Understanding IUL's: Financial Tips From The Experts

Understanding IUL's: Financial Tips From The Experts

Uploaded by

jhuaman748976Copyright:

Available Formats

Understanding IUL's: Financial Tips From The Experts

Understanding IUL's: Financial Tips From The Experts

Uploaded by

jhuaman748976Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Understanding IUL's: Financial Tips From The Experts

Understanding IUL's: Financial Tips From The Experts

Uploaded by

jhuaman748976Copyright:

Available Formats

How Do Fees Who Are We?

FAMILY FIRST LIFE PRESENTS:

Impact Retirement? Family First Life is a dedicated team of

professional, licensed agents who work in

your local community to help you protect

what matters most – your family. All Family Financial Tips From the Experts

First Agents are State licensed and represent

multiple carriers and products, so their loyalty

is to you the client, and they can remain

A impartial while finding you the best fit for your

insurance needs.

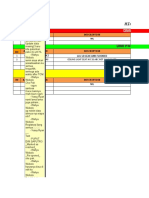

A. 1% Annual Fee: $7,612,256

B. 2% Annual Fee: $5,743,490

C. 3% Annual Fee: $4,321,943

How do fees impact retirement? Over a 20-

year period – December 31, 1993 through

December 31, 2013 – the S&P 500 returned an

average annual return of 9.28%. However, the

average mutual fund investor made just over

2.54%, according to Dalbar¹, one of the leading

industry research firms. That’s nearly an 80%

difference!

To add insult to injury, the “all-in” cost of mutual

funds is on average 3.17% per year, according to

Forbes². This is when you add the management Understanding

IUL’s

fees, the transaction costs, the sales loads, etc.

Perhaps this number doesn’t sound high to you.

Consider this: The market was “flat” between

2000 and 2009, a period known as the lost

decade. There were lots of ups and downs,

but nobody made money. If you were paying

3% annually during this period, your $100,000

portfolio would have approximately $70,000 (or

be down 30%) at the end of this “flat” period.³

1. www.dalbar.com

2.http://www.forbes.com/2011/04/04/real-cost-mutual-fund-taxes-fees-

retirement-bernicke.html

www.fami lyfi r stli fe.com

3. http://humanelevation.tonyrobbins.com/blog/money/5-costly-investing- www.fa milyfi r stli fe .c om

© 2018 Safe Money Smart, LLC

mistakes

How Does Point to Point Indexing Work?

Six Reasons

You Should Have an IUL

1. If you want to supple-

ment your retirement with

tax free income.

2. If you are concerned

about taxation in the future.

3. If you don’t want

negative returns.

4. If you have maxed out

qualified contributions.

What is Index Universal Life?

5. If you are a business and • It’s a life insurance policy first - which provides • You can take out policy loans, tax free, before

are looking to insure key •

a Tax Free Death Benefit.

It has fees, just like all insurance products. Ask •

the age of 591/2.

You can create income tax free through policy

employees. for an expense report. loans.

• Your policy’s cash value grows tax deferred. • It can provide a tax free death benefit that

avoids probate.

6. If you want to leave a

legacy for your loved ones. What Would It Take To Earn Back Your Losses?

%

Indexed Universal Life products are not an investment in the

%

“market” or in the applicable index and are subject to all policy

fees and charges normally associated with most universal life %

insurance. Life insurance policies have terms under which

the policy may be continued in force or discontinued. Current %

risk rates and interest rates are not guaranteed. Therefore, the

planned periodic premium may not be sufficient to carry the %

contract to maturity. The Index Accounts are subject to caps and

participation rates. In no case will the interest credited be less %

than 0 percent. The policy’s death benefit is paid upon the death

of the insured. The policy does not continue to accumulate cash

value and excess interest after the insured’s death.

