Fria

Fria

Uploaded by

HannahKathleneFranciscoCopyright:

Available Formats

Fria

Fria

Uploaded by

HannahKathleneFranciscoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Fria

Fria

Uploaded by

HannahKathleneFranciscoCopyright:

Available Formats

R.A. No.

10142

Financial Rehabilitation and Insolvency Act of 2010 (FRIA)

Republic Act No. 10142 is a law providing for the rehabilitation or liquidation of financially

distressed enterprises and individuals. It is the law that replaced the 1909 Insolvency Act.

Objectives of FRIA:

The rehabilitation or liquidation shall be made with a view

To ensure or maintain certainly and predictability in commercial affairs,

Preserve and maximize the value of the assets of these debtors,

Recognize creditor rights and respect priority of claims, and

Ensure equitable treatment of creditors who are similarly situated.

Cases governed by the FRIA are:

(a) the rehabilitation of sole proprietorships,

(b) the insolvency and liquidation cases of corporations, partnerships and other associations, and

(c) insolvency and suspension of payments/discharge of individuals.

(e) Liquidation cases emanating from administrative proceedings.

Exclusions from FRIA

A. Entities

(a) Bank shall refer to any duly licensed bank or quasi-bank that is potentially or actually

subject to conservatorship, receivership or liquidation proceedings under the New Central

Bank Act (Republic Act No. 7653) or successor legislation;

(b) Insurance company shall refer to those companies that are potentially or actually

subject to insolvency proceedings under the Insurance Code (Presidential Decree No.

1460) or successor legislation; and

(c) Pre-need company shall refer to any corporation authorized/licensed to sell or offer to

sell pre-need plans.

B. Assets excluded from insolvency proceedings

the insolvent debtors family home as provided by law, or the homestead in which he or

she resides, and land necessarily used in connection therewith;

ordinary tools and implements personally used by him or her in his or her trade,

employment or livelihood;

three horses, or three cows, or three carabaos or other beasts of burden at the option of

the judgment obligor as may be necessary in his ordinary occupation;

his necessary clothing and articles for ordinary personal use, excluding jewelry;

household furniture and utensils necessary for housekeeping, and used for that purpose

by the judgment obligor and his family such as the judgment obligor may select,

of a value not exceeding 100,000 Philippine pesos;

the professional libraries and equipment of judges, lawyers, physicians,

pharmacists, dentists, engineers, surveyors, clergymen, teachers and other

professionals, not exceeding 300,000 Philippine pesos in value;

one fishing boat and accessories not exceeding the total value of 100,000

Philippine pesos owned by a fisherman and by the lawful use of which he or

she earns his livelihood;

as much of the salaries, wages or earnings of the insolvent debtor for his or

her personal services within the four months preceding the levy as are

necessary for the support of his or her family;

lettered gravestones;

monies, benefits, privileges or annuities accruing or in any manner growing

out of any life insurance;

the right to receive legal support, or money or property obtained as such

support, or any pension or gratuity from the government; and

properties specially exempt by law (Rules of Court rule 39 section 13; FRIA

section 130).

Definition of Terms:

1. Debtor Debtor shall refer to, unless specifically excluded by a provision of this Act, a

sole proprietorship duly registered with the Department of Trade and Industry (DTI), a

partnership duly registered with the Securities and Exchange Commission (SEC), a

corporation duly organized and existing under Philippine laws, or an individual debtor

who has become insolvent as defined herein.

2. Insolvency - when an organization, or individual, can no longer meet its financial

obligations with its lender or lenders as debts become due.

3. Liquidation - Winding up of a firm by selling off its free (un-pledged) assets to convert

them into cash to pay the firm's unsecured creditors. Any remaining amount is distributed

among the shareholders in proportion to their shareholdings.

4. Liquidator - a person who is appointed when a company is in the process of winding-up.

A liquidator is responsible for collecting all the assets of a company and settling all

claims against the company.

5. Rehabilitation - refer to the restoration of the debtor to a condition of successful

operation and solvency, if it is shown that its continuance of operation is economically

feasible and its creditors can recover by way of the present value of payments projected

in the plan, more if the debtor continues as a going concern than if it is immediately

liquidated.

