Management of Accounts Receivable Sample Problems

Management of Accounts Receivable Sample Problems

Uploaded by

Julienne AristozaCopyright:

Available Formats

Management of Accounts Receivable Sample Problems

Management of Accounts Receivable Sample Problems

Uploaded by

Julienne AristozaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Management of Accounts Receivable Sample Problems

Management of Accounts Receivable Sample Problems

Uploaded by

Julienne AristozaCopyright:

Available Formats

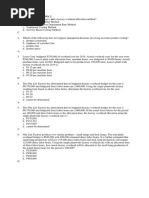

Illustration 1: A company has prepared the following projections for a year

Sales 21000 units

Selling Price per unit Rs.40

Variable Costs per unit Rs.25

Total Costs per unit Rs.35

Credit period allowed One month

The company proposes to increase the credit period allowed to its customers from one month

to two months .It is envisaged that the change in policy as above will increase the sales by 8%.

The company desires a return of 25% on its investment. You are required to examine and advise

whether the proposed credit policy should be implemented or not?

Solution:

Particulars Present Proposed Incremental

Sales (units) 21000 22680 1680

Contribution per unit Rs.15 Rs.15 Rs.15

Total Contribution Rs.3,15,000 Rs.3,40,000 Rs.25,200

Variable cost @ Rs.25 5,25,000 5,67,000 42,000

Fixed Cost 2,10,000 2,10,000 ------

42,000

Total Cost 7,35,000 7,77,000 -----

Credit period 1 month 2 month

Average debtors at cost Rs.61250 Rs.1,29,500 Rs.68,250

Incremental Return = Increased Contribution/Extra Funds

Blockage *100

= Rs.25,200/Rs.68,250*100

=36.92%

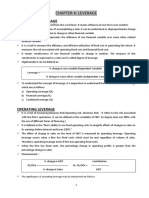

Illustration 2: ABC & Company is making sales of Rs.16,00,000 and it extends a

credit of 90 days to its customers. However, in order to overcome the financial

difficulties, it is considering to change the credit policy. The proposed terms of credit

and expected sales are given hereunder:

Policy Terms Sales

I 75 days Rs.15,00,000

II 60 days Rs. 14,50,000

III 45 days Rs 14,25,000

IV 30 days Rs 13,50,000

V 15 days

Rs.13,00,000

The firm has variable cost of 80% and fixed cost of Rs.1,00,000. The cost of capital is 15%.

Evaluate different policies and which policy should be adopted?

Solution:

figures in Rs.

Particular

Present I II III IV V

s

Sales 1,600,000 1,500,000 1,450,000 1,425,000 1,350,000 1,300,000

Variable cost 1,280,000 1,200,000 1,160,000 1,140,000 1,080,000 1,040,000

Fixed Cost 100,000 100,000 100,000 100,000 100,000 100,000

Profit (A) 220,000 200,000 190,000 185,000 170,000 160,000

Total Cost 1,380,000 1,300,000 1,260,000 1,240,000 1,180,000 1,140,000

Average 345,000 270,833 210,000 155,000 98,333 47,500

Receivable

(Cost360x

credit period

Cost of 51,750 40,625 31,500 23,250 14,750 7,125

debtors @

15% (B)

Net profit (A 168,250 159,350 158,500 161,750 155,250 152,875

B)

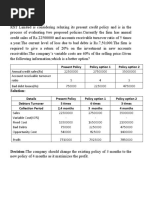

Illustration3: A trader whose current sales are Rs.1,500,000 per annum and average collection period is 30 days

wants to pursue a more liberal credit policy to improve sales. A study made by consultant firm reveals the following

information.

Credit Policy increase in collection period Increase in sales

A 15 days Rs.60,000

B 30 days 90,000

C 45 days 150,000

D 60 days 180,000

E 90 days 200,000

The selling price per unit is Rs.5. Average Cost per unit is Rs.4 and variable cost per unit I Rs.2.75 paise per unit. The

required rate of return on additional investments is 20 percent (cost of capital). Assume 360 days a year and also

assume that there are no bad debts. Which of the above policies would you recommend for adoption.

