Economic Problems in Micro, Small and Medium Enterprises (MSME) in India

Economic Problems in Micro, Small and Medium Enterprises (MSME) in India

Uploaded by

900deleteCopyright:

Available Formats

Economic Problems in Micro, Small and Medium Enterprises (MSME) in India

Economic Problems in Micro, Small and Medium Enterprises (MSME) in India

Uploaded by

900deleteOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Economic Problems in Micro, Small and Medium Enterprises (MSME) in India

Economic Problems in Micro, Small and Medium Enterprises (MSME) in India

Uploaded by

900deleteCopyright:

Available Formats

Advances In Management

Vol. 5 (9) Sep. (2012)

Case Study:

Economic Problems in Micro, Small and

Medium Enterprises (MSMES) in India

Venkateswarlu P. *1 and Ravindra P.S.

1. Department of Commerce & Management Studies, Andhra University, Visakhapatnam, Andhra Pradesh, INDIA

2. Miracle School of Management, Miracle City, Bhogapuram, Vizianagaram (Dist.) 535216 (A.P.), INDIA

*po_venkat@yahoo.com

Abstract

government tax, VAT and customs duty; heavy advertising

and promotional costs; payroll, rent

and utilities;

transportation and petrol costs; high interest rates on loans;

ability to meet financial obligation; training and development

costs; insurance costs and delay in account receivables

payment.6

Globally, there is an increased recognition of the

important role played by micro, small and medium

enterprises (MSMEs) in the economic development of a

country. Similarly, in the South Asia region, MSMEs

are the main engines behind the economic growth. In

particular, MSMEs are one of the biggest contributors

to GDP, employment and play a core role in the supply

chain of large businesses. One of the major problems

faced by MSMEs in South Asian countries is lack of

finance to advance business growth. MSMEs lack setup

capital, liquid capital, working capital and investment

capital to survive and grow in a dynamic and predatory

competitive business environment. MSMEs heavily

depend on the financial institutions such as banks,

credit corporations and development banks for the

supply of finance to meet their daily financial needs.

Overview of MSMEs in the Manufacturing

Sector of India

Indias economy is principally resource oriented although the

size of the manufacturing sector has increased over the recent

years. The manufacturing

sector of India includes the

manufacture of items such as textiles, garments, footwear,

sugar, food processing, beverages (including mineral water)

and wood based industries. Initially, manufacturing basically

involved agricultural products such as sugar and timber.

Since 1986 the production of

garment has increased

tremendously due to the introduction of tax exemptions for

factories exporting 70% of their annual

production8.

Manufacturing sector contributes

to the GDP, creates

employment and generates foreign exchange earnings. GDP

from the manufacturing sector increased from around 12% in

3

the late 1980s to about 15% in 1990s.

According to the

Employment Survey Report (2009) there were a total of

22,599 wage earners and 2,412 salary earners employed in

the manufacturing sector of India.

Keywords: MSMEs, Post Crisis, Economic problems, Public

Policy, Development Banks, Regulatory Policies, India.

Introduction

MSMEs in the manufacturing sector of India are mainly

export oriented and include industries such as textiles,

garments, footwear, sugar, food processing, beverages

(including mineral water) and wood based industries. The

government has provided tax concessions to some selected

manufacturing sectors in recognition of the importance of this

sector to Indias economy. Manufacturing sector has been one

of the major contributors to GDP, employment and foreign

exchange earnings. Particularly, the

MSMEs in

the

manufacturing sector of India have made remarkable

contribution in economic growth, employment, innovation,

competition and poverty reduction. Financing the MSMEs is

one of the

major problems

faced by contemporary

owners/mangers of MSMEs in the manufacturing sector of

India.4

Literature Review

The issue of small business finance has been receiving

increasing attention over the recent decade in the extant

literature. There have been studies on various branches of

small businesses: two of these branches are namely financial

management practices of small businesses and implications

of financial management strategies on the survival and

growth of small businesses have been polarized by Berger

and Udell 2. Contemporary studies have tested the hypotheses

for financial variables for other developing countries. There

have been numerous studies that analyze the economic

problems affecting the growth and survival of MSMEs. These

studies are both quantitative and qualitative in nature.