6. Rehabilitation Plan - a plan by which the financial well-being and viability of an

insolvent debtor can be restored using various means including, but not limited to, debt

forgiveness, debt rescheduling, reorganization or quasi-reorganization, dacion en pago,

debt-equity conversion and sale of the business (or parts of it) as a going concern, or

setting-up of new business entity.

7. Pre-negotiated Rehab - Includes as a schedule of the debtor's debts and liabilities; an

inventory of the debtor's assets; the pre-negotiated Rehabilitation Plan, including the

names of at least three (3) qualified nominees for rehabilitation receiver; and a summary

of disputed claims against the debtor and a report on the provisioning of funds to account

for appropriate payments should any such claims be ruled valid or their amounts adjusted.

8. Out-of-court/informal restructuring agreement - An agreement between two litigants

to settle a matter privately before the Court has rendered its decision.

9. Standstill period - the period agreed upon by the debtor and its creditors to enable them

to negotiate and enter into an out-of-court or informal restructuring/workout agreement or

rehabilitation plan

10. Cram down effect - the involuntary imposition by a court of a reorganization plan over

the objection of some classes of creditors.

11. Liquidation order - occurs when the court finds the petition for liquidation sufficient in

form and substance it shall, within five (5) working days issue the Liquidation Order

mentioned in Section 112 of the FRIA.

Nature and proceedings on:

1. Court-supervised Rehabilitation - If the court finds the petition for rehabilitation to be

sufficient in form and substance,

it will issue a commencement order, which shall, among other

things:

appoint a rehabilitation receiver;

summarise the requirements and deadlines for creditors to establish their claims against

the debtor;

prohibit suppliers of goods or services from withholding supply for as long as the debtor

makes prompt payments;

prohibit the debtor from making any payment of its outstanding liabilities; and

issue a stay or suspension order (FRIA section 16).

Imposition of national and local taxes and fees, penalties and surcharges are also waived

from issuance of the commencement order until approval of the rehabilitation plan or

dismissal of the petition (FRIA section 19).

2. Liquidation - At any time during the pendency of court-supervised or pre-negotiated

rehabilitation proceedings, the debtor may also initiate liquidation proceedings by filing a

motion in the same court where the rehabilitation proceedings are pending to convert the

rehabilitation proceedings into liquidation proceedings.

If the petition or motion is sufficient in form and substance, the court shall issue an Order:

(1) directing the publication of the petition or motion in a newspaper of general

circulation once a week for two (2) consecutive weeks; and

(2) directing the debtor and all creditors who are not the petitioners to file their comment

on the petition or motion within fifteen (15) days from the date of last publication.

3. Insolvency of Individual Debtor

An individual debtor who, possessing sufficient property to cover all his debts but

foreseeing the impossibility of meeting them when they respectively fall due, may file a

verified petition that he be declared in the state of suspension of payments by the court of

the province or city in which he has resides for six (6) months prior to the filing of his

petition. He shall attach to his petition, as a minimum: (a) a schedule of debts and

liabilities; (b) an inventory of assess; and (c) a proposed agreement with his creditors.

If the court finds the petition sufficient in form and substance, it shall, within five (5) working

days from the filing of the petition, issue an Order:

(a) calling a meeting of all the creditors named in the schedule of debts and liabilities at

such time not less than fifteen (15) days nor more than forty (40) days from the date of

such Order and designating the date, time and place of the meeting;

(b) directing such creditors to prepare and present written evidence of their claims before

the scheduled creditors' meeting;

(c) directing the publication of the said order in a newspaper of general circulation

published in the province or city in which the petition is filed once a week for two (2)

consecutive weeks, with the first publication to be made within seven (7) days from the

time of the issuance of the Order;

(d) directing the clerk of court to cause the sending of a copy of the Order by registered

mail, postage prepaid, to all creditors named in the schedule of debts and liabilities;

(e) forbidding the individual debtor from selling, transferring, encumbering or disposing

in any manner of his property, except those used in the ordinary operations of commerce

or of industry in which the petitioning individual debtor is engaged so long as the

proceedings relative to the suspension of payments are pending;

(f) prohibiting the individual debtor from making any payment outside of the necessary

or legitimate expenses of his business or industry, so long as the proceedings relative to

the suspension of payments are pending; and

(g) appointing a commissioner to preside over the creditors' meeting.