You might also like

- What Would Billionaires Do Quickstart GuideDocument36 pagesWhat Would Billionaires Do Quickstart GuideRich Diaz100% (27)

- Becoming Your Own BankerDocument14 pagesBecoming Your Own Bankereagleye794% (17)

- John Deere F510 and F525 User ManualDocument396 pagesJohn Deere F510 and F525 User ManualDávid Németh100% (1)

- Become Your Own Banker PDFDocument9 pagesBecome Your Own Banker PDFMichael Heidbrink88% (17)

- WFG ScriptsDocument35 pagesWFG ScriptsAmit86% (7)

- Compensation WFG 4-2020Document12 pagesCompensation WFG 4-2020Lora Levitchi100% (4)

- Abbot Hematology Cell-Dyn Sapphire Operation ManualDocument1,178 pagesAbbot Hematology Cell-Dyn Sapphire Operation Manualkarolis.polonskasNo ratings yet

- BUDGETING SUCKS Garrett Gunderson Dale ClarkeDocument136 pagesBUDGETING SUCKS Garrett Gunderson Dale ClarkeRich Diaz100% (2)

- Bank On YourselfDocument62 pagesBank On YourselfRay Woolson100% (7)

- The Bankers Code The Most Powerful Wealth Building Strategies Finally Revealed PDFDocument136 pagesThe Bankers Code The Most Powerful Wealth Building Strategies Finally Revealed PDFDigital Nomad Investor94% (16)

- Final 655N00595 SPDH Frame Repair HingeDocument2 pagesFinal 655N00595 SPDH Frame Repair HingeKerlos100% (2)

- What Would The Rockefellers Do.. BookDocument184 pagesWhat Would The Rockefellers Do.. BookAli El93% (29)

- The Retirement MiracleDocument145 pagesThe Retirement MiracleJoseAlicea95% (21)

- Tax Free Retirement WebinarDocument28 pagesTax Free Retirement Webinarphillies1111No ratings yet

- Wealth Factory The Investment Guide For EntrepreneursDocument25 pagesWealth Factory The Investment Guide For EntrepreneursPedroBernabe100% (2)

- 25 Ways To Build Your Buyers List Susan Lassiter-LyonDocument4 pages25 Ways To Build Your Buyers List Susan Lassiter-Lyonkyle_luithlyNo ratings yet

- Bankers Code, Debt Millionaire, Wealthy CodeDocument91 pagesBankers Code, Debt Millionaire, Wealthy CodeJohn Turner100% (4)

- The AND AssetDocument132 pagesThe AND AssetPawan Kumar67% (3)

- Infinite Banking Concept: How to invest in Real Estate with Infinite Banking, #1From EverandInfinite Banking Concept: How to invest in Real Estate with Infinite Banking, #1Rating: 2.5 out of 5 stars2.5/5 (2)

- Infinite Banking ConceptDocument17 pagesInfinite Banking Conceptbooklover2100% (6)

- 10 Top Recruting Secrets Brian CarruthersDocument4 pages10 Top Recruting Secrets Brian Carruthersjacob_bebe100% (1)

- 2 PageDocument2 pages2 Pageapi-306698090No ratings yet

- Seven Crucial Components of a Well Designed I.U.L. (Indexed Universal Life)From EverandSeven Crucial Components of a Well Designed I.U.L. (Indexed Universal Life)No ratings yet

- Tax-Free RetirementDocument8 pagesTax-Free RetirementNelson Yong100% (2)

- Tax-Free RetirementDocument8 pagesTax-Free RetirementYesy Amaya0% (1)

- Tax Free Wealth: Learn the strategies and loopholes of the wealthy on lowering taxes by leveraging Cash Value Life Insurance, 1031 Real Estate Exchanges, 401k & IRA InvestingFrom EverandTax Free Wealth: Learn the strategies and loopholes of the wealthy on lowering taxes by leveraging Cash Value Life Insurance, 1031 Real Estate Exchanges, 401k & IRA InvestingNo ratings yet

- Iul IraDocument3 pagesIul IraWadnerson BoileauNo ratings yet

- Fast StartDocument13 pagesFast Startapi-243169874100% (1)

- Life Insurance For The WealthyDocument8 pagesLife Insurance For The WealthySherrel Lin67% (3)

- White Paper On Becoming Your Own BankerDocument7 pagesWhite Paper On Becoming Your Own BankerAnonymous tD1HSz3100% (4)