Owners/managers in the manufacturing sector are faced with

a range of financial problems; namely, inability to obtain

external financing; inability to obtain internal financing;

insufficient capital, start-up costs; expensive raw materials;

high wholesale price; large losses due to scrap rate, sabotage,

breakage and crime; decline in sales volume; bad debts and

write offs; heavy equipment and

maintenance costs;

This study underscored eleven economic problems that affect

the survival of the MSMEs; namely, inability to obtain

outside financing; insufficient capital; heavy operating

expenses; poor money management; large losses due to

(36)

Advances In Management

Vol. 5 (9) Sep. (2012)

crime; meeting the payroll; inability to obtain trade credit;

insufficient profit; ability to meet financial obligations; health

insurance costs and cost of workers compensation.

follows; 2 (1%) were less that 20 years, 51 (24.6%) were

between 20-30 years of age, 59 (28.5%) were between 31-40

years and 95 (45.91%) were more than 40 years old. A vast

majority of the

owners/managers working experience

concentrated between 5-10 years (77 owners/managers;

37.2%) followed by 11-15 years (57 owners/managers;

27.5%), less than 5 years (34 owners/managers; 16.4%), 1620 years (28 owners/managers; 13.5%) and more than 21

years (11 owners/managers; 5.3%). The secondary data were

collected from the annual reports of Reserve Bank of India.

Thevaruban11 examined small scale industries and its

financial problems in Sri Lanka. He underscored that MSMEs

of small scale industries in Sri Lanka find it extremely

difficult to get outside credit because the cash inflow and

savings of the MSMEs in

the small scale sector

is

significantly low .5 Hence, bank and non bank financial

institutions do not emphasize much on credit lending for the

development of the MSMEs in the small scale sector in Sri

Lanka.

Analysis and Discussion

The mean scores are sub-divided according to the size of the

business to get a broad understanding of how each of the

economic problems affects the MSMEs in the manufacturing

sector of India. Table 2 shows that factors with high mean

values are foremost economic problems facing MSMEs.

These economic problems are as follows: namely; inability to

obtain external financing; inability to

obtain internal

financing; insufficient capital, start-up costs; expensive raw

materials; high wholesale price; large losses due to scrap rate,

sabotage, breakage and crime; decline in sales volume; bad

debts and write offs; heavy equipment and maintenance costs;

government tax, VAT. and customs duty; payroll, rent and

utilities; transportation and petrol costs; high interest rates on

loans; ability to meet financial obligation; insurance costs and

delay in account receivables payment. Economic problems

which are of less significance to the owners/managers, are

heavy advertising and promotional costs; and training and

development costs.

Research Methodology

The definition of MSMEs varies from country to country . 1

The Commonwealth Secretariats definitions of MSMEs for

small states were used for tabulating and analyzing the size

distribution of the sample. In particular, businesses with

turnover (TO) of less than 100,000 (TO 100,000) were

considered as micro, more than or equal to 100,000 to less

than or equal to 200,000 (100,000 TO 200,000) were

tagged as small and more than or equal to 200,000 to less

than or equal to 500,000 (200,000 TO 500,000) were

regarded as medium. The present study consists of both

primary data and secondary data. After conducting the

literature review, a self administered questionnaire was

designed and delivered to the owners/mangers of MSMEs in

the manufacturing sector of India. Self responsibility was

taken in the delivery and assortment of the questionnaire

because the response rate seems higher than it is for straight

forward mail surveys.

During the start-up stage of a MSME, the owners/managers

will have to depend on both formal and informal channels of

financing12. MSMEs are faced with heavy start-up costs

(MB=4.07; SB=4.97; ME=4.92) because they need to secure

enough finance for purchase of assets and meeting daily

operational expenses 7. This outcome is clearly evident with

the high rating for expensive raw materials (MB=4.88;

SB=4.94; ME=4.88), high wholesale price (MB=4.81;

SB=4.88; ME=4.92), payroll rent and utilities (MB=4.09;

SB=4.97; ME=4.77) and transportation and payroll costs

(MB=4.02; SB=4.78; ME=4.92). Notably, the need for

finance by the MSMEs fluctuates due to the MSMEs age of

maturity in the pecuniary life cycle. Owners/managers of

MSMEs will distinctively rely on internal and external

sources of funds to finance their businesses. MSMEs in the

manufacturing sector of India find that debt financing is

necessary. Particularly, internal sources of finance for the

owners/managers of MSMEs include personal savings and

borrowings from family and friends. When the internal

financing is insufficient, then

the owners/managers of

MSMEs will resort to external sources of funds. The external

sources of financing

for owners/managers in

the

manufacturing sector of

India include banks, business

suppliers and asset based lenders.

The owners/mangers were asked to use their experiences in

their business to rate the questions on a five point Likert scale

where (1) signified not important and (5) signified extremely

important. The questionnaire was developed using the

previous questionnaires developed by Reynolds 10 for his

studies. The questionnaires used for these studies were further

modified to reflect the India context. The questionnaire was

pre-tested with 20 owners/managers of MSMEs. The

owners/managers comments were gathered and the questions

were revised accordingly.

