4 Reasons Why You Should Not Surrender Your Policy: Think Again

4 Reasons Why You Should Not Surrender Your Policy: Think Again

Uploaded by

Dhanesh GaikwadCopyright:

Available Formats

4 Reasons Why You Should Not Surrender Your Policy: Think Again

4 Reasons Why You Should Not Surrender Your Policy: Think Again

Uploaded by

Dhanesh GaikwadOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

4 Reasons Why You Should Not Surrender Your Policy: Think Again

4 Reasons Why You Should Not Surrender Your Policy: Think Again

Uploaded by

Dhanesh GaikwadCopyright:

Available Formats

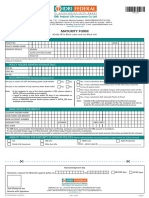

(Kindly fill in Block Letter and Use Black Ink)

4 REASONS WHY YOU SHOULD NOT SURRENDER YOUR POLICY

1 2 3 4

YOUR LIFE INSURANCE YOU MAY HAVE YOU LOSE THE YOUR NEW LIFE

COVER STOPS TO PAY TAX ON YOUR OPPORTUNITY TO INSURANCE POLICY

SURRENDER AMOUNT GROW YOUR MONEY WILL COST YOU MORE

THINK AGAIN

Are you sure you want to surrender?

On Surrendering, your LIFE COVER ceases, depriving you and your family of the policy benefits.

Buying Insurance later may prove to be expensive with increasing age.

POLICY INFORMATION

POLICY NO

POLICY OWNER NAME F I R S T N A M E M I D D L E N A M E L A S T N A M E

CONTACT DETAILS MOBILE EMAIL ID

LAND LINE (STD CODE)

REASON FOR Financial Reasons Personal Expenses

SURRENDER Dissatisfied with Services Unsatisfactory Returns

OTHER REASONS, PLEASE SPECIFY____________________________________________________________________________

POLICY HOLDER IDENTIFICATION DETAILS

PAN No

AADHAR No

CKYC No

EIA No

DOCUMENTATION (Mandatory Requirement )

Are you holding a citizenship of any country other than India? YES NO Yes, I have submitted the policy document

Yes, I have submitted Indemnity bond duly notarised in lieu of

Are you a tax resident of any country other than India? YES NO policy bond

Yes I have attached a cancelled cheque with preprinted name of

Note: If the response to any of the above question is YES, please submit a FATCA_CRS form available on

our website. the account holder /self-attested Bank statement or Pass-book

I agree to submit a new form within 30 days if any information or certification on

this form becomes incorrect or changes.

copy duly attested by Bank.

Incase of NRE/NRO account details please submit a FATCA_CRS form available on our website. Yes, I have submitted Self attested Photo Id Proof

BANK DETAILS FOR PAYOUT

ACCOUNT HOLDER NAME F I R S T N A M E M I D D L E N A M E L A S T N A M E

BANK NAME AND BRANCH

BANK ACCOUNT NUMBER

ACCOUNT TYPE SAVINGS NRE / NRO *

IFSC CODE

* For NRE bank account,letter from Bank/bank statement confirming premiums are received from the NRE account is mandatory.

* In case cancelled cheque copy is of New Account, self attested copy of bank statement is mandatory.

Note: IFLI will not be responsible in case of non - credit to customer's account for reasons of incomplete/incorrect bank account information provided by the customer

Acknowledgment Slip

Received a request for Surrender against policy no _______________________ on D D M M Y Y Y Y

Before 3:00 pm After 3:00 pm

Seal /Stamp of the Branch with Signature

FOR OFFICE USE

DATE D D M M Y Y Y Y TIME (Tick ) BEFORE 3:00 pm AFTER 3:00 pm

STAMP OF BRANCH SIGNATURE OF OFFICIAL

DECLARATION

I/We understand that the surrender of the policy results in the termination of the policy and that I/We are required to return the original policy document to

the Company. I/ We also understand and agree that the policy shall be deemed to have been duly surrendered and the company discharged of all liabilities

under it upon the payment of surrender value, not withstanding the non production of the original policy document to the company, for any reason. Where

the policy is not submitted to the Company, the policy owner here by agrees to indemnify the Company against all liabilities that the Company may incur on

account of any claim being made by any other person on the basis of possession of the policy document or otherwise. I/We also understand that the contract

of insurance shall be deemed to have been duly terminated on my/our signing this application form for surrender of the policy.

