Manual of Accounting Principles New

Manual of Accounting Principles New

Uploaded by

Gul Muhammad NoonariCopyright:

Available Formats

Manual of Accounting Principles New

Manual of Accounting Principles New

Uploaded by

Gul Muhammad NoonariOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Manual of Accounting Principles New

Manual of Accounting Principles New

Uploaded by

Gul Muhammad NoonariCopyright:

Available Formats

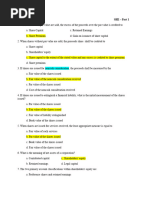

Manual of Accounting Principles Table of Contents

TABLE OF CONTENTS

1 OVERVIEW - PURPOSE AND SCOPE OF THE MANUAL 1.1

1.1 Purpose of the Manual 1.2

1.2 Structure of the Manual 1.3

1.2.2 Reader guidance 1.3

1.3 Authority, applicability, distribution and maintenance of the Manual 1.4

1.3.1 Authority 1.4

1.3.2 Effective date 1.4

1.3.3 Coverage 1.4

1.3.4 Compliance 1.5

1.3.5 Distribution, maintenance and update 1.5

1.3.6 Explanatory note 1.6

2 ACCOUNTING CONCEPTS 2.1

2.1 Consolidated Fund and Public Account 2.2

2.1.1 Introduction 2.2

2.1.2 Certain funds and accounts to be kept by Governments 2.2

2.1.3 Consolidated Fund 2.2

2.1.4 Public Account 2.2

2.1.5 Explanatory note 2.3

2.2 Accounting Model 2.5

2.2.1 Introduction 2.5

2.2.2 Accounting elements 2.5

2.2.3 Revenues 2.5

2.2.4 Expenditure and commitments 2.5

2.2.5 Assets 2.6

2.2.6 Liabilities 2.7

2.2.7 Equity 2.7

2.2.8 Double entry book keeping 2.7

2.2.9 Classification of transactions 2.7

2.2.10 Explanatory note 2.7

2.3 Internal Control 2.11

2.3.1 Introduction 2.11

2.3.2 Definition 2.11

2.3.3 Explanatory note 2.11

2.4 Budgeting 2.12

2.4.1 Introduction 2.12

2.4.2 Budgeting 2.12

2.4.3 Explanatory note 2.12

3 ACCOUNTING POLICIES 3.1

3.1 Accounting period 3.2

3.1.1 Introduction 3.2

Issued 13-Feb-99May 2005 Page 2 Mastermap.doc

Manual of Accounting Principles Table of Contents

3.1.2 Accounting period 3.2

3.1.3 Explanatory note 3.2

3.2 Accounting records 3.3

3.2.1 Introduction 3.3

3.2.2 Definition 3.3

3.2.3 Making of proper entries 3.3

3.2.4 Errors omission and corrections 3.3

3.2.5 Maintenance of accounting records 3.3

3.2.6 Minimum periods for retention 3.4

3.3 Accounting elements 3.5

3.3.1 Introduction 3.5

3.3.2 Assets 3.5

3.3.3 Liabilities 3.5

3.3.4 Equity 3.6

3.3.5 Revenues 3.7

3.3.6 Expenses 3.7

3.3.7 Explanatory note 3.8

3.4 Banking 3.11

3.4.1 Introduction 3.11

3.4.2 Banking 3.11

3.5 Reporting 3.13

3.5.1 Introduction 3.13

3.5.2 Reporting 3.13

3.5.3 Explanatory note 3.13

3.6 Inter entity transactions 3.16

3.6.1 Introduction 3.16

3.6.2 Inter entity transactions 3.16

4 ORGANISATION OF FINANCIAL AND ACCOUNTING RESPONSIBILITIES

4.1

4.1 Financial and accounting responsibilities of the Public Accounts Committee 4.2

4.1.1 Responsibilities 4.2

4.1.2 Constitution 4.2

4.1.3 Accountability 4.2

4.2 Financial and accounting responsibilities of the Auditor-General’s Office 4.3

4.2.1 Responsibilities 4.3

4.2.2 Accountability 4.4

4.3 Financial and accounting responsibilities of the Office of the Controller General of

Accounts 4.5

4.3.1 Responsibilities 4.5

4.3.2 Accountability 4.6

4.4 Financial and accounting responsibilities of the Accountants-Generals’ Offices 4.7

4.4.1 Responsibilities 4.7

4.4.2 Accountability 4.7

4.4.3 Explanatory note 4.7

Issued 13-Feb-99May 2005 Page 3 Mastermap.doc

Manual of Accounting Principles Table of Contents

4.5 Financial and accounting responsibilities of the Ministry of Finance - Finance Division

(Federal) / Department (Provincial) 4.8

4.5.1 Responsibilities 4.8

4.5.2 Accountability 4.8

4.6 Financial and accounting responsibilities of the Central Board of Revenue 4.9

4.6.1 Responsibilities 4.9

4.6.2 Accountability 4.9

4.6.3 Explanatory Note 4.9

4.7 Financial and accounting responsibilities of the State Bank of Pakistan and its agent/s

4.10

4.7.1 Responsibilities 4.10

4.7.2 Explanatory note 4.10

4.8 Financial and accounting responsibilities of centralised accounting entities. 4.11

4.8.1 Responsibilities 4.11

4.8.2 Determination of entities to be included in Schedule 1 & 2 of this Manual. 4.11

4.9 Financial and accounting responsibilities of Schedule 1 entities 4.12

4.9.1 Responsibilities 4.12

4.9.2 Determination of entities to be listed in Schedule 1 4.12

5 FINANCIAL AND ACCOUNTING RESPONSIBILITIES OF

ADMINISTRATIVE FINANCIAL AND ACCOUNTS OFFICERS 5.1

5.1 Financial and accounting responsibilities of financial officers 5.2

5.2 Financial and accounting responsibilities of Principal Accounting Officers 5.3

5.2.1 Position 5.3

5.2.2 Definition 5.3

5.2.3 Responsibilities 5.3

5.2.4 Accountability 5.3

5.2.5 Explanatory note 5.3

5.3 Financial and accounting responsibilities of the Financial Adviser 5.4

5.3.1 Position 5.4

5.3.2 Definition 5.4

5.3.3 Responsibilities 5.4

5.3.4 Accountability 5.4

5.3.5 Explanatory note 5.4

5.4 Financial and accounting responsibilities of Finance and Accounts Officers 5.5

5.4.1 Position 5.5

5.4.2 Definition 5.5

5.4.3 Responsibilities 5.5

5.4.4 Accountability 5.5

5.5 Financial and accounting responsibilities of Internal Audit Officer 5.6

5.5.1 Position 5.6

5.5.2 Definition 5.6

5.5.3 Responsibilities 5.6

5.5.4 Accountability 5.6

5.6 Financial and accounting responsibilities of Project Director 5.7

5.6.1 Position 5.7

Issued 13-Feb-99May 2005 Page 4 Mastermap.doc

Manual of Accounting Principles Table of Contents

5.6.2 Definition 5.7

5.6.3 Responsibilities 5.7

5.6.4 Accountability 5.7

5.7 Financial and accounting responsibilities of Auditor-General of Pakistan 5.8

5.7.1 Position 5.8

5.7.2 Definition 5.8

5.7.3 Responsibilities 5.8

5.7.4 Accountability 5.8

5.8 Financial and accounting responsibilities of Controller General of Accounts 5.9

5.8.1 Position 5.9

5.8.2 Definition 5.9

5.8.3 Responsibilities 5.9

5.8.4 Accountability 5.9

5.9 Financial and accounting responsibilities of Accountants-General 5.10

5.9.1 Position 5.10

5.9.2 Definition 5.10

5.9.3 Responsibilities 5.10

5.9.4 Accountability 5.10

6 SCHEDULE 1 - SELF ACCOUNTING ENTITIES 6.1

6.1 Schedule of self accounting entities 6.2

7 SCHEDULE 2 - EXEMPT ENTITIES 7.1

7.1 Schedule of exempt entities 7.2

Issued 13-Feb-99May 2005 Page 5 Mastermap.doc

Manual of Accounting Principles Overview

1 Overview - purpose

and scope of the

Manual

Issued May 2005 Page1 overfin.doc

Manual of Accounting Principles Overview

1.1 Purpose of the Manual

1.1.1.1 The purpose of this Manual is to:

set out the accounting principles to be used in accounting for the

transactions of centralised and self accounting entities within the control

of the Federal and Provincial Government. It excludes exempt entities as

defined in Schedule two of this manualManual

outline the roles and accountability of specified organisations and officers

of the centralised accounting and self accounting entities

1.1.1.2 This manual will cover the Principles, Policies and Procedures in relation to

Centralised Accounting Entities and will only lay down the Principles for Self

Accounting Entities because the Policies and Procedures for Self Accounting

Entities are covered by their individual rules and regulations.