Solution:

Particulars Present A B C D E

Credit period 30 days 45 days 60 days 75 days 90 days 120 days

No. of units @ Rs.5 300,000 312,000 318,000 330,000 336,000 340,000

Sales 1,500,000 1,560,000 1,590,000 1,650,000 1,680,000 1,700,000

Variable 8,25,000 8,58,000 874,500 907,500 924,000 935,000

cost@ 2.75

Fixed Cost 375,000 375,000 375,000 375,000 375,000 375,000

Total Cost 1,200,000 1,233,000 1,249,500 1,282,500 1,299,000 1,310,000

Profit (A) 300,000 327,000 340,500 367,500 381,000 390,000

Average

debtors 100,000 154,125 208,250 267,188 324,750 436,667

cost(at cost)

[(TC )(x/360)]

Cost of

investment@ 20,000 30,825 41,650 53,437 64,950 87,333

20% (B)

Net Profit (A- 280,000 296,175 298,850 314,063 316,050 302,667

B)

Lets Sum Up

The receivables emerge when goods are sold on credit and the payments are deferred by the customers. So, every firm

should have a well-defined credit policy.

The receivables management refers to managing the receivables in the light of costs and benefit associated with a

particular credit policy.

Receivables management involves the careful consideration of the following aspects: Forming of credit policy, Executing the

credit policy, Formulating and executing collection policy.

The credit policy deals with the setting of credit standards and credit terms relating to discount and credit period.

The credit evaluation includes the steps required for collection and analysis of information regarding the credit worthiness

of the customer.

You might also like

- Working Capital QuestionsDocument10 pagesWorking Capital QuestionsVaishnavi VenkatesanNo ratings yet

- Financial Leverage QuestionsDocument2 pagesFinancial Leverage QuestionsjeganrajrajNo ratings yet

- Case Drink at Home, IncDocument2 pagesCase Drink at Home, IncsnehmadhurNo ratings yet

- Underarmour Case StudyDocument33 pagesUnderarmour Case StudyMarienMina100% (1)

- Question Bank B 604 F: Working Capital Management UNIT-1-Basic Working Capital & Computation of Working CapitalDocument12 pagesQuestion Bank B 604 F: Working Capital Management UNIT-1-Basic Working Capital & Computation of Working CapitalBhavya Shrivastava100% (3)

- Mba - Problems On Capital Structure TheoriesDocument6 pagesMba - Problems On Capital Structure TheoriesPadyala Sriram33% (3)

- Problems On Cash Budget MBADocument3 pagesProblems On Cash Budget MBAsafwanhossain100% (2)

- Financial Management Solved ProblemsDocument50 pagesFinancial Management Solved ProblemsAnonymous RaQiBV75% (4)

- Problems in EBITDocument4 pagesProblems in EBITtj0000780% (5)

- Stock Valuation SolutionsDocument6 pagesStock Valuation SolutionsShubham Aggarwal100% (3)

- Answers For Problems On Financial Leverage - 1-4Document4 pagesAnswers For Problems On Financial Leverage - 1-4jeganrajraj83% (6)

- Consti 1 Gatmaytan Finals Reviewer PDFDocument130 pagesConsti 1 Gatmaytan Finals Reviewer PDFJulienne AristozaNo ratings yet

- Beano's Café Marketing AnswerDocument2 pagesBeano's Café Marketing AnswerJulienne Aristoza100% (4)

- Chapter 07 Design Organize Sales ForceDocument39 pagesChapter 07 Design Organize Sales ForceThanh Trúc Nguyễn Đăng100% (1)

- Recivable ManagmentDocument26 pagesRecivable ManagmentAnkita Mukherjee100% (1)

- Receivable Management Llustration 1: A Company Has Prepared The Following Projections For A YearDocument6 pagesReceivable Management Llustration 1: A Company Has Prepared The Following Projections For A YearJC Del MundoNo ratings yet

- Working Capital Management - NumericalsDocument9 pagesWorking Capital Management - NumericalsAnjali JainNo ratings yet

- Dividend Decision Question-3Document10 pagesDividend Decision Question-3Savya Sachi50% (2)

