Tax Card 2013-14

Tax Card 2013-14

Uploaded by

Mudassir IjazCopyright:

Available Formats

Tax Card 2013-14

Tax Card 2013-14

Uploaded by

Mudassir IjazOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Tax Card 2013-14

Tax Card 2013-14

Uploaded by

Mudassir IjazCopyright:

Available Formats

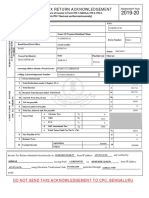

Income Tax Card Tax Year 2014

01/08/2013

READYINCOMETAXCARDFORTAXYEAR2014

FOR SALARIED PERSONS

TAX RATES FOR BUSINESS INDIVIDUALS & AOPs

Taxable Income (Rupees)

Taxable Income (Rupees)

Rate of Tax

Rate of Tax

0 to 400,000

0%

0 to 400,000

0%

400,001 to 750,000

5%

400,001 to 750,000

10%

750,001 to 1,400,000

Rs. 17,500+ 10%

750,001 to 1,500,000

Rs. 35,000 + 15%

1,400,001 to 1,500,000

Rs. 82,500+ 12.5%

1,500,001 to 2,500,000

Rs. 147,500 + 20%

1,500,001 to 1,800,000

Rs. 95,000+ 15%

2,500,001 to 4,000,000

Rs. 347,500 + 25%

1,800,001 to 2,500,000

Rs. 140,000+ 17.5%

4,000,001 to 6,000,000

Rs. 722,500 + 30%

2,500,001 to 3,000,000

Rs. 262,500 + 20%

Exceeding 6,000,000

Rs. 1,322,500 + 35%

3,000,001 to 3,500,000

Rs. 362,500 + 22.5%

3,500,001 to 4,000,000

Rs. 475,000 + 25%

4,000,001 to 7,000,000

Rs. 600,000 + 27.5%

Exceeding 7,000,000

Rs. 1,425,000 + 30%

A salaried person whose salary income is Rs. 500,000/- or more, will file return of Income electronically and it shall be accompanied

by the proof of tax deduction or payment of tax and wealth statement alongwith its reconciliation.

Reduction of 40% tax for full time teacher or researcher, employed in non profit education or Recognized Research Institutions as

per clause 2 of Part-III of the Second Schedule.

Every resident taxpayer being an individual required to file return of income & member of an AOP, shall also file Wealth Statement &

Wealth Reconciliation Statement.

Holder of Commercial or Industrial connection of electricity where annual amount of bill exceeds Rs. 500,000/- is also required to

furnish return of income.

TAX RATES FOR COMPANIES

All Companies except Banking Companies

34%

Banking Companies

35%

ADVANCE TAX INSTALLMENTS U/S 147

DEDUCTION AT SOURCE AGAINST RENT U/S 155 (INDIVIDUALS / AOPs)

Following persons shall be liable to pay advance tax u/s 147:

Gross Rental (Rupees)

1. Every company,

Rate of Tax

0 to 150,000

0%

Exclusions

150,001 to 1,000,000

10%

Persons whose income is covered under 'Dividend', 'Royalty/FTS of non-residents', 'Shipping/Air transport business of nonresidents', 'Salary' or income from which tax collected/deducted is final discharge of liability i.e. FTR mode.

Exceeding 1,000,000

2. Every individual or AOP whose latest assessed taxable income is Rs.500,000 or more,

Rs. 85,000 + 15%

DEDUCTION AT SOURCE AGAINST RENT U/S 155 (COMPANIES)

MINIMUM TAXES

Narration

15% of the gross amount of rent

Section

Rates

Minimum Tax for companies.

113

1% of the Turnover

Distributors of Cigarettes manufactured in Pakistan, Distributors of

Pharmaceutical products, Distributors of Fertilizers & Distributors of

consumer goods including FMCG, Petroleum agents & distributors who are

registered under the Sales Tax Act, 1990, Flour mills, Rice mills & dealers.

113

0.2% of the Turnover

DEDUCTION / COLLECTION AT SOURCE (ADJUSTABLE)

Narration

Poultry industry including poultry breeding, broiler production, egg production

& poultry feed production.

113

Motorcycle dealers registered under the Sales Tax Act, 1990.