1.1.1.3 This Manual defines the framework within which accounting transactions are to

be treated and recorded, and accounting and financial responsibilities are to be

assigned.

1.1.1.4 Detailed accounting policies and procedures are contained in the Accounting

Policies and Procedures Manual. Reference should be made to the Accounting

Policies and Procedures Manual, Financial Reporting Manual, Chart of

Accounts, Manual of External Reporting Requirements in determining the rules

and procedures for the treatment and recording of specific transactions.

1.1.1.5 Documents relevant to accounting and financial management of centralised

accounting and self accounting entities include:

Chart of Accounts

Delegation of Financial Power under the Financial Rules

Rules of Business

Accounting Policies and Procedures Manual

General Financial Rules

Federal/Provincial Treasury Rules

Financial Reporting Manual

Manual of External Reporting Requirements

Issued May 2005 Page2 overfin.doc

Manual of Accounting Principles Overview

1.2 Structure of the Manual

1.2.1.1 This Manual is in three parts.

1.2.1.2 The first part of this Manual, comprising section 1, provides an overview of the

purpose and scope of this Manual.

1.2.1.3 The second part of this Manual, comprising sections 2 and 3, sets out the

accounting principles to be used by centralised accounting and self accounting

entities and upon which the detailed policies and procedures contained in the

Accounting Policies and Procedures Manual are based.

1.2.1.4 The third part of this Manual, comprising sections 4 and 5, outlines the financial

and accounting responsibilities of specified organisations and financial officers

1.2.1.5 There are two Schedules attached to this Manual.

1.2.1.5.1 Schedule 1 is a list of all self accounting entitiesdetails examples of

Self Accounting Entities.

1.2.1.5.2 Schedule 2 is a list of all exempt entitiesdetails examples of

Exempt Entities.

1.2.2 Reader guidance

1.2.2.1 The organisation of the sections, headings and sub headings is shown in the

Table of Contents at the front of this Manual.

1.2.2.2 The layout of each page within this Manual is standardised. The title of the

Manual and the name of the chapter are displayed in the top left and right

corners of each page respectively. The footer for each page contains the issue

date, page number and file reference.

1.2.2.3 Each section of this Manual has the principles appearing at the front of the

section. Any detailed or additional explanation and guidance is contained in the

“Explanatory notes” subsection. Principles should not be interpreted without

first making reference to the explanatory notes.

Issued May 2005 Page3 overfin.doc

Manual of Accounting Principles Overview

1.3 Authority, applicability, distribution and maintenance of the Manual

1.3.1 Authority

1.3.1.1 This Manual is issued to set out the accounting principles in accordance with

which the accounts of the federation and the provinces shall be kept, in

pursuance of article, 170 of the Constitution of Islamic Republic of Pakistan.

1.3.2 Effective date

1.3.2.1 The effective date for application of this Manual is the date of issue of the

Manual by the Auditor-General.

1.3.2.2 All accounting entities will have up to two financial years (commencing from 1

July subsequent to the effective date of release) to be in full compliance with this

Manual.

1.3.3 Coverage

Accounting entity

1.3.3.1 An accounting entity is any unit of Government (eg. ministry, division, and

department), whose principal source of funding is an appropriation from the

Federal and Provincial Governments, which prepares input to the accounting

system and which is not defined in Schedule 2 of this Manual.

1.3.3.2 There are two types of accounting entities, namely centralised accounting

entities and self accounting entities.

Centralised accounting entities

1.3.3.3 A centralised accounting entity is any accounting entity for whom the

Accountant-Generaloffice of the Controller General of Accounts has primary

responsibility for the accounting and reporting function of that entity.

1.3.3.4 Unless specifically stated otherwise the term accounting entity will include all

centralised accounting entities.

Self accounting entities

1.3.3.5 A self accounting entity is any accounting entity for whom the Principal

Accounting Officer has primary responsibility for the accounting and reporting

functions. A list of these entities is contained in Schedule 1 of this Manual.

1.3.3.6 Unless specifically stated otherwise, the term accounting entity will include all

self accounting entities.

Exempt entities

1.3.3.7 An exempt entity is any entity defined in Schedule 2 of this Manual.

1.3.3.8 The term accounting entity excludes exempt entities.

Issued May 2005 Page4 overfin.doc

Manual of Accounting Principles Overview

1.3.4 Compliance

1.3.4.1 Compliance with the Manual is mandatory for all accounting entities.

1.3.4.2 In the event that a guideline in this Manual conflicts with other Manuals,

directives or practices, other than those amending this Manual, the guidance in

this Manual will prevail.

1.3.4.3 Accounting entities are not authorised to implement accounting principles in

conflict with, or contrary to, those set out in this Manual.

1.3.4.4 Sections 5 4 and 6 5 covering the “Organisation of Financial and Accounting

Responsibilities” and the “Financial and Accounting Responsibilities of Financial

Officers” provide specific guidance as to the accounting and financial

management responsibilities of key organisations and financial officers.

1.3.4.5 The guidance contained in sections 6 and 74 and 5 are in addition to, and in no

way negate or replace those responsibilities and accountabilities contained in the

Delegation of Financial Power under the Financial Rules, the Authorities

Manual, the Rules of Business and any other directives issued by a competent

authority.

1.3.5 Distribution, maintenance and update

1.3.5.1 The Auditor-General of Pakistan will be responsible for:

the initial issue of the Manual to all Principal Accounting Officers of

accounting entities

1.3.5.2 The Controller General of Accounts will be responsible for:

the maintenance and update of the Manual, including distribution of any

updates or amendments to all Principal Accounting Officers of

accounting entities. However, where a change to methods and principles

defined in NAM is to be introduced, this will be updated/changed in

consultation with the Auditor General of Pakistan.

1.3.5.3 The Auditor-General of Pakistan will be responsible for:

the initial issue of the Manual to all Principal Accounting Officers of

accounting entities

the maintenance and update of the Manual, including distribution of any

updates or amendments to all Principal Accounting Officers of

accounting entities

1.3.5.4 For all accounting entities, the Principal Accounting Officer will ensure that:

initial copies of the Manual are distributed to all finance and accounts

officers within the accounting entity

all subsequent updates and amendments of the Manual are distributed to

all finance and accounts officers within the accounting entity

Issued May 2005 Page5 overfin.doc

Manual of Accounting Principles Overview

1.3.6 Explanatory note

Statutory and legal requirement for compliance

1.3.6.1 Compliance with the directives and principles contained in this Manual are

mandatory as the principles and directives contained in this Manual have been

issued under the the Pakistan (Audit and Accounts) Order 1973Ordinance 2001.

The powers and functions of Auditor General of Pakistan are contained in

Auditor General’s (Functions, Powers and Terms and Conditions of Service)

Ordinance 2001, while the powers and functions of Controller General of

Accounts are contained in Controller General of Accounts (Appointment,

Functions and Powers) Ordinance 2001.