The revised version of the

questionnaire was delivered to 300 owners/managers of

MSMEs in India.

Apparently, out of the 300 questionnaires distributed, 207 (69

per cent) owners/managers returned the questionnaires. Table

1 shows the sample distribution of the owner managers of the

MSMEs. The demographic indicators considered were

gender, social group, age and working experience. Out of the

207 owners/managers there were 164 (79.2%) males and 43

(20.8%) females. Of the 207 owners/managers to the social

group item, 30 (14.5%) were Scheduled castes, 148 (71.5%)

were Scheduled tribes, 22 (10.6%) were Backward class and

7 (3.4%) were Others. The distribution of the age item is as

(37)

Advances In Management

Vol. 5 (9) Sep. (2012)

Essentially, it is difficult for the owners/managers in the

manufacturing sector of India to secure loan as banks and

other commercial lenders are charging high interest rates on

MSME loans. Table 3 shows interest rates on MSME loans

provided by banks in India.

liability insurance cover for MSMEs helps in securing good

customers. This is clearly evident from high responses from

owners/managers for heavy equipment and maintenance costs

(MB=3.93; SB=4.48; ME=4.81), large losses due to scrap

rate, sabotage, breakage and crime (MB=3.70; SB=3.94;

ME=3.77) and insurance

costs (MB=2.95;

SB=3.27;

ME=3.81). Apparently, the low means for heavy advertising

and promotional costs (MB=2.09; SB=2.24; ME=2.58) and

training and

development costs (MB=2.07; SB=2.28;

ME=2.38) indicate that MSMEs primary goal is to survive in

contracting economic environment of India.

Table 3 shows that ANZ is charging 10.95% on MSME

loans, Westpac Banking Corporation is charging 9.99%,

Baroda is charging 10% to 11% and FDB has various

schemes for MSMEs and it charges interest according to each

of the schemes. The high responses for interest rates on loans

from the owners/managers are

clearly evident of

the

economic problems that the manufacturing sector is currently

facing ((MB=4.86; SB=4.76; ME=4.88).

Recommendations

1. Minimum Government Regulation and tax: Notably,

one of the serious complaints from MSME owners/managers

is the impact of regulation on MSMEs and particularly the

disproportionate impact of government regulations on

MSMEs in India. The disproportionate impact of the

government regulation and taxation system hinders the

growth and survival of MSMEs in India and might otherwise

drive out some of these MSMEs who make substantial

contribution to the economy .9 Essentially, from the public

policy perspective, both the direct cost of regulation and the

cost of compliance of the regulation should be reduced.

In 2009, Indias economy contracted by an estimate of 2.5%.

Apparently, a contraction in the economy has resulted in

declining ability of the MSME to obtain internal (MB=4.74;

SB=4.79; ME=4.73) and

external (MB=4.83; SB=4.91;

ME=4.77) financing, diminishing sales volume (MB=4.86;

SB=4.64; ME=4.96), insufficient working capital (MB=4.93;

SB=4.87; ME=4.96), increase in bad debts and write offs

(MB=4.74; SB=4.82;

ME=4.88), delays

in accounts

receivables payments (MB=4.98; SB=4.88; ME=4.69) and

declining debt to equity

ratio (MB=4.91; SB=4.97;

ME=4.84).

2. Better Access to Finance: Importantly, commercial

markets work extremely well in providing financial services

to the MSMEs. Apart from the obvious banking services,

more specialist services such as term loans, factoring, invoice

financing, leasing and venture capital are offered by firms

which rigorously compete with each other to maximize their

profits. Also part of this competition, MSMEs find it difficult

to compete with its large counterparts and access the services

on offer. This constrains their growth and survival. It is

essential for policy makers to recognize that there need to be

cohesive and precise public policy targeted for MSMEs that

will ensure that MSMEs are well protected in this dynamic

and competitive environment. This recognizes the need for

extensive range of diverse and well targeted programmes

such as loan guarantee programmes; regulating the interest

rate charged on MSME loans by the commercial markets;

establishment of well established venture capital market;

establishment of markets for private placements and initial

public offerings of varying sizes; government sponsored

programs for delivering credit and equity funds of small

business units; creating good awareness on the financial

programs available to small businesses and ensuring that

MSMEs keep proper financial records.