- Bank On Yourself Special ReportDocument25 pagesBank On Yourself Special Reportblcksource100% (1)

- Infinite Banking ConceptDocument9 pagesInfinite Banking ConceptBarney AdlersNo ratings yet

- Nationwide IULDocument20 pagesNationwide IULdjdazedNo ratings yet

- Be Your Own BankerDocument51 pagesBe Your Own Bankersalemselva100% (2)

- Fast Track Training Financial AdsvisorDocument46 pagesFast Track Training Financial AdsvisorAstalavista ADios100% (1)

- He Ccount: How To Fund Your Own Worry-Free, 100% Tax-Free RetirementDocument34 pagesHe Ccount: How To Fund Your Own Worry-Free, 100% Tax-Free RetirementAl PerhacsNo ratings yet

- Yfb Tax Free BookDocument40 pagesYfb Tax Free Bookblcksource100% (1)

- Corporate Owned Life InsuranceDocument12 pagesCorporate Owned Life InsuranceMartin McTaggartNo ratings yet

- Iul PresentationDocument6 pagesIul Presentationapi-258221737100% (1)

- Cash Flow Investor Toolkit Rich DadDocument9 pagesCash Flow Investor Toolkit Rich DadangryvikingNo ratings yet

- Retire Like a Rock Star: The Kick Butt Savings Solution That Eliminates The 7 Deadly Sins of Your IRA or 401(k)From EverandRetire Like a Rock Star: The Kick Butt Savings Solution That Eliminates The 7 Deadly Sins of Your IRA or 401(k)No ratings yet

- The Tree of WealthDocument122 pagesThe Tree of WealthMikeDouglas100% (3)

- Summary of David McKnight's The Power of Zero, Revised and UpdatedFrom EverandSummary of David McKnight's The Power of Zero, Revised and UpdatedRating: 1 out of 5 stars1/5 (1)

- May Issue Larr-Murphy Report (LMR)Document34 pagesMay Issue Larr-Murphy Report (LMR)John Papola100% (2)

- McGriff EbookDocument63 pagesMcGriff Ebookramsrivatsan_92100% (1)

- Build Issue 1 v2Document22 pagesBuild Issue 1 v2Rich DiazNo ratings yet

- Todd Falcone 25 BIGGEST Mistakes Cheat SheetDocument12 pagesTodd Falcone 25 BIGGEST Mistakes Cheat Sheeta_rogall7926100% (1)

- 1843 Owner Financing Mortgage ContractDocument3 pages1843 Owner Financing Mortgage ContractRichie Battiest-CollinsNo ratings yet

- Universal Life Insurance Fact SheetDocument2 pagesUniversal Life Insurance Fact Sheetket_nguyen003No ratings yet

- Steps To Invest in Tax Deeds and Tax Lien CertificatesDocument3 pagesSteps To Invest in Tax Deeds and Tax Lien Certificatesericsobe7100% (1)

- L&L 30 - Tom Hopkins MethodDocument5 pagesL&L 30 - Tom Hopkins MethodDumitru Holban-UliniciNo ratings yet

- Bank On Yourself Special ReportDocument26 pagesBank On Yourself Special ReportMike H100% (1)

- How To Be A Real Estate Investor by Phil Pustejovsky FreeDocument200 pagesHow To Be A Real Estate Investor by Phil Pustejovsky FreeZulhisan Afli JNo ratings yet

- Replace Your Mortgage Ebook - No - Companion PDFDocument62 pagesReplace Your Mortgage Ebook - No - Companion PDFJeff Smith100% (3)

- Whole Life InsuranceDocument14 pagesWhole Life InsuranceSushma DudyallaNo ratings yet

- Confessions of a CPA: Why What I Was Taught To Be True Has Turned Out Not To BeFrom EverandConfessions of a CPA: Why What I Was Taught To Be True Has Turned Out Not To BeNo ratings yet

- Tax LienDocument167 pagesTax LienThomas Wise100% (3)

- Real Estate InvestingDocument32 pagesReal Estate InvestingRudra SinghNo ratings yet