1.3.6.2 The Ordinance 2001 for the Controller General of Accounts provides that the

Controller General of Accounts will prepare and maintain the accounts of the

Federation, the Provinces and district governments in such forms and in

accordance with such methods and principles as the Auditor-General may, with

the approval of the President, prescribe from time to time. The Pakistan (Audit

and Accounts) Order 1973, provides that the Auditor-General will be

responsible for keeping the accounts of the Federation and of each Province,

other than certain specified entitiesThe Ordinance 2001 for the Auditor General

of Pakistan provides that the Auditor General will certify accounts of

Federation, of each Province and of each district. The two Order Ordinances

areis issued subsequent to Article 170 of the Constitution of the Islamic

Republic of Pakistan which states that “the accounts of the Federation and of

the Provinces shall be kept in such form and in accordance with such principles

and methods as the Auditor-General may, with the approval of the President

prescribe”.

Note: The Pakistan Audit and Accounts Order 1973 will be substituted by “ Pakistan Audit and

Accounts Act” when passed by the Parliament.

Issued May 2005 Page6 overfin.doc

Manual of Accounting Principles Accounting concepts

2 Accounting concepts

Issued12/02/2019 May 2005 Page 1 concfin.doc

Manual of Accounting Principles Accounting concepts

2.1 Consolidated Fund and Public Account

2.1.1 Introduction

2.1.1.1 The purpose of this section is to define and detail the principles upon which the

Consolidated Fund and Public Account are established and operate.

2.1.2 Certain funds and accounts to be kept by Governments

2.1.2.1 Each Provincial Government and the Federal Government will maintain a

Consolidated Fund and a Public Account.

2.1.2.2 Each Local Government shall have a Fund and a Public Account as defined in

the Local Government Ordinance 2001 (Chapter XII LGO 2001).

2.1.3 Consolidated Fund

Definition

2.1.3.1 All moneys received, all loans raised and all moneys received in repayment of

any loan by the Government, will form the Consolidated Fund of the

Government.

Schedule of Authorised Expenditure

2.1.3.2 No expenditures will be met from the Consolidated Fund unless specified in a

duly approved “Schedule of Authorised Expenditure”.

2.1.4 Public Account

Definition

2.1.4.1 The following moneys will form the Public Account:

received by or on behalf of the Government, other than those belonging

to the Consolidated Fund

deposited with the Supreme / High Court or any other court established

under authority of the Government

collected by the Local Government on behalf of other parties or held in

trust for a special purpose are not available for annual appropriation.

Expenditure from and receipts to the Public Account

2.1.4.2 All receipts and withdrawals from the Public Account will be regulated by Act

of Parliament or in the absence of such an Act, shall be determined by rules

made by the President / Governor.

Issued12/02/2019 May 2005 Page 2 concfin.doc

Manual of Accounting Principles Accounting concepts

2.1.5 Explanatory note

Constitutional requirements

2.1.5.1 Articles 78 and 118 of the Constitution of the Islamic Republic of Pakistan

provide that each Provincial Government and the Federal Government will

maintain a Consolidated Fund and Public Account. The Local Government

Ordinance 2001 provides that each Local Government will maintain a Fund and

Public Account.

2.1.5.2 The Constitution further provides that:

all moneys received by that Government, all loans raised by that

Government and all moneys received by it in repayment of any loan will

form part of that Fund

all other moneys, other than those belonging to the Consolidated Fund

will form the Public Account

2.1.5.3 Articles 83 and 123 determine that no expenditure may be incurred upon the

Consolidated Fund unless it has been duly authenticated. Expenditure is deemed

to be duly authenticated if, and only if:

it has been specified in the “Schedule of Authorised Expenditure” (the

Schedule being the grants made or deemed to have been made by the

National / Provincial Assembly, in accordance with Articles 82 and 122)

the Schedule has been signed by the Prime Minister / Chief Minister

the Schedule has been laid before the National / Provincial Assembly.

2.1.5.4 The “Schedule of Authorised Expenditure” is valid for that financial year only

(Article 80 and 120).

2.1.5.5 Articles 79 and 119 state that all receipts into and withdrawals from the Public

Account require an Act of Parliament or in the absence of such an Act, rules

made by the President / Governor.

Consolidated Fund - role and function

2.1.5.6 The Consolidated Fund is the operating account of the Government, the balance

of which is available for appropriation against the general operations of

Government.

Public Account - role and function

2.1.5.7 The Public Account consists of those specific purpose moneys for which the

Government has a statutory or other obligation to account for, but which are

not available for appropriation against the general operations of Government.

The Public Account will therefore consist of a series of accounts, each of which

will have specific rules governing its operation.

Issued12/02/2019 May 2005 Page 3 concfin.doc

Manual of Accounting Principles Accounting concepts

Consolidated Fund - modified cash, accrual accounting and the Schedule

of Authorised Expenditure

2.1.5.8 It is a requirement of the Constitution that no expenditure from the

Consolidated Fund shall be deemed to be duly authorised unless it is specified in

the Schedule of Authorised Expenditure.

2.1.5.9 The Constitution also requires that the Schedule of Authorised Expenditure

lapse with the passing of each financial year.

2.1.5.10 However, as expenditure can only be charged against the Consolidated

Fund when a cash payment is made. This in no way precludes commitments and

accruals being recognised and brought to account, as they are recognised

against an non-cash or accrual item eg. commitments or creditors, not against

the Consolidated Fund (until such time as the cash payment is made).

2.1.5.11 While the Constitution does not preclude the bringing to account of

accruals or commitments, it does prevent the accruals or commitments from

being paid against a prior year’s Schedule of Authorised Expenditure. For this

reason, entities with accruals or commitments from a previous period should

ensure that they have allowed for the payment of these accruals and

commitments against that year’s Schedule of Authorised Payments.

Issued12/02/2019 May 2005 Page 4 concfin.doc

Manual of Accounting Principles Accounting concepts

2.2 Accounting Model

2.2.1 Introduction

2.2.1.1 The purpose of this section is to outline the accounting model for the

application of the accounting policies contained in section.

2.2.2 Accounting elements

2.2.2.1 Revenues, expenses, assets, liabilities and equity will be recognised in

accordance with the principles set down in section 3.3 and as detailed in the

Chart of Accounts Manual.

2.2.3 Revenues

2.2.3.1 All revenue will be accounted for on an as received basis, in accordance with the

definitions laid down in section 3.3.5 of this Manual and the directives contained

in the Accounting Policies and Procedures Manual.

Example

2.2.3.2 A tax assessment is issued on 2 August and the payee makes payment on 1

September. In this example the revenue would be recognised not upon the issue

of the assessment on 2 August but upon the receipt of the cash from the payee

on 1 September.

2.2.4 Expenditure and commitments

Expenses

2.2.4.1 All expenses will be accounted for on a cash basis or on a committed basis in

accordance with the definitions laid down in 3.3.6 of this Manual and the

directives contained in the Accounting Policies and Procedures Manual.

Commitments

2.2.4.2 Commitments will be recognised when and only when there is a properly

authorised obligation to make a payment against the Schedule of Authorised

Expenditure, for which the amount of the transaction is known and the supplier

has been nominated, not when the cash is paid.

2.2.4.3 Commitments should not be entered into where the total value of the

commitment will result in total expenditure in excess of the Schedule of

Authorised Expenditure.

2.2.4.4 Commitments will be reversed when and only when any of the following

conditions are met:

the cash payment is made

the authorisation to make the payment lapses ie. end of financial year

the obligation to make a future payment ceases to exist

Issued12/02/2019 May 2005 Page 5 concfin.doc

Manual of Accounting Principles Accounting concepts

2.2.4.5 All commitments will lapse in accord with the Schedule of Authorised

Expenditure to which they relate ie. at the end of the financial year.

Commitments lapsing at year end and validated for the next financial year should

be reinstated with the commencement of the following year’s Schedule of

Authorised Expenditure.

2.2.4.6 Commitments will only be recognised when the value of the commitment

exceeds the threshold criteria set down in the Accounting Policies and

Procedures Manual.