Government financial regulation on MSMEs has significantly

disadvantaged the MSMEs as compared

to its large

counterparts. Specifically, the financial regulations imposed

on MSMEs such as government tax, VAT and customs duty

have various implications on the success and survival of

small business. More importantly, government has provided

enormous tax breaks to large employers who operate in tax

free jurisdictions- tax free

zones. Owners/managers of

MSMEs in the manufacturing sector of India usually have the

political clout to enjoy such tax free advantages however, the

idea of MSMEs tax free

zones have not yet been

implemented in India. Currently, the owners/managers of the

manufacturing sector are charged 31% income tax on their

profits and 12.5% VAT. This is clearly evident from high

rating for responses for government income tax, VAT and

customs duty from owners/mangers from the manufacturing

sector of India (MB=4.98; SB=4.96; ME=4.58).

MSMEs in the manufacturing sector of India are handicapped

with low echelon of process automation and elevated cost of

importing better technology. The imported technologies and

the software solutions are not customized and further the cost

of customization is

exorbitant. More importantly, the

maintenance is expensive and time consuming. In particular,

the manufacturing sector in India is also faced with large

losses due to scrap rate, damage, breakage and crime.

Simultaneously, the MSMEs have to develop an insurance

plan for their business. MSMEs in the manufacturing sector

of India often insure for property and liability insurance. Of

greater significance is the fact that having a property and

3. Proper Cash and Credit Management Practices: MSME

owners/managers need to realize that the real success of the

business is based on their ability to keep close control over

cash flows, avoiding holding excessive stocks and collecting

debts on time. Many MSMEs in India have failed because the

owners/managers focused more on technical matters and

forgot about cash flows. MSMEs still believe that delivering

(38)

Advances In Management

Vol. 5 (9) Sep. (2012)

a quality service ensures timely payment however, owners

and managers of MSMEs in India need to recognize that they

need to do something positive to ensure timely payment from

debtors. Owners/managers of MSMEs have to ensure that

they send timely invoices to their customers. Overdue credit

accounts avert further sales to the slow paying customer. This

overdue account ties up sellers working capital and can also

lead to losses from bad debts. There are four key items which

the MSMEs need to tightly manage i.e. annual profit growth

percentage, to equal or exceed sales growth percentage; cash

flow effectiveness to minimize external debt; efficient use of

assets that is as slim as possible to achieve sales and interest

avoidance since the cost is a drain in profits.

Table 1

Demographic Characteristics of the owners/managers

Demographic

Characteristics

Gender

Civilization

Age

Working

Experience

Demographic Variables

Micro Business

(MB) N=67

No % No

Male

49

73.1

Female 18

26.9

Scheduled Caste

16

23.9

Scheduled Tribes

36

53.7

Backward class

10

14.9

Others 5 7.5 0 0.0 2 2.8 7 3.4

Less than 20 Years

0

0.0

20 30 Years

15

22.4

31 40 Years

24

35.8

More than 40 Years

28

41.8

Less than 5 Years

10

14.9

5 10 Years

29

43.3

11 15 Years

15

22.4

16 20 Years

10

14.9

More than 21 Years

3

4.5

Small Business

(SB) N=69

% No

52

75.4

17

24.6

4

5.8

65

94.2

0

0.0

Medium Enterprises

(ME) N=71

%

63

88.7 164

8

11.3 43

10

14.1

47

66.2

12

16.9

Total

N=207

No

%

79.2

20.8

30

14.5

148

71.5

22

10.6

0

6

9

54

4

10

34

15

6

2

30

26

13

20

38

8

3

2

2

51

59

95

34

77

57

28

11

0.0

8.7

13.0

78.3

5.8

14.5

49.3

21.7

8.7

2.8

42.3

36.6

18.3

28.2

53.5

11.3

4.2

2.8

1.0

24.6

28.5

45.9

16.4

37.2

27.5

13.5

5.3

Sources: Primary data

Table 2

Simple statistics of the Economic Problems facing owners/managers

Economic problems

F1

Liability to obtain external financing

F2

Inability to obtain internal financing

F3

Insufficient working capital

F4 Start-up costs

F5

Expensive raw materials

F6

High wholesale price

F7

Large losses due to scrap rate, breakage and crime

F8

Decline in sales volume

F9

Bad debts and written off

F10 Heavy equipment maintenance costs

F11 Government tax, VAT and customs duty

F12 Heavy advertising and promotional costs

F13 Payroll, rent and amenities

F14 Transportation and petrol costs 4.02

F15 High interest rates on loans

F16 Ability to meet financial obligations

F17 Training and development costs

F18 Insurance costs

F19 Delays in account receivables payment

Sources: Primary data

Micro

Business

MB

4.83

4.74

4.93

4.07

4.88

4.81

3.70

4.86

4.74

3.93

4.98

2.09

4.09

4.86

4.91

2.07

2.95

4.98

(39)

