivity concept

c. unit of measure concept

d. cost and objectivity concepts

ANS: A

DIF: Difficult

OBJ: 01-02

34. John Williams owns stock in the Indoor Advertising Company. Recently, John was paid

$18,000 in the form of cash dividends from Indoor Advertising, and he contributed $10,000,

in his name, to the Red Cross. The contribution of the $10,000 should be recorded on the

accounting records of which of the following entities?

a. Indoor Advertising and the Red Cross

16 Chapter 1/Introduction to Accounting and Business

b.

c.

d.

ANS:

John William's personal records and the Red Cross

John William's personal records and Indoor Advertising

John William's personal records, Indoor Advertising, and the Red Cross

B

DIF: Difficult

OBJ: 01-02

35. Equipment with an estimated market value of $45,000 is offered for sale at $65,000. The

equipment is acquired for $10,000 in cash and a note payable of $40,000 due in 30 days. The

amount used in the buyer's accounting records to record this acquisition is

a. $50,000

b. $65,000

c. $10,000

d. $45,000

ANS: A

DIF: Difficult

OBJ: 01-02

36. ____ is the authoritative body having the primary responsibility for developing accounting

principles.

a. FASB

b. IRS

c. SEC

d. AICPA

ANS: A

DIF: Easy OBJ: 01-02

37. Which of the following concepts relates to separating the reporting of business and personal

economic transactions?

a. Cost Concept

b. Unit of Measure Concept

c. Business Entity Concept

d. Objectivity Concept

ANS: C

DIF: Easy OBJ: 01-02

38. Aztec Company is selling a piece of land adjacent to their business. An appraisal reported

the market value of the land to be $100,000. The Majestic Company initially offered to buy

the land for $87,000. The companies settled on a purchase price of $95,000. On the same

day, another piece of land on the same block sold for $102,000. Under the cost concept,

what is the amount that will be used to record this transaction in the accounting records?

a. $100,000

b. $87,000

c. $102,000

d. $95,000

ANS: D

DIF: Moderate

OBJ: 01-02

39. Which of the following is not true of accounting principles?

a. Financial accountants follow generally accepted accounting principles (GAAP).

b. Following GAAP allows users to compare one company to another.

c. A new accounting principle can be adopted with stockholders approval.

Chapter 1/Introduction to Accounting and Business 17

d. The Financial Accounting Standards Board (FASB) has primary responsibility for

developing accounting principles.

e. Accounting principles develop from research, accepted accounting practices, and

pronouncements of authoritative bodies.

ANS: C

DIF: Moderate

OBJ: 01-02

40. Owned resources of a business are referred to as

a. assets

b. liabilities

c. equities

d. revenues

ANS: A

DIF: Easy OBJ: 01-03

41. Assets are

a. always greater than liabilities.

b. either cash or accounts receivables

c. the same as expenses because they are acquired with cash

d. financed by the company and/or creditors

ANS: D

DIF: Easy OBJ: 01-03

42. Debts owed by a business are referred to as

a. accounts receivables

b. equities

c. stockholders equity

d. liabilities

ANS: D

DIF: Easy OBJ: 01-03

43. The accounting equation may be expressed as

a. Assets = Equities - Liabilities

b. Assets + Liabilities = Stockholders Equity

c. Assets = Revenues less Liabilities

d. Assets - Liabilities = Stockholders Equity

ANS: D

DIF: Moderate

OBJ: 01-03

44. Which of the following is not an asset?

a. Investments

b. Cash

c. Inventory

d. Stockholders Equity

ANS: D

DIF: Easy OBJ: 01-03

45. The assets and liabilities of the company are $155,000 and $60,000 respectfully.

Stockholders equity should equal

a. $215,000

b. $155,000

c. $60,000

18 Chapter 1/Introduction to Accounting and Business

d. $95,000

ANS: A

DIF:

Easy

OBJ: 01-03

46. If total liabilities decreased by $25,000 during a period of time and stockholders' equity

increased by $30,000 during the same period, the amount and direction (increase or

decrease) of the period's change in total assets is

a. $65,000 increase

b. $5,000 decrease

c. $5,000 increase

d. $65,000 decrease

ANS: C

DIF: Moderate

OBJ: 01-03

47. Which of the following is not a true statement about the accounting equation and its

elements?

a. The accounting equation is Assets = Liabilities - Stockholders Equity.

b. Assets are the resources a business possesses.

c. Liabilities represent debts of a business.

d. Examples of assets are cash, land, buildings, and equipment.

e. Stockholders equity are the rights of the stockholders.