Example

2.2.4.7 An entity enters into a commitment to purchase a photocopier on the 2 March

but makes payment on 6 April. In this example the commitment would be

recorded against the appropriation on 2 March. With the making of the

payment on 6 April, the commitment would be reversed and the expense

recognised.

2.2.4.8 Explanatory Note

An authorised obligation means that a legal requirement exists to honour the

terms of the contract.

Commitments relate to authorised obligations to make payments against the

current Schedule of Authorised Expenditure. Where there is an authorised

obligation to make payments against a future Schedule of Authorised

Expenditure, such obligations will be recognised as Deferred Liabilities in

accordance with the directives laid down in Chapter 11 of the Accounting

Policies and Procedures Manual.

2.2.5 Assets

2.2.5.1 All assets will be accounted for on a modified cash basis in accordance with the

definition laid down in section 3.3.2 of this Manual, and the directives contained

in the Accounting Policies and Procedures Manual

Example

2.2.5.2 There is a three year development plan to construct a new building, with Rs 1

million worth of expenditure being incurred each financial year. In this example

the Rs 1 million would be recognised in accordance with the principles on

expenses eg. Rs 1 million in 19X120X1, Rs 1 million in 19X2 20X2 and Rs 1

million in 19X320X3. However, upon completion of the building, the building

would be recorded in the asset register of the entity responsible for the asset at

the constructed cost of Rs 3 million. Certain entities may choose to record the

expenditure against a work-in-progress memorandum ledger.

Issued12/02/2019 May 2005 Page 6 concfin.doc

Manual of Accounting Principles Accounting concepts

2.2.6 Liabilities

2.2.6.1 All liabilities, other than commitments (which will be accounted for on a

modified cash basis), will be accounted for on a cash basis, in accordance with

the definitions laid down in section 3.3.3 of this Manual and the directives

contained in the Accounting Policies and Procedures Manual.

Example

2.2.6.2 An entity enters into a three year lease with payments of Rs 10,000 each

financial year. In this example the payments of Rs 10,000 against the current

Schedule of Authorised Expenditure would be recognised as a commitment

upon receipt of the invoice and an expense upon making the payment. The

payment against future Schedule of Authorised Expenditure (ie the balance of

Rs 20,000) will be recognised as Deferred Liabilities.

2.2.7 Equity

2.2.7.1 Unless otherwise specified, the Government of Pakistan is the sole holder of the

residual value of all accounting entities.

2.2.7.2 Equity will be accounted for in accordance with the definitions and directives

laid down in section 3.3.4

Example

2.2.7.3 A self accounting entity is to be wound up. All assets are to be sold or

transferred and any commitments are to be paid. In this example, any residual

from the sale of assets less commitments would be payable to the Government

of Pakistan ie. the Consolidated Fund.

2.2.8 Double entry book keeping

2.2.8.1 All accounts will be maintained on a double entry basis in accordance with the

definition laid down in section 3.3.7.198 and the Accounting Policies and

Procedures Manual.

2.2.9 Classification of transactions

2.2.9.1 All transactions will be classified in accordance with the Chart of Accounts as

outlined in Chart of Accounts.

2.2.10 Explanatory note

Modified cash basis of accounting

2.2.10.1 The modified basis of accounting, records transactions on a cash basis but

also takes into account the commitments, acquisition of fixed assets, and

incurrence of liabilities during an accounting period.

Issued12/02/2019 May 2005 Page 7 concfin.doc

Manual of Accounting Principles Accounting concepts

Adoption of a modified cash basis of accounting in Pakistan

2.2.10.2 The accounting system of the Government of Pakistan is based on a

centralised (i.e. Controller General of Accounts is responsible for Federation,

Provinces and District Government level accounts) system of accounting and

reporting, with primary focus on ensuring due control over, and reporting

against appropriations.

2.2.10.3 So long as the primary accountability of accounting officers remained

solely against appropriations, a cash basis of accounting was sufficient.

However, the need to ensure the efficient and effective allocation of resources in

addition to monitoring and ensuring due control over appropriations, has been

revised in favour of a modified cash basis with the capacity to move to a full

accrual system if and when appropriate.

2.2.10.4 An initial step in this reform process is the memorandum recording of

certain assets, liabilities and commitments (commitments in form of

memorandum account).

Accounting elements

2.2.10.5 An accounting system is simply a means of collecting, aggregating and

reporting on financial transactions. The core to any accounting system is the

accounting elements (assets, liabilities, revenues, expenses and equity) as these

form the basis upon which transactions are classified, recorded and reported

upon.

2.2.10.6 The Government of Pakistan has adopted a modified cash basis of

accounting, however, the accounting elements (as defined in section 3.3

Accounting Elements) are based on accruals concepts of accounting. While the

modified cash basis of accounting makes limited use of these definitions,

particularly in terms of the overall reporting structure, the adoption of principles

founded in a full accruals system is seen as an essential first step in moving

towards a resource based management system and the introduction of a

computerised general government accounting and reporting system.

2.2.10.7 Listed below are specific references to provide guidance in determining

the principles upon which the cash based model has been modified. Detailed

explanations on specific transaction treatment, including reporting and

accounting are contained in the Accounting Policies and Procedures Manual.

Government as owner and funder of services

2.2.10.8 The Government of Pakistan has two distinct roles within the modified

cash model. The first is as the owner of all accounting entities (section 3.3.4

Equity). The second role is as the funder of services. This distinction is

important in determining the entity / Government relationship.

2.2.10.9 As the owner of the equity the Government of Pakistan holds title to the

residual value of the accounting entity should the entity cease to operate. In

addition, it also has some say on the structure and operation of the entity.

Issued12/02/2019 May 2005 Page 8 concfin.doc

Manual of Accounting Principles Accounting concepts

2.2.10.10 As the funder of the services the Government is responsible for

representing the public in defining the needs of the community and ensuring

value for money in the provision of services. Defining these needs and deciding

the appropriate levels of funding is the purpose of the appropriation and

budgeting cycle.

Accounting for commitments

2.2.10.11 The primary basis for transaction accounting and reporting is cash based.

It is not of itself sufficient to ensure due and proper control over expenditure,

particularly in terms of ensuring the matching of expenditure on significant items

against appropriations. For this reason the cash basis of accounting has been

modified to account for certain expenditure on a commitments basis.

2.2.10.12 Accounting for commitments requires that transactions be recognised in

the books of accounts as and when there is a properly authorised obligation to

make a future payment, for which the amount of the transaction is known and

the supplier has been nominated.

2.2.10.13 As the principal reason for recognising commitments is the matching of

the obligation to make a future payment against the appropriation, thereby

ensuring proper control over the Schedule of Authorised Expenditure, it follows

that entities should not enter into commitments that would result in the total

accumulated expenditure to date plus outstanding commitments, exceeding the

amount specified in the Schedule of Authorised Expenditure.

2.2.10.14 As a commitment is made against a particular Schedule of Authorised

Expenditure, the commitment must lapse with the ceasing of the Schedule of

Authorised Expenditure. Since the liability for payment does not necessarily

lapse, it will be necessary for the commitment to reinstated against the following

year’s Schedule of Authorised Expenditure.

2.2.10.15 As at year end, all outstanding commitments will be disclosed. Details of

disclosure requirements and the directives for reinstatement are contained in the

Accounting Policies and Procedures Manual.

Recording of physical assets

2.2.10.16 The Government, through the development program, makes substantial

investment in the community in the form of infrastructure and other assets.

Government entities are given responsibility for the development, management

and maintenance of these assets. For this reason it is important that the

Government maintain proper records of the assets and monitors the entity

responsible for the care and maintenance of the assets. For this reason assets

will be expensed, that is charged against the current years’ appropriation, upon

purchase and recorded in an asset register as a memorandum record. The asset

registers will record assets by category and will be used to report on the assets

on a regular basis.

Issued12/02/2019 May 2005 Page 9 concfin.doc

Manual of Accounting Principles Accounting concepts

Supplementary information to be maintained

2.2.10.17 The base for transaction recognition and reporting is modified cash this

necessitates that certain assets and liabilities be recorded and reported.