113

Pakistan International Airlines Corporation.

Builders and Land Developers.

Import of edible oil & packing material.

0.5% of the Turnover

113A , 113B

As Federal Government specify

in Official Gazette

148(8)

5%

153(1)(b)

7%

Transport services (except companies).

153(1)(b)

2%

235

* As per Table

DEDUCTION / COLLECTION AT SOURCE (FINAL TAX REGIME)

Rates

148

5.5%

Import of Goods (For Companies except Industrial Undertaking).

148

Dividend.

150

Profit on debt (except companies).

Royalty or fee for Technical services rendered by non residents.

5% & 5.5%

Import of foreign produced films.

148

12%

Profit on debt (In case of companies).

151

10%

Services (In case of companies).

153(1)(b)

6%

Contracts (In case of listed companies).

153(1)(c)

6%

231A

0.3%

Cash withdrawal.

Transactions in Bank.

231AA

0.3%

Registration of new motor vehicle.

231B

* As per Table

Commission earned by member of stock exchange on purchase & sale of

shares.

233A

0.01%

Goods transport vehicle.

234

* As per Table

Electricity Bill in case of companies and in case of Individual & AOP bill

amount more than Rs. 30,000 per month.

235

* As per Table

Telephone and mobile usage.

Section

Import of Goods (Individuals & AOP's).

Rates

148

0.25% of the Turnover

113

Electricity Bill upto 30,000 per month (Individual & AOP).

Section

Import of Goods by Industrial Undertaking.

0.5% of the Turnover

Services (except companies).

Narration

"Income from property" is chargeable to tax under Normal Tax Regime.

236

* As per Table

Goods sold by auction.

236A

10%

Purchase of Air Ticket.

236B

5%

Sale/Transfer of Immovable Property.

236C

0.5%

Functions & Gatherings.

236D

10%

Foreign Produced TV Drama dubbed in Urdu by Landing Rights Channel

(Per Episode).

236E

Rs. 100,000/-

Foreign Produced TV Play dubbed in Urdu by Landing Rights Channel

(Single Episode).

236E

Rs. 100,000/-

5%

7.5% & 10%

151

10%

152(1)

15%

Payment to a non resident on account of contract (construction, assembly or

installation, including supervisory activities) and contract for advertisement

services rendered by TV Satellite Channels.

152(1A)

6%

Insurance premium and re-insurance premium paid to non resident person.

152(1AA)

5%

Sale of Rice, cotton seed & edible oils.

153(1)(a)

1.5%

Supply of Goods (All Companies except manufacturer of such goods & listed

companies).

153(1)(a)

3.5%

Supply of Goods (Individual & AOP).

153(1)(a)

4%

Contracts (All cases of companies except listed companies).

153(1)(c)

6%

Contracts (taxpayers except all cases of companies).

153(1)(c)

6.5%

Cable Television Operator.

236F(1)

* As per Table

IPTV, FM Radio, MMDS, Mobile TV, Mobile Audio, Satellite TV Channel &

Landing Rights.

236F(2)

20%

Manufacturer or commercial importer of electronics, sugar, cement, iron &

steel products, fertilizer, motorcycles, pesticides, cigarettes, glass, textile,

beverages, paint or foam sector, at the time of Sales to Distributor, dealers

and wholesalers shall collect advance tax.

236G

0.1%

Every manufacturer, distributor, dealer, wholesaler or commercial importer of

electronics, sugar, cement, iron & steel products, fertilizer, motorcycles,

pesticides, cigarettes, glass, textile, beverages, paint or foam sector, at the

time of Sales to Retailers shall collect advance tax.

236H

0.5%

Fee paid to Educational institution if it exceeds Rs. 200,000/-.

236I

5%

From Dealers, Commission agents & arhatis:

Amount of Tax (p.a)

Services rendered to Exporter of stitching, dying, printing, embroidery,

washing, sizing and weaving.

Group or Class

153(2)

0.5%

154

1%

154(2)

5%

5,000

Any other category

5,000

10,000

236J

Exports.

Indenting commission.

Sale of goods to an exporter under inland back-to-back LC or any other

arrangement like SPO.

154(3)

1%

Prize on Prize Bond & cross-word puzzle.