ANS: A

DIF: Moderate

OBJ: 01-03

48. Which of the following is not a business transaction?

a. make a sales offer

b. sell goods for cash

c. receive cash for services to be rendered later

d. pay for supplies

ANS: A

DIF: Moderate

OBJ: 01-04

49. A business paid $9,000 to a creditor in payment of an amount owed. The effect of the

transaction on the accounting equation was to

a. increase one asset, decrease another asset

b. increase an asset, increase a liability

c. decrease an asset, decrease a liability

d. increase an asset, increase stockholders' equity

ANS: C

DIF: Moderate

OBJ: 01-04

50. Earning revenue

a. increases assets, increases stockholders equity.

b. increases assets, decreases stockholders' equity

c. increases one asset, decreases another asset

d. decreases assets, increases liabilities

ANS: A

DIF: Moderate

OBJ: 01-04

51. The monetary value charged to customers for the performance of services sold is called a(n)

a. asset

b. net income

Chapter 1/Introduction to Accounting and Business 19

c. capital

d. revenue

ANS: D

DIF:

Easy

OBJ: 01-04

52. Revenues are reported when

a. a contract is signed

b. cash is received from the customer

c. work is begun on the job

d. work is completed on the job

ANS: D

DIF: Moderate

OBJ: 01-04

53. Expenses are recorded when

a. cash is paid for services rendered

b. a bill is received in advance of services rendered

c. services are rendered

d. none are correct

ANS: C

DIF: Moderate

OBJ: 01-04

54. Goods purchased on account for future use in the business, such as supplies, are called

a. prepaid liabilities

b. revenues

c. prepaid expenses

d. liabilities

ANS: C

DIF: Easy OBJ: 01-04

55. The asset created by a business when it makes a sale on account is termed

a. accounts payable

b. prepaid expense

c. unearned revenue

d. accounts receivable

ANS: D

DIF: Easy OBJ: 01-04

56. The debt created by a business when it makes a purchase on account is referred to as an

a. account payable

b. account receivable

c. asset

d. expense payable

ANS: A

DIF: Easy OBJ: 01-04

57. If total assets decreased by $47,000 during a period of time and stockholders' equity

increased by $24,000 during the same period, then the amount and direction (increase or

decrease) of the period's change in total liabilities is

a. $23,000 increase

b. $47,000 decrease

c. $71,000 decrease

d. $71,000 increase

20 Chapter 1/Introduction to Accounting and Business

ANS: C

DIF:

Moderate

OBJ: 01-04

58. The payment of dividends

a. increase expenses

b. decrease expenses

c. increase cash

d. decrease stockholders' equity

ANS: D

DIF: Easy OBJ: 01-04

59. Stockholders' Equity is increased by which of the following accounts?

a. cash

b. revenue

c. accounts receivable

d. all are correct

ANS: B

DIF: Easy OBJ: 01-04

60. How does the purchase of supplies on account affect the accounting equation?

a. assets increase; stockholders' equity decreases

b. assets increase; liabilities increase

c. assets increase; liabilities decrease

d. liabilities increase; stockholders' equity decreases

ANS: B

DIF: Moderate

OBJ: 01-04

61. How does the rendering of services on account affect the accounting equation?

a. assets increase; stockholders equity increases

b. assets decrease; stockholders' equity decrease

c. assets increase; stockholders' equity decreases

d. liabilities increase; stockholders' equity decreases

ANS: A

DIF: Moderate

OBJ: 01-04

62. How does paying a liability in cash affect the accounting equation?

a. assets increase; liabilities decrease

b. assets increase; liabilities increase

c. assets decrease; liabilities decrease

d. liabilities decrease; stockholders' equity increases

ANS: C

DIF: Moderate

OBJ: 01-04

63. How does the payment of dividends affect the accounting equation?

a. assets decrease; stockholders' equity decreases

b. assets decrease; stockholders' equity increases

c. assets increase; liabilities decrease

d. no effect on the assets, liabilities, or stockholders' equity

ANS: A

DIF: Moderate

OBJ: 01-04

64. How does receiving a bill to be paid next month for services rendered affect the accounting

equation?

Chapter 1/Introduction to Accounting and Business 21

a.

b.

c.

d.

ANS:

assets decrease; stockholders' equity decreases

assets increase; liabilities increase

liabilities increase; stockholders' equity increases

liabilities increase; stockholders' equity decreases

D

DIF: Moderate

OBJ: 01-04

65. How does the collection of cash from a customer who was previously put on account affect

the accounting equation?

a. assets decrease; stockholders' equity decreases

b. assets increase; stockholders' equity increases

c. assets increase; assets decrease

d. assets increase; liabilities increase

ANS: C

DIF: Moderate

OBJ: 01-04

66. How does the purchase of equipment by signing a note affect the accounting equation?

a. assets increase; assets decrease

b. assets increase; liabilities decrease

c. assets increase; liabilities increase

d. assets increase; stockholders' equity increases

ANS: C

DIF: Moderate

OBJ: 01-04

67. Land, originally purchased for $20,000, is sold for $75,000 in cash. What is the effect of the

sale on the accounting equation?

a. assets increase $75,000; stockholders' equity increases $75,000

b. assets increase $55,000; stockholders' equity increases $55,000

c. assets increase $75,000; liabilities decrease $20,000; stockholders' equity increases

$55,000

d. assets increase $20,000; no change for liabilities; stockholders' equity increases $75,000

ANS: B

DIF: Difficult

OBJ: 01-04

68. The Kennedy Company sold land for $60,000 in cash. The land was originally purchased for

$40,000, and at the time of the sale, $15,000 was still owed to First National Bank on that

purchase. After the sale, The Kennedy Company paid off the loan to First National Bank.