2.2.10.18 The primary responsibility for maintaining the necessary records, such as

asset registers and schedules of liabilities, rests with the entity charged with the

responsibility for the day to day management of the asset or liability. As part of

that responsibility the entity has an obligation to maintain appropriate records

and provide the proper information to enable the reporting on the management

of those assets or liabilities to other users eg. the Government of Pakistan.

2.2.10.19 The form and content of the supplementary information will be

determined by the Ministry / Department of Finance / Controller General of

Accounts and / or the Auditor-General.

Appropriations as revenue

2.2.10.20 Within the modified cash basis of accounting, appropriations will be

recognised as revenues to the entity upon receipt of the notification of release

from the Ministry / Department of Finance in accordance with the directives laid

down in APPM.

Taxes not to be recorded as revenues of the collecting agency

2.2.10.21 Taxes, fees and fines collected on behalf of the Government will not form

revenues of the collecting agency (section 3.3.7.7), unless otherwise specified by

the Government.

Expenditures of entities not to be met direct from Consolidated Fund

Revenue

2.2.10.22 Taxes, fees and fines collected on behalf of the Government are to be paid

into the Consolidated Fund.

Revenues and expenditures to be shown gross

2.2.10.23 The netting off of expenditures and revenues is not permitted. All

revenues and all expenditures will be shown on a gross basis.

Explanatory Note

2.2.10.24 Any receipts received by the Government Office are not revenues on part

of the collecting entity and will not be retained to meet departmental or other

types of expenditure, unless otherwise permitted by the Government.

2.2.10.25 Not withstanding the above, a refund received by the Government for

goods or services purchased represents a reduction in the original expenditure

incurred by the Government. Refunds received must not be considered as

revenue.

Issued12/02/2019 May 2005 Page 10 concfin.doc

Manual of Accounting Principles Accounting concepts

2.3 Internal Control

2.3.1 Introduction

2.3.1.1 The purpose of this section is to provide general principles regarding internal

control as they relate to the accounting procedures of all accounting entities.

2.3.1.2 Detailed application of the mandatory internal control procedures is contained in

the Accounting Policies and Procedures Manual and as noted in Government

Finance Regulation 13.

2.3.2 Definition

2.3.2.1 The term internal control system refers to the policies and procedures adopted

by the entity to assist in achieving, as far as practicable, the financial

management and accountability objectives of the Government.

2.3.2.2 The Principal Accounting Officer in conjunction with the Internal Audit Officer

will be responsible for ensuring that a proper system of internal control exists

within the entity. This includes ensuring:

the orderly and proper conduct of its function

adherence to accounting policies and procedures

stewardship of assets

prevention and detection of fraud and error

accuracy and completeness of accounting records

timely and proper preparation of accounting information.

2.3.3 Explanatory note

2.3.3.1 The following objectives are essential in the establishment of proper internal

control:

all transactions are executed in accordance with the rules and regulations

issued by the Government

all transactions and other events are promptly recorded in the correct

amount, in the appropriate accounts and in the proper accounting period

so as to permit preparation of accounting information in accordance with

the accounting policies and procedure

recorded assets are compared with the existing assets at reasonable

intervals and appropriate action is taken regarding any differences

Issued12/02/2019 May 2005 Page 11 concfin.doc

Manual of Accounting Principles Accounting concepts

2.4 Budgeting

2.4.1 Introduction

2.4.1.1 The purpose of this section is to set out the principles for the authorisation of

the annual budget of the Government of Pakistan.

2.4.1.2 For detail budgeting process and procedures refer to chapter 3 – Budgetary

Control of the APPM.

2.4.2 Budgeting

Submission of estimates

2.4.2.1 Accounting entities will prepare and submit budget estimates in accordance with

the procedures set out in the Accounting Policies and Procedures Manual and

Government Finance Regulations as prescribed by the Ministry of Finance.

Annual budget statement

2.4.2.2 The Government will, for each financial year, prepare a statement of the

estimated receipts and expenditure of the Government.

Budget statement disclosure

2.4.2.3 The annual budget statement shall show separately:

the sums to meet expenditure described by the Constitution as

expenditure charged upon the Consolidated Fund

the sums required to meet other expenditure proposed to be made from

the Consolidated Fund

2.4.2.4 The annual budget statement shall distinguish expenditure on revenue account

from other expenditure.

2.4.3 Explanatory note

The Budget

2.4.3.1 The budget is the principal document by which the Government sets out its

financial plan for the following financial year, namely how much the plan will

cost (i.e. expenditure) and how much and in what way, money will be raised to

finance the expenditure (i.e. revenue).

2.4.3.2 The budget consists of a number of documents:

Annual Budget Statement - summary of the overall budget position

(revenue and expenditure)

Schedule of Authorised Expenditure - detailed estimates of Consolidated

Fund - current expenditure and detailed estimates of Consolidated Fund -

development expenditure

Issued12/02/2019 May 2005 Page 12 concfin.doc

Manual of Accounting Principles Accounting concepts

Finance Act - the legal instrument through which the budget becomes an

act of law. The Finance Act also makes the necessary amendments to

existing legislation required by the budget eg. amendments to tax rates,

introduction of new taxes etc.

The budget cycle

2.4.3.3 The budget cycle consists of six phases:

setting of budget policy and initiatives - Cabinet will meet to determine

budget policy, initiatives and priorities. The budget policy, initiatives and

priorities will then be communicated to the Ministry of Finance, who will

then communicate these to ministries and departments via the financial

advisers

preparation - the preparation of the budget papers commences in October

of each financial year with the preparation and submission of entity

estimates/bids and the subsequent review and consolidation of those

submissions by the Ministry of Finance

authorisation - this phase commences with the submission of the annual

budget to the Assembly and is completed when the entity gains control

over its appropriations

implementation - the next step in the cycle is for the entity to implement

the activities for which it has been funded. The recording and control of

these activities is the subject of the accounting system

reporting - reporting is the first step through which individuals within the

entity and the Minister are held accountable for the implementation of the

budget. This step involves both internal and external reporting (refer to

section 3.5)

performance review - this phase incorporates both internal and external

review and together with the reporting phase covers most of what is

referred to as accountability. The principal offices concerned with the

review of performance are the Auditor-General’s office and the Public

Accounts Committee

Issued12/02/2019 May 2005 Page 13 concfin.doc

Manual of Accounting Principles Accounting Policies

3 Accounting Policies

Issued 17/10/98May 2005 Page 1 polifin.doc

Manual of Accounting Principles Accounting Policies

3.1 Accounting period

3.1.1 Introduction

3.1.1.1 The purpose of this section is to define the accounting period.

3.1.2 Accounting period

Definition

3.1.2.1 “Accounting period” will be the financial year commencing 1 July and ending 30

June, and will consist of twelve monthly periods.

3.1.3 Explanatory note

3.1.3.1 Article 260 of the Constitution of the Islamic Republic of Pakistan defines the

financial year as being “a year commencing on the first of July”. This definition

has been adopted for the purposes of this Manual and the Accounting Policies

and Procedures Manual.

Issued 17/10/98May 2005 Page 2 polifin.doc

Manual of Accounting Principles Accounting Policies

3.2 Accounting records

3.2.1 Introduction

3.2.1.1 The purpose of this section is to define the accounting records and determine

the rules for the keeping and maintenance of those records.

3.2.2 Definition

3.2.2.1 “Accounting records” are any book of account upon which transactions are

recorded or any other document issued or used in the preparation and

processing of the transactions of accounting entities.

3.2.2.2 “Books of account” are any account, deed or any other document or record

however compiled, recorded or stored whether in written form, printed form,

microfilm, or electronic form.

3.2.3 Making of proper entries

3.2.3.1 In the preparation and processing of transactions and in all accounting and

related entries, pencil will not to be used. All entries will be inked.

3.2.4 Errors omission and corrections

3.2.4.1 Erasures (including the use of correction fluids or chemicals) are not permitted

in any books of account.