156

15%

Winnings from a raffle, lottery, prize on winning a quiz, prize offered by a

company for promotion of sale.

156

20%

Commission on petroleum products.

7,500

The Rate of collection u/s 233AA by NCCPL on Profit earned by the member, margin financer or

securities lender.

10%

TAX REDUCTION ON IMPORT OF HYBRID CARS U/S 148

156A

10%

Brokerage and commission.

233

10%

Commission to Advertising Agents.

233

5%

Upto 1200CC

100%

234A

4%

1201 to 1800CC

50%

1801 to 2500CC

25%

CNG Stations (on amount of Gas bill).

Particulars

RATE OF INITIAL ALLOWANCE U/S 23

Particulars

Rate

Plant & Machinery

25%

Building

25%

* RateshavebeenprescribedinatabularformatintheFirstScheduleoftheIncomeTaxOrdinance,2001.

ANJUMASIMSHAHIDRAHMAN

CHARTEREDACCOUNTANTS

Pak Law Publication

Office # 05, Ground Floor, Arshad Mansion, Near Chowk A.G Office,

Nabha Road Lahore.Ph. 042-37350473 Cell # 0300-8848226

Rate of Reduction

You might also like

- E-Statement of Account: Meezan Bank LTDDocument1 pageE-Statement of Account: Meezan Bank LTDMudassir Ijaz0% (1)

- 6 Month Paypal TransactionDocument3 pages6 Month Paypal Transactioncharlesgym2002No ratings yet

- UK Natwest Statement - 2 - 3Document2 pagesUK Natwest Statement - 2 - 3shahid2opu60% (5)

- Form 16 ExcelDocument2 pagesForm 16 Excelapi-372756275% (8)

- Pakistan Army BondDocument6 pagesPakistan Army Bondapi-375001367% (3)

- Mcqs For Second Year of Articleship: © The Institute of Chartered Accountants of IndiaDocument11 pagesMcqs For Second Year of Articleship: © The Institute of Chartered Accountants of IndiaSajal GoyalNo ratings yet

- Hi SAP Dme FormatDocument8 pagesHi SAP Dme Formatrohit12345aNo ratings yet

- WWF Taxation Order FOrmatDocument6 pagesWWF Taxation Order FOrmatSohaib ZafarNo ratings yet

- Tax System in Pakistan.Document20 pagesTax System in Pakistan.Hashir KhanNo ratings yet

- Company Law by Luqman Baig PDFDocument2 pagesCompany Law by Luqman Baig PDFYounas Ali KhanNo ratings yet

- WPPF and WWF (As Per Labour Law and Rules Amended Upto Sept 2015) Accountants PerspectiveDocument29 pagesWPPF and WWF (As Per Labour Law and Rules Amended Upto Sept 2015) Accountants PerspectiveFahim Khan0% (1)

- MSC and SP Code 31.03.15..Document186 pagesMSC and SP Code 31.03.15..hidehelpNo ratings yet

- SMEDA Partnership DeedDocument6 pagesSMEDA Partnership DeedArshed MehmoodNo ratings yet

- Income Tax Chapter-10 NoteDocument6 pagesIncome Tax Chapter-10 NoteRAGIB SHAHRIAR RAFINo ratings yet

- Draft Rejoinder To CatDocument3 pagesDraft Rejoinder To CatVigneshwar Raju Prathikantam100% (1)

- Telangana Excise Act, 1968Document34 pagesTelangana Excise Act, 1968bharatheeeyuduNo ratings yet

- RevisedSugarFactoryTender PDFDocument243 pagesRevisedSugarFactoryTender PDFsaisridhar99100% (1)

- Foreign Trade Policy (2015-2020)Document17 pagesForeign Trade Policy (2015-2020)Neha RawalNo ratings yet

- Change Management: Itc LTDDocument17 pagesChange Management: Itc LTDNakshtra DasNo ratings yet

- ITC Change Mgmt. ReportDocument27 pagesITC Change Mgmt. Reportprem_raebareliNo ratings yet

- Numericals On MAT-115JBDocument2 pagesNumericals On MAT-115JBReema Laser100% (1)