- How To Build A Team Workbook PDFDocument50 pagesHow To Build A Team Workbook PDFsundevil2010usa4605No ratings yet

- Youth Questionnaire CurecDocument20 pagesYouth Questionnaire CurecwdejanesNo ratings yet

- Alfie 200 - Cleaning Unit For Coolant - Instruction Manual - 2009Document38 pagesAlfie 200 - Cleaning Unit For Coolant - Instruction Manual - 2009Centrifugal Separator100% (1)

- DirectoryDocument160 pagesDirectoryDhungel PrabhuNo ratings yet

- Presented To The Faculty of Bula National School of Fisheries General Santos CityDocument8 pagesPresented To The Faculty of Bula National School of Fisheries General Santos CityUnknown NameNo ratings yet

- HNDBK Finaldraft2005 PDFDocument181 pagesHNDBK Finaldraft2005 PDFSejal AmbetkarNo ratings yet

- New Microsoft Excel WorksheetDocument4 pagesNew Microsoft Excel WorksheetVidhi ThakarNo ratings yet

- Credit Analysis of Cipla LTDDocument3 pagesCredit Analysis of Cipla LTDnishthaNo ratings yet

- 15 Group Savings Linked Insurance SchemeDocument5 pages15 Group Savings Linked Insurance SchemeVikramjeet MannNo ratings yet

- Sds-Tampa Tex TPX 170Document14 pagesSds-Tampa Tex TPX 170Mahmudol Hasan TarekNo ratings yet

- Food Processing NC II RubricDocument1 pageFood Processing NC II RubricPaola Cristina Paguio100% (1)

- Bee Family PDFDocument28 pagesBee Family PDFDelos NourseiNo ratings yet

- Republic Act No 10607Document7 pagesRepublic Act No 10607Romel TorresNo ratings yet

- Cold StorageDocument50 pagesCold StoragemanishNo ratings yet

- Chapter 3 Alkenes and Alkynes PowerpointDocument61 pagesChapter 3 Alkenes and Alkynes PowerpointFreya An YbanezNo ratings yet

- GestaltchartDocument1 pageGestaltchartVeronicaNo ratings yet

- NABL 142 Policy On Calibration & TreasebilityDocument5 pagesNABL 142 Policy On Calibration & Treasebilitysudhasesh2000100% (2)

- Senior Environmental Project Manager in Cleveland Akron OH Resume Christopher KunkleDocument2 pagesSenior Environmental Project Manager in Cleveland Akron OH Resume Christopher KunkleChristopherKunkleNo ratings yet

- Rational Emotive TherapyDocument8 pagesRational Emotive Therapypoonam.pbsNo ratings yet

- Neossance Squalane - Brochure v3 1114 (2022)Document2 pagesNeossance Squalane - Brochure v3 1114 (2022)Antoine PiccirilliNo ratings yet

- DQS352 Assignment 1 GROUP 2 (SCAFFOLDING)Document42 pagesDQS352 Assignment 1 GROUP 2 (SCAFFOLDING)Alessazier GenerNo ratings yet

- Environmental Degradation in Yakurr LGADocument14 pagesEnvironmental Degradation in Yakurr LGAAkpan-Ibiang OfemNo ratings yet

- 10014251293004001Document2 pages10014251293004001Chandan ChatterjeeNo ratings yet

- Ba Maintenance Hilight 31 Oct 2020Document14 pagesBa Maintenance Hilight 31 Oct 2020Achmad Faisal CanNo ratings yet

- Bab IV Daftar PustakaDocument2 pagesBab IV Daftar PustakaNumbi HerizasiwiNo ratings yet

- Digital Polarimeter To Auto ClaveDocument9 pagesDigital Polarimeter To Auto ClaveTanvi ZakardeNo ratings yet

- Marine Cargo InsuranceDocument10 pagesMarine Cargo InsurancemarinedgeNo ratings yet

- Training Schedule 2021 - SLVDocument4 pagesTraining Schedule 2021 - SLVFerdie OSNo ratings yet