Small

Business

SB

4.91

4.79

4.87

4.97

4.94

4.88

3.94

4.64

4.82

4.48

4.76

2024

4.97

4.78

4.76

4.97

2.27

3.27

4.88

Medium

Enterprise

MB

4.77

4.73

4.96

4.92

4.88

4.92

3.77

4.96

4.88

4.81

4.58

2.58

4.77

4.92

4.88

4.84

2.38

3.81

4.69

Min Max

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

5.00

5.00

5.00

5.00

5.00

5.00

5.00

5.00

5.00

5.00

5.00

5.00

5.00

5.00

5.00

5.00

5.00

5.00

5.00

Advances In Management

Vol. 5 (9) Sep. (2012)

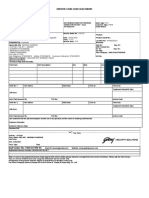

Table 3

Interest Rates on MSME loans Provided by Banks in India

Bank

Type of MSME Loan

Limits

ANZ India

FDB

MSME loans

Micro Credit Scheme

Agri Finance Scheme

Focus sector loans less than 25,00,000

Micro loans and SME loans in:

Wholesale, retail, hotels & restaurants

Transport, communication & storage

Professional & business services

MSME loans

<25,00,000

-

Interest Rate on MSME loans

p.a.

10.95%

6.5%

7.5%

8.6% - 9.6%

8.6% - 9.6%

9.99%

25,00,000 1,00,00,000

<25,00,000

10%

Westpac

Corporation

Baroda

Banking

Commercial loans

11%

(Source: Reserve Bank of India reports)

4. Datta D., Small Business Finance: Implications of Delay in

Formal Sector, International Journal of Economics and Finance, 2

(4), 25-31 (2010)

Conclusion

This study analyzed the importance of nineteen economic

problems facing owners/managers of MSMEs. Economic

problems of great concern to owners/mangers of MSMEs are

as follows: namely; inability to obtain external financing;

inability to obtain internal financing; insufficient capital,

start-up costs; expensive raw materials; high wholesale price;

large losses due to scrap rate, sabotage, breakage and crime;

decline in sales volume; bad debts and write offs; heavy

equipment and maintenance costs; government tax, VAT and

customs duty; payroll, rent and utilities; transportation and

petrol costs; high interest rates on loans; ability to meet

financial obligation; insurance costs and delay in account

receivables payment. Economic problems which are of less

significance to the owners/managers are heavy advertising

and promotional costs; and training and development costs.

5. Ganesan S., Management of Small Construction Firms: A Case

Study of Sri Lanka,Singapore, Hong Kong, Thailand, the Philippines

and Japan, Japan, Asian Productivity Organisation (1982)

6. Laxmi M. N. and Kumar S., Industrial Development, New

Delhi, Discovery Publishing House (1999)

7. Levy B., Berry A. and Nugent J.B., Fulfilling the Export

Potential of Small and Medium Firms,

Kluwer Academic

Publishers, USA (1999)

8. Narayan P.K. and Prasad B.C., Indias Sugar, Tourism and

Garment Industries: A Survey of Performance, Problems and

Potentials, Journal of Indian Studies, 1(1) (2003)

9. Price J., Understand Your Accounts: A Guide to Small

Business Finance, 4th Ed., London, Kogan Page Limited (1999)

References

10. Reynolds R., The Status

of Microenterprise Programs,

International Advances in Economic Research, 4(3) (1998)

1. Abdullah and Baker M.I.B., eds., Small and Medium

Enterprises in Asian Pacific Countries, New York, Nova Science

Publishers (2005)

11. Thevaruban J.S., Small Scale Industries and its Financial

Problems in Sri Lanka, Journal of Asia Entrepreneurship and

Sustainability, I, 66-74 (2009)

2. Berger A.N. and Udell G.F., Small Business Credit Availability

and Relationship Lending: The Importance of Bank Organizational

Structure, The Economic Journal, 112, 477 (2002)

12. Yusuf A., Critical Success Factors for Small Business:

Perceptions of South Asian Entrepreneurs, Journal of Small

Business Management, 33(2) (1995).

3. Chand G., Overview of Current Economic Conditions in India,

Pacific Educational Resources India Ltd. India, Suva (2004)

(Received 13thFebruary 2012, accepted 20th June 2012).