RESIDENTIAL DECLARATION BY POLICY HOLDER

“I am a Non Resident Resident of India within Section 6 of the Income Tax Act, 1961.In the event there is any income tax demand (including interest,

charges or levies) raised in India in respect of these amounts, I/we undertake to pay the demand forthwith and indemnify and hold IDB IFederal Life

Insurance Company Ltd. harmless from any income tax demand (including interest, penalty, charges or levies) raised in India on the IDBI Federal life

Insurance Company Ltd. on account of any misstatement / misrepresentation/ errors of omission or commission by me or any other person, and provide IDBI

Federal Life Insurance Company Ltd. with all information/documents that may be necessary for any proceedings before Income-tax / Appellate Authorities in

India.”

DISCHARGE RECEIPT

I/We hereby agree to accept the payout amount and confirm of having understood and agree to all the conditions and information mentioned in

the form.

I / We discharge the company, IDBI Federal Life Insurance Co Ltd of all my / our claims or demands and responsibilities under the above

mentioned policy.

Affix One Rupee

Revenue Stamp

& Sign Across

Note: Discharge Voucher stands cancelled incase request made towards policy payment is rejected by IDBI Federal Life Insurance Co Ltd

PLACE

Signature of the Policy

Holder/ Assignee

(having understood and

agreed to above declaration) DATE D D M M Y Y Y Y

DECLARATION (By Person filing the form on behalf of the policy holder for forms signed in Vernacular languages or Thumb Impression)

I _______________________________________________________________, having known the policy holder for a period of __________________________

do declare that I have explained the nature of questions contained in this form to the policy holder. I have also explained that the answers to the

questions form the basis for accepting this request for Surrender.

Signature of the Person PLACE

filling the form on

behalf of the policy

holder

(For forms signed in Vernacular

Language/ Thumb Impression) DATE D D M M Y Y Y Y

GENERAL INSTRUCTION

1. Amount Payable on Surrender is as per the policy terms and conditions.

2. All the required details in the form should be completely filled in.

3. The cut off time for NAV application in respect of allocation and redemption of units is 3:00 pm.This implies that if the application for surrender is received

up to 3:00 pm on a week day except holiday, the same day's unit value will be applicable.However if the application is received after 3:00 p.m. the next

declared NAV will be applied.

4. In case policy is assigned, payout will be made to the Assignee and request needs to be signed by Assignee, if payout is required to be made to Assignor

then Assignment form is required first.

5. TDS will be applicable as per the prevailing tax laws of India. NRE customer, may submit Form 10 F and TRC for tax exemption,subject to it's validity.

6.Request must be received from Life Assured upon auto vesting.

You might also like

- 333 Gems of Tharizdun - The HomebreweryDocument3 pages333 Gems of Tharizdun - The HomebreweryAlex OsgoodNo ratings yet

- SCHOOL COUNSELING Final Notes-CombinedDocument152 pagesSCHOOL COUNSELING Final Notes-CombinedRashi AtreyaNo ratings yet

- Policy Fund Withdrawal Form v2Document2 pagesPolicy Fund Withdrawal Form v2Julius Harvey Prieto BalbasNo ratings yet

- A Long Way Down by Nick Hornby The Berkley Publishing Group by The Penguin Group, 2005Document3 pagesA Long Way Down by Nick Hornby The Berkley Publishing Group by The Penguin Group, 2005lizkomp3No ratings yet

- Maturity Form: Policy InformationDocument2 pagesMaturity Form: Policy Informationroodra singh ranawatNo ratings yet

- Surrender / Partial Withdrawal Form: Facts To Be Considered Before Filling Up The FormDocument3 pagesSurrender / Partial Withdrawal Form: Facts To Be Considered Before Filling Up The FormDevendra RawoolNo ratings yet