You might also like

- Stocks 136-141Document3 pagesStocks 136-141Rej Patnaan100% (1)

- Estate Tax LectureDocument7 pagesEstate Tax LectureVanilyn LaresmaNo ratings yet

- PICPA - Member in Good Standing 2022Document1 pagePICPA - Member in Good Standing 2022Ricalyn E. SumpayNo ratings yet

- Lesson 2 Percentage TaxesDocument15 pagesLesson 2 Percentage Taxesman ibeNo ratings yet

- TaxationDocument9 pagesTaxationGio PacayraNo ratings yet

- PPG Annex B-2-Commitment Form For Alternate AAOs - 18mar2021 (Clean)Document2 pagesPPG Annex B-2-Commitment Form For Alternate AAOs - 18mar2021 (Clean)Bin Mac100% (6)

- Respondent MemorialDocument23 pagesRespondent MemorialAnonymous uHAFY6qLbz75% (4)

- Miriam Defensor Santiago V. Commission On Elections G.R. No. 127325. March 19, 1997Document3 pagesMiriam Defensor Santiago V. Commission On Elections G.R. No. 127325. March 19, 1997Jien Lou100% (2)

- Pre-Arrest Bail Protective)Document11 pagesPre-Arrest Bail Protective)api-3745637No ratings yet

- 14 PPT-Slides-Sept-14-2023Document28 pages14 PPT-Slides-Sept-14-2023valmadridhazelNo ratings yet

- Sales.1505-1506 in Relation To Article 559 Cases.2016Document27 pagesSales.1505-1506 in Relation To Article 559 Cases.2016Joven CamusNo ratings yet

- NegoDocument16 pagesNegodollyccruzNo ratings yet

- Vat System and OptDocument15 pagesVat System and Optlyra21No ratings yet

- 06 Estate Tax PayableDocument12 pages06 Estate Tax PayableJabonJohnKennethNo ratings yet

- Drill Contract 1 PDFDocument2 pagesDrill Contract 1 PDFweqweqw0% (1)

- Republic Act No Rental LawDocument8 pagesRepublic Act No Rental LawAdrian FranzingisNo ratings yet

- Valencia Chap 5 Estate TaxDocument11 pagesValencia Chap 5 Estate TaxCha DumpyNo ratings yet

- Contracts Chapter 3 Form of ContractsDocument9 pagesContracts Chapter 3 Form of ContractsAira MalinabNo ratings yet

- Other Percentage TaxesDocument9 pagesOther Percentage TaxesLeonard CañamoNo ratings yet

- Tax Cases'RemediesDocument137 pagesTax Cases'RemediesDigna Burac-CollantesNo ratings yet

- Activity Task Law On Sales PDFDocument2 pagesActivity Task Law On Sales PDFCaila Chin DinoyNo ratings yet

- Essential Requisites of ContractsDocument16 pagesEssential Requisites of ContractsAmie Jane MirandaNo ratings yet

- Bouncing Checks Law: Batas Pambansa Bilang No. 22Document8 pagesBouncing Checks Law: Batas Pambansa Bilang No. 22Chara etang100% (1)

- 12 Item MCQDocument1 page12 Item MCQKHAkadsbdhsgNo ratings yet

- Deduction QuizzerDocument7 pagesDeduction QuizzerJanice Barbasa BiduaNo ratings yet

- RFBT RC ExamDocument9 pagesRFBT RC Examjeralyn juditNo ratings yet

- 6295d1e06f5c6 Cpale RFBT ReviewerDocument15 pages6295d1e06f5c6 Cpale RFBT ReviewerKimNo ratings yet

- Chapter 2 - Donor's Tax (Notes)Document8 pagesChapter 2 - Donor's Tax (Notes)Angela Denisse FranciscoNo ratings yet

- Chapter 1 - Fundamental Concepts of Donor's Taxation (Notes)Document3 pagesChapter 1 - Fundamental Concepts of Donor's Taxation (Notes)Angela Denisse FranciscoNo ratings yet

- Article 1582. Primary Obligations of The VendeeDocument8 pagesArticle 1582. Primary Obligations of The Vendeehyunsuk fhebieNo ratings yet

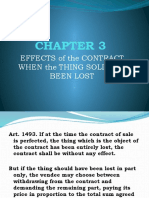

- Chapter 3 Effects of The Contract When The Thing Sold Has Been LostDocument9 pagesChapter 3 Effects of The Contract When The Thing Sold Has Been Lostjohn llaneraNo ratings yet