YYY

(40)

You might also like

- Https Smartnetasp - Godrej.com Baanservice PrintReport3460.jspDocument1 pageHttps Smartnetasp - Godrej.com Baanservice PrintReport3460.jspShrikant DetheNo ratings yet

- PESTEL ANALYSIS and SWOTDocument3 pagesPESTEL ANALYSIS and SWOTAman GuptaNo ratings yet

- IBA Code For Banking PracticeDocument5 pagesIBA Code For Banking PracticeHemlata LodhaNo ratings yet

- Memo 21-22.07 Termination of The Forensic Audit of Telestaff Time Keeping System For Larry Scirotto Chief of Police For Lack of IndependenceDocument16 pagesMemo 21-22.07 Termination of The Forensic Audit of Telestaff Time Keeping System For Larry Scirotto Chief of Police For Lack of IndependenceAmanda RojasNo ratings yet

- LEMMY RESEARCH PROPOSAL FINAL by Robbin.444Document21 pagesLEMMY RESEARCH PROPOSAL FINAL by Robbin.444roby ankyNo ratings yet

- Smes in Bangladesh-Prospects and Challenges: ProblemDocument29 pagesSmes in Bangladesh-Prospects and Challenges: ProblemAmirul HakimNo ratings yet

- Determinants of Micro and Small Enterprises Growth in Ethiopia PDFDocument14 pagesDeterminants of Micro and Small Enterprises Growth in Ethiopia PDFetebark h/michaleNo ratings yet

- SME - An Indian PerspectiveDocument7 pagesSME - An Indian PerspectivesurendragiriaNo ratings yet

- Of Bangladesh: Determinants and Remedial Measures: Financial Distress in Small and Medium Enterprises (SME)Document16 pagesOf Bangladesh: Determinants and Remedial Measures: Financial Distress in Small and Medium Enterprises (SME)Yasmine MagdiNo ratings yet

- Project PropsoalDocument10 pagesProject Propsoalsaieshgadhave7666No ratings yet

- Financing Constraint For MSME SectorDocument9 pagesFinancing Constraint For MSME SectorYakejjzNo ratings yet

- Financial Distress Analysis in Indian AuDocument9 pagesFinancial Distress Analysis in Indian AuGanesh KumarNo ratings yet

- Financing Decision - SMEs Data - V1Document17 pagesFinancing Decision - SMEs Data - V1Trịnh Hồng HàNo ratings yet

- BE Session 1Document28 pagesBE Session 1Prakash MishraNo ratings yet

- Menike LMCS - 2018 - Effect of Financial Literacy On Firm Performance of Small and Medium Enterprises in Sri LankaDocument25 pagesMenike LMCS - 2018 - Effect of Financial Literacy On Firm Performance of Small and Medium Enterprises in Sri Lankayuta nakamotoNo ratings yet

- Redefining MSME With CRM Practices: Dr. Suresh Chandra BihariDocument7 pagesRedefining MSME With CRM Practices: Dr. Suresh Chandra BihariBipul BanerjeeNo ratings yet

- MSME Issues and Challenges 1Document7 pagesMSME Issues and Challenges 1Rashmi Ranjan PanigrahiNo ratings yet

- Submitted ToDocument5 pagesSubmitted Tosrabon ahmedNo ratings yet

- Business Environment 3Document6 pagesBusiness Environment 3Deepanshu RajawatNo ratings yet

- 10138-Article Text-37447-1-10-20180228Document12 pages10138-Article Text-37447-1-10-20180228JabbaNo ratings yet

- The Causal E of Small and Medium Enterprises in Vietnam: Ffect of Access To Finance On ProductivityDocument19 pagesThe Causal E of Small and Medium Enterprises in Vietnam: Ffect of Access To Finance On ProductivitySteamPunkNo ratings yet

- Chapter 1 - ThesisDocument8 pagesChapter 1 - ThesisRed SecretarioNo ratings yet

- Section IDocument4 pagesSection ISoumya JainNo ratings yet

- Examining The Determinants and Consequences of Financial Constraints Faced by Micro, Small and Medium Enterprises ' OwnersDocument22 pagesExamining The Determinants and Consequences of Financial Constraints Faced by Micro, Small and Medium Enterprises ' OwnersMUHAMMAD KAISNo ratings yet

- Internship ReportDocument16 pagesInternship ReportPooja ChoudharyNo ratings yet

- Banking On SME GrowthDocument34 pagesBanking On SME GrowthYuresh NadishanNo ratings yet

- Sabari Final ProjectDocument54 pagesSabari Final ProjectRam KumarNo ratings yet