What is the effect of the sale and the payoff of the loan on the accounting equation?

a. assets increase $20,000; liabilities decrease $15,000; stockholders' equity increases

$5,000

b. assets increase $5,000; liabilities decrease $15,000; stockholders' equity increases

$20,000

c. assets increase $60,000; liabilities decrease $15,000; stockholders' equity increases

$20,000

d. assets increase $20,000; liabilities decrease $15,000; stockholders' equity increases

$35,000

ANS: B

DIF: Difficult

OBJ: 01-04

22 Chapter 1/Introduction to Accounting and Business

69. On November 1 of the current year, the assets and liabilities of Jim Chu, M.D., are as

follows: Cash, $10,000; Accounts Receivable, $8,200; Supplies, $1,050; Land, $25,000;

Accounts Payable, $6,530. What is the amount of stockholders' equity as of November 1 of

the current year?

a. $37,720

b. $44,430

c. $21,500

d. $50,780

ANS: A

DIF: Moderate

OBJ: 01-04

70. Al Shea is a stockholder and operator of SawTooth Company. As of the end of its accounting

period, December 31, 2007, SawTooth Company has assets of $925,000 and liabilities of

$285,000. During 2008, Al Shea invested an additional $50,000 in exchange for capital

stock and was paid dividends in the amount of $30,000 from the business. What is the

amount of net income during 2008, assuming that as of December 31, 2008, assets were

$980,000, and liabilities were $255,000?

a. $ 95,000

b. $ 65,000

c. $165,000

d. $725,000

ANS: B

DIF: Difficult

OBJ: 01-04

71. The total assets and the total liabilities of a business at the beginning and at the end of the

year appear below. During the year, the stockholders were paid dividends in the amount of

$50,000 and had made an additional investment of $35,000 in the business.

Beginning of year

End of year

Assets

$295,000

355,000

Liabilities

$190,000

220,000

Chapter 1/Introduction to Accounting and Business 23

The amount of net income for the year was

a. $85,000

b. $40,000

c. $135,000

d. $45,000

ANS: D

DIF: Difficult

OBJ: 01-04

72. If stockholdersequity at the beginning of the period was $65,000, ending balance is

$43,000, and the dividends were paid in the amount of $16,000, the amount of net income or

net loss was

a. net income of $37,000

b. net income of $8,000

c. net loss of $22,000

d. net loss of $6,000

ANS: D

DIF: Difficult

OBJ: 01-04

73. Transactions affecting stockholders' equity include

a. stockholders investments and payment of liabilities

b. stockholders investments and dividends, revenues, and expenses

c. stockholders investments, revenues, expenses, and collection of accounts receivable

d. dividends, revenues, expenses, and purchase of supplies on account

ANS: B

DIF: Easy OBJ: 01-04

74. Rudy River is starting his computer repair business and has deposited in initial investment of

$10,000 into the business cash account in exchange for capital stock. Identify how the

accounting equation will be affected.

a. Increase Assets (Cash) and increase Liabilities (Accounts Payable)

b. Increase Assets (Cash) and increase Assets (Accounts Receivable)

c. Increase Assets (Accounts Receivable) and decrease Liabilities (Accounts Payable)

d. Increase Assets (Cash) and increase Stockholders Equity (Capital Stock)

ANS: D

DIF: Moderate

OBJ: 01-04

75. Rivers Computer Makeover Company purchased $15,000 of Computer and Office

Equipment. The company paid $3,000 in cash at the time of the purchase and signed a

promissory note for the remainder to be paid in six monthly installments. How will this

transaction affect the accounting equation?

a. Increase Assets (Computer and Office Equipment $15,000) and decrease Liabilities

(Accounts Payable $15,000)

b. Increase Total Assets by a net amount of $12,000 (increase Computer and Office

Equipment $15,000 and decrease Cash $3,000) and increase Liabilities (Notes Payable

$12,000)

c. Increase Total Assets by a net amount of $15,000 (increase Computer and Office

Equipment $12,000 and increase Cash $3,000) and decrease Liabilities (Accounts

Payable $15,000)

24 Chapter 1/Introduction to Accounting and Business

d. Increase Assets (Computer and Office Equipment $12,000) and increase Liabilities

(Accounts Payable $12,000)

ANS: B

DIF: Difficult

OBJ: 01-04

76. Rivers Computer Makeover Company purchased various computer supplies on account to be

used for repairing their customers computers. How will this business transaction affect the

accounting equation?

a. Increase Assets (Supplies) and decrease Assets (Cash)

b. Increase Assets (Supplies) and Increase Liabilities (Accounts Payable)

c. Increase Assets (Supplies) and decrease Stockholders Equity (Supplies Expense)

d. Increase Stockholders Equity (Supplies Expense) and increase Liabilities (Accounts

Payable)

ANS: A

DIF: Moderate

OBJ: 01-04

77. There are four transactions that affect stockholders equity. Which are the two transactions

that increase stockholders equity?

a. Revenues and expenses

b. Expenses and dividends

c. Revenues and stockholders investments

d. Stockholders investments and expenses

ANS: C

DIF: Easy OBJ: 01-04

78.