- SVat Quick GuideDocument20 pagesSVat Quick GuideIndrajithAbeysinghe100% (1)

- CA Final IDT Amendments May21 Tharun Raj @CA - Study - NotesDocument57 pagesCA Final IDT Amendments May21 Tharun Raj @CA - Study - NotesKrishna Rama Theertha KoritalaNo ratings yet

- CS Executive Tax Laws Suggested Answers-1Document21 pagesCS Executive Tax Laws Suggested Answers-1nehaNo ratings yet

- Advanced Taxation: The Institute of Chartered Accountants of PakistanDocument4 pagesAdvanced Taxation: The Institute of Chartered Accountants of PakistanAhmed Raza MirNo ratings yet

- Performance Rewards Circular 2022Document6 pagesPerformance Rewards Circular 2022Syed Qalb-e-Raza NaqviNo ratings yet

- Sindh Sales Tax On Services Rules 2011 (Amendede Upto 30 Nov 2012) PDFDocument64 pagesSindh Sales Tax On Services Rules 2011 (Amendede Upto 30 Nov 2012) PDFrohail51No ratings yet

- Guidance Note On GST Audit ICAI PDFDocument529 pagesGuidance Note On GST Audit ICAI PDFLitesh ChopraNo ratings yet

- Tax Card 2024-25Document2 pagesTax Card 2024-25inam.khosa50% (2)

- Google Drive (SH)Document2 pagesGoogle Drive (SH)Danial TariqNo ratings yet

- Individual Txation FY 2019 20 With Demo of Return FilingDocument73 pagesIndividual Txation FY 2019 20 With Demo of Return FilingGanesh PNo ratings yet

- Taxguru - In-Guide To Approved Gratuity FundDocument12 pagesTaxguru - In-Guide To Approved Gratuity FundnanuNo ratings yet

- Change in Exim PolicyDocument50 pagesChange in Exim Policya_aka198986% (7)

- Memarts For Amalgam ConsultantsDocument24 pagesMemarts For Amalgam ConsultantsHulka KihangaNo ratings yet

- Ratios For CMA Report and Bank Funding - Taxguru - inDocument4 pagesRatios For CMA Report and Bank Funding - Taxguru - inShreeRang Consultancy100% (1)

- GST 11th EditionDocument432 pagesGST 11th EditionBhavin PathakNo ratings yet

- Partnership Firm TaxationDocument4 pagesPartnership Firm TaxationAvishek PathakNo ratings yet

- Income Tax Vol-1 50th EditionDocument373 pagesIncome Tax Vol-1 50th EditionBhavin PathakNo ratings yet

- Ind-AS-PPT ICSI 180414Document57 pagesInd-AS-PPT ICSI 180414Ashish SalunkheNo ratings yet

- Presention On: One Person Company (OPC)Document18 pagesPresention On: One Person Company (OPC)Prience 1213No ratings yet

- Bangladesh - Income Tax at A Glance - FY - 2015 - 16Document33 pagesBangladesh - Income Tax at A Glance - FY - 2015 - 16fullerineNo ratings yet

- Sindh Weights & Measures Act 1975 PDFDocument20 pagesSindh Weights & Measures Act 1975 PDFAnonymous C4vzh7100% (1)

- FBR PDFDocument118 pagesFBR PDFNaeem AkhtarNo ratings yet

- Checklist For Income Tax Returns FilingDocument4 pagesChecklist For Income Tax Returns FilingSabin YadavNo ratings yet

- CA Inter Paper 6 All Question PapersDocument116 pagesCA Inter Paper 6 All Question PapersNivedita SharmaNo ratings yet

- Tata Consultancy Services: Presented ByDocument18 pagesTata Consultancy Services: Presented ByVikrant KhandaleNo ratings yet

- SRO 586 of 1991Document2 pagesSRO 586 of 1991Abdul QadirNo ratings yet

- Valuers RegistrationDocument15 pagesValuers Registrationgsm.nkl6049No ratings yet

- PNB Univ Help Manual - Learner - v1Document31 pagesPNB Univ Help Manual - Learner - v1Anup SadhuNo ratings yet

- DRC-07 AdvisoryDocument4 pagesDRC-07 AdvisoryGaurav KapriNo ratings yet

- Import and ExportDocument14 pagesImport and ExportMuhammad NoumanNo ratings yet