- The Effects of External Factors On Industry PerformanceDocument7 pagesThe Effects of External Factors On Industry PerformanceMewaie KassaNo ratings yet

- Working Capital FinanceDocument54 pagesWorking Capital FinanceAnkur RazdanNo ratings yet

- Small and Medium EnterprisesDocument19 pagesSmall and Medium EnterpriseskalaivaniNo ratings yet

- Thesis On Micro Small and Medium EnterprisesDocument7 pagesThesis On Micro Small and Medium Enterprisesafcnfajtd100% (2)

- SME ExchangeDocument14 pagesSME ExchangeDebasish MaitraNo ratings yet

- Analysis of The Influence of External and InternalDocument10 pagesAnalysis of The Influence of External and Internalwchigumbu200No ratings yet

- Report On MSMEDocument27 pagesReport On MSMERohit Gupta50% (2)

- Problem StatementDocument2 pagesProblem StatementSon Go HanNo ratings yet

- 54 18349policy - Brief - 27 - 04 - Final PDFDocument5 pages54 18349policy - Brief - 27 - 04 - Final PDFjosua_007No ratings yet

- Working Capital Financing Preferences: The Case of Mauritian Manufacturing Small and Medium-Sized Enterprises (Smes)Document33 pagesWorking Capital Financing Preferences: The Case of Mauritian Manufacturing Small and Medium-Sized Enterprises (Smes)SanaNo ratings yet

- Role of SME's in Economic GrowthDocument7 pagesRole of SME's in Economic GrowthAlina JamilNo ratings yet

- Small and Medium Enterprises in India: Emerging Paradigm and Role For Chartered AccountantsDocument5 pagesSmall and Medium Enterprises in India: Emerging Paradigm and Role For Chartered AccountantsvikrantdifferentNo ratings yet

- Challenges of Financing Small Scale Business Enterprises in NigeriaDocument66 pagesChallenges of Financing Small Scale Business Enterprises in NigeriaShaguolo O. Joseph100% (3)

- MSME SummaryDocument3 pagesMSME SummaryVashistaNo ratings yet

- Literature Review For Retail BankingDocument10 pagesLiterature Review For Retail BankingNishant Grover100% (1)

- MA0044Document11 pagesMA0044Mrinal KalitaNo ratings yet

- NabutolaFactors Influencing Performance of Small and Medium Enterprises in The Central Business District - PDFDocument95 pagesNabutolaFactors Influencing Performance of Small and Medium Enterprises in The Central Business District - PDFKyla Buot VergaraNo ratings yet

- Telebrii ShamoDocument42 pagesTelebrii ShamoNahom Asegid TeressaNo ratings yet

- Hab TishDocument36 pagesHab TishHabtamu LemaNo ratings yet

- Sme ReportDocument25 pagesSme Reportyatheesh07No ratings yet

- SME Sector-Opportunities and Challenges-Project Report KVDocument36 pagesSME Sector-Opportunities and Challenges-Project Report KVRamanNo ratings yet

- Abstract of Micro and Small ProjectDocument8 pagesAbstract of Micro and Small Projectdambarudhara khodaNo ratings yet

- Problems of SMEDocument16 pagesProblems of SMEsamy7541No ratings yet

- Factors Affecting Small and Medium Enterprises Access To Capital - Evidence From VietnamDocument17 pagesFactors Affecting Small and Medium Enterprises Access To Capital - Evidence From VietnamthangdqNo ratings yet

- Kaleem Research Proposal (Lack of Finance in SME's)Document7 pagesKaleem Research Proposal (Lack of Finance in SME's)Hera NaeemNo ratings yet

- AmboDocument41 pagesAmbohiluf berhe100% (1)

- Participation of Banks in Small Enterprise Financing: Problems and Issues For BangladeshDocument22 pagesParticipation of Banks in Small Enterprise Financing: Problems and Issues For Bangladeshsharmachandan41321No ratings yet

- Determinants The of Micro and Small Enterprises Performance in Karat Town, Konso, EthiopaDocument10 pagesDeterminants The of Micro and Small Enterprises Performance in Karat Town, Konso, EthiopaKanbiro OrkaidoNo ratings yet

- Determinants of Micro and Small Enterprises Growth in Ethiopia: The Case of Nekemte Town of Oromia Region, EthiopiaDocument14 pagesDeterminants of Micro and Small Enterprises Growth in Ethiopia: The Case of Nekemte Town of Oromia Region, EthiopiaBiniyam YitbarekNo ratings yet

- Econs Projec402-WPS OfficeDocument9 pagesEcons Projec402-WPS OfficeabsalomabnerNo ratings yet