- Futuregensurrenderform 25Document2 pagesFuturegensurrenderform 25accountsNo ratings yet

- 1100113918860_AVF_Decleration (1)Document1 page1100113918860_AVF_Decleration (1)harshjainn6No ratings yet

- Surrender FormDocument2 pagesSurrender FormpghoshNo ratings yet

- AVF DeclerationDocument1 pageAVF DeclerationdeepakkNo ratings yet

- Policy Cancellation(Surrender-Form)Document2 pagesPolicy Cancellation(Surrender-Form)dineshd.devarajanNo ratings yet

- Birla Policy Surrender Form - January 2024Document2 pagesBirla Policy Surrender Form - January 2024rishsomzavNo ratings yet

- AVF DeclerationDocument1 pageAVF Declerationpersonalusage988No ratings yet

- AVF DeclerationDocument1 pageAVF DeclerationKrishna UpadhyayNo ratings yet

- AVF DeclerationDocument1 pageAVF DeclerationDhanyaNo ratings yet

- AVF DeclerationDocument1 pageAVF DeclerationMohd FaizanNo ratings yet

- 1100106915929_AVF_DeclerationDocument1 page1100106915929_AVF_DeclerationvaarshikreddycNo ratings yet

- Life Insurance Policy Surrender Request Form FIllableDocument1 pageLife Insurance Policy Surrender Request Form FIllableNew BossNo ratings yet

- Policy-Amendment-FormDocument18 pagesPolicy-Amendment-FormmaxlifeinsuranceNo ratings yet

- Surrender FormDocument4 pagesSurrender Formideaooze creatorsNo ratings yet

- Pre-Mature Exit Form Jan 19Document2 pagesPre-Mature Exit Form Jan 19antriksh82No ratings yet

- Policy Fund Withdrawal Form: FWP/FSC CodeDocument2 pagesPolicy Fund Withdrawal Form: FWP/FSC CodeEra gasper100% (1)

- Reliance Life - Bank Details UpdationDocument2 pagesReliance Life - Bank Details UpdationmayurkkhatriNo ratings yet

- Surrender FormDocument6 pagesSurrender FormShaikhSabiyaNo ratings yet

- Future Vector Care-Proposal Form (Single Member)Document2 pagesFuture Vector Care-Proposal Form (Single Member)Arup GhoshNo ratings yet

- BDO Life - Life Insurance Policy Benefit Instruction FormDocument1 pageBDO Life - Life Insurance Policy Benefit Instruction Formonetwelve4teenNo ratings yet

- E VisaDocument3 pagesE Visazahoorunisa20No ratings yet

- Icici LambordDocument2 pagesIcici LambordkveramalluNo ratings yet

- Think Again!: Policy Surrender FormDocument2 pagesThink Again!: Policy Surrender FormSumitt SinghNo ratings yet

- (Dd/mm/yyyy) (Dd/mm/yyyy)Document8 pages(Dd/mm/yyyy) (Dd/mm/yyyy)anupama.chavan202No ratings yet

- CCD MID/Declaration: Application DetailsDocument1 pageCCD MID/Declaration: Application DetailsAashay MohareNo ratings yet

- Application For General Changes: (Kindly Fill in Block Letter and Use Black Ink)Document2 pagesApplication For General Changes: (Kindly Fill in Block Letter and Use Black Ink)Nithin K ReethanNo ratings yet

- Deed of Assignment - 102018Document5 pagesDeed of Assignment - 102018Kawaii YoshinoNo ratings yet

- TOP_UP_9cdadfc628Document2 pagesTOP_UP_9cdadfc628docs9919No ratings yet

- Policy Surrender FormDocument2 pagesPolicy Surrender Formsai.punjaguttaNo ratings yet

- EOI CommDocument2 pagesEOI CommVansh AroraNo ratings yet

- Know Yor Customer - Addendum: (For Third Party Payment)Document2 pagesKnow Yor Customer - Addendum: (For Third Party Payment)Shrikant GawhaneNo ratings yet