- History of Income Tax Law in PakistanDocument2 pagesHistory of Income Tax Law in PakistaniitebaNo ratings yet

- Prevention of Sexual Harassment Policy (POSH) at Work Place: 1. ObjectiveDocument11 pagesPrevention of Sexual Harassment Policy (POSH) at Work Place: 1. ObjectiveRijul KotianNo ratings yet

- GST Debit Note Format in ExcelDocument4 pagesGST Debit Note Format in ExcelVivek PadoleNo ratings yet

- Procedure For Appointment of AuditorDocument5 pagesProcedure For Appointment of AuditorVrushali BandaNo ratings yet

- ZS Associates - Compensation Annexure - 2023-24Document2 pagesZS Associates - Compensation Annexure - 2023-24Aishwarya GuptaNo ratings yet

- DT Icai MCQ 3Document5 pagesDT Icai MCQ 3Anshul JainNo ratings yet

- Vakrangee Kendra Franchisee AgreementDocument28 pagesVakrangee Kendra Franchisee AgreementAditi Taneja100% (1)

- E Way Bill GST 2017Document11 pagesE Way Bill GST 2017Ca Dhruv AgrawalNo ratings yet

- ŠKODA Accessories KUSHAQ Brochure Oct 22Document13 pagesŠKODA Accessories KUSHAQ Brochure Oct 22malyadri RegulaNo ratings yet

- GST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyFrom EverandGST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyRating: 5 out of 5 stars5/5 (1)

- Withholding Tax Rates (Income Tax Ordinance, 2001) For Tax Year 2016Document4 pagesWithholding Tax Rates (Income Tax Ordinance, 2001) For Tax Year 2016Shahid SiddiqueNo ratings yet

- 4/25/2016 21st MCMC 1Document19 pages4/25/2016 21st MCMC 1ShaniNo ratings yet

- FGFGDocument13 pagesFGFGamir farooquiNo ratings yet

- Finance Bill 2014Document18 pagesFinance Bill 2014Tanvir Ahmed SyedNo ratings yet

- Daily Report 28-11-2019Document2 pagesDaily Report 28-11-2019Mudassir IjazNo ratings yet

- Ready Short Sell LimitDocument4 pagesReady Short Sell LimitMudassir IjazNo ratings yet

- CSE Equity Market Performance - One Year Equity Market PerformanceDocument2 pagesCSE Equity Market Performance - One Year Equity Market PerformanceMudassir IjazNo ratings yet

- Pakistan Oil Refining Blending Transportation Storage and Marketing Rules 2016Document62 pagesPakistan Oil Refining Blending Transportation Storage and Marketing Rules 2016Mudassir IjazNo ratings yet

- Government of Pakistan Ministry of Law, Justice: NotificationDocument2 pagesGovernment of Pakistan Ministry of Law, Justice: NotificationMudassir IjazNo ratings yet

- Pakistan Stock Exchange Limited: Notice For All Market Participants Corporate Briefing by World Call LimitedDocument1 pagePakistan Stock Exchange Limited: Notice For All Market Participants Corporate Briefing by World Call LimitedMudassir IjazNo ratings yet

- Withholding Tax Regime (Rates Card) Guidelines For The Taxpayers, Tax Collectors & Withholding Agents (Updated Up To 1 July, 2014)Document31 pagesWithholding Tax Regime (Rates Card) Guidelines For The Taxpayers, Tax Collectors & Withholding Agents (Updated Up To 1 July, 2014)charismaticimranNo ratings yet

- Daily Quotations: Friday September 29, 2017Document24 pagesDaily Quotations: Friday September 29, 2017Mudassir IjazNo ratings yet

- Daily Quotations: Friday September 29, 2017Document24 pagesDaily Quotations: Friday September 29, 2017Mudassir IjazNo ratings yet

- Bop CW PDFDocument1 pageBop CW PDFMudassir IjazNo ratings yet

- Daily Quotations: Friday September 29, 2017Document24 pagesDaily Quotations: Friday September 29, 2017Mudassir IjazNo ratings yet

- Buyback Regulations 2019Document22 pagesBuyback Regulations 2019Mudassir IjazNo ratings yet