- The Influence of Financial Literacy On Smes Performance Through Access 1528 2635 24-5-595Document17 pagesThe Influence of Financial Literacy On Smes Performance Through Access 1528 2635 24-5-595rexNo ratings yet

- Challenges of Small Enterprises in Cabanatuan CityDocument11 pagesChallenges of Small Enterprises in Cabanatuan CityMonique TorresNo ratings yet

- Small and Medium Enterprises Financial ProblemsDocument4 pagesSmall and Medium Enterprises Financial ProblemsSaleh RehmanNo ratings yet

- Impact of Working Capital Management OnDocument10 pagesImpact of Working Capital Management OnNejash Abdo IssaNo ratings yet

- 2020 Factors Affect The Success and Exellence of SMEsDocument11 pages2020 Factors Affect The Success and Exellence of SMEsAbdii BoruuNo ratings yet

- Kodak-Branding AssignmentDocument39 pagesKodak-Branding AssignmentChristina HeaNo ratings yet

- 97 Quotes by Robert Kiyosaki ("Author Rich Dad Poor Dad")Document7 pages97 Quotes by Robert Kiyosaki ("Author Rich Dad Poor Dad")SumbotyNo ratings yet

- CRM at YES BankDocument10 pagesCRM at YES BankShallu Aggarwal100% (1)

- Electronic Payment Settelment System in HDFC Bank-1Document27 pagesElectronic Payment Settelment System in HDFC Bank-1manisha mangesh manjrekarNo ratings yet

- Ethical-Conduct-Policy-Arup-Oct 2023Document1 pageEthical-Conduct-Policy-Arup-Oct 2023James CubittNo ratings yet

- Report On Project Finance & AppraisalDocument40 pagesReport On Project Finance & AppraisalSarthak RaychoudhuryNo ratings yet

- China's ExportDocument84 pagesChina's ExportCurieHNo ratings yet

- CH 6 - Death of A PartnerDocument41 pagesCH 6 - Death of A Partnermamta.bdvrrmaNo ratings yet

- Questionnaries - Customer Lifetime Value On OTT PlatformsDocument3 pagesQuestionnaries - Customer Lifetime Value On OTT PlatformsRajni KumariNo ratings yet

- Kurt Sullivan Income Statement To Republic Bank 2020-2022Document7 pagesKurt Sullivan Income Statement To Republic Bank 2020-2022Stephen FrancisNo ratings yet

- HRM CaseDocument3 pagesHRM CaseManna Mammen100% (1)

- MBR Final ReportDocument23 pagesMBR Final Reportshahrukh AliyaNo ratings yet

- Transformation in Revenue AccountingDocument92 pagesTransformation in Revenue AccountingTestspotyfireal EsyNo ratings yet

- CHAPTER 9 - Entry StrategyDocument43 pagesCHAPTER 9 - Entry StrategyLê Tiểu BăngNo ratings yet

- Sop For Mba AccountingDocument2 pagesSop For Mba Accountingsagor mollaNo ratings yet

- Reorganization Vs Rationalization - Admin LawDocument7 pagesReorganization Vs Rationalization - Admin LawMary Grace Dionisio-RodriguezNo ratings yet

- Overview HRMDocument17 pagesOverview HRMWILD ROSENo ratings yet

- IQ Coop Loan Applcation - Non Member - New Loan Form (Revised)Document6 pagesIQ Coop Loan Applcation - Non Member - New Loan Form (Revised)Cathlyn PalceNo ratings yet

- Ch06 JeterDocument26 pagesCh06 JeterLydia WulandariNo ratings yet

- MEM678 - Assignment 1 - 20.10.2013Document5 pagesMEM678 - Assignment 1 - 20.10.2013Mohammad FadhliNo ratings yet

- Mid Term QPDocument8 pagesMid Term QPawaisawais95138No ratings yet

- Corporate Governance at RBSDocument19 pagesCorporate Governance at RBSAishwarya SolankiNo ratings yet

- VouchingDocument22 pagesVouchingVinayak Saxena100% (1)

- Apr 2017 - Emirates Provident Mondial FlyerDocument2 pagesApr 2017 - Emirates Provident Mondial Flyernunov_144376No ratings yet

- Case 3 PDFDocument3 pagesCase 3 PDFBilawal Ali100% (1)

- BCG Toyota Supplier Relationships PDFDocument14 pagesBCG Toyota Supplier Relationships PDFsaket raj100% (1)

- Fees Structure 2024 25Document2 pagesFees Structure 2024 25manuj pareekNo ratings yet