3.2.4.2 Correction of errors will be made by reversing the original entries in full and

posting the correct entries, a cross reference between the original entries and the

correcting entries will be included. Where the correction is made in a manual

system the officer making the correcting entry should initial and date the cross

reference.

3.2.5 Maintenance of accounting records

3.2.5.1 Books of account will use pre-numbered pages and primary books of accounts

eg. cash books and ledgers, are to be bound.

3.2.5.2 Under no circumstances are pages to be removed from any primary book of

account.

3.2.5.3 All electronic records will be backed up on a regular basis (preferably daily and

at least weekly).

3.2.5.4 All backups will be stored in a secure location.

3.2.5.5 Periodic backups (monthly) will be made and stored at a secure off-site location.

3.2.6 Minimum periods for retention

3.2.6.1 All accounting records will be retained either in their original form or suitable

substitute for a period of ten years from the date of certification of the latest

Issued 17/10/98May 2005 Page 3 polifin.doc

Manual of Accounting Principles Accounting Policies

entry by audit or review by the PAC (whichever is latest). Some records may be

destroyed after a period of ten years.

Issued 17/10/98May 2005 Page 4 polifin.doc

Manual of Accounting Principles Accounting Policies

3.3 Accounting elements

3.3.1 Introduction

3.3.1.1 The purpose of this section is to establish definitions of the elements for the

classification of transactions (namely assets, liabilities, equity, revenues and

expenses).

3.3.1.2 The Federal and Provincial Government operate on a modified cash basis of

accounting. The “definition” and “recognition criteria” for the accounting

elements listed in this section are based upon a full accruals concept. For this

reason the “Application” paragraph for each element provides guidance on the

interpretation of the definitions in a modified cash model.

3.3.2 Assets

Definition

3.3.2.1 “Assets” are future economic benefits controlled by the entity as a result of past

transactions or other past events.

Recognition criteria

3.3.2.2 An asset will be recognised when:

it is probable that the future economic benefits will occur

the asset possesses a cost or other value that can be measured reliably

Application

3.3.2.3 All assets will be expensed, that is charged against the current years’

appropriation, at the time of purchase

3.3.2.4 Expenditure which relates to physical assets will be recorded as memorandum

items in an “Physical Assets Register” in accordance with the definitions and

directives laid down in section 2.2.4 Expenditure and commitments.

3.3.2.5 Expenditure which relates to financial assets will be recorded as in memorandum

items in an “Financial Assets Register” in accordance with the definitions and

directives laid down in section 2.2.4 Expenditure and commitments.

3.3.3 Liabilities

Definition

3.3.3.1 “Liabilities” are future sacrifices of economic benefits that the entity is presently

obliged to make as a result of past transactions or other past events.

Recognition criteria

Issued 17/10/98May 2005 Page 5 polifin.doc

Manual of Accounting Principles Accounting Policies

3.3.3.2 A liability will be recognised when:

it is probable that the future sacrifice of economic benefits will be

required

the amount of the liability can be measured reliably

Application

3.3.3.3 Liabilities will be recognised on cash or as committed basis, with the

commitment or expense being made against the appropriation given for that

expenditure.

Current liabilities are the obligations payable at the demand of the creditor

and those part of other obligation whose liquidation is expected within

one year of the reporting date

Long term liabilities are the obligation which are expected to be liquidated

after a period of one year of the reporting date

3.3.3.4 Commitment will be recorded as memorandum items in the commitments

section of the “Budget Head Register” in accordance with the definitions and

directives laid down in section 2.2.4 Expenditure and commitments.

3.3.3.5 Liabilities other than commitments will be recorded as memorandum items in a

“Liabilities Register” in accordance with the definitions and directives laid down

in section 2.2.4 Expenditure and commitments6 Liabilities.

3.3.4 Equity

Definition

3.3.4.1 “Equity” is the residual interest in the assets of the entity after deduction of its

liabilities.

Application

3.3.4.2 Equity will be recognised in accounting records as per codes stated in the Chart

of Accounts Manual and procedures laid down in the APPM.

3.3.4.3 All transfers of equity will be accounted for on a cash basis and will be treated

as revenues to the receiving entity and as expenses to the contributing entity.

3.3.5 Revenues

Definition

3.3.5.1 “Revenues” are increases in economic benefits in the form of increases or

enhancements of assets or decreases of liabilities that, other than those relating

to contributions by the Government as owner, result in an increase in equity.

Recognition criteria

3.3.5.2 An item of revenue will be recognised when:

Issued 17/10/98May 2005 Page 6 polifin.doc

Manual of Accounting Principles Accounting Policies

it is probable that the increase of future economic benefits related to the

increase in assets and/or decrease in liabilities will occur

the increase in future economic benefits related to the increase in assets

and/or decrease in liabilities can be measured reliably

Application

3.3.5.3 Revenues will be recognised on a cash basis (ie. as and when the entity gains

control over the cash). In addition to this where the future revenue of a

Government can be estimated, this information will be disclosed in the accounts

by the way of a note.

3.3.6 Expenses

Definition

3.3.6.1 “Expenses” are decreases in future economic benefits in the form of reductions

in assets or increases in liabilities of the entity that, other than those relating to

distributions by Government as owners, result in a decrease in equity.

Recognition criteria

3.3.6.2 An expense will be recognised when:

it is probable that the decrease in future economic benefits related to the

reduction in assets and/or increases in liabilities will occur

the decrease in future economic benefits can be measured reliably

Application

3.3.6.3 Expenses will be recognised on a cash or as committed basis, with the expense

or commitment being made against the appropriation given for that expenditure.

3.3.7 Explanatory note

Definition of accounting elements

3.3.7.1 The purpose of the accounting model is to portray the financial effects of

transactions. In order to do this it is necessary to group the transactions into

broad classes according to their economic characteristics. These broad classes

are to be referred to as the accounting elements, namely assets, liabilities, equity,

revenue and expenditure.

3.3.7.2 Details regarding the classification of the accounting elements are contained in

chapter 4 Chart of Accounts.

Financial assets and liabilities

3.3.7.3 The term financial assets and liabilities refers to those assets and liabilities

consisting of cash and cash equivalents. Cash equivalents are items readily

converted into cash e.g. bearer bonds.

Issued 17/10/98May 2005 Page 7 polifin.doc

Manual of Accounting Principles Accounting Policies

Recognition of accounting elements

3.3.7.4 Subsequent to determining the broad classes, it is necessary to specify the

criteria that need to be met before the accounting elements can be recognised in

the books of account. The underlying assumption in determining the criteria for

recognition is there exists a present obligation or an expectation that economic

benefits will flow to or from an entity. Recognition is then based on there being

sufficient certainty that the flow of economic benefits to or from the entity will

occur.

Economic benefits

3.3.7.5 The term economic benefits refer to the potential to increase or decrease the

flow of cash or cash equivalents of the entity. However, a modified cash basis

of accounting precludes the accounting for “potential” flows, other than

commitments, and instead requires the actual cash to be accounted for.

Control and present obligations

3.3.7.6 The term “control over the future economic benefits” is defined as the capacity

of the entity to enjoy the benefits and deny or regulate the access of others to

the benefits.

3.3.7.7 Where an entity acts as an agent the revenues or expenses should not be

recorded in the primary books of account other than as a matter of stewardship.

For example, an entity collecting taxes will not normally control the future

economic benefits embodied in the tax collections and as such would not

recognise the taxes as revenues of the entity. The entity may however recognise

“taxes collected on behalf of the Government” as subsidiary information on the

overall performance of the entity.

3.3.7.8 The term “present obligations” is defined as a duty or responsibility of the entity

to act or perform in a certain way. An obligation implies the involvement of

two separate parties, namely the entity and a party external to the entity.

Occurrence of past transaction or other past event

3.3.7.9 The term “occurrence of past transaction or other past event” refers to the

requirement that, in order for an accounting element to be recognised in the

books of account, it must have been the result of a transaction or other past

event giving the entity control over the future economic benefits or giving rise

to a present obligation upon the future economic benefits.