- Quarterly Accounts On Webs IteDocument2 pagesQuarterly Accounts On Webs IteMudassir IjazNo ratings yet

- Accounting Standards For NGOsDocument34 pagesAccounting Standards For NGOsMudassir IjazNo ratings yet

- Accounting Standards For NGOsDocument34 pagesAccounting Standards For NGOsMudassir IjazNo ratings yet

- GST Sales AmbikaDocument1 pageGST Sales Ambikakoradiyagautam.bNo ratings yet

- BpiDocument35 pagesBpiChing CamposagradoNo ratings yet

- TAX 1 - Income Tax - 1Document8 pagesTAX 1 - Income Tax - 1Yella Mae Pariña RelosNo ratings yet

- Jawapan Chapter 3Document7 pagesJawapan Chapter 3wawan0% (2)

- 2006 BIR - Ruling - DA 432 06 - 20210505 13 1t6tcx6Document3 pages2006 BIR - Ruling - DA 432 06 - 20210505 13 1t6tcx6Boss NikNo ratings yet

- First Salary Borl-HpclDocument6 pagesFirst Salary Borl-HpclRatan SinghNo ratings yet

- Capital and Revenue: Q.9. Write Down A Note On Capital & Revenue Expenditure Necessary To DifferentiateDocument4 pagesCapital and Revenue: Q.9. Write Down A Note On Capital & Revenue Expenditure Necessary To Differentiateatia khanNo ratings yet

- Shihab Ay 2019-20 Itr PDFDocument1 pageShihab Ay 2019-20 Itr PDFjijil mp50% (2)

- rc151 Fill 23eDocument4 pagesrc151 Fill 23eSarena LiNo ratings yet

- Bill of Supply For Electricity: Due DateDocument1 pageBill of Supply For Electricity: Due DateVinnay DahiyaNo ratings yet

- Final Settlement PageDocument6 pagesFinal Settlement Pagemohammad zubairNo ratings yet

- Postal Services in GoaDocument16 pagesPostal Services in GoaPrajot MorajkarNo ratings yet

- Acct Statement - XX6479 - 29052023Document2 pagesAcct Statement - XX6479 - 29052023Aaradhya BorkarNo ratings yet

- Evolution of Cheques and Paper Based Clearing in IndiaDocument4 pagesEvolution of Cheques and Paper Based Clearing in IndiaAbhishek PatilNo ratings yet

- Special Treatment of Fringe Benefits: Fringe Benefit Monetary ValueDocument2 pagesSpecial Treatment of Fringe Benefits: Fringe Benefit Monetary ValueOwlHeadNo ratings yet

- SAP TablesDocument25 pagesSAP TablesFercho Canul CentenoNo ratings yet

- Rek Mandiri Oct New PDFDocument2 pagesRek Mandiri Oct New PDFFarid RuskandaNo ratings yet

- Commissioner of Internal Revenue Vs Algue Inc., and Court of Tax Appeals GR No. L-28896. February 17, 1988 FactsDocument61 pagesCommissioner of Internal Revenue Vs Algue Inc., and Court of Tax Appeals GR No. L-28896. February 17, 1988 FactsShall PMNo ratings yet

- Smart Summary Income Taxes CFADocument3 pagesSmart Summary Income Taxes CFAKazi HasanNo ratings yet

- Iberotrade Inv #24099Document1 pageIberotrade Inv #24099David ArteagaNo ratings yet

- Key Fact Statement For Deposit Accounts: UBL Freelance Digital AccountDocument1 pageKey Fact Statement For Deposit Accounts: UBL Freelance Digital AccountZainabNo ratings yet

- DT 0108a Employer Annual Tax Deduction Schedule v1 2Document1 pageDT 0108a Employer Annual Tax Deduction Schedule v1 2joseph borketeyNo ratings yet

- Advice of Deposit - Non-NegotiableDocument1 pageAdvice of Deposit - Non-NegotiableMolina VaneNo ratings yet

- Sep Net BillDocument3 pagesSep Net Billlalitha.160798No ratings yet

- TNG Ewallet TransactionsDocument12 pagesTNG Ewallet TransactionsArina KhairunisaNo ratings yet