- Walter's Model Formula: Unit - Iv Part - C Problems and SolutionsDocument3 pagesWalter's Model Formula: Unit - Iv Part - C Problems and SolutionsHarihara PuthiranNo ratings yet

- Problems LeverageDocument20 pagesProblems LeverageMadhav RajbanshiNo ratings yet

- Cash Budget Problems and SolutionsDocument6 pagesCash Budget Problems and Solutionstamberahul1256100% (1)

- Final Accounts 1. As Per Schedule III of Companies Act 2013, Prepare Financial Statement For Gillette India PVT LTDDocument3 pagesFinal Accounts 1. As Per Schedule III of Companies Act 2013, Prepare Financial Statement For Gillette India PVT LTDermias100% (1)

- EBIT-EPS AnalysisDocument11 pagesEBIT-EPS Analysisaasim agha0% (1)

- Capital Structure Theory - MM ApproachDocument2 pagesCapital Structure Theory - MM ApproachSigei Leonard100% (1)

- Cost of Redeemable Preference SharesDocument3 pagesCost of Redeemable Preference SharesChithra NairNo ratings yet

- Solution 4Document5 pagesSolution 4askdgas50% (2)

- Ebit - Eps Analysis SolutionsDocument14 pagesEbit - Eps Analysis Solutionsvedhanarayanan2404No ratings yet

- Problems and SolutionsDocument7 pagesProblems and SolutionsMohitAhuja50% (2)

- Problems On Lease and Hire PurchaseDocument2 pagesProblems On Lease and Hire Purchase29_ramesh17050% (2)

- Answer Key For Strategic Cost Management MC QuestionsDocument18 pagesAnswer Key For Strategic Cost Management MC QuestionsDalia DelrosarioNo ratings yet

- 1 From The Following Information Prepare A Statement Showing The Working CapitalDocument4 pages1 From The Following Information Prepare A Statement Showing The Working CapitalHarihara PuthiranNo ratings yet

- Income From House Property: Solution To Assignment SolutionsDocument4 pagesIncome From House Property: Solution To Assignment SolutionsAsar QabeelNo ratings yet

- Practice Questions For Schedule III Financial StatementsDocument3 pagesPractice Questions For Schedule III Financial StatementsREEMA MATHIAS67% (3)

- Chapter 7Document19 pagesChapter 7Arun Kumar SatapathyNo ratings yet

- Home Work Section Working CapitalDocument10 pagesHome Work Section Working CapitalSaloni AgrawalNo ratings yet

- Leverages ProblemsDocument4 pagesLeverages Problemsk,hbibk,n50% (2)

- Receivable ManagementDocument39 pagesReceivable ManagementIquesh Gupta100% (1)

- Dividend DecisionDocument4 pagesDividend DecisionKhushi Rani100% (2)

- Chapter 4: LeverageDocument15 pagesChapter 4: LeverageSushant MaskeyNo ratings yet

- Solution:: Present Policy Policy Option 1 Policy Option 2Document2 pagesSolution:: Present Policy Policy Option 1 Policy Option 2Dimple RajpalNo ratings yet

- Lease Question and SolutionDocument7 pagesLease Question and Solutionsajedul100% (1)

- Process Accounts: Normal/Abnormal Loss/Gain: Problems and SolutionsDocument16 pagesProcess Accounts: Normal/Abnormal Loss/Gain: Problems and Solutionspuneet jainNo ratings yet

- Financial Management - Cost of CapitalDocument23 pagesFinancial Management - Cost of CapitalSoledad Perez33% (3)

- 1 Working CapitalDocument63 pages1 Working CapitalDeepika Mittal50% (2)

- Chapter - 3 Short Term FinancingDocument11 pagesChapter - 3 Short Term FinancingmuzgunniNo ratings yet

- Corporate Finance Session-3Document3 pagesCorporate Finance Session-3Pandy PeriasamyNo ratings yet

- Budgetary ControlDocument5 pagesBudgetary ControlJasdeep Singh DeepuNo ratings yet

- Cost AccountingDocument6 pagesCost Accountingchirag shahNo ratings yet

- 10 Capital Budgetting Techniques of Evolution PDFDocument57 pages10 Capital Budgetting Techniques of Evolution PDFVishesh GuptaNo ratings yet

- 2..working Capital Management ProblemsDocument9 pages2..working Capital Management ProblemsAnshu Soumya100% (1)

- Accounting Problems On Joint Venture AccountsDocument6 pagesAccounting Problems On Joint Venture Accountskulvirchanna06No ratings yet

- 68 Practical Questions of House PropertyDocument14 pages68 Practical Questions of House Propertyshrikant100% (1)

- 7 Additional Solved Problems 6Document14 pages7 Additional Solved Problems 6Pranoy SarkarNo ratings yet

- Factoring Problems-SolutionsDocument11 pagesFactoring Problems-SolutionsChinmayee ChoudhuryNo ratings yet

- Working Capital Mgt. - Unit 5Document23 pagesWorking Capital Mgt. - Unit 5DrShailesh Singh Thakur100% (2)

- Joint Products & by ProductsDocument56 pagesJoint Products & by Productsanon_67206536267% (3)

- Activity Based Costing Test QuestionsDocument5 pagesActivity Based Costing Test QuestionsMehul Gupta100% (1)

- Ratios Solved ProblemsDocument8 pagesRatios Solved ProblemsYasser Maamoun50% (2)

- M 5 Problem Set SolutionsDocument9 pagesM 5 Problem Set SolutionsNiyati Shah100% (1)

- Balance of Payments Format and NumericalsDocument10 pagesBalance of Payments Format and NumericalsSarthak Gupta100% (2)

- Working Capital ManagementDocument32 pagesWorking Capital ManagementrutikaNo ratings yet

- Problems On Transfer PricingDocument4 pagesProblems On Transfer Pricingdjgavli11210100% (1)

- Accounting For Managerial DecisionsDocument6 pagesAccounting For Managerial DecisionsKrutika ManeNo ratings yet

- Advance Financial Management AssignmentDocument4 pagesAdvance Financial Management AssignmentRishabh JainNo ratings yet

- Financial ManagementDocument7 pagesFinancial Managementsakshisharma17164No ratings yet

- John Hay PAC vs. Lim Case DigestDocument2 pagesJohn Hay PAC vs. Lim Case DigestJulienne Aristoza100% (1)

- The 1987 Constitution of The Republic of The Philippines: PreambleDocument49 pagesThe 1987 Constitution of The Republic of The Philippines: PreambleJulienne AristozaNo ratings yet

- PI 100 First SessionDocument26 pagesPI 100 First SessionJulienne AristozaNo ratings yet

- Mock Recitation-Characteristic of Criminal LawDocument8 pagesMock Recitation-Characteristic of Criminal LawJulienne AristozaNo ratings yet

- 19th Century PhilippinesDocument18 pages19th Century PhilippinesJulienne Aristoza73% (26)

- Case Analysis - PaperDocument9 pagesCase Analysis - PaperJulienne AristozaNo ratings yet

- Receivables ManagementDocument6 pagesReceivables ManagementJulienne AristozaNo ratings yet

- Case Study HBPDocument20 pagesCase Study HBPJulienne AristozaNo ratings yet

- Strategic Management (Vision Mission, BOD, Corporate Governance)Document48 pagesStrategic Management (Vision Mission, BOD, Corporate Governance)Julienne AristozaNo ratings yet

- 9 Introduction To Variance Analysis and Standard CostsDocument4 pages9 Introduction To Variance Analysis and Standard CostsJulienne AristozaNo ratings yet

- Iloilo As An Investment OpportunityDocument3 pagesIloilo As An Investment OpportunityJulienne AristozaNo ratings yet

- Batch Vs Real Time ProcessingDocument27 pagesBatch Vs Real Time ProcessingJulienne AristozaNo ratings yet

- Business Analysis On BMW's Flexibility StrategyDocument21 pagesBusiness Analysis On BMW's Flexibility StrategyJulienne AristozaNo ratings yet

- A Literary Piece On MancriminationDocument2 pagesA Literary Piece On MancriminationJulienne AristozaNo ratings yet

- Comparison of Quantitative and Qualitative Research Traditions: Epistemological, Theoretical, and Methodological DifferencesDocument16 pagesComparison of Quantitative and Qualitative Research Traditions: Epistemological, Theoretical, and Methodological DifferencesRendorn Guerrin100% (1)

- Role of BOD in Corporate GovernanceDocument9 pagesRole of BOD in Corporate GovernanceJulienne AristozaNo ratings yet

- INSURANCE - NotesDocument18 pagesINSURANCE - NotesJulienne Aristoza100% (1)

- Audit Problems Cash QuizzerDocument3 pagesAudit Problems Cash QuizzerJulienne AristozaNo ratings yet

- Pyhtila KaisaDocument69 pagesPyhtila Kaisaalan brandambassadorNo ratings yet

- Tradersworld 63Document161 pagesTradersworld 63anudora100% (1)

- Costing For Materials and LabourDocument6 pagesCosting For Materials and LabourShriyaNo ratings yet

- CMA April - 14 Exam Question PDFDocument63 pagesCMA April - 14 Exam Question PDFArup Saha50% (2)

- Initiating Price IncreasesDocument5 pagesInitiating Price IncreasesDurgaChaitanyaPrasadKondapalliNo ratings yet

- Module 5 NotesDocument20 pagesModule 5 NotesHarshith AgarwalNo ratings yet

- Hardware Store Sample Business PlanDocument22 pagesHardware Store Sample Business PlanPrince EugoNo ratings yet

- Angelito Alvarez Sales Account Executive LagunaDocument5 pagesAngelito Alvarez Sales Account Executive LagunaRonie CerinoNo ratings yet

- CHP 6. Cost Sheet - CapranavDocument14 pagesCHP 6. Cost Sheet - CapranavMonikaNo ratings yet

- 99 Operations Management Dissertation Topics Research IdeasDocument1 page99 Operations Management Dissertation Topics Research IdeasKyla Jane CaballesNo ratings yet

- Correction of ErrorsDocument2 pagesCorrection of ErrorsJean Emanuel100% (1)

- Block 2 - Updated Ansswer 2019Document25 pagesBlock 2 - Updated Ansswer 2019Ahmad FarooqNo ratings yet

- Session 3-Process Analysis II-V1Document13 pagesSession 3-Process Analysis II-V1Jiny Lee0% (1)

- ABMA 106 - Module 2Document31 pagesABMA 106 - Module 2dendenramos767No ratings yet

- NEW NEGT Company Sup Pres Final (For B2B)Document25 pagesNEW NEGT Company Sup Pres Final (For B2B)Shylesh RaveendranNo ratings yet

- SCM ProjectDocument12 pagesSCM Project49 Modasser Islam EmonNo ratings yet

- Corporate Finance Chapter 001Document35 pagesCorporate Finance Chapter 001thuy37No ratings yet

- Inventories Cost ApproachDocument56 pagesInventories Cost ApproachJD DLNo ratings yet

- Buying and SellingDocument35 pagesBuying and SellingIreneRoseMotas100% (3)

- Theory Strategic DEFDocument33 pagesTheory Strategic DEFNoa Sanchez FerminNo ratings yet

- 1.5.3 Business ObjectivesDocument29 pages1.5.3 Business Objectivesmohammedabunaja10No ratings yet

- Erprfp JPDCLDocument390 pagesErprfp JPDCLanand kumarNo ratings yet

- BMW X1 Media PlanDocument21 pagesBMW X1 Media PlanjustinecristiniNo ratings yet

- Inventory ModelDocument22 pagesInventory ModelJacky Boy Endencio AtienzaNo ratings yet

- R12 General LedgerDocument45 pagesR12 General Ledgerkaushalpatel2767% (6)

- Chapter 2 - PARCORDocument21 pagesChapter 2 - PARCORairajoyminiano16No ratings yet

- 1 Analyse The Impact On Harry's BusDocument1 page1 Analyse The Impact On Harry's Busekemaankhan2009No ratings yet