- 317 Art. 1561 Obligations of The Vendor Conditions and Warranties 318 Sales Art. 1561Document9 pages317 Art. 1561 Obligations of The Vendor Conditions and Warranties 318 Sales Art. 1561elaineNo ratings yet

- General Provisions Summary NotesDocument4 pagesGeneral Provisions Summary Notesfklakjdkjfla100% (1)

- DocxDocument4 pagesDocxKimmy Shawwy0% (1)

- Auditing Problem (Modules 7-10)Document6 pagesAuditing Problem (Modules 7-10)Serena Van der WoodsenNo ratings yet

- 048 Ang Vs CADocument12 pages048 Ang Vs CACeslhee AngelesNo ratings yet

- Lichauco vs. Olegario and Olegario 43 Phil. 540, June 20, 1922 FactsDocument1 pageLichauco vs. Olegario and Olegario 43 Phil. 540, June 20, 1922 FactsHazel LomonsodNo ratings yet

- Corplaw 1-47Document482 pagesCorplaw 1-47LUNANo ratings yet

- RFBT (Pinnacle Notes)Document1 pageRFBT (Pinnacle Notes)Justz LimNo ratings yet

- PRELIMS Law 3Document4 pagesPRELIMS Law 3ALMA MORENANo ratings yet

- Instances When A Stockholder Can Exercise His Appraisal RightDocument2 pagesInstances When A Stockholder Can Exercise His Appraisal RightKaren RabadonNo ratings yet

- Estate Tax Amnesty ActDocument10 pagesEstate Tax Amnesty ActJocelyn MendozaNo ratings yet

- Natural Obligations QandaDocument5 pagesNatural Obligations QandaFloramae PasculadoNo ratings yet

- 100 Questions Sales With Answers - Compress PDFDocument25 pages100 Questions Sales With Answers - Compress PDFGwyneth TorrefloresNo ratings yet

- MODULE 1 BOUNCING CHECK LAW (BP BLG 22)Document11 pagesMODULE 1 BOUNCING CHECK LAW (BP BLG 22)jangjangNo ratings yet

- Warranty Against Hidden Defects of or Encumbrances Upon The Thing SoldDocument2 pagesWarranty Against Hidden Defects of or Encumbrances Upon The Thing SoldartNo ratings yet

- Module 1 ESTATE TAXATIONDocument7 pagesModule 1 ESTATE TAXATIONArj Sulit Centino DaquiNo ratings yet

- Performance AgreementDocument3 pagesPerformance AgreementAnita WilliamsNo ratings yet

- Law 15Document5 pagesLaw 15ram RedNo ratings yet

- Value-Added Tax Description: BIR Form 2550MDocument15 pagesValue-Added Tax Description: BIR Form 2550MJAYAR MENDZNo ratings yet

- RFBT 3 Practice QuizDocument7 pagesRFBT 3 Practice QuizJyNo ratings yet

- Cebu Cpar Center Inc.: Tel. No.: (032) 345-0553 / 0906-2251746Document9 pagesCebu Cpar Center Inc.: Tel. No.: (032) 345-0553 / 0906-2251746Anonymous aRheeMNo ratings yet

- Transfer and Business TaxationDocument33 pagesTransfer and Business TaxationMaricar RoqueNo ratings yet

- SCRA People V CondeDocument15 pagesSCRA People V CondeMiakaNo ratings yet

- Vat With TrainDocument16 pagesVat With TrainElla QuiNo ratings yet

- Mind MapsDocument12 pagesMind MapsLoueli IleuolNo ratings yet

- Accounting For Income TaxDocument56 pagesAccounting For Income TaxEau Claire DomingoNo ratings yet

- Fria Resa New LawsDocument6 pagesFria Resa New LawsAldrin AntonioNo ratings yet

- RFBT 34new-3Document1 pageRFBT 34new-3CPANo ratings yet

- Installment Sales and Condominium Act: Atty. Coco Chanel G. GarciaDocument21 pagesInstallment Sales and Condominium Act: Atty. Coco Chanel G. GarciaGround ZeroNo ratings yet