There are four transactions that directly affect Stockholders Equity. Which are the two

transactions that decrease Stockholders Equity?

a. Dividends and expenses

b. Revenues and expenses

c. Stockholders investments and revenues

d. Stockholders investments and expenses

ANS: A

DIF: Easy OBJ: 01-04

79. Rivers Computer Makeover Company has received $3,500 in cash for services rendered.

What affect does this transaction have on the accounting equation?

a. Increase Assets (Cash) and decrease Stockholders Equity (Expenses)

b. Increase Assets (Cash) and decrease Assets (Accounts Receivable)

c. Increase Assets (Accounts Receivable) and increase Stockholders Equity (Fees Earned)

d. Increase Assets (Cash) and increase Stockholders Equity (Fees Earned)

ANS: D

DIF: Moderate

OBJ: 01-04

80. Rivers Computer Makeover Company paid their first installment on their Notes Payable in

the amount of $2,000. How will this transaction affect the accounting equation?

a. Increase Liabilities (Notes Payable) and decrease Assets (Cash)

b. Decrease Assets (Cash) and decrease Stockholders Equity (Note Payable Expense)

c. Decrease Assets (Cash) and decrease Assets (Notes Receivable)

d. Decrease Assets (Cash) and decrease Liabilities (Notes Payable)

ANS: D

DIF: Moderate

OBJ: 01-04

Chapter 1/Introduction to Accounting and Business 25

81. Rivers Computer Makeover Company received their first electric bill in the amount of $60

which will be paid next month. How will this transaction affect the accounting equation?

a. Increase Liabilities (Accounts Payable) and decrease Stockholders Equity (Utilities

Expense)

b. Increase Liabilities (Accounts Receivable) and decrease Stockholders Equity (Utilities

Expense)

c. Decrease Assets (Cash) and decrease Liabilities (Accounts Payable)

d. Decrease Assets (Cash) and decrease Stockholders Equity (Utilities Expense)

ANS: A

DIF: Moderate

OBJ: 01-04

82. Rudy Rivers has withdrawn $750 from Rivers Computer Makeover Companys cash account

to deposit in his personal account. How does this transaction affect Rivers Computer

Makeover Companys accounting equation?

a. Increase Assets (Accounts Receivable) and decrease Assets (Cash)

b. Decrease Assets (Cash) and decrease Stockholders Equity (Dividends)

c. Decrease Assets (Cash) and decrease Liabilities (Accounts Payable)

d. Increase Assets (Cash) and decrease Stockholders Equity (Dividends)

ANS: B

DIF: Moderate

OBJ: 01-04

83. Which of the following is not a business transaction?

a. Becky deposits $25,000 in a bank account in the name of Beckys Daycare.

b. Becky provided services to customers earning fees of $300.

c. Becky pays her monthly personal credit card bill.

d. Becky hires a part-timer to begin work next week.

e. Becky purchased cribs for her daycare agreeing to pay the supplier next month.

ANS: C

DIF: Difficult

OBJ: 01-04

84. The financial statement that presents a summary of the revenues and expenses of a business

for a specific period of time, such as a month or year, is called a(n)

a. prior period statement

b. statement of retained earnings

c. income statement

d. balance sheet

ANS: C

DIF: Easy OBJ: 01-05

85. All of the following are financial statement(s) of a corporation except the

a. statement of retained earnings

b. statement of owner's equity

c. income statement

d. statement of cash flows

ANS: B

DIF: Easy OBJ: 01-05

86. Which of the following financial statements reports information as of a specific date?

a. income statement

b. statement of retained earnings

c. statement of cash flows

26 Chapter 1/Introduction to Accounting and Business

d. balance sheet

ANS: D

DIF: Easy

OBJ: 01-05

87. Four financial statements are usually prepared for a business. The statement of cash flows is

usually prepared last. The statement of retained earnings (RE), the balance sheet (B), and the

income statement (I) are prepared in a certain order to obtain information needed for the

next statement. In what order are these three statements prepared?