- Stamp & Time Stamp & TimeDocument2 pagesStamp & Time Stamp & Timeronny_fernandes363No ratings yet

- Kori Engineering Credit Application FormDocument6 pagesKori Engineering Credit Application Formaj.ngadaNo ratings yet

- Iob Health Care Plus Policy Proposal FormDocument2 pagesIob Health Care Plus Policy Proposal FormPritamjit RoutNo ratings yet

- Cfi PDFDocument1 pageCfi PDFAmit KambojNo ratings yet

- Tang Flex Life Plan-Proposal Form (3yrs Tenure)Document4 pagesTang Flex Life Plan-Proposal Form (3yrs Tenure)leofaith390No ratings yet

- 2022_Assignment-of-Policy-Form-for-Corporate-Entity-PO-FILLABLE-v2Document3 pages2022_Assignment-of-Policy-Form-for-Corporate-Entity-PO-FILLABLE-v2mikeydraken122000No ratings yet

- Payout RequestDocument2 pagesPayout RequestInfopedia OnlinehereNo ratings yet

- Customer Declaration and ECS FormDocument1 pageCustomer Declaration and ECS FormJanakiRamanNo ratings yet

- Assignment Form EnglishDocument1 pageAssignment Form Englishaltwinw413No ratings yet

- Fund_Transfer_Form_oct_dbbbe2a610Document3 pagesFund_Transfer_Form_oct_dbbbe2a610sonali257biswasNo ratings yet

- Nomination Form_SUD LifeDocument3 pagesNomination Form_SUD LifesuhasyelaveNo ratings yet

- Individual-Regular-Form93569 - June 2023 - GPDocument7 pagesIndividual-Regular-Form93569 - June 2023 - GPkishoreNo ratings yet

- FOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/OtherDocument2 pagesFOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/OtherAnithaNo ratings yet

- Freelook Cancellation FormDocument2 pagesFreelook Cancellation Formideaooze creatorsNo ratings yet

- Assignment of Policy Form For Corporate PolicyownerDocument3 pagesAssignment of Policy Form For Corporate PolicyownerjedNo ratings yet

- Standing Instruction Form Through IndusInd Bank Account-2Document1 pageStanding Instruction Form Through IndusInd Bank Account-2SonuNo ratings yet

- Assignment Form EnglishDocument2 pagesAssignment Form EnglishjessotjNo ratings yet

- Policy-Surrender-Form-3Document2 pagesPolicy-Surrender-Form-3Andre NajealNo ratings yet

- Personal Particulars Update Form 092022Document4 pagesPersonal Particulars Update Form 092022shamini.subramaniamNo ratings yet

- Payout RequestDocument2 pagesPayout RequestUth NationNo ratings yet

- Alternate Mode Mandate Form - 21012023Document1 pageAlternate Mode Mandate Form - 21012023successinvestment2005No ratings yet

- 050050021 KYCThird Party Payor V5Document2 pages050050021 KYCThird Party Payor V5sadharanidharanNo ratings yet

- Health Statement FormDocument2 pagesHealth Statement FormRose Ann DuqueNo ratings yet

- Are You Taking The Right Decision For Your Family?: Full Surrender FormDocument2 pagesAre You Taking The Right Decision For Your Family?: Full Surrender FormvijaysinhrajputNo ratings yet

- Innocent Spouse Relief: How You May Not Have To Pay Your Taxes!From EverandInnocent Spouse Relief: How You May Not Have To Pay Your Taxes!No ratings yet

- Foreign Exchange Market: By: Baja, Angelica Joyce L. Ebora, Shiela Mae G. Montenegro, Er G. Ibon, Ina Aiel BDocument35 pagesForeign Exchange Market: By: Baja, Angelica Joyce L. Ebora, Shiela Mae G. Montenegro, Er G. Ibon, Ina Aiel BShiela Mae EboraNo ratings yet

- CCTV Katalog ProdukDocument6 pagesCCTV Katalog ProdukalkhairatfajhryNo ratings yet