- Dokumen - Tips Commodatum Vs Mutuum Vs DepositDocument8 pagesDokumen - Tips Commodatum Vs Mutuum Vs DepositShazna SendicoNo ratings yet

- Ejercito vs. Sandiganbayan and People of The Philippines, 509 SCRA 190Document12 pagesEjercito vs. Sandiganbayan and People of The Philippines, 509 SCRA 190samantha oxfordNo ratings yet

- Insolvency Proceedings Under The Financial Rehabilitation and Insolvency Act (Fria) of 2010Document10 pagesInsolvency Proceedings Under The Financial Rehabilitation and Insolvency Act (Fria) of 2010Benedict AlvarezNo ratings yet

- Insolvency Proceedings Under The Financial Rehabilitation and Insolvency ActDocument15 pagesInsolvency Proceedings Under The Financial Rehabilitation and Insolvency ActmowzjeyneNo ratings yet

- Principles of Corporate Taxation PDFDocument253 pagesPrinciples of Corporate Taxation PDFASIFNo ratings yet

- Crim Digests 1Document7 pagesCrim Digests 1Michelle SilvaNo ratings yet

- Baldoza Vs Dimaano 1976Document3 pagesBaldoza Vs Dimaano 1976Onireblabas Yor OsicranNo ratings yet

- No81 11VE ChockalingamDocument13 pagesNo81 11VE Chockalingamchrysalis592100% (1)

- Hart and Austin DebateDocument3 pagesHart and Austin Debateahmedkhan1.isbNo ratings yet

- Capacity To ContractDocument6 pagesCapacity To ContractSEKANISH KALPANA ANo ratings yet

- City of Manila v. Grecia CuerdoDocument1 pageCity of Manila v. Grecia CuerdoRostum AgapitoNo ratings yet

- 22A-22B Hafiz Rafique-01Document4 pages22A-22B Hafiz Rafique-01SamerNo ratings yet

- CASE No. 61 1. Demaisip vs. CA, September 25, 1959Document2 pagesCASE No. 61 1. Demaisip vs. CA, September 25, 1959Al Jay MejosNo ratings yet

- Manosca Vs CA CDDocument2 pagesManosca Vs CA CDPrieti HoomanNo ratings yet

- Sources For National History DayDocument26 pagesSources For National History Dayapi-443889958No ratings yet

- Digest GR No. 171396Document2 pagesDigest GR No. 171396Talledo SandraNo ratings yet

- Uehfuwefuwefuuiwefuwefwef 89 Wef 98 WefDocument2 pagesUehfuwefuwefuuiwefuwefwef 89 Wef 98 WefujihhNo ratings yet

- PDIC Vs CA, Et. Al.Document2 pagesPDIC Vs CA, Et. Al.Charles Roger Raya100% (1)

- Respondent Memorial (LLDC - 019)Document46 pagesRespondent Memorial (LLDC - 019)Rohan VermaNo ratings yet

- MDJReportDocument2 pagesMDJReportPaul FarrellNo ratings yet

- First Division: Gabriela Coronel, Petitioner, vs. Atty. Nelson A. CUNANAN, RespondentDocument6 pagesFirst Division: Gabriela Coronel, Petitioner, vs. Atty. Nelson A. CUNANAN, RespondentClement del RosarioNo ratings yet

- Criminal Law 1Document44 pagesCriminal Law 1Jasmine A. M. WallohNo ratings yet

- Indemnity BondDocument1 pageIndemnity BondSibasish SahooNo ratings yet

- Fule Case LTDDocument2 pagesFule Case LTDDexter Lee GonzalesNo ratings yet

- Pupillage UK Handbook20august202011lcDocument140 pagesPupillage UK Handbook20august202011lcVanessa LeeNo ratings yet

- 1992 ZMHC 3Document2 pages1992 ZMHC 3Angel MoongaNo ratings yet

- 5-Dela Vina v. CIRDocument7 pages5-Dela Vina v. CIRjillian margaux royNo ratings yet

- Joint Venture AgreementDocument5 pagesJoint Venture AgreementMahran GuesmiNo ratings yet

- Fria ReportDocument12 pagesFria ReportCianne AlcantaraNo ratings yet

- Motion For Leave of Court To Effect Service of SummonsDocument2 pagesMotion For Leave of Court To Effect Service of SummonsReddick RoseNo ratings yet