Financial Results Annual 2010 RMWL

Financial Results Annual 2010 RMWL

Uploaded by

Sanjay GulatiCopyright:

Available Formats

Financial Results Annual 2010 RMWL

Financial Results Annual 2010 RMWL

Uploaded by

Sanjay GulatiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Financial Results Annual 2010 RMWL

Financial Results Annual 2010 RMWL

Uploaded by

Sanjay GulatiCopyright:

Available Formats

Media World

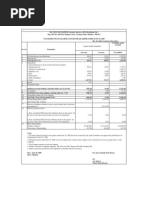

Audited Financial Results for the year ended 31 March 2010 Rs. Lakh

Sr. Particulars 01.04.09 to 01.04.08 to

No. 31.03.10 31.03.09

1 Income

a) Net Sales / Income from Operations 18,007.19 -

b) Other Operational Income 65.27 -

Total Income 18,072.46 -

2 Expenditure

a) Direct Operational Expenses 7,878.36 -

b) Personnel Cost 4,500.74 -

c) Depreciation 1,982.02 0.17

d) Amortisation 1,660.01 -

e) Administration and Other Expenses 7,316.28 1.72

Total Expenditure (a+b+c+d+e) 23,337.41 1.89

3 Profit/(Loss) from Operations before Other Income, Interest & Exceptional items (1-2) (5,264.95) (1.89)

4 Other Income 310.74 -

5 Profit/(Loss) before Interest & Exceptional Items (3+4) (4,954.21) (1.89)

6 Interest Expense / (Income) (net) 2,658.46 (95.03)

7 Profit/(Loss) after Interest before exceptional items (5-6) (7,612.67) 93.14

8 Exceptional Items - -

9 Profit/(Loss) from Ordinary Activities before tax (7-8) (7,612.67) 93.14

10 Tax expense

a) Current Tax - 32.30

b) Deferred Tax - (0.16)

11 Net Profit/(Loss) from Ordinary Activities after tax (9-10) (7,612.67) 61.00

12 Extraordinary Items - -

13 Net Profit/(Loss) for the year (7,612.67) 61.00

14 Paid-up Equity Capital (Face Value Rs.5/- per share) 2,306.31 105.50

15 Reserves excluding Revaluation Reserves (2,964.16) 1,046.07

16a Earnings per share for the year before extra-ordinary Items (in Rupees)

- Basic / Diluted (24.90) 2.89

16b Earnings per share for the year after extra-ordinary Items (in Rupees)

- Basic / Diluted (24.90) 2.89

17 Public Shareholding

- Number of Shares 17,771,170 -

- Percentage of Shareholding 38.53 -

18 Promoters and Promoter Group Shareholding

a) Pledged / Encumbered

- Number of Shares - -

- Percentage of Shares (as a % of the total shareholding of promoter and promoter group) - -

- Percentage of Shares (as a % of the total share capital of the Company) - -

b) Non-encumbered

- Number of Shares 28,355,000 2,110,000

- Percentage of Shares (as a % of the total shareholding of promoter and promoter group) 100.00 100.00

- Percentage of Shares (as a % of the total share capital of the Company) 61.47 100.00

Segmentwise Revenue, Results and Capital Employed for the year ended 31 March 2010

Rs. Lakh

Particulars 01.04.09 to

31.03.10

Segment Revenue

Radio Broadcasting 16,293.68

Outdoor 1,635.96

Others 505.82

18,435.47

Less: Intersegment Revenue 52.26

Total Income 18,383.21

Segment Results (Profit/(Loss) before Interest and Tax)

Radio Broadcasting (3,357.21)

Outdoor (1,468.61)

Others (28.27)

Total Segment Results (4,854.09)

Less: Interest Expense and Finance Charges (net) 2,658.46

Less: Other unallocable expense net of unallocable income 100.12

Total Profit before Tax (7,612.67)

Capital employed (Segment Assets less Segment Liabilities)

Radio Broadcasting 26,261.81

Outdoor 3,482.19

Others (405.10)

Unallocated (29,996.76)

Total (657.86)

Notes :

1 The Honorable High Court of Judicature at Bombay has sanctioned a scheme of Arrangement between the Company and Reliance MediaWorks

Limited {formerly Adlabs Films Limited (AFL)}, towards the demerger of Radio division from AFL and to be vested in the Company with effect from

1 April, 2008. The Statutory accounts of the Company for the year 2008-09 were approved by Shareholders of the Company on 25 May 2009, before

the Scheme was filed with the Registrar of Companies on 30 June 2009, hence the Audited financials of the Company for the year 2008-09 does not

have effect of the Scheme.

2 On 22 July 2009, the Company has received a fresh certificate of incorporation from the Registrar of Companies changing the name of the Company

from Reliance Unicom Limited to Reliance Media World Limited.

3 After the review by the Audit Committee, the Board of Directors of the Company have approved the financial results at its meeting held on 28 May 2010.

4 There were no complaints from the investors pending at the beginning of the quarter.

The number of complaints received and resolved during the quarter were Nil.

5 The Company has not recognised deferred tax asset on the basis of prudence and virtual certainty.

For Reliance Media World Limited

Place : Mumbai

Date : 28 May, 2010 Director

Reliance Media World Limited

Registered Office: 401, 4th Floor, Infiniti, Link Road, Oshiwara, Andheri (West), Mumbai 400 053.

You might also like

- Primer 2015Document18 pagesPrimer 2015pierrefrancNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Accenture Risk Analytics Network Credit Risk AnalyticsDocument16 pagesAccenture Risk Analytics Network Credit Risk AnalyticssuryanshNo ratings yet

- Unitech Consolidated 31-03-10Document3 pagesUnitech Consolidated 31-03-10sriramrangaNo ratings yet

- KIL Result June-2022Document3 pagesKIL Result June-2022akshay kausaleNo ratings yet

- MMFSL Fin Results Q1 F2019 LODR Clause 33 FianlDocument2 pagesMMFSL Fin Results Q1 F2019 LODR Clause 33 FianlIMAM JAVOORNo ratings yet

- March29 AGMDocument4 pagesMarch29 AGMakshay kausaleNo ratings yet

- Publication 30-06-09Document2 pagesPublication 30-06-09SuhasNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- UFRJUNE2014Document1 pageUFRJUNE2014himaNo ratings yet

- Ramco Annual Report 2014Document2 pagesRamco Annual Report 2014nithinNo ratings yet

- q1 09 IOL Netcom ResultsDocument1 pageq1 09 IOL Netcom ResultsmixedbagNo ratings yet

- Nuvama Board Report 22 23 25 JAN 2024Document90 pagesNuvama Board Report 22 23 25 JAN 2024cheatersoul7No ratings yet

- Report of The DirectorsDocument5 pagesReport of The Directorspeter9836935619No ratings yet

- December23 AGMDocument2 pagesDecember23 AGMakshay kausaleNo ratings yet

- Cash Flow Statement ConsolidatedDocument2 pagesCash Flow Statement Consolidatedsamarth rajvaidNo ratings yet

- Go Digit General Insurance Limited Financials Income StatementDocument3 pagesGo Digit General Insurance Limited Financials Income StatementShuchita AgarwalNo ratings yet

- Consolidated Balance Sheet For Hindustan Unilever LTDDocument11 pagesConsolidated Balance Sheet For Hindustan Unilever LTDMohit ChughNo ratings yet

- Ai CF 14-15Document1 pageAi CF 14-15subhash dalviNo ratings yet

- Final CMADocument6 pagesFinal CMAManjari AgrawalNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- December22 AGMDocument2 pagesDecember22 AGMakshay kausaleNo ratings yet

- Uco BankDocument8 pagesUco BankRishabh KumarNo ratings yet

- The Statement of Profit or Loss and Other Comprehensive Income Textbook Pages: 115 - 136Document29 pagesThe Statement of Profit or Loss and Other Comprehensive Income Textbook Pages: 115 - 136Cheuk Ying NicoleNo ratings yet

- CFS Sample Project - 2Document6 pagesCFS Sample Project - 2Riya JainNo ratings yet

- Annual Report FY 2022 23Document4 pagesAnnual Report FY 2022 23Piyush PalawatNo ratings yet

- SCABAA 2021-2023 - TAADocument6 pagesSCABAA 2021-2023 - TAAlgubontoc accountingNo ratings yet

- Result September 2012Document1 pageResult September 2012akshay kausaleNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Cipla - Unaudited Fin Result For The Quarter Ended 30th June 2010Document4 pagesCipla - Unaudited Fin Result For The Quarter Ended 30th June 2010thelostbardNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Eastern Coalfields LimitedDocument9 pagesEastern Coalfields LimitedSyed Shamiul HaqueNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Consolidated Q4Document6 pagesConsolidated Q4Qazi MudasirNo ratings yet

- Mar 12Document1 pageMar 12akshay kausaleNo ratings yet

- ESTADOS fINANCIEROS SUPERMERCADOS DIADocument42 pagesESTADOS fINANCIEROS SUPERMERCADOS DIARichard NavarroNo ratings yet

- DPL Annual Report 2022 23 PagesDocument1 pageDPL Annual Report 2022 23 Pagesworkf17hoursformeNo ratings yet

- Unaudited Financial 0608Document3 pagesUnaudited Financial 0608manish_khabarNo ratings yet

- Cash Flow Statement 2019-2020 CCLDocument2 pagesCash Flow Statement 2019-2020 CCLAmit SinghNo ratings yet

- Akamai Model Iteration 1Document187 pagesAkamai Model Iteration 1philip18chiuNo ratings yet

- Consolidated Cash Flow StatementDocument2 pagesConsolidated Cash Flow Statementshikhamit20No ratings yet

- Consolidated Financial Statements As of December 31 2020Document86 pagesConsolidated Financial Statements As of December 31 2020Raka AryawanNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- The Procter & Gamble Company Consolidated Statements of EarningsDocument5 pagesThe Procter & Gamble Company Consolidated Statements of EarningsJustine Maureen AndalNo ratings yet

- Q4FY19 Press TableDocument9 pagesQ4FY19 Press TableSumit SharmaNo ratings yet

- Asian Paints Annual Report 2016-17Document2 pagesAsian Paints Annual Report 2016-17Amit Pandey0% (1)

- 2017 Revenues 41,381 40,859: (In Millions of Euros, Except For Per Share Data)Document37 pages2017 Revenues 41,381 40,859: (In Millions of Euros, Except For Per Share Data)Cristina PascariNo ratings yet

- TML Ir Ar 2018 19Document1 pageTML Ir Ar 2018 19SRINIDHI PEESAPATINo ratings yet

- The Catholic Syrian Bank LimitedDocument2 pagesThe Catholic Syrian Bank Limitedsaravanan aNo ratings yet

- InvestorPresentation-1H2016vFpinang CoalDocument20 pagesInvestorPresentation-1H2016vFpinang CoalHendry ChristiantoNo ratings yet

- integrated-annual-report-2022-23-155-156-cropped (1)Document2 pagesintegrated-annual-report-2022-23-155-156-cropped (1)sureshfck32No ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- 1272380424153-SEBI - FORMAT March2010Document5 pages1272380424153-SEBI - FORMAT March2010Harshitha UchilNo ratings yet

- Capgemini - 2024-02-20 - 2023 Consolidated Financial StatementsDocument67 pagesCapgemini - 2024-02-20 - 2023 Consolidated Financial Statementshabiyek787No ratings yet

- Scabaa 2021-2023 - TaytaganDocument6 pagesScabaa 2021-2023 - Taytaganlgubontoc accountingNo ratings yet

- Indian Oil (Cfs) Profit and Loss_2023Document1 pageIndian Oil (Cfs) Profit and Loss_2023Kamla JainNo ratings yet

- Indian Oil (CFS) Profit and Loss - 2023Document1 pageIndian Oil (CFS) Profit and Loss - 2023kavyagarg8542No ratings yet

- Devon Q4-2019-DVN-Supplemental-TablesDocument11 pagesDevon Q4-2019-DVN-Supplemental-TablesMiguel RamosNo ratings yet

- Central Coalfields Limited: Consolidated Cash Flow Statement (Indirect Method) For The Year Ended 31st March, 2020Document2 pagesCentral Coalfields Limited: Consolidated Cash Flow Statement (Indirect Method) For The Year Ended 31st March, 2020Amit SinghNo ratings yet

- First Quarter Financial Statement and Dividend AnnouncementDocument9 pagesFirst Quarter Financial Statement and Dividend Announcementkelvina_8No ratings yet

- FAD 2022 - Dr. Lisa Su - Opening Final PostDocument38 pagesFAD 2022 - Dr. Lisa Su - Opening Final PostVashishth DudhiaNo ratings yet

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- Revuto Whitepaper v1.9Document49 pagesRevuto Whitepaper v1.9mberchtoldNo ratings yet

- Merger Between HDFC Bank and Times BankDocument4 pagesMerger Between HDFC Bank and Times BankFaisal Balsharaf0% (1)

- Cacn040 Test 3 - 2023 Suggested Solution - 008Document18 pagesCacn040 Test 3 - 2023 Suggested Solution - 008Given RefilweNo ratings yet

- Modified Industrial Infrastructure Upgradation SchemeDocument1 pageModified Industrial Infrastructure Upgradation SchemeAYUSH RAINo ratings yet

- In Other Words, Given The Choice Between Two Equally Risky Investments, An Investor WillDocument6 pagesIn Other Words, Given The Choice Between Two Equally Risky Investments, An Investor WillOumer ShaffiNo ratings yet

- Sharath Chandra.M.S. Vinoth Babu Vinoth Arumugam Avudaipan Ramiah Dinesh MuthuDocument27 pagesSharath Chandra.M.S. Vinoth Babu Vinoth Arumugam Avudaipan Ramiah Dinesh MuthuAvudaiappan RamNo ratings yet

- AUG 2023 PaySlipDocument1 pageAUG 2023 PaySlipts.hcltechbee2022No ratings yet

- Corporation Consideration To Share Capital Quiz 1Document7 pagesCorporation Consideration To Share Capital Quiz 1ycalinaj.cbaNo ratings yet

- Year 0 1 2 3: Investment Done - 9 Cash Flow Operation 3 3 2 Salvage Value 5 Total Cash Flow - 9 3 3 7Document3 pagesYear 0 1 2 3: Investment Done - 9 Cash Flow Operation 3 3 2 Salvage Value 5 Total Cash Flow - 9 3 3 7Rubab IqbalNo ratings yet

- Pract 1Document22 pagesPract 1Ros Yaj NivrameNo ratings yet

- Global Ime Bank 2013Document34 pagesGlobal Ime Bank 2013Keshab PandeyNo ratings yet

- Nikhil ProjectDocument76 pagesNikhil Project81 AMOGH WAINGANKARNo ratings yet

- Adv Accts 100ADocument9 pagesAdv Accts 100ASurajNo ratings yet

- Seminar Questions Set II-1Document4 pagesSeminar Questions Set II-1fanuel kijojiNo ratings yet

- Internship Report On: "Foreign Remittance of Prime Bank LTD"Document7 pagesInternship Report On: "Foreign Remittance of Prime Bank LTD"Md Khaled NoorNo ratings yet

- Empowerment Technology Project 2Document2 pagesEmpowerment Technology Project 2Jacinthe Angelou D. PeñalosaNo ratings yet

- Lecture4 - Investment Decision Rules S22023Document38 pagesLecture4 - Investment Decision Rules S22023gregNo ratings yet

- Is There A Future For The EU After The Crisis?: Olaf CrammeDocument14 pagesIs There A Future For The EU After The Crisis?: Olaf CrammeVishal JainNo ratings yet

- Base Institute - Namakkal - PH: 900 37 111 66: - Mock - Ibpsguide.in - 1Document288 pagesBase Institute - Namakkal - PH: 900 37 111 66: - Mock - Ibpsguide.in - 1Kartik MaheshwariNo ratings yet

- IDBI Federal Life InsuranceDocument44 pagesIDBI Federal Life InsuranceChithra LekhaNo ratings yet

- Islamic Banking in Bangladesh Current ST PDFDocument25 pagesIslamic Banking in Bangladesh Current ST PDFAbuzar GifariNo ratings yet

- CBR Proposals Regarding Accounting For Cryptocurrencies in Accordance With Romanian Accounting A65Document14 pagesCBR Proposals Regarding Accounting For Cryptocurrencies in Accordance With Romanian Accounting A65luisNo ratings yet

- 16 - Thesis Outline - Capital in CashDocument2 pages16 - Thesis Outline - Capital in CashPhuc Hoang DuongNo ratings yet

- Fundamentals of Accounting 1 Week 1 OnlineDocument10 pagesFundamentals of Accounting 1 Week 1 OnlineJuline Ashley A CarballoNo ratings yet

- P& L and Balancesheet QuestionsDocument5 pagesP& L and Balancesheet Questionsshubhanshu1204No ratings yet

- Turkish Report 2019Document80 pagesTurkish Report 2019Menekşe UçaroğluNo ratings yet

- Credit by Debraj RayDocument35 pagesCredit by Debraj RayRigzin YangdolNo ratings yet

- An Analytical Study of Foreign Direct InvestmentDocument19 pagesAn Analytical Study of Foreign Direct InvestmentNeha SachdevaNo ratings yet