- LLB 3 New Application Form Data 2019Document5 pagesLLB 3 New Application Form Data 2019deepaksolarNo ratings yet

- FINAL Duty List Annual Function 2024-Middle Block.docxDocument7 pagesFINAL Duty List Annual Function 2024-Middle Block.docxerenyeager4745No ratings yet

- BTCHDocument5 pagesBTCHMartín MaioranoNo ratings yet

- Tamil NaduDocument2 pagesTamil Nadusandramankore3No ratings yet

- Trust Deed OF Akhil Bhartiya Vishwakarma Mahasabha India (A.B.V.M.INDIA)Document9 pagesTrust Deed OF Akhil Bhartiya Vishwakarma Mahasabha India (A.B.V.M.INDIA)dk pathakNo ratings yet

- Health Information System For ML Transes p2Document15 pagesHealth Information System For ML Transes p2naam.hussin.sjcNo ratings yet

- Tourist Visa Extension: Bi Form No. Tvs-Cgaf-Ve-2016 Consolidated General Application Form FORDocument1 pageTourist Visa Extension: Bi Form No. Tvs-Cgaf-Ve-2016 Consolidated General Application Form FORTin AvenidaNo ratings yet

- Demand Letter (DelaPena)Document2 pagesDemand Letter (DelaPena)acubalawoffice acubaNo ratings yet

- Sandvik: Date Updated by Change Not. Date Was Before Pcs. RevDocument1 pageSandvik: Date Updated by Change Not. Date Was Before Pcs. Revpaul heberth areche conovilcaNo ratings yet

- Reservation With Amendment DPC Puc VPP PDFDocument181 pagesReservation With Amendment DPC Puc VPP PDFPonnamal DNo ratings yet

- Queer and Present Danger Ruby RichDocument5 pagesQueer and Present Danger Ruby RichNatalia Cariaga100% (1)

- Arabic Language and Culture Education PackDocument69 pagesArabic Language and Culture Education PackC. de N. Luis CALIZAYA PortalNo ratings yet

- Answer Key Materi 1 UtsDocument10 pagesAnswer Key Materi 1 UtsKusuma Aji SuryaNo ratings yet

- QUANTITY SURVEY 2.2Document5 pagesQUANTITY SURVEY 2.2zodiackiller1960sNo ratings yet

- Ancient Egypt Sketchnotes Hqw2jeDocument4 pagesAncient Egypt Sketchnotes Hqw2jeajulukefrancis6419No ratings yet

- Diasporic Disorder in Amitav Ghosh's The Glass PalaceDocument3 pagesDiasporic Disorder in Amitav Ghosh's The Glass PalaceEditor IJTSRDNo ratings yet

- Discourse EthicsDocument14 pagesDiscourse EthicsPriyankar SinghNo ratings yet

- The 2 International Olympiad On Astronomy and Astrophysics (IOAA) As A Forum in Promoting AstronomyDocument2 pagesThe 2 International Olympiad On Astronomy and Astrophysics (IOAA) As A Forum in Promoting AstronomyNaman GuptaNo ratings yet

- TPM and OEEDocument46 pagesTPM and OEErajee101100% (2)

- Peace Quotes Updated May 2013Document124 pagesPeace Quotes Updated May 2013Steve FryburgNo ratings yet

- Menu KN DigitalDocument2 pagesMenu KN DigitalKepegawaian Kanwil Prov. Sumatera UtaraNo ratings yet

- Model Test 2Document7 pagesModel Test 2Fairuz HusnaNo ratings yet

- Origin of The Sumerian Name and Sign For 'Wheat' - John A. Halloran 2011Document1 pageOrigin of The Sumerian Name and Sign For 'Wheat' - John A. Halloran 2011ALACANANo ratings yet

- Reading Assignment - The Hero's JourneyDocument3 pagesReading Assignment - The Hero's JourneyweweNo ratings yet

- Survey On Employee Engagement at Cognizant Technology SolutionsDocument6 pagesSurvey On Employee Engagement at Cognizant Technology SolutionsRaman ShanmugaNo ratings yet