a. I,RE, B

b. B, I, RE

c. RE, I, B

d. B,RE, I

ANS: A

DIF: Easy OBJ: 01-05

88. Liabilities are reported on the

a. income statement

b. statement of retained earnings

c. statement of cash flows

d. balance sheet

ANS: D

DIF: Easy OBJ: 01-05

89. Cash investments made by the stockholders of the business are reported on the statement of

cash flows in the

a. financing activities section

b. investing activities section

c. operating activities section

d. supplemental statement

ANS: A

DIF: Easy OBJ: 01-05

90. The year-end balance of the retained earnings account appears in

a. both the statement of retained earnings and the income statement

b. only the statement of retained earnings

c. both the statement of retained earnings and the balance sheet

d. both the statement of retained earnings and the statement of cash flows

ANS: C

DIF: Easy OBJ: 01-05

91. A financial statement user would determine if a company was profitable or not during a

specific period of time by reviewing

a. the Income Statement.

b. the Balance Sheet.

c. the Statement of Cash Flows.

d. cannot be determined.

ANS: A

DIF: Easy OBJ: 01-05

92. If the president of the company wanted to know how money flowed into and out of the

company, what financial statement would she use?

a. Income Statement

Chapter 1/Introduction to Accounting and Business 27

b.

c.

d.

ANS:

Statement of Cash Flows

Balance Sheet

None are correct.

B

DIF: Easy OBJ: 01-05

93. The asset section of the Balance Sheet normally presents assets in

a. alphabetical order.

b. order of largest to smallest dollar amounts.

c. in the order what will be converted into cash.

d. no order.

ANS: C

DIF: Easy OBJ: 01-05

94. The statement of cash flows is separately in three major sections. They are as follows:

a. Operating, Investing, and Financing

b. Revenues, Expenses, and Net Income

c. Assets, Liabilities, and Stockholders Equity

d. Investments, Dividends, and Income

ANS: A

DIF: Easy OBJ: 01-05

95. Which of the following is not a principle financial statement?

a. Income Statement

b. Statement of Resources Owned

c. Statement of Retained Earnings

d. Statement of Cash Flows

e. Balance Sheet

ANS: B

DIF: Easy OBJ: 01-05

EXERCISE/OTHER

1.

Give the major disadvantage of disregarding the cost concept and constantly revaluing assets

based on appraisals and opinions.

ANS:

Accounting reports would become unstable and unreliable.

DIF: Easy OBJ: 01-01

NAT: AACSB Analytic | AICPA FN-Measurement

2.

On June 7, Roller Skates Company offered to pay $75,000 for land that had a selling price of

$90,000. On June 15, Roller Skates accepted a counteroffer of $83,000. On July 5, the land

was assessed at a value of $100,000 for property tax purposes. On December 10, Roller

Skates Company was offered $125,000 for the land by another company. At what value

should the land be recorded in Roller Skates Companys records?

ANS:

$83,000

DIF: Easy OBJ: 01-02

NAT: AACSB Analytic | AICPA FN-Measurement TOP: Example Exercise 1-1

28 Chapter 1/Introduction to Accounting and Business

3.

Dan Aaron is the president and operator of Reach It Baseball Batting Cages. At the end of its

accounting period, December 31, 2007, Reach It has assets of $650,000 and liabilities of

$225,000. Using the accounting equation, determine the following amounts:

(a) Stockholders Equity as of December 31, 2007.

(b) Stockholders Equity as of December 31, 2008, assuming that assets increased

by $85,000 and liabilities increased by $15,000 during 2008.

ANS:

(a) $650,000 = $225,000 + $425,000

(b) ($650,000 + $85,000) = ($225,000 + $15,000) + $495,000

DIF: Moderate

OBJ: 01-03

NAT: AACSB Analytic | AICPA FN-Measurement TOP: Example Exercise 1-2

4. Sara Thomson is the president and operates the Thomson Company. The following selected

transactions were completed by Thomson Company during August:

1.

2.

3.

4.

5.

6.

Received cash from the stockholder as additional investment $15,000.

Paid creditors on account $3,000.

Billed customers for services on account, $7,665.

Received cash from customers on accounts $5,645.

Paid cash dividends, $3,500.

Received electric bill $60, to be paid next month.

Indicate the effect of each transaction on the accounting equation:

1) By Account type - (A)assets, (L)liabilities, (SE)Stockholders Equity,

(R)revenue, and (E)expense

2) Name of Account for the entry

3) The amount by of the transaction.

4) Indicate the specific item within the account equation element that is affected.

Note: Each transaction has two entries.

Entry

Acct Name of Amount Increase or

Type Acct

Decrease

(1)

(2)

(3)

(4)

1

2

3

4

5

6

Acct

Type

(1)

Entry

Name

Amount Increase or

of Acct

Decrease

(2)

(3)

(4)

Chapter 1/Introduction to Accounting and Business 29

ANS:

Entry

Name of Amount Increase or

Acct

Decrease

(2)

(3)

(4)

Cash

15,000 Incr

Acct

Type

(1)

A

2

3

A

A

4

5

A

A

5.