Prior Year Adjustments

3.3.7.10 Receipts and Expenditure which occurs in the current year, relating to

previous years due to error or omission are referred to as Previous Year

adjustments.

3.3.7.11 Previous year adjustments will need to be made against the Schedule of

Authorised Expenditure in the current year with the permission of the Auditor-

General routed through the administrative/department and will be shown by way

of note accompanying the Financial Reports.

Issued 17/10/98May 2005 Page 8 polifin.doc

Manual of Accounting Principles Accounting Policies

3.3.7.12 Prior year adjustments that relate to misclassification without any impact

on the cash balance of either the Consolidated Fund or Public Account and with

the permission of the Auditor-General/Controller General of Accounts routed

through the administrative ministry/department will be shown by way of note

accompanying the Financial Reports.

3.3.7.13 Detailed directions on the disclosure of prior year adjustments for

reporting purposes are contained in the Accounting Policies and Procedures

Manual.

Probability

3.3.7.14 The term probable means that the chance of the future economic benefits

or sacrifice of economic benefits arising is more likely rather than less likely.

Reliable measurement

3.3.7.15 For an accounting element to meet the recognition criteria it must possess

a cost or other value that can be measured in a manner that accurately and

faithfully represents the transactions that have occurred.

Contributions by owners and distributions to owners

3.3.7.16 Contributions by owners and distributions to owners are non-reciprocal

transfers between an entity and the Federal and Provincial Government acting in

its capacity as owner.

3.3.7.17 Distributions to owners are made at the discretion of the ownership group

or its representatives after satisfying restrictions imposed by legislation or by

agreements with other entities. Generally, an entity is not obliged to transfer

assets to owners except in the event of the entity being wound up (paragraphs

2.12.10.8 to 2.12.10.10 Government as owner and funder of services).

3.3.7.18 Within a modified cash basis of accounting contributions by owners are

recognised within the books of accounts as revenue, to the receiving entity and

as an expense to the contributing entity.

Double entry book keeping

3.3.7.19 The adoption of accounting elements, as defined above, necessitates the

adoption of a double entry book keeping system. For example the recognition

of revenue occurs simultaneously with the recognition of increases in assets or

decreases in liabilities.

Generally Accepted Accounting Principles (GAAP)

3.3.7.20 The accounting principles set out in this Manual are generally consistent

with those set out in the “Framework for the Preparation and Presentation of

Financial Statements” issued by the International Accounting Standards

Committee, in so far as that framework addresses the definition and recognition

of accounting elements.

Issued 17/10/98May 2005 Page 9 polifin.doc

Manual of Accounting Principles Accounting Policies

3.4 Banking

3.4.1 Introduction

3.4.1.1 The purpose of this section is to set out the principles for banking by accounting

entities.

3.4.2 Banking

State Bank of Pakistan to be the sole banker

3.4.2.1 Government will only bank with the State Bank of Pakistan or its authorised

agent/s under the authorised agreement.

Operation of bank accounts

3.4.2.2 Government will not open or operate bank accounts outside of those authorised

by the Ministry of Finance.

Bank accounts are to be operated by authorised officers only.

3.4.2.3 All banking transactions will be conducted in accordance with the principles laid

down in the Accounting Policies and Procedures Manual and / or the Federal /

Provincial Treasury Rules as issued by the Ministry of Finance, the Controller

General of Accounts or the Auditor-General.

Withdrawals from bank accounts

3.4.2.4 All payments will be made by cheque, transfer or direct debit unless otherwise

authorised by the Ministry of Finance or the Controller General of Accounts. or

the Auditor-General.

3.4.2.5 Only official Government issued cheques will be used when making payments by

cheque unless otherwise specifically authorised by Government

3.4.2.6 All cheques and direct debits will be authorised in accordance with the policies

and procedures set out in the Accounting Policies and Procedures Manual and /

or the Federal / Provincial Treasury Rules as issued by the Ministry/Department

of Finance.

Deposits to bank accounts

3.4.2.7 All cash receipts will be deposited in branches of the State Bank of Pakistan or

the National Bank of Pakistan or their specifically authorised agents.

3.4.2.8 Cash receipts will be deposited on the day of the receipt, unless otherwise

authorised by the Ministry of Finance.

3.4.2.9 Government department should keep the cash transactions to the minimum

level.

Issued 17/10/98May 2005 Page 10 polifin.doc

Manual of Accounting Principles Accounting Policies

3.4.2.10 All cash receipts will be retained in a secure location until such time as the

monies are deposited.

3.4.2.11 All deposits will be accounted for in accordance with the policies and

procedures set out in the Accounting Policies and Procedures Manual.

Reconciliation of bank accounts

3.4.2.12 At the close of each month, the entity will reconcile its books of accounts

with the bank records. This reconciliation is to be performed in accordance with

the policies and procedures set out in the Accounting Policies Procedure

Manual, GFR and Federal / Provincial Treasury Rules.

Issued 17/10/98May 2005 Page 11 polifin.doc

Manual of Accounting Principles Accounting Policies

3.5 Reporting

3.5.1 Introduction

3.5.1.1 The purpose of this section is to set out the principles for reporting by

accounting entities.

3.5.1.2 The timing and format of various periodic reports are set out in the Financial

Reporting Manual.

3.5.2 Reporting

Preparation of financial reports

3.5.2.1 Financial reports will be prepared in the format and manner prescribed in the

Accounting Policies and Procedures Manual.

Purpose of financial reports

3.5.2.2 Financial reports will be prepared in a manner that will communicate

comprehensive, relevant, reliable, understandable and comparable information in

a timely manner about a reporting entity to meet the needs of the users of those

financial reports.

3.5.3 Explanatory note

Purpose of financial reports

3.5.3.1 Financial reports are a means of communicating relevant and reliable

information about a reporting entity to users. The objective of those financial

reports is to meet the needs of those identified as the users of the financial

reports. Those needs depend, in turn, on the activities of reporting entities and

the decisions users make about them.

3.5.3.2 Financial reports serve two broad purposes the first is to assist users in the

allocation of resources. The second purpose is to provide a mechanism to

enable an entity and the Government, as the owner of that entity, to discharge

their joint accountabilities.

Users of financial reports

3.5.3.3 Given the purpose of financial reports, it therefore follows that there are three

broad groups of users of financial reports:

the Federal, and Provincial and Local/District Governments, and the

Provincial Governments as providers of resources

the public as the recipient of goods and services

the Public Accounts Committee, the Federal, and Provincial and

Local/District Governments and the public, as parties performing a

review or oversight function

Issued 17/10/98May 2005 Page 12 polifin.doc

Manual of Accounting Principles Accounting Policies

Objective of financial reports

3.5.3.4 The objective of financial reports is to meet the needs of the users of those

financial reports, namely:

to provide information about the financial position, performance and

changes in financial position of the reporting entity

to discharge the accountability of the entity for stewardship of the

resources entrusted to them

Qualitative characteristics of information

3.5.3.5 The qualitative characteristics of information are defined in the International

Accounting Standards Committee’s “Framework for the Preparation and

Presentation of Financial Statements”, these characteristics are summarised in

the following paragraphs.

3.5.3.6 There are five qualitative characteristics to be considered in the collection and

reporting of financial information to be provided to users, these are:

understandability - the information must be readily understood by users

with a reasonable knowledge of the activities of the entity, its economic

environment and accounting framework

relevance - to be useful, information must be relevant to the decision

making needs of the users. It should help users in making predictions

about the outcomes of past, present or future events and / or confirm or

correct past evaluations. The information should also assist users to

assess the rendering of accountability of the entity

reliability - users must be capable of depending on the information

contained in the financial reports to represent faithfully and without bias

or undue error, the transactions or events that either it purports to

represent or could reasonably be expected to represent. It should be

noted that the Federal and Provincial Government does not comply with

GAAP in that legal form takes precedence over economic substance

comparability - users must be able to discern and evaluate similarities in,

and differences between, the nature and effects of transactions and

events, at one time and over time

materiality - all financial information should be assessed as to whether its

omission or misstatement could influence the economic decisions of users

taken on the basis of the financial statements

Constraints on relevant and reliable information

3.5.3.7 Financial information which is relevant and reliable may lose its relevance if

there is undue delay in the reporting of the information. Thus, the time available

to gather and report financial information is a major constraint. In balancing the

two the overriding consideration is how best to meet the needs of users.

