SP500 Valuation

SP500 Valuation

Uploaded by

streettalk700Copyright:

Available Formats

SP500 Valuation

SP500 Valuation

Uploaded by

streettalk700Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

SP500 Valuation

SP500 Valuation

Uploaded by

streettalk700Copyright:

Available Formats

Macro: SP 500 November 30, 2017

We believe that the chief determinant of future total returns is the relative valuation of the index at the time of purchase. We measure

valuation using the Price/Peak Earnings multiple as advocated by Dr. John Hussman. We believe the main benefit of using peak

earnings is the inherent conservatism it affords: not subject to analyst estimates, not subject to the short-term ebbs and flows of

business, and not subject to short-term accounting distortions. Annualized total returns can be calculated over a horizon period for

given scenarios of multiple expansion or contraction.

Our analysis highlights expansion/contraction to the minimum, mean, average, and maximum multiples (our data-set begins in January

1900) . The baseline assumptions for nominal growth and horizon period are 6% and 10 years, respectively. We also provide graphical

analysis of how predicted returns compare to actual returns historically.

We provide sensitivity analysis to our baseline assumptions. The first sensitivity table, ceterus paribus, shows how future returns are

impacted by changing the horizon period. The second sensitivity table, ceterus paribus, shows how future returns are impacted by

changing the growth assumption.

We also include the following information: duration, over(under)-valuation, inflation adjusted price/10-year real earnings, dividend

yield, option-implied volatility, skew, realized volatility, historical relationships between inflation and p/e multiples, and historical

relationship between p/e multiples and realized returns.

Our analysis is not intended to forecast the short-term direction of the SP500 Index. The purpose of our analysis is to identify the

relative valuation and inherent risk offered by the index currently.

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

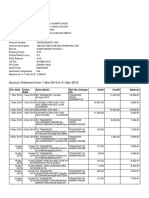

Predicted Returns November 30, 2017

SP 500 Valuation Model: Peak Earnings

Predicted 10-Year Annual Return v Realized

March 1957- Current, Monthly Observations

30.00 30.00

25.00 25.00

20.00 20.00

15.00 15.00

10.00 10.00

5.00 5.00

0.00 0.00

(5.00) (5.00)

(10.00) (10.00)

Predicted 10-Y Annual Return (Maximum Price/Peak Earnings) Predicted 10-Y Annual Return (Average Price/Peak Earnings)

Predicted 10-Y Annual Return (Median Price/Peak Earnings) Predicted 10-Y Annual Return (Minimum Price/Peak Earnings)

Actual Annual Return (RHS)

As of 11/30/2017: If current Price/Peak Earnings of 23.6 expands or contracts to:

Maximum Price/Peak Earnings of 33.5, Predicted Return = 11.32%, Capital Gain 9.77% Dividend 1.55%

Minimum Price/Peak Earnings of 3.0, Predicted Return = -5.71%, Capital Gain -13.87% Dividend 8.16%

Average Price/Peak Earnings of 12.6 Predicted Return = 2.19%, Capital Gain -0.42% Dividend 2.61%

Median Price/Peak Earnings of 12.1, Predicted Return = 1.87%, Capital Gain -0.81% Dividend 2.68%

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

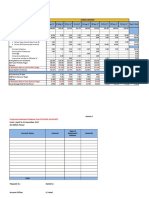

Predicted Returns: Sensitivity Analysis November 30, 2017

Price / Peak Earnings

Time Horizon 3.0 7.0 9.0 11.0 12.1 12.6 14.0 16.0 18.0 21.0 23.0 25.0 27.0 29.0 31.0 33.5

10 (5.71) (2.15) (0.45) 1.07 1.83 2.14 3.05 4.21 5.27 6.70 7.57 8.38 9.14 9.86 10.53 11.32

9 (7.67) (3.41) (1.47) 0.24 1.10 1.45 2.47 3.77 4.96 6.57 7.54 8.45 9.30 10.11 10.87 11.75

8 (10.06) (4.96) (2.74) (0.78) 0.19 0.59 1.75 3.23 4.57 6.40 7.50 8.54 9.50 10.42 11.28 12.28

7 (13.04) (6.92) (4.34) (2.09) (0.97) (0.51) 0.83 2.53 4.08 6.18 7.46 8.65 9.76 10.82 11.82 12.98

6 (16.84) (9.46) (6.44) (3.80) (2.49) (1.95) (0.39) 1.60 3.43 5.89 7.39 8.79 10.11 11.36 12.53 13.91

5 (21.85) (12.89) (9.29) (6.14) (4.57) (3.94) (2.07) 0.33 2.52 5.49 7.30 9.00 10.60 12.11 13.55 15.22

4 (28.75) (17.79) (13.40) (9.55) (7.62) (6.84) (4.53) (1.56) 1.16 4.89 7.17 9.31 11.34 13.26 15.09 17.23

3 (38.77) (25.33) (19.83) (14.95) (12.48) (11.47) (8.49) (4.62) (1.05) 3.89 6.94 9.83 12.57 15.19 17.70 20.64

2 (54.29) (38.29) (31.24) (24.77) (21.42) (20.04) (15.91) (10.46) (5.32) 1.93 6.49 10.87 15.09 19.16 23.10 27.78

1 (78.54) (64.58) (56.28) (47.73) (42.97) (40.94) (34.67) (25.88) (17.04) (3.73) 5.16 14.07 22.99 31.92 40.86 51.88

Price / Peak Earnings

Growth Rate 3.0 7.0 9.0 11.0 12.1 12.6 14.0 16.0 18.0 21.0 23.0 25.0 27.0 29.0 31.0 33.5

0.06 (5.71) (2.15) (0.45) 1.07 1.83 2.14 3.05 4.21 5.27 6.70 7.57 8.38 9.14 9.86 10.53 11.32

0.05 (6.52) (3.04) (1.35) 0.15 0.90 1.20 2.10 3.25 4.30 5.71 6.57 7.38 8.13 8.84 9.51 10.28

0.04 (7.33) (3.92) (2.26) (0.78) (0.04) 0.27 1.15 2.29 3.32 4.73 5.58 6.37 7.12 7.82 8.48 9.25

0.03 (8.15) (4.81) (3.17) (1.71) (0.97) (0.67) 0.20 1.33 2.35 3.74 4.58 5.36 6.10 6.80 7.45 8.21

0.02 (8.96) (5.70) (4.08) (2.63) (1.91) (1.61) (0.75) 0.36 1.38 2.75 3.58 4.36 5.09 5.77 6.42 7.18

0.01 (9.77) (6.58) (4.99) (3.56) (2.84) (2.55) (1.69) (0.60) 0.40 1.76 2.58 3.35 4.07 4.75 5.40 6.14

Valuation Date 11/30/2017

Current Price / Peak Earnings 23.6

Growth Rate 0.06

Time Horizon (Years) 10

Current Dividend Yield 0.0182

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

Price to Peak Earnings November 30, 2017

SP 500 Valuation Model

Price / Peak Earnings

March 1957- Current, Monthly Observations

40.0

35.0

30.0

25.0

20.0

15.0

10.0

5.0

0.0

As of 11/30/2017: Price/Peak Earnings 23.6

To get at the significance of the P/E, you have to start by understanding that stocks are not a claim to earnings anyway. Stocks are a claim to a future stream of

free cash flows the cash that can actually be delivered to shareholders over time after all other obligations have been satisfied, including the provision for future

growth. Knowing this already tells us a lot. For example, price/earnings ratios based on operating earnings are inherently misleading, since that earnings figure

does not deduct interest owed to bondholders nor taxes owed to the government. This isn't to say that P/E ratios are useless, but it's important for the E

chosen by an investor to have a reasonably stable relationship to what matters, which is the long-term stream of free cash flows. For that reason, our favored

earnings measure for market valuation (though it can't be used for individual stocks) is peak earnings - the highest level of net earnings achieved to date.

(Excerpted from Dr. John Hussman)

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

Duration November 30, 2017

SP 500 Valuation Model

Duration In Years (Price / Dividend)

March 1957- Current, Monthly Observations

100.0

90.0

80.0

70.0

60.0

50.0

40.0

30.0

20.0

10.0

0.0

As of 11/30/2017: Duration 55.0 years

In the case of equities, duration measures the percentage change in stock prices in response to a 1% change in the long-term return that stocks are priced to deliver.

So we have a basic financial planning concept. If a buy-and-hold investor with no particular view about market conditions or future returns wishes to have a fairly

predictable amount of wealth at some future date, that investor should hold a portfolio with a duration that is roughly equal to the investment horizon. (Excerpted

from Dr. John Hussman)

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

Valuation November 30, 2017

SP 500 Valuation Model

Relative to 10% Annual Total Return over 10-Year Horizon

March 1957- Current, Monthly Observations

225.000 (5.00)

A

c

200.000 t

u

175.000 a

O

v 0.00 l

e 150.000

r A

(

U n

Y

n P 125.000 n

e

e u

d 5.00 a

r 100.000 a

e r

c l

r

e

)

75.000 H

n

R

V t o

e

a a 50.000 r

10.00 t

l g i

u

u e z

25.000 r

a o

n

t n

i 0.000

O

o 15.00 v

n (25.000) e

r

(50.000)

1

0

(75.000) 20.00

-

Percentage Over(Under) Valued Actual Annual Return

As of 11/30/2017: Overvalued by 108.8%

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

Inflation Adjusted PE November 30, 2017

SP500 Valuation Model

Real Price to 10-Year Real Earnings

March 1957- Current, Monthly Observations

50.0

45.0

40.0

35.0

30.0

25.0

20.0

15.0

10.0

5.0

0.0

As of 11/30/2017: Real Price to 10-Year Real Earnings 31.9x

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

Dividend Yield November 30, 2017

SP 500 Valuation Model

Dividend Yield

March 1957- Current, Monthly Observations

7.00%

6.00%

5.00%

4.00%

3.00%

2.00%

1.00%

0.00%

As of 11/30/2017: Dividend Yield 1.82%

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

Option Implied Volatility November 30, 2017

CBOE VIX Index

10-Day Exponential Moving Average

75.00

11/21/2008, 69.34

65.00

55.00

45.00

10/4/2011, 40.28

10/10/2002, 39.17

35.00

9/2/2015, 26.83

25.00

15.00

7/7/2014, 11.17 11/30/2017, 10.56

2/23/2007, 10.39

5.00

VIX measures 30-day expected volatility of the S&P 500 Index. The components of VIX are near- and next-term put and call

options, usually in the first and second SPX contract months. Near-term options must have at least one week to expiration; a

requirement intended to minimize pricing anomalies that might occur close to expiration.

As of 11/30/2017: 10-Day EMA 10.56

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

Option Skew November 30, 2017

CBOE Skew Index

10-Day Exponential Moving Average

150.00

3/20/2017, 146.57

145.00 6/28/2016, 141.16

1/15/2016, 140.07

140.00 7/14/2014, 137.31

135.00

8/29/2005, 131.14 2/18/2011, 131.07

130.00

125.00

120.00

115.00

11/30/2017, 129.94

110.00

105.00

100.00

The CBOE SKEW Index ("SKEW") is an index derived from the price of S&P 500 tail risk. The price of S&P 500 tail risk is calculated

from the prices of S&P 500 out-of-the-money options. SKEW typically ranges from 100 to 150. A SKEW value of 100 means that

the perceived distribution of S&P 500 log-returns is normal, and the probability of outlier returns is therefore negligible. As SKEW

rises above 100, the left tail of the S&P 500 distribution acquires more weight, and the probabilities of outlier returns become

more significant.

As of 11/30/2017: 10-Day EMA 129.94

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

Realized Volatility November 30, 2017

SP500 Valuation Model

Annualized Volatility

March 1957- Current, Monthly Observations

30.00

25.00

20.00

15.00

10.00

5.00

0.00

As of 11/30/2017: 5.04%

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

Inflation and PE Multiples November 30, 2017

Price to Peak Earnings v %Y/Y CPI

40.00

35.00

P

r

i

c 30.00

e

t

o 25.00

P

e

20.00

a

k

E 15.00

a

r

n

i 10.00

n

g

s

5.00

0.00

(4.00) (2.00) 0.00 2.00 4.00 6.00 8.00 10.00 12.00 14.00 16.00

%Y/Y CPI

1970s 1980s 1990s 2000s 2010s

Lower levels of inflation are rewarded with higher earnings multiples.

Higher levels of inflation are punished with lower earnings multiples.

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

Inflation and PE Multiples November 30, 2017

Price to Peak Earnings v Volatility of %Y/Y CPI

40.00

35.00

P

r

i

c 30.00

e

t

o 25.00

P

e

20.00

a

k

E 15.00

a

r

n

i 10.00

n

g

s

5.00

0.00

0.00 0.50 1.00 1.50 2.00 2.50 3.00

1Y StDev %Y/Y CPI

1970s 1980s 1990s 2000s 2010s

Lower levels of volatility are rewarded with higher earnings multiples.

Higher levels of volatility are punished with lower earnings multiples.

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

PE Multiples and Realized Returns November 30, 2017

Realized Returns v Valuation

20.0

R 15.0

e

a

l

i

z A

n

e 10.0

n

d

u

a

1 l

0

i

Y

z

5.0

e

R d

e

t

u

r

n 0.0

(5.0)

5.00 10.00 15.00 20.00 25.00 30.00 35.00

Price to Peak Earnings

1970s 1980s 1990s 2000s

Lower valuations are rewarded with higher realized returns.

Higher valuations are punished with lower realized returns.

As of 11/30/2017: Price to Peak Earnings 23.6x Average: 12.6x

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

You might also like

- New General Mathematics For Secondary Schools 1 TG Full PDFDocument60 pagesNew General Mathematics For Secondary Schools 1 TG Full PDFMark Juniel Monzon69% (32)

- Cost and Production ToyataDocument3 pagesCost and Production ToyataJayaraj PoojaryNo ratings yet

- Plantilla para Calcular El Coeficiente K2Document4 pagesPlantilla para Calcular El Coeficiente K2Martin Jesus Maguiña CustodioNo ratings yet

- C19a Rio's SpreadsheetDocument8 pagesC19a Rio's SpreadsheetaluiscgNo ratings yet

- Answer Case Study-Smart CityDocument2 pagesAnswer Case Study-Smart CityRizky Almadinah AgustyNo ratings yet

- Corporate Finance: Class Notes 8Document18 pagesCorporate Finance: Class Notes 8Sakshi VermaNo ratings yet

- Advanced Capital Budgeting 3 HW - Q6Document4 pagesAdvanced Capital Budgeting 3 HW - Q6sairad1999No ratings yet

- International Financial Statistics (IFS)Document14 pagesInternational Financial Statistics (IFS)Muhammad Shahzad Ijaz (Mr. IJ)No ratings yet

- ECON254 Lecture3 Costs-SupplyDocument37 pagesECON254 Lecture3 Costs-SupplyKhalid JassimNo ratings yet

- Per AO Level (Sample Illustrative Template) : Period CoveredDocument3 pagesPer AO Level (Sample Illustrative Template) : Period CoveredAnonymous iScW9lNo ratings yet

- Tugas 6 BaprogDocument12 pagesTugas 6 BaprogAndy FadhilaNo ratings yet

- LabFG - 01 Practia 1Document7 pagesLabFG - 01 Practia 1andresmosqueragunadNo ratings yet

- Advanced Capital Budgeting 3 HW - q7Document3 pagesAdvanced Capital Budgeting 3 HW - q7sairad1999No ratings yet

- Startup Finance ModelDocument88 pagesStartup Finance ModelAbhishek AggarwalNo ratings yet

- Ejercicios Tema 3Document48 pagesEjercicios Tema 3Javier RubiolsNo ratings yet

- Jawaban tugas-BAB II-DISTRIBUSI-editDocument3 pagesJawaban tugas-BAB II-DISTRIBUSI-editSarazara IsaNo ratings yet

- Fronton 1 Tajeo 27N Tajeo 27S Tajeo 50N Tajeo 50S Tajeo 60N Tajeo 60S Tajeo 85N Tajeo 85SDocument5 pagesFronton 1 Tajeo 27N Tajeo 27S Tajeo 50N Tajeo 50S Tajeo 60N Tajeo 60S Tajeo 85N Tajeo 85SDannyElbisCatuntaHuisaNo ratings yet

- Lab ManualDocument6 pagesLab ManualNetsi FikiruNo ratings yet

- ESCOBER - SQ2 - Time Value of MoneyDocument48 pagesESCOBER - SQ2 - Time Value of MoneyNike Jericho EscoberNo ratings yet

- Sage One DF PDFDocument10 pagesSage One DF PDFBskkamNo ratings yet

- Statistics: N Valid Missing Mean Std. Error of Mean Median Mode Std. Deviation Variance Range Minimum Maximum SumDocument2 pagesStatistics: N Valid Missing Mean Std. Error of Mean Median Mode Std. Deviation Variance Range Minimum Maximum SumSiti Nur AfifahNo ratings yet

- UTS Statistika & Propabilitas 2019/2020: Program Studi Teknik Informatika Universitas Bumigora Mataram Ubg Mataram 2019Document7 pagesUTS Statistika & Propabilitas 2019/2020: Program Studi Teknik Informatika Universitas Bumigora Mataram Ubg Mataram 2019RSIA PERMATA HATINo ratings yet

- Batch 2Document1 pageBatch 2TRY11E PRIYADHARSHINI.MNo ratings yet

- Euroland - PlanilhaDocument4 pagesEuroland - PlanilhaIsrael VianaNo ratings yet

- Investment CriteriaDocument15 pagesInvestment CriteriaGOWTHAM K KNo ratings yet

- LINFASDocument25 pagesLINFASNani MulyatiNo ratings yet

- ContohcrossDocument3 pagesContohcrossMakarNo ratings yet

- Reuters ProVestor Plus Company ReportDocument20 pagesReuters ProVestor Plus Company ReportDunes BasherNo ratings yet

- Pws Anak 2Document1 pagePws Anak 2Andi SetiawanNo ratings yet

- Taller Esfuerzos GeostaticosDocument1 pageTaller Esfuerzos GeostaticosNicolas BilbaoNo ratings yet

- Consolidation Result Sheet: XXX Civil Engineering DepartmentDocument1 pageConsolidation Result Sheet: XXX Civil Engineering DepartmentMarshallNo ratings yet

- Construction Report Project ManagementDocument7 pagesConstruction Report Project ManagementTony Valdez100% (1)

- 2021-Risk and Rate of Return 2Document62 pages2021-Risk and Rate of Return 2Nur RofiumNo ratings yet

- Solution Key of Quiz 1 Statistics - Mathematics For Mnagment - Fall - 2021 27032022 034720pmDocument4 pagesSolution Key of Quiz 1 Statistics - Mathematics For Mnagment - Fall - 2021 27032022 034720pmhassanmuzammil217No ratings yet

- Micro Eportfolio Monopoly Spreadsheet Data - SPG 18 - FinalDocument4 pagesMicro Eportfolio Monopoly Spreadsheet Data - SPG 18 - Finalapi-302890540No ratings yet

- Which Project Should You Accept and Why?: Chart TitleDocument7 pagesWhich Project Should You Accept and Why?: Chart Titlesohinidas91No ratings yet

- Capital Budgeting Decisions - Great LakeDocument11 pagesCapital Budgeting Decisions - Great LakeHalsa SNo ratings yet

- 1301Document1 page1301Eric HuangNo ratings yet

- Stable DividendDocument6 pagesStable Dividendanon-821638100% (2)

- Reporter: Kenneth B. Dizon Joseph Kent Paring Carlo GillaDocument7 pagesReporter: Kenneth B. Dizon Joseph Kent Paring Carlo GillaLyceljine C. TañedoNo ratings yet

- Topic: Table of SpecificationsDocument5 pagesTopic: Table of Specificationsprincerojas630No ratings yet

- Batch 1Document1 pageBatch 1TRY11E PRIYADHARSHINI.MNo ratings yet

- 7 Psy Chart XLSDocument34 pages7 Psy Chart XLSlakshminarayananNo ratings yet

- Theory of Costs A ReviewerDocument11 pagesTheory of Costs A ReviewerRina SoNo ratings yet

- Financiero SmuckersDocument9 pagesFinanciero SmuckerserickNo ratings yet

- Soil Boring 1Document239 pagesSoil Boring 1Muhammad Rizki SalmanNo ratings yet

- Ratio Analysis CHARTDocument2 pagesRatio Analysis CHARTSaumay BhargavaNo ratings yet

- FrameDesign DocumentDocument12 pagesFrameDesign Documentlaleska moyaNo ratings yet

- Data Demografi: Statistics Pekerjaan SuamiDocument2 pagesData Demografi: Statistics Pekerjaan SuamiAnonymous EVOIHPYNo ratings yet

- SPSS TabulasiDocument4 pagesSPSS TabulasiFeri DanielNo ratings yet

- 5-Year Budget: Indirect Cost Rates 2014-2016Document10 pages5-Year Budget: Indirect Cost Rates 2014-2016Ch Raheel BhattiNo ratings yet

- Bai 2.xlsx De2Document4 pagesBai 2.xlsx De2letruongkhanhdung096No ratings yet

- Precipitaciones MaximasDocument18 pagesPrecipitaciones MaximasEdison Jerson Ramirez ToledoNo ratings yet

- Kitchen Aid Products, Inc., Manufactures Small Kitchen AppliancesDocument7 pagesKitchen Aid Products, Inc., Manufactures Small Kitchen AppliancesGalina FateevaNo ratings yet

- Faisal Mid Excel GraphsDocument5 pagesFaisal Mid Excel Graphsfasi12No ratings yet

- Business Description: XYZ Website TelephoneDocument8 pagesBusiness Description: XYZ Website TelephoneStock PromotionsNo ratings yet

- Solve Splits Feedback ToolDocument6 pagesSolve Splits Feedback ToolkabyaNo ratings yet

- EWMA Cusum Charts Examples Ch09Document4 pagesEWMA Cusum Charts Examples Ch09Diana RuizNo ratings yet

- Output SPSSDocument76 pagesOutput SPSSmuliadin_74426729No ratings yet

- Analisis Univariat: StatisticsDocument3 pagesAnalisis Univariat: StatisticsNadya ParamithaNo ratings yet

- Data KajianDocument3 pagesData KajianfikririansyahNo ratings yet

- AroundTheWorldIn8Pages Q1 2019 LVDocument41 pagesAroundTheWorldIn8Pages Q1 2019 LVstreettalk700No ratings yet

- Greg Morris - 2017 Economic & Investment Summit Presentation - Questionable PracticesDocument53 pagesGreg Morris - 2017 Economic & Investment Summit Presentation - Questionable Practicesstreettalk700No ratings yet

- GTA Introduction RIA ProDocument7 pagesGTA Introduction RIA Prostreettalk700100% (2)

- EmpDocument6 pagesEmpdpbasicNo ratings yet

- Investor Intelligence Techical Analysis GuideDocument25 pagesInvestor Intelligence Techical Analysis Guidestreettalk700No ratings yet

- Summer Market Outlook & ForecastDocument51 pagesSummer Market Outlook & Forecaststreettalk700No ratings yet

- X-Factor Report 1/28/13 - Will The Market Ever Correct?Document10 pagesX-Factor Report 1/28/13 - Will The Market Ever Correct?streettalk700No ratings yet

- Value Investor Forum Presentation 2015 (Print Version)Document29 pagesValue Investor Forum Presentation 2015 (Print Version)streettalk700No ratings yet

- Companies Paying Dividend SP500 - 2007-2015Document8 pagesCompanies Paying Dividend SP500 - 2007-2015streettalk700No ratings yet

- Psychology of Risk-Behavioral Finance PerspectiveDocument28 pagesPsychology of Risk-Behavioral Finance Perspectivestreettalk700No ratings yet

- Unconventional Policies and Their Effects On Financial Markets PDFDocument36 pagesUnconventional Policies and Their Effects On Financial Markets PDFSoberLookNo ratings yet

- Companies Paying Dividend SP500 - 2007-2015Document8 pagesCompanies Paying Dividend SP500 - 2007-2015streettalk700No ratings yet

- A. Gary Shilling's: InsightDocument4 pagesA. Gary Shilling's: Insightstreettalk700100% (1)

- Lacy Hunt - Hoisington - Quartely Review Q1 2014Document5 pagesLacy Hunt - Hoisington - Quartely Review Q1 2014TREND_7425No ratings yet

- GMO Capital Q4 2012 LetterDocument14 pagesGMO Capital Q4 2012 LetterWall Street WanderlustNo ratings yet

- Understanding The Bear CaseDocument17 pagesUnderstanding The Bear Casestreettalk700No ratings yet

- Cycles and Possible OutcomesDocument6 pagesCycles and Possible Outcomesstreettalk700No ratings yet

- The Great American Non-RecoveryDocument10 pagesThe Great American Non-Recoverystreettalk700No ratings yet

- Valuations Suggest Extremely Overvalued MarketDocument9 pagesValuations Suggest Extremely Overvalued Marketstreettalk700No ratings yet

- A Comparison of The Real-Time Performance of Business Cycle Dating MethodsDocument28 pagesA Comparison of The Real-Time Performance of Business Cycle Dating MethodscaitlynharveyNo ratings yet

- Is US Economic Growth OverDocument25 pagesIs US Economic Growth Overstreettalk700No ratings yet

- Personal Finance Webinar Presentation 11/12/2012 Streettalk AdvsiorsDocument19 pagesPersonal Finance Webinar Presentation 11/12/2012 Streettalk Advsiorsstreettalk700No ratings yet

- Is US Economic Growth OverDocument25 pagesIs US Economic Growth Overstreettalk700No ratings yet

- Stem ProjectDocument16 pagesStem Projectapi-314126399No ratings yet

- The Schools Listed Overleaf Have All Been Authorised by Their Local EducationDocument9 pagesThe Schools Listed Overleaf Have All Been Authorised by Their Local Educationjarienza.gehNo ratings yet

- Second Term Exam Revision Worksheet Islamic Grade 5 2Document13 pagesSecond Term Exam Revision Worksheet Islamic Grade 5 2Asmaa HefziNo ratings yet

- Collective ResponsibilityDocument34 pagesCollective ResponsibilityalbertolecarosNo ratings yet

- 35-Article Text-158-1-10-20220424Document8 pages35-Article Text-158-1-10-20220424kelompok 4 Ekonomi lingkunganNo ratings yet

- Mauritius SDG Investor MapDocument17 pagesMauritius SDG Investor Mapabhay.mathurNo ratings yet

- Check Point Engineer TroubleshootingDocument3 pagesCheck Point Engineer TroubleshootingvikrantageorgeNo ratings yet

- Relevant Contracts TaxDocument11 pagesRelevant Contracts TaxTe KruNo ratings yet

- India - Political Divisions and Physical FeaturesDocument61 pagesIndia - Political Divisions and Physical FeaturesemlynjiteshtNo ratings yet

- Fresher Juice Activation PlanDocument14 pagesFresher Juice Activation PlanMalik Muhammad SufyanNo ratings yet

- EST Brochure JordanDocument2 pagesEST Brochure JordanMahmood ShanaahNo ratings yet

- Redefining The Role of The TeacherDocument4 pagesRedefining The Role of The TeacherJavier DominguezNo ratings yet

- 4a's Approach Lesson Plan.Document2 pages4a's Approach Lesson Plan.Ceraz AbdurahmanNo ratings yet

- Syllabus: International Institute of Professional Studies Davv, IndoreDocument13 pagesSyllabus: International Institute of Professional Studies Davv, IndoreKavish SharmaNo ratings yet

- Checklist A1 Version 1.0Document11 pagesChecklist A1 Version 1.0Renzo Diaz DelgadoNo ratings yet

- RoEnRo - Year - II - Nos - 2-3 - February 2014 - June 2015Document177 pagesRoEnRo - Year - II - Nos - 2-3 - February 2014 - June 2015Gabriela PachiaNo ratings yet

- Sujet BTS Anglais 2022Document4 pagesSujet BTS Anglais 2022MoïsetteNo ratings yet

- Economic Nationalism (DoW) (Self)Document7 pagesEconomic Nationalism (DoW) (Self)Shaurya JeetNo ratings yet

- Account Statement From 1 Mar 2019 To 31 Mar 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Mar 2019 To 31 Mar 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSaurabh SinghNo ratings yet

- Core Mantle Change Impact MineDocument211 pagesCore Mantle Change Impact MineVincent J. CataldiNo ratings yet

- Shell Mex House Pearsons PLC History British Intelligence and OilDocument8 pagesShell Mex House Pearsons PLC History British Intelligence and OilJohn Adam St Gang: Crown ControlNo ratings yet

- Lesson Worksheet: 6.1A MeanDocument7 pagesLesson Worksheet: 6.1A Meanwaiman fuNo ratings yet

- Supply Chain Management-PepsiDocument25 pagesSupply Chain Management-PepsiSusrita Sen98% (48)

- Chapter 2 - Examples - SolutionsDocument11 pagesChapter 2 - Examples - SolutionsAhmed walidNo ratings yet

- Hmda Brochure NeopolisDocument33 pagesHmda Brochure NeopolisJohn SharonNo ratings yet

- Questions On Real Options in Capital BudgetingDocument2 pagesQuestions On Real Options in Capital Budgetingjoelmanoj98No ratings yet

- LacosteDocument21 pagesLacosteSunny SharmaNo ratings yet

- Online PP2Document20 pagesOnline PP2Muhammad HanifNo ratings yet