The assets and liabilities of Robinson Tree Services at May 31, 2008, the end of the current

year, and its revenue and expenses for the year are listed below. The stockholders equity

was $190,000 at June 1, 2007, the beginning of the current year.

Cash

Acct

Rec

Cash

Cash

Acct

Type

(1)

SE

3,000 Decr

7,665 Incr

L

R

5,645 Incr

3,500 Decr

A

SE

Name of

Acct

(2)

Capital

stock

Liab

Fees

Earned

Acct Rec

Dividend

s

Util Exp

Entry

Amount

Increase or

Decrease

(3)

(4)

15,000 Incr

3,000 Decr

7,665 Incr

5,645 Decr

3,500 Incr

Acct

60 Incr

E

60 Incr

Pay

DIF: Difficult

OBJ: 01-04

NAT: AACSB Analytic | AICPA FN-Measurement TOP: Example Exercise 1-3

Accounts Payable

Accounts Receivable

Cash

Fees Earned

Land

Building

$1,200

$12,340

$32,990

$78,350

$65,000

$143,670

Miscellaneous Expense

Office Expense

Supplies

Wages Expense

Dividends

$220

$560

$1,670

$26,770

$3,000

Prepare an income statement for the current year ended May 31, 2008.

ANS:

Robinson Tree Services

Income Statement

For the Year Ended May 31, 2008

Fees Earned

Expenses:

$78,350

Wages Expense

Office Expense

Miscellaneous Expense

Total Expenses

Net Income

$26,770

560

220

27,550

$50,800

30 Chapter 1/Introduction to Accounting and Business

DIF: Moderate

OBJ: 01-05

NAT: AACSB Analytic | AICPA FN-Measurement TOP: Example Exercise 1-4

6.

The assets and liabilities of Robinson Tree Services at May 31, 2008, the end of the current

year, and its revenue and expenses for the year are listed below. The capital stock was

$100,000 at June 1, 2007, the beginning of the current year. Mr. Robinson invested an

additional $15,000 in the business in exchange for capital stock during the year.

Accounts Payable

Accounts Receivable

Cash

Fees Earned

Land

Building

$1,200

$12,340

$32,990

$78,350

$65,000

$143,670

Miscellaneous Expense

Office Expense

Supplies

Wages Expense

Dividends

Retained Earnings

$220

$560

$1,670

$26,770

$3,000

$90,000

Prepare a statement of retained earnings for the current year ended May 31, 2008.

ANS:

Robinson Tree Services

Statement of Retained Earnings

For the Year Ended May 31, 2008

Retained earnings, June 1, 2007

Net Income for the year

$90,000

50,800

$140,800

3,000

$137,800

Less dividends

Retained earnings, May 31, 2008

DIF: Moderate

OBJ: 01-05

NAT: AACSB Analytic | AICPA FN-Measurement TOP: Example Exercise 1-5

7.

The assets and liabilities of Robinson Tree Services at May 31, 2008, the end of the current

year, and its revenue and expenses for the year are listed below. The capital stock account

was $100,000 at June 1, 2007, the beginning of the current year. Additional information: Mr.

Robinson made an additional investment of $15,000 in exchange for capital stock during the

year.

Accounts Payable

Accounts Receivable

Cash

Fees Earned

Land

Retained earnings

$1,200

$12,340

$32,990

$78,350

$65,000

$90,000

Miscellaneous Expense

Office Expense

Building

Wages Expense

Dividends

$220

$560

$143,670

$26,770

$3,000

Chapter 1/Introduction to Accounting and Business 31

Prepare a balance sheet for the current year ended May 31, 2008.

ANS:

Robinson Tree Services

Balance Sheet

May 31, 2008

Assets

Cash

Accounts Receivable

Land

Building

Total Assets

Liabilities

$32,990 Accounts Payable

12,340

65,000 Stockholders Equity

143,670 Capital stock

115,000

Retained Earnings

137,800

Total Stockholders Equity

$254,000 Total liab and Stockholders

Equity

$ 1,200

252,800

$254,000

DIF: Moderate

OBJ: 01-05

NAT: AACSB Analytic | AICPA FN-Measurement TOP: Example Exercise 1-6

8.

A summary of cash flows for Robinson Tree Services for the year ended May 31, 2008, is

shown below.

Cash receipts:

Cash received from customers

Cash received from additional investment by stockholder

$82,990

15,000

Cash payments:

Cash paid for expenses

Cash paid for land

Cash paid for supplies

Dividends

$26,000

65,000

430

3,000

The cash balance as of June 1, 2007

$29,340

32 Chapter 1/Introduction to Accounting and Business

Prepare a statement of cash flows for Robinson Tree Services for the year ended May 31,

2008.

ANS:

Robinson Tree Services

Statement of Cash Flows

For the Year Ended May 31, 2008

Cash flows from operating activities:

Cash received from customers

Deduct cash payments for expenses/supplies

Net cash flows from operating expenses

$82,990

26,430

$56,560

Cash flows from investing activities:

Cash paid for land and building

(65,000)

Cash from financing activities:

Cash received from stockholder as investment

Deduct cash dividends paid

Net cash flows from financing activities

Net increase in cash during year

Cash as of June 1, 2007

Cash as of May 31, 2008

15,000

3,000

12,000

$ 3,560

29,340

$32,900

DIF: Difficult

OBJ: 01-05

NAT: AACSB Analytic | AICPA FN-Measurement TOP: Example Exercise 1-7

9. What information does the Income Statement give to business stakeholders?

ANS:

The Income Statement reports the revenues and expenses for a period of time. The result is either

a Net Income or a Net Loss.

DIF: Easy OBJ: 01-05

NAT: AACSB Analytic | AICPA FN-Measurement

10. What are the three sections of the Statement of Cash Flows?

ANS:

Operating Activities, Investing Activities, and the Financing Activities

DIF: Easy OBJ: 01-05

NAT: AACSB Analytic | AICPA FN-Measurement

Chapter 1/Introduction to Accounting and Business 33

PROBLEM

1.

For each of the following companies, identify whether they are a service, merchandising, or

manufacturing business.

A.

B.

C.

D.

E.

F.

G.

H.

I.

Dillards

Time Warner Cable

ebay.com

Blockbuster

Applebees

Sylvania

Circuit City

Banana Republic

H & R Block

ANS:

A.

B.

C.

D.

E.

F.

G.

H.

I.

Merchandising

Service

Service

Service

Service / Manufacturing

Manufacturing

Merchandising

Merchandising

Service

DIF: Moderate

OBJ: 01-01

NAT: AACSB Analytic | AICPA FN-Measurement

2.

What type of business stakeholders are the following? Identify them as Capital Market

Stakeholders, Product or Service Market Stakeholders, Government Stakeholders, or

Internal Stakeholders.

A.

B.

C.

D.

E.

F.

G.

H.

Payroll Manager

Bank

Presidents Secretary

Internal Revenue Service

Raw Material Vendors

Owner

Social Security Administration

Health Insurance Provider

34 Chapter 1/Introduction to Accounting and Business

ANS:

A.

B.

C.

D.

E.

F.

G.

H.

Internal Stakeholder

Capital market stakeholder

Internal Stakeholder

Government Stakeholder

Product or service market stakeholder

Capital market stakeholder

Government Stakeholder

Product or service market stakeholder

DIF: Moderate

OBJ: 01-01

NAT: AACSB Analytic | AICPA FN-Measurement

3.

Determine the missing amount for each of the following:

Assets

(a)

$50,000

$35,000

Liabilities

$18,000

(b)

$ 7,000

Stockholders' Equity

$11,000

$28,000

(c)

ANS:

(a) $29,000

(b) $22,000

(c) $28,000

DIF: Easy OBJ: 01-02

NAT: AACSB Analytic | AICPA FN-Measurement

4.

Indicate whether each of the following represents an asset, liability, or stockholders' equity:

(a)

(b)

(c)

(d)

(e)

(f)

accounts payable

wages expense

capital

accounts receivable

dividends

land

ANS:

(a) liability

(b) stockholders equity

(c) stockholders equity

(d) asset

(e) stockholders equity

(f) asset

Chapter 1/Introduction to Accounting and Business 35

DIF: Easy OBJ: 01-02

NAT: AACSB Analytic | AICPA FN-Measurement

5.

Identify each of the following as an (1) increase in stockholders' equity, or a (2) decrease in

stockholders' equity.

(a)

(b)

(c)

(d)

(e)

(f)

Fees Earned

Wages Expense

Dividends

Lawn Care Revenue

Investment

Supplies Expense

ANS:

(a) 1

(b) 2

(c) 2

(d) 1

(e) 1

(f) 2

DIF: Easy OBJ: 01-03

NAT: AACSB Analytic | AICPA FN-Measurement

36 Chapter 1/Introduction to Accounting and Business

6.

Selected transactions completed by a corporation are described below. Indicate the effects of

each transaction on assets, liabilities, and stockholders' equity by inserting "+" for increase

and "-" for decrease in the appropriate columns at the right. If appropriate, you may insert

more than one symbol in a column. If there is no change in the column, leave it blank.

(a)

Received cash from stockholder as an additional

investment

(b) Purchased supplies on account

(c) Paid rent for the current month

(d) Received cash for services sold to customers

(e) Returned some defective supplies purchased in (b)

(f) Paid insurance premiums in advance

(g) Paid cash to creditor for purchases in (b)

(h) Charged customers for services sold on account

(i) Paid cash to a customer as a refund for an

overcharge

(j) Received cash on account from customers

(k) Dividends paid

(l) Recorded the cost of supplies used during the year

(m) Received invoice for electricity used

(n) Paid wages

(o) Purchased a truck for cash

ANS:

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

(i)

(j)

(k)

(l)

(m)

(n)

(o)

A

+

+

+

+,+

+,-

L

+

+

+

-

+

+,-

SE

+

DIF: Moderate

OBJ: 01-04

NAT: AACSB Analytic | AICPA FN-Measurement

A

_____

L

_____

SE

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

_____

Chapter 1/Introduction to Accounting and Business 37

7.

Henrys Taxes, a tax preparation business had the following transactions during the month of

April:

Example: Received cash the stockholder, $15,000.

1. Received cash for providing accounting services, $8,000.

2. Billed customers on account for providing services, $4,000.

3. Paid advertising expense, $400.

4. Received cash from customers on account, $3,500.

5. Dividends were paid to stockholders, $1,000.

6. Received telephone bill, $100.

7. Paid telephone bill, $100.

Required:

1) In the table below, state the accounts affected by each transaction.

2) Indicate the effect on the accounting equation of each transaction.

Assets

= Liabilities

Ex Cash

+15,000

1.

2.

3.

4.

5.

6.

7.

+ Stockholders

Equity

+15,000

ANS:

Ex

1.

2.

3.

4.

5.

6.

7.

Assets

Cash +15,000

Cash + 8,000

A/R + 4,000

Cash -400

Cash + 3,500

A/R -3,500

Cash -1,000

Cash -100

= Liabilities

A/P + 100

A/P -100

DIF: Moderate

OBJ: 01-04

NAT: AACSB Analytic | AICPA FN-Measurement

+ Stockholders Equity

+15,000

Revenues + 8,000

Revenues + 4,000

Expenses - 400

Dividends -1,000

Expenses -100

38 Chapter 1/Introduction to Accounting and Business

8.

From the following list of accounts taken from Danson's accounting records, identify those

that would appear on the Income Statement.

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Rent Expense

Land

Capital

Fees Earned

Dividends

Wages Expense

Investment

ANS:

(a), (d), (f)

DIF: Easy OBJ: 01-05

NAT: AACSB Analytic | AICPA FN-Measurement

9.

Identify which of the following accounts appear on a balance sheet.

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Cash

Fees Earned

Capital Stock

Wages Payable

Rent Expense

Prepaid Advertising

Land

ANS:

(a), (c), (d), (f), (g)

DIF: Easy OBJ: 01-05

NAT: AACSB Analytic | AICPA FN-Measurement

10. Indicate whether each of the following activities would be reported on the Statement of Cash

Flows as an Operating Activity, an Investing Activity, a Financing Activity, or does not

appear on the Cash Flow Statement.

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Cash paid for building

Cash paid to suppliers

Cash paid for dividends

Cash received from customers

Cash received from the sale of capital stock.

Cash received from the sale of a building

Borrowed cash from a bank

Chapter 1/Introduction to Accounting and Business 39

ANS:

(a) Investing

(b) Operating

(c) Financing

(d) Operating

(e) Financing

(f) Investing

(g) Financing

DIF: Difficult

OBJ: 01-05

NAT: AACSB Analytic | AICPA FN-Measurement

11. For each of the following, determine the amount of net income or net loss for the year.

(a)

(b)

(c)

(d)

Revenues for the year totaled $90,500 and expenses totaled $44,500. The

stockholder made an additional investment of $15,000 in exchange for capital

stock during the year.

Revenues for the year totaled $75,500 and expenses totaled $110,500. Dividends

were paid in the amount of $20,000 during the year.

Revenues for the year totaled $198,000 and expenses totaled $85,000. The

stockholder invested an additional $20,000 in exchange for capital stock and

dividends of $15,000 per paid during the year.

Revenues for Smith Co. totaled $273,500 and expenses totaled $263,800. Cash

dividends of $30,000 were paid during the year.

ANS:

(a) $46,000 net income ($90,500 - $44,500)

(b) $35,000 net loss ($75,500 - $110,500)

(c) $113,000 net income ($198,000 - $85,000)

(d) $9,700 net income ($273,500 - $263,800)

DIF: Difficult

OBJ: 01-05

NAT: AACSB Analytic | AICPA FN-Measurement

12. The total assets and total liabilities of Missy's Draperies, Inc. at the beginning and at the end

of the current fiscal year are as follows:

Total assets

Total liabilities

Jan. 1 Dec. 31

$250,000 $430,000

200,000 140,000

40 Chapter 1/Introduction to Accounting and Business

(a)

(b)

(c)

(d)

Determine the amount of net income earned during the year. The stockholders

did not invest any additional assets in the business during the year and made no

dividends were paid.

Determine the amount of net income during the year. The assets and liabilities

at the beginning and at the end of the year are unchanged from the amounts

presented above. However, dividends of $32,000 were paid in cash during the

year (no additional investments).

Determine the amount of net income earned during the year. The assets and

liabilities at the beginning and at the end of the year are unchanged from the