3.5.3.8 The Manual of Accounting Principles sets out the broad principles and

objectives to be followed in the preparation of financial reports. The

Issued 17/10/98May 2005 Page 13 polifin.doc

Manual of Accounting Principles Accounting Policies

Accounting Policies and Procedures Manual details the procedures to be

followed in the preparation of accounts eg. closing of accounts, year end

adjustments etc. and prescribes the form, content and timing for the preparation

and submission of reports.

Issued 17/10/98May 2005 Page 14 polifin.doc

Manual of Accounting Principles Accounting Policies

3.6 Inter entity transactions

3.6.1 Introduction

3.6.1.1 The purpose of this section is to set out the principles for accounting for inter

entity transactions by accounting entities.

3.6.2 Inter entity transactions

Definition

3.6.2.1 Inter entity transactions are accounting transactions performed by one

District/Local Government or the Province or the Federation but belonging to

budget of a different District/Local Government or Province or the Federation.

3.6.2.2 Inter entity transaction of all those entities maintaining the same bank account

should be made through book adjustment and those entities having different

bank account should be made through cheques.

Accounting treatment

3.6.2.3 Inter entity transactions will be recognised in the accounts of the receiving entity

only and will not form revenues or expenses of the incurring entity.

3.6.2.4 All inter entity transactions are to be accounted for in accordance with the

policies and procedures contained in the Accounting Policies and Procedures

Manual.

Issued 17/10/98May 2005 Page 15 polifin.doc

Manual of Accounting Principles Organisation of financial and

accounting responsibilities

4 Organisation of

financial and

accounting

responsibilities

Issued 17/10/98May 2005 Page 1 orgfafin.doc

Manual of Accounting Principles Organisation of financial and

accounting responsibilities

4.1 Financial and accounting responsibilities of the Public Accounts Committee

4.1.1 Responsibilities

4.1.1.1 The responsibilities referred to below incorporate both the Public Accounts

Committee and the Provincial Public Accounts Committee.

4.1.1.2 The Public Accounts Committee is responsible for examination and reporting as

detailed in the consolidated financial statements prepared by the Auditor-

GeneralController General of Accounts.

4.1.1.3 The responsibilities of the Public Accounts Committee are governed by the

Rules and Procedures of the National or Provincial Assembly.

4.1.1.4 The Public Accounts Committees are required to submit their findings and

recommendations to Parliament and to the Principal Accounting Officer of the

concerned entity for actioning.

4.1.2 Constitution

4.1.2.1 The Public Accounts Committee is constituted from the members of the

National or Provincial Assembly.

4.1.3 Accountability

4.1.3.1 The Public Accounts Committee reports to Parliament, however, there are no

legislative powers covering the accountability of the Public Accounts

Committee to Parliament.

Issued 17/10/98May 2005 Page 2 orgfafin.doc

Manual of Accounting Principles Organisation of financial and

accounting responsibilities

4.2 Financial and accounting responsibilities of the Auditor-General’s Office

4.2.1 Responsibilities

Responsibilities of the Auditor-General’s Office include (as laid down in the

Auditor General’s (Functions, Powers and Terms and Conditions of Services)

Ordinance 2001:

4.2.1.1 Auditor – General to certify accounts – The Auditor-General shall, on the

basis of such audit as he may consider appropriate and necessary, certify the

accounts, compiled and prepared by Controller General of Accounts or any

other person authorised in that behalf, for each financial year, showing under the

respective heads the annual receipts and disbursements for the purpose of the

Federation, of each Province and of each district, and shall submit the certified

accounts with such notes, comments or recommendations as he may consider

necessary to the President or the Governor of a Province or the designated

District Authority, as the case may be.

4.2.1.2 Provisions relating to Audit – The Auditor General shall –

audit all expenditure from the Consolidated Fund of the Federation and of

each Province and to ascertain whether the moneys shown in the accounts

as having been disbursed were legally available for, and applicable to, the

service or purpose to which they have been applied or charged and whether

the expenditure conforms to the authority which governs it.

audit all transactions of the Federation and of the Provinces relating to

Public Accounts.

audit all trading, manufacturing, profit and loss accounts and balance sheets

and other subsidiary accounts kept by Order of the President or of the

Governor of a Province in any Federal or Provincial departments; and

audit, subject to the provisions of this Ordinance, the accounts of any

authority or body established by the Federation or a Province, and in each

case to report on the expenditure, transactions or accounts so audited by

him.

4.2.1.3 Audit of receipts and expenditures of holders of authorities substantially

financed by loans and grants – Where any body or authority is substantially

financed by loans or grants from Consolidated Fund of Federal Government or

of any Province or of any district, the Auditor-General shall subject to the

provisions of any law for the time being in force applicable to the body or

authority, as the case may be, audit the accounts of that body or authority.

Explanation – Where the loans or grants to a body or authority from the

Consolidated Fund of Federal Government or of any Province or of any district

in a financial year is not less than five million rupees and the amount of such

grant or loan is not less than fifty per cent of the total expenditure of that body

or authority, such body or authority shall be, deemed, for the purposes of this

section, to be substantially financed by such loans or grants as the case may be.

4.2.1.4 Auditor General to give information and undertake studies, etc.- The

Auditor-General shall, in so far as the accounts enable him so to do, give to the

Issued 17/10/98May 2005 Page 3 orgfafin.doc

Manual of Accounting Principles Organisation of financial and

accounting responsibilities

Federal Government, the Provincial Government and the District Government,

as the case may be, such information and to undertake such studies and analysis

as they may, from time to time, require.

4.2.1.5 Functions of the Auditor General in the case of grants or loans given to

other authorities or bodies – (1) Where any grant or loan is given for any

specific purpose from the Consolidated Fund of Federal Government or of any

Province or of any district to any authority or body, not being a foreign State or

international organisation, the Auditor General may scrutinize the accounts by

which the sanctioning authority satisfies itself as to the fulfilment of the

conditions subject to which such grants or loans were given and for this purpose

have the right of access, after giving reasonable previous notice, to the books

and accounts of that authority or body; Provided that the President, the

Governor of a Province or the authority of a district, as the case may be, is of

the opinion that it is not necessary to do so in the public interest.

4.2.1.6 (2) While exercising the powers conferred on him by sub-section (1), the

Auditor-General shall not have right of access to the books and accounts of any

authority or body if the law, by or under which such authority or body has been

established, provides for the audit or the accounts of such authority or body by

an agency other than the Auditor-General.

4.2.1.7 Audit of receipts of Federation or of Provinces or of districts – The Auditor

General shall audit all receipts which are payable into the Consolidated Fund or

Public Account of the Federal Government and of each Province and in the

accounts of each district and to satisfy himself that all such receipts which are

payable into the Consolidated Fund, Public Account or any district account have

been properly and correctly deposited and rules and procedures relating to

which receipts are being fully observed and the systems are in place to ensure

proper assessment and collection of government receipts.

4.2.1.8 Audit on accounts of stores and stock – The Auditor General shall have

authority to audit and report on the accounts of stores and stock kept in any

office or department of the Federation or of a Province or of a district.

4.2.1.9 Responsibilities of the Auditor-General’s Office include:

4.2.1.10 certify the accounts of the entities other than those specified in Schedule 2

of this Manual

4.2.1.11 report the result of the examination to the Government

4.2.1.12 supply financial information on an as required basis to the Federal or the

Provincial Governments or their representatives

4.2.1.13 submission of the annual accounts of the Federation and each Province to

the President or the